1. Introduction

The global atmospheric concentration of carbon dioxide (CO

2), measured at the Mauna Loa Observatory [

1], has exceeded 430 parts per million (ppm). This level exceeds concentrations from all previous interglacial periods over the past 800,000 to 1 million years, as indicated by paleoclimate ice core data [

2]. This milestone highlights the significant and rapid impact of human activities on the Earth’s climate system. Since the onset of the Industrial Revolution, human activities have introduced vast quantities of CO

2 into the atmosphere, fundamentally altering the natural carbon cycle. The rise—over 100 ppm in just 250 years—is unprecedented in the paleoclimate record, with current concentrations increasing by about 2 ppm annually. Currently, human-induced fossil fuel emissions persist at a staggering rate, with an estimated 1,000 metric tons of CO

2 released globally every second [

2].

The industrial sector is a particularly significant contributor to global emissions. In Poland, for example, industry accounts for around 38% of electric energy consumption and is responsible for 9.6% of national CO

2 emissions associated with direct fossil fuel use [

3]. This makes the sector both a critical challenge and a key opportunity in climate mitigation efforts. However, despite its potential for substantial efficiency gains, progress is often hindered by a lack of awareness at operational and management levels. This is compounded by a widespread sense of disconnection or helplessness, which is often expressed through attitudes such as: “Climate change is a global issue—what difference can I make?” or “Change is necessary, but it shouldn’t affect me personally.”

Industry holds immense potential to become a catalyst for change [

4]. However, most research to date has focused on energy-intensive sectors and large-scale implementations, such as those in Toyota and Siemens [

5,

6]. Improving energy efficiency in industrial processes not only enhances competitiveness by reducing operational costs [

7] but also contributes directly to the mitigation of CO

2 emissions—the dominant driver of anthropogenic climate change—while strengthening energy security by reducing dependence on fossil fuel imports [

8] and increasing resilience to energy price fluctuations.

Utilities such as natural gas, steam, water, and compressed air are integral to industrial operations, yet their production and distribution are often inefficient and costly. Implementing an Energy Management System (EMS)—a structured framework for monitoring, analyzing, and continuously improving energy performance—can help address these inefficiencies. ISO 50001 (adopted in Poland as PN-EN ISO 50001:2018) provides a globally recognized standard for EMS implementation [

9]. It establishes baseline energy performance, defines relevant indicators, and supports data-driven decision-making. This enables organizations to reduce costs, minimize environmental impact, and improve operational transparency.

Recent data highlight the growing global adoption of ISO 50001. As of late 2023, approximately 25,000 organizations had achieved certification [

9,

10], compared with approximately 18,200 in 2019 and just 450 in 2011 [

11]. This trend reflects a broader organizational shift toward structured energy governance—particularly in energy-intensive sectors—positioning EMS not only as a compliance tool, but also as a strategic driver of operational excellence. Moreover, EMS adoption aligns with wider industrial transformations, including digitalization and the pursuit of energy self-sufficiency—key hallmarks of the so-called “factories of the future.”

In this context, the implementation of EMS offers a powerful pathway toward structured and measurable improvements in energy performance [

4,

11,

12]. EMS frameworks enable companies to achieve the following:

Systematically meter and monitor energy use, often through the deployment of submeters at key process points.

Introduce Energy Performance Indicators (EnPIs) that relate energy usage to production, space, or financial metrics [

8].

Facilitate data-driven decision-making, enabling targeted investments and operational changes that deliver measurable gains in energy performance.

Unlike isolated or one-off energy-saving actions, EMS supports continuous improvement by embedding energy considerations into day-to-day operations, strategic planning, and organizational culture. This potential has been demonstrated in recent studies [

13], showing that flexible management systems can substantially reduce energy costs and enhance real-time optimization.

Among the available literature on the industrial automotive sector, several studies highlight the integration of Energy Management Systems (EMSs) within broader strategic frameworks. These works often focus on localized implementations and specific elements—such as the deployment of Energy Performance Indicators (EnPIs)—as seen in studies of the Italian rubber industry [

14]. Although focused on a related subsector, given rubber’s key role in automotive production (e.g., tires, seals, gaskets), such studies primarily emphasize the application of innovative tools such as EnPIs, rather than the organizational embedding of EMS as a whole.

This study was designed to assess the extent of EMS adoption among automotive-sector enterprises located in the Upper Silesia region—a hub of industrial activity in Poland. The aim was to evaluate not only the prevalence of EMSs, but also related practices such as energy metering, EnPI usage, audit implementation, and investment in energy efficiency. Understanding the maturity of these practices provides insights into how the industrial sector can increase its contribution to climate goals while improving operational excellence.

2. Research Questions

This study seeks to explore the diffusion of Energy Management Systems (EMSs) and related practices among industrial firms in the Silesian Voivodeship of Poland, with a specific focus on the automotive sector. The research is guided by a series of targeted questions aimed at assessing both the adoption and depth of EMS integration. A complete list of research questions is provided in

Appendix B, including the following:

This includes not only total energy metering and the use of normalized indicators relating energy usage to physical or financial outputs.

- 2.

What types of Energy Performance Indicators (EnPIs) are used by firms?

The key focus here is the variety and prevalence of EnPIs adopted by companies.

- 3.

To what extent are submeters installed within enterprises?

Submetering is investigated as a proxy for the level of detail in energy monitoring, enabling internal accountability and more targeted energy management.

- 4.

How prevalent are energy audits, and what actions have resulted from them?

This question addresses the implementation of energy audits and the extent to which firms have acted upon their recommendations.

- 5.

What is the reported extent of process improvements aimed at energy efficiency, and what specific examples are provided?

The focus here is on the depth and nature of the actions taken to enhance energy performance, including documented interventions and self-reported outcomes.

Previous studies have addressed the explicit presence and reported the impact of EMSs [

15]. In contrast, this study adopts an indirect approach aimed at capturing the degree of systemic integration. The survey design incorporated behavioral and structural indicators, providing a more nuanced perspective on how EMS-related practices are embedded within everyday organizational routines, particularly in automotive enterprises operating in the Upper Silesia region of Poland.

3. Survey Participation

3.1. Location

All the entities surveyed (n = 40) are located within the Upper Silesian Province (Śląskie Voivodeship) in southern Poland. This region is one of the most industrialized areas in the country, with a historical concentration of energy-intensive sectors, including automotive manufacturing, metallurgy, and chemical processing. Consequently, it is a particularly relevant case for examining industrial approaches to energy management and efficiency improvements.

Focusing exclusively on the Upper Silesian Province allows for a detailed assessment of regional practices within a highly urbanized, post-industrial landscape, where firms face both economic incentives and regulatory pressures to modernize their energy usage and reduce consumption. Insights drawn from this region could also be used to benchmark similar industrial hubs in Central and Eastern Europe that are undergoing energy transitions.

3.2. Industry

At least five of the companies in the sample explicitly identified themselves as being in the automotive sector, based on descriptions of their main production activities. These activities reflect a wide spectrum of operations within the automotive value chain, including the following:

Production lines for welding systems;

Galvanic zinc coating services;

Manufacturing of special-purpose vehicles (e.g., tanks, armored vehicles);

Production of screws, nuts, and other fasteners for automotive applications;

Manufacturing of sealing components and converting processes tailored to the automotive market.

This list is not exhaustive and likely does not cover all possible types of automotive-related activities in the dataset. By its nature, the automotive industry is broad and often overlaps with the fields of general machinery, electronics, and chemical processing. Nevertheless, the identified firms represent a diverse cross-section of the sector, ranging from heavy vehicle assembly to precision component manufacturing.

Given this diversity, it can be assumed that their energy consumption profiles vary significantly, depending on the dominant processes used—such as electroplating, high-temperature operations, or energy-intensive automation systems.

3.3. Company Size Profile

To contextualize the findings, companies were classified by size using employee count as a proxy, based on European Union definitions [

16] (

Table 1):

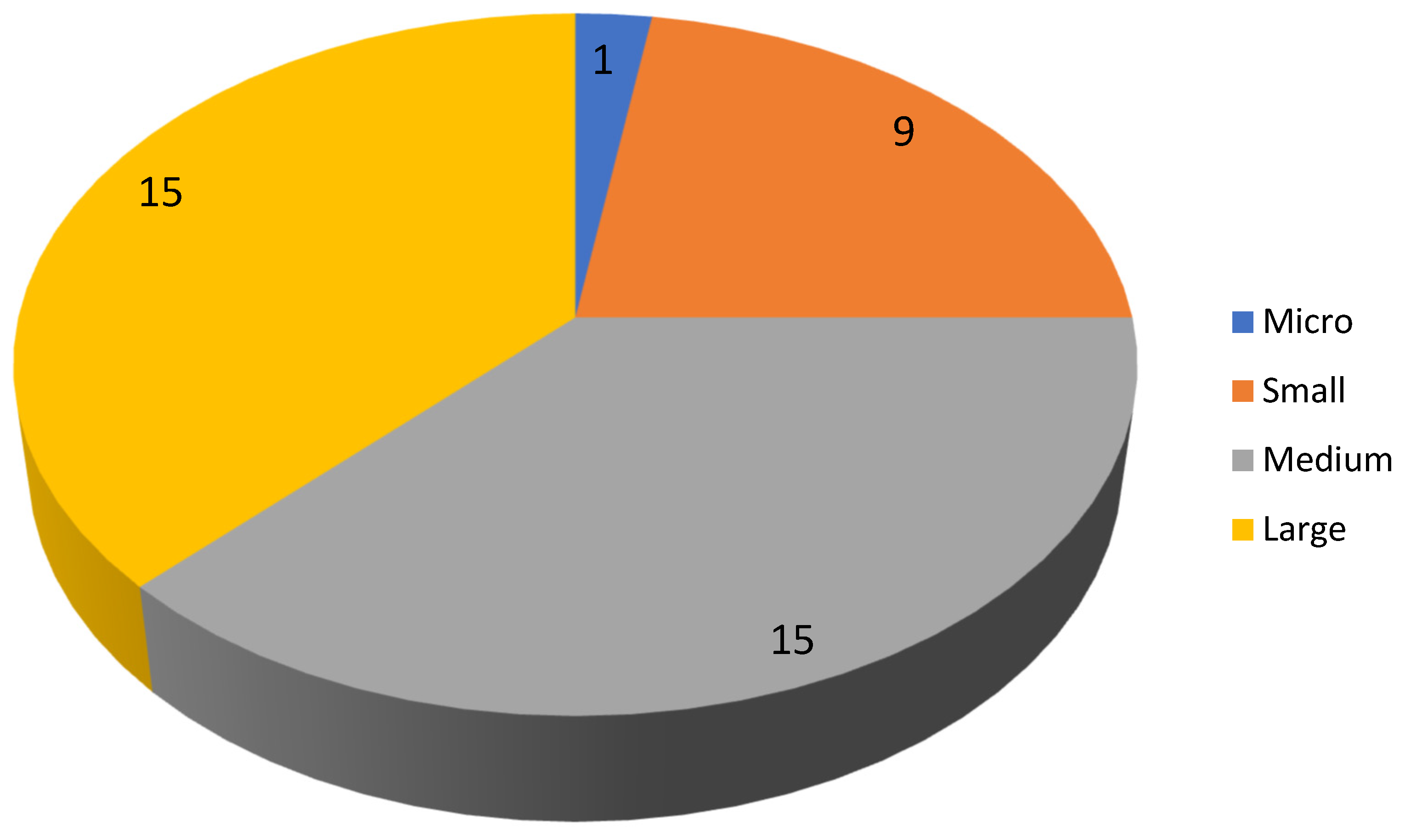

Of the 40 companies surveyed, the majority were classified as medium or large enterprises, with only a small number falling into the micro and small categories (

Figure 1):

This distribution indicates that the dataset is heavily weighted towards larger firms, which may influence the scale, structure, and formality of the reported energy management practices. Although underrepresented, smaller companies are likely to face greater limitations in terms of technical expertise, financial resources, and infrastructure—factors that may hinder the adoption of EMS, submetering, or detailed EnPI frameworks.

It is essential to understand that this size-based context is essential when interpreting the findings, particularly about the implementation barriers and scalability of energy initiatives across different organizational types.

4. Methodology

4.1. Survey Design and Data Collection

The data for this study were gathered through a structured survey conducted using the Computer-Assisted Telephone Interviewing (CATI) method. This approach was selected for its effectiveness in reaching a diverse range of industrial enterprises and its ability to ensure standardized, high-quality responses across interviews.

The survey focused on production facilities located in the Silesian Voivodeship, with particular emphasis on companies operating in the automotive sector. A total of 40 companies participated in the study.

According to the latest data from the Central Statistical Office of Poland (GUS), as of 2024, approximately 400 enterprises operate in the Silesian Voivodeship within sectors classified under the Polish Classification of Activities (PKD) [

17]. These include the following:

Division 29—Manufacture of motor vehicles, trailers, and semi-trailers (excluding motorcycles), specifically the following:

Subclass 29.3—Manufacture of parts and accessories for motor vehicles.

The respondents were primarily technical managers, energy specialists, or plant operations staff, which ensured that the information provided reflected informed perspectives on energy use and investment decisions.

A key challenge in conducting this type of survey lies in reaching individuals within companies who are both knowledgeable and responsible for energy-related matters. Many industrial facilities are reluctant to participate in such studies [

6], often due to a perceived lack of relevance or importance. For this reason, the authors deliberately excluded online survey formats, as these are often completed carelessly or left unanswered, or are delegated to lower-level staff who lack access to the key information required for the study.

The CATI method was chosen to address these challenges, as it allowed for direct contact with the appropriate personnel, thereby ensuring higher data quality and greater response reliability [

18].

The interviews followed a semi-structured format, based on a predefined questionnaire. This approach facilitated the collection of both quantitative data (through closed-ended questions) and qualitative insights (through open-ended prompts), particularly regarding energy monitoring, EnPI usage, audit implementation, and energy efficiency investments.

4.2. Survey Scope

The questionnaire (see

Appendix B) was designed to explore key aspects of organizational energy management. All interviews were conducted between February and March 2025, with durations ranging from approximately 15 to 30 min, depending on the depth of participant responses.

4.3. Data Validation

To ensure the integrity and reliability of the data collected, a logical consistency check was performed across all major response categories. This process involved cross-validating the declared practices—such as energy monitoring, EnPI usage, audit implementation, and efficiency investments—with the corresponding qualitative or quantitative details provided by respondents.

No internal inconsistencies or contradictions were identified. In particular,

All respondents who reported using Energy Performance Indicators (EnPIs) also selected at least one specific EnPI type.

All firms monitoring energy consumption submitted some form of usage data.

All companies claiming to have conducted energy audits included supporting information such as the year of execution, scope, or outcomes.

All organizations that reported investments in energy efficiency described the specific actions undertaken.

This level of alignment lends credibility to the responses as a whole and suggests that participants provided consistent and considered information throughout the survey.

The interviews followed a semi-structured format, based on a predefined questionnaire. This approach facilitated the collection of both quantitative data (through closed-ended questions) and qualitative insights (through open-ended prompts), particularly regarding energy monitoring, EnPI usage, audit implementation, and energy efficiency investments.

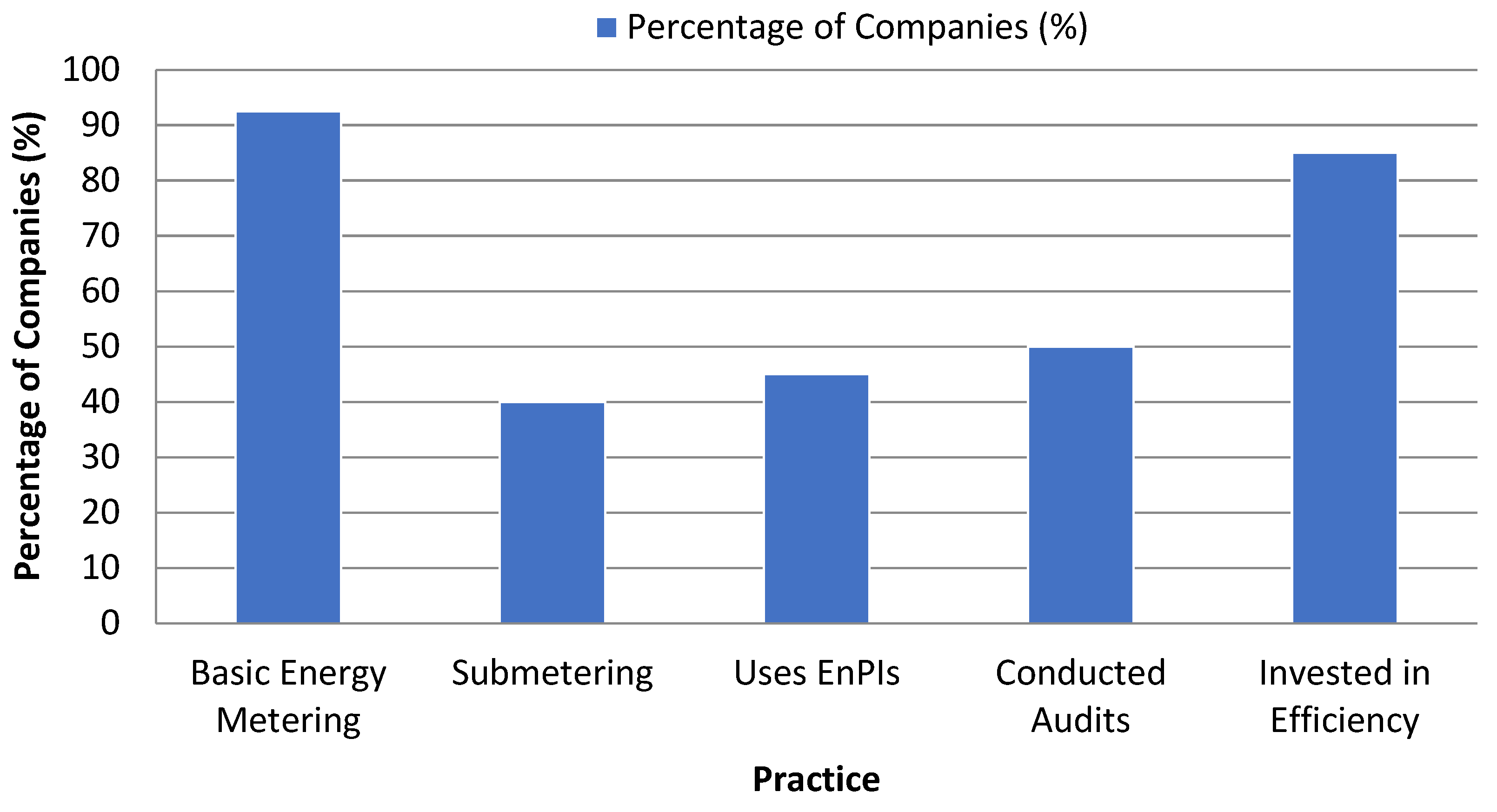

5. Results and Discussion

Analysis of the survey responses shows that the vast majority of interviewed companies monitor total energy consumption, indicating widespread recognition of energy as an important operational parameter. However, substantially fewer firms reported using submetering, and the application of Energy Performance Indicators (EnPIs) was only somewhat more common. This suggests that although general energy tracking is prevalent, detailed process-level visibility and normalized benchmarking practices remain relatively underdeveloped (

Figure 2).

Half of the surveyed companies have implemented energy audits, with adoption more common among larger enterprises. Notably, most respondents reported undertaking energy-saving actions such as LED lighting upgrades, equipment modernization, and process improvements. A more detailed breakdown of these patterns is provided in the following sections.

5.1. Energy Monitoring Practices

Among the 40 companies surveyed, 37 firms (92.5%) reported monitoring total energy or heat consumption at their facilities (see

Appendix A,

Table A1). This indicates a strong awareness of the importance of energy tracking as a key factor in operational efficiency.

In contrast, only three firms (7.5%) stated that they do not monitor energy consumption at all. These companies also reported the following:

No use of Energy Performance Indicators (EnPIs).

No implementation of energy audits.

And generally provided less detailed responses throughout the survey.

This suggests that energy monitoring functions as a gateway capability—companies that actively monitor their energy use are significantly more likely to adopt other energy-related practices such as conducting audits, tracking Energy Performance Indicators (EnPIs), and planning targeted investments in efficiency improvements. This relationship is supported by empirical evidence; for example, a study conducted in Pakistan [

19] demonstrated that the implementation of an energy monitoring and data logging system in an automobile factory enabled the collection of detailed consumption data, which proved instrumental in both identifying inefficiencies and informing subsequent energy-saving measures.

Interestingly, of the three companies that reported not monitoring energy, only one was a micro-enterprise, while the other two were classified as small and medium enterprises, respectively. This suggests that the absence of energy monitoring is not exclusively a function of company size. While smaller firms’ limited resources may contribute to such gaps, other factors—such as organizational culture, lack of awareness, or absence of internal accountability structures—may also play a significant role in whether a company chooses to monitor its energy use. This highlights the importance of providing not only technical solutions but also addressing behavioral and managerial barriers to the adoption of energy management.

5.2. Submetering Practices

Submetering, which is defined as using secondary meters to monitor energy consumption at the departmental, process, or individual equipment level, is a cornerstone of advanced energy management [

6,

19]. It enables companies to move beyond aggregate consumption figures and supports targeted efficiency measures, internal accountability, and accurate cost allocation.

Survey Findings:

A total of 16 out of 40 companies (40%) reported having installed submeters in addition to their main energy meters.

A total of 24 companies (60%) rely solely on main (total) metering, with no internal breakdown of consumption. Of these, three companies indicated that they do not monitor energy use at all.

The adoption of submetering often requires additional infrastructure, system integration, and data management capabilities, which may be less accessible to smaller firms (see

Appendix A,

Table A2). An analysis by company size reveals a clear pattern. A chi-square statistical test confirmed that this relationship was significant (χ

2 = 9.45,

p ≈ 0.024). The

p-value is less than 0.05, which indicates a statistically significant association between company size and the likelihood of implementing submetering.

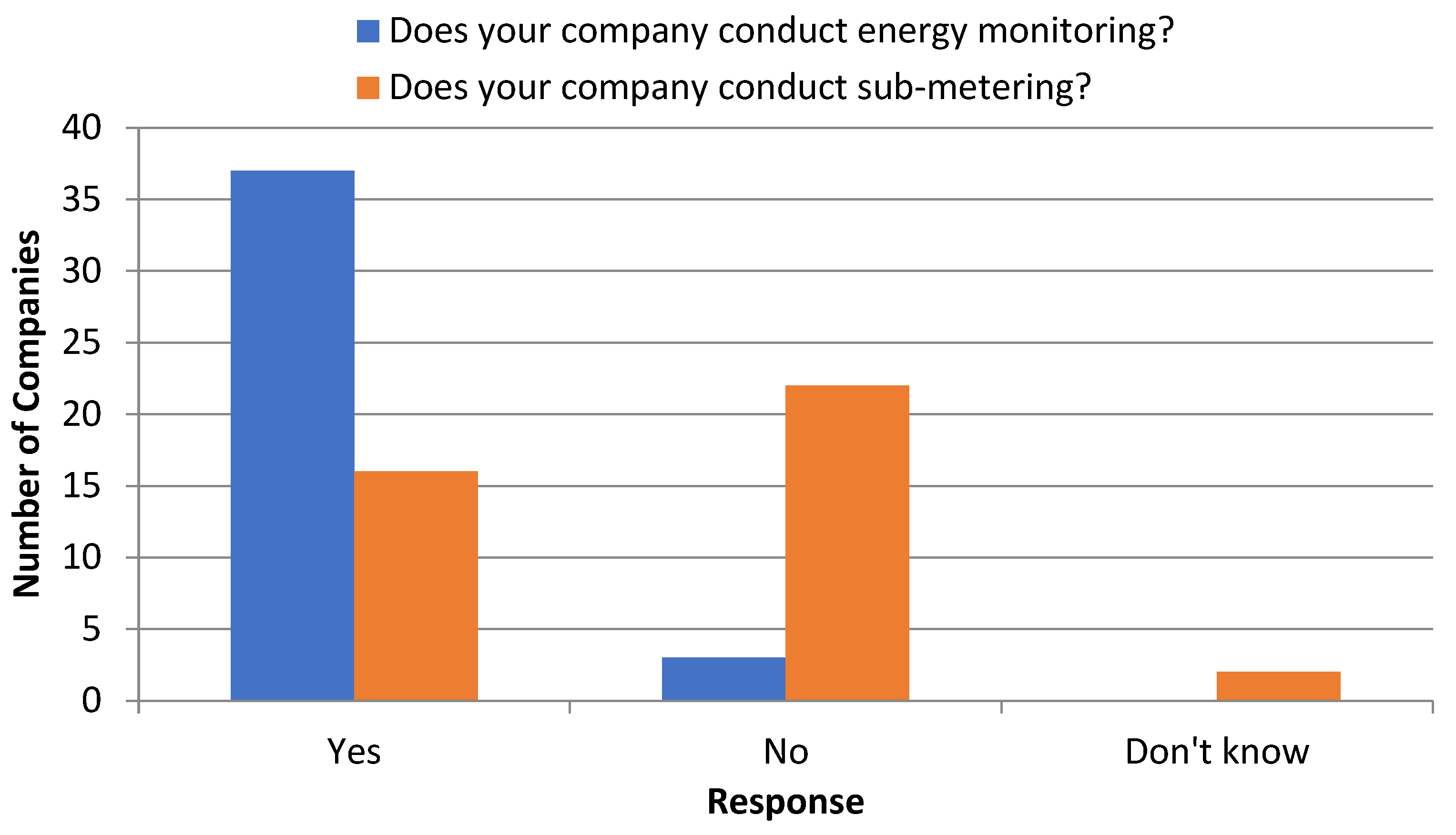

5.3. Metering vs. Submetering: The Implementation Gap

Although basic metering is widely implemented, the survey revealed that submetering is significantly less common. There is a visible discrepancy between companies that report conducting energy monitoring and those that utilize submetering:

This suggests that over half of the companies that monitor energy (approximately 57%) do not use submeters, relying solely on main meters; thus, while general awareness of energy consumption is high, granularity is lacking in many cases.

Chi-square test (χ

2 = 2.37,

p ≈ 0.124). The

p-value is greater than 0.05, indicating no statistically significant association between monitoring energy and having submeters (see

Appendix A,

Table A3). While there appears to be a practical gap (some companies that monitor do not use submeters), this gap is not statistically strong enough to be considered significant based on this sample size.

Notably, no participants reported using real-time or automated monitoring systems. Furthermore, none of the firms indicated integrating monitoring data into dashboards, EMSs, or regular management reports. This suggests that although energy data may be collected, there is often a disconnect between its acquisition and its integration into the organization’s operational processes.

5.4. Use and Interpretation of Energy Performance Indicators (EnPIs)

Survey results show that 45% of the 40 companies reported using at least one Energy Performance Indicator (EnPI), while 55% do not use EnPIs at all. These indicators are used to normalize energy consumption against various operational outputs, supporting efficiency tracking and strategic decision-making.

Among EnPI users, the most common metrics include the following:

Product-based (kWh per unit produced)—12 firms;

Sales-based (kWh per PLN revenue)—seven firms;

Facility area-based (kWh per m2)—five firms;

Facility volume-based (kWh per m3)—two firms.

No respondents reported using custom or alternative EnPIs, suggesting a limited diversity of metrics and a reliance on conventional benchmarks. The predominance of product-based indicators reflects a focus on operational efficiency closely tied to manufacturing output, particularly relevant in production-driven sectors such as automotive manufacturing. Sales-based metrics offer some linkage between energy use and financial performance, while space-based EnPIs are relatively rare, likely due to their limited relevance in process-oriented operations.

Analysis of the 40 surveyed firms (see

Appendix A,

Table A4) shows that EnPI adoption increases markedly with company size. Among large enterprises, 11 of 15 firms reported using EnPIs. Medium-sized companies show moderate adoption (5 of 15), while small and micro firms lag significantly (only 2 of 10 combined). The association between company size and EnPI adoption is statistically significant (chi-square test: χ

2 = 8.40,

p ≈ 0.039), suggesting that technical capacity, data availability, and analytical resources influence EnPI uptake.

This disparity may indicate a structural gap in strategic energy management between large firms and SMEs. EnPIs are a cornerstone of performance-based energy management. While product-linked metrics provide a good starting point, broader integration of process-specific and financial indicators is likely needed to support deeper operational insights and long-term planning. Expanding EnPI adoption among SMEs—through simplified tools, templates, or policy incentives—could play a pivotal role in improving industrial energy governance across the region.

5.5. Audit Practices and Investments

Energy audits offer a structured approach to identifying inefficiencies and guiding targeted energy improvements. In parallel, energy efficiency investments translate these insights into operational upgrades. This section evaluates how firms approach both activities—individually and in relation to each other.

5.5.1. Audit Participation

Half of the companies surveyed (20 out of 40) reported having conducted energy audits. All these firms provided detailed information, including the year, scope, and outcomes of the audits, reflecting high credibility and formality. Audit implementation is closely linked to company size (see

Appendix A,

Table A5):

A total of 13 of 15 large firms had conducted audits;

Only one of nine small firms, and none of the micro firms, had conducted audits.

A chi-square test (χ2 = 15.11, p ≈ 0.0017) confirmed a statistically significant association between company size and audit uptake. This suggests that smaller firms face considerable barriers, including limited resources, expertise, and external support.

5.5.2. Investment Practices

A substantial 85% of companies (34 out of 40) reported investing in energy efficiency. These investments focused on LED lighting, insulation improvements, and equipment modernization. However, only four companies quantified investment levels (e.g., “1% of revenue”), while 30 gave vague or non-quantifiable responses such as “we don’t track this.” This indicates that while operational action is widespread, strategic financial tracking is rare.

Interestingly, unlike audits, investment activity did not correlate with company size (see

Appendix A,

Table A6). All categories—large, medium, and small firms—reported similar investment rates. A chi-square test (χ

2 = 0.61,

p ≈ 0.894) found no statistically significant difference.

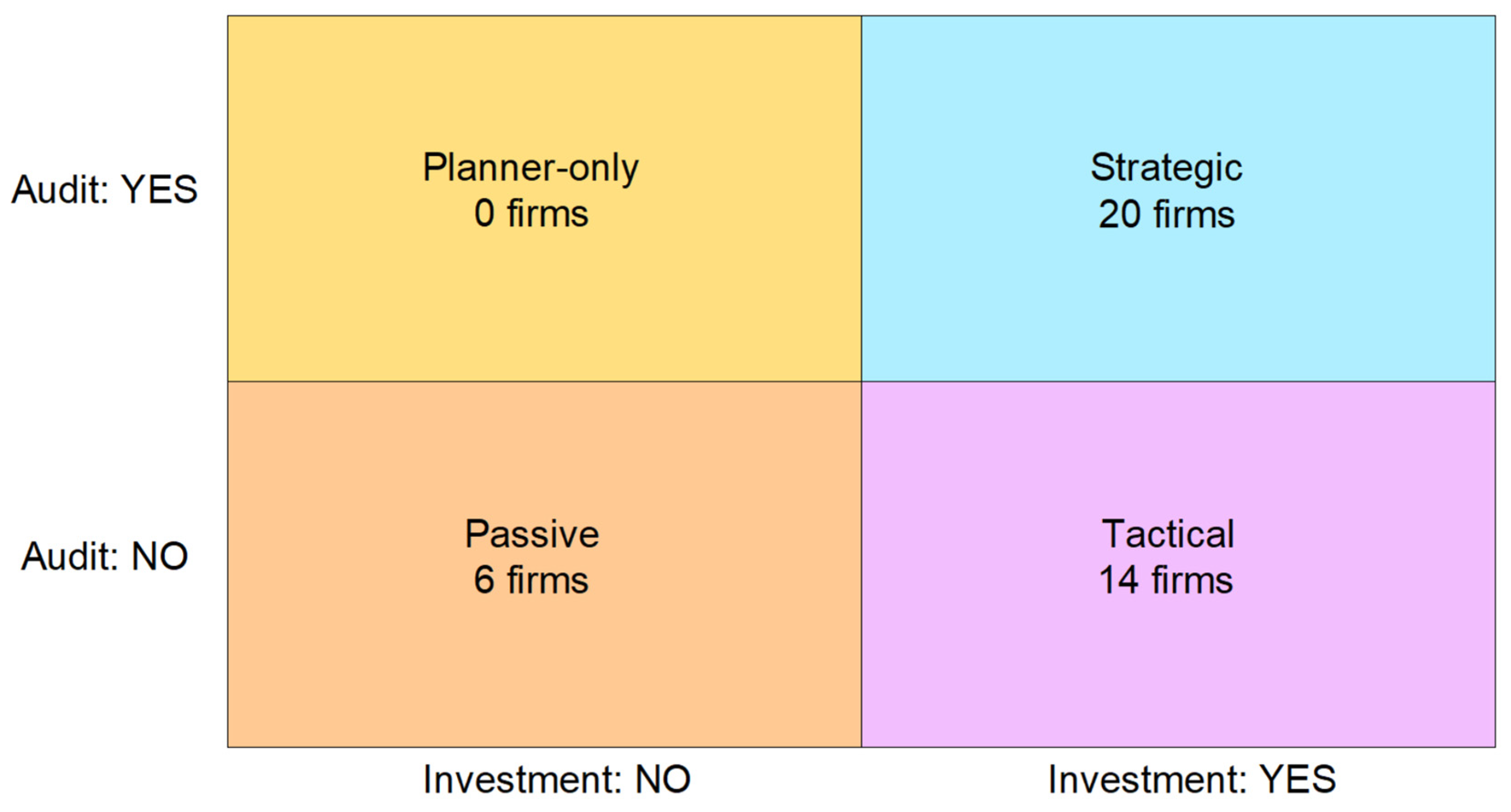

5.5.3. Strategic Disconnect Between Audits and Investments

While the vast majority of surveyed companies (85%) reported undertaking energy efficiency investments, the use of energy audits as a planning and evaluation tool was significantly lower, with only half of the firms indicating that they had conducted audits. This discrepancy suggests a potential disconnect between operational actions and strategic energy planning.

A closer analysis reveals that investment activity is high across all company sizes, including micro and small enterprises. However, energy audits remain concentrated among larger firms, with limited uptake in smaller organizations. When cross-referenced, this distribution indicates that while the motivation to invest is widespread, strategic energy planning—anchored in diagnostic tools and feedback mechanisms—is often missing, particularly among SMEs (

Figure 4).

The absence of companies in the “Planner-only” category (those who audited but did not invest) further reinforces the conclusion that audits are rarely formal exercises disconnected from implementation. Instead, the main gap lies in companies acting without evaluating their energy performance beforehand—especially among smaller firms in the region.

This might suggest that energy management is treated as a set of isolated technical actions rather than an embedded, system-oriented process. This is consistent with the broader pattern observed in this study: energy-related activities are present but often not institutionalized.

5.6. Energy Efficiency Measures

The survey collected detailed accounts of actions undertaken by companies to reduce energy and heat consumption. These measures represent a critical aspect of operational sustainability and were evaluated in terms of their frequency and variety. All 34 firms that reported energy-saving actions provided written descriptions of the implemented measures.

A thematic analysis of the open-ended responses revealed the distribution of energy-saving initiatives based on the number of mentions. The full breakdown is available in

Appendix A,

Table A7.

These findings indicate a strong focus on technological modernization, including replacing equipment and updating production processes. Lighting retrofits—primarily LED installations—are also common, likely due to their low cost and quick return on investment. Thermal insulation measures and waste heat recovery are among the more advanced or capital-intensive practices. Meanwhile, renewable energy installations (e.g., photovoltaic panels) are present but are reported less frequently.

The reported actions reflect a broad spectrum of engagement, ranging from basic infrastructure improvements to advanced process redesign. However, the effectiveness of these actions remains difficult to assess, as no firms reported quantitative outcomes such as energy savings in kWh or cost reductions in PLN. This limitation is examined in more detail in the following section.

5.7. Quantitative Tracking of Results

While most surveyed companies (through their representatives) reported engaging in energy efficiency initiatives, a key limitation emerged in their ability—or willingness—to provide quantitative evidence of outcomes.

Survey Findings:

None of the 34 companies that described energy-saving actions included any quantitative results in their responses.

None of the firms reported outcomes such as “% reduction in energy use”, “kWh saved”, or “financial return on investment”.

This lack of quantitative follow-up suggests a potential gap in performance measurement and post-implementation evaluation. Without such quantification, firms are limited in their ability to assess the effectiveness or cost-efficiency of implemented energy measures. The absence of measurable outcomes in the survey further supports the thesis that EMSs in the region may not yet be fully adopted. This, in turn, reinforces the view that energy initiatives are often implemented in an ad hoc and non-systematic manner.

6. Conclusions

This study provides a detailed evaluation of energy management practices within the automotive manufacturing sector in the Silesian Voivodeship. Based on survey data from 40 companies, the findings indicate a generally high level of basic awareness regarding energy efficiency. However, the integration of these measures into structured, system-based approaches appears to be partial or fragmented.

A notable shortcoming is the absence of quantitative follow-up: none of the surveyed firms reported measurable outcomes, such as energy savings in kilowatt-hours (kWh) or financial returns. While certain principles of Energy Management Systems (EMSs) appear to be reflected in operational practices, no firms reported having a formal EMS in place or ISO 50001 certification.

It appears unlikely that none of the surveyed enterprises utilize any form of EMS, especially given its growing international adoption [

11]. A more plausible explanation is that the individuals interviewed—while knowledgeable about day-to-day operations—may not have been familiar with the formal structure or terminology of EMS, or did not associate existing practices with the concept of systematized energy management. This suggests that EMS frameworks may not yet be fully embedded in the organizational culture or vocabulary, especially at the operational level.

Additionally, the lack of reported metrics may reflect limited respondent knowledge or superficial engagement with the CATI survey process. Such factors could have introduced reporting bias or resulted in an underestimation of actual practices. Future research should aim to validate these findings through complementary methods—such as on-site audits or in-depth interviews—and examine how internal communication, staff expertise, and organizational structures affect the quality and completeness of energy-related reporting.

Overall, while the region’s industrial sector demonstrates encouraging engagement with energy-related activities, these efforts often remain insufficiently systematized, with gaps in performance tracking and long-term strategic integration. Promoting the adoption of structured EMSs, outcome-based monitoring, and greater cultural alignment with energy goals could substantially improve both operational efficiency and sustainability performance within Upper Silesia’s automotive industry.

Given the urgent climate imperative—marked by record-high atmospheric CO2 levels—and the substantial role of the industrial sector in global emissions, strengthening the strategic depth of energy management is not merely a matter of operational efficiency. It also represents a critical step toward climate responsibility in manufacturing.