1. Introduction

The growing threats of climate change, brought about by human-caused increases in carbon dioxide (CO

2) emissions and the burning of fossil fuels, are becoming acknowledged as a global ecological emergency. The shift from fossil fuels to renewable energy is crucial, and identifying the catalysts and comprehending the characteristics of this transition is vital, as the successful implementation of renewable energy requires coordinated efforts [

1]. The climate issue, which is primarily caused by the unsustainable use of fossil fuels, was the central focus of COP28 and underlined the importance of achieving carbon neutrality. A fair and equitable shift toward renewable energy (REN) sources is another key focus of COP28 [

2]. In contrast to fossil fuels, which play a key role in the environment and the energy systems, REN is currently in a crucial developmental stage. Making this transition therefore requires the support of governments in formulating strong energy policies and providing research and development (R&D) incentives [

3].

Energy policy is the cornerstone for the regulation and management of an economy’s energy infrastructure. It covers a wide range of issues, from policies on emission reduction mechanisms and resource distribution to promoting the use of low-carbon energy technologies. The reliability and stability of the energy policies play a crucial role in shaping investment choices, energy frameworks, and consumption trends [

4]. The potential uncertainties of these policies, stemming from political, economic, and geopolitical instability, influence investment decisions and the resulting consumption patterns of renewable and fossil fuels.

Due to the lower cost of fossil fuels compared to renewables, the contribution of REN to the energy mix of countries remains relatively low. Making these technologies cost-competitive and integrating them into the existing infrastructure is the critical path to increasing the use of REN. Therefore, it is essential to engage in R&D activities in the field of renewable technologies to improve their technological advancement and promote their broader integration into the energy system [

5,

6]. In this context, the role of governments is crucial in facilitating and supporting further R&D of renewable energy technologies in order to increase their share in the overall energy supply. De La Tour et al. [

7] emphasize that public R&D for energy can bridge the technology divide between renewable and fossil fuels.

Countries are increasingly concerned about geopolitical risks, i.e., the potential impact of a global political crisis on their economies and natural resources. Conflicts, terrorist attacks, economic sanctions, and other political occurrences are examples of the many forms in which these risks manifest themselves [

8]. Geopolitical risks affect renewable energies in two ways. On the one hand, ongoing geopolitical risks (GPRs) jeopardize investments in REN by negatively impacting trade and international economic well-being and creating uncertainties that lead to a decline in both demand and supply channels [

9,

10]. GPR can also change the behavior of the private sector, resulting in delays in investment decisions and expenditures on production and consumption [

11]. On the other hand, geopolitical risk can enhance renewable energy output by influencing both the demand and supply dynamics of fossil fuel markets in response to fossil fuel price volatility. For example, an upsurge in the oil and gas prices leads to an elevation in the demand for REN as a potential substitute [

12]. In addition, renewable energy technologies can benefit from geopolitical risks in terms of energy security. Fossil fuels are predominantly sourced from countries exposed to geopolitical risks, and potential supply disruptions can impose significant costs on society. To prevent this problem, countries can broaden their domestic energy mix towards renewables [

13].

The world’s most significant source of emissions is China, which is the focus of this study. Recently, China has invested heavily in its energy industry to close the gap between the demand and supply, while the usage of fossil fuels has greatly increased China’s reliance on conventional energy supplies. The Chinese economy is significantly reliant on imports of fossil fuels. In 2023, crude oil imports to China reached a record high, and China imported 11.3 million barrels per day, 10% more than in 2022. Between 2019 and 2021, China imported 15% of its crude oil from Russia, and its crude oil imports in 2023 came mainly from Russia, Iraq, and Saudi Arabia [

14]. Dependence on oil imports has risen to almost 72%, making China the world’s largest importer of crude oil. Additionally, in 2023, China added 474 million tons of coal to its imports, increasing its coal dependence on foreign suppliers to 9.16% [

15]. This dependence makes China vulnerable to supply interruptions due to external occurrences, including geopolitical risks and energy policy uncertainty.

In an effort to mitigate the climate risks associated with oil and coal dependence, China has formulated its dual carbon goals, stating that it intends to peak CO

2 emissions by 2030 and become carbon neutral by 2060 [

16]. To attain these objectives, China has taken a number of measures to promote clean energy R&D, hence expediting the carbon reduction process inside energy market. According to estimates by the International Energy Agency (IEA), the Chinese government spent USD 8.3 billion on energy R&D in 2021, accounting for 26% of total global energy R&D spending. A large portion of this financing is going towards fossil fuel technology. In fact, China is the world’s largest spender on fossil fuel R&D. Moreover, most of the increase in public R&D investment in 2022 comes from the Chinese government and its key state-owned firms involved in the energy sector [

17].

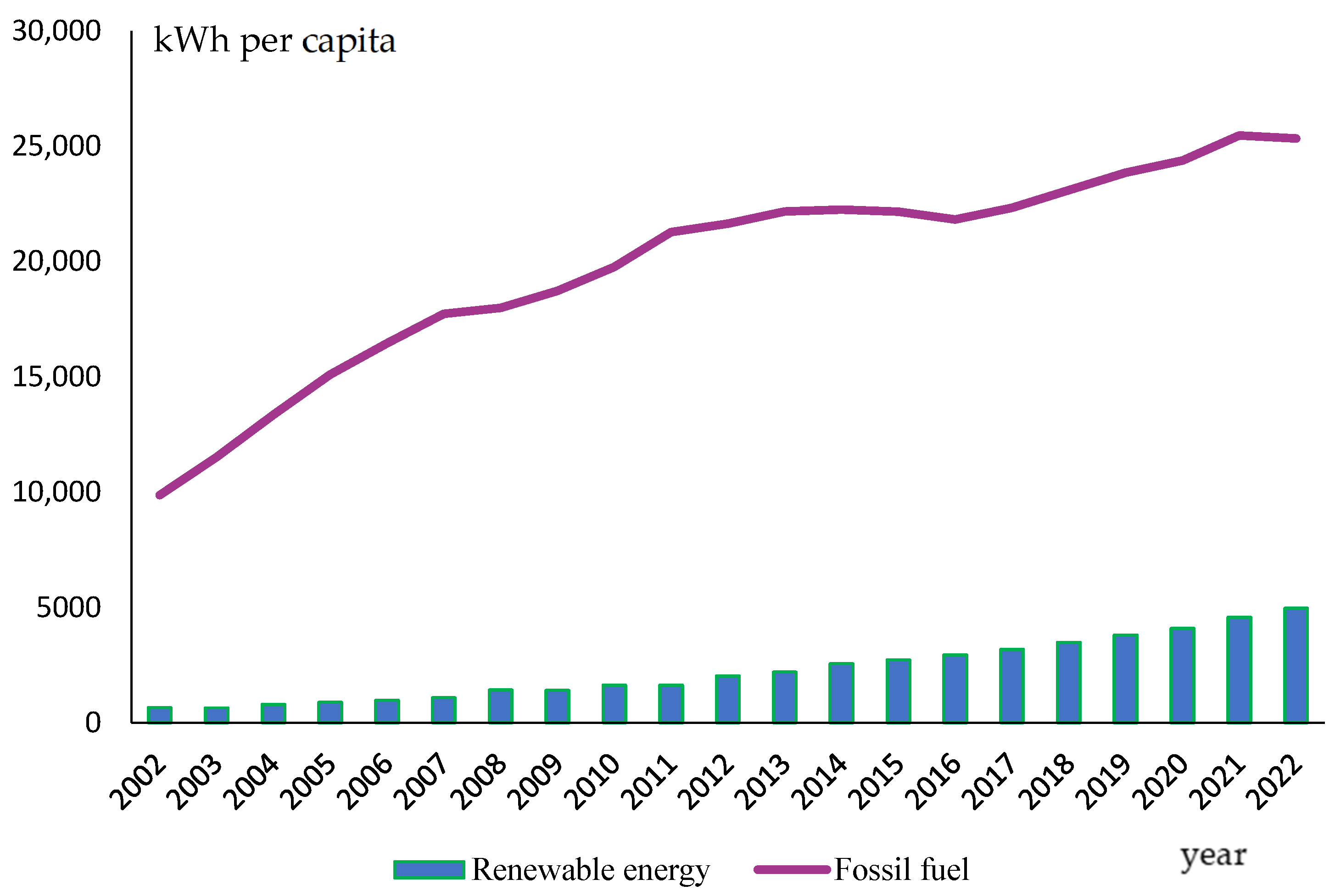

Figure 1 shows the pattern in the consumption of REN and fossil fuels in China. Fossil fuel consumption and REN consumption increased from 2002 to 2022. The increase in fossil fuels is slighter than in REN. REN consumption increased by 647% between 2002 and 2022, from 665.8 kWh per capita to 4974.1 kWh per capita. In contrast, fossil fuel consumption rose by 156.5%, rising from 9881.2 kWh per capita in 2002 to 25,344.2 kWh per capita in 2022.

China is the largest emitter of carbon and the foremost energy consumer globally. It is critical to shift China’s energy infrastructure toward low-carbon technologies to reduce the severity of the world’s climate crisis. Hence, China is an important case study. In this context, this study analyzes the influence of energy policy uncertainty (ENPU), geopolitical risk, and R&D investment on renewable energy and fossil fuels in China.

This study provides a novel contribution by simultaneously examining the comparative effects of ENPU, GPR, and R&D expenditure on both renewable energy and fossil fuel consumption in China. Unlike previous research, which often focuses on isolated impacts of these factors or solely on renewable energy, this analysis uniquely integrates ENPU, GPR, and R&D into a cohesive framework to assess their differential influences on China’s dual energy systems. By addressing this gap, this study offers critical insights into how these factors shape China’s energy transition, particularly in the context of its position as the world’s largest carbon emitter and energy consumer, thereby informing targeted policy strategies for achieving carbon neutrality and enhancing energy security. Previous research has also broadly concentrated on the impact of geopolitical tension on REN technologies [

19,

20], ignoring its effects on fossil fuels. The geopolitical tension between Russia and Ukraine has a far larger impact on the global economy when compared to other tensions. The Russian economy is significantly interconnected with other nations, particularly in terms of raw materials and energy exchange. China’s high reliance on Russian oil supplies could potentially expose the country to this geopolitical tension. Therefore, it is of utmost importance to analyze which geopolitical risk influences fossil fuel consumption in China.

The subsequent sections of this study are organized as follows.

Section 2 provides an overview of previous studies on the topic and identifies research gaps.

Section 3 builds the empirical model and describes the data in detail.

Section 4 delves into the regression outcomes. Finally,

Section 5 concludes this study and provides policy recommendations.

3. Data and Methodology

This study explores the impact of energy policy uncertainty, geopolitical risk, and R&D expenditure on renewable energy and fossil fuel consumption in China. For this purpose, this study considers monthly data from 2002M10 to 2022M10. The data sources, which contain 241 observations for each variable, are listed in

Table 1. The annual data are converted to a monthly frequency using the quadratic match sum (QMS) approach to avoid bias due to small sample size. Following Yi et al. [

41], this study converts yearly data on renewable energy, fossil fuels, and R&D investments into monthly data employing the QMS approach. The QMS approach accounts for seasonality and volatility and mitigates the risk of limited sample size by converting low-frequency data into high-frequency data.

This study first considers the ENPU index proposed by Dang et al. [

42]. This index is constructed utilizing certain keywords, such as energy sector, uncertainty, energy, environment, and energy pricing, which are derived from Google keyword trends via a text-searching methodology. Second, Caldara and Iacoviello [

10] established the GPR index as a factor influencing the dynamics of renewable energy and fossil fuels. This indicator is derived by analyzing the quantity of articles related to six categories of geopolitical tensions and events across 11 prominent newspapers on a monthly basis. Third, R&D expenditures are included in the model as an indicator of technological development. The empirical models are represented as follows:

In Equations (1) and (2), REN denotes renewable energy consumption, FOS stands for fossil fuel consumption, ENPU is the energy policy uncertainty, GPR is geopolitical risks, and R&D represents research and development expenditures. To obtain the elasticities of the variables, this study applies a logarithmic differentiation to the variables of interest, and ln shows the logarithmic transformation.

Table 1 presents the measurement, source, and symbol of the variables.

Figure 2 shows the time trends of the data. REN and R&D have an increasing linear trend. Fossil fuel consumption shifts from its initial growth to a plateau in the 2010s, while ENPU and GPR display persistent oscillations over the entire period. This pronounced curvature, turning points, and irregular cycles underscore the inherently nonlinear dynamics in the majority of the data.

The choice of empirical model in this study is based on compelling economic and theoretical considerations that fill the research gaps in the existing literature on China’s energy sector. The primary economic justification for the model lies in its ability to simultaneously analyze the comparative effects of three variables: ENPU, GPR, and R&D expenditures on REN and FOS. This two-pronged approach is critical to understanding the complex dynamics of China’s energy transition, as the country is the world’s largest carbon emitter and consumer of energy. The framework of the model is designed to test a series of research hypotheses (H1–H4) based on economic theory. For example, the inclusion of the ENPU variable is based on the theory that political instability caused by China’s different energy market objectives can influence investment decisions and consumption patterns in both the renewable and fossil fuel sectors. Similarly, the inclusion of GPR in the model is justified by the theory that geopolitical conflict can disrupt fossil fuel supplies and increase prices, which in turn incentivizes a shift to domestic renewable energy sources to increase energy security. The model also incorporates R&D expenditure to test the economic theory that technological advances can reduce the cost and improve the efficiency of both renewable and fossil fuel technologies, which in turn affects their respective consumption. By using the Fourier-ADL method, the model is specifically chosen to account for multiple structural changes and smooth breaks in the data, which are characteristic of economic time series and often overlooked by conventional methods. This robust methodology, together with the use of monthly data converted using the quadratic match–sum approach to mitigate sample size issues, provides a comprehensive framework to empirically test the economic rationales for the selection of the model.

Table 2 illustrates the summarized statistics. The highest average value belongs to FOS, while the lowest value belongs to R&D. ENPU is the most volatile variable, while FOS is the least volatile variable, among others. All variables, with the exception of GPR, exhibit a left-skewed distribution. REN, GPR, and R&D display characteristics of a platykurtic, while the others exhibit a leptokurtic characteristic.

The first part of the empirical analysis includes the examination of stochastic properties of the variables of interest by employing Augmented Dickey–Fuller (ADF) [

44] and Fourier ADF [

45]. The Fourier ADF test extends the ADF test by embedding sine and cosine terms in the regression so that it can capture smooth structural shifts nonparametrically without pre-specifying break dates. These Fourier components introduce flexible, wave-like regressors that adapt to unknown nonlinear patterns in the series. The associated F-statistic then evaluates the joint significance of all added sine and cosine terms: a value exceeding the critical threshold indicates that these trigonometric regressors are significant, confirming the presence of the underlying nonlinearity.

The second part of the analysis uses the Autoregressive Distributed Lag (ADL) approach of Banerjee et al. [

46]. This method eliminates the necessity of defining break durations and prevents power loss associated with excessive use of dummies. Banerjee et al. [

46] incorporated Fourier functions of Gallant [

47] into the model to account for multiple structural changes. This makes Fourier ADL a more effective approach compared to traditional cointegration methods. Accordingly, the following empirical models are applied to ascertain whether ENPU, GPR, and R&D cointegrate with REC and FOS:

In Equations (3) and (4), k stands for a certain frequency value, and the sine and cosine functions capture the smooth and sharp breaks. To evaluate the null hypothesis of no cointegration, the t-statistic is employed as in Equation (5):

The final step focuses on the estimation of the long-term connection between ENPU, GPR, R&D, REN, and FOS, applying the fully modified ordinary least squares (FMOLS) method of Phillips and Hansen [

48].

4. Empirical Results

Table 3 illustrates the unit root outcomes for ADF and Fourier ADF tests. The Fourier ADF results show that the F-statistic is significant for the REN, GPR, and R&D series, evidence of underlying nonlinear dynamics and a clear indication that the Fourier-augmented specification is warranted for these variables. By contrast, the F-statistic for FOS and ENPU remains below its critical threshold, implying that their behavior can be adequately described by the conventional ADF framework. Importantly, both the traditional ADF (for FOS and ENPU) and the Fourier ADF (for REN, GPR, and R&D) uniformly classify all five series as integrated of order one, I(1), becoming stationary after first differencing.

Table 4 displays the Fourier ADL cointegration outcomes for Model 1 and Model 2. The computed t-statistic for Model 1 is −5.194 and for Model 2 is −4.376, both exceeding the significance threshold values at the 1% and 5% levels, respectively. Thus, the results show that ENPU, GPR, R&D, REC, and FOS all fluctuate around a steady long-run equilibrium.

Table 5 and

Table 6 display the long-term elasticities for Model 1 and Model 2, respectively.

The coefficient of ENPU (0.022) is statistically significant and positive. This implies that potential uncertainty in energy policy heightens concerns about the climate crisis, which positively influences investors to direct their investment decisions towards sustainable energy technologies. This, in turn, prompts China to shift its energy technology preferences towards domestic low-carbon sources. As a result, the shift in its consumption pattern augments the share of renewable energy in its energy portfolio. The findings align with those of He and Xu [

4], who demonstrate that uncertain energy policies catalyze the transition of the energy system to green technologies in China.

Geopolitical instability is positively correlated with the growth of the REN-based structure. A 1% increase in GPR leads to a corresponding increase in REN by 0.165%. In other words, geopolitical risk in China serves as a significant catalyst for the increasing adoption of REN. The geopolitical risk results in significant uncertainty over fossil fuel distribution. Consequently, it can incentivize China to minimize its dependence on fossil fuels and redirect its focus to increase renewable energy production capabilities. This finding is also parallel to the conclusions of Su et al. [

35], who reveal that geopolitical risk in China directs energy consumption patterns towards renewable energy due to rising fossil fuel prices. In contrast, Islam et al. [

49] document the inhibitory impact of GPR on clean energy in China. Along this vein, Lin et al. [

50] indicate that GPR acts as a barrier to widespread investment in green technologies in China.

R&D spending has an incentive impact on the deployment of REN. This finding is consistent with the progress of China in patenting activity. The Chinese government has invested 70% more in renewable energy R&D since 2015, positioning the country to become a global leader in green energy innovation. Qi et al. [

51] prove that spending on R&D facilitates the energy transition in China from coal to renewables. Likewise, Li et al. [

36] conclude that investment in R&D in China is a significant catalyst for the shift to renewable energy. Khezri et al. [

37] point out that the impact of R&D on low-carbon technologies varies. A high level of R&D fosters the advancement of various REN technologies, whereas low levels of R&D tend to support hydropower initiatives. This supports that R&D has varying impacts across different economies, contingent upon their respective levels of development.

Energy policy uncertainty has no statistically significant effect on fossil fuel consumption. The coefficient of ENPU (0.002) is statistically insignificant, which means that uncertain conditions in energy policy in China have no influence on the consumption pattern of conventional technologies. Yasmeen and Shah [

21] point out that unpredictable situations in energy policy alter the energy consumption choices of the G7 economies in favor of minimizing fossil fuel usage. Likewise, Dai et al. [

24] highlight that energy-related uncertainty minimizes the fossil fuel demand.

The outcomes further reveal that GPR has an adverse impact on fossil fuel consumption. In fact, China is the leading importer of crude oil worldwide. Escalating geopolitical concerns increase the fluctuations in fossil fuel prices. This, in turn, exacerbates China’s energy insecurity, stemming from its dependence on imported oil, thereby necessitating a transformation of the energy mix towards a more efficient framework. Moreover, Russia is a significant source of oil imports for China. More recently, Russia’s attack on Ukraine, together with the resulting restrictions on trade in fossil fuels, has caused significant problems in the energy markets. Consequently, this problem could hamper oil imports and lead to a decline in fossil fuel consumption in China.

R&D activities are associated with connected to fossil fuel consumption. This suggests that R&D efforts help China’s ability to innovate in fossil fuel technology, which in turn makes these technologies more efficient. In addition, technological advancements through R&D can lower the costs associated with fossil fuels. These result in increased fossil fuel consumption. The result is expected since fossil fuel technologies accounted for a larger portion of China’s public energy R&D growth in 2023. Moreover, China ranks among the leading developers in enhancing fossil fuel technology for power generation and holds a significant majority of patents primarily for the domestic market, which increases their utilization.

This study also applies the dynamic ordinary least squares (DOLS) approach of Stock and Watson [

52] by adding Fourier terms for a robustness check and presents the findings in

Table 7.

The findings in

Table 7 indicate that ENPU and R&D have an increasing effect on energy consumption. An increase in GPR promotes the use of renewable energy, while conversely, it reduces the use of fossil fuels. These results confirm the robustness of the FMOLS outcomes. The findings of this study align with and diverge from existing literature, enriching the discourse on energy transition dynamics. The finding that ENPU positively influences REN aligns with research by He and Xu [

4], who also demonstrated that such uncertainty can act as a catalyst for green energy transition in Chinese cities. This contrasts with studies like that of Pata [

23] and Dai et al. [

24], who found that ENPU can hinder REN demand in countries like the US, Germany, Spain, Japan, and G7 economies. This highlights a potential divergence in how policy uncertainty is perceived and acted upon in different national contexts. Similarly, the result showing that GPR encourages REN adoption is consistent with the work of Alsagr and Van Hemmen [

28] and Cai and Wu [

29], who found that GPR can heighten energy security concerns and spur a shift towards renewables. However, this contradicts studies by Abbas et al. [

20], who documented GPR’s inhibitory impact on clean energy investments in China. The findings on R&D expenditures’ dual effect, promoting both REN and fossil fuel consumption, are partially supported by Wong et al. [

38] and Churchill et al. [

39], who showed R&D spending increases fossil fuel use in OECD countries. However, it extends this by confirming a positive effect on renewables, as found by Alam et al. [

34] and Li et al. [

36].

Figure 3 shows a visual summary of the outcomes. In economic terms, companies and policymakers interpret energy policy uncertainty as a signal that future regulations may favor low-carbon, modular technologies; to hedge their bets, they increase their investment in renewable energy assets, which are seen as more adaptable to changing regulations. Geopolitical risks are increasing concerns about supply disruptions in oil and gas markets, leading to a strategic focus on domestically produced renewables and a simultaneous decrease in the consumption of imported fossil fuels. Finally, R&D expenditures drive innovation in all energy technologies: Cost reductions and efficiency improvements are making both fossil and renewable solutions more attractive and increasing overall consumption. This underscores the dual role of uncertainty and innovation in managing China’s evolving energy mix.

This study’s findings on China hold significant implications for other economies, yet they also underscore certain unique aspects of the Chinese context that may limit direct generalizability. The results on ENPU suggest that, for any country aiming for a low-carbon transition, consistent and transparent energy policies are crucial for building investor confidence and shifting consumption patterns towards sustainable technologies. Similarly, the finding that GPR can act as a catalyst for increased renewable energy adoption and a decrease in fossil fuel use is highly relevant for all nations, particularly those with a high reliance on imported fuels. This underscores the strategic value of domestically produced renewables for enhancing energy security. However, this study also highlights distinguishing factors specific to China. As the world’s largest carbon emitter and energy consumer, the scale of China’s energy dynamics is unparalleled. Furthermore, this study identifies a “dual investment path” where R&D expenditures boost consumption of both renewable and fossil fuels, a result of significant government funding allocated to fossil fuel technologies. This dual approach contrasts with a singular focus on clean energy innovation seen in many other countries. Finally, China’s high dependence on imported fossil fuels, especially from geopolitically sensitive regions, makes its response to GPR particularly pronounced. While the core dynamics identified in this study offer valuable insights for global policymakers, these unique characteristics of the Chinese energy landscape must be considered when applying the findings to other economies.

5. Conclusions

This study analyzes the influence of energy-related policy uncertainty, geopolitical tension, and R&D investment on renewable energy and fossil fuels in China. To this end, the Fourier ADL test and the FMOLS method are used. Based on the empirical findings, energy-related uncertainty results in heightened renewable energy usage while exerting no significant influence on fossil fuels. Additionally, investments in R&D boost the use of renewable energy and fossil fuels in China. This illustrates the proactive involvement of the Chinese government in advancing clean technology projects and fostering renewable technologies through R&D spending. The results further point out that the potential geopolitical tensions are driving up demand for renewable energy in China while decreasing the use of fossil fuels. Dependence on imported fuels can exacerbate the risk profile of countries reliant on fossil fuels, and this can render China susceptible to geopolitical instability. China can counteract the impact of uncertainty by implementing a strategic plan that could decrease its reliance on imported energy commodities and increase the share of REN in the current energy system.

This study has significant implications for the formulation of policies concerning energy uncertainty, R&D expenditure, and geopolitical risk in China. First, implementing risk mitigation strategies, such as guarantees or insurance programs, can safeguard investors against prospective alterations in energy policy, thereby alleviating the effects of future uncertainty. Keeping energy policies consistent should be a top priority for the Chinese government, which means meticulously evaluating economic circumstances and environmental issues. Building cohesive and transparent energy policy frameworks that enable the shift toward more diverse energy sources requires the encouragement of partnerships across governments, international organizations, and companies. Second, as the foremost carbon emitter globally, China needs to dedicate a larger proportion of its R&D budget to clean energy implementation rather than to overall energy technology development. Furthermore, to spearhead the energy transition to low-carbon technologies, Chinese companies should continually enhance the efficiency of their R&D spending, with an emphasis on creating sustainable technologies that are efficient and affordable. Third, investing more in low-carbon energy technologies can position countries as significant actors in the future and help resolve ecological concerns and geopolitical disputes at the regional level. Therefore, global collaboration is essential for the advancement of REN exploration. In addition, to reduce the possibility of a disruption in supply due to the geopolitical risks, governments should think about cybersecurity, energy flow, and location when they plan renewable energy projects.

Based on the findings of this study, additional policy recommendations should be developed specifically for the energy industry itself. To accelerate the energy transition, governments should incentivize private sector investment in renewable energy projects through green bonds and other financing mechanisms, facilitating access to capital for energy companies. At the same time, policymakers need to support investments in the modernization of energy infrastructure, including smart grid technologies and energy storage solutions, to improve the integration of renewable energy sources and increase energy security. In addition, market-based mechanisms such as carbon taxes or emissions trading schemes can be introduced to encourage industry to move away from fossil fuels. Finally, governments should increase R&D budgets for energy efficiency and low-carbon technologies and promote collaboration between energy companies, universities, and research centers to accelerate the commercialization of innovative solutions.

The limitations of this study are as follows. First, this research primarily examines China, a major player in the global carbon market. Future research may focus on the ten countries with the largest carbon emissions or those that are heavily industrialized. Second, analyzing the variables that impact both renewable and fossil fuels is the primary objective of this study. Future studies may examine specific energy sources, such as solar, wind, biofuel, coal, or oil, rather than concentrating exclusively on aggregate renewable or fossil fuel categories. Third, the analysis of this study takes geopolitical and energy policy uncertainties into account. Future research can examine the comparative influences of energy, economics, climate policy, and geopolitical risk. The implications of this for achieving a carbon-neutral economy are far-reaching. Fourth, future studies could improve the generalizability of this investigation by incorporating macroeconomic stability and policy dynamics in the analysis. In this context, future studies could add macroeconomic indicators such as GDP growth rate, inflation, unemployment rates, or foreign direct investment as control variables. This would allow for a more isolated understanding of the impact of key variables such as energy policy uncertainty, geopolitical risk, and R&D expenditures. Fifth, researchers can investigate the impacts of GPR, ENPU, and R&D on agricultural [

53] and energy markets [

54]. Thus, researchers can evaluate the effects of uncertainty, risk, and technological progress on energy and agricultural stock markets by considering Fourier functions.