Valuation of Medical Innovation Handling with Uncertainty and Risk

Abstract

1. Introduction

- NPV = net present value;

- CF = (free) cash flow;

- n = the time in years before the future cash flow occurs;

- r = cost of capital.

2. Materials and Methods

2.1. Uncertainty in Economic Valuation

2.1.1. Costs

2.1.2. Sales

2.1.3. Cost of Capital

3. Results

3.1. Handling Uncertainty in Economic Valuation

3.1.1. Uncertainty and Risk

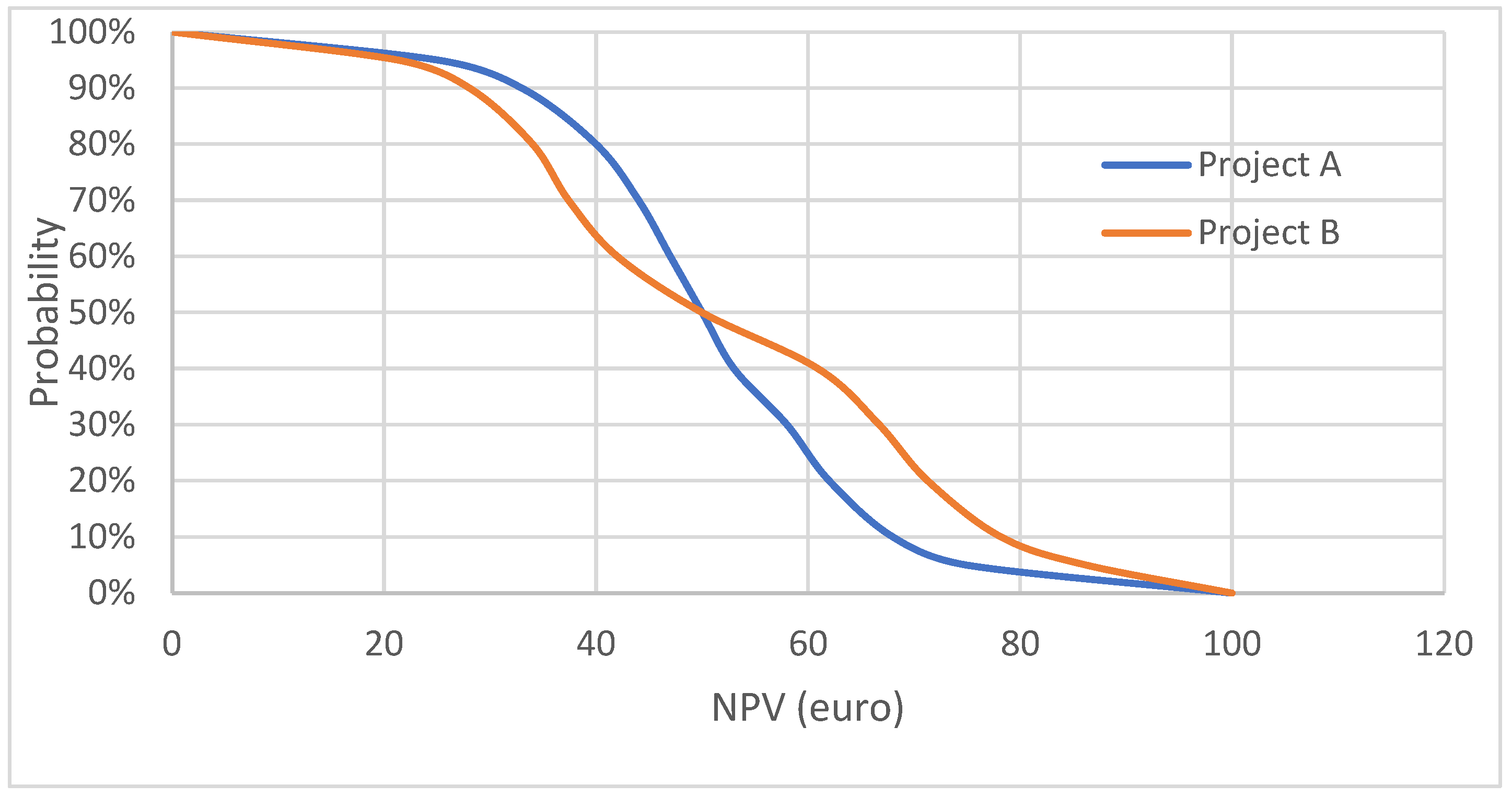

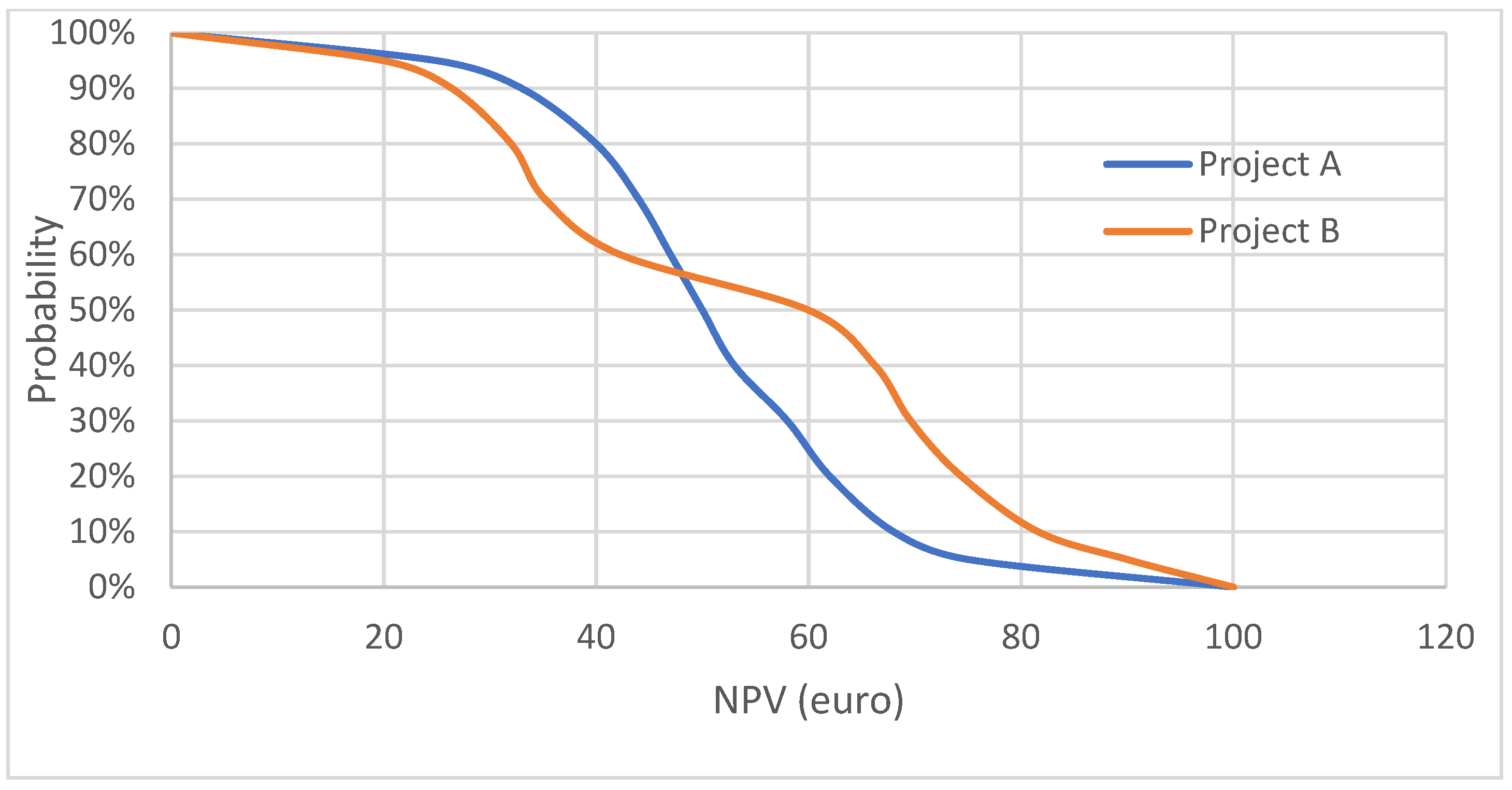

3.1.2. Acceptability Curve

3.1.3. Uncertainty in Cost of Capital

- E(Ri) = expected return of investment;

- Rf = risk-free rate;

- βi = beta of the investment;

- E(Rm) = expected return on market

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Nuijten, M.; Van Wilder, P. The impact of early phase price agreements on prices of orphan drugs. BMC Health Serv. Res. 2021, 21, 222. [Google Scholar] [CrossRef] [PubMed] [PubMed Central]

- Nuijten, M.J.C.; Vis, J. Evaluation and valuation of innovative medicinal products. J. Rare Dis. Res. Treat. 2016, 2, 1–11. [Google Scholar] [CrossRef]

- Nuijten, M.; Capri, S. Pricing of orphan drugs in oncology and rare diseases. J. Mark. Access Health Policy 2020, 8, 1838191. [Google Scholar] [CrossRef] [PubMed] [PubMed Central]

- Berdud, M.; Drummond, M.; Towse, A. Establishing a Reasonable Price for an Orphan Drug. Cost Eff. Resour. Alloc. 2018, 18, 31. [Google Scholar] [CrossRef] [PubMed]

- Kaiser, A.D.; Assenmacher, M.; Schröder, B.; Meyer, M.; Orentas, R.; Bethke, U.; Dropulic, B. Towards a commercial process for the manufacture of genetically modified T cells for therapy. Cancer Gene Ther. 2015, 22, 72–78. [Google Scholar] [CrossRef] [PubMed] [PubMed Central]

- Mestre-Ferrandiz, J.; Sussex, J.; Towse, A. The R&D Cost of a New Medicine; Office of Health Economics: London, UK, 2012; ISBN 978-1-899040-19-3. [Google Scholar]

- Pennings, E.; Sereno, L. Evaluating pharmaceutical R&D under technical and economic uncertainty. Eur. J. Oper. Res. 2011, 212, 374–385. [Google Scholar]

- Wouters, O.J.; Kesselheim, A.S.; Kuha, J.; Luyten, J. Sales revenues for new therapeutic agents approved by the US Food and Drug Administration from 1995 to 2014: A retrospective study. Value Health 2024, in press. [Google Scholar] [CrossRef] [PubMed]

- Morel, T.; Cano, S.J. Measuring what matters to rare disease patients—Reflections on the work by the IRDiRC task-force on patient-centered outcome measures. Orphanet J. Rare Dis. 2017, 12, 171. [Google Scholar] [CrossRef] [PubMed]

- Nuijten, M.J.; Pronk, M. Financial Valuation Algorithm for the Assessment of the Future Sales of a New, Innovative Medicinal Product. J. Priv. Equity 2014, 17, 35–44. [Google Scholar] [CrossRef]

- Brouwer, W.B.; Niessen, L.W.; Postma, M.J.; Rutten, F.F. Need for differential discounting of costs and health effects in cost effectiveness analyses. BMJ 2005, 331, 446–448. [Google Scholar] [CrossRef] [PubMed]

- Wakutsu, N.; Hirose, E.; Yonemoto, N.; Demiya, S. Assessing Definitions and Incentives Adopted for Innovation for Pharmaceutical Products in Five High-Income Countries: A Systematic Literature Review. Pharm. Med. 2023, 37, 53–70. [Google Scholar] [CrossRef] [PubMed] [PubMed Central]

- Nuijten, M. Pricing Zolgensma—The world’s most expensive drug. J Mark Access Health Policy 2021, 10, 2022353. [Google Scholar] [CrossRef] [PubMed]

- Hagenbeek, A.; Gribben, J.; Jäger, U.; Kapitein, P.; Merlini, G.; Piggin, M.; Groot, C.A.U.; Doeswijk, R. Fair Pricing of Innovative Medicines: An EHA Position Paper. Hemasphere 2020, 4, e488. [Google Scholar] [CrossRef] [PubMed] [PubMed Central]

- Grabowski, J.R.; Harrington, J.P.; Nunes, C. Valuation Handbook: Guide to Cost of Capital; Duff & Phelps: New York, NY, USA, 2015. [Google Scholar]

- Doubilet, P.; Begg, C.B.; Weinstein, M.C. Probabilistic sensitivity analysis using Monte Carlo simulation. Med. Decis. Mak. 1985, 5, 157–177. [Google Scholar] [CrossRef] [PubMed]

- Koerkamp, B.G.; Hunink, M.M.; Stijnen, T.; Hammitt, J.K.; Kuntz, K.M.; Weinstein, M.C. Limitations of Acceptability Curves for Presenting Uncertainty in Cost-Effectiveness Analysis. Med. Decis. Mak. 2007, 27, 101–111. [Google Scholar] [CrossRef] [PubMed]

- Chen, Q.; Ayer, T.; Chhatwal, J. Sensitivity Analysis in Sequential Decision Models: A Probabilistic Approach. Med. Decis. Mak. 2017, 37, 243–252. [Google Scholar] [CrossRef] [PubMed]

- Fama, E.F.; French, K.R. The Capital Asset Pricing Model: Theory and Evidence. J. Econ. Perspect. 2004, 18, 25–46. [Google Scholar] [CrossRef]

- Su, R.; Li, M.; Fang, Y.; Yang, C. Valuation method of intellectual property pledge financing based on income interval analysis and risk adjustment coefficient. Humanit. Soc. Sci. Commun. 2023, 10, 501. [Google Scholar] [CrossRef]

- Kaló, Z.; Petykó, Z.I.; Fricke, F.U.; Maniadakis, N.; Tesař, T.; Podrazilová, K.; Espin, J.; Inotai, A. Development of a core evaluation framework of value-added medicines: Report 2 on pharmaceutical policy perspectives. Cost Eff. Resour. Alloc. 2021, 19, 42. [Google Scholar] [CrossRef] [PubMed] [PubMed Central]

- Petykó, Z.I.; Kaló, Z.; Espin, J.; Podrazilová, K.; Tesař, T.; Maniadakis, N.; Fricke, F.U.; Inotai, A. Development of a core evaluation framework of value-added medicines: Report 1 on methodology and findings. Cost Eff. Resour. Alloc. 2021, 19, 57. [Google Scholar] [CrossRef] [PubMed] [PubMed Central]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nuijten, M.; Capri, S. Valuation of Medical Innovation Handling with Uncertainty and Risk. J. Mark. Access Health Policy 2024, 12, 199-208. https://doi.org/10.3390/jmahp12030016

Nuijten M, Capri S. Valuation of Medical Innovation Handling with Uncertainty and Risk. Journal of Market Access & Health Policy. 2024; 12(3):199-208. https://doi.org/10.3390/jmahp12030016

Chicago/Turabian StyleNuijten, Mark, and Stefano Capri. 2024. "Valuation of Medical Innovation Handling with Uncertainty and Risk" Journal of Market Access & Health Policy 12, no. 3: 199-208. https://doi.org/10.3390/jmahp12030016

APA StyleNuijten, M., & Capri, S. (2024). Valuation of Medical Innovation Handling with Uncertainty and Risk. Journal of Market Access & Health Policy, 12(3), 199-208. https://doi.org/10.3390/jmahp12030016