Is the Grid Ready for the Electric Vehicle Transition?

Abstract

1. Introduction

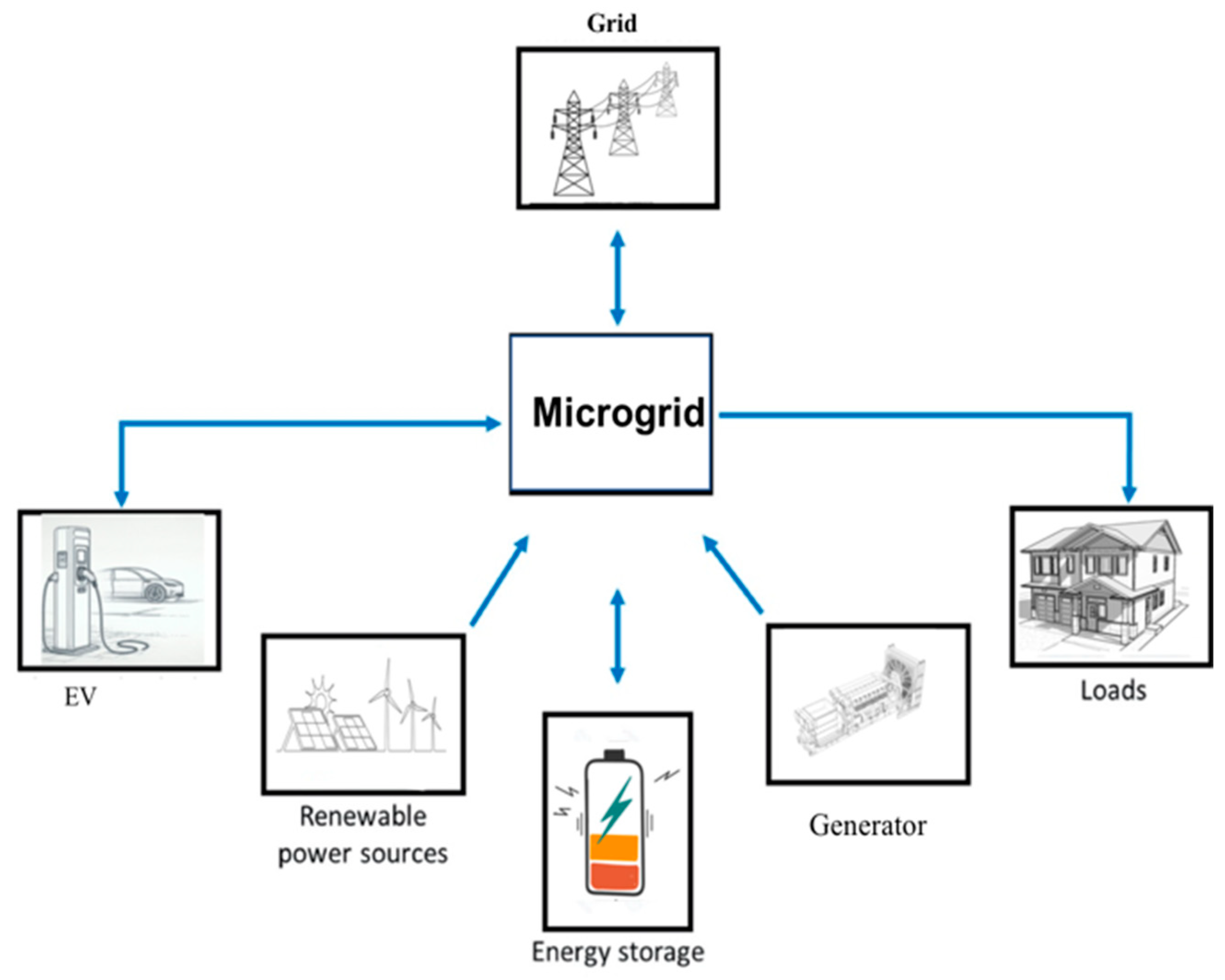

2. Literature Review

2.1. Distribution-Level Impacts and Hosting Capacity

2.2. Smart Charging and Demand-Side Control

2.3. Vehicle-to-Grid (V2G) and Bidirectional Charging

2.4. Operational and Real-Time Challenges

2.5. Policy, Markets, and Stakeholder Coordination

- (1)

- Unmanaged charging often creates local distribution problems before bulk grid problems appear. Upgrades (transformers, service runs) may be needed in high-penetration neighborhoods [22].

- (2)

- Smart charging can defer or avoid many upgrades and integrate more renewables by shifting the load to midday or off-peak periods [23].

- (3)

- V2G could provide valuable services, but real-world uptake is limited by economics, standards, and battery warranty concerns; more pilots and market designs are needed [24].

- (4)

- High-power fast charging is a special case: it can create severe short-term peaks and may require local storage, dedicated grid upgrades, or managed queuing/CS scheduling [25].

- (5)

- Policy and coordination are critical: technical solutions alone will not scale without tariffs, interconnection policy, and data privacy frameworks [13].

3. Increased Electricity Demand and Strain on Grids

3.1. Charging Infrastructure Planning

- Residential/light-use scenario:

- Public and commercial infrastructure:

- Fast-charging focused (urban, highway):

- U.S. target (Department of Energy (DOE), National Electric Vehicle Infrastructure (NEVI) plans):

- South Korea (2023):

- Average EV consumption: ~15–20 kWh per 100 km;

- Annual driving (global average): ~12,000–15,000 km/year;

- 1800–3000 kWh/year per EV.

3.2. Grid Stress and Electric Vehicle Transition

- Voltage fluctuations;

- Overheating of grid components;

- Risk of localized blackouts or the need for load shedding;

- Reduced lifespan of equipment due to overuse.

- Smart charging systems that schedule EV charging during off-peak hours;

- Battery energy storage at the station to buffer demand;

- Time-of-use pricing to discourage peak-hour charging.

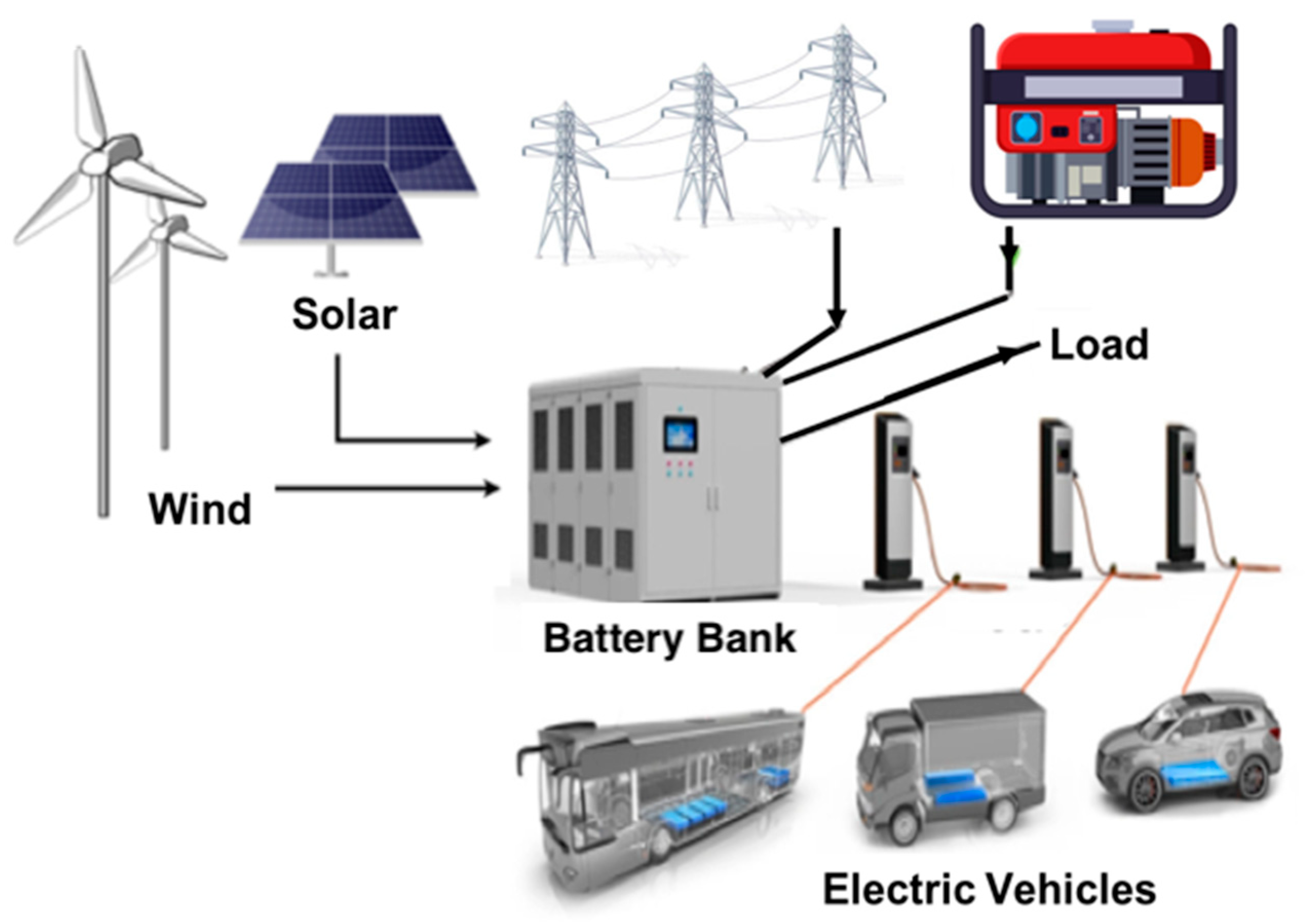

3.3. Renewable Energy and Off-Grid Charging Solutions

- Fast-Charging Hubs

- Gas Station Replacements

3.4. Grid Context

- Urban feeders: More capacity but also more constraints/transformer loading and longer interconnection queues in hotspots.

- Rural feeders: Weaker lines/voltages, but easier land/staging for on-site storage and bigger PV to manage peaks.

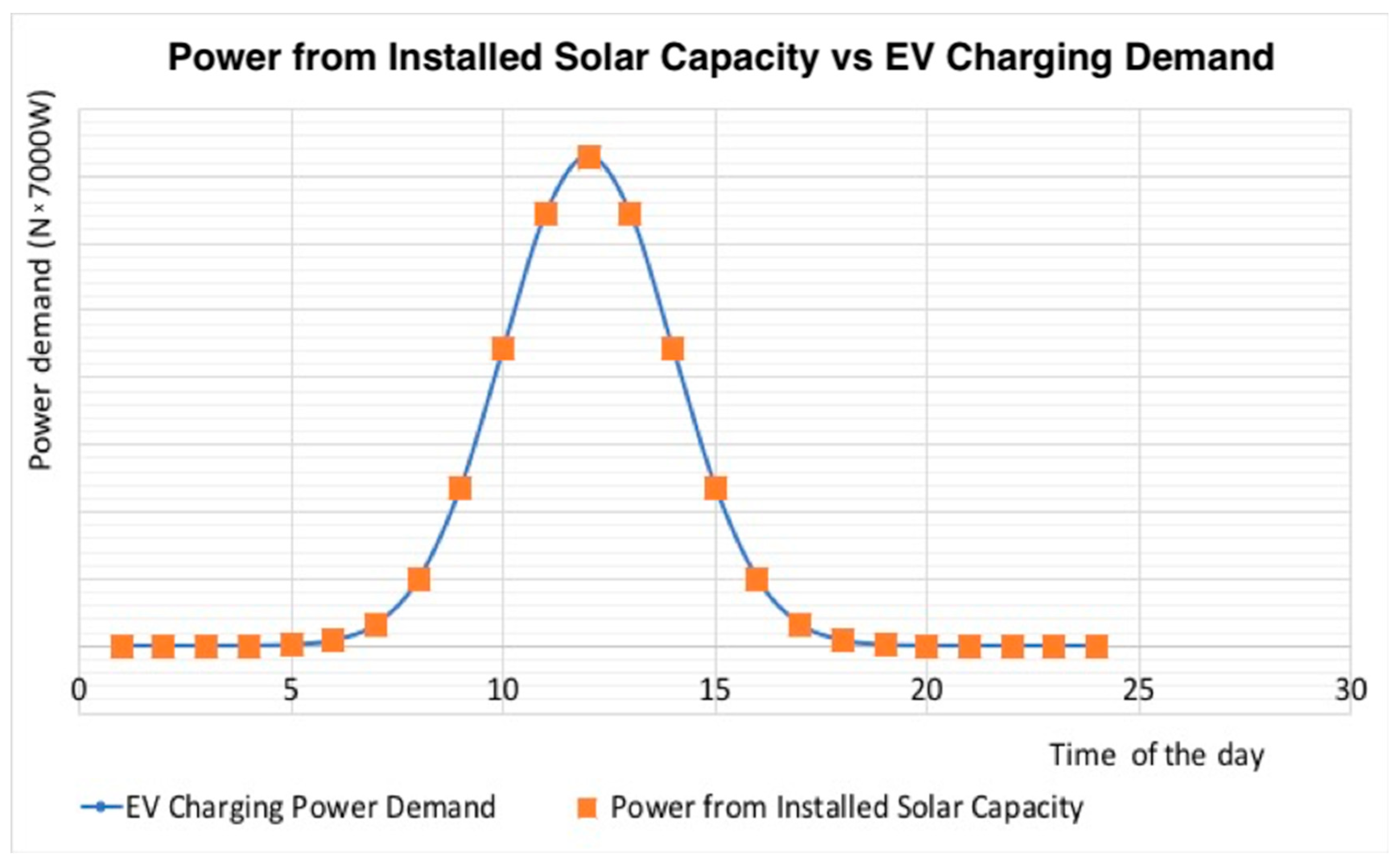

3.5. Load Profile (This Matters as Much as the Sun)

- Workplace/daytime L2 aligns well with the solar curve → high PV self-consumption with minimal storage.

- Residential/evening or highway DCFC is anti-solar (evenings/weekends, stochastic peaks) → storage or grid import becomes key.

- Fleet depots (school buses, municipal, and delivery): Predictable dwell times; often ideal for PV + storage arbitrage and demand-charge control.

4. Power and Energy Demand from EV Fleet: Case Study of the USA

4.1. Installed Capacity and Energy Consumption in the United States

4.2. Energy Demand from EV Fleet

4.2.1. Charging Speed and User Convenience

- Moderate Charging Time: A 7 kW charger provides a balance between fast charging and cost. For a typical EV battery of 50 kWh, the charging time from 0% to 100% at 7 kW is

- Improves Adoption: For users without access to fast chargers, 7 kW ensures daily driving needs (30–60 km) can be met with just 1–2 h of charging.

4.2.2. Electrical Infrastructure Compatibility

- Single-Phase Residential Systems: In many regions (e.g., Europe, Asia), single-phase 230 V systems are standard. At 32 A, the maximum continuous power is

- Avoids Grid Overload: Compared to high-power DC fast chargers (50 kW+), 7 kW AC chargers reduce peak demand and lower stress on local distribution networks.

4.2.3. Cost and Infrastructure Efficiency

- Lower Installation Cost: AC 7 kW chargers are significantly cheaper than DC fast chargers in terms of hardware and grid upgrades.

- Energy Efficiency: AC charging at 7 kW typically maintains high efficiency (≈94%), reducing energy losses compared to higher current draws.

4.2.4. Vehicle Onboard Charger Limitations

- Many EVs are equipped with onboard chargers rated 6.6 kW or 7.4 kW, making 7 kW the sweet spot for AC charging without exceeding onboard limits.

4.2.5. Alignment with Global Standards

- IEC 61851 and SAE J1772 recommend 7.4 kW (230 V, 32 A single-phase) as a standard for level 2 AC charging [51].

- Used widely in Europe, Asia, and North America for home and public charging.

4.2.6. Grid-Friendly and Renewable Integration

- At 7 kW, load management and demand response systems can effectively schedule charging during off-peak hours, supporting renewable energy integration without destabilizing the grid.

- Evolution in EV-related energy demands in the Europe:

4.3. Forecast of Electricity Usage in the Transportation Sector

4.4. Evolution of the Electricity Sector vs. The S-Curve in the Adoption of EVs in the USA

- ○

- Electricity Sector Investment Trends in the USA

- Long-term and capital intensive: Power plants require upfront investment with long lead times (5–15+ years).

- Driven by policy and demand forecasts: Federal/state policies (e.g., Inflation Reduction Act), emissions targets, and expected load growth from EVs and electrification drive investments.

- Grid modernization focus: Increasing investments in transmission, smart grids, storage, and distributed energy resources.

- •

- USD 100B+ annually in U.S. power sector investments [65].

- •

- Shift toward renewables: Solar, wind, and storage now dominate new capacity.

- •

- Utilities are now planning for EV-driven load growth, leading to strategic investments in grid expansion and resiliency.

- ○

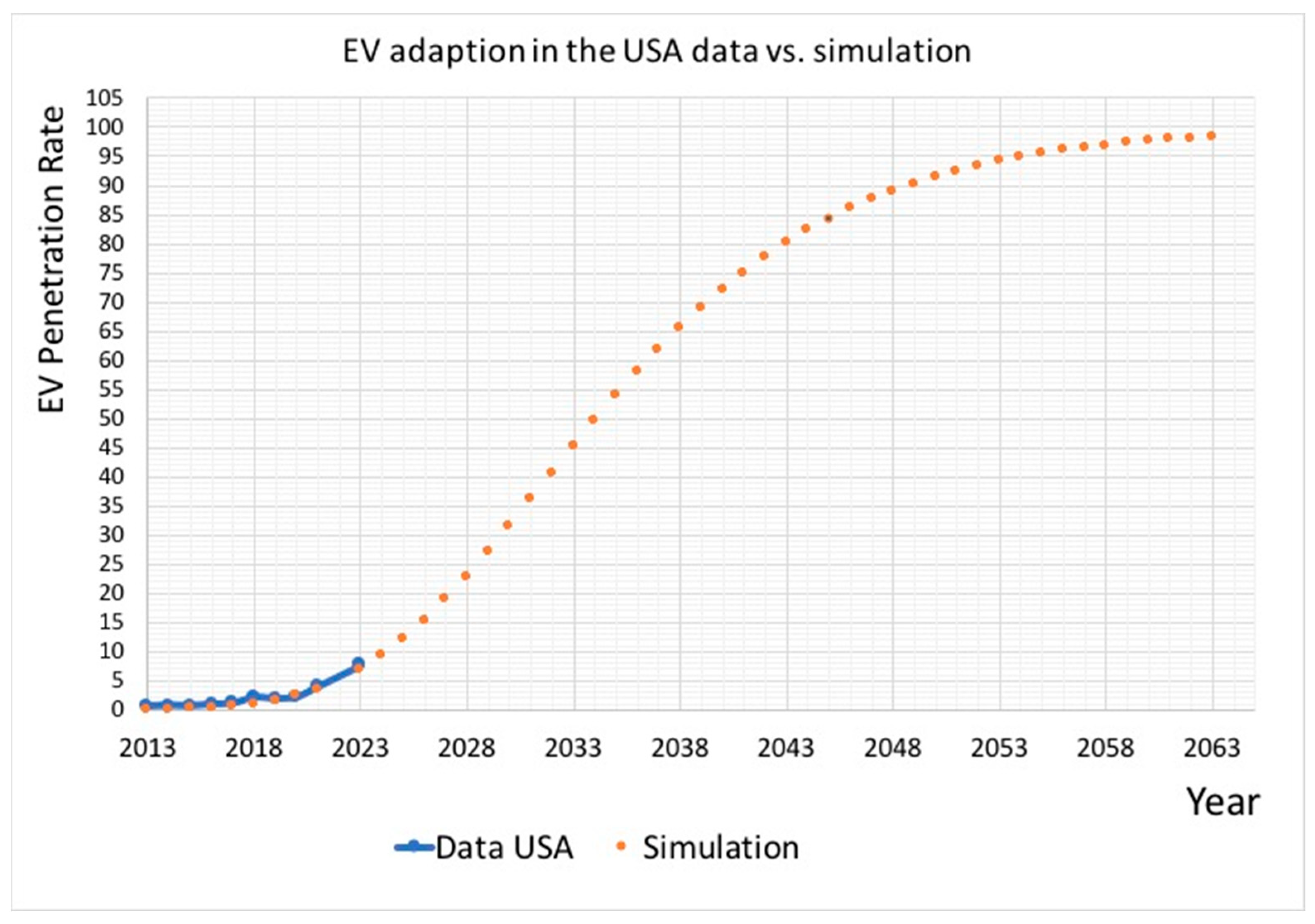

- S-Curve of EV adoption in the USA

- Slow start → rapid growth → saturation.

- EV adoption driven by price drops (esp. batteries), policy incentives, infrastructure, and consumer behavior.

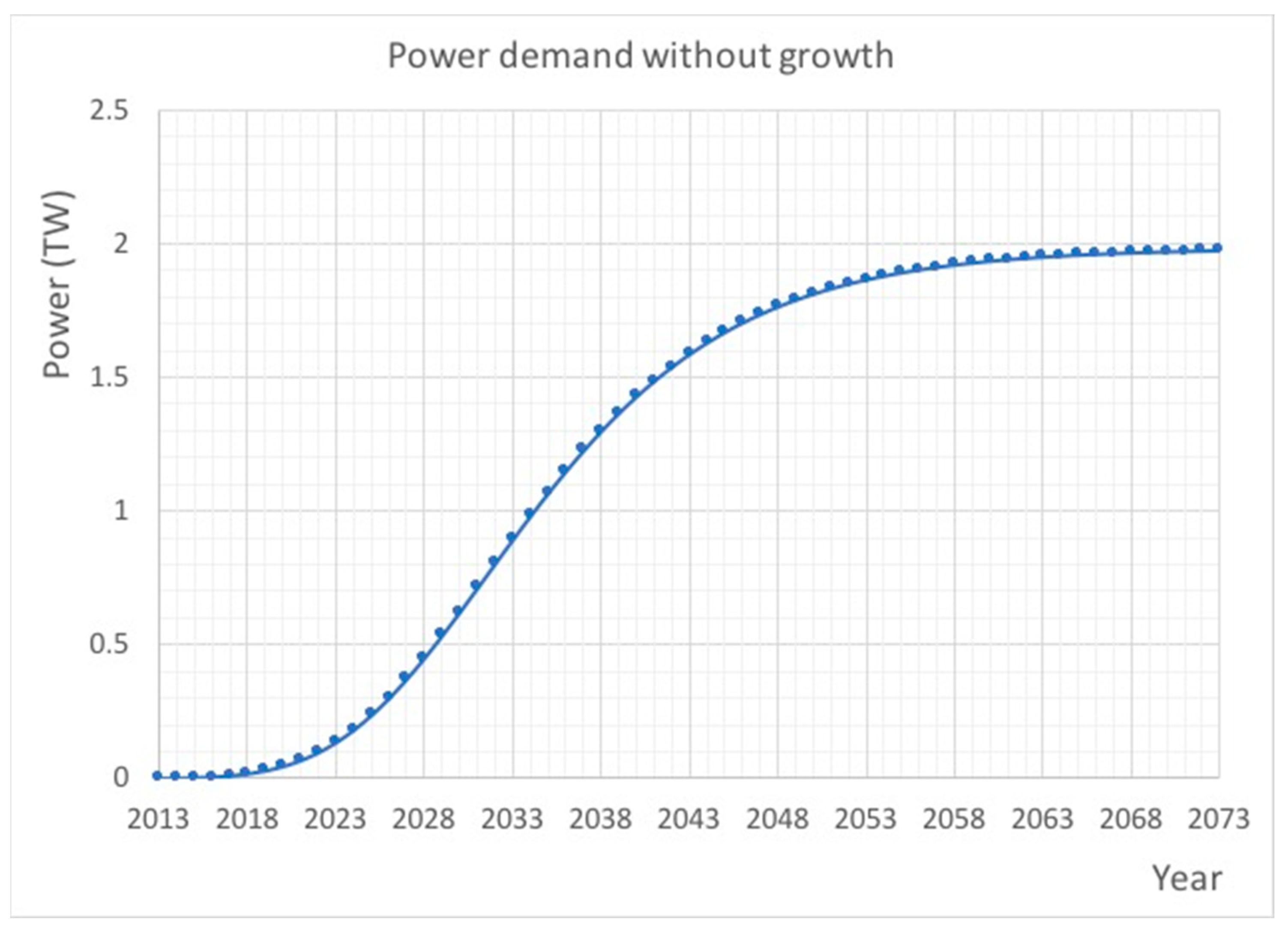

- Inflection point/early majority (Figure 7):

- ○

- EVs ~10–12% of new vehicle sales (2024 data).

- ○

- Used EV market growing.

- ○

- Infrastructure (chargers) lagging behind but accelerating.

- Federal policies: IRA (Inflation Reduction Act) subsidies, tax credits for EVs and chargers.

- State mandates, e.g., California’s ZEV (Zero Emission Vehicle) mandates.

- Private investment in charging networks (Tesla, Electrify America, etc.).

- ○

- Interconnection and implications

- EVs increase electricity demand → need for new generation capacity and grid upgrades.

- EV adoption accelerates grid modernization: more flexible, digital, and distributed systems.

- The mismatch in timelines: EV growth is fast after the inflection point in the curve (Figure 7), but utility investment cycles are slower. There is risk of grid unpreparedness without coordination.

- Opportunity: EVs can be grid assets (V2G, smart charging) but it requires integrated planning.

- ○

- Strategic insight

- Align EV adoption trajectories with utility infrastructure planning.

- Accelerate permitting and interconnection for power projects.

- Scale charging infrastructure with high geographic equity.

- EV Fleet Evolution: 2006–2024 and Future Outlook

- In 2006, EVs were virtually negligible in the U.S. fleet, with fewer than ~10,000 plug-in vehicles. Low-speed EVs numbered around 60–76,000, but mass-market highway-capable EVs were nearly absent [66].

- By 2020, the cumulative plug-in electric vehicles sold since 2010 reached ~1.8 million, with roughly 2 million EVs on the road (about 1% of ~290 million total vehicles) [67].

- In 2024, new EV registrations were around 1.1 million (~9.2% of new registrations), aligning with Experian’s estimate of ~4 million EVs on the road out of 292 million (~1.4%) [68].

- EY (pre-pandemic) projected EVs would rise from ~2 million in 2020 (~2%) to ~88 million (approx. 65% share) by 2050 in U.S. fleet stock [70].

- IEA/EIA scenarios suggest 11–26% of light-duty vehicle stock in 2050 will be plug-in vehicles, depending on assumptions (~up to 65% under aggressive adoption) [71].

- Based on a slower turnover, even if all new sales became electric, it would likely take until the 2040s or 2050s before EVs constitute a majority of the total fleet (~60–70%) [72].

- As of 2024, the U.S.’s total installed generating capacity stood at approximately 1250 GW (~1.25 TW) [73].

- Significant capacity additions are occurring, and about 35 GW were added in 2024 [74].

- According to EIA’s ‘Annual Energy Outlook Reference Case’, the total capacity doubles (2.1 TW–2.2 TW) by 2050, roughly 2 × from the current ~1.1 TW in 2022 [75].

- Replacing fossil fuels and supporting EV load means capacity must expand not only to meet demand but also to replace the retired coal and gas plants, and firm capacity must ensure reliability.

- Battery storage growth (~doubling in 2024 alone) is vital to support intermittent solar and wind power [79].

- The EV fleet grew from virtually zero in 2006 to ~4 million by 2024 (~1–1.4% of total vehicles).

- If adoption accelerates, EVs could make up 25–65% of U.S. vehicles by 2050, depending on turnover and policy.

- Installed generating capacity has grown to ~1.25 TW by 2024 and is projected to double or even triple by 2050, with solar and wind dominating the expansion.

- The shift is not just growth, it is a transformation of the energy system, coupling clean generation growth with massive new electricity demands from electric transport.

4.5. Vehicle to Grid

4.6. Policy and Market Barriers

- Interconnection certification bottlenecks

- Wholesale market access is still incomplete

- Retail tariffs and metering rules are not V2G-ready

- Consumer protection and warranty ambiguity

- Fragmented pilots and permitting

4.7. Technical and Standards Barriers and Solutions

- Interoperability across the stack is immature

- Device availability and pairing constraints

- Cybersecurity and identity management

- Telemetry, baselining, and aggregation control

- Battery degradation uncertainty (and perception)

4.8. Practical Roadmap

- Start where value is the highest: Commercial fleets (buses, last-mile vans) with depot dwell time and predictable schedules; use DC V2G first to reduce interop friction [88].

- Standard gates for new installs: Require an ISO 15118-20 capability for any bidirectional port after a future cutoff; keep DIN 70121 as receive-only during transition [85].

- Finish the market plumbing: Complete FERC 2222 implementations with V2G-specific telemetry/baseline rules; allow small-asset aggregations everywhere [91].

- Fix interconnection now: Maintain UL 1741 SB waivers where needed with clear criteria; publish a uniform fast-track checklist for V2G DC/AC (UL 9741 + 1741 SA/SB, SAE J3072) [80].

- Tariffs that pencil out: EV export rates that stack TOU and ancillary service payments; explicit sub-metering rules at the EVSE; and customer protections and warranty addenda [92].

- Interoperability proof: Fund recurring multi-vendor plugfests and publish pass/fail matrices (ISO 15118-20 + OCPP backend behaviors) [85].

- Trust and security: Adopt a national/sector PKI and certificate policy aligned with 15118-20; require secure update practices in interconnection approvals [85].

5. Conclusions

- 1.

- S-Curve of EV adoption

- 2.

- Implications for the grid involve

- Load growth: As EV adoption increases, electricity demand rises significantly, particularly in residential areas.

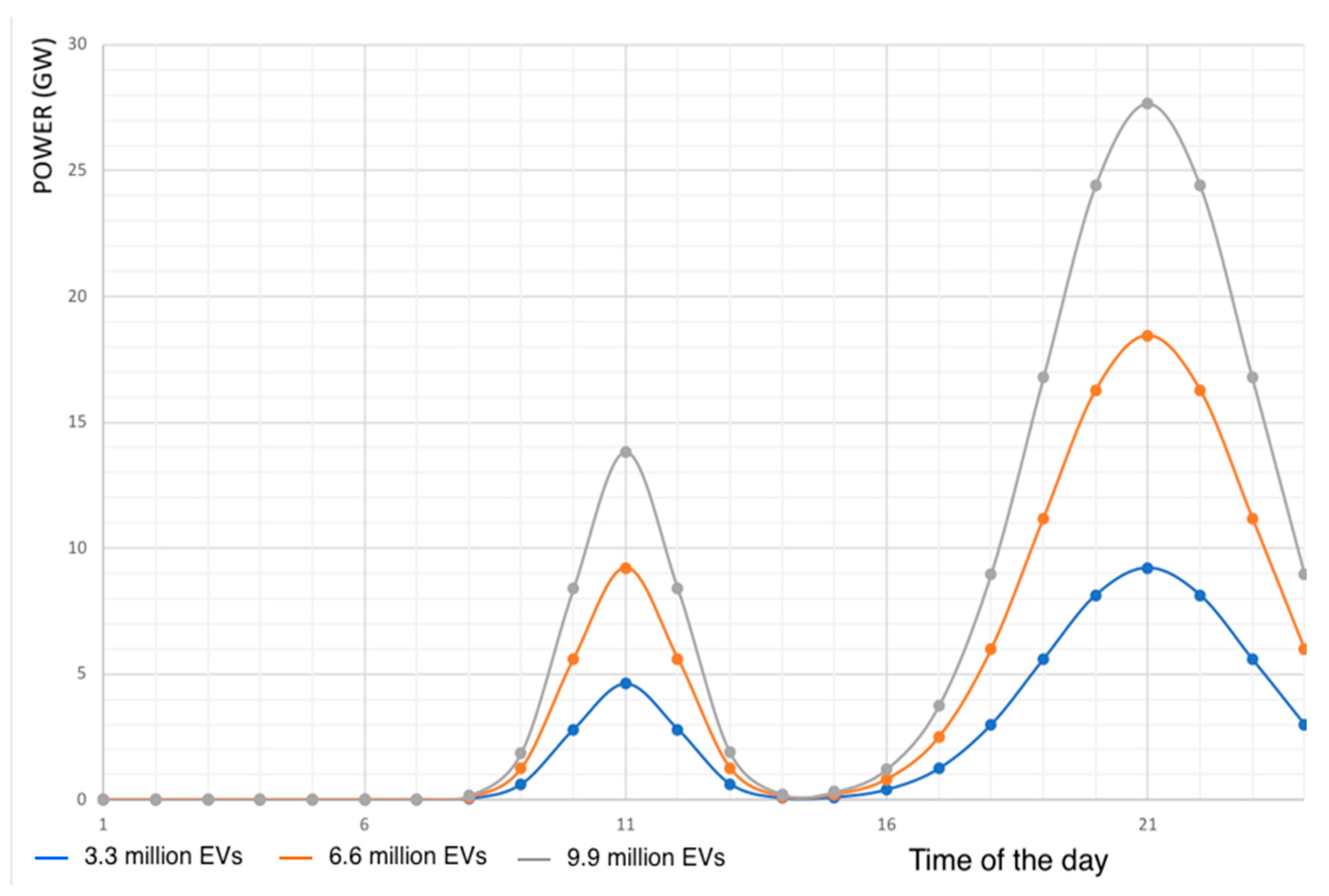

- Peak demand stress: Unmanaged EV charging, especially in the evenings, could exacerbate peak load issues and would require a behavior shift.

- Infrastructure needs: Grid modernization, more transformers, distribution upgrades, and smart meters will be necessary.

- Smart charging: Time-of-use pricing, V2G, and managed charging can mitigate stress and improve efficiency.

- Renewable integration: As EVs can act as distributed storage, they can help stabilize the grid when paired with intermittent renewables like solar and wind.

- 3.

- Timing is critical

5.1. Policy Changes

5.1.1. Grid Modernization and Reliability Mandates

- Require utilities to upgrade aging infrastructure and incorporate smart grid technologies (real-time monitoring, automation).

- Implement performance standards for resilience against EV load spikes.

5.1.2. Charging Infrastructure Regulation

- Set national standards for fast charging (power levels, connectors).

- Right-to-charge laws for apartments and workplaces.

- Mandate interoperability between charging networks.

5.1.3. Renewable Integration and Storage Policies

- Policies to align EV load growth with renewable generation expansion.

- Incentives for grid scale and distributed storage to balance intermittent renewables.

5.1.4. Dynamic Pricing and Demand Response

- Mandate time-of-use tariffs or real-time pricing to encourage off-peak EV charging.

- Encourage V2G participation through clear market rules.

5.1.5. Planning and Forecasting Requirements

- Require utilities to model EV adoption scenarios in Integrated Resource Plans (IRPs).

- Long-term forecasting to avoid under/over-investment

5.2. Investment Priorities

5.2.1. Transmission and Distribution Upgrades

- Reinforce distribution feeders in urban and suburban areas (EV clusters).

- Expand high-voltage transmission for renewables and EV charging corridors.

5.2.2. Charging Network Deployment

- Highway fast chargers with high power (≥350 kW).

- Urban DC fast-charging hubs in dense cities.

- Residential and workplace slow chargers with incentives for smart charging.

5.2.3. Smart Grid and Digitalization

- Deploy Advanced Metering Infrastructure (AMI) for real-time data.

- Invest in AI-based load forecasting and automated demand response systems.

5.2.4. Energy Storage and Flexible Resources

- Battery storage for peak shaving and renewable balancing.

- Distributed energy resources (DER) like rooftop solar panels and batteries near EV clusters.

5.2.5. Vehicle-to-Grid (V2G) Infrastructure

- Enable bidirectional chargers.

- Create market participation frameworks so EVs can provide ancillary services.

5.3. Investment Models and Financing

- Public–Private Partnerships (PPPs) for charging infrastructure.

- Green bonds and climate funds for grid modernization.

- Utility cost recovery mechanisms to finance upgrades.

5.4. Timeline Considerations Based on the S-Curve Adoption of EVs

- Short-term (2025): Smart charging incentives, basic V2G pilots, and targeted distribution upgrades.

- Medium-term (2030): Large-scale charging corridors, V2G integration, and significant grid reinforcement.

- Long-term (2040+): Full digital grid, autonomous charging, and renewable-dominated EV ecosystem.

Funding

Data Availability Statement

Conflicts of Interest

References

- Abo-Khalil, A.G.; Abdelkareem, M.A.; Sayed, E.T.; Maghrabie, H.M.; Radwan, A.; Rezk, H.; Olabi, A.G. Electric vehicle impact on energy industry, policy, technical barriers, and power systems. Int. J. Thermofluids 2022, 13, 100134. [Google Scholar] [CrossRef]

- Zhu, Y.; Choma, E.F.; Wang, K.; Wang, H. Electric vehicle adoption delivers public health and environmental benefits. Eco Environ. Health 2023, 2, 193–194. [Google Scholar] [CrossRef]

- Tan, V.K.M.; Yong, J.Y.; Ramachandaramurthy, V.K.; Mansor, M.; Teh, J.; Guerrero, J.M. Factors influencing global transportation electrification: Comparative analysis of electric and internal combustion engine vehicles. Renew. Sustain. Energy Rev. 2023, 184, 113582. [Google Scholar] [CrossRef]

- Liu, H.; Wang, D.Z.W. Locating multiple types of charging facilities for battery electric vehicles. Transp. Res. Part B Methodol. 2017, 103, 30–55. [Google Scholar] [CrossRef]

- Yoldaş, Y.; Önen, A.; Muyeen, S.M.; Vasilakos, A.V.; Alan, İ. Enhancing smart grid with microgrids: Challenges and opportunities. Renew. Sustain. Energy Rev. 2017, 72, 205–214. [Google Scholar] [CrossRef]

- Khan, A.A.; Kubra, K.; Islam, M.R.; Rahman, M.A.; Hassan, M. Microgrid-based operational framework for grid resiliency enhancement: A case study at KUET campus in Bangladesh. Energy Rep. 2024, 11, 1752–1765. [Google Scholar] [CrossRef]

- Kumar, P.; Channi, H.K.; Kumar, R.; Rajiv, A.; Kumari, B.; Singh, G.; Singh, S.; Dyab, I.F.; Lozanović, J. A comprehensive review of vehicle-to-grid integration in electric vehicles: Powering the future. Energy Convers. Manag. X 2025, 25, 100864. [Google Scholar] [CrossRef]

- Owens, J.; Miller, I.; Gençer, E. Can vehicle-to-grid facilitate the transition to low carbon energy systems? Energy Adv. 2022, 1, 943–1072. [Google Scholar] [CrossRef]

- Mathisen, S.; Zeyringer, M.; Haaskjold, K.; Löffler, K.; Mata, É.; Sandvall, A.; Andersen, K.S.; Vågerö, O.; Wolfgang, O. The REPowerEU policy’s impact on the Nordic power system. Energy Strategy Rev. 2024, 54, 101454. [Google Scholar] [CrossRef]

- Vezzoni, R. Green growth for whom, how and why? The REPowerEU Plan and the inconsistencies of European Union energy policy. Energy Res. Soc. Sci. 2023, 101, 103134. [Google Scholar] [CrossRef]

- Diouf, B. The Electric Vehicle Transition. Environ. Sci. Adv. 2024, 3, 332. [Google Scholar] [CrossRef]

- Diouf, B. Modeling the Used Vehicle Market Share in the Electric Vehicle Transition. World Electr. Veh. J. 2025, 16, 29. [Google Scholar] [CrossRef]

- The Department of Energy’s Energy. Available online: https://www.energy.gov/sites/default/files/2024-10/Congressional%20Report%20EV%20Grid%20Impacts.pdf (accessed on 5 August 2025).

- Ayoade, I.A.; Longe, O.M. A Comprehensive Review on Smart Electromobility Charging Infrastructure. World Electr. Veh. J. 2024, 15, 286. [Google Scholar] [CrossRef]

- Duan, C.; Motter, A.E. Grid congestion stymies climate benefit from U.S. vehicle electrification. Nat. Commun. 2025, 16, 7242. [Google Scholar] [CrossRef]

- van den Berg, M.A.; Lampropoulos, I.; Alskaif, T.A. Impact of electric vehicles charging demand on distribution transformers in an office area and determination of flexibility potential. Sustain. Energy Grids Netw. 2021, 26, 100452. [Google Scholar] [CrossRef]

- Johnsen, D.; Ostendorf, L.; Bechberger, M.; Strommenger, D. Review on Smart Charging of Electric Vehicles via Market-Based Incentives, Grid-Friendly and Grid-Compatible Measures. World Electr. Veh. J. 2023, 14, 25. [Google Scholar] [CrossRef]

- The Department of Energy’s Energy. Available online: https://www.energy.gov/sites/default/files/2025-01/Vehicle_Grid_Integration_Asseessment_Report_01162025.pdf (accessed on 5 August 2025).

- Štogl, O.; Miltner, M.; Zanocco, C.; Traverso, M.; Starý, O. Electric vehicles as facilitators of grid stability and flexibility: A multidisciplinary overview. WIREs Energy Environ. 2024, 13, e536. [Google Scholar] [CrossRef]

- Khan, M.O.; Kirmani, S.; Rihan, M. Impact assessment of electric vehicle charging on distribution networks. Renew. Energy Focus 2024, 50, 100599. [Google Scholar] [CrossRef]

- Al-Amin, G.M.; Shafiullah, M.; Shoeb, S.M.; Ferdous, S.M.; Anda, M. Grid Integration of EV: A review on stakeholder’s objectives, challenges, and strategic implications. e-Prime 2025, 11, 100930. [Google Scholar] [CrossRef]

- Nutkani, I.; Toole, H.; Andrew, L.P.C. Impact of EV charging on electrical distribution network and mitigating solutions—A review. IET Smart Grid 2024, 7, 485–502. [Google Scholar] [CrossRef]

- Bastida-Molina, P.; Rivera, Y.; Berna-Escriche, C.; Blanco, D.; Álvarez-Piñeiro, L. Challenges and Opportunities in Electric Vehicle Charging: Harnessing Solar Photovoltaic Surpluses for Demand-Side Management. Machines 2024, 12, 144. [Google Scholar] [CrossRef]

- Zhang, C.; Wang, X.; Wang, Y.; Tang, P. Economic Viability of Vehicle-to-Grid (V2G) Reassessed: A Degradation Cost Integrated Life-Cycle Analysis. Sustainability 2025, 17, 5626. [Google Scholar] [CrossRef]

- Ibrahim, R.A.; Gaber, I.M.; Zakzouk, N.E. Analysis of multidimensional impacts of electric vehicles penetration in distribution networks. Sci. Rep. 2024, 14, 27854. [Google Scholar] [CrossRef]

- Visaria, A.A.; Jensen, A.F.; Thorhauge, M.; Mabit, S.E. User preferences for EV charging, pricing schemes, and charging infrastructure. Transp. Res. Part A Policy Pract. 2022, 165, 120–143. [Google Scholar] [CrossRef]

- Dini, P.; Saponara, S.; Colicelli, A. Overview on Battery Charging Systems for Electric Vehicles. Electronics 2023, 12, 4295. [Google Scholar] [CrossRef]

- Weiss, M.; Winbush, T.; Newman, A.; Helmers, E. Energy Consumption of Electric Vehicles in Europe. Sustainability 2024, 16, 7529. [Google Scholar] [CrossRef]

- Charging the Future. Available online: https://evbox.com/en/ev-home-charger-electricity-usage (accessed on 5 August 2025).

- Global EV Sales by Country. Available online: https://roadgenius.com/cars/ev/statistics/sales-by-country/ (accessed on 5 August 2025).

- Share Plug-In Electric Cars in Selected Markets. Available online: https://en.wikipedia.org/wiki/Electric_car_use_by_country#/media/File:PEVs_in_use_Top_countries_&_regional_markets_2020.png (accessed on 5 August 2025).

- The Global EV Market Overview in 2025. Available online: https://www.virta.global/global-electric-vehicle-market (accessed on 5 August 2025).

- Automotive Registered Statistics for 2023. Available online: https://www.mk.co.kr/en/society/10921207 (accessed on 5 August 2025).

- EVs Registered in South Korea. Available online: https://www.statista.com/statistics/1097976/south-korea-total-registration-number-of-electric-vehicles/ (accessed on 5 August 2025).

- Countries with Best EV Charging Infrastructure. Available online: https://www.statista.com/chart/30897/countries-with-the-best-ev-charging-infrastructure/ (accessed on 5 August 2025).

- City Population in Norway. Available online: https://www.citypopulation.de/en/norway/cities/ (accessed on 5 August 2025).

- Ahmad, F.; Iqbal, A.; Ashraf, I.; Marzband, M.; Khan, I. Optimal location of electric vehicle charging station and its impact on distribution network: A review. Energy Rep. 2022, 8, 2314–2333. [Google Scholar] [CrossRef]

- Off-Grid Charging-Station. Available online: https://yocharge.com/faq/what-is-off-grid-ev-charging-station/ (accessed on 5 August 2025).

- Yang, M.; Sun, X.; Liu, R.; Wang, L.; Zhao, F.; Mei, X. Predict the lifetime of lithium-ion batteries using early cycles: A review. Appl. Energy 2024, 376, 124171. [Google Scholar] [CrossRef]

- Carlton, G.J.; Sultana, S. Electric vehicle charging station accessibility and land use clustering: A case study of the Chicago region. J. Urban Mobil. 2022, 2, 100019. [Google Scholar] [CrossRef]

- EV Charging Infrastructure in the U.S. Available online: https://www.pewresearch.org/data-labs/2024/05/23/electric-vehicle-charging-infrastructure-in-the-u-s/ (accessed on 5 August 2025).

- Proximity to Charging Stations. Available online: https://inframanage.com/proximity-to-charging-station-correlates-with-ev-switch-us-survey/ (accessed on 5 August 2025).

- EV Charging Habits. Available online: https://www.weforum.org/stories/2023/01/electric-cars-charging-habits/ (accessed on 5 August 2025).

- Ahmad, T.; Zhang, D. A critical review of comparative global historical energy consumption and future demand: The story told so far. Energy Rep. 2020, 6, 1973–1991. [Google Scholar] [CrossRef]

- U.S. Energy Information Administration. Monthly Energy Review, April 2022; U.S. EIA: Washington, DC, USA, 2022. [Google Scholar]

- U.S. Energy. Available online: https://www.eia.gov/energyexplained/us-energy-facts/ (accessed on 5 August 2025).

- Energy Production and Consumption in the U.S. Available online: https://www.e-education.psu.edu/ebf301/node/457 (accessed on 5 August 2025).

- Rigogiannis, N.; Bogatsis, I.; Pechlivanis, C.; Kyritsis, A.; Papanikolaou, N. Moving towards Greener Road Transportation: A Review. Clean Technol. 2023, 5, 766–790. [Google Scholar] [CrossRef]

- Barman, P.; Dutta, L.; Bordoloi, S.; Kalita, A.; Buragohain, P.; Bharali, S.; Azzopardi, B. Renewable energy integration with electric vehicle technology: A review of the existing smart charging approaches. Renew. Sustain. Energy Rev. 2023, 183, 113518. [Google Scholar] [CrossRef]

- U.S. Energy Consumption by Sector. Available online: https://www.statista.com/statistics/560927/us-retail-electricity-consumption-by-sector/ (accessed on 5 August 2025).

- Tasnim, M.N.; Akter, S.; Shahjalal, M.; Shams, T.; Davari, P.; Iqbal, A. A critical review of the effect of light duty electric vehicle charging on the power grid. Energy Rep. 2023, 10, 4126–4147. [Google Scholar] [CrossRef]

- Electric Power Sector Capacity. Available online: https://www.statista.com/statistics/504369/electric-power-sector-capacity-in-the-us-forecast/ (accessed on 5 August 2025).

- Gielen, D.; Boshell, F.; Saygin, D.; Morgan, D.M.; Wagner, N.; Gorini, R. The role of renewable energy in the global energy transformation. Energy Strategy Rev. 2019, 24, 38–50. [Google Scholar] [CrossRef]

- Nogueira, T.; Sousa, E.; Alves, G.R. Electric vehicles growth until 2030: Impact on the distribution network power. Energy Rep. 2022, 8, 145–152. [Google Scholar] [CrossRef]

- McKinsey & Company. Global Energy Perspective 2024. McKinsey Global Energy and Materials Practice. 2024. Available online: https://www.mckinsey.com/industries/energy-and-materials/our-insights/global-energy-perspective (accessed on 5 August 2025).

- Hamed, M.M.; Ali, H.; Abdelal, Q. Forecasting annual electric power consumption using a random parameters model with heterogeneity in means and variances. Energy 2022, 255, 124510. [Google Scholar] [CrossRef]

- Paul, J.; Blumenberg, E. Vehicle ownership rates: The role of lifecycle, period, and cohort effects. Transp. Res. Interdiscip. Perspect. 2023, 21, 100892. [Google Scholar] [CrossRef]

- Buhmann, K.M.; Criado, J.R. Consumers’ preferences for electric vehicles: The role of status and reputation. Transp. Res. Part D Transp. Environ. 2023, 114, 103530. [Google Scholar] [CrossRef]

- Wang, H.; Guo, F.; Sivakumar, A. Analysing the impact of electric vehicle charging on households: An interrelated load profile generation approach. Energy Build. 2025, 335, 115558. [Google Scholar] [CrossRef]

- Andersen, F.M.; Jacobsen, H.K.; Gunkel, P.A. Hourly charging profiles for electric vehicles and their effect on the aggregated consumption profile in Denmark. Int. J. Electr. Power Energy Syst. 2021, 130, 106900. [Google Scholar] [CrossRef]

- Baek, K.; Lee, E.; Kim, J. A dataset for multi-faceted analysis of electric vehicle charging transactions. Sci. Data 2024, 11, 262. [Google Scholar] [CrossRef]

- Manousakis, N.M.; Kanellos, F.D. Integration of Renewable Energy and Electric Vehicles in Power Systems: A Review. Processes 2023, 11, 1544. [Google Scholar] [CrossRef]

- Amiruddin, A.; Dargaville, R.; Liebman, A.; Gawler, R. Integration of Electric Vehicles and Renewable Energy in Indonesia’s Electrical Grid. Energies 2024, 17, 2037. [Google Scholar] [CrossRef]

- Electricity Demand in 2050. Available online: https://www.pnnl.gov/main/publications/external/technical_reports/PNNL-23491.pdf (accessed on 5 August 2025).

- U.S. Energy Expenditure. Available online: https://www.ft.com/content/051f2361-de09-4744-814f-0de4b9b6c0d0 (accessed on 5 August 2025).

- EV Fleet Projection. Available online: https://about.bnef.com/insights/clean-transport/electric-vehicle-fleet-set-to-hit-100-million-by-2026-but-stronger-push-needed-to-stay-on-track-for-net-zero/ (accessed on 5 August 2025).

- Pelegov, D.V.; Chanaron, J.-J. Electric Car Market Analysis Using Open Data: Sales, Volatility Assessment, and Forecasting. Sustainability 2023, 15, 399. [Google Scholar] [CrossRef]

- EV Adoption Trends. Available online: https://www.spglobal.com/mobility/en/research-analysis/electric-vehicle-adoption-trends-its-not-all-grim.html (accessed on 5 August 2025).

- Number of EVs in the U.S. Available online: https://www.experian.com/blogs/ask-experian/how-many-evs-are-in-us/ (accessed on 5 August 2025).

- Shaping the EV Market. Available online: https://www.ey.com/en_us/insights/automotive/five-hypotheses-shaping-the-electric-vehicle-market (accessed on 5 August 2025).

- EV Adoption in the U.S. Available online: https://evtcp.org/country/united-states-of-america/ (accessed on 5 August 2025).

- New Cars Market in the U.S. Available online: https://time.com/6280316/ev-impact-aging-gasoline-cars/ (accessed on 5 August 2025).

- Energy Sources in the U.S. Available online: https://natlawreview.com/article/evolving-mix-energy-sources-uss-electric-generating-capacity (accessed on 5 August 2025).

- Mix of Energy Sources in the U.S. Available online: https://www.eia.gov/energyexplained/electricity/electricity-in-the-us-generation-capacity-and-sales.php (accessed on 5 August 2025).

- Evolution Mix of Energy Sources in the U.S. Available online: https://www.foley.com/insights/publications/2024/09/the-evolving-mix-of-the-energy-sources-for-the-u-s-s-electric-generating-capacity/ (accessed on 5 August 2025).

- Load Growth. Available online: https://www.utilitydive.com/news/icf-sees-25-load-growth-by-2030-up-to-40-price-increase/748711/ (accessed on 5 August 2025).

- Plug-In EVs. Available online: https://en.wikipedia.org/wiki/Plug-in_electric_vehicle (accessed on 5 August 2025).

- Here’s How EV Sales Are Affecting Oil Demand. Available online: https://www.investors.com/news/oil-prices-trump-drill-baby-drill-evs-oil-stocks-demand (accessed on 5 August 2025).

- Rahman, M.M.; Thill, J.-C. A Comprehensive Survey of the Key Determinants of Electric Vehicle Adoption: Challenges and Opportunities in the Smart City Context. World Electr. Veh. J. 2024, 15, 588. [Google Scholar] [CrossRef]

- California Public Utilities Commission. Available online: https://www.cpuc.ca.gov/-/media/cpuc-website/divisions/energy-division/documents/transportation-electrification/energization/2025-vgi-forum-slide-deck.pdf (accessed on 5 August 2025).

- AI and Grid. Available online: https://www.ul.com/news/ul-solutions-issues-first-certification-ul-9741-and-ul-1741-sa-ai-driven-vehicle-grid (accessed on 5 August 2025).

- Federal Energy Regulatory Commission. Available online: https://cuswebsite.blob.core.windows.net/2222tracker/Tracker-Report-November-2024.pdf (accessed on 5 August 2025).

- California Public Utilities Commission. Available online: https://www.cpuc.ca.gov/industries-and-topics/electrical-energy/infrastructure/transportation-electrification/vehicle-grid-integration-activities (accessed on 5 August 2025).

- Menyhart, J. Electric Vehicles and Energy Communities: Vehicle-to-Grid Opportunities and a Sustainable Future. Energies 2025, 18, 854. [Google Scholar] [CrossRef]

- California Energy Commission. Available online: https://e-mobility.abb.com/sites/default/files/2024-12/241218_ABB_White-Paper.pdf (accessed on 5 August 2025).

- SAE International. Fermata Energy. Available online: https://fermataenergy.com/resources/key-takeaways-from-v2g-forum-san-diego-2024/ (accessed on 5 August 2025).

- Johnson, J.; Berg, T.; Anderson, B.; Wright, B. Review of Electric Vehicle Charger Cybersecurity Vulnerabilities, Potential Impacts, and Defenses. Energies 2022, 15, 3931. [Google Scholar] [CrossRef]

- Dik, A.; Omer, S.; Boukhanouf, R. Electric Vehicles: V2G for Rapid, Safe, and Green EV Penetration. Energies 2022, 15, 803. [Google Scholar] [CrossRef]

- Sagaria, S.; van der Kam, M.; Boström, T. Vehicle-to-grid impact on battery degradation and estimation of V2G economic compensation. Appl. Energy 2025, 377 Pt B, 124546. [Google Scholar] [CrossRef]

- V2G. Available online: https://newmobility.news/2025/08/05/german-study-shows-v2g-has-minor-impact-on-battery-degradation/ (accessed on 5 August 2025).

- Federal Energy Regulatory Commission. Available online: https://www.ferc.gov/ferc-order-no-2222-explainer-facilitating-participation-electricity-markets-distributed-energy (accessed on 5 August 2025).

- California Energy Commission. Available online: https://www.energy.ca.gov/programs-and-topics/programs/vehicle-grid-integration-program (accessed on 5 August 2025).

- Fang, X.; Misra, S.; Xue, G.; Yang, D. Smart grid—the new and improved power grid: A survey. IEEE Commun. Surv. Tutorials 2012, 14, 944–980. [Google Scholar] [CrossRef]

| Use Case | Power to Install per EV | Notes |

|---|---|---|

| Home charging | 2–3 kW | Overnight slow charge (level 1/2) |

| Workplace/public | 5–7 kW | Level 2 chargers |

| Fast-charging sites | 10–50+ kW | DC fast charging (DCFC) or Tesla superchargers |

| National grid avg. | ~1.5–3 kW per EV | Depends on usage intensity |

| EV Penetration Rate | Installed Capacity (MW) | Generation (GWh) | Vehicles (fleet) | EVs Fleet | All EVs (MW) * | Max Evs * Possible | Power * Mismatch (MW) | |

|---|---|---|---|---|---|---|---|---|

| Norway | 29% | 40,540 | 143,383 | 3,469,692 | 900,000 | 24,288 | 5,791,429 | +16,252 |

| Iceland | 18% | 3006 | 19,865 | 306,563 | 19,215 | 2146 | 429,429 | +860 |

| Sweden | 11% | 52,706 | 173,754 | 5,682,251 | 560,000 | 39,776 | 7,529,429 | +12,930 |

| Denmark | 11% | 19,503 | 33,727 | 3,222,575 | 300,000 | 22,558 | 2,786,143 | −3055 |

| Finland | 8.1% | 24,784 | 70,162 | 4,221,852 | 83,800 | 29,553 | 3,540,571 | −4769 |

| Netherlands | 8.3% | 57,194 | 120,840 | 10,062,194 | 700,000 | 70,435 | 8,170,571 | −13,241 |

| Germany | 5.4% | 261,086 | 560,759 | 52,714,433 | 2,500,000 | 369,001 | 37,298,000 | −107,915 |

| Switzerland | 5.8% | 24,014 | 58,726 | 5,301,789 | 172,000 | 37,113 | 3,430,571 | −13,099 |

| Portugal | 1.87 | 23,316 | 45,543 | 7,198,871 | 111,000 | 50,392 | 3,330,857 | −27,076 |

| United Kingdom | 5% | 111,020 | 318,595 | 41,700,000 | 1,580,000 | 291,900 | 15,860,000 | −180,880 |

| France | 4.1% | 148,914 | 446,291 | 44,444,965 | 1,570,000 | 311,115 | 21,273,429 | −162,201 |

| Belgium | 8.2% | 26,310 | 90,893 | 6,977,664 | 254,240 | 48,844 | 3,758,571 | −22,534 |

| China | 7.6% | 2,593,589 | 8,881,870 | 440,000,000 | 21,800,000 | 3,080,000 | 370,512,714 | −486,411 |

| Italy | 3.8% | 123,327 | 274,164 | 44,888,074 | 220,000 | 314,217 | 17,618,143 | −190,890 |

| Spain | 1.2 | 130,908 | 265,312 | 30,724,166 | 466,178 | 215,069 | 18,701,143 | −84,161 |

| Greece | 2.3% | 22,336 | 49,179 | 5,777,241 | 134,484 | 40,441 | 3,190,857 | −18,105 |

| Canada | 2.3% | 158,973 | 637,996 | 26,302,526 | 550,000 | 184,118 | 22,710,429 | −25,145 |

| South Korea | 2.4% | 146,539 | 606,760 | 25,949,201 | 553,000 | 181,644 | 20,934,143 | −35,105 |

| United States | 2.1% | 1,201,260 | 4,291,954 | 283,400,986 | 4,800,000 | 1,983,807 | 171,608,571 | −782,547 |

| New Zealand | 2.4% | 10,412 | 44,178 | 4,794,156 | 102,384 | 33,559 | 1,487,429 | −23,147 |

| Capital City/Country | Size Capital (km2) | National Density/km2 | Density (Capital)/km2 | Population Capital City | Pop. Growth (%) (2023–2024) | Number of Cars per 1000 (National) |

|---|---|---|---|---|---|---|

| Oslo/Norway | 426 | 18.24 | 1684 | 717,710 | 0.86 | 550 |

| Reykjavik/Iceland | 73.1 | 3.733 | 3281 | 239,733 | 1.88 | 779 |

| Stockholm/Sweden | 483 | 25.91 | 3748 | 1,809,412 | 1.12 | 473 |

| Copenhagen/Denmark | 292 | 138.8 | 4717 | 1,378,649 | 0.93 | 472 |

| Helsinki/Finland | 214 | 18.44 | 3148 | 674,500 | 0.88 | 660 |

| Amsterdam/Netherlands | 168 | 533.3 | 6782 | 1,136,210 | 1 | 501 |

| Berlin/Germany | 891 | 231.3 | 4036 | 3,596,999 | 0.81 | 578 |

| Bern/Switzerland | 51.6 | 217.1 | 2655 | 136,988 | 0.54 | 546 |

| Lisbon/Portugal | 84.9 | 112.2 | 6427 | 545,796 | −0.13 | 549 |

| London/United Kingdom | 1172 | 276 | 7490 | 8,776,535 | 0.74 | 480 |

| Paris/France | 106 | 121.1 | 20,016 | 2,113,705 | −0.61 | 570 |

| Brussels/Belgium | 33.1 | 383.3 | 5948 | 196,828 | 1.23 | 507 |

| Beijing/China | 16,410 | 150 | 1332 | 18,960,744 | 1.27 | 194 |

| Roma/Italy | 1287 | 195.3 | 2140 | 2,754,719 | 0.42 | 682 |

| Madrid/Spain | 606 | 96.32 | 5650 | 3,422,416 | 0.56 | 553 |

| Athena/Greece | 38.96 | 79.40 | 17,000 | 3,146,164 | −0.07 | 550 |

| Ottawa/Canada | 549 | 4.209 | 1945 | 1,068,821 | 1.45 | 707 |

| Seoul/Republic of Korea | 605 | 484.7 | 15,839 | 9,586,195 | 0.21 | 500 |

| Washington/United States | 158 | 37.18 | 4289 | 678,972 | 0.92 | 850 |

| Auckland/New Zealand | 607 | 19.29 | 2372 | 1,440,300 | 0.34 | 889 |

| Gas Station | Off-Grid EV Station | Future Off-Grid EV Station | |

|---|---|---|---|

| Capacity | 12,000 gal | 60,000 kWh/120 m3 | 60,000 kWh/45.42 m3 |

| Tank | 60 L | 40 kWh | 40 kWh |

| Number of vehicles | 750 | 750 | 750 |

| Energy density | 32.4 MJ/L | 500 Wh/L | 2400 Wh/L |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|---|---|

| Residential | 1411.06 | 1378.65 | 1469.1 | 1440.3 | 1464.6 | 1470.5 | 1509.2 |

| Commercial | 1367.19 | 1352.89 | 1381.76 | 1360.88 | 1287.4 | 1328.4 | 1390.9 |

| Industrial | 976.72 | 984.3 | 1001.6 | 1002.35 | 959.1 | 1000.6 | 1020.5 |

| Transportation | 7.5 | 7.52 | 7.67 | 7.63 | 6.5 | 6.3 | 6.6 |

| Aspect | Electricity Sector and Power Plants | EV Adoption (S-Curve) |

|---|---|---|

| Time Horizon | Long (10–40 years lifespan for assets) | Medium (10–15 years to full market maturity) |

| Investment Dynamics | Policy and forecast-driven, steady capital deployment | Consumer behavior-driven, nonlinear growth |

| Growth Curve | Linear or incremental (with policy shocks) | Exponential (S-curve) |

| Tech Disruption | Gradual transition (e.g., coal → renewables) | Rapid, with tipping points (battery breakthroughs, mandates) |

| Policy Role | Crucial (e.g., clean energy standards, tax credits) | Crucial (e.g., EV tax credits, bans on ICE sales) |

| Infrastructure Bottleneck | Grid interconnection delays, transmission siting issues | Charging infrastructure, battery supply chains |

| Market Actors | Regulated utilities, IPPs, and federal/state governments | Automakers, consumers, startups, and federal/state regulators |

| Metric | ~2006 | ~2020 | 2023/24 | 2050 Projection |

|---|---|---|---|---|

| EV Fleet (plug-in stock) | ~10 k | ~2 M (1%) | ~4 M (~1.4%) | ~65–90 M (~25–65%) depending on scenario |

| Total vehicle stock | ~250 M | ~290 M | ~292 M | ~350–400 M |

| Installed capacity (GW) | ~800–900 GW (est) | ~1150 GW | ~1250 GW | ~2100–2500 GW (2×–3× current) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Diouf, B. Is the Grid Ready for the Electric Vehicle Transition? Energies 2025, 18, 4730. https://doi.org/10.3390/en18174730

Diouf B. Is the Grid Ready for the Electric Vehicle Transition? Energies. 2025; 18(17):4730. https://doi.org/10.3390/en18174730

Chicago/Turabian StyleDiouf, Boucar. 2025. "Is the Grid Ready for the Electric Vehicle Transition?" Energies 18, no. 17: 4730. https://doi.org/10.3390/en18174730

APA StyleDiouf, B. (2025). Is the Grid Ready for the Electric Vehicle Transition? Energies, 18(17), 4730. https://doi.org/10.3390/en18174730