Two-Factor Authentication Scheme for Mobile Money: A Review of Threat Models and Countermeasures

Abstract

1. Introduction

- Presents the concept of authentication and types of authentication factors.

- Presents an overview of the MMS architecture and mobile money access.

- Explains the authentication scheme for mobile money in Uganda.

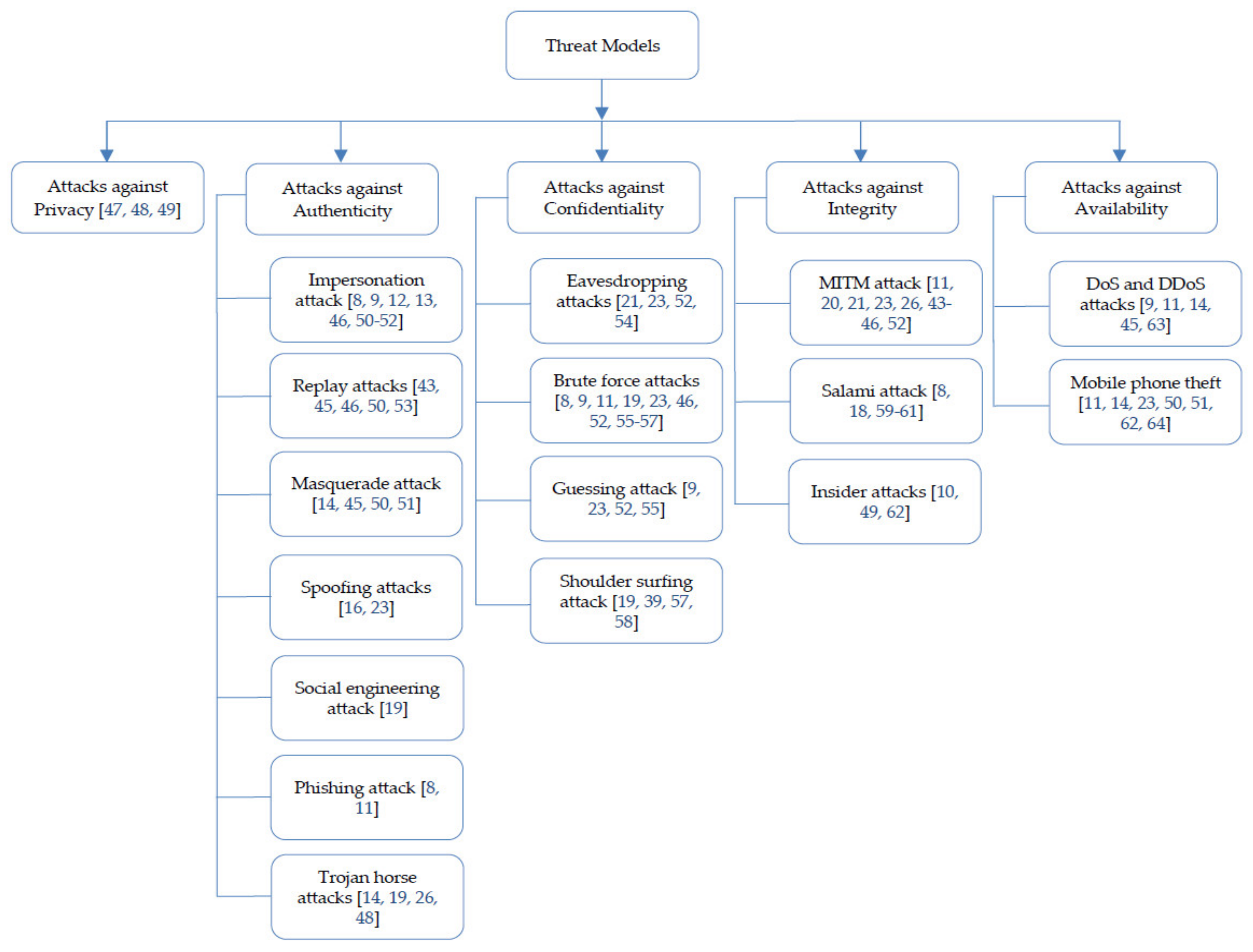

- Discusses the five categories of the threat models, namely, attacks against privacy, attacks against authentication, attacks against confidentiality, attacks against integrity, and attacks against availability.

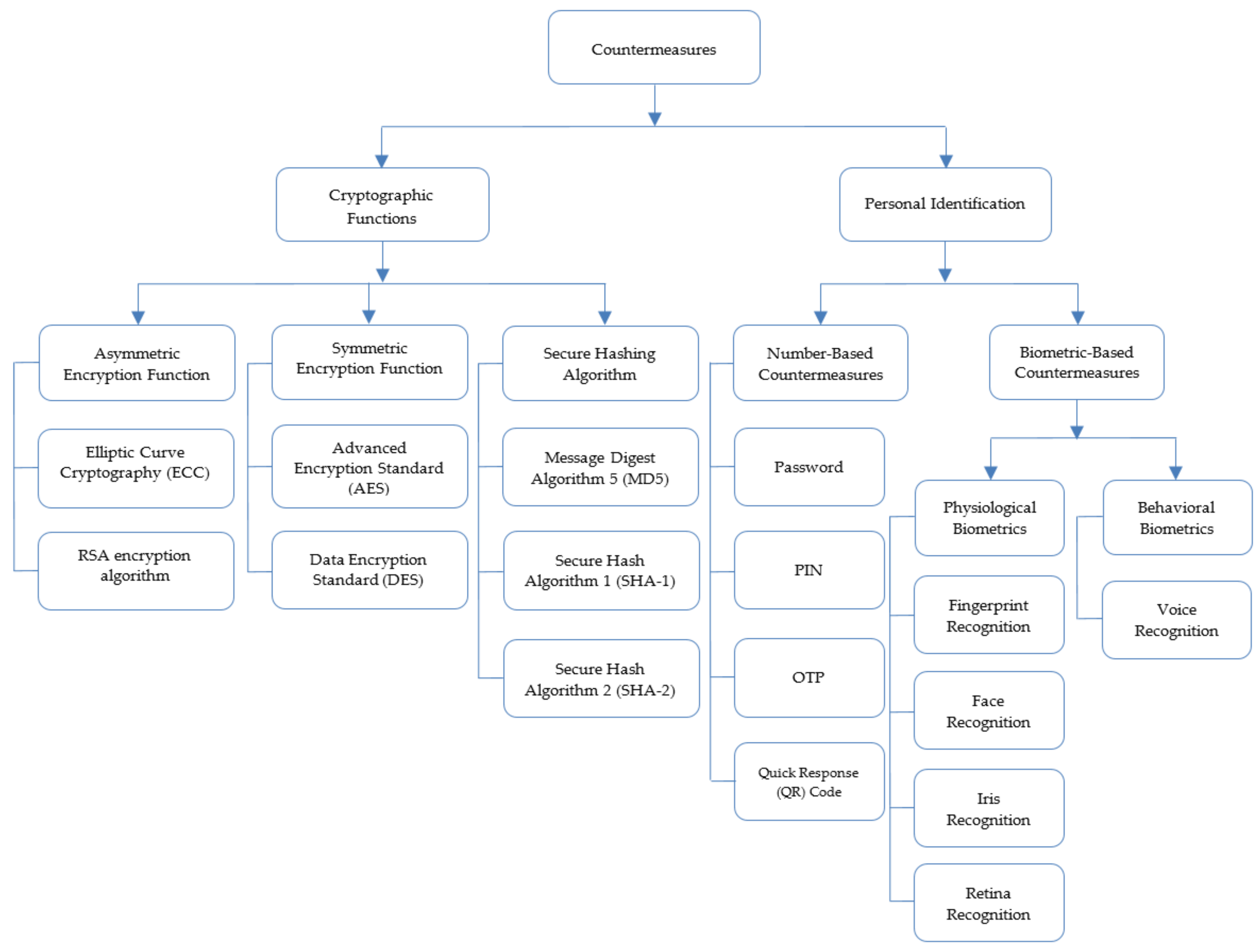

- Provide countermeasures for the threat models in mobile money’s 2FA scheme.

2. Related Work

2.1. Concept of Authentication

- ■

- Something you know (knowledge factor) such as a password, personal identification number (PIN), an answer to a security question.

- ■

- Something you have (ownership factor) such as security token, subscriber identity module (SIM) card, one-time password (OTP) token, employee access card.

- ■

- Something you are (biometric factor) such as biometric fingerprint, face, iris, retina, voice, gait, keystroke dynamics, gaze gestures, signature, deoxyribonucleic acid (DNA).

2.2. Types of Authentication Factors

- Single-Factor Authentication (SFA)Single-factor authentication was defined by Rouse [32] and Rahav [33] as the process via which a person seeking access requests an authenticating party to attest their personality by availing a single attribute linked to the identity, for example, the use of a PIN to unlock a phone. Many companies accepted SFA because it is simple and user-friendly [34]. However, this form of authentication cannot be applied to financial institutions and other relevant transactions because it is vulnerable to shoulder surfing attacks, brute force attacks, social engineering attacks, and impersonation attacks [33].

- Two-Factor Authentication (2FA)Two-factor authentication was defined by Rahav [33] as the process via which a person seeking access requests an authenticating party to attest their personality by availing two attributes such as something you know and either something you have or something you are that are linked to the identity. Mobile money authentication, for example, relies on 2FA. In 2FA, the attacker must have the two identifiers for access [33]. Nevertheless, the 2FA is susceptible to eavesdropping, MITM attack, and forgery or Trojan horse attack and is not fully effective against phishing [34].

- Multifactor Authentication (MFA)Rahav [33] defined MFA as the process via which a person seeking access requests an authenticating party to attest their personality by availing multiple identifiers such as something you know, something you have, and something you are that are linked to the identity to grant access. In MFA, three factors such as knowledge, ownership, and biometric are all used together during authentication [33]. Many computing devices and critical services are adopting MFA because it provides higher levels of security against the different attacks [34,35]. MFA becomes more successful when one of the authentication factors is separated physically from the device from which the client accesses the application or resource [36]. The use of biometrics in the MFA process helps to improve identity proof and has a profound effect on the security of the system [34,37].

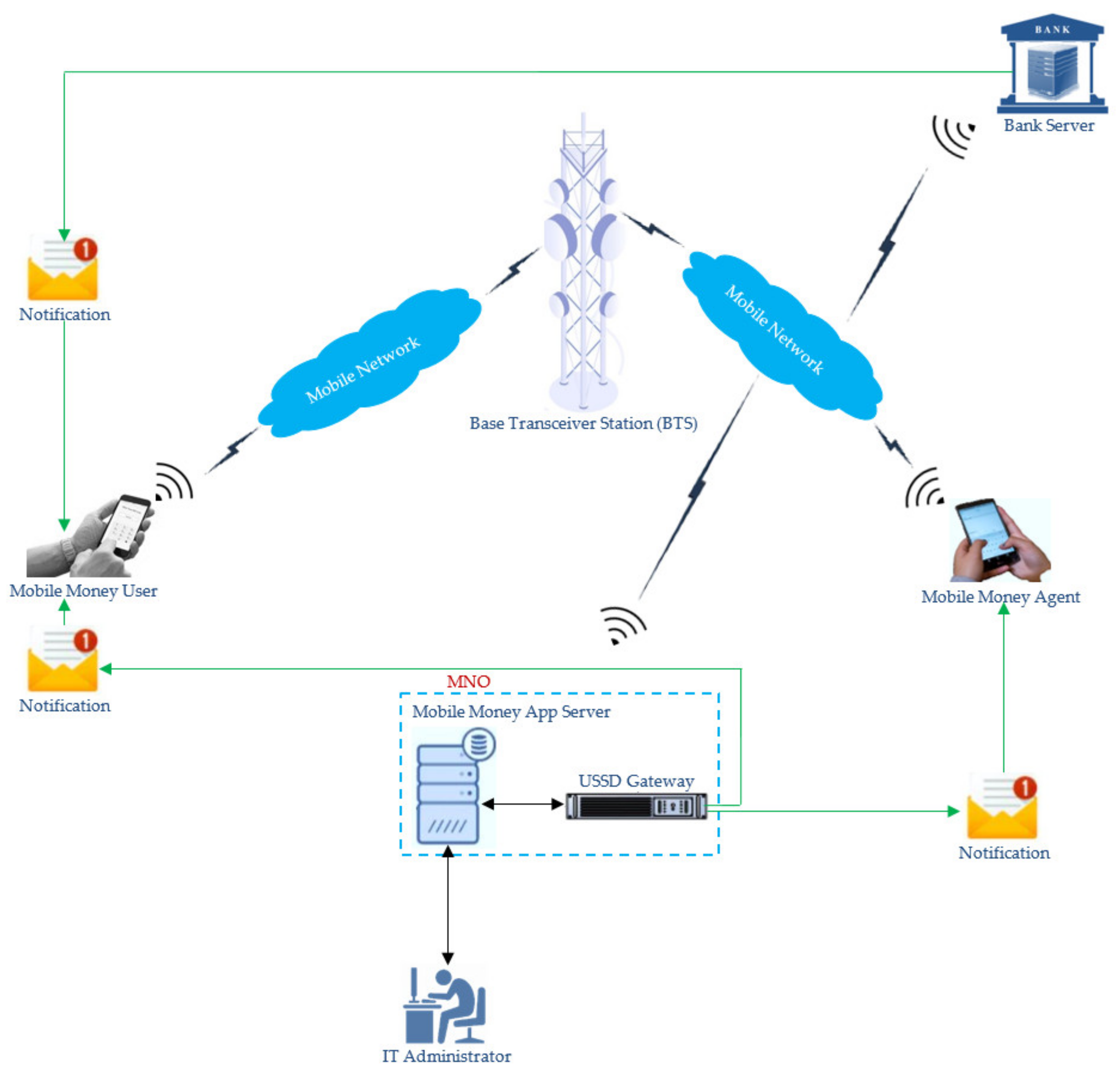

2.3. Mobile Money System Architecture

2.4. Mobile Money Access

- ○

- Unstructured Supplementary Services Data (USSD): This is a communications protocol used by mobile communication technology in mobile networks to send texts between mobile phones and an application program without internet access [21]. It is session-based and interactive, but much faster since it involves simple operations that are handset-independent [39]. All seven MMSPs in Uganda, namely, MTN Uganda, Airtel, UTL, Africell, M-Cash, Ezeey Money, and Micropay, work by initiating a session between the mobile phone and the server through dialling a USSD code, for example, by dialling *165# in MTN to display the mobile money menu, followed by a series of steps to accomplish a transaction [2]. There are two modes of USSD operations, namely, the mobile-initiated operation and the network-initiated operation [39].

- ○

- SIM Toolkit (STK): This is the portion of the GSM standard that enables the SIM to initiate activities to further exploit SMS by providing value-added services such as mobile banking [41]. GSMA [42] added that the STK is a set of applications that run on the SIM card and interact with the mobile device. Mobile operators use STK to present information about their services to subscribers [41]. The mobile money transaction is achieved when the mobile money platform breaks down the transaction into a series of logical steps by using STK and then reassembles the different steps into a complex statement, which is transmitted to the server via SMS [2].

- ○

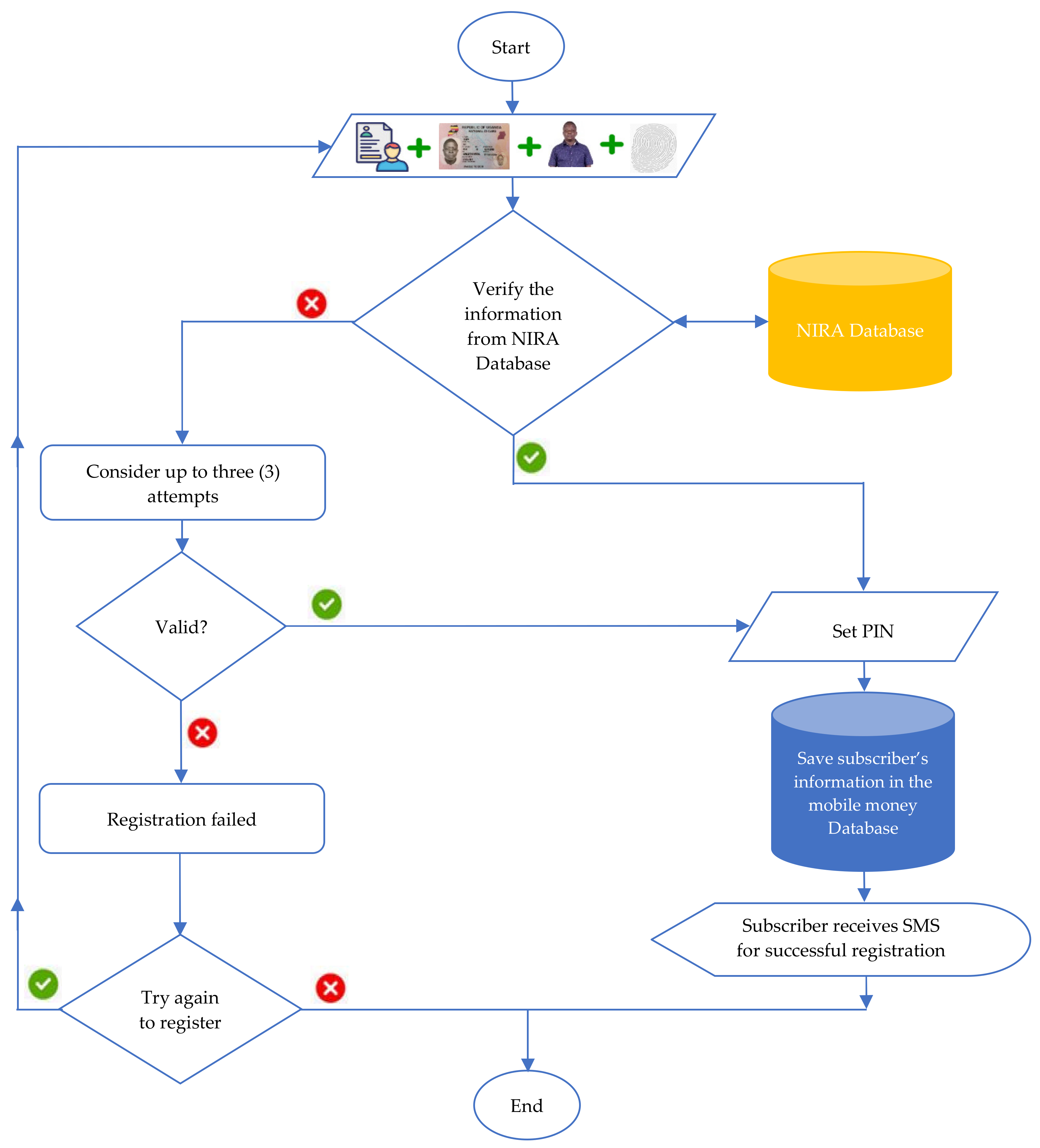

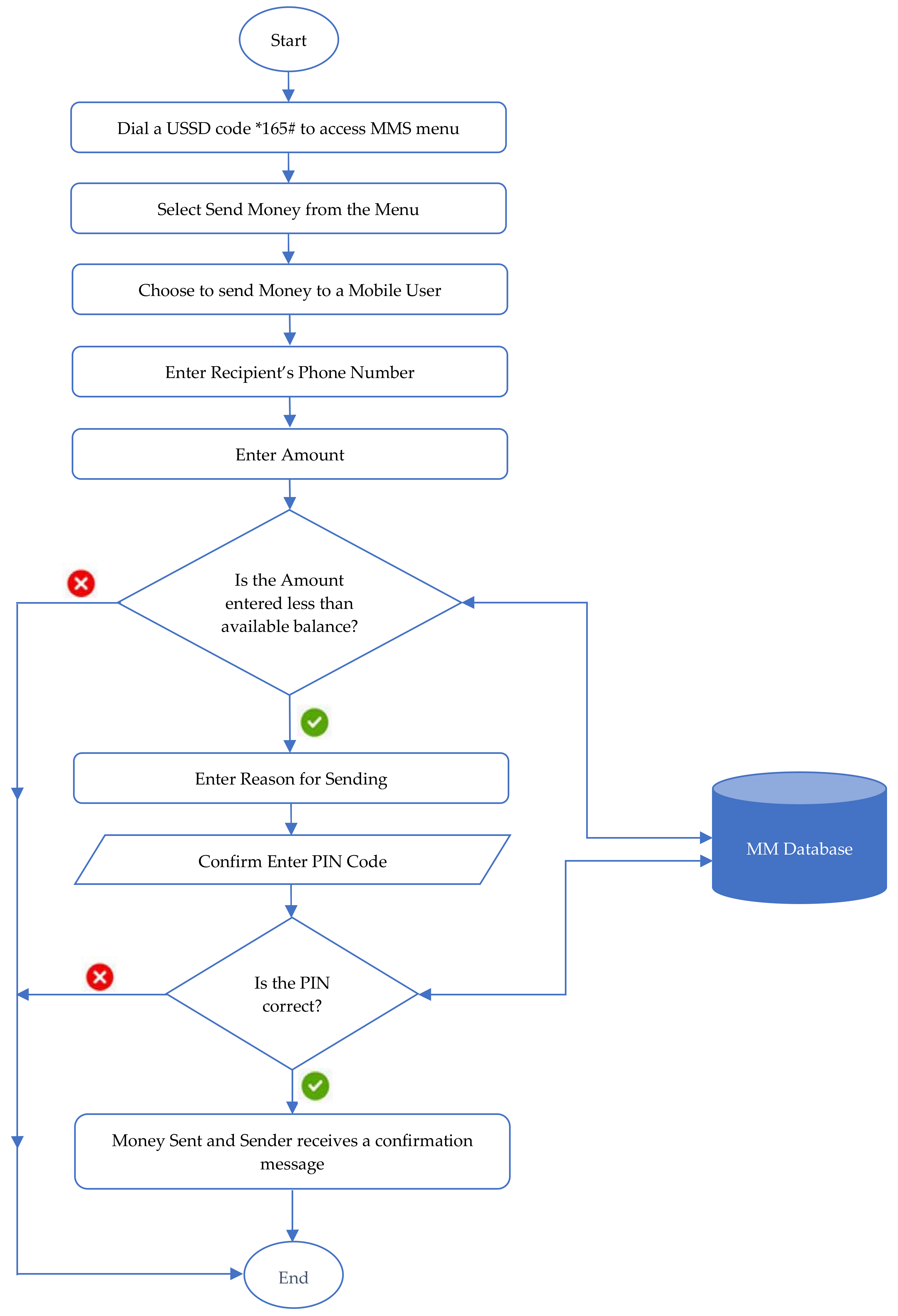

2.5. The Authentication Scheme for Mobile Money in Uganda

- The Enrolment PhaseThe enrolment phase involves obtaining subscriber’s details, including biodata, fingerprint, passport photo, national identification number (NIN) of the national ID, or valid passport and provisionally saving the information in the MNO’s mobile money database. The NIN or passport number is verified from the national identification and registration authority’s (NIRA) database. If the NIN matches with the one in the NIRA database, the subscriber is allowed to set the mobile money PIN. The subscriber’s information is updated and saved in the database, and a confirmation message is sent to the subscriber for successful mobile money registration. If the NIN or passport number provided by the subscriber does not exist in the NIRA database, they are allowed to retry three times. If all the three attempts fail, a confirmation message is sent to the subscriber to try again. Figure 2 shows the data flow diagram for the mobile money enrolment phase.

- The Authentication PhaseDuring the authentication phase, to send money to an MTN Uganda mobile user, the sender sticks to the following steps: (1) dial *165#, (2) select send money from the menu, (3) choose to send money to a mobile user, (4) enter recipient’s phone number, and (5) enter amount. The amount entered is compared with the available electronic balance in the sender’s account. If the amount is less than the amount entered, it terminates the transaction; otherwise, the sender continues. Then, (6) enter the reason for sending, and (7) confirm by entering the PIN Code. The application server then authenticates the PIN. If the PIN is correct, the money is sent, and (8) the sender receives a confirmation message; otherwise, they are allowed to retry for the maximum of three times. Note that the confirmation message contains details about the amount sent, the recipient’s name and phone number, the fee charged for sending the money, the reason for sending the money, the available balance in the sender’s account, and the transaction ID. Figure 3 shows the data flow diagram for a mobile money authentication phase.

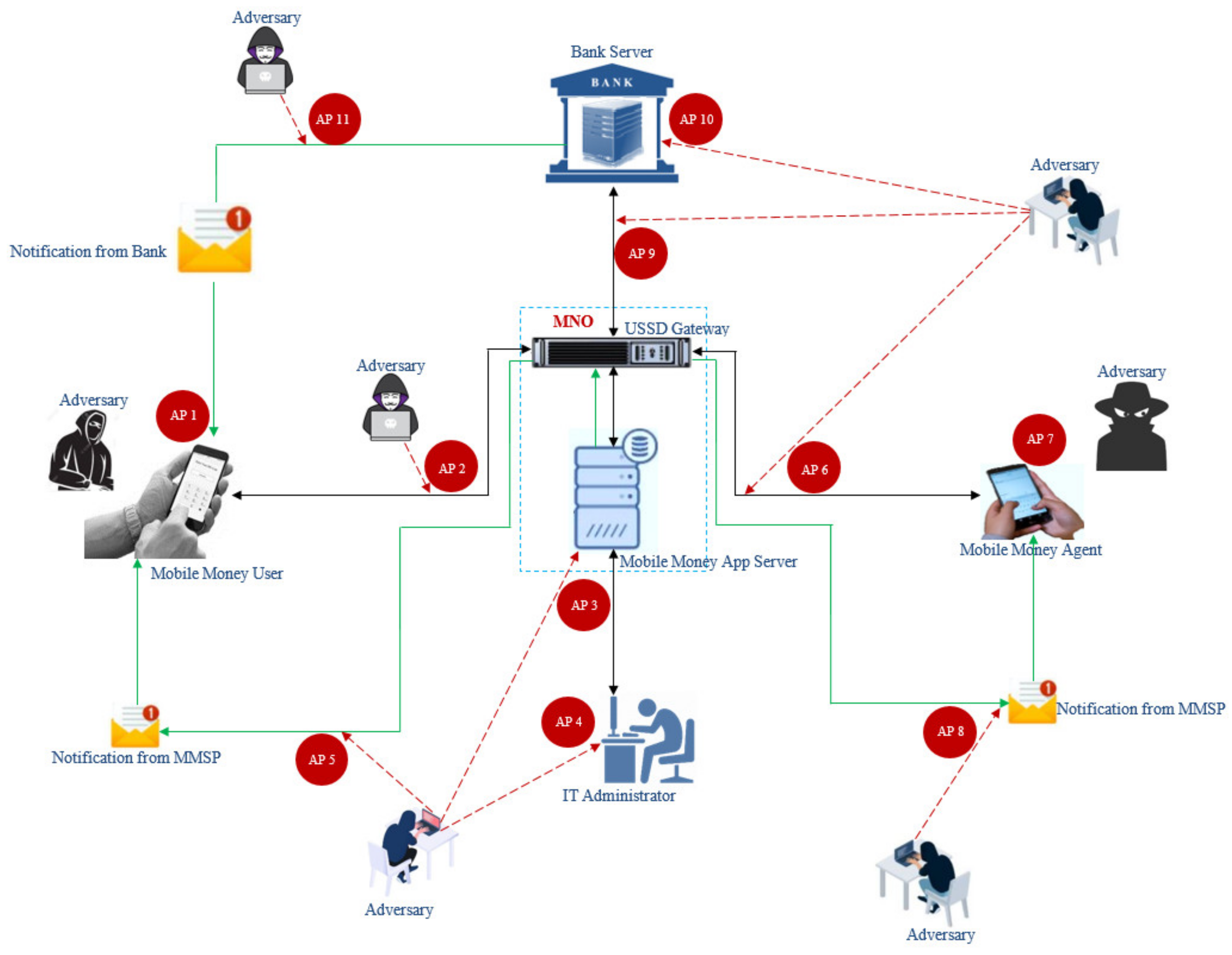

2.6. Various Attacks on Mobile Money System

- ■

- The attack on mobile money users, i.e., authentication attack at AP 1: The attacker gets access to the user’s PIN through shoulder surfing since the PIN used is only four or five digits long and is unmasked [39]. Once the attacker accesses the PIN, they can perform a fraudulent transaction. The attacker can also perform a brute force attack because of the simplicity of the PIN [11,23,44].

- ■

- ■

- The attack on the mobile money app server at AP 3: The adversary attacks the server and makes it unavailable to both mobile money users and agents. According to Castle et al. [11], attackers target mobile money servers and overwhelm them with fake traffic to block requests from mobile money users and agents. Attackers also install malware on the mobile money app server to deduct a small amount of money from the mobile money user’s and agent’s wallet and deposits it into the attacker’s account without them realising [18].

- ■

- The attack on IT administrator (AP 4): The intruder, insider, or unauthorised person can hack into the administrator’s computer and change the credentials so that the administrator cannot access the system.

- ■

- The attack on the mobile money agent (AP 7): The adversary uses a shoulder surfing technique to steal the agent’s commission PIN or gives the wrong PIN repeatedly when making a transaction to get access to the agents’ PIN. According to Buku and Mazer [12] and Lonie [13], the adversary gives the wrong mobile phone number repeatedly to get an agent’s PIN and uses the PIN to gain unauthorised access to the agent’s float account.

- ■

- The attack on the bank server (AP 10): The attacker makes the bank server unavailable to the mobile money user who wishes to transfer money from the bank account to the mobile money wallet through a denial-of-service attack.

- ■

2.7. Threat Models

2.7.1. Attacks against Privacy

2.7.2. Attacks against Authentication

- ✘

- Impersonation attacks: This is an attack where the adversary successfully assumes the identity of a legitimate mobile money user or agent to access either the MMS or the information and services of a registered user. People share their PINs among friends and families to perform transactions on their behalf. In case an attacker gets access to such a PIN, they can use it to log in to their mobile money accounts, perform fraudulent transactions, or change their PIN [8,9,12,13,46,50,51,52].

- ✘

- Replay attack: This is where an attacker eavesdrops on network communication between the mobile money user and MMS, intercepts the data packets that include the PIN, and then fraudulently delays or resends it to the recipient. This takes place in the form of eavesdropping on mobile communication, and mobile money platforms use SMS to notify mobile money users and agents. The SMS is protected using weak algorithms like the A5 and attackers with scanning software can easily intercept, modify, and resend them [45,46,50,53]. The attacker can misuse the previously exchanged messages between the mobile money user and MMSP to perform the replay attacks [43].

- ✘

- Masquerade attack: A masquerade attack is an attack where an adversary obtains the subscribers’ SIM card and PIN and uses them either to request money from legitimate user’s friends and relatives or to perform fraudulent transactions. This occurs when the attacker obtains the credentials of the authorised user through social engineering techniques and uses them to swap the SIM card. Furthermore, the adversary can also use fake documents to register the SIM cards of legitimate users and have full access to the mobile money account of the victims [14,45,50,51].

- ✘

- ✘

- Social engineering attack: This is the manipulation of people to reveal confidential information like mobile money PIN so that the attacker can gain control over the user’s mobile money account [19]. Mobile money platforms use PINs for securing mobile money accounts, which makes them vulnerable to many security threats, including social engineering attacks [19]. Attackers use social engineering techniques to circumvent mobile money’s 2FA scheme, compromise user accounts, and avoid fraud detection technologies [19].

- ✘

- Phishing attacks: This is a deceitful attempt by adversaries to obtain confidential information such as mobile money PINs from mobile money users and agents by impersonating employees of MMSP in electronic communication. Ali, Dida, and Sam [8] further expanded the definition as “a form of mobile money crime where fraudsters masquerade as employees of the MMSP by calling or sending SMS messages to mobile money users and agents to reveal their data including PINs for an update” (p. 18). Phishing starts when an adversary intercepts the network traffic between the mobile money user or agent and the mobile money application server and then uses a fraudulent call or message to lure the victim into revealing their credentials. The message is created to look as if it comes from the MMSP. Then, the victim is persuaded into providing the mobile money PIN to the fraudster [11].

- ✘

- Trojan horse attacks: A Trojan horse is malicious software that, once installed on a phone, either steals sensitive information and sends it to the attacker or creates a backdoor for the attacker to have access to the phone. It uses a Trojan horse program employed by hackers and adversaries to compromise the authentication system. Mobile money users and agents are tricked by some form of social engineering into loading and executing Trojans on their phones. Once activated, Trojans can enable hackers to spy on mobile money users and agents, steal their mobile money PINs, and gain backdoor access to their mobile money accounts [19,26,48]. Moreover, adversaries can install malware that gives them the exclusive right to redirect users to their network [14].

2.7.3. Attacks against Confidentiality

- Eavesdropping attacks: This is where an attacker secretly overhears information transmitted over the communication channel between the mobile money application server and mobile money user, the mobile money application server and mobile money agent, or the bank server and mobile money application server, without being authorised by the trusted parties. The attacker takes advantage of unsecured network communications to access sensitive information. This is common when the data transmitted over the communication channel are in plaintext [21,54]. Mtaho [52] observed that attackers use network sniffer software such as Wireshark to intercept data in transit. Furthermore, attackers also take advantage of weak encryption keys used and the weak secure sockets layer (SSL)/transport layer security (TLS) implementation, which gives them the opportunity to snoop the communication channel [23].

- Brute force attacks: This is where an adversary guesses the PIN of a mobile money user or agent to gain access to their mobile money account. It is a simple attack method and has a high success rate because MMS uses numeric PINs to authenticate users [8,9,11,23,46,52,55]. Kunda and Chishimba [19] also observed that, in authenticating users using a smartphone, when the PIN is entered several times, it might leave a greasy residue or scratches on the touch screen, which may make it easy for the attacker to guess. Brinzel, Anita, and Shraddha [56] and Aloul, Zahidi, and El-Hajj [57] concluded that using a PIN for authentication is vulnerable to a brute force attack.

- Shoulder Surfing attack: This is where an attacker obtains information such as PINs and other confidential data by looking over the victim’s shoulder while performing a mobile money transaction. Attackers take advantage of crowded places where mobile money agents operate and where mobile money users perform transactions. The mobile money PIN used for authenticating a user is simple and unmasked, thus making it easy for the attacker to see and memorise [19,39,57,58].

2.7.4. Attacks against Integrity

- ○

- MITM attack: This is an attack where the intruder intercepts communications between mobile money users and the MMS, between mobile money agents and MMS, between mobile money users and the bank, or between the MMS and the bank and becomes familiar with the messaging system, thereby transmitting fake data to either party. The attacker sits between mobile money users and the MMSP and makes them believe that they are communicating directly to each other, when in fact the adversary controls the entire conversation [11,46]. According to Mahajan, Saran, and Rajagopalan [44] and Reaves et al. [23], the attacker controls the traffic into the mobile money platform to manipulate the credentials of the user and to perform transactions on behalf of the victim. Likewise, the adversary can use a BTS with the same mobile network code as the subscriber’s real network to perform a MITM attack since the network authenticates users [26,43,45]. Furthermore, the information carried within the communication channel is in plaintext, thus making USSD data vulnerable to attack and redirection [20,21,52].

- ○

- Salami attack: This is where an employee of a financial institution installs a malware like a Trojan horse on the server hosting the application to withdraw a small amount of money from the subscribers’ accounts and deposit it into their account. The salami attack can be internal or external and difficult to notice since the malware modifies the data in financial systems and a small amount is deducted from the customers’ wallets [8,18,59,60,61].

- ○

- Insider attacks: This is where an employee of the MMSP who has enough information about the organisation’s security practices, MMS, and data attacks the mobile money application server or MMS. According to Trulioo [62] and Musuva-Kigen et al. [10], insiders and employees of the MMSP due to inside access facilitate most mobile money fraud. This has resulted in organisations losing huge amounts of money to the tune of billions of shillings because of employee fraud within the companies or institutions [10]. Additionally, Gilman and Joyce [49] and Trulioo [62] noted that less scrupulous employees abuse their privileges by accessing customer mobile money information and stealing money from customers’ wallets.

2.7.5. Attacks against Availability

- ○

- DoS and DDoS attacks: DoS attack is where attackers overwhelm mobile money server with fake traffic to block requests from legitimate users requesting to access the services. The DDoS attack, on the other hand, is a kind of attack where adversaries overwhelm the mobile money server from different sources, thus making it difficult to stop the attacks. The goal of DoS and DDoS attacks is to make mobile money services unavailable by flooding servers with an immense amount of data to make it busy and unable to provide services to legitimate users [11,45]. Additionally, when DoS and DDoS occur, mobile money agents, banks, and MMSPs lose money, and mobile money users cannot access their mobile wallet accounts [9,11,14,63].

- ○

- Mobile phone theft: According to Reaves et al. [23] and Castle et al. [11], when an attacker steals the mobile money user’s or agent’s mobile phone, the SIM card that has a wallet account becomes unavailable. It also results in loss of data and service access [64]. Moreover, an attacker can swap SIM cards for those of the mobile money users and agents and take over the victims’ e-wallet account, thus making it unavailable for legitimate users [14,50,51,62].

2.8. Countermeasures

2.8.1. Cryptographic Functions

- Asymmetric Encryption Function: The examples of asymmetric encryption functions used in the 2FA scheme for mobile money are elliptic curve cryptography (ECC) and the Rivest–Shamir–Adleman (RSA) encryption algorithm. The mobile money authentication schemes [66,67,68,69,70] use ECC. The scheme proposed by Bojjagani and Sastry [66] uses SMS, elliptic curve integrated encryption scheme (ECIES), and elliptic curve digital signature algorithm (ECDSA) to ensure user authentication, data confidentiality, and nonrepudiation, thereby reducing computation complexity in mobile banking. Using the elliptic curve Menezes-qua-Vanstone (EC-MQV) key agreement protocol in [67] gave resistance against MITM attacks, SIM cloning and swapping attacks, DoS attacks, and message modification. The scheme in [68] used biometric fingerprints or retinal images on the basis of ECC to provide strong security against MITM attacks, replay attacks, DoS attacks, spoofing attacks, and repudiation. Furthermore, the scheme is effective in terms of computation and communication. Shilpa and Panchami [69] employed biometric, IMEI number, and SIM serial number, colour encryption with ECC to improve the security of mobile banking. The scheme [70] integrated secure ECC to provide data confidentiality, data integrity, and user authentication in mobile banking. The scheme proposed by Sharma and Bohra [71] employed a hybrid cryptographic authentication method using the quick response (QR) code and OTP to improve user authentication and confidentiality in online banking. Additionally, using the encrypted QR code with RSA in the scheme in [72] ensured the legitimacy of the user, information confidentiality, integrity, and accuracy in mobile payment.

- Symmetric Encryption Function: The examples of symmetric encryption functions used in mobile money authentication include data encryption standard (DES) and advanced encryption standard (AES). Using triple-DES (3DES) in [73] provided more security in a cashless transaction than DES. The scheme proposed by [74] used a PIN, SIM card, and face recognition with a DES/3DES encryption algorithm to enforce the security between the mobile payment application and the virtual private ad hoc network. Alornyo et al. [75] employed identity-based cryptography in securing mobile money wallets to resist insider attacks, and it consumed less computational cost in token generation. The scheme proposed by [76] used a dynamic mobile phone token, SSL protocol, and AES to encrypt the transaction information and combat MITM attacks, replay attacks, and transactions repudiation. The scheme in [56] used a QR code with AES-128 bit encryption–decryption and secure hash algorithm 1 (SHA-1) for securing Android smartphones from attacks.

- Secure Hash Function: The MD5, SHA-1, and SHA-2 are common examples of hash functions used in mobile money authentication. Alhothailya et al. [77] proposed an authentication scheme for online banking using a one-time-username and SHA-1 hash function to calculate the ticket’s hash value. Using a vehicle’s identity and the SIM to secure the mobile money authentication system in [78] offered higher security against the increasing identity thefts, SIM cloning, and other cybercrimes.

2.8.2. Personal Identification

- Number-Based Countermeasures: The examples of number-based countermeasures used in mobile money authentication include password, PIN, OTP, and QR code.

- Password: A password is a string of characters including letters, digits, or symbols that a user memorises secretly to confirm their identity. An authentication party verifies the identity of a person to access a service. It is a requirement that the password should be long (at least eight characters), a mixture of both uppercase and lowercase letters, as well as letters and numbers, and should include special characters. Similarly, a password must be changed frequently and easy to remember, but a nondictionary word so that it is hard for an attacker to guess. In most cases, the password is used alongside a username during authentication. Authentication schemes in [79,80,81] used a password to enhance the security of mobile money. The scheme in [80] integrated username and password, phone number, and voice biometric solutions during the authentication of M-Pesa transactions. The scheme in [81] employed username, password, and fingerprint in mobile banking transaction. The password remains the weakest component of many authentication systems [82].

- PIN: Hao-Jun, Wei-Chi, and Yu-Xuan [83] defined a PIN as a numeric key used for authenticating users in an electronic transaction. For user convenience, PINs are often short (up to eight digits) to allow access to only authorised users. PINs are widely used for user authentication such as withdrawing cash from mobile money or withdrawing money from an automated teller machine (ATM) [84]. Mtaho [52], Islam [85], Ombiro [86], Singh and Jasmine [87], Fan et al. [88], Islam et al. [89], and Zadeh and Barati [90] employed authentication schemes using PINs to verify user identity. Using PINs, the schemes in [86,87,90] provided convenience, efficiency, reliability, and security in mobile transactions. Moreover, the schemes in [52,85,89] used PINs to achieve better dependability and customer satisfaction. The PIN should be easy to remember, random, and hard to guess, while it should be changed frequently, distinct for different accounts, and not written down or stored in plaintext [52]. However, using a PIN in mobile money authentication is susceptible to shoulder surfing attacks, brute force attacks, and smudge attacks [83,84,91].

- OTP: Elganzoury, Abdelhafez, and Hegazy [92] defined OTP as a unique and time-sensitive string of alphanumeric characters generated and forwarded to the user’s mobile phone via either email or SMS for a single authentication session. Clock time-based OTP, pattern-based OTP, and random key-based OTP are the three methods used to generate OTP on the basis of the secret key derived from the Diffie–Hellman algorithm [93,94]. The OTP generator located on the server machine creates the OTP and sends it to the user to complete the authentication process [95,96]. If an adversary succeeds in accessing the OTP, they may not be able to predict the next because of its random generation. The authentication schemes in [71,79,86,87,90,97,98] employed OTP, which is fast, efficient, reliable, and convenient. Furthermore, it is resistant to phishing attacks, identity theft, guessing attacks, brute force attacks, and unauthorised access by attackers.

- QR Code: A QR Code is a two-dimensional barcode encoded using standardised modes to store information that can be read using an imaging device such as a smartphone camera [99]. The swift expansion of QR code in mobile wallets is because of ease of use, security, cost-effectiveness, and trackability [100,101]. The schemes proposed by [56,71,100,102,103] employed QR codes to ensure convenience, accuracy, confidentiality, nonrepudiation, integrity, speed, and safety in payment transactions. Additionally, it offers resistance against impersonation attack, shoulder-surfing attack, identity theft, and brute force attack.

- Biometric-Based Countermeasures: Biometrics are the unique physical or behavioural characteristics used to verify a person’s identity [30]. There are two types of biometrics, namely, physiological biometrics and behavioural biometrics.

- Physiological biometrics: Physiological biometrics use the physical characteristics of a person to determine their identity. Examples of physiological biometrics used in mobile money authentication include fingerprint recognition, face recognition, iris recognition, and retina recognition. Islam [85], Mtaho [52], Ahsan et al. [104], Fan et al. [88], Okpara and Bekaroo [105], Sharma and Mathuria [81] used fingerprint recognition in mobile money authentication to offer security against identity theft, shoulder surfing attack, replay attack, impersonation attack, and counterfeit, and it was responsible for privacy protection. The scheme in [90] used facial recognition in authentication to increase the security and reliability of mobile banking systems. Using iris recognition, the scheme in [89] helped to achieve better efficiency, accuracy, dependability, customer satisfaction, and security during mobile money authentication. Moreover, the scheme in [68] employed retina recognition in mobile money authentication to provide security against MITM attack, replay attack, DoS attack, spoofing attack, and repudiation.

- Behavioural biometrics: Behavioural biometrics depend on an individual’s behavioural characteristics to identify them. Voice recognition is the only example of behavioural biometrics used in mobile money authentication. The authentication schemes in [80,86] used voice recognition to increase efficiency, convenience, and security, as well as to resist impersonation attack.

3. Materials and Methods

4. Results and Discussion

- ✘

- Attacks against privacy: In this attack, adversaries infringe on the privacy of mobile money users, agents, MNO, and the MMS. They also compromise the PINs of the subscribers so that the attacker can use them to illegally access the financial details of the victim and perform illicit transactions. Additionally, attackers take advantage of the illiteracy of mobile money users and agents to access their mobile money PINs and accounts. To deal with this attack, [71,106] proposed a hybrid cryptographic method on the basis of the MD5 algorithm and the RSA algorithm. Bojjagani and Sastry [66] and Salim, Sagheer, and Yaseen [70] suggested ECDSA for digital signature and ECIES using AES-GCM as the encryption algorithm. Makulilo [47] recommended general data privacy legislation and sector-specific laws that protect privacy. Moreover, digital communications law and user regulations in mobile money provide data privacy, confidentiality, and lawful interception.

- ✘

- Impersonation attacks: An attacker can assume the identity of a legitimate mobile money user or agent, access the financial details of a registered user, and perform fraudulent transactions. There are 14 authentication protocols [56,66,67,68,69,70,72,77,81,87,88,102,103,105] to prevent impersonation attacks. The schemes in [81,105] employed fingerprint biometrics. Bojjagani and Sastry [66], Ray, Biswas, and Dasgupta [68], and Shilpa and Panchami [69] used elliptic curve cryptosystems. Singh and Jasmine [87], Kisore and Sagi [67], Rodrigues, Chaudhari, and More [56], Alhothailya et al. [77], and Salim, Sagheer, and Yaseen [70] adopted hashing functions. Purnomo, Gondokaryono, and Kim [72] proposed an asymmetric encryption function. The idea of mutual authentication was proposed in [72,88]. On the other hand, [102,103] used random values like OTP.

- ✘

- Replay attack: An attacker eavesdrops on network communication between the mobile money user and MMS, and intercepts the data packets that include the PIN, and then delays and resends it to the recipient. To thwart this attack, [66,68,69,102,103] employed pairing-based cryptography and timestamps in encrypted data. Rodrigues, Chaudhari, and More [56] and Salim, Sagheer, and Yaseen [70] adopted techniques with hashing functions. Alhothailya et al. [77] proposed the use of a one-time username to secure the system against this attack.

- ✘

- Masquerade attack: This is where an adversary uses social engineering techniques to obtain the subscribers’ SIM card, PIN, or other credentials of the authorised users and uses them to request money from legitimate user’s friends and relatives and to carry out illegal business. To resist masquerade attacks, [66,68,69] proposed deploying the elliptic curve cryptosystem. Purnomo, Gondokaryono, and Kim [72] and Fan et al. [88] adopted mutual authentication techniques. Kisore and Sagi [67], Rodrigues, Chaudhari, and More [56], Sharma and Bohra [71], Alhothailya et al. [77], and Salim, Sagheer, and Yaseen [70] used the idea of hash functions. Coneland and Crespi [78], Okpara and Bekaroo [105], Sharma and Mathuria [81], Chetalam [80], and Islam et al. [89] proposed the use of physiological and behavioural biometrics.

- ✘

- Spoofing attacks: An adversary can assume the role of a mobile system administrator and have full access to the system. The poor protection offered to most mobile money applications and systems allows the attackers to hack and control the systems. Security against this attack was ensured in [68,80,81,89,104,105,107] by using biometric authentication. Purnomo, Gondokaryono, and Kim [72] and Fan et al. [88] used mutual authentication techniques.

- ✘

- Social engineering attack: Mobile money platforms use PINs to secure mobile money accounts, thus making them vulnerable to many security threats, including social engineering attacks. Attackers also use social engineering techniques to circumvent mobile money’s 2FA scheme, compromise user accounts, and avoid fraud detection technologies. Security against social engineering attacks is ascertained using a multifactor authentication scheme, customer alert systems, and anti-phishing systems [108]. Luo et al. [109], Chinta, Alaparthi, and Koda [110], and Conteh and Schmick [111] adopted a multidimensional approach, including technology, policies, procedures, standards, employee training, and awareness programs. Hamandi et al. [112] proposed an anomaly-based intrusion detection system to thwart SMS messaging attacks.

- ✘

- Phishing attacks: This is where fraudsters masquerade as staff of MMSP and call or send SMS messages to the subscribers to lure them into revealing their mobile money PIN. Resiliency against phishing attacks is enhanced by employing multifactor authentication, an anomaly-based intrusion detection system, email authentication, encryption, secure sockets layer, reports of suspicious activities, back-end analytics, user training and awareness, content-based filtering, blacklisting, and whitelisting [112,113,114]. Aleroud and Zhou [115] used machine learning, profile matching, text mining, ontology, honeypots, and client-server authentication to detect phishing attacks.

- ✘

- Trojan horse attacks: Attackers use social engineering to trick mobile money users and agents into loading and executing Trojans on their phones. Once activated, Trojans can enable hackers to spy on mobile money users and agents, steal their mobile money PINs, and gain backdoor access to their mobile money accounts. The security against Trojan horse attacks was ensured in [68,69] by using the idea of integrating biometrics and cryptography. Jung et al. [116] proposed binary code obfuscation and hardware-based code attestation. Bosamia and Patel [106] adopted malware detection and prevention techniques.

- ✘

- Eavesdropping attacks: This is where an attacker secretly overhears information transmitted over the communication channel without being authorised by the trusted parties. The attacker takes advantage of unsecured network communications to access sensitive information. Salim, Sagheer, and Yaseen [70] enforced security against eavesdropping attacks by using a message authentication code (MAC). Bojjagani and Sastry [66] proposed the use of ECIES and ECDSA.

- ✘

- ✘

- Guessing attack: Mobile money users and agents use a PIN during mobile money authentication and the PIN used is only four or five digits, entered when unmasked, thus making it guessable. To thwart this attack, [66,67,68,69,70] employed the elliptic curve cryptosystem. Singh and Jasmine [87] adopted a password-salting mechanism. Rodrigues, Chaudhari, and More [56] and Alhothailya et al. [77] used hashing functions.

- ✘

- ✘

- MITM attack: In this attack, the adversary sits between the mobile money user and MMSP and makes them believe that they are communicating directly with each other, when in fact the attacker controls the entire conversation. There are different authentication protocols [56,66,67,68,69,70,71,73,74,76,79,85,86,90,102,103] that are resilient against MITM attacks. To deal with this attack, [66,69] proposed the use of ECC. Ray, Biswas, and Dasgupta [68] proposed the use of both biometric fingerprint and ECC, [79,85,86,90] used multi-factor authentication, and [56,67,70,71,73,74,76,102,103] proposed the use of symmetric encryption and message authentication code.

- ✘

- Salami attack: This is where an employee of a financial institution installs a malware like a Trojan horse on the server hosting the mobile money application to withdraw a small amount of money from the subscribers’ accounts and deposit it into their account. To thwart this attack, [18] suggested that there is a need to define an efficient and robust user and security policy that contains different privileges, updates security systems, initiates both SMS and email messages to alert customers regarding any transaction that occurs, and advises the customers to report any unaware money reductions.

- ✘

- Insider attacks: This is where an employee of the MMSP who has enough information about the organisation’s security practices, MMS, and data attacks the mobile money application server or MMS. To resist insider attacks, [66,68,70] used elliptic curve cryptography. Alornyo et al. [75] employed identity-based cryptography, and [117] proposed a certificate-based signcryption scheme.

- ✘

- DoS and DDoS attacks: This is where attackers overwhelm mobile money servers with fake traffic to block requests from legitimate users requesting to access the services. The goal is to make mobile money services unavailable to legitimate users. Resiliency against DoS attacks is enhanced by using cryptographic hash functions [56,67,68,70,71,77,87]. Mtaho [52], Ahsan et al. [104], Okpara and Bekaroo [105], and Sharma and Mathuria [81] proposed the use of biometric fingerprint authentication. On the other hand, to deal with a DDoS attack, [118] introduced a nonlinear control approach that can prevent malicious attack packets. Cepheli, Büyükçorak, and Kurt [119] proposed a hybrid intrusion detection system that utilises anomaly- and signature-based detection methods.

- ✘

- Mobile phone theft: When an attacker steals the mobile money user’s or agent’s mobile phone, the SIM card that has a wallet account becomes unavailable. Tu et al. [64] proposed technical countermeasures such as remote device wipe, training customers, access blocking, data encryption, online or offline data backup, remote access to built-in cameras, global positioning system (GPS) device tracking, and PIN protection.

5. Conclusions and Future Work

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Suri, T. Mobile Money. Annu. Rev. Econ. 2017, 9, 497–520. [Google Scholar] [CrossRef]

- Grundmann, A.S. Feasibility Study of a Mobile Payment System on Kasadaka: A Sustainable Voice Service Platform. Bachelor’s Thesis, Vrije Universiteit, Amsterdam, The Netherlands, 2018. [Google Scholar]

- Kanobe, F.; Alexander, M.P.; Bwalya, K.J. Information Security Management Scaffold for Mobile Money Systems in Uganda. In Proceedings of the 18th European Conference on Cyber Warfare & Security, University of Coimbra, Coimbra, Portugal, 4–5 July 2019; pp. 239–248. [Google Scholar]

- Uganda Communications Commission (UCC). Telecommunications, Broadcasting and Postal Markets Industry Report Q2 (April–June) 2019; UCC: Kampala, Uganda, 2019. Available online: https://www.ucc.co.ug/wp-content/uploads/2017/09/Industry-Report-Q2-April-June-2019-Final.pdf (accessed on 18 June 2020).

- Bank of Uganda (BoU). Bank of Uganda (BoU) Annual Report-2018/19; Bank of Uganda: Kampala, Uganda, 2019. Available online: https://www.bou.or.ug/bou/bouwebsite/bouwebsitecontent/publications/Annual_Reports/All/Annual-Report-2019.pdf (accessed on 14 July 2020).

- Okeleke, K. Uganda: Driving Inclusive Socio-Economic Progress through Mobile-Enabled Digital Transformation; GSM Association: London, UK, 2019; Available online: https://www.gsma.com (accessed on 20 May 2020).

- Darvish, H.; Husain, M. Security Analysis of Mobile Money Applications on Android. In Proceedings of the 2018 IEEE International Conference on Big Data (Big Data), Seattle, WA, USA, 10–13 December 2018; pp. 3072–3078. [Google Scholar]

- Ali, G.; Dida, M.A.; Sam, A.E. Evaluation of Key Security Issues Associated with Mobile Money Systems in Uganda. Information 2020, 11, 309. [Google Scholar] [CrossRef]

- Gwahula, R. Risks and Barriers Associated with Mobile Money Transactions in Tanzania. Bus. Manag. Strat. 2016, 7, 121–139. [Google Scholar]

- Musuva-Kigen, P.; Ekpeke, M.; Inkoom, E.; Inkoom, B.; Masesa, D.; Kaimba, B.; Mbae, K. Kenya Cyber Security Report 2016; Serianu Ltd.: Nairobi, Kenya, 2016. [Google Scholar]

- Castle, S.; Pervaiz, F.; Weld, G.; Roesner, F.; Anderson, R. Let’s talk money: Evaluating the security challenges of mobile money in the developing world. In Proceedings of the 7th Annual Symposium on Computing for Development (ACM DEV’16), New York, NY, USA, 18–20 November 2016; pp. 1–10. [Google Scholar]

- Buku, M.; Mazer, R. Fraud in Mobile Financial Services: Protecting Consumers, Providers, and the System. 2017. Available online: http://www.cgap.org/publications/fraud-mobile-financial-services (accessed on 11 March 2020).

- Lonie, S. Fraud Risk Management for Mobile Money: An Overview. 2017. Available online: https://www.chyp.com/wp-content/uploads/2018/06/Fraud-Risk-Management-for-MM-31.07.2017.pdf (accessed on 12 February 2020).

- Bosamia, M.P. Mobile Wallet Payments Recent Potential Threats and Vulnerabilities with its possible security Measures. In Proceedings of the 2017 International Conference on Soft Computing and Its Engineering Applications (icSoftComp-2017), Changa, India, 1–2 December 2017; pp. 1–7. [Google Scholar]

- Maseno, E.M.; Ogao, P.; Matende, S. Vishing Attacks on Mobile Platform in Nairobi County Kenya. Int. J. Adv. Res. Comput. Sci. Technol. IJARCST 2017, 5, 73–77. [Google Scholar]

- Akomea-Frimpong, I.; Andoh, C.; Akomea-Frimpong, A.; Dwomoh-Okudzeto, Y. Control of Fraud on Mobile money services in Ghana: An exploratory study. J. Money Laund. Control 2019, 22, 300–317. [Google Scholar] [CrossRef]

- Balasubramanian, S. Study of Cybercrime in the Banking and Financial Sectors. Int. J. Sci. Res. Comput. Sci. Eng. Inf. Technol. 2018, 3, 1205–1212. [Google Scholar]

- Alhassan, N.S.; Yusuf, M.O.; Karmanje, A.R.; Alam, M. Salami Attacks and their Mitigation—An Overview. In Proceedings of the 5th International Conference on Computing for Sustainable Global Development, New Delhi, India, 14–16 March 2018; pp. 4639–4642. [Google Scholar]

- Kunda, D.; Chishimba, M. A Survey of Android Mobile Phone Authentication Schemes. Mob. Netw. Appl. 2018, 73, 1–9. [Google Scholar] [CrossRef]

- Phipps, R.; Mare, S.; Ney, P.; Webster, J.; Heimerl, K. ThinSIM-Based Attacks on Mobile Money Systems. In Proceedings of the COMPASS ’18: ACM SIGCAS Conference on Computing and Sustainable Societies (COMPASS), New York, NY, USA, 20–22 June 2018; pp. 1–11. [Google Scholar]

- Talom, F.S.G.; Tengeh, R.K. The Impact of Mobile Money on the Financial Performance of the SMEs in Douala, Cameroon. Sustainability 2019, 12, 183. [Google Scholar] [CrossRef]

- Saxena, S.; Vyas, S.; Kumar, B.S.; Gupta, S. Survey on Online Electronic Payments Security. In Proceedings of the 2019 Amity International Conference on Artificial Intelligence (AICAI), Dubai, UAE, 4–6 February 2019; pp. 746–751. [Google Scholar]

- Reaves, B.; Bowers, J.; Scaife, N.; Bates, A.; Bhartiya, A.; Traynor, P.; Butler, K.R.B. Mo(bile) money, mo(bile) problems: Analysis of branchless banking applications. ACM Trans. Priv. Secur. 2017, 20, 1–31. [Google Scholar] [CrossRef]

- Maina, J. Data Protection in Mobile Money; GSMA: London, UK, 2019. [Google Scholar]

- GSMA. The Mobile Economy Sub-Saharan Africa 2018; GSMA: London, UK, 2018. [Google Scholar]

- Nair, S.; Khatri, S.K.; Gupta, H. A Model to Enhance Security of Digital Transaction. In Proceedings of the 4th International Conference on Information Systems and Computer Networks (ISCON), Mathura, India, 21–22 November 2019; pp. 17–21. [Google Scholar]

- Ferrag, M.A.; Maglaras, L.; Derhab, A.; Janicke, H. Authentication schemes for smart mobile devices: Threat models, countermeasures, and open research issues. Telecommun. Syst. 2020, 73, 1–32. [Google Scholar] [CrossRef]

- Han, D.; Chen, Y.; Li, T.; Zhang, R.; Zhang, Y.; Hedgpeth, T. Proximity-Proof: Secure and Usable Mobile Two-Factor Authentication. In Proceedings of the 24th Annual International Conference on Mobile Computing and Networking (MobiCom ’18), New Delhi, India, 29 October–2 November 2018; pp. 401–415. [Google Scholar]

- Dmitrienko, A.; Liebchen, C.; Rossow, C.; Sadeghi, A.-R. On the (In)Security of Mobile Two-Factor Authentication. In Proceedings of the 2014 International Conference on Financial Cryptography and Data Security, Christ Church, Barbados, 3–7 March 2014; FC 2014, LNCS 8437. Springer: Berlin/Heidelberg, Germany, 2014; pp. 365–383. [Google Scholar]

- Promontory. Biometric Authentication in Payments: Considerations for Policymakers; Promontory Financial Group: Washington, DC, USA, 2017. [Google Scholar]

- Hayikader, S.; Hanis, F.N.; Ibrahim, J. Issues and Security Measures of Mobile Banking Apps. Int. J. Sci. Res. Publ. 2016, 6, 36–41. [Google Scholar]

- Rouse, M. Single-Factor Authentication (SFA). 2017. Available online: https://searchsecurity.techtarget.com/ (accessed on 1 May 2020).

- Rahav, A. The Secret Security Wiki. 2018. Available online: https://doubleoctopus.com/security-wiki/authentication/single-factor-authentication/ (accessed on 4 May 2020).

- Ometov, A.; Bezzateev, S.; Mäkitalo, N.; Andreev, S.; Mikkonen, T.; Koucheryavy, Y. Multi-Factor Authentication: A Survey. Cryptography 2018, 2, 1. [Google Scholar] [CrossRef]

- Bissada, A.; Olmsted, A. Mobile multi-factor authentication. In Proceedings of the 12th International Conference for Internet Technology and Secured Transactions (ICITST), Cambridge, UK, 11–14 December 2017; pp. 210–211. [Google Scholar]

- Australian Cyber Security Centre (ACSC). Implementing Multi-Factor Authentication. 2019. Available online: https://www.acsc.gov.au/ (accessed on 22 May 2020).

- Hamilton, C.; Olmstead, A. Database multi-factor authentication via pluggable authentication modules. In Proceedings of the 12th International Conference for Internet Technology and Secured Transactions (ICITST), Cambridge, UK, 11–14 December 2017; pp. 367–368. [Google Scholar]

- Pareek, A.; Khandaker, E. Building an In-House Mobile Money Platform (UNCDF); UN Capital Development Fund: New York, NY, USA, 2018. [Google Scholar]

- Nyamtiga, B.W.; Sam, A.; Laizer, L.S. Security Perspectives for USSD versus SMS in Conducting Mobile Transactions: A Case Study of Tanzania. Int. J. Technol. Enhanc. Emerg. Eng. Res. 2013, 1, 38–43. [Google Scholar]

- McGrath, F.; Lonie, S. Platforms for Successful Mobile Money Services; GSMA: London, UK, 2013. [Google Scholar]

- Nyaketcho, D.; Lindskog, D.; Ruhl, R. STK Implementation in SMS Banking in M-Pesa—Kenya, Exploits and Feasible Solutions; Concordia: St. Louis, MO, USA, 2017. [Google Scholar]

- GSMA. First Steps for Mitigating Simjacker-Related Risks Right Now; GSMA: London, UK, 2019. [Google Scholar]

- Saxena, N.; Payal, A. Enhancing Security System of Short Message Service for M-Commerce in GSM. Int. J. Comput. Sci. Eng. Technol. IJCSET 2011, 2, 127–133. [Google Scholar]

- Mahajan, R.; Saran, J.; Rajagopalan, A. Mitigating Emerging Fraud Risks in the Mobile Money Industry; Deloitte: Mumbai, India, 2015. [Google Scholar]

- Schneier, B. Two-Factor Authentication: Too Little, Too Late. Commun. ACM 2005, 48, 1. [Google Scholar] [CrossRef]

- Liu, F. Efficient Two-Factor Authentication Protocol Using Password and Smart Card. J. Comput. 2013, 8, 3257–3263. [Google Scholar] [CrossRef]

- Makulilo, A.B. Privacy in mobile money: Central banks in Africa and their regulatory limits. Int. J. Law Inf. Technol. 2015, 23, 372–391. [Google Scholar] [CrossRef]

- Harris, A.; Goodman, S.; Traynor, P. Privacy and Security Concerns Associated with Mobile Money Applications in Africa. Wash. J. Law Technol. Arts 2013, 8, 1–20. [Google Scholar]

- McKee, K.; Kaffenberger, M.; Zimmerman, J. Doing Digital Finance Right: The Case for Stronger Mitigation of Customer Risks. 2015. Available online: https://www.cgap.org/sites/default/files/researches/documents/Focus-Note-Doing-Digital-Finance-Right-Jun-2015.pdf (accessed on 13 July 2020).

- Gilman, L.; Joyce, M. Managing the Risk of Fraud in Mobile Money. 2012. Available online: http://www.gsma.com/mmu (accessed on 28 February 2020).

- Mudiri, J.L. Fraud in Mobile Financial Services; MicroSave: New Delhi, India, 2012. [Google Scholar]

- Mtaho, A.B. Improving Mobile Money Security with Two-Factor Authentication. Int. J. Comput. Appl. 2015, 109, 9–15. [Google Scholar]

- Paik, M. Stragglers of the herd get eaten: Security concerns for GSM mobile banking applications. In Proceedings of the Eleventh Workshop on Mobile Computing Systems & Applications, New York, NY, USA, 22–23 February 2010. [Google Scholar]

- Nyamtiga, B.W.; Anael, S.; Loserian, L.S. Enhanced Security Model for Mobile Banking Systems in Tanzania. Int. J. Technol. Enhanc. Emerg. Eng. Res. 2013, 1, 4–19. [Google Scholar]

- Mtaho, A.B.; Mselle, L. Securing Mobile money services in Tanzania: A Case of Vodacom M-Pesa. Int. J. Comput. Sci. Netw. Solut. 2014, 2, 1–11. [Google Scholar]

- Brinzel, R.; Anita, C.; Shraddha, M. Two-Factor Verification using QR-code: A unique authentication system for Android Smartphone users. In Proceedings of the 2nd International Conference on Contemporary Computing and Informatics (ic3i), Noida, India, 14–17 December 2016; pp. 457–462. [Google Scholar]

- Aloul, F.; Zahidi, S.; El-Hajj, W. Two-Factor authentication using mobile phones. In Proceedings of the 2009 IEEE/ACS International Conference on Computer Systems and Applications, Rabat, Morocco, 10–13 May 2009; pp. 641–644. [Google Scholar]

- Jarecki, S.; Krawczyk, H.; Shirvanian, M.; Saxena, N. Two-Factor Authentication with End-to-End Password Security. In Proceedings of the International Conference on Practice and Theory in Public Key Cryptography (PKC), Rio De Janeiro, Brazil, 25–29 March 2018; pp. 431–461. [Google Scholar]

- Kaur, S.; Sharma, S.; Singh, A. Cyber Security: Attacks, Implications, and Legitimations across the Globe. Int. J. Comput. Appl. 2015, 114, 21–23. [Google Scholar] [CrossRef]

- Sadekin, S.M.; Shaikh, H.M. Security of E-Banking in Bangladesh. J. Financ. Account. 2016, 4, 1–8. [Google Scholar] [CrossRef]

- Altwairqi, A.F.; AlZain, M.A.; Soh, B.; Masud, M.; Al-Amri, J. Four Most Famous Cyber Attacks for Financial Gains. Int. J. Eng. Adv. Technol. IJEAT 2019, 9, 2131–2139. [Google Scholar]

- Trulioo. Emerging Fraud Risk in the Mobile Wallet Ecosystem. 2015. Available online: https://www.trulioo.com/blog/emerging-fraud-risk-in-the-mobile-wallet-ecosystem/ (accessed on 14 March 2020).

- Mutong’Wa, S.M.; Khaemba, S.W. A comparative study of critical success factors (CSFS) in the implementation of mobile money transfer services in Kenya. Eur. J. Eng. Technol. 2014, 2, 8–31. [Google Scholar]

- Tu, Z.; Turel, O.; Yuan, Y.; Archer, N. Learning to cope with information security risks regarding mobile device loss or theft: An empirical examination. Inf. Manag. 2015, 52, 506–517. [Google Scholar] [CrossRef]

- Barker, E.; Barker, C.W. Recommendation for Key Management: Part 2—Best Practices for Key Management Organizations; NIST Special Publication 800-57, Rev. 1; National Institute of Standards and Technology: Gaithersburg, MD, USA, 2019.

- Bojjagani, S.; Sastry, V.N. SSMBP: A Secure SMS-based Mobile Banking Protocol with Formal Verification. In Proceedings of the IEEE 11th International Conference on Wireless and Mobile Computing, Networking and Communications (WiMob), Abu Dhabi, UAE, 19–21 October 2015; pp. 252–259. [Google Scholar]

- Kisore, N.R.; Sagi, S. A secure SMS protocol for implementing the digital cash system. In Proceedings of the 2015 International Conference on Advances in Computing, Communications and Informatics (ICACCI), Kochi, India, 10–13 August 2015; pp. 1883–1892. [Google Scholar]

- Ray, S.; Biswas, G.P.; Dasgupta, M. Secure Multi-Purpose Mobile-Banking Using Elliptic Curve Cryptography. Wirel. Pers. Commun. 2016, 90, 1331–1354. [Google Scholar] [CrossRef]

- Shilpa, S.; Panchami, V. BISC Authentication Algorithm: An Efficient New Authentication Algorithm Using Three-Factor Authentication for Mobile Banking. In Proceedings of the 2016 Online International Conference on Green Engineering and Technologies (IC-GET), Coimbatore, India, 19 November 2016; pp. 1–5. [Google Scholar]

- Salim, A.; Sagheer, A.; Yaseen, L. Design and Implementation of a Secure Mobile Banking System Based on Elliptic Curve Integrated Encryption Schema. In Proceedings of the Communications in Computer and Information Science, Gdańsk, Poland, 23–24 June 2020; Springer Nature: Cham, Switzerland, 2020; pp. 424–438. [Google Scholar]

- Sharma, N.; Bohra, B. Enhancing online banking authentication using the hybrid cryptographic method. In Proceedings of the 3rd International Conference on Computational Intelligence & Communication Technology (CICT), Ghaziabad, India, 9–10 February 2017; pp. 1–8. [Google Scholar]

- Purnomo, A.T.; Gondokaryono, Y.S.; Kim, C.-S. Mutual authentication in securing a mobile payment system using encrypted QR code based on Public Key Infrastructure. In Proceedings of the 6th International Conference on System Engineering and Technology (ICSET), Bandung, Indonesia, 3–4 October 2016; pp. 194–198. [Google Scholar]

- Mitra, S.; Jana, B.; Poray, J. Implementation of a Novel Security Technique Using Triple-DES in Cashless Transaction. In Proceedings of the 2017 International Conference on Computer, Electrical & Communication Engineering (ICCECE), Kolkata, India, 22–23 December 2017; pp. 1–6. [Google Scholar]

- Hu, J.-Y.; Sueng, C.-C.; Liao, W.-H.; Ho, C.C. Android-Based mobile payment service protected by 3-factor authentication and virtual private ad hoc networking. In Proceedings of the 2012 Computing, Communications and Applications Conference, Hong Kong, China, 11–13 January 2012; pp. 111–116. [Google Scholar]

- Alornyo, S.; Mireku, K.K.; Tonny-Hagan, A.; Hu, X. Mobile Money Wallet Security against Insider Attack Using ID-Based Cryptographic Primitive with Equality Test. In Proceedings of the 2019 International Conference on Cyber Security and Internet of Things (ICSIoT), Accra, Ghana, 29–31 May 2019; pp. 82–87. [Google Scholar]

- Zhang, X.; Zeng, H.; Zhang, X. Mobile payment protocol based on dynamic mobile phone token. In Proceedings of the IEEE 9th International Conference on Communication Software and Networks (ICCSN), Guangzhou, China, 6–8 May 2017; pp. 680–685. [Google Scholar]

- Alhothailya, A.; Alrawaisa, A.; Hua, C.; Lie, W. One-Time-Username: A Threshold-Based Authentication System. In Proceedings of the International Conference on Identification, Information and Knowledge in the Internet of Things, Qufu, China, 19–21 October 2017; pp. 426–432. [Google Scholar]

- Coneland, R.; Crespi, N. Wallet-On-Wheels—Using a vehicle’s identity for secure mobile money. In Proceedings of the 17th International Conference on Intelligence in Next Generation Networks (ICIN), Venice, Italy, 15–16 October 2013; pp. 102–109. [Google Scholar]

- Akoramurthy, B.; Arthi, J. GeoMoB—A Geo Location based browser for secured Mobile Banking. In Proceedings of the IEEE Eighth International Conference on Advanced Computing (ICoAC), Chennai, India, 19–21 January 2017; pp. 83–88. [Google Scholar]

- Chetalam, J.L. Enhancing Security of MPesa Transactions by Use of Voice Biometrics. Master’s Thesis, United States of International University, Nairobi, Kenya, 2018. [Google Scholar]

- Sharma, L.; Mathuria, M. Mobile banking transaction using fingerprint authentication. In Proceedings of the 2nd International Conference on Inventive Systems and Control (ICISC), Coimbatore, India, 19–20 January 2018; pp. 1300–1305. [Google Scholar]

- Wimberly, H.; Liebrock, L.M. Using Fingerprint Authentication to Reduce System Security: An Empirical Study. In Proceedings of the 2011 IEEE Symposium on Security and Privacy, Berkeley, CA, USA, 22–25 May 2011; pp. 32–46. [Google Scholar]

- Hao-Jun, X.; Wei-Chi, K.; Yu-Xuan, D. An Observation Attacks Resistant PIN-Entry Scheme Using Localized Haptic Feedback. In Proceedings of the 2016 IEEE Region 10 Symposium (TENSYMP), Bali, Indonesia, 9–11 May 2016; pp. 59–64. [Google Scholar]

- Bultel, X.; Dreier, J.; Giraud, M.; Izaute, M.; Kheyrkhah, T.; Lafourcade, P.; Mot’a, L. Security Analysis and Psychological Study of Authentication Methods with PIN Codes. In Proceedings of the 12th International Conference on Research Challenges in Information Science (RCIS), Nantes, France, 29–31 May 2018; pp. 1–11. [Google Scholar]

- Islam, M.S. An algorithm for electronic money transaction security (Three Layer Security): A new approach. Int. J. Secur. Appl. 2015, 9, 203–214. [Google Scholar] [CrossRef]

- Ombiro, Z.B.H. Mobile-Based Multi-Factor Authentication Scheme for Mobile Banking. Master’s Thesis, University of Nairobi, Nairobi, Kenya, 2016. [Google Scholar]

- Singh, B.; Jasmine, K.S. Secure End-To-End Authentication for Mobile Banking. In Advances in Intelligent Systems and Computing; Springer: Cham, Switzerland, 2015; Volume 349, pp. 223–232. [Google Scholar]

- Fan, K.; Li, H.; Jiang, W.; Xiao, C.; Yang, Y. U2F based secure mutual authentication protocol for mobile payment. In Proceedings of the ACM Turing 50th Celebration Conference, Shanghai, China, 12–14 May 2017; pp. 1–6. [Google Scholar]

- Islam, I.; Munim, K.M.; Islam, M.N.; Karim, M.M. A Proposed Secure Mobile Money Transfer System for SME in Bangladesh: An Industry 4.0 Perspective. In Proceedings of the 2019 International Conference on Sustainable Technologies for Industry 4.0 (STI), Dhaka, Bangladesh, 24–25 December 2019; pp. 1–6. [Google Scholar]

- Zadeh, M.J.; Barati, H. Security Improvement in Mobile Banking Using Hybrid Authentication. In Proceedings of the 3rd International Conference on Advances in Artificial Intelligence, Istanbul, Turkey, 26–28 October 2019; pp. 198–201. [Google Scholar]

- Kasat, O.K.; Bhadade, U.S. Revolving Flywheel PIN Entry Method to Prevent Shoulder Surfing Attacks. In Proceedings of the 3rd International Conference for Convergence in Technology (I2CT), Pune, India, 6–8 April 2018; pp. 1–5. [Google Scholar]

- Elganzoury, H.S.; Abdulhafez, A.A.; Hegazy, A.A. A Provably Secure Android-Based Mobile Banking Protocol. Int. J. Secur. Appl. 2017, 11, 77–88. [Google Scholar] [CrossRef]

- Verma, A.; Brar, R.; Ummat, A. Cloud Computing and Homomorphic Encryption. Int. J. Comput. Sci. Inf. Secur. IJCSIS 2017, 15, 47–55. [Google Scholar]

- Venkatesh, G.; Gopal, S.V.; Meduri, M.; Sindhu, C. Application of Session Login and One Time Password in Fund Transfer System Using RSA Algorithm. In Proceedings of the International Conference on Electronics, Communication, and Aerospace Technology ICECA 2017, Coimbatore, India, 20–22 April 2017; pp. 732–738. [Google Scholar]

- Srivastava, S.; Sivasankar, M. On the generation of alphanumeric one time passwords. In Proceedings of the 2016 International Conference on Inventive Computation Technologies (ICICT), Coimbatore, India, 26–27 August 2016; pp. 1–3. [Google Scholar]

- Prasad, K.; Aithal, P.S. A Study on Multifactor Authentication Model Using Fingerprint Hash Code, Password and OTP. Int. J. Adv. Trends Eng. Technol. 2018, 3, 1–11. [Google Scholar]

- Soare, C.A. Internet Banking Two-Factor Authentication using Smartphones. J. Mob. Embed. Distrib. Syst. 2012, 4, 12–18. [Google Scholar]

- Iftikhar, J.; Hussain, S.; Mansoor, K.; Ali, Z.; Chaudhry, S.A. Symmetric-Key Multi-Factor Biometric Authentication Scheme. In Proceedings of the 2nd International Conference on Communication, Computing and Digital Systems (C-CODE), Islamabad, Pakistan, 6–7 March 2019; pp. 288–292. [Google Scholar]

- Surekha, A.; Anand, P.M.R.; Indu, I. E-Payment Transactions Using Encrypted QR Codes. Int. J. Appl. Eng. Res. 2015, 10, 460–463. [Google Scholar]

- Ugwu, C.; Mesigo, T. A Novel Mobile Wallet Based on Android OS and Quick Response Code Technology. Int. J. Adv. Res. Comput. Sci. Technol. IJARCST 2015, 3, 85–89. [Google Scholar]

- Ruslan, M.K.; Gusti, S.; Yudi, F.; Anderes, G. QR Code Payment in Indonesia and Its Application on Mobile Banking. In Proceedings of the FGIC 2nd Conference on Governance and Integrity, Yayasan Pahang, Malaysia, 19–20 August 2019; pp. 551–568. [Google Scholar]

- Tandon, A.; Sharma, R.; Sodhiya, S.; Vincent, P.D. QR Code-based secure OTP distribution scheme for Authentication in Net-Banking. Int. J. Eng. Technol. IJET 2013, 5, 2502–2505. [Google Scholar]

- Ximenes, A.M.; Sukaridhoto, S.; Sudarsono, A.; Albaab, M.R.; Basri, H.; Yani, M.A.; Islam, E. Implementation QR Code Biometric Authentication for Online Payment. In Proceedings of the 2019 International Electronics Symposium (IES), Surabaya, Indonesia, 27–28 September 2019; pp. 676–682. [Google Scholar]

- Ahsan, K.; Iqbal, S.; Hussain, M.A.; Nadeem, A. A Mobile Payment Model Using Biometric Technology. Int. J. Adv. Sci. Eng. Technol. 2016, 4, 17–20. [Google Scholar]

- Okpara, O.S.; Bekaroo, G. Cam-Wallet: Fingerprint-Based authentication in M-wallets using embedded cameras. In Proceedings of the 2017 IEEE International Conference on Environment and Electrical Engineering and 2017 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I&CPS Europe), Milan, Italy, 6–9 June 2017; pp. 1–5. [Google Scholar]

- Bosamia, M.; Patel, D. Wallet Payments Recent Potential Threats and Vulnerabilities with its possible security Measures. Int. J. Comput. Sci. Eng. 2019, 7, 810–817. [Google Scholar] [CrossRef]

- Fujii, H.; Tsuruoka, Y. SV-2FA: Two-Factor User Authentication with SMS and Voiceprint Challenge-Response. In Proceedings of the 8th International Conference for Internet Technology and Secured Transactions (ICITST-2013), London, UK, 9–12 December 2013; pp. 283–287. [Google Scholar]

- Airehrour, D.; Nair, N.V.; Madanian, S. Social Engineering Attacks and Countermeasures in the New Zealand Banking System: Advancing a User-Reflective Mitigation Model. Information 2018, 9, 110. [Google Scholar] [CrossRef]

- Luo, X.; Brody, R.; Seazzu, A.; Burd, S. Social Engineering: The Neglected Human Factor for Information Security Management. Inf. Resour. Manag. J. 2011, 3, 1–8. [Google Scholar] [CrossRef]

- Chinta, M.; Alaparthi, J.; Koda, E. A Study on Social Engineering Attacks and Defence Mechanisms. Int. J. Comput. Sci. Inf. Secur. IJCSIS 2016, 14, 225–231. [Google Scholar]

- Conteh, N.Y.; Schmick, P.J. Cybersecurity: Risks, vulnerabilities, and countermeasures to prevent social engineering attacks. Int. J. Adv. Comput. Res. 2016, 6, 31–38. [Google Scholar] [CrossRef]

- Hamandi, K.; Salman, A.; Elhajj, I.H.; Chehab, A.; Kayssi, A. Messaging Attacks on Android: Vulnerabilities and Intrusion Detection. Mob. Inf. Syst. 2015, 1–13. [Google Scholar] [CrossRef]

- Shahriar, H.; Klintic, T.; Clincy, V. Mobile Phishing Attacks and Mitigation Techniques. J. Inf. Secur. 2015, 6, 206–212. [Google Scholar] [CrossRef]

- Singh, L.J.; Imphal, N. A Survey on Phishing and Anti-Phishing Techniques. Int. J. Comput. Sci. Trends Technol. IJCST 2018, 6, 62–68. [Google Scholar]

- Aleroud, A.; Zhou, L. Phishing environments, techniques, and countermeasures: A survey. Comput. Secur. 2017, 68, 160–196. [Google Scholar] [CrossRef]

- Jung, J.-H.; Kim, J.Y.; Lee, H.-C.; Yi, J.H. Repackaging Attack on Android Banking Applications and Its Countermeasures. Wirel. Pers. Commun. 2013, 73, 1421–1437. [Google Scholar] [CrossRef]

- Lu, Y.; Li, J. Efficient Certificate-Based Signcryption Secure against Public Key Replacement Attacks and Insider Attacks. Sci. World J. 2014, 2014, 295419. [Google Scholar] [CrossRef]

- Li, M.; Li, M. An Adaptive Approach for Defending against DDoS Attacks. Math. Probl. Eng. 2010, 2010, 570940. [Google Scholar] [CrossRef]

- Cepheli, Ö.; Büyükçorak, S.; Kurt, G.K. Hybrid Intrusion Detection System for DDoS Attacks. J. Electr. Comput. Eng. 2016, 2016, 1075648. [Google Scholar] [CrossRef]

| S/No | Countermeasure | Scheme | |

|---|---|---|---|

| 1 | Asymmetric encryption function | ECC | [66,67,68,69,70] |

| RSA encryption algorithm | [72] | ||

| 2 | Symmetric encryption function | DES | [73,74,75] |

| AES | [56,76] | ||

| 3 | Secure hash function | SHA-1 | [77,78] |

| 4 | Number-based countermeasures | Password | [79,80,81] |

| PIN | [52,83,84,85,86,87,88,89,90,91] | ||

| OTP | [71,79,86,87,90,97,98] | ||

| QR Code | [56,71,100,102,103] | ||

| 5 | Biometric-based countermeasures | Fingerprint recognition | [52,81,85,88,104,105] |

| Facial recognition | [90] | ||

| Iris recognition | [89] | ||

| Retina recognition | [68] | ||

| Voice recognition | [80,86] | ||

| S/No | Threat Models | Countermeasure | References |

|---|---|---|---|

| 1 | Attacks against privacy | A hybrid cryptographic method using the MD5 algorithm and the RSA algorithm. | [71,106] |

| ECDSA for digital signature and ECIES that uses AES-GCM as the encryption algorithm. | [66,70] | ||

| General data privacy legislation and sector-specific laws. | [47] | ||

| 2 | Impersonation attacks | Fingerprint biometrics. | [81,105] |

| Elliptic curve cryptosystems. | [66,68,69] | ||

| Hashing functions. | [56,67,70,77,87] | ||

| Asymmetric encryption function. | [72] | ||

| Mutual authentication. | [72,88] | ||

| Use of random values like OTP. | [102,103] | ||

| 3 | Replay attacks | Pairing-based cryptography and timestamp in encrypted data. | [66,68,69,102,103] |

| Hashing functions. | [56,70] | ||

| Use of one-time username. | [77] | ||

| 4 | Masquerade attack | Elliptic curve cryptosystem. | [66,68,69] |

| Mutual authentication technique. | [72,88] | ||

| Hash functions. | [56,67,70,71,77] | ||

| Use of physiological and behavioural biometrics. | [78,80,81,89,105] | ||

| 5 | Spoofing attacks | Biometric authentication. | [68,80,81,89,104,105,107] |

| Mutual authentication technique. | [72,88] | ||

| 6 | Social engineering attack | Multifactor authentication scheme, customer alert systems, antiphishing systems. | [108] |

| Multidimensional approach, including technology, policies, procedures, standards, employee training, and awareness programs. | [109,110,111] | ||

| Anomaly-based intrusion detection system to thwart SMS messaging attacks. | [112] | ||

| 7 | Phishing attacks | Multifactor authentication, anomaly-based intrusion detection system, email authentication, encryption, secure sockets layer, reports of suspicious activities, back-end analytics, user training/awareness, content-based filtering, blacklisting, and whitelisting. | [112,113,114] |

| Using machine learning, profile matching, text mining, ontology, honeypots, and client–server authentication. | [115] | ||

| 8 | Trojan horse attacks | Integrating biometric and cryptography. | [68,69] |

| Binary code obfuscation and hardware-based code attestation. | [116] | ||

| Malware detection and prevention technique. | [106] | ||

| 9 | Eavesdropping attacks | Message authentication code (MAC). | [70] |

| Use of ECIES and ECDSA. | [66] | ||

| 10 | Brute force attacks | Use of cryptographic hash functions. | [56,70,77,87] |

| 11 | Guessing attack | Elliptic curve cryptosystem. | [66,67,68,69,70] |

| Password-salting mechanism. | [87] | ||

| Hashing functions. | [56,77] | ||

| 12 | Shoulder surfing attack | Use of sightless multifactor authentication. | [79,80,81,85,86,89,90,105] |

| 13 | Man-in-the-middle (MITM) attack | Elliptic curve cryptosystem. | [66,69] |

| Use of both biometric fingerprint and elliptic curve cryptosystem. | [68] | ||

| Multifactor authentication. | [79,85,86,90] | ||

| Symmetric encryption and message authentication code. | [56,67,70,71,73,74,76,102,103] | ||

| 14 | Salami attack | Defining an efficient and robust user and security policy that contains different privileges, updating security systems, initiating both SMS and email message alerting customers regarding any transaction that occurs, and advising the customers to report any unaware money reductions. | [18] |

| 15 | Insider attacks | Using elliptic curve cryptography. | [66,68,70] |

| Using identity-based cryptography. | [75] | ||

| Certificate-based signcryption. | [117] | ||

| 16 | Denial of service (DoS) attacks | Cryptographic hash functions. | [56,67,68,70,71,77,87] |

| Biometric fingerprint authentication. | [52,81,104,105] | ||

| Distributed denial of service (DDoS) attacks | Nonlinear control approach that can prevent malicious attack packets. | [118] | |

| A hybrid intrusion detection system that uses both anomaly-based and signature-based detection methods. | [119] | ||

| 17 | Mobile phone theft | Remote device wipe, training customers, access blocking, data encryption, online or offline data backup, remote access to built-in cameras, GPS device tracking, and PIN protection. | [64] |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ali, G.; Ally Dida, M.; Elikana Sam, A. Two-Factor Authentication Scheme for Mobile Money: A Review of Threat Models and Countermeasures. Future Internet 2020, 12, 160. https://doi.org/10.3390/fi12100160

Ali G, Ally Dida M, Elikana Sam A. Two-Factor Authentication Scheme for Mobile Money: A Review of Threat Models and Countermeasures. Future Internet. 2020; 12(10):160. https://doi.org/10.3390/fi12100160

Chicago/Turabian StyleAli, Guma, Mussa Ally Dida, and Anael Elikana Sam. 2020. "Two-Factor Authentication Scheme for Mobile Money: A Review of Threat Models and Countermeasures" Future Internet 12, no. 10: 160. https://doi.org/10.3390/fi12100160

APA StyleAli, G., Ally Dida, M., & Elikana Sam, A. (2020). Two-Factor Authentication Scheme for Mobile Money: A Review of Threat Models and Countermeasures. Future Internet, 12(10), 160. https://doi.org/10.3390/fi12100160