1. Introduction

In the COMESA region, economic growth has been unstable and closely linked to fluctuations in the energy market as reflected by stock market performance. This instability threatens the region’s goals for sustainable development and economic resilience, making the challenges more severe and highlighting the need for collective action [

1,

2]. A key factor contributing to this vulnerability is the heavy reliance on fossil fuels such as oil, coal, and natural gas to meet the region’s energy demands. Traditional energy sources have long been the backbone of many COMESA member states, making their economies vulnerable to global fossil fuel price shocks. For instance, a rise in oil prices can lead to higher production costs and increased inflationary pressures, which in turn can destabilize economic growth [

3]. The heavy reliance on fossil fuels also traps the COMESA region in a cycle of vulnerability, where economic stability is frequently disrupted by external market conditions beyond its control [

4].

Another major challenge in the COMESA region is the lack of commitment to developing green energy. Despite global targets aimed at transitioning to renewable energy, progress toward cleaner power systems remains disappointing for most member countries. Ref. [

5] identifies several reasons for this gap, including limited financing, insufficient technical expertise, and weak planning frameworks. Consequently, these countries miss out on low-carbon energy sources that are both more affordable and sustainable. This situation is made even worse by inefficiencies in energy policy, where efforts to promote green energy are often held back by resistance to reforms that could reduce economic dependence on fossil fuels.

Inconsistent and poorly designed energy policies lead to energy shortages, higher costs, and reduced industrial productivity, which in turn constrain economic growth [

1]. This disrupts the supply of energy and also creates an element of unpredictability that slows down investments in the energy market [

6]. This has multiple downstream effects. A lack of diversification increases economic volatility, as fossil fuels traded like any other commodity are subject to sharp price fluctuations. Sudden fuel price hikes driven by market dynamics can trigger inflation, reduce consumer spending, and ultimately lower economic output. Indeed, this economic instability and low level of development limited the countries in the region to poor economic foundations, thus further eroding their potential to develop consistently and sustainably [

3].

Secondly, the limited situation in the energy market continues to affect the performance of stock markets directly. Fluctuations in energy prices also impact stock markets; rising fossil fuel costs increase operating expenses for businesses, which can, in turn, lead to a decline in stock prices [

7]. On the other hand, the lack of development of the green energy sector has resulted in lost potential for the stock market surge through investment in renewable energy companies [

8]. The stock exchange and energy market in COMESA are integrated and closely linked to economic growth. A common narrative is that of the stock markets serving as leading indicators of economic health, revealing investor sentiment and economic expectations. Research has shown that the volatility greatly influences investment performance in the stock market in energy prices. For instance, an increase in fossil fuel prices would affect stock prices through higher operating costs for firms as well as lower consumer discretionary spending [

7].

Conversely, when modern innovations in green energy occur, they can lead to investor funds being allocated to firms in renewable power production and other sectors, which in effect drives green markets. Therefore, the development of an emerging green energy industry might offer both new areas of investment to the market and the development of a stronger and more diversified stock market in COMESA [

8,

9]. The interactive conditional correlation analysis reveals the very close relationship between the energy market, economic growth, and stock market performance in COMESA, which is driven by both global and regional events. Transitioning to more sustainable energy sources offers large trade and sustainable development opportunities, but it also means managing fossil energy dependencies and economic vulnerabilities.

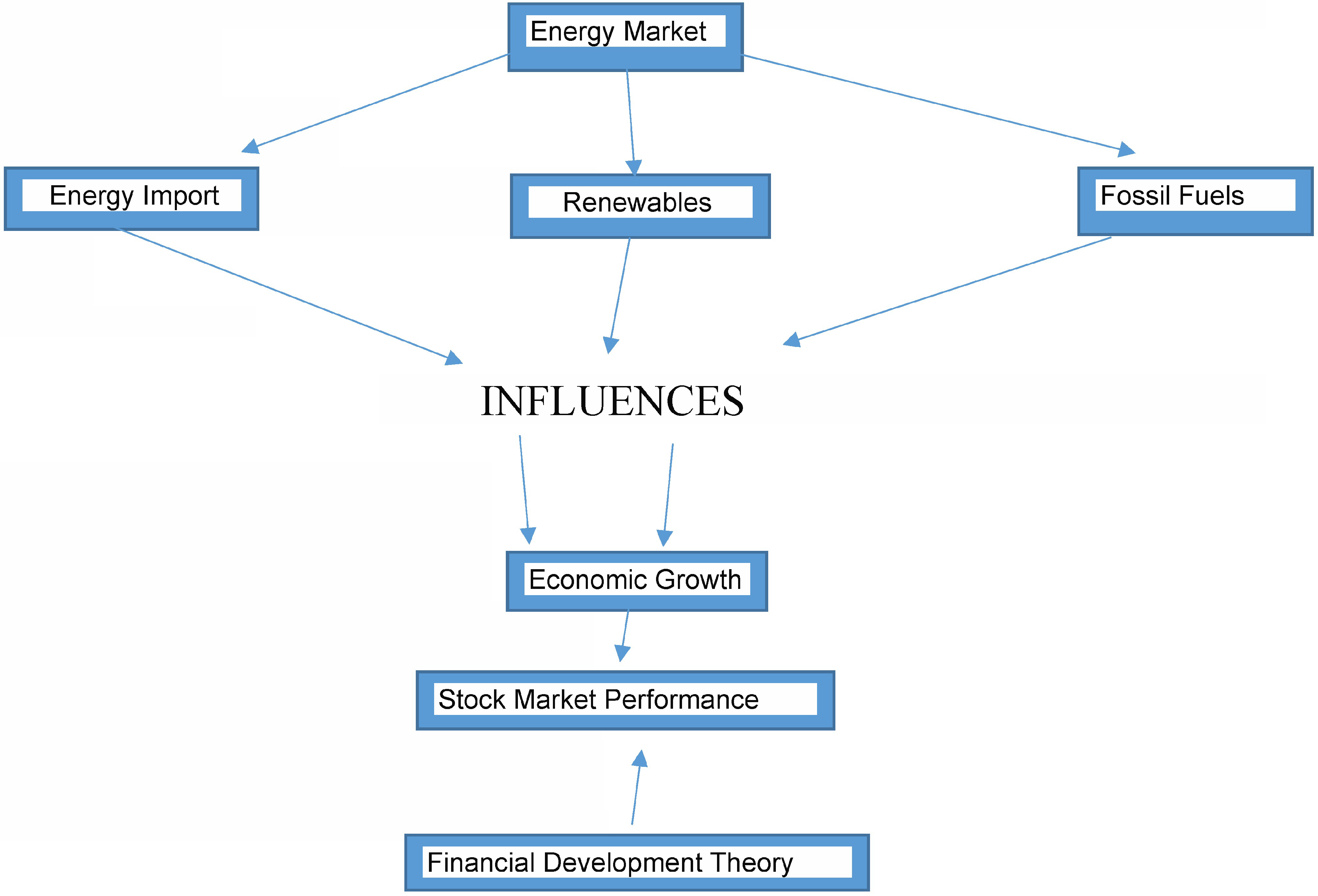

This study contributes to knowledge by explaining the linkages among the energy market, economic growth, and stock market performance, specifically in COMESA. Combining fossil fuels and green energy, the study gives a complete view of the interaction between energy price risk and economic and stock market dynamics at a regional level. It is crucial for policymakers, investors, and scholars aiming to develop strategies that enhance economic resilience and promote sustainability. This study, in contrast, concentrates attention on the economic consequences of varying prices of fossil fuels in COMESA. The study also evidences the economic opportunities that could arise from a switch to renewable energy, evidencing the positive effect that green energy investments have on economic growth, employment, and reductions in the cost of energy. Equally important is research on the effects of energy market dynamics on the performance of stock markets in COMESA. This study examines how changing energy price trends will impact investor sentiment and stock prices, with a specific focus on energy-intensive industries.

3. Research Model

Driscoll–Kraay Standard Errors (DKSE) are used for serial correlation and heteroscedasticity problems [

69]. This robust estimator confirms reliable inference in dynamic panel models by correcting standard errors and cross-sectional dependence. The Westerlund Co-integration Test (WCT) and the Cross-Sectional Augmented Dickey–Fuller (CADF) test are used to check the long-run relationships between variables [

70]. These methods work well for heterogeneous panels and are consistent in recognizing co-integration under cross-sectional dependence. While the CADF test uses cross-sectional averages to account for dependency, the Westerlund test offers group-mean and panel-mean statistics. The Pesaran Panel Unit Root Test is used to verify that the panel data is stationary. The test considers cross-sectional dependence while extending the Augmented Dickey–Fuller framework to panel situations. The existence of a unit root is assumed by the null hypothesis.

The model of our research is stated thus,

Where:

3.1. Data and Sources

The annual data are obtained from the World Bank Development Indicators from 1990 to 2022. The explanatory variable in this study includes the energy market as measured in terms of energy prices, fossil fuel consumption, energy consumption, and GDP growth. The dependent variable of the study is stock market performance measured in terms of stock market capitalization. The study employs annual data from 1990 to 2022 obtained from the World Bank Development Indicators, aiming at several key variables. The dependent variable is Market Capitalization (MCAP), which denotes the total market value of open-traded companies’ shares within the COMESA region’s stock exchanges. This measure is a crucial indicator of the general size and strength of the stock market, showing investor confidence and the economic events of the region. Between the dependent variables, Fossil Energy Consumption (FSIL) measures the aggregate usage of energy derived from fossil fuels such as coal, oil, and natural gas within the COMESA nations.

This study employs a purposeful sample technique, which allows us to select COMESA member countries with the most consistent and available data spanning from 1990 to 2022. With this method employed, it confirms the relevance to the question and the robustness of the region assessment. The World Bank development indicator was employed due to the credibility and reliability of the data source. Then, to boost validity, second-generation panel econometrics techniques were employed in our analysis, which account for cross-sectional dependence, non-stationarity, and heterogeneity, to confirm that the model will precisely capture the dynamics and connections among the countries. The relationship between the research question and the analytical model is rooted in the research on energy market variables and how economic growth affects the stock market performance. This was carried out through quantile estimation and robust correction.

This variable is vital for understanding the dependency on traditional energy sources and their impact on the COMESA region’s economic stability. Likewise, Renewable Energy Consumption (RECO) denotes the total usage of energy from renewable sources, including solar, wind, hydroelectric, and biomass. This variable illustrates the extent to which COMESA countries are shifting towards sustainable and environmentally friendly energy sources. Another significant explanatory variable is Energy Imports (EIMP), which measures the total amount of energy imported by the COMESA nations. This variable, expressed as a proportion of total energy consumption, reflects the region’s reliance on external sources for its energy needs. A high dependence on energy imports signifies weaknesses in external market settings and geopolitical factors. Finally, Gross Domestic Product Growth (GDPG) signifies the annual percentage growth rate of the Gross Domestic Product in the COMESA region. This variable works as an indicator of the total economic performance and growth, giving insights into the economic resilience and development of the member countries. The study covers the member countries of the Common Market for Eastern and Southern Africa (COMESA), which include Burundi, Comoros, the Democratic Republic of Congo, Djibouti, Egypt, Eritrea, Eswatini, Ethiopia, Kenya, Libya, Madagascar, Malawi, Mauritius, Rwanda, Seychelles, Somalia, Sudan, Tunisia, Uganda, Zambia, and Zimbabwe.

3.2. Method

In the examination of the panel of this research, we would make use of the Method of Moments Quantile Regression (MMQR) model, as proposed by [

71], to examine the relationship among energy market variables, economic growth, and stock market performance in the COMESA region. This study inspects the connections between economic growth, natural resource rents, energy consumption, and environmental sustainability in the COMESA region. The analysis utilizes second-generation econometric models to account for the relationships among these variables, including cross-sectional dependence, heterogeneity, and non-stationarity in the panel data. Cross-sectional dependence occurs as a result of common economic, environmental, and structural attributes among nations. The Pesaran Panel Unit Root Test is used to verify that the panel data is stationary. This test considers cross-sectional dependence while extending the Augmented Dickey–Fuller framework to panel situations. The existence of a unit root is assumed by the null hypothesis. Global energy price variations and regional trade agreements might concurrently affect several countries within the region. The following tests are employed to confirm the presence of cross-dependency. Pesaran and Yamagata’s Heterogeneity Slope Test is used to evaluate heterogeneity among nations. Slope coefficient consistency across panel units is tested, and significant results show that diverse models are required. We chose the 5th, 25th, 50th, 75th, and 95th quantiles to represent a wide range of stock market situations, from low (underperforming markets) to high (outperforming markets). This spread enables us to see how energy consumption and economic growth affect financial performance not only on average, but also at different levels of market capitalization. This helps in the COMESA region because it helps capture data clearly, where we have a wide range of market structures among member countries. This is also consistent with [

71], where they allow different quantiles to compare and interpret data across their study.

The MMQR model is estimated using panel data from 1990 to 2022 for COMESA member states. The data, obtained from the World Bank Development Indicators, include:

Dependent Variable:

Market Capitalization (MCAP) represents the total market value of publicly traded companies in COMESA.

Independent Variables:

GDP Growth (GDPG)

Fossil Energy Consumption (FSIL)

Renewable Energy Consumption (RECO), and

Energy Imports (EIMP)

Where:

Also, presents the parameter coefficient, and shows the stochastic error term.

The data collected was from the World Bank datasets (

Table 1); hence, we use the World Bank Development Indicators (WDI).

4. Data Analysis

The results of the cross-sectional dependency tests (

Table 2) provide strong evidence of cross-sectional dependence among the variables in the dataset. This finding implies that economic shocks or fluctuations affecting one country in the COMESA region are likely to influence other countries within the region, indicating interconnections across the panel data.

The Pesaran test for cross-sectional dependence yields a statistic of 15.51, with a p-value of 0.00. This result, significant at the 1% level (***), strongly supports the presence of cross-sectional dependence, indicating that the variables are not independently distributed across countries. Similarly, the Fisher test, with a statistic of 50.34 and a p-value of 0.03, is significant at the 5% level (**). This additional evidence confirms the findings from the Pesaran test and reinforces the conclusion of cross-sectional dependencies in the data. The Frees test statistic of 4.57 also exceeds the critical values at all levels of significance provided by Frees’ Q distribution (0.41 at 10%, 0.57 at 5%, and 0.90 at 1%), establishing significance at the 1% level (***). This result further supports the conclusion of significant cross-sectional dependence, with strong evidence that countries within the panel are economically interlinked.

The results of the Pesaran Panel Unit Root Test (

Table 3) indicate that certain variables in the dataset are stationary, while others are non-stationary at levels but become stationary after the first difference. This is evident from the test statistics compared to the critical values at the 10%, 5%, and 1% significance levels. For the variable Market Capitalization (MCAP), the test statistic of −3.82 is highly significant at the 1% level (***), which suggests that the MCAP is stationary in levels. Similarly, Energy Import (EIMP) shows a test statistic of −3.83, also significant at the 1% level (***), indicating that EIMP is stationary at levels as well. However, other variables, including the GDP Growth (GDPG), Fossil Energy Consumption (FSIL), and Renewable Energy Consumption (RECO), show test statistics of −1.15, −0.86, and −1.38, respectively, which are all higher than the critical values for stationarity at the usual significance levels. This result indicates that these variables are non-stationary in their original form and may require differencing to become stationary. After the first difference, these variables show significant test statistics: the first difference of GDP Growth (∆GDPG) has a test statistic of −2.23, significant at the 5% level (**), while the first differences of the Fossil Energy Consumption (∆FSIL) and Renewable Energy Consumption (∆RECO) have test statistics of −2.63 and −2.57, respectively, both significant at the 1% level (*). These results confirm that differencing has successfully rendered these variables stationary.

The study proceeds to use the Heterogeneity Slope Test to assess whether there are significant differences in the slopes of the variables across cross-sectional units in the panel data. This test is vital as it helps us to find out the connection between the variables in our research, to check how consistent they are across entities, or how they differ, which is very important when making a decision or generalizing our results. In

Table 4, in the above table, our results display that the test statistics for both Δ (first difference) and Δ Adj (adjusted first difference) are highly significant, with a

p-value of 0.00 for both. The Δ value has a test statistic of 8.03, and the Δ Adj value has a test statistic of 11.21. Both test statistics are statistically significant at the 1% significance level (***), which shows strong evidence against our null hypothesis of homogeneity. This simply means that the slope coefficients for the variables differ significantly across the cross-sectional units in the panel, which suggests that the connections between the independent variables and the dependent variable are not the same for the entities in the sample. The significant outcome from both Δ and Δ Adj further supports the presence of heterogeneity in the model, which supports the notion that the homogeneity of slopes does not hold in this study. Therefore, heterogeneity should be reflected in the model specification, as it shows that the individual characteristics or differences across the entities are necessary for accurate estimation and inference. It may also suggest the need to apply models that account for this heterogeneity, such as fixed effects or random effects models, depending on the nature of the data and the underlying assumptions.

Next, the study determines whether there is a long-run equilibrium relationship between the variables in the model. Co-integration tests are particularly important in time-series and panel data analysis because they help to identify whether the variables move together over time, indicating a stable long-term relationship. In this case, the use of various co-integration tests provides a comprehensive approach to confirm the presence of such relationships between the energy market, economic growth, and stock market performance in the context of COMESA. The results from all of the tests in

Table 5 indicate statistically significant evidence of co-integration, as the

p-values for each of the tests are 0.00, which is well below the 1% significance level (***). This implies that the null hypothesis of no co-integration is rejected in favor of the alternative hypothesis that the variables are co-integrated, meaning they share a common long-term trend. The Westerlund test statistic is 18.55, and the modified Dickey–Fuller test statistic is −17.99, both of which are highly significant, indicating strong evidence of co-integration. Similarly, the traditional Dickey–Fuller test and the Augmented Dickey–Fuller test have statistics of −7.38 and −4.56, respectively, which are also significant at the 1% level, confirming the robustness of the results. Furthermore, it is worth noting that our unadjusted modified Dickey–Fuller and unadjusted Dickey–Fuller tests have indicators of −3.65 and −7.38, respectively, with matching

p-values of 0.00, which additionally support the notion that co-integration exists among the variables. The importance of these various tests is to strengthen the idea that, notwithstanding the potential short-term fluctuations, there is an unwavering long-run relationship between the energy market, economic growth, and stock market performance in the COMESA region.

Table 6 shows the effects of the MMQR model, which examines the relationship between market capitalization (MCAP) and some other dependent variables: GDP growth (GDPG), fossil energy consumption (FSIL), renewable energy consumption (RECO), and energy imports (EIMP). We will make use of the MMQR model, which will evaluate the coefficients at different quantiles (5%, 25%, 50%, 75%, and 95%). This will help us understand how the connection between our dependent variable, MCAP, and other of our independent variables varies at different points of distribution. This method allows us to identify the impact of the variables at the lower, middle, and upper tails of the MCAP distribution, giving us the analog to understand the fundamental dynamics compared to conventional OLS regressions. At the 5th quantile, GDPG has a negative and statistically significant coefficient of −0.44, which suggests that higher economic growth is linked with lower market capitalization at the lower end of the distribution. The result is different from the general expectation that economic growth is positively associated with market performance [

53,

66]. FSIL, RECO, and EIMP show positive and statistically significant coefficients of 2.89, 3.86, and 1.08, respectively, which show that these energy-related factors have a positive effect on market capitalization at this quantile. The value of intercept at the 5th quantile is 376.82, which is highly significant, showing a positive baseline level of market capitalization when all variables are set to zero, which primarily associates with the notion that energy markets and related organizations play a vital role in the economy and market performance [

7,

20].

At the 25th quantile, GDPG suggests a slightly stronger negative effect on MCAP at −0.71, while FSIL, RECO, and EIMP uphold positive coefficients and go on to be statistically significant at 4.31, 5.26, and 0.91, respectively. This persistent positive effect of energy variables on market capitalization matches with the study underlining the role of energy consumption in driving economic growth and market performance, particularly in developing nations [

7,

57]. The intercept rises to 485.50, which signifies a higher baseline market capitalization at this quantile compared to the 5th quantile. At the 50th quantile, the negative connection between GDPG and MCAP becomes more evident at −1.02, while there is a positive effect of FSIL at 5.99, RECO at 6.91, and EIMP at 0.70, which shows as significant. The intercept increased to 613.61, indicating that higher market capitalization is associated with a larger baseline value at the median of the market capitalization (MCAP) distribution. These outcomes are in line with findings in the literature that propose that energy markets, particularly renewable energy, can positively influence financial markets [

20,

46].

At the 75th quantile, GDPG had a further negative effect at −2.36, and the coefficients for FSIL (13.17) and RECO (13.99) are particularly greater than that of previous quantiles, although the coefficient for EIMP is negative at −0.17. This change in the connection between EIMP and MCAP at the upper middle quantile proposes a diminishing positive effect of energy imports on market capitalization. The outcome will be explained by the fact that higher levels of energy imports might signify economic dependence on foreign energy sources, which could dampen market confidence [

29]. The intercept value rises to 762.76, showing even higher baseline market capitalization at the 75th quantile. At the 95th quantile, GDPG continues to employ its negative effect of −4.15, and FSIL (22.80) and RECO (23.48) are equally highly significant with great positive coefficients. On the other hand, the coefficient for EIMP turns out to be negative at −1.33, showing a possibly negative impact of energy imports on MCAP at the top levels of market capitalization. This study reveals concerns over the sustainability of the dependence on energy imports, which can worsen economic weaknesses, as argued by [

30]. The intercept further increases to 898.67, indicating the highest baseline level of market capitalization in the upper quantile.

These results align with the existing literature on the relationship between energy consumption and economic variables, particularly in the context of energy and economic growth. For example, Ref. [

7] found that renewable energy consumption positively affects economic performance, which is similar to the significant positive coefficients observed for RECO in this study. Similarly, Ref. [

64], emphasized the role of financial markets, which aligns with the positive relationships between energy factors (FSIL, RECO, and EIMP) and MCAP in this study. Additionally, the results are consistent with the findings of [

61], who noted the growing role of energy investments, particularly in renewable energy, in driving economic outcomes and market performance in Africa. The consistently positive relationship between RECO and MCAP across quantiles further supports the view that a transition toward renewable energy may enhance economic growth and financial market development. However, the negative relationship between GDPG and MCAP at higher quantities of MCAP suggests that in more developed markets, the effect of economic growth on market capitalization may diminish, possibly due to diminishing returns at higher levels of development. This aligns with findings from studies such as [

41], who suggested that the relationship between growth and market performance could weaken as economies reach higher stages of development.

The results from the Driscoll–Kraay Standard Errors (DKSE) method in

Table 7 provide estimates of the relationship between market capitalization (MCAP) and various explanatory variables: GDP growth (GDPG), fossil energy consumption (FSIL), renewable energy consumption (RECO), and energy imports (EIMP). The DKSE method is particularly valuable for accounting for potential heteroscedasticity and auto-correlation in the panel data, making it more robust for inference when the standard assumptions of panel regression models may not hold [

69] Starting with the coefficient for GDPG, which is negative (−1.43) and statistically insignificant (

p-value = 0.51), the lack of significance suggests that economic growth, at least in the context of COMESA, does not have a clear or immediate effect on market capitalization when using the DKSE method.

This result contrasts with the theoretical expectation that higher economic growth should be linked to greater market capitalization, as proposed by [

32,

66], who found that economic growth generally has a positive effect on financial markets. The insignificance of GDP growth in this case may offer important insights into the growth dynamics within the COMESA region suggesting that, despite experiencing substantial economic growth, these countries may still face structural barriers that prevent them from effectively translating that growth into financial market expansion.

The coefficients for FSIL and RECO are positive and highly significant (

p-values of 0.00), which indicates that energy consumption, especially fossil fuel and renewable energy, has a positive effect on market capitalization in the COMESA region. The coefficient for FSIL is 8.19 and for RECO is 9.08, proposing that both fossil and renewable energy consumption drive market capitalization in the COMESA region. This is consistent with findings in the literature, where [

7,

20] argue that energy consumption, particularly from renewable sources, plays a crucial role in driving both economic growth and stock market performance. The strong positive relationship between energy consumption and market capitalization is further supported by [

31], who emphasized the importance of energy infrastructure in stimulating economic activity and financial development. These findings suggest that energy, particularly from renewable sources, plays a vital role in advancing financial markets in developing regions such as the COMESA bloc.

The coefficient for EIMP is 0.44 and significant at the 10% level (

p-value = 0.09), showing a positive, although relatively weaker, connection between energy imports and market capitalization. This shows that more dependence on imported energy could marginally boost market capitalization; however, the result is not as strong as the energy consumption variables. This outcome could be explained by the fact that energy imports may serve as a short-term solution to energy shortages, thereby soothing markets in the short term but not necessarily achieving long-term sustainable growth. The literature on energy security, such as [

29], emphasizes that while energy imports can address short-term energy demands, they are not a sustainable substitute for long-term economic stability or growth in developing markets. This perspective helps explain the moderate coefficient on energy imports (EIMP) observed in this study.

From a different perspective of finance growth theory, GDP growth displays an insignificant relationship with market capitalization in the high quantiles. This result makes sense in the context of COMESA because economic growth in the region has often been driven by government or donor-funded infrastructure projects rather than by private sector investment. As a result, increases in GDP do not necessarily lead to higher profits for publicly listed companies, which weakens the usual link between economic growth and stock market performance.

In summary, our study has established the following findings:

Fossil fuel consumption and renewable energy adoption significantly influence the stock market performance, whilst the renewable energy coefficient shows a strong effect at the low quantile of stock market performance.

Energy import, on the other hand, has a slightly positive effect at low quantiles, though it became negative in higher quantiles, which depicts a vulnerability to external dependence.

Economic growth doesn’t show a statistically significant effect on market capitalization within the COMESA region, which is a resultant effect of structural barriers in the financial transmission within this region.

The above results have served as the foundation for our thesis, which posits that energy policy and composition are crucial elements to consider in shaping financial market dynamics in a developing region, specifically COMESA.