Abstract

The interest in forests from a climate and biodiversity perspective is increasing. Several scientific scenarios and political narratives suggest that reduced timber harvest may facilitate these perspectives. However, reducing timber harvest in one location might result in an increased harvest elsewhere. A harvest leakage might occur. This study estimates the magnitude of leakage due to potential reductions in timber harvests in Sweden. The leakage is calculated using an empirical estimation model based on market responses. The results indicate that 24–77 percent of the reduced harvest will be offset by an opposing change in other countries, depending on timber assortment and time horizon. Thus, the magnitude of the leakage is case specific, but, in all cases, sizeable. Subsequently, the expected climate benefits of policies may be severely reduced if the leakage is left unaddressed in the policy design.

1. Introduction

It is known that growing forests sequester carbon from the atmosphere and help mitigate the impacts of climate change. Carbon is sequestered in the growing biomass (above- and below ground) and in the soil, while carbon is released by timber harvest as well as by natural decomposition and disturbances (e.g., wildfires, storms and insect infestations). In Europe, most forests are managed and have been estimated to have a carbon stock of 10,593 Mt C, with an average annual increase of 155 Mt C [1]. In Sweden, a small open economy with a large forest endowment, the carbon stock in productive forests has been estimated at 1200 Mt C with an annual net sequestration of 10.4 Mt C [2]. In this context, it is not surprising that forest carbon sequestration is relevant for climate policies.

A key issue for designing climate policies is the leakage effect. In this paper, leakage is defined as the spatial or temporal effect on net carbon sequestration of other forests resulting from a climate policy on a specific forest. Leakage may, therefore, weaken the effectiveness of climate policies [3]. It may offset climate measures and may even reverse the intention of the climate policies. Policy measures that may cause leakage can be both directly and indirectly connected to climate issues. For instance, a unilateral policy resulting in higher production costs for firms emitting carbon dioxide may cause the firms to relocate outside the geographical reach of the policy, causing a leakage. A leakage may also occur if the policy causes higher imports. In both cases, the emissions are reduced in the geographical area affected by the policy but could increase in other areas. It has been shown that the risk of leakage is higher amongst countries with stronger economic ties [4].

It is also possible that forest set-aside policies could cause a leakage. For instance, if the timber supply in the geographical policy area decreases, and if, consequently, timber imports increase or if production capacity relocates to outside the geographical policy area, a leakage occurs. Restoration of wetlands and forest set-asides are but a few of the measures that have the potential to reduce the timber supply. Forest set-asides are defined as areas of forest land that are permanently removed from timber production and land-use change to provide ecological benefits, including carbon sequestration [5].

In the EU, policies to prevent leakage, such as border carbon adjustment (BCA), are likely to be implemented soon. The rationale for BCAs is to levy import tariffs on imported goods that correspond to the additional costs of production in the EU due to its climate policies. Therefore, the competition between domestic and imported goods is not distorted. It has been indicated that BCA is usually more effective at counteracting leakage than, e.g., tax exemptions and output-based rebates; however, output-based rebating for specific sectors can also be effective under certain circumstances [6]. However, ref. [7] shows that BCA reduces leakage only by six percent.

The purpose of this study is to estimate the magnitude of leakage due to potential reductions in timber harvests in Sweden. Approximately 86 million cubic meters are annually harvested, with a net annual growth of 21 million cubic meters. A method to estimate the leakage is developed and empirically implemented for three wood assortments (timber, pulpwood and fuelwood) and for three scenarios with different harvesting restrictions (5, 10 and 20 percent).

Previous Research

A common approach to estimate leakage is from sectorial perspectives. In this approach, it is usually the leakage of carbon dioxide that is assessed. For instance, climate policies will cause a 28 percent leakage in the energy sector [8], a 50 percent leakage in the agricultural and steel sectors [9], a 30 percent leakage in the aluminium sector [10], and a 70 percent leakage in the cement industry [11]. The average carbon leakage from the energy sector is 16 percent and 40 percent from the forest sector [12]. Therefore, they conclude that forest carbon policies are more vulnerable to carbon leakage compared to energy carbon policies.

The methodological approaches include qualitative studies, e.g., ref. [13], meta-analyses, e.g., ref. [12], and literature reviews, e.g., ref. [14]. Quantitative studies use general equilibrium models, e.g., ref. [15]; sector models, e.g., ref. [16]; econometrics [17]; or simulations [18]. Studies using general equilibrium models indicate a leakage of up to 30 percent from unilateral climate policies [7,19,20]. The most common method to assess leakage is mathematical simulation models where economic systems are optimised. This could either be computable general equilibrium (CGE) models or partial equilibrium models (e.g., sector models). The former type of model commonly produces lower leakage since more sectors can adjust to the changes, thereby mitigating the leakage to a certain degree. For instance, ref. [21] estimates a leakage of approximately 25 percent in the EU with a €20 carbon price. However, with the same carbon price, ref. [11] estimates the leakage from the EU cement industry to be 70 percent.

Leakage resulting from various forest-related measures has also been addressed in the literature. Carbon credits [22], various compensation and set-aside schemes [5,23,24,25], carbon emission targets [26] and forest plantations [27] have been studied. However, most relevant for this study is how measures to reduce harvests might cause leakage. It has been shown that almost 89 percent of a 10 percent harvesting restriction in China is leaked to adjacent countries [28]. A more recent study supports that result, estimating the leakage between 82 and 58 precent depending on the carbon price (9.8–54 USD per ton) [29].

In a European context, ref. [30] estimates a leakage of 64 percent if the harvests are reduced by 4.5 percent, ref. [31] estimates a leakage of 79 percent if the harvests are reduced by 20 percent and ref. [32] estimates a 73 percent leakage if the harvests are reduced by 42 percent. For the Nordic countries, using the Nordic Forest Sector Model, the harvest leakage is estimated to be 57–106 percent, depending on the country and the magnitude of the harvesting reduction (±10–±50 percent) [33]. For Norway, a reduction of timber harvesting by 10, 30 or 50 percent will have leakage between 60 and 100 percent [16]. Finally, ref. [34] estimates the leakage from a reduced harvest for eight countries that have made major changes in their forest management practices to, on average, 55.6 percent. The magnitude of the leakage is similar between the studies, but the harvesting reductions are not. A plausible explanation could be that the leakage is independent of the scale of the harvesting reduction, i.e., even limited harvesting reductions will cause considerable leakage.

Mostly developed forest-endowed countries are analysed. Groups of countries are also commonly studied, such as Europe [26,30,31,32] and North America [15,17,22,23,35]. Studies on individual countries include China [28]; Norway [16]; Bolivia [24]; Guatemala [36]; México [25]; Bhutan [37]; Vietnam [38]; India [18]; and the Philippines [39]. Also, larger aggregations are studied, such as countries with tropical forests [40] and globally [5,27].

The literature review suggests that leakage depends on the assumptions made as well as on the context and analysed measures. Thus, empirical analyses are imperative to understand the magnitude of potential leakage from measures that reduce wood harvesting. The contribution of this study is to provide such an empirical analysis for Sweden, which, interestingly, has not been conducted before.

2. Materials and Methods

Leakage is a major challenge for assessing the impact of, e.g., climate policies. Leakage implies that an activity on a specific forest stand and time has an impact on other forest stands or time periods [41]. Leakage assessments are commonly divided into primary (direct) and secondary (indirect) leakage effects [42]. Primary leakage occurs when the climate benefits of an activity are entirely or partially negated by increased climate emissions from similar processes in other areas by parties directly linked to the activity. Fundamentally, primary leakage indicates the displacement, rather than avoidance, of the undesirable activity. For example, a specified forest area is demarcated for preservation, causing the forest owner to move harvesting to other areas outside the specified area. Primary leakage has been associated with REDD+ or LULUCF activities but can also occur from other types of activities. Secondary leakage occurs when an activity creates incentives to increase climate emissions elsewhere. It does not need to be directly linked to, nor carried out by, the affected parties. Normally, secondary leakage is assessed in the context of changing market-based incentives. That is, emission reductions are negated by emissions caused by shifts in supply and demand of affected products. For example, a specified forest area is demarcated for preservation, causing a decrease in timber supply, thereby increasing the timber price and increasing harvest elsewhere.

Different methods have been developed to empirically assess leakage [42]. Depending on the research problem, the assessment of either primary or secondary leakage are appropriate, even though they overlap to a certain degree. Methods to assess secondary leakage are concerned with production levels, prices and market behaviour. From this perspective the assessment is focusing on how the leakage is affected by changing harvesting levels given specific market characteristics [23,27]. It has been shown that the size and competition on the international markets, as well as the substitutability between products and between imports and exports, affect the magnitude of the leakage [43]. Swedish forestry is generally run on a commercial basis where the price signals guide the behaviour of the forest owners. Thus, in a Swedish forestry context, it is more appropriate to assess secondary than primary leakage.

2.1. Model of Market Induced Leakage

To assess the magnitude of leakage caused by a harvesting restriction, a model of market-induced leakage is developed. The definition of a leakage suggests that a change in roundwood production on one market is likely to induce responses in other roundwood markets via market linkages. That is, by imposing harvesting restrictions on a market, the market mechanism is likely to counteract the reduced harvest with an increased harvest elsewhere. Therefore, leakage can be defined as [15]:

where is the change in harvested roundwood on the market imposing the harvesting restriction , and is the net change in total harvest in all unrestricted and linked roundwood markets (multiplied by 100 to express the leakage in percentage).

To assess the magnitude of the leakage, empirical specifications of market response mechanisms must be derived. Adapting the model outlined by ref. [23], it is assumed that one roundwood market is unilaterally subject to a harvesting restriction. It is further assumed that roundwood from different markets are perfect substitutes, that the total volume of harvestable roundwood is fixed, and that the markets have the same roundwood price. In the following, the time subscript has been omitted, but the supply functions are conditional on harvested volumes and prices for any given time-period.

The roundwood supply functions of the restricted and unrestricted markets are represented by:

where is the roundwood price, is a vector of input prices, and is the fixed harvestable volume of roundwood. The subscript represents the market that is imposing a harvesting restriction (a.k.a. the restricted market), and represents all other roundwood markets without harvesting restrictions that are linked to the restricted market (a.k.a. the unrestricted markets).

The aggregate roundwood demand function is given by:

where is a vector of shift variables (e.g., income, price of substitutes). Market equilibrium occurs at a roundwood price level that equates roundwood supply and demand.

The residual roundwood demand facing the unrestricted market is defined as the difference between the aggregate roundwood demand and the roundwood supply from the restricted market:

Using the residual roundwood demand in the market equilibrium condition gives an equilibrium for the unrestricted markets:

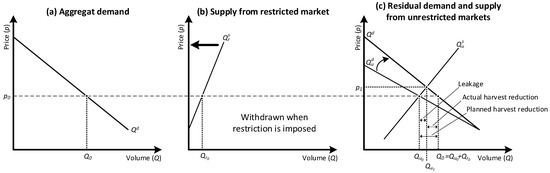

The outlined market can be illustrated as in Figure 1. From left to right, the panels represent (a) the aggregate roundwood demand , (b) the supply from the restricted market , and (c) the residual roundwood demand and supply for the unrestricted markets.

Figure 1.

Conceptual illustration of market-induced leakage. Source: ref. [23].

Before any harvesting restrictions are imposed, the equilibrium price is and the equilibrium volume is . The latter consists of volumes from the to-be restricted market and the unrestricted markets . In this situation, the residual roundwood demand is the difference between the aggregate demand and the supply from the to-be restricted market.

When the harvesting restriction is imposed, the supply from the restricted market is withdrawn . Consequently, the residual demand merges with the aggregate demand , indicating that the aggregate demand needs to be satisfied solely by the supply from the unrestricted markets.

However, at the initial equilibrium price , a demand surplus occurs. Consequently, the equilibrium price increases, inducing an increase in the supply from the unrestricted markets but also a decrease in the aggregate demand. A new equilibrium is reach at and . Subsequently, the aggregate harvest increases by , the harvest from the restricted market decreases by and the harvest from the unrestricted markets increases by .

Mathematically, since (the harvesting restriction is complete), the change in the residual demand from initial volumes can be expressed as:

Manipulating Equation (8) by including the expression for demand elasticity , a policy scale parameter , and that , the following expression can be derived (see Appendix A for details):

The policy scale parameter is what ref. [23] calls the preservation parameter and expresses the baseline ration between the roundwood harvest and the restricted and unrestricted markets. The change in supply from initial volumes on the unrestricted markets can be expressed as:

which, after including the expression for supply elasticity, becomes (see Appendix A for details):

Imposing market equilibrium and solving for the proportional change in the equilibrium price:

Using Equation (12) on the equilibrium condition obtains the change in the harvesting level from the unrestricted markets. Note that the residual demand corresponds with market demand after imposing the harvesting restriction :

Finally, Equation (13) can be used to derive an empirical expression for the leakage defined in Equation (1) (see Appendix A for details):

Differentiating Equation (14) indicates that the leakage increases with supply elasticity and decreases with demand elasticity . Furthermore, the model indicates that the leakage is proportionally larger when the harvesting restriction is small .

2.2. Data

The data needed to simulate the leakage from harvesting restrictions are limited to information on demand and supply elasticities, and on policy implications (or assumptions) regarding the size of the harvesting restriction. The availability of elasticities affects the possibility to assess temporal and spatial leakage effects for different wood assortments. The more disaggregated the elasticities are, the more detailed the leakage effects can be simulated. Table 1 summarises representative estimates of elasticities for Sweden.

Table 1.

Supply and demand elasticity estimates for timber, pulpwood and fuel wood in the short run (SR) and long run (LR).

The elasticities for Sweden presented in Table 1 are based on average annual data on prices and volumes between 1966 and 2006 [44]. The demand elasticities are divided into short- and long-run time perspectives as well as into three wood assortments: timber, pulpwood and fuel wood. The short run is as within a year as ref. [44]. A similar disaggregation of the supply elasticities is not possible due to missing data.

Global demand elasticities for important trade partners of forest products to Sweden are estimated by refs. [45,46]. The estimates are aggregates for roundwood or conifers. Table 2 presents demand elasticities for Estonia, Latvia, Russia, Finland and Norway, disaggregated into the short and long run when possible. All presented elasticities are based on total volumes (compared to volume per capita).

Table 2.

Global demand elasticity estimates for roundwood in the short run (SR) and long run (LR).

Finally, the imposed harvesting restriction is exogenously implemented using the preservation parameter defined in Equation (9). The harvesting restriction can be imposed directly by explicitly prohibiting harvesting in certain areas or it can be imposed indirectly because of, e.g., biodiversity protection. Harvesting restrictions can also be the results of a wide range of policy measures, behaviour changes of forest owners or natural changes. In this context, it is the size of the reduced harvesting that is of interest, not why the restriction is imposed. Three levels of harvesting reductions are implemented: 5, 10 and 20 percent. Table 3 presents the actual harvesting levels of timber, pulpwood and fuel wood in 2022, which are the assumed baseline values for the analysis. In addition, the effect of the harvesting restrictions in absolute volume terms are presented.

Table 3.

Scenario-based harvesting restrictions (million solid cubic meters).

3. Results

The results of the harvesting restrictions are presented in Table 4 for the three wood assortments. The estimates are impact assessments where all other factors are held constant. Therefore, the results are not to be treated as a forecast. Both the domestic and global demand elasticities are used in the simulations. However, only a small share of the Swedish roundwood production is exported, suggesting that the results using the domestic demand elasticities are more accurate. Nevertheless, if the share of international trade increases for Sweden, making the global demand elasticities more central, the results indicate that the leakage will increase for timber and fuel wood, but decrease for pulpwood.

Table 4.

Simulation results of leakage under different harvest reductions (%) using domestic elasticities.

The estimated leakages are interpreted as the percentage of the domestic harvesting reduction that is displaced to other countries. For example, if the harvesting of timber is reduced by ten percent , 26.4 percent of the timber reduction will be displaced to other countries in the short run and 25.3 percent in the long run. Combined with the information in Table 3, this corresponds to almost one million cubic meters of timber that will be displaced to other countries. Alternatively, the leakage rates can be interpreted as the share of each cubic meter reduced harvest that is displaced to other countries. That is, for each cubic meter of timber that is restricted from being harvested in Sweden, 0.264 and 0.253 cubic meters are displaced to other countries in the short and long run, respectively.

The results indicate that for timber, the leakage is between 23.7 and 62.5 percent, for pulpwood between 30.2 and 52.6 percent, and for fuel wood between 25.6 and 76.6 percent. The high short-run leakage effect for fuel wood is explained by the relatively high supply elasticity indicating that forest owners are more price sensitive regarding fuel wood compared to the other assortments.

According to the model, the leakage is expected to increase with decreasing harvesting reductions. Intuitively, this can be interpreted as that other countries can compensate harvesting restrictions more easily if they are not too high. The results confirm this expectation. However, for the individual wood assortments the change in leakage is relatively smaller with larger harvesting reductions. For example, if domestic demand is dominating the range of the short-run leakage estimates for pulpwood is only 3.3 percentage points, i.e., the difference between the highest short-run leakage for pulpwood (52.6 percent) and the lowest (49.3 percent) is 3.3 percentage points. This can be explained by the accessible volumes of roundwood in other counties, few trade restrictions, and unilateral measure to reduce harvesting.

The leakage is lower for timber compared to pulpwood if domestic demand is dominating, but the reverse if global demand is dominating. Technical this can be explained by the absolute higher demand elasticity for pulpwood and the absolute lower demand elasticity for timber, with a global demand. Intuitively, the difference can be explained by the fact that timber, as a feedstock, is more limited compared to pulpwood. Pulpwood has more substitutes compared to timber, e.g., woodchips. The difference between the short and long run indicate that the leakage is generally lower in the long run. This reflects the time it takes to adjust behaviour, value chains or technical solutions. It also suggests that the effects of harvesting restrictions increase carbon sequestration over time.

Fuelwood has a relative high leakage both in the short and long term, albeit somewhat lower in the long term. The relatively high leakage for fuelwood can be explained by its high supply elasticity, indicating that the supply of fuelwood has a higher price sensibility compared to timber and pulpwood. That is, a price change will have a relatively large impact on the supply of fuelwood compared to timber and pulpwood. The difference between the short- and long-term leakage for fuelwood is explained by the corresponding difference in the demand elasticities. In the long term, households can change their heating system, which suggests that the long-term demand elasticity of fuelwood is relatively high.

4. Discussions

The study focuses on market-driven harvest leakage due to different levels of harvesting restrictions in Sweden. The harvesting restrictions are implemented to represent changes in, e.g., forest conservation to protect biodiversity, or forest set-asides to increase the carbon sequestration in the growing biomass. The results are based on numerical estimations using the hypothetical harvesting restrictions and market response, expressed as elasticities. The following discussions highlight the implications of the results and outline the limitations of the methodological framework. The results should be interpreted in response to the imposed harvesting restrictions, not as predictive forecasts. Furthermore, the empirical results presented here are primarily applicable to Sweden, where the timber markets are well-developed. Markets that are well-functioning tend to expand the spatial boundary of the market and, thereby, increasing the area the harvest can be displaced to [23].

A noteworthy finding is the variation of the estimated leakage rates, from approximately 24 to 77 percent, depending on wood assortment (timber, pulpwood, and fuelwood) and time perspective (short and long run). However, similar ranges of harvest leakage are reported in previous studies. For example, ref. [15] indicates that 42–95 percent of a harvesting reduction in one country can be displaced elsewhere. They argue that leakage can be mitigated by multilateral cooperation between countries if it involves more than just a few countries. Similarly, a scenario for the implementation of the EU biodiversity strategy, corresponding to a 48 percent reduction of the roundwood production, suggests that 63 percent of the reduction is displaced [48]. Even by imposing a lower harvesting restriction, the leakage rates are found to be significant. By implementing reference levels for the EU forest carbon sinks, corresponding to a 20 percent harvesting restriction, up to 79 percent of the reduced harvest in the EU (including Norway) is estimated to be displaced to countries outside the EU [31]. A similar approach regarding harvesting restrictions is used by ref. [16] that imposes harvesting restrictions of 10, 30 and 50 percent in Norway. They find that between 60 and 100 percent of the harvesting reduction will be displaced to other countries. In addition, they argue that lower restrictions result in higher leakage rates. This appears plausible since smaller reductions can more easily be offset by other countries, while larger reductions might force the using sectors (e.g., pulp and paper industry, sawmills) to change their structure, technology or production. For the Nordic countries, leakage rates are estimated between 61 and 73 percent for Norway, 59 and 81 percent for Sweden, 57 and 89 percent for Finland, and 59 and 106 percent for Denmark [33]. Overall, these studies indicate leakage patterns consistent with the findings in this study.

There are limitations of the study that need to be addressed. Firstly, the analytical approach is based on market response, represented by supply and demand elasticities. Since elasticities are estimated under a specific context, specific policy scenarios, including behavioural changes, are difficult to assess without estimating a new set of elasticities. Given the static nature of the estimated elasticities, assessing dynamic leakage effects is also difficult beyond the short- and long-term assessments made in the study. The imposed harvesting restrictions are described in general terms, without any further discussion of how they are imposed and which type of forest owner they affect. Secondly, the wider context of leakage is not fully recognised in the model. For instance, potential leakage is also affected by, e.g., trade policies, transportation costs, market regulations, timber certifications, and forestry issues, in addition to market responses. Some of these aspects might be captured by the estimated elasticities, but normally, a competitive and open market is assumed. This limitation suggests that other issues than changes in market response are difficult to assess using the model outline in this study. Thirdly, forests are a spatial distributed resource. This might indicate that a lower spatial resolution is needed to better estimate the leakage rates. While the used geographical resolution (i.e., country level) might be suitable for policy analyses, they may still be too large for actual trade patterns, and behaviour aspects. Consequently, by using regional-specific elasticities, additional insights towards the leakage rates could be gained. Finally, the estimated leakage rates are simply focusing on harvest leakage (or production leakage). As such, it does not fully account for carbon leakage, even though the carbon content of displaced volumes can be calculated, since changes in soil carbon, albedo effects, carbon emissions related to transportation and industrial processes, substitution effects, and variations in forest growth are not accounted for.

The consistent results amongst the studies assessing harvest leakage, including this study, suggest that harvest leakage is present and significant and must be carefully considered when formulating policies or other measures that reduce the supply of domestic roundwood. Otherwise, the effectiveness of the policies might be undermined, i.e., making it more difficult to achieve stipulated targets [31]. From a policy perspective, the leakage can be mitigated, thus increasing the effectiveness of the proposed policy, if multilateral policy agreements can be implemented [14]. This speaks in favour of CBAM to internalising the carbon cost of products entering the EU and, thereby, levelling the competitiveness between EU and non-EU products [49]. Moreover, policies reducing trading costs (e.g., regulatory trade barriers, high transportation and transaction costs) are expected to increase trade but might also increase the leakage by making it less costly to offset a reduced domestic roundwood supply with increasing imports. High leakage rates can also be explained by the homogenous nature of roundwood from boreal forests. The substitutability between domestic and imported roundwood is high [50], indicating a higher leakage rate than would be the case otherwise. However, testing the robustness of leakage to changes in the elasticity of substitution found that the leakage rates are robust [15].

Sensitivity Analysis

To assess the robustness of the estimated leakage rates to the uncertainties regarding the applied elasticities, a series of sensitivity analyses are performed where the elasticities are allowed to vary by ±0.05. Specifically, the sensitivity analyses are based on variations of the short-term domestic elasticities. Table 5 presents the changes applied to the elasticities in the sensitivity analyses.

Table 5.

Variations in the elasticities used in the sensitivity.

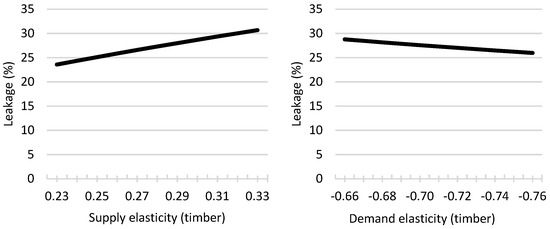

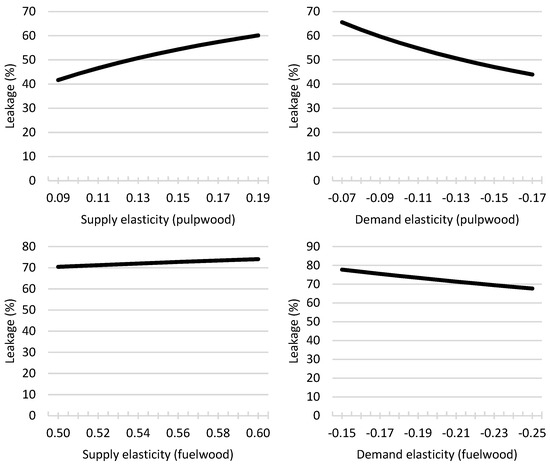

It is expected that the leakage will increase with the supply elasticity and decrease with the demand elasticity . Figure 2 illustrates the change in leakage with the variation in the elasticities. As expected, the leakage increases with the supply elasticities and decreases with the demand elasticities. Variations in the demand and supply elasticities of pulpwood have the largest impact on the leakage. Also, variations in the supply elasticity of timber result in relatively large changes in the leakage. Variations in the other elasticities result in smaller changes in leakage. Limited responsiveness to smaller changes in the timber supply and demand elasticities is also found by ref. [33]. Therefore, the validity and accuracy of this study’s results are strengthened.

Figure 2.

Sensitivity analyses of short-term demand and supply elasticities for timber, pulpwood and fuelwood.

5. Conclusions

Forests make significant contributions to climate mitigation. They sequester carbon from the atmosphere, and they provide renewable and emission-neutral materials that store carbon and that can be used to replace emission-intensive materials and fuels. In this study, secondary leakage of reduced timber harvests is analysed. This type of leakage occurs via well-established international roundwood markets. However, with similar carbon prices, the relative cost is not affected as there are with unilateral measures. The analysis is based on speculative harvest reductions of 5, 10 and 20 percent on timber pulpwood and fuelwood. Previous studies indicate a wide range of leakage rates, where applied methods, evaluated policies, climate zones and other geographical restrictions are affecting the outcome. However, the previous studies with a comparable approach and application find similar results as in this study.

The general conclusions are that policies aiming to increase the climate benefits of forests must be considered as part of a larger system and contextual setting. For instance, smaller constellations of countries, in relation to the global market, and with common policies have higher leakage effects. Lower trading costs (e.g., trade regulations and transportation costs) and a high degree of substitutability between domestic and imported goods also tend to increase leakage. Specifically, the results indicate that the differences in leakage for the different wood assortments depend on the size of the harvesting restriction, the price sensitivities of demand and supply and the time horizon (short or long term). The results indicate that more extensive harvesting restrictions imply a lower proportionate leakage, that the leakage is higher in the short term compared to the long term, and that a higher demand–price sensitivity implies lower leakage, while a higher supply–price sensitivity implies higher leakage.

The results indicate that leakage is an important issue to consider when designing and implementing climate policies affecting the forestry sector. In the context of the study, a leakage implies that a reduced timber harvest in one country will increase timber harvest in other countries. The results suggest that for each cubic meter of reduced harvest in Sweden, the harvest in other countries will increase by between 0.237 and 0.766 cubic meters, depending on wood assortment, time horizon and export intensity (domestic or global demand elasticities). Thus, a harvest reduction in Sweden will partly be displaced to other countries and could, therefore, negate the intended aim of the harvest reduction. In practical terms, the leakage is explained by increasing timber imports to Sweden, or by a discrete or gradual relocation of demand-side production capacities abroad. The part of the harvest reduction that is not displaced to other countries is absorbed by measures to increase the resource efficiency, reduce production or closure of production lines. A high leakage rate suggests that such measures may be costly, indicating that an increase in timber imports is preferred.

Three caveats of the estimated leakage are worth commenting on. Firstly, leakage goes both ways. Changes in Swedish climate policies will affect other countries via leakage, but changes in other countries policies will also affect Sweden via leakage. This bidirectional impact has not been analysed cohesively before. For example, if Sweden reduces its timber supply (for whatever reason) it is reasonable to assume that a leakage will occur to other countries. However, if other countries also reduce their timber supply, a leakage to Sweden is expected. The net effect of the leakages is best analysed from a system perspective including both temporal and spatial dimensions. However, the changes in relative prices should be able to indicate the general direction of the leakage. Secondly, a displacement of timber harvest to other countries explicitly assumes that they have the capacity to increase their harvests. This assumption tends to overestimate the leakage effect. There could be economic or technical constraints restricting other countries to increase their timber harvest. It could also be similar desires to reduce the harvest levels due to climate issues. Markets could be established with new trading partners but usually at a higher cost. There is also a risk that leakage leads to increased imports from more environmentally sensitive areas compared to the areas that are protected domestically (both in terms of carbon sequestration potential and biodiversity). Moreover, changes in social aspects in the exporting countries may also be significant in the event Sweden changes its timber imports. Finally, if a reduced harvest is displaced to better managed forests, or if the displacement leads to more resource efficient solutions, then leakage is a positive phenomenon. However, leakage from Sweden can arguably not be seen from this perspective given the forest management practices and efficient forest industry that the country has. However, it might be possible to make the argument for potential leakage to Sweden. But that assumes that Sweden is willing and able to increase its timber harvest to compensate for reductions in other countries.

Funding

This research was funded by Formas, the Swedish research council for sustainable development (reg. no. 2019-00334).

Data Availability Statement

Data are contained within the article.

Acknowledgments

The author thank Bio4Energy, a strategic research environment supported through the Swedish Government’s Strategic Research Area initiative.

Conflicts of Interest

The author declares no conflicts of interest.

Appendix A

Deriving the expression for the change in the residual demand. Starting with the following expression:

Demand elasticity is defined as:

Manipulating Equation (A1) to include the expression of the demand elasticity:

Using

Including a policy scale parameter defined as:

yields:

Deriving the expression for the change in the supply from the unrestricted markets. Starting with the following expression:

Supply elasticity is defined as:

Manipulating Equation (A7) to include the expression of the demand elasticity:

Deriving the expression for leakage. Starting with the following expression:

and using the equilibrium condition derived in Equation (13) and the definition of the policy scale parameter :

References

- Forest Europe. State of Europe’s Forests 2020; Forest Europe: Bratislava, Slovakia, 2020; Available online: https://foresteurope.org/ (accessed on 20 June 2022).

- EPA—The Swedish Environmental Protection Agency. Nettoutsläpp och Nettoupptag av Växthusgaser från Markanvändning (LULUCF). 2023. Available online: https://www.naturvardsverket.se/data-och-statistik/klimat/vaxthusgaser-nettoutslapp-och-nettoupptag-fran-markanvandning/ (accessed on 2 July 2022).

- Martin, R.; Muûls, M.; de Preux, L.B.; Wagner, U.J. On the empirical content of carbon leakage criteria in the EU emissions trading scheme. Ecol. Econ. 2014, 105, 78–88. [Google Scholar] [CrossRef]

- Ostwald, M.; Henders, S. Making two parallel land-use sector debates meet: Carbon leakage and indirect land-use change. Land Use Policy 2014, 36, 533–542. [Google Scholar] [CrossRef]

- Sun, B.; Sohngen, B. Set-asides for carbon sequestration: Implications for permanence and leakage. Clim. Change 2009, 96, 409–419. [Google Scholar] [CrossRef]

- Fischer, C.; Fox, A.K. Comparing policies to combat emissions leakage: Border carbon adjustments versus rebates. J. Environ. Econ. Manag. 2012, 64, 199–216. [Google Scholar] [CrossRef]

- Branger, F.; Quirion, P. Climate policy and the ‘carbon haven’ effect. Wiley Interdiscip. Rev. Clim. Change 2014, 5, 53–71. [Google Scholar] [CrossRef]

- Paroussos, L.; Fragkos, P.; Capros, P.; Fragkiadakis, K. Assessment of carbon leakage through the industry channel: The EU perspective. Technol. Forecast. Soc. Change 2015, 90, 204–219. [Google Scholar] [CrossRef]

- Key, N.; Tallard, G. Mitigating methane emissions from livestock: A global analysis of sectoral policies. Clim. Change 2012, 112, 387–414. [Google Scholar] [CrossRef]

- Demailly, D.; Quirion, P. Changing the Allocation Rules in the EU ETS: Impact on Competitiveness and Economic Efficiency. Fondazione Eni Enrico Mattei. FEEM Working Paper No. 89. 2008. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1302768 (accessed on 25 June 2022).

- Ponssard, J.P.; Walker, N. EU emissions trading and the cement sector: A spatial competition analysis. Clim. Policy 2008, 8, 467–493. [Google Scholar] [CrossRef]

- Pan, W.; Kim, M.-K.; Ning, Z.; Yang, H. Carbon leakage in energy/forest sectors and climate policy implications using meta-analysis. For. Policy Econ. 2020, 115, 102161. [Google Scholar] [CrossRef]

- Andrasko, K. Forest management for greenhouse gas benefits: Resolving monitoring issues across project and national boundaries. Mitig. Adapt. Strateg. Glob. Change 1997, 2, 117–132. [Google Scholar] [CrossRef]

- Jonsson, R.; Mbongo, W.; Felton, A.; Boman, M. Leakage Implications for European Timber Markets from Reducing Deforestation in Developing Countries. Forests 2012, 3, 736–744. [Google Scholar] [CrossRef]

- Gan, J.; McCarl, B.A. Measuring transnational leakage of forest conservation. Ecol. Econ. 2007, 64, 423–432. [Google Scholar] [CrossRef]

- Kallio, A.M.I.; Solberg, B. Leakage of forest harvest changes in a small open economy: Case Norway. Scand. J. For. Res. 2018, 33, 502–510. [Google Scholar] [CrossRef]

- Wear, D.N.; Murray, B.C. Federal timber restrictions, interregional spillovers, and the impact on US softwood markets. J. Environ. Econ. Manag. 2004, 47, 307–330. [Google Scholar] [CrossRef]

- Hooda, N.; Gera, M.; Andrasko, K.; Sathaye, J.; Gupta, M.K.; Vasistha, H.B.; Chandran, M.; Rassaily, S.S. Community and farm forestry climate mitigation projects: Case studies from Uttaranchal, India. Mitig. Adapt. Strateg. Glob. Change 2007, 12, 1099–1130. [Google Scholar] [CrossRef]

- Böhringer, C.; Carbone, J.C.; Rutherford, T.F. Unilateral climate policy design: Efficiency and equity implications of alternative instruments to reduce carbon leakage. Energy Econ. 2012, 34, S208–S217. [Google Scholar] [CrossRef]

- Böhringer, C.; Balistreri, E.J.; Rutherford, T.F. Embodied Carbon Tariffs. Scand. J. Econ. 2018, 120, 183–210. [Google Scholar] [CrossRef]

- Demailly, D.; Quirion, P. European emission trading scheme and competitiveness: A case Study on the iron and steel industry. Energy Econ. 2008, 30, 2009–2027. [Google Scholar] [CrossRef]

- Nepal, P.; Ince, P.J.; Skog, K.E.; Chang, S.J. Forest carbon benefits, costs and leakage effects of carbon reserve scenarios in the United States. J. For. Econ. 2013, 19, 286–306. [Google Scholar] [CrossRef]

- Murray, B.C.; McCarl, B.A.; Lee, H.-C. Estimating Leakage from Forest Carbon Sequestration Programs. Land Econ. 2004, 80, 109–124. [Google Scholar] [CrossRef]

- Sohngen, B.; Brown, S. Measuring leakage from carbon projects in open economies: A stop timber harvesting project in Bolivia as a case study. Can. J. For. Res. 2004, 34, 829–839. [Google Scholar] [CrossRef]

- Alix-Garcia, J.M.; Shapiro, E.N.; Sims, K.R.E. Forest Conservation and Slippage: Evidence from Mexico’s National Payments for Ecosystem Services Program. Land Econ. 2012, 88, 613–638. [Google Scholar] [CrossRef]

- Michetti, M.; Rosa, R. Afforestation and Timber management compliance strategies in climate Policy—A Computable general equilibrium analysis. Clim. Change 2012, 77, 139–148. [Google Scholar] [CrossRef]

- Sedjo, R.; Sohngen, B. Forestry Sequestration of CO2 and Markets for Timber. RFF (Resources for the Future), Discussion Paper 00-35. 2000. Available online: https://www.rff.org/publications/working-papers/forestry-sequestration-of-co2-and-markets-for-timber/ (accessed on 22 June 2022).

- Hu, X.; Shi, G.; Hodges, D. International market leakage from China’s forestry policies. Forests 2014, 5, 2613–2625. [Google Scholar] [CrossRef]

- Qiao, D.; Zhang, Z.; Li, H. How does carbon trading impact China’s forest carbon sequestration potential and carbon leakage? Forests 2024, 15, 497. [Google Scholar] [CrossRef]

- Päivinen, R.; Kallio, A.M.I.; Solberg, B.; Käär, L. EU Forest reference levels: The compatible harvest volumes compiled and assessed in terms of forest sector market development. For. Policy Econ. 2022, 140, 102748. [Google Scholar] [CrossRef]

- Kallio, A.M.I.; Solberg, B.; Käär, L.; Päivinen, R. Economic impacts of setting reference levels for the forest carbon sinks in the EU on the European forest sector. For. Policy Econ. 2018, 92, 193–201. [Google Scholar] [CrossRef]

- Dieter, M.; Weimar, H.; Iost, S.; Englert, H.; Fischer, R.; Günter, S.; Morland, C.; Roering, H.-W.; Schier, F.; Seintsch, B.; et al. Assessment of Possible Leakage Effects of Implementing EU COM Proposals for the EU Biodiversity Strategy on Forestry and Forests in Non-EU Countries; Thünen Working Paper 159; Thünen Institute of International Forestry and Forest Economics: Braunschweig, Germany, 2020. [Google Scholar]

- Hu, J.; Jåstad, E.-O.; Bolkesjø, T.-F.; Rørstad, P.-K. The quantification and tracing of leakage in the forest sector in Nordic countries. Forests 2024, 15, 254. [Google Scholar] [CrossRef]

- Meyfroidt, P.; Rudel, T.K.; Lambin, E.F. Forest transitions, trade, and the global displacement of land use. Proc. Natl. Acad. Sci. USA 2010, 107, 20917–20922. [Google Scholar] [CrossRef]

- Sohngen, B.; Mendelsohn, R.; Sedjo, R. Forest management, conservation, and global timber markets. Am. J. Agric. Econ. 1999, 81, 1–13. [Google Scholar] [CrossRef]

- Fortmann, L.; Sohngen, B.; Southgate, D. Assessing the Role of Group Heterogeneity in Community Forest Concessions in Guatemala’s Maya Biosphere Reserve. Land Econ. 2017, 93, 503–526. [Google Scholar] [CrossRef]

- Jadin, I.; Meyfroidt, P.; Lambin, E.F. Forest protection and economic development by offshoring wood extraction: Bhutan’s clean development path. Reg. Environ. Change 2016, 16, 401–415. [Google Scholar] [CrossRef]

- Meyfroidt, P.; Lambin, E.F. Forest transition in Vietnam and displacement of deforestation abroad. Proc. Natl. Acad. Sci. USA 2009, 106, 16139–16144. [Google Scholar] [CrossRef] [PubMed]

- Lasco, R.D.; Pulhin, F.B.; Sales, R.F. Analysis of leakage in carbon sequestration projects in forestry: A case study of upper Magat watershed, Philippines. Mitig. Adapt. Strateg. Glob. Change 2007, 12, 1189–1211. [Google Scholar] [CrossRef]

- Kuik, O. REDD+ and international leakage via food and timber markets: A CGE analysis. Mitig. Adapt. Strateg. Glob. Change 2014, 19, 641–655. [Google Scholar] [CrossRef]

- IPCC—Intergovernmental Panel on Climate Change. Section 2.3.5.2. Leakage. In Land-Use, Land-Use Change, and Forestry—A Special Report of the Intergovernmental Panel on Climate Change (IPCC); Watson, R.T., Noble, I.R., Bolin, B., Ravindranath, N.H., Verardo, D.J., Dokken, D.J., Eds.; Cambridge University Press: Cambridge, UK, 2000; Available online: https://archive.ipcc.ch/ipccreports/sres/land_use/ (accessed on 2 July 2022).

- Aukland, L.; Costa, P.M.; Brown, S.A. A conceptual framework and its application for addressing leakage: The case of avoided deforestation. Clim. Policy 2003, 3, 123–136. [Google Scholar] [CrossRef]

- Marcu, A.; Egenhofer, C.; Roth, S.; Stoefs, W. Carbon Leakage: An Overview. Centre for European Policy Studies, CEPS Special Report No. 79. 2013. Available online: https://www.ceps.eu/ceps-publications/carbon-leakage-overview/ (accessed on 12 July 2022).

- Geijer, E.; Bostedt, G.; Brännlund, R. Damned if you do, damned if you do not—Reduced Climate Impact vs. Sustainable Forests in Sweden. Resour. Energy Econ. 2011, 33, 94–106. [Google Scholar] [CrossRef]

- Morland, C.; Schier, F.; Janzen, N.; Weimar, H. Supply and demand functions for global wood markets: Specification and plausibility testing of econometric models within the global forest sector. For. Policy Econ. 2018, 92, 92–105. [Google Scholar] [CrossRef]

- Skjerstad, S.H.F.; Kallio, A.M.I.; Bergland, O.; Solberg, B. New elasticities and projections of global demand for coniferous sawnwood. For. Policy Econ. 2021, 122, 102336. [Google Scholar] [CrossRef]

- Swedish Forest Agency. Skogsstyrelsens Statistikdatabas. 2023. Available online: https://pxweb.skogsstyrelsen.se/pxweb/sv/Skogsstyrelsens%20statistikdatabas/ (accessed on 19 June 2023).

- Schier, F.; Iost, S.; Seintsch, B.; Weimar, H.; Dieter, M. Assessment of possible production leakage from implementing the EU biodiversity strategy on forest product markets. Forests 2022, 13, 1225. [Google Scholar] [CrossRef]

- European Commission. Carbon Border Adjustment Mechanism. 2025. Available online: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en (accessed on 13 February 2025).

- Lundmark, R.; Shahrammehr, S. Sweden’s import substitution possibilities for roundwood. Scand. J. For. Res. 2011, 26, 146–153. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).