1. Introduction

The development of modern economies is increasingly shaped by the urgent need for sustainable energy policies that address environmental degradation, energy security, and economic resilience. The above is crucial from the perspective of the broader security of societies and economies [

1,

2]. In this process, green energy is growing in importance [

3], enjoying increasing interest in the business sphere [

4,

5,

6] and among individual consumers [

7] worldwide, and its development in an environmental context is becoming an absolute necessity. Among the range of renewable energy solutions, wind energy is recognized as an environmentally friendly and appropriate alternative to traditional sources of electricity supply [

8,

9]. Wind energy is currently a leading trend in the transformation of the world’s energy system [

10], with the United States among the leaders in this development. The further development of this field depends on a number of conditions, which include, on the one hand, geographical conditions and wind resources, technical–technological solutions and advances in wind turbine technology, and growing interest in wind energy investments, and, on the other hand, political–economic realities, social acceptance, and the environmental impact of the development in question [

11].

In the United States, the energy sector has been undergoing a significant transition, driven by the global climate agenda, geopolitical shifts, and the country’s internal regulatory changes. A key component of this transformation is the growing reliance on renewable energy sources, with wind energy playing a pivotal role [

12].

The disruptions in global fossil fuel markets following recent geopolitical conflicts, including the Russian invasion of Ukraine, have underscored the vulnerability of energy systems dependent on non-renewable imports. While the United States is largely self-sufficient in fossil fuel production, the volatility of global markets and the increasing domestic demand for clean energy have prompted an accelerated shift towards renewables, including onshore and offshore wind energy.

The U.S. wind energy market has evolved rapidly in recent years, supported by federal and state-level policies, technological advancements, and decreasing costs of turbine installation and operation. However, despite this momentum, the market faces a range of challenges, including grid integration issues, supply chain constraints, and social acceptance concerns. Moreover, regulatory uncertainty at both state and federal levels poses additional barriers to long-term investment.

Given this context, the objective of this review is to critically assess the current state of the U.S. wind energy market, identify key drivers and barriers to its further development, and highlight areas requiring more focused research and policy attention. The review focuses on selected aspects of the wind energy market in the United States, considering both macroeconomic and local (community-level) perspectives. Particular attention is paid to the integration of wind energy in the national energy mix, regional disparities in market development, the emerging offshore wind sector, and the underexplored potential of small-scale wind installations for individual consumers.

To this end, the paper adopts a structured literature review methodology, encompassing scientific publications, industry reports, and policy documents. The aim is to identify dominant themes in the literature and to map areas of high, moderate, and low research intensity across multiple dimensions: technological development, the regulatory framework, environmental and economic implications, and public perception of wind energy in the U.S.

2. Literature Review and Contextual Background

This review is based on an analysis of the available literature, including industry reports, statistical materials, scientific articles, and studies relevant to the subject matter. The literature resources were obtained by searching databases, including Scopus, Web of Science, and Google Scholar, based on keywords adopted for this review.

The review of the literature obtained involved selecting it for the purposes of the review. The study used 65 current sources, including 30 reports and thematic studies and 35 articles and review studies. The first part defined the background of the review. This was followed by a multi-faceted literature review to develop strategic priorities and policy recommendations for the wind energy sector in the U.S., which concluded the study.

The development of the wind energy sector in the United States is influenced by a complex interplay of policy frameworks, economic drivers, technological innovations, and regional characteristics. In this section, we review the key contextual factors and the recent literature that define the current state of the U.S. wind energy market, including national and subnational energy strategies, incentive mechanisms, market trends in onshore and offshore segments, and emerging issues related to small-scale wind deployment. This background provides a foundation for understanding the challenges and opportunities that shape the sector’s future trajectory.

2.1. Energy Transition and Policy Landscape in the United States

The energy transition in the United States has accelerated significantly over the past two decades, driven by a convergence of environmental imperatives, economic motivations, technological innovation, and changing public attitudes. As the second-largest global emitter of CO

2, the U.S. has faced mounting pressure—both domestically and internationally—to decarbonize its economy. In response, the country has made substantial progress in diversifying its energy portfolio, notably through the expansion of wind and solar power, which are now central to national energy strategies [

13].

Wind energy, in particular, has become a key pillar of the U.S. energy mix, both in terms of installed capacity and its contribution to electricity generation. According to the U.S. Energy Information Administration, wind power accounted for more than 10% of total electricity generation in 2022, a significant increase from approximately 2% in 2010 [

14]. This upward trend reflects the combined effects of market dynamics, supportive policy frameworks, and ongoing technological innovation. Over the past decade, the levelized cost of energy (LCOE) for wind has declined by more than 70%, making it one of the most cost-competitive sources of new power generation in several U.S. regions [

15].

Improvements in turbine design—including larger rotor diameters, taller hub heights, and enhanced materials—have significantly increased energy capture, especially in areas with moderate wind resources [

16]. At the same time, policy instruments such as the federal Production Tax Credit (PTC), state-level Renewable Portfolio Standards (RPSs), and streamlined permitting in wind-rich regions have contributed to sustained growth [

17,

18].

The long-term potential of wind energy in the U.S. remains substantial. The U.S. Department of Energy’s Wind Vision report projected that wind could supply up to 35% of the nation’s electricity by 2050 under favorable market and policy conditions [

19]. More recent updates by the National Renewable Energy Laboratory (NREL) suggest that achieving these targets will require continued investment in transmission infrastructure, workforce development, and local community engagement [

20].

Another important dimension of the U.S. energy transition is the role of public perception and local acceptance of wind energy projects. While national surveys indicate generally favorable attitudes toward renewable energy, local opposition—often described as the “Not In My Backyard” (NIMBY) effect—can significantly delay or block project development. Resistance is often rooted in concerns about visual impacts, noise, land use, and effects on property values or wildlife [

21]. Addressing these challenges requires early-stage community engagement, transparent consultation processes, and benefit-sharing mechanisms such as community ownership models or local tax revenue reinvestment [

22]. In this regard, policies that integrate social acceptance into planning frameworks have proven effective in several states, particularly in the Midwest and Northeast.

Furthermore, energy justice and equity concerns have become increasingly central to the American clean energy discourse. Historically marginalized communities—including Indigenous tribes and low-income urban or rural populations—have borne a disproportionate share of pollution from fossil fuel infrastructure while being excluded from the benefits of renewable energy deployment. Recent federal efforts, such as the Justice40 Initiative, seek to allocate at least 40% of certain federal investments (including clean energy) to disadvantaged communities [

23]. In parallel, tribal energy sovereignty has gained visibility, with several Native American tribes investing in wind projects as a means of achieving both economic self-determination and environmental stewardship [

24].

2.2. Regulatory Support and Federal/State Incentives (e.g., PTC and IRA)

The expansion of wind energy in the United States has been closely linked to a long-standing framework of federal and state-level policy incentives designed to stimulate renewable deployment, reduce carbon emissions, and enhance energy security. At the federal level, two core instruments—the Production Tax Credit (PTC) and the Investment Tax Credit (ITC)—have served as financial cornerstones of wind energy development.

The PTC, first enacted under the Energy Policy Act of 1992, provides a per-kilowatt-hour (kWh) tax credit for electricity generated by qualified wind projects during the first 10 years of operation. This mechanism significantly improved the economic competitiveness of wind energy, particularly in the early 2000s, contributing to year-over-year capacity growth. The PTC has undergone multiple extensions and expirations, creating cycles of market volatility and policy uncertainty [

25]. Complementing the PTC, the ITC offers a tax credit based on a percentage of capital investment, providing more predictable support for project developers [

16].

A major structural shift occurred with the passage of the Inflation Reduction Act (IRA) in August 2022. The IRA represents the most substantial federal investment in clean energy in U.S. history, allocating over USD 370 billion to climate and energy security. Importantly for wind energy, the IRA extends PTC and ITC benefits through at least 2032, introduces bonus credits for projects located in energy communities or using domestic content, and supports domestic manufacturing of wind turbine components [

26]. As summarized in

Table 1, the interplay between federal tax incentives and state-level mandates like Renewable Portfolio Standards (RPSs) has created a multilayered support system that underpins both utility-scale and distributed wind deployment.

It also incentivizes long-term planning by offering developers clarity and flexibility regarding technology-neutral tax credits, which can adapt to emerging renewable innovations.

In addition to federal action, state-level policies have been crucial catalysts for regional wind market development. Over 30 U.S. states and territories have adopted Renewable Portfolio Standards (RPSs)—mandates requiring a specified share of electricity to come from renewable sources. States such as Texas, Iowa, and Oklahoma, which lead the nation in installed wind capacity, have benefited from a combination of wind resource abundance, transmission investment, and supportive regulatory environments [

27]. In many cases, utilities are also required to offer green tariffs or enter into power purchase agreements (PPAs) that promote large-scale wind integration.

Importantly, the interaction between state and federal incentives has created synergies that accelerate market deployment, though it has also introduced uneven development patterns. States without RPS policies or those politically aligned with fossil fuel interests have experienced slower adoption, illustrating the role of ideological and institutional divergence in shaping the wind energy landscape [

13].

Another notable feature of the IRA is the technology-neutral Clean Electricity Production Credit (CEPC), which begins in 2025 and replaces the PTC and ITC for new clean energy projects regardless of generation source. This mechanism promotes long-term investment certainty and encourages innovation across the renewable sector. The law also introduces “energy community” bonuses, designed to support job creation in regions previously reliant on fossil fuels, and provides credits for projects meeting domestic content and prevailing wage requirements [

28].

State-level actions have also expanded beyond RPS mandates to include clean energy standards (CESs), net metering reforms, and regional greenhouse gas initiatives. For instance, California’s SB100 law mandates 100% clean electricity by 2045, while New York’s Climate Leadership and Community Protection Act (CLCPA) targets 70% renewable electricity by 2030. These ambitious policies serve as models for other jurisdictions, and they signal the importance of aligning state planning, permitting, and transmission development with federal funding opportunities under the IRA framework [

29].

2.3. Onshore Wind Market: Dynamics, Regions, Trends

Onshore wind energy represents the dominant segment of the U.S. wind industry and continues to play a foundational role in the country’s clean energy transition. As of the end of 2023, the United States had deployed over 140 GW of installed onshore wind capacity, accounting for approximately 90% of total wind energy output. This dominance stems from a combination of favorable wind resources, mature technology, and supportive regulatory environments at the federal and state levels [

30].

Regionally, the heartland of U.S. wind development lies in the Great Plains and Midwest, often referred to as the “wind belt”. States like Texas, Iowa, Oklahoma, Kansas, and Nebraska benefit from high wind speeds, flat terrain, and expansive land availability. Among them, Texas is by far the largest contributor, with over 37 GW of installed wind capacity. The success of the Competitive Renewable Energy Zones (CREZ) transmission buildout in Texas, along with market-based dispatch under the ERCOT system, has made it a model for integrating variable renewables at scale [

31].

Iowa and Oklahoma follow with over 12 GW each, and both have developed policy frameworks and utility procurement mechanisms that support continued expansion. Capacity factors for modern wind farms in these regions often exceed 40–45%, with some projects approaching 50%, owing to improved turbine designs with taller towers and larger rotors, better site selection, and optimized maintenance schedules. As a result, the levelized cost of energy (LCOE) for onshore wind has dropped significantly—reaching as low as USD 30/MWh in the best locations—making it one of the most cost-effective sources of new generation capacity [

32].

However, this rapid expansion has also created significant grid integration challenges. The pace of transmission development has lagged behind wind deployment, especially in regions operated by Midcontinent Independent System Operator (MISO) and Southwest Power Pool (SPP). As a result, several high-wind zones experience curtailments during periods of low demand and limited export capacity. Additionally, congested interconnection queues, uncertain cost-sharing rules, and regional transmission planning gaps introduce investment risks that delay or deter new projects [

33].

From a market design perspective, onshore wind also faces exposure to volatile merchant markets and evolving capacity compensation mechanisms, particularly in areas without long-term power purchase agreements (PPAs) or state mandates. The introduction of time-variant pricing, negative pricing events, and ancillary service requirements may shift revenue streams and require hybridization with storage or flexible generation.

Social and regulatory dynamics present additional complexities. In several states, local opposition to new wind farms has emerged in the form of zoning restrictions, height limitations, and minimum setback requirements, often framed in terms of noise, landscape aesthetics, or wildlife impacts. Although national polling indicates strong public support for renewable energy, local acceptance can be highly variable and influenced by community engagement practices, landowner compensation, and trust in developers [

22].

Moreover, the saturation of high-quality sites in traditional wind states has prompted developers to explore new regions, including the Southeast and Mountain West, where wind economics are historically less favorable. These frontier markets will likely require policy tailoring, infrastructure investment, and technological innovation—such as low-wind-speed turbines—to become viable on a large scale.

2.4. Offshore Wind: Recent Developments and Outlook

While the U.S. onshore wind sector has reached technological maturity and scale, offshore wind remains in a developmental phase—yet it is increasingly regarded as one of the most promising frontiers for decarbonization and energy diversification in the United States. The long, resource-rich coastlines of the Atlantic, Pacific, and Gulf of Mexico offer immense untapped wind potential. The National Renewable Energy Laboratory (NREL) estimates that U.S. waters contain over 2000 GW of technical offshore wind potential, enough to supply nearly double the nation’s current electricity demand [

34].

Recognizing this opportunity, the Biden administration elevated offshore wind to a national strategic priority. In 2021, it announced a target of 30 GW of installed offshore capacity by 2030 and 110 GW by 2050, supported by historic levels of federal investment, permitting reform, and inter-agency collaboration. This policy push was reinforced through provisions in the Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act (IIJA), which earmark billions for clean energy infrastructure, grid modernization, and domestic supply chain development [

35].

2.4.1. Federal Actions and BOEM Leasing

Central to offshore wind deployment is the role of the Bureau of Ocean Energy Management (BOEM), which administers leasing and environmental review processes on the Outer Continental Shelf. Since 2021, BOEM has accelerated its leasing activity and completed multiple successful auctions, including high-profile sales in New York Bight, California, and North Carolina. The California auction in December 2022 marked a watershed moment as the first large-scale federal lease sale for floating wind platforms, raising over USD 750 million in bids from companies such as RWE, Equinor, and Ocean Winds [

36].

In total, BOEM has now leased enough offshore acreage to support more than 40 GW of capacity, with over 25 active projects in various stages of development. The agency has also introduced the Smart from the Start initiative to streamline permitting and reduce conflicts with fishing, tribal, and coastal interests. In tandem, the Department of the Interior (DOI) and the Department of Commerce (NOAA) are coordinating impact assessments and mitigation plans for marine ecosystems, birds, and endangered species.

2.4.2. Project Pipeline and Regional Focus

The U.S. offshore wind pipeline has grown dramatically. As of early 2024, the country had installed just 0.1 GW (primarily the 30 MW Block Island Wind Farm in Rhode Island and the 12 MW Coastal Virginia pilot), but over 8 GW is under construction, including major commercial-scale projects:

Vineyard Wind 1 (Massachusetts): 800 MW, expected online in 2024.

South Fork Wind (New York): 132 MW, to begin operations in 2024.

Ocean Wind 1 (New Jersey): 1100 MW, expected by 2025.

Coastal Virginia Offshore Wind (CVOW): 2640 MW, planned by 2026–2027.

The Northeast and Mid-Atlantic are currently leading development due to relatively shallow waters (suitable for fixed-bottom foundations), high population density, and strong state policy support through offshore wind procurement mandates and power purchase agreements (PPAs) [

37].

The West Coast, in contrast, requires floating wind platforms due to steep ocean bathymetry. While this introduces technical and logistical complexity, it also opens new frontiers for innovation. NREL projects that floating wind could account for up to 60% of total offshore capacity by 2050, especially as turbine sizes increase (15+ MW) and cost curves decline through learning and scale [

38].

As outlined in

Table 2, several commercial-scale offshore wind projects are under construction in the U.S., with the Northeast and Mid-Atlantic leading due to policy support and shallow-water conditions.

2.4.3. Economic and Industrial Considerations

Offshore wind remains capital-intensive, with levelized costs of electricity (LCOEs) currently ranging from USD 80 to 120/MWh, depending on site characteristics, foundation type, and transmission requirements. However, cost trajectories are expected to follow onshore trends, especially as domestic manufacturing scales up and supply chains localize. To this end, the IRA offers bonus tax credits for projects using U.S.-sourced components or located in energy communities transitioning from fossil fuels.

Federal and state agencies are also investing in port infrastructure, specialized installation vessels, and training programs to support the burgeoning offshore workforce. Key port upgrades are underway in New Bedford (MA), Elizabeth (NJ), and Humboldt Bay (CA), with the goal of transforming these areas into logistics hubs for offshore turbine assembly and transport [

39].

2.4.4. Challenges and Social Acceptance

Despite favorable policy and market dynamics, offshore wind development in the U.S. faces several barriers:

Permitting delays: Projects must navigate extensive federal, state, and local reviews, often taking 7–10 years from lease to commissioning.

Environmental concerns: Impacts on marine mammals (e.g., North Atlantic right whales), fisheries, and birds have led to lawsuits and calls for stricter oversight.

Community opposition: Coastal residents and tourism-based economies have raised concerns about visual impacts and property values, particularly in densely populated regions like Long Island and Cape Cod.

Grid integration: Offshore wind will require major transmission upgrades, including subsea cables, offshore substations, and long-distance HVDC lines to inland load centers.

Efforts to mitigate these concerns include community benefit agreements, stakeholder engagement forums, and adaptive permitting approaches that allow for phased buildout and environmental monitoring.

2.4.5. Outlook

If federal and state policies remain supportive and permitting is streamlined, the U.S. offshore wind sector could reach cost parity with fossil generation by the early 2030s and provide up to 20% of national electricity by 2050. It also holds immense potential for job creation—with over 77,000 new jobs projected in construction, operations, and manufacturing by 2030, according to the DOE [

34].

In summary, the U.S. offshore wind industry has shifted from vision to implementation, with early projects setting the stage for broader deployment. While numerous challenges remain, the sector is poised to become a cornerstone of America’s low-carbon energy future.

As summarized in

Table 3, recent technical and environmental indicators demonstrate the maturity and competitiveness of wind energy in both onshore and offshore segments.

2.5. Technological, Economic, and Environmental Aspects

The rapid growth of wind energy in the United States has been underpinned by a dynamic evolution in technology, cost structure, and understanding of environmental implications. Over the past two decades, technological innovation has played a central role in improving the performance and cost-competitiveness of wind power systems.

Modern onshore wind turbines typically exceed 4 MW in nameplate capacity, with rotor diameters surpassing 130 m and hub heights exceeding 100 m. These advances enable more efficient energy capture, especially in regions with moderate wind resources. In the offshore sector, turbines have reached 12–15 MW, with manufacturers such as Siemens Gamesa and GE Vernova pioneering next-generation machines for floating and fixed-bottom applications [

39]. The move toward larger, modular components has also streamlined construction and maintenance processes, particularly through pre-assembly at specialized ports.

As a result of these innovations, the levelized cost of electricity (LCOE) for wind energy has fallen dramatically. In leading regions such as the Great Plains and Texas, LCOE values are now below USD 30/MWh, making wind among the most cost-effective sources of new electricity generation—even without subsidies [

38]. Offshore wind remains more expensive, typically in the USD 80–120/MWh range, but is projected to become increasingly competitive as floating technologies mature and domestic supply chains scale up.

Another crucial technological development involves the integration of wind energy with energy storage systems and smart grid infrastructure. These combinations help address the intermittency of wind generation by enabling load shifting, frequency regulation, and peak shaving. Grid operators such as CAISO and ERCOT are testing advanced forecasting tools, battery co-location models, and virtual power plants, which together enhance wind energy’s value to the overall power system [

30].

From an environmental perspective, wind energy offers one of the lowest life-cycle carbon footprints among energy sources. According to life-cycle assessments (LCAs), wind emits only 3–15 gCO

2/kWh, compared to over 400 gCO

2/kWh for natural gas and 900 gCO

2/kWh for coal [

40]. These benefits are further amplified by the fact that wind turbines do not produce local air pollution or require water for cooling, in contrast to conventional thermal plants.

Nevertheless, ecological and social concerns remain. Avian and bat mortality, particularly for raptors and migratory species, has prompted calls for improved siting practices, monitoring technologies (e.g., radar and cameras), and adaptive turbine curtailment strategies. The impact on natural habitats and land use is another source of contention, especially in rural or culturally sensitive areas. Though wind farms typically occupy a small fraction of the total land area they are sited on (as turbines are spaced out and co-located with agriculture), fragmentation of ecosystems and noise pollution have been cited as risks requiring better mitigation frameworks [

41].

Offshore wind brings its own set of environmental trade-offs, including underwater noise, seabed disturbance, and potential displacement of marine species and fisheries. These effects have led to legal challenges and resistance from coastal communities. Although U.S. regulations mandate Environmental Impact Statements (EISs) and stakeholder consultation, experts note that the current patchwork of state and federal rules leads to delays, inconsistencies, and lack of harmonization. There is a growing consensus that a streamlined, science-based national framework is needed to guide environmental permitting and ensure equitable outcomes for local communities and ecosystems [

42].

In summary, wind energy is now both technologically mature and economically attractive, with significant environmental advantages over fossil fuels. Yet further progress hinges on addressing residual ecological concerns, expanding system flexibility through digital integration, and improving the consistency of environmental regulation. These cross-cutting issues will be decisive in determining whether wind energy can scale sustainably to meet ambitious national decarbonization goals.

2.6. Wind Energy for Small-Scale Consumers and Distributed Systems

While utility-scale wind dominates the U.S. wind energy landscape, distributed and small-scale wind systems remain a largely untapped opportunity. As of 2023, the total installed capacity of distributed wind energy in the United States was approximately 970 MW, with applications ranging from farms and ranches to schools, municipal buildings, and off-grid cabins [

43].

Despite its potential, the adoption of small wind turbines (≤100 kW) lags far behind that of distributed solar photovoltaics, which benefit from lower costs, streamlined permitting, and strong brand recognition. Several barriers hinder the widespread use of small wind systems, including high upfront costs, zoning and height restrictions, limited installer networks, and low consumer awareness. Additionally, wind resource availability at the distribution level is highly site-specific, requiring accurate siting, which adds complexity and cost [

44].

However, recent developments offer new momentum for the small wind segment. One trend involves the integration of small wind turbines into hybrid renewable energy systems, often in combination with solar PV and battery storage. These systems are increasingly being adopted in remote communities, tribal lands, and resilient microgrids, where they provide backup power during outages or serve as the primary energy source for isolated users [

45]. Small-scale wind has proven especially valuable in Alaska and the Great Plains, where wind speeds are favorable and grid access may be limited.

At the policy level, the Inflation Reduction Act (IRA) includes expanded tax credits and grant programs for rural energy systems and domestic clean energy manufacturing, which may benefit distributed wind in the coming years. Programs under the U.S. Department of Agriculture’s Rural Energy for America Program (REAP) now provide more generous funding for wind and hybrid installations in agricultural and rural communities [

43].

To accelerate deployment, policy and regulatory interventions are required, including standardized interconnection rules, streamlined permitting, and targeted incentives. Public education and technical assistance programs can also improve acceptance and adoption, particularly when community ownership models and participatory planning are introduced. Localized manufacturing of small wind components could further drive down costs and strengthen supply chains.

In summary, small-scale and distributed wind represents a niche but strategically important part of the U.S. renewable energy portfolio. While challenges persist, especially relative to distributed solar, evolving market conditions, hybrid technologies, and tailored policy support have the potential to unlock growth in this underutilized sector.

3. Discussion: Key Patterns, Gaps, and Emerging Directions in the U.S. Wind Energy Market

The review of the academic literature, policy frameworks, and technical reports reveals several key findings regarding the current state and future prospects of the U.S. wind energy market. The results are structured around six thematic areas: (1) policy and regulatory dynamics; (2) onshore wind development; (3) offshore wind progress; (4) technological and economic performance; (5) environmental implications; and (6) distributed and small-scale wind applications.

3.1. Federal Policy as a Primary Market Driver

Federal instruments such as the Production Tax Credit (PTC), the Investment Tax Credit (ITC), and the recent Inflation Reduction Act (IRA) have been central to wind energy deployment in the U.S. The IRA, in particular, introduces unprecedented long-term visibility and financial support, fostering both utility-scale and distributed projects. State-level Renewable Portfolio Standards (RPSs) have further complemented federal policies, especially in high-wind states such as Texas and Iowa. However, uneven implementation across states has created a fragmented regulatory landscape, limiting harmonized market expansion.

At this point, it is worth noting that Corporate Power Purchase Agreements (CPPAs) are increasingly shaping utility-scale wind deployment, particularly among technology firms pursuing ambitious decarbonization targets and ESG commitments. Major corporations such as Google, Amazon, and Microsoft have signed multi-gigawatt CPPAs to secure long-term access to renewable electricity, often from new wind farms specifically developed for these contracts. CPPAs provide revenue certainty to project developers, facilitating project financing without relying solely on traditional utility off-takers. They also allow corporations to hedge against future energy price volatility while directly contributing to grid decarbonization. The growth of virtual and sleeved CPPAs further enables participation across multiple jurisdictions. However, the expansion of CPPAs raises questions about access equity, as smaller firms and communities may lack the negotiating power or creditworthiness to engage in similar arrangements. Future regulatory frameworks may need to address these asymmetries while encouraging broader market participation.

3.2. Onshore Wind Dominance and Regional Saturation

Onshore wind remains the backbone of U.S. wind energy, with over 140 GW of installed capacity as of 2023, accounting for the vast majority of total wind generation in the country. The Midwest and Great Plains regions continue to dominate in deployment due to their superior and consistent wind resources, availability of land, and proactive investments in transmission infrastructure. States such as Texas, Iowa, Oklahoma, and Kansas have become national leaders not only in installed capacity but also in fostering favorable policy environments and market-based mechanisms such as Renewable Portfolio Standards and competitive power purchase agreements (PPAs).

However, despite this historical success, the onshore wind sector is increasingly facing structural and logistical constraints that hinder further rapid expansion. High-quality wind resource areas in several leading states have approached saturation, limiting the availability of economically viable sites for new developments. Simultaneously, transmission grid congestion—particularly in the Midcontinent Independent System Operator (MISO) and Southwest Power Pool (SPP) regions—has emerged as a critical bottleneck. Long interconnection queues and delays in permitting new transmission lines undermine project timelines and increase uncertainty for developers and investors.

Local opposition has also intensified in some regions, with increasingly restrictive zoning ordinances, noise regulations, and visual impact concerns creating political friction at the municipal and county levels. The phenomenon known as NIMBYism (“Not In My Backyard”) has led to moratoriums on new wind installations in certain jurisdictions, complicating efforts to expand capacity even in states with otherwise supportive renewable energy policies.

Moreover, the expansion into new geographic regions, such as the southeastern United States, remains limited by a combination of weaker wind resources, less developed transmission infrastructure, and the absence of aggressive state-level clean energy mandates. In such contexts, the economic feasibility of onshore wind projects is often marginal without tailored financial incentives, such as production tax credits (PTCs), investment tax credits (ITCs), or direct procurement by corporate buyers seeking renewable energy attributes.

Beyond the technical and regulatory landscape, the strategic importance of domestic wind energy has grown in response to heightened geopolitical tensions. The instability in global fossil fuel markets—exacerbated by events such as the war in Ukraine and supply disruptions from major oil- and gas-exporting countries—has underscored the value of wind power as a secure, homegrown energy source. Wind energy reduces dependence on volatile international supply chains, enhances national energy sovereignty, and contributes to price stability for electricity markets increasingly exposed to global shocks. As the United States pursues a more resilient and diversified energy portfolio, the onshore wind sector is poised to play a central role—provided that systemic barriers are addressed through coordinated infrastructure investments, regulatory reforms, and sustained political support.

3.3. Offshore Wind: From Vision to Implementation

Offshore wind in the United States is undergoing a pivotal transformation—from early-stage demonstration and limited pilot projects to large-scale commercial development. This transition has been catalyzed by a confluence of policy drivers at both the federal and state levels. The Bureau of Ocean Energy Management (BOEM) has accelerated leasing activity along the Atlantic and Pacific coasts, offering long-term clarity and expanding designated Wind Energy Areas (WEAs) through competitive auctions. In parallel, several coastal states—most notably New York, New Jersey, Massachusetts, and California—have introduced ambitious procurement mandates and multi-gigawatt targets, often through Contracts for Differences (CfDs) and Offshore Renewable Energy Certificates (ORECs), designed to de-risk investments and ensure stable revenue streams.

In 2023, over 8 GW of offshore wind capacity was under active construction, including landmark utility-scale projects such as Vineyard Wind 1, Ocean Wind 1, and South Fork Wind. These projects represent a turning point for the U.S. offshore wind industry, establishing the supply chain foundations, permitting precedents, and operational standards for future development. The national offshore wind project pipeline now exceeds 40 GW—more than five times the current construction volume—reflecting strong developer interest and long-term market potential.

However, multiple systemic challenges continue to delay progress and raise development costs. Permitting remains one of the most significant hurdles, characterized by multi-agency review processes, overlapping jurisdictional authority, and lengthy environmental assessments. Legal uncertainties surrounding marine mammal protection, commercial fishing rights, and migratory bird pathways have further contributed to litigation and administrative delays. Public opposition has emerged in several coastal communities, particularly around visual impact concerns, navigation safety, and local ecosystem disruption. The “not-in-my-ocean” variant of NIMBYism has already prompted resistance in areas such as Long Island and Cape Cod.

Infrastructure readiness also presents a major constraint. The United States currently lacks a robust network of dedicated offshore wind ports, specialized turbine installation vessels (WTIVs), and high-capacity interconnection infrastructure. Many key supply chain elements—including nacelle assembly, cable manufacturing, and blade fabrication—remain heavily reliant on European firms, limiting local content and raising logistical complexity. Without targeted investment in domestic port facilities (e.g., New Bedford and NJ Wind Port), Jones Act-compliant vessels, and workforce development, scaling offshore wind deployment may fall short of federal ambitions.

An emerging frontier within the offshore segment is floating wind technology, which offers significant promise for deepwater regions, particularly along the Pacific Coast, the Gulf of Maine, and parts of the Gulf of Mexico. The technological feasibility of floating platforms has been demonstrated in Europe and Asia, but cost-competitiveness remains a challenge. Current levelized cost of energy (LCOE) estimates for floating offshore wind exceed USD 100/MWh, compared to USD 70–80/MWh for fixed-bottom installations. Nevertheless, innovation in mooring systems, dynamic cables, and modular substructures—combined with DOE funding initiatives and public–private partnerships—may gradually close the cost gap.

Overall, the offshore wind sector in the United States stands at a critical inflection point. Policy momentum, private capital, and climate imperatives align in support of rapid expansion, but realization of this potential will depend on the timely resolution of permitting, infrastructure, and public acceptance barriers. A coordinated federal–state–industry approach is essential to unlock the full decarbonization and economic benefits of offshore wind energy.

To fully unlock the potential of offshore wind energy in the United States, a multidimensional approach involving administrative, technical, infrastructural, and institutional mechanisms is required. Drawing from both domestic pilot programs and global best practices, the integration of these measures can accelerate deployment, reduce risks, and ensure long-term sustainability.

Administrative simplification is at the core of effective project realization. The Bureau of Ocean Energy Management (BOEM) introduced initiatives such as Smart from the Start to streamline the permitting process, aiming to shorten project development timelines from over a decade to as little as 5–7 years [

46]. Creating a “one-stop-shop” permitting system and enhancing inter-agency coordination are critical steps toward more efficient governance [

38].

From a technical standpoint, advances in floating platform technology, the scaling up of wind turbines to 15–20 MW, and the modularization of components significantly expand the scope of viable offshore sites, particularly in deeper waters [

38,

47]. The integration of digital tools such as digital twins, remote monitoring, and predictive maintenance allows operators to reduce downtime and optimize asset management [

48].

Infrastructure and logistics are also vital. The development of specialized offshore wind ports such as New Bedford, MA, and the New Jersey Wind Port serves as a foundation for effective turbine assembly, storage, and transportation [

38,

47]. Investments in Jones Act-compliant installation vessels and high-capacity cranes enhance the ability to conduct domestic operations without relying on foreign-flagged ships, thus ensuring supply chain independence.

Equally important are institutional and social frameworks that build trust and ensure equitable distribution of project benefits. Mechanisms such as community benefit agreements, local co-ownership models, and inclusive stakeholder engagement strategies increase social license to operate and reduce the risk of community opposition [

22,

49]. Case studies in states like New York and Massachusetts illustrate the effectiveness of these measures in fostering public support and long-term cooperation [

23].

In summary, an integrated policy and operational framework—combining administrative efficiency, technological innovation, infrastructure readiness, and social equity—will be essential to realize the full decarbonization and economic potential of offshore wind in the U.S.

An overview of the most impactful administrative, technical, infrastructural, and institutional solutions supporting offshore wind deployment in the U.S. is summarized in

Table 4 below.

3.3.1. Conceptual Approaches to Regulatory Innovation

Despite promising federal initiatives such as “Smart from the Start,” significant regulatory fragmentation persists between federal and state jurisdictions, which can lead to delays, inconsistencies, and increased project risk. One of the key conceptual needs is the harmonization of permitting and approval processes across different levels of governance [

46]. Coordinated regulation would reduce administrative complexity and increase investor confidence.

Another essential innovation would be the introduction of a nationwide modular Environmental Impact Assessment (EIA) framework. This system could allow project developers to reuse standardized baseline studies and streamline reviews by regulatory bodies [

47]. Such an approach, already piloted in limited regions, could cut costs and shorten development timelines [

38].

Legislative modernization may also include the establishment of fully integrated “one-stop-shop” permitting systems. Drawing on international models—such as Denmark’s Energistyrelsen and the Netherlands’ centralized offshore wind tendering system—the U.S. could adopt a unified framework that combines environmental, maritime, and grid-related reviews into a single point of access [

49].

These regulatory concepts are either newly introduced or currently under limited implementation in the U.S. Their full-scale deployment would represent a significant institutional innovation, with the potential to accelerate offshore wind development while maintaining environmental and social standards [

23].

3.3.2. International Comparison of Offshore Wind Development Models

Compared to global offshore wind leaders such as Denmark, the Netherlands, and the United Kingdom, the regulatory and institutional landscape in the United States remains relatively fragmented and less streamlined. While the U.S. has made substantial progress through initiatives led by the Bureau of Ocean Energy Management (BOEM) and recent federal incentives, significant challenges persist in terms of project coordination, permitting speed, and integration with power markets [

23,

46].

European countries tend to implement centralized governance frameworks that unify permitting, environmental assessments, grid connections, and auction systems under a single institutional structure. For example, Denmark’s Energistyrelsen (Danish Energy Agency) coordinates site leasing, environmental approval, and transmission planning, enabling predictable timelines and investor confidence. The Netherlands utilizes a similar model through the Ministry of Economic Affairs and Climate Policy, which designates Wind Energy Areas, conducts environmental studies, and issues development rights based on integrated tenders [

49,

50].

The United Kingdom offers another mature model, with the Crown Estate managing seabed leasing and Ofgem overseeing transmission assets. Competitive auctions in the UK are structured with Contracts for Difference (CfDs), which ensure revenue certainty and drive down the levelized cost of electricity (LCOE). In contrast, U.S. offshore wind auctions are often held without guaranteed power purchase agreements (PPAs), requiring developers to engage in separate, state-led procurement negotiations [

38].

Although the Inflation Reduction Act (IRA) and enhanced BOEM coordination mark an important shift toward strategic alignment, further harmonization of state and federal regulations is needed to reach European levels of efficiency and scale [

47,

51]. The

Table 5 (below) highlights key structural differences in permitting, auction design, and institutional coordination between the U.S. and selected European countries in offshore wind development practices.

3.4. Cost Reduction and Technological Maturity

Technological innovation has drastically lowered the levelized cost of electricity (LCOE) for wind, with some onshore projects achieving costs below USD 30/MWh. Advancements in turbine size, rotor diameter, and smart grid integration have enhanced efficiency and dispatchability. Offshore LCOEs remain higher but are on a downward trajectory. Integration with storage systems and digital tools (e.g., forecasting and AI-based dispatch) is improving reliability and system value, especially in variable renewable portfolios.

3.5. Environmental and Social Acceptance Challenges

Wind energy remains one of the cleanest electricity sources in terms of life-cycle emissions. However, ecological concerns—including bird and bat mortality, habitat fragmentation, and marine species disruption—persist. Regulatory gaps in environmental assessments and inconsistent permitting practices further exacerbate delays. Social acceptance varies widely, with localized opposition affecting siting decisions. Community engagement and benefit-sharing mechanisms have proven effective in mitigating resistance but remain underutilized.

While community and regulatory initiatives remain inconsistent, several mitigation measures already in use—particularly those addressing ecological impacts—have shown measurable effectiveness in both U.S. and European projects. For instance, seasonal construction windows (e.g., avoiding pile-driving during peak marine mammal activity) have proven successful in reducing behavioral disturbances among whales and dolphins [

46]. Similarly, the deployment of bubble curtains around turbine foundations during installation has significantly reduced underwater noise propagation, thus mitigating auditory stress for marine fauna [

23].

In avian protection, measures such as painting one rotor blade black have been shown to decrease bird collisions by up to 70% in Scandinavian studies [

52]. Radar-based detection systems and temporary shutdown protocols during high-risk migration periods are also being piloted in several offshore farms in the North Sea and along the U.S. Atlantic coast [

38]. While long-term population effects remain difficult to generalize, initial empirical evidence suggests that combining spatial planning, construction restrictions, and real-time monitoring leads to a substantial reduction in acute environmental risks.

3.6. Untapped Potential of Small-Scale Wind

Distributed wind, including small-scale systems (<100 kW), remains underdeveloped despite its potential for resilience and rural electrification. High costs, limited installer networks, and regulatory barriers have hindered growth. Hybrid systems (wind + solar + storage) are gaining attention in off-grid and microgrid applications. Recent IRA provisions and USDA programs may stimulate growth, but targeted policy support and public education are needed to unlock this segment.

Small wind systems have been successfully implemented in various U.S. settings, particularly in rural, agricultural, and tribal communities. For example, in Alaska and the Great Plains, small turbines are used to power isolated farms and reduce diesel dependence [

48]. The Winnebago Tribe of Nebraska deployed small-scale wind systems in combination with solar and battery storage to power tribal facilities and improve local energy resilience [

51]. In New York, a K-12 school district installed 10 kW rooftop turbines as part of a STEM education and clean energy program [

53]. Such use cases demonstrate the role of small wind in supporting energy equity, educational outreach, and decentralized grid integration. Nonetheless, these examples remain exceptions, and a broader uptake will require improved policy visibility and streamlined interconnection processes.

As summarized in

Table 6, the current landscape of the U.S. wind energy market is shaped by a complex interplay of enabling factors and structural barriers across multiple domains, including policy, technology, environmental governance, and social acceptance.

Future research should explore integrated socio-technical frameworks, long-term forecasting models, and comparative policy evaluations to guide evidence-based decision-making in wind energy development. In particular, interdisciplinary approaches that combine engineering, economics, environmental science, and social acceptance studies are needed to better understand trade-offs between efficiency, equity, and ecological integrity. In the area of social perception research, it is important to diagnose openness to renewable energy sources, which shapes consumer preferences—investment and purchasing preferences—that have a significant impact on this dimension of the economy [

54,

55].

In view of the above, forecasting tools should incorporate not only technological cost curves and resource availability, but also behavioral factors, permitting dynamics, and interregional grid constraints. Comparative analyses of policy instruments—such as tax incentives, auction schemes, and community ownership models—can offer insights into what configurations most effectively accelerate deployment while maintaining local legitimacy. Moreover, increased attention should be paid to how wind energy intersects with broader sustainability goals, including biodiversity preservation, energy justice, and labor market transitions in fossil-dependent regions.

As landmark policies like the Inflation Reduction Act (IRA) continue to unfold and corporate renewable procurement mechanisms evolve—including the proliferation of Corporate Power Purchase Agreements (CPPAs)—their long-term systemic impacts on energy markets, equity outcomes, and the diffusion of innovation across different regions and socio-economic groups warrant continuous empirical monitoring. This includes assessing how these mechanisms affect investment flows, market concentration, community participation, and the pace of technological adoption in both high-capacity and underserved areas.

3.7. Mapping Sectoral Aspects: Novelty, Relevance, and Research Alignment

This section provides a structured overview of how the key research propositions relate to identified sectoral aspects in the U.S. wind energy market. The approach follows a thematic map that connects empirical gaps, conceptual innovation, and relevance to policy or market practice.

Each hypothesis or analytical proposition in the article aligns with a major category of drivers, barriers, or strategic opportunities in the U.S. wind sector. Their novelty stems either from a lack of prior comparative analysis, emerging regulatory mechanisms, underexplored technological configurations, or insufficient integration of environmental and social dimensions.

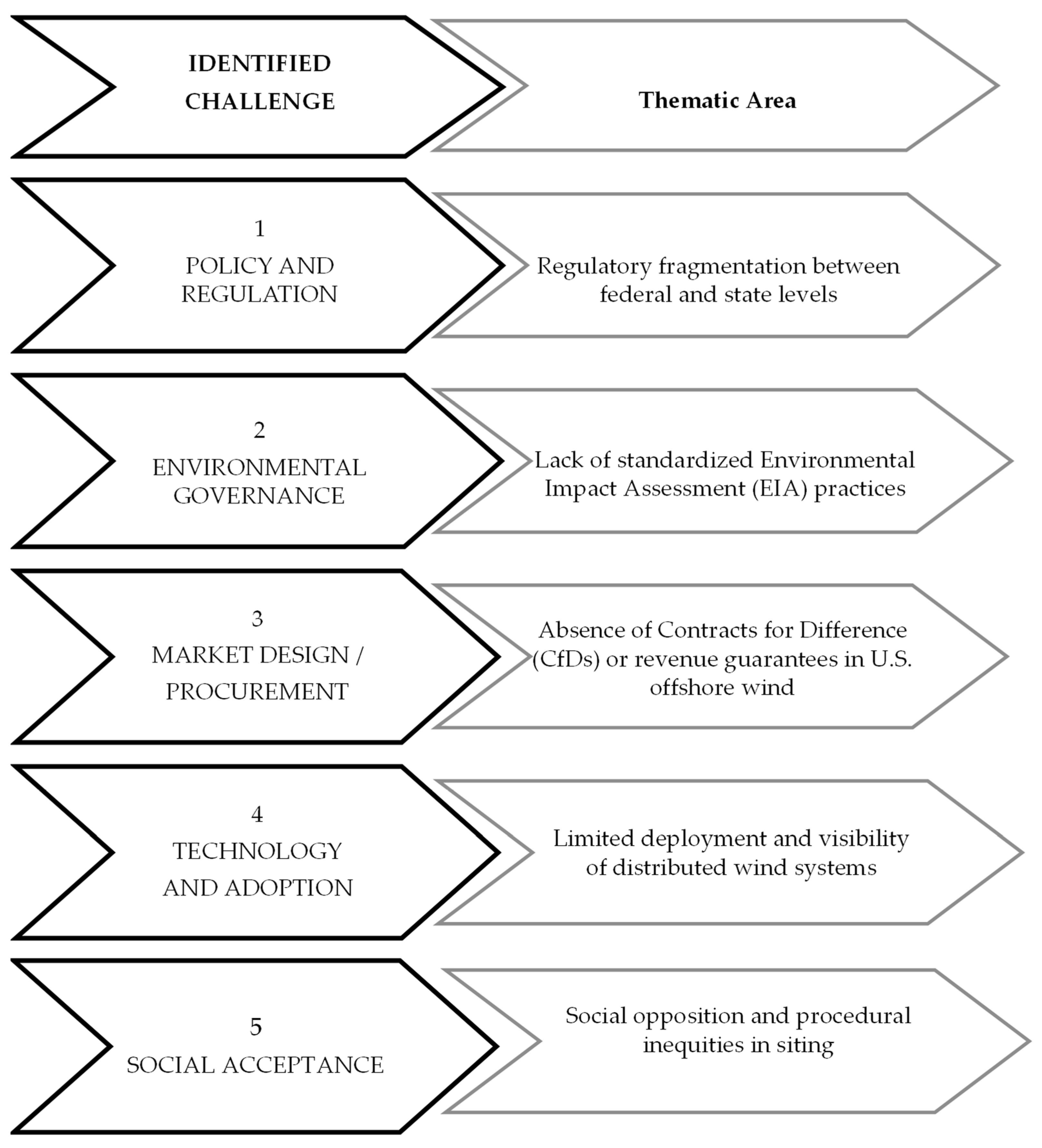

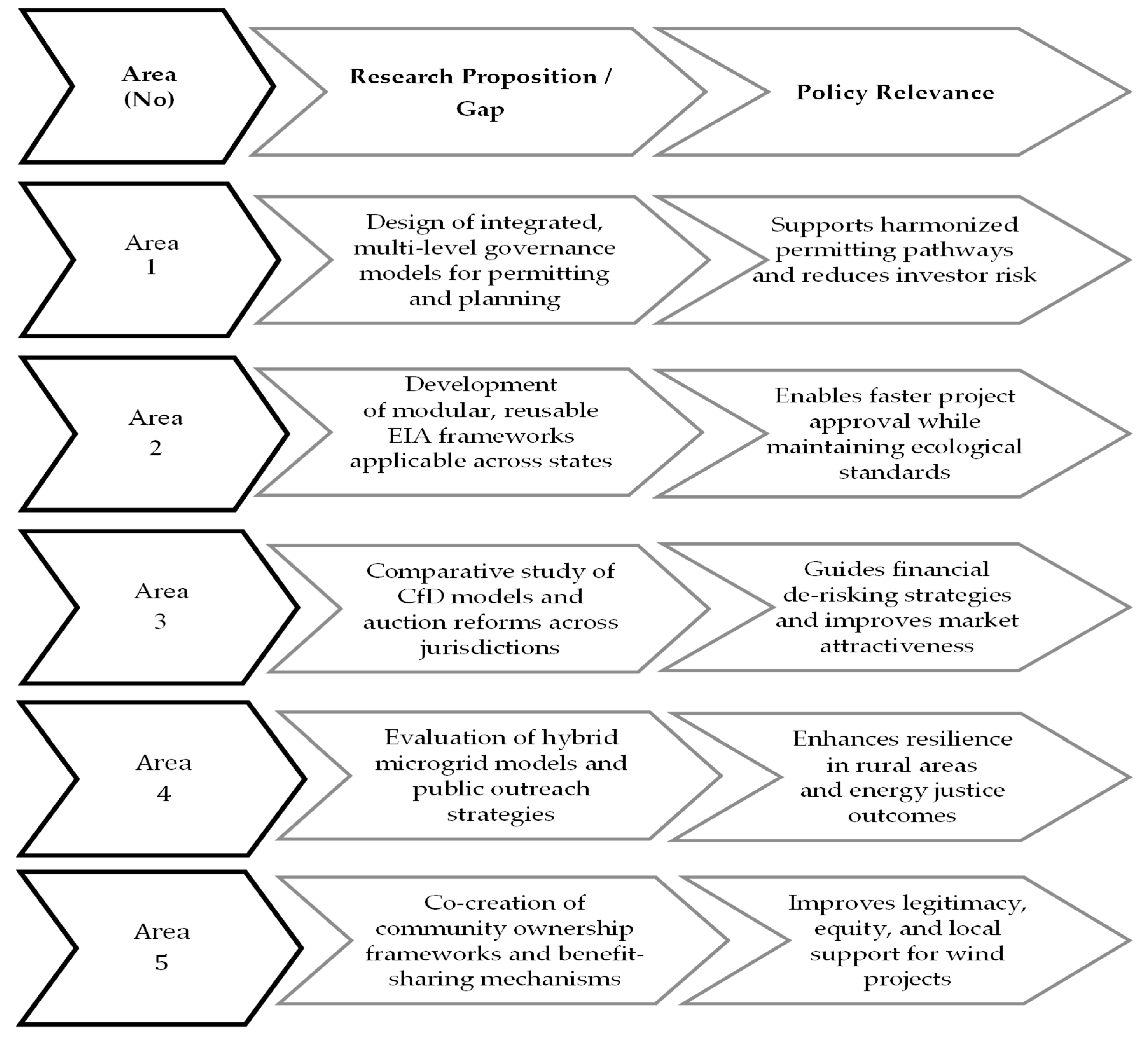

Figure 1 illustrates this mapping structure.

This mapping underscores the analytical coherence and originality of the study. By systematically linking each dimension—ranging from regulatory fragmentation and permitting inefficiencies to emerging technologies and distributed wind applications—with specific research angles, the paper highlights both persistent structural challenges and underexplored areas of innovation. Particular emphasis is placed on novel concepts such as modular environmental impact assessments, one-stop-shop permitting frameworks, floating offshore technologies, and small-scale hybrid systems. These issues have received limited treatment in the existing literature and remain at the early stages of implementation in the U.S. context. Therefore, the proposed conceptual and empirical contributions address recognized knowledge gaps and offer practical insights for accelerating wind energy development under the evolving conditions of the American energy transition.

4. Conclusions

4.1. Summary of Review Results

A comprehensive review of the literature, technical reports, and policy analyses on the U.S. wind energy market reveals several key conclusions regarding its structure, recent trends, and strategic directions:

The United States continues to strengthen the role of wind energy in its national energy mix. As of 2023, total installed wind power capacity exceeded 140 GW, accounting for over 10% of electricity generation in multiple Midwestern states. Offshore wind capacity under construction surpassed 8 GW, and a pipeline exceeding 40 GW positions the U.S. as a global offshore wind contender. Federal targets include reaching 30 GW offshore by 2030 and potentially 110 GW by 2050 [

16,

56].

The policy landscape is a major enabler of market expansion. Instruments such as the Inflation Reduction Act (IRA), Production Tax Credit (PTC), and Investment Tax Credit (ITC) have significantly de-risked wind investments, especially through long-term visibility. State-level Renewable Portfolio Standards (RPSs) and Corporate Power Purchase Agreements (CPPAs) have further fueled deployment, especially among large tech firms pursuing ESG commitments. These frameworks have facilitated project financing and encouraged innovation adoption [

29,

38].

Technological advancements and falling LCOEs are transforming market dynamics. The onshore wind LCOE has dropped below USD 30/MWh in several U.S. regions, while offshore costs are projected to fall below USD 50/MWh by 2035. Innovations include larger turbines (over 15 MW offshore), floating platforms, hybrid renewable systems, and AI-enabled grid forecasting tools, which improve dispatchability and system integration [

32,

45,

57].

The potential of small-scale wind energy remains underexploited. Distributed wind capacity remained under 1 GW in 2023, far behind solar. Barriers include high upfront costs, complex permitting, and limited public awareness. However, hybrid systems and rural energy programs under the IRA and USDA could unlock this market segment. Expanding small wind could enhance grid resilience, especially in remote or disaster-prone regions [

43].

Environmental and social dimensions are increasingly critical. While wind has one of the lowest life-cycle carbon footprints, challenges include wildlife disruption, land use conflicts, and marine ecosystem impacts. Moreover, local opposition (NIMBYism) and procedural delays due to inconsistent permitting practices have stalled numerous projects. Integrated environmental impact assessments and inclusive stakeholder engagement are essential [

41].

Strategic value is enhanced by geopolitical factors. In light of fossil fuel market volatility and geopolitical events such as the war in Ukraine, wind energy offers a secure and domestic alternative. Reducing reliance on international energy supply chains enhances U.S. energy sovereignty and economic stability [

58].

The current literature highlights several gaps and research opportunities. While topics such as federal incentives, onshore capacity trends, and turbine cost declines are well documented, less attention is given to small-scale wind, equity in CPPAs, long-term storage integration, and social acceptance dynamics. Only a fraction of studies focus on micro-wind, hybrid energy systems in rural communities, or comparative permitting reforms across states.

Future research should prioritize the development of integrated interdisciplinary models that capture the complex trade-offs between economic efficiency, environmental sustainability, and social equity in wind energy deployment. These models should incorporate dynamic interactions among policy instruments, market behaviors, environmental externalities, and stakeholder preferences, enabling a more holistic understanding of long-term system performance. In parallel, continuous empirical monitoring of the Inflation Reduction Act (IRA) and its implementation will be essential to assess its long-term systemic impacts on innovation diffusion, regional equity, and market concentration. Particular attention should be paid to whether IRA incentives are equitably accessed across developer scales and geographies, including rural and disadvantaged communities.

Comparative studies of state-level permitting practices, auction mechanisms, and community wind ownership models are recommended to identify policy configurations that yield high deployment rates while maintaining public legitimacy. Additionally, further research is needed on public sentiment, procedural justice, and social acceptance dynamics, as localized resistance remains a critical barrier to wind energy expansion. Environmental justice considerations, including the fair distribution of risks and benefits, should be systematically integrated into project planning and policy design.

Attention must also be directed toward labor market transitions in fossil-dependent regions, with robust analyses of reskilling programs, regional economic diversification, and job quality in the wind sector. To support proactive planning, data-driven foresight tools should be developed, combining behavioral, regulatory, and infrastructure-related constraints to anticipate grid bottlenecks, optimize siting, and refine investment strategies under uncertainty. Technologies such as digital twins, agent-based models, and AI-enhanced forecasting can contribute significantly to this goal.

Moreover, research should explore innovative procurement and financing mechanisms—such as inclusive Corporate Power Purchase Agreements (CPPAs), green banks, and cooperative investment models—that can broaden market access for small firms, municipalities, and underrepresented groups. Finally, wind energy should be more explicitly linked to broader climate and sustainability targets, including biodiversity conservation, energy democracy, and global decarbonization pathways, ensuring that deployment strategies are aligned not only with cost and capacity metrics but also with principles of justice, resilience, and long-term planetary health.

While this paper has examined the structural drivers and barriers shaping the U.S. wind energy sector, a forward-looking perspective is required to translate the findings into actionable strategies. The following section outlines strategic priorities and targeted policy recommendations that can enhance deployment efficiency, equity, and long-term sustainability across all wind market segments.

4.2. Strategic Priorities and Policy Recommendations for the U.S. Wind Energy Sector

The successful scaling of wind energy in the United States will depend not only on technology readiness and market conditions, but also on coherent strategic action. Based on the preceding analysis, this section identifies five key policy priorities and provides actionable recommendations to address systemic bottlenecks, leverage federal initiatives, and promote regional innovation. The goal is to align environmental, economic, and social objectives while accelerating the energy transition.

To maximize the contribution of wind energy to the U.S. energy transition, a strategic, multi-layered policy approach is essential. This must align federal leadership with state implementation, address fragmented permitting structures, and support the entire value chain—from early-stage planning to community engagement. The recommendations below are based on an integrative analysis of current practices and comparative insights from international frontrunners.

Federal–State Regulatory Harmonization**: The U.S. must move beyond a dual-track permitting framework toward a nationally coordinated system. Harmonizing permitting procedures between the Bureau of Ocean Energy Management (BOEM), state energy agencies, and local jurisdictions will reduce administrative delays and improve investor confidence. A national permitting roadmap with modular EIA standards should be developed to create transparency and predictability across regions [

47,

51].

Institutional One-Stop-Shops**: Establishing fully integrated permitting entities—drawing on models from Denmark and the Netherlands—will significantly accelerate offshore wind deployment. These entities should coordinate environmental reviews, maritime zoning, grid connections, and community consultations within a single platform. Piloting such models in key coastal states (e.g., New York, California, and Massachusetts) would generate replicable frameworks for national adoption [

49,

50].

Targeted Support for Distributed and Small-Scale Wind**: Unlocking the potential of distributed wind requires public awareness campaigns, targeted grants (e.g., USDA REAP), and simplified inter-connection standards. In rural, tribal, and island communities, hybrid microgrid solutions (wind + solar + storage) can enhance energy security and reduce diesel reliance. Federal funding mechanisms should prioritize demonstration projects and workforce development in underserved areas [

48].

Equity and Public Participation**: Social acceptance must be embedded into project design through benefit-sharing, community co-ownership, and inclusive engagement practices. Policies should support low-income and BIPOC communities in accessing the economic benefits of wind energy. National guidelines on equity-centered project development could reduce opposition and increase the pace of approvals [

22].

Long-Term Grid Integration and Forecasting**: Investment in high-capacity transmission corridors, regional balancing markets, and digital infrastructure is vital to accommodate variable wind resources. Inter-agency planning and AI-based forecasting tools can improve system reliability and reduce curtailment. DOE should expand scenario modeling to include behavioral, technological, and market uncertainty factors [

38].

Cross-Sectoral and Interdisciplinary Research**: Federal funding should promote interdisciplinary research that links technical performance with social science, labor studies, biodiversity, and land use planning. Wind energy policies must be integrated into broader sustainability agendas—including just transition, local manufacturing, and habitat conservation—to ensure durable and inclusive development.