Hydrogen and Ammonia Production and Transportation from Offshore Wind Farms: A Techno-Economic Analysis

Abstract

:1. Introduction

2. Methodology

2.1. Levelized Cost of Hydrogen

2.2. Hydrogen Transportation

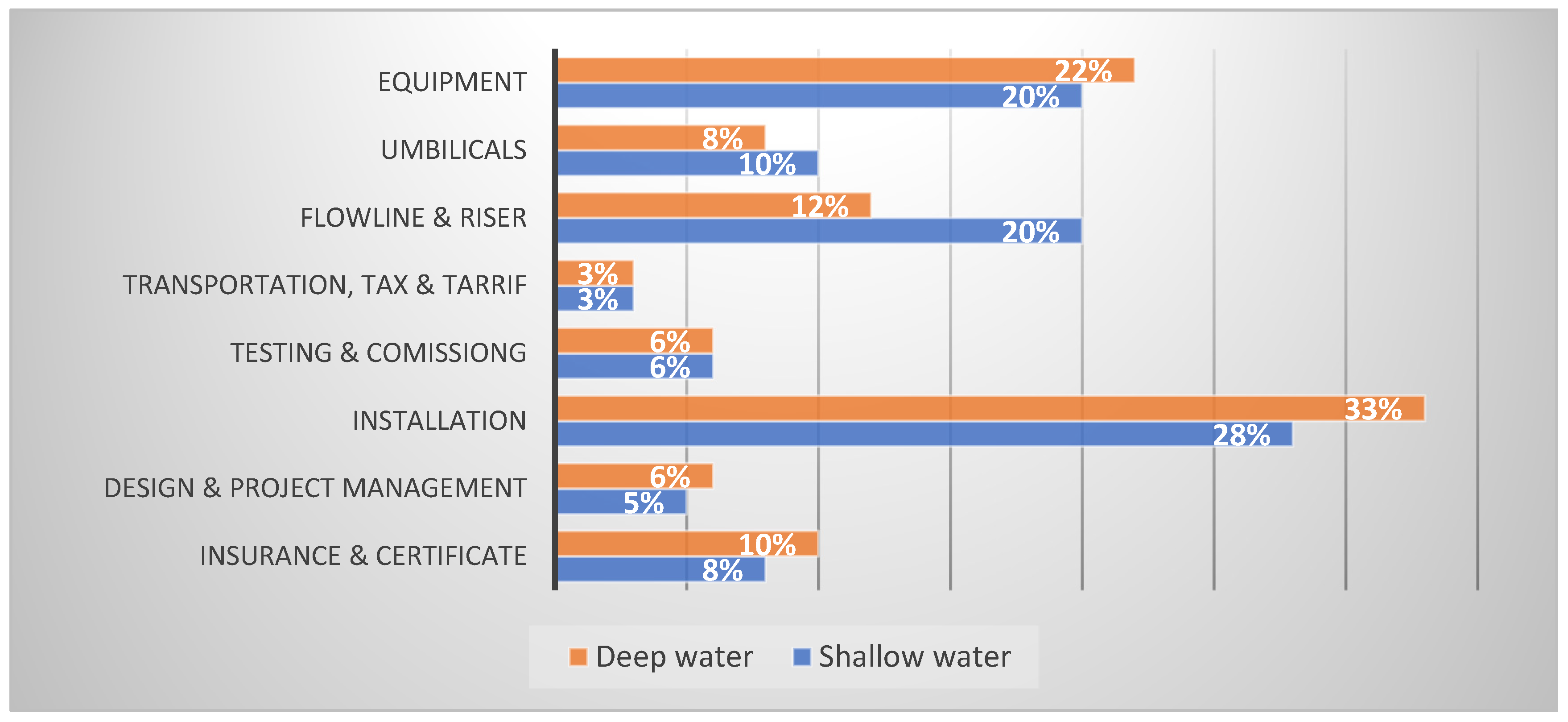

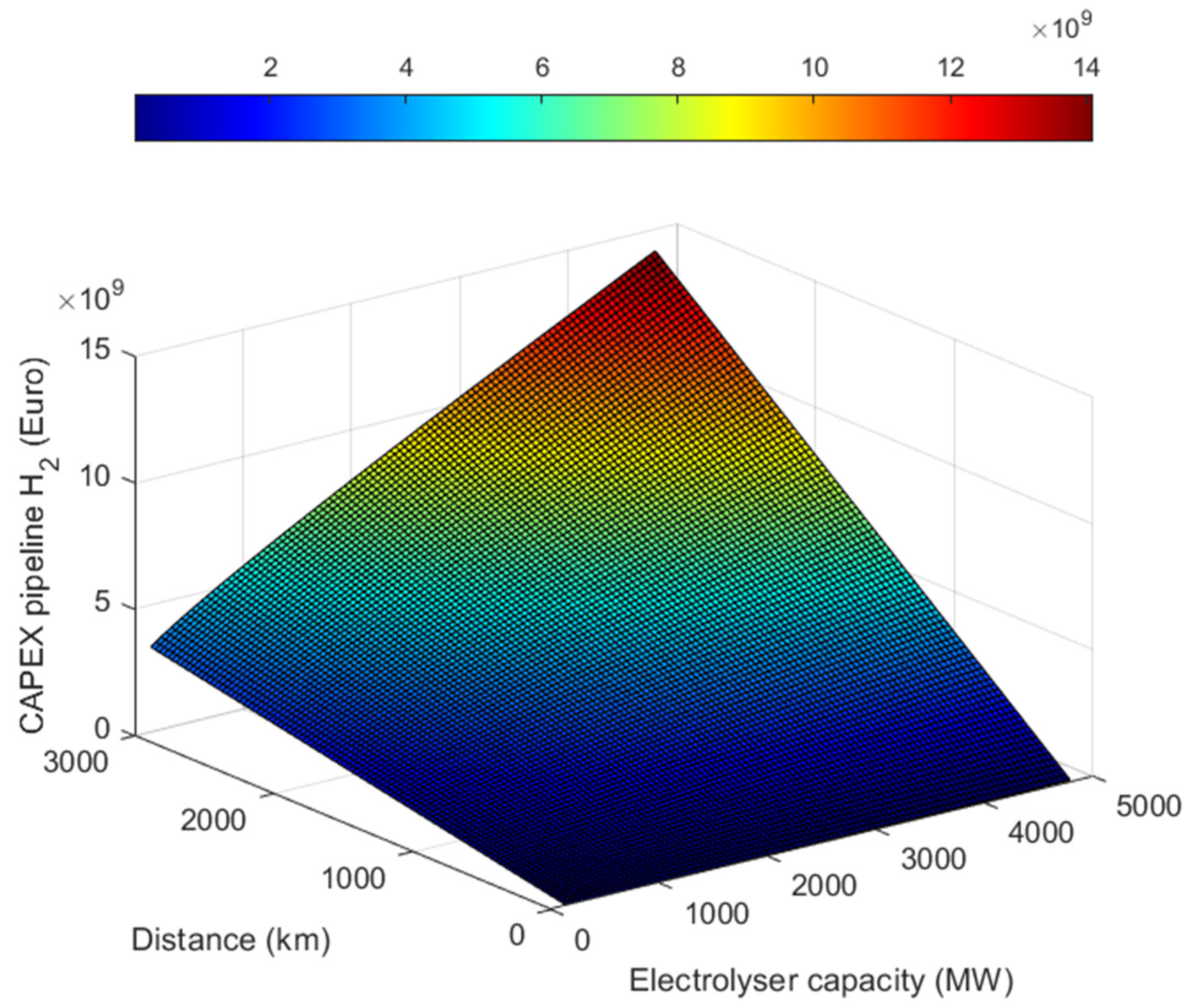

2.2.1. Transportation by Pipeline

2.2.2. Transportation by Ship

2.3. Levelized Cost of Ammonia

2.3.1. Ammonia Transportation by Pipeline

2.3.2. Ammonia Transportation by Ship

2.4. Sensitivity Analysis

- Capacity Factor (CF) of the wind farm: Analyzed at values of 30%, 40%, and 50%.

- Efficiency of the PEM electrolyzer: Considered at 50%, 60%, and 70% [63].

- CAPEX variations for turbines and platforms: Evaluated at −20%, baseline (100%), and +20%.

- CAPEX variations for electrolyzer and its platform: Similarly assessed at −20%, baseline (100%), and +20%.

3. Results and Discussion

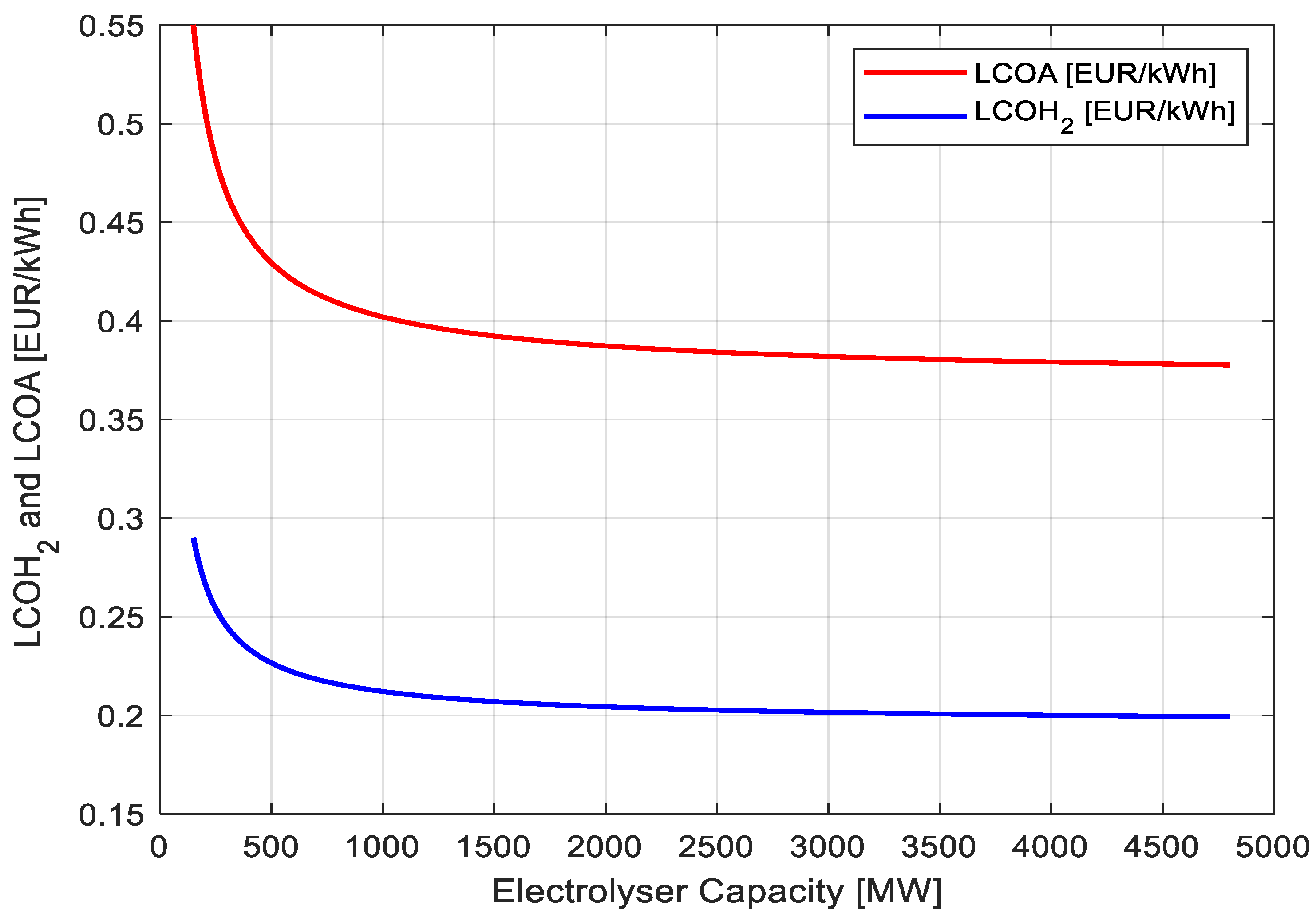

3.1. Levelized Cost of Hydrogen/Ammonia

3.2. Levelized Cost of Transport for Hydrogen and Ammonia

3.2.1. Hydrogen

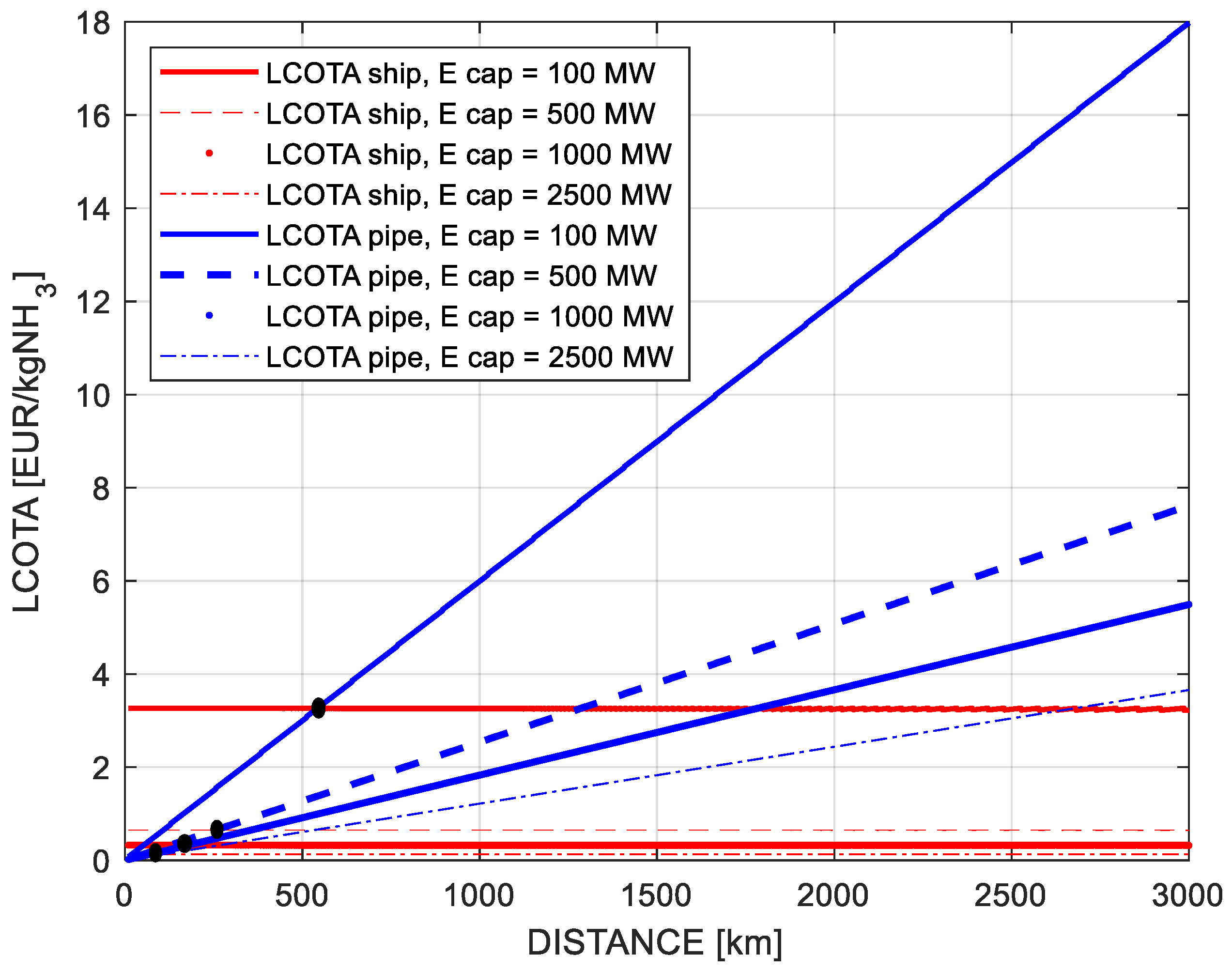

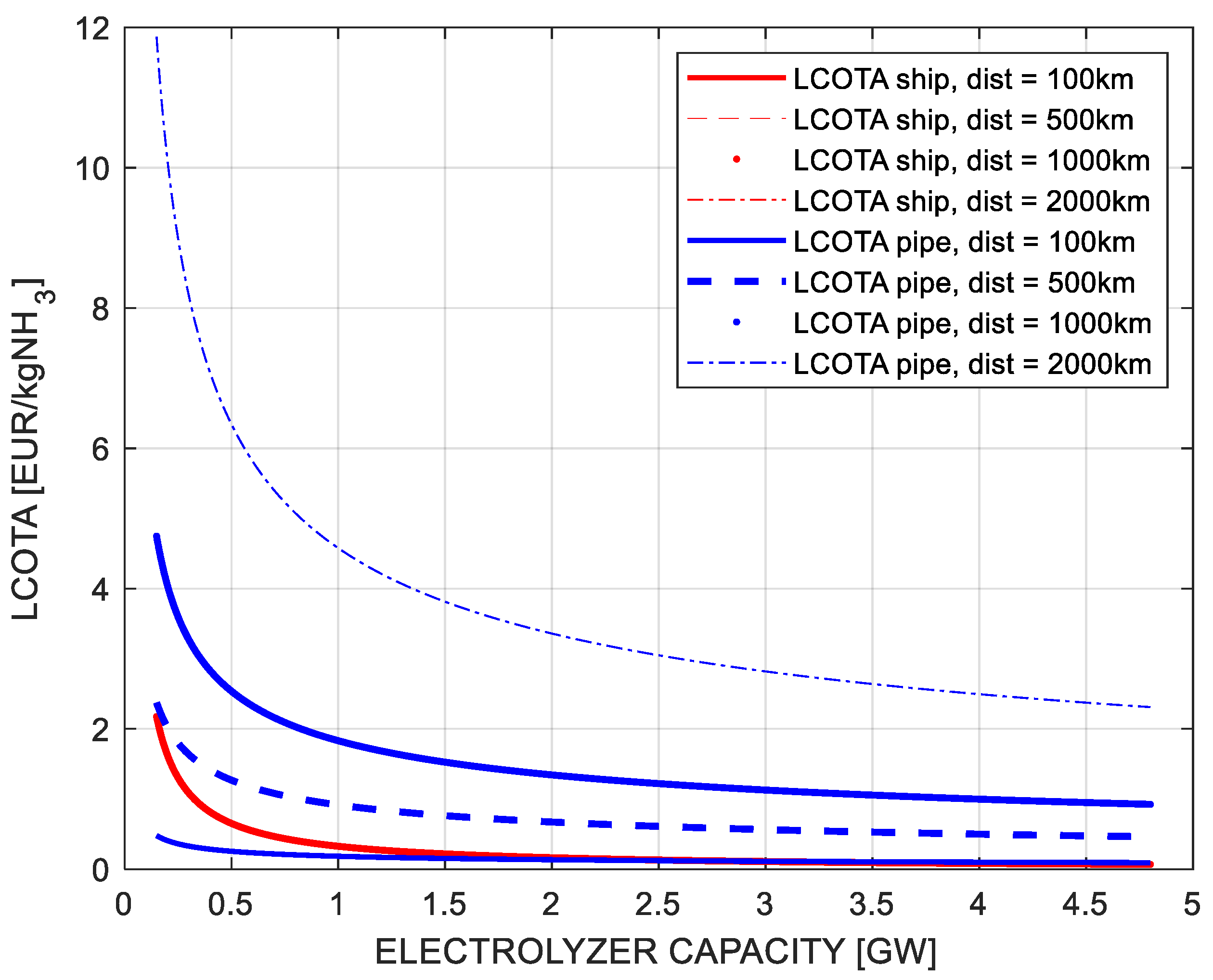

3.2.2. Ammonia

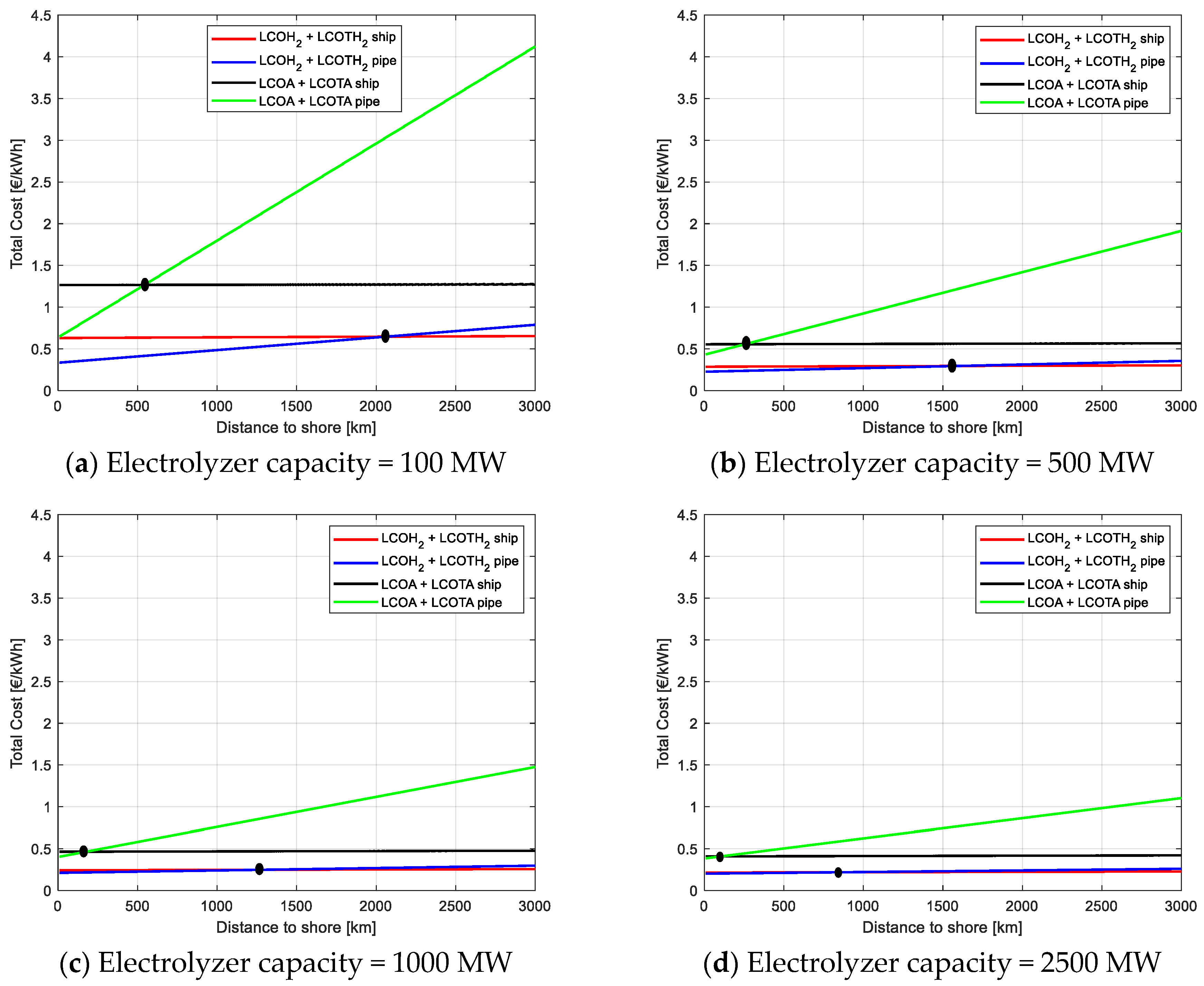

3.3. Total Levelized Cost After Transport for Hydrogen and Ammonia

Sensitivity Analysis of the Total Levelized Costs After Transport

3.4. Discussion and Comparison of Results

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| ASU | Air Separation Unit |

| CAPEX | Capital Expenditure |

| CO2eq | Carbon Dioxide Equivalent |

| DECEX | Decommissioning Expenditure |

| FLCOA | Final Levelized Cost of Ammonia |

| FLCOH2 | Final Levelized Cost of Hydrogen |

| HB | Haber–Bosch |

| HVAC | High Voltage Alternating Current |

| HVDC | High Voltage Direct Current |

| IC | Installation Cost |

| IRENA | International Renewable Energy Agency |

| LCOA | Levelized Cost of Ammonia |

| LCOH2 | Levelized Cost of Hydrogen |

| LCOT | Levelized Cost of Transport |

| LCOTH | Levelized Cost of Transport for Hydrogen |

| LH2 | Liquid Hydrogen |

| LHV | Lower Heating Value |

| LNG | Liquefied Natural Gas |

| LPG | Liquefied Petroleum Gas |

| MCH | Methylcyclohexane |

| NPV | Net Present Value |

| OPEX | Operational Expenditure |

| OWHS | Offshore Wind Hydrogen Systems |

| OWP2A | Offshore Wind Power to Ammonia |

| OWP2H | Offshore Wind Power to Hydrogen |

| PEM | Proton Exchange Membrane |

| SMR | Steam Methane Reforming |

| Tcap | Tanker Capacity |

| Vship | Vessel Speed |

References

- Gür, T.M. Review of electrical energy storage technologies, materials and systems: Challenges and prospects for large-scale grid storage. Energy Environ. Sci. 2018, 11, 2696–2767. [Google Scholar] [CrossRef]

- Cesaro, Z.; Nayak-Luke, R.M.; Bañares-Alcántara, R. Chapter 2—Energy Storage Technologies: Power-to-X. In Techno-Economic Challenges of Green Ammonia as an Energy Vector; Valera-Medina, A., Banares-Alcantara, R., Eds.; Academic Press: Cambridge, MA, USA, 2021; pp. 15–26. [Google Scholar] [CrossRef]

- Green Hydrogen A Guide To Policy Making. Irena. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Nov/IRENA_Green_hydrogen_policy_2020.pdf (accessed on 3 March 2025).

- Davis, S.J.; Lewis, N.S.; Shaner, M.; Aggarwal, S.; Arent, D.; Azevedo, I.L.; Benson, S.M.; Bradley, T.; Brouwer, J.; Chiang, Y.-M.; et al. Net-zero emissions energy systems. Science 2018, 360, eaas9793. [Google Scholar] [CrossRef] [PubMed]

- Mazloomi, K.; Gomes, C. Hydrogen as an energy carrier: Prospects and challenges. Renew. Sustain. Energy Rev. 2012, 16, 3024–3033. [Google Scholar] [CrossRef]

- Carbo, M.C. Global Technology Roadmap for CCS in Industry; United Nations Industrial Development Organization: Vienna, Austria, 2011. [Google Scholar]

- Aneke, M.; Wang, M. Energy storage technologies and real life applications—A state of the art review. Appl. Energy 2016, 179, 350–377. [Google Scholar] [CrossRef]

- Agency, I.E. Towards Hydrogen Definitions Based on Their Emissions Intensity; OECD: Paris, France, 2023. [Google Scholar] [CrossRef]

- Communication COM/2020/301: A Hydrogen Strategy for a Climate-Neutral Europe|Knowledge for Policy. Available online: https://knowledge4policy.ec.europa.eu/publication/communication-com2020301-hydrogen-strategy-climate-neutral-europe_en (accessed on 13 December 2024).

- Geopolitics of the Energy Transformation: The Hydrogen Factor. Available online: https://www.irena.org/publications/2022/Jan/Geopolitics-of-the-Energy-Transformation-Hydrogen (accessed on 15 July 2024).

- Chatterjee, S.; Parsapur, R.K.; Huang, K.-W. Limitations of Ammonia as a Hydrogen Energy Carrier for the Transportation Sector. ACS Energy Lett. 2021, 6, 4390–4394. [Google Scholar] [CrossRef]

- Kleinman Center for Energy Policy. Ammonia’s Role in a Net-Zero Hydrogen Economy. Available online: https://kleinmanenergy.upenn.edu/research/publications/ammonias-role-in-a-net-zero-hydrogen-economy/ (accessed on 27 January 2025).

- Avery, W.H. A role for ammonia in the hydrogen economy. Int. J. Hydrogen Energy 1988, 13, 761–773. [Google Scholar] [CrossRef]

- Wijayanta, A.T.; Oda, T.; Purnomo, C.W.; Kashiwagi, T.; Aziz, M. Liquid hydrogen, methylcyclohexane, and ammonia as potential hydrogen storage: Comparison review. Int. J. Hydrogen Energy 2019, 44, 15026–15044. [Google Scholar] [CrossRef]

- Dong, C.; Huang, G.; Cheng, G. Offshore wind can power Canada. Energy 2021, 236, 121422. [Google Scholar] [CrossRef]

- Wang, Y.; Dong, G.; Yu, J.; Qin, C.; Feng, Y.; Deng, Y.; Zhang, M. In-situ green hydrogen production from offshore wind farms, a prospective review. Renew. Energy 2025, 239, 122099. [Google Scholar] [CrossRef]

- Huang, J.; Balcombe, P.; Feng, Z. Technical and economic analysis of different colours of producing hydrogen in China. Fuel 2023, 337, 127227. [Google Scholar] [CrossRef]

- Hill, S.J.P.; Bamisile, O.; Hatton, L.; Staffell, I.; Jansen, M. The cost of clean hydrogen from offshore wind and electrolysis. J. Clean. Prod. 2024, 445, 141162. [Google Scholar] [CrossRef]

- Alsir, A. Making the Breakthrough: Green Hydrogen Policies and Technology Costs; Energy Oman Magazine: Muscat, Oman, 2023. [Google Scholar]

- Poshydon|Green Hydrogen Energy. Available online: https://poshydon.com/en/home-en/ (accessed on 14 December 2024).

- Hydrogen Island. Available online: https://www.cip.com/approach/our-projects/hydrogen-island/ (accessed on 13 December 2024).

- NortH2|Kickstarting the Green Hydrogen Economy. Available online: https://www.north2.eu/ (accessed on 14 December 2024).

- AquaVentus Förderverein e.V. Available online: https://aquaventus.org/en/ (accessed on 14 December 2024).

- Dolphyn Hydrogen. Available online: https://www.dolphynhydrogen.com/ (accessed on 14 December 2024).

- El-Kady, A.H.; Amin, M.T.; Khan, F.; El-Halwagi, M.M. Identification and assessment of risk factors in offshore wind-integrated hydrogen production system. Int. J. Hydrogen Energy 2024, 52, 1312–1332. [Google Scholar] [CrossRef]

- Ramakrishnan, S.; Delpisheh, M.; Convery, C.; Niblett, D.; Vinothkannan, M.; Mamlouk, M. Offshore green hydrogen production from wind energy: Critical review and perspective. Renew. Sustain. Energy Rev. 2024, 195, 114320. [Google Scholar] [CrossRef]

- Dinh, V.N.; Leahy, P.; McKeogh, E.; Murphy, J.; Cummins, V. Development of a viability assessment model for hydrogen production from dedicated offshore wind farms. Int. J. Hydrogen Energy 2021, 46, 24620–24631. [Google Scholar] [CrossRef]

- Yan, Y.; Zhang, H.; Liao, Q.; Liang, Y.; Yan, J. Roadmap to hybrid offshore system with hydrogen and power co-generation. Energy Convers. Manag. 2021, 247, 114690. [Google Scholar] [CrossRef]

- Bonacina, C.N.; Gaskare, N.B.; Valenti, G. Assessment of offshore liquid hydrogen production from wind power for ship refueling. Int. J. Hydrogen Energy 2022, 47, 1279–1291. [Google Scholar] [CrossRef]

- Zhao, F.; Wang, Z.; Dong, B.; Li, M.; Ji, Y.; Han, F. Comprehensive life cycle cost analysis of ammonia-based hydrogen transportation scenarios for offshore wind energy utilization. J. Clean. Prod. 2023, 429, 139616. [Google Scholar] [CrossRef]

- Cava, C.; Gagliardi, G.G.; Piscolla, E.; Borello, D. Techno-Economic Analysis of Hydrogen Transport via Truck Using Liquid Organic Hydrogen Carriers. Processes 2025, 13, 1081. [Google Scholar] [CrossRef]

- Giampieri, A.; Ling-Chin, J.; Roskilly, A.P. Techno-economic assessment of offshore wind-to-hydrogen scenarios: A UK case study. Int. J. Hydrogen Energy 2024, 52, 589–617. [Google Scholar] [CrossRef]

- Gonzalez-Arceo, A.; Blanco-Aguilera, R.; Berasategi, J.; Martinez-Agirre, M.; Martinez, A.; Iglesias, G.; Penalba, M. Techno-economic assessment of far-offshore hydrogen-carrying energy vectors off the Iberian Peninsula. Energy Convers. Manag. 2024, 300, 117915. [Google Scholar] [CrossRef]

- Sage, V.; Patel, J.; Hazewinkel, P.; Yasin, Q.U.A.; Wang, F.; Yang, Y.; Kozielski, K.; Li, C. Recent progress and techno-economic analysis of liquid organic hydrogen carriers for Australian renewable energy export—A critical review. Int. J. Hydrogen Energy 2024, 56, 1419–1434. [Google Scholar] [CrossRef]

- Lucas, T.R.; Ferreira, A.F.; Pereira, R.B.S.; Alves, M. Hydrogen production from the WindFloat Atlantic offshore wind farm: A techno-economic analysis. Appl. Energy 2022, 310, 118481. [Google Scholar] [CrossRef]

- Jang, D.; Kim, K.; Kim, K.-H.; Kang, S. Techno-economic analysis and Monte Carlo simulation for green hydrogen production using offshore wind power plant. Energy Convers. Manag. 2022, 263, 115695. [Google Scholar] [CrossRef]

- Salmon, N.; Bañares-Alcántara, R. Green ammonia as a spatial energy vector: A review. Sustain. Energy Fuels 2021, 5, 2814–2839. [Google Scholar] [CrossRef]

- Kim, A.; Kim, H.; Choe, C.; Lim, H. Feasibility of offshore wind turbines for linkage with onshore green hydrogen demands: A comparative economic analysis. Energy Convers. Manag. 2023, 277, 116662. [Google Scholar] [CrossRef]

- Bai, R.; Cai, G.; Chen, X.; Nie, S.; Zhou, Z.; Gao, L.; Wang, P. Enriching wind power utility through offshore wind-hydrogen-chemicals nexus: Feasible routes and their economic performance. J. Clean. Prod. 2024, 476, 143732. [Google Scholar] [CrossRef]

- Singlitico, A.; Østergaard, J.; Chatzivasileiadis, S. Onshore, offshore or in-turbine electrolysis? Techno-economic overview of alternative integration designs for green hydrogen production into Offshore Wind Power Hubs. Renew. Sustain. Energy Transit. 2021, 1, 100005. [Google Scholar] [CrossRef]

- Wang, H.; Daoutidis, P.; Zhang, Q. Harnessing the Wind Power of the Ocean with Green Offshore Ammonia. ACS Sustain. Chem. Eng. 2021, 9, 14605–14617. [Google Scholar] [CrossRef]

- Hong, X.; Thaore, V.B.; Karimi, I.A.; Farooq, S.; Wang, X.; Usadi, A.K.; Chapman, B.R.; Johnson, R.A. Techno-enviro-economic analyses of hydrogen supply chains with an ASEAN case study. Int. J. Hydrogen Energy 2021, 46, 32914–32928. [Google Scholar] [CrossRef]

- De Almeida, J.O.; Shadman, M.; Ramos, J.d.S.; Bastos, I.T.C.; Silva, C.; Chujutalli, J.A.H.; Amiri, M.M.; Bergman-Fonte, C.; Ferreira, G.R.L.; Carreira, E.d.S.; et al. Techno-economic analysis of hydrogen production from offshore wind: The case of Brazil. Energy Convers. Manag. 2024, 322, 119109. [Google Scholar] [CrossRef]

- Song, S.; Lin, H.; Sherman, P.; Yang, X.; Nielsen, C.P.; Chen, X.; McElroy, M.B. Production of hydrogen from offshore wind in China and cost-competitive supply to Japan. Nat. Commun. 2021, 12, 6953. [Google Scholar] [CrossRef] [PubMed]

- Spatolisano, E.; Restelli, F.; Pellegrini, L.A.; Cattaneo, S.; de Angelis, A.R.; Lainati, A.; Roccaro, E. Liquefied hydrogen, ammonia and liquid organic hydrogen carriers for harbour-to-harbour hydrogen transport: A sensitivity study. Int. J. Hydrogen Energy 2024, 80, 1424–1431. [Google Scholar] [CrossRef]

- Jano-Ito, M.; Valera-Medina, A. Techno-economics of ammonia as an energy carrier. Exporting wind from the North Atlantic Ocean/North Sea to Wales. J. Ammon. Energy 2024, 2. [Google Scholar] [CrossRef]

- Peecock, A.; Hull-Bailey, B.; Hastings, A.; Martinez-Felipe, A.; Wilcox, L.B. Techno-economic assessment of liquid carrier methods for intercontinental shipping of hydrogen: A case study. Int. J. Hydrogen Energy 2024, 94, 971–983. [Google Scholar] [CrossRef]

- Niblett, D.; Delpisheh, M.; Ramakrishnan, S.; Mamlouk, M. Review of next generation hydrogen production from offshore wind using water electrolysis. J. Power Sources 2023, 592, 233904. [Google Scholar] [CrossRef]

- Dinh, Q.V.; Pereira, P.H.T.; Dinh, V.N.; Nagle, A.J.; Leahy, P.G. Levelised cost of transmission comparison for green hydrogen and ammonia in new-build offshore energy infrastructure: Pipelines, tankers, and HVDC. Int. J. Hydrogen Energy 2024, 62, 684–698. [Google Scholar] [CrossRef]

- Topham, E.; McMillan, D.; Bradley, S.; Hart, E. Recycling offshore wind farms at decommissioning stage. Energy Policy 2019, 129, 698–709. [Google Scholar] [CrossRef]

- Rogeau, A.; Vieubled, J.; De Coatpont, M.; Nobrega, P.A.; Erbs, G.; Girard, R. Techno-economic evaluation and resource assessment of hydrogen production through offshore wind farms: A European perspective. Renew. Sustain. Energy Rev. 2023, 187, 113699. [Google Scholar] [CrossRef]

- Baufumé, S.; Grüger, F.; Grube, T.; Krieg, D.; Linssen, J.; Weber, M.; Hake, J.-F.; Stolten, D. GIS-based scenario calculations for a nationwide German hydrogen pipeline infrastructure. Int. J. Hydrogen Energy 2013, 38, 3813–3829. [Google Scholar] [CrossRef]

- Redactoramexico. Siemens Commissions One of Germany’s Largest Green Hydrogen Generation Plants. Hydrogen Central. Available online: https://hydrogen-central.com/siemens-commissions-germanys-largest-green-hydrogen-generation-plants/ (accessed on 16 January 2025).

- Bai, Y.; Bai, Q. Subsea Engineering Handbook; Gulf Professional Publishing: Houston, TX, USA, 2010. [Google Scholar]

- News & Events. Kawasaki Heavy Industries, Ltd. Available online: https://global.kawasaki.com/en/corp/newsroom/news/detail/?f=20191211_3487 (accessed on 15 July 2024).

- Current Status of Hydrogen Liquefaction Costs. Department of Energy, USA. August 2019. Available online: https://www.hydrogen.energy.gov/docs/hydrogenprogramlibraries/pdfs/19001_hydrogen_liquefaction_costs.pdf?Status=Master (accessed on 15 January 2025).

- Li, Y. Optimising Liquefied Natural Gas [LNG] Supply Chains: A Case Study for China. Master’s Dissertation, World Maritime University, Malmö, Sweden, 2002. Available online: https://commons.wmu.se/all_dissertations/378 (accessed on 16 February 2025).

- Rouwenhorst, K.H.R.; Krzywda, P.M.; Benes, N.E.; Mul, G.; Lefferts, L. Chapter 4—Ammonia Production Technologies. In Techno-Economic Challenges of Green Ammonia as an Energy Vector; Valera-Medina, A., Banares-Alcantara, R., Eds.; Academic Press: Cambridge, MA, USA, 2021; pp. 41–83. [Google Scholar] [CrossRef]

- Nielsen, A. Ammonia Storage and Transportation-Safety. In Ammonia: Catalysis and Manufacture; Nielsen, A., Ed.; Springer: Berlin/Heidelberg, Germany, 1995; pp. 329–346. [Google Scholar] [CrossRef]

- Fasihi, M.; Weiss, R.; Savolainen, J.; Breyer, C. Global potential of green ammonia based on hybrid PV-wind power plants. Appl. Energy 2021, 294, 116170. [Google Scholar] [CrossRef]

- Galimova, T.; Fasihi, M.; Bogdanov, D.; Breyer, C. Feasibility of green ammonia trading via pipelines and shipping: Cases of Europe, North Africa, and South America. J. Clean. Prod. 2023, 427, 139212. [Google Scholar] [CrossRef]

- Seo, Y.; An, J.; Park, E.; Kim, J.; Cho, M.; Han, S.; Lee, J. Technical–Economic Analysis for Ammonia Ocean Transportation Using an Ammonia-Fueled Carrier. Sustainability 2024, 16, 827. [Google Scholar] [CrossRef]

- Buttler, A.; Spliethoff, H. Current status of water electrolysis for energy storage, grid balancing and sector coupling via power-to-gas and power-to-liquids: A review. Renew. Sustain. Energy Rev. 2018, 82, 2440–2454. [Google Scholar] [CrossRef]

- Bosch, J.; Staffell, I.; Hawkes, A.D. Global levelised cost of electricity from offshore wind. Energy 2019, 189, 116357. [Google Scholar] [CrossRef]

- Hinkley, J.T.; Heenan, A.R.; Low, A.C.S.; Watson, M. Hydrogen as an export commodity—Capital expenditure and energy evaluation of hydrogen carriers. Int. J. Hydrogen Energy 2022, 47, 35959–35975. [Google Scholar] [CrossRef]

- A One-GigaWatt Green-Hydrogen Plant Advanced Design and Total Installed-Capital Costs—Hydrohub Innovation Program. Available online: https://ispt.eu/media/Public-report-gigawatt-advanced-green-electrolyser-design.pdf (accessed on 1 March 2025).

- Demystifying Electrolyzer Production Costs—Center on Global Energy Policy at Columbia University SIPA | CGEP %, Center on Global Energy Policy at Columbia University SIPA|CGEP. Available online: https://www.energypolicy.columbia.edu/demystifying-electrolyzer-production-costs/ (accessed on 16 December 2024).

- Green Hydrogen Cost Reduction: Scaling Up Electrolysers to Meet the 1.5C Climate Goal—IRENA. Available online: https://parquetecnologico.ufc.br/wp-content/uploads/2021/02/sim.irena-green-hydrogen-cost-2020.pdf (accessed on 16 January 2025).

- Reksten, A.H.; Thomassen, M.S.; Møller-Holst, S.; Sundseth, K. Projecting the future cost of PEM and alkaline water electrolysers; a CAPEX model including electrolyser plant size and technology development. Int. J. Hydrogen Energy 2022, 47, 38106–38113. [Google Scholar] [CrossRef]

- Breunis, W.F. Hydrogen Gas Production from Offshore Wind A Cost-Benefit Analysis of Optionality Through Grid Connection. Master’s Thesis, Delft University of Technology, Delft, The Netherlands. Available online: https://repository.tudelft.nl/record/uuid:592c4ab2-7ab1-428b-b54c-1c44afc5ba5a (accessed on 10 January 2025).

- Moreno, F.D.C. Design of an Electrolyzer Integrated in an Offshore Wind Turbine System. Ph.D. Thesis, University of Twente, Enschede, The Netherlands, 2021. Available online: https://ris.utwente.nl/ws/portalfiles/portal/267465220/PDEng_Report_FDCM.pdf (accessed on 10 January 2025).

- Valera-Medina, A.; Xiao, H.; Owen-Jones, M.; David, W.I.F.; Bowen, P.J. Ammonia for power. Prog. Energy Combust. Sci. 2018, 69, 63–102. [Google Scholar] [CrossRef]

- Kaiser, M.J.; Snyder, B.F. Modeling offshore wind installation costs on the U.S. Outer Continental Shelf. Renew. Energy 2013, 50, 676–691. [Google Scholar] [CrossRef]

- Cevasco, D.; Koukoura, S.; Kolios, A.J. Reliability, availability, maintainability data review for the identification of trends in offshore wind energy applications. Renew. Sustain. Energy Rev. 2021, 136, 110414. [Google Scholar] [CrossRef]

- The Future of Hydrogen—Analysis. IEA. Available online: https://www.iea.org/reports/the-future-of-hydrogen (accessed on 15 July 2024).

| Component | OPEX (% of CAPEX) |

|---|---|

| Wind turbines | 2.5 |

| HVDC/HVAC substation | 3 |

| Electrolyzers | 4 |

| Power converters | 2 |

| Desalinator | 3 |

| Power cables | 0.2 |

| Pipelines | 2 |

| Parameter | Lower | Standard | Higher |

|---|---|---|---|

| CF wind farm (%) | 0.3 | 0.4 | 0.5 |

| PEM efficiency (%) | 0.5 | 0.6 | 0.7 |

| CAPEX turbines and platforms | −20% | 100% | +20% |

| CAPEX electrolyzer and platform | −20% | 100% | +20% |

| Study | Electrolyzer Capacity and Distance | Transport | Results (LCOH2, LCOA, LCOT) |

|---|---|---|---|

| This study | Variable distance and electrolyzer capacity | Both | LCOH2: 6.7–9.8 EUR/kg LCOA: 1.9–2.8 EUR/kg LCOT: 0.2–15 EUR/kg (pipeline) LCOT: 0.3–10.2 EUR/kg (shipping) |

| [18] | Fixed distance and electrolyzer capacity | Pipeline and storage in salt cavern | LCOH: 10.49 EUR/kg |

| [27] | Variable distance | both | LCOH pipeline: 3.4 USD/kg (10 km)– 21.42 USD/kg (500 km) LCOH ship: 4.77 USD/kg (10 km)–4.79 (500 km) |

| [28] | Fixed distance and electrolyzer capacity | both | LCOH 14.62 USD/kg (pipeline)–15.54 USD/kg (ship) |

| [29] | Variable distance and electrolyzer capacity | both | LCOH Ship: GBP 3.04/kg–GBP 1.54/kg Pipeline: GBP 5.76/kg–GBP 10.26/kg |

| [30] | Fixed distance and electrolyzer capacity | Both | LCOH: Pipeline: 4.20–52.57 EUR/kg Ship: 10.96–110.88 EUR/kg LCOA: Ammonia: 1.55–14.21 EUR/kg |

| [32] | Fixed distance and electrolyzer capacity | pipeline | LCOH 2–10 EUR/kg |

| [38] | Variable distance and electrolyzer capacity | pipeline | LCOH 4.76–5.98 USD/kg |

| [41] | Variable distance and electrolyzer capacity | pipeline | LCOH 2.4–6.0 EUR/kg |

| [42] | Variable distance and fixed electrolyzer capacity | pipeline | LCOH 2.25–2.9 EUR/kg |

| [43] | Variable distance and electrolyzer capacity | both | LCOTA: Pipeline: 0.0765 EUR/kgNH3 to 0.0263 EUR/kgNH3 Ship: 0.025 EUR/kgNH3 to 0.23 EUR/kgNH3 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Joyo, F.H.; Falasco, A.; Groppi, D.; Sferra, A.S.; Astiaso Garcia, D. Hydrogen and Ammonia Production and Transportation from Offshore Wind Farms: A Techno-Economic Analysis. Energies 2025, 18, 2292. https://doi.org/10.3390/en18092292

Joyo FH, Falasco A, Groppi D, Sferra AS, Astiaso Garcia D. Hydrogen and Ammonia Production and Transportation from Offshore Wind Farms: A Techno-Economic Analysis. Energies. 2025; 18(9):2292. https://doi.org/10.3390/en18092292

Chicago/Turabian StyleJoyo, Farhan Haider, Andrea Falasco, Daniele Groppi, Adriana Scarlet Sferra, and Davide Astiaso Garcia. 2025. "Hydrogen and Ammonia Production and Transportation from Offshore Wind Farms: A Techno-Economic Analysis" Energies 18, no. 9: 2292. https://doi.org/10.3390/en18092292

APA StyleJoyo, F. H., Falasco, A., Groppi, D., Sferra, A. S., & Astiaso Garcia, D. (2025). Hydrogen and Ammonia Production and Transportation from Offshore Wind Farms: A Techno-Economic Analysis. Energies, 18(9), 2292. https://doi.org/10.3390/en18092292