The Real Option Approach to Investment Decisions in Hybrid Renewable Energy Systems: A Systematic Literature Review

Abstract

1. Introduction

- What is the current state of the art in the ROA applied to multiple RES technologies with a focus on HP and PV in the area of power generation?

- What are the main findings, novel gaps, and future directions of this research area in the context of the energy transition?

2. Materials and Methods

2.1. Search Strategy and Selection Process

2.2. Meta-Analysis

3. Results

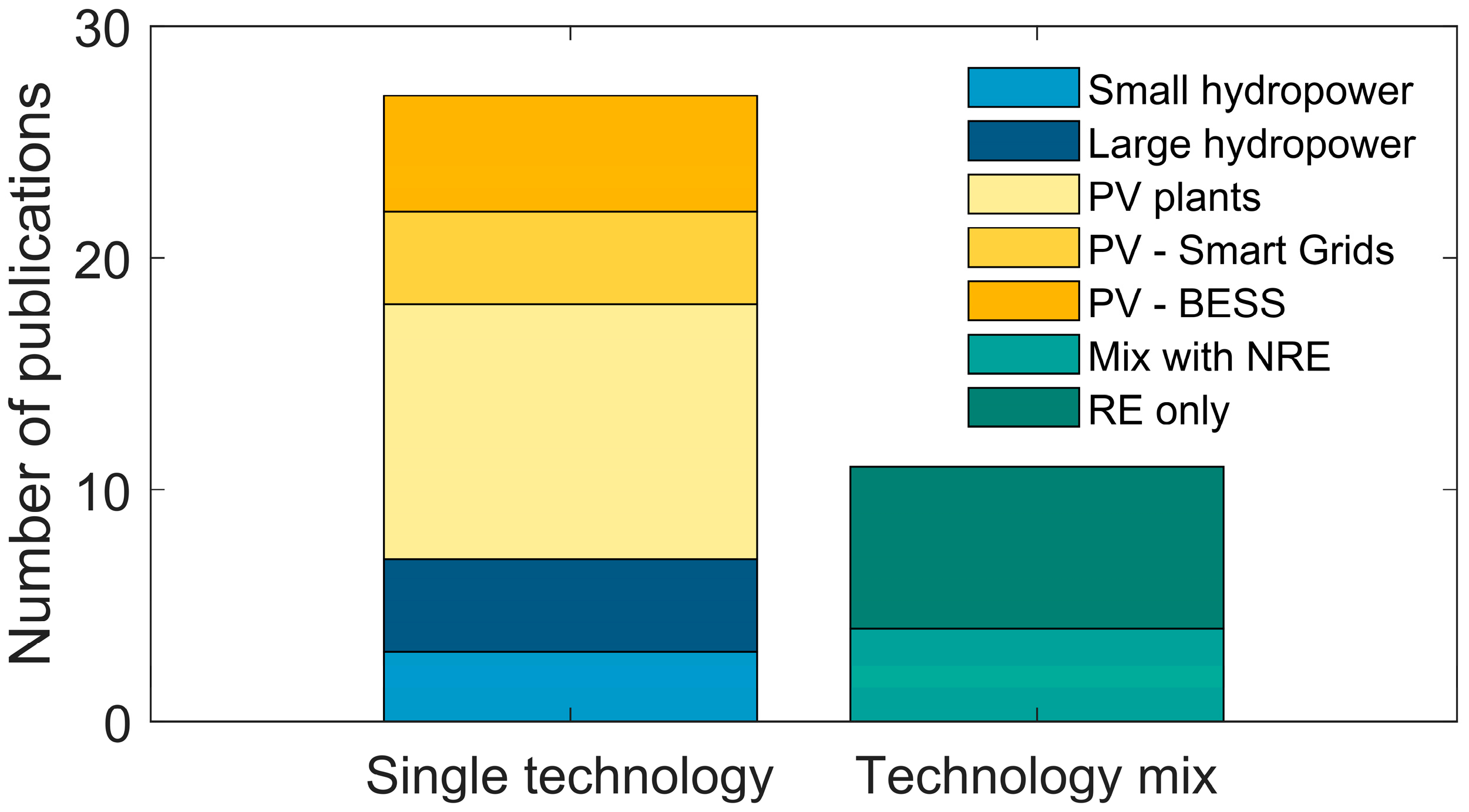

3.1. Technology Adoption

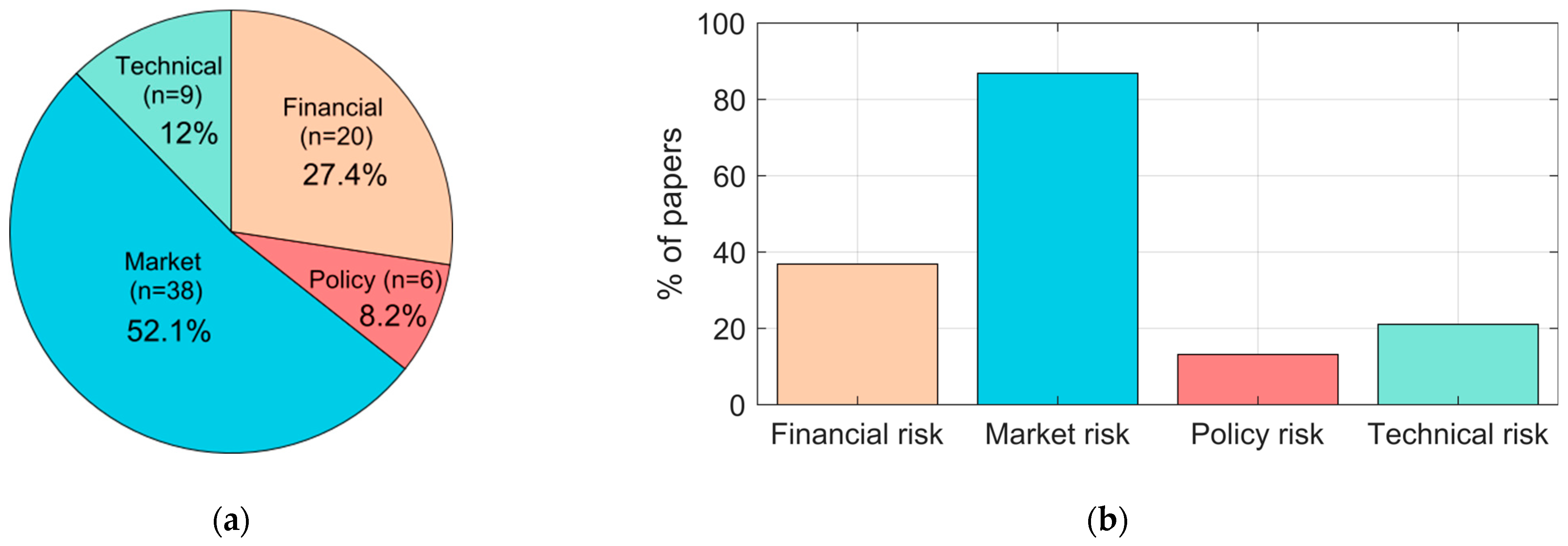

3.2. Source of Uncertainty, Uncertainty Modeling, and Real Options

4. Discussion

4.1. Hydropower Projects

4.2. Solar Photovoltaic Projects

4.3. Technology Mix

4.4. HRES Overview

4.5. Practical Implications for Investors and Planners

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| ROA | Real option approach |

| GHG | Greenhouse gas |

| EU | European Union |

| CC | Climate change |

| CEP | Clean Energy Package |

| CECs | Citizen energy communities |

| RECs | Renewable energy communities |

| RES | Renewable energy sources |

| RE | Renewable energy |

| HRES | Hybrid renewable energy systems |

| RO | Real option |

| R&D | research and development |

| PV | Photovoltaic |

| HP | Hydropower |

| SHP | Small hydropower |

| DP | Dynamic programming |

| O&M | Operation and maintenance |

| NRE | Non-renewable energy |

| GBM | Geometric Brownian motion |

| RoR | Run-of-river |

| NPV | Net Present Value |

| CER | Certified emission reductions |

| IDM | Investment Decision-Making |

| BESS | Battery energy storage systems |

| SGs | Smart grids |

| CAPEX | Capital expenditure |

| PVB | PV battery |

| BIPV | Building integrated photovoltaic |

| P2P | Peer-to-peer |

| LCOE | Levelized Cost of Energy |

| UET | Unconventional energy technology |

| RSHPP | Ringwall storage hybrid power plant |

Appendix A

| Energy Source(s) | Authors and Ref. | Year | Power Generation Technology | Country | Option | Valuation Approach | Source of Uncertainty |

|---|---|---|---|---|---|---|---|

| HYDRO | Bockman et al. [113] | 2008 | SHP plants | Norway | To defer | DP | Electricity price |

| Martínez-Ceseña and Mutale [109] | 2011 | Storage HP plants | Other | To defer | Decision tree | Electricity price | |

| Andersson et al. [110] | 2014 | Storage HP plants | Norway | To expand | DP | Electricity price | |

| Fertig et al. [111] | 2014 | Pumped-storage HP plants | Germany Norway | To defer | Simulations | Electricity price | |

| Linnerud and Simonsen [114] | 2014 | SHP plants | Norway | To defer | Simulations | Electricity price, policy (subsidies) | |

| Locatelli et al. [112] | 2016 | Pumped-storage HP plants | UK | Time-to-build | Simulations | Capital cost | |

| Kim et al. [115] | 2017 | SHP plants | Indonesia | Compound option (to fund/abandon) | Decision tree | O&M cost, energy production, tariff, CER price | |

| SOLAR | Martínez-Ceseña and Mutale [89] | 2011 | Off-grid PV plants | UK | Time-to-build | Decision tree | Consumer demand |

| Martínez-Ceseña et al. [90] | 2013 | Domestic PV plants | UK | To defer | Others | PV efficiency, PV cost | |

| Biondi and Moretto [91] | 2015 | Domestic PV plants | Italy | To defer | DP | Electricity price, PV costs | |

| Gahrooei et al. [92] | 2016 | Domestic PV plants | US | To defer | DP | Building energy demand, electricity price | |

| Zhang et al. [157] | 2016 | Domestic PV plants | China | To defer | DP | CO2 price, NRE cost, RE investment cost, electricity price | |

| Kim et al. [94] | 2017 | Domestic PV plants | South Korea | To defer | Decision tree | Electricity price | |

| Bertolini et al. [100] | 2018 | Domestic PV plants | Italy | To defer To switch | DP | Electricity price (selling) | |

| Moon and Baran [95] | 2018 | Domestic PV plants | US, Germany, Japan, and Korea | To defer | DP | PV Cost | |

| D’Alpaos and Moretto [101] | 2019 | Domestic PV plants | Italy | To switch To defer | Simulations | Electricity price (selling) | |

| Penizzotto et al. [96] | 2019 | Domestic PV plants | Argentina | To defer | Simulations | Electricity price, PV cost | |

| Di Bari [97] | 2020 | Domestic PV plants | Italy | To defer | Decision tree | Electricity price | |

| Kelly and Leahy [105] | 2020 | Not specified | Ireland | To defer | Simulations | Electricity price, future BESS CAPEX and degradation | |

| Ma et al. [106] | 2020 | Domestic PVBs | Australia | Compound option (to defer/expand) | Simulations | Peak power demand, diesel price and generator cost, PV-battery cost | |

| Castellini et al. [102] | 2021 | Domestic PV plants | Italy | To defer | DP | Electricity price (selling) | |

| Castellini et al. [103] | 2021 | Domestic PV plants | Italy | To defer | DP | Electricity price (selling) | |

| Andreolli et al. [104] | 2022 | Domestic PVBs | Italy | To defer | DP | Electricity price | |

| Hassi et al. [107] | 2022 | Domestic PVBs | Chile | Compound option (To defer/expand) | Simulations | Electricity price, PV and battery cost | |

| Li and Cao [108] | 2022 | Domestic PVBs | China | Compound option (to delay/abandon and defer/expand) | DP | Electricity price, CO2 price | |

| Biancardi et al. [98] | 2023 | Domestic/utility-scale PV plants | Italy | Compound option (to switch size) | Simulations | Electricity price | |

| Or et al. [99] | 2024 | Domestic PV plants | Turkey | To defer | Simulations | PV and inverter costs, electricity tariff and distribution price | |

| MIX | Siddiqui and Fleten [83] | 2010 | UET and RE | Other | To deploy, to invest, to switch | DP | Electricity price, UET operating cost |

| Kjærland and Larsen [79] | 2010 | Storage HP and thermal power plants | Norway | To switch | DP | Reservoir level | |

| Reuter et al. [84] | 2012 | Wind power and pumped-storage HP plants | Germany and Norway | To defer | DP | Electricity price, energy production | |

| Detert and Kotani [80] | 2013 | Coal-fired, wind, and solar thermal power plants | Mongolia | To switch | DP | Fuel price | |

| Passos et al. [85] | 2014 | Wind power and SHP plants | Brazil | To defer | Simulations | Electricity price | |

| Rohlfs and Madlener [81] | 2014 | Coal-fired, wind, and gas-fired power plants | Germany | To defer | Decision tree | Electricity, coal, natural gas prices | |

| Weibel and Madlener [86] | 2015 | Pumped-storage HP plant, wind power and PV plants (ringwall storage hybrid power plant) | Germany | To defer | Decision tree | Wind intensity and solar irradiation, electricity price | |

| Mancini et al. [87] | 2016 | Wind power and PV power plants | Italy | To abandon | Decision tree | Energy production, market | |

| Gazheli and Van Den Bergh [40] | 2018 | Wind power and PV plants | Other | To defer | DP | Electricity price, wind and PV costs | |

| Li et al. [88] | 2019 | Storage HP and PV plants | Other | To defer | DP | Electricity price, wind and hydro costs | |

| Zhang et al. [82] | 2022 | Coal-fired, gas-fired, wind power, PV, and biomass plants | China | To defer | DP | Electricity, fuel, carbon prices, RE certificates, wind and PV costs |

References

- Darmstadter, J.; Fri, R.W. Interconnections between energy and the environment: Global challenges. Annu. Rev. Energy Environ. 1992, 17, 45–76. [Google Scholar] [CrossRef]

- Dincer, I.; Rosen, M.A. Energy, environment and sustainable development. Appl. Energy 1999, 64, 427–440. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Greenhouse Gas Emissions from Energy Data Explorer. Available online: https://www.iea.org/data-and-statistics/data-tools/greenhouse-gas-emissions-from-energy-data-explorer (accessed on 23 January 2024).

- Kaygusuz, K. Energy and environmental issues relating to greenhouse gas emissions for sustainable development in Turkey. Renew. Sustain. Energy Rev. 2009, 13, 253–270. [Google Scholar] [CrossRef]

- Smil, V. Energy Transitions; Bloomsbury Publishing: London, UK, 2010. [Google Scholar]

- European Commission. Joint Research Centre. GHG Emissions of All World Countries: 2023; Publications Office: Luxembourg, 2023. [Google Scholar]

- Larch, M.; Wanner, J. The consequences of non-participation in the Paris Agreement. Eur. Econ. Rev. 2024, 163, 104699. [Google Scholar] [CrossRef]

- European Commission. Energy and the Green Deal. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/energy-and-green-deal_en#a-clean-energy-transition (accessed on 23 January 2024).

- European Commission. Renewable Energy Targets. Available online: https://energy.ec.europa.eu/topics/renewable-energy/renewable-energy-directive-targets-and-rules/renewable-energy-targets_en (accessed on 30 January 2024).

- European Commission Clean Energy for All Europeans Package. Available online: https://energy.ec.europa.eu/topics/energy-strategy/clean-energy-all-europeans-package_en (accessed on 30 January 2024).

- The European Parliament and the Council of the European Union. Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on Common Rules for the Internal Market for Electricity and Amending Directive 2012/27/EU (Recast) (Text with EEA Relevance). Off. J. Eur. Union 2019, 158, 125–199. [Google Scholar]

- European Commission. Renewable Energy Directive. Available online: https://energy.ec.europa.eu/topics/renewable-energy/renewable-energy-directive-targets-and-rules/renewable-energy-directive_en (accessed on 30 January 2024).

- Lowitzsch, J.; Hoicka, C.E.; van Tulder, F.J. Renewable energy communities under the 2019 European Clean Energy Package—Governance model for the energy clusters of the future? Renew. Sustain. Energy Rev. 2020, 122, 109489. [Google Scholar] [CrossRef]

- The European Parliament and the Council of the European Union. Directive (EU) 2023/2413 of the European Parliament and of the Council of 18 October 2023 amending Directive (EU) 2018/2001, Regulation (EU) 2018/1999 and Directive 98/70/EC as regards the promotion of energy from renewable sources, and repealing Council Directive (EU) 2015/652. Off. J. Eur. Union 2023. Available online: http://data.europa.eu/eli/dir/2023/2413/oj (accessed on 23 January 2024).

- European Commission. Energy Communities. Available online: https://energy.ec.europa.eu/topics/markets-and-consumers/energy-communities_en (accessed on 30 January 2024).

- Milčiuvienė, S.; Kiršienė, J.; Doheijo, E.; Urbonas, R.; Milčius, D. The Role of Renewable Energy Prosumers in Implementing Energy Justice Theory. Sustainability 2019, 11, 5286. [Google Scholar] [CrossRef]

- Rathnayaka, A.J.D.; Potdar, V.M.; Dillon, T.; Kuruppu, S. Framework to manage multiple goals in community-based energy sharing network in smart grid. Int. J. Electr. Power Energy Syst. 2015, 73, 615–624. [Google Scholar] [CrossRef]

- Espe, E.; Potdar, V.; Chang, E. Prosumer Communities and Relationships in Smart Grids: A Literature Review, Evolution and Future Directions. Energies 2018, 11, 2528. [Google Scholar] [CrossRef]

- Roberts, J. Power to the people? Implications of the Clean Energy Package for the role of community ownership in Europe’s energy transition. Rev. Eur. Comp. Int. Environ. Law 2020, 29, 232–244. [Google Scholar] [CrossRef]

- Magnani, N.; Osti, G. Does civil society matter? Challenges and strategies of grassroots initiatives in Italy’s energy transition. Energy Res. Soc. Sci. 2016, 13, 148–157. [Google Scholar] [CrossRef]

- Johansen, K. Blowing in the wind: A brief history of wind energy and wind power technologies in Denmark. Energy Policy 2021, 152, 112139. [Google Scholar] [CrossRef]

- Wierling, A.; Schwanitz, V.J.; Zeiß, J.P.; Bout, C.; Candelise, C.; Gilcrease, W.; Gregg, J.S. Statistical Evidence on the Role of Energy Cooperatives for the Energy Transition in European Countries. Sustainability 2018, 10, 3339. [Google Scholar] [CrossRef]

- Huybrechts, B.; Mertens, S. The Relevance of the Cooperative Model in the Field of Renewable Energy. Ann. Public Coop. Econ. 2014, 85, 193–212. [Google Scholar] [CrossRef]

- Holstenkamp, L. The Rise and Fall of Electricity Distribution Cooperatives in Germany 2015. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2727780 (accessed on 30 January 2024).

- Bauwens, T.; Gotchev, B.; Holstenkamp, L. What drives the development of community energy in Europe? The case of wind power cooperatives. Energy Res. Soc. Sci. 2016, 13, 136–147. [Google Scholar] [CrossRef]

- Heras-Saizarbitoria, I.; Sáez, L.; Allur, E.; Morandeira, J. The emergence of renewable energy cooperatives in Spain: A review. Renew. Sustain. Energy Rev. 2018, 94, 1036–1043. [Google Scholar] [CrossRef]

- Soeiro, S.; Ferreira Dias, M. Energy cooperatives in southern European countries: Are they relevant for sustainability targets? Energy Rep. 2020, 6, 448–453. [Google Scholar] [CrossRef]

- Candelise, C.; Ruggieri, G. Status and Evolution of the Community Energy Sector in Italy. Energies 2020, 13, 1888. [Google Scholar] [CrossRef]

- Grignani, A.; Gozzellino, M.; Sciullo, A.; Padovan, D. Community Cooperative: A New Legal Form for Enhancing Social Capital for the Development of Renewable Energy Communities in Italy. Energies 2021, 14, 7029. [Google Scholar] [CrossRef]

- Haas, R.; Panzer, C.; Resch, G.; Ragwitz, M.; Reece, G.; Held, A. A historical review of promotion strategies for electricity from renewable energy sources in EU countries. Renew. Sustain. Energy Rev. 2011, 15, 1003–1034. [Google Scholar] [CrossRef]

- Streimikiene, D.; Siksnelyte-Butkiene, I.; Lekavicius, V. Energy Diversification and Security in the EU: Comparative Assessment in Different EU Regions. Economies 2023, 11, 83. [Google Scholar] [CrossRef]

- De Rosa, M.; Gainsford, K.; Pallonetto, F.; Finn, D.P. Diversification, concentration and renewability of the energy supply in the European Union. Energy 2022, 253, 124097. [Google Scholar] [CrossRef]

- Gitelman, L.; Kozhevnikov, M.; Visotskaya, Y. Diversification as a Method of Ensuring the Sustainability of Energy Supply within the Energy Transition. Resources 2023, 12, 19. [Google Scholar] [CrossRef]

- Odeh, R.P.; Watts, D. Impacts of wind and solar spatial diversification on its market value: A case study of the Chilean electricity market. Renew. Sustain. Energy Rev. 2019, 111, 442–461. [Google Scholar] [CrossRef]

- Bajpai, P.; Dash, V. Hybrid renewable energy systems for power generation in stand-alone applications: A review. Renew. Sustain. Energy Rev. 2012, 16, 2926–2939. [Google Scholar] [CrossRef]

- Shivarama Krishna, K.; Sathish Kumar, K. A review on hybrid renewable energy systems. Renew. Sustain. Energy Rev. 2015, 52, 907–916. [Google Scholar] [CrossRef]

- León Gómez, J.C.; De León Aldaco, S.E.; Aguayo Alquicira, J. A Review of Hybrid Renewable Energy Systems: Architectures, Battery Systems, and Optimization Techniques. Eng 2023, 4, 1446–1467. [Google Scholar] [CrossRef]

- Cretì, A.; Fontini, F. Economics of Electricity: Markets, Competition and Rules; Cambridge University Press: Cambridge, UK, 2019; ISBN 978-1-107-18565-4. [Google Scholar]

- Kozlova, M. Real option valuation in renewable energy literature: Research focus, trends and design. Renew. Sustain. Energy Rev. 2017, 80, 180–196. [Google Scholar] [CrossRef]

- Gazheli, A.; Van Den Bergh, J. Real options analysis of investment in solar vs. wind energy: Diversification strategies under uncertain prices and costs. Renew. Sustain. Energy Rev. 2018, 82, 2693–2704. [Google Scholar] [CrossRef]

- Myers, S.C. Determinants of corporate borrowing. J. Financ. Econ. 1977, 5, 147–175. [Google Scholar] [CrossRef]

- Dixit, A.K.; Pindyck, R.S. Investment Under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994; ISBN 978-0-691-03410-2. [Google Scholar]

- Trigeorgis, L.; Reuer, J.J. Real options theory in strategic management. Strateg. Manag. J. 2017, 38, 42–63. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The pricing of options and corporate liabilities. J. Political Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Brennan, M.J.; Schwartz, E.S. Evaluating Natural Resource Investments. J. Bus. 1985, 58, 135. [Google Scholar] [CrossRef]

- McDonald, R.; Siegel, D. The Value of Waiting to Invest. Q. J. Econ. 1986, 101, 707–727. [Google Scholar] [CrossRef]

- Trigeorgis, L. Real Options: Managerial Flexibility and Strategy in Resource Allocation; MIT Press: Cambridge, MA, USA, 1996. [Google Scholar]

- Tourinho, O.A.F. The Valuation of Reserves of Natural Resources: An Option Pricing Approach; University of California: Berkeley, CA, USA, 1979. [Google Scholar]

- Paddock, J.L.; Siegel, D.R.; Smith, J. Option Valuation of Claims on Real Assets: The Case of Offshore Petroleum Leases. Q. J. Econ. 1988, 103, 479–508. [Google Scholar] [CrossRef]

- Ekern, S. An option pricing approach to evaluating petroleum projects. Energy Econ. 1988, 10, 91–99. [Google Scholar] [CrossRef]

- Felder, F.A. Integrating financial theory and methods in electricity resource planning. Energy Policy 1996, 24, 149–154. [Google Scholar] [CrossRef]

- Ghosh, K.; Ramesh, V.C. An options model for electric power markets. Int. J. Electr. Power Energy Syst. 1997, 19, 75–85. [Google Scholar] [CrossRef]

- Venetsanos, K.; Angelopoulou, P.; Tsoutsos, T. Renewable energy sources project appraisal under uncertainty: The case of wind energy exploitation within a changing energy market environment. Energy Policy 2002, 30, 293–307. [Google Scholar] [CrossRef]

- Hoff, T.E.; Margolis, R.M.; Herig, C. A Simple Method for Consumers to Address Uncertainty When Purchasing Photovoltaics. Cleanpower Research 2003. Available online: https://www.cleanpower.com/wp-content/uploads/2012/02/018_PurchasingPVUnderUncertainty.pdf (accessed on 30 January 2024).

- Wang, T.; de Neufville, R. Building Real Options into Physical Systems with Stochastic Mixed-Integer Programming; MIT Press: Cambridge, MA, USA, 2004. [Google Scholar]

- Menegaki, A. Valuation for renewable energy: A comparative review. Renew. Sustain. Energy Rev. 2008, 12, 2422–2437. [Google Scholar] [CrossRef]

- Fernandes, B.; Cunha, J.; Ferreira, P. The use of real options approach in energy sector investments. Renew. Sustain. Energy Rev. 2011, 15, 4491–4497. [Google Scholar] [CrossRef]

- Martínez Ceseña, E.A.; Mutale, J.; Rivas-Dávalos, F. Real options theory applied to electricity generation projects: A review. Renew. Sustain. Energy Rev. 2013, 19, 573–581. [Google Scholar] [CrossRef]

- Schachter, J.A.; Mancarella, P. A critical review of Real Options thinking for valuing investment flexibility in Smart Grids and low carbon energy systems. Renew. Sustain. Energy Rev. 2016, 56, 261–271. [Google Scholar] [CrossRef]

- Lazo, J.; Watts, D. The use of real options approach in solar photovoltaic literature: A comprehensive review. Sustain. Energy Technol. Assess. 2023, 57, 103204. [Google Scholar] [CrossRef]

- Alonso-Travesset, À.; Coppitters, D.; Martín, H.; de la Hoz, J. Economic and Regulatory Uncertainty in Renewable Energy System Design: A Review. Energies 2023, 16, 882. [Google Scholar] [CrossRef]

- International Energy Agency. Hydropower. Available online: https://www.iea.org/energy-system/renewables/hydroelectricity (accessed on 8 February 2024).

- Scott, C.A.; Khaling, S.; Shrestha, P.P.; Riera, F.S.; Choden, K.; Singh, K. Renewable Electricity Production in Mountain Regions: Toward a People-Centered Energy Transition Agenda. Mt. Res. Dev. 2023, 43, A1–A8. [Google Scholar] [CrossRef]

- Proietti, S.; Sdringola, P.; Castellani, F.; Astolfi, D.; Vuillermoz, E. On the contribution of renewable energies for feeding a high altitude Smart Mini Grid. Appl. Energy 2017, 185, 1694–1701. [Google Scholar] [CrossRef]

- François, B.; Borga, M.; Creutin, J.D.; Hingray, B.; Raynaud, D.; Sauterleute, J.F. Complementarity between solar and hydro power: Sensitivity study to climate characteristics in Northern-Italy. Renew. Energy 2016, 86, 543–553. [Google Scholar] [CrossRef]

- Kittner, N.; Gheewala, S.H.; Kammen, D.M. Energy return on investment (EROI) of mini-hydro and solar PV systems designed for a mini-grid. Renew. Energy 2016, 99, 410–419. [Google Scholar] [CrossRef]

- Lee, N.; Grunwald, U.; Rosenlieb, E.; Mirletz, H.; Aznar, A.; Spencer, R.; Cox, S. Hybrid floating solar photovoltaics-hydropower systems: Benefits and global assessment of technical potential. Renew. Energy 2020, 162, 1415–1427. [Google Scholar] [CrossRef]

- Fang, W.; Huang, Q.; Huang, S.; Yang, J.; Meng, E.; Li, Y. Optimal sizing of utility-scale photovoltaic power generation complementarily operating with hydropower: A case study of the world’s largest hydro-photovoltaic plant. Energy Convers. Manag. 2017, 136, 161–172. [Google Scholar] [CrossRef]

- Brown, C.R. Economic Theories of the Entrepreneur: A Systematic Review of the Literature; Cranfield University: Wharley End, UK, 2007. [Google Scholar]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G.; PRISMA Group. Preferred Reporting Items for Systematic Reviews and Meta-Analyses: The PRISMA Statement. BMJ 2009, 339, b2535. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. Syst. Rev. 2021, 10, 89. [Google Scholar] [CrossRef] [PubMed]

- Xiao, Y.; Watson, M. Guidance on Conducting a Systematic Literature Review. J. Plan. Educ. Res. 2019, 39, 93–112. [Google Scholar] [CrossRef]

- D’Alpaos, C.; Andreolli, F. The economics of Solar Home Systems: State of art and future challenges in local energy markets. Valori E Valutazioni 2020, 24, 77–96. [Google Scholar]

- D’Alpaos, C.; Bragolusi, P. Buildings energy retrofit valuation approaches: State of the art and future perspectives. Valori E Valutazioni 2018, 20, 79–94. [Google Scholar]

- Di Corato, L.; Moretto, M. Investing in biogas: Timing, technological choice and the value of flexibility from input mix. Energy Econ. 2011, 33, 1186–1193. [Google Scholar] [CrossRef]

- International Energy Agency. Global Energy Crisis—Topics. Available online: https://www.iea.org/topics/global-energy-crisis (accessed on 28 March 2024).

- Andreolli, F.; D’Alpaos, C.; Kort, P. Does P2P trading favor investments in PV–Battery Systems? Energy Econ. 2025, 145, 108418. [Google Scholar] [CrossRef]

- Dønnestad, E.M.; Fleten, S.-E.; Kleiven, A.; Lavrutich, M.; Teige, A.M. A real options analysis of existing green energy facilities: Maintain or replace? Energy Syst. 2024, 15, 993–1025. [Google Scholar] [CrossRef]

- Kjærland, F.; Larsen, B. The value of operational flexibility by adding thermal to hydropower: A real option approach. J. Appl. Oper. Res. 2010, 2, 43–61. [Google Scholar]

- Detert, N.; Kotani, K. Real options approach to renewable energy investments in Mongolia. Energy Policy 2013, 56, 136–150. [Google Scholar] [CrossRef]

- Rohlfs, W.; Madlener, R. Optimal investment strategies in power generation assets: The role of technological choice and existing portfolios in the deployment of low-carbon technologies. Int. J. Greenh. Gas Control 2014, 28, 114–125. [Google Scholar] [CrossRef]

- Zhang, M.; Tang, Y.; Liu, L.; Zhou, D. Optimal investment portfolio strategies for power enterprises under multi-policy scenarios of renewable energy. Renew. Sustain. Energy Rev. 2022, 154, 111879. [Google Scholar] [CrossRef]

- Siddiqui, A.; Fleten, S.-E. How to proceed with competing alternative energy technologies: A real options analysis. Energy Econ. 2010, 32, 817–830. [Google Scholar] [CrossRef]

- Reuter, W.H.; Fuss, S.; Szolgayová, J.; Obersteiner, M. Investment in wind power and pumped storage in a real options model. Renew. Sustain. Energy Rev. 2012, 16, 2242–2248. [Google Scholar] [CrossRef]

- Passos, A.C.; Street, A.; Fanzeres, B.; Bruno, S. A novel framework to define the premium for investment in complementary renewable projects. In Proceedings of the 2014 Power Systems Computation Conference, Wrocław, Poland, 18–22 August 2014; IEEE: Wrocław, Poland, 2014; pp. 1–7. [Google Scholar]

- Weibel, S.; Madlener, R. Cost-effective design of ringwall storage hybrid power plants: A real options analysis. Energy Convers. Manag. 2015, 103, 871–885. [Google Scholar] [CrossRef]

- Mancini, M.; Sala, R.; Tedesco, D.; Travaglini, A. A real options investment model for the evaluation of wind and photovoltaic plants. In Proceedings of the 2016 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Bali, Indonesia, 4–7 December 2016; pp. 1101–1105. [Google Scholar]

- Li, Y.; Yang, W.; Tian, L.; Yang, J. Diversified Energy Investment Strategies based on Real Options: Hydropower vs. Solar Power. Int. J. Nonlinear Sci. 2019, 28, 120–127. [Google Scholar]

- Martinez-Cesena, E.A.; Mutale, J. Assessment of demand response value in photovoltaic systems based on real options theory. In Proceedings of the 2011 IEEE Trondheim PowerTech, Trondheim, Norway, 19–23 June 2011; pp. 1–8. [Google Scholar]

- Martinez-Cesena, E.A.; Azzopardi, B.; Mutale, J. Assessment of domestic photovoltaic systems based on real options theory. Prog. Photovolt. Res. Appl. 2013, 21, 250–262. [Google Scholar] [CrossRef]

- Biondi, T.; Moretto, M. Solar Grid Parity dynamics in Italy: A real option approach. Energy 2015, 80, 293–302. [Google Scholar] [CrossRef]

- Gahrooei, M.R.; Zhang, Y.; Ashuri, B.; Augenbroe, G. Timing residential photovoltaic investments in the presence of demand uncertainties. Sustain. Cities Soc. 2016, 20, 109–123. [Google Scholar] [CrossRef]

- Zhang, M.M.; Zhou, P.; Zhou, D.Q. A real options model for renewable energy investment with application to solar photovoltaic power generation in China. Energy Econ. 2016, 59, 213–226. [Google Scholar] [CrossRef]

- Kim, B.; Kim, K.; Kim, C. Determining the optimal installation timing of building integrated photovoltaic systems. J. Clean. Prod. 2017, 140, 1322–1329. [Google Scholar] [CrossRef]

- Moon, Y.; Baran, M. Economic analysis of a residential PV system from the timing perspective: A real option model. Renew. Energy 2018, 125, 783–795. [Google Scholar] [CrossRef]

- Penizzotto, F.; Pringles, R.; Olsina, F. Real options valuation of photovoltaic power investments in existing buildings. Renew. Sustain. Energy Rev. 2019, 114, 109308. [Google Scholar] [CrossRef]

- Di Bari, A. A Real Options Approach to Valuate Solar Energy Investment with Public Authority Incentives: The Italian Case. Energies 2020, 13, 4181. [Google Scholar] [CrossRef]

- Biancardi, M.; Bufalo, M.; Di Bari, A.; Villani, G. Flexibility to switch project size: A real option application for photovoltaic investment valuation. Commun. Nonlinear Sci. Numer. Simul. 2023, 116, 106869. [Google Scholar] [CrossRef]

- Or, B.; Bilgin, G.; Akcay, E.C.; Dikmen, I.; Birgonul, M.T. Real options valuation of photovoltaic investments: A case from Turkey. Renew. Sustain. Energy Rev. 2024, 192, 114200. [Google Scholar] [CrossRef]

- Bertolini, M.; D’Alpaos, C.; Moretto, M. Do Smart Grids boost investments in domestic PV plants? Evidence from the Italian electricity market. Energy 2018, 149, 890–902. [Google Scholar] [CrossRef]

- D’Alpaos, C.; Moretto, M. Do Smart grid innovations affect real estate market values? AIMS Energy 2019, 7, 141–150. [Google Scholar] [CrossRef]

- Castellini, M.; Menoncin, F.; Moretto, M.; Vergalli, S. Photovoltaic Smart Grids in the prosumers investment decisions: A real option model. J. Econ. Dyn. Control 2021, 126, 103988. [Google Scholar] [CrossRef]

- Castellini, M.; Di Corato, L.; Moretto, M.; Vergalli, S. Energy exchange among heterogeneous prosumers under price uncertainty. Energy Econ. 2021, 104, 105647. [Google Scholar] [CrossRef]

- Andreolli, F.; D’Alpaos, C.; Moretto, M. Valuing investments in domestic PV-Battery Systems under uncertainty. Energy Econ. 2022, 106, 105721. [Google Scholar] [CrossRef]

- Kelly, J.J.; Leahy, P.G. Optimal investment timing and sizing for battery energy storage systems. J. Energy Storage 2020, 28, 101272. [Google Scholar] [CrossRef]

- Ma, Y.; Swandi, K.; Chapman, A.C.; Verbič, G. Multi-stage compound real options valuation in residential PV-Battery investment. Energy 2020, 191, 116537. [Google Scholar] [CrossRef]

- Hassi, B.; Reyes, T.; Sauma, E. A Compound Real Option Approach for Determining the Optimal Investment Path for RPV-Storage Systems. Energy J. 2022, 43, 83–103. [Google Scholar] [CrossRef]

- Li, L.; Cao, X. Comprehensive effectiveness assessment of energy storage incentive mechanisms for PV-ESS projects based on compound real options. Energy 2022, 239, 121902. [Google Scholar] [CrossRef]

- Martínez-Ceseña, E.A.; Mutale, J. Application of an advanced real options approach for renewable energy generation projects planning. Renew. Sustain. Energy Rev. 2011, 15, 2087–2094. [Google Scholar] [CrossRef]

- Andersson, A.M.; Elverhøi, M.; Fleten, S.-E.; Fuss, S.; Szolgayová, J.; Troland, O.C. Upgrading hydropower plants with storage: Timing and capacity choice. Energy Syst. 2014, 5, 233–252. [Google Scholar] [CrossRef]

- Fertig, E.; Heggedal, A.M.; Doorman, G.; Apt, J. Optimal investment timing and capacity choice for pumped hydropower storage. Energy Syst. 2014, 5, 285–306. [Google Scholar] [CrossRef]

- Locatelli, G.; Invernizzi, D.C.; Mancini, M. Investment and risk appraisal in energy storage systems: A real options approach. Energy 2016, 104, 114–131. [Google Scholar] [CrossRef]

- Bøckman, T.; Fleten, S.-E.; Juliussen, E.; Langhammer, H.J.; Revdal, I. Investment timing and optimal capacity choice for small hydropower projects. Eur. J. Oper. Res. 2008, 190, 255–267. [Google Scholar] [CrossRef]

- Linnerud, K.; Simonsen, M. Swedish-Norwegian tradable green certificates: Scheme design flaws and perceived investment barriers. Energy Policy 2017, 106, 560–578. [Google Scholar] [CrossRef]

- Kim, K.; Park, H.; Kim, H. Real options analysis for renewable energy investment decisions in developing countries. Renew. Sustain. Energy Rev. 2017, 75, 918–926. [Google Scholar] [CrossRef]

- Afzali, P.; Hosseini, S.A.; Peyghami, S. A Comprehensive Review on Uncertainty and Risk Modeling Techniques and Their Applications in Power Systems. Appl. Sci. 2024, 14, 12042. [Google Scholar] [CrossRef]

- Egli, F. Renewable energy investment risk: An investigation of changes over time and the underlying drivers. Energy Policy 2020, 140, 111428. [Google Scholar] [CrossRef]

- Egré, D.; Milewski, J.C. The diversity of hydropower projects. Energy Policy 2002, 30, 1225–1230. [Google Scholar] [CrossRef]

- Botter, G.; Basso, S.; Porporato, A.; Rodriguez-Iturbe, I.; Rinaldo, A. Natural streamflow regime alterations: Damming of the Piave river basin (Italy). Water Resour. Res. 2010, 46. [Google Scholar] [CrossRef]

- Lazzaro, G.; Basso, S.; Schirmer, M.; Botter, G. Water management strategies for run-of-river power plants: Profitability and hydrologic impact between the intake and the outflow. Water Resour. Res. 2013, 49, 8285–8298. [Google Scholar] [CrossRef]

- Basso, S.; Lazzaro, G.; Bovo, M.; Soulsby, C.; Botter, G. Water-energy-ecosystem nexus in small run-of-river hydropower: Optimal design and policy. Appl. Energy 2020, 280, 115936. [Google Scholar] [CrossRef]

- Kuriqi, A.; Pinheiro, A.N.; Sordo-Ward, A.; Bejarano, M.D.; Garrote, L. Ecological impacts of run-of-river hydropower plants—Current status and future prospects on the brink of energy transition. Renew. Sustain. Energy Rev. 2021, 142, 110833. [Google Scholar] [CrossRef]

- Tsuanyo, D.; Amougou, B.; Aziz, A.; Nka Nnomo, B.; Fioriti, D.; Kenfack, J. Design models for small run-of-river hydropower plants: A review. Sustain. Energy Res. 2023, 10, 3. [Google Scholar] [CrossRef]

- Klein, S.J.W.; Fox, E.L.B. A review of small hydropower performance and cost. Renew. Sustain. Energy Rev. 2022, 169, 112898. [Google Scholar] [CrossRef]

- Kriett, P.O.; Salani, M. Optimal control of a residential microgrid. Energy 2012, 42, 321–330. [Google Scholar] [CrossRef]

- D’Alpaos, C.; Andreolli, F. Renewable Energy Communities: The Challenge for New Policy and Regulatory Frameworks Design. In New Metropolitan Perspectives. NMP 2020. Smart Innovation, Systems and Technologies; Bevilacqua, C., Calabrò, F., Della Spina, L., Eds.; Springer: Cham, Switzerland, 2021; Volume 178, pp. 500–509. [Google Scholar] [CrossRef]

- EU Science Hub. Photovoltaic Geographical Information System (PVGIS)—European Commission. Available online: https://joint-research-centre.ec.europa.eu/photovoltaic-geographical-information-system-pvgis_en (accessed on 28 March 2024).

- Lian, J.; Zhang, Y.; Ma, C.; Yang, Y.; Chaima, E. A review on recent sizing methodologies of hybrid renewable energy systems. Energy Convers. Manag. 2019, 199, 112027. [Google Scholar] [CrossRef]

- Thirunavukkarasu, M.; Sawle, Y.; Lala, H. A comprehensive review on optimization of hybrid renewable energy systems using various optimization techniques. Renew. Sustain. Energy Rev. 2023, 176, 113192. [Google Scholar] [CrossRef]

- Olatomiwa, L.; Mekhilef, S.; Ismail, M.S.; Moghavvemi, M. Energy management strategies in hybrid renewable energy systems: A review. Renew. Sustain. Energy Rev. 2016, 62, 821–835. [Google Scholar] [CrossRef]

- Arul, P.G.; Ramachandaramurthy, V.K.; Rajkumar, R.K. Control strategies for a hybrid renewable energy system: A review. Renew. Sustain. Energy Rev. 2015, 42, 597–608. [Google Scholar] [CrossRef]

- Siddaiah, R.; Saini, R.P. A review on planning, configurations, modeling and optimization techniques of hybrid renewable energy systems for off grid applications. Renew. Sustain. Energy Rev. 2016, 58, 376–396. [Google Scholar] [CrossRef]

- Ammari, C.; Belatrache, D.; Touhami, B.; Makhloufi, S. Sizing, optimization, control and energy management of hybrid renewable energy system—A review. Energy Built Environ. 2022, 3, 399–411. [Google Scholar] [CrossRef]

- Fathima, A.H.; Palanisamy, K. Optimization in microgrids with hybrid energy systems—A review. Renew. Sustain. Energy Rev. 2015, 45, 431–446. [Google Scholar] [CrossRef]

- Come Zebra, E.I.; van der Windt, H.J.; Nhumaio, G.; Faaij, A.P.C. A review of hybrid renewable energy systems in mini-grids for off-grid electrification in developing countries. Renew. Sustain. Energy Rev. 2021, 144, 111036. [Google Scholar] [CrossRef]

- Dawoud, S.M.; Lin, X.; Okba, M.I. Hybrid renewable microgrid optimization techniques: A review. Renew. Sustain. Energy Rev. 2018, 82, 2039–2052. [Google Scholar] [CrossRef]

- Al-falahi, M.D.A.; Jayasinghe, S.D.G.; Enshaei, H. A review on recent size optimization methodologies for standalone solar and wind hybrid renewable energy system. Energy Convers. Manag. 2017, 143, 252–274. [Google Scholar] [CrossRef]

- Goel, S.; Sharma, R. Performance evaluation of stand alone, grid connected and hybrid renewable energy systems for rural application: A comparative review. Renew. Sustain. Energy Rev. 2017, 78, 1378–1389. [Google Scholar] [CrossRef]

- Sawle, Y.; Gupta, S.C.; Bohre, A.K. Review of hybrid renewable energy systems with comparative analysis of off-grid hybrid system. Renew. Sustain. Energy Rev. 2018, 81, 2217–2235. [Google Scholar] [CrossRef]

- Mohammed, Y.S.; Mustafa, M.W.; Bashir, N. Hybrid renewable energy systems for off-grid electric power: Review of substantial issues. Renew. Sustain. Energy Rev. 2014, 35, 527–539. [Google Scholar] [CrossRef]

- Ma, W.; Xue, X.; Liu, G. Techno-economic evaluation for hybrid renewable energy system: Application and merits. Energy 2018, 159, 385–409. [Google Scholar] [CrossRef]

- Neves, D.; Silva, C.A.; Connors, S. Design and implementation of hybrid renewable energy systems on micro-communities: A review on case studies. Renew. Sustain. Energy Rev. 2014, 31, 935–946. [Google Scholar] [CrossRef]

- Izadyar, N.; Ong, H.C.; Chong, W.T.; Leong, K.Y. Resource assessment of the renewable energy potential for a remote area: A review. Renew. Sustain. Energy Rev. 2016, 62, 908–923. [Google Scholar] [CrossRef]

- Khare, V.; Nema, S.; Baredar, P. Solar-wind hybrid renewable energy system: A review. Renew. Sustain. Energy Rev. 2016, 58, 23–33. [Google Scholar] [CrossRef]

- Yang, Y.; Bremner, S.; Menictas, C.; Kay, M. Battery energy storage system size determination in renewable energy systems: A review. Renew. Sustain. Energy Rev. 2018, 91, 109–125. [Google Scholar] [CrossRef]

- Anoune, K.; Bouya, M.; Astito, A.; Abdellah, A.B. Sizing methods and optimization techniques for PV-wind based hybrid renewable energy system: A review. Renew. Sustain. Energy Rev. 2018, 93, 652–673. [Google Scholar] [CrossRef]

- Bhandari, B.; Poudel, S.R.; Lee, K.-T.; Ahn, S.-H. Mathematical modeling of hybrid renewable energy system: A review on small hydro-solar-wind power generation. Int. J. Precis. Eng. Manuf.-Green Technol. 2014, 1, 157–173. [Google Scholar] [CrossRef]

- Javed, M.S.; Ma, T.; Jurasz, J.; Amin, M.Y. Solar and wind power generation systems with pumped hydro storage: Review and future perspectives. Renew. Energy 2020, 148, 176–192. [Google Scholar] [CrossRef]

- Khan, F.A.; Pal, N.; Saeed, S.H. Review of solar photovoltaic and wind hybrid energy systems for sizing strategies optimization techniques and cost analysis methodologies. Renew. Sustain. Energy Rev. 2018, 92, 937–947. [Google Scholar] [CrossRef]

- Sinha, S.; Chandel, S.S. Review of software tools for hybrid renewable energy systems. Renew. Sustain. Energy Rev. 2014, 32, 192–205. [Google Scholar] [CrossRef]

- Bahramara, S.; Moghaddam, M.P.; Haghifam, M.R. Optimal planning of hybrid renewable energy systems using HOMER: A review. Renew. Sustain. Energy Rev. 2016, 62, 609–620. [Google Scholar] [CrossRef]

- Kim, K.; Park, T.; Bang, S.; Kim, H. Real Options-Based Framework for Hydropower Plant Adaptation to Climate Change. J. Manag. Eng. 2017, 33. [Google Scholar] [CrossRef]

- Gaudard, L. Pumped-storage project: A short to long term investment analysis including climate change. Renew. Sustain. Energy Rev. 2015, 49, 91–99. [Google Scholar] [CrossRef]

- Swanson, A.R.; Sakhrani, V.; Preston, M.S. Flexible design at Batoka Dam: How Real Options Analysis compares to other decision-making tools. Renew. Energy Focus 2019, 31, 1–8. [Google Scholar] [CrossRef]

- Swanson, R.; Sakhrani, V. Appropriating the value of flexibility in ppp megaproject design. J. Manag. Eng. 2020, 36. [Google Scholar] [CrossRef]

- Hassan, Q.; Algburi, S.; Sameen, A.Z.; Salman, H.M.; Jaszczur, M. A review of hybrid renewable energy systems: Solar and wind-powered solutions: Challenges, opportunities, and policy implications. Results Eng. 2023, 20, 101621. [Google Scholar] [CrossRef]

- Zhang, M.; Zhou, D.; Zhou, P. A real option model for renewable energy policy evaluation with application to solar PV power generation in China. Renew. Sustain. Energy Rev. 2014, 40, 944–955. [Google Scholar] [CrossRef]

| Criteria | ID | Description |

|---|---|---|

| Inclusion | G1 | Power generation |

| G2 | Technology (HP, SHP, PV, mix) | |

| Exclusion | G3 | Policy evaluation |

| G4 | R&D investments/programs | |

| S1 | No ROs valuation | |

| S2 | Utility-scale PV projects | |

| S3 | CC adaptation strategies |

| Authors and Ref. | Power Generation Technology | Technical Risk | Market Risk | Policy Risk | Financial Risk |

|---|---|---|---|---|---|

| Bockman et al. [113] | SHP plants | Electricity price | |||

| Martínez-Ceseña and Mutale [109] | Storage HP plants | Electricity price | |||

| Andersson et al. [110] | Storage HP plants | Electricity price | |||

| Fertig et al. [111] | Pumped storage HP plants | Electricity price | |||

| Linnerud and Simonsen [114] | SHP plants | Electricity price | Subsidies | ||

| Locatelli et al. [112] | Pumped storage HP plants | CAPEX | |||

| Kim et al. [115] | SHP plants | Energy production | RE tariffs, CER price | O&M cost | |

| Martínez-Ceseña and Mutale [89] | Off-grid PV plants | Consumer energy demand | |||

| Martínez-Ceseña et al. [90] | Domestic PV plants | PV efficiency | PV cost | ||

| Biondi and Moretto [91] | Domestic PV plants | Electricity price | PV cost | ||

| Gahrooei et al. [92] | Domestic PV plants | Building performance | Electricity price | ||

| Zhang et al. [93] | Domestic PV plants | Electricity price | CO2 price | RE investment cost and NRE cost | |

| Kim et al. [94] | Domestic PV plants | Electricity price | |||

| Bertolini et al. [100] | Domestic PV plants | Energy price | |||

| Moon and Baran [95] | Domestic PV plants | PV cost | |||

| D’Alpaos and Moretto [101] | Domestic PV plants | Energy price | |||

| Penizzotto et al. [96] | Domestic PV plants | Electricity price | PV cost | ||

| Di Bari [97] | Domestic PV plants | Electricity price | |||

| Kelly and Leahy [105] | Not specified | Battery degradation | Electricity price | Future BESS CAPEX | |

| Ma et al. [106] | Domestic PVBs | Peak demand, diesel price | Generator cost, PVB cost | ||

| Castellini et al. [102] | Domestic PV plants | Energy price | |||

| Castellini et al. [103] | Domestic PV plants | Energy price | |||

| Andreolli et al. [104] | Domestic PVBs | Energy price | |||

| Hassi et al. [107] | Domestic PVBs | Electricity price | PV cost, battery cost | ||

| Li and Cao [108] | Domestic PVBs | Electricity price | CO2 price | ||

| Biancardi et al. [98] | Domestic/utility-scale PV plants | Electricity price | |||

| Or et al. [99] | Domestic PV plants | Electricity tariff, electricity distribution price | PV cost, inverter cost | ||

| Siddiqui and Fleten [83] | Unconventional Energy Technology (UET) and RE | Electricity price | UET operating cost | ||

| Kjærland and Larsen [79] | Storage HP and thermal power plants | Reservoir level | |||

| Reuter et al. [84] | Wind power and pumped-storage HP plants | Energy production (wind) | Electricity price | ||

| Detert and Kotani [80] | Coal-fired, wind and solar thermal power plants | Fuel price | |||

| Passos et al. [85] | Wind power and SHP plants | Energy price | |||

| Rohlfs and Madlener [81] | Coal-fired, wind, gas-fired power plants | Electricity, coal and natural gas prices | |||

| Weibel and Madlener [86] | Pumped-storage HP plant, wind power and PV plants (ringwall storage hybrid power plant) | Wind intensity, solar irradiation | Electricity price | ||

| Mancini et al. [87] | Wind power and PV power plants | Energy production | Market conditions | ||

| Gazheli and Van Den Bergh [40] | Wind power and PV plants | Electricity price | Wind and PV costs | ||

| Li et al. [88] | Storage HP and PV power plants | Electricity price | Wind and HP costs | ||

| Zhang et al. [82] | Coal-fired, gas-fired, wind power, PV, and biomass plants | Electricity, fuel prices | Carbon prices (CO2), RE certificates | Wind and PV costs |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Carozzani, A.; D’Alpaos, C. The Real Option Approach to Investment Decisions in Hybrid Renewable Energy Systems: A Systematic Literature Review. Energies 2025, 18, 5535. https://doi.org/10.3390/en18205535

Carozzani A, D’Alpaos C. The Real Option Approach to Investment Decisions in Hybrid Renewable Energy Systems: A Systematic Literature Review. Energies. 2025; 18(20):5535. https://doi.org/10.3390/en18205535

Chicago/Turabian StyleCarozzani, Anna, and Chiara D’Alpaos. 2025. "The Real Option Approach to Investment Decisions in Hybrid Renewable Energy Systems: A Systematic Literature Review" Energies 18, no. 20: 5535. https://doi.org/10.3390/en18205535

APA StyleCarozzani, A., & D’Alpaos, C. (2025). The Real Option Approach to Investment Decisions in Hybrid Renewable Energy Systems: A Systematic Literature Review. Energies, 18(20), 5535. https://doi.org/10.3390/en18205535