Investment Uncertainty Analysis in Eucalyptus Bole Biomass Production in Brazil

Abstract

1. Introduction

2. Materials and Methods

2.1. Study Stands

2.2. Silvicultural System

2.3. Experimental Design

2.4. Economic-Financial Analysis

2.5. Quantitative Methods of Investment Analysis

2.6. Risk Analysis

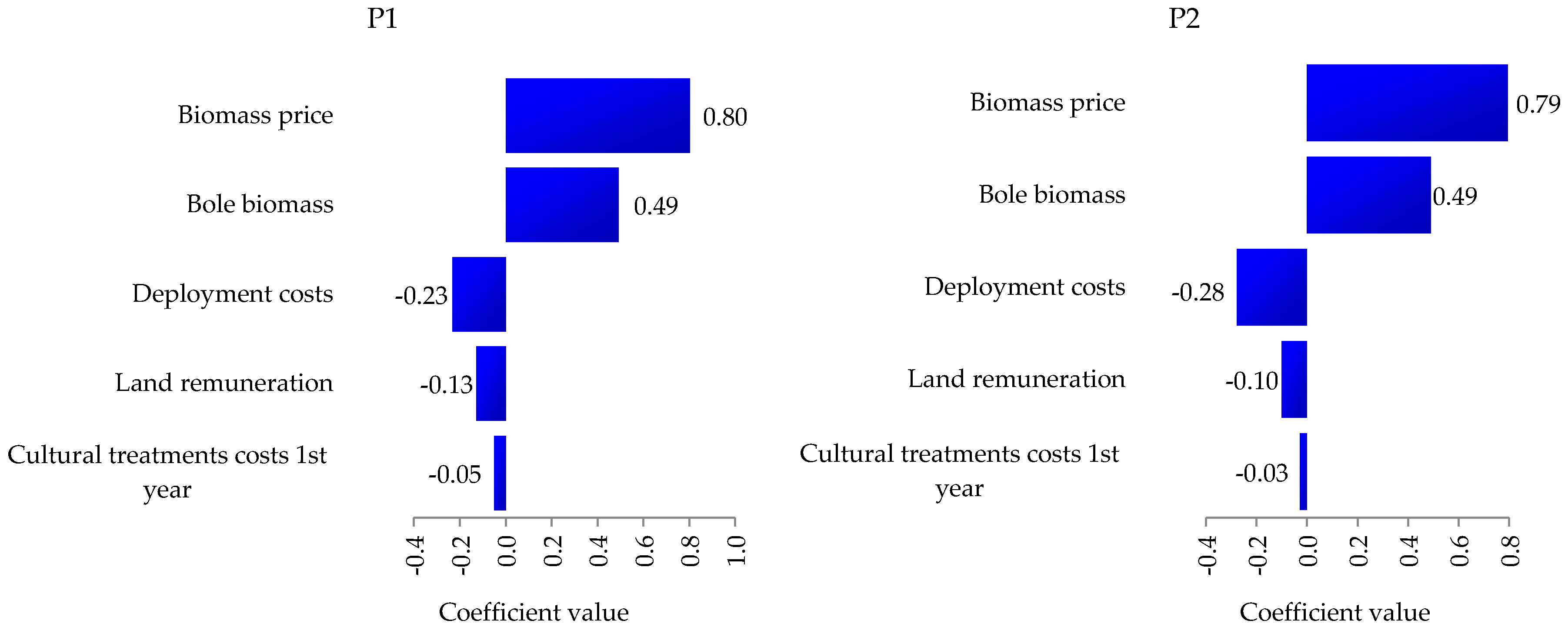

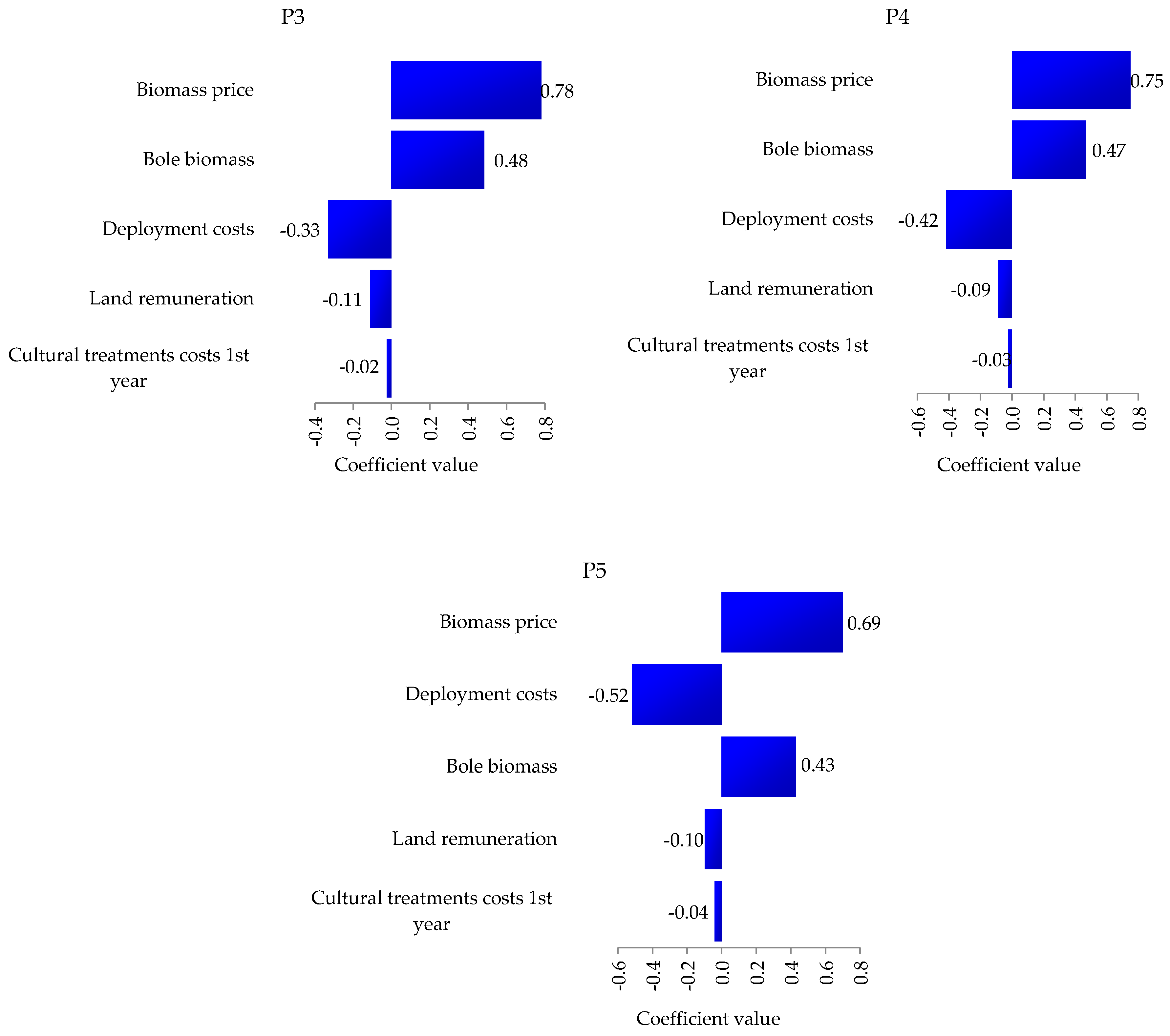

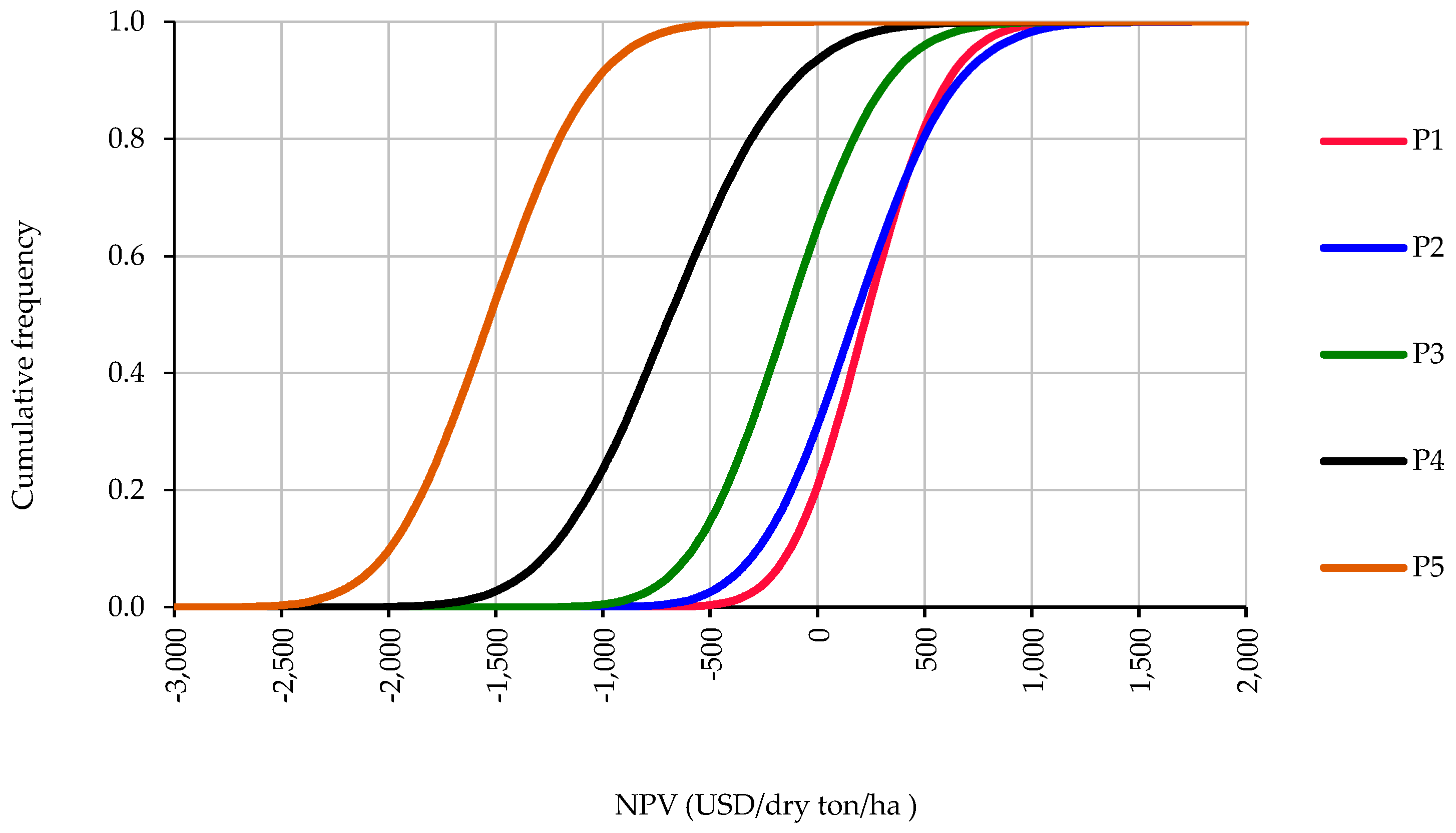

3. Results

4. Discussion

5. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

References

- De Andrade, T.C.G.R.; de Barros, N.F.; Dias, L.E.; Azevedo, M.I.R. Biomass yield and calorific value of six clonal stands of Eucalyptus urophylla S. T. Blake cultivated in Northeastern Brazil. Cerne 2013, 19, 467–472. [Google Scholar] [CrossRef]

- Gonzalez, R.; Treasure, T.; Phillips, R.; Jameel, H.; Saloni, D.; Abt, R.; Wright, J. Converting Eucalyptus biomass into ethanol: Financial and sensitivity analysis in a co-current dilute acid process. Part II. Biomass Bioenergy 2011, 35, 767–772. [Google Scholar] [CrossRef]

- Cozzi, M.; Di Napoli, F.; Viccaro, M.; Romano, S. Use of Forest Residues for Building Forest Biomass Supply Chains: Technical and Economic Analysis of the Production Process. Forests 2013, 4, 1121–1140. [Google Scholar] [CrossRef]

- Wagner, J.E. Forestry Economics: A Managerial Approach; Routledge: Abingdon, UK, 2012; ISBN 978-0-41-577440-6. [Google Scholar]

- Holopainen, M.; Mäkinen, A.; Rasinmäki, J.; Hyytiäinen, K.; Bayazidi, S.; Vastaranta, M.; Pietilä, I. Uncertainty in Forest Net Present Value Estimations. Forests 2010, 1, 177–193. [Google Scholar] [CrossRef]

- Rode, R.; Leite, H.G.; da Silva, M.L.; Ribeiro, C.A.Á.S.; Binoti, D.H.B. The economics and optimal management regimes of eucalyptus plantations: A case study of forestry outgrower schemes in Brazil. For. Policy Econ. 2014, 44, 26–33. [Google Scholar] [CrossRef]

- Rosa, R.; Soares, P.; Tomé, M. Evaluating the Economic Potential of Uneven-aged Maritime Pine Forests. Ecol. Econ. 2018, 143, 210–217. [Google Scholar] [CrossRef]

- Hauk, S.; Knoke, T.; Wittkopf, S. Economic evaluation of short rotation coppice systems for energy from biomass—A review. Renew. Sustain. Energy Rev. 2014, 29, 435–448. [Google Scholar] [CrossRef]

- Skevas, T.; Swinton, S.M.; Tanner, S.; Sanford, G.; Thelen, K.D. Investment risk in bioenergy crops. GCB Bioenergy 2016, 8, 1162–1177. [Google Scholar] [CrossRef]

- Hildebrandt, P.; Knoke, T. Investment decisions under uncertainty—A methodological review on forest science studies. For. Policy Econ. 2011, 13, 1–15. [Google Scholar] [CrossRef]

- Larocque, G.R.; Bhatti, J.S.; Liu, J.; Ascough, J.C., II; Luckai, N.; Gordon, A.M. The importance of uncertainty and sensitivity analyses in process-based models of carbon and nitrogen cycling in terrestrial ecosystems with particular emphasis on forest ecosystems: Selected papers from a workshop organized by the International Society for Ecological Modelling (ISEM) at the third biennial meeting of the International Environmental Modelling and Software Society (IEMSS) in Burlington, Vermont, USA, August 9–13, 2006. Ecol. Model. 2008, 219, 261–263. [Google Scholar] [CrossRef]

- Helton, J.C. Treatment of Uncertainty in Performance Assessments for Complex Systems. Risk Anal. 1994, 14, 483–511. [Google Scholar] [CrossRef]

- Nguyen, A.-T.; Reiter, S.; Rigo, P. A review on simulation-based optimization methods applied to building performance analysis. Appl. Energy 2014, 113, 1043–1058. [Google Scholar] [CrossRef]

- Brosig, F.; Meier, P.; Becker, S.; Koziolek, A.; Koziolek, H.; Kounev, S. Quantitative Evaluation of Model-Driven Performance Analysis and Simulation of Component-Based Architectures. IEEE Trans. Softw. Eng. 2015, 41, 157–175. [Google Scholar] [CrossRef]

- MacCalman, A.D.; Vieira, H.; Lucas, T. Second-order nearly orthogonal Latin hypercubes for exploring stochastic simulations. J. Simul. 2017, 11, 137–150. [Google Scholar] [CrossRef]

- Lane, T.J.; Shukla, D.; Beauchamp, K.A.; Pande, V.S. To milliseconds and beyond: Challenges in the simulation of protein folding. Curr. Opin. Struct. Biol. 2013, 23, 58–65. [Google Scholar] [CrossRef] [PubMed]

- Mun, J. Modeling Risk; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2012; ISBN 978-1-11-836633-2. [Google Scholar]

- Arnold, U.; Yildiz, Ö. Economic risk analysis of decentralized renewable energy infrastructures—A Monte Carlo Simulation approach. Renew. Energy 2015, 77, 227–239. [Google Scholar] [CrossRef]

- Lee, B.; Heo, J.; Choi, N.H.; Moon, C.; Moon, S.; Lim, H. Economic evaluation with uncertainty analysis using a Monte-Carlo simulation method for hydrogen production from high pressure PEM water electrolysis in Korea. Int. J. Hydrogen Energy 2017, 42, 24612–24619. [Google Scholar] [CrossRef]

- Kallio, A.M.I. Accounting for uncertainty in a forest sector model using Monte Carlo simulation. For. Policy Econ. 2010, 12, 9–16. [Google Scholar] [CrossRef]

- Platon, V.; Constantinescu, A. Monte Carlo Method in Risk Analysis for Investment Projects. Procedia Econ. Financ. 2014, 15, 393–400. [Google Scholar] [CrossRef]

- Batan, L.Y.; Graff, G.D.; Bradley, T.H. Techno-economic and Monte Carlo probabilistic analysis of microalgae biofuel production system. Bioresour. Technol. 2016, 219, 45–52. [Google Scholar] [CrossRef] [PubMed]

- Afanasyeva, S.; Saari, J.; Kalkofen, M.; Partanen, J.; Pyrhönen, O. Technical, economic and uncertainty modelling of a wind farm project. Energy Convers. Manag. 2016, 107, 22–33. [Google Scholar] [CrossRef]

- Clancy, D.; Breen, J.P.; Thorne, F.; Wallace, M. A stochastic analysis of the decision to produce biomass crops in Ireland. Biomass Bioenergy 2012, 46, 353–365. [Google Scholar] [CrossRef]

- Dickmann, D. Silviculture and biology of short-rotation woody crops in temperate regions: Then and now. Biomass Bioenergy 2006, 30, 696–705. [Google Scholar] [CrossRef]

- Hinchee, M.; Rottmann, W.; Mullinax, L.; Zhang, C.; Chang, S.; Cunningham, M.; Pearson, L.; Nehra, N. Short-rotation woody crops for bioenergy and biofuels applications. Vitro Cell. Dev. Biol. Plant 2009, 45, 619–629. [Google Scholar] [CrossRef] [PubMed]

- Santos, H.G.; Almeida, J.A.; Oliveira, J.B.; Lumbreras, J.F.; Anjos, L.H.C.; Coelho, M.R.; Jacomine, P.K.T.; Cunha, T.J.F.; Oliveira, V.A. Sistema Brasileiro de Classificação de Solos, 3rd ed.; EMBRAPA: Brasília, Brazil, 2013; ISBN 978-8-57-035198-2. [Google Scholar]

- Assaf Neto, A. Os métodos quantitativos de análise de investimentos. Caderno Estudos 1992, 1–16. [Google Scholar] [CrossRef]

- De Oliveira, F.L.R.; Cabacinha, C.D.; Santos, L.D.T.; Barroso, D.G.; Júnior, S.; Dos, A.; Brant, M.C.; Sampaio, R.A.; de Oliveira, F.L.R.; Cabacinha, C.D.; et al. Productive behavior of eucalyptus and acacia, in different arrangements of crop-livestock-forest integration. Cerne 2015, 21, 227–233. [Google Scholar] [CrossRef]

- Sereghetti, G.C.; Lanças, K.P.; Sartori, M.S.; Rezende, M.A.; Soler, R.R. Efeito do espaçamento no crescimento e na densidade básica da madeira de Eucalyptus urophylla X Eucalyptus grandis em florestas de ciclo curto. Energ. Agric. 2015, 30, 257–262. [Google Scholar] [CrossRef]

- Barbosa, V.C.; Breitschaft, A.M.S. Um aparato experimental para o estudo do princípio de Arquimedes. Rev. Bras. Ensino Fís. 2006, 26, 115–122. [Google Scholar] [CrossRef]

- Instituto de Economia Agrícola Mercados Florestais. Available online: http://www.iea.sp.gov.br/out/florestas.php (accessed on 30 August 2017).

- Instituto de Economia Agrícola Valor de Terra Nua. Available online: http://ciagri.iea.sp.gov.br/nia1/precor.aspx?cod_tipo=1&cod_sis=8 (accessed on 30 August 2017).

- Banco Central do Brasil Correção de Valores. Available online: https://www3.bcb.gov.br/CALCIDADAO/publico/exibirFormCorrecaoValores.do?method=exibirFormCorrecaoValores&aba=1 (accessed on 10 August 2017).

- Assaf Neto, A.; Lima, F.G.; Araújo, A.M.P. Metodologia de Cálculo do Custo de Capital no Brasil. Rev. Adm. 2008, 43, 72–83. [Google Scholar]

- Villadsen, B.; Vilbert, M.J.; Harris, D.; Lawrence Kolbe, A. The Capital Asset Pricing Model and Variations. In Risk and Return for Regulated Industries; Elsevier: New York, NY, USA, 2017; pp. 51–95. [Google Scholar]

- Žižlavský, O. Net Present Value Approach: Method for Economic Assessment of Innovation Projects. Procedia Soc. Behav. Sci. 2014, 156, 506–512. [Google Scholar] [CrossRef]

- Ben-Horin, M.; Kroll, Y. A simple intuitive NPV-IRR consistent ranking. Q. Rev. Econ. Financ. 2017, 66, 108–114. [Google Scholar] [CrossRef]

- Biondi, Y. The double emergence of the Modified Internal Rate of Return: The neglected financial work of Duvillard (1755–1832) in a comparative perspective. Eur. J. Hist. Econ. Thought 2006, 13, 311–335. [Google Scholar] [CrossRef]

- Banco Central do Brasil Sistema Gerenciador de Séries Temporais. Available online: https://www3.bcb.gov.br/sgspub/localizarseries/localizarSeries.do?method=prepararTelaLocalizarSeries (accessed on 4 September 2017).

- Reul, R.I. Profitability index for investments. Harv. Bus. Rev. 1957, 35, 116–132. [Google Scholar]

- Li, T.; Roskilly, A.P.; Wang, Y. A Regional Life Cycle Sustainability Assessment Approach and its Application on Solar Photovoltaic. Energy Procedia 2017, 105, 3320–3325. [Google Scholar] [CrossRef]

- Resurreccion, E.P.; Colosi, L.M.; White, M.A.; Clarens, A.F. Comparison of algae cultivation methods for bioenergy production using a combined life cycle assessment and life cycle costing approach. Bioresour. Technol. 2012, 126, 298–306. [Google Scholar] [CrossRef] [PubMed]

- Abensur, E.O. A multicriteria optimization model applied to the capital budgeting process. Gest. Produç. 2012, 19, 747–758. [Google Scholar] [CrossRef]

- Ponciano, N.J.; de Souza, P.M.; da Mata, H.T.C.; Vieira, J.R.; Morgado, I.F. Análise de viabilidade econômica e de risco da fruticultura na região norte Fluminense. Rev. Econ. Sociol. Rural 2004, 42, 615–635. [Google Scholar] [CrossRef]

- Peternelli, L.A.; da Silva, G.F.; Leite, H.G. Uma proposta para a geração de amostras aleatórias nos problemas de simulação em modelos de planejamento. Rev. Árvore 2006, 30, 749–758. [Google Scholar] [CrossRef]

- Lyra, G.B.; Ponciano, N.J.; de Souza, P.M.; de Sousa, E.F.; Lyra, G.B. Viabilidade econômica e risco do cultivo de mamão em função da lâmina de irrigação e doses de sulfato de amônio. Acta Sci. Agron. 2010, 32. [Google Scholar] [CrossRef]

- Simões, D.; Andrés Daniluk Mosquera, G.; Cristina Batistela, G.; Raimundo de Souza Passos, J.; Torres Fenner, P. Quantitative Analysis of Uncertainty in Financial Risk Assessment of Road Transportation of Wood in Uruguay. Forests 2016, 7, 130. [Google Scholar] [CrossRef]

- Garlick, A. Estimating Risk: A Management Approach; Gower Publishing Limited: Aldershot, UK, 2007; ISBN 978-0-56-608776-9. [Google Scholar]

- Fritzson, P. Introduction to Modeling and Simulation of Technical and Physical Systems with Modelica; John Wiley & Sons: Hoboken, NJ, USA, 2011; ISBN 978-1-11-801068-6. [Google Scholar]

- Doane, D.P.; Seward, L.E. Applied Statistics in Business & Economics, 4th ed.; McGraw-Hill Education: New York, NY, USA, 2014; ISBN 978-0-07-783730-3. [Google Scholar]

- Box, G.E.P.; Jenkins, G.M. Time Series Analysis: Forecasting and Control, 3rd ed.; Holden-Day: San Francisco, CA, USA, 1970; ISBN 978-0-81-621104-3. [Google Scholar]

- Werner, L.; Ribeiro, J.L.D. Previsão de demanda: Uma aplicação dos modelos Box-Jenkins na área de assistência técnica de computadores pessoais. Gest. Produç. 2003, 10, 47–67. [Google Scholar] [CrossRef]

- Sato, R.C. Gerenciamento de doenças utilizando séries temporais com o modelo ARIMA. Einstein 2013, 11, 128–131. [Google Scholar] [CrossRef] [PubMed]

- Almpanidis, G.; Kotropoulos, C. Phonemic segmentation using the generalised Gamma distribution and small sample Bayesian information criterion. Speech Commun. 2008, 50, 38–55. [Google Scholar] [CrossRef]

- Franzblau, A.N. A Primer of Statistics for Non-Statisticians; Harcourt, Brace: Oxford, UK, 1958; Volume viii, ISBN 978-1-57-473439-3. [Google Scholar]

- Qin, X.; Ma, X.; Bai, H. A Risk-Sensitivity Analysis on NPV Model of Investment Projects. In Computational Risk Management; Wu, D.D., Ed.; Springer: Berlin/Heidelberg, Germany, 2011; pp. 277–281, ISBN 978-3-64-215242-9; 978-3-64-215243-6. [Google Scholar]

- Rezende, M.L.; Richardson, J.W. Risk analysis of using sweet sorghum for ethanol production in southeastern Brazil. Biomass Bioenergy 2017, 97, 100–107. [Google Scholar] [CrossRef]

- Palisade Corporation. Palisade Corporation @Risk for Excel. v. 7.5.1; Palisade Corporation: Ithaca, NY, USA, 2016. [Google Scholar]

- Matsumoto, M.; Nishimura, T. Mersenne Twister: A 623-dimensionally Equidistributed Uniform Pseudo-random Number Generator. ACM Trans. Model. Comput. Simul. 1998, 8, 3–30. [Google Scholar] [CrossRef]

- Damodaran, A. Total Betas by Sector. Available online: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/totalbeta.html (accessed on 29 January 2018).

- Ericsson, K.; Rosenqvist, H.; Nilsson, L.J. Energy crop production costs in the EU. Biomass Bioenergy 2009, 33, 1577–1586. [Google Scholar] [CrossRef]

- Zhang, W.-Y.; Wei, Z.-W.; Wang, B.-H.; Han, X.-P. Measuring mixing patterns in complex networks by Spearman rank correlation coefficient. Phys. A Stat. Mech. Appl. 2016, 451, 440–450. [Google Scholar] [CrossRef]

- Te Nijenhuis, J.; Bakhiet, S.F.; van den Hoek, M.; Repko, J.; Allik, J.; Žebec, M.S.; Sukhanovskiy, V.; Abduljabbar, A.S. Spearman’s hypothesis tested comparing Sudanese children and adolescents with various other groups of children and adolescents on the items of the Standard Progressive Matrices. Intelligence 2016, 56, 46–57. [Google Scholar] [CrossRef]

- Finger, R. Assessment of uncertain returns from investment in short rotation coppice using risk adjusted discount rates. Biomass Bioenergy 2016, 85, 320–326. [Google Scholar] [CrossRef]

- Giarola, S.; Bezzo, F.; Shah, N. A risk management approach to the economic and environmental strategic design of ethanol supply chains. Biomass Bioenergy 2013, 58, 31–51. [Google Scholar] [CrossRef]

- Petković, D. Adaptive Neuro-Fuzzy Optimization of the Net Present Value and Internal Rate of Return of a Wind Farm Project under Wake Effect. J. Cent. Cathedra 2015, 8, 11–28. [Google Scholar]

| Descriptive Measure | Bole Biomass (Dry ton/ha) | ||||

|---|---|---|---|---|---|

| P1 | P2 | P3 | P4 | P5 | |

| Minimum | 84.34 | 105.85 | 100.59 | 120.66 | 96.70 |

| Maximum | 113.95 | 142.99 | 135.96 | 163.09 | 130.71 |

| Mean | 99.10 | 124.41 | 118.29 | 141.87 | 113.75 |

| Mode | 98.57 | 124.49 | 118.92 | 141.56 | 113.66 |

| Standard Deviation | 6.06 | 7.63 | 7.24 | 8.71 | 6.95 |

| Stochastic Variable (USD/ha) | Financial Investment Project | ||||

|---|---|---|---|---|---|

| P1 | P2 | P3 | P4 | P5 | |

| Deployment costs | 1095.50 | 1745.23 | 1909.90 | 3033.38 | 3206.21 |

| Cultural treatment costs 1st year | 209.87 | 210.82 | 210.24 | 210.34 | 209.61 |

| Cultural treatment costs 2nd year | 76.67 | 76.15 | 76.77 | 76.22 | 76.81 |

| Administration costs in years 1 to 3 | 50.20 | 50.03 | 49.97 | 50.04 | 50.19 |

| Land remuneration in years 1 to 3 | 251.87 | 251.14 | 250.91 | 251.67 | 250.35 |

| Descriptive Measure | Modified Internal Rate of Return (%) | ||||

|---|---|---|---|---|---|

| P1 | P2 | P3 | P4 | P5 | |

| Minimum | −9.7 | −12.5 | −14.2 | −17.2 | −27.2 |

| Maximum | 35.4 | 31.5 | 26.6 | 22.8 | 9.2 |

| Mean | 14.2 | 12.3 | 7.7 | 2.4 | −6.8 |

| Mode | 13.7 | 12.0 | 7.5 | 3.5 | −7.8 |

| Standard Deviation | 5.3 | 5.2 | 4.9 | 4.7 | 4.3 |

| Descriptive Measure | Profitability Index | ||||

|---|---|---|---|---|---|

| P1 | P2 | P3 | P4 | P5 | |

| Minimum | 0.25 | 0.33 | 0.31 | 0.31 | 0.12 |

| Maximum | 2.66 | 2.18 | 1.86 | 1.59 | 1.05 |

| Mean | 1.29 | 1.17 | 0.99 | 0.82 | 0.55 |

| Mode | 1.28 | 1.12 | 0.93 | 0.76 | 0.54 |

| Standard Deviation | 0.28 | 0.22 | 0.19 | 0.15 | 0.11 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Simões, D.; Dinardi, A.J.; Da Silva, M.R. Investment Uncertainty Analysis in Eucalyptus Bole Biomass Production in Brazil. Forests 2018, 9, 384. https://doi.org/10.3390/f9070384

Simões D, Dinardi AJ, Da Silva MR. Investment Uncertainty Analysis in Eucalyptus Bole Biomass Production in Brazil. Forests. 2018; 9(7):384. https://doi.org/10.3390/f9070384

Chicago/Turabian StyleSimões, Danilo, Ailton Jesus Dinardi, and Magali Ribeiro Da Silva. 2018. "Investment Uncertainty Analysis in Eucalyptus Bole Biomass Production in Brazil" Forests 9, no. 7: 384. https://doi.org/10.3390/f9070384

APA StyleSimões, D., Dinardi, A. J., & Da Silva, M. R. (2018). Investment Uncertainty Analysis in Eucalyptus Bole Biomass Production in Brazil. Forests, 9(7), 384. https://doi.org/10.3390/f9070384