1. Introduction

One can intuitively suspect that capital return rate in forestry can be maximized by growing trees experiencing a value-adding assortment transition. The volumetric growth within a stand can possibly be allocated to trees experiencing such an assortment transition by harvesting trees that already have completed most of the transition. Such a transition situation may possibly endure over several harvesting cycles, provided the tree species is at least somewhat shade-tolerant.

There is a large body of literature discussing the effect of thinning schedules on the net present value of revenues [

1,

2,

3,

4,

5,

6,

7,

8,

9]. It appears that the optimal number of thinnings, thinning intensity, as well as selection between continuous-cover forestry and clearcuttings depends on the applied discounting interest rate [

1,

2,

3,

4,

5,

6,

7,

8,

9]. The discounting interest rate is supposed to reflect the cost of capital; however, the actual expense of borrowing varies widely, and the opportunity costs in terms of missed alternative investments tend to vary more. We find such a discounting approach inappropriate, since consequences may be financially devastating [

10].

An improvement harvesting may contribute to the capital return rate on a forest stand. We intend to design such an initial improvement harvesting. Provided significant improvement of capital return rate is possible through harvesting, we look forward to further harvestings in order to retain a high capital return rate. We take it granted that removal of trees with obvious quality defects or visible loss of vigor improves further productivity of the stand. In addition to the quality thinning, the effect of diameter-limit cutting on the capital return rate is investigated.

We adopt a practical focus to a few fertile Norway spruce-dominated stands in Eastern Finland, where observations regarding the present structure of the tree populations are collected. Then, the growth of trees, as well as recruitment of new trees, is clarified according to an empirical growth model, constructed on the basis of a large Norwegian dataset [

11,

12]. Even if the practical focus is in semiboreal spruce stands, the results may be, at least qualitatively, applicable to any circumstances where at least to some degree shade-tolerant trees experience a value-adding assortment transition. Different tree species, however, are likely to require a calibrated growth model of their own.

First, materials and methods are introduced. This offers a description of the example sites, the applied growth model, as well as financial methods. Then quality thinning is introduced on the basis of quality classification of the trees recorded in field measurements, and the quality thinning is combined with diameter-limit cutting. The capital return rate is reported as relative value growth rate within a five-year period after any thinning. The capital return rate is clarified first after quality thinning only, and then as a function of any applied cutting limit diameter. Finally, simulated further development of the stands under repeated diameter-limit cuttings is reported, and some implications of the results are discussed.

4. Discussion

One must raise a question regarding the capital return rate over the entire rotation, including the decades necessary to grow a young stand to a state where the improvement harvesting can be implemented. The present data does provide some tools for solving this question. Firstly, the characteristic tree age of the seven non-thinned stands discussed varied from 31 to 45 years. Second, the computed stumpage value of trees to be collected in the improvement harvesting varied 2400–9200 Euros/ha. Third, the present bare land value, as well as the present level of artificial regeneration and young stand cleaning expenses are known. These can be discounted to the time of artificial regeneration and young stand cleaning. A natural discounting interest possibly equals the present bare land appreciation rate.

It has been recently shown that an accurate computation of a representative (expected) value of capital return rate requires knowledge of the details of the yield function [

10]. However, an approximation can be gained simply as an internal rate of return [

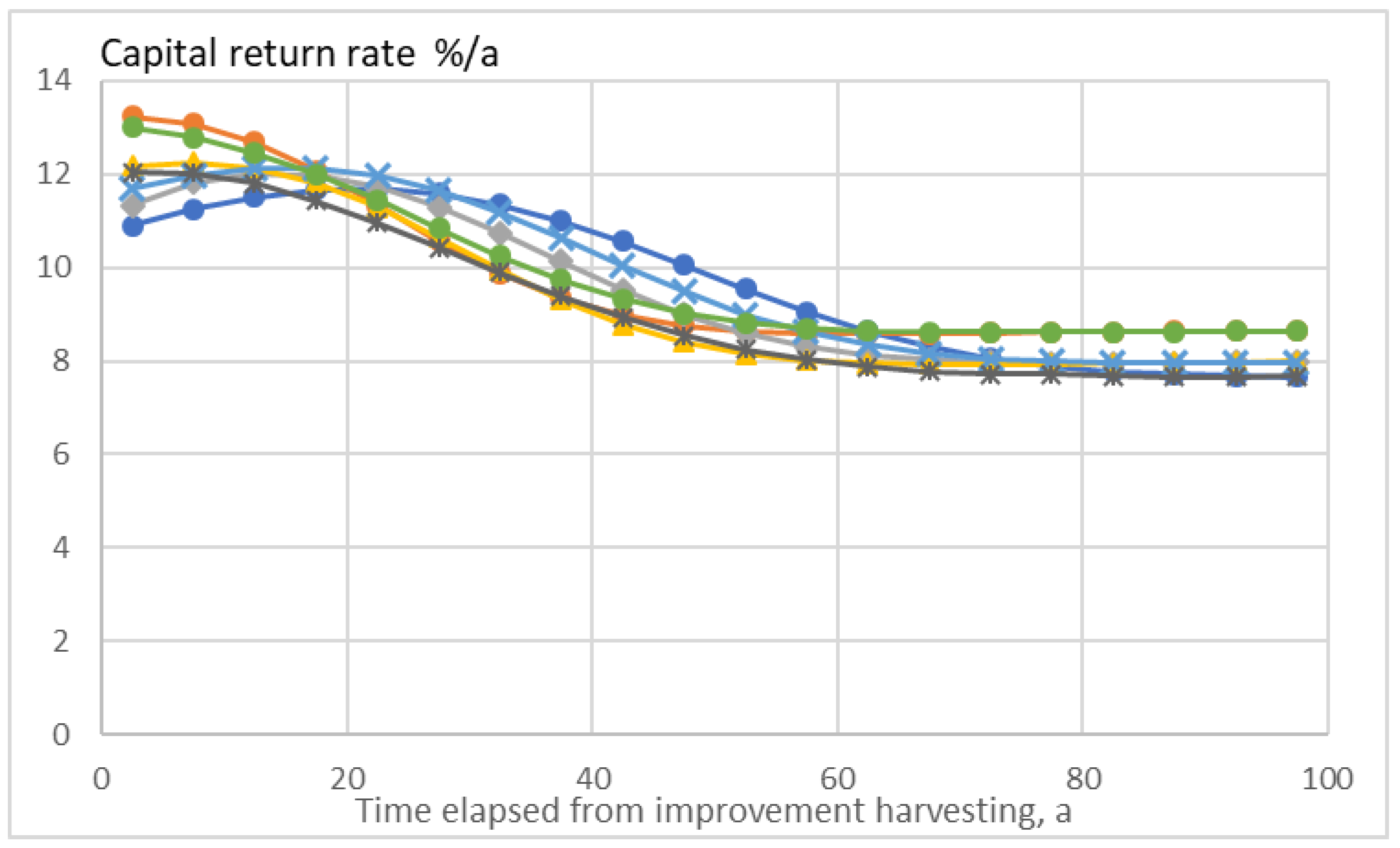

10]. Considering the numbers discussed in the preceding paragraph, the annual internal return rates up to the improvement harvesting appear to be 3.7%–7.5%, with a mode value of 6.6%. This is less than the capital return rate in the stationary state (

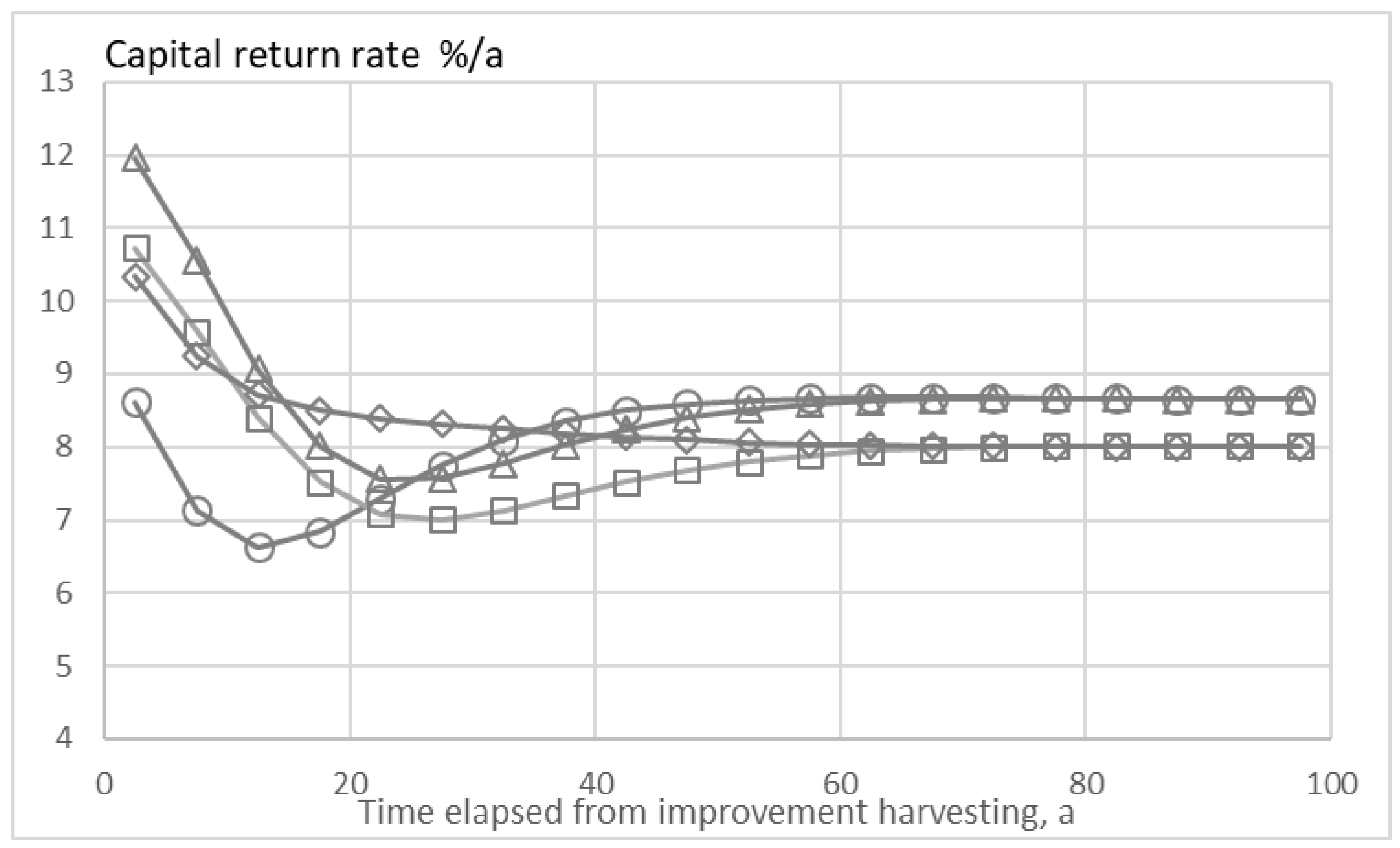

Figure 3). However, considering the fact that there is a significantly elevated capital return rate during the first four decades after the improvement harvesting (

Figure 3), rotation forestry with repeated high thinnings apparently provides somewhat greater capital return rate as stationary continuous-cover forestry.

In the context of a comparison between rotation forestry with repeated high thinnings on the one hand and stationary continuous-cover forestry on the other, one possibly should discuss other factors, in addition to the capital return rate. Firstly, the harvest volume is much greater in rotation forestry (

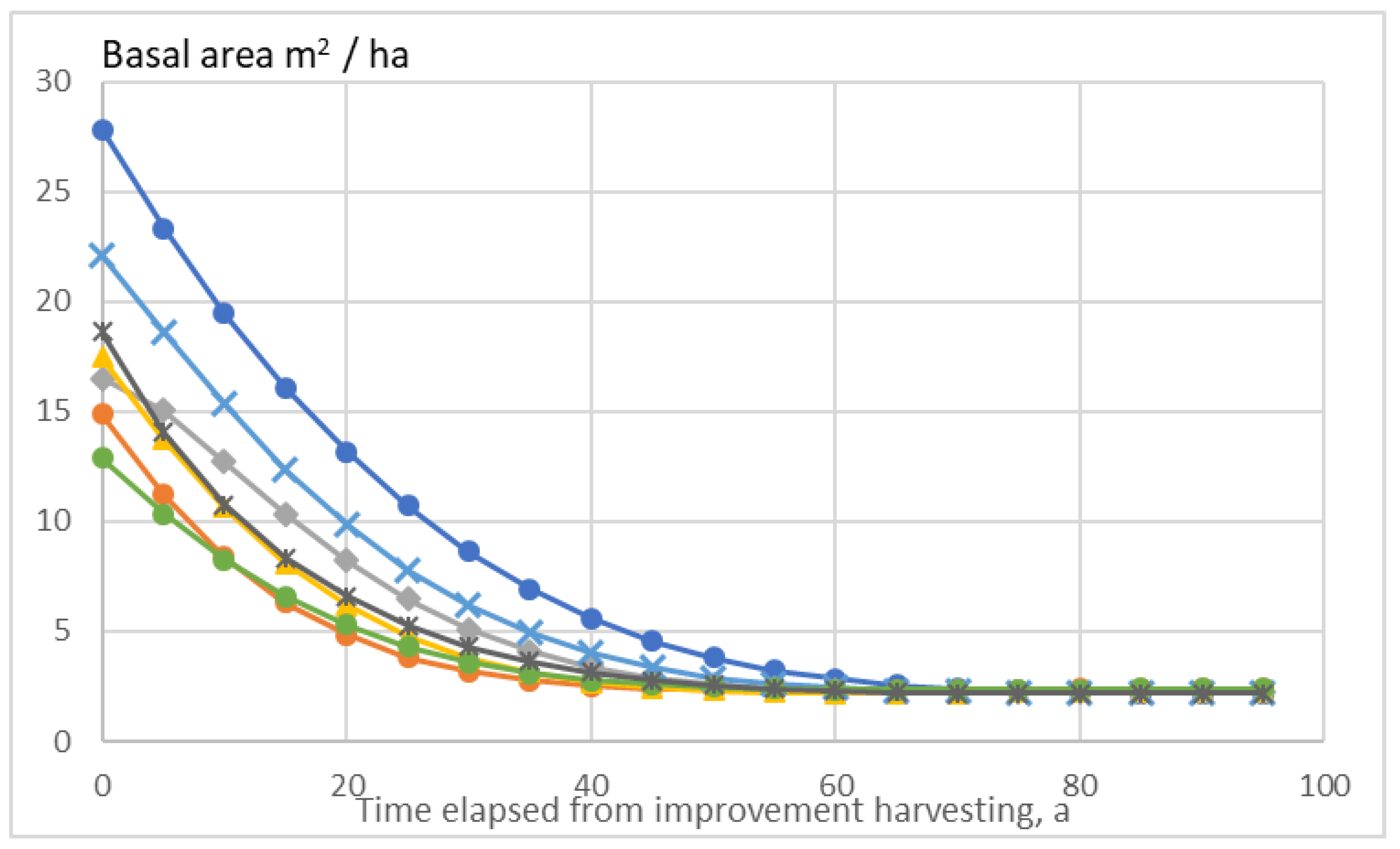

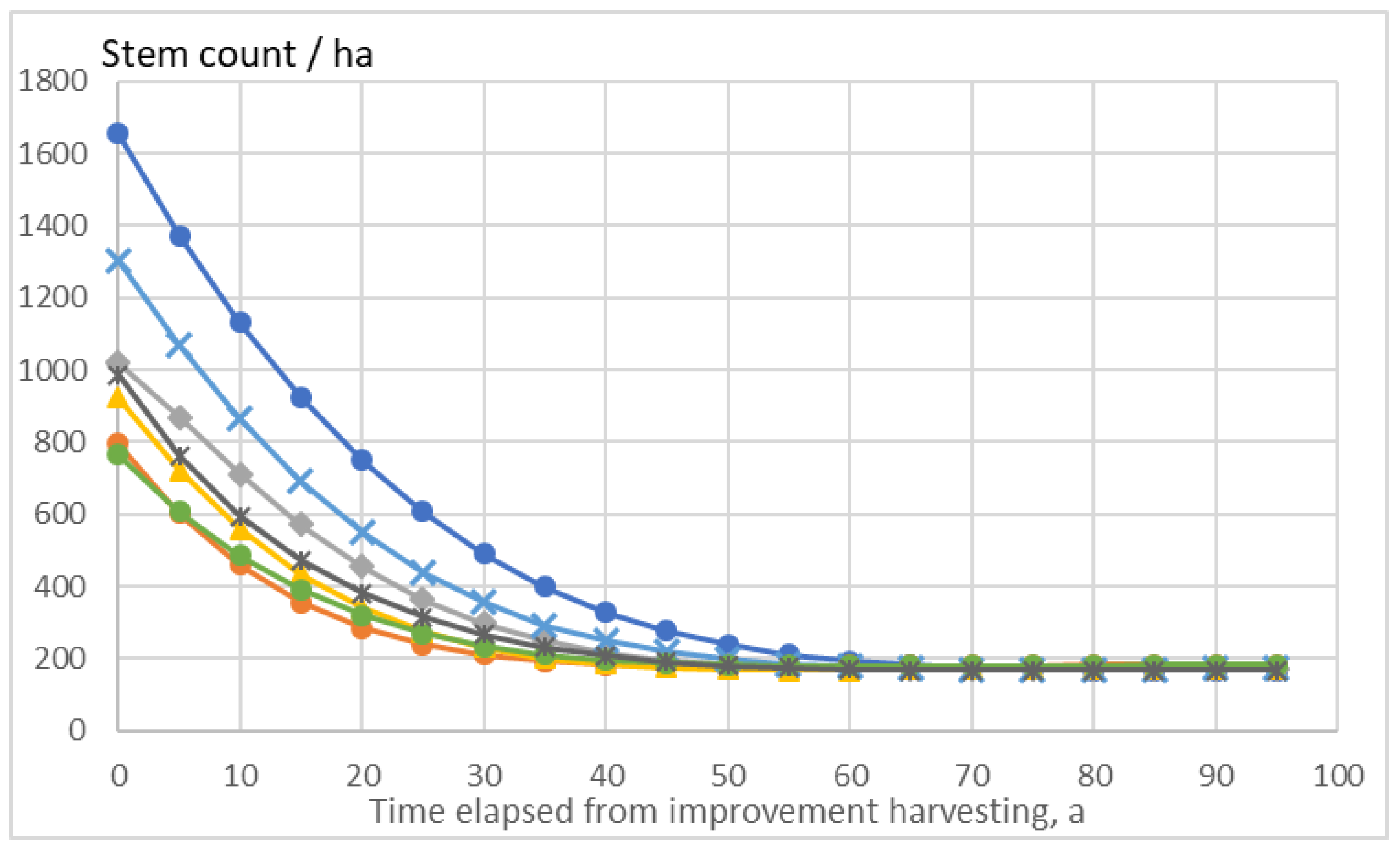

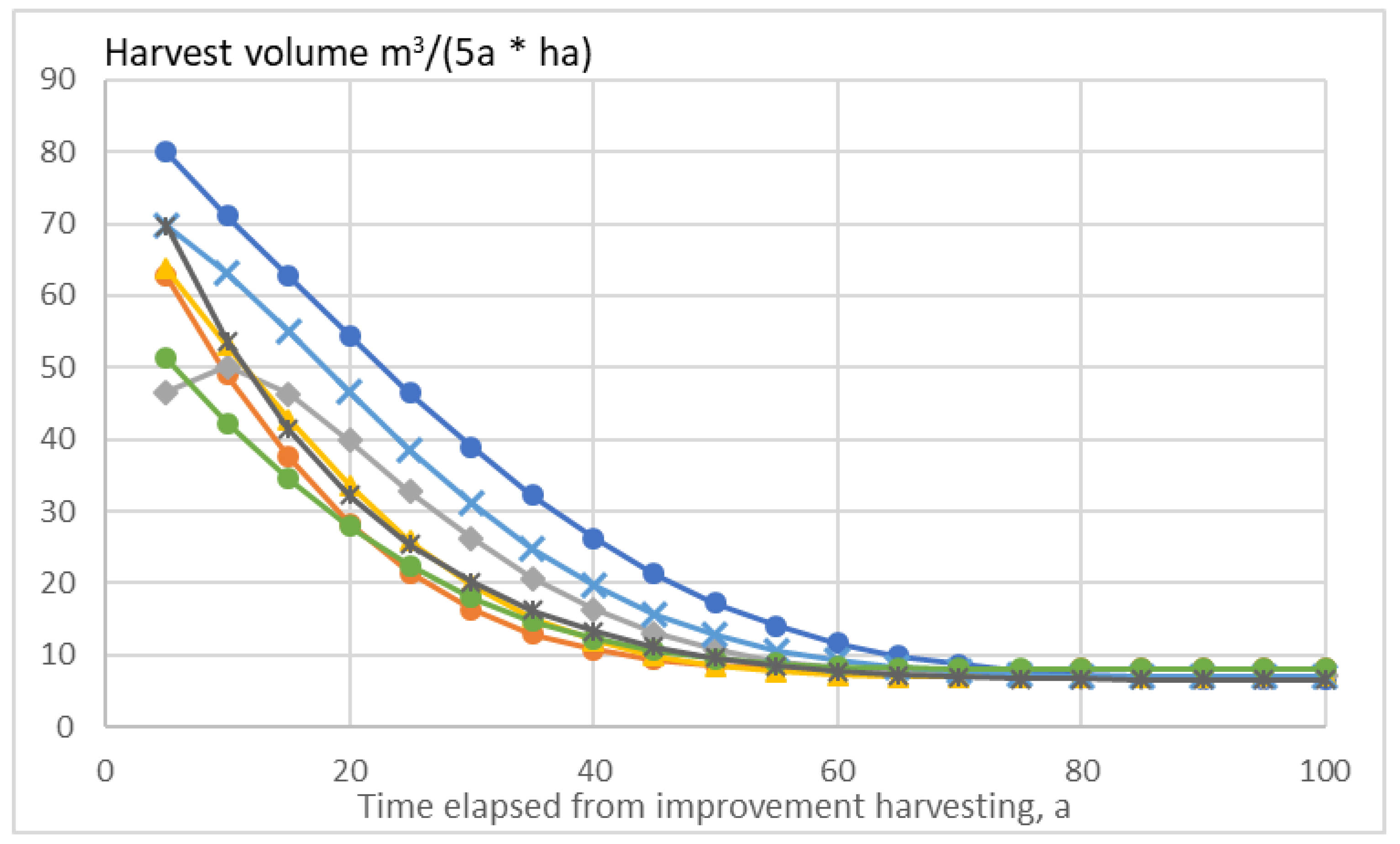

Figure 6). Secondly, the low basal area and stem count in the stationary state (

Figure 4 and

Figure 5) may induce a significant risk of wind damage. An intense improvement harvesting in rotation forestry also may induce an elevated risk of wind damage [

16,

17], but that risk can be reduced by implementing the improvement harvesting in stages, if necessary. Thirdly, risks involved in lengthy stationary forestry in terms of diseases and eventual loss of vigor are not fully known.

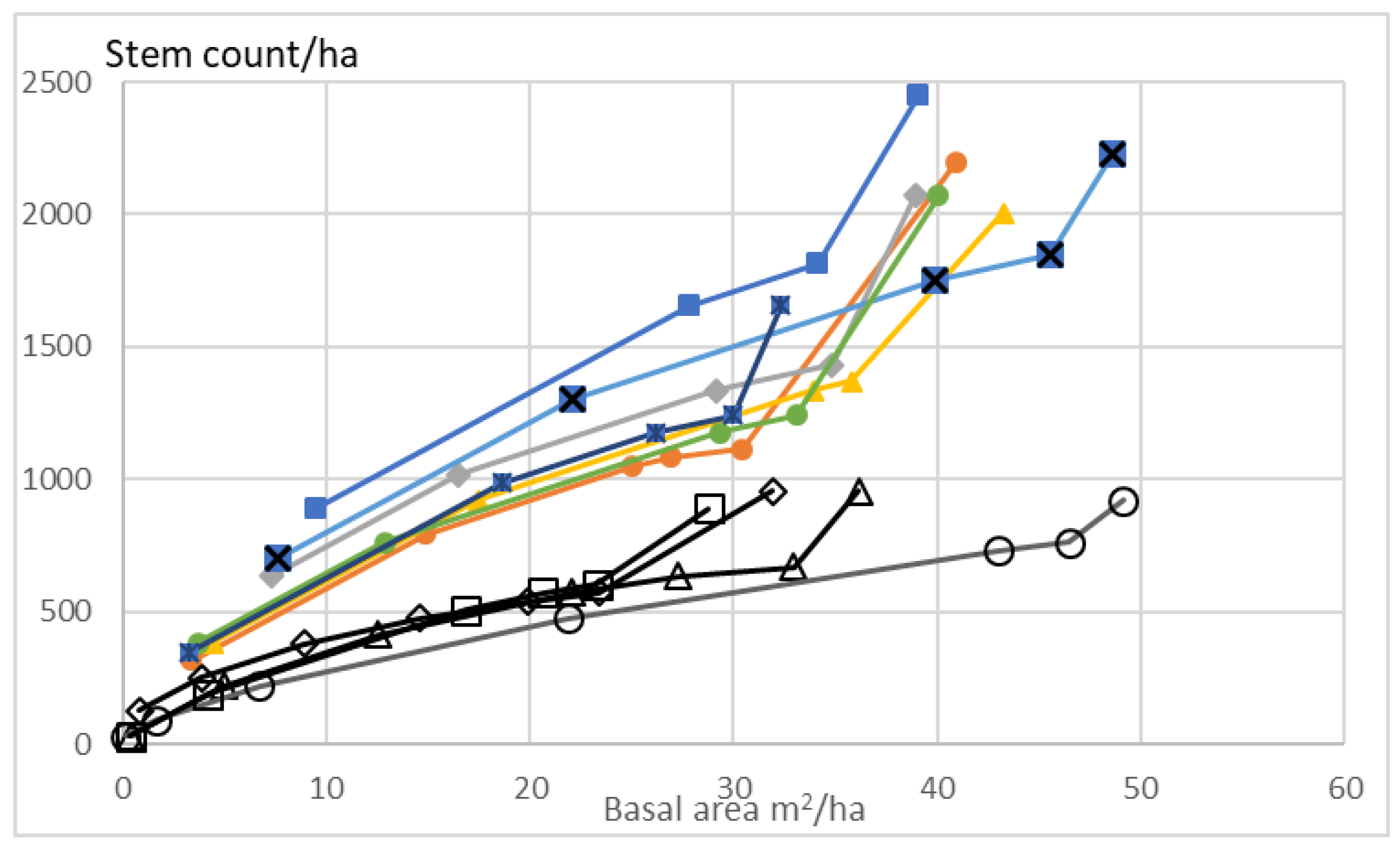

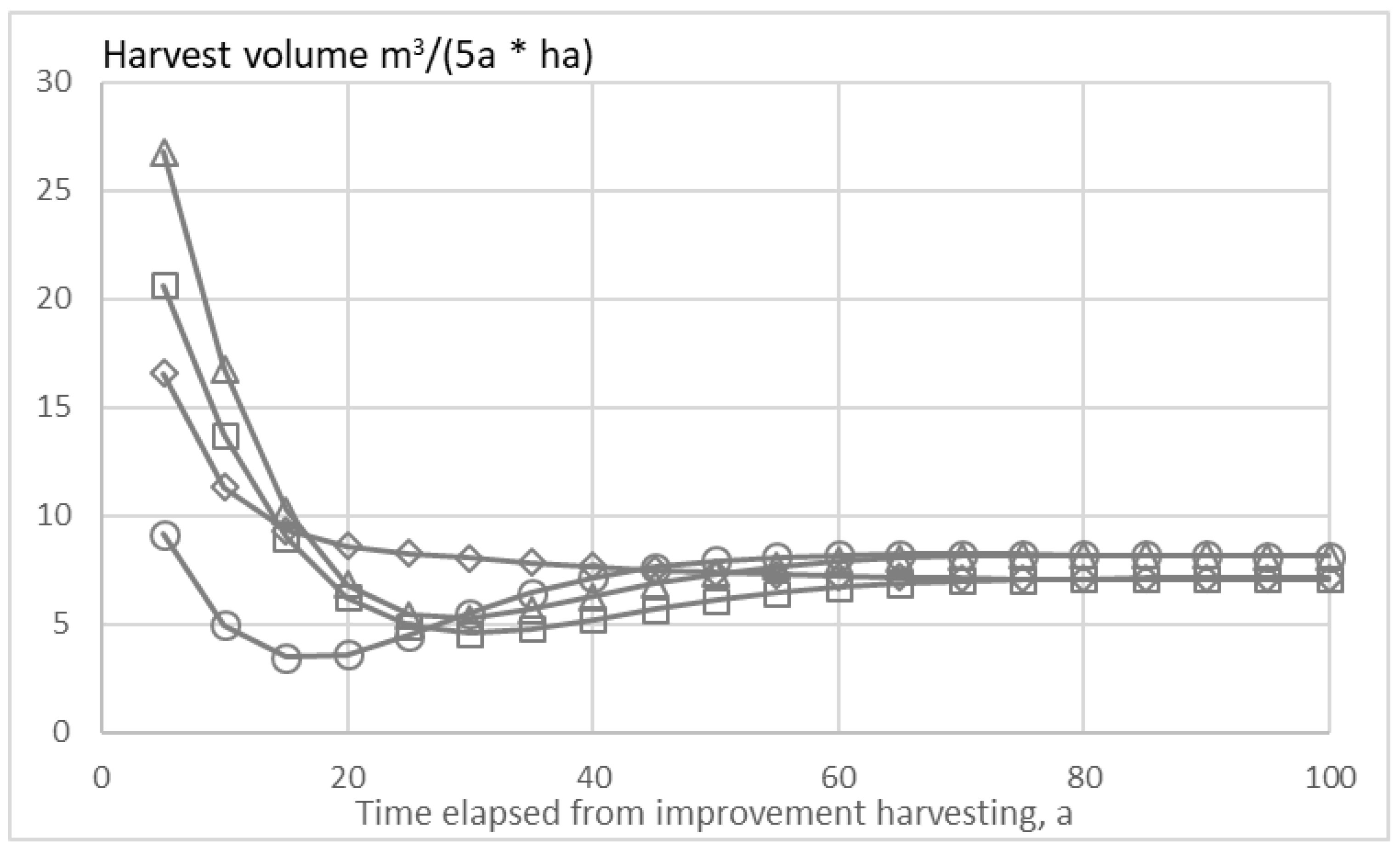

Stands previously thinned commercially demonstrate a rather small basal area and stem count after the improvement harvesting (

Figure 1 and

Figure 7). The scarcity of pulpwood-sized trees results as a rapid decline in basal area, stem count, harvest yield and capital return rate (

Figure 8 and

Figure 9). On the other hand, a significant increment of capital return rate can be achieved by partial diameter-limit cutting, or by thinning from above (

Figure 7). A larger cutting limit diameter obviously would increase the remaining basal area and harvest yield, at the expense of a lower capital return rate after the improvement harvesting (

Figure 7).

Figure 10 shows the evolution of the capital return rate in previously thinned stands, but now with 250 mm cutting limit diameter. In comparison to

Figure 8 we find that the situation is clearly impaired. The initial values of capital return rate, gained after the improvement harvesting, are much lower, as already indicated in

Figure 7. The capital return rate in the stationary state also is lower with the higher cutting limit diameter (

Figure 10).

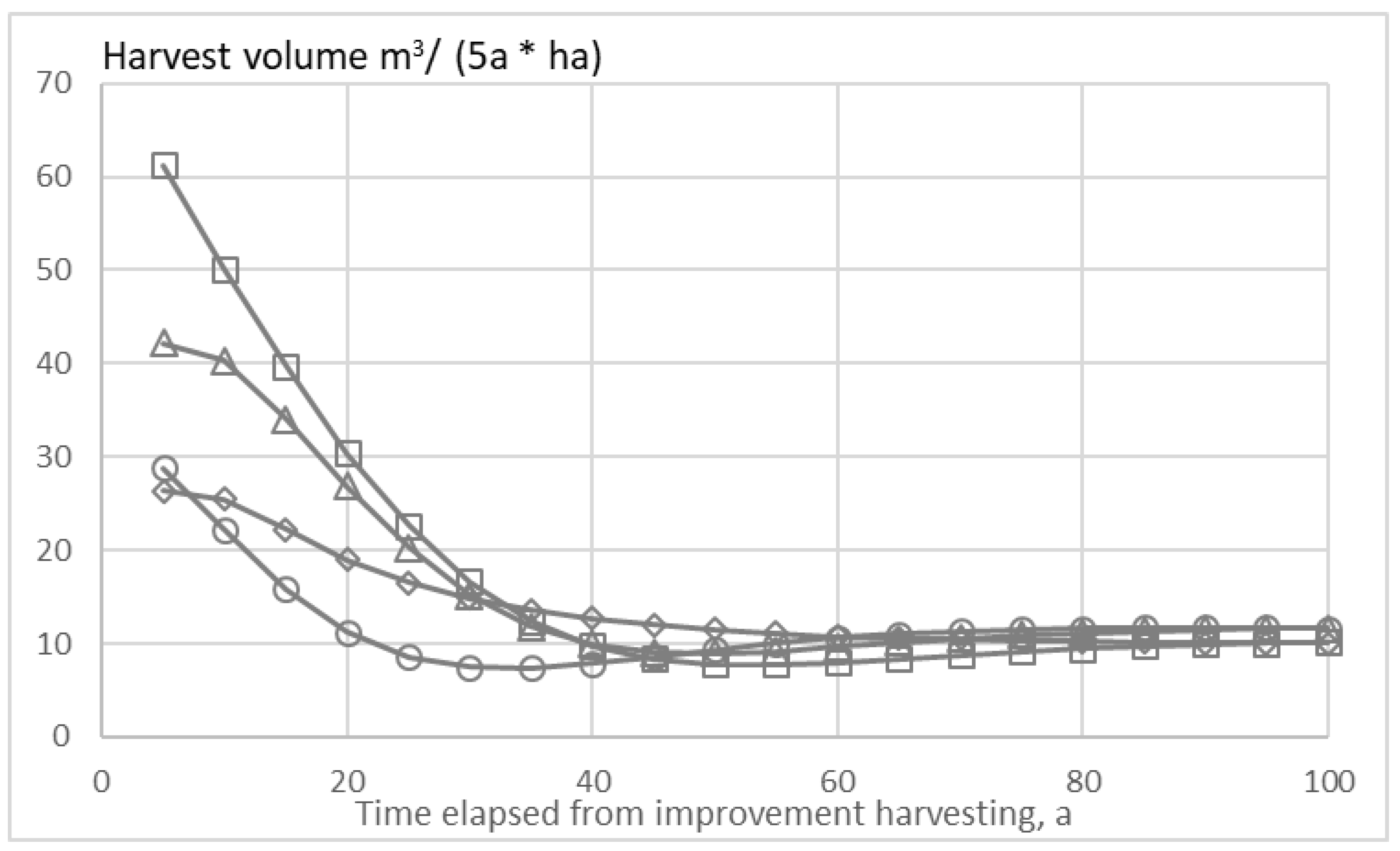

There are some benefits that are achieved at the expense of the lower capital return rate. The stem count, and in particular the basal area is greater, and this corresponds to a greater volumetric harvest yield as is shown in

Figure 11, in comparison to

Figure 9. Not only the initial harvest volume, gained five years after the improvement harvesting, is greater, but the stationary harvest volume also is greater. Even if the capital return rate in

Figure 11 is clearly less than in

Figure 9, it is much greater than in the absence of any diameter-limit cutting in

Figure 7. This does, however, not change the fact that much of the financial productivity has been ruined by thinning from below, in comparison of

Figure 10 to

Figure 3.

Several earlier studies indicate stationary continuous-cover forestry would be more profitable than rotation forestry [

2,

3,

4,

8]. The results of this paper are contradictory. There are several obvious reasons for the discrepancy. Firstly, the economic criteria differ. Most commonly, a discounted net present value of revenues has been maximized, using an external discounting interest rate [

2,

3,

4,

8,

18]. It has been recently shown that maximization of net present value in general yields incorrect results from the viewpoint of wealth accumulation, particularly in the case of fertile stands [

10]. Secondly, stationary continuous-cover forestry has been compared with clearcuttings, instead of a procedure of repeated high thinnings [

2,

3]. It is also worth noting that sustainability has been secured by using a penalty function for declining stem counts [

3]. Declining stem counts however are an essential feature of

Figure 5, and it is closely related to the excess capital return appearing in

Figure 3.

Interestingly, the cutting programs of high capital return display many of the traits demonstrated as optimal by Kilkki and Väisänen [

1], even if their objective function was a discounted net present value of revenues. A possible explanation for the similarity of the procedures is that the applied discounting rate accidentally was not far from the internal rate of return achievable in their example stands [

1,

10].

There are uncertainties in the growth model applied. The most uncertain submodel within the experimental model applied here is the recruitment model [

11]. The recruitment model is crucial from the viewpoint of the amount of trees that can be maintained at the stationary state. The recruitment model is less essential in the case of rotation forestry containing artificial regeneration, improvement harvesting, and repeated high thinnings after the improvement harvesting.

It would be of interest to compare the present outcome with different growth modellings, as well as with different tree species, climates, and regions. Quite a few investigations have been published reporting recruitment, growth, and mortality [

5,

19,

20,

21,

22,

23]. However, it appears that most of such modellings do not converge to any natural stationary state under a demographic stationarity criterion [

13]. A common reason for such failure appears to be an inappropriate description of mortality: in case growth rate diminishes but mortality does not increase, a large number of trees accumulates to large diameter classes. It also would be beneficial to compare with Asian and American tree species. Excellent field studies are available [

24,

25], but well-formulated growth models would be needed for detailed financial analysis.

It remains to be investigated whether various growth models would produce coherent results under the boundary condition of frequently repeated diameter-limit cuttings. However, we have implemented some preliminary investigations using the growth model of Pukkala et al. [

19]. Firstly, the greatest capital return rate is gained by diameter-limit harvesting to the transition diameter between pulpwood and sawlogs, regardless of the growth model. However, the rate of recruitment is faster in the model of Pukkala et al. [

19], resulting as basal area, stem count and harvest volume larger than indicated for the stationary state in

Figure 4,

Figure 5 and

Figure 6. Secondly, the effect of spacing on diameter growth is stronger according to the model of Pukkala et al. [

19], resulting as high growth rates in sparse stands. On the other hand, dense stands hardly achieve a basal area of 45 m

2/ha within a century. Stands with basal area over 55 m

2/ha exist in the area, in agreement with the growth model of Bollandsås et al. [

11].

In addition to tree species, growth conditions, and models describing growth and recruitment, financial and technical circumstances would vary by geographic region. The basic requirement for the applicability of the results of this study is that trees experience a value-adding assortment transition. The magnitude of the value transition may be a function of not only location but also time. Assortment values given by Rämö and Tahvonen [

14] in terms of national stumpage prices from 2000–2011 correspond to the valuation of sawlogs in the example area during the time of writing rather accurately. However, the valuation of pulpwood in the example area is now about 15% less. This makes the value transition sharper than descried in the numerical treatments above. Correspondingly, the capital return rate becomes higher at the assortment transition, and it is even more essential to concentrate growth in trees experiencing the assortment transition. A less pronounced value transition, in comparison to values given by Rämö and Tahvonen [

14], would have the opposite effect.

There are other issues contributing to the sharpness of the value transition, in addition to the percentage value increment from one assortment to another. The volumetric amount of two assortments, pulpwood and sawlogs, as a function of tree diameter, was given by of Rämö and Tahvonen [

14,

15] in terms of a deterministic array. In reality, the yield of sawlogs is stochastic, depending on the appearance probability of defects on the one hand, and tolerance of defects on the sawlog market on the other hand. Numerical treatments of this paper were based on a simplified description of any 50 mm diameter class by its central tree, and the first diameter class assumed to yield sawlogs was centered in 225 mm diameter. Considering the stochastic nature of the sawlog yield, the cutting limit diameter possibly should not be taken at the lower end of this diameter class, but is should be selected somewhere within this diameter class so that the probability of gaining a sawlog will become high.

It is evident from

Figure 4 that high capital return rate is gained from stands with relatively low basal area of trees, and correspondingly relatively low standing trunk volume, as well a low capitalization per unit area. An increment of standing volume would increase growth, at the expense of capital return rate (compare

Figure 9 and

Figure 11, and

Figure 8 and

Figure 10). Stands of high capital return rate but low capitalization, and at most moderate volumetric growth are not effective in carbon sequestration [

26,

27]. We intend to discuss this in more detail in a forthcoming paper.