International Diffusion of Renewable Energy Innovations: Lessons from the Lead Markets for Wind Power in China, Germany and USA

Abstract

:1. Introduction

2. Lead Markets for Renewable Energy Innovations

2.1. Demand Side of Domestic Market

2.2. Supply Side of Domestic Market

2.3. Policy Mix

2.4. Technological Capability

2.5. Market Structure

| Factors | Definition |

|---|---|

| Demand side of domestic market | Ability of a country to develop a market earlier than others, creating the possibility to shape foreign markets and serve foreign demand. |

| Supply side of domestic market | Demonstration advantage |

| Demonstration effect derived from the ability of a country to be the first to successfully diffuse a new technology. | |

| Export capacity | |

| Ability of a country’s industry to respond to consumer needs in other countries. | |

| Policy mix | Ability to define policy measures (in terms of environmental regulation and technology policy) that are followed in other countries. |

| Technological capability | Knowledge base and absorptive capability. |

| Integration into knowledge networks (industrial clusters, research institutions and international partnerships). | |

| Market Structure | High competition level in the domestic market enhances pressure to innovate and reduce prices. |

3. Lead Markets in the Wind Power Industry

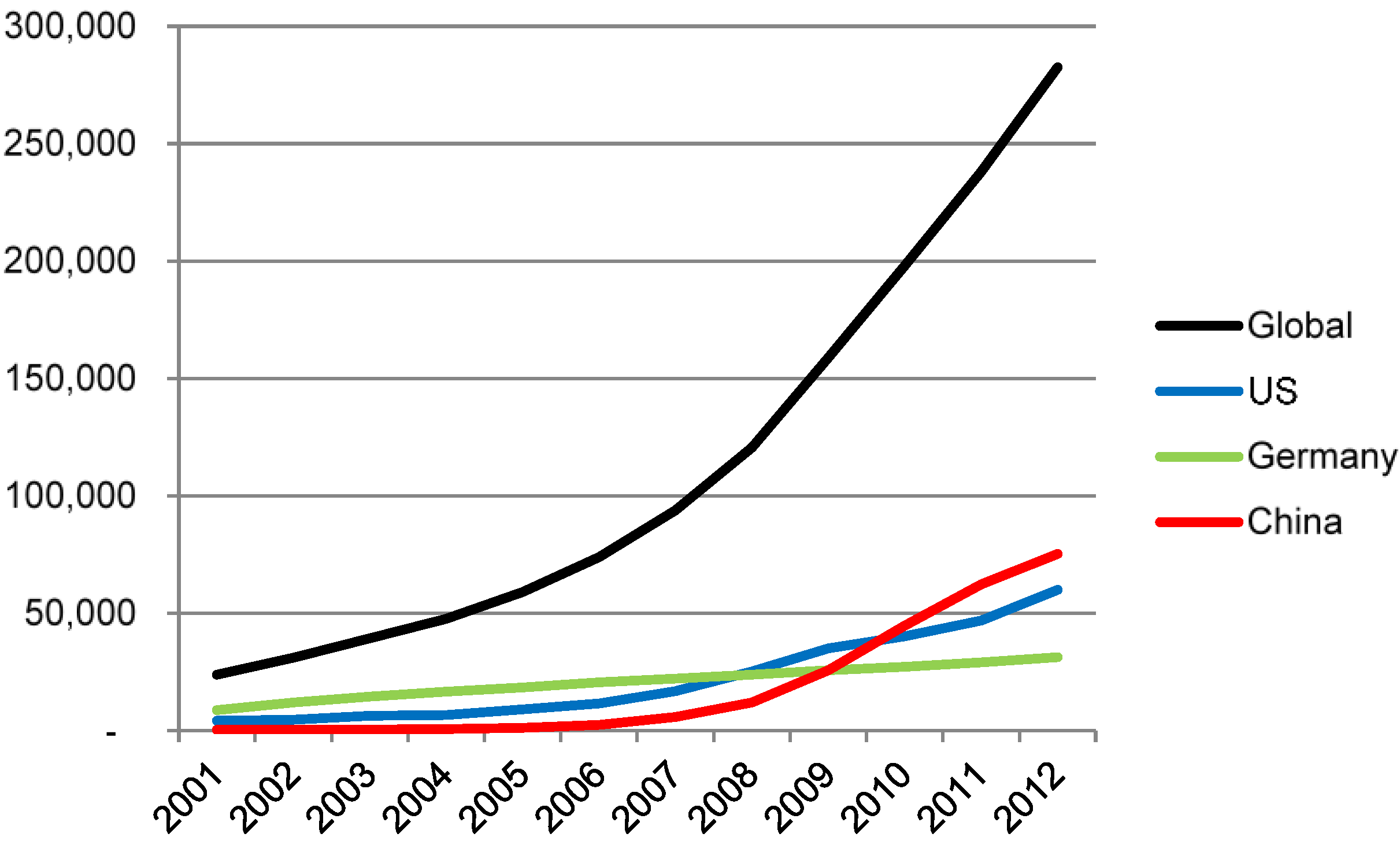

3.1. Demand Side of Domestic Market

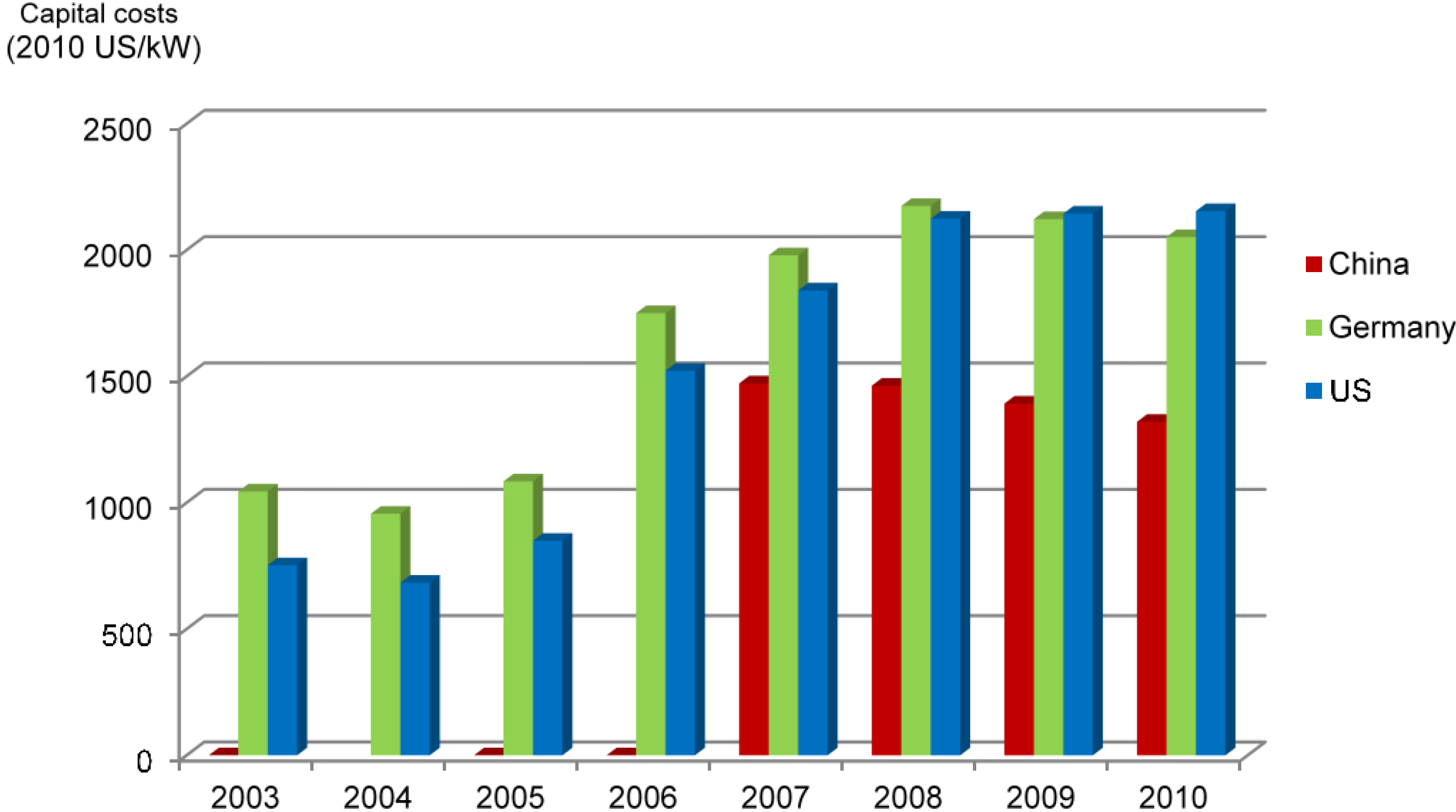

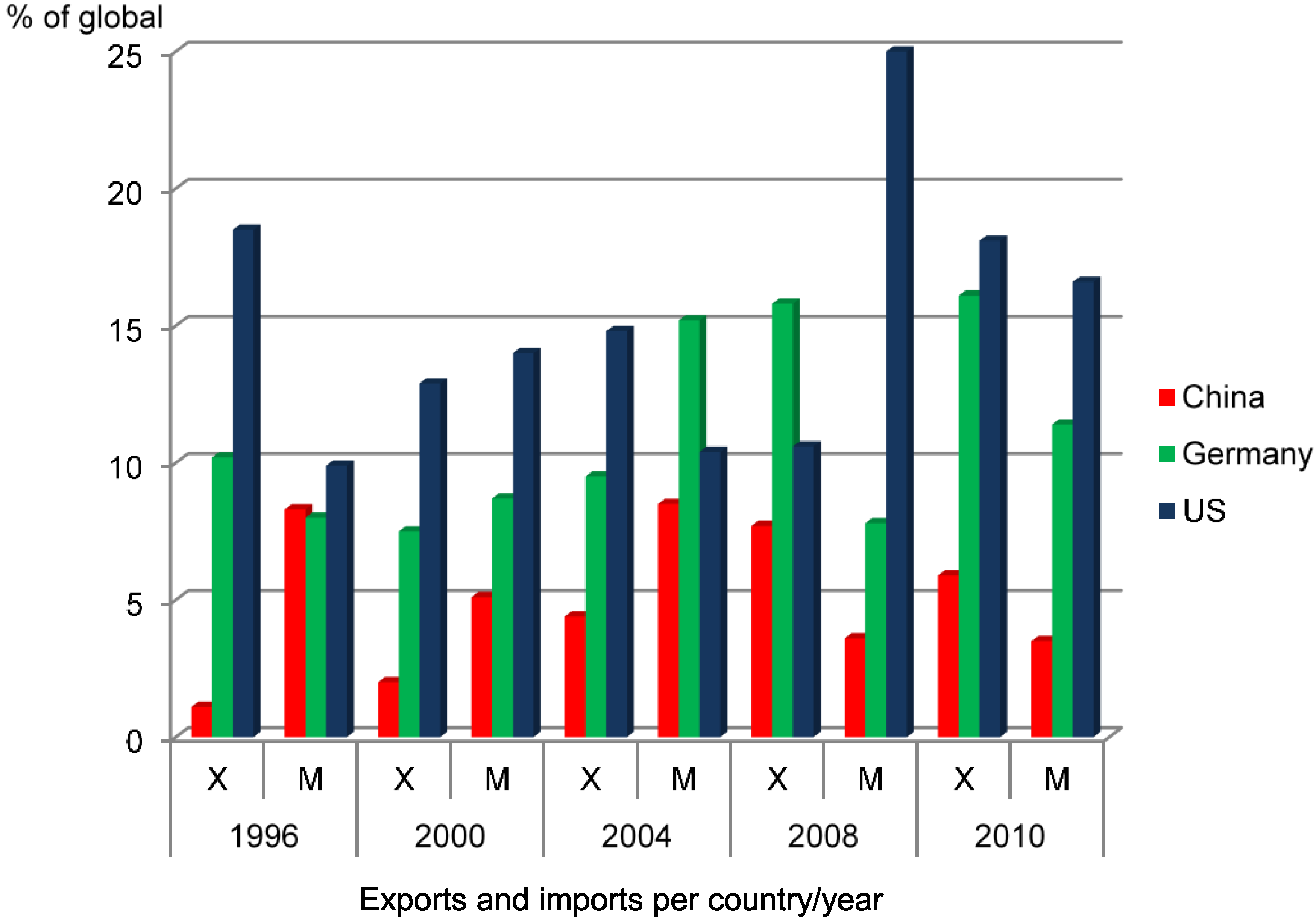

3.2. Supply Side of Domestic Market

3.3. Policy Mix

| Support Instrument Used by Country/Year of 1st Implementation | China | Germany | USA |

|---|---|---|---|

| Feed in Tariffs | 2009 | 1991 | |

| Premium or Adder System | 2012 | ||

| Auction or tendering system | 2002 | ||

| Tax based (electricity) production incentives | 1992 | ||

| Spot market trading | 2008 | ||

| Investment subsidy or tax credit | 1981 | ||

| Tradable Green Certificate | 1998 * | ||

| Concessionary finance through government supported agencies | 2001 | 1989 | 1992 |

| Concession on import duty | 2003–2010 | ||

| Renewable energy Portfolio Standard or Purchase Obligation | 2006 | 2002 * | |

| Federal or state-level targets (binding or indicative) for electricity generation | 2007 | 1991 | 2002 * |

| Project siting guidelines | 1997 | 2002 | |

| Project permitting process | 2001 | 2005 | |

| Priority access to the grid | 2009 | 1991 | |

| Grid code | 2008 |

3.4. Technological Capability

3.5. Market Structure

| Technology/Power Generation in GW | China | USA | Germany |

|---|---|---|---|

| Bio-power | 6.2 | 15.8 | 8.1 |

| Geothermal power | 0 | 3.4 | 0 |

| Solar PV | 19.9 | 12.1 | 36 |

| Concentrating thermal power (CSP) | 0 | 0.9 | 0 |

| Wind power | 91 | 61 | 34 |

| Germany | China | USA | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Company | HQ | LF | % | Company | HQ | LF | % | Company | HQ | LF | % |

| Enercon | Germany | Yes | 49.6 | Goldwind | China | Yes | 23.3 | GE Wind | USA | Yes | 38.2 |

| Vestas | Denmark | Yes | 20.0 | United Power 2 | China | Yes | 9.3 | Siemens | Germany | Yes | 20.1 |

| Repower 1 | Germany | Yes | 16.2 | Ming Yang 3 | China | Yes | 8.0 | Vestas | Denmark | Yes | 13.8 |

| Nordex | Germany | Yes | 8.4 | Envision | China | Yes | 7.0 | Gamesa | Spain | Yes | 10.2 |

| Siemens | Germany | Yes | 1.3 | XEMC-Wind | China | Yes | 6.5 | Repower | Germany | No | 4.5 |

| GE Wind | USA | Yes | 1.2 | Shanghai Electric | China | Yes | 6.3 | Mitsubishi | Japan | No | 3.2 |

| Others | 3.3 | Sinovel | China | Yes | 5.6 | Nordex | Germany | No | 2.1 | ||

| CSIC-Haizhuang | China | Yes | 4.9 | Clipper | USA | Yes | 1.9 | ||||

| Dong Fang | China | Yes | 3.6 | Acciona | Spain | No | 1.5 | ||||

| Zhejiang Windey | China | Yes | 3.4 | Suzlon | India | No | 1.4 | ||||

| Others | 22.2 | Other | 3.0 | ||||||||

| Top 6 sum | 96.7 | Top 10 sum | 78.8 | Top 10 sum | 97.0 | ||||||

4. Comparison of Lead Market Factors

| Lead Market Factor | China | Germany | United States |

|---|---|---|---|

| Demand side of domestic market | ++ | 0 | + |

| Supply side of domestic market | + | ++ | 0 |

| Policy mix | ++ | + | 0 |

| Technological capability | 0 | ++ | + |

| Market Structure | + | + | 0 |

5. Assessment of Lead Market Potential

6. Concluding Remarks

Author Contributions

Conflicts of Interest

References

- International Energy Agency (IEA). CO2 Emissions from Fuel Combustion: Highlights; IEA: Paris, France, 2013. [Google Scholar]

- Anadón, L.D. Missions-oriented RD&D institutions in energy between 2000 and 2010: A comparative analysis of China, the United Kingdom and the United States. Res. Policy 2012, 41, 1742–1756. [Google Scholar] [CrossRef]

- Fankhauser, S.; Bowen, A.; Calel, R.; Dechezleprêtre, A.; Grover, D.; Rydge, J.; Sato, M. Who will win the green race? In search of environmental competitiveness and innovation. Glob. Environ. Chang. 2013, 23, 902–913. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. A tale of two market failures: Technology and environmental policy. Ecol. Econ. 2005, 54, 164–174. [Google Scholar] [CrossRef]

- Mowery, D.C.; Nelson, R.R.; Martin, B.R. Technology policy and global warming: Why new policy models are needed (or why putting new wine in old bottles won’t work). Res. Policy 2010, 39, 1011–1023. [Google Scholar] [CrossRef]

- European Commission (EC). Energy Economic Development in Europe; EC: Brussels, Belgium, 2014. [Google Scholar]

- National Renewable Energy Laboratory (NREL). IEA Wind Task 26: The Past and Future Cost of Wind Energy, Work Package 2; Technical Report NREL/TP-6A20–53510; NREL: Denver, CO, USA, 2012.

- United Nations Environment Programme (UNEP). China’s Green Long March; UNEP: Nairobi, Kenya, 2013. [Google Scholar]

- Global Energy Assessment (GEA). Global Energy Assessment—Toward a Sustainable Future; Cambridge University Press: Cambridge, UK; New York, NY, USA; the International Institute for Applied Systems Analysis: Laxenburg, Austria, 2012. [Google Scholar]

- IEA. Redrawing the Energy-Climate Map; World Energy Outlook Special Report; IEA: Paris, France, 2013. [Google Scholar]

- UNEP. Global Trends in Renewable Energy Investment; Frankfurt School-UNEP Centre/BNEF: Frankfurt am Main, Germany, 2014. [Google Scholar]

- International Renewable Energy Agency (IRENA). Renewable Power Generation Costs: Summary for Policy Makers; IRENA: Abu Dhabi, UAE, 2012. [Google Scholar]

- IEA. Technology Roadmap: Wind Energy; IEA: Paris, France, 2013. [Google Scholar]

- Beise, M.; Rennings, K. Lead markets and regulation: A framework for analyzing the international diffusion of environmental innovations. Ecol. Econ. 2005, 52, 5–17. [Google Scholar] [CrossRef]

- Binz, C.; Truffer, B.; Coenen, L. Why space matters in technological innovation systems—Mapping global knowledge dynamics of membrane bioreactor technology. Res. Policy 2014, 43, 138–155. [Google Scholar] [CrossRef]

- Coenen, L.; Benneworth, P.; Truffer, B. Toward a spatial perspective on sustainability transitions. Res. Policy 2012, 41, 968–979. [Google Scholar] [CrossRef]

- Nill, J.; Kemp, R. Evolutionary approaches for sustainable innovation policies: From niche to paradigm? Res. Policy 2009, 38, 668–680. [Google Scholar] [CrossRef]

- Grubler, A. Energy transitions research: Insights and cautionary tales. Energy Policy 2012, 50, 8–16. [Google Scholar] [CrossRef]

- Pearson, P.J.G.; Foxon, T.J. A low carbon industrial revolution? Insights and challenges from past technological and economic transformations. Energy Policy 2012, 50, 117–127. [Google Scholar] [CrossRef]

- Verbong, G.P.J.; Geels, F.W. Exploring sustainability transitions in the electricity sector with socio-technical pathways. Technol. Forecast. Soc. Chang. 2010, 77, 1214–1221. [Google Scholar] [CrossRef]

- Markard, J.; Raven, R.; Truffer, B. Sustainability transitions: An emerging field of research and its prospects. Res. Policy 2012, 41, 955–967. [Google Scholar] [CrossRef]

- Smith, A.; Voß, J.P.; Grin, J. Innovation studies and sustainability transitions: The allure of the multi-level perspective and its challenges. Res. Policy 2010, 39, 435–448. [Google Scholar] [CrossRef]

- Quitzow, R. The Co-evolution of Policy, Market and Industry in the Solar Energy Sector: A Dynamic Analysis of Technological Innovation Systems for Solar Photovoltaics in Germany and China; FFU Report 06-2013; Freie Universität Berlin: Berlin, Germany, 2013. [Google Scholar]

- Utterback, J. Mastering the Dynamics of Innovation; Harvard Business School Press: Boston, MA, USA, 1994. [Google Scholar]

- Utterback, J.M.; Suaréz, F.F. Innovation, competition and industrial structure. Res. Policy 1993, 22, 1–21. [Google Scholar] [CrossRef]

- Popp, D.; Newell, R.G.; Jaffe, A.B. Energy, the environment, and technological change. In Handbook of the Economics of Innovation; Halland, B.H., Rosenberg, N., Eds.; Academic Press: Burlington, VT, USA, 2010; Volume II, pp. 873–938. [Google Scholar]

- Janicke, M.; Jacob, K. Lead markets for environmental innovations. Glob. Environ. Polit. 2004, 4, 29–46. [Google Scholar] [CrossRef]

- Rennings, K.; Smidt, W. A Lead Market Approach towards the Emergence and Diffusion of Coal-Fired Power Plant Technology; ZEW—Centre for European Economic Research Discussion Paper No. 08-058; Centre for European Economic Research (ZEW): Mannheim, Germany, August 2008. [Google Scholar]

- Edler, J.; Georghiou, L.; Blind, K.; Uyarra, E. Evaluating the demand side: New challenges for evaluation. Res. Eval. 2012, 21, 33–47. [Google Scholar] [CrossRef]

- Walz, R.; Köhler, J. Using lead market factors to assess the potential for a sustainability transition. Environ. Innov. Soc. Trans. 2014, 10, 20–41. [Google Scholar] [CrossRef]

- Köhler, J.; Walz, R.; Marscheder-Weidemann, F.; Thedieck, B. Lead markets in 2nd generation biofuels for aviation: A comparison of Germany, Brazil and the USA. Environ. Innov. Soc. Trans. 2014, 10, 59–76. [Google Scholar] [CrossRef]

- Beise, M. Lead markets: Country-specific drivers of the global diffusion of innovations. Res. Policy 2004, 33, 997–1018. [Google Scholar] [CrossRef]

- Horbach, J.; Chen, Q.; Rennings, K.; Vögele, S. Do lead markets for clean coal technology follow market demand? A case study for China, Germany, Japan and the US. Environ. Innov. Soc. Trans. 2014, 10, 42–58. [Google Scholar] [CrossRef]

- Beise, M.; Cleff, T. Assessing the lead market potential of countries for innovation projects. J. Int. Manag. 2004, 10, 453–477. [Google Scholar] [CrossRef]

- Popp, D.; Hascic, I.; Medhi, N. Technology and the diffusion of renewable energy. Energy Econ. 2011, 33, 648–662. [Google Scholar] [CrossRef]

- Costantini, V.; Mazzanti, M. On the green and innovative side of trade competitiveness? The impact of environmental policies and innovation on EU exports. Res. Policy 2012, 41, 132–153. [Google Scholar] [CrossRef]

- Chowdhury, S.; Sumita, U.; Islam, A.; Bedja, I. Importance of policy for energy system transformation: Diffusion of PV technology in Japan and Germany. Energy Policy 2014, 68, 285–293. [Google Scholar] [CrossRef]

- Wilson, C. Up-scaling, formative phases, and learning in the historical diffusion of energy technologies. Energy Policy 2012, 50, 81–94. [Google Scholar] [CrossRef]

- Jänicke, M.; Lindemann, S. Governing environmental innovations. Environ. Polit. 2010, 19, 127–141. [Google Scholar] [CrossRef]

- Dosi, G.; Pavitt, K.; Soete, L. Technology and trade: An overview of the literature. In The Economics of Technical Change and International Trade; Laboratory of Economics and Management (LEM), Sant’Anna School of Advanced Studies: Pisa, Italy, 1990; Chapter 2; pp. 15–39. [Google Scholar]

- Autant-Bernard, C.; Fadairo, M.; Massard, N. Knowledge diffusion and innovation policies within the European regions: Challenges based on recent empirical evidence. Res. Policy 2013, 42, 196–210. [Google Scholar] [CrossRef]

- Aghion, P.; Dewatripont, M.; Du, L.; Harrison, A.; Legros, P. Industrial Policy and Competition; No. w18048; National Bureau of Economic Research: Cambridge, MA, USA, 2012. [Google Scholar]

- Blanco, M.I. The economics of wind energy. Renew. Sustain. Energy Rev. 2009, 13, 1372–1382. [Google Scholar] [CrossRef]

- Dechezleprêtre, A.; Glachant, M. Does Foreign Environmental Policy Influence Domestic Innovation? Evidence from the Wind Industry; Grantham Research Institute on Climate Change and the Environment, Working Paper No. 44; London School of Economics: London, UK, 2011. [Google Scholar]

- Gosens, J.; Lu, Y. From lagging to leading? Technological innovation systems in emerging economies and the case of Chinese wind power. Energy Policy 2013, 60, 234–250. [Google Scholar] [CrossRef]

- Corsatea, T.D.; Giaccaria, S.; Arántegui, R.L. The role of sources of finance on the development of wind technology. Renew. Energy 2014, 66, 140–149. [Google Scholar] [CrossRef]

- Dalbem, M.C.; Brandão, L.E.T.; Gomes, L.L. Can the regulated market help foster a free market for wind energy in Brazil? Energy Policy 2013, 23, 56–83. [Google Scholar]

- Gallagher, K.S.; Anadon, L.D.; Kempener, R.; Wilson, C. Trends in investments in global energy research, development, and demonstration. Wiley Interdiscip. Rev. Clim. Chang. 2011, 2, 373–396. [Google Scholar] [CrossRef]

- Global Wind Energy Council (GWEC). China Windpower Outlook; GWEC: Brussels, Belgium, 2012. [Google Scholar]

- GWEC. Global Wind Report: Annual Market Update 2012; GWEC: Brussels, Belgium, 2013. [Google Scholar]

- Bolinger, M.; Wiser, R. Understanding wind turbine price trends in the U.S. over the past decade. Energy Policy 2012, 42, 628–641. [Google Scholar] [CrossRef]

- IRENA. Renewable Energy Technologies: Cost Analysis Series: Wind Power; IRENA: Abu Dhabi, UAE, 2012. [Google Scholar]

- Tan, X.; Zhao, Y.; Polycarp, C.; Bai, J. China’s Overseas Investments in the Wind and Solar Industries: Trends and Drivers; World Resources Institute: Washington, DC, USA, 2013. [Google Scholar]

- WindGuard. Onshore Wind Energy Cost Situation International Comparison; Deutsche WindGuard GmbH: Varel, Germany, 2014. [Google Scholar]

- Fraunhofer Institute. Wind Energy Report: Germany 2011; Fraunhofer Institute for Wind Energy and Energy System Technology (IWES): Kassel, Germany, 2012. [Google Scholar]

- Qiu, Y.; Anadon, L.D. The price of wind power in China during its expansion: Technology adoption, learning-by-doing, economies of scale, and manufacturing localization. Energy Econ. 2012, 34, 772–785. [Google Scholar] [CrossRef]

- Wiser, R.; Bolinger, M. Wind Technologies Market Report; Lawrence Berkeley National Laboratory, US Department of Energy (DOE): Oak Ridge, VT, USA, 2013.

- Ru, P.; Zhi, Q.; Zhang, F.; Zhong, X.; Li, J.; Su, J. Behind the development of technology: The transition of innovation modes in China’s wind turbine manufacturing industry. Energy Policy 2012, 43, 58–69. [Google Scholar] [CrossRef]

- Glachant, M.; Dussaux, D.; Ménière, Y.; Dechezleprêtre, A. Greening Global Value Chains: Innovation and the International Diffusion of Technologies and Knowledge; Policy Research Working Paper 6467; World Bank: Paris, France, 2013. [Google Scholar]

- BTM Navigant. Global Forecast for the Wind Industry; BTM Navigant: Ringkøbing, Denmark, 2013. [Google Scholar]

- Haščič, I. Environmental Innovation in Germany; OECD Environment Working Papers No. 53; Organisation for Economic Cooperation and Development (OECD) Publishing: Paris, France, 2012. [Google Scholar]

- David, A.; Fravel, D. U.S. Wind Turbine Export Opportunities in Canada and Latin America; Office of Industries, US International Trade Commission: Washington, DC, USA, 2012.

- Neij, L.; Andersen, P.D. A Comparative assessment of wind turbine innovation and diffusion policies. In Global Energy Assessment-Toward a Sustainable Future; Cambridge University Press: Cambridge, UK; New York, NY, USA; the International Institute for Applied Systems Analysis: Laxenburg, Austria, 2012. [Google Scholar]

- Cao, J.; Groba, F. Chinese Renewable Energy Technology Exports: The Role of Policy, Innovation and Markets; DIW Berlin Discussion Paper 1263; The German Institute for Economic Research (DIW Berlin): Berlin, Germany, 2013. [Google Scholar]

- UN Comtrade. Data Basis Query. 2011. Available online: http://comtrade.un.org/db/ (accessed on 11 April 2014).

- Jenner, S.; Groba, F.; Indvik, J. Assessing the strength and effectiveness of renewable electricity feed-in tariffs in European Union countries. Energy Policy 2013, 52, 385–401. [Google Scholar] [CrossRef]

- Ragwitz, M.; Winkler, J.; Klessmann, C.; Gephart, M.; Resch, G. Recent Developments of Feed-in Systems in the EU; International Feed-In Cooperation; Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU): Bonn, Germany, 2012.

- European Wind Energy Association (EWEA). Building a Stable Future; Annual Report; EWEA: Brussels, Belgium, 2013. [Google Scholar]

- IRENA. 30 Years of Policies for Wind Energy: Lessons from 12 Wind Energy Markets; IRENA: Abu Dhabi, UAE, 2012. [Google Scholar]

- IEA. World Energy Investment Outlook; Special Report; IEA: Paris, France, 2014. [Google Scholar]

- Huang, C.; Su, J.; Zhao, X.; Sui, J.; Ru, P.; Zhang, H.; Wang, X. Government funded renewable energy innovation in China. Energy Policy 2012, 51, 121–127. [Google Scholar] [CrossRef]

- Lewis, J.I. Building a national wind turbine industry: Experiences from China, India and South Korea. Int. J. Technol. Glob. 2011, 5, 281–305. [Google Scholar] [CrossRef]

- Li, J.; Wang, X. Energy and climate policy in China’s twelfth five-year plan: A paradigm shift. Energy Policy 2012, 41, 519–528. [Google Scholar] [CrossRef]

- IEA. Renewable Energy: Policy Considerations for Deploying Renewables; IEA: Paris, France, 2012. [Google Scholar]

- Lewis, J.I.; Wiser, R.H. Fostering a renewable energy technology industry: An international comparison of wind industry policy support mechanisms. Energy Policy 2007, 35, 1844–1857. [Google Scholar] [CrossRef]

- International Monetary Fund (IMF). External Debt Statistics: Guide for Compilers and Users—Appendix III, Glossary; IMF: Washington, DC, USA, 2003. [Google Scholar]

- Bell, M.; Pavitt, K. The development of technological capabilities. In U. Haque, Trade, Technology and International Competitiveness; Word Bank: Washington, DC, USA, 1995. [Google Scholar]

- Ek, K.; Söderholm, P. Technology learning in the presence of public R&D: The case of European wind power. Ecol. Econ. 2010, 69, 2356–2362. [Google Scholar] [CrossRef]

- Ernst, D.; Kim, L. Global production networks, knowledge diffusion, and local capability formation. Res. Policy 2002, 31, 1417–1429. [Google Scholar] [CrossRef]

- Braun, F.; Schmidt-Ehmcke, J.; Zloczysti, P. Innovative activity in wind and solar technology: Empirical evidence on knowledge spillovers using patent data. In Working Paper nr.3, Growth and Sustainability Policies for Europe Project (GRASP); European Commission: Berlin, Germany, 2010. [Google Scholar]

- Kirkegaard, J.F.; Hanemann, T.; Weischer, L. It Should Be a Breeze: Harnessing the Potential of Open Trade and Investment Flows in the Wind Energy Industry; Working Paper Series WP09–14; Peterson Institute for International Economics: Washington, DC, USA, 2009. [Google Scholar]

- U.S. Department of Energy (DOE). Renewable Energy Data Book; DOE: Washington, DC, USA, 2012.

- Tan, X.; Seligsohn, D. Scaling Up Low-Carbon Technology Deployment: Lessons from China; World Resource Institute (WRI): Washington, DC, USA, 2010. [Google Scholar]

- Johnstone, N.; Hascic, I.; Kalamova, M. Environmental policy design characteristics and technological innovation. J. Anal. Inst. Econ. 2010, 27, 275–299. [Google Scholar]

- Schumpeter, J.A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Transaction Publishers: New Brunswick, NJ, USA, 1982. [Google Scholar]

- Cleff, T.; Rennings, K. Theoretical and Empirical Evidence of Timing-to-Market and Lead Market Strategies for Successful Environmental Innovation; Simon Fraser University Department of Economics Working Papers No. 11; Simon Fraser University Publishing: Burnaby, BC, Canada, 2011. [Google Scholar]

- World Wind Energy Association (WWEA). World Wind Report Key Figures 2013; WWEA: Bonn, Germany, 2014. [Google Scholar]

- Cotrell, J.; Stehly, T.; Johnson, J.; Roberts, J.O.; Parker, Z.; Scott, G.; Heimiller, D. Analysis of Transportation and Logistics Challenges Affecting the Deployment of Larger Wind Turbines: Summary of Results; Technical Report NREL/TP-5000–61063; NREL: Denver, CO, USA, 2014.

- Bloomberg News. China’s Wind Turbine Makers Face Market Consolidation; Bloomberg. 18 April 2014. Available online: http://www.bloomberg.com/news/2014-04-17/china-s-wind-turbine-makers-face-consolidation-as-glut-lingers.html (accessed on 7 January 2014).

- REN21. Renewables 2014 Status Report; REN21 Secretariat: Paris, France, 2014. [Google Scholar]

- James, T.; Goodrich, A. Supply Chain and Blade Manufacturing: Considerations in the Global Wind Industry; Technical Report NREL/PR-6A20–60063; NREL: Denver, CO, USA, 2013.

- Renewable Energy Sources 2012; Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU), Division E I1 (Strategic and Economic Aspects of the Energiewende): Bonn, Germany, 28 February 2013.

- Smith Stegen, K.; Seel, M. The winds of change: How wind firms assess Germany’s energy transition. Energy Policy 2013, 61, 1481–1489. [Google Scholar]

- Del Río, P.; Calvo Silvosa, A.; Iglesias Gómez, G. Policies and design elements for the repowering of wind farms: A qualitative analysis of different options. Energy Policy 2011, 39, 1897–1908. [Google Scholar] [CrossRef]

- Celasun, O.; Di Bella, G.; Mahedy, T.; Papageorgiou, C. The U.S. Manufacturing Recovery: Uptick or Renaissance? IMF Working Paper WP14/28; IMF: Washington, DC, USA, 2014. [Google Scholar]

- Lindman, Å.; Söderholm, P. Wind power learning rates: A conceptual review and meta-analysis. Energy Econ. 2012, 34, 754–761. [Google Scholar] [CrossRef]

- Peters, M.; Schneider, M.; Griesshaber, T.; Hoffmann, V.H. The impact of technology-push and demand-pull policies on technical change—Does the locus of policies matter? Res. Policy 2012, 41, 1296–1308. [Google Scholar] [CrossRef]

- EC. Implementing the Community Lisbon Programme: A Policy Framework to Strengthen EU Manufacturing-Towards a More Integrated Approach for Industrial Policy; European Commission Communication COM 474 Final; EC: Brussels, Belgium, 2005. [Google Scholar]

- Luke Georghiou. Final Evaluation of the Lead Market Initiative; Report No. NB3011290ENN; Publications Office of the European Union: Luxembourg, Luxembourg, 2011. [Google Scholar]

- Hannon, A.; Liu, Y.; Walker, J.; Wu, C. Delivering Low Carbon Growth: A Guide to China’s 12th Five Year Plan; HSBC Report; The Climate Group: London, UK, March 2011. [Google Scholar]

© 2014 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lacerda, J.S.; Van den Bergh, J.C.J.M. International Diffusion of Renewable Energy Innovations: Lessons from the Lead Markets for Wind Power in China, Germany and USA. Energies 2014, 7, 8236-8263. https://doi.org/10.3390/en7128236

Lacerda JS, Van den Bergh JCJM. International Diffusion of Renewable Energy Innovations: Lessons from the Lead Markets for Wind Power in China, Germany and USA. Energies. 2014; 7(12):8236-8263. https://doi.org/10.3390/en7128236

Chicago/Turabian StyleLacerda, Juliana Subtil, and Jeroen C. J. M. Van den Bergh. 2014. "International Diffusion of Renewable Energy Innovations: Lessons from the Lead Markets for Wind Power in China, Germany and USA" Energies 7, no. 12: 8236-8263. https://doi.org/10.3390/en7128236

APA StyleLacerda, J. S., & Van den Bergh, J. C. J. M. (2014). International Diffusion of Renewable Energy Innovations: Lessons from the Lead Markets for Wind Power in China, Germany and USA. Energies, 7(12), 8236-8263. https://doi.org/10.3390/en7128236