Identifying Resilience Factors of Power Company Business Models

Abstract

1. Introduction

- -

- Lack of an approach adequate to the current situation of Polish energy companies to study the effects of the energy transition on energy companies.

- -

- The dimensions and factors of business model resilience have been insufficiently investigated in relation to energy companies in the literature.

- -

- However, an adequate methodological framework for identifying the elements of the energy company business model vulnerable to change and a methodological framework for measuring and assessing the resilience of the model has not been developed.

- -

- A comprehensive system for assessing the resilience of an energy company’s business model, including the principles and processes for conducting business model resilience assessments and defining conclusions and recommendations for the company, has not yet been developed.

2. Literature Review

2.1. The Business Model and Its Resilience

- -

- There is considerable interest in research on the meaning and measurement of resilience from various research perspectives (mainly foreign publications).

- -

- A significant number of studies deal with the identification of dimensions and indicators for measuring resilience to natural disasters and climate change as one of the important challenges facing economies, communities, and at the local or societal level—inspiring research on the resilience of organizations and business models.

- -

- Business model resilience is introduced as a conceptual framework to better understand the systemic dimensions of businesses affected by sustainability transformations and how they are shaped.

- -

- The close relationship between systems, organization and business model resilience, and sustainability is identified; additionally, the need for a holistic, integrated approach to measurement and assessment is highlighted. Building and measuring resilience are considered a process in relation to the dimensions, characteristics, and factors of resilience, as well as the relationship between them in various cross-sections.

2.2. Resilience Under an Energy Transition Conditions

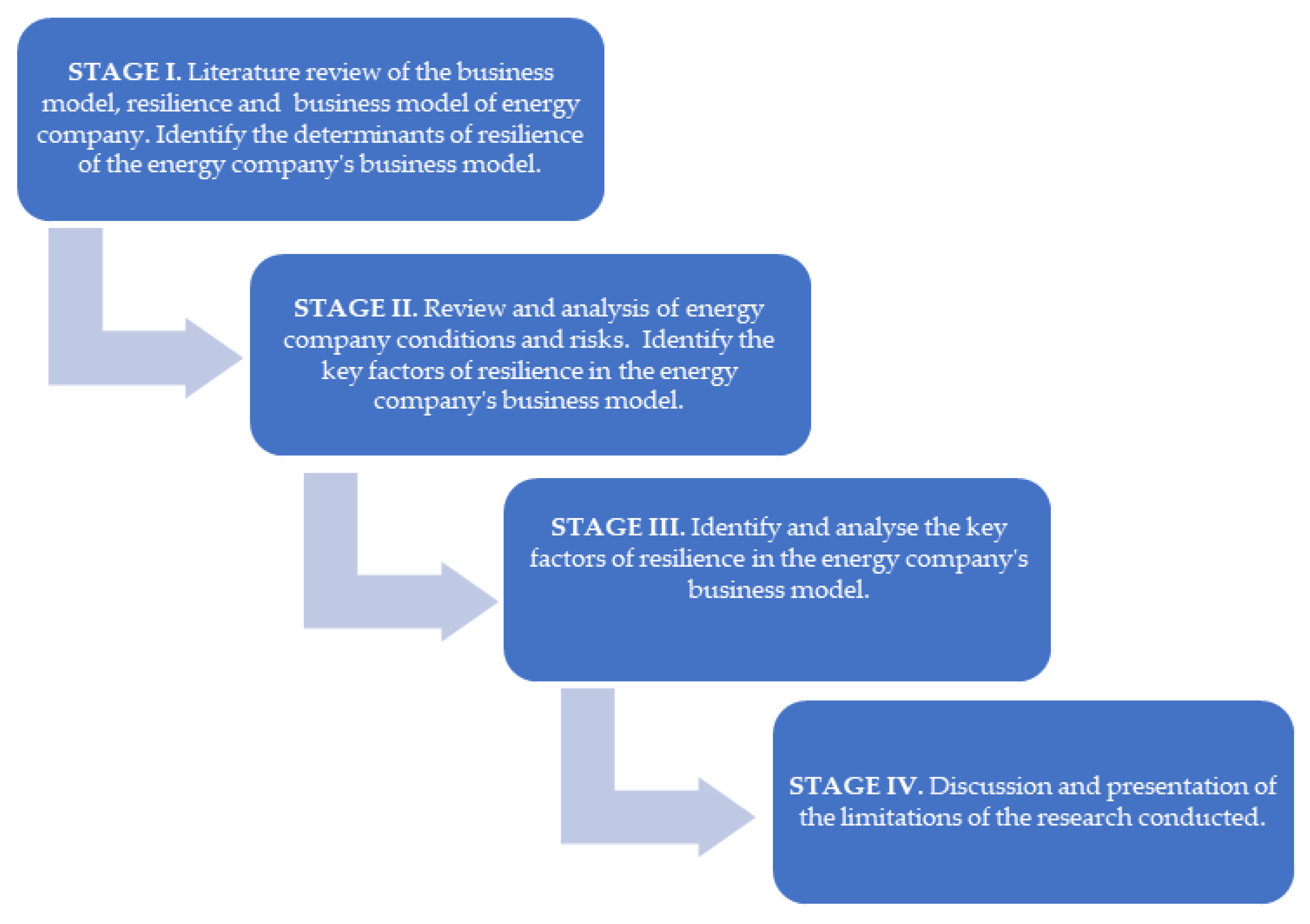

3. Methodology

- (1)

- Determinants related to the role of the business model:

- −

- the dynamics and alignment of the various components of the model with the implementation of the strategy and its change,

- −

- tolerance of the model to volatility to accommodate strategy implementation,

- −

- feedback systems on model effectiveness/fit with strategy/strategy conditions.

- (2)

- Determinants of the dominant types/types of models:

- −

- relationship between customer value creation and company profitability,

- −

- the impact of business architecture and its changes on value creation,

- −

- the role of innovation in value creation,

- −

- dependence of the business model on components outside the company’s control,

- −

- the ability of the business model to balance potentials,

- −

- the relationship between balancing potentials and building long-term value,

- −

- the impact of social responsibility on building long-term value.

- (3)

- Determinants related to the main activities of the business model:

- −

- the interrelationship between the elements of the chain,

- −

- the level of risk and uncertainty of the entire value chain and its individual links,

- −

- tolerance/ability to absorb changes in individual links and the whole chain,

- −

- systems for securing/maintaining business continuity and risk prevention,

- −

- communication and feedback systems between links in the chain,

- −

- adaptability of chain links to change—adapting and driving change in an efficient and cost-effective way without compromising quality.

- (4)

- Determinants related to the main products:

- −

- the impact of individual product changes on the value offered to the customer,

- −

- the level of risk and uncertainty of individual products on the value offered to the customer,

- −

- feedback on how products match the value expected by customers,

- −

- ability to adapt the value offered to changes in the environment—responding quickly and flexibly to customer needs,

- −

- systems to protect innovative product solutions from imitation and copying,

- −

- product innovation.

- (5)

- Determinants relating to ownership structure:

- −

- adaptability to stakeholder/owner expectations,

- −

- risks and uncertainty of the effects of ownership decisions on the business.

- −

- comparable importance: 1,

- −

- moderate prevalence: 3,

- −

- strong advantage: 5,

- −

- very strong advantage: 7,

- −

- extreme advantage: 9,

- −

- intermediate values between those described above: 2, 4, 6, 8.

- (a)

- the first and second elements are equally important (rating: 1),

- (b)

- the first element is more important than the second (rating: 2, 3, 4, 5, 6, 7, 8, 9),

- (c)

- the second element is more important than the first (rating: 1/2, 1/3, 1/4, 1/5, 1/6, 1/7, 1/8, 1/9).

- –

- Competence and Knowledge: Experts were chosen based on their deep understanding of the electric power industry, ensuring that they possessed relevant technical and operational knowledge.

- –

- Experience: A focus on practical experience in operational and strategic management is crucial. This allows for insights that are grounded in real-world applications and challenges.

- –

- Diversity of Perspectives: To capture a wide range of insights, experts were selected from various areas of the company’s operations. This diversity helps in understanding the multifaceted nature of resilience within the business model.

- –

- Independence: Ensuring that the selected experts are independent and not biased by internal company politics or specific agendas was essential for obtaining objective viewpoints.

4. Results

Data

5. Discussion

- 1.

- The proposed framework of resilience business model, grounded in the CANVAS framework and aligned with the principles of the New Era of Innovation, contributes to the ongoing discourse. It will be evaluated alongside alternative solutions, including the approach proposed by Radic et al. [77]. By validating findings from a systematic literature research in an empirical survey among managers and decision makers from SMEs in Saxony, they identified 11 factors that are constitutive of business model resilience.

- 2.

- The energy transition requires significant changes to the business models of energy companies, in particular, the reconfiguration of the chain and resources [78,79] toward the construction of low- and zero-carbon energy sources [43,54] necessary to achieve climate neutrality [80,81,82], which, for business continuity and energy security, requires resilient business models.

- 3.

- Critical to the assessment of business model resilience is the identification of the key factors responsible for the resilience of an energy company’s business model. Despite extensive research in the area of resilience, a cohesive framework for business model resilience that demonstrates practical applicability remains elusive. We believe that our investigation partially fills this gap and will significantly contribute to the broader discourse on identifying and understanding the resilience factors of business models in large corporations.

- 4.

- The use of the research process proposed in this paper allows for the identification of key factors responsible for the resilience of an energy company’s business model. The AHP model used in this study is a structured tool that helps individuals and groups prioritize and select alternatives based on multiple criteria. While it is widely used due to its systematic approach, it does have several limitations:

- -

- Subjectivity: AHP relies heavily on the judgment of experts to assign weights and rates to criteria and alternatives. This subjectivity led to some inconsistencies in the results.

- -

- Complexity of large problems: As the number of criteria and alternatives increases, the pairwise comparison process becomes more complex and time-consuming. This led to cognitive overload for experts and may have resulted in less reliable judgments.

- -

- Inconsistency in judgments: Pairwise comparisons can lead to inconsistencies, especially when there are many comparisons. The consistency ratio (CR) is often used to measure this; however, achieving a high level of consistency in practice has proven difficult.

- -

- Sensitivity to input changes: Small changes in the input judgments can lead to significant changes in the final rankings, making the process sensitive to initial estimates and potentially leading to different decisions based on minor adjustments.

- -

- Difficulty in Measuring Intangible Criteria: AHP may struggle with criteria that are difficult to quantify, such as communication and customer relations or climate policy, making it challenging to assign accurate weights.

- -

- Dependence on a clear hierarchy: AHP assumes that criteria can be organized hierarchically, which may not always be the case in complex scenarios in which criteria are interrelated.Building on the Analytic Hierarchy Process (AHP) methodology, future research could be enhanced by incorporating the Fuzzy Analytic Hierarchy Process (FAHP) [83]. This approach addresses the challenge of feature weighting by utilizing fuzzy expert opinions, often referred to as “soft opinions,” which provide a more nuanced and realistic perspective compared to traditional precise assessments, known as “hard opinions”.

- 5.

- Despite these limitations, the AHP remains a valuable tool for decision-making when used thoughtfully and in conjunction with other methods and considerations. Understanding the key factors responsible for the resilience of an energy company’s business model is key to building a tool for assessing the resilience of the business model, allowing for the measurement of resilience in key areas of the company in this context, in particular the selection of appropriate metrics for assessing resilience and their definition.

6. Conclusions

- -

- assessment of the achieved level of indicators in the different periods of analysis,

- -

- assessment of changes and trends in the development of indicators over time in correlation with events that caused specific significant changes and the impact of changes on resilience,

- -

- comparison of the results with benchmarks or accepted standards,

- -

- interrelationships and relationships between resilience factors,

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1

| Analysis of the importance of resilience factors—Customer value area (A matrix) | |||||||||||

| Factors | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | |

| V1 | 1 | 1 | 7 | 7 | 7 | 3 | 3 | 3 | 1 | 1/3 | |

| V2 | 1 | 1 | 7 | 3 | 5 | 1 | 1 | 3 | 1 | 1/6 | |

| V3 | 1/7 | 1/7 | 1 | 1/6 | 2 | 1 | 1/3 | 1/4 | 1/7 | 1/9 | |

| V4 | 1/7 | 1/3 | 6 | 1 | 4 | 1 | 1 | 3 | 1/4 | 1/5 | |

| V5 | 1/7 | 1/5 | 1/2 | 1/4 | 1 | 1/6 | 1/6 | 1/4 | 1/5 | 1/6 | |

| V6 | 1/3 | 1 | 1 | 1 | 6 | 1 | 4 | 5 | 1 | 1 | |

| V7 | 1/3 | 1 | 3 | 1 | 6 | 1/4 | 1 | 1 | 1/4 | 1/6 | |

| V8 | 1/3 | 1/3 | 4 | 1/3 | 4 | 1/5 | 1 | 1 | 1/5 | 1/4 | |

| V9 | 1 | 1 | 7 | 4 | 5 | 1 | 4 | 5 | 1 | 2 | |

| V10 | 3 | 6 | 9 | 5 | 6 | 1 | 6 | 4 | 1/2 | 1 | |

| ∑ | 7.43 | 12.01 | 45.50 | 22.75 | 46.00 | 9.62 | 21.50 | 25.50 | 5.54 | 5.39 | |

| Analysis of the importance of resilience factors—Customer value area (B matrix) | |||||||||||

| Factors | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | ∑ |

| V1 | 0.1346 | 0.0833 | 0.1538 | 0.3077 | 0.1522 | 0.3120 | 0.1395 | 0.1176 | 0.1804 | 0.0618 | 1.64 |

| V2 | 0.1346 | 0.0833 | 0.1538 | 0.1319 | 0.1087 | 0.1040 | 0.0465 | 0.1176 | 0.1804 | 0.0309 | 1.09 |

| V3 | 0.0192 | 0.0119 | 0.0220 | 0.0073 | 0.0435 | 0.1040 | 0.0155 | 0.0098 | 0.0258 | 0.0206 | 0.28 |

| V4 | 0.0192 | 0.0278 | 0.1319 | 0.0440 | 0.0870 | 0.1040 | 0.0465 | 0.1176 | 0.0451 | 0.0371 | 0.66 |

| V5 | 0.0192 | 0.0167 | 0.0110 | 0.0110 | 0.0217 | 0.0173 | 0.0078 | 0.0098 | 0.0361 | 0.0309 | 0.18 |

| V6 | 0.0449 | 0.0833 | 0.0220 | 0.0440 | 0.1304 | 0.1040 | 0.1860 | 0.1961 | 0.1804 | 0.1854 | 1.18 |

| V7 | 0.0449 | 0.0833 | 0.0659 | 0.0440 | 0.1304 | 0.0260 | 0.0465 | 0.0392 | 0.0451 | 0.0309 | 0.56 |

| V8 | 0.0449 | 0.0278 | 0.0879 | 0.0147 | 0.0870 | 0.0208 | 0.0465 | 0.0392 | 0.0361 | 0.0463 | 0.45 |

| V9 | 0.1346 | 0.0833 | 0.1538 | 0.1758 | 0.1087 | 0.1040 | 0.1860 | 0.1961 | 0.1804 | 0.3708 | 1.69 |

| V10 | 0.4038 | 0.4996 | 0.1978 | 0.2198 | 0.1304 | 0.1040 | 0.2791 | 0.1569 | 0.0902 | 0.1854 | 2.27 |

| ∑ | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | |

Appendix A.2

| Analysis of the importance of resilience factors—Resources and competences area (A matrix) | ||||||||||||||||||||||

| Factors | R1 | R2 | R3 | R4 | R5 | R6 | R7 | R8 | R9 | R10 | R11 | R12 | R13 | R14 | R15 | R16 | R17 | R18 | R19 | R20 | R21 | |

| R1 | 1 | 1/4 | 5 | 2 | 1/5 | 8 | 1/5 | 1/4 | 1 | 1 | 1 | 1 | 3 | 3 | 1 | 1/5 | 1/7 | 3 | 5 | 2 | 2 | |

| R2 | 4 | 1 | 1 | 5 | 4 | 7 | 3 | 2 | 1 | 1 | 3 | 1 | 6 | 7 | 2 | 1/5 | 1/5 | 6 | 9 | 1 | 1 | |

| R3 | 1/5 | 1 | 1 | 1/5 | 1 | 1 | 1 | 1 | 1 | 6 | 1/4 | 5 | 4 | 1/4 | 1/3 | 1/2 | 1/3 | 5 | 9 | 1/4 | 5 | |

| R4 | 1/2 | 1/5 | 5 | 1 | 4 | 8 | 1 | 1/3 | 1 | 3 | 3 | 4 | 1 | 1 | 1/4 | 1/4 | 1/4 | 4 | 8 | 6 | 3 | |

| R5 | 5 | 1/4 | 1 | 1/4 | 1 | 1 | 1/3 | 1/4 | 5 | 1/3 | 1/4 | 1 | 4 | 4 | 1 | 1/4 | 1/3 | 4 | 3 | 1/3 | 9 | |

| R6 | 1/8 | 1/7 | 1 | 1/8 | 1 | 1 | 1/7 | 1/4 | 1/3 | 1/5 | 1/5 | 1 | 1/3 | 1/3 | 1 | 1/5 | 1/5 | 4 | 3 | 3 | 2 | |

| R7 | 5 | 1/3 | 1 | 1 | 3 | 7 | 1 | 1 | 1/3 | 3 | 1 | 1 | 4 | 2 | 1 | 1/3 | 1/3 | 5 | 6 | 1 | 5 | |

| R8 | 4 | 1/2 | 1 | 3 | 4 | 4 | 1 | 1 | 1/5 | 1 | 1 | 1 | 4 | 2 | 1 | 1/3 | 1/3 | 1 | 3 | 1/3 | 2 | |

| R9 | 1 | 1 | 1 | 1 | 1/5 | 3 | 3 | 5 | 1 | 1 | 4 | 3 | 1/4 | 3 | 2 | 1/5 | 1/3 | 3 | 4 | 1/5 | 2 | |

| R10 | 1 | 1 | 1/6 | 1/3 | 3 | 5 | 1/3 | 1 | 1 | 1 | 1/5 | 1/3 | 4 | 6 | 1 | 1/4 | 1/3 | 4 | 5 | 2 | 2 | |

| R11 | 1 | 1/3 | 4 | 1/3 | 4 | 5 | 1 | 1 | 1/4 | 5 | 1 | 1/5 | 4 | 3 | 1 | 1/4 | 1/4 | 5 | 7 | 1/6 | 1/3 | |

| R12 | 1 | 1 | 1/5 | 1/4 | 1 | 1 | 1 | 1 | 1/3 | 3 | 5 | 1 | 3 | 4 | 4 | 1/5 | 1/3 | 1 | 4 | 1/6 | 2 | |

| R13 | 1/3 | 1/6 | 1/4 | 1 | 1/4 | 3 | 1/4 | 1/4 | 4 | 1/4 | 1/4 | 1/3 | 1 | 1/3 | 1 | 1/7 | 1/5 | 2 | 2 | 1/4 | 1/3 | |

| R14 | 1/3 | 1/7 | 4 | 1 | 1/4 | 3 | 1/2 | 1/2 | 1/3 | 1/6 | 1/3 | 1/4 | 3 | 1 | 4 | 1/5 | 1/5 | 1 | 5 | 1/4 | 1/3 | |

| R15 | 1 | 1/2 | 3 | 4 | 1 | 1 | 1 | 1 | 1/2 | 1 | 1 | 1/4 | 1 | 1/4 | 1 | 1/4 | 1/5 | 5 | 6 | 1 | 1 | |

| R16 | 5 | 5 | 2 | 4 | 4 | 5 | 3 | 3 | 5 | 4 | 4 | 5 | 7 | 5 | 4 | 1 | 1 | 7 | 9 | 1 | 7 | |

| R17 | 7 | 5 | 3 | 4 | 3 | 5 | 3 | 3 | 3 | 3 | 4 | 3 | 5 | 5 | 5 | 1 | 1 | 5 | 7 | 1 | 4 | |

| R18 | 1/3 | 1/6 | 1/5 | 1/4 | 1/4 | 1/4 | 1/5 | 1 | 1/3 | 1/4 | 1/5 | 1 | 1/2 | 1 | 1/5 | 1/7 | 1/5 | 1 | 6 | 1/7 | 3 | |

| R19 | 1/5 | 1/9 | 1/9 | 1/8 | 1/3 | 1/3 | 1/6 | 1/3 | 1/4 | 1/5 | 1/7 | 1/4 | 1/2 | 1/5 | 1/6 | 1/9 | 1/7 | 1/6 | 1 | 1/9 | 1/3 | |

| R20 | 1/2 | 1 | 4 | 1/6 | 3 | 1/3 | 1 | 3 | 5 | 1/2 | 6 | 6 | 4 | 4 | 1 | 1 | 1 | 7 | 9 | 1 | 7 | |

| R21 | 1/2 | 1 | 1/5 | 1/3 | 1/9 | 1/2 | 1/5 | 1/2 | 1/2 | 1/2 | 3 | 1/2 | 3 | 3 | 1 | 1/7 | 1/4 | 1/3 | 3 | 1/7 | 1 | |

| ∑ | 39.03 | 20.10 | 38.13 | 29.37 | 38.59 | 69.42 | 22.33 | 26.67 | 31.37 | 35.40 | 38.83 | 36.12 | 62.58 | 55.37 | 32.95 | 7.16 | 7.57 | 73.50 | 114.00 | 21.35 | 59.33 | |

| Analysis of the importance of resilience factors—Resources and competences area (B matrix) | ||||||||||||||||||||||

| Factors | R1 | R2 | R3 | R4 | R5 | R6 | R7 | R8 | R9 | R10 | R11 | R12 | R13 | R14 | R15 | R16 | R17 | R18 | R19 | R20 | R21 | ∑ |

| R1 | 0.0256 | 0.0124 | 0.1311 | 0.0681 | 0.0052 | 0.1152 | 0.0090 | 0.0094 | 0.0319 | 0.0282 | 0.0258 | 0.0277 | 0.0479 | 0.0542 | 0.0303 | 0.0279 | 0.0189 | 0.0408 | 0.0439 | 0.0937 | 0.0337 | 0.88 |

| R2 | 0.1025 | 0.0498 | 0.0262 | 0.1703 | 0.1036 | 0.1008 | 0.1344 | 0.0750 | 0.0319 | 0.0282 | 0.0773 | 0.0277 | 0.0959 | 0.1264 | 0.0607 | 0.0279 | 0.0264 | 0.0816 | 0.0789 | 0.0468 | 0.0169 | 1.49 |

| R3 | 0.0051 | 0.0498 | 0.0262 | 0.0068 | 0.0259 | 0.0144 | 0.0448 | 0.0375 | 0.0319 | 0.1695 | 0.0064 | 0.1384 | 0.0639 | 0.0045 | 0.0101 | 0.0699 | 0.0440 | 0.0680 | 0.0789 | 0.0117 | 0.0843 | 0.99 |

| R4 | 0.0128 | 0.0100 | 0.1311 | 0.0341 | 0.1036 | 0.1152 | 0.0448 | 0.0125 | 0.0319 | 0.0847 | 0.0773 | 0.1108 | 0.0160 | 0.0181 | 0.0076 | 0.0349 | 0.0330 | 0.0544 | 0.0702 | 0.2811 | 0.0506 | 1.33 |

| R5 | 0.1281 | 0.0124 | 0.0262 | 0.0085 | 0.0259 | 0.0144 | 0.0149 | 0.0094 | 0.1594 | 0.0094 | 0.0064 | 0.0277 | 0.0639 | 0.0722 | 0.0303 | 0.0349 | 0.0440 | 0.0544 | 0.0263 | 0.0156 | 0.1517 | 0.94 |

| R6 | 0.0032 | 0.0071 | 0.0262 | 0.0043 | 0.0259 | 0.0144 | 0.0064 | 0.0094 | 0.0106 | 0.0056 | 0.0052 | 0.0277 | 0.0053 | 0.0060 | 0.0303 | 0.0279 | 0.0264 | 0.0544 | 0.0263 | 0.1405 | 0.0337 | 0.50 |

| R7 | 0.1281 | 0.0166 | 0.0262 | 0.0341 | 0.0777 | 0.1008 | 0.0448 | 0.0375 | 0.0106 | 0.0847 | 0.0258 | 0.0277 | 0.0639 | 0.0361 | 0.0303 | 0.0466 | 0.0440 | 0.0680 | 0.0526 | 0.0468 | 0.0843 | 1.09 |

| R8 | 0.1025 | 0.0249 | 0.0262 | 0.1022 | 0.1036 | 0.0576 | 0.0448 | 0.0375 | 0.0064 | 0.0282 | 0.0258 | 0.0277 | 0.0639 | 0.0361 | 0.0303 | 0.0466 | 0.0440 | 0.0136 | 0.0263 | 0.0156 | 0.0337 | 0.90 |

| R9 | 0.0256 | 0.0498 | 0.0262 | 0.0341 | 0.0052 | 0.0432 | 0.1344 | 0.1875 | 0.0319 | 0.0282 | 0.1030 | 0.0831 | 0.0040 | 0.0542 | 0.0607 | 0.0279 | 0.0440 | 0.0408 | 0.0351 | 0.0094 | 0.0337 | 1.06 |

| R10 | 0.0256 | 0.0498 | 0.0044 | 0.0114 | 0.0777 | 0.0720 | 0.0149 | 0.0375 | 0.0319 | 0.0282 | 0.0052 | 0.0092 | 0.0639 | 0.1084 | 0.0303 | 0.0349 | 0.0440 | 0.0544 | 0.0439 | 0.0937 | 0.0337 | 0.88 |

| R11 | 0.0256 | 0.0166 | 0.1049 | 0.0114 | 0.1036 | 0.0720 | 0.0448 | 0.0375 | 0.0080 | 0.1412 | 0.0258 | 0.0055 | 0.0639 | 0.0542 | 0.0303 | 0.0349 | 0.0330 | 0.0680 | 0.0614 | 0.0078 | 0.0056 | 0.96 |

| R12 | 0.0256 | 0.0498 | 0.0052 | 0.0085 | 0.0259 | 0.0144 | 0.0448 | 0.0375 | 0.0106 | 0.0847 | 0.1288 | 0.0277 | 0.0479 | 0.0722 | 0.1214 | 0.0279 | 0.0440 | 0.0136 | 0.0351 | 0.0078 | 0.0337 | 0.87 |

| R13 | 0.0085 | 0.0083 | 0.0066 | 0.0341 | 0.0065 | 0.0432 | 0.0112 | 0.0094 | 0.1275 | 0.0071 | 0.0064 | 0.0092 | 0.0160 | 0.0060 | 0.0303 | 0.0200 | 0.0264 | 0.0272 | 0.0175 | 0.0117 | 0.0056 | 0.44 |

| R14 | 0.0085 | 0.0071 | 0.1049 | 0.0341 | 0.0065 | 0.0432 | 0.0224 | 0.0188 | 0.0106 | 0.0047 | 0.0086 | 0.0069 | 0.0479 | 0.0181 | 0.1214 | 0.0279 | 0.0264 | 0.0136 | 0.0439 | 0.0117 | 0.0056 | 0.59 |

| R15 | 0.0256 | 0.0249 | 0.0787 | 0.1362 | 0.0259 | 0.0144 | 0.0448 | 0.0375 | 0.0159 | 0.0282 | 0.0258 | 0.0069 | 0.0160 | 0.0045 | 0.0303 | 0.0349 | 0.0264 | 0.0680 | 0.0526 | 0.0468 | 0.0169 | 0.76 |

| R16 | 0.1281 | 0.2488 | 0.0525 | 0.1362 | 0.1036 | 0.0720 | 0.1344 | 0.1125 | 0.1594 | 0.1130 | 0.1030 | 0.1384 | 0.1119 | 0.0903 | 0.1214 | 0.1397 | 0.1321 | 0.0952 | 0.0789 | 0.0468 | 0.1180 | 2.44 |

| R17 | 0.1794 | 0.2488 | 0.0787 | 0.1362 | 0.0777 | 0.0720 | 0.1344 | 0.1125 | 0.0956 | 0.0847 | 0.1030 | 0.0831 | 0.0799 | 0.0903 | 0.1517 | 0.1397 | 0.1321 | 0.0680 | 0.0614 | 0.0468 | 0.0674 | 2.24 |

| R18 | 0.0085 | 0.0083 | 0.0052 | 0.0085 | 0.0065 | 0.0036 | 0.0090 | 0.0375 | 0.0106 | 0.0071 | 0.0052 | 0.0277 | 0.0080 | 0.0181 | 0.0061 | 0.0200 | 0.0264 | 0.0136 | 0.0526 | 0.0067 | 0.0506 | 0.34 |

| R19 | 0.0051 | 0.0055 | 0.0029 | 0.0043 | 0.0086 | 0.0048 | 0.0075 | 0.0125 | 0.0080 | 0.0056 | 0.0037 | 0.0069 | 0.0080 | 0.0036 | 0.0051 | 0.0155 | 0.0189 | 0.0023 | 0.0088 | 0.0052 | 0.0056 | 0.15 |

| R20 | 0.0128 | 0.0498 | 0.1049 | 0.0057 | 0.0777 | 0.0048 | 0.0448 | 0.1125 | 0.1594 | 0.0141 | 0.1545 | 0.1661 | 0.0639 | 0.0722 | 0.0303 | 0.1397 | 0.1321 | 0.0952 | 0.0789 | 0.0468 | 0.1180 | 1.68 |

| R21 | 0.0128 | 0.0498 | 0.0052 | 0.0114 | 0.0029 | 0.0072 | 0.0090 | 0.0188 | 0.0159 | 0.0141 | 0.0773 | 0.0138 | 0.0479 | 0.0542 | 0.0303 | 0.0200 | 0.0330 | 0.0045 | 0.0263 | 0.0067 | 0.0169 | 0.48 |

| ∑ | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | |

Appendix A.3

| Analysis of the importance of resilience factors—Value chain management area (A matrix) | ||||||||||||||||||||||

| Factors | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | C15 | C16 | C17 | C18 | C19 | C20 | C21 | |

| C1 | 1 | 7 | 7 | 5 | 5 | 1 | 8 | 8 | 4 | 3 | 9 | 7 | 7 | 8 | 8 | 8 | 8 | 6 | 4 | 4 | 1 | |

| C2 | 1/7 | 1 | 2 | 3 | 1 | 1 | 5 | 2 | 1 | 1/4 | 5 | 1 | 1 | 1 | 5 | 3 | 2 | 1 | 6 | 6 | 1 | |

| C3 | 1/7 | 1/2 | 1 | 1/3 | 1/4 | 1/6 | 1 | 4 | 1 | 1/6 | 1 | 1 | 1 | 5 | 1 | 1/5 | 1/3 | 1/8 | 1 | 1/4 | 1/9 | |

| C4 | 1/5 | 1/3 | 3 | 1 | 1 | 1/5 | 6 | 8 | 1 | 1 | 3 | 1 | 1 | 1 | 1 | 4 | 3 | 1/5 | 1/3 | 1/3 | 1/7 | |

| C5 | 1/5 | 1 | 4 | 1 | 1 | 1 | 9 | 9 | 5 | 3 | 9 | 4 | 4 | 9 | 3 | 6 | 3 | 3 | 1 | 1 | 1/4 | |

| C6 | 1 | 1 | 6 | 5 | 1 | 1 | 9 | 7 | 3 | 1 | 9 | 1 | 6 | 9 | 8 | 3 | 3 | 1/4 | 1/3 | 1/3 | 1/8 | |

| C7 | 1/8 | 1/5 | 1 | 1/6 | 1/9 | 1/9 | 1 | 1 | 1/8 | 1/9 | 1 | 1/9 | 1/8 | 1/3 | 1/4 | 1/5 | 1/4 | 1/9 | 1/5 | 1/5 | 1/8 | |

| C8 | 1/8 | 1/2 | 1/4 | 1/8 | 1/9 | 1/7 | 1 | 1 | 1/7 | 1/9 | 1 | 1/3 | 1 | 1/3 | 1 | 1/6 | 1/3 | 1/8 | 1/3 | 1/3 | 1/8 | |

| C9 | 1/4 | 1 | 1 | 1 | 1/5 | 1/3 | 8 | 7 | 1 | 1 | 8 | 1/6 | 1/3 | 1/3 | 2 | 1 | 1 | 1/5 | 1/3 | 1/3 | 1/7 | |

| C10 | 1/3 | 4 | 6 | 1 | 1/3 | 1 | 9 | 9 | 1 | 1 | 7 | 1 | 5 | 7 | 5 | 3 | 3 | 1/6 | 1/3 | 1/3 | 1/4 | |

| C11 | 1/9 | 1/5 | 1 | 1/3 | 1/9 | 1/9 | 1 | 1 | 1/8 | 1/7 | 1 | 1/4 | 1/3 | 1/3 | 1/5 | 1/7 | 1/5 | 1/5 | 1/6 | 1/6 | 1/9 | |

| C12 | 1/7 | 1 | 1 | 1 | 1/4 | 1 | 9 | 3 | 6 | 1 | 4 | 1 | 1/3 | 1 | 1/2 | 1 | 1/3 | 1/6 | 1/3 | 1/3 | 1/7 | |

| C13 | 1/7 | 1 | 1 | 1 | 1/4 | 1/6 | 8 | 1 | 3 | 1/5 | 3 | 3 | 1 | 3 | 1 | 1/4 | 1/4 | 1/6 | 1/6 | 1/6 | 1/9 | |

| C14 | 1/8 | 1 | 1/5 | 1 | 1/9 | 1/9 | 3 | 3 | 3 | 1/7 | 3 | 1 | 1/3 | 1 | 1/6 | 1/5 | 1/7 | 1/7 | 1/8 | 1/8 | 1/9 | |

| C15 | 1/8 | 1/5 | 1 | 1 | 1/3 | 1/8 | 4 | 1 | 1/2 | 1/5 | 5 | 2 | 1 | 6 | 1 | 1/3 | 1 | 1/5 | 1/2 | 1/2 | 1/9 | |

| C16 | 1/8 | 1/3 | 5 | 1/4 | 1/6 | 1/3 | 5 | 6 | 1 | 1/3 | 7 | 1 | 4 | 5 | 3 | 1 | 1 | 1 | 1/3 | 1/3 | 1/9 | |

| C17 | 1/8 | 1/2 | 3 | 1/3 | 1/3 | 1/3 | 4 | 3 | 1 | 1/3 | 5 | 3 | 4 | 7 | 1 | 1 | 1 | 1/4 | 1/3 | 1/3 | 1/9 | |

| C18 | 1/6 | 1 | 8 | 5 | 1/3 | 4 | 9 | 8 | 5 | 6 | 5 | 6 | 6 | 7 | 5 | 1 | 4 | 1 | 1 | 1 | 1/6 | |

| C19 | 1/4 | 1/6 | 1 | 3 | 1 | 3 | 5 | 3 | 3 | 3 | 6 | 3 | 6 | 8 | 2 | 3 | 3 | 1 | 1 | 1 | 1/9 | |

| C20 | 1/4 | 1/6 | 4 | 3 | 1 | 3 | 5 | 3 | 3 | 3 | 6 | 3 | 6 | 8 | 2 | 3 | 3 | 1 | 1 | 1 | 1/9 | |

| C21 | 1 | 1 | 9 | 7 | 4 | 8 | 8 | 8 | 7 | 4 | 9 | 7 | 9 | 9 | 9 | 9 | 9 | 6 | 9 | 9 | 1 | |

| ∑ | 6.0825 | 23.1000 | 65.4500 | 40.5417 | 17.8944 | 26.1345 | 118.0000 | 96.0000 | 49.8929 | 28.9913 | 107.0000 | 46.8611 | 64.4583 | 96.3333 | 59.1167 | 48.4929 | 46.8429 | 22.3040 | 27.8250 | 27.0750 | 5.4702 | |

| Analysis of the importance of resilience factors—Value chain management area (B matrix) | ||||||||||||||||||||||

| Factors | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | C15 | C16 | C17 | C18 | C19 | C20 | C21 | ∑ |

| C1 | 0.1644 | 0.3030 | 0.1070 | 0.1233 | 0.2794 | 0.0383 | 0.0678 | 0.0833 | 0.0802 | 0.1035 | 0.0841 | 0.1494 | 0.1086 | 0.0830 | 0.1353 | 0.1650 | 0.1708 | 0.2690 | 0.1438 | 0.1477 | 0.1828 | 2.99 |

| C2 | 0.0235 | 0.0433 | 0.0306 | 0.0740 | 0.0559 | 0.0383 | 0.0424 | 0.0208 | 0.0200 | 0.0086 | 0.0467 | 0.0213 | 0.0155 | 0.0104 | 0.0846 | 0.0619 | 0.0427 | 0.0448 | 0.2156 | 0.2216 | 0.1828 | 1.31 |

| C3 | 0.0235 | 0.0216 | 0.0153 | 0.0082 | 0.0140 | 0.0064 | 0.0085 | 0.0417 | 0.0200 | 0.0057 | 0.0093 | 0.0213 | 0.0155 | 0.0519 | 0.0169 | 0.0041 | 0.0071 | 0.0056 | 0.0359 | 0.0092 | 0.0203 | 0.36 |

| C4 | 0.0329 | 0.0144 | 0.0458 | 0.0247 | 0.0559 | 0.0077 | 0.0508 | 0.0833 | 0.0200 | 0.0345 | 0.0280 | 0.0213 | 0.0155 | 0.0104 | 0.0169 | 0.0825 | 0.0640 | 0.0090 | 0.0120 | 0.0123 | 0.0261 | 0.67 |

| C5 | 0.0329 | 0.0433 | 0.0611 | 0.0247 | 0.0559 | 0.0383 | 0.0763 | 0.0938 | 0.1002 | 0.1035 | 0.0841 | 0.0854 | 0.0621 | 0.0934 | 0.0507 | 0.1237 | 0.0640 | 0.1345 | 0.0359 | 0.0369 | 0.0457 | 1.45 |

| C6 | 0.1644 | 0.0433 | 0.0917 | 0.1233 | 0.0559 | 0.0383 | 0.0763 | 0.0729 | 0.0601 | 0.0345 | 0.0841 | 0.0213 | 0.0931 | 0.0934 | 0.1353 | 0.0619 | 0.0640 | 0.0112 | 0.0120 | 0.0123 | 0.0229 | 1.37 |

| C7 | 0.0206 | 0.0087 | 0.0153 | 0.0041 | 0.0062 | 0.0043 | 0.0085 | 0.0104 | 0.0025 | 0.0038 | 0.0093 | 0.0024 | 0.0019 | 0.0035 | 0.0042 | 0.0041 | 0.0053 | 0.0050 | 0.0072 | 0.0074 | 0.0229 | 0.16 |

| C8 | 0.0206 | 0.0216 | 0.0038 | 0.0031 | 0.0062 | 0.0055 | 0.0085 | 0.0104 | 0.0029 | 0.0038 | 0.0093 | 0.0071 | 0.0155 | 0.0035 | 0.0169 | 0.0034 | 0.0071 | 0.0056 | 0.0120 | 0.0123 | 0.0229 | 0.20 |

| C9 | 0.0411 | 0.0433 | 0.0153 | 0.0247 | 0.0112 | 0.0128 | 0.0678 | 0.0729 | 0.0200 | 0.0345 | 0.0748 | 0.0036 | 0.0052 | 0.0035 | 0.0338 | 0.0206 | 0.0213 | 0.0090 | 0.0120 | 0.0123 | 0.0261 | 0.57 |

| C10 | 0.0548 | 0.1732 | 0.0917 | 0.0247 | 0.0186 | 0.0383 | 0.0763 | 0.0938 | 0.0200 | 0.0345 | 0.0654 | 0.0213 | 0.0776 | 0.0727 | 0.0846 | 0.0619 | 0.0640 | 0.0075 | 0.0120 | 0.0123 | 0.0457 | 1.15 |

| C11 | 0.0183 | 0.0087 | 0.0153 | 0.0082 | 0.0062 | 0.0043 | 0.0085 | 0.0104 | 0.0025 | 0.0049 | 0.0093 | 0.0053 | 0.0052 | 0.0035 | 0.0034 | 0.0029 | 0.0043 | 0.0090 | 0.0060 | 0.0062 | 0.0203 | 0.16 |

| C12 | 0.0235 | 0.0433 | 0.0153 | 0.0247 | 0.0140 | 0.0383 | 0.0763 | 0.0313 | 0.1203 | 0.0345 | 0.0374 | 0.0213 | 0.0052 | 0.0104 | 0.0085 | 0.0206 | 0.0071 | 0.0075 | 0.0120 | 0.0123 | 0.0261 | 0.59 |

| C13 | 0.0235 | 0.0433 | 0.0153 | 0.0247 | 0.0140 | 0.0064 | 0.0678 | 0.0104 | 0.0601 | 0.0069 | 0.0280 | 0.0640 | 0.0155 | 0.0311 | 0.0169 | 0.0052 | 0.0053 | 0.0075 | 0.0060 | 0.0062 | 0.0203 | 0.48 |

| C14 | 0.0206 | 0.0433 | 0.0031 | 0.0247 | 0.0062 | 0.0043 | 0.0254 | 0.0313 | 0.0601 | 0.0049 | 0.0280 | 0.0213 | 0.0052 | 0.0104 | 0.0028 | 0.0041 | 0.0030 | 0.0064 | 0.0045 | 0.0046 | 0.0203 | 0.33 |

| C15 | 0.0206 | 0.0087 | 0.0153 | 0.0247 | 0.0186 | 0.0048 | 0.0339 | 0.0104 | 0.0100 | 0.0069 | 0.0467 | 0.0427 | 0.0155 | 0.0623 | 0.0169 | 0.0069 | 0.0213 | 0.0090 | 0.0180 | 0.0185 | 0.0203 | 0.43 |

| C16 | 0.0206 | 0.0144 | 0.0764 | 0.0062 | 0.0093 | 0.0128 | 0.0424 | 0.0625 | 0.0200 | 0.0115 | 0.0654 | 0.0213 | 0.0621 | 0.0519 | 0.0507 | 0.0206 | 0.0213 | 0.0448 | 0.0120 | 0.0123 | 0.0203 | 0.66 |

| C17 | 0.0206 | 0.0216 | 0.0458 | 0.0082 | 0.0186 | 0.0128 | 0.0339 | 0.0313 | 0.0200 | 0.0115 | 0.0467 | 0.0640 | 0.0621 | 0.0727 | 0.0169 | 0.0206 | 0.0213 | 0.0112 | 0.0120 | 0.0123 | 0.0203 | 0.58 |

| C18 | 0.0274 | 0.0433 | 0.1222 | 0.1233 | 0.0186 | 0.1531 | 0.0763 | 0.0833 | 0.1002 | 0.2070 | 0.0467 | 0.1280 | 0.0931 | 0.0727 | 0.0846 | 0.0206 | 0.0854 | 0.0448 | 0.0359 | 0.0369 | 0.0305 | 1.63 |

| C19 | 0.0411 | 0.0072 | 0.0153 | 0.0740 | 0.0559 | 0.1148 | 0.0424 | 0.0313 | 0.0601 | 0.1035 | 0.0561 | 0.0640 | 0.0931 | 0.0830 | 0.0338 | 0.0619 | 0.0640 | 0.0448 | 0.0359 | 0.0369 | 0.0203 | 1.14 |

| C20 | 0.0411 | 0.0072 | 0.0611 | 0.0740 | 0.0559 | 0.1148 | 0.0424 | 0.0313 | 0.0601 | 0.1035 | 0.0561 | 0.0640 | 0.0931 | 0.0830 | 0.0338 | 0.0619 | 0.0640 | 0.0448 | 0.0359 | 0.0369 | 0.0203 | 1.19 |

| C21 | 0.1644 | 0.0433 | 0.1375 | 0.1727 | 0.2235 | 0.3061 | 0.0678 | 0.0833 | 0.1403 | 0.1380 | 0.0841 | 0.1494 | 0.1396 | 0.0934 | 0.1522 | 0.1856 | 0.1921 | 0.2690 | 0.3235 | 0.3324 | 0.1828 | 3.58 |

| ∑ | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | |

Appendix A.4

| Analysis of the importance of resilience factors—Value capture and profitability area (A matrix) | |||||||||||

| Factors | P1 | P2 | P3 | P4 | P5 | P6 | P7 | P8 | P9 | P10 | |

| P1 | 1 | 1/5 | 1 | 1/5 | 1/5 | 1/5 | 1/5 | 1 | 4 | 4 | |

| P2 | 5 | 1 | 1 | 1/8 | 6 | 1 | 2 | 5 | 3 | 3 | |

| P3 | 1 | 1 | 1 | 1/7 | 3 | 1 | 2 | 3 | 3 | 3 | |

| P4 | 5 | 8 | 7 | 1 | 3 | 1/3 | 1/5 | 1/3 | 3 | 6 | |

| P5 | 5 | 1/6 | 1/3 | 1/3 | 1 | 1/3 | 3 | 1 | 1/3 | 1 | |

| P6 | 5 | 1 | 1 | 3 | 3 | 1 | 3 | 3 | 3 | 3 | |

| P7 | 5 | 1/2 | 1/2 | 5 | 1/3 | 1/3 | 1 | 6 | 1 | 3 | |

| P8 | 1 | 1/5 | 1/3 | 3 | 1 | 1/3 | 1/6 | 1 | 3 | 1 | |

| P9 | 1/4 | 1/3 | 1/3 | 1/3 | 3 | 1/3 | 1 | 1/3 | 1 | 3 | |

| P10 | 1/4 | 1/3 | 1/3 | 1/6 | 1 | 1/3 | 1/3 | 1 | 1/3 | 1 | |

| ∑ | 28.50 | 12.73 | 12.83 | 13.30 | 21.53 | 5.20 | 12.90 | 21.67 | 21.67 | 28.00 | |

| Analysis of the importance of resilience factors—Value capture and profitability area (B matrix) | |||||||||||

| Factors | P1 | P2 | P3 | P4 | P5 | P6 | P7 | P8 | P9 | P10 | ∑ |

| P1 | 0.0351 | 0.0157 | 0.0779 | 0.0150 | 0.0093 | 0.0385 | 0.0155 | 0.0462 | 0.1846 | 0.1429 | 0.58 |

| P2 | 0.1754 | 0.0785 | 0.0779 | 0.0094 | 0.2786 | 0.1923 | 0.1550 | 0.2308 | 0.1385 | 0.1071 | 1.44 |

| P3 | 0.0351 | 0.0785 | 0.0779 | 0.0107 | 0.1393 | 0.1923 | 0.1550 | 0.1385 | 0.1385 | 0.1071 | 1.07 |

| P4 | 0.1754 | 0.6283 | 0.5455 | 0.0752 | 0.1393 | 0.0641 | 0.0155 | 0.0154 | 0.1385 | 0.2143 | 2.01 |

| P5 | 0.1754 | 0.0131 | 0.0260 | 0.0251 | 0.0464 | 0.0641 | 0.2326 | 0.0462 | 0.0154 | 0.0357 | 0.68 |

| P6 | 0.1754 | 0.0785 | 0.0779 | 0.2255 | 0.1393 | 0.1923 | 0.2326 | 0.1385 | 0.1385 | 0.1071 | 1.51 |

| P7 | 0.1754 | 0.0393 | 0.0390 | 0.3759 | 0.0155 | 0.0641 | 0.0775 | 0.2769 | 0.0462 | 0.1071 | 1.22 |

| P8 | 0.0351 | 0.0157 | 0.0260 | 0.2255 | 0.0464 | 0.0641 | 0.0129 | 0.0462 | 0.1385 | 0.0357 | 0.65 |

| P9 | 0.0088 | 0.0262 | 0.0260 | 0.0251 | 0.1393 | 0.0641 | 0.0775 | 0.0154 | 0.0462 | 0.1071 | 0.54 |

| P10 | 0.0088 | 0.0262 | 0.0260 | 0.0125 | 0.0464 | 0.0641 | 0.0258 | 0.0462 | 0.0154 | 0.0357 | 0.31 |

| ∑ | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | |

Appendix A.5

| Analysis of the importance of resilience factors—Sustainable development area (A matrix) | |||||||||

| Factors | D1 | D2 | D3 | D4 | D5 | D6 | D7 | D8 | |

| D1 | 1 | 5 | 1/5 | 3 | 3 | 1/4 | 1/4 | 1/5 | |

| D2 | 1/5 | 1 | 1/4 | 1 | 1 | 1/3 | 1/3 | 1/4 | |

| D3 | 5 | 4 | 1 | 4 | 4 | 1/5 | 1/5 | 1/6 | |

| D4 | 1/3 | 1 | 1/4 | 1 | 3 | 1/4 | 1/4 | 1/4 | |

| D5 | 1/3 | 1 | 1/4 | 1/3 | 1 | 1/6 | 1/6 | 1/5 | |

| D6 | 4 | 3 | 5 | 4 | 6 | 1 | 1 | 2 | |

| D7 | 4 | 3 | 5 | 4 | 6 | 1 | 1 | 2 | |

| D8 | 5 | 4 | 6 | 4 | 5 | 1/2 | 1/2 | 1 | |

| ∑ | 19.8667 | 22.0000 | 17.9500 | 21.3333 | 29.0000 | 3.7000 | 3.7000 | 6.0667 | |

| Analysis of the importance of resilience factors—Sustainable development area (B matrix) | |||||||||

| Factors | D1 | D2 | D3 | D4 | D5 | D6 | D7 | D8 | ∑ |

| D1 | 0.0503 | 0.2273 | 0.0111 | 0.1406 | 0.1034 | 0.0676 | 0.0676 | 0.0330 | 0.70 |

| D2 | 0.0101 | 0.0455 | 0.0139 | 0.0469 | 0.0345 | 0.0901 | 0.0901 | 0.0412 | 0.37 |

| D3 | 0.2517 | 0.1818 | 0.0557 | 0.1875 | 0.1379 | 0.0541 | 0.0541 | 0.0275 | 0.95 |

| D4 | 0.0168 | 0.0455 | 0.0139 | 0.0469 | 0.1034 | 0.0676 | 0.0676 | 0.0412 | 0.40 |

| D5 | 0.0168 | 0.0455 | 0.0139 | 0.0156 | 0.0345 | 0.0450 | 0.0450 | 0.0330 | 0.25 |

| D6 | 0.2013 | 0.1364 | 0.2786 | 0.1875 | 0.2069 | 0.2703 | 0.2703 | 0.3297 | 1.88 |

| D7 | 0.2013 | 0.1364 | 0.2786 | 0.1875 | 0.2069 | 0.2703 | 0.2703 | 0.3297 | 1.88 |

| D8 | 0.2517 | 0.1818 | 0.3343 | 0.1875 | 0.1724 | 0.1351 | 0.1351 | 0.1648 | 1.56 |

| ∑ | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | |

Appendix A.6

| Analysis of the importance of resilience factors—Alignment with strategy area (A Matrix) | |||||

| S1 | S2 | S3 | S4 | ||

| S1 | 1 | 3 | 5 | 5 | |

| S2 | 1/3 | 1 | 1/3 | 4 | |

| S3 | 1/5 | 3 | 1 | 4 | |

| S4 | 1/5 | 1/4 | 1/4 | 1 | |

| ∑ | 1.7333 | 7.2500 | 6.5833 | 14.0000 | |

| Analysis of the importance of resilience factors—Alignment with strategy area (B Matrix) | |||||

| S1 | S2 | S3 | S4 | ∑ | |

| S1 | 0.5769 | 0.4138 | 0.7595 | 0.3571 | 2.11 |

| S2 | 0.1923 | 0.1379 | 0.0506 | 0.2857 | 0.67 |

| S3 | 0.1154 | 0.4138 | 0.1519 | 0.2857 | 0.97 |

| S4 | 0.1154 | 0.0345 | 0.0380 | 0.0714 | 0.26 |

| ∑ | 1.0000 | 1.0000 | 1.0000 | 1.0000 | |

Appendix B

| Main Criteria | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Customer Value | Resources and Competences | Value Chain | Value Capture and Profitability | Sustainable Development | Alignment with Strategy | ||||||||||||

| Sub-Criteria | |||||||||||||||||

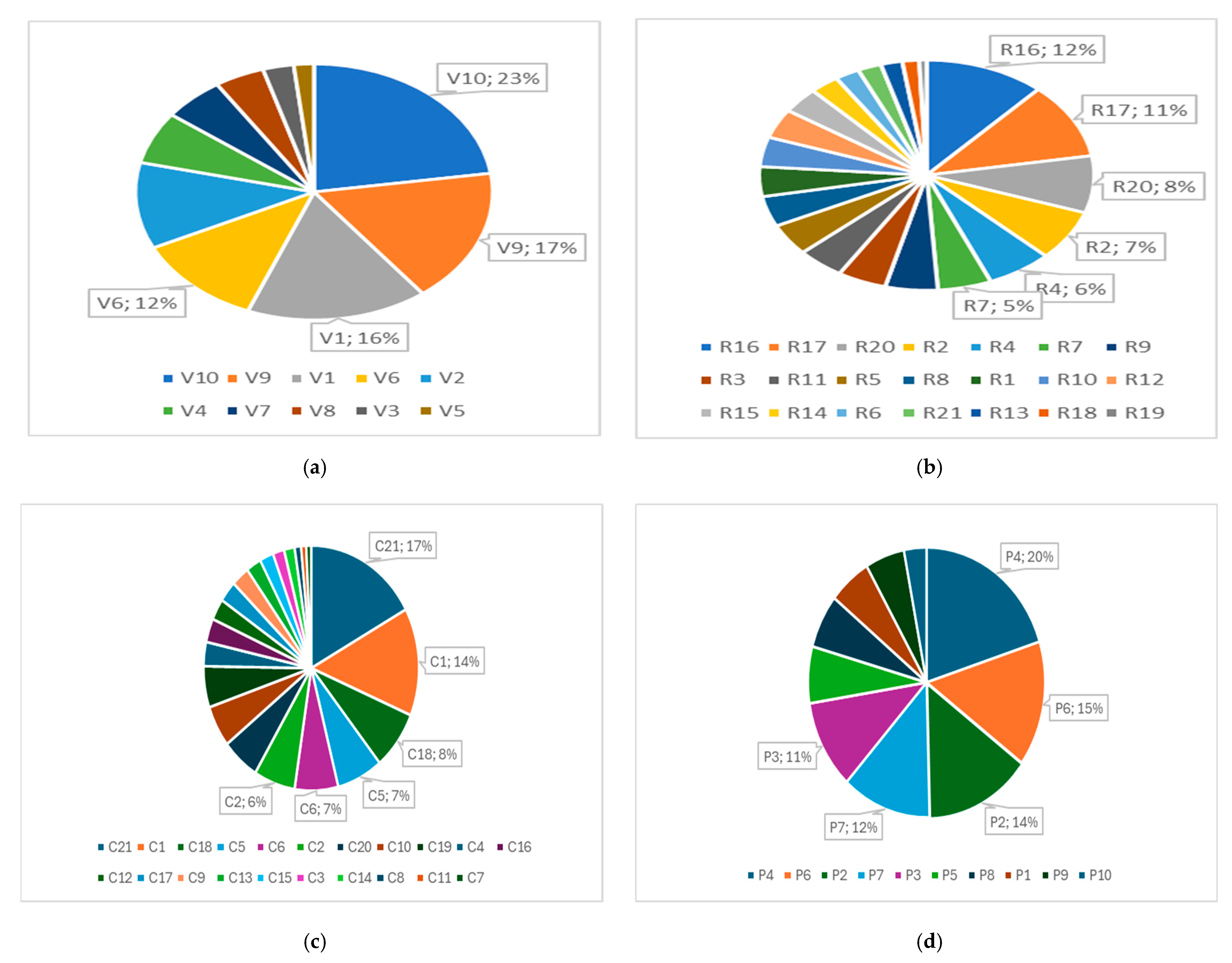

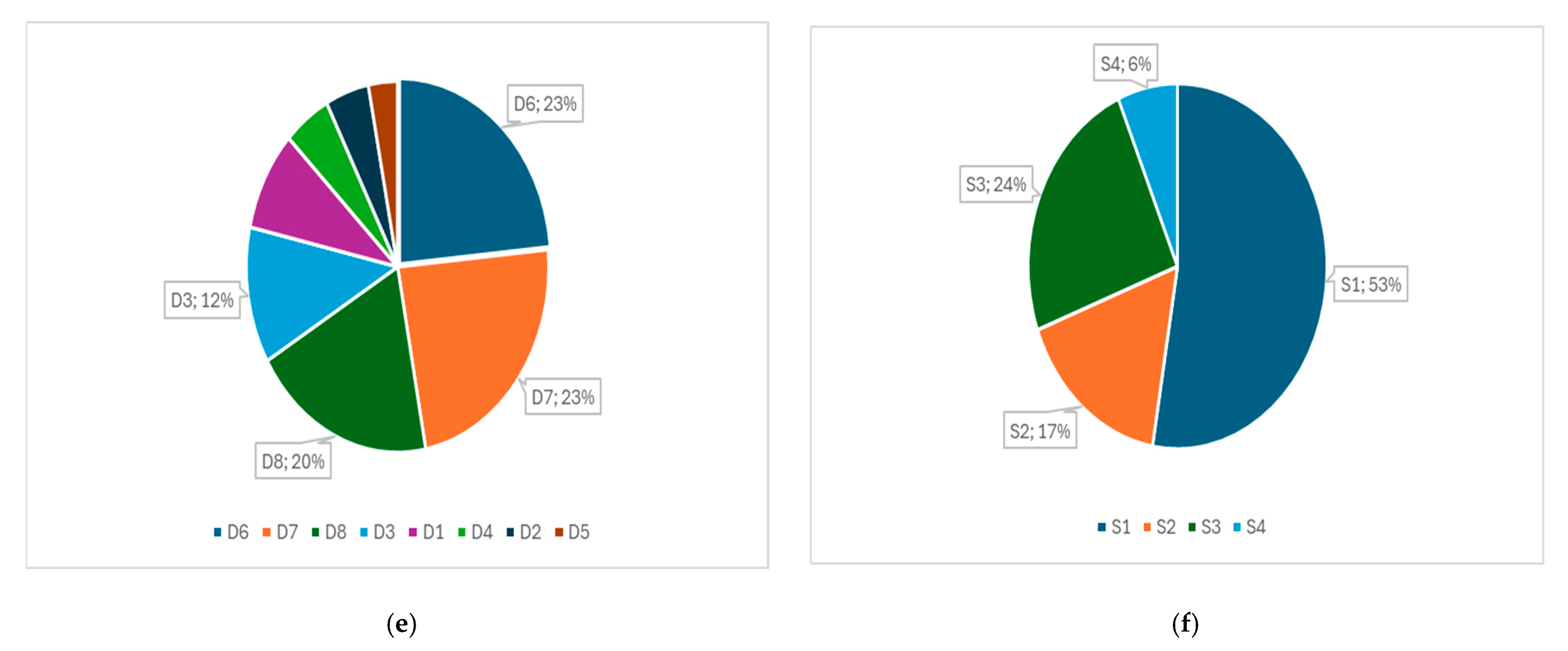

| Factor | wi | Rank/ Priority | Factor | wi | Rank/ Priority | Factor | wi | Rank/ Priority | Factor | wi | Rank/ Priority | Factor | wi | Rank/ Priority | Factor | wi | Rank/ Priority |

| V1 | 0.16 | 3 | R1 | 0.04 | 10–15 | C1 | 0.14 | 2 | P1 | 0.06 | 7–8 | D1 | 0.09 | 5 | S1 | 52.68 | 1 |

| V2 | 0.11 | 5 | R2 | 0.07 | 4 | C2 | 0.06 | 6–7 | P2 | 0.14 | 3 | D2 | 0.05 | 6–7 | S2 | 16.66 | 3 |

| V3 | 0.03 | 9 | R3 | 0.05 | 6–9 | C3 | 0.02 | 15–18 | P3 | 0.11 | 5 | D3 | 0.12 | 4 | S3 | 24.17 | 2 |

| V4 | 0.07 | 6 | R4 | 0.06 | 5 | C4 | 0.03 | 10–14 | P4 | 0.20 | 1 | D4 | 0.05 | 6–7 | S4 | 6.48 | 4 |

| V5 | 0.02 | 10 | R5 | 0.04 | 10–15 | C5 | 0.07 | 4–5 | P5 | 0.07 | 6 | D5 | 0.03 | 8 | |||

| V6 | 0.12 | 4 | R6 | 0.02 | 17–20 | C6 | 0.07 | 4–5 | P6 | 0.15 | 2 | D6 | 0.24 | 1–2 | |||

| V7 | 0.06 | 7 | R7 | 0.05 | 6–9 | C7 | 0.01 | 19–21 | P7 | 0.12 | 4 | D7 | 0.24 | 1–2 | |||

| V8 | 0.05 | 8 | R8 | 0.04 | 10–15 | C8 | 0.01 | 19–21 | P8 | 0.06 | 7–8 | D8 | 0.20 | 3 | |||

| V9 | 0.17 | 2 | R9 | 0.05 | 6–9 | C9 | 0.03 | 10–14 | P9 | 0.05 | 9 | ||||||

| V10 | 0.23 | 1 | R10 | 0.04 | 10–15 | C10 | 0.05 | 8–9 | P10 | 0.03 | 10 | ||||||

| R11 | 0.05 | 6–9 | C11 | 0.01 | 19–21 | ||||||||||||

| R12 | 0.04 | 10–15 | C12 | 0.03 | 10–14 | ||||||||||||

| R13 | 0.02 | 17–20 | C13 | 0.02 | 15–18 | ||||||||||||

| R14 | 0.03 | 16 | C14 | 0.02 | 15–18 | ||||||||||||

| R15 | 0.04 | 10–15 | C15 | 0.02 | 15–18 | ||||||||||||

| R16 | 0.12 | 1 | C16 | 0.03 | 10–14 | ||||||||||||

| R17 | 0.11 | 2 | C17 | 0.03 | 10–14 | ||||||||||||

| R18 | 0.02 | 17–20 | C18 | 0.08 | 3 | ||||||||||||

| R19 | 0.01 | 21 | C19 | 0.05 | 8–9 | ||||||||||||

| R20 | 0.08 | 3 | C20 | 0.06 | 6–7 | ||||||||||||

| R21 | 0.02 | 17–20 | C21 | 0.17 | 1 | ||||||||||||

References

- European Commission. Delivering the European Green Deal. COM/2019/640-2019; 2019. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/delivering-european-green-deal_en#key-steps (accessed on 15 June 2024).

- Schleussner, C.-F.; Ganti, G.; Lejeune, Q.; Zhu, B.; Pfleiderer, P.; Prütz, R.; Ciais, P.; Frölicher, T.L.; Fuss, S.; Gasser, T.; et al. Overconfidence in Climate Overshoot. Nature 2024, 634, 366–373. [Google Scholar] [CrossRef] [PubMed]

- Kaczmarek, J.; Kolegowicz, K.; Szymla, W. Restructuring of the Coal Mining Industry and the Challenges of Energy Transition in Poland (1990–2020). Energies 2022, 15, 3518. [Google Scholar] [CrossRef]

- Popczyk, J. Transformacja energetyki (za pomocą reformy ustrojowej rynku energii elektrycznej) do monizmu elektrycznego odnawialnych źródeł energii 2050—Raport. Energetyka Społeczeństwo—Polityka 2018, 2, 3–87. [Google Scholar] [CrossRef]

- Agarwal, R. Economic Analysis of Renewable Power-to-Gas in Norway. Sustainability 2022, 14, 16882. [Google Scholar] [CrossRef]

- Sołtysik, M.; Kozakiewicz, M.; Jasiński, J. Profitability of Prosumers According to Various Business Models—An Analysis in the Light of the COVID-19 Effect. Energies 2021, 14, 8488. [Google Scholar] [CrossRef]

- Saaty, T.L. How to make a decision: The analytic hierarchy process. Eur. J. Oper. Res. 1990, 48, 9–26. [Google Scholar] [CrossRef]

- Taeuscher, K.; Abdelkafi, N. Busieness Model Rebustness: A System Dynamics Approach. In Proceedings of the Conference: European Academy of Management (EURAM), Warsaw, Poland, 13 January 2015. [Google Scholar]

- Prahalad, C.K.; Krishnan, M.S. New Age of Innovation; Mc Graw Hill: New York, NY, USA, 2008; pp. 15–29. [Google Scholar]

- Ostervalder, A.; Pigneur, Y. Business Model Generation; John Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- Ibrahim, Y.; Aslan, S.; Maryam, M.B.Y.; Saleh, K.I.; Amina, U.S. Review of Literature on Business Models and Innovation. J. Adv. Res. Dyn. Control Syst. 2020, 12, 1470–1486. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. Business Model Design and the Performance of Entrepreneurial Firms. Organ. Sci. 2007, 18, 183. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. Business Model Design: An Activity System Perspective. Long Range Plan. 2010, 43, 216–226. [Google Scholar] [CrossRef]

- Amit, R.; Zott, C. Business Model Innovation Strategy; John Wiley & Sons Inc.: Hoboken, NJ, USA, 2020. [Google Scholar]

- Teece, D.J. Business Models, Business Strategy and Innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Chesborough, H.; Rosenbloom, R. The role of the business model in capturing value from innovation: Evidence from Xerox Corporation’s technology spinoff companies. Ind. Corp. Change 2002, 11, 533–534. [Google Scholar]

- Seddon, P.; Lewis, G. Strategy and Business Models: What’s the Difference? In Proceedings of the PACIS 2003 Proceedings 17, Adelaide, Australia, 10–13 July 2003. [Google Scholar]

- Magretta, J. Why Business Models Matter. Harv. Bus. Rev. 2002, 80, 86–92. [Google Scholar] [PubMed]

- Afuah, A.; Tucci, C.L. Internet Business Models and Strategies; McGraw-Hill Higher Education: New York, NY, USA, 2003; Volume 5. [Google Scholar]

- Afuah, A. Business Model Innovation. Concepts, Analysis, and Cases; Taylor&Francis Ltd.: Oxfordshire, UK, 2014. [Google Scholar]

- Shafer, S.M.; Smith, H.J.; Linder, J.C. The Power of Business Models. Bus. Horiz. 2005, 48, 199–207. [Google Scholar] [CrossRef]

- Johnson, M.W.; Christensen, C.C.; Kagermann, H. Reinventing Your Business Model. Harv. Bus. Rev. 2008, 87. [Google Scholar]

- Sliwotzky, A.; Morrison, D.; Andelmann, B. The Profit Zone: How Strategic Business Design Will Lead You to Tomorrow’s Profits; Crown: Savannah, GA, USA, 2002. [Google Scholar]

- Gassmann, O.; Frankenberger, K.; Csik, M. Revolutionizing the Business Model. In Management of the Fuzzy Front End of Innovation; Gassmann, O., Schweitzer, F., Eds.; Springer: New York, NY, USA, 2014; pp. 89–98. [Google Scholar] [CrossRef]

- Palzkill-Vorbeck, A. Business Model Resilience in the Context of Corporate Sustainability Transformation; Wuppertal Institute for Climate, Environment and Energy: Wuppertal, Germany, 2014. [Google Scholar]

- Palzkill, A.; Augenstein, K. Business model resilience—Understanding the role of companies in societal transformation processes. UmweltWirtschaftsForum 2017, 25, 61–70. [Google Scholar] [CrossRef]

- Berkes, F.; Ross, H. Community resilience: Toward an integrated approach. Soc. Nat. Resour. 2013, 26, 5–20. [Google Scholar] [CrossRef]

- Francis, R.; Beker, B. A metric and frameworks for resilience analysis of engineered and infrastructure systems. Reliab. Eng. Syst. Saf. 2014, 121, 90–103. [Google Scholar] [CrossRef]

- Tobin, G.A. Sustainability and community resilience: The holy grail of hazards planning? Environ. Hazards 1999, 1, 13–16. [Google Scholar]

- Cutter, S.L.; Barnes, L.; Berry, M.; Burton, C.; Evans, E.; Tate, E.; Webb, J. A place-based model for understanding community resilience to natural disasters. Global Environ. Change 2008, 18, 598–606. [Google Scholar] [CrossRef]

- Norris, F.H.; Stevens, S.; Pfefferbaum, B.; Pfefferbaum, R. Community Resilience as a Metaphor, Theory, Set of Capacities and Strategy for Disaster Readiness. Am. J. Community Psychol 2008, 51, 127–150. [Google Scholar] [CrossRef]

- Mallak, L. Measuring Resilience in Health care Provider Organizations. Health Manpow. Manag. 1998, 24, 148–152. [Google Scholar] [CrossRef] [PubMed]

- Bruneau, M.; Chang, S.E.; Eguci, R.T.; Lee, G.C.; O’Rourke, T.D.; Reinhorn, A.M.; Shinozuka, M.; Tierney, K.; Wallace, W.A.; von Winterfeld, D. Framework to quantita tively assess and enhance the seismic resilience of communities. In Proceedings of the 13th World Conference on Earthquake Engineering, Vancouver, BC, Canada, 1–6 August 2004. [Google Scholar]

- Walker, B.; Holling, C.S.; Carpenter, S.R.; Kinzig, A. Resilience, Adaptability and Transformability in Social-ecological Systems. Ecol. Soc. 2004, 9, 5. [Google Scholar] [CrossRef]

- Longstaff, P.H.; Armstrong, N.J.; Perrin, K.; Parker, W.M.; Hidek, M.A. Building Resilient Communities: A Preliminary Framework for Assessment. Homel. Secur. Aff. 2010, 6, 3–17. [Google Scholar]

- McManus, S. Organisational Resilience in New Zeeland; University of Canterbury: Christchurch, New Zeeland, 2008; pp. 129–131. [Google Scholar]

- Stephenson, A.; Vargo, J.; Sewilla, E. Measuring and comparing organisational resilience in Auckland. Aust. J. Emerg. Manag. 2010, 25, 27–32. [Google Scholar]

- Otola, I.; Knop, L. A bibliometric analysis of resilience and business model using VOSviewer. Pol. J. Manag. Stud. 2023, 28, 255–273. [Google Scholar] [CrossRef]

- Otola, I.; Grabowska, M.; Krupka, Z. Trust and Organizational Resilience; Routledge: New York, NY, USA, 2023. [Google Scholar] [CrossRef]

- Taeuscher, K.; Abdelkafi, N. Scalability and robustness of business models for sustainability: A simulation experiment. J. Clean. Prod. 2018, 170, 654–664. [Google Scholar] [CrossRef]

- Abdelkafi, N.; Taeuscher, K. Business Models for Sustainability From a System Dynamics Perspective. Organ Environ. 2016, 29, 74–96. [Google Scholar] [CrossRef]

- Jorge-Vazquez, J.; Kaczmarek, J.; Knop, L.; Kolegowicz, K.; Náñez Alonso, S.L.; Szymla, W. Energy transition in Poland and Spain against changes in the EU energy and climate policy. J. Clean. Prod. 2024, 468, 143018. [Google Scholar] [CrossRef]

- Straková, J.; Kostiuk, Y. Importance of Business Process Quality for Creating Added Value and Raising Reputation of Companies in Low-Carbon Economy. Energies 2023, 16, 6388. [Google Scholar] [CrossRef]

- Abdelkafi, N.; Makhotin, S.; Posselt, T. Business models innovations for electric mobility—What can be learned from existing business model patterns? Int. J. Innov. Manag. 2013, 17, 13400033. [Google Scholar] [CrossRef]

- Giehl, J.; Göcke, H.; Grosse, B.; Kochems, J.; Müller, J. Survey and Classification of Business Models for the Energy Transformation. Energies 2020, 13, 2981. [Google Scholar] [CrossRef]

- Brzóska, J.; Krannich, M. Modele biznesu innowacyjnej energetyki (Business Model of Innovative Energy Sector). Stud. Ekon. Zesz. Nauk. Uniw. Ekon. W Katowicach 2016, 280, 7–20. Available online: https://bazekon.uek.krakow.pl/rekord/171455163 (accessed on 15 June 2024).

- Burger, S.P.; Luke, M. Business models for distributed energy resources: A review and empirical analysis. Energy Policy 2017, 109, 30–248. [Google Scholar] [CrossRef]

- Strupeit, L.; Pial, A. Overcoming barriers to renewable energy discussion: Business models for customer sited solar photovoltaics in Japan, Germany and the United States. J. Clean. Prod. 2015, 123, 124–136. [Google Scholar] [CrossRef]

- Brzóska, J.; Knop, L.; Odlanicka-Poczobutt, M.; Zuzek, D.K. Antecedents of Creating Business Models in the Field of Renewable Energy Based on the Concept of the New Age of Innovation. Energies 2022, 15, 5511. [Google Scholar] [CrossRef]

- Hamwi, M.; Understanding and Analysing Business Models in the Context of Energy Transition. Proposition of the DRBMC (Demand Response Business Model Canvas) to Design New Entrepreneur’s Business Model in “Demand Response” Markets. Automatic. Université de Bordeaux. 2019. Available online: https://theses.hal.science/tel-02316384v2 (accessed on 15 June 2024).

- European Commission. Fit for 55 Package. COM/2021/550-2020 and 2021. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021DC0550 (accessed on 22 February 2023).

- European Commission. REPowerEU: A Plan to Rapidly Reduce Dependence on Russian Fossil Fuels and Fast Forward the Green Transition. 2022. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_22_3131 (accessed on 1 July 2022).

- European Commission. Renewable Energy Targets. 2022. Available online: https://energy.ec.europa.eu/topics/renewable-energy/renewable-energy-directive-targets-and-rules/renewable-energy-targets_en#:~:text=The%202030%20targets,-Building%20on%20the&text=The%20Commission%20presented%20Europe’s%20new,overall%20energy%20mix%20by%202030 (accessed on 31 July 2022).

- PEP 2040, 2021. Polityka Energetyczna Polski do 2040r. (PEP 2040. Energy Policy of Poland Until 2040). Ministry of Climate and Environment: Poland. Available online: https://www.gov.pl/web/klimat/polityka-energetyczna-polski-do-2040-r-przyjeta-przez-rade-ministrow (accessed on 14 January 2024).

- Jonek-Kowalska, I. Towards the reduction of CO2 emissions. Paths of pro-ecological transformation of energy mixes in European countries with an above-average share of coal in energy consumption. Resour. Policy 2022, 77, 102701. [Google Scholar] [CrossRef]

- Hargroves, K.; James, B.; Lane, J.; Newman, P. The Role of Distributed Energy Resources and Associated Business Models in the Decentralised Energy Transition: A Review. Energies 2023, 16, 4231. [Google Scholar] [CrossRef]

- Sułek, A.; Borowski, P.F. Business Models on the Energy Market in the Era of a Low-Emission Economy. Energies 2024, 17, 3235. [Google Scholar] [CrossRef]

- Atstaja, D.; Cudecka-Purina, N.; Koval, V.; Kuzmina, J.; Butkevics, J.; Hrinchenko, H. Waste-to-Energy in the Circular Economy Transition and Development of Resource-Efficient Business Models. Energies 2024, 17, 4188. [Google Scholar] [CrossRef]

- Bryant, S.; Straker, K.; Wrigley, C. The typologies of power: Energy ulility business models in an increasingly renewable sector. J. Clean. Prod. 2018, 195, 1032–1046. [Google Scholar] [CrossRef]

- Frantzis, L.; Grahamm, S.; Katofskym, R.; Sawyerm, H. Photovoltaics Business Models. In Subcontract Report of the National of the U.S. Department of Energy, Office of Energy Efficiency& Renewable Energy; National Renewable Energy Laboratory: Golden, CO, USA, 2008. [Google Scholar]

- Matusiak, B.E. Modele Biznesowe na Nowym Zintegrowanym Rynku Energii; Uniwersytet Łódzki: Łódź, Poland, 2013; Available online: https://dspace.uni.lodz.pl:8443/xmlui/handle/11089/30259 (accessed on 14 January 2024).

- Faridpak, B.; Musilek, P. Resilient Operation Strategies for Integrated Power-Gas Systems. Energies 2024, 17, 6270. [Google Scholar] [CrossRef]

- Ford, R.; Hardym, J. Are we seeing clearly? The need for aligned vision and supporting strategies to deliver net-zero electricity systems. Energy Policy 2020, 147, 111902. [Google Scholar] [CrossRef] [PubMed]

- Erdiwansyah; Gani, A.; Mamat, R.; Nizar, M.; Yana, S.; Rosdi, S.M.; Zaki, M.; Eko, S.R. The Business Model for Access to Affordable RE on Economic, Social, and Environmental Value: A Review. Geomat. Environ. Eng. 2023, 17, 5–43. [Google Scholar] [CrossRef]

- Knop, L.; Staszewska, J. Odporność modeli biznesu przedsiębiorstwa energetycznego w kontekście neutralności klimatycznej. Pr. Nauk. Uniw. Ekon. We Wrocławiu 2024, 68, 64–78. [Google Scholar]

- Staszewska, J. The impact of energy transition on the changes to the energy company’s business model. Sci. Pap. Silesian Univ. Technol.—Organ. Manag. Ser. 2022, 157, 537–558. [Google Scholar] [CrossRef]

- Gitelman, L.; Kozhevnikov, M. New Business Models in the Energy Sector in the Context of Revolutionary Transformations. Sustainability 2023, 15, 3604. [Google Scholar] [CrossRef]

- Gorzeń-Mitka, I.; Wieczorek-Kosmala, M. Mapping the Energy Sector from a Risk Management Research Perspective: A Bibliometric and Scientific Approach. Energies 2023, 16, 2024. [Google Scholar] [CrossRef]

- Tokarski, S.; Magdziarczyk, M.; Smoliński, A. An Analysis of Risks and Challenges to the Polish Power Industry in the Year 2024. Energies 2024, 17, 1044. [Google Scholar] [CrossRef]

- Spada, M.; Paraschiv, F.; Burgherr, P. A comparison of risk measures for accidents in the energy sector and their implications on decision-making strategies. Energy 2018, 154, 277–288. [Google Scholar] [CrossRef]

- Franc-Dąbrowska, J.; Mądra-Sawicka, M.; Milewska, A. Energy Sector Risk and Cost of Capital Assessment—Companies and Investors Perspective. Energies 2021, 14, 1613. [Google Scholar] [CrossRef]

- Cabała, P. Proces analitycznej hierarchizacji w ocenie wariantów rozwiązań projektowych (Analytical Hierarchy Process in the Assessment of Project Variants). Przedsiębiorstwo We Współczesnej Gospod.—Teor. I Prakt. Res. Enterp. Mod. Econ.—Theory Pract. 2018, 1, 23–33. [Google Scholar] [CrossRef]

- Encyclopedia of Management, Analytic Hierarchy Process—Encyclopedia of Management. Available online: https://www.mfiles.co.uk/ (accessed on 28 August 2021).

- Adamus, W.; Gręda, A. Wspomaganie decyzji wielokryterialnych w rozwiązywaniu wybranych problemów organizacyjnych i menedżerskich (Multiple criteria decision support in organizational and management chosen problems solving. Badania Oper. I Decyzyjne 2005, 2, 5–36. Available online: https://yadda.icm.edu.pl/baztech/element/bwmeta1.element.baztech-article-BUJ3-0004-0026 (accessed on 14 January 2024).

- Casey, M.A.; Kueger, R.A. Focus Groups: A Practical Guide for Applied Research, 3rd ed.; Sage: Thousand Oaks, CA, USA, 2000. [Google Scholar]

- Dilshad, R.M.; Latif, M.I. Focus Group Interview as a Tool for Qualitative Research: An Analysis. Pak. J. Soc. Sci. 2013, 33, 191–198. Available online: https://pjss.bzu.edu.pk/index.php/pjss/article/view/189 (accessed on 14 January 2024).

- Radic, M.; Herrmann, P.; Haberland, P.; Riese, C. Development of a Business Model Resilience Framework for Managers and Strategic Decision-makers. Schmalenbach J. Bus. Res. 2022, 74, 575–601. [Google Scholar] [CrossRef] [PubMed]

- Kashav, S.; Centobelli, P.; Cerchione, R.; Ertz, M. Managing supply chain resilience to pursue business and environmental strategies. Bus. Strat. Env. 2019, 29, 1215–1246. [Google Scholar] [CrossRef]

- Wieland, A.; Durach, C.F. Two perspectives on supply chain resilience. J. Bus. Logist. 2021, 42, 315–322. [Google Scholar] [CrossRef]

- Kasperczyk, D.; Urbaniec, K.; Barbusiński, K.; Rene, E.R.; Colmenares-Quintero, R.F. Development and adaptation of the technology of air biotreatment in trickle-bed bioreactor to the automotive painting industry. J. Clean. Prod. 2021, 309, 127440. [Google Scholar] [CrossRef]

- Capros, P.; Zazias, G.; Evangelopoulou, S.; Kannavou, M.; Fotiou, T.; Siskos, P.; de Vita, A.; Sakellaris, K. Energy-system modelling of the EU strategy towards climate-neutrality. Energy Policy 2019, 134, 110960. [Google Scholar] [CrossRef]

- Wang, Y.M.; Luo, Y.; Hua, Z. On the extent analysis method for fuzzy AHP and its applications. Eur. J. Oper. Res. 2008, 186, 735–747. [Google Scholar] [CrossRef]

- International Energy Agency. Net Zero by 2050 A Roadmap for the Global Energy Sector; International Energy Agency: Paris, France, 2021. Available online: www.iea.org (accessed on 6 February 2025).

- European Environment Agency. A Future Based on Renewable Energy; European Environment Agency: Copenhagen, Denmark, 2022; p. 7. Available online: www.eea.europa.eu (accessed on 6 February 2025).

- European Commission. Open Access to the Power Grid Shapes a More Sustainable Energy Future; European Commission: Luxembourg, Brussels, 2022. Available online: www.cordis.europa.eu (accessed on 6 February 2025).

- International Energy Agency. World Energy Employment; International Energy Agency: Paris, France, 2023. Available online: www.iea.org (accessed on 6 February 2025).

| Item | Researchers | The Approaches Presented |

|---|---|---|

| 1. | Berkes, Ross [28] | Presenting an integrated approach to community resilience research. |

| 2. | Francis, Beker [29] | Discussing the resilience assessment framework in five elements: identification system, vulnerability analysis, setting resilience goals, stakeholder engagement; the most important element of the assessment—continuous questioning of the organization’s risk model and recognition that failures may be inevitable. |

| 3. | Tobin [30] | Pointing to a framework for analyzing sustainability and resilience based on based on three theoretical models: the mitigation model, the recovery model and the structural—cognitive model. |

| 4. | Cutter, et al. [31] | Discussing a set of community resilience indicators that include ecological, social and economic, institutional, infrastructural and community competence dimensions. |

| 5. | Norris, et al. [32] | Describing a resilience model that links a network of adaptive capacities (resources with dynamic attributes) to adaptation after disruption or adversity, resilience results from four basic sets of adaptive capacities: economic development, social capital, information and communication, and community competence. |

| 6. | Mallak [33] | Presenting six factors influencing the resilience of an organization or individual: solution-focused goal orientation, avoidance, critical understanding, role dependence, source dependence, and resource availability. |

| 7. | Bruneau et al. [34] | Describing the dimensions of resilience, both physical and social systems: robustness, redundancy, resourcefulness, speed—four dimensions of resilience: technical, organizational, social and economic. |

| 8. | Walker et al. [35] | Presenting an assessment of resilience along four dimensions: latitude (the spectrum of attraction and diversity of system options), resistance (the system’s capacity for change and thus the system’s ability to talk and learn), uncertainty (distances to critical points and the probability of exceeding them) and panarchy (the system’s dependencies on other systems and interactions). |

| 9. | Longstaff et al. [36] | Pointing out critical elements for assessing resilience; five subsystems in terms of efficiency, diversity and redundancy and its adaptability in terms of institutional memory, capacity for innovation and internal and external bonding; proposing questions to assess the resilience of the community subsystem. |

| 10. | Ince et al. [27] | Discussing research on organizational resilience, focusing on the dimensions, actions and responses of organizations to disruptions or crises that affect performance and business continuity, as well as the characteristics of and capabilities that distinguish resilient organizations from other organizational management concepts: strategic planning, knowledge management and innovation. |

| 11. | McManus [37] | Describing a method of multiple case studies and a five-step process for assessing resilience, interviews and observation; 15 indicators of resilience. |

| 12. | Stephenson et al. [38] | Representing a modification in S. McManus’ model for measuring organizational resilience with an additional dimension—the resilience ethos; an additional six indicators. |

| 13. | Otola et al. [39,40] | combine theoretical and empirical perspectives on the two issues of trust and organizational resilience in an environment that is difficult to predict. |

| 14. | Taeuscher and Abdelkafi [41,42] | find that the reliability of a business model decreases if the structure is intolerant of the uncertain dynamics associated with its components. The robustness of a business model increases with decreasing uncertainty about its components and increasing tolerance to unpredictable component dynamics. The level of uncertainty of key components, tolerance to volatility and unpredictable component dynamics, feedback on the effectiveness of the business model, and adaptability of the business model structure constitute the four groups of business model resilience analysis criteria proposed by the authors. |

| Item | Component | Supporting Questions |

|---|---|---|

| I | Customer value | What are the key factors responsible for the resilience of the value offered to customers in the business model? (Is the model aligned with customer/segment requirements and market environment? Is it consistent with external expectations?) |

| II | Resources and competences | What are the key factors responsible for the resilience of resources and competencies in the business model? (Are the resources required by the business model for its implementation secured in the company’s existing capabilities now and in the future?) |

| III | Value chain | What are the key factors responsible for value chain resilience in the business model? (Do the designed value chain and processes allow for effective exploitation and renewal of resources and skills?) |

| IV | Value capture and profitability | What are the key factors responsible for the resilience of value capture and profitability in the business model? (Does the designed architecture of the value creation mechanisms enable value delivery? Is the designed architecture of the value capture mechanisms effective?) |

| V | Sustainable development | What are the key sustainability drivers influencing the resilience of the business model? (Do the mechanisms of the business model enable sustainability?) |

| VI | Alignment with strategy | What are the key factors responsible for aligning the business model with the company’s strategy? (Do the mechanisms of the model enable strategy implementation?) |

| Customer Value | Resources and Competences | Value Chain |

|---|---|---|

| (V1) A diversified, flexible offer tailored to the needs of products and services and meeting the needs of customers. (V2) The speed of introducing changes to the offer, allowing you to stay ahead of the competition. (V3) Media monitoring, building contacts and relations with the media. (V4) Communication and customer relations. (V5) Continuous improvement of customer service standards. (V6) Communication processes with the external and internal environment. (V7) Standards and procedures for testing the quality of products/services and customer service. (V8) Monitoring the effectiveness of marketing activities, including acquiring new and losing customers. (V9) Procedures and tools to support the maintenance of existing and recovery of lost customers. (V10) Standards to protect the value offered to the customer and the competitive advantages achieved. | (R1) Production assets adapted to the consequences of extreme weather events and weather variability in Business Areas sensitive to these factors. (R2) Production and network assets adapted to the generation of renewable energy and zero and low-emission technologies for the generation of electricity and heat. (R3) Availability of environmental resources. (R4) Meeting the requirements of the licensed activity. (R5) Procedures for maintaining the required level of performance of pollution abatement devices. (R6) Constant supervision over compliance with the conditions of environmental decisions. (R7) Constant technical supervision of production assets, particularly those exposed to weather anomalies. (R8) Procedures for monitoring the condition of machinery, equipment and installations and for responding to emergencies. (R9) Asset insurance against random events (excluding assets underground). (R10) Procedures for monitoring the availability of generating units and demand reduction and transferring capacity obligations requiring reservation to dedicated intra-group reserve units or external entities. (R11) Developed and maintained business continuity plans. (R12) IT solutions with technical parameters, ensuring an acceptable level of reliability and efficiency of operation. (R13) Plans for the protection of facilities subject to mandatory protection. (R14) Procedures for complying with applicable information protection rules. (R15) Procedures and mechanisms to reduce the risk to resources in the event of emergency events. (R16) Ability to meet obligations on an ongoing basis. (R17) Ability to obtain and handle financing. (R18) Conducting a policy of dialogue with the Social Party and active internal communication in employee matters. (R19) Adoption and implementation of the Recruitment, Selection and Adaptation Policy of Company Employees and the Policy of compliance with the Ethics Rules and counteracting Mobbing and Discrimination. Diversity Policy and Human Rights Respect Policy. (R20) Development of staff competences, enhancing professional skills and the work culture of employees in line with strategic objectives. (R21) Raising the level of employee awareness in the field of security and data protection. | (C1) Risk level of the entire value chain and its individual links. (C2) Compliance of the processes with the applicable regulations. (C3) Monitoring and analysis of new technological solutions limiting the impact of adverse weather conditions on the volume of electricity produced. (C4) Implemented Internal Control System and control mechanisms for conducted processes. (C5) Implemented business continuity plan. (C6) Implemented mechanisms and tools for collecting information on threats and identifying potential security threats. (C7) Implemented Code of Conduct for Contractors. (C8) Standardization of the rules of conducting proceedings in the purchasing process and its transparency. (C9) Durability of relations with contractors/suppliers. (C10) Diversification of contractors and suppliers, eliminating business continuity threats. (C11) Process maturity and flexibility of process management. (C12) Implemented procedures for reporting external fraud. (C13) Constant monitoring of the legal environment and changes in legal regulations related to information security or compliance. (C14) Monitoring the process of implementing changes to internal regulations required by law. (C15) Procedures and standards for monitoring working conditions and the correctness of its organization. (C16) Use and development of external and internal communication tools. (C17) Monitoring of situations and events that may cause social anxiety. (C18) Constant monitoring of external and internal threats. (C19) Planning and conducting training in the field of continuity of operation and security of manufacturing infrastructure, IT and OT. (C20) Planning and conducting training for employees in the field of applicable safety procedures. (C21) Debt management |

| Value capture and profitability | Sustainable development | Alignment with strategy |

| (P1) Diversified revenue streams (P2) Stability of revenue streams (P3) Planning, monitoring and control of financial parameters (revenue, costs, results) and the impact of changes on the covenant. (P4) EBITDA generated within the business model. (P5) Mechanisms to eliminate the adverse impact of changes in exchange rates on earnings and the size of exposure to minimize the negative effects of changes in interest rates. (P6) Mechanisms to eliminate adverse price movements in the wholesale electricity market and related product markets, including the price of CO2 emission allowances, resulting in a negative impact on the financial result. (P7) Procedures to monitor changes in weather conditions to take action to mitigate the effects of falling energy and heat sales volumes, falling production volumes, deteriorating quality indicators and regulated revenue. (P8) Transfer of interest rate risk using derivatives. (P9) Procedures and standards for assessing the financial health and reliability of suppliers, contractors and subcontractors. (P10) An organizational culture focused on building value. | (D1) Defined strategy of sustainable development. (D2) Mechanisms and tools of corporate social responsibility aimed at building long-term value. (D3) The degree of impact of business activities on the environment and the use of its resources. (D4) Implemented Climate policy. (D5) Implemented Environmental policy. (D6) Mechanisms to prevent above-normal pollution, damage, disturbance or failure of installations or equipment resulting in a negative impact on the environment. (D7) Implementation of investments from the sphere of environmental protection to minimize the effects of the adverse impact of mining and processing activities on the environment and climate. (D8) Technical and organizational solutions to minimize the impact of activities on climate change | (S1) Defined strategy with strategic options considering changes in the conditions of the environment. (S2) Matching individual components of the model to the strategy. (S3) Include EU climate policy objectives in the strategy. (S4) Strategy review and update mechanisms |

| Customer Value | Resources and Competences | Value Chain | Value Capture and Profitability | Sustainable Development | Alignment with Strategy |

|---|---|---|---|---|---|

| 0.1754 | 0.4148 | 0.2751 | 0.5029 | 0.1862 | 0.1440 |

| Item | Model Element Business | Key Resilience Factors Identified Through Relevance Analysis |

|---|---|---|

| 1. | Customer value | (V10) Standards to protect the value offered to the customer and the competitive advantages achieved. (V9) Procedures and tools to support the retention of existing and recovery of lost customers. (V1) A diversified, flexible offer tailored to the demand for products and services and in line with customer needs. (V6) Communication and customer relations. |

| 2. | Resources and competences | (R16) Ability to meet obligations on an ongoing basis. (R17) Ability to obtain and handle funding. (R20) Development of staff competences, enhancing professional skills and the work culture of employees in line with strategic objectives. (R2) Production and network assets adapted to the generation of renewable energy and zero and low-emission technologies for the generation of electricity and heat. (R4) Meeting the requirements of the licensed activity. (R7) Constant technical supervision of production assets, particularly those exposed to weather anomalies. |

| 3. | Value chain | (C21) Receivables management. (C1) Risk level of the entire value chain and its individual links. (C18) Constant monitoring of external and internal threats. (C5) Implemented business continuity plan. (C6) Implemented mechanisms and tools to collect threat information and identify potential security risks. (C2) Compliance of the processes with the applicable regulations (C20) Planning and conducting training for employees on applicable safety procedures. (C10) Diversification of contractors and suppliers, eliminating threats to business continuity. |

| 4. | Value capture and profitability | (P4) EBITDA generated within the business model. (P6) Mechanisms to eliminate adverse price movements in the wholesale electricity market and related product markets, including the price of CO2 emission allowances resulting in a negative impact on the financial result. (P2) Stability of revenue streams. (P7) Procedures to monitor changes in weather conditions to take action to mitigate the effects of falling energy and heat sales volumes, falling production volumes, deteriorating quality indicators and regulated revenue. (P3) Planning, monitoring, and control of financial parameters (revenue, costs, results) and the impact of changes on the covenant. |

| 5. | Sustainable development | (D6) Mechanisms to prevent above-normal pollution, damage, disturbance or failure of installations or equipment resulting in a negative impact on the environment. (D7) Implementation of investments from the sphere of environmental protection to minimize the effects of the adverse impact of mining and processing activities on the environment and climate. (D8) Technical and organizational solutions to minimize the impact of activities on climate change. |

| 6. | Alignment with strategy | (S1) Defined strategy with strategic options considering changes in the environmental conditions. (S2) Matching the individual components of the model to the strategy. (S3) Include EU climate policy objectives in the strategy. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Staszewska, J.; Knop, L. Identifying Resilience Factors of Power Company Business Models. Energies 2025, 18, 992. https://doi.org/10.3390/en18040992

Staszewska J, Knop L. Identifying Resilience Factors of Power Company Business Models. Energies. 2025; 18(4):992. https://doi.org/10.3390/en18040992

Chicago/Turabian StyleStaszewska, Joanna, and Lilla Knop. 2025. "Identifying Resilience Factors of Power Company Business Models" Energies 18, no. 4: 992. https://doi.org/10.3390/en18040992

APA StyleStaszewska, J., & Knop, L. (2025). Identifying Resilience Factors of Power Company Business Models. Energies, 18(4), 992. https://doi.org/10.3390/en18040992