A Credit Rating Model in a Fuzzy Inference System Environment

Abstract

1. Introduction

2. Literature Review and Basic Definitions

2.1. Literature Review

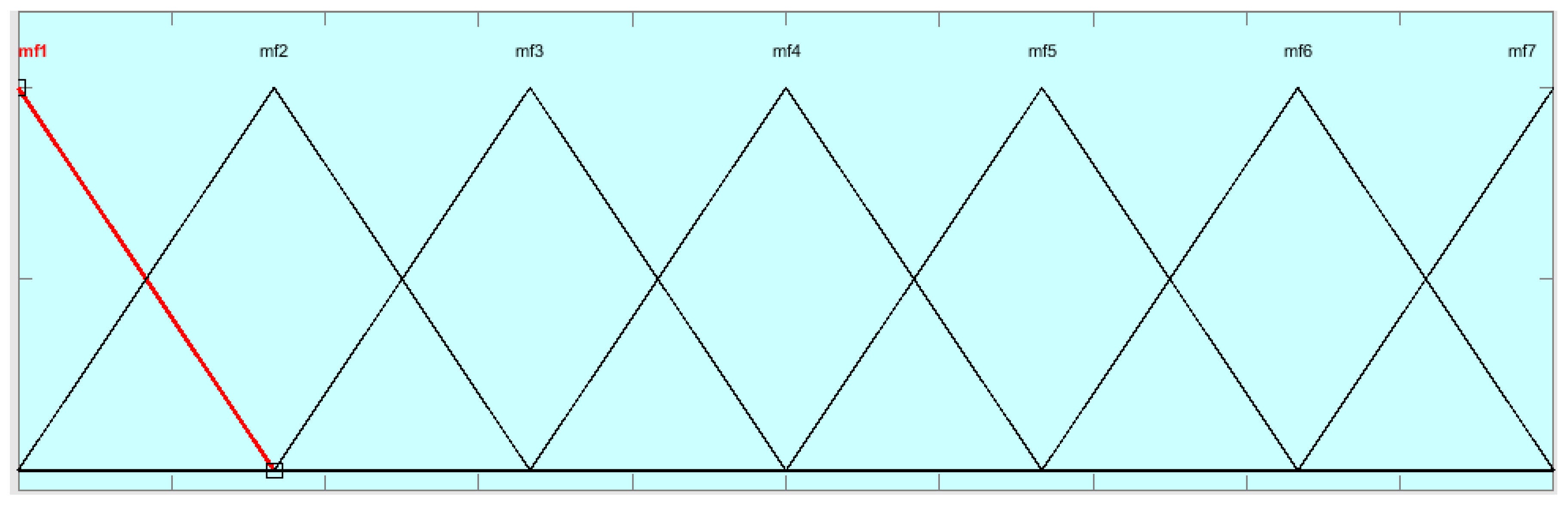

2.2. Fuzzy Inference System

3. Research Methodology

- Which variables are suitable for the EGFI as well as for other credit rating agencies?

- How does the uncertain environment affect these variables?

- (a)

- These variables were sent to the experts of the EGFI to determine which ones were suitable for credit rating agencies.

- (b)

- Within the Delphi method, a 5-point Likert scale was used.

- (c)

- When the average of the experts’ opinions was less than 4, this variable was eliminated.

4. Data Analysis

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Pamucar, D.; Ćirović, G. Vehicle route selection with an adaptive neuro fuzzy inference system in uncertainty conditions. Decis. Mak. Appl. Manag. Eng. 2018, 1, 13–37. [Google Scholar] [CrossRef]

- Sremac, S.; Tanackov, I.; Kopić, M.; Radović, D. ANFIS model for determining the economic order quantity. Decis. Mak. Appl. Manag. Eng. 2018, 1, 81–92. [Google Scholar] [CrossRef]

- Lukovac, V.; Pamučar, D.; Popović, M.; Đorović, B. Portfolio model for analyzing human resources: An approach based on neuro-fuzzy modeling and the simulated annealing algorithm. Expert Syst. Appl. 2017, 90, 318–331. [Google Scholar] [CrossRef]

- Pamučar, D.; Ljubojević, S.; Kostadinović, D.; Đorović, B. Cost and risk aggregation in multi-objective route planning for hazardous materials transportation—A neuro-fuzzy and artificial bee colony approach. Expert Syst. Appl. 2016, 65, 1–15. [Google Scholar] [CrossRef]

- Pamučar, D.; Vasin, L.; Atanasković, P.; Miličić, M. Planning the City Logistics Terminal Location by Applying the Green-Median Model and Type-2 Neurofuzzy Network. Comput. Intell. Neurosci. 2016, 2016, 6972818. [Google Scholar] [CrossRef] [PubMed]

- Akkoç, S. An empirical comparison of conventional techniques, neural networks and the three stage hybrid Adaptive Neuro Fuzzy Inference System (ANFIS) model for credit scoring analysis: The case of Turkish credit card data. Eur. J. Oper. Res. 2012, 222, 168–178. [Google Scholar] [CrossRef]

- Ramkumar, M.; Busi, M. A modified ANP and fuzzy inference system based approach for risk assessment of in-house and third party e-procurement systems. Strateg. Outsourcing Int. J. 2016, 9, 159–188. [Google Scholar] [CrossRef]

- Yazdi, H.S.; Pourreza, R.; Sadoghi Yazdi, M. Constraint learning using adaptive neural-fuzzy inference system. Int. J. Intell. Comput. Cybern. 2010, 3, 257–278. [Google Scholar] [CrossRef]

- Moghadam, S.A.; Karimi, M.; Sadi Mesgari, M. Application of a fuzzy inference system to mapping prospectivity for the Chahfiroozeh copper deposit, Kerman, Iran. J. Spat. Sci. 2015, 60, 233–255. [Google Scholar] [CrossRef]

- Dash, R.; Dash, P. Efficient stock price prediction using a Self Evolving Recurrent Neuro-Fuzzy Inference System optimized through a Modified technique. Expert Syst. Appl. 2016, 52, 75–90. [Google Scholar] [CrossRef]

- Mihaelajméno, M.O.O. Credit Rating Agency Performance in Terms of Profit. Procedia Econ. Financ. 2015, 30, 631–642. [Google Scholar] [CrossRef]

- Gheissari, A. Contemporary Iran: Economy, Society, Politics; Oxford University Press: New York, NY, USA, 2009. [Google Scholar]

- Al-Najjar, D.; Al-Najjar, B. Developing a multi stage predicting system for corporate credit rating in emerging markets: Jordanian case. J. Enterp. Inf. Manag. 2014, 27, 475–487. [Google Scholar] [CrossRef]

- Bian, J. Regulating the Chinese credit rating agencies: Progress and challenges. J. Money Laund. Control 2015, 18, 66–80. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Cheng, C.-H. Hybrid models based on rough set classifiers for setting credit rating decision rules in the global banking industry. Knowl. Based Syst. 2013, 39, 224–239. [Google Scholar] [CrossRef]

- Doumpos, M.; Niklis, D.; Zopounidis, C.; Andriosopoulos, K. Combining accounting data and a structural model for predicting credit ratings: Empirical evidence from European listed firms. J. Bank. Financ. 2015, 50, 599–607. [Google Scholar] [CrossRef]

- Gibilaro, L.; Mattarocci, G. Pricing policies and customers’ portfolio concentration for rating agencies: Evidence from Fitch, Moody’s and S&P. Acad. Bank. Stud. J. 2011, 10, 23–51. [Google Scholar]

- Gogas, P.; Papadimitriou, T.; Agrapetidou, A. Forecasting bank credit ratings. J. Risk Financ. 2014, 15, 195–209. [Google Scholar] [CrossRef]

- Orsenigo, C.; Vercellis, C. Linear versus nonlinear dimensionality reduction for banks’ credit rating prediction. Knowl. Based Syst. 2013, 47, 14–22. [Google Scholar] [CrossRef]

- Ozturk, H.; Namli, E.; Erdal, H.I. Modelling sovereign credit ratings: The accuracy of models in a heterogeneous sample. Econ. Model. 2016, 54, 469–478. [Google Scholar] [CrossRef]

- Pasricha, P.; Selvamuthu, D.; Viswanathan, A. Markov regenerative credit rating model. J. Risk Financ. 2017, 18, 311–325. [Google Scholar] [CrossRef]

- Hu, H.; Hu, H. The impact of sovereign rating events on bank stock returns: An empirical analysis for the Eurozone. J. Risk Financ. 2017, 18, 338–367. [Google Scholar] [CrossRef]

- Mamdani, E.H.; Assilian, S. An experiment in linguistic synthesis with a fuzzy logic controller. Int. J. Man-Mach. Stud. 1975, 7, 1–13. [Google Scholar] [CrossRef]

- Mamdani, E.H. Application of fuzzy algorithms for control of simple dynamic plant. Proc. Inst. Electr. Eng. 1974, 121, 1585–1588. [Google Scholar] [CrossRef]

- Sugeno, M. Theory of Fuzzy Integrals and Its Applications. Ph.D. Thesis, Tokyo Institute of Technology, Tokyo, Japan, 1974. [Google Scholar]

- Takagi, T.; Sugeno, M. Fuzzy identification of systems and its applications to modeling and control. IEEE Trans. Syst. Man Cybern. 1985, 15, 116–132. [Google Scholar] [CrossRef]

- Anderson, R.C.; Mansi, S.A.; Reeb, D.M. Founding family ownership and the agency cost of debt. J. Financ. Econ. 2003, 68, 263–285. [Google Scholar] [CrossRef]

- Syau, Y.-R.; Hsieh, H.-T.; Lee, E.S. Fuzzy numbers in the credit rating of enterprise financial condition. Rev. Quant. Financ. Account. 2001, 17, 351–360. [Google Scholar] [CrossRef]

- Asquith, P.; Beatty, A.; Weber, J. Performance pricing in bank debt contracts. J. Account. Econ. 2005, 40, 101–128. [Google Scholar] [CrossRef]

- Baghai, R.P.; Servaes, H.; Tamayo, A. Have rating agencies become more conservative? Implications for capital structure and debt pricing. J. Financ. 2014, 69, 1961–2005. [Google Scholar] [CrossRef]

- An, X.; Deng, Y.; Sanders, A.B. Subordination level as a predictor of credit risk. In Proceedings of the Cambridge-UNC Charlotte Symposium, Cambridge, UK, 12–14 June 2006. [Google Scholar]

- Kong, D.; Tiong, R.L.; Cheah, C.Y.; Permana, A.; Ehrlich, M. Assessment of credit risk in project finance. J. Constr. Eng. Manag. 2008, 134, 876–884. [Google Scholar] [CrossRef]

- Gray, S.; Mirkovic, A.; Ragunathan, V. The determinants of credit ratings: Australian evidence. Aust. J. Manag. 2006, 31, 333–354. [Google Scholar] [CrossRef]

- Min, J.H.; Lee, Y.-C. A practical approach to credit scoring. Expert Syst. Appl. 2008, 35, 1762–1770. [Google Scholar] [CrossRef]

- Huang, Z.; Chen, H.; Hsu, C.-J.; Chen, W.-H.; Wu, S. Credit rating analysis with support vector machines and neural networks: A market comparative study. Decis. Support Syst. 2004, 37, 543–558. [Google Scholar] [CrossRef]

- Barry, P.J.; Escalante, C.L.; Ellinger, P.N. Credit risk migration analysis of farm businesses. Agric. Financ. Rev. 2002, 62, 1–11. [Google Scholar] [CrossRef]

- Dincer, H.; Yuksel, S.; Hacioglu, U. CAMELS-based Determinants for the Credit Rating of Turkish Deposit Banks. Int. J. Financ. Bank. Stud. 2015, 4, 1. [Google Scholar]

- Hajek, P.; Michalak, K. Feature selection in corporate credit rating prediction. Knowl. Based Syst. 2013, 51, 72–84. [Google Scholar] [CrossRef]

- Hossain, S.B. Credit Rating Methodology of the Bangladesh Rating Agency Limited; UIU Institutional Reposity: Dhaka, Bangladesh, 2018. [Google Scholar]

- Yang, C.-C.; Ou, S.-L.; Hsu, L.-C. A Hybrid Multi-Criteria Decision-Making Model for Evaluating Companies’ Green Credit Rating. Sustainability 2019, 11, 1506. [Google Scholar] [CrossRef]

- Gül, S.; Kabak, Ö.; Topcu, Y.İ. An OWA Operator-Based Cumulative Belief Degrees Approach for Credit Rating. Int. J. Intell. Syst. 2018, 33, 998–1026. [Google Scholar] [CrossRef]

- Mishra, S.; Bansal, R. Credit rating and its interaction with financial ratios: A study of BSE 500 companies. In Behavioral Finance and Decision-Making Models; IGI Global: Hershey, PA, USA, 2019; pp. 251–268. [Google Scholar]

- Chi, G.; Zhang, Y.; Shi, B. The debt rating for small enterprises based on Probit regression. J. Manag. Sci. China 2016, 19, 136–156. [Google Scholar]

- Gül, S.; Kabak, Ö.; Topcu, I. A multiple criteria credit rating approach utilizing social media data. Data Knowl. Eng. 2018, 116, 80–99. [Google Scholar] [CrossRef]

- Du, Y. Enterprise Credit Rating Based on Genetic Neural Network. In MATEC Web of Conferences; EDP Sciences: Les Ulis, France, 2018; Volume 227, p. 2011. [Google Scholar]

- Kashif, M.; Ahmed, J.; Islam, M.; Gillani, U.F. Effect of Credit Rating on Trade Credit: Empirical Evidences from Pakistani Non-financial Firms. Int. J. Econ. Financ. Res. Appl. 2019, 3, 1–10. [Google Scholar]

- Li, Z.; Zheng, X. A Critical Study of Commercial Banks’ Credit Risk Assessment and Management for SMEs: The Case of Agricultural Bank of China. J. Appl. Manag. Invest. 2017, 6, 106–117. [Google Scholar]

- Akdoğu, E.; Alp, A. Credit risk and governance: Evidence from credit default swap spreads. Financ. Res. Lett. 2016, 17, 211–217. [Google Scholar] [CrossRef]

- Grassa, R. Corporate governance and credit rating in Islamic banks: Does Shariah governance matters? J. Manag. Gov. 2016, 20, 875–906. [Google Scholar] [CrossRef]

- Kachwala, S.T.; Singla, C. Impact of Ownership Structure on Agency Cost of Debt in India; Indian Institute of Management Ahmedabad: Ahmedabad, India, 2016. [Google Scholar]

- Chodnicka-Jaworska, P. Macroeconomic aspects of banks’ credit ratings. Equilib. Q. J Econ. Econ. Policy 2017, 12, 101–120. [Google Scholar] [CrossRef]

- D’Apice, V.; Ferri, G.; Lacitignola, P. Rating Performance and Bank Business Models: Is There a Change with the 2007–2009 Crisis? Ital. Econ. J. 2016, 2, 385–420. [Google Scholar] [CrossRef]

- Sariannidis, N.; Papadakis, S.; Garefalakis, A.; Lemonakis, C.; Kyriaki-Argyro, T. Default avoidance on credit card portfolios using accounting, demographical and exploratory factors: Decision making based on machine learning (ML) techniques. Ann. Oper. Res. 2019, 277, 1–25. [Google Scholar] [CrossRef]

- Cuny, C.; Dube, S. Does reporting quality moderate the relation between economic changes and changes in the cost of debt? In Proceedings of the 28th Annual Conference on Financial Economics and Accounting, Philadelphia, PA, USA, 10–11 November 2017. [Google Scholar]

- DeBoskey, D.; Li, Y.; Lobo, G.J.; Luo, Y. Transparency of Corporate Political Disclosure and the Cost of Debt; Working Paper; San Diego State University: San Diego, CA, USA, 2017. [Google Scholar]

- Boumparis, P.; Milas, C.; Panagiotidis, T. Fair or not? How credit rating agencies calculated their ratings during the Eurozone crisis. Available online: http://eprints.lse.ac.uk/70340/ (accessed on 15 April 2019).

- Chang, J.-H.; Hung, M.-W.; Tsai, F.-T. Credit contagion and competitive effects of bond rating downgrades along the supply chain. Financ. Res. Lett. 2015, 15, 232–238. [Google Scholar] [CrossRef]

- Saleh, M.H.; Jaber, J.J.; Al-khawaldeh, A.A. The role of credit scoring, cost and product discrimination in improving the competitiveness of Jordanian insurance companies. Int. J. Econ. Financ. 2016, 8, 252–259. [Google Scholar] [CrossRef]

- Saha, N.; Paul, K.C. Impact of Credit Rating on the Corporate Rate of Interest and Investment Flow: A Study with Reference to Some Selected Indian Companies. Ph.D. Thesis, Vidyasagar University, Midnapore, India, 2017. [Google Scholar]

- Pap, M.; Homolya, D. Measurement and mitigation of country risk: The role of quantitative and qualitative factors, Insurance market trends. In Proceedings of the 8th International Scientific Conference “Future World by 2050”, Pula, Croatia, 1–3 June 2017; Volume 1, p. 193. [Google Scholar]

- Sahi, C.A.I.; Rasheed, A. Impact of sovereign credit rating and country risk on bond market of Pakistan. Paradigms 2017, 11, 1h. [Google Scholar]

- Bojadziev, G.; Bojadziev, M. Fuzzy Sets, Fuzzy Logic, Applications; World Scientific: Singapore, 1995; Volume 5. [Google Scholar]

- Kaur, A.; Kaur, A. Comparison of fuzzy logic and neuro-fuzzy algorithms for air conditioning system. Int. J. Soft Comput. Eng. 2012, 2, 417–420. [Google Scholar]

- Shleeg, A.A.; Ellabib, I.M. Comparison of mamdani and sugeno fuzzy interference systems for the breast cancer risk. Int. J. Comput. Inf. Sci. Eng. 2013, 7, 387–391. [Google Scholar]

| VARIABLES | DM1 | DM2 | DM3 | DM4 | DM5 | DM6 | DM7 | DM8 | DM9 |

|---|---|---|---|---|---|---|---|---|---|

| DEBT-TO-EQUITY RATIO | 4 | 5 | 4 | 5 | 3 | 4 | 5 | 5 | 4 |

| DEBT RATIO TO EBITDA | 5 | 5 | 5 | 4 | 3 | 4 | 5 | 5 | 4 |

| DSCR | 5 | 4 | 4 | 5 | 5 | 5 | 5 | 4 | 3 |

| INTEREST COVERAGE RATIO | 3 | 4 | 5 | 5 | 5 | 4 | 5 | 4 | 5 |

| CASH FROM OPERATING ACTIVITIES RATIO TO TOTAL SALES | 5 | 5 | 5 | 5 | 4 | 5 | 3 | 5 | 4 |

| ROE | 4 | 4 | 5 | 4 | 5 | 4 | 5 | 4 | 3 |

| OPERATING PROFIT MARGIN | 5 | 5 | 5 | 4 | 5 | 4 | 3 | 4 | 5 |

| CURRENT RATIO | 4 | 5 | 4 | 5 | 4 | 5 | 4 | 3 | 4 |

| QUICK RATIO | 5 | 5 | 5 | 5 | 4 | 5 | 4 | 5 | 3 |

| ASSET TURNOVER | 4 | 4 | 4 | 5 | 4 | 5 | 4 | 5 | 3 |

| MANAGEMENT STRUCTURE | 4 | 4 | 4 | 5 | 5 | 4 | 5 | 3 | 5 |

| SUCCESSION PLANNING | 4 | 3 | 4 | 5 | 4 | 3 | 3 | 2 | 4 |

| STRATEGIC PLANNING | 3 | 3 | 3 | 3 | 4 | 5 | 3 | 4 | 2 |

| CORPORATE GOVERNANCE | 4 | 4 | 4 | 5 | 5 | 5 | 3 | 4 | 5 |

| OWNERSHIP STRUCTURE | 3 | 5 | 4 | 4 | 5 | 4 | 5 | 4 | 3 |

| DIVERSIFICATION OF INCOME | 4 | 4 | 5 | 4 | 5 | 4 | 3 | 3 | 5 |

| PAYMENT RECORDS | 5 | 5 | 4 | 5 | 4 | 5 | 4 | 3 | 4 |

| COMPANY AUDITORS | 3 | 3 | 3 | 2 | 3 | 4 | 5 | 3 | 4 |

| QUALITY AND TRANSPARENCY OF REPORTING | 3 | 4 | 4 | 5 | 5 | 5 | 5 | 3 | 4 |

| COMPETITIVENESS | 4 | 5 | 5 | 5 | 4 | 5 | 3 | 4 | 5 |

| POSITION IN THE INDUSTRY/MARKET | 3 | 4 | 5 | 5 | 5 | 5 | 4 | 5 | 4 |

| RISK OF INDUSTRY | 3 | 3 | 3 | 4 | 3 | 4 | 2 | 3 | 4 |

| GROUPS OF COUNTRY RISK | 4 | 5 | 5 | 5 | 5 | 4 | 4 | 3 | 4 |

| VARIABLES | AVERAGE SCORE | ACCEPT/REJECT | |

|---|---|---|---|

| 1 | debt-to-equity ratio | 4.333333333 | Accept |

| 2 | debt ratio to EBITDA | 4.444444444 | Accept |

| 3 | DSCR | 4.444444444 | Accept |

| 4 | interest coverage ratio | 4.444444444 | Accept |

| 5 | cash from operating activities ratio to total sales | 4.555555556 | Accept |

| 6 | ROE | 4.222222222 | Accept |

| 7 | operating profit margin | 4.444444444 | Accept |

| 8 | current ratio | 4.222222222 | Accept |

| 9 | quick ratio | 4.555555556 | Accept |

| 10 | asset turnover | 4.222222222 | Accept |

| 11 | management structure | 4.333333333 | Accept |

| 12 | succession planning | 3.555555556 | Reject |

| 13 | strategic planning | 3.333333333 | Reject |

| 14 | corporate governance | 4.333333333 | Accept |

| 15 | ownership structure | 4.111111111 | Accept |

| 16 | diversification of income | 4.111111111 | Accept |

| 17 | payment records | 4.333333333 | Accept |

| 18 | company auditors | 3.333333333 | Reject |

| 19 | quality and transparency of reporting | 4.222222222 | Accept |

| 20 | competitiveness | 4.444444444 | Accept |

| 21 | position in the industry/market | 4.444444444 | Accept |

| 22 | risk of industry | 3.222222222 | Reject |

| 23 | groups of country risk | 4.333333333 | Accept |

| Factor | References |

|---|---|

| debt-to-equity ratio | [28,29] |

| debt ratio to EBITDA | [30,31] |

| DSCR | [32,33] |

| interest coverage ratio | [34,35] |

| cash from operating activities ratio to total sales | [36] |

| ROE | [37,38,39] |

| operating profit margin | [40,41] |

| current ratio | [42,43] |

| quick ratio | [41,44,45] |

| asset turnover | [46,47] |

| management structure | [48] |

| corporate governance | [49,50] |

| ownership structure | [50,51] |

| diversification of income | [52,53] |

| payment records | [54] |

| quality and transparency of reporting | [55,56] |

| competitiveness | [57,58,59] |

| company position | [60] |

| country risk | [61,62] |

| Variable | Range | |

|---|---|---|

| debt-to-equity ratio | very poor | |

| almost very poor | ||

| poor | ||

| average | ||

| good | ||

| very good | ||

| debt ratio to EBITDA | very poor | |

| poor | ||

| average | ||

| good | ||

| very good | ||

| DSCR | very poor | |

| poor | ||

| average | ||

| good | ||

| very good | ||

| interest coverage ratio | very poor | |

| poor | ||

| average | ||

| good | ||

| very good | ||

| cash from operating activities ratio to total sales | very poor | |

| poor | ||

| average | ||

| good | ||

| very good | ||

| ROE | very poor | |

| poor | ||

| average | ||

| good | ||

| very good | ||

| operating profit margin | very poor | |

| poor | ||

| average | ||

| good | ||

| very good | ||

| current ratio | very poor | |

| poor | ||

| average | ||

| good | ||

| very good | ||

| quick ratio | very poor | |

| poor | ||

| average | ||

| good | ||

| very good | ||

| asset turnover | very poor | |

| poor | ||

| average | ||

| good | ||

| very good | ||

| management structure | inadequate | |

| below average | ||

| average | ||

| above average | ||

| adequate | ||

| corporate governance | weakness | |

| average | ||

| satisfied | ||

| very good | ||

| excellent | ||

| ownership structure | weakness | |

| average | ||

| satisfied | ||

| very good | ||

| excellent | ||

| diversification of income | one specific income | |

| limited | ||

| balanced | ||

| highly diversified income | ||

| very highly diversified income | ||

| payment records | very poor | |

| poor | ||

| average | ||

| good | ||

| very good | ||

| quality and transparency of reporting | very poor | |

| poor | ||

| average | ||

| good | ||

| very good | ||

| competitiveness | enemy | |

| aggressive | ||

| average | ||

| suitable | ||

| without threat | ||

| company position | starter | |

| small performer | ||

| middle performer | ||

| main performer | ||

| market leader | ||

| country risk | highest risk | |

| almost high risk | ||

| often risk | ||

| middle risk | ||

| low risk | ||

| very low risk | ||

| no risk | ||

| If | If | If | If | If | If | If | If | If | If | If | If | If | If | If | If | If | If | If | then |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| very poor | very poor | very poor | very poor | very poor | very poor | very poor | very poor | very poor | very poor | inadequate | weakness | weakness | one specific income | very poor | very poor | enemy | starter | highest risk | 7 |

| very poor | very poor | very poor | very poor | very poor | very poor | very poor | very poor | very poor | very poor | Inadequate | weakness | weakness | one specific income | very poor | very poor | enemy | starter | almost high risk | 6 |

| almost poor | poor | poor | poor | poor | poor | poor | poor | poor | poor | below average | average | average | limited | poor | poor | aggressive | small performer | often risk | 5 |

| poor | average | average | average | average | average | average | average | average | average | average | satisfied | satisfied | balanced | average | average | average | middle performer | middle risk | 4 |

| average | good | good | good | good | good | good | good | good | good | above average | very good | very good | highly diversified income | good | good | suitable | main performer | low risk | 3 |

| good | very good | very good | very good | very good | very good | very good | very good | very good | very good | adequate | excellent | excellent | very highly diversified income | very good | very good | without threat | market leader | very low risk | 2 |

| very good | very good | very good | very good | very good | very good | very good | very good | very good | very good | adequate | excellent | excellent | very highly diversified income | very good | very good | without threat | market leader | no risk | 1 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Karbassi Yazdi, A.; Hanne, T.; Wang, Y.J.; Wee, H.-M. A Credit Rating Model in a Fuzzy Inference System Environment. Algorithms 2019, 12, 139. https://doi.org/10.3390/a12070139

Karbassi Yazdi A, Hanne T, Wang YJ, Wee H-M. A Credit Rating Model in a Fuzzy Inference System Environment. Algorithms. 2019; 12(7):139. https://doi.org/10.3390/a12070139

Chicago/Turabian StyleKarbassi Yazdi, Amir, Thomas Hanne, Yong J. Wang, and Hui-Ming Wee. 2019. "A Credit Rating Model in a Fuzzy Inference System Environment" Algorithms 12, no. 7: 139. https://doi.org/10.3390/a12070139

APA StyleKarbassi Yazdi, A., Hanne, T., Wang, Y. J., & Wee, H.-M. (2019). A Credit Rating Model in a Fuzzy Inference System Environment. Algorithms, 12(7), 139. https://doi.org/10.3390/a12070139