The Effects of Renewable Energy, Economic Growth, and Trade on CO2 Emissions in the EU-15

Abstract

1. Introduction

- Does the growth of economic activity predominantly lead to an increase in CO2 emissions?

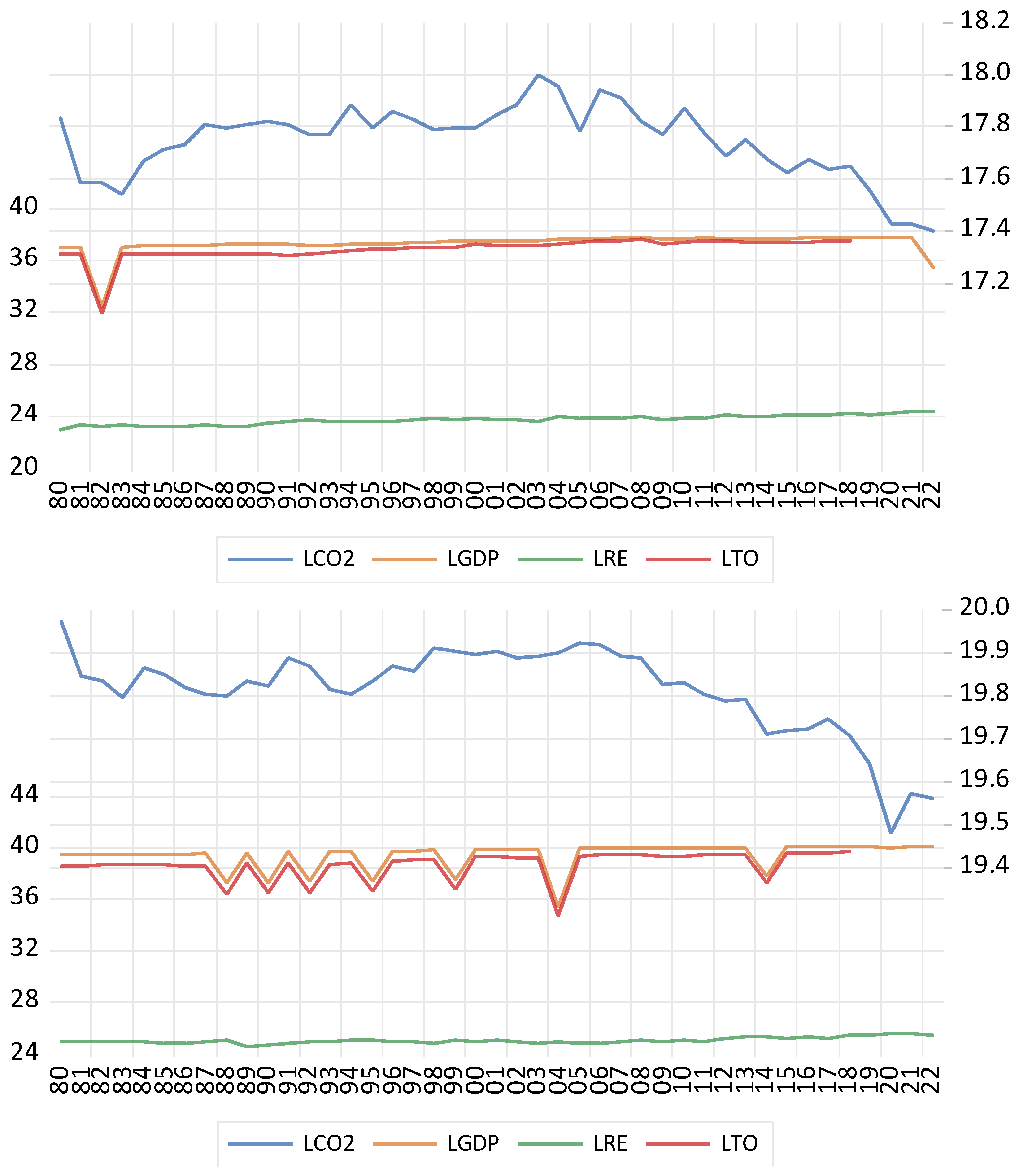

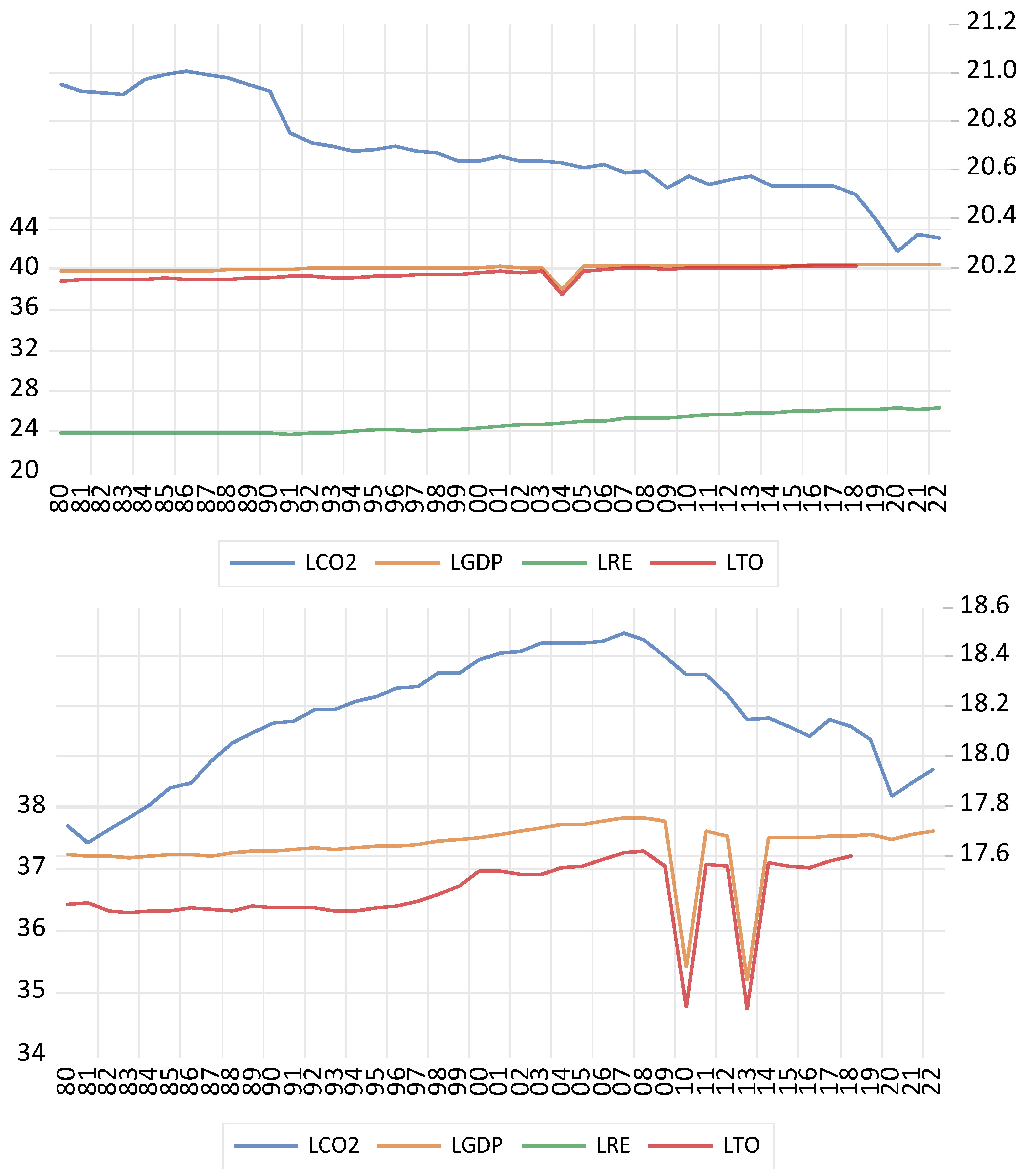

- To what extent does the increased utilization of renewable energy sources contribute to the reduction in CO2 emissions?

2. Literature Review

2.1. The Relationship Between Economic Growth and CO2 Emissions

2.2. The Relationship Between Renewable Energy and CO2 Emissions

2.3. The Relationship Between Trade and CO2 Emissions

2.4. Research Gaps in the Literature

3. Methods

3.1. Model and Theoretical Basis

3.2. Unit Root Test

3.3. ARDL Cointegration

3.4. Panel Cointegration

- Intercepts: Accounting for individual-specific effects;

- Short-run dynamics: Capturing heterogeneity in the adjustment process;

- Cointegrating vector: Enforcing homogeneity in the long-run relationship across the panel.

4. Data

5. Results and Analysis

5.1. The Findings of Unit Root Tests

5.2. The Findings of ARDL Tests

5.3. The Long-Run and Short-Run Analyses

5.4. The Robustness Check

6. Concluding Remarks and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- EIA. Energy Information Association, U.S. 2025. Available online: https://www.eia.gov/ (accessed on 1 December 2024).

- BP Statistics. Statistical Review of World Energy. 2021. Available online: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html (accessed on 1 December 2024).

- Gardiner, R.; Hajek, P. Interactions among energy consumption, CO2, and economic development in European Union countries. Sustain. Dev. 2019, 28, 723–740. [Google Scholar] [CrossRef]

- Mongo, M.; Laforest, V.; Belaid, F.; Tanguy, A. Assessment of the impact of the circular economy on CO2 emissions in Europe. J. Innov. Econ. Manag. 2022, 3, 15–43. [Google Scholar] [CrossRef]

- Fu, Q.; Alvarez-Otero, S.; Sial, M.S.; Comite, U.; Zheng, P.; Samad, S.; Olah, J. Impact of Renewable Energy on Economic Growth and CO2 Emissions—Evidence from BRICS Countries. Processes 2021, 9, 1281. [Google Scholar] [CrossRef]

- Kim, S. The Effects of information and communication technology, economic growth, trade openness, and renewable energy on CO2 emissions in OECD countries. Energies 2022, 15, 2517. [Google Scholar] [CrossRef]

- Jozwik, B.; Sarigul, S.S.; Topcu, B.A.; Cetin, M.; Dogan, M. Trade openness, economic growth, capital, and financial globalization: Unveiling their impact on renewable energy consumption. Energies 2025, 18, 1244. [Google Scholar] [CrossRef]

- Saidi, K.; Omri, A. The impact of renewable energy on carbon emissions and economic growth in 15 major renewable energy-consuming countries. Environ. Res. 2020, 186, 109567. [Google Scholar] [CrossRef]

- Supron, B.; Myszczydzyn, J. Impact of Renewable and Non-Renewable Energy Consumption and CO2 Emissions on Economic Growth in the Visegrad Countries. Energies 2023, 16, 7163. [Google Scholar] [CrossRef]

- Onofrei, M.; Vatamanu, A.F.; Cigu, E. The relationship between economic growth and CO2 emissions in EU countries: A cointegration analysis. Front. Environ. Sci. 2022, 10, 934885. [Google Scholar] [CrossRef]

- Bekaliyev, A.; Junissov, A.; Kakimov, Y.; Poulopoulos, S.G. Evaluation of decoupling of GDP and CO2 emissions in EU-15. IOP Conf. Ser. Earth Environ. Sci. 2021, 899, 012028. [Google Scholar] [CrossRef]

- Shahbaz, M.; Lorente, D.B.; Sharma, R. Economic Growth and Envrionmental Quality in a Post-Pandemic World; Routledge: London, UK, 2023. [Google Scholar]

- Ghazouani, T.; Maktouf, S. Impact of natural resources, trade openness, and economic growth on CO2 emissions in oil-exporting countries: A panel autoregressive distributed lag analysis. Nat. Resour. Forum 2024, 48, 211–231. [Google Scholar] [CrossRef]

- Goswami, A.; Kapoor, H.M.; Jangir, R.K.; Ngigi, C.N.; Nowrouzi-Kia, B.; Chattu, V.K. Impact of Economic Growth, Trade Openness, Urbanization and Energy Consumption on Carbon Emissions: A Study of India. Sustainability 2023, 15, 9025. [Google Scholar] [CrossRef]

- Mester, I.; Simut, R.; Mester, L.; Bac, D. An investigation of tourism, economic growth, CO2 emissions, trade openness and energy intensity index nexus: Evidence for the European Union. Energies 2023, 16, 4308. [Google Scholar] [CrossRef]

- Acheampong, A.O. Economic growth, CO2 emissions and energy consumption: What causes what and where? Energy Econ. 2018, 74, 677–692. [Google Scholar] [CrossRef]

- Jaber, M.M.; Szep, T.; El-Naqa, A.R.; Abusmier, A.R. Energy Consumption, Economic Growth, and Climate Change Nexus in Jordan: Insights from the Toda Yamamoto Causality Test. Resources 2025, 14, 36. [Google Scholar] [CrossRef]

- Dogan, E.; Aslan, A. Exploring the relationship among CO2 emissions, real GDP, energy consumption and tourism in the EU and candidate countries: Evidence from panel models robust to heterogeneity and cross-sectional dependence. Renew. Sustain. Energy Rev. 2017, 77, 239–245. [Google Scholar] [CrossRef]

- Shahnazi, R.; Shabani, Z.D. The effects of renewable energy, spatial spillover of CO2 emissions and economic freedom on CO2 emissions in the EU. Renew. Energy 2021, 169, 293–307. [Google Scholar] [CrossRef]

- Madrani, A.; Streimikiene, D.; Cavallaro, F.; Loganathan, N.; Khoshonoudi, M. Carbon dioxide (CO2) emissions and economic growth: A systematic review of two decades of research from 1995 to 2017. Sci. Total Environ. 2019, 649, 31–49. [Google Scholar] [CrossRef]

- Bekun, F.V.; Alola, A.A.; Gyamfi, B.A.; Yaw, S.S. The relevance of EKC hypothesis in energy intensity real-output trade-off for sustainable development in EU-27. Environ. Sci. Pollut. Res. 2021, 28, 51137–51148. [Google Scholar] [CrossRef] [PubMed]

- Rahman, M.M.; Vu, X.-B. The nexus between renewable energy, economic growth, trade, urbanization and environmental quality: A comparative study for Australia and Canada. Renew. Energy 2020, 155, 617–627. [Google Scholar] [CrossRef]

- Yang, G.; Sun, T.; Wang, J.; Li, X. Modeling the nexus between carbon dioxide emissions and economic growth. Energy Policy 2015, 86, 104–117. [Google Scholar] [CrossRef]

- Fávero, L.P.; Souza, R.D.F.; Belfiore, P.; Luppe, M.R.; Severo, M. Global relationship between economic growth and CO2 emissions across time: A multilevel approach. Int. J. Glob. Warm. 2022, 26, 38–63. [Google Scholar] [CrossRef]

- Lorente, D.B.; Shahbaz, M.; Roubaud, D.; Farhani, S. How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 2018, 113, 356–367. [Google Scholar] [CrossRef]

- Li, W.; Yang, G.; Li, X. Modeling the evolutionary nexus between carbon dioxide emissions and economic growth. J. Clean. Prod. 2019, 215, 1191–1202. [Google Scholar] [CrossRef]

- Purwono, R.; Sugiharti, L.; Esquivias, M.A.; Fadliyanti, L.; Rahmawati, Y.; Wijimulawiani, B.S. The impact of tourism, urbanization, globalization, and renewable energy on carbon emissions: Testing the inverted N-shape environmental Kuznets curve. Soc. Social Sci. Humanit. Open 2024, 10, 100917. [Google Scholar] [CrossRef]

- Sterpu, M.; Soava, G.; Mehedintu, A. Impact of Economic Growth and Energy Consumption on Greenhouse Gas Emissions: Testing Environmental Curves Hypotheses on EU Countries. Sustainability 2018, 10, 3327. [Google Scholar] [CrossRef]

- Wang, S.; Li, Q.; Fang, C.; Zhou, C. The relationship between economic growth, energy consumption, and CO2 emissions: Empirical evidence from China. Sci. Total Environ. 2016, 542, 360–371. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Energy consumption, CO2 emissions, and economic growth: An ethical dilemma. Renew. Sustain. Energy Rev. 2017, 68, 808–824. [Google Scholar] [CrossRef]

- Mohmmed, A.; Li, Z.; Arowolo, A.O.; Su, H.; Deng, X.; Najmuddin, O.; Zhang, Y. Driving factors of CO2 emissions and nexus with economic growth, development and human health in the Top Ten emitting countries. Resour. Conserv. Recycl. 2019, 148, 157–169. [Google Scholar] [CrossRef]

- Salahuddin, M.; Gow, J. Effects of energy consumption and economic growth on environmental quality: Evidence from Qatar. Environ. Sci. Pollut. Res. 2019, 26, 18124–18142. [Google Scholar] [CrossRef] [PubMed]

- Sarkodie, S.A.; Owusu, P.A.; Leirvik, T. Global effect of urban sprawl, industrialization, trade and economic development on carbon dioxide emissions. Environ. Res. Lett. 2020, 15, 034049. [Google Scholar] [CrossRef]

- Radmehr, R.; Henneberry, S.R.; Shayanmehr, S. Renewable Energy Consumption, CO2 Emissions, and Economic Growth Nexus: A Simultaneity Spatial Modeling Analysis of EU Countries. Struct. Change Econ. Dyn. 2021, 57, 13–27. [Google Scholar] [CrossRef]

- Wang, Q.; Li, C.; Li, R. How does renewable energy consumption and trade openness affect economic growth and carbon emissions? International evidence of 122 countries. Energy Environ. 2023, 36, 187–211. [Google Scholar] [CrossRef]

- Isik, C.; Bulut, U.; Ongan, S.; Islam, H.; Irfan, M. Exploring how economic growth, renewable energy, internet usage, and mineral rents influence CO2 emissions: A panel quantile regression analysis for 27 OECD countries. Resour. Policy 2024, 92, 105025. [Google Scholar] [CrossRef]

- Leitão, N.C.; Lorente, D.B. The linkage between economic growth, renewable energy, tourism, CO2 emissions, and international trade: The evidence for the European Union. Energies 2020, 13, 4838. [Google Scholar] [CrossRef]

- Bhat, J.A. Renewable and non-renewable energy consumption—Impact on economic growth and CO2 emissions in five emerging market economies. Environ. Sci. Pollut. Res. 2018, 25, 35515–35530. [Google Scholar] [CrossRef]

- Chen, C.; Pinar, M.; Stengos, T. Renewable energy and CO2 emissions: New evidence with the panel threshold model. Renew. Energy 2022, 194, 117–128. [Google Scholar] [CrossRef]

- Raihan, A.; Ibrahim, S.; Ridwan, M.; Rahman, M.S.; Mainul Bari, A.B.M.; Atasoy, F.G. Role of renewable energy and foreign direct investment toward economic growth in Egypt. Innov. Green. Dev. 2025, 4, 100185. [Google Scholar] [CrossRef]

- Chen, Y.; Zhao, J.; Lai, Z.; Wang, Z.; Xia, H. Exploring the effects of economic growth, and non-renewable energy consumption China’s emissions: Evidence from a regional panel analysis. Renew. Energy 2019, 140, 341–353. [Google Scholar] [CrossRef]

- Sharif, A.; Mishra, A.; Sinha, A.; Jia, Z.; Shahbaz, M. The renewable energy consumption- environmental degradation nexus in top 10 polluted countries: Fresh Insights from quantile-on-quantile regression approach. Renew. Energy 2020, 150, 670–690. [Google Scholar] [CrossRef]

- Karaaslan, A.; Çamkaya, S. The relationship between CO2 emissions, economic growth, health expenditure, and renewable and non-renewable energy consumption: Empirical evidence from Turkey. Renew. Energy 2022, 190, 457–466. [Google Scholar] [CrossRef]

- Alpirandi, F.; Stoppato, A.; Mirandola, A. Estimating CO2 emisisons reduction from renewable energy use in Italy. Renew. Energy 2016, 96, 220–232. [Google Scholar] [CrossRef]

- Mutascu, M.; Sokic, A. Trade openness-CO2 emissions nexus: A wavelet evidence from EU. Environ. Model. Assess. 2020, 25, 411–428. [Google Scholar] [CrossRef]

- Shahbaz, M.; Tiwari, A.K.; Nasir, M. The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 2013, 61, 1452–1459. [Google Scholar] [CrossRef]

- Ansari, M.A.; Haider, S.; Khan, N.A. Does trade openness affects global carbon dioxide emissions: Evidence from the top CO2 emitters. Manag. Environ. Qual. Int. J. 2020, 31, 32–53. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Leitão, N.C. The role of tourism, trade, renewable energy use and carbon dioxide emissions on economic growth: Evidence of tourism-led growth hypothesis in EU-28. Environ. Sci. Pollut. Res. 2020, 27, 45883–45896. [Google Scholar] [CrossRef]

- Dou, Y.; Zhao, J.; Malik, M.N.; Dong, K. Assessing the impact of trade openness on CO2 emissions: Evidence from China-Japan-ROK FTA countries. J. Environ. Manag. 2021, 296, 113241. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, F. The effects of trade openness on decoupling carbon emissions from economic growth–evidence from 182 countries. J. Clean. Prod. 2021, 279, 123838. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasreen, S.; Ahmed, K.; Hammoudeh, S. Trade openness-carbon emissions nexus: The importance of turning points of trade openness for country panels. Energy Econ. 2017, 61, 221–232. [Google Scholar] [CrossRef]

- Hdom, H.A.; Fuinhas, J.A. Energy production and trade openness: Assessing economic growth, CO2 emissions and the applicability of the cointegration analysis. Energy Strategy Rev. 2020, 30, 100488. [Google Scholar] [CrossRef]

- Haug, A.A.; Ucal, M. The role of trade and FDI for CO2 emissions in Turkey: Nonlinear relationships. Energy Econ. 2019, 81, 297–307. [Google Scholar] [CrossRef]

- Haliciouglu, F. An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 2009, 37, 1156–1164. [Google Scholar] [CrossRef]

- Bento, J.P.C.; Moutihno, V. CO2 emissions, non- renewable and renewable electricity production, economic growth, and international trade in Italy. Renew. Sustain. Energy Rev. 2016, 55, 142–155. [Google Scholar] [CrossRef]

- Khan, Z.; Ali, M.; Jinyu, L.; Shahbaz, M.; Siqun, Y. Consumption- based carbon emissions and trade nexus: Evidence from nine oil exporting countries. Energy Econ. 2020, 89, 104806. [Google Scholar] [CrossRef]

- Sebri, M.; Ben-Salha, O. On the causal dynamics between economic growth, renewable energy consumption, CO2 emissions and trade openness: Fresh evidence from BRICS countries. Renew. Sustain. Energy Rev. 2014, 39, 14–23. [Google Scholar] [CrossRef]

- Jamil, K.; Liu, D.; Gul, R.F.; Hussain, Z.; Mohsin, M.; Qin, G.; Khan, F.U. Do remittance and renewable energy affect CO2 emissions? An empirical evidence from selected G-20 countries. Energy Environ. 2022, 33, 916–932. [Google Scholar] [CrossRef]

- Paparoditis, E.; Politis, D.N. The asymptotic size and power of the augmented Dickey–Fuller test for a unit root. Econom. Rev. 2018, 37, 955–973. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Narayan, P.K. The saving and investment nexus for China: Evidence from cointegration tests. Appl. Econ. 2005, 37, 1979–1990. [Google Scholar] [CrossRef]

- Turner, P. Response surfaces for an F-test for cointegration. Appl. Econ. Lett. 2006, 13, 479–482. [Google Scholar] [CrossRef]

- Nkoro, E.; Uko, A.K. Autoregressive Distributed Lag (ARDL) cointegration technique: Application and interpretation. J. Stat. Econom. Methods 2016, 5, 63–91. [Google Scholar]

- Natsiopoulos, K.; Tzeremes, N.G. ARDL: An R Package for ARDL Models and Cointegration. Comput. Econ. 2023, 64, 1757–1773. [Google Scholar] [CrossRef]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Isiksal, A.Z.; Assi, A.F. Determinants of sustainable energy demand in the European economic area: Evidence from the PMG-ARDL model. Technol. Forecast. Soc. Social Change 2022, 183, 121901. [Google Scholar] [CrossRef]

- Ameyaw, B.; Li, Y.; Ma, Y.; Agyeman, J.K.; Appiah-Kubi, J.; Annan, A. Renewable electricity generation proposed pathways for the US and China. Renew. Energy 2021, 170, 212–223. [Google Scholar] [CrossRef]

- Pea-Assounga, J.B.B.; Bambi, P.D.R.; Jafarzadeh, E.; Ngapey, J.D.N. Investigating the impact of crude oil prices, CO2 emissions, renewable energy, population growth, trade openness, and FDI on sustainable economic growth. Renew. Energy 2025, 241, 122353. [Google Scholar] [CrossRef]

- World Development Indicators. 2024. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 1 December 2024).

- Abid, M.; Sakrafi, H.; Gheraia, Z.; Abdelli, H. Does renewable energy consumption affect ecological footprints in Saudi Arabia? A bootstrap causality test. Renew. Energy 2022, 189, 813–821. [Google Scholar] [CrossRef]

- Raifu, I.A.; Obaniyi, F.A.; Nnamani, G.; Salihu, A.A. Revisiting causal relationship between renewable energy and economic growth in OECD countries: Evidence from a novel JKS’s Granger non-causality test. Renew. Energy 2025, 244, 122559. [Google Scholar] [CrossRef]

- Abbasi, K.R.; Adedoyin, F.F.; Abbas, J.; Hussain, K. The impact of energy depletion and renewable energy on CO2 emissions in Thailand: Fresh evidence from the novel dynamic ARDL simulation. Renew. Energy 2021, 180, 1439–1450. [Google Scholar] [CrossRef]

- Awan, A.; Sadiq, M.; Hassan, S.T.; Khan, I.; Khan, N.H. Combined nonlinear effects of urbanization and economic growth on CO2 emissions in Malaysia. An application of QARDL and KRLS. Urban. Clim. 2022, 46, 101342. [Google Scholar] [CrossRef]

- Namahoro, J.P.; Wu, Q.; Zhou, N.; Xue, S. Impact of energy intensity, renewable energy, and economic growth on CO2 emissions: Evidence from Africa across regions and income levels. Renew. Sustain. Energy Rev. 2021, 147, 111233. [Google Scholar] [CrossRef]

- Mirziyoyeva, Z.; Salahodjaev, R. Renewable energy and CO2 emissions intensity in the top carbon intense countries. Renew. Energy 2022, 192, 507–512. [Google Scholar] [CrossRef]

- Rehman, A.; Alam, M.M.; Ozturk, I.; Alvarado, R.; Murshed, M.; Isik, C.; Ma, H. Globalization and renewable energy use: How are they contributing to upsurge the CO2 emissions? A global perspective. Environ. Sci. Pollut. Res. 2022, 30, 9699–9712. [Google Scholar] [CrossRef] [PubMed]

- Pata, U.K.; Dam, M.M.; Kaya, F. How effective are renewable energy, tourism, trade openness, and foreign direct investment on CO2 emissions? An EKC analysis for ASEAN countries. Environ. Sci. Pollut. Res. 2022, 30, 14821–14837. [Google Scholar] [CrossRef]

- Wencong, L.; Kasimov, I.; Saydaliev, H.B. Foreign direct investment and renewable energy: Examinig the environmental Kuznets curve in resource-rich transition economies. Renew. Energy 2023, 208, 301–310. [Google Scholar] [CrossRef]

- Cai, X.; Wei, C. Does financial inclusion and renewable energy impede environmental quality: Empirical evidence from BRI countries. Renew. Energy 2023, 209, 481–490. [Google Scholar] [CrossRef]

- Lähteenmäki-Uutela, A.; Haukioja, T.; Pohjola, T. From global Doughnut sustainability to local tourism destination management. Hotel. Tour. Manag. 2024, 12, 107–121. [Google Scholar] [CrossRef]

- Tingli, L.; Ishtiaq, M.; Saud, S.; Rasheed, M.Q. Achieving sustainable development in emerging economies: Interplay between markets, resources, and environment. Renew. Energy 2025, 238, 121941. [Google Scholar] [CrossRef]

- Mihajlović, V.; Tubić-Ćurčić, T.; Lojanica, N.; Mihajlović, N. Impact of tourism on economic growth and CO2 emissions in the EU: A dynamic panel threshold analysis. Hotel. Tour. Manag. 2025, 13, 9–24. [Google Scholar] [CrossRef]

| Variables | Austria | Belgium | Denmark | Finland | France | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| At Level | At 1st Difference | At Level | At 1st Difference | At Level | At 1st Difference | At Level | At 1st Difference | At Level | At 1st Difference | |

| T-Stat | T-Stat | T-Stat | T-Stat | T-Stat | T-Stat | T-Stat | T-Stat | T-Stat | T-Stat | |

| lnCO2t | −1.43 | −6.43 ** | −1.55 | −8.19 ** | 0.61 | −8.02 ** | −0.12 | −5.78 ** | −0.84 | −7.57 ** |

| lnGDPt | −4.06 ** | −10.71 ** | −5.78 ** | −5.58 ** | −5.58 ** | −9.63 ** | −4.90 ** | −9.99 ** | −6.96 ** | −6.26 ** |

| lnREt | −1.69 | −8.89 ** | −1.10 | −5.07 ** | −3.89 ** | −2.95 * | −1.37 | −8.92 ** | −1.34 | −8.37 ** |

| lnTOt | −2.89 | −9.99 ** | 3.81 ** | −6.53 ** | −5.02 ** | −6.27 ** | −4.27 ** | −10.16 ** | −6.31 | −5.93 ** |

| Variables | Germany | Greece | Ireland | Italy | Luxembourg | |||||

| At level | At 1st difference | At level | At 1st difference | At level | At 1st difference | At level | At 1st difference | At level | At 1st difference | |

| t-stat | t-stat | t-stat | t-stat | t-stat | t-stat | t-stat | t-stat | t-stat | t-stat | |

| lnCO2t | −0.26 | −5.86 ** | −1.67 | −4.76 ** | −1.68 | −4.85 ** | −0.79 | −6.25 ** | −2.05 | −5.50 ** |

| lnGDPt | −5.13 ** | −10.67 ** | −1.22 | −2.27 | −1.33 | −7.28 ** | −6.56 ** | −6.10 ** | −2.02 | −5.09 ** |

| lnREt | −1.41 | 4.85 ** | 0.46 | −6.12 ** | −0.86 | −8.27 | −0.37 | −6.32 ** | −1.78 | −7.18 ** |

| lnTOt | −3.12 * | −9.81 ** | −5.51 ** | −10.48 ** | −1.18 | −6.68 ** | −5.71 ** | −5.83 ** | −0.62 | −5.18 ** |

| Variables | The Netherlands | Portugal | Spain | Sweden | United Kingdom | |||||

| At level | At 1st difference | At level | At 1st difference | At level | At 1st difference | At level | At 1st difference | At level | At 1st difference | |

| t-stat | t-stat | t-stat | t-stat | t-stat | t-stat | t-stat | t-stat | t-stat | t-stat | |

| lnCO2t | −1.52 | −2.89 * | −2.75 | −7.23 ** | −2.06 | −5.41 ** | −1.13 | −6.85 ** | 0.97 | −6.42 ** |

| lnGDPt | −6.81 ** | −5.85 ** | −1.80 | −2.93 | −2.29 | −2.80 | −0.10 | −5.72 ** | −5.44 ** | −7.00 * |

| lnREt | −0.88 | −8.25 ** | −0.77 | −9.92 ** | 0.26 | −8.13 ** | −1.72 | −9.42 ** | 1.30 | −6.01 ** |

| lnTOt | −5.83 ** | −5.82 ** | −2.84 | −5.59 ** | −1.71 | −5.43 ** | −0.48 | −4.98 ** | −4.76 ** | −8.29 ** |

| Estimated Model Flnco2 (lnCO2/lnGDP, lnRE, lnTO) | ||

|---|---|---|

| Country | Optimal Lag Length | F-Statistics |

| Austria | 2, 1, 3, 3 | 6.68 ** |

| Belgium | 3, 1, 0, 1 | 8.46 *** |

| Denmark | 2, 2, 2, 0 | 4.97 * |

| Finland | 3, 1, 3, 1 | 7.73 *** |

| France | 1, 1, 3, 1 | 4.87 * |

| Germany | 3, 0, 0, 0 | 10.41 *** |

| Ireland | 1, 0, 2, 0 | 9.17 *** |

| Italy | 1, 3, 2, 3 | 21.81 *** |

| Luxembourg | 2, 3, 0, 3 | 8.56 *** |

| The Netherlands | 2, 0, 2, 0 | 8.63 *** |

| Sweden | 1, 2, 0, 0 | 1.96 |

| UK | 4, 4, 0, 4 | 5.9 ** |

| Case III | ||

| Significance level | I(0) | I(1) |

| 10% | 2.933 | 4.020 |

| 5% | 3.548 | 4.803 |

| 1% | 5.018 | 6.610 |

| Case V | ||

| Significance level | I(0) | I(1) |

| 10% | 3.760 | 4.795 |

| 5% | 4.510 | 5.643 |

| 1% | 6.238 | 7.740 |

| Dependent Variable lnCO2t | Austria | Belgium | Denmark | Finland | ||||

|---|---|---|---|---|---|---|---|---|

| Variables | Coeff | t-stat | Coeff | t-stat | Coeff | t-stat | Coeff | t-stat |

| lnGDPt | 1.87 | 3.17 ** | 1.65 | 10.82 ** | 5.70 | 2.97 ** | 1.14 | 2.01 * |

| lnREt | −0.96 | −3.44 ** | −0.13 | −6.51 ** | −0.29 | −2.61 ** | −0.68 | −1.15 |

| lnTOt | −1.51 | −0.53 | −0.53 | −3.99 ** | −1.55 | −3.49 ** | −0.49 | −1.65 |

| Dependent variable lnCO2t | France | Germany | Ireland | Italy | ||||

| Variables | Coeff | t-stat | Coeff | t-stat | Coeff | t-stat | Coeff | t-stat |

| lnGDPt | −2.20 | −0.81 | 0.01 | 0.08 | 0.43 | 2.81 ** | 0.58 | 4.66 ** |

| lnREt | −1.64 | −1.19 | 0.27 | 3.24 ** | −0.44 | −2.14 * | −0.59 | −4.03 ** |

| lnTOt | 2.05 | 0.92 | −0.03 | −0.34 | 0.20 | 1.91 * | 0.66 | 2.29 ** |

| Dependent variable lnCO2t | Luxembourg | The Netherlands | United Kingdom | |||||

| Variables | Coeff | t-stat | Coeff | t-stat | Coeff | t-stat | ||

| lnGDPt | −2.61 | −3.03 ** | 1.60 | 15.20 ** | 0.93 | 2.59 ** | ||

| lnREt | −0.55 | −2.58 ** | 0.01 | 0.06 | −0.16 | −2.63 ** | ||

| lnTOt | 2.14 | 3.13 ** | −0.82 | −15.61 ** | 0.67 | 1.92 * | ||

| Dependent Variable ΔlnCO2t | Austria | Belgium | Denmark | Finland | ||||

|---|---|---|---|---|---|---|---|---|

| Variables | Coeff | t-stat | Coeff | t-stat | Coeff | t-stat | Coeff | t-stat |

| ΔlnGDPt | −1.14 | −1.56 | 0.27 | 0.57 | 1.50 | 1.70 | 0.48 | 0.96 |

| ΔlnREt | 0.55 | 3.82 ** | −0.04 | −0.85 | −0.32 | 3.00 ** | −0.19 | −2.39 ** |

| ΔlnTOt | 0.53 | 2.99 ** | 0.08 | 0.78 | −0.20 | −0.83 | 0.21 | 1.18 |

| ECMt−1 | −0.41 | −5.46 ** | −1.04 | −6.92 ** | −0.60 | −4.58 ** | −0.46 | −6.01 ** |

| Adjusted R2 | 0.909 | 0.908 | 0.905 | 0.914 | ||||

| Dependent variable ΔlnCO2t | France | Germany | Ireland | Italy | ||||

| Variables | Coeff | t-stat | Coeff | t-stat | Coeff | t-stat | Coeff | t-stat |

| ΔlnGDPt | −0.54 | −1.43 | 0.72 | 3.26 ** | −0.13 | −2.47 ** | 0.57 | 2.28 ** |

| ΔlnREt | −0.08 | −3.10 ** | −0.14 | −2.99 ** | −0.02 | −0.52 | −0.16 | −5.64 ** |

| ΔlnTOt | 0.17 | 2.29 ** | 0.02 | 0.33 | −0.02 | −0.19 | 0.05 | 0.94 |

| Dummy1991 | - | - | −0.10 | −5.59 ** | - | - | - | - |

| ECMt−1 | −0.11 | −4.43 ** | −0.46 | −6.77 ** | −0.70 | −6.76 ** | −0.64 | −9.81 ** |

| Adjusted R2 | 0.914 | 0.919 | 0.894 | 0.893 | ||||

| Dependent variable ΔlnCO2t | Luxembourg | The Netherlands | United Kingdom | |||||

| Variables | Coeff | t-stat | Coeff | t-stat | Coeff | t-stat | ||

| ΔlnGDPt | −0.50 | −1.14 | 1.46 | 4.08 * | 0.77 | 3.22 ** | ||

| ΔlnREt | 0.37 | 3.64 * | 0.001 | 0.06 | 0.10 | 2.47 ** | ||

| ΔlnTOt | 0.72 | 3.59 * | −0.33 | −2.98 * | 0.07 | 0.83 | ||

| Dummy1997 | - | - | - | - | −0.04 | −2.14 * | ||

| Dummy 2002 | - | - | - | - | −0.06 | −3.13 ** | ||

| ECMt−1 | −0.33 | −6.21 * | −1.12 | −12.61 * | −0.36 | −5.20 ** | ||

| Adjusted R2 | 0.871 | 0.879 | 0.897 | |||||

| Dependent Variable | Austria | Belgium | Denmark | Finland | France | Germany |

|---|---|---|---|---|---|---|

| ΔlnCO2t | ||||||

| JB | 1.37 (0.50) | 2.14 (0.34) | 0.90 (0.64) | 0.91 (0.63) | 2.08 (0.35) | 0.08 (0.96) |

| ARCH | 0.49 (0.47) | 2.74 (0.10) | 0.94 (0.32) | 0.40 (0.52) | 0.19 (0.66) | 2.26 (0.12) |

| BG | 0.02 (0.97) | 0.01 (0.98) | 2.82 (0.08) | 2.44 (0.11) | 2.08 (0.16) | 0.53 (0.60) |

| Dependent variable | Ireland | Italy | Luxembourg | The Netherlands | United Kingdon | |

| ΔlnCO2t | ||||||

| JB | 1.06 (0.59) | 0.05 (0.97) | 0.26 (0.88) | 0.38 (0.83) | 0.75 (0.68) | |

| ARCH | 1.44 (0.24) | 1.08 (0.31) | 3.10 (0.09) | 0.71 (0.40) | 0.08 (0.77) | |

| BG | 2.07 (0.15) | 1.22 (0.32) | 1.06 (0.36) | 2.43 (0.12) | 0.10 (0.91) | |

| Test | Statistics | Probability | Residual Variance | HAC Variance |

|---|---|---|---|---|

| Kao | −1.31 | 0.0957 | 0.003 | 0.003 |

| Long-run analysis | ||||

| Coefficient | Std. error | Statistics | Probability | |

| lnGDPt | 0.95 | 2.83 | 3.38 | 0.00 |

| lnREt | −0.23 | 0.09 | −2.41 | 0.02 |

| lnTOt | −1.03 | 0.31 | −3.28 | 0.00 |

| Constant | 27.47 | 4.61 | 5.95 | 0.00 |

| Short-run analysis | ||||

| ECM-1 | −0.02 | 0.005 | −3.00 | 0.00 |

| ΔlnREit | −0.08 | 0.31 | −2.44 | 0.01 |

| ΔlnTOit | −0.05 | 0.03 | −1.54 | 0.12 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lojanica, N.; Pantović, D.; Dimitrijević, M.; Obradović, S.; Nancu, D. The Effects of Renewable Energy, Economic Growth, and Trade on CO2 Emissions in the EU-15. Energies 2025, 18, 4363. https://doi.org/10.3390/en18164363

Lojanica N, Pantović D, Dimitrijević M, Obradović S, Nancu D. The Effects of Renewable Energy, Economic Growth, and Trade on CO2 Emissions in the EU-15. Energies. 2025; 18(16):4363. https://doi.org/10.3390/en18164363

Chicago/Turabian StyleLojanica, Nemanja, Danijela Pantović, Miloš Dimitrijević, Saša Obradović, and Dumitru Nancu. 2025. "The Effects of Renewable Energy, Economic Growth, and Trade on CO2 Emissions in the EU-15" Energies 18, no. 16: 4363. https://doi.org/10.3390/en18164363

APA StyleLojanica, N., Pantović, D., Dimitrijević, M., Obradović, S., & Nancu, D. (2025). The Effects of Renewable Energy, Economic Growth, and Trade on CO2 Emissions in the EU-15. Energies, 18(16), 4363. https://doi.org/10.3390/en18164363