Unlocking Sustainable Profitability: Economic Feasibility of Integrated Crop–Livestock–Forest Systems for Pasture Recovery in the Brazilian Cerrado

Abstract

1. Introduction

2. Materials and Methods

2.1. Study Area and Integrated System Design

2.2. Financial Modeling and Credit Line Scenarios

3. Results

3.1. Financial Performance by Credit Line

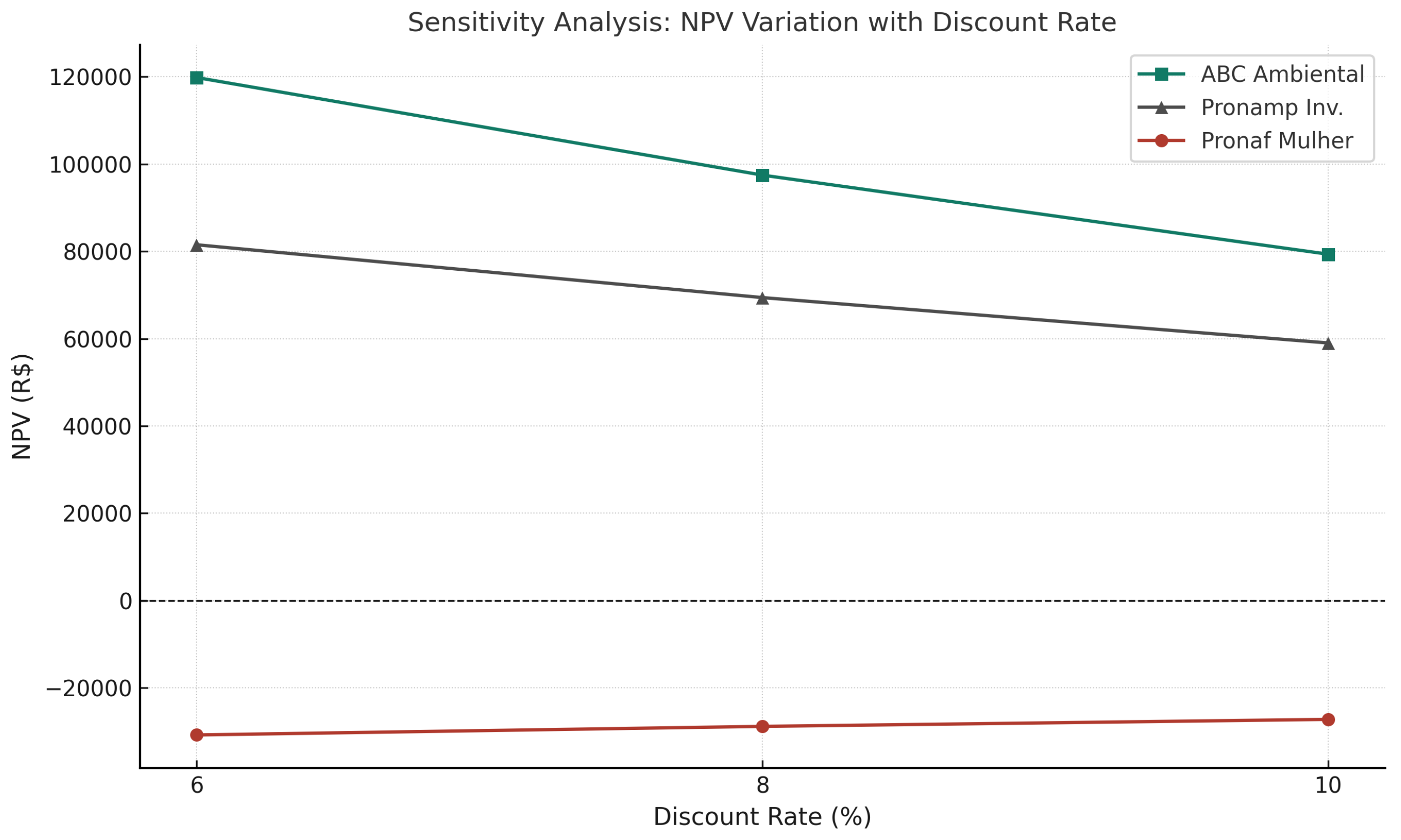

3.2. Sensitivity Analysis

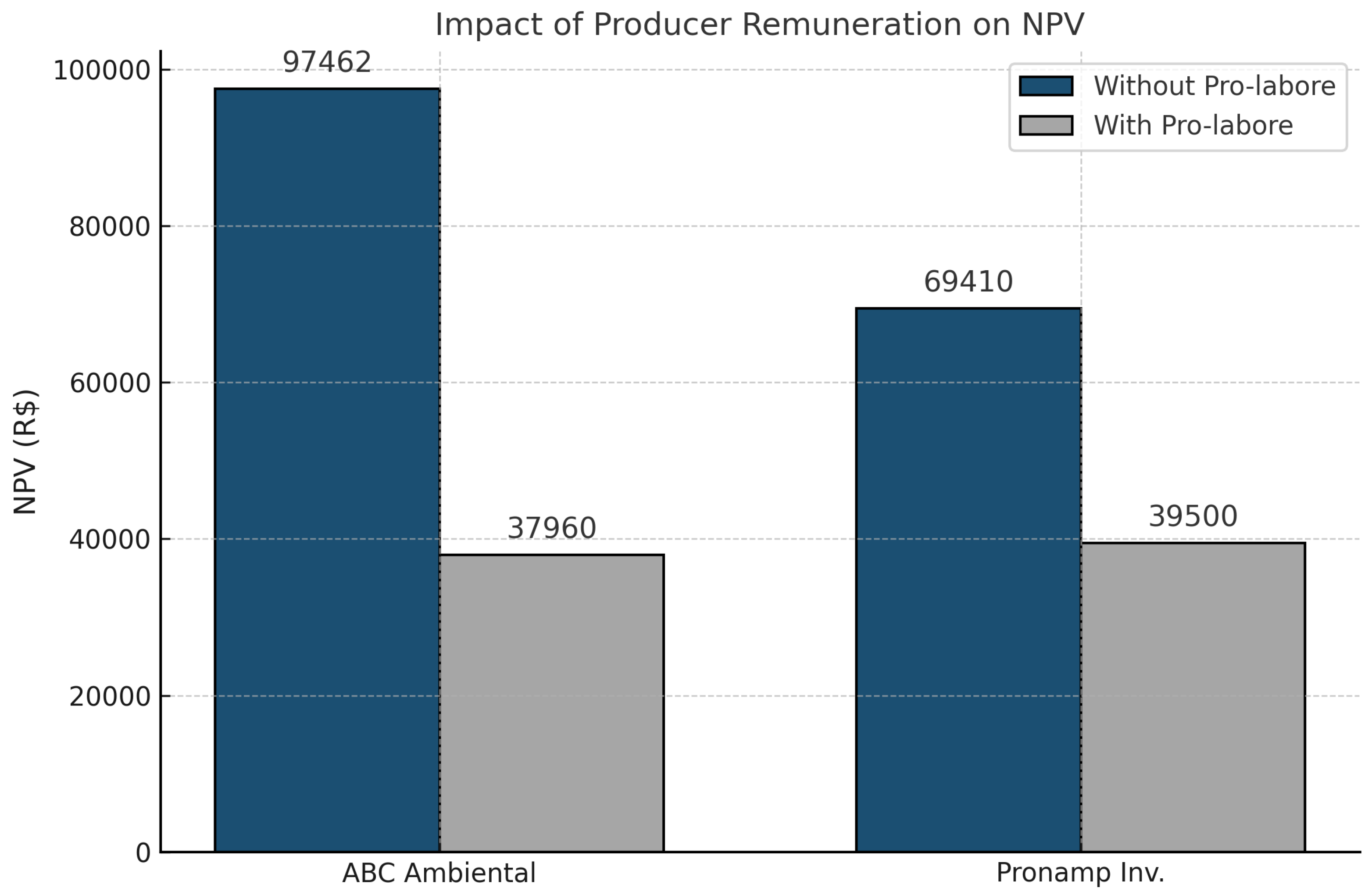

3.3. Impact of Producer Remuneration

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AU | Adult animal unit |

| B/C | Benefit–cost ratio |

| BPE | Equivalent periodic benefit |

| FAO | Food and agriculture organization |

| IBGE | Instituto Brasileiro de Geografia e Estatística |

| ILPF | Integrated crop–livestock–forest systems |

| IRR | Internal rate of return |

| MAPA | Ministério da Agricultura, Pecuária e Abastecimento |

| MIRR | Modified internal rate of return |

| PSA | Payments for environmental services |

References

- Food and Agriculture Organization of the United Nations (FAO). The State of Food and Agriculture 2022: Overcoming Water Challenges in Agriculture, 2022. Available online: https://openknowledge.fao.org/items/98a4c80a-b4d3-403c-8557-d8536c8316ee (accessed on 18 May 2025).

- De Oliveira Silva, R.; Barioni, L.G.; Hall, J.A.J.; Moretti, A.C.; Veloso, R.F.; Alexander, P.; Crespolini, M.; Moran, D. Sustainable intensification of Brazilian livestock production through optimized pasture restoration. Agric. Syst. 2017, 153, 201–211. [Google Scholar] [CrossRef]

- MapBiomas. MapBiomas Project: Brazilian Land Use and Cover, 2023. Available online: https://mapbiomas.org/ (accessed on 15 July 2023).

- Murgueitio, E.; Calle, Z.; Uribe, F.; Calle, A.; Solorio, B. Native trees and shrubs for the productive rehabilitation of tropical cattle ranching lands. For. Ecol. Manag. 2011, 261, 1654–1663. [Google Scholar] [CrossRef]

- Monjardino, M.; Loi, A.; Thomas, D.T.; Revell, C.K.; Flohr, B.M.; Llewellyn, R.S.; Norman, H.C. Improved legume pastures increase economic value, resilience and sustainability of crop-livestock systems. Agric. Syst. 2022, 203, 103519. [Google Scholar] [CrossRef]

- Instituto Brasileiro de Geografia e Estatística (IBGE). Censo Agropecuário 2017: Resultados Definitivos, 2020. Available online: https://biblioteca.ibge.gov.br/index.php/biblioteca-catalogo?view=detalhes&id=73096 (accessed on 18 May 2025).

- Pontes, L.S.; Barro, R.S.; Savian, J.V.; Berndt, A.; Moletta, J.L.; Porfírio-da-Silva, V.; Bayer, C.; Carvalho, P.C.F. Performance and methane emissions by beef heifer grazing in temperate pastures and in integrated crop–livestock systems: The effect of shade and nitrogen fertilization. Agric. Ecosyst. Environ. 2018, 253, 90–97. [Google Scholar] [CrossRef]

- Bungenstab, D.J.; Assad, E.D.; Martins, S.C.; Cordeiro, L.A.M.; Evangelista, B.A. Sequestro de carbono e mitigação de emissões de gases de efeito estufa pela adoção de sistemas integrados. In ILPF: Inovação com Integração de Lavoura, Pecuária e Floresta; Bungenstab, D.J., de Almeida, R.G., Laura, V.A., Balbino, L.C., Ferreira, A.D., Eds.; Embrapa: Brasília, Brazil, 2019; pp. 154–170. Available online: https://www.infoteca.cnptia.embrapa.br/infoteca/bitstream/doc/1112696/1/PLSequestroCarbonoAssad.pdf (accessed on 15 July 2023).

- Strassburg, B.B.N.; Silva, V.P.; Feltran-Barbieri, R. Economics of pasture restoration: Financial and environmental benefits of integrated systems. J. Agric. Econ. 2022, 74, 125–140. [Google Scholar] [CrossRef]

- Feltran-Barbieri, R.; Féres, J.G. Degraded pastures in Brazil: Improving livestock production and forest restoration. R. Soc. Open Sci. 2021, 8, 201854. [Google Scholar] [CrossRef] [PubMed]

- Ministério da Agricultura e Pecuária (MAPA). Relatório de Gestão 2023, 2023. Available online: https://www.gov.br/agricultura/pt-br/acesso-a-informacao/auditorias/relatorio-de-gestao/RelatriodeGestode2023.pdf (accessed on 18 May 2025).

- Climate Policy Initiative. Landscape of Climate Finance for Land Use in Brazil, 2021–2023, 2023. Available online: https://www.climatepolicyinitiative.org/publication/landscape-of-climate-finance-for-land-use-in-brazil-2021-2023/ (accessed on 15 July 2023).

- Liu, H.; Zhao, Y.; Tang, J. A simulation-based deterministic approach for optimizing agro-ecological investments. J. Oper. Res. Soc. 2023. [Google Scholar] [CrossRef]

- Silva Junior, C.; Fonseca, M.; Souza, C. Economic modeling of forest restoration under policy scenarios in the Amazon. For. Policy Econ. 2023, 154, 102957. [Google Scholar] [CrossRef]

- Farashahi, M.; Bertsimas, D. Robust investment analysis using deterministic and stochastic models. Manag. Sci. 2023. [Google Scholar] [CrossRef]

- Oliveira, J.R.; Costa, F.M. Discount rate benchmarks in agroecological project analysis: A Brazilian case. Agric. Financ. Rev. 2023. [Google Scholar] [CrossRef]

- Lima, M.S.; Barbosa, A.C. Capital cost scenarios for agroforestry systems: Evidence from integrated crop-livestock-forestry in Brazil. Environ. Manag. 2022, 70, 645–658. [Google Scholar]

- Gittinger, J.P. Economic Analysis of Agricultural Projects; The Johns Hopkins University Press: Baltimore, MD, USA, 1982; Available online: https://archive.org/details/economicanalysis0000gitt_k2f3 (accessed on 15 July 2023).

- Rezende, J.L.P.; Oliveira, A.D. Análise Econômica e Social de Projetos Florestais; Universidade Federal de Viçosa: Viçosa, Brazil, 2001; Available online: https://livraria.funep.org.br/product/analise-economica-e-social-de-projetos-florestais-2-edic-o/ (accessed on 15 July 2023).

- Magni, C.A. Average Internal Rate of Return and Investment Decisions: A New Perspective. Eng. Econ. 2010, 55, 150–180. [Google Scholar] [CrossRef]

- Brigham, E.F.; Gapenski, L.C. Intermediate Financial Management, 5th ed.; Dryden Press: Fort Worth, TX, USA, 1996; Available online: https://www.abebooks.com/9780030234514/Intermediate-Financial-Management-Brigham-Eugene-0030234514/plp (accessed on 15 July 2023).

- Boardman, A.E.; Greenberg, D.H.; Vining, A.R.; Weimer, D.L. Cost-Benefit Analysis: Concepts and Practice, 5th ed.; Cambridge University Press: Cambridge, UK, 2018; Available online: https://books.google.com/books/about/Cost_Benefit_Analysis.html?id=xj8LEAAAQBAJ (accessed on 15 July 2023).

- Zhao, Y.; Sun, K. Estimating economic profit for land use investment evaluation. Energy Econ. 2024, 126, 108138. [Google Scholar] [CrossRef]

- Ahmed, S.; Rivera, J. Economic performance indicators in agricultural finance: The role of profit-based metrics. N. Am. J. Econ. Financ. 2025, 64, 102404. [Google Scholar] [CrossRef]

- Almeida, C.S.; Fonseca, J.P.; Ribeiro, M.A. Sustainable rural credit: Economic and environmental impacts of financing policies in Brazil. Rev. Bras. Econ. Rural 2020, 62, 243–266. [Google Scholar] [CrossRef]

- Ponciano, N.J.; Shirota, R.; Souza, P.M.A.; Souza, G.S. Risk analysis in agricultural projects: A Monte Carlo approach. Rev. Econ. Sociol. Rural 2004, 42, 457–474. [Google Scholar] [CrossRef]

- Ferreira, L.A.; Nascimento, P.R.; Silveira, J.M.F.J. Digitalization of rural credit and access to financing: Challenges and opportunities in Brazil. Estud. Econômicos 2021, 50, 421–438. [Google Scholar] [CrossRef]

- Souza, P.M.; Almeida, R.F.; Carvalho, T.G. Resource allocation analysis of the ABC program in Brazil: Challenges and perspectives. Rev. Econ. Sociol. Rural 2021, 57, 234–252. [Google Scholar] [CrossRef]

- Batalha, M.O.; Silveira, J.M.F.J.; Souza Filho, H.M. Financial analysis of sustainable agricultural systems: Challenges and opportunities in rural credit. Rev. Econ. Sociol. Rural 2022, 60, 431–453. [Google Scholar] [CrossRef]

- Pereira, R.T.; Gomes, M.C.; Oliveira, D.F. Payments for environmental services and financial incentives in the restoration of degraded pastures. Rev. Bras. Políticas Públicas 2022, 12, 211–230. [Google Scholar] [CrossRef]

- Cunha, L.E. Viabilidade Econômica de Linhas de Crédito para Recuperação de Pastagens Degradadas no Brasil. Master’s Thesis, Departamento de Engenharia Florestal, Universidade de Brasília, Brasília, Brazil, 2025; 96p. [Google Scholar]

| Activity | Category | Method/Unit | Cost (BRL) | Year | Total (BRL) |

|---|---|---|---|---|---|

| Baru production | Soil preparation | Harrowing (h) | 180.00 | 0 | 360.00 |

| Fertilization (L) | 0.72 | 0 | 3600.00 | ||

| Ant control (kg) | 45.00 | 0 | 225.00 | ||

| Pest control (kg) | 15.00 | 0 | 37.50 | ||

| Labor (day) | 100.00 | 0 | 500.00 | ||

| Planting | Seedlings (unit) | 11.00 | 0 | 5500.00 | |

| Seeds (kg) | 75.00 | 0 | 375.00 | ||

| Inputs (L) | 26.30 | 0 | 657.50 | ||

| Harvest | Manual (day) | 150.00 | 3 * | 4500.00 | |

| Processing (day) | 150.00 | 3 * | 2250.00 | ||

| Cattle production | Cattle inputs | Calf purchase (BRL) | 2641.50 | 2, 4, 6, 8, 10 | 7924.50 |

| Mineral salt (bags) | 120.00 | 2 * | 480.00 | ||

| Corn (kg) | 1.20 | 2 * | 1728.00 | ||

| Açu grass (kg) | 0.30 | 2 * | 2016.00 | ||

| Electric fence (ha) | 3534.95 | 0 | 7069.90 | ||

| Water trough (unit) | 400.00 | 2 | 400.00 | ||

| Anthelmintic (mL) | 1.50 | 2 * | 31.50 | ||

| FMD vaccine (dose) | 2.00 | 2 * | 12.00 | ||

| Rabies vaccine (dose) | 3.50 | 2 * | 10.50 | ||

| Pasture maintenance | Limestone (t) | 83.33 | 2, 4, 6, 8, 10 | 333.33 | |

| NPK fertilizer (bags) | 120.00 | 2 * | 480.00 | ||

| Herbicide (L) | 70.00 | 2 * | 140.00 | ||

| Mowing (ha) | 150.00 | 2 * | 300.00 |

| Products | Production | Sale Price (BRL/m3) | ICMS | Net Revenue (BRL/Year) |

|---|---|---|---|---|

| Chestnuts (kg/year) | 30 | R$ 80.00 | 12% | R$ 2112.00 |

| Roasted chestnuts (kg/year) | 30 | R$ 100.00 | 12% | R$ 2640.00 |

| Shelled chestnuts (kg/year) | 30 | R$ 120.00 | 12% | R$ 3168.00 |

| Cattle (@/cycle) | 91.89 | R$ 307.00 | 12% | R$ 24,825.00 |

| Totals | R$ 607.00 | R$ 32,745.00 |

| Credit Line | Max. Amount (R$) | Grace Period (Years) | Total Term (Years) | Interest Rate (% p.a.) |

|---|---|---|---|---|

| Pronaf Floresta | 100,000.00 | 12 | 20 | 3.00 |

| Pronaf Agroecologia | 250,000.00 | 3 | 10 | 3.00 |

| Pronaf Mulher | 250,000.00 | 3 | 10 | 8.00 |

| Pronaf Agroindústria | 210,000.00 | 3 | 10 | 3.00 |

| Pronaf Eco | 165,000.00 | 3 | 10 | 3.00 |

| Pronamp Investimento | 600,000.00 | 2 | 8 | 6.00 |

| Pronamp | 430,000.00 | 3 | 8 | 6.00 |

| ABC Ambiental | 2,000,000.00 | 8 | 12 | 6.00 |

| Self-financing (own funds) | – | 0 | – | – |

| Indicator | Formula and Description |

|---|---|

| Net present value (NPV) [18] | |

| Equivalent periodic benefit (EPB) [19] | |

| Internal rate of return (IRR) [20] | |

| Modified internal rate of return (MIRR) [21] | |

| Payback period (PBP) [22] | |

| Benefit–cost ratio (B/C) [22] | |

| Economic profit (EP) [23,24] |

| Credit Line | Financed (BRL) | NPV (BRL) | BPE (BRL) | TIR (%) | MTIR (%) | Payback (yrs) | B/C |

|---|---|---|---|---|---|---|---|

| ABC Ambiental | 343,930.43 | 97,462.41 | 13,652.18 | 35% | 27% | 17 | 1.24 |

| Pronamp Inv. | 343,930.43 | 69,410.33 | 9722.74 | 37% | 32% | 18 | 1.22 |

| Pronaf Agroec. | 250,000.00 | 59,414.78 | 8322.61 | 33% | 26% | 18 | 1.23 |

| Pronaf Floresta | 100,000.00 | 49,195.32 | 6891.10 | 31% | 16% | 9 | 1.17 |

| Pronaf Agroind. | 210,000.00 | 33,366.13 | 5137.15 | 29% | 23% | 21 | 1.17 |

| Pronaf Eco | 165,000.00 | 26,821.12 | 3757.00 | 26% | 13% | 13 | 1.08 |

| Pronamp | 343,930.43 | 2204.72 | 308.83 | 9% | 9% | 69 | 1.03 |

| Self-financing | – | −4248.61 | −595.13 | 6% | 10% | 26 | 1.10 |

| Pronaf Mulher | 250,000.00 | −28,804.09 | −4034.77 | #NÚM! | −100% | (none) | 0.94 |

| Credit Line | NPV @ 6% p.a. | NPV @ 8% p.a. | NPV @ 10% p.a. |

|---|---|---|---|

| ABC Ambiental | 119,819.92 | 97,462.41 | 79,339.73 |

| Pronamp Investimento | 81,514.98 | 69,410.33 | 59,012.93 |

| Pronaf Agroecologia | 71,293.75 | 59,414.78 | 49,406.81 |

| Pronaf Floresta | 58,054.16 | 49,195.32 | 41,335.50 |

| Pronaf Agroindústria | 48,061.53 | 40,143.44 | 33,366.13 |

| Pronaf Eco | 33,081.56 | 26,821.12 | 21,673.01 |

| Pronamp (conventional) | 5662.56 | 2204.72 | −722.13 |

| Self–financing | 1310.07 | −10,029.54 | −8456.38 |

| Pronaf Mulher | −30,771.24 | −28,804.09 | −27,199.60 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cunha, L.E.; Souza, Á.N.d.; Andrade, J.G.d.; Joaquim, M.S.; Lima, M.d.F.d.B.; Nunes, A.d.S.; Miguel, E.P.; Cruz, J.Á.F.; Barbosa, G.F.B.; Saraiva, C.d.S. Unlocking Sustainable Profitability: Economic Feasibility of Integrated Crop–Livestock–Forest Systems for Pasture Recovery in the Brazilian Cerrado. Forests 2025, 16, 978. https://doi.org/10.3390/f16060978

Cunha LE, Souza ÁNd, Andrade JGd, Joaquim MS, Lima MdFdB, Nunes AdS, Miguel EP, Cruz JÁF, Barbosa GFB, Saraiva CdS. Unlocking Sustainable Profitability: Economic Feasibility of Integrated Crop–Livestock–Forest Systems for Pasture Recovery in the Brazilian Cerrado. Forests. 2025; 16(6):978. https://doi.org/10.3390/f16060978

Chicago/Turabian StyleCunha, Laís Ernesto, Álvaro Nogueira de Souza, Juliana Gonçalves de Andrade, Maísa Santos Joaquim, Maria de Fátima de Brito Lima, Aline da Silva Nunes, Eder Pereira Miguel, Jainara Ávila França Cruz, Gabriel Farias Brito Barbosa, and Carolina da Silva Saraiva. 2025. "Unlocking Sustainable Profitability: Economic Feasibility of Integrated Crop–Livestock–Forest Systems for Pasture Recovery in the Brazilian Cerrado" Forests 16, no. 6: 978. https://doi.org/10.3390/f16060978

APA StyleCunha, L. E., Souza, Á. N. d., Andrade, J. G. d., Joaquim, M. S., Lima, M. d. F. d. B., Nunes, A. d. S., Miguel, E. P., Cruz, J. Á. F., Barbosa, G. F. B., & Saraiva, C. d. S. (2025). Unlocking Sustainable Profitability: Economic Feasibility of Integrated Crop–Livestock–Forest Systems for Pasture Recovery in the Brazilian Cerrado. Forests, 16(6), 978. https://doi.org/10.3390/f16060978