An Exploration of a Balanced Up-Downwind Scheme for Solving Heston Volatility Model Equations on Variable Grids

Abstract

1. Introduction

2. Results

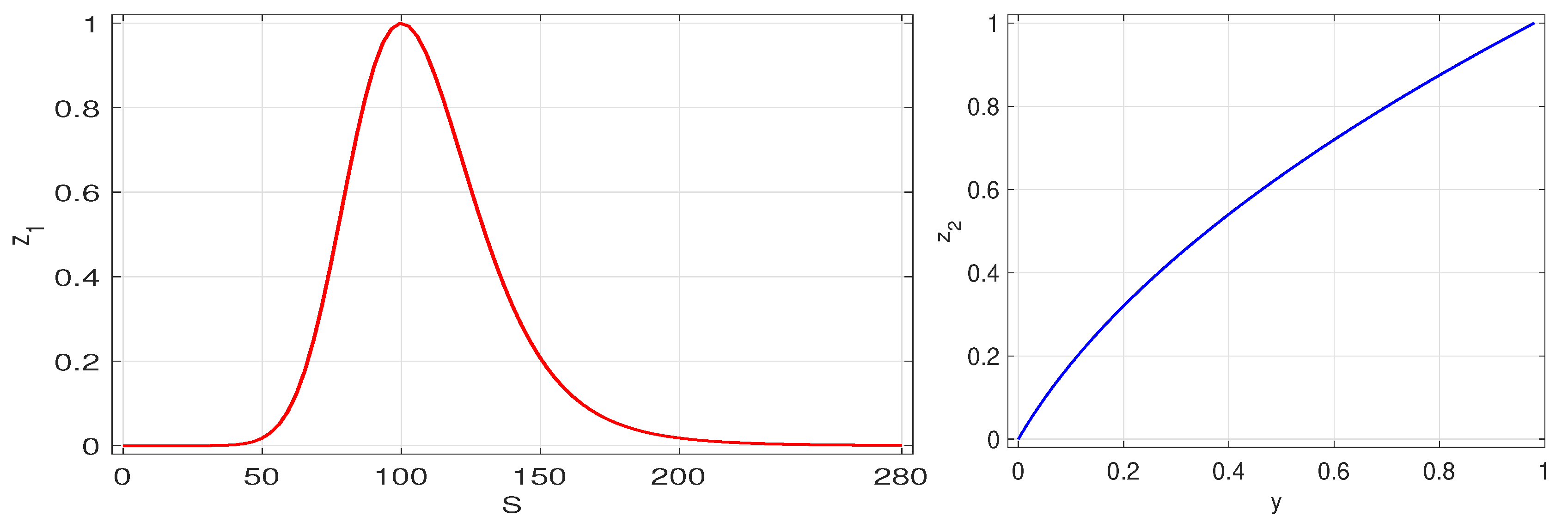

2.1. Balanced Up-Downwind Semi-Discretized Scheme

2.1.1. Case for

2.1.2. Case for

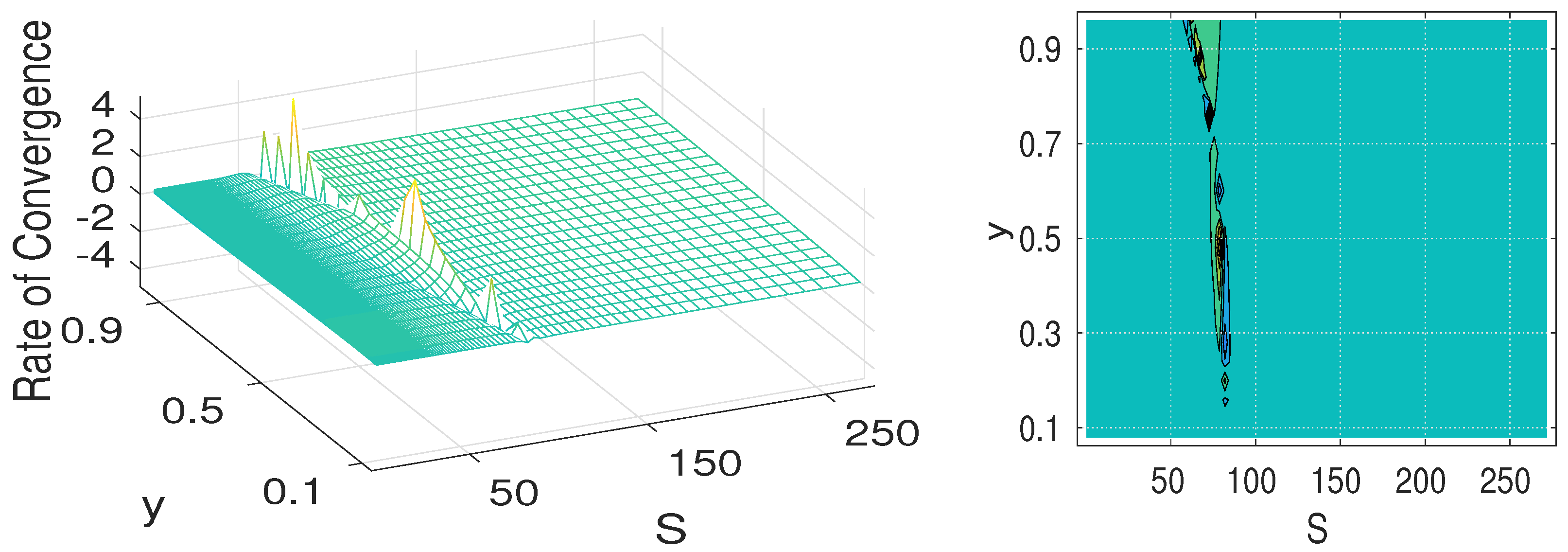

2.2. Numerical Stability

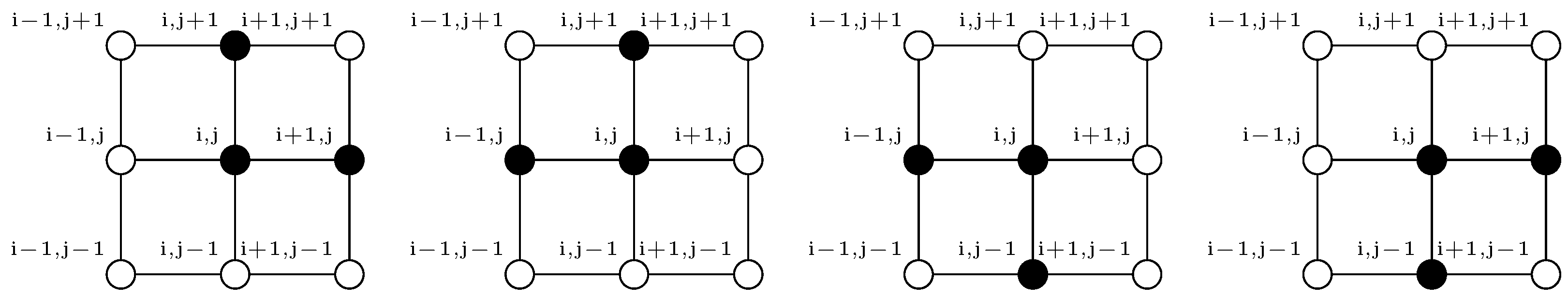

- Discs centered at an internal mesh point;

- discs centered on one of the Dirichlet boundaries;

- discs centered on the Neumann boundary;

- discs centered at one of the intersection mesh points of two Dirichlet boundaries; and

- discs centered at one of the intersection mesh points of one Dirichlet boundary and the Neumann boundary.

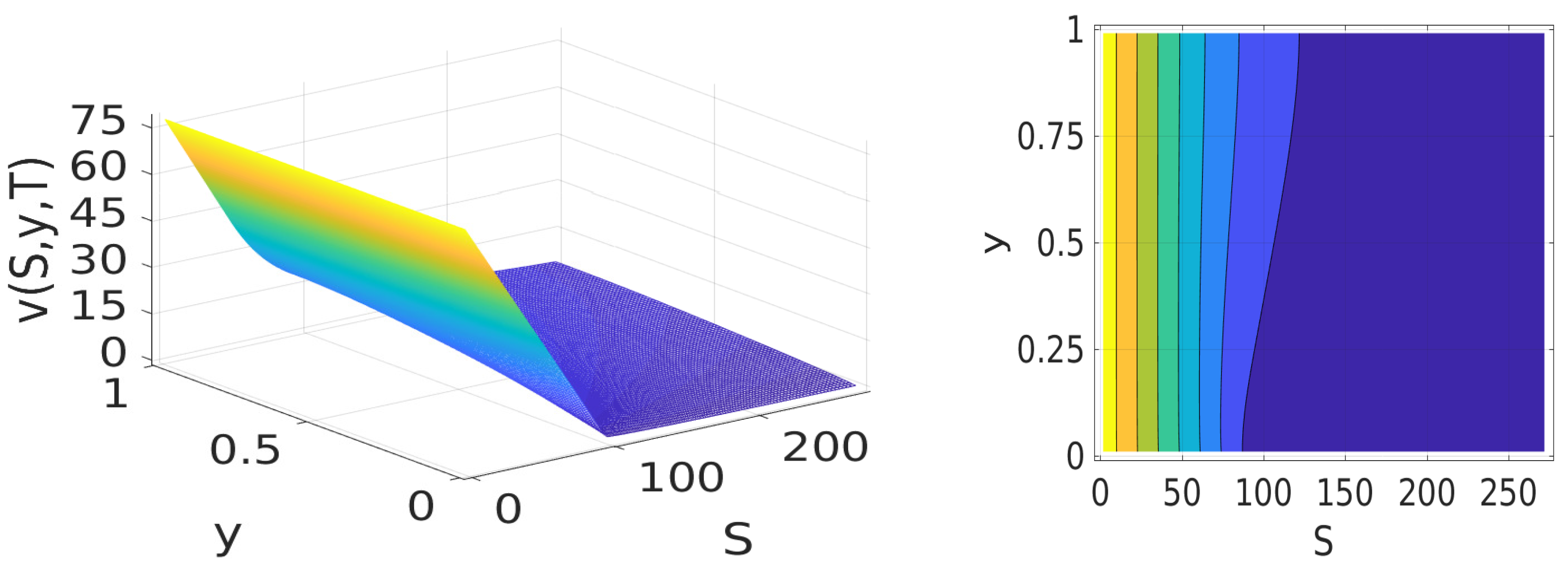

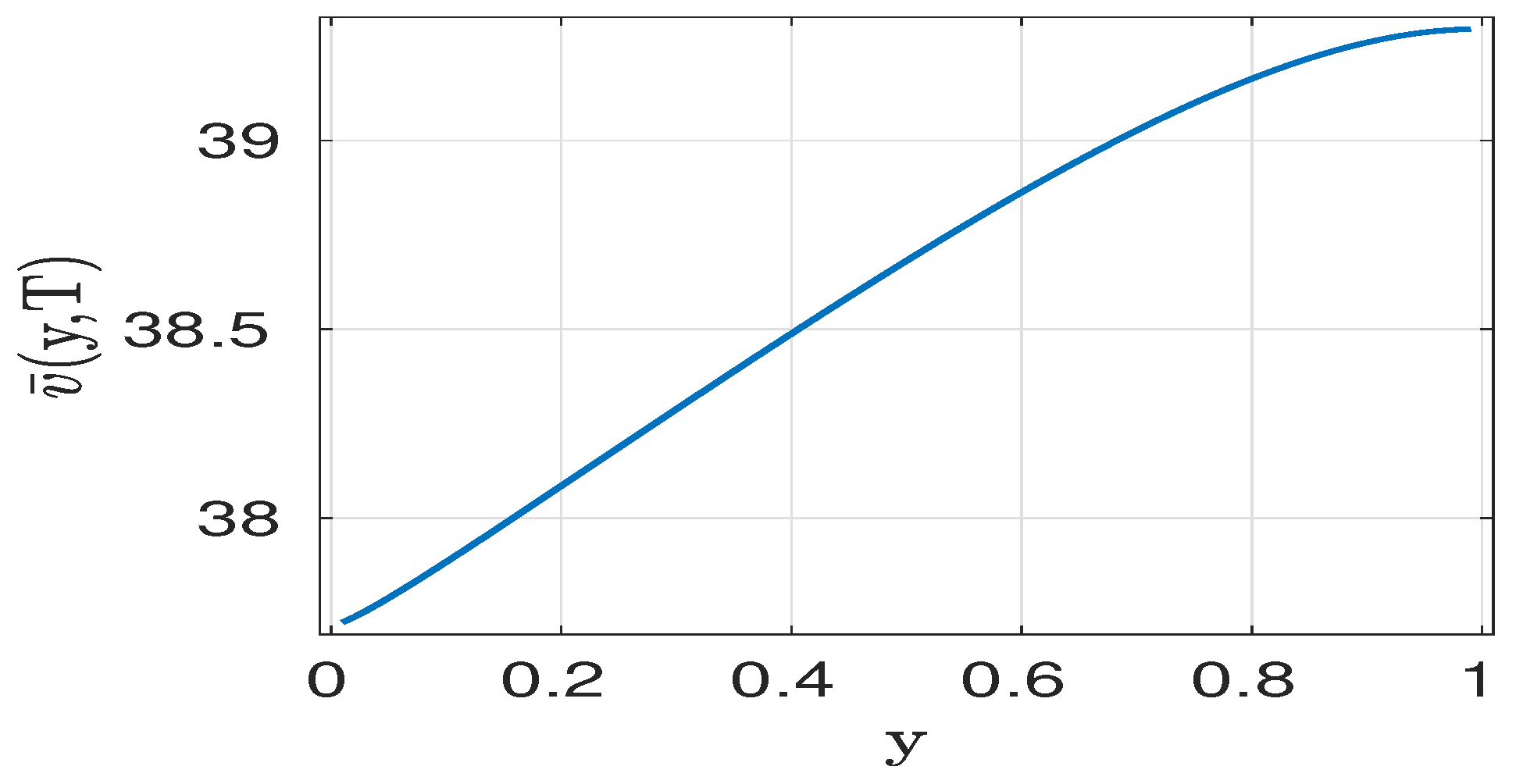

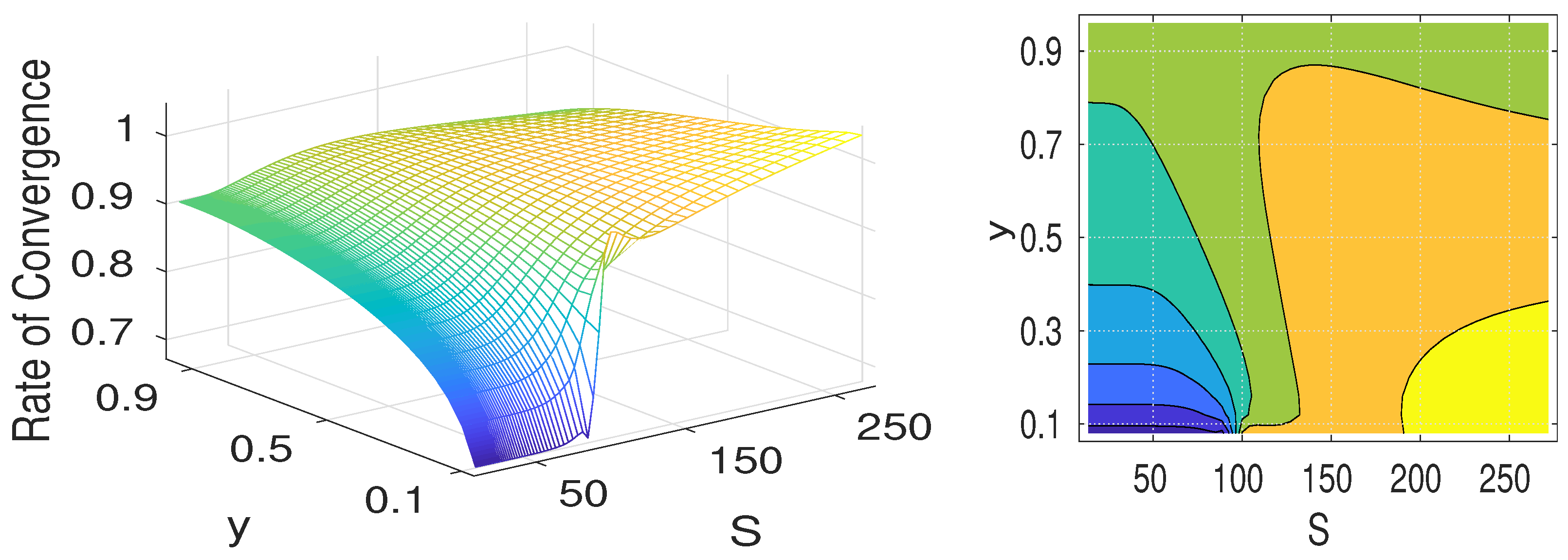

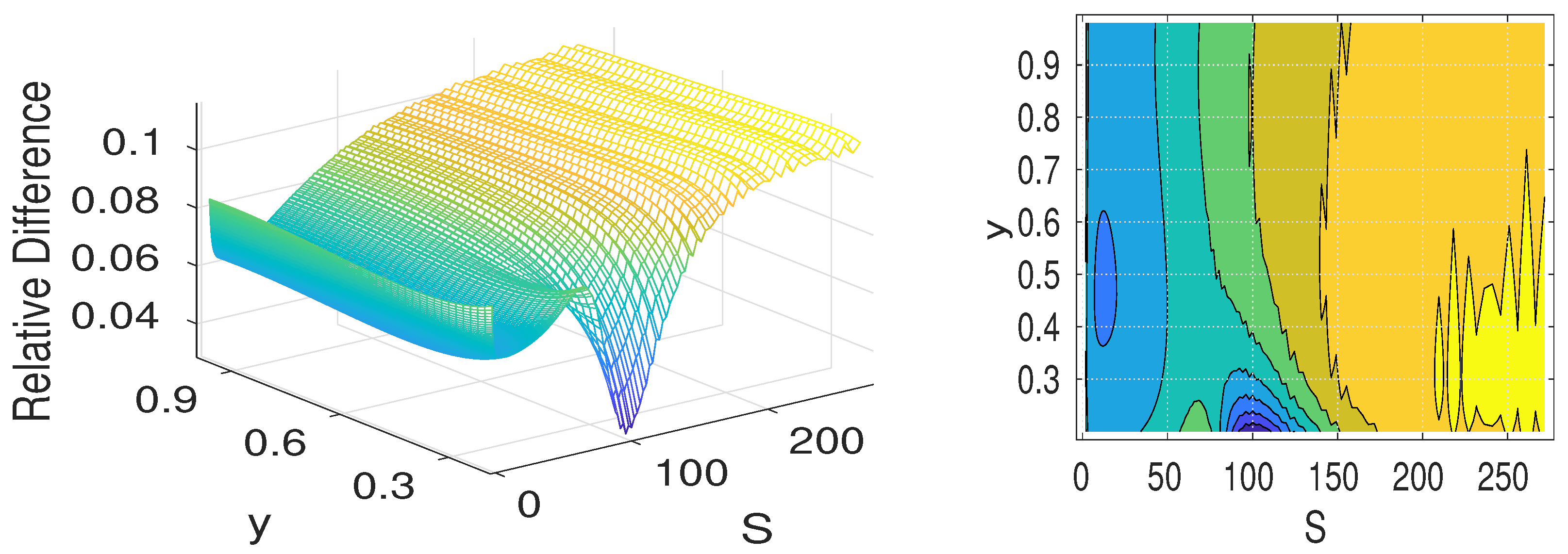

2.3. Computational Experiments

3. Discussion

4. Materials and Methods

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| ADI | Alternating direction implicit |

| BSM | Black-Scholes-Merton |

| DDR | Double data rate |

| HPC | High-performance computing |

| LOD | Local one-dimensional |

| RAM | Random access memory |

| GB | Gigabyte |

| TB | Terabyte |

References

- Fornberg, B. Calculation of weights in finite difference formulas. SIAM Rev. 1998, 40, 685–691. [Google Scholar] [CrossRef]

- Ma, K.; Forsyth, P.A. An unconditionally monotone numerical scheme for the two-factor uncertain volatility model. IMA J. Numer. Anal. 2017, 37, 905–944. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The pricing of options and corporate liabilities. J. Polit. Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Düring, B.; Fournié, M.; Heuer, C. High-order compact finite difference schemes for option pricing in stochastic volatility models on non-uniform grids. J. Comput. Appl. Math. 2014, 271, 247–266. [Google Scholar] [CrossRef]

- Cui, Y.R.; del Baño Rollin, S.; Germano, G. Full and fast calibration of the Heston stochastic volatility model. Eur. J. Oper. Res. 2017, 263, 625–638. [Google Scholar] [CrossRef]

- Heston, S. A Closed-form for options with stochastic volatility with applications to bond and currency options. Rev. Finan. Stud. 1993, 6, 327–343. [Google Scholar] [CrossRef]

- Rouah, F.D. The Heston Model and Its Extensions in Matlab and C; John Wiley & Sons: New York, NY, USA, 2013. [Google Scholar]

- Düring, B.; Fournié, M. High-order compact finite difference scheme for option pricing in stochastic volatility models. J. Comput. Appl. Math. 2012, 236, 4462–4473. [Google Scholar] [CrossRef]

- Ikonen, S.; Toivanen, J. Efficient numerical methods for pricing American options under stochastic volatility. Numer. Meth. Partial Differ. Equat. 2008, 24, 104–126. [Google Scholar] [CrossRef]

- Iserles, A. A First Course in the Numerical Analysis of Differential Equations, 2nd ed.; Cambridge University Press: New York, NY, USA, 2008. [Google Scholar]

- Albrecher, H.; Predota, M. On Asian option pricing for NIG Lévy processes. J. Comput. Appl. Math. 2004, 172, 153–168. [Google Scholar] [CrossRef]

- Hendricks, C.; Ehrhardt, M.; Günther, M. High-order ADI schemes for diffusion equations with mixed derivatives in the combination technique. Appl. Numer. Math. 2016, 101, 36–52. [Google Scholar] [CrossRef]

- In’ t Hout, K.J.; Welfert, B.D. Stability of ADI schemes applied to convection-diffusion equations with mixed derivative terms. Appl. Numer. Math. 2007, 57, 19–36. [Google Scholar] [CrossRef]

- Zhu, S.P.; Chen, W.T. A predictor-corrector scheme based ADI method for pricing American puts with stochastic volatility. Comput. Math. Appl. 2011, 62, 1–26. [Google Scholar] [CrossRef]

- Shreve, S. Stochastic Calculus for Finance II: Continuous-Time Models; Springer: New York, NY, USA, 2004. [Google Scholar]

- Fusai, G.; Meucci, A. Pricing discretely monitored Asian options under Lévy processes. J. Bank. Financ. 2008, 32, 2076–2088. [Google Scholar] [CrossRef]

- Rachev, S.T. Handbook of Computational and Numerical Methods in Finance; Birkhäuser: Boston, MA, USA, 2014. [Google Scholar]

- Sheng, Q.; Padgett, J. On the stability of a variable step exponential splitting method for solving multidimensional quenching-combustion equations. Proc. Math. Stat. 2016, 171, 155–167. [Google Scholar]

- Padgett, J.; Sheng, Q. Numerical solution of degenerate stochastic Kawarada equations via a semi-discretized approach. Appl. Math. Comput. 2018, 325, 210–226. [Google Scholar] [CrossRef]

- Noble, J.; Daniel, J.W. Applied Linear Algebra, 3rd ed.; Prentice-Hall: Upper Saddle River, NJ, USA, 1988. [Google Scholar]

- Lax, P.D.; Richtmyer, R.D. Survey of the stability of linear finite difference equations. Commun. Pure Appl. Math. 1956, 9, 267–293. [Google Scholar] [CrossRef]

- Meng, Q.J.; Ding, D.; Sheng, Q. Preconditioned iterative methods for fractional diffusion models in finance. Numer. Meth. Partial Differ. Equat. 2015, 31, 1382–1395. [Google Scholar] [CrossRef]

- Hull, J.C. Option, Futures and Other Derivatives, 9th ed.; Pearson Education: Upper Saddle River, NJ, USA, 2015. [Google Scholar]

- Cheng, H.; Lin, P.; Sheng, Q.; Tan, R. Solving degenerate reaction-diffusion equations via variable step Peaceman-Rachford splitting. SIAM J. Sci. Comput. 2003, 25, 1273–1292. [Google Scholar] [CrossRef]

| Key Parameter | Value Used |

|---|---|

| Strike price | |

| Volatility of volatility | |

| Risk-free interest rate | |

| Mean reversion speed | |

| Long-run mean of volatility |

| Mesh Steps | Rconv. Rates | |||

|---|---|---|---|---|

| 0.6193 | 0.6134 | 0.6026 | ||

| 1.0024 | 0.9976 | 0.9811 | ||

| 0.9026 | 0.90438 | 0.9053 | ||

| 0.6324 | 0.6221 | 0.6206 | ||

| 0.9674 | 1.0007 | 1.0151 | ||

| 0.8342 | 0.8300 | 0.8296 | ||

| 0.5824 | 0.5971 | 0.6179 | ||

| 0.9941 | 0.9437 | 0.9586 | ||

| 0.7952 | 0.8015 | 0.8142 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, C.; Sheng, Q. An Exploration of a Balanced Up-Downwind Scheme for Solving Heston Volatility Model Equations on Variable Grids. Algorithms 2019, 12, 30. https://doi.org/10.3390/a12020030

Sun C, Sheng Q. An Exploration of a Balanced Up-Downwind Scheme for Solving Heston Volatility Model Equations on Variable Grids. Algorithms. 2019; 12(2):30. https://doi.org/10.3390/a12020030

Chicago/Turabian StyleSun, Chong, and Qin Sheng. 2019. "An Exploration of a Balanced Up-Downwind Scheme for Solving Heston Volatility Model Equations on Variable Grids" Algorithms 12, no. 2: 30. https://doi.org/10.3390/a12020030

APA StyleSun, C., & Sheng, Q. (2019). An Exploration of a Balanced Up-Downwind Scheme for Solving Heston Volatility Model Equations on Variable Grids. Algorithms, 12(2), 30. https://doi.org/10.3390/a12020030