Hybrid Fixed and Floating Wind Turbine Siting in the Mediterranean Region: An Energy and Economic Analysis

Abstract

1. Introduction

2. State-of-the-Art

2.1. Feasibility Studies on OWFs

2.2. Feasibility Studies on Floating OWFs

2.3. Innovation

3. Materials and Methods

3.1. Theoretical Background

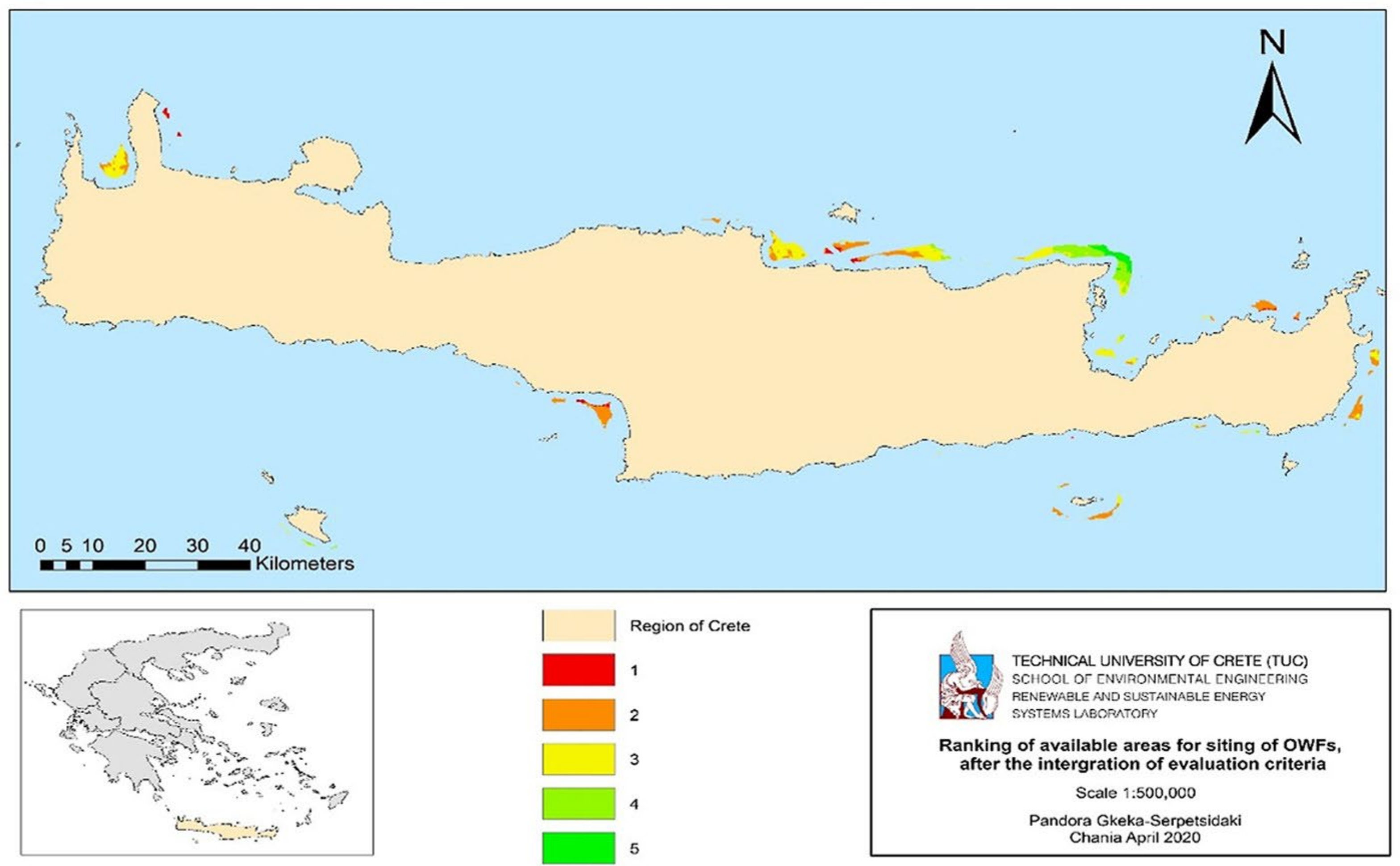

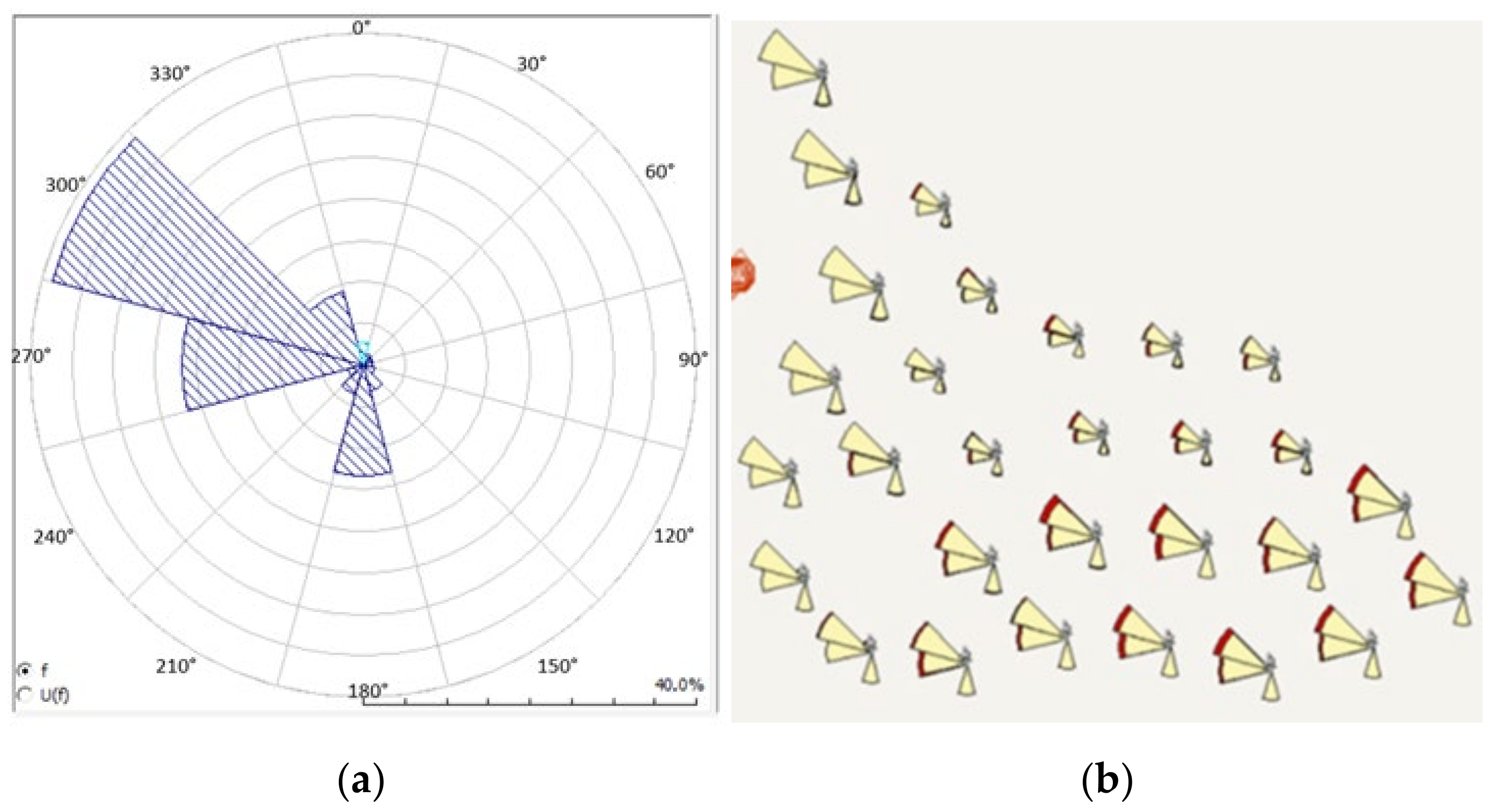

3.2. Study Area

3.3. Methodological Framework

- Payback period (PP)

- NPV (Net present value)

- Internal rate of return (IRR)

- Levelised cost of energy (LCOE)

4. Results

4.1. Results from the Energy Analysis

4.2. Results from the Economic Analysis

- Scenario 3 incurs a negative NPV of −94,167 k€ at the average price and −28,848 k€ at the maximum price.

- Scenario 2 offers a positive NPV of 12,298 k€ at the average price and a significantly higher positive NPV of 167,140 k€ at the maximum price. It stands out as the most attractive option due to its highest NPVs, lowest total cost, and highest annual revenues, making it preferable over Scenario 1 and Scenario 3 for better economic performance and revenue potential.

- Scenario 1: The PP turns positive for the average energy price between years 13 and 14. It becomes positive for the maximum energy price between years 9 and 10, with a 9-year PP observed between −29,699 k€ and 28,270 k€.

- Scenario 2: The PP for the average energy price turns positive between years 9 and 10, with the last negative value at −32,279 k€ and the first positive value at 18,564 k€. The PP turns positive for the maximum energy price between years 7 and 8, ranging from −7532 k€ to 62,227 k€.

- Scenario 3: The PP becomes favourable for the average energy price between years 12 and 13. The maximum energy price turns positive between years 9 and 10, ranging from −13,652 k€ to 37,930 k€.

- Scenario 1: The NPV for the average energy price is −119,076 k€, indicating a negative NPV, while the maximum price is 20,112 k€. Even though the peak value is high, the negative average value may indicate that some periods or conditions are high risk.

- Scenario 2: The average value is positive and reaches 12,298 k€, with a maximum positive and high value (167,140 k€), indicating stable profits and high returns.

- Scenario 3: The average NPV is −94,167 k€, while the maximum is 28,848 k€. Although the maximum value is positive, the average value is negative, indicating a risk of loss.

4.3. Sensitivity Analysis

4.4. Discussion Section

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AEP | Annual Energy Production |

| BFWT(s) | Bottom-Fixed Wind Turbine(s) |

| CAPEX | Capital Expenditure |

| DECEX | Decommissioning Cost |

| FWT(s) | Floating Wind Turbine(s) |

| GIS | Geographic Information System |

| IRR | Internal rate of return |

| LCOE | Levelised Cost of Energy |

| NPV | Net Present Value |

| OPEX | Operating Expenses |

| OWF(s) | Offshore Wind Farm(s) |

| OWT(s) | Offshore Wind Turbines(s) |

| PP | Payback Period |

| RES | Renewable Energy Sources |

| WF(s) | Wind Farm(s) |

| WT(s) | Wind Turbine(s) |

References

- Schallenberg-Rodríguez, J.; Montesdeoca, N.G. Spatial Planning to Estimate the Offshore Wind Energy Potential in Coastal Regions and Islands. Practical Case: The Canary Islands. Energy 2018, 143, 91–103. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Offshore Wind Outlook 2019: World Energy Outlook Special Report; International Energy Agency: Paris, France, 2019. [Google Scholar]

- Soares-Ramos, E.P.P.; de Oliveira-Assis, L.; Sarrias-Mena, R.; Fernández-Ramírez, L.M. Current Status and Future Trends of Offshore Wind Power in Europe. Energy 2020, 202, 117787. [Google Scholar] [CrossRef]

- Tsoutsos, T.; Tsitoura, I.; Kokologos, D.; Kalaitzakis, K. Sustainable Siting Process in Large Wind Farms Case Study in Crete. Renew. Energy 2015, 75, 474–480. [Google Scholar] [CrossRef]

- Gkeka-Serpetsidaki, P.; Tsoutsos, T. A Methodological Framework for Optimal Siting of Offshore Wind Farms: A Case Study on the Island of Crete. Energy 2022, 239, 122296. [Google Scholar] [CrossRef]

- Maienza, C.; Avossa, A.M.; Ricciardelli, F.; Scherillo, F.; Georgakis, C.T. A Comparative Analysis of Construction Costs of Onshore and Shallow- and Deep-Water Offshore Wind Farms. In Proceedings of the XV Conference of the Italian Association for Wind Engineering: IN VENTO 2018; Lecture Notes in Civil Engineering. Springer: Cham, Switzerland, 2019; Volume 27, pp. 440–453. [Google Scholar] [CrossRef]

- Martinez, A.; Iglesias, G. Multi-Parameter Analysis and Mapping of the Levelised Cost of Energy from Floating Offshore Wind in the Mediterranean Sea. Energy Convers. Manag. 2021, 243, 114416. [Google Scholar] [CrossRef]

- Faraggiana, E.; Ghigo, A.; Sirigu, M.; Petracca, E.; Giorgi, G.; Mattiazzo, G.; Bracco, G. Optimal Floating Offshore Wind Farms for Mediterranean Islands. Renew. Energy 2024, 221, 119785. [Google Scholar] [CrossRef]

- Dos Reis, M.M.L.; Mazetto, B.M.; da Silva, E.C.M. Economic Analysis for Implantation of an Offshore Wind Farm in the Brazilian Coast. Sustain. Energy Technol. Assess. 2021, 43, 100955. [Google Scholar] [CrossRef]

- Satir, M.; Murphy, F.; McDonnell, K. Feasibility Study of an Offshore Wind Farm in the Aegean Sea, Turkey. Renew. Sustain. Energy Rev. 2018, 81, 2552–2562. [Google Scholar] [CrossRef]

- Kim, C.K.; Jang, S.; Kim, T.Y. Site Selection for Offshore Wind Farms in the Southwest Coast of South Korea. Renew. Energy 2018, 120, 151–162. [Google Scholar] [CrossRef]

- Spyridonidou, S.; Vagiona, D.G.; Loukogeorgaki, E. Strategic Planning of Offshore Wind Farms in Greece. Sustainability 2020, 12, 905. [Google Scholar] [CrossRef]

- Cali, U.; Erdogan, N.; Kucuksari, S.; Argin, M. Techno-Economic Analysis of High Potential Offshore Wind Farm Locations in Turkey. Energy Strategy Rev. 2018, 22, 325–336. [Google Scholar] [CrossRef]

- Sim, J. An Economic Evaluation of Potential Offshore Wind Farm Sites in South Korea Using a Real Options Approach. Energy Rep. 2023, 10, 29–37. [Google Scholar] [CrossRef]

- Ohunakin, O.S.; Matthew, O.J.; Adaramola, M.S.; Atiba, O.E.; Adelekan, D.S.; Aluko, O.O.; Henry, E.U.; Ezekiel, V.U. Techno-Economic Assessment of Offshore Wind Energy Potential at Selected Sites in the Gulf of Guinea. Energy Convers. Manag. 2023, 288, 117110. [Google Scholar] [CrossRef]

- Díaz, H.; Soares, C.G. Cost and Financial Evaluation Model for the Design of Floating Offshore Wind Farms. Ocean Eng. 2023, 287, 115841. [Google Scholar] [CrossRef]

- Blanco, M.I. The Economics of Wind Energy. Renew. Sustain. Energy Rev. 2009, 13, 1372–1382. [Google Scholar] [CrossRef]

- Stehly, T.; Duffy, P. 2021 Cost of Wind Energy Review; NREL: Golden, CO, USA, 2021; pp. 1–65. [Google Scholar]

- Topham, E.; McMillan, D. Sustainable Decommissioning of an Offshore Wind Farm. Renew. Energy 2017, 102, 470–480. [Google Scholar] [CrossRef]

- Maienza, C.; Avossa, A.M.; Ricciardelli, F.; Coiro, D.; Troise, G.; Georgakis, C.T. A Life Cycle Cost Model for Floating Offshore Wind Farms. Appl. Energy 2020, 266, 114716. [Google Scholar] [CrossRef]

- Topham, E.; McMillan, D.; Bradley, S.; Hart, E. Recycling Offshore Wind Farms at Decommissioning Stage. Energy Policy 2019, 129, 698–709. [Google Scholar] [CrossRef]

- Aldersey-Williams, J.; Rubert, T. Levelised Cost of Energy—A Theoretical Justification and Critical Assessment. Energy Policy 2019, 124, 169–179. [Google Scholar] [CrossRef]

- The Crown Estate. Offshore Renewable Energy Catapult. In Guide to an Offshore Wind Farm; The Crown Estate: London, UK, 2019. [Google Scholar]

- Wind Farm Costs. Available online: https://guidetoanoffshorewindfarm.com/wind-farm-costs/ (accessed on 10 March 2023).

- Santhakumar, S.; Heuberger-Austin, C.; Meerman, H.; Faaij, A. Technological Learning Potential of Offshore Wind Technology and Underlying Cost Drivers. Sustain. Energy Technol. Assess. 2023, 60, 103545. [Google Scholar] [CrossRef]

- Tsarknias, N.; Gkeka-Serpetsidaki, P.; Tsoutsos, T. Exploring the Sustainable Siting of Floating Wind Farms in the Cretan Coastline. Sustain. Energy Technol. Assess. 2022, 54, 102841. [Google Scholar] [CrossRef]

- Santhakumar, S.; Smart, G.; Noonan, M.; Meerman, H.; Faaij, A. Technological Progress Observed for Fixed-Bottom Offshore Wind in the EU and UK. Technol. Forecast. Soc. Change 2022, 182, 121856. [Google Scholar] [CrossRef]

- Christoforaki, M.; Tsoutsos, T. Sustainable Siting of an Offshore Wind Park a Case in Chania, Crete. Renew. Energy 2017, 109, 624–633. [Google Scholar] [CrossRef]

- Giatrakos, G.P.; Tsoutsos, T.D.; Zografakis, N. Sustainable Power Planning for the Island of Crete. Energy Policy 2009, 37, 1222–1238. [Google Scholar] [CrossRef]

- Hellenic Hydrocarbons and Energy Resources Management Company S.A. (HEREMA). National Programme for the Development of Offshore Wind Farms, Athens, September 2023. Available online: https://herema.gr/wp-content/uploads/2023/10/%CE%A3%CE%A7%CE%95%CE%94%CE%99%CE%9F-%CE%95%CE%98%CE%9D%CE%99%CE%9A%CE%9F%CE%A5-%CE%A0%CE%A1%CE%9F%CE%93%CE%A1%CE%91%CE%9C%CE%9C%CE%91%CE%A4%CE%9F%CE%A3-%CE%A5%CE%91%CE%A0_%CE%95%CE%94%CE%95%CE%A5%CE%95%CE%A0.pdf (accessed on 1 October 2023).

- Hellenic Hydrocarbons and Energy Resources Management Company S.A. (HEREMA). Strategic Environmental Impact Assessment (SEIA)—National Programme for the Development of Offshore Wind Farms. Athens, September 2023, Greece: LDK Consultants & Nature Conservation Consultants (NCC). Available online: https://herema.gr/wp-content/uploads/2023/10/%CE%A3%CE%9C%CE%A0%CE%95_%CE%95%CE%B8%CE%BD%CE%B9%CE%BA%CF%8C-%CE%A0%CF%81%CF%8C%CE%B3%CF%81%CE%B1%CE%BC%CE%BC%CE%B1-%CE%A5%CE%91%CE%A0_%CE%95%CE%94%CE%95%CE%A5%CE%95%CE%A0.pdf (accessed on 1 October 2023).

- Regulatory Authority for Energy (RAE). Decision No. 88/2023: Determination of Renewable Energy Project Capacity Margin in Crete After the Completion of Phase II Interconnection with the Hellenic Electricity Transmission System (HETS), Pursuant to Paragraph 4 of Article 100 of Law 4821/2021 (Government Gazette A’ 134). Athens, Greece: RAE. 2023. Available online: https://www.raaey.gr/energeia/wp-content/uploads/2023/03/67%CE%A79%CE%99%CE%94%CE%9E-%CE%969%CE%A4.pdf (accessed on 20 October 2023).

- Independent Power Transmission Operator|IPTO. Available online: https://www.admie.gr/en (accessed on 22 April 2020).

- Biza, S.; Piromalis, D.; Barkas, D.; Psomopoulos, C.S.; Tsirekis, C.D. CREte–Peloponnese 150KV AC Interconnection. Simulation Results for Transient Phenomena in Main Switches. Energy Procedia 2019, 157, 1366–1376. [Google Scholar] [CrossRef]

- Gkeka-Serpetsidaki, P.T. Sustainable Siting of Offshore Wind Farms. Ph.D. Thesis, Technical University of Crete, Chania, Greece, 2024. [Google Scholar]

- Global Wind Atlas. Available online: https://globalwindatlas.info/ (accessed on 10 April 2020).

- Gkeka-Serpetsidaki, P.T.; Papadopoulos, S.; Tsoutsos, T. Assessment of the Visual Impact of Offshore Wind Farms. Renew. Energy 2022, 190, 358–370. [Google Scholar] [CrossRef]

- Gkeka-Serpetsidaki, P.; Tsoutsos, T. Integration Criteria of Offshore Wind Farms in the Landscape: Viewpoints of Local Inhabitants. J. Clean. Prod. 2023, 417, 137899. [Google Scholar] [CrossRef]

- González, J.S.; García, Á.L.T.; Payán, M.B.; Santos, J.R.; Rodríguez, Á.G.G. Optimal Wind-Turbine Micro-Siting of Offshore Wind Farms: A Grid-like Layout Approach. Appl. Energy 2017, 200, 28–38. [Google Scholar] [CrossRef]

- MHI Vestas Offshore Wind. Available online: https://www.mhivestasoffshore.com/ (accessed on 1 April 2020).

- Offshore Wind Turbines I Siemens Gamesa. Available online: https://www.siemensgamesa.com/global/en/home/products-and-services/offshore.html (accessed on 1 April 2020).

- Castro-Santos, L.; Filgueira-Vizoso, A.; Lamas-Galdo, I.; Álvarez-Feal, C.; Carral-Couce, L. Influence of the Discount Rate in the Economic Analysis of a Floating Offshore Wind Farm in the Galician Region of the European Atlantic Area. In Proceedings of the International Conference on Offshore Mechanics and Arctic Engineering—OMAE, Madrid, Spain 17–22 June 2018; Volume 10. [Google Scholar] [CrossRef]

- Market Monitoring Report. Monthly-Public-2. Available online: https://www.raaey.gr/energeia/wp-content/uploads/2023/08/202301_Monthly_Report_Public_2_v2.pdf (accessed on 10 April 2024).

- Ghigo, A.; Cottura, L.; Caradonna, R.; Bracco, G.; Mattiazzo, G. Platform Optimization and Cost Analysis in a Floating Offshore Wind Farm. J. Mar. Sci. Eng. 2020, 8, 835. [Google Scholar] [CrossRef]

- ELIAMEP. The Socio-Economic Impact of Offshore Wind Energy in Greece. In Offshore Wind Energy in Greece: Estimating the Socio-Economic Impact; ELIAMEP: Athens, Greece, 2021. [Google Scholar]

| Type | 1st Scenario | 2nd Scenario | 3rd Scenario |

|---|---|---|---|

| Model of BFWTs | Vestas V164-9.5 MW | Vestas V236-15 MW | Siemens Gamesa SG167-8 MW |

| Number of BFWTs | 19 | 11 | 18 |

| Model of FWT | Siemens Gamesa SG154-6 MW | Siemens Gamesa SG154-6 MW | Siemens Gamesa SG154-6 MW |

| Number FWTs | 10 | 8 | 11 |

| Sum | 29 | 19 | 29 |

| £ | € | |

|---|---|---|

| Development and licencing services | 12,025,000 | 13,982,558 |

| (i) Environmental studies, (ii) Assessment of resources, (iii) Geological and hydrological studies, (iv) Engineering and consultancy | 3,848,000 | 4,474,419 |

| Other (includes developer staff hours and other subcontracted work) | 12,987,000 | 15,101,163 |

| Project development and management (Sum) | 28,860,000 | 33,558,140 |

| 19 BFWTs (1 M£/MW) | 180,500,000 | 209,883,721 |

| 10 FWTs (1.3 M£/MW) | 78,000,000 | 90,697,674 |

| OWTs (Nacelle, rotor, tower, etc.) (Sum) | 258,500,000 | 300,581,395 |

| Offshore substation (electrical system, facilities, structure) | 28,860,000 | 33,558,140 |

| Onshore substation (Buildings, access, security, other) | 7,215,000 | 8,389,535 |

| Cables (Extract & Type & Anchor & Protect) | 40,885,000 | 47,540,698 |

| Foundation installation | 18,050,000 | 20,988,372 |

| Offshore substation installation | 6,317,500 | 7,345,930 |

| Construction of onshore substation | 4,512,500 | 5,247,093 |

| Onshore installation of export cables | 902,500 | 1,049,419 |

| Offshore cable installation | 39,710,000 | 46,174,419 |

| WT installation | 9,025,000 | 10,494,186 |

| Offshore logistics | 541,500 | 629,651 |

| Other | 38,266,000 | 44,495,349 |

| Installation and commissioning BFWTs (Sum) | 117,325,000 | 136,424,419 |

| Installation Floating type TLP (steel) | 6,519,767 | 7,581,125 |

| Synthetic rope | 334,884 | 389,400 |

| Chain | 125,581 | 146,025 |

| Wire rope | 20,930 | 24,337 |

| Mooring (Sum) | 481,395 | 559,762 |

| Anchor | 265,116 | 308,275 |

| TOTAL CAPEX | 488,911,279 | 568,501,487 |

| Index | Years | Cost (k€) |

|---|---|---|

| CAPEX | 8 | 568,501 |

| OPEX | 25 | 546,278 |

| DECEX | 3 | 22,295 |

| Sum (CAPEX + OPEX + DECEX) | 36 | 1,137,075 |

| Average Energy Price Net Cash Flows | 36 | 412,424 |

| Maximum Energy Price Net Cash Flows | 36 | 821,723 |

| AEP (MWh) | 25 | 15,199 |

| NPV Average Energy Price | 36 | −119,076 |

| NPV Maximum Energy Price | 36 | 20,112 |

| Scenario | AEP (GWh) | PP (Years) | IRR (%) | NPV (k€) | LCOE (€/MWh) | CAPEX (k€) | OPEX (k€) | DECEX (k€) | |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Average Energy Price | 635.45 | 13th–14th | 3.74 | −119,076 | 33.9 | 568,501 | 546,278 | 22,295 |

| Maximum Energy Price | 9th–10th | 6.33 | 20,112 | ||||||

| 2 | Average Energy Price | 708.64 | 9th–10th | 6.23 | 12,298 | 27.8 | 505,037 | 485,295 | 19,807 |

| Maximum Energy Price | 7th–8th | 8.78 | 167,140 | ||||||

| 3 | Average Energy Price | 562.47 | 12th–13th | 3.97 | −94,167 | 32.3 | 492,696 | 473,436 | 19,323 |

| Maximum Energy Price | 9th–10th | 6.55 | 28,848 | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gkeka-Serpetsidaki, P.; Fotiou, D.; Tsoutsos, T. Hybrid Fixed and Floating Wind Turbine Siting in the Mediterranean Region: An Energy and Economic Analysis. Energies 2025, 18, 5739. https://doi.org/10.3390/en18215739

Gkeka-Serpetsidaki P, Fotiou D, Tsoutsos T. Hybrid Fixed and Floating Wind Turbine Siting in the Mediterranean Region: An Energy and Economic Analysis. Energies. 2025; 18(21):5739. https://doi.org/10.3390/en18215739

Chicago/Turabian StyleGkeka-Serpetsidaki, Pandora, Dimitris Fotiou, and Theocharis Tsoutsos. 2025. "Hybrid Fixed and Floating Wind Turbine Siting in the Mediterranean Region: An Energy and Economic Analysis" Energies 18, no. 21: 5739. https://doi.org/10.3390/en18215739

APA StyleGkeka-Serpetsidaki, P., Fotiou, D., & Tsoutsos, T. (2025). Hybrid Fixed and Floating Wind Turbine Siting in the Mediterranean Region: An Energy and Economic Analysis. Energies, 18(21), 5739. https://doi.org/10.3390/en18215739