I4.0I: A New Way to Rank How Involved a Company Is in the Industry 4.0 Era

Abstract

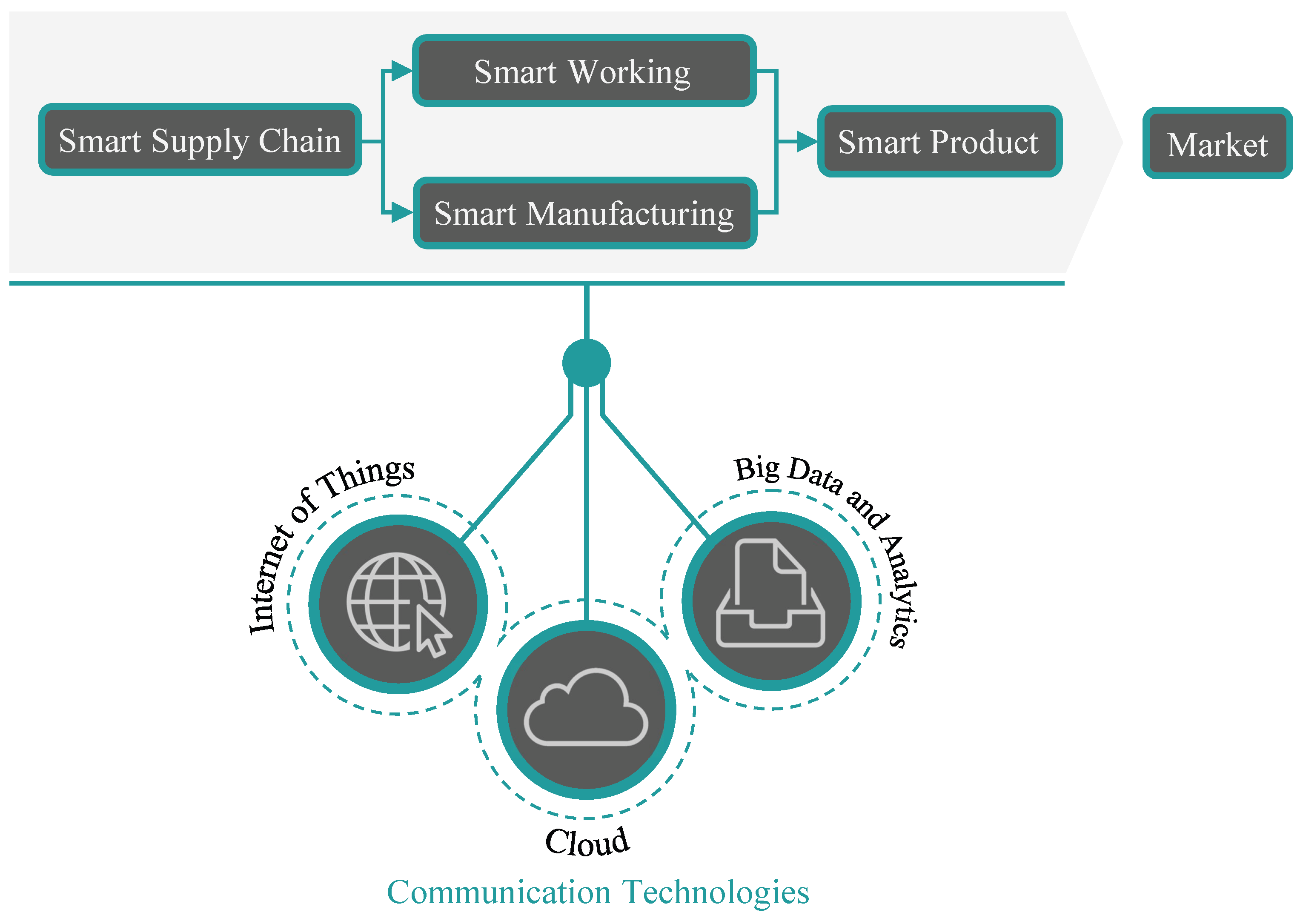

1. Introduction

- Presenting an overview of the Industry 4.0 technologies, as well as analyzing each one of them and their role in smart manufacturing;

- Allowing companies to measure how many of the I4.0 technologies they had already implemented and to rank them;

- Enabling a better competitiveness between I4.0-driven factories, encouraging economic and technological growth worldwide.

2. Related Work

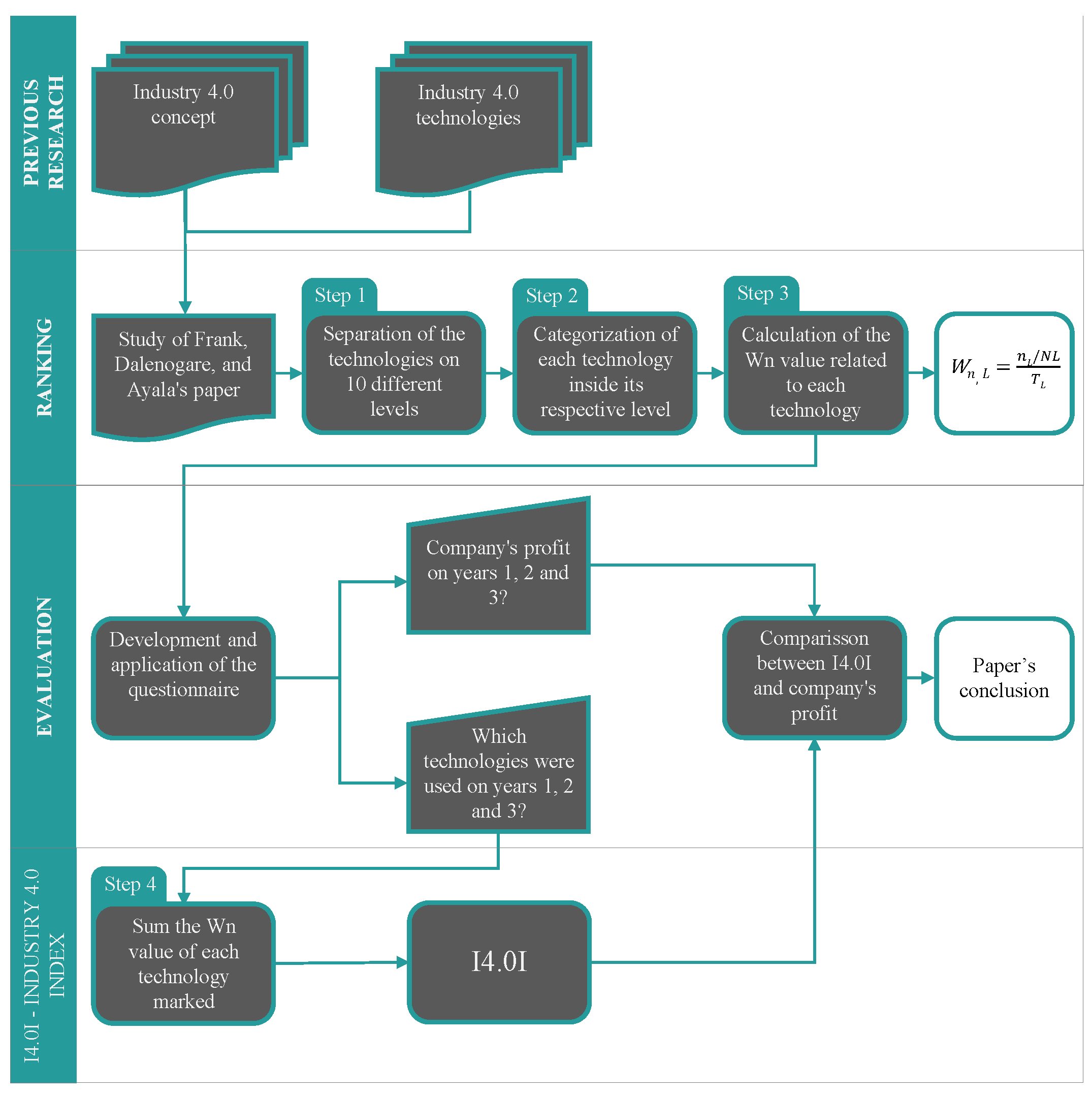

3. I4.0I Proposal—Industry 4.0 Index

3.1. Industry 4.0 Technologies: An Overview

3.2. Design Decisions

3.3. Methodology

3.3.1. Step 1: Categorization of the Technologies in Levels

3.3.2. Step 2: Ranking Each Technology Inside Its Level

3.3.3. Step 3: Computing Each Technology’s Value

- L = technology’s level;

- nL: position of the technology inside its own level;

- Wn,L: technology’s truth value related to its n number;

- NL: total number of technologies on the respective level;

- Technology A:

- Technology B:

- Technology C:

- Technology D:

3.3.4. Step 4: Generating the Final Value for I4.0I

4. Modeling the Experiments

- Profit’s growth rates (PGR):

- I4.0I’s growth rates (IGR):

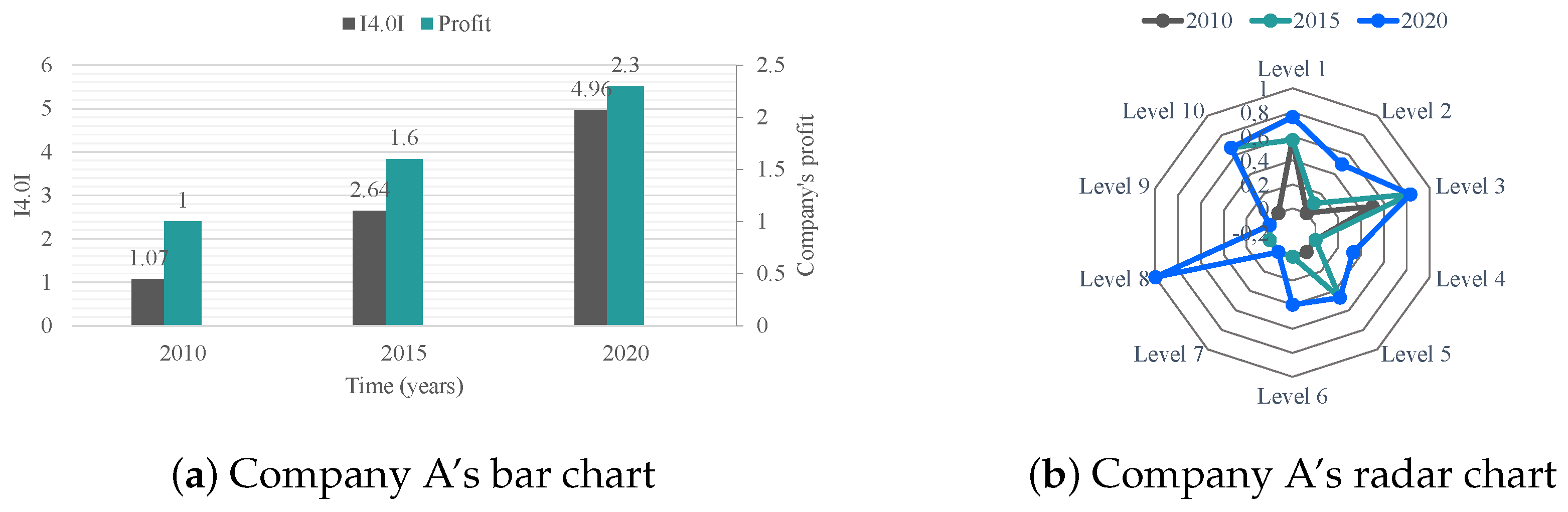

5. Case Study

- Profit’s growth rates (PGR):

- I4.0I’s growth rates (IGR):

6. Results

- With Company B’s data, the IGR2015–2010 was smaller than the PGR2015–2010, but in the next five years, the I4.0I grew at a rate of about 38% faster than the profit.

- Company C’s I4.0I growth rates were approximately the same as the profits in all periods analyzed, with a range of .

7. Discussion

8. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Liao, Y.; Deschamps, F.; de Freitas Rocha Loures, E.; Ramos, L.F.P. Past, present and future of Industry 4.0—A systematic literature review and research agenda proposal. Int. J. Prod. Res. 2017, 55, 3609–3629. [Google Scholar] [CrossRef]

- Chiarello, F.; Trivelli, L.; Bonaccorsi, A.; Fantoni, G. Extracting and mapping industry 4.0 technologies using wikipedia. Comput. Ind. 2018, 100, 244–257. [Google Scholar] [CrossRef]

- Kagermann, H.; Helbig, J.; Hellinger, A.; Wahlster, W. Recommendations for Implementing the Strategic Initiative INDUSTRIE 4.0: Securing the Future of German Manufacturing Industry; Final Report of the Industrie 4.0 Working Group; Technical Report; Acatech—National Academy of Science and Engineering: Munich, Germany, 2013. [Google Scholar]

- Reif, R.; Jackson, S.; Liveris, A. Report To The President Accelerating U.S. Advanced Manufacturing; Technical Report; President’s Council of Advisors on Science and Technology (PCAST): Washington, DC, USA, 2014. [Google Scholar]

- State Council of People Republic of China. Building a World Manufacturing Power—Premier and ‘Made in China 2025’ Strategy; Technical Report; Institute for Security & Development Policy: Beijing, China, 2017. [Google Scholar]

- Gouvernement de La République Française. The New Face of Industry in France: Building the Industry of the Future; Technical Report; Ministère du Redressement Productif: Paris, France, 2016. [Google Scholar]

- Rupp, M.; Schneckenburger, M.; Merkel, M.; Börret, R.; Harrison, D.K. Industry 4.0: A Technological-Oriented Definition Based on Bibliometric Analysis and Literature Review. J. Open Innov. 2021, 7, 68. [Google Scholar] [CrossRef]

- Wang, S.; Wan, J.; Li, D.; Zhang, C. Implementing Smart Factory of Industrie 4.0: An Outlook. Int. J. Distrib. Sens. Netw. 2016, 12, 3159805. [Google Scholar] [CrossRef]

- Stock, T.; Obenaus, M.; Kunz, S.; Kohl, H. Industry 4.0 as enabler for a sustainable development: A qualitative assessment of its ecological and social potential. Process. Saf. Environ. Prot. 2018, 118, 254–267. [Google Scholar] [CrossRef]

- Frank, A.; Dalenogare, L.; Ayala, N. Industry 4.0 technologies: Implementation patterns in manufacturing companies. Int. J. Prod. Econ. 2019, 210, 15–26. [Google Scholar] [CrossRef]

- Telukdarie, A.; Buhulaiga, E.; Bag, S.; Gupta, S.; Luo, Z. Industry 4.0 implementation for multinationals. Process. Saf. Environ. Prot. 2018, 118, 316–329. [Google Scholar] [CrossRef]

- El-Tamimi, A.M. Evaluation of the Implementation of Business Practices and Advanced Manufacturing Technology (AMT) in Saudi Industry. J. King Saud Univ. 2010, 22, 139–151. [Google Scholar] [CrossRef]

- Zahraee, S.M.; Rohani, J.M.; Wong, K.Y. Application of computer simulation experiment and response surface methodology for productivity improvement in a continuous production line: Case study. J. King Saud Univ. 2018, 30, 207–217. [Google Scholar] [CrossRef]

- Singh, S.; Singhal, S. Implementation and analysis of the clustering process in the enhancement of manufacturing productivity. J. King Saud Univ. 2020, 33, 482–490. [Google Scholar] [CrossRef]

- Rübel, S.; Emrich, A.; Klein, S.; Loos, P. A Maturity Model for Business Model Management in Industry 4.0. In Proceedings of the Multikonferenz Wirtschaftsinformatik 2018, Data driven X; Turning Data into Value. Multikonferenz Wirtschaftsinformatik (MKWI-2018), Lüneburg, Germany, 6–9 March 2018; Drews, P., Funk, B., Niemeyer, P., Xie, L., Eds.; Leuphana Universität Lüneburg: Lüneburg, Germany; Number 5, pp. 2031–2042. [Google Scholar]

- Ganzarain, J.; Errasti, N. Three stage maturity model in SME’s toward industry 4.0. J. Ind. Eng. Manag. 2016, 9, 1119–1128. [Google Scholar] [CrossRef]

- Westermann, T.; Dumitrescu, R. Maturity Model-Based Planning Of Cyber-Physical Systems In The Machinery And Plant Engineering Industry. In Proceedings of the Ds 92: Proceedings of the design 2018 15th International Design Conference, Dubrovnik, Croatia, 21–24 May 2018; pp. 3041–3052. [Google Scholar] [CrossRef]

- Leyh, C.; Bley, K.; Schäffer, T.; Forstenhäusler, S. SIMMI 4.0—A maturity model for classifying the enterprise-wide it and software landscape focusing on Industry 4.0. In Proceedings of the 2016 Federated Conference on Computer Science and Information Systems (FedCSIS), Gdansk, Poland, 11–14 September 2016; pp. 1297–1302. [Google Scholar] [CrossRef]

- De Carolis, A.; Macchi, M.; Kulvatunyou, B.; Brundage, M.; Terzi, S. Maturity Models and Tools for Enabling Smart Manufacturing Systems: Comparison and Reflections for Future Developments. In Product Lifecycle Management and the Industry of the Future; Rios, J., Bernard, A., Bouras, A., Foufou, S., Eds.; Springer International Publishing: Berlin/Heidelberg, Germany, 2017; pp. 23–35. [Google Scholar]

- Schumacher, A.; Erol, S.; Sihn, W. A Maturity Model for Assessing Industry 4.0 Readiness and Maturity of Manufacturing Enterprises. Procedia CIRP 2016, 52, 161–166. [Google Scholar] [CrossRef]

- Koska, A.; Goksu, N.; Erdem, M.; Fettahlioglu, H. Measuring the Maturity of a Factory for Industry 4.0. Int. J. Acad. Res. Bus. Soc. Sci. 2017, 7, 52–60. [Google Scholar] [CrossRef]

- Schuh, G.; Anderl, R.; Gausemeier, J.; Hompel, M.; Wahlster, W. Industrie 4.0 Maturity Index: Managing the Digital Transformation of Companies; ACATECH Studie; Utz Verlag GmbH: Munich, Germany, 2017. [Google Scholar]

- Lichtblau, K.; Stich, V.; Bertenrath, R.; Blum, M.; Bleider, M.; Millack, A.; Schmitt, K.; Schmitz, E.; Schroter, M. IMPULS—Industrie 4.0-Readiness; Technical Report; VDMA Impuls-Stiftung: Frankfurt, Germany, 2015. [Google Scholar]

- Ustundag, A.; Cevikcan, E. Industry 4.0: Managing The Digital Transformation; Springer Series in Advanced Manufacturing; Springer: Berlin/Heidelberg, Germany, 2018. [Google Scholar] [CrossRef]

- Hajoary, P.K. Industry 4.0 Maturity and Readiness- A case of a Steel Manufacturing Organization. Proc. Comput. Sci. 2023, 217, 614–619. [Google Scholar] [CrossRef]

- Shafik, M.; Case, K. Systematic Literature Review of SME Industry 4.0 Readiness Models. In Proceedings of the Advances in Manufacturing Technology XXXV: Proceedings of the 19th International Conference in Manufacturing Research, Incorporating the 36th National Conference in Manufacturing Research, Derby, UK, 6–8 September 2022. [Google Scholar]

- Popkova, E.; Ragulina, Y.; Bogoviz, A. Industry 4.0: Industrial Revolution of the 21st Century; Studies in Systems, Decision and Control; Springer International Publishing: Berlin/Heidelberg, Germany, 2018. [Google Scholar]

- Velásquez, N.; Estevez, E.; Pesado, P. Methodological Framework Based on Digital Technologies for the Implementation of Industry 4.0 in SMEs. In Proceedings of the 2019 Sixth International Conference on eDemocracy eGovernment (ICEDEG), Quito, Ecuador, 24–26 April 2019; pp. 371–374. [Google Scholar] [CrossRef]

- Jeschke, S.; Brecher, C.; Meisen, T.; Ozdemir, D.; Eschert, T. Industrial Internet of Things and Cyber Manufacturing Systems; Springer International Publishing: Berlin/Heidelberg, Germany, 2017; pp. 3–19. [Google Scholar] [CrossRef]

- Zhong, R.; Dai, Q.; Qu, T.; Hu, G.; Huang, G. RFID-enabled real-time manufacturing execution system for mass-customization production. Robot. -Comput.-Integr. Manuf. 2013, 29, 283–292. [Google Scholar] [CrossRef]

- Blanc, P.; Demongodin, I.; Castagna, P. A holonic approach for manufacturing execution system design: An industrial application. Eng. Appl. Artif. Intell. 2008, 21, 315–330. [Google Scholar] [CrossRef]

- Gilchrist, A. Industry 4.0: The Industrial Internet of Things; Springer International Publishing: Berlin/Heidelberg, Germany, 2016. [Google Scholar] [CrossRef]

- Shrouf, F.; Ordieres, J.; Miragliotta, G. Smart factories in Industry 4.0: A review of the concept and of energy management approached in production based on the Internet of Things paradigm. In Proceedings of the 2014 IEEE International Conference on Industrial Engineering and Engineering Management, Selangor, Malaysia, 9–12 December 2014; pp. 697–701. [Google Scholar] [CrossRef]

- Bahrin, M.; Othman, M.; Azli, N.; Talib, M. Industry 4.0: A review on industrial automation and robotic. J. Teknol. 2016, 78, 137–143. [Google Scholar] [CrossRef]

- Tao, F.; Qi, Q.; Liu, A.; Kusiak, A. Data-driven smart manufacturing. J. Manuf. Syst. 2018, 48, 157–169. [Google Scholar] [CrossRef]

- Mortensen, S.; Madsen, O. A Virtual Commissioning Learning Platform. Proc. Manuf. 2018, 23, 93–98. [Google Scholar] [CrossRef]

- Weller, C.; Kleer, R.; Piller, F. Economic implications of 3D printing: Market structure models in light of additive manufacturing revisited. Int. J. Prod. Econ. 2015, 164, 43–56. [Google Scholar] [CrossRef]

- Porter, M.; Heppelmann, J. How Smart, Connected Products Are Transforming Companies. Harv. Bus. Rev. 2015, 93, 53–71. [Google Scholar]

- Scurati, G.; Gattullo, M.; Fiorentino, M.; Ferrise, F.; Bordegoni, M.; Uva, A. Converting maintenance actions into standard symbols for Augmented Reality applications in Industry 4.0. Comput. Ind. 2018, 98, 68–79. [Google Scholar] [CrossRef]

- Gorecky, D.; Khamis, M.; Mura, K. Introduction and establishment of virtual training in the factory of the future. Int. J. Comput. Integr. Manuf. 2017, 30, 182–190. [Google Scholar] [CrossRef]

- Abdel-Basset, M.; Manogaran, G.; Mohamed, M. Internet of Things (IoT) and its impact on supply chain: A framework for building smart, secure and efficient systems. Future Gener. Comput. Syst. 2018, 86, 614–628. [Google Scholar] [CrossRef]

- Yu, C.; Xu, X.; Lu, Y. Computer-Integrated Manufacturing, Cyber-Physical Systems and Cloud Manufacturing – Concepts and relationships. Manuf. Lett. 2015, 6, 5–9. [Google Scholar] [CrossRef]

- Lu, Y. Industry 4.0: A survey on technologies, applications and open research issues. J. Ind. Inf. Integr. 2017, 6, 1–10. [Google Scholar] [CrossRef]

- Segovia, V.R.; Theorin, A. History of Control History of PLC and DCS; University of Lund: Lund, Switzerland, 2012. [Google Scholar]

- Schütze, A.; Helwig, N.; Schneider, T. Sensors 4.0—Smart sensors and measurement technology enable Industry 4.0. J. Sensors Sens. Syst. 2018, 7, 359–371. [Google Scholar] [CrossRef]

- Ujvarosi, A. Evolution of SCADA Systems. Bull. Transilv. Univ. Bras. 2016, 9, 63–68. [Google Scholar]

- Jacobs, F.R.; Weston, F.T. Enterprise resource planning (ERP)—A brief history. J. Oper. Manag. 2007, 25, 357–363. [Google Scholar] [CrossRef]

- Kumar, N. The Evolution of M2M Technology—From M2M to IoT; Plasma Business Intelligence: Irving, TX, USA, 2018. [Google Scholar]

- Gasparetto, A.; Scalera, L. A Brief History of Industrial Robotics in the 20th Century. Adv. Hist. Stud. 2019, 08, 24–35. [Google Scholar] [CrossRef]

- Bryson, S.; Kenwright, D.; Cox, M.; Ellsworth, D.; Haimes, R. Visually Exploring Gigabyte Data Sets in Real Time. Commun. ACM 1999, 42, 82–90. [Google Scholar] [CrossRef]

- Schiuma, G.; Schettini, E.; Santarsiero, F. How Wise Companies Drive Digital Transformation. J. Open Innov. 2021, 7, 122. [Google Scholar] [CrossRef]

- Heras-Saizarbitoria, I.; Dick, G.; Casadesus, M. ISO 9000 registration’s impact on sales and profitability A longitudinal analysis of performance before and after accreditation. Int. J. Qual. Reliab. Manag. 2002, 19, 774–791. [Google Scholar] [CrossRef]

| Model Name [Source] | Dimensions Analyzed by the Model to Determine the Maturity Level | Industry 4.0 Maturity Levels |

|---|---|---|

| A Maturity Model for Business Model Management in Industry 4.0 [15] | - Customer segment - Value proposition - Channels - Customer relationship - Source of income - Key resources - Key activities - Key partners - Cost structure | - Implicit - Defined - Validated/standardized - Analyzed - Optimized |

| Three Stage Maturity Model in SME’s Towards Industry 4.0 [16] | The analyzed dimensions are not well-explained | - Initial - Managed - Defined - Transform - Detailed business model |

| Maturity Model-Based Planning Of Cyber-Physical Systems In The Machinery And Plant Engineering Industry [17] | - Vertical integration - Horizontal integration - Connectivity - Network connection - Security | - Communication and analysis - Interpretation and service - Adaption and optimization - Cooperation |

| SIMMI 4.0 – A Maturity Model for Classifying the Enterprise-wide IT and Software Landscape Focusing on Industry 4.0 [18] | - Vertical integration - Horizontal integration - Digital product development - Cross-sectional technology criteria | - Basic digitization - Cross-departmental digitization - Horizontal and vertical digitization - Full digitization - Optimized full digitization |

| DREAMY Digital REadiness Assessment MaturitY [19] | - Design and engineering - Production management - Quality management - Maintenance management - Logistics management | - Initial - Managed - Defined - Integrated and interoperable - Digital-oriented |

| A maturity model for assessing Industry 4.0 readiness and maturity of manufacturing enterprises [20] | - Strategy - Leadership - Customers - Products - Operations - Culture - People - Governance - Technology | Defines five generic levels, where the first level defines a lack of attributes of Industry 4.0 and the last level is the state of the art. |

| Measuring the Maturity of a Factory for Industry 4.0 [21] | - Product development - Technology - Production management - Production monitoring - Material and inventory - Management of stock - Quality Assurance - Product life cycle management (PLM) - Selection of Toyota production system (TPS) - Green and lean production structure (GALP) | The result is given by a number between 1 and 5, whereby, the bigger the value, bigger is the maturity level. |

| Industrie 4.0 Maturity Index (Acatech Study) [22] | - Resources - Information systems - Culture - Organizational structure | - Computerization - Connectivity - Visibility - Transparency - Predictive capacity - Adaptability |

| IMPULS—Industrie 4.0 Readiness [23] | - Employees - Strategy and organization - Smart factory - Smart operations - Smart products - Data-driven services | - Outsider - Beginner - Intermediate - Experienced - Expert - Top performer |

| Category | Technology (Source) | Description |

|---|---|---|

| Smart manufacturing | Sensors [22,29] | Device that detects or measures a physical property and registers, indicates, or responds to it. |

| Actuators [22,29] | Device that transforms a control signal (electrical) into a mechanical action. | |

| Programmable logic controllers (PLC) [22,29] | Robust computers used for industrial automation, which automate a specific process, function or production line. | |

| Supervisory control and data acquisition (SCADA) [10,30,31] | System for collecting and analyzing data in real time used to monitor and control a plant or equipment in industries. | |

| Manufacturing execution systems (MES) [10,30,31] | Set of tools (software and hardware) that confront what was planned and what is actually being executed. | |

| Enterprise resource planning (ERP) [8] | Software platform developed to interconnect several departments of a company, enabling the automation and storage of all information. | |

| Energy monitoring [3,32] | Hardware and software that connect to energy resources to provide information on energy consumption. | |

| Energy improvement [3,33] | Use of data obtained at the factory to improve energy consumption through intelligent systems. | |

| Traceability of final products [8,10] | Possibility to track finished products inside and outside the factory by placing sensors. | |

| Traceability of raw materials [10] | Possibility to track raw materials inside and outside the factory by placing sensors. | |

| Automatic nonconformities identification [10,34] | Automatic identification of nonconformities in production. | |

| Industrial robots [32] | Use of automatic and reprogrammable robots in manufacturing systems. | |

| Machine-to-machine (M2M) communication [32] | Wired or wireless network configuration that allows devices of the same type and capacity to communicate and self-organize freely. | |

| AI for production [32] | Artificial intelligence techniques applied to the improvement of production and assistance in considering last minute orders. | |

| AI for maintenance [35] | Artificial intelligence techniques used to predict and diagnose failures, classifying the type and recommending maintenance actions. | |

| Virtual commissioning [36] | Using a virtual plant model and real PLCs, it allows a complete simulation of manufacturing processes for authentication. | |

| Additive manufacturing [37] | It allows product customization using digital models and 3D printing without major manufacturing penalties. | |

| Smart products | Flexible lines [8] | Reconfigurable manufacturing, where machines self-organize and adapt to different types of products. |

| Passive smart products [38] | Products capable of monitoring their condition and reporting to the company. | |

| Active smart products [38] | Products with self-optimization capabilities based on data acquisition and remote-control capabilities. | |

| Autonomous smart products [38] | Products that learn, adapt, and operate on their own. | |

| Smart working | Remote monitoring [34] | It allows workers to monitor production, see problems, and give instructions even when outside the factory. |

| Collaborative robots [34] | Use of robots capable of interacting with human beings, assisting them in manufacturing. | |

| Smart working | Remote operation [34] | Ability to operate a system or machines remotely. |

| Augmented reality [39,40] | Use of virtual objects layers in a real environment to aid in maintenance and training. | |

| Virtual reality [39,40] | Use of a totally virtual environment to aid in maintenance and training. | |

| Smart supply chain | Digital platform with other companies’ units [10,41] | Use of an electronic form for interaction and exchange of materials between the company and its other units. |

| Digital platform with suppliers [10,41] | Use of an electronic means for interaction and exchange of materials between the company and its suppliers. | |

| Digital platform with customers [10,41] | Use of an electronic means for interaction and exchange of materials between the company and its customers. | |

| Communication technologies | Internet of things (IoT) [35] | Wireless interconnection of devices (sensors) via the internet, allowing them to receive and send data. |

| Cloud [35,42] | Internet service provider that can be accessed remotely, facilitating the integration of different devices and easy information sharing. | |

| Big data and analytics [38,43] | Use of advanced analytical techniques on very large and diverse data sets. |

| L | nL | Technology | Expected Market Investment | Time on the Market | Logical Analysis |

|---|---|---|---|---|---|

| 3 | 2 | Technology A | There is not enough information | Since BBBB | Technology A is required to obtain technology D. |

| 4 | Technology B | B’s profit > C’s profit | Since CCCC | No requirements. | |

| 3 | Technology C | C’s profit < B’s profit | Since AAAA | No requirements. | |

| 1 | Technology D | There is not enough information | There is not enough information | To obtain technology D, it is necessary to have technology A. |

| L | nL | Technology | Expected Market Investment | Time on the Market | Logical Analysis | Wn,L |

|---|---|---|---|---|---|---|

| 3 | 1 | Technology D | There is not enough information. | There is not enough information. | To obtain technology D, it is necessary to have technology A. | 0.1 |

| 2 | Technology A | There is not enough information. | Since BBBB | Technology A is required to obtain technology D. | 0.2 | |

| 3 | Technology C | C’s profit < B’s profit | Since AAAA | No requirements. | 0.3 | |

| 4 | Technology B | B’s profit > C’s profit | Since CCCC | No requirements. | 0.4 |

| L | nL | Technology | Wn,L |

|---|---|---|---|

| 1 | 1 | Sensors | 0.05 |

| 2 | Actuators | 0.10 | |

| 3 | PLC | 0.14 | |

| 4 | SCADA | 0.19 | |

| 5 | MES | 0.24 | |

| 6 | ERP | 0.29 | |

| 2 | 1 | Energy monitoring | 0.10 |

| 2 | Energy improvement | 0.20 | |

| 3 | Remote monitoring | 0.30 | |

| 4 | Internet of things | 0.40 | |

| 3 | 1 | Traceability of final products | 0.17 |

| 2 | Passive smart products | 0.33 | |

| 3 | Cloud | 0.50 | |

| 4 | 1 | Digital platform with other companies’ units | 0.33 |

| 2 | Traceability of raw materials | 0.67 | |

| 5 | 1 | Automatic nonconformities identification | 0.07 |

| 2 | Collaborative robots | 0.13 | |

| 3 | M2M communication | 0.20 | |

| 4 | Industrial robots | 0.27 | |

| 5 | Big data and analytics | 0.33 | |

| 6 | 1 | AI for production | 0.10 |

| 2 | AI for maintenance | 0.20 | |

| 3 | Virtual commissioning | 0.30 | |

| 4 | Active smart products | 0.40 | |

| 7 | 1 | Digital platform with suppliers | 0.33 |

| 2 | Remote operation | 0.67 | |

| 8 | 1 | Autonomous smart products | 1.00 |

| 9 | 1 | Digital platform with customers | 0.17 |

| 2 | Virtual reality | 0.33 | |

| 3 | Augmented reality | 0.50 | |

| 10 | 1 | Additive manufacturing | 0.33 |

| 2 | Flexible lines | 0.67 |

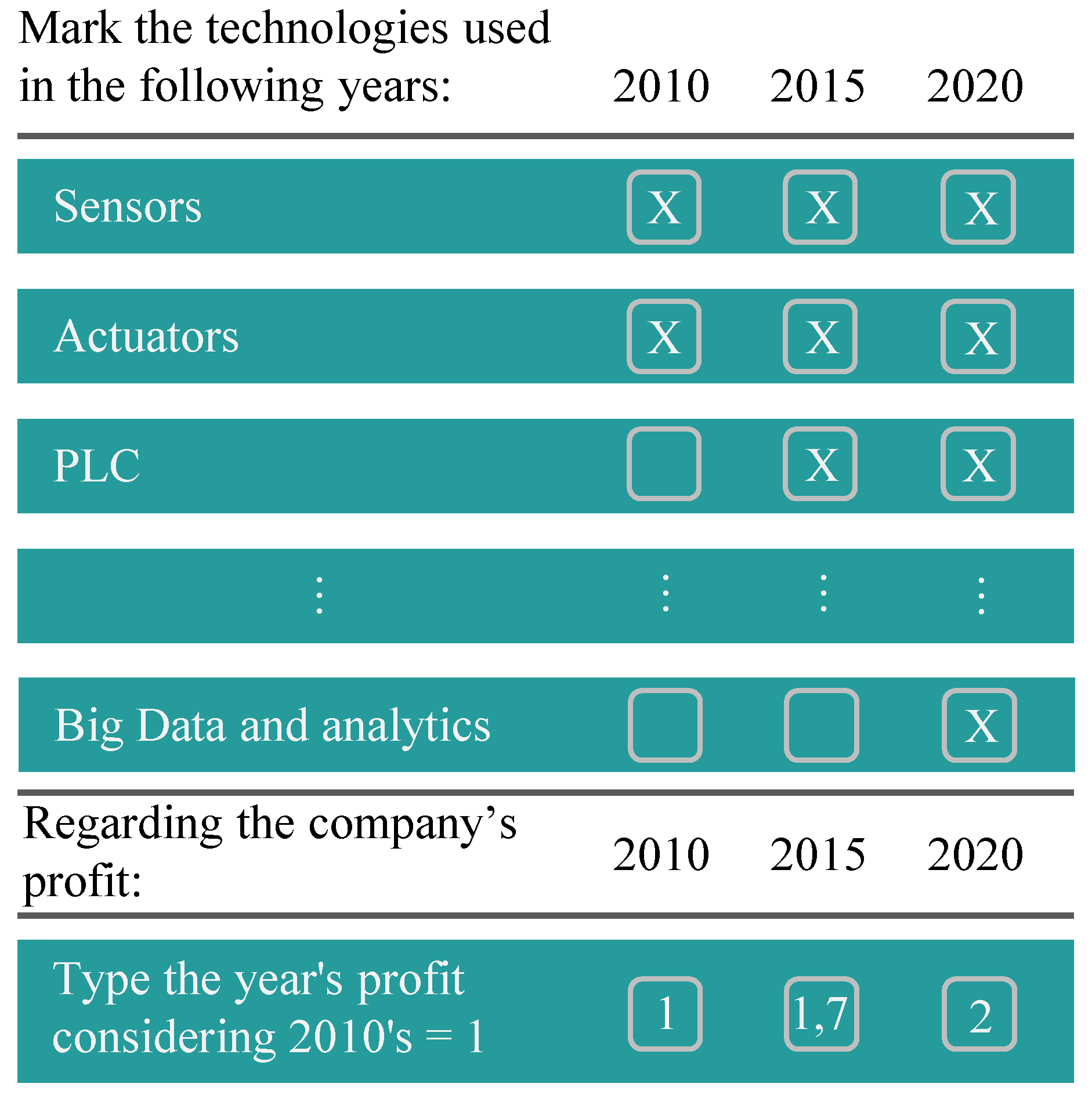

| Mark the technologies used in the following years: | |||

|---|---|---|---|

| Technology | 2010 | 2015 | 2020 |

| Sensors | X | X | X |

| Actuators | X | X | X |

| Programmable logic controllers (PLC) | X | X | X |

| Supervisory control and data acquisition (SCADA) | X | ||

| Manufacturing execution systems (MES) | |||

| Enterprise resource planning (ERP) | X | X | X |

| Energy monitoring | |||

| Energy improvement | |||

| Traceability of final products | |||

| Traceability of raw materials | |||

| Automatic nonconformities identification | |||

| Industrial Robots | X | X | |

| Machine-to-machine (M2M) communication | X | X | |

| AI for production | |||

| AI for maintenance | |||

| Virtual commissioning | |||

| Additive manufacturing | |||

| Flexible lines | X | X | |

| Passive smart products | X | X | |

| Active smart products | X | ||

| Autonomous smart products | X | ||

| Remote monitoring | |||

| Collaborative robots | |||

| Remote operation | |||

| Augmented reality | |||

| Virtual reality | |||

| Digital platform with other companies’ units | X | ||

| Digital platform with suppliers | |||

| Digital platform with customers | |||

| Technology | 2010 | 2015 | 2020 |

| Internet of things (IoT) | X | ||

| Cloud | X | X | X |

| Big data and analytics | |||

| Regarding the company’s profit: | 2010 | 2015 | 2020 |

| Type the year’s profit considering 2010 = 1 | 1 | 1.6 | 2.3 |

| 2010 | 2015 | 2020 | |

|---|---|---|---|

| I4.0I | 1.07 | 2.64 | 4.96 |

| Profit | 1 | 1.6 | 2.3 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zilli, V.F.B.; Paredes Crovato, C.D.; Righi, R.d.R.; Mejia, R.I.G.; Pesenti, G.; Singh, D. I4.0I: A New Way to Rank How Involved a Company Is in the Industry 4.0 Era. Future Internet 2023, 15, 73. https://doi.org/10.3390/fi15020073

Zilli VFB, Paredes Crovato CD, Righi RdR, Mejia RIG, Pesenti G, Singh D. I4.0I: A New Way to Rank How Involved a Company Is in the Industry 4.0 Era. Future Internet. 2023; 15(2):73. https://doi.org/10.3390/fi15020073

Chicago/Turabian StyleZilli, Vitória Francesca Biasibetti, Cesar David Paredes Crovato, Rodrigo da Rosa Righi, Rodrigo Ivan Goytia Mejia, Giovani Pesenti, and Dhananjay Singh. 2023. "I4.0I: A New Way to Rank How Involved a Company Is in the Industry 4.0 Era" Future Internet 15, no. 2: 73. https://doi.org/10.3390/fi15020073

APA StyleZilli, V. F. B., Paredes Crovato, C. D., Righi, R. d. R., Mejia, R. I. G., Pesenti, G., & Singh, D. (2023). I4.0I: A New Way to Rank How Involved a Company Is in the Industry 4.0 Era. Future Internet, 15(2), 73. https://doi.org/10.3390/fi15020073