Logging Contractors’ Growth in the Southern Cone: An Analysis of Contractor Business Strategies, Innovation, and Mechanization

Abstract

1. Introduction

2. Materials and Methods

The Evolution of the Contractors as Entrepreneurs

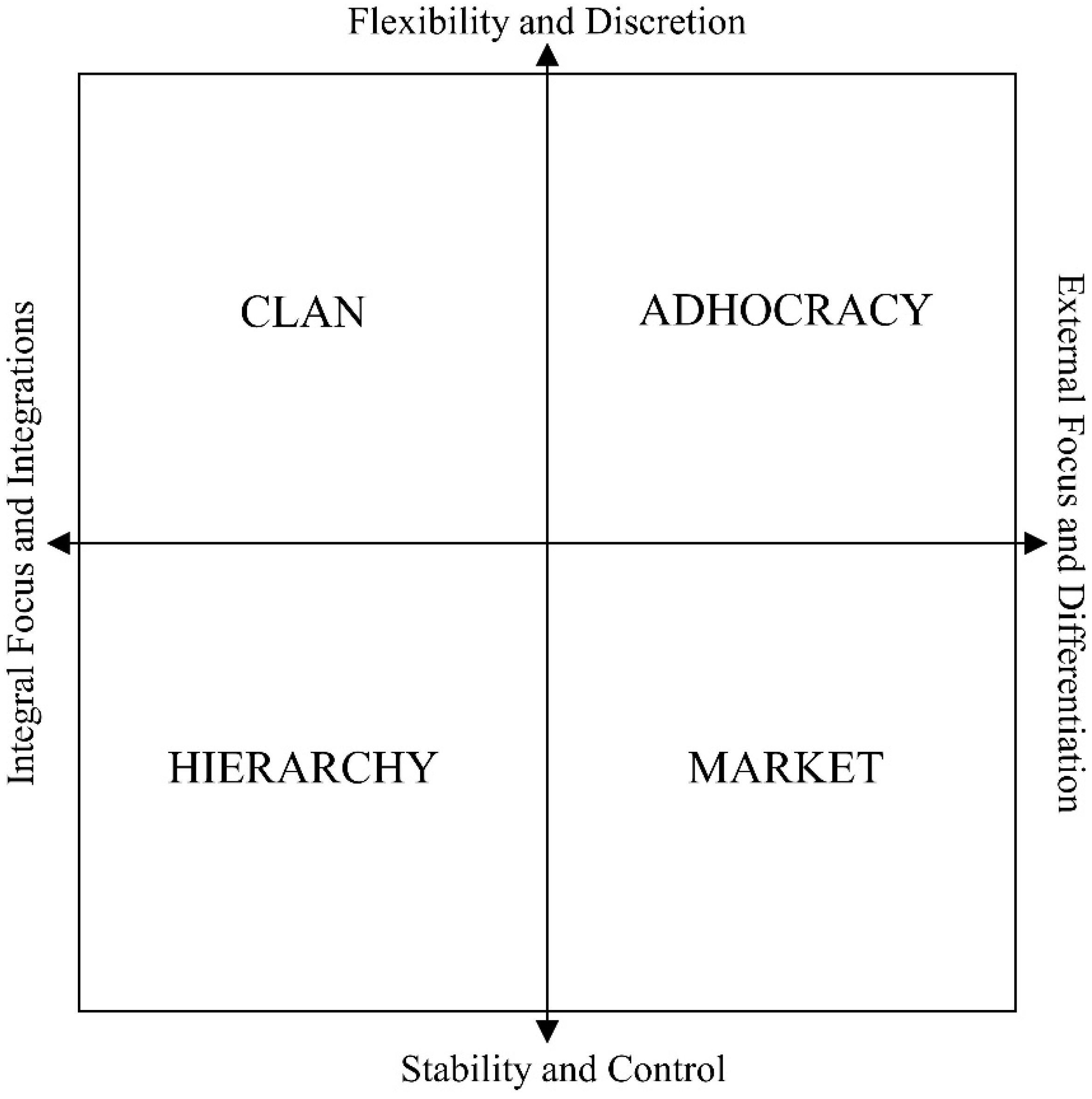

- Innovation ability and interest in innovation were related to the entrepreneurial dimension, related to an adhocracy company.

- Job satisfaction and the company’s management were related to the administrative dimension, related to an hierarchy company.

- Commitment to the organization and innovation strategy were related to the dimension of organization of the company, related to a clan company.

- Results of the company and management of the company were related to the dimension of market, related to a market company.

- Model 1 is a linear model considering capital, number of employees, and companies’ age as covariates. The fixed effects where contracting, mechanization and the time period—either 0 to 5 years before the survey, or 6 to 10 years before.

- Model 2 is a mixed linear model with capital, number of employees, and companies’ age as covariates and the same fixed effects than Model 1.

- Model 3 added to the linear model 1 the random effects such as moment, innovation and business strategy—either as an independent firm or mutualistic relations with the wood consumer. These last two variables were composed from the results of surveys as mentioned in Table 1.

- Model 4 is a mixed linear model, which included as random effects the moment, innovation and business strategy.

3. Results

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Siry, J.; Greene, W.D.; Harris, T.; Izlar, R.; Hamsley, A.; Eason, K.; Tye, T.; Baldwin, S.; Hyldahl, C. Wood supply chain and fiber cost. What can we do better? For. Prod. J. 2006, 56, 5–10. [Google Scholar]

- Eriksson, M.; LeBel, L.; Lindroos, O. The effect of customer–contractor alignment in forest harvesting services on contractor profitability and the risk for relationship breakdown. Forests 2017, 8, 360. [Google Scholar] [CrossRef]

- Conrad, J.L., IV; Greene, W.D.; Hiesl, P. A review of rhanges in US logging businesses 1980s–Present. J. For. 2018, 116, 291–303. [Google Scholar] [CrossRef]

- Prudham, W.S. Downsizing nature: Managing risk and knowledge economies through production subcontracting in the Oregon logging sector. Environ. Plan. 2002, 34, 145–166. [Google Scholar] [CrossRef]

- Hultåker, O.; Bohlin, F. Developing the Business: Logging Contractors’ Strategic Choices for Profitability and Work Environment. In Proceedings of the Biennial Meeting of the Scandinavian Society of Forest Economics, Vantaa, Finland, 12–15 May 2004; pp. 13–22. [Google Scholar]

- Erlandsson, E. The Impact of Industrial Context on Procurement, Management and Development of Harvesting Services: A Comparison of Two Swedish Forest Owners Associations. Forests 2013, 4, 1171–1198. [Google Scholar] [CrossRef]

- Fernandes, O. Diretrizes estratégicas para a consolidação da terceirização no setor florestal Brasileiro. [Strategic guidelines to consolidate the outsourcing in Brazilian forest sector]. In 12° Seminário de Atualização em Sistemas de Colheita de Madeira e Transporte Florestal; Anais UFPR Ed.: Curitiba, Brazil, 2002; pp. 19–36. (In Portuguese) [Google Scholar]

- Stone, I.J.; Benjamin, J.G.; Leahy, J. Applying Innovation Theory to Maine’s Logging Industry. J. For. 2011, 109, 462–469. [Google Scholar]

- Mac Donagh, P.; Botta, G.; Schlichter, T.; Cubbage, F. Harvesting contractor production and costs in forest plantations of Argentina, Brazil, and Uruguay. Int. J. For. Eng. 2017, 28, 157–168. [Google Scholar] [CrossRef]

- Conrad, J.; Vokoun, M.; Prisley, S.P.; Bolding, C.M. Barriers to logging production and efficiency in Wisconsin. Int. J. For. Eng. 2017, 28, 57–65. [Google Scholar] [CrossRef]

- Eriksson, M.; LeBel, L.; Lindroos, O. Management of outsourced forest harvesting operations for better customer-contractor alignment. For. Policy Econ. 2015, 53, 45–55. [Google Scholar] [CrossRef]

- Parise, D.; Malinovski, J. Análisis y reflexiones, sobre el desarrollo tecnológico de la cosecha forestal en el Brasil. [Forest harvesting technological development, analysis and reflections]. In XII Seminário de Atualização em Sistemas de Colheita de Madeira e Transporte Florestal; Anais UFPR Ed.: Curitiba, Brazil, 2002; pp. 78–109. [Google Scholar]

- Häggström, C.; Kawasaki, A.; Lidestav, G. Profiles of forestry contractors and development of the forestry-contracting sector in Sweden. Scand. J. For. Res. 2013, 28, 395–404. [Google Scholar] [CrossRef]

- Hodgson, G. Evolutionary and Competence-Based Theories of the Firm. J. Econ. Stud. 1998, 25, 25–56. [Google Scholar] [CrossRef]

- Gustafsson, Å. Assessing work order information quality in harvesting. Silva Fenn. 2017, 51, 6989. [Google Scholar] [CrossRef][Green Version]

- Mäkkinen, P. Success factors for forest machine entrepreneurs. J. For. Eng. 1997, 8, 27–35. [Google Scholar]

- Okey, F.O.; Visser, R. Operational efficiency analysis of New Zealand timber harvesting contractors using data envelopment analysis. Int. J. For. Eng. 2017, 28, 85–93. [Google Scholar] [CrossRef]

- Hovgaard, A.; Hansen, E. Innovativeness in the forest products industry. For. Prod. J. 2004, 54, 26–33. [Google Scholar]

- Cameron, K.S.; Quinn, R.E. Diagnosing and Changing Organizational Culture: Based on the Competing Values Framework, Revised ed.; The Jossey-Bass Business & Management Series; Jossey-Bass, Ed.; A Wiley Imprint: San Francisco, CA, USA, 2006; p. 258. ISBN 13 978-0-7879-8283-6. [Google Scholar]

- Benjamin, J.G.; Bick, S.; Farrand, W.; Germain, R. Characteristics of Successful and Innovative Logging Contractors in the Northeast US. In Proceedings of the 37th Council on Forest Engineering Annual Meeting, Moline, IL, USA, 22–25 June 2014. [Google Scholar]

- Bell, A.; Jones, K. Explaining Fixed Effects: Random Effects Modeling of Time-Series Cross-Sectional and Panel Data. Political Sci. Res. Methods 2015, 3, 133–153. [Google Scholar] [CrossRef]

- Crespel, P.; Hansen, E. Managing for innovation: Insights into a successful company. For. Prod. J. 2008, 58, 9. [Google Scholar]

- Milner, H.; Kubota, K. Why the move to free trade? Democracy and trade policy in the developing countries. Int. Organ. 2004, 59, 107–143. [Google Scholar] [CrossRef]

- R Core Team. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2018; Available online: https://www.R-project.org/ (accessed on 13 December 2018).

- Pinheiro, J.; Bates, D.; DebRoy, S.; Sarkar, D. R Core Team nlme: Linear and Nonlinear Mixed Effects Models. 2018. Available online: https://CRAN.R-project.org/package=nlme (accessed on 13 December 2018).

- Lenth, R.V. Least-Squares Means: The R Package lsmeans. J. Stat. Softw. 2016, 69, 1–33. [Google Scholar] [CrossRef]

- Fox, J.; Weisberg, S. Multivariate Linear Models in R—An Appendix to an R Companion to Applied Regression, 2nd ed.; SAGE Publications, Inc.: Thousand Oaks, California, USA, 2011; ISBN 978-1-4129-7514-8. [Google Scholar]

- Hendrickx, J. Tools for Evaluating Collinearity Usage and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2012; Available online: https://CRAN.R-project.org/package=perturb (accessed on 13 December 2018).

- Cubbage, F.; Koesbandana, S.; Mac Donagh, P.; Rubilar, R.; Balmelli, G.; Morales Olmos, V.; De La Torre, R.; Murara, M.; Hoeflich, V.; Kotze, H.; et al. Global timber investments, wood costs, regulation, and risk. Biomass Bioenergy 2010, 34, 1667–1678. [Google Scholar] [CrossRef]

- Carter, D.; Cubbage, F. Technical efficiency and industrial evolution in southern US pulpwood harvesting. Can. J. For. Res. 1994, 24, 217–224. [Google Scholar] [CrossRef]

- Siry, J.; Cubbage, F.; Sills, E. Forest Production. In Forest in a Market Economy; Sills, E., Abt, K., Eds.; Kluwer Academic Publishers: Dordrecht, The Netherlands, 2003; pp. 59–78. [Google Scholar]

- Baker, S.A.; Greene, W.D. Changes in Georgia’s logging workforce, 1987–2007. South. J. Appl. For. 2008, 32, 60–68. [Google Scholar]

| Concept | Dimension | Description | Scale |

|---|---|---|---|

| Innovation capacity | Product Process Business | Trend of the company to adopt/create technology | 1 rejection 5 very likely |

| Interest in innovation | Interest in innovation | Individual interest in developing new ideas | 1 rejection 5 very likely |

| Organizational commitment (sharing) | Loyalty Identification Membership | Sense of belonging and complementation with the contracting company | 1 rejection 5 very likely |

| Innovation strategy | Product Process Business Resources for R&D | Degree of integration of the innovation strategy of the enterprise | 1 very low 5 very high |

| Job satisfaction | Job satisfaction | Self-describing | 1 rejection 5 satisfied |

| Business strategy | Low Costs Differentiation | Success in the negotiations | 1 low costs 5 differentiation |

| The company’s results | Sales Growth in sales Net profit | Referenced in the competitors | 1—less than 20% up to 5—Top 20% |

| The company’s management | Management systems Software | Use of management systems by costs, margins, or by indicators | 1 without indicators 5 ABC |

| Models | 1 (lm) | 2 (lmm) | 3 (lm) | 4 (lmm) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Predictor | df | χ2 | p-value | df | χ2 | p-value | df | χ2 | p-value | df | χ2 | p-value |

| (Intercept) | 1 | 3488.702 | 0.000 | 1 | 1911.334 | 0.000 | 1 | 477.994 | 0.000 | 1 | 369.784 | 0.000 |

| Capital | 1 | 0.350 | 0.554 | 1 | 0.236 | 0.627 | 1 | 0.251 | 0.616 | 1 | 0.005 | 0.942 |

| N° Employees | 1 | 29.695 | 0.000 | 1 | 24.511 | 0.000 | 1 | 27.076 | 0.000 | 1 | 16.667 | 0.000 |

| Age | 1 | 0.027 | 0.869 | 1 | 0.005 | 0.945 | 1 | 0.910 | 0.340 | 1 | 0.448 | 0.503 |

| Contracting | 1 | 16.008 | 0.000 | 1 | 11.254 | 0.001 | 1 | 14.282 | 0.000 | 1 | 9.848 | 0.002 |

| Mechanization | 1 | 28.146 | 0.000 | 1 | 23.591 | 0.000 | 1 | 28.848 | 0.000 | 1 | 22.595 | 0.000 |

| Moment | 1 | 4.577 | 0.032 | 1 | 6.254 | 0.012 | 1 | 2.194 | 0.139 | 1 | 3.745 | 0.053 |

| Innovation | 1 | 7.501 | 0.006 | 1 | 5.818 | 0.016 | ||||||

| Business | 1 | 0.102 | 0.750 | 1 | 0.182 | 0.669 | ||||||

| Moment × Innovation | 1 | 5.842 | 0.016 | 1 | 10.781 | 0.001 | ||||||

| N | 106 | 106 | 106 | 106 | ||||||||

| AIC | 257.126 | 254.110 | 271.810 | 262.303 | ||||||||

| R2 * | 0.577 | 0.499 | 0.618 | 0.525 | ||||||||

| Conditional R2 | 0.674 | 0.735 | ||||||||||

| Models | 1 (lm) | 2 (lmm) | 3 (lm) | 4 (lmm) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Predictor | df | χ2 | p-value | df | χ2 | p-value | df | χ2 | p-value | df | χ2 | p-value |

| (Intercept) | 1 | 3.019 | 0.082 | 1 | 4.303 | 0.038 | 1 | 1.470 | 0.225 | 1 | 1.090 | 0.297 |

| Capital | 1 | 0.143 | 0.705 | 1 | 0.194 | 0.659 | 1 | 0.000 | 0.998 | 1 | 0.030 | 0.863 |

| Contracting | 1 | 2.327 | 0.127 | 1 | 1.845 | 0.174 | 1 | 0.313 | 0.576 | 1 | 0.668 | 0.414 |

| N° Employees | 1 | 2.690 | 0.101 | 1 | 3.276 | 0.070 | 1 | 2.705 | 0.100 | 1 | 3.885 | 0.049 |

| Innovation | 1 | 3.805 | 0.051 | 1 | 5.462 | 0.019 | ||||||

| Business | 1 | 0.005 | 0.944 | 1 | 0.091 | 0.763 | ||||||

| Contracting × Capital | 1 | 0.152 | 0.697 | 1 | 0.185 | 0.667 | 1 | 0.640 | 0.424 | 1 | 0.683 | 0.409 |

| Contracting × N° Employees | 1 | 5.185 | 0.023 | 1 | 6.372 | 0.012 | 1 | 2.414 | 0.120 | 1 | 3.494 | 0.062 |

| Contracting × Innovation | 1 | 0.662 | 0.416 | 1 | 1.095 | 0.295 | ||||||

| Contracting × Business | 1 | 0.171 | 0.679 | 1 | 0.212 | 0.645 | ||||||

| N | 42 | 42 | 42 | 42 | ||||||||

| AIC | 751.147 | 689.931 | 753.362 | 692.810 | ||||||||

| R2 | 0.174 | 0.127 | 0.541 | 0.440 | ||||||||

| Conditional R2 | 0.906 | 0.936 | ||||||||||

| Models | 1 (lm) | 2 (lmm) | 3 (lm) | 4 (lmm) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Predictor | df | χ2 | p-value | df | χ2 | p-value | df | χ2 | p-value | df | χ2 | p-value |

| (Intercept) | 1 | 0.187 | 0.665 | 1 | 0.096 | 0.757 | 1 | 0.625 | 0.429 | 1 | 2.249 | 0.134 |

| Capital | 1 | 1.570 | 0.210 | 1 | 0.562 | 0.454 | 1 | 1.919 | 0.166 | 1 | 0.791 | 0.374 |

| Contracting | 1 | 0.235 | 0.627 | 1 | 0.006 | 0.936 | 1 | 0.003 | 0.954 | 1 | 0.408 | 0.523 |

| N° Employees | 1 | 4.808 | 0.028 | 1 | 9.695 | 0.002 | 1 | 4.496 | 0.034 | 1 | 11.562 | 0.001 |

| Innovation | 1 | 1.044 | 0.307 | 1 | 1.623 | 0.203 | ||||||

| Business | 1 | 0.133 | 0.715 | 1 | 0.035 | 0.852 | ||||||

| Contracting × Capital | 1 | 1.265 | 0.261 | 1 | 4.807 | 0.028 | 1 | 0.915 | 0.339 | 1 | 4.897 | 0.027 |

| Contracting × N° Employees | 1 | 1.511 | 0.219 | 1 | 4.398 | 0.036 | 1 | 1.531 | 0.216 | 1 | 5.564 | 0.018 |

| Contracting × Innovation | 1 | 0.046 | 0.830 | 1 | 0.006 | 0.940 | ||||||

| Contracting × Business | 1 | 0.128 | 0.720 | 1 | 0.383 | 0.536 | ||||||

| N | 42 | 42 | 42 | 42 | ||||||||

| AIC | 665.127 | 664.598 | 629.145 | 629.082 | ||||||||

| R2 | 0.653 | 0.614 | 0.686 | 0.616 | ||||||||

| Conditional R2 | 0.964 | 0.965 | ||||||||||

| Models | 1 (lm) | 2 (lmm) | 3 (lm) | 4 (lmm) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Predictor | df | χ2 | p-value | df | χ2 | p-value | df | χ2 | p-value | df | χ2 | p-value |

| (Intercept) | 1 | 13.023 | 0.000 | 1 | 15.321 | 0.000 | 1 | 0.425 | 0.515 | 1 | 0.566 | 0.452 |

| Capital | 1 | 1.075 | 0.300 | 1 | 1.265 | 0.261 | 1 | 0.980 | 0.322 | 1 | 1.307 | 0.253 |

| Contracting | 1 | 4.777 | 0.029 | 1 | 5.620 | 0.018 | 1 | 0.171 | 0.679 | 1 | 0.228 | 0.633 |

| N° Employees | 1 | 0.339 | 0.561 | 1 | 0.398 | 0.528 | 1 | 0.206 | 0.650 | 1 | 0.275 | 0.600 |

| Innovation | 1 | 4.142 | 0.042 | 1 | 5.522 | 0.019 | ||||||

| Business | 1 | 0.131 | 0.717 | 1 | 0.175 | 0.676 | ||||||

| Contracting × Capital | 1 | 2.561 | 0.110 | 1 | 3.013 | 0.083 | 1 | 0.371 | 0.542 | 1 | 0.495 | 0.482 |

| Contracting × N° Employees | 1 | 3.067 | 0.080 | 1 | 3.608 | 0.057 | 1 | 0.248 | 0.619 | 1 | 0.330 | 0.565 |

| Contracting × Innovation | 1 | 0.008 | 0.930 | 1 | 0.010 | 0.919 | ||||||

| Contracting × Business | 1 | 1.280 | 0.258 | 1 | 1.707 | 0.191 | ||||||

| N | 40 | 40 | 40 | 40 | ||||||||

| AIC | 642.514 | 646.514 | 593.138 | 597.138 | ||||||||

| R2 | 0.653 | 0.431 | 0.687 | 0.605 | ||||||||

| Conditional R2 | 0.975 | 0.999 | ||||||||||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mac Donagh, P.; Velazco, S.J.E.; Botta, G.F.; Schlichter, T.; Cubbage, F. Logging Contractors’ Growth in the Southern Cone: An Analysis of Contractor Business Strategies, Innovation, and Mechanization. Forests 2019, 10, 69. https://doi.org/10.3390/f10010069

Mac Donagh P, Velazco SJE, Botta GF, Schlichter T, Cubbage F. Logging Contractors’ Growth in the Southern Cone: An Analysis of Contractor Business Strategies, Innovation, and Mechanization. Forests. 2019; 10(1):69. https://doi.org/10.3390/f10010069

Chicago/Turabian StyleMac Donagh, Patricio, Santiago José Elías Velazco, Guido F. Botta, Tomas Schlichter, and Frederick Cubbage. 2019. "Logging Contractors’ Growth in the Southern Cone: An Analysis of Contractor Business Strategies, Innovation, and Mechanization" Forests 10, no. 1: 69. https://doi.org/10.3390/f10010069

APA StyleMac Donagh, P., Velazco, S. J. E., Botta, G. F., Schlichter, T., & Cubbage, F. (2019). Logging Contractors’ Growth in the Southern Cone: An Analysis of Contractor Business Strategies, Innovation, and Mechanization. Forests, 10(1), 69. https://doi.org/10.3390/f10010069