The Impact of Selected Market Factors on the Prices of Wood Industry By-Products in Poland in the Context of Climate Policy Changes

Abstract

1. Introduction

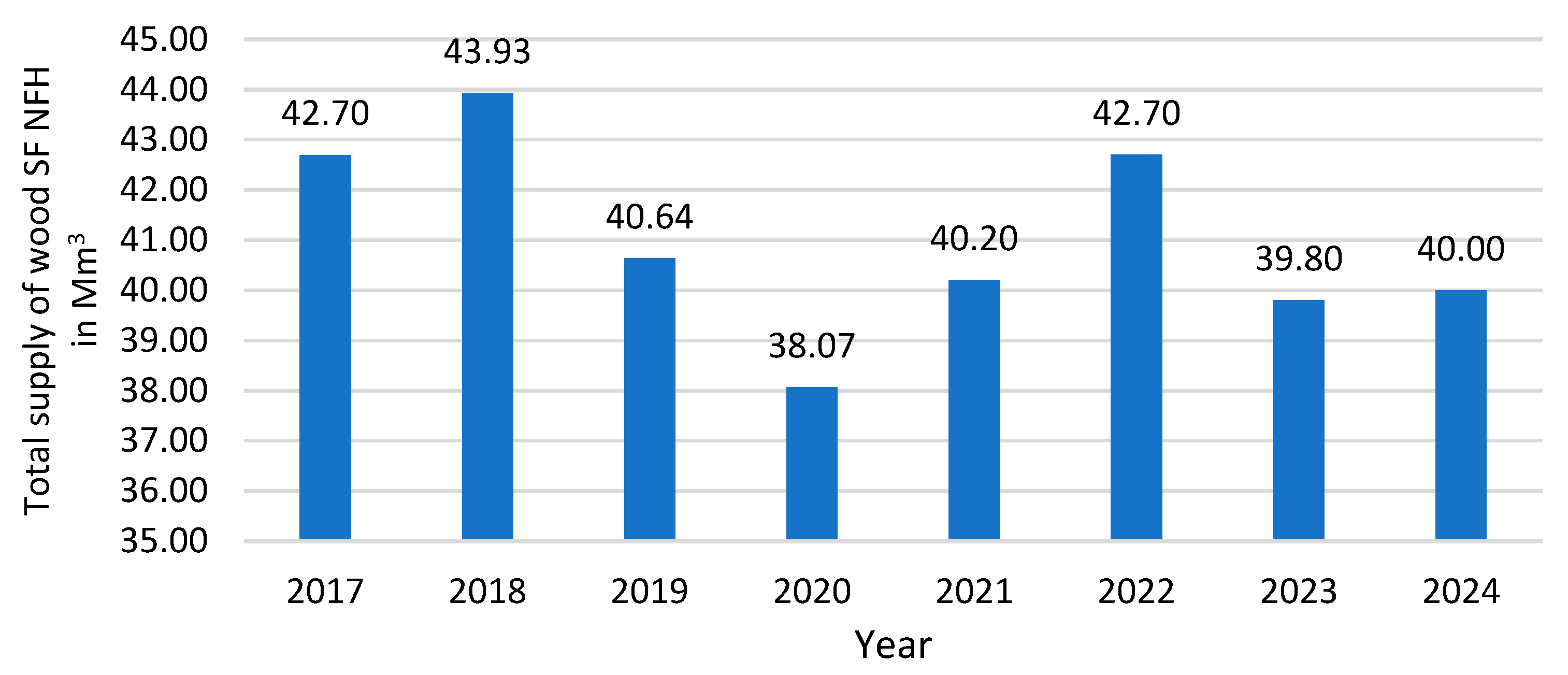

Potential Sources of Energy and Bioenergy in Poland

2. Materials and Methods

2.1. Data Sources

2.2. Methods

2.2.1. CatBoost and Random Forest for Time Series Forecasting

2.2.2. General Form of the Model

- —the predicted value of the dependent variable at time t;

- —the value of the j j-th explanatory variable with a time lag of lj;

- N—the number of explanatory variables;

- lj—the selected time lag for variable Xn, determined empirically.

2.2.3. Model Performance Metrics

- n—number of observations;

- yᵢ—observed value;

- ŷᵢ—value predicted by the model.

2.2.4. CatBoost Model—Hyperparameters

- Number of trees: 100;

- Learning rate: 0.3;

- Maximum tree depth: 6;

- Regularization strength: 3;

- Feature fraction: 1 (all features used for each tree);

- Training reproducibility: Enabled—a fixed random seed or deterministic settings were applied.

2.2.5. Random Forest Model—Hyperparameters

2.2.6. Analysis of Feature Contributions Using SHAP

- φⱼ—SHAP value for feature j;

- N—the set of all features;

- S—a subset of features not including feature j;

- p—the total number of features;

- f(S)—the model prediction using only the features in subset S;

- f(S ∪ {j})—the model prediction after adding feature j to subset S.

3. Results

3.1. Analysis of Volatility and Price Seasonality Wood Industry By-Products

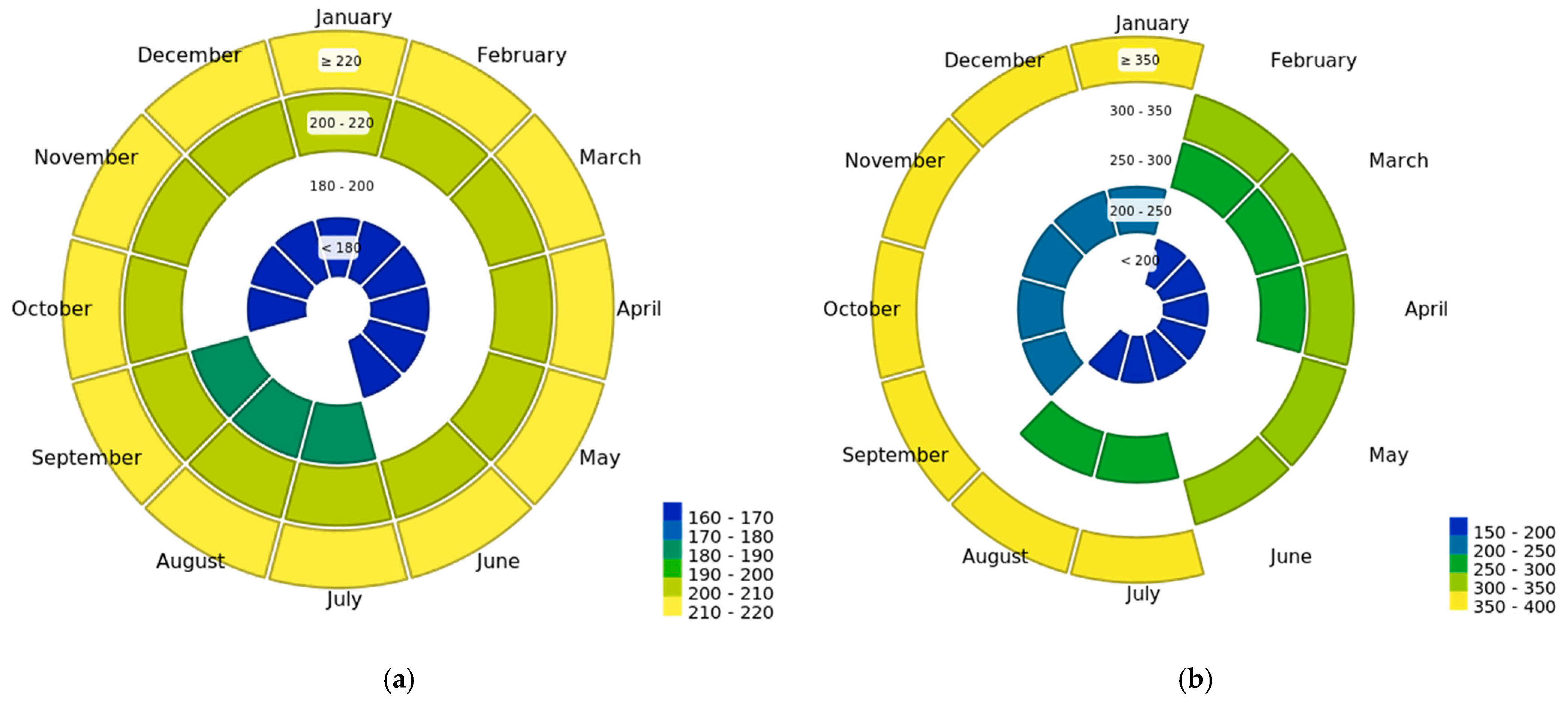

3.1.1. Seasonality of Pulpwood Chips’ Prices

3.1.2. Seasonality of Sawmill Chips’ Prices

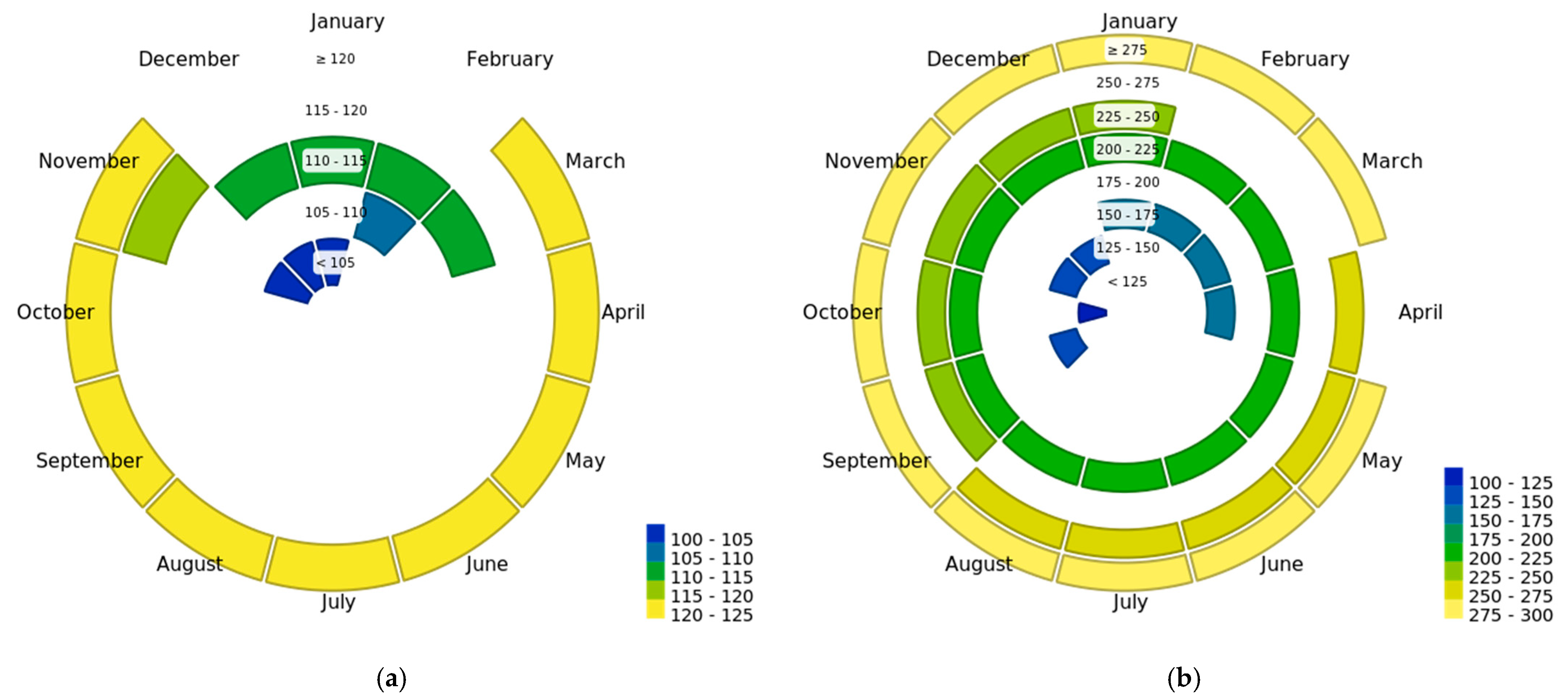

3.1.3. Seasonality of Sawdust Prices

3.1.4. Seasonality of Bark Prices

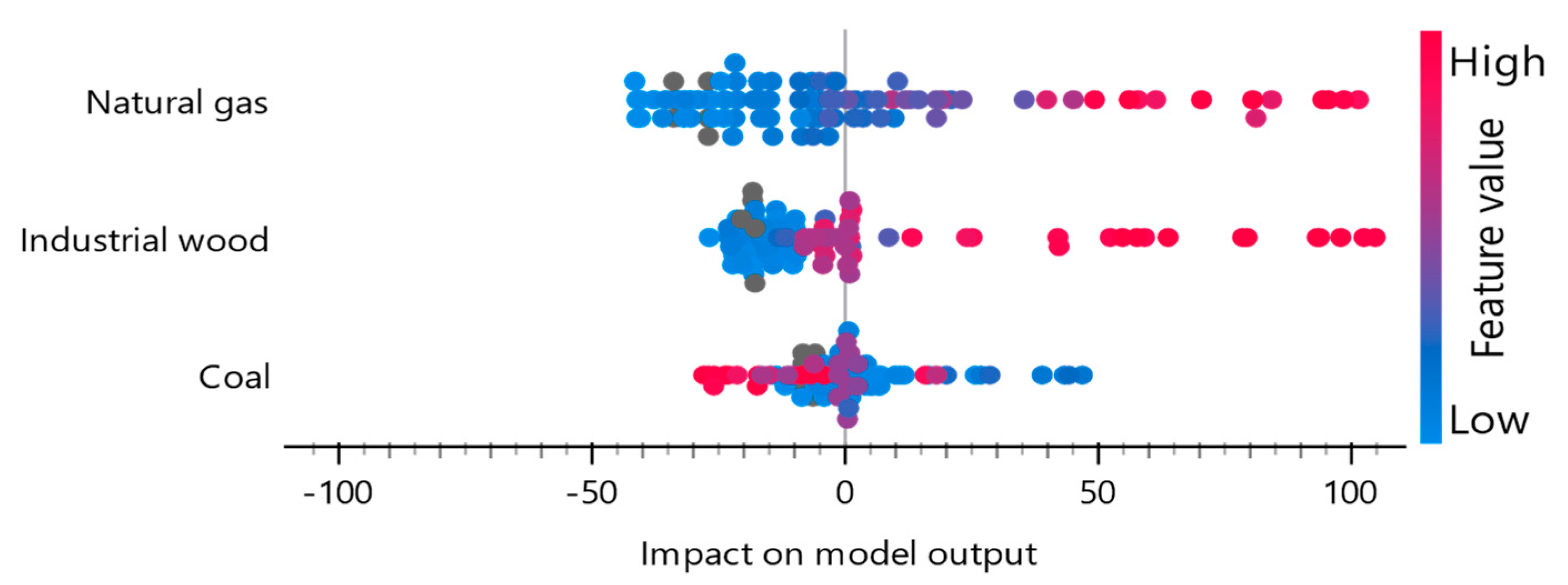

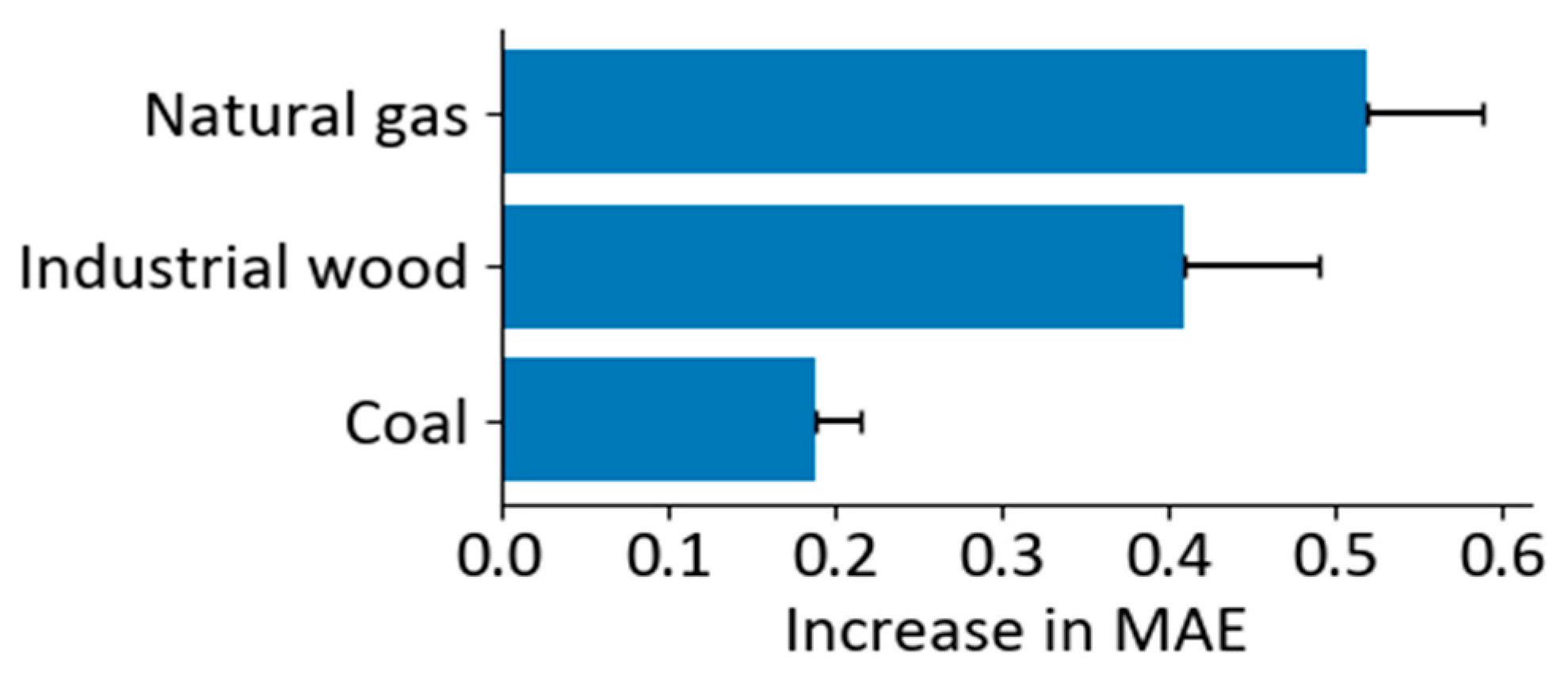

3.2. Analysis of the Relationship Between Prices of Wood-Industry By-Products and the Prices of Fossil Fuels and Industrial Processing Timber

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Gagnon, B.; Tanguay, X.; Amor, B.; Imbrogno, A.F. Forest Products and Circular Economy Strategies: A Canadian Perspective. Energies 2022, 15, 673. [Google Scholar] [CrossRef]

- Lieder, M.; Rashid, A. Towards Circular Economy Implementation: A Comprehensive Review in the Context of Manufacturing Industry. J. Clean. Prod. 2016, 115, 36–51. [Google Scholar] [CrossRef]

- Van Holsbeeck, S.; Brown, M.; Srivastava, S.K.; Ghaffariyan, M.R. A Review on the Potential of Forest Biomass for Bioenergy in Australia. Energies 2020, 13, 1147. [Google Scholar] [CrossRef]

- Näyhä, A. Transition in the Finnish Forest-Based Sector: Company Perspectives on the Bioeconomy, Circular Economy and Sustainability. J. Clean. Prod. 2019, 209, 1294–1306. [Google Scholar] [CrossRef]

- Giezen, M. Shifting Infrastructure Landscapes in a Circular Economy: An Institutional Work Analysis of the Water and Energy Sector. Sustainability 2018, 10, 3487. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Savaget, P.; Bocken, N.M.P.; Hultink, E.J. The Circular Economy—A new sustainability para-digm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef]

- De Doile, G.N.D.; Rotella Junior, P.; Rocha, L.C.S.; Bolis, I.; Janda, K.; Coelho Junior, L.M. Hybrid Wind and So-lar Photovoltaic Generation with Energy Storage Systems: A Systematic Literature Review and Contributions to Technical and Economic Regulations. Energies 2021, 14, 6521. [Google Scholar] [CrossRef]

- Nunes, A.M.M.; Coelho Junior, L.M.; Abrahão, R.; Santos Júnior, E.P.; Simioni, F.J.; Rotella Junior, P.; Rocha, L.C.S. Public Policies for Renewable Energy: A Review of the Perspectives for a Circular Economy. Energies 2023, 16, 485. [Google Scholar] [CrossRef]

- Kyoto Protocol to the United Nations Framework Convention on Climate Change, 10 December 1997, 2303 U.N.T.S. 162. Available online: https://unfccc.int/resource/docs/convkp/kpeng.pdf (accessed on 15 January 2025).

- Paris Agreement to the United Nations Framework Convention on Climate Change, 12 December 2015, T.I.A.S. No. 16-1104. Available online: https://unfccc.int/sites/default/files/english_paris_agreement.pdf (accessed on 15 January 2025).

- European Commission. Regulation (EU) 2021/1119 of the European Parliament and of the Council of 30 June 2021 Establishing the Framework for Achieving Climate Neutrality and Amending Regulations (EC) No 401/2009 and (EU) 2018/1999 (‘European Climate Law’). Available online: https://eur-lex.europa.eu/eli/reg/2021/1119/oj/eng (accessed on 15 January 2025).

- European Commission. Directive of the European Parliament and of the Council of 18 October 2023 Amending Directive (EU) 2018/2001, Regulation (EU) 2018/1999 and Directive 98/70/EC as Regards the Promotion of Energy from Renewable Sources, and Repealing Council Directive (EU) 2015/652. 2023. Available online: https://www.europeansources.info/record/proposal-for-a-directive-amending-directive-eu-2018-2001-regulation-eu-2018-1999-and-directive-98-70-ec-as-regards-the-promotion-of-energy-from-renewable-sources-and-repealing-council-directive (accessed on 20 April 2025).

- Dyrektywa Parlamentu Europejskiego i Rady (UE) 2018/2001 z dnia 11 grudnia 2018 r. w Sprawie Promowania Stosowania Energii ze źródeł Odnawialnych (Przekształcenie). Available online: https://eur-lex.europa.eu/legal-content/PL/ALL/?uri=CELEX%3A32018L2001 (accessed on 20 April 2025).

- IEA Bioenergy. IEA-Bioenergy Annual Report 2021. Available online: https://www.ieabioenergy.com/blog/publications/iea-bioenergy-annual-report-2021 (accessed on 4 April 2025).

- Guney, T.; Kantar, K. Biomass energy consumption and sustainable development. Int. J. Sustain. Dev. World Ecol. 2020, 27, 762–767. [Google Scholar] [CrossRef]

- Hosen, M.E.; Siddik, M.N.A.; Miah, M.F.; Ali, M.H.; Alam, M.S. Biomass energy for sustainable development: Evidence from Asian countries. Environ. Dev. Sustain. 2024, 26, 3617–3637. [Google Scholar] [CrossRef]

- Bilgili, F.; Koçak, E.; Bulut, Ü.; Kuşkaya, S. Can biomass energy be an efficient policy tool for sustainable development? Renew. Sustain. Energy Rev. 2017, 71, 830–845. [Google Scholar] [CrossRef]

- Camia, A.; Robert, N.; Jonsson, K.; Pilli, R.; Garcia Condado, S.; Lopez Lozano, R.; Van Der Velde, M.; Ronzon, T.; Gurria Albusac, P.; M’barek, R.; et al. Biomass Production, Supply, Uses and Flows in the European Union: First Results from an Integrated Assessment; JRC Sci. Policy Rep; Publications Office of the European Union: Luxembourg, 2018; Available online: https://www.eea.europa.eu (accessed on 30 April 2025).

- Shabani, N.; Akhtari, S.; Sowlati, T. Value chain optimization of forest biomass for bioenergy production: A review. Renew. Sustain. Energy Rev. 2013, 23, 299–311. [Google Scholar] [CrossRef]

- Scarlat, N.; Dallemand, J.-F.; Monforti-Ferrario, F.; Nita, V. The role of biomass and bioenergy in a future bioeconomy: Policies and facts. Environ. Dev. 2015, 15, 3–34. [Google Scholar] [CrossRef]

- Tursi, A. A review on biomass: Importance, chemistry, classification, and conversion. Biofuel Res. J. 2019, 6, 962–979. [Google Scholar] [CrossRef]

- Titus, B.D.; Brown, K.; Helmisaari, H.-S.; Vanguelova, E.; Stupak, I.; Evans, A.; Clarke, N.; Guidi, C.; Bruckman, V.J.; Varnagiryte-Kabasinskiene, I.; et al. Sustainable forest biomass: A review of current residue harvesting guidelines. Energy Sustain. Soc. 2021, 11, 220. [Google Scholar] [CrossRef]

- Kurowska, A. Odpady drzewne w świetle polskich i unijnych przepisów prawnych. Sylwan 2015, 159, 355–360. [Google Scholar]

- Borzęcki, K.; Pudełko, R.; Kozak, M.; Borzęcka, M.; Faber, A. Przestrzenne rozmieszczenie odpadów drzewnych w Europie. Sylwan 2018, 162, 563–571. [Google Scholar]

- Munis, R.A.; Martins, J.C.; Camargo, D.A.; Simões, D. Dynamics of Pinus wood prices for different timber assortments: Comparison of stochastic processes. Bois For. Trop. 2022, 351, 45–52. [Google Scholar] [CrossRef]

- Olsson, O.; Hillring, B. Price relationships and market integration in the Swedish wood fuel market. Biomass Bioenergy 2013, 57, 78–85. [Google Scholar] [CrossRef]

- Malaty, R.; Toppinen, A.; Viitanen, J. Modelling and forecasting Finnish pine sawlog stumpage prices using alternative time-series methods. Can. J. For. Res. 2007, 37, 178–187. [Google Scholar] [CrossRef]

- Mei, B.; Clutter, M.; Harris, T. Modeling and forecasting pine sawtimber stumpage prices in the US South by various time series models. Can. J. For. Res. 2010, 40, 1506–1516. [Google Scholar] [CrossRef]

- Leskien, P.; Kangas, J. Modelling future timber price development by using expert judgments and time series analysis. Silva Fenn. 2001, 35, 93–102. [Google Scholar] [CrossRef]

- Meyer, J.; von Cramon-Taubadel, S. Asymmetric price transmission: A survey. J. Agric. Econ. 2004, 55, 581–611. [Google Scholar] [CrossRef]

- Mäki-Hakola, M. Roundwood Price Development and Market Linkages in Central and Northern Europe; Pellervo Economic Research Institute: Helsinki, Finland, 2004; Available online: https://www.ptt.fi/wp-content/uploads/media/liitteet/tp68.pdf (accessed on 20 April 2025).

- Mäki-Hakola, M. Cointegration of the Roundwood Markets around the Baltic Sea: An Empirical Analysis of Rundwood Markets in Finland, Estonia, Germany and Lithuania; Pellervo Economic Research Institute: Helsinki, Finland, 2002; Available online: https://www.ptt.fi/wp-content/uploads/media/liitteet/tp55.pdf (accessed on 10 April 2025).

- Mutanen, A.; Toppinen, A. Price dynamics in the Russian-Finnish roundwood trade. Scand. J. For. Res. 2007, 22, 71–80. [Google Scholar] [CrossRef]

- Niquidet, K.; Manlay, B. Testing for nonlinear spatial integration in roundwood markets. For. Sci. 2011, 57, 301–308. [Google Scholar] [CrossRef]

- Ning, Z.; Sun, C. Vertical price transmission in timber and lumber markets. J. For. Econ. 2014, 20, 17–32. [Google Scholar] [CrossRef]

- Kożuch, A.; Cywicka, D.; Adamowicz, K. A comparison of artificial neural network and time series models for timber price forecasting. Forests 2023, 14, 177. [Google Scholar] [CrossRef]

- Wagner, J.E.; Rahn, J.; Cavo, M. A pragmatic method to forecast stumpage prices. For. Sci. 2019, 65, 429–438. [Google Scholar] [CrossRef]

- Mehrotra, S.N.; Carter, D.R. Forecasting performance of lumber futures prices. Econ. Res. Int. 2017, 2017, 1650363. [Google Scholar] [CrossRef]

- Sivaram, M. Modeling the price of trends of teak wood using statistical and artificial neural network techniques. Electron. J. Appl. Stat. Anal. 2014, 7, 180–198. [Google Scholar] [CrossRef]

- Tsekos, C.; Tandurella, S.; de Jong, W. Estimation of lignocellulosic biomass pyrolysis product yields using artificial neural networks. J. Anal. Appl. Pyrolysis 2021, 157, 105180. [Google Scholar] [CrossRef]

- Parzych, S.; Mandziuk, A. Kształtowanie się cen sprzedaży drewna w użytkowaniu przedrębnym w drzewostanach dębowych w zależności od wieku. Sylwan 2021, 165, 600–608. [Google Scholar] [CrossRef]

- Koutroumanidis, T.; Ioannou, K.; Arabatzis, G. Predicting fuelwood prices in Greece with the use of ARIMA models, artificial neural networks and a hybrid ARIMA–ANN model. Energy Policy 2009, 37, 3627–3634. [Google Scholar] [CrossRef]

- Verly Lopes, D.J.; Bobadilha, G.S.; Peres Vieira Bedette, A. Analysis of lumber prices time series using long short-term memory artificial neural networks. Forests 2021, 12, 428. [Google Scholar] [CrossRef]

- Gangwar, S.; Bali, V.; Kumar, A. Comparative analysis of wind speed forecasting using LSTM and SVM. EAI Endorsed Trans. Scalable Inf. Syst. 2020, 7, e1. [Google Scholar] [CrossRef]

- Zhao, X.; Yu, B.; Liu, Y.; Chen, Z.; Li, Q.; Wang, C.; Wu, J. Estimation of poverty using random forest regression with multi-source data: A case study in Bangladesh. Remote Sens. 2019, 11, 375. [Google Scholar] [CrossRef]

- Zhou, X.; Zhu, X.; Dong, Z.; Guo, W. Estimation of biomass in wheat using random forest regression algorithm and remote sensing data. Crop J. 2016, 4, 212–219. [Google Scholar] [CrossRef]

- Pierdzioch, C.; Risse, M. Forecasting precious metal returns with multivariate random forests. Empir. Econ. 2020, 58, 1167–1184. [Google Scholar] [CrossRef]

- Yoon, J. Forecasting of real GDP growth using machine learning models: Gradient boosting and random forest approach. Comput. Econ. 2021, 57, 247–265. [Google Scholar] [CrossRef]

- Gumus Kiran, M.; Gumus, S. Crude oil price forecasting using XGBoost. In 2017 International Conference on Computer Science and Engineering (UBMK); IEEE: Antalya, Turkey, 2017; pp. 1100–1103. [Google Scholar] [CrossRef]

- Wang, S.X.; Zhao, W.; Guo, D. An application of a three-stage XGBoost-based model to sales forecasting of a cross-border e-commerce enterprise. Math. Probl. Eng. 2019, 2019, 8503252. [Google Scholar] [CrossRef]

- He, M.; Li, W.; Via, B.K.; Zhang, Y. Nowcasting of lumber futures price with Google Trends Index using machine learning and deep learning models. For. Prod. J. 2022, 72, 11–20. [Google Scholar] [CrossRef]

- Leszczyszyn, E. Wood by-products and their use in Poland in a context of the direct survey of wood producers. Intercathedra 2018, 34, 35–43. [Google Scholar] [CrossRef]

- Kawa, A. Łańcuch dostaw biomasy drzewnej–wyniki ilościowych badań empirycznych. Pr. Nauk. Uniw. Ekon. Wrocławiu 2024, 68, 57–68. [Google Scholar] [CrossRef]

- Mydlarz, K.; Wieruszewski, M. The energy potential of firewood and by-products of round wood processing—Economic and technical aspects. Energies 2024, 17, 4797. [Google Scholar] [CrossRef]

- Piwowar, A.; Dzikuć, M. Outline of the economic and technical problems associated with the co-combustion of biomass in Poland. Renew. Sustain. Energy Rev. 2016, 54, 415–420. [Google Scholar] [CrossRef]

- Wanat, L.; Mikołajczak, E. The value and profitability of converting sawmill wood by-products to paper production and energy. In Pulp and Paper Processing; IntechOpen Limited: London, UK, 2018; p. 109. [Google Scholar] [CrossRef]

- Izdebski, W.; Izdebski, M.; Kosiorek, K. Evaluation of economic possibilities of production of second-generation spirit fuels for internal combustion engines in Poland. Energies 2023, 16, 892. [Google Scholar] [CrossRef]

- Čermák, M.; Malatakova, J.; Malatak, J.; Aniszewska, M.; Gendek, A. Regional wood chip quality parameters decomposition and price linkage with impact on Polish energy sustainability: Time frequency analysis between 2013 and 2019. Heliyon 2024, 10, e33322. [Google Scholar] [CrossRef] [PubMed]

- Górna, A.; Szabelska-Beręsewicz, A.; Wieruszewski, M.; Starosta-Grala, M.; Stanula, Z.; Kożuch, A.; Adamowicz, K. Predicting Post-Production Biomass Prices. Energies 2023, 16, 3470. [Google Scholar] [CrossRef]

- Urząd Regulacji Energetyki. Energetyka w Liczbach-2022. Warszawa, Październik 2023. Departament Ryn-ków Energii Elektrycznej i Ciepła URE/Oddziały Terenowe URE. ISBN 978-83-948942-6-9. Available online: https://www.ure.gov.pl/pl/cieplo/energetyka-cieplna-w-l/11407,2022.html (accessed on 10 May 2025).

- Leśnictwo. 2024. Available online: https://www.bdl.lasy.gov.pl/portal/gus-lesnictwo (accessed on 30 May 2025).

- Order. 2021. Order No. 24 of the Director General of the State Forests of April 27, 2021 on the Indication of Wood Assortments Appropriate for the So-Called Forest Biomass Market for Energy Purposes in Accordance with the Principle of Cascading Use of Wood Raw Material. Available online: https://drewno.lasy.gov.pl/zarzadzenie-nr-24-dyrektora-generalnego-lasow-panstwowych-z-dnia-27-kwietnia-2021-roku-w-sprawie-wskazania-sortymentow-drzewnych-wlasciwych-dla-rynku-tzw-biomasy-lesnej-na-cele-energetyczne/ (accessed on 2 May 2025).

- USA liczą na Zwiększenie Importu Pelletu Drzewnego do Europy. Magazyn Biomasa. Available online: https://magazynbiomasa.pl/usa-licza-na-zwiekszenie-importu-pelletu-drzewnego-do-europy (accessed on 4 May 2025).

- Mydlarz, K.; Wieruszewski, M. Economic, Technological as Well as Environmental and Social Aspects of Local Use of Wood By-Products Generated in Sawmills for Energy Purposes. Energies 2022, 15, 1337. [Google Scholar] [CrossRef]

- Kurowska, A. Struktura podaży odpadów drzewnych w Polsce. Sylwan 2016, 160, 187–196. [Google Scholar]

- Ceny Energii i Surowców Energetycznych w Polsce. Available online: https://energy.instrat.pl/ceny/ (accessed on 12 January 2025).

- Aktualne Ceny Biomasy na Giełdzie Baltpool. Available online: https://magazynbiomasa.pl/aktualne-ceny-biomasy-na-gieldzie-baltpool-tydzien-26/ (accessed on 24 July 2025).

- Rocznik Statystyczny Leśnictwa. 2023. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-lesnictwa-2023,13,6 (accessed on 7 January 2025).

- Rocznik Statystyczny Rezczpospolitej Polskiej. 2023. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-rzeczypospolitej-polskiej-2023,2,23.html (accessed on 7 January 2025).

- Rocznik Statystyczny Leśnictwa. 2022. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-lesnictwa-2022,13,5.html (accessed on 7 January 2025).

- Rocznik Statystycznny Leśnictwa. 2021. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-lesnictwa-2021,13,4.html (accessed on 7 January 2025).

- Sprawozdanie Finansowo-Gospodarcze PGL LP. 2023. Available online: https://www.lasy.gov.pl/pl/informacje/publikacje/informacje-statystyczne-i-raporty/sprawozdanie-finansowo-gospodarcze-pgl-lp/sprawozdanie-finansowo-gospodarcze-pgl-lp-za-rok-2023.pdf (accessed on 7 January 2025).

- Sprawozdanie Finansowo-Gospodarcze PGL LP. 2022. Available online: https://www.lasy.gov.pl/pl/informacje/publikacje/informacje-statystyczne-i-raporty/sprawozdanie-finansowo-gospodarcze-pgl-lp/sprawozdanie-finansowo-gospodarcze-pgl-lp-za-rok-2022.pdf/view (accessed on 7 January 2025).

- Sprawozdanie Finansowo-Gospodarcze PGL LP. 2021. Available online: https://www.lasy.gov.pl/pl/informacje/publikacje/informacje-statystyczne-i-raporty/sprawozdanie-finansowo-gospodarcze-pgl-lp/sprawozdanie-finansowo-gospodarcze-za-2021-rok.pdf/view (accessed on 7 January 2025).

- Sprawozdanie Finansowo-Gospodarcze PGL LP. 2020. Available online: https://www.lasy.gov.pl/pl/informacje/publikacje/informacje-statystyczne-i-raporty/sprawozdanie-finansowo-gospodarcze-pgl-lp/sprawozdanie-finansowo-gospodarcze-pgl-lp-za-2020-rok_.pdf/view (accessed on 7 January 2025).

- Sprawozdanie Finansowo-Gospodarcze PGL LP. 2019. Available online: https://www.lasy.gov.pl/pl/informacje/publikacje/informacje-statystyczne-i-raporty/sprawozdanie-finansowo-gospodarcze-pgl-lp/sprawozdanie-finansowo-gospodarcze-2019.pdf/view (accessed on 7 January 2025).

- Przemysł Drzewny. Available online: https://przemysldrzewny.eu/index.php/2024/12/27/ranking-najwiekszych-przedsiebiorstw-tartacznych-siegnelismy-dna-czekamy-na-wzrost/ (accessed on 24 July 2025).

- Prokhorenkova, L.; Gusev, G.; Vorobev, A.; Dorogush, A.; Gulin, A. CatBoost: Unbiased boosting with categorical features. In Proceedings of the 32nd Conference on Neural Information Processing Systems (NeurIPS 2018), Montréal, QC, Canada, 3–8 December 2018; Available online: https://proceedings.neurips.cc/paper_files/paper/2018/file/14491b756b3a51daac41c24863285549-Paper.pdf (accessed on 10 April 2025).

- Hancock, J.T.; Khoshgoftaar, T.M. CatBoost for big data: An interdisciplinary review. J. Big Data 2020, 7, 94. [Google Scholar] [CrossRef]

- Liu, Y.; Wang, Y.; Zhang, J. New machine learning algorithm: Random Forest. In Information Computing and Applications. ICICA 2012; Liu, B., Ma, M., Chang, J., Eds.; Lecture Notes in Computer Science; Springer: Berlin/Heidelberg, Germany, 2012; Volume 7473, pp. 256–263. [Google Scholar] [CrossRef]

- Loecher, M.; Lai, D.; Qi, W. Approximation of SHAP values for randomized tree ensembles. In Proceedings of the International Cross-Domain Conference for Machine Learning and Knowledge Extraction, Vienna, Austria, 23–26 August 2022; Springer: Cham, Switzerland, 2022; pp. 18–31. [Google Scholar] [CrossRef]

- Kraev, E.; Koseoglu, B.; Traverso, L.; Topiwalla, M. Shap-Select: Lightweight feature selection using SHAP values and regression. arXiv 2024, arXiv:2410.06815. Available online: https://www.researchgate.net/publication/384769721_Shap-Select_Lightweight_Feature_Selection_Using_SHAP_Values_and_Regression (accessed on 12 May 2025). [CrossRef]

- Popp, J.; Kovács, S.; Oláh, J.; Divéki, Z.; Balázs, E. Bioeconomy: Biomass and biomass-based energy supply and demand. New Biotechnol. 2021, 60, 76–84. [Google Scholar] [CrossRef]

- Inci, M.; Çelik, Ö.; Lashab, A.; Bayındır, K.Ç.; Vasquez, J.C.; Guerrero, J.M. Power system integration of electric vehicles: A review on impacts and contributions to the smart grid. Appl. Sci. 2024, 14, 2246. [Google Scholar] [CrossRef]

- Ntombela, M.; Musasa, K.; Moloi, K. A comprehensive review of the incorporation of electric vehicles and renewable energy distributed generation regarding smart grids. World Electr. Veh. J. 2023, 14, 176. [Google Scholar] [CrossRef]

- Raman, R.; Sreenivasan, A.; Kulkarni, N.V.; Suresh, M.; Nedungadi, P. Analyzing the contributions of biofuels, biomass, and bioenergy to sustainable development goals. iScience 2025, 28, 112157. [Google Scholar] [CrossRef]

- Zhao, X.; Li, X.; Wu, Y.; Qiao, L.; Zhang, C. Assessment of the effects of China’s new energy vehicle industry policies: From the perspective of moderating effect of consumer characteristics. Environ. Dev. Sustain. 2025, 27, 4319–4340. [Google Scholar] [CrossRef]

- Mignogna, D.; Szabó, M.; Ceci, P.; Avino, P. Biomass energy and biofuels: Perspective, potentials, and challenges in the energy transition. Sustainability 2024, 16, 7036. [Google Scholar] [CrossRef]

- CEPI/Nova Institute. 2024. Wood Fibre Based Biorefineries Double Turnover in 3 Years to €6 Billion, Highlighting Rapid Growth in European Bio-Refinery Sector. Available online: https://www.cepi.org/press-release-wood-fibre-based-biorefineries-double-turnover-in-3-years-to-e6-billion/ (accessed on 25 July 2025).

- Bentsen, N.S. Biomass for biorefineries: Availability and costs. In Biorefinery; Bastidas-Oyanedel, J.R., Schmidt, J., Eds.; Springer: Cham, Switzerland, 2019; pp. 25–44. [Google Scholar] [CrossRef]

- Di Gruttola, F.; Borello, D. Analysis of the EU secondary biomass availability and conversion processes to produce advanced biofuels: Use of existing databases for assessing a metric evaluation for the 2025 perspective. Sustainability 2021, 13, 7882. [Google Scholar] [CrossRef]

- Bruck, S.R.; Parajuli, R.; Chizmar, S.; Sills, E.O. Impacts of COVID-19 pandemic policies on timber markets in the Southern United States. J. For. Bus. Res. 2023, 2, 130–167. Available online: https://www.srs.fs.usda.gov/pubs/ja/2023/ja_2023_bruck_001.pdf (accessed on 12 May 2025). [CrossRef]

- Gökhan, S.; Gungor, E. Determination of the seasonal effect on the auction prices of timbers and prediction of future prices. J. Bartin Fac. For. 2018, 20, 266–277. [Google Scholar] [CrossRef]

- Friedman, J.H. Greedy function approximation: A gradient boosting machine. Ann. Stat. 2001, 29, 1189–1232. [Google Scholar] [CrossRef]

- Breiman, L. Random forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Cha, G.-W.; Moon, H.-J.; Kim, Y.-C. Comparison of random forest and gradient boosting machine models for predicting demolition waste based on small datasets and categorical variables. Int. J. Environ. Res. Public Health 2021, 18, 8530. [Google Scholar] [CrossRef] [PubMed]

- Abrell, J.; Kosch, S.; Rausch, S. How Effective Is Carbon Pricing? Emissions and Cost Impacts of the UK Carbon Tax; ETH Zurich: Zurich, Switzerland, 2021; Available online: https://abrell.eu/public/papers/abrell_kosch_rausch_uk_carbon_tax.pdf (accessed on 25 July 2025).

- Bohdan, A.; Klosa, S.; Romaniuk, U. Fluctuations of natural gas prices for households in the 2017–2022 period—Polish case study. Energies 2023, 16, 1824. [Google Scholar] [CrossRef]

- Guotao, W.; Qi, L.; Zhengbing, L.; Haoran, Z.; Yongtu, L.; Xuemei, W. How does soaring natural gas prices impact renewable energy: A case study in China. Energy 2022, 252, 123940. [Google Scholar] [CrossRef]

- Zych, G.; Bronicki, J.; Czarnecka, M.; Kinelski, G.; Kamiński, J. The cost of using gas as a transition fuel in the transition to low-carbon energy: The case study of Poland and selected European countries. Energies 2023, 16, 994. [Google Scholar] [CrossRef]

- Kożuch, A.; Cywicka, D.; Adamowicz, K.; Wieruszewski, M.; Wysocka-Fijorek, E.; Kiełbasa, P. The Use of Forest Biomass for Energy Purposes in Selected Eu-ropean Countries. Energies 2023, 16, 5776. [Google Scholar] [CrossRef]

- Kumar Das, A.; Baldo, M.; Dobor, L.; Seidl, R.; Rammer, W.; Modlinger, R.; Washaya, P.; Merganičová, K.; Hlásny, T. The Increasing Role of Drought as an Inciting Factor of Bark Beetle Outbreaks Can Cause Large-Scale Transformation of Central European Forests. Landsc. Ecol. 2025, 40, 108. [Google Scholar] [CrossRef]

- Machado-Nunez Morerio, J.; Eid, T.; Antón-Fernández, C.; Kangas, A.; Trømborg, E. Natural Disturbances Risks in European Boreal and Temperate Forests and Their Links to Climate Change—A Review of Modelling Approaches. For. Ecol. Manag. 2022, 509, 120071. [Google Scholar] [CrossRef]

- Johnson, N.; Krey, V.; McCollum, D.L.; Rao, S.; Riahi, K.; Rogelj, J. Stranded on a low-carbon planet: Implications of climate policy for the phase-out of coal-based power plants. Technol. Forecast. Soc. Change 2015, 90 Pt A, 89–102. [Google Scholar] [CrossRef]

- Wang, Z.; Hou, H.; Wei, R.; Li, Z. A distributed market-aided restoration approach of multi-energy distribution systems considering comprehensive uncertainties from typhoon disaster. IEEE Trans. Smart Grid 2025, 11029621. [Google Scholar] [CrossRef]

- Tiwari, R.S.; Sharma, J.P.; Gupta, O.H.; Sufyan, M.A. Extension of pole differential current based relaying for bipolar LCC HVDC lines. Sci. Rep. 2025, 15, 16142. [Google Scholar] [CrossRef] [PubMed]

| Assortment | N | Mean. | Med. | Min. | Max. | Q1 | Q3 | Stand. Dev. | Coef var. |

|---|---|---|---|---|---|---|---|---|---|

| Pulpwood chips PLN/m3 | 88 | 223 | 200 | 101 | 400 | 200 | 220 | 61 | 28 |

| Sawmill chips PLN/m3 | 88 | 187 | 150 | 101 | 400 | 150 | 180 | 71 | 38 |

| Bark PLN/m3 | 88 | 168 | 125 | 100 | 300 | 120 | 220 | 66 | 39 |

| Sawdust PLN/m3 | 88 | 199 | 154 | 100 | 550 | 136 | 225 | 101 | 51 |

| S4 PLN/m3 | 88 | 108 | 102 | 96 | 129 | 100 | 111 | 11 | 10 |

| Industrial wood (roundwood) PLN/m3 | 88 | 247 | 208 | 189 | 359 | 197 | 301 | 56 | 23 |

| Fossil fuels (coal) PLN/t | 88 | 368 | 264 | 209 | 741 | 250 | 482 | 169 | 46 |

| Natural gas PLN/MWh | 88 | 183 | 122 | 28 | 920 | 80 | 212 | 171 | 93 |

| Model | MSE | RMSE | MAE | MAPE | R2 |

|---|---|---|---|---|---|

| CatBoost | 559.226 | 23.648 | 13.826 | 0.062 | 0.901 |

| Random Forest | 1061.097 | 32.574 | 21.436 | 0.093 | 0.813 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kożuch, A.; Cywicka, D.; Wieruszewski, M.; Gejdoš, M.; Adamowicz, K. The Impact of Selected Market Factors on the Prices of Wood Industry By-Products in Poland in the Context of Climate Policy Changes. Energies 2025, 18, 4418. https://doi.org/10.3390/en18164418

Kożuch A, Cywicka D, Wieruszewski M, Gejdoš M, Adamowicz K. The Impact of Selected Market Factors on the Prices of Wood Industry By-Products in Poland in the Context of Climate Policy Changes. Energies. 2025; 18(16):4418. https://doi.org/10.3390/en18164418

Chicago/Turabian StyleKożuch, Anna, Dominika Cywicka, Marek Wieruszewski, Miloš Gejdoš, and Krzysztof Adamowicz. 2025. "The Impact of Selected Market Factors on the Prices of Wood Industry By-Products in Poland in the Context of Climate Policy Changes" Energies 18, no. 16: 4418. https://doi.org/10.3390/en18164418

APA StyleKożuch, A., Cywicka, D., Wieruszewski, M., Gejdoš, M., & Adamowicz, K. (2025). The Impact of Selected Market Factors on the Prices of Wood Industry By-Products in Poland in the Context of Climate Policy Changes. Energies, 18(16), 4418. https://doi.org/10.3390/en18164418