4.3. Co-Integration Analysis Using the NARDL Model

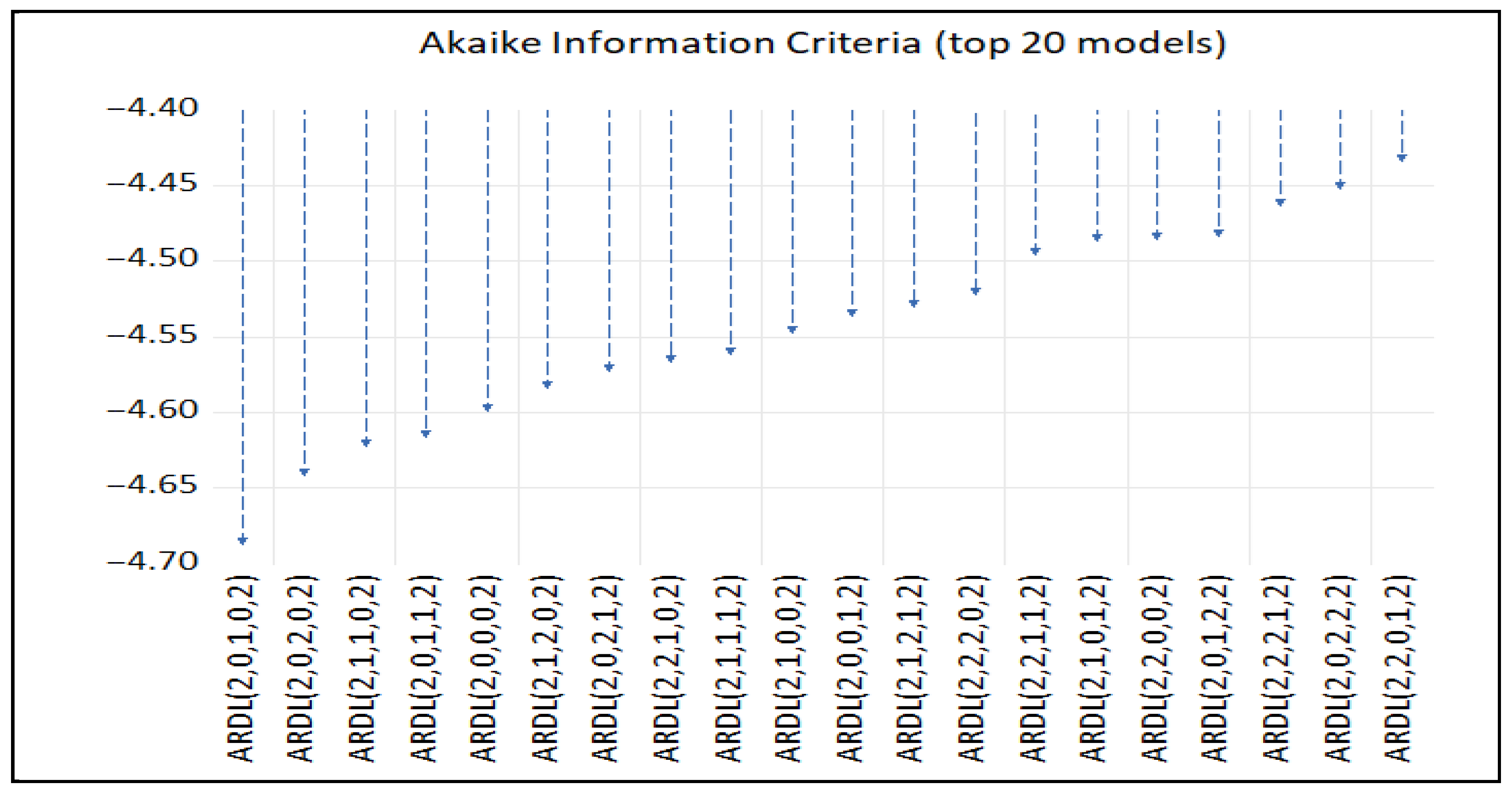

Given these results, the application of the NARDL model is justified, as it can take into account asymmetries and nonlinearities in the relationships between variables. To select the length of the lags for the NARDL model, we use the Akaike Selection Criterion (AIC). The diagram below presents the results from the lags of 20 nonlinear NARDL models. The smallest value of the Akaike criterion gives the optimal lag length of the variables in the nonlinear NARDL model. Similar findings have been provided by SIC and HQIC lag selection criteria.

From

Figure 2, the nonlinear model NARDL(2,0,1,0,2) is the most appropriate (it presents the fewest errors). After finding the optimal lag length, we can estimate the nonlinear model NARDL(2,0,1,0,2).

Table 6 presents the short-run and long-run coefficient estimates of the nonlinear NARDL(2,0,1,0,2) model, with positive and negative shocks occurring in the asymmetric determinants of the renewable and non-renewable energy sources variables (Dependent Variable D(LGDP).

The results in

Table 6 show that gross fixed capital as a percentage of GDP contributes positively to the country’s economic growth at the level of 1% in the long run. In contrast, the total labor force contributes negatively to the country’s economic growth at the level of 5%. The results of

Table 6 show that increases (positive changes) in renewable energy sources in the long term contribute positively to the country’s economic growth, while conversely decreases (negative changes) have no effect on economic growth. Also, increases (positive changes) in non-renewable energy sources have a positive effect on growth, while decreases (negative changes) in non-renewable energy sources have a negative effect on growth. Here, we should mention that because the coefficient on negative non-renewable sources is greater than that on positive non-renewable sources, we conclude that decreases in the production of non-renewable energy sources have a greater impact on growth than increases in these sources.

From the short-term estimates of the NARDL model in

Table 6, we observe that economic growth is not affected by the total labor force, while it is positively affected by the negative change in non-renewable energy sources in the current period and negatively by the negative change in non-renewable energy sources in the previous period at a level of 1%.

Furthermore, the results of both the statistical and diagnostic tests show that there is no problem in the model we are studying. Specifically, the results of the diagnostic tests for the ARDL(2,0,1,0,2) model reveal that there is no problem with autocorrelation, heteroscedasticity, and normality. Meanwhile, the results of the Ramsey (RESET) tests show that there is no error in the specification of the model. Because the results of both the statistical and diagnostic tests do not present any problems, we can proceed to examine the long-term relationship between the variables.

We examine the existence of the long-run cointegrated relationship between the variables of the NARDL(2,0,1,0,2) model by testing the bounds (bound test).

Table 7 presents the results of the nonlinear ARDL bound test model for the co-integration of the variables.

The results of

Table 7 show that there is a long-term relationship between the variables of the NARDL(2,0,1,0,2) model that we are examining because the calculated

F-statistic exceeds all upper critical limits (F = 6.639 > 5.691).

Since there is co-integration between the variables, we can estimate the long-run and short-run relationships of the model NARDL(2,0,1,0,2).

Table 8 presents the long-run and short-run estimates of the coefficients of the NARDL(2,0,1,0,2) model.

The results in

Table 8 show that the long-run elasticity coefficients of gross fixed capital as a percentage of GDP are positively related to the production process, while the total labor force is negatively related to the production process at significance levels of 1% and 5%, respectively. Also, from the results of

Table 8, it appears that the long-run elasticity coefficients (LNRE

+ LNRE

−) associated with the positive and negative shocks occurring in non-renewable energy sources are statistically significant at the 1% level. Additionally, the results show that the long-run elasticity coefficients (LRE

+) related to the positive shocks occurring in renewable energy sources are statistically significant at the 1% level. Therefore, irregular changes in non-renewable energy sources (both positive and negative shocks) and irregular changes in renewable energy sources (only negative shocks) create potentially asymmetric impacts on the production process in the long run.

This means that regardless of whether non-renewable energy sources increase or decrease, the production process (GDP) is significantly affected in both directions. In other words, we would say that non-renewable energy sources have a two-way causal relationship with the production process. Their increase fuels growth, while their decrease strikes growth. For renewable energy sources, the long-run coefficients are only significant in positive shocks, meaning that when the production of renewable energy sources increases, there is a positive contribution to the production process. However, when there is a reduction (negative shock), there is no significant effect on production. Therefore, we can say that for Greece, the production process is not yet so dependent on renewable energy sources that their reduction would negatively affect it in the long term.

Also, the results in

Table 8 show that the short-run elasticity coefficients (LNRE

− LNRE

+) in the current period related to the positive and negative shocks occurring in non-renewable energy sources are statistically significant at the 1% level. In contrast, the short-run elasticity coefficients (LNRE

−) with a time lag related to negative shocks occurring in non-renewable energy sources are statistically significant at the 1% level. Therefore, we can say that irregular changes in non-renewable energy sources (positive and negative shocks) in the current time period and in (negative shocks) in the period with a time lag create potentially asymmetric impacts on the production process in the short term.

The significant short-term contributions of non-renewable energy sources in the current period mean that changes in non-renewable sources have a direct and strong impact on the production process. Therefore, whether non-renewable sources increase or decrease, the country’s economy responds immediately. In other words, we can say that the country has a high energy dependence on fossil fuels. In addition, the short-term significant coefficients of non-renewable energy sources with a time lag only in negative shocks can be interpreted as indicating that the negative changes (reduction in consumption or production of non-renewable sources) have a delayed negative effect. In other words, we would say that the reduction in the use of non-renewable energy sources does not immediately affect the production process, but the “cost” appears with a delay.

The fact that the coefficients on renewable energy sources are not statistically significant in the short run means that fluctuations in renewable energy sources do not have a measurable or direct impact on the production process. This is because renewable energy sources have a smaller share in the energy mix, so their short-term changes do not affect the production process.

We should also mention here that the short-run elasticity coefficients of gross fixed capital as a percentage of GDP and the short-run elasticity coefficients of the total labor force do not contribute to the production process. Furthermore, we should note that the error correction coefficient is negative and less than unity and statistically significant at the 1% level. Furthermore, the error correction coefficient shows the speed with which the production process adjusts to deviations from the long-run equilibrium. This deviation correction is 75% for each year (fast return).

The presence or absence of asymmetric effects of renewable and non-renewable energy sources on economic growth was investigated using the Wald test on the coefficients of positive and negative shocks of the variables for both the long-term and short-term horizons. The results of the Wald tests are provided in

Table 9.

The results in

Table 9 show that the model we are examining includes an asymmetric long-run relationship between renewable energy sources and economic growth, but not in the short run. Furthermore, for non-renewable energy sources, the results show that there is a symmetrical relationship with growth in both the long and short terms.

The asymmetric long-term relationship between renewable energy sources means that positive and negative changes in renewable energy sources have different effects on the production process over time. The symmetric long-run relationship between non-renewable energy sources means that positive and negative changes in non-renewable energy sources have a similar effect on the production process in the long run.

In the short-term relationship, there is no effect on renewable energy sources, meaning that in the short term, changes in renewable energy sources do not affect the production process in a statistically significant way. Furthermore, in the short term, the symmetrical relationship between non-renewable energy sources affects the production process in a similar way, either increasing or decreasing.

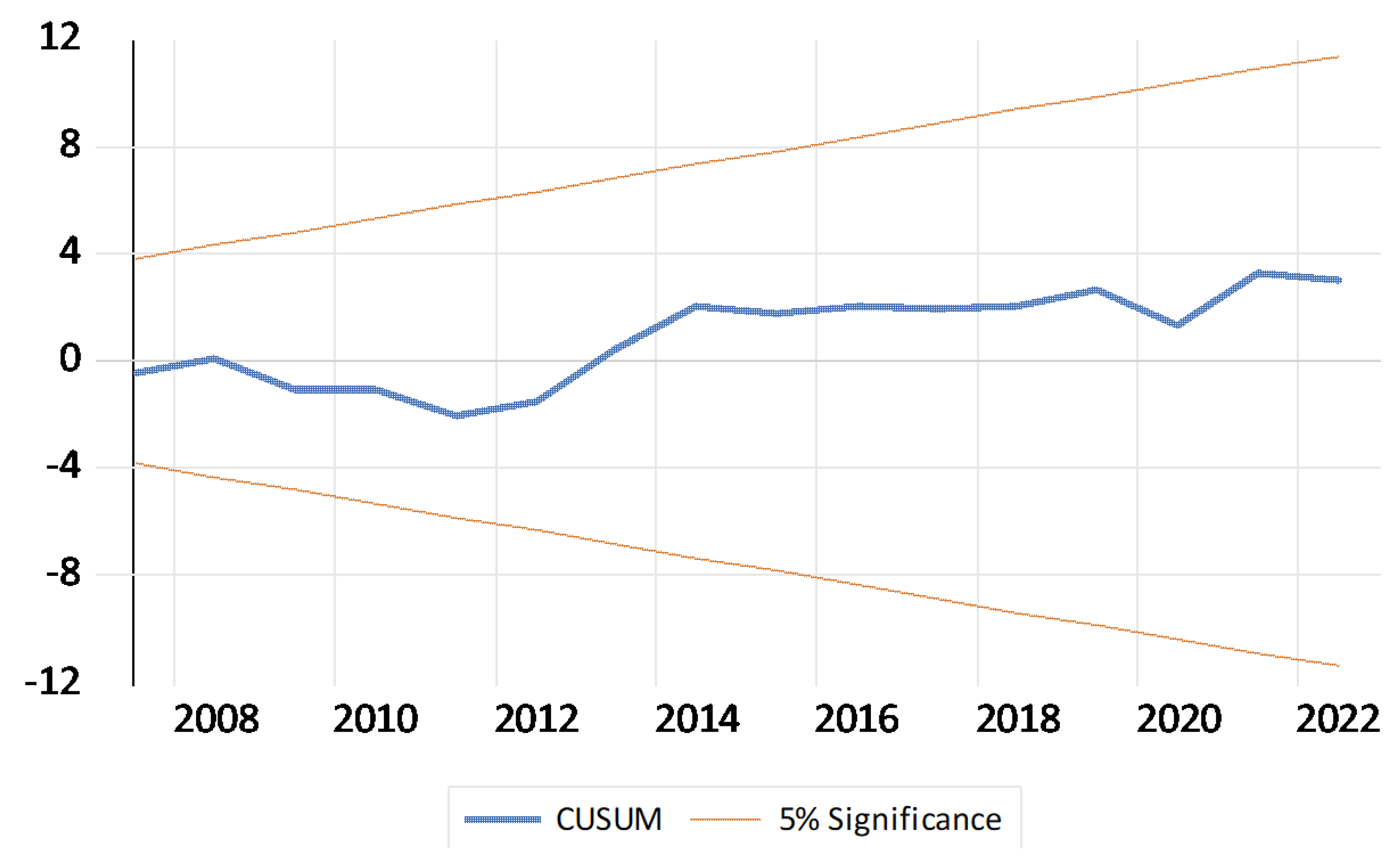

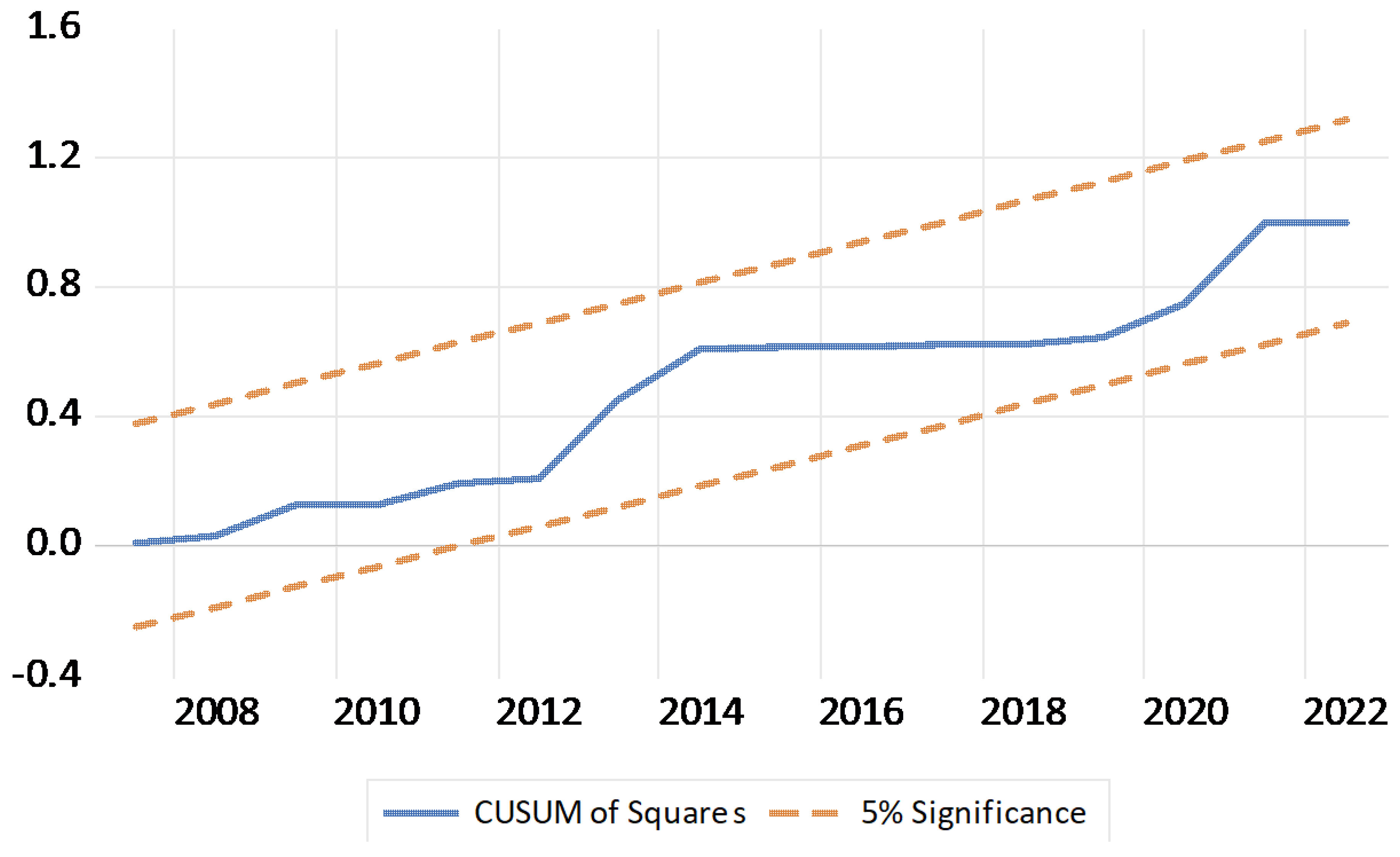

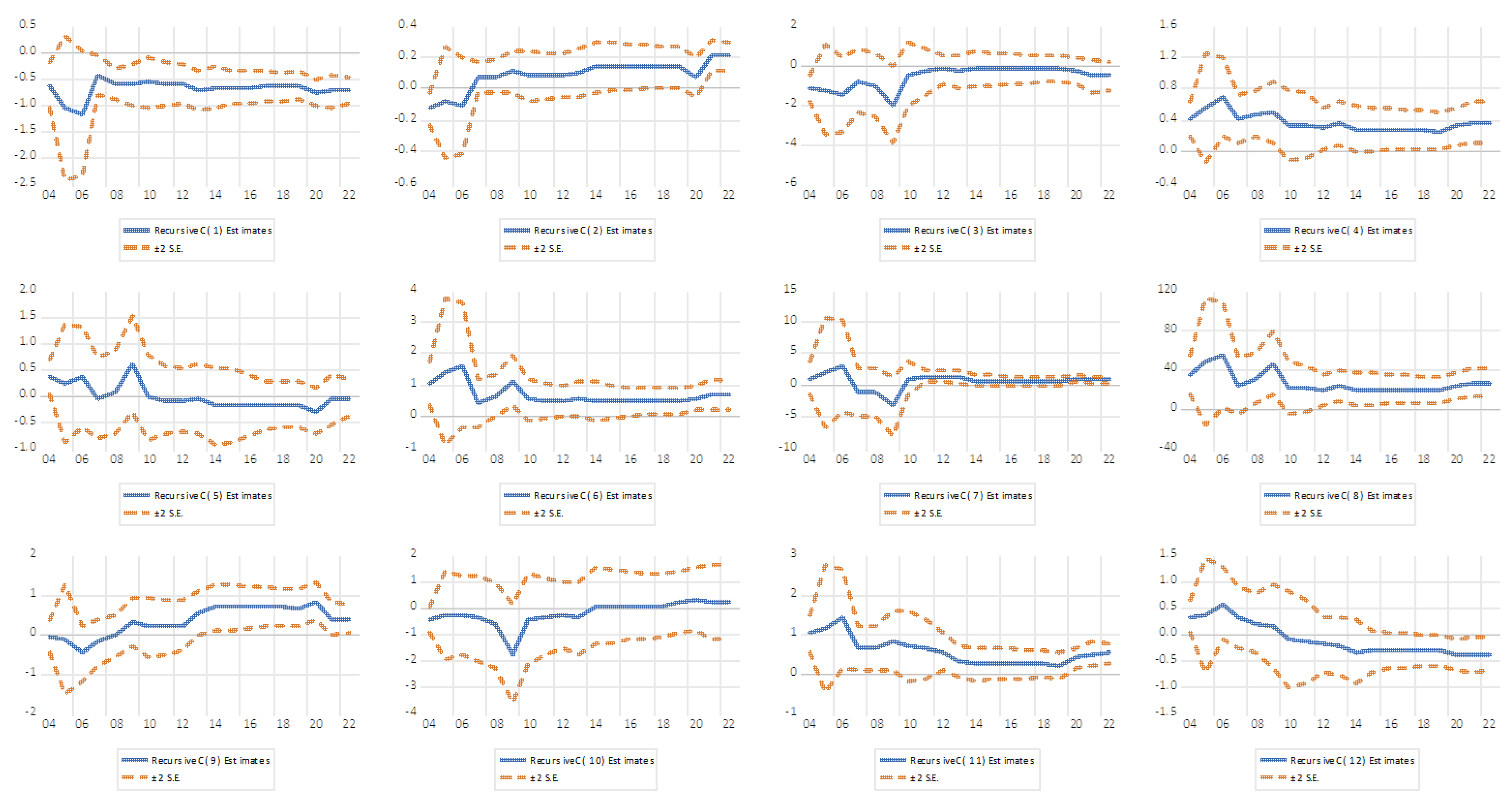

To examine the reliability of the results of the NARDL(2,0,1,0,2) model, we present the CUSUM and CUSUMSQ tests of [

44], as well as the recursive coefficients test for the stability of each coefficient of the model.

Figure 3 and

Figure 4 illustrate the temporal behavior of the sum of the repeated residuals and the sum of the squares of the repeated residuals, respectively and confirm whether the long-term and short-term relationship estimated is stable throughout the period under consideration.

Figure 5 illustrates the test of the recursive coefficients of the NARDL(2,0,1,0,2) model.

From the above diagram, we observe that the CUSUM curve remains within the confidence limits. Therefore, we can say that the estimated coefficients in the NARDL model (2,0,1,0,2) are stable throughout the period under consideration, at a significance level of 95%.

From the above diagram, we observe that the CUSUMSQ curve remains within the confidence limits. Therefore, we can say that there are no serious changes in the error variance. Therefore, the NARDL(2,0,1,0,2) model is reliable. This robustness check further highlights that the observed asymmetry is not a byproduct of the chosen lag specification and that the estimated parameters are stable over time, thereby strengthening the validity of the empirical results.

To examine the evolution of the estimates of the regression coefficients on the NARDL(2,0,1,0,2) model data, we use the following diagram.

Figure 5 shows the two standard error bands around the estimated coefficients.

From the above diagram, we observe that the estimated values of all coefficients converge to stable levels as the sample size increases. This fact suggests that the NARDL(2,0,1,0,2) model is stable and its estimates are reliable. The small fluctuations observed in some periods do not affect the broader stability. Therefore, we can say that the long-term and short-term relationships estimated by the NARDL(2,0,1,0,2) model consistently reflect the dynamics of the variables.

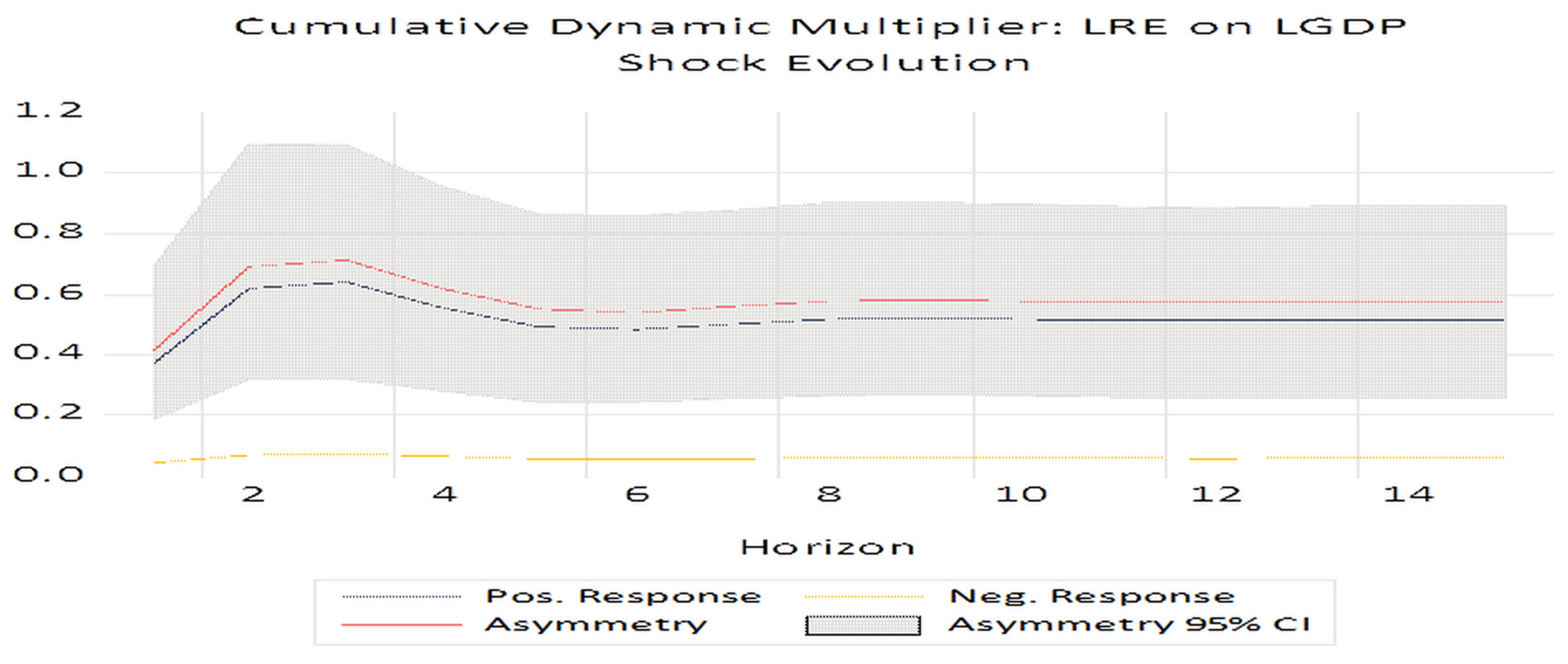

The NARDL model uses Cumulative Dynamic Multipliers (CDMs) to assess the impact of asymmetric changes in the explanatory variables on the dependent variable over time. These multipliers can be positive or negative, reflecting asymmetric effects. The results of the NARDL model confirm the existence of an asymmetric co-integration relationship of renewable energy sources to economic growth. Therefore, cumulative potential multipliers can be used to illustrate the asymmetric responses of renewable energy sources to a change in economic growth.

Figure 6 shows the responses of economic growth to changes in renewable energy sources (long-term asymmetry and short-term symmetry).

From

Figure 6, we observe that positive shocks from renewable energy sources seem to have a greater impact on economic growth than negative shocks. The difference in impacts seems to be at its maximum in the third year after its occurrence, according to the data in the figure. As shown in

Figure 6, the asymmetric impact of renewable energy sources on economic growth is significant in the long run, because the red line marked with “asymmetry” (which shows the impact regardless of whether the change is positive or negative) differs significantly from 0 over the entire period considered. Therefore, we can say that positive changes in renewable energy sources act as a lever for growth (investments, technology, jobs, and environmental benefits). Therefore, their impact is disproportionately greater. Negative changes in renewable energy sources do not have a correspondingly large negative impact because of the following:

They do not yet have the largest share in the energy mix.

There are institutional supports (subsidies, long-term contracts).

Table 10 presents the results of the asymmetric causality test between the variables of renewable energy sources and productive growth.

As can be seen from

Table 10, there is a causal relationship between positive shocks to renewable energy sources and economic growth, as well as from economic growth to positive shocks to renewable energy sources. This means that when the production of renewable energy sources increases (a positive shock), this has a causal effect on economic growth. In other words, more “clean” energy leads to higher growth either through

When there is a causal relationship between economic growth and positive shocks in renewable energy sources, it means that increased economic growth causes more positive changes in renewable energy sources. In other words, when the economy grows, demand/investment in renewable energy sources also increases. This can be carried out via the following:

Higher public and private investments in renewable sources;

Better technological infrastructure;

Stricter environmental policies implemented when there is economic comfort.