Abstract

This article proposes recognizing innovation as the European Union’s “fifth freedom”, alongside the free movement of goods, services, capital, and people, with the aim of embedding it into renewable energy legislation. Focusing on renewable energy storage—a critical but overlooked component of decarbonization—it identifies structural barriers in EU cleantech innovation, including regulatory fragmentation, slow financing, and weak industrial coordination. To address these, this article introduces the Risk–Resilience–Reward (RRR) framework, a strategic tool for more anticipatory policymaking. It outlines how the proposed Clean Energy Delivery Agency and Clean Energy Deployment Fund could operationalize the RRR framework to accelerate storage deployment and strengthen EU competitiveness. Embedding purpose-led principles in energy policy, this article positions storage as the “unsung hero of decarbonization” and offers takeaways for advancing a just, sustainable EU economy.

1. Introduction

In a world awash with policies and polarities, the European Union (EU) institutions find themselves sieged by national governments and businesses, calling for curbing bureaucracy and green policies [1]. The underlying reasoning is often prompted by Trump’s deregulation agenda, which is allegedly poised to pump the US economy for long-term growth [2]. The claim is, however, compounding two arguments. On the one hand, it displays an anti-bureaucratic narrative, whereby regulatory efforts may lead to bureaucracy inflation at loggerheads with innovation. On the other hand, protestors entwine bureaucracy with the demanding requirements posed by green deal policies, especially in terms of reporting. The deregulation agenda is an anti-red tape revolution, which could in principle work, if performed properly. And yet, it is usually proposed in a rush by leaders desperate for growth [3].

While such calls for deregulation proliferate, macroeconomic responses to stagnation and geopolitical instability—such as the European Central Bank’s decision to lower interest rates starting in mid-2024—highlight the broader challenge of maintaining economic momentum. These monetary interventions, occurring amid strategic tensions with China and the uncertainty surrounding a potential return of protectionist U.S. policies, reflect a deeper anxiety about Europe’s economic resilience and strategic autonomy. Interest rates cuts around the world testify to times of growing geopolitical uncertainties, as mirrored by the rallying of the value of gold [4]. The current policy rates seem on a trajectory to promote the liquidity monetary policy regime that have been a byproduct of the Great Recession, especially in the United States (US), with a financialization of the economy that is obliged to spur further financialization to avert more dire risks [5]. Additionally, in particular in the US, the pandemic may have distorted the US labor market, showing a more unstable unemployment picture than it actually is, while the economy is actually thriving and going backward in the business cycle from late to mid-cycle in a Benjamin Button reversal of sorts [4]. In such atypical situations, we may expect further non-conventional monetary policies, in particular forward guidance, with central banks providing information on the future path of interest rates to affect expectations.

In macroeconomics, however, monetary policies affect only the short-term fluctuations of the business cycle rather than its trend. The fluctuations of the business cycles are determined by the potential Gross Domestic Product (GDP), which is the maximum amount of goods and services that a country can produce while occupying all the available resources, and by expectations of how much the market will absorb, namely, the aggregate demand. Fluctuations in the GDP level expand to the economic cycle as changes in discrete components of an economic system transmit to all others, amplifying their effects. To change the trend of growth, the main instrument is offered by regulatory frameworks or substantial long-term investments [6], while fiscal and monetary policies rather affect the short term.

Therefore, regulation does not sap innovation but, if crafted properly, is its very underpinning. For instance, cybersecurity and criminal law can complement and extend trade secret protections, serving as gap-fillers and enablers of innovation, by safeguarding the knowledge assets that underpin industrial competitiveness and, at times, economic survival. This type of precedent suggest that innovation-enabling regulation is not only feasible but already happening in several policy fields [7].

In Europe, the backlash against regulation is compounded with the overall fear of “de-industrialization”, whereby the European Union risks losing competitiveness in the absence of an “assertive” industrial policy, as well as “realistic” changes to the Green Deal [8]. Truly, industrial policy interventions in Europe have so far missed effectiveness targets due to three coordination challenges [6]. The first is the competition mismatch [9]: the EU wields weak powers to carry out an aggressive industrial policy [10]. Similarly, its Member States have no institutional incentives to coordinate their industrial policies [9]. Even when carrying them in a solipsistic way, they lack substantial leeway because monetary aid may distort competition within the EU internal market [9]. Meanwhile, European companies compete in less free trade and more protectionist global markets with state-supported companies, including in Japan, China, and the US [9].

Second, industrial policy effectiveness was missed due to the lack of reliable speed in financing, in particular for the energy sector [11]. Although the overall budget is considerable, funds are fragmented across Member States, limiting economies of scale for pioneering innovation and maintaining high levels of bureaucracy for businesses [6].

Third, policy domains are not effectively coordinated, mixing fiscal incentives for local production with trade measures without effectively shielding the internal market from foreign competitors’ subsidization, which is a non-tariff barrier to trade [12]. The challenges facing the EU’s innovation ecosystem—competition mismatch, unreliable financing speed, and fragmented policy coordination—are compounded in the cleantech sector due to the carbon footprint and geopolitical vulnerabilities of power systems [13], which demand a new, structured approach to policymaking.

This article explores the proposal of recognizing innovation as a “fifth freedom” within the EU Single Market, alongside the existing four freedoms (movement of goods, services, capital, and people). Its aim is to embed the fifth freedom in renewable energy legislation. This article deepens the complex policy area of cleantech innovation, particularly in renewable energy storage, and argues that EU legislation has often hindered its development rather than enabling it. To address this issue, this paper introduces the Risk, Resilience, and Reward (RRR) framework, which provides a structured approach to anticipatory and systematic policymaking. This framework aims to help policymakers navigate complex challenges—such as the energy transition—by balancing risks, building resilience, and ensuring rewards. Ultimately, this article provides preliminary evidence for shaping anticipatory and systematic policies for cleaner and fairer energy systems. After presenting pertinent theories of innovation, including those relevant to policy-making in anticipatory and systematic policymaking (II), this article underscores the role of the RRR policy framework (III) and its application in the field of energy storage, described here as the unsung hero of decarbonization (IV). The concluding remarks will offer insights for future innovation policy-making (V).

2. Materials and Methods

This research draws from legal theory, EU law, innovation studies, and climate governance. A foundational step in this research involved a doctrinal analysis of EU treaties, case law, and legislative instruments, applying methods outlined in traditional legal scholarship [14]. These included a close reading of the Treaty on the Functioning of the European Union (TFEU), particularly Articles 26–37 (internal market) and 194 (energy policy). The evolution of the four freedoms was analyzed in light of landmark European Court of Justice (ECJ) decisions and more recent jurisprudence addressing digital and energy markets.

This method enabled the identification of normative tensions and structural exclusions within the internal market framework, particularly concerning the regulation of intangibles and emergent technologies such as renewable storage. To understand how innovation and storage have been treated within EU climate and energy policy, this research applied process tracing and a qualitative content analysis of key policy documents. Sources included the European Green Deal, Fit for 55, REPowerEU, Horizon Europe strategic plans, and Commission Staff Working Documents related to the Innovation Fund and energy storage strategies (e.g., SWD(2020) 176 final).

This method was chosen to trace the policy evolution and reveal gaps between ambition (e.g., climate neutrality by 2050) and regulation (e.g., the absence of EU-wide targets for energy storage). The Risk–Resilience–Reward (RRR) framework was based on Anthea Roberts’ application in international economic law [15]. It was further enriched by building on the literature on anticipatory governance [16], mission-oriented innovation policy [17], and reflexive regulation for energy transitions whereby regulation is delegated across actors and institutions to catalyze procedural changes in attitudes and processes rather than to solely command and control [18]. This conceptual triangulation was chosen to ensure that the framework is both theoretically grounded and practically adaptable. The RRR model was then applied to the specific case of renewable energy storage, drawing insights from market data and strategic reports to illustrate how storage can become a decarbonization systemic enabler.

This article partly employed a critical comparative analysis [19], examining parallel approaches in other global jurisdictions, such as in the US and China’s green industrial policies, to underscore the strategic risks of the EU regulatory lag. This transnational lens helps position the EU’s internal market strategy within the broader global innovation race in green technologies, with attention to geoeconomics and equity implications.

3. Results

3.1. Innovation as the Fifth Freedom

3.1.1. Innovation and Sustainability

Research, innovation, and competitiveness constitute the so-called “fifth dimension” of the European Union, not yet its fifth freedom. While the freedom to provide services is a cornerstone of the single market, innovation reaches far beyond. It encompasses research and development, emerging technologies, and novel business models. This “fifth freedom” envisions a European market that transcends the traditional trade in goods and services, opening space for the free movement of intangibles such as knowledge, innovation, research, and skills [20]. Rather than duplicating existing categories, conceptualizing innovation as a distinct European freedom is intended to clarify and strengthen the EU’s capacity to coordinate fragmented instruments across the four freedoms and include research and industrial ecosystems.

Innovation is the engine of economic growth in Schumpeterian terms [21]. Defined as the capability of arranging the economic requirements for implementing an invention and then diffusing it, Joseph Alois Schumpeter’s description of innovation is still influential in contemporary economics [22].

Innovations are typically managed as one fundamental variable to oversee and assess quarterly or annually. However, innovations can take various forms. They might aim at enhancing designs, optimizing operations, or disrupting the market. Each type necessitates distinct leadership, personnel, resources, and incentives. Schumpeter identified “new combinations” as a primary source of endogenous economic development, namely, innovations that successfully penetrate markets [23,24]. In this sense, as reprised by Rebecca Henderson, innovation includes not only technological advancements like product and process improvements but also the discovery of new resources, the development of new markets, and novel organizational structures for economic processes [25].

A systemic, or architectural, understanding of innovation is particularly apt in sustainability matters. Architectural innovation is defined as a type of innovation that alters the architecture of a product or system while maintaining the integrity of many of its existing components [26]. Developed with a focus on the physical architecture of products, architectural innovation has been applied to systemic changes across entire industries [27].

Architectural innovation is particularly challenging for firms because it requires both leveraging and reconfiguring existing assets and skills, a process complicated by deeply ingrained organizational knowledge and practices. Unlike incremental innovations (a steady progression of tweaks) or radical innovations (the challenge of creating something totally different), which have clearer paths for management, architectural innovation demands a more nuanced approach to reorganizing and rethinking existing systems and knowledge [25]. Architectural innovation is harder to achieve than disruptive technological innovation because individuals employed in specific organizations are usually engrossed in their tasks, rather than in how the industry is likely to change. Importantly, businesses can invest in architectural change before their competitors, but regulation plays a structural role to support technological development through architectural innovation.

Architectural innovation is complementary to and often builds on several dichotomies of innovations with different speeds. The concept of different innovation “tempos” is deeply influenced by Kuhn’s distinction between revolutionary and normal science, from which several distinction have arisen [28]: radical and incremental innovations, as introduced by Abernathy and Utterback [29]; continuous and discontinuous technological evolution, as portrayed by Porter [30]; and disruptive and sustaining innovations, as presented by Christensen [31]. In terms of intensity, rather than tempo, Taleb contrasted exogenous events, often scientific or technological, as black swans and white swans, the disproportionate influence of exceptional, unpredictable, and infrequent occurrences that lie outside the bounds of normal distribution [32]. Other types of innovation include closed and open innovation. Coined in 2003 by Henry Chesbrough, open innovation challenges the traditional closed model where a firm keeps all its innovation processes internal [33]. Open innovation recognizes the value of external ideas and collaborations. Firms can leverage both internal and external knowledge, and explore various paths to commercialize ideas. This shift creates a more porous organizational boundary, allowing for greater flow of knowledge and accelerating sustainable solutions. As highlighted by Barbara Bigliardi and Serena Filippelli [34], innovation’s collaborative nature is crucial for tackling sustainability challenges. Researchers emphasize the need for stronger networks and co-creation to achieve positive environmental, social, and economic outcomes [35]. Public institutions are also recognizing this potential, co-funding projects that encourage open innovation for a more sustainable future [36]. While open innovation offers a powerful framework, research on its application to sustainability is still evolving [37].

3.1.2. Innovation Policy

Technological development unfolds over time and can only be explained by the interaction of a multitude of social, political, institutional, and technological factors [38]. Innovation is highly dependent on policy, especially with regard to green industrial policies. Despite the availability of relevant resources and articles addressing aspects of these interconnections, research explicitly linking innovation, sustainability innovation, and green industrial policy remains limited [39]. The interlinks between innovation and policy are often unclear due to the multifaceted nature of the innovation process.

Charles Weiss and William B. Bonvillian have outlined three models that highlight this complexity [40]. The Linear Model (or Pipeline Model), championed by Vannevar Bush [41], views innovation as a supply-side process driven by fundamental scientific research, which then pushes practical applications. The Induced Model reverses this direction, suggesting that external economic and policy demands pull research toward specific applications. However, both models assume a linear progression that oversimplifies the innovation process. The Connected Model, in contrast, adopts a non-linear, systems approach where innovation is shaped by the interplay between organizations and institutions that link supply and demand forces [42]. This model better captures the dynamic and iterative nature of innovation by reflecting that innovation is not linear: it involves feedback loops, iteration, and institutional interaction. However, the Connected Model also reveals the complexities and uncertainties in aligning innovation policies with actual innovation outcomes. In this sense, innovation is understood as a complex, interactive learning process that is impacted by and impacts policy [43]. To achieve significant breakthroughs, it has emerged that policy must enhance transformative innovation [28]. In this context, “[i]nnovation policy is public actions that influence innovation processes: that is, the development and diffusion of (product and process) innovations” [43].

Innovation policy can be embedded in industrial policies, namely, “those government policies that explicitly target the transformation of the structure of economic activity in pursuit of some public goal”, such as “to stimulate innovation, productivity, and economic growth”, or climate transition and good jobs [44]. Consequently, industrial policy is key for economic transformation [45] and can overlap with innovation policies [46]. Industrial policy aims to achieve structural change, and is by nature controversial, as public authorities do exercise choice and discretion [44]. Coordinating industrial and innovation policy, however, is particularly challenging. Europe is still lacking a coherent innovation framework that operationalizes cross-border industrial policies. Notably, EU-level instruments remain poorly coordinated with national incentives, leading to weak links between reported climate spending and actual outcomes, warranting novel policy models that are systemic and anticipatory (see infra 3.2) [47].

3.2. Systemic and Anticipatory Policymaking: The RRR Policy Framework

3.2.1. Systemic and Anticipatory Policymaking

Anticipatory innovation governance is a key, and still fairly unexplored concept, in the field of innovation studies. Anticipatory innovation governance has been put forward by the OECD Observatory of Public Sector Innovation (OPSI) as “a broad-based capacity to actively explore options as part of broader anticipatory governance, with a particular aim of spurring on innovations (novel to the context, implemented and value shifting products, services and processes) connected to uncertain futures in the hopes of shaping the former through the innovative practice” [48]. Because technology tends to develop faster than policy, over the last 15 years, policymakers have been increasingly interested in “futures thinking” and “foresight methods” [49], as well as the anticipatory governance of emerging technologies [50] and responsible research and innovation [51]. Meanwhile, critique has mounted on simple “futures talk” and the ability to effectively “future-proof” [52].

Anticipatory innovation governance provides a framework for addressing complex, uncertain challenges by embedding foresight and futures thinking into policy design, execution, and evaluation. Recent scholarship highlights the increasing role of anticipatory governance within the EU policymaking sphere, particularly in response to rapid technological advancements [53]. These studies emphasize the necessity of proactive rather than reactive governance approaches, advocating for policies that not only adapt to emerging challenges but also shape future trajectories through strategic interventions.

The concept of anticipatory policy effectiveness enhances this approach by ensuring that anticipation is central to policy processes. By aligning innovation with long-term policy goals, anticipatory governance can create conditions for both technological breakthroughs and societal resilience.

Combining effectiveness and anticipatory policy, anticipatory policy effectiveness displays anticipation as “central to how a policy is designed, executed and assessed” and measures it along three dimensions—analytical, political and operational, which are particularly important in tackling such a complex and multifaceted problem as climate change [54].

A key aspect of anticipatory governance is its ability to foster value innovation—introducing novel, high-impact solutions that challenge existing paradigms while generating substantial societal and economic benefits. It is key to move beyond traditional cost-based innovation metrics toward more holistic approaches that consider long-term sustainability and societal well-being [55]. Anticipatory governance enables policymakers to identify and support these innovations by incorporating early-stage insights into legislative frameworks, for instance, through expert surveys, ensuring that regulatory environments facilitate rather than hinder transformative change.

However, critiques of “futures talk” highlight the limitations of merely projecting possible scenarios without ensuring concrete mechanisms for implementation [56]. Effective anticipatory governance must balance exploratory foresight with actionable strategies that integrate stakeholder engagement and policy adaptability within a systemic perspective of multiple interactions and timeframes.

Policymaking should thus be not only anticipatory but also systemic. Within the renewable energy sector, anticipatory governance is increasingly recognized as essential for bridging innovation and policy effectiveness. The current literature points to the need for more holistic approaches that incorporate both supply-side and demand-side measures [57]. For instance, while supply-side policies such as subsidies and R&D investments have driven technological advancements in renewable energy, they must be complemented by robust demand-side policies that ensure market adoption and long-term viability.

The integration of demand-side policies, such as dynamic pricing, consumer incentives, and regulatory targets, plays a crucial role in aligning renewable energy innovation with broader sustainability goals [58]. Anticipatory governance provides a pathway to achieve this alignment by proactively assessing potential market barriers, stakeholder needs, and policy levers that can drive the widespread adoption of clean energy technologies. Anticipatory innovation governance must thus be operationalized through structured policy mechanisms. This requires a commitment to long-term strategic foresight, cross-sectoral collaboration, and adaptive regulatory frameworks that can respond to emerging technological and societal shifts.

3.2.2. The Risk–Reward–Resilience (RRR) Policy Framework

One way of embedding anticipatory principles into innovation policymaking is the Risk–Reward–Resilience Framework (RRR), which was forged by Anthea Roberts in the field of international economic law [15]. The aim of the present paper is to operationalize the framework for embedding the fifth freedom in clean energy innovation policy (see infra in this section and Section 4). While other initiatives, such as the robust enforcement of intellectual property rights and enhanced coordination among EU Member States, are essential [59], my proposal does not aim to replace these efforts. Rather, it seeks to embed them within a systemic and anticipatory innovation policy. The RRR framework offers a strategic compass to guide this integration.

In an increasingly complex world, in fact, it is essential to account for the dynamic interactions of three key dimensions—risk, reward, and resilience—each shaped by distinct drivers. While risk arises from the interplay of hazards or threats, exposure, and vulnerability, reward emerges from the convergence of opportunity, access, and capability. Resilience, in turn, is determined by an entity’s absorptive, adaptive, and transformative capacities. Amid uncertainties, growth strategically depends on how such different drivers of risk, reward, and resilience can best interact, including to boost innovation.

One of the most underlooked legacies in EU policy is the fundamental shift from shareholders’ to stakeholders’ primacy through a rift of sustainability legislation, both ex ante and ex post. Such a regulatory signal has revived the idea of the purpose, rather than only the mission, of businesses as growth engines. Through the ex ante impact forecasting and forward/future thinking, businesses can “produce profitable solutions to the problems of people and planet” rather than “profit from producing problems for people or planet” [60]. In this sense, innovation can be a tool through which the profit and purpose trade-off can be governed ex ante, solving additionality issues [61].

In the past, innovation thrived in an environment of abundant resources and minimal constraints, allowing for a focus on expansive exploration with tools that managed the balance between profit and purpose. However, the present scenario demands a shift toward lean innovation due to the scarcity of resources and the abundance of constraints. This change requires a more anticipatory and systemic approach where innovation must be efficient, sustainable, and effective in balancing profit with societal purpose. Central to this transformation is the deep purpose triad, which emphasizes intentionality—the purpose or impact must be defined upfront; measurability, as much as in financial matters; and additionality—making an extra effort to add impact over profit and thus being able to accept a disproportionate risk-adjusted return.

To operationalize this purpose-led perspective within the context of innovation policy, the RRR framework offers actionable knowledge. The necessity of the RRR framework can be shown through the shortcomings of the Green Deal legislative package, which fell short in coordinating reward mechanisms with risk and resilience considerations, partly due to the absence of standardized green accounting practices shared with Member States. As the European Court of Auditors noted, the contribution of the Recovery and Resilience Facility to the green transition remained “unclear” due to inconsistent methodologies on green accounting and limited guidance [62].

Within the RRR framework, innovation must adjust risk. This involves creating policy opportunities, including through subsidies, that are accessible and leveraging capabilities to deliver more than what naturally comes from profit, embracing additionality by accepting disproportionate risk-adjusted returns to generate a significant long-term impact that is clearly measurable. Reward within the RRR framework should center on fostering cooperation between EU countries to create joint investments that maximize the efficiency and impact of the energy transition. The reward structure should incentivize cross-border collaboration on projects with clearly quantifiable benefits, such as a shared renewable infrastructure, regional grid integration, or energy storage targets; this approach not only enhances economic efficiency but also strengthens the geopolitical resilience of the EU energy system. The reward for participants should be aligned with the broader benefits to EU-wide energy security, sustainable innovation, and equity, reinforcing the notion that collective action drives greater value.

Within the RRR framework, as applied to policy, resilience is determined by an entity’s absorptive, adaptive, and transformative capacities. For innovation to be sustainable, it must enhance the resilience of systems, communities, and businesses by improving their ability to absorb shocks, including preventive dependencies on commodities prone to price shocks, adaptation to changes, and transformation in response to new challenges through centralized and decentralized mechanisms. This resilience aspect ensures that innovation contributes to long-term sustainability, aligning with the needs for both green and just transitions.

Amid uncertainties, growth strategically depends on how these drivers of risk, reward, and resilience can best interact, including to boost innovation. By embedding the RRR framework, innovation policy can be directed toward creating a balance where profit and purpose are not in conflict but are synergistic, ensuring that in a world of few resources and many constraints, innovation contributes to a sustainable, equitable future [63].

4. Discussion

4.1. The Case of Clean Energy Innovation Through Storage

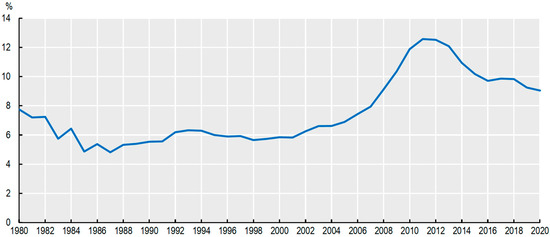

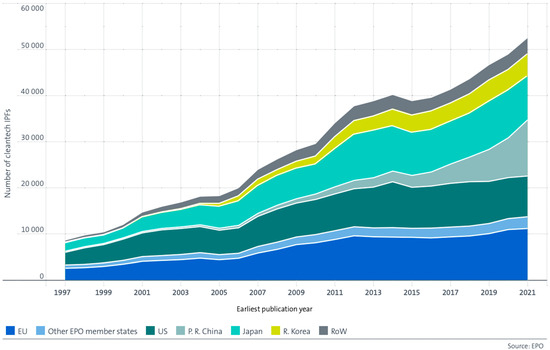

In lieu of a straightforward metric to gauge the success of low-carbon technologies, patent applications and approvals have emerged as a surrogate indicator for innovation activity. From the 1990s through the 2000s, significant advancements were made in the innovation and evolution of low-carbon energy technologies. However, since 2011, there has been a noticeable decline in the global patenting activity related to low-carbon innovation, with the share of climate-related inventions across all technological fields dropping from 12.6% of global filings in 2011 to just 9.0% by 2020, as shown in Figure 1 [64], with noticeable decline especially in Japan and the EU, as shown in Figure 2 [65].

Figure 1.

The decline in global patenting efforts. Reproduced with permission from [64].

Figure 2.

Trends in International Patent Families in clean and sustainable technologies, 1997–2021, where Japan and the EU led in the period up to 2011–2012 [65].

In surveys, smaller companies have been univocal in pointing to access to finance as the main barrier to the commercialization of clean and sustainable technologies in Europe [66], putting innovation at risk.

As the 1973 oil crisis sparked innovation, including in wind and solar tech, today’s energy transitions, geopolitics, and cost-of-living crises require strengthening the link between clean energy and innovation, with better innovation policy supporting renewable energy sources. Such a link entails a focus on the resilience and flexibility provided by, inter alia, renewable energy storage, which notably responds to the need for wind and solar energy to be either stored or backed up to handle changes in demand as well as in solar and wind output, toward a fair, green, and digital transition.

Lying at the interface between security of supply and grid resilience, renewable energy storage is key to decarbonization [67], grid modernization [68], and democratization [69]. Recent legislative and soft law developments include the European Commission’s 2023 recommendations on energy storage, which aim to accelerate deployment through capacity assessments, regulatory barrier removal, and support for long-term storage innovation [70]. Additionally, the 2023 Electricity Market Design (EMD) reform introduces “flexibility” as a key concept, requiring Member States to regularly evaluate their flexibility needs, thereby institutionalizing the role of storage [71]. Practical examples such as Estonia’s pilot renewable storage program, backed by EUR 9.6 million from the Recovery and Resilience Facility and supporting over 10 MW in new capacity, provide concrete illustrations of national efforts aligned with EU policy [72]. Moreover, patent data signal growing momentum through the role of Artificial Intelligence (AI). A joint report from the European Patent Office (EPO) and the International Energy Agency (IEA) shows a sixfold increase in patents integrating AI into grid technologies, with battery storage emerging as a focal point of innovation [73]. Together, these insights not only strengthen the case for enhanced storage policy but also highlight the fragmented nature of current efforts, justifying the need for a coordinated RRR framework at EU level.

Most notably, EU legislation lacks mandatory targets for energy storage and has been remarkably slow in acknowledging the ESS’s role in achieving the EU’s climate and sustainability goals, as identified through a synergetic reading of the most storage-relevant Sustainable Development Goals (SDGs). At the same time, existing financial flows to renewable storage are not monitored nor prospected [74], revealing a blind spot in EU regulations that the EU has only recently started to tackle.

Overall, storage legislation seems inadequate to fulfil the EU’s expected need for more than 200 GW of energy storage capacity by 2030, up from roughly 60 GW in 2022 [75]. A huge opportunity is offered by the recently approved EU Net Zero Industry Act (NZIA) and the larger EU initiatives of revamping green industrial policy. However, the NZIA has already been dubbed a paper tiger [76].

By nature, energy storage technologies pose a regulatory challenge. The sheer diversity of these technologies complicates the design of market frameworks and pricing mechanisms that effectively encourage innovation across different solutions [77]. This challenge gives rise to three distinct categories of barriers: (a) those linked to financing, (b) those associated with electricity market design, and (c) those concerning net-zero industrial innovation.

In fact, storage faces several technical hurdles. First, the rapid expansion of renewable energy sources, such as wind and solar, has outpaced the development of the grid infrastructure, leading to significant curtailments because the storage infrastructure is inadequate. For instance, in 2024, nearly 10% of Britain’s wind energy and 30% of Northern Ireland’s were curtailed due to inadequate infrastructure to transport or store excess electricity when the demand is low. This mismatch results in wasted electricity and increased costs for consumers [78].

Second, grid operators must update grid codes, interconnection procedures, and dispatch protocols to accommodate storage assets; however, outdated and not sufficiently coordinated regulations hinder the deployment of grid-level innovative storage solutions [79].

Third, the EU faces significant challenges in securing critical raw materials essential for battery energy storage systems. Demand for materials such as lithium, cobalt, and nickel is projected to exceed the supply from existing and newly announced mines [80]. Recent studies suggest that medium-scale storage solutions, such as liquid organic hydrogen carriers, show potential due to their high storage capacity and stability, while large-scale options such as salt caverns are deployable only in certain areas, but financing challenges still loom large [81].

The storage policy gap is particularly relevant given recent evidence showing that achieving net-zero goals requires an integrated approach to technology, finance, and governance, particularly in sectors such as hydrogen production and carbon utilization [82].

Accordingly, we identify a gap in policy and regulatory tools supporting architectural innovation for storing renewable energy, which is extremely complex, but still one of the least expensive and most sustainable cost power solution in the future [83]. Experts show that storage technology may transition the European power system toward a cost-optimal, 100% renewable energy system, in accord with the Paris Agreement and the SDGs. The energy transition will not happen through centralized grids, which are not bound to occur. Conversely, it was highlighted that a 100% renewable energy in Europe should be coupled also with decentralized prosumers (individuals who both consume and produce renewable energy), deploying their own storage technologies, with lower energy costs and increased flexibility [84]. Although storage technologies and prosumers will be essential to attain a renewable energy supply [84], these are not sufficiently considered from the perspective of policy [84], and not at all from the viewpoint of architectural innovations for Europe. This riddle makes storage the unsung hero of decarbonization.

4.2. The RRR Framework Applied to EU’s Cleantech Innovation

Embedding the fifth freedom in renewable energy legislation, as this article aims to show, seeks to position research and innovation at the core of the internal market, ensuring that knowledge flows freely across disciplines, borders, and sectors to drive economic growth, societal progress, and technological leadership. However, this vision must address three critical barriers: competition mismatch, unreliable financing speed, and fragmented policy coordination (supra 1). Embedding the Risk–Resilience–Reward (RRR) Framework within policy proposals such as those put forward in the Letta Report (e.g., on the establishment of the Clean Energy Delivery Agency and the Clean Energy Deployment Fund) [85] would strengthen the EU’s ability to tackle these structural weaknesses and foster innovation-driven industrial transformation.

The Clean Energy Delivery Agency is envisioned as a dedicated body to coordinate and accelerate the deployment of clean energy projects across the EU. Its primary functions include centralized coordination to ensure alignment with EU objectives; technical assistance to provide Member States with support for project development and execution; streamlining processes, notably permitting and grid access; and stakeholder engagement, including by involving national authorities. Briefly, this agency aims to address the current fragmentation in energy project implementation and to ensure a cohesive approach towards the EU’s net-zero targets [85].

As a complementary institution to the Agency, the Clean Energy Deployment Fund would be a financial mechanism to de-risk investments, notably by offering itself guarantees or co-financing tools to crowd in private investment. Its role hinges also on supporting research and development in emerging cleantech to maintain the EU’s competitiveness Furthermore, it would also ensure fairness by allocating resources to projects in regions that might otherwise struggle to secure funding, promoting balanced development across Member States. In summary, by mobilizing both public and private capital, the fund would bridge the investment gap in the clean energy sector [85].

Operationalizing the RRR framework may help put it into action and reveal further innovation implications for these two institutions in at least three ways. First, in terms of geopolitical risk and strategic dependencies, the Clean Energy Delivery Agency could serve as a central hub to bridge the EU’s industrial policy gap. Unlike the US, China, and Japan—where state-backed enterprises benefit from direct subsidies and protectionist policies—the EU has weak institutional levers to support its strategic industries. By aligning regulatory bodies, research consortia, and financial mechanisms, the agency would create a structured innovation-to-market pathway that ensures fair competition while avoiding internal market distortions, including through the use of state aid for cleantech policy. Additionally, linking clean energy with digital innovations, notably through investments in Artificial Intelligence (AI), as well as EU industrial strategies would incentivize cross-border industrial coordination, preventing Member States from acting in isolation.

The Clean Energy Deployment Fund should be explicitly structured to ensure reliable speed in investments and address the EU’s slow and fragmented financing mechanisms. Despite a considerable EU budget, funds remain dispersed across Member States, limiting economies of scale and delaying first-mover innovation. A more centralized, risk-calibrated funding model—guided by the RRR framework—would streamline access to capital for clean energy startups and innovative storage solutions developed in Europe, entailing pooling resources for large-scale, cross-border AI–energy collaborations.

Second, in terms of reward, the EU’s policy landscape is fragmented, often mixing local fiscal incentives for production with trade measures that fail to shield the internal market from foreign-subsidized competitors. The fifth freedom, embedded within the Clean Energy Deployment Fund, would establish a coherent policy mechanism embedding reward-based incentives that prioritize EU-originating clean energy, in particular storage, thus preventing market cannibalization by non-EU subsidized firms and ensuring that European innovation translates into long-term industrial competitiveness.

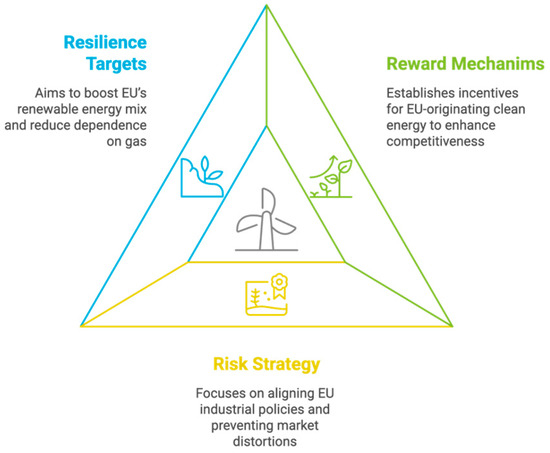

Third, in terms of resilience, only an EU-wide renewable energy storage target and strategy, alike the EU renewable energy targets and strategies set forth within Fit for 55 package [86], can boost Europe’s resilience of its own renewable energy mix and lessen strategic dependence on gas, including from Allies, which offer powerful institutional incentives for Member States to coordinate their industrial policies. This operationalization of the RRR framework is shown in Figure 3 below.

Figure 3.

The RRR Framework applied to the EU’s cleantech innovation, particularly renewable energy storage (Author ©).

A clear roadmap for institutional design and enforcement mechanisms—developed by the European Commission in consultation with Member States—should be prepared in time for integration into the mid-term revision of the Multiannual Financial Framework (MFF 2028–2034). To ensure its effectiveness, a roadmap for funding allocation and investment oversight—coordinated by the European Commission, in particular DG ENER and DG CLIMA, with the European Investment Bank (EIB)—should also be proposed ahead of the next MFF cycle to ensure dedicated, risk-calibrated financing for strategic clean energy projects.

This operationalization of the Clean Energy Delivery Agency and the Clean Energy Deployment Fund through the RRR framework showcases regulatory recommendations to harmonize disparate financing and regulatory pathways at the EU level, reducing barriers to cleantech deployment, including in energy storage. The Risk–Resilience–Reward framework, combined with the fifth freedom, offers a comprehensive response to the EU’s structural challenges in industrial policy, financing speed, and policy coordination.

5. Recommendations and Conclusions

The internal market was founded on the four freedoms—the free movement of people, goods, services, and capital—which is deeply rooted in 20th-century economic theory. However, this categorization struggles to reflect the evolving dynamics of a market increasingly shaped by digitalization, innovation, and the uncertainties of climate change [85]. The distinction between goods and services has become increasingly blurred, as services are often embedded within goods. Moreover, this framework fails to account for the intangible nature of the digital economy or the opportunities and risks emerging from the shift toward a circular economy. Additionally, the four freedoms no longer adequately capture the transition from an economy based on ownership to one centered on shared resources. Toward the end of his tenure, even the founding father of the internal market, Jacques Delors, acknowledged the need to explore a new dimension for the internal market, one that better aligns with these contemporary challenges and opportunities.

This article has argued that integrating innovation as a fifth freedom, alongside the Risk–Resilience–Reward (RRR) framework, provides a systematic and forward-looking strategy to navigate these structural barriers. At its core, the RRR framework offers a toolkit for EU policymakers to approach the energy transition anticipatorily and systematically, rather than reactively. Applied to renewable energy storage, it highlights why storage must no longer be treated as an afterthought, void of an EU-wide target and strategy, but rather as a foundational pillar of decarbonization.

By making innovation a named policy freedom, the EU would signal that it is not only protecting market transactions but also actively tackling the structural conditions for industrial transformation. This is particularly urgent in the context of geopolitical competition over clean technologies, where the US, China, and others deploy integrated state-led strategies combining capital, IP policy, and strategic procurement, elements that are currently disjointed in the EU’s internal market.

To translate the fifth freedom and RRR framework into effective policy tools, EU institutions and Member States should consider the following steps:

- Codify Innovation as a Policy Freedom in Primary Law

The European Commission and Council should explore incorporating innovation as a legally recognized “fifth freedom” through treaty amendment. This move would elevate innovation to the same level as the four traditional freedoms, signaling a shift toward a future-oriented, knowledge-based economy and enabling better coordination between industrial, digital, and climate policies.

- 2.

- Establish a Legislative Mandate for the Clean Energy Delivery Agency with RRR Framework

The European Commission should propose a dedicated regulation to formally establish the Clean Energy Delivery Agency with a clear legislative mandate grounded in the Risk–Resilience–Reward (RRR) framework. This would ensure that the Agency does not merely coordinate clean energy deployment but actively contributes to industrial transformation by (i) mitigating geopolitical risk through centralized coordination, permitting streamlining, and support for strategic supply chains; (ii) enhancing systemic resilience by facilitating cross-border storage and grid projects that bolster the EU’s energy autonomy and reduce the risks of blackouts and power shortages; and (iii) aligning incentives to maximize economic and societal value, including supporting high-impact innovations and ensuring a fair distribution of projects across Member States. Embedding the RRR framework in the Agency’s founding legislation would equip it to serve not only as a technical body but as a strategic industrial enabler, thus bridging innovation, regulation, and market deployment in line with the fifth freedom. A centralized EU agency is also critical to overcome bottlenecks in project deployment and support Member States in executing the upcoming Clean Industrial Deal.

- 3.

- Operationalize the Clean Energy Deployment Fund with RRR Criteria

The Clean Energy Deployment Fund should be embedded within an existing financial institution, notably the European Investment Bank (EIB), through a dedicated regulation with a Risk–Resilience–Reward (RRR) investment mandate. This means (i) prioritizing strategic autonomy through cleantech-ready risk management tools and by supporting projects that reduce dependency on foreign cleantech supply chains; (ii) funding energy storage capacity and AI-enabled grid technologies to balance intermittent renewables to increase resilience; and (iii) structuring investment incentives to support market entrants and EU-based cleantech innovators, especially in underserved regions, not only through the large tickets currently deployed by the EIB.

- 4.

- Launch a European Strategy for Energy Storage with Binding Targets

In line with Fit for 55 and the Hydrogen Strategy, the Commission should propose a directive or delegated act setting EU-wide targets for renewable energy storage capacity. Energy storage must be treated as critical infrastructure—no less essential than renewable generation itself.

- 5.

- Create a European Innovation Sandbox for Cleantech

To accelerate deployment, the EU should launch an “innovation sandbox” framework for cleantech and digital energy solutions, allowing regulatory experimentation with technologies such as AI-enabled grid optimization, advanced materials, and second-life batteries. This would mirror initiatives in the digital single market and financial regulation, offering temporary regulatory flexibility to test solutions at scale.

- 6.

- Integrate the Fifth Freedom in the European Semester and Recovery Plans

National governments should be encouraged to embed innovation and the RRR framework in their structural reforms under the European Semester, namely, the EU’s annual cycle of economic and fiscal policy coordination, and within investment strategies financed by the Recovery and Resilience Facility. This would enable alignment between EU-level innovation priorities and national funding programs.

- 7.

- Strengthen Procurement and IP Policies in Cleantech

The EU should develop a strategic procurement framework prioritizing EU-origin clean technologies in public tenders, especially where state-backed foreign competition distorts the market. At the same time, a stronger EU-level IP policy is needed to protect and commercialize innovations arising from EU-funded R&D.

Conclusively, to maintain global competitiveness and meet climate goals, the EU must move beyond reactive policy measures and adopt a proactive, innovation-driven approach. The RRR framework, transforming regulation from an innovation hamper to an enabler of industrial opportunities, in particular elevates renewable storage as the backbone of the EU’s clean energy transition. It is key to note that the concept of innovation as the ‘fifth freedom’—as proposed in the Letta Report—has emerged in general EU discussions only last year [87]. To date, most responses to such proposal have remained largely descriptive and exploratory [88], with limited translation into formalized policy models, underscoring this article’s contribution to an early-stage yet critical area of EU policy development [89].

Funding

This project has received funding from the European Union’s Horizon 2020 research and innovation program under the Marie Sklodowska-Curie grant agreement No. 101028505.

Acknowledgments

In this section, I acknowledge rich conversations entertained on this article within one of EIEE’s monthly meetings and the inspirations gleaned during the Macroeconomics class held by Anna Paola Florio (FT MBA 2024/2025, GSOM, Polytechnic University of Milan).

Conflicts of Interest

The author declares no conflicts of interest.

Abbreviations

The following abbreviation is used in this manuscript:

| NZIA | Net-Zero Industry Act |

References

- Hancock, A. Brussels Under Pressure to Curb Green Agenda in Response to Trump. Financial Times, 26 January 2025. Available online: https://www.ft.com/content/da348979-0261-4468-ba93-d6164fb1865b (accessed on 27 January 2025).

- Pigott, M. Deregulation Nation: Industries Poised for Change Under Trump. IBIS World, 16 January 2025. Available online: https://www.ibisworld.com/blog/trump-deregulation/ (accessed on 27 January 2025).

- Available online: https://www.economist.com/leaders/2025/01/30/milei-modi-trump-an-anti-red-tape-revolution-is-under-way?utm_campaign=a.the-economist-this-week&utm_medium=email.internal-newsletter.np&utm_source=salesforce-marketing-cloud&utm_term=1%2F30%2F2025&utm_id=2058733 (accessed on 27 January 2025).

- El-Erian, M. The Federal Reserve’s Insurance Policy. Financial Times, 30 September 2024. Available online: https://www.ft.com/content/10378b46-b6b0-43b8-9323-820c0cc13445 (accessed on 27 January 2025).

- Franz, J. Benjamin Button’s Clues for the US Economy. The Financial Times, 30 October 2024. Available online: https://www.ft.com/content/4550e8d2-a135-4c6c-b127-2f4d4d8e6263 (accessed on 27 January 2025).

- Draghi, M. The Future of European Competitiveness. Part A—A Competitiveness Strategy for Europe; European Commission: Brussels, Belgium, 2024; pp. 8+33. Available online: https://commission.europa.eu/document/download/97e481fd-2dc3-412d-be4c-f152a8232961_en?filename=The%20future%20of%20European%20competitiveness%20_%20A%20competitiveness%20strategy%20for%20Europe.pdf (accessed on 27 January 2025).

- Vecellio Segate, R. Securitizing Innovation to Protect Trade Secrets Between “the East” and “the West”: A Neo-Schumpeterian Public Legal Reading. UCLA Pac. Basin Law J. 2020, 37, 121. [Google Scholar] [CrossRef]

- Longhin, D. Urso: L’Europa Difenda L’Industria. Sul Green Deal Servono Modifiche Realistiche. La Repubblica, 27 January 2025. Available online: https://www.repubblica.it/economia/2025/01/27/news/trump_dazi_adolfo_urso_intervista-423963370/?ref=RHLM-BG-P7-S1-T1 (accessed on 27 January 2025).

- Hettne, J. European Industrial Policy and State Aid—A Competence Mismatch? Svenska Institutet för Europapolitiska Studier: Stockholm, Sweden, 2020; pp. 1–3. Available online: https://lucris.lub.lu.se/ws/portalfiles/portal/75749823/European_industrial_policy_Sieps2020_1epa.pdf (accessed on 27 January 2025).

- Bown, C.P. Trade Policy, Industrial Policy, and the Economic Security of the European Union (Jan 29, 2024) Peterson Institute for International Economics Working Paper 24-2. Available online: https://ssrn.com/abstract=4834530 (accessed on 27 January 2025).

- Neuhoff, K.; Richstein, J.C.; Kröger, M. Reacting to changing paradigms: How and why to reform electricity markets. Energy Policy 2023, 180, 113691. [Google Scholar] [CrossRef]

- Hoffmann, T.S. Legal Recommendations Amidst Political Realities: Reconciling the Foreign Subsidies Regulation with State Aid Law and WTO Frameworks. Eur. Foreign Aff. Rev. 2024, 29, 493. [Google Scholar] [CrossRef]

- Blondeel, M.; Bradshaw, M.J.; Bridge, G.; Kuzemko, C. The geopolitics of energy system transformation: A review. Geogr. Compass 2021, 15, e12580. [Google Scholar] [CrossRef]

- Hutchinson, T.; Duncan, N. Defining and Describing What We Do: Doctrinal Legal Research. Deakin Law Rev. 2012, 17, 83–119. [Google Scholar] [CrossRef]

- Roberts, A. Risk, Reward, and Resilience Framework: Integrative Policy Making in a Complex World. J. Int. Econ. Law 2023, 26, 233–265. [Google Scholar] [CrossRef]

- Guston, D.H. Understanding ‘anticipatory governance’. Soc. Stud. Sci. 2013, 44, 218. [Google Scholar] [CrossRef] [PubMed]

- Mazzucato, M. Mission-Oriented Innovation Policy: Challenges and Opportunities; UCL Institute for Innovation and Public Purpose: London, UK, 2018. [Google Scholar]

- Teubner, G.; Bremen, F. After legal instrumentalism. In Dilemmas of Law in the Welfare State; Teubner, G., Ed.; De Gruyter: Berlin, Germany, 1988; p. 299. [Google Scholar]

- Frankenberg, G. Critical Comparisons: Re-Thinking Comparative Law; Routledge: London, UK, 2010. [Google Scholar]

- Bridson, B. Beyond the Four Freedoms: Europe and the Innovation Gap; UncoverIE: Madrid, Spain, 2025. [Google Scholar]

- Schumpeter, J.A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Harvard University Press: Cambridge, MA, USA, 1934. [Google Scholar]

- Carayannis, E.G.; Ziemnowicz, C. Rediscovering Schumpeter: Creative Destruction Evolving into “Mode 3”; Springer: Berlin/Heidelberg, Germany, 2007. [Google Scholar]

- Hanusch, H.; Pyka, A. ‘Schumpeter, Joseph Alois’ (1883–1950) in id. In Elgar Companion to Neo-Schumpeterian Economics; Edward Elgar Publishing: Cheltenham, UK, 2007; p. 22. [Google Scholar]

- Schumpeter, J.A. Capitalism, Socialism and Democracy; Harper and Roe Publishers: New York, NY, USA, 1942; p. 66. [Google Scholar]

- Henderson, R. Innovation in the 21st Century: Architectural Change, Purpose, and the Challenges of Our Time. Manag. Sci. 2021, 67, 5479–5488; discussion 5480–5481. [Google Scholar] [CrossRef]

- Henderson, R.; Clark, K. Architectural innovation: The reconfiguration of existing product technologies and the failure of established firms. Admin. Sci. Quart. 1990, 35, 9. [Google Scholar] [CrossRef]

- Brusoni, S.; Jacobides, M.; Prencipe, A. Strategic dynamics in industry architectures and the challenges of knowledge integration. Eur. Manag. Rev. 2009, 6, 209. [Google Scholar] [CrossRef]

- Sen, A. Totally radical: From transformative research to transformative innovation. Sci. Public Policy 2014, 41, 344, About three types of innovation, see pp. 345+347. [Google Scholar] [CrossRef]

- Abernathy, W.J.; Utterback, J.M. Patterns of industrial innovation. Technol. Rev. 1978, 80, 40. [Google Scholar]

- Porter, M. Competitive Advantage; Free Press: Los Angeles, CA, USA, 1985. [Google Scholar]

- Christensen, C. The Innovator’s Dilemma: The Revolutionary Book That Will Change the Way You Do Business; Harper Collins: New York, NY, USA, 2003. [Google Scholar]

- Taleb, N. The Black Swan: The Impact of the Highly Improbable; Random House: New York, NY, USA, 2007. [Google Scholar]

- Chesbrough, H. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business School Press: Cambridge, MA, USA, 2003. [Google Scholar]

- Bigliardi, B.; Filippelli, S. Sustainability and Open Innovation: Main Themes and Research Trajectories. Sustainability 2022, 14, 1. [Google Scholar] [CrossRef]

- Rupo, D.; Perano, M.; Centorrino, G.; Sanchez, A.V. A framework based on sustainability, open innovation, and value cocreation paradigms: A case in an Italian maritime cluster. Sustainability 2018, 10, 729. [Google Scholar] [CrossRef]

- See also Adams, R.; Jeanrenaud, S.; Bessant, J.; Denyer, D.; Overy, P. Sustainability-oriented Innovation: A Systematic Review. Int. J. Manag. Rev. 2016, 18, 180. [Google Scholar] [CrossRef]

- Payán-Sánchez, B.; Belmonte-Ureña, L.J.; Plaza-Úbeda, J.A.; Vazquez-Brust, D.; Yakovleva, N.; Pérez-Valls, M. Open Innovation for Sustainability or Not: Literature Reviews of Global Research Trends. Sustainability 2021, 13, 1136. [Google Scholar] [CrossRef]

- Wicki, S.; Hansen, E.G. Clean energy storage technology in the making: An innovation systems perspective on flywheel energy storage. J. Clean. Prod. 2017, 162, 1118. [Google Scholar] [CrossRef]

- Lipnik, A.; Lipnik, M.C. Sustainable Innovation: Definitions, Priorities and Emerging Issues. In Governance and Management of Sustainable Innovation. Learning from Experience to Shape the Future; Springer International Publishing: Cham, Switzerland, 2020. [Google Scholar]

- Weiss, C.; Bonvillian, W. Structuring an Energy Technology Revolution; MIT Press: Cambridge, MA, USA, 2009. [Google Scholar]

- Bush, V. Science, The Endless Frontier, A Report to the President by Vannevar Bush, Director of the Office of Scientific Research and Development. July 1945 (United States Government Printing Office, Washington, 1945). Available online: https://www.nsf.gov/about/history/vbush1945.htm (accessed on 27 January 2025).

- Bonvillian, W.B. Power Play: The DARPA Model and US Energy Policy. (2006) American Interest, November/December: 39. Available online: https://courses.cs.washington.edu/courses/csep590a/06au/readings/bonvillian.pdf (accessed on 27 January 2025).

- Chaminade, C.; Edquist, C. From Theory to Practice: The Use of the Systems of Innovation Approach in Innovation Policy. In Innovation, Science, and Institutional Change; Hage, J., Meeus, M., Eds.; OUP: Oxford, UK, 2006; pp. 142–143. [Google Scholar]

- Juhász, R.; Lane, N.J.; Rodrik, D. New Economics of Industrial Policy. Annu. Rev. Econ. 2023, 16, 213–242. [Google Scholar] [CrossRef]

- List, F. The National System of Political Economy; J.B. Lippincott & Company: Philadelphia, PA, USA, 1856. [Google Scholar]

- Mazzucato, M. The Entrepreneurial State: Debunking Public vs. Private Sector Myths; Anthem Press: London, UK, 2014. [Google Scholar]

- Borowiecki, M.; Giménez, J.C.; Giovannelli, F.; Vanni, F. Accelerating the EU’s Green Transition; Working Papers No. 1777; OECD Economics Department: Paris, France, 2023; p. 25. [Google Scholar]

- Tõnurist, P.; Hanson, A. Strategic Foresight for Better Policies Building Effective Governance in the Face of Uncertain Futures; OECD: Paris, France, 2019; p. 33. [Google Scholar]

- Minkkinen, M. The anatomy of plausible futures in policy processes: Comparing the cases of data protection and comprehensive security. Technol. Forecast. Soc. Chang. 2019, 143, 172–180. [Google Scholar] [CrossRef]

- Barben, D.; Fisher, E.; Selin, C.; Guston, D.H. Anticipatory Governance of Nanotechnology: Foresight, Engagement, and Integration. In The Handbook of Science and Technology Studies; Hackett, E.J., Amsterdamska, O., Lynch, M., Wajcman, J., Eds.; MIT Press: Cambridge, MA, USA, 2008; p. 979. [Google Scholar]

- Sutcliffe, H. A Report on Responsible Research and Innovation. 2011. Available online: http://ec.europa.eu/research/science-society/document_library/pdf_06/rri-report-hilary-sutcliffe_en (accessed on 27 January 2025).

- Nordmann, A. A forensics of wishing: Technology assessment in the age of technoscience. Poiesis Prax. 2010, 7, 5. [Google Scholar] [CrossRef]

- Borras, S.; Seabrooke, L. The role of anticipatory governance in EU policymaking. J. Eur. Public Policy 2023, 31, 2371. [Google Scholar]

- Singh Bali, A.; Capano, G.; Ramesh, M. Anticipating and Designing for Policy Effectiveness. Policy Soc. 2019, 38, 1. [Google Scholar] [CrossRef]

- Stilgoe, J.; Owen, R.; Macnaghten, P. Developing a framework for responsible innovation. Res. Policy 2013, 42, 1568–1680; discussion 1570. [Google Scholar] [CrossRef]

- Seidl, T.; Schmitz, L. Moving on to not fall behind? Technological sovereignty and the “geo-dirigiste” turn in EU industrial policy. J. Eur. Public Policy 2023, 31, 2147. [Google Scholar] [CrossRef]

- Stevens, K.A.; Tang, T.; Hittinger, E. Innovation in complementary energy technologies from renewable energy policies. Renew. Energy 2023, 209, 431. [Google Scholar] [CrossRef]

- Lazarus, M.; van Asselt, H. Fossil fuel supply and climate policy: Exploring the road less taken. Clim. Chang. 2018, 150, 1. [Google Scholar] [CrossRef]

- Borgogni, D. The Doctrine of Equivalents at the Unified Patent Court: A Comparative Analysis of the Main EPC Jurisdictions and a Shot at Harmonization. GRUR Int. 2025, 74, 331. [Google Scholar] [CrossRef]

- Mayer, C. It’s Time to Redefine the Purpose of Business. Here’s a Roadmap; World Economic Forum: Cologny, Switzerland, 2020; Available online: https://www.weforum.org/agenda/2020/01/its-time-for-a-radical-rethink-of-corporate-purpose/ (accessed on 27 January 2025).

- Serafeim, G. Purpose and Profit: How Business Can Lift Up the World; Harper Collins Leadership: London, UK, 2022; p. 135. [Google Scholar]

- European Court of Auditors. Green Transition: Unclear Contribution from the Recovery and Resilience Facility; Special Report; European Court of Auditors: Luxembourg, 2022; pp. 5–60. [Google Scholar]

- Vergote, S.; Egenhofer, C. Accelerating the Greening of EU Industry. In Delivering a Climate Neutral Europe; Delbeke, J., Ed.; Routledge: London, UK, 2024. [Google Scholar]

- Cervantes, M. Driving Low-Carbon Innovations for Climate Neutrality; STI Policy Papers No. 143; DSTI/CIIE/STP (2022)1/FINAL; OECD: Paris, France, 2023; p. 16. [Google Scholar]

- EPO—EIB. Financing and Commercialisation of Cleantech Innovation. 2024. Available online: https://www.eib.org/en/publications/20240003-commercialisation-of-clean-and-sustainable-technologies (accessed on 27 January 2025).

- European Investment Bank. Financing and Commercialisation of Cleantech Innovation; European Investment Bank: Luxembourg, 2024; p. 13. [Google Scholar]

- Jafari, M.; Botterud, A.; Sakti, A. Decarbonizing power systems: A critical review of the role of energy storage. Renew. Sustain. Energy Rev. 2022, 158, 1. [Google Scholar] [CrossRef]

- Sahoo, S.; Timmann, P. Energy Storage Technologies for Modern Power Systems: A Detailed Analysis of Functionalities, Potentials, and Impacts. IEEE Access 2023, 11, 49689. Available online: https://ieeexplore.ieee.org/document/10121760 (accessed on 27 January 2025). [CrossRef]

- Dorahaki, S.; Abdollahi, A.; Rashidinejad, M.; Moghbeli, M. The role of energy storage and demand response as energy democracy policies in the energy productivity of hybrid hub system considering social inconvenience cost. J. Energy Storage 2021, 33, 102022. [Google Scholar] [CrossRef]

- European Commission. Recommendations on Energy Storage. 2023. Available online: https://energy.ec.europa.eu/topics/research-and-technology/energy-storage/recommendations-energy-storage_en (accessed on 30 May 2025).

- See Directive (EU) 2024/1711 of the European Parliament and of the Council of 13 June 2024 Amending Directives (EU) 2018/2001 and (EU) 2019/944 as Regards Improving the Union’s Electricity Market Design (Text with EEA Relevance) PE/2/2024/REV/1 OJ L, 2024/1711, 26.6.2024. ELI. Available online: http://data.europa.eu/eli/dir/2024/1711/oj (accessed on 27 January 2025).

- European Commission. Pilot Energy Storage Programme—Estonia. Available online: https://commission.europa.eu/projects/pilot-energy-storage-programme_en (accessed on 30 May 2025).

- European Patent Office and International Energy Agency. Patents for Enhanced Electricity Grids. A Global Trend Analysis of Innovation in Physical and Smart Grids. 2024. Available online: https://iea.blob.core.windows.net/assets/a1d20b0d-fd3f-442f-8067-6e5ac6c93521/PatentsforEnhancedElectricityGrids.pdf (accessed on 30 May 2025).

- Velten, E.K.; Duwe, M.; Schöberlein, P.; Stüdeli, L.M.; Evans, N.; Felthöfer, C. Flagship Report: State of EU Progress to Climate Neutrality an Indicator-Based Assessment Across 13 Building Blocks for a Climate Neutral Future; European Climate Neutrality Observatory: Berlin, Germany, 2023; pp. 15–30. [Google Scholar]

- Tagliapietra, S.; Veugelers, R.; Zettelmeyer, J. Rebooting the European Union’s Net Zero Industry Act; Bruegel: Bruxelles, Belgium, 2023. [Google Scholar]

- Packroff, J. Europe’s Net-Zero Industry Law Will Do Little for Manufacturing Ambitions, Experts Say; Euroactiv: Bruxelles, Belgium, 2024. [Google Scholar]

- Castagneto Gissey, G.; Dodds, P.E.; Radcliffe, J. Market and regulatory barriers to electrical energy storage innovation. Renew. Sustain. Energy Rev. 2018, 82, 781–790. [Google Scholar] [CrossRef]

- Millard, R. Green energy gets switched off as power systems fail to keep up. Financial Times, 27 February 2025. [Google Scholar]

- Bryant, J. Regulatory Challenges and Opportunities for Energy Storage in the Decarbonization Agenda. European Future Energy Forum, 16 January 2025. [Google Scholar]

- Holman, J. Critical Raw Material Supply Gaps Threaten EU Clean Energy Goals: Report; S&P Global: New York, NY, USA, 2024. [Google Scholar]

- Mehr, A.S.; Phillips, A.D.; Brandon, M.P.; Pryce, M.T.; Carton, J.G. Recent challenges and development of technical and technoeconomic aspects for hydrogen storage, insights at different scales; A state of art review. Int. J. Hydrogen Energy 2024, 70, 786. [Google Scholar] [CrossRef]

- Zhang, Z.; Xu, C.; Cheng, G.; Von Lau, E. Towards carbon neutrality: A comprehensive study on the utilization and resource recovery of coal-based solid wastes. Int. J. Coal Sci. Technol. 2025, 12, 34. [Google Scholar] [CrossRef]

- Child, M.; Bogdanov, D.; Breyer, C. The role of storage technologies for the transition to a 100% renewable energy system in Europe. Energy Procedia 2018, 155, 44. [Google Scholar] [CrossRef]

- Child, M.; Kemfert, C.; Bogdanov, D.; Breyer, C. Flexible electricity generation, grid exchange and storage for the transition to a 100% renewable energy system in Europe. Renew. Energy 2019, 139, 80–101; discussion 80–81+95. [Google Scholar] [CrossRef]

- Letta, E. More than a Market; April 2024; pp. 7+67+69. Available online: https://www.consilium.europa.eu/media/ny3j24sm/much-more-than-a-market-report-by-enrico-letta.pdf (accessed on 27 January 2025).

- Available online: https://epthinktank.eu/2024/08/01/fit-for-55-package/#:~:text=The%20’fit%20for%2055’%20package,2030%2C%20compared%20with%201990%20levels (accessed on 27 January 2025).

- Sturm, T. The EU’s Fifth Freedom: Why and How to Develop the ‘Freedom of Knowledge. Eur. Rev. 2025, 33, 19. [Google Scholar] [CrossRef]

- Martins, B. Research, Innovation and Data: A Fifth Freedom in the EU Single Market? Bruegel: Bruxelles, Belgium, 2024. [Google Scholar]

- Parra, D.; Mauger, R. A new dawn for energy storage: An interdisciplinary legal and techno-economic analysis of the new EU legal framework. Energy Policy 2022, 171, 113262. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).