The research aimed to determine the total future industrial heat demand globally and then to break this down into the number of reactors that might be able to meet this demand based on conservative assumptions. This can be broken down into the following three stages:

2.1. Demand Forecasting

Demand forecasting methodologies are based on predicting future demand based on historical demand and other impacting factors. The functional specification for the model required the prediction of the global energy demand for heat and electricity up until 2050 and the potential markets for nuclear energy.

The accuracy of the future forecast is dependent on the quality of the starting data, but there is limited public information available due to its commercial value. The most suitable data for energy demand comes from the IEA, which works with governments and local organisations to determine the energy spent in each sector. This data was available from 1960 for the 150 countries which the IEA work with. After reviewing the IEA data, it was determined that most countries that could deploy nuclear energy were within the IEA data, meaning this a suitable dataset to be used in the model. The IEA reports provide data on the primary energy sources delivered to each sector, such as raw materials (oil, coal, and natural gas) alongside secondary energy sources, e.g., heat. The granularity provided by the IEA for each heat demand is important to determine the temperature demands.

To forecast the demand, the model used an industry-standard approach where the natural log of the intensity of the energy is proportional to the gross domestic product per capita (GDPPC), as shown in Equation (1) [

16]. This method of demand forecasting is similar to that used in the IEA, who do not publish their forecasting methodology, but Hua Liao et al. propose a similar approach as shown in Equation (1) when ignoring market share against other technologies [

17]. This relationship can be expanded to include the change in GDPPC and, therefore, the intensity of the demand at future years.

The chosen method for the results presented in this article for demand forecasting were based upon fixed effects panel regression to determine the beta coefficients for each country.

The analysis was performed on data from 2009–2019 as these capture the transition to a low-carbon society and negate the energy impact of the COVID-19 pandemic. Therefore, any energy predictions used in this model assume that energy use will reach that of pre-COVID-19 levels, which aligns with the literature [

18].

GDPPC is required to perform the analysis, but this is not easily accessible globally. Therefore, the population database from the World Bank was used [

19] to provide forecasted populations for all the required countries. To predict the GDPPC, this used a combination of data from the International Monetary Fund (IMF) on the historical and predicted GDP per country until 2027 [

20]. Beyond 2027, the OECD’s GDP forecasts were used for 47 countries, grouping the countries per income group to predict GDP [

21]. Similar income groups for GDP growth (fractional) over time were applied to any countries missing in the IMF’s database. The use of additional datasets for the world population and GDPPC could provide more rigor and a method of integrating uncertainty into the model based on the data use. However, very few databases with these details for every country required are available and this limits the model to the data chosen.

To determine the beta coefficients (Equation (1)), a script was created in R version 4.1.2 [

22] using the PLM module version 2.6.0 [

23], which performed the panel regression based on the input data. The beta factors were then added to the model for the demand forecasting.

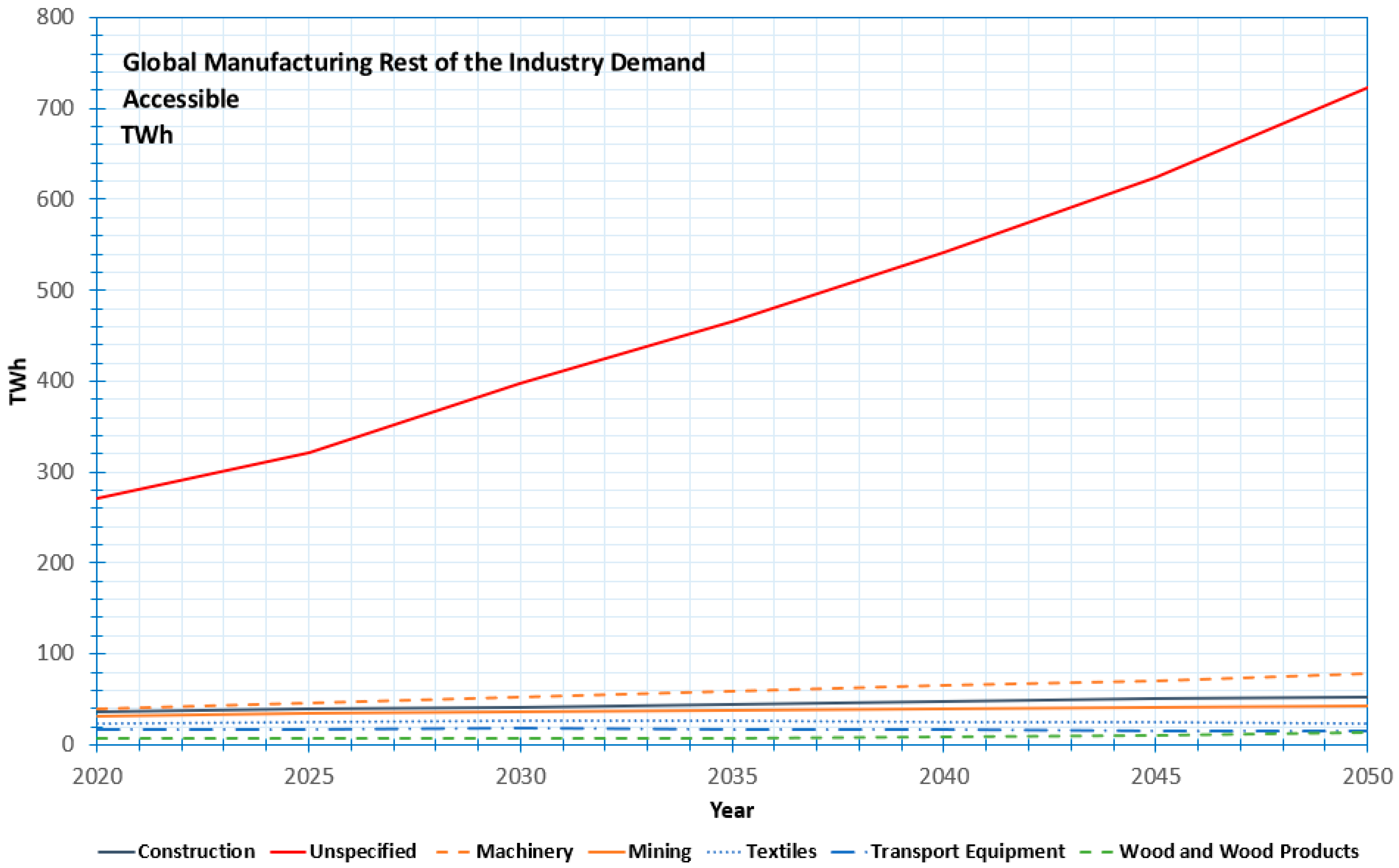

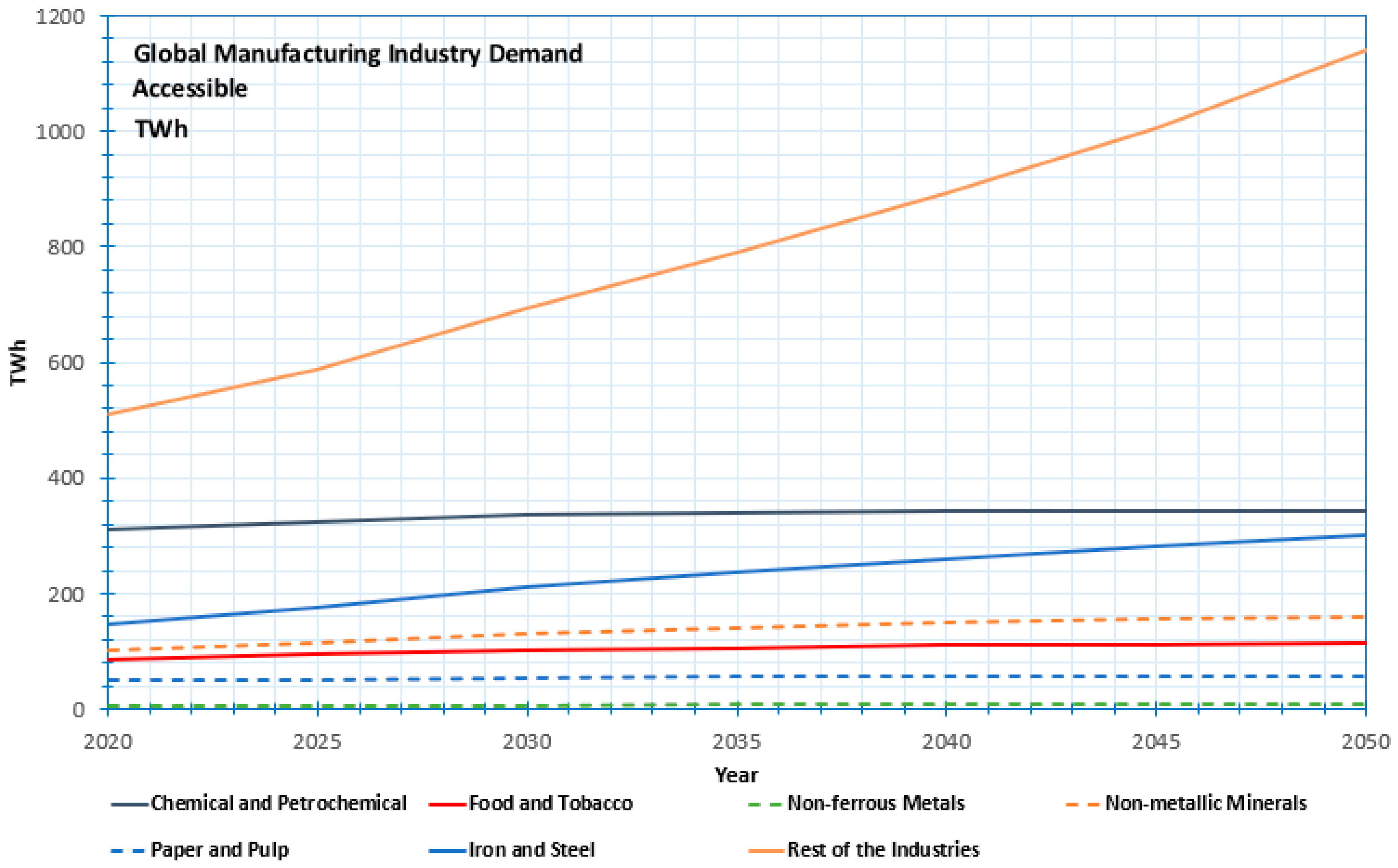

The model breaks down the heat demand into the thirteen industrial sectors based on the IEA datasets listed below (sometimes referred to as manufacturing in IEA documentation). It is noted that there are several industries which are missing from the IEA data—these industries are captured within the Unspecified category.

| Non-metallic Minerals Paper and Pulp Iron and Steel Textiles Transport Equipment Wood and Wood Products

|

IEA provides primary energy data for heat, coal, oil, and natural gas for each of the thirteen sectors, where all these energy demands were forecasted within the model to determine the required demands.

The option to include buildings in the analysis was omitted (despite data being available) due to the market for space heating being so vast. Due to the low temperatures of space heating, these could be supplied via waste heat of nuclear energy, but this would require a whole-system approach, which is beyond the scope of this study and could make the results seem overly optimistic.

This article focuses on replacing demands met by fossil fuels and has not considered a lifecycle assessment of the energy produced, which would provide a more comprehensive analysis of carbon savings.

2.2. Temperature Requirements

Each of the IEA datasets has different temperature requirements dependent on the process performed. During a literature review for each of the industries, it became apparent that there is limited information on the required temperatures for some industries. There are some modern examples where demands have been calculated, but there is limited information on how the temperatures for these processes were determined [

24]. One study by the Ecoheat & Power group in 2006 gathered data from industry users across Europe for their demand and temperature requirements. This study engaged end users, increasing the confidence in the data, such that it is still referenced today and used in European policy and IEA [

25,

26]. The Ecoheat 2006 study groups the IEA demand sectors into the following temperature ranges: low, medium and high temperatures, as denoted in

Table 1.

The broad ranges of temperatures assigned to

Table 1 require further refinement for the model to reduce uncertainty in processes greater than 400 °C. The >400 °C section has been split into two, up to 750 °C and over 750 °C, as these are commonly used temperature brackets. This next section provides some justifications for the temperatures used in the model.

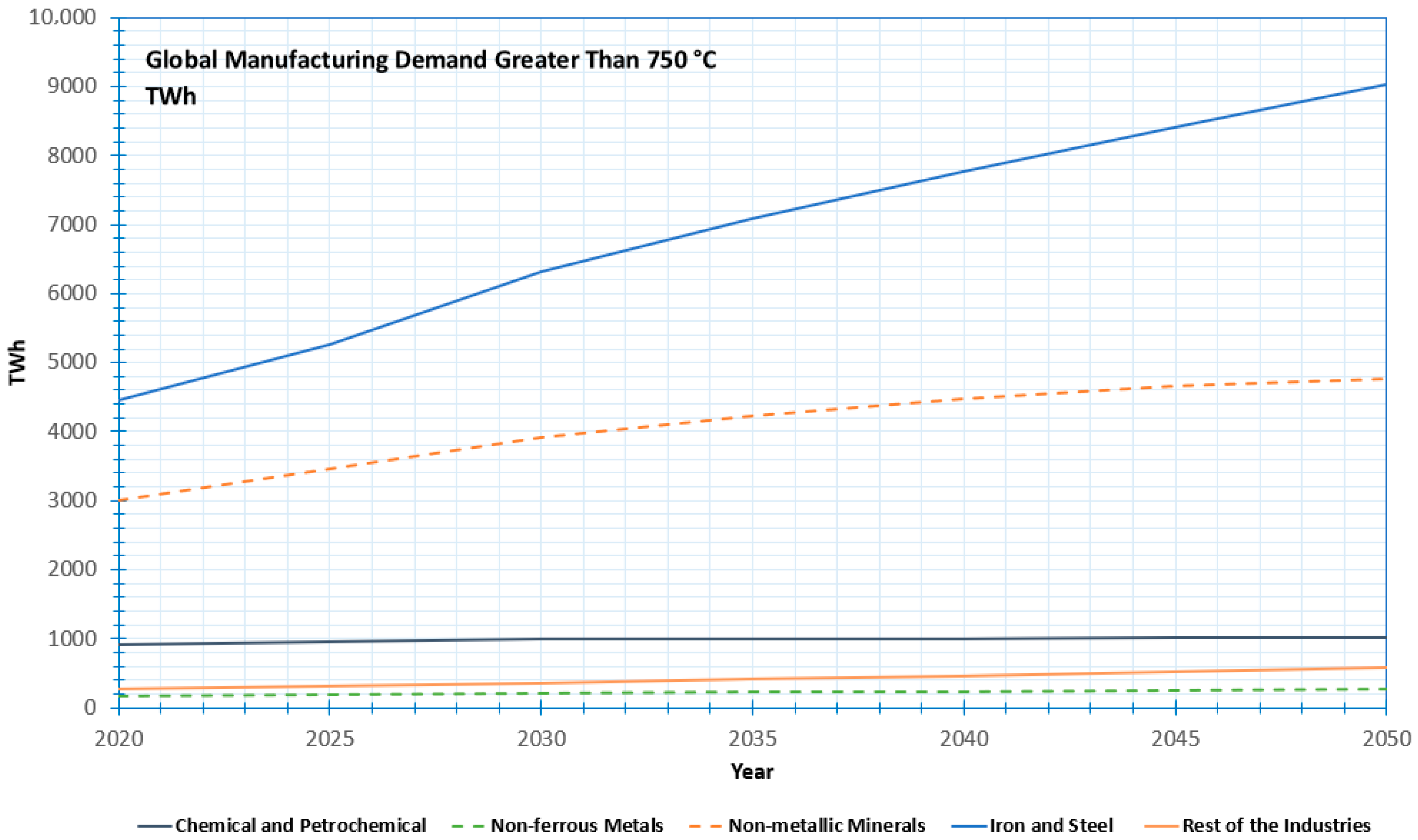

Chemical and petrochemical industry—Several high-temperature processes (>750 °C) are required in the chemical industry (e.g., ammonia and ethanol production [

24]). Processes such as coke and oil refinement require a temperature up to 730 °C, which account for a significant proportion (17%) of UK industrial heat demand [

27]. As this is one of the largest demands globally, there needs to be further clarification on the temperature ranges. Due to the challenge of finding data, the proportion of demand greater than 750 °C is assumed to be 50% of this demand, as this acts as a conservative representation.

Pulp and paper industry—M. Rehfeldt et al. note that chemical pulp requires <200 °C [

24]. There is limited information on processes greater than 400 °C, so the model assumes that all this high-temperature demand is below 750 °C.

Iron and Steel industry—The demands in this sector below 400 °C are negligible. Blast furnaces make up most of this demand, where 77% of the demand is greater than 1000 °C. The model, therefore, assumes that none of this demand is below 750 °C. It is recognised that, in some cases, blast furnaces are being phased out in favour of electric alternatives (which should be captured by the forecasting approach based on historical demand).

Non-metallic mineral products industry—The production of products such as glass (800–1500 °C), cement (1300–1500 °C), and ceramics (800–2700 °C) falls within this category [

27]. Each of these products require a variety of temperatures, but most of them are above 750 °C.

Non-ferrous metal industry—The demand for these materials is high due to the number of everyday products produced from them. Most manufacturing steps require process operations greater than 750 °C, e.g., Aluminium (1200 °C [

28]), Copper (1250 °C [

29]), Tin (1150 °C [

30]). This puts these demands beyond 750 °C.

Rest of the industries—The Ecoheat 2006 study groups all remaining industries together alongside the unspecified demand. Due to the breadth of these industries, it is assumed that the high-temperature demand is split evenly between <750 °C and >750 °C.

Comparison with the other cited literature indicates that there are large differences in predicted demands per sector [

24]. It is challenging to band an industry into temperature brackets, for example, there are 15,000 different chemicals produced, and not every chemical can be assessed in this analysis. This suggests that some sectors may benefit from a degree of flexibility in supplied heat and, in some cases, innovation could reduce the temperature requirements of these processes. These findings highlight the need for a better understanding of the global heat demands of industry, including specific information on the temperatures required and possible future developments.

The revised temperature demand profiles used in the model are shown in

Table 2, where the temperatures below 400 °C are from the Ecoheat 2006 study. These demands assume that similar processes will be used across all the industries, as developed from the European data in 2006. For temperatures which sit between brackets, the energy demand is linearly extrapolated across the bracket. For some of the industries with temperature requirements greater than 750 °C, nuclear-enabled hydrogen could be a viable option. Hydrogen production and demand from nuclear energy are not evaluated here to add conservatism to the outputs of this article. Aviation and shipping (transport) are omitted from the demand requirements in the current version of the model due to the limited market penetration for nuclear in these sectors at the time of writing.

As there is not an easy way to determine the future penetration of nuclear energy into the heat market, the model allows the user to input this data as a variable (percentage of total market). A conservative estimation of a 10% replacement of fossil fuel use has been chosen for this analysis. This 10% is likely to comprise the largest facilities in these sectors, which require constant throughput, where it is viable to locate a nuclear reactor on or near the location of the demand.

There is a limitation in the spatial distribution of the heat demand, as heat is not as easily transportable as electricity (but there are ongoing developments in this field [

31]). Some examples of how to integrate nuclear heat production in an industrial cluster have been performed, but more work is required to understand the practical application of the technology [

32].

Not all countries will be suitable for nuclear energy due to nuclear policies, regulation, and the viability of supply versus demand. The model incorporates several user-defined functions to filter out countries that currently cannot deploy nuclear for one of the following two reasons:

Nuclear capability—Nuclear market share is only possible if the country will have nuclear energy by the chosen market year. Countries which have stated they want to deploy nuclear and by when have been included for this filter.

Nuclear policy—The model should only consider countries where its legal and/or in line with governmental policies. This current assessment rules out the following countries: Australia, Austria, Belgium, Denmark, Germany, Ireland, Italy, Serbia, Spain, and Switzerland.

The model for this article uses the WNA countries which will have nuclear energy by 2040 to determine the new nations that will adopt the technology [

7]. Application of these filters (including WNA’s reference data) limits the total accessible market to 41 countries capable of using nuclear energy in 2050. This assumption is relatively conservative, as successful deployments are likely to encourage other countries to adopt the technology. Furthermore, there are a number of countries with anti-nuclear policies that are considering amending these in order to achieve their energy transition targets [

33].

2.3. Reactors Used in the Analysis

To determine the demand which can be met by different reactor types, the reactors being used in the analysis should be defined with relevant justifications. The heat market analysis was performed using a standard SMR light water reactor (LWR) with the parameters shown in

Table 3. These parameters were chosen to make this study applicable to a broad range of LWR vendors, but the market analysis can be tailored to other designs. Most reactors deployed globally are LWRs, which operate at an outlet temperature from 280 to 330 °C globally [

34]. For this analysis, a median value of 305 °C was used as the outlet temperature.

The heat analysis was also performed with a HTGR to determine the difference in market penetration on heat demand between the two designs. The only change in the HTGR parameters was that the outlet temperature was set to 900 °C, allowing access to a larger market.

The study recognises that there is a wide range of other reactor designs that may have advantages over those studied here. Very-High-Temperature Reactors (VHTRs) might obtain temperatures over 1000 °C, and the fluid fuel in molten salt reactors gives them a great deal of flexibility in design with relatively high potential heat output. However, this study has been restricted to the UK Government’s preferred technologies, as outlined in their Civil Nuclear: Roadmap to 2050 [

35]. HTGRs should be considered as an example technology representing the use case for any ANT; the exact choice of reactor is very likely to be site-, demand-, and application-specific.