2.1. Transport Energy Transformation Towards Low and Zero Emission Transport

According to the International Energy Agency (IEA), CO

2 emissions from the transport sector reached almost 8 billion tons in 2022, accounting for about 23% of global emissions from fossil fuel combustion. Preliminary data for 2023/2024 indicate a further small increase of about 0.8% globally, making it the fastest growing sector in terms of final energy consumption emissions [

9]. The most promising strategy is low- and zero-emission technologies, based primarily on vehicle electrification and the use of hydrogen. At this stage, it is important to reduce CO

2 emissions throughout the entire life cycle of electric vehicles. It is also necessary to consider the method of accounting for carbon dioxide emission allowances in the energy market settlement process, specifically in relation to the trade of electricity intended for electric vehicles [

10]. Equally important are the energy distribution systems dedicated to electric vehicles [

11], the organization of charging systems [

12,

13], the energy trading system [

14], the forecasting of electrical load [

15], and the safety of electric vehicle charging systems [

16].

Thanks to the high efficiency of battery electric drives and the possibility of smart charging and integration of these vehicles with energy networks (Vehicle to Grid–V2G), it is possible to reduce the total costs of the energy system, according to [

17] even by about 1.6% in the PyPSA Eur model (integrated simulation model of the energy system of Europe–Python for Power System Analysis Europe)—which shows the potential for synergy between transport and energy. The analysis by the authors of [

18,

19] confirms that electrification translates not only into emission reduction, but also into increased operational efficiency, although it creates new challenges related to infrastructure and battery recycling. The importance of multicriteria decision-making tools in transport planning is highlighted by [

20], who developed a method to select scenarios for urban transport systems with varying shares of electric vehicles. Their work supports strategic decisions regarding the structure of urban mobility in light of emission, efficiency and cost factors.

In the area of heavy and long-distance transport, analyses indicate that hydrogen is a valuable complement to electrification, offering a long range and fast refueling. However, only hydrogen produced from renewable sources–via electrolysis powered by RES or nuclear energy–shows real decarbonization potential, as confirmed by the publication [

21]. Conversely, hydrogen produced from natural gas without CO

2 capture is characterized by high trace emissions, exceeding 10 kg CO

2 per kilogram H

2, which limits the environmental benefits.

An important contribution to the discussion is presented in the study [

22], where the authors assessed the real costs and barriers of BEV (Battery Electric Vehicle) and FCEV (Fuel Cell Electric Vehicle) technologies in road transport based on the Whole Systems system model. Their results show that although BEVs dominate in medium and light fleets, hydrogen gains a competitive advantage in the heavy vehicle segment when “immeasurable” costs–such as refueling time, load capacity limitations, and adaptation barriers–are considered. From the perspective of operational costs and environmental impact, the analysis by [

23] offers comparative insight into different vehicle propulsion systems. The study confirms the significant emission reduction potential of BEVs and FCEVs, while also addressing the economic aspects that influence fleet operator decisions.

Public transport is another area where interest in low-emission technologies is growing rapidly. Although electric buses are gaining popularity thanks to MDPI (2023), there is a lack of data from real implementations, especially in countries outside Europe and the USA. The work [

24] shows that zero-emission vehicles and drones in last-mile logistics have potential, but require coordinated technological and regulatory integration. At the same time, studies on low-emission zones (LEZs) indicate a slow adoption of truly zero-emission solutions, where initially hybrids and plug-in HEVs (Hybrid Electric Vehicles) dominated. A notable advancement in sustainable delivery logistics is presented by [

25], who propose a delivery planning method in urban areas that incorporates environmental aspects. This model aids in optimizing transport scenarios by balancing emissions, congestion, and logistics performance.

Life Cycle Assessment (LCA) analyses of individual vehicle types provide valuable data. For example study [

26] presents Well-to-Wheel (WTW) comparisons of electric and hydrogen vehicles, indicating that the condition of low emission BEV depends on the source of electric energy. In turn, [

27] distinguishes five EV (Electric Vehicle) models with the best LCA results—BYD Dolphin, Hyundai KONA, Jeep Avenger, Opel Corsa and Tesla Model 3—showing that electromobility can be truly ecological, as long as the production of batteries takes place in compliance with environmental standards. In terms of energy usage optimization, the work of [

28] addresses the challenge of minimizing electricity consumption by municipal electric fleets amid charging uncertainties. Their results demonstrate how adaptive planning can improve energy use and cost efficiency in urban contexts.

An interesting perspective on cost and emission simulations in heavy transport is presented by [

29] through a Total Cost of Ownership (TCO) model for different powertrain configurations of heavy goods vehicles, also taking into account infrastructure and real fleet data. Their forecasts show that with technological progress and policy support, zero-emission vehicles are becoming competitive. The challenges of planning under uncertainty are addressed by [

30], who apply fuzzy logic as a tool for supporting transport development decisions. Their work is particularly applicable where input data is ambiguous or based on expert judgment, which is often the case in early-stage planning of electromobility systems.

However, the transformation of transport cannot be treated in isolation–it requires close integration with the global energy system based on renewable energy sources. The authors in the publication [

31] emphasize the need to synchronize the production of vehicles and energy. Additionally, study [

18], utilizing the PyPSA-Eur model, highlights significant cost savings in the integration of V2G and smart charging, which reduces the need for energy storage. In the area of energy systems [

32] present the opportunity to adapt existing gas pipelines to the transmission of hydrogen, which translates into possible infrastructure savings.

System dynamics (SD) analyses, as in [

33], show that dynamic models do not effectively take into account temporal dependencies and feedbacks, e.g., between technology adoption and network and policy needs, which limits the accuracy of transformation scenario forecasts. It seems that future research should focus on several key areas: detailed LCA and TCO modelling of heavy vehicles, non-road, rail, sea and air transport–especially using synthetic fuels (SAF, ammonia); implementation of V2G, AI and digital tools in logistics management; and behavioral and social analyses that take into account cultural norms, technological acceptance and educational mechanisms. Particular attention should be paid to countries of the Global South, where infrastructural, legislative and financial barriers may force other paths of technological transformation.

The transformation of transport towards a low- and zero-emission future requires at least parallel development of electric vehicles and hydrogen technologies, strong integration with green energy sources, adequate support policies, research towards social adoption and behavioral change (changes in attitudes and habits of users) and adaptation to local conditions of developing markets. Only an approach that is both interdisciplinary and global will create a real chance for sustainable transport of the future, consistent with the goals of climate agreements and the economic needs of societies.

Research gaps in light of the above text and in the context of the topic include:

lack of spatial analyses linking charging infrastructure deployment to urban form, TEN-T corridors, and regional energy profiles [

34],

limited data from Central and Eastern Europe and insufficient methodologies for assessing infrastructure effectiveness in a systemic and social context,

underexplored integration of AFIR regulations with national energy and transport strategies, including the role of local governance,

no standardized indicators for evaluating AFIR compliance and infrastructure performance across regions,

insufficient consideration of user behavior, social acceptance, and service quality in the planning of public charging infrastructure,

fragmented treatment of hydrogen infrastructure and absence of long-term strategies for maintaining and upgrading AFIR-compliant networks beyond 2025.

2.2. Electromobility—Growth Dynamics, Characteristics of BEV and FCEV Vehicles

The transformation of the transport sector towards low and zero emissions is a process of fundamental importance in the context of global climate commitments, with electric vehicles playing a central role in this transition. According to a report [

9] prepared by the International Energy Agency, global sales of electric vehicles in 2023 reached about 14 million units, which constituted an 18% share of new passenger car sales. This is a 35% increase compared to 2022. By the end of 2023, more than 40 million BEVs (Battery Electric Vehicles) and PHEVs (Plug-in Hybrid Electric Vehicles) were already on the roads around the world.

The main centers of electromobility development are China, Europe and the United States, which together account for over 90% of global EV sales [

35]. In China, over 9 million electric vehicles were sold in 2023, and the share of EVs in new car sales exceeded 50% [

36]. In Europe, the largest market share is held by Norway, the Netherlands and Germany, where supportive subsidy schemes and tax incentives led to EVs accounting for between 20% and over 80% of new vehicle registrations in 2023 [

37]. In the USA, sales growth was supported by federal tax breaks under the act [

38], although local data from 2024 indicate a slight slowdown in dynamics [

39].

BEVs are currently the dominant type of electric drive. They are powered exclusively by an electric motor and supplied with energy stored in lithium-ion batteries. Their efficiency is over 85–90%, which significantly exceeds combustion engines (25–30%) [

40]. Modern vehicles such as Tesla Model 3, Hyundai Ioniq 6 or Mercedes EQS offer a range of 400 to 700 km [

41].

BEVs are increasingly used not only in the consumer sector, but also in public transport [

42] and urban logistics. An example is Shenzhen in China, which in 2018 completed the full electrification of its entire fleet of city buses (over 16,000 vehicles), and then also of taxis [

43]. Similar activities are being carried out in Amsterdam, Hamburg and Santiago de Chile [

44].

According to the report [

45], the number of electric buses in the world has exceeded 820,000 units. China accounts for over 60% of the entire global fleet of EV buses, while Europe is still catching up, with an average share of EVs in city bus sales at 12–15% [

46]. At the same time, the segment of electric vans is being intensively developed–used, among others, by courier companies [

47].

Fuel Cell Electric Vehicles (FCEVs) are electric vehicles in which energy is generated through an electrochemical reaction between hydrogen and oxygen in a fuel cell. Their greatest advantage is short refueling time (3–5 min) and extended ranges–often exceeding 600–700 km. As a result, FCEVs are considered a complementary technology to BEVs, especially in long-distance and heavy transport [

40,

48].

However, the decarbonisation potential of hydrogen depends on its production method. Only the so-called green hydrogen, produced in the electrolysis process powered by renewable energy sources (RES), ensures substantial emission reductions. Hydrogen produced from natural gas without CO

2 capture (commonly referred to as grey hydrogen) generates emissions of 10–12 kg CO

2 per kilogram of H

2 [

48,

49].

Examples of FCEV implementations include the H2Haul project (EU), Hyundai XCIENT’s fleet of trucks in Germany and Switzerland, and Nikola and Hyzon’s operations in the U.S. A Whole Systems Analysis report from University College London found that FCEVs outperform BEVs in the heavy-duty vehicle sector when factors such as refueling times, payload constraints, and infrastructure availability are taken into account [

50].

2.3. Segmentation of the Electromobility Market

The development of electromobility is not limited to the passenger car segment, although this category continues to dominate in terms registration number. Global markets show an increasingly distinct differentiation in the applications of electric vehicles, responding to the specific needs of the logistics sector [

51], public transport [

52,

53], industry, car-sharing [

54,

55] and individual users. Therefore, it is necessary to discuss electromobility in the division into four basic segments: passenger cars, delivery vehicles, trucks and micromobiles.

The segment of electric passenger vehicles remains the most developed and diversified. The market offer today includes not only premium cars, such as Tesla Model S, Porsche Taycan or Mercedes EQS, but also city and compact vehicles, such as Fiat 500e, Renault Zoe, Opel Corsa Electric or Dacia Spring [

41]. The key challenge remains to reduce the price of the vehicle and the availability of models in the economy class, which are most important in developing countries [

9].

Chinese-made models have gained popularity in the European market, offering competitive range and pricing. According to data from the European Association of Automobile Manufacturers [

56], in the first quarter of 2024, EVs accounted for over 14% of new registrations in the EU.

The electrification of light-duty vehicles (LDVs) is progressing rapidly, especially in countries with a growing share of e-commerce. For example, Amazon has ordered 100,000 Rivian electric vans for the US market [

47], while in Europe, DHL and UPS are electrifying their delivery fleets as part of sustainable city logistics programs. LDVs are particularly well suited to electromobility due to their predictable routes, short daily distances, and the possibility of overnight charging.

The heavy-duty vehicle (HDV) segment poses a particular challenge for electromobility due to the weight of the batteries, limited range and high energy demand [

57,

58]. However, significant progress has been noticeable in recent years. Electric trucks manufactured by Volvo Trucks, Scania and Daimler offer ranges of 250–300 km and are implemented in regional logistics [

59] and urban transport [

60]. In Germany, tests of the so-called megawatt charging corridors (MCS–Megawatt Charging System) are underway, which are to serve HDV vehicles [

9]. For longer distance transport, FCEV technology is more important–e.g., Hyundai XCIENT with hydrogen drive implemented in Switzerland and Germany [

61].

Micromobility vehicles, such as scooters, e-bikes or electric scooters [

62], are playing an increasingly important role in the structure of urban mobility [

63]. According to the report [

64], up to 30% of journeys in European cities can be replaced by light vehicles with a range of up to 10 km. Integrating micromobility with public transport can reduce congestion, improve air quality and reduce emissions [

65,

66,

67]. Numerous cities have introduced public e-scooter rental systems (e.g., Paris, Berlin, Warsaw), although some–such as Paris in 2023–have withdrawn their presence from public spaces due to concerns over safety and regulatory control [

68].

2.4. Impact of Electromobility on the Environment and Public Health

It is commonly assumed that electric vehicles do not emit CO

2 during operation. However, a comprehensive assessment of their impact on the environment requires the use of the LCA (Life Cycle Assessment) methodology, covering the entire life cycle of the vehicle–from raw material extraction, through battery production, use, to end-of-life recycling. Well-to-Wheel (WTW) studies show that the carbon footprint of BEVs can be 50–70% lower than that of combustion vehicles–provided that the energy comes from renewable energy sources [

69,

70].

The study [

69] showed that BEV production is more emission-intensive (mainly due to the battery). However, this difference is eliminated after a mileage of about 50,000 km–or as early as 20,000 km when powered by clean energy sources. The production of lithium-ion batteries is associated with intensive consumption of resources: lithium, cobalt, nickel and graphite. These raw materials are predominantly sourced from regions including South America (lithium), the Democratic Republic of Congo (cobalt) and China (graphite), which creates environmental and social challenges. An important aspect at this stage involves research focused on the recycling of used batteries from end-of-life electric vehicles [

71,

72,

73]. This process is often referred to as the “second life” of batteries and is directly linked to end-of-life battery management [

74], battery life cycle assessment (LCA) [

75], and the principles of sustainable development [

76,

77]. An alternative approach under consideration is the use of sodium-ion batteries in electric vehicles.

Electromobility also contributes to improving health conditions in cities. Electric vehicles are much quieter, thereby reducing noise pollution—one of the main factors influencing stress, sleep disorders and cardiovascular diseases [

78]. In addition, the lack of exhaust emissions (NO

x, PM10) improves air quality, especially in congested urban areas. In Paris, after the introduction of low-emission zones and an increase in the share of EVs in the city fleet, a 30% reduction in NO

2 concentration was recorded within 3 years [

79].

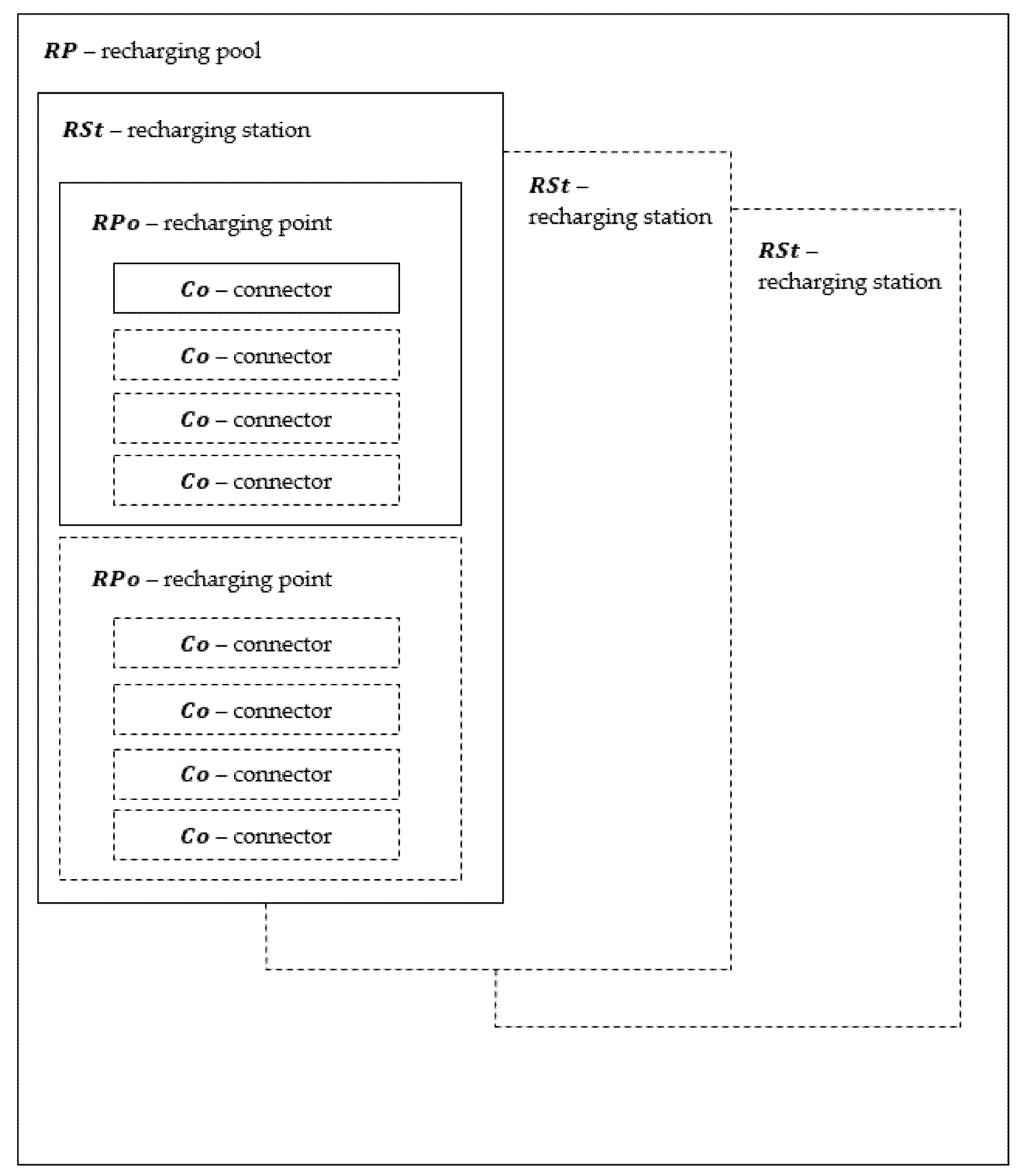

2.5. Electromobility—Transport Infrastructure

The development of transport infrastructure dedicated to electromobility is an essential element of the energy and transport transformation [

80]. Accelerating the electrification of the vehicle fleet worldwide would not be possible without the parallel development of an extensive and reliable network of charging points. The lack of such infrastructure would lead to the phenomenon of the so-called “range anxiety”, i.e., the fear of users running out of energy during the journey, which would significantly reduce their willingness to choose an electric vehicle. Modern charging infrastructure is not limited to physical stations—it also includes energy sources, interoperable payment systems, charging standards, integration with transmission networks and increasingly advanced tools for managing the charging process, such as smart charging or Vehicle-to-Grid (V2G) technology.

According to data from the International Energy Agency [

9], by the end of 2023, there were over 2.7 million public charging points in the world, of which about one million were fast or ultra-fast charging stations. The largest market in terms of the number of points installed is China, which accounts for about 60% of the global charging infrastructure. In Europe, this share is about 25%, while in the United States it is slightly less than 10% [

9]. This regional imbalance is one of the main challenges for the unified development of the EV market on a global scale.

Charging infrastructure is categorized into three main types, differing in power and vehicle charging time. The most basic type is home AC chargers with a power of up to 22 kW. They are intended mainly for individual users and residents of multi-family buildings. Charging times with these units typically range from 6 to 12 h, depending on battery capacity and grid conditions. The second type is public DC chargers with a power of 50 to 150 kW, which can be found at shopping centers, petrol stations, transport hubs and in urban areas. They allow 80% battery charging in 30 to 45 min. The fastest solution is ultra-fast DC stations with a power of over 150 kW, which are installed along highways and transport corridors, especially in Europe and North America. Examples include the European network Ionity and the American Electrify America, which offer charging stations with capacities of up to 350 kW [

81].

For the needs of heavy transport, the Megawatt Charging System (MCS) technology has been developed. This system enables charging of heavy goods vehicles at power levels up to 1.5 MW, significantly reducing charging times to durations acceptable for logistics operators. In Europe, pilots of this technology are being carried out as part of the Heavy Vehicle Charging Europe project, with the participation of companies such as Scania, MAN, Siemens and ABB [

82]. MCS is anticipated to play a critical role in the process of electrification of heavy goods vehicles, where standard charging turns out to be insufficient in terms of both power and transmission infrastructure.

In the case of electric heavy-duty vehicles (eHDVs), a crucial aspect is the development of charging strategies that correspond to the available high-power charging systems designed specifically for heavy vehicles. Political and economic conditions related to the implementation of various charging systems and support for the electric vehicle sector play a significant role in this process [

83]. These actions include the integration of medium- and high-power charging vehicles with the electrical grid [

84]. The challenges of integration are detailed in the Resources for the Future Report 23-03 [

85]. All these challenges ultimately contribute to achieving a zero-emission heavy vehicle fleet [

86]. One proposed solution involves the use of swappable batteries, which reduces vehicle downtime during charging. The developed Battery-as-a-Service (BaaS) business model enables electric vehicle buyers to purchase vehicles and lease or subscribe to batteries [

87]. Battery swapping systems are currently undergoing extensive testing in China.

An extremely important direction in the development of charging infrastructure are real-time energy management technologies [

88,

89]. Smart charging is a strategy in which vehicle charging is adjusted to the current state of the power grid, energy availability (including from renewable energy sources) and individual user preferences. This solution allows for the reduction of peak energy demand and increases the share of renewable energy sources in the energy mix. Research conducted in Germany and the Netherlands shows that the implementation of smart charging systems can reduce the costs of investment and operation of the network by 10–20% over a decade [

90].

A more advanced form of integrating electromobility with the energy sector is the Vehicle-to-Grid (V2G) technology, whereby electric vehicles function as temporary energy storage devices. V2G enables not only drawing energy from the grid, but also releasing it, e.g., during peak demand hours, which stabilizes the operation of the energy system and reduces the need to build additional energy storage facilities. Analyses [

91] show that full integration of V2G technology in Europe could bring savings of EUR 150–200 billion by 2040, while reducing the demand for stationary energy storage facilities.

An effective charging infrastructure also requires a well-thought-out geographical location. Research conducted by [

92] indicates that planning charging stations using predictive algorithms and GIS data allows for more effective coverage of the actual needs of users. For example, in Amsterdam, a predictive system was implemented ensuring that charging points are located no further than 400 m from each resident’s home, which significantly improved accessibility and user satisfaction.

The literature further indicates that the efficiency of infrastructure depends on factors such as: population density, availability of night charging (especially in multi-family buildings), integration with the public transport network and local availability of energy from renewable sources [

46,

93]. Only when these conditions are met is it possible to fully use the potential of the electromobility system [

94].

However, the development of electromobility infrastructure encounters numerous barriers [

95,

96]. On the technical side, the most frequently indicated problem is the limited availability of connection power, especially in urban and suburban areas, where the network load is already high [

97]. Additionally, the absence of standardized technical standards and communication protocols—different types of plugs, applications and payment systems limit the interoperability of charging stations. Furthermore, local infrastructure congestion is particularly problematic when charging entire fleets of vehicles at the same time, necessitating energy management solutions and investments in the transmission network.

From an economic and regulatory perspective, the development of ultra-fast charging stations is associated with very high costs–the construction of a single point with a capacity of over 150 kW can reach up to EUR 500,000. In many countries, especially developing ones, there is also a lack of public support mechanisms or credit systems for infrastructure investments. The unification of legal standards regarding the availability of information on the location of stations, connection power or charging prices is also insufficient, which prevents effective planning and integration of mobile applications in public transport systems.

At the social level, infrastructure development is met with resistance from residents–especially in housing estates, where the location of stations is associated with aesthetic, legal and land ownership issues. There is also a lack of widely available data on user behavior, their preferences regarding places and hours of charging, which makes it difficult to optimize the location of new stations. As noted by [

69], understanding the behavioral patterns of EV users should be the foundation of any effective infrastructure strategy.