Abstract

This study aims to analyze the determinants that influence the consumers’ disposition to invest in microgrid technology in the United Arab Emirates (UAE). This research offers valuable insights for policymakers on investors’ motivations to develop strategies to foster microgrid technology adoption through end-user investments leading to a reduction in microgrid high capital cost. The study employed descriptive statistics, correlation, and regression analyses to analyze the responses of a sample of property owners to a quantitative survey. The study examines such variables as strategic alignment, profitability, digitization, renewable energy utilization, CO2 emission reduction, and disaster recovery readiness. The data collected reveal a moderate level of understanding and cost-awareness of microgrid technology among the respondents, with a mean of 2.46 out of 5. Notably, the data highlight the significant influence of strategic alignment with the UAE’s national energy goals on the respondents’ inclination to invest in microgrids, with a strong positive correlation of 0.942 at the 0.01 level (two-tailed). By comparison, profitability and disaster recovery have a comparatively weaker correlation. Furthermore, based on the data collected during this study, it has been determined that there is a strong value added by the microgrid initiatives considering the UAE’s strategic direction and the positive influence of reduced CO2. The regression models used were highly significant at F = 85.690. There is an acceptable level of multicollinearity with VIF values ranging from 1.087 to 2.155. UAE Strategy has low collinearity. UAE Strategy emerges as the only significant predictor of willingness to invest (p < 0.001) in the stepwise regression analysis. The analysis shows that villa and townhouse owners are willing to invest in community microgrid given that it is aligned with UAE strategy and leads to CO2 emissions reduction.

1. Introduction

Microgrid technology is a transformative change that offers a paradigm shift in how electricity is generated, distributed, and consumed. The microgrid has emerged as a strategic solution to counter the mounting challenges of climate change, energy security, and the increasing integration of renewable energy sources. It is proving to be a technology that is strongly capable of fostering sustainable and resilient energy ecosystems.

At its core, a microgrid is a localized energy system that can operate either in conjunction with or independently of the main power grid. This independence grants microgrids the ability to seamlessly integrate renewable energy sources, storage systems, and advanced control technologies. The significance of microgrid technology lies in its potential to address critical issues facing modern energy infrastructures.

For example, microgrids enhance energy resilience by providing a decentralized structure that can continue to function even during grid disturbances or outages [1]. They facilitate the integration of renewable energy sources on a localized scale and empower communities to manage and optimize their energy consumption more efficiently. Moreover, by incorporating advanced control systems, microgrids enable real-time monitoring, load balancing, and demand response, contributing to energy efficiency and cost savings [2].

The United Arab Emirates (UAE) has undergone a remarkable transformation as it strives for economic diversification. In recent years, it has also gone through a strategic shift, guided by the recognition of its need to balance economic growth with environmental sustainability. This has prompted a concerted effort to diversify the energy mix and foster innovation across the energy sector. As a result, the UAE envisions smart cities where cutting-edge technologies, such as microgrids, optimize energy use, reduce waste, and enhance overall sustainability.

Powered by an abundance of sunlight, the nation is actively pursuing projects to harness the potential of solar energy to meet the increasing demands of its population. Ambitious initiatives, such as the Mohammed bin Rashid Al Maktoum Solar Park, exemplify the country’s commitment to scaling up renewable capacity and reducing carbon emissions. This transformation extends beyond the production side to consumption patterns and energy efficiency.

This work addresses the transformative potential of microgrids, their alignment with the UAE’s sustainable strategy, and the unique context of the imperative to overcome challenges to their widespread adoption. This study will present an analysis of the results of a survey that was conducted among property owners in the Sheikh Zayed Housing Program (SZHP) about their willingness to invest in MG for the power supply for their villas. The SZHP provides interest-free housing in the form of affordable, yet high-quality villas for Emirati families. The strategic deployment of microgrids within SZHP housing complexes aligns with broader national goals, emphasizing the program’s commitment to innovative and sustainable solutions [3,4].

The rationale for focusing on property owners within this program is that it addresses a significant segment of the UAE’s housing landscape. This segment typically possesses a degree of financial autonomy and decision-making power that is crucial for the adoption of innovative technologies like microgrids. Additionally, this segment often has higher energy demands compared to other sections of the population.

1.1. Objectives and Contributions

The primary objective of this research is analyzing the key determinants influencing the willingness of property owners in the UAE to invest in MG technology.

The contributions of this work can be enumerated in the following points:

- Enhanced understanding of MG technology perception among consumers in the UAE

- Identification of key determinants for consumer’s willingness to invest in MG technology

- Insight into the impact of strategic alignment with the UAE’s strategic energy direction on consumer investment decisions

- Empirical data on consumer preferences and barriers regarding microgrid investment

- Guidance for policymakers and industry stakeholders

- Contribution to the literature on microgrids in the UAE

1.2. Research Significance

This research article points out several points explaining the significance of this study specifically and the field of microgrid in general. Here are some points:

- There is limited research on the importance and possible contribution of the microgrid technology to the UAE power industry, especially for the domestic consumer investing in microgrid infrastructure. Their degree of willingness to invest is not discussed in the literature.

- In the US, the microgrid is being treated as a strong possible upgrade to the main grid in terms of considering the new paradigm of the main grid, one consisting of multiple microgrids containing distributed energy generation rather than a conventional macro grid with centralized power generation. Understanding the willingness to invest among end users can help understand the practicality of such paradigm for the UAE, given the high cost of microgrid.

- This study is done on a group that is key to the future of the UAE as a country. Moreover, the study is done at a time of economic growth in the UAE in general, along with an announced commitment during COP28 toward net-zero emissions by 2050. The participants’ willingness to invest can reflect widely on the Emirati segment of the country’s population.

- Demonstrating quantitative findings on the influence of each captured variable can further inform policy decisions on considering microgrid as a part of the UAE’s vision when it comes to climate change and economy.

- This research can help in understanding the investment potential of microgrids, or lack thereof, and if there is a market for public–private partnerships.

2. Literature Review

The literature on microgrid technology provides a comprehensive understanding of the challenges that face, and the potential solutions provided by, this decentralized energy paradigm. To add, a review of the literature reveals that the global MG deployment has been driven by the growing need for resilient and sustainable energy solutions [5].

2.1. Global Microgrid Trends

Technological advancements have shaped global microgrid trends, with innovations in energy storage, advanced control systems, and renewable energy integration. This is linked to increased efficiency and viability as well as grid stability [6,7]. Furthermore, MGs facilitate higher penetration of renewable energy sources, which offer a solution for remote or off-grid locations. This is beneficial to address energy access challenges on a global scale.

Microgrids are characterized by their decentralized structure and their ability to operate independently or in conjunction with the main grid, and are used to enhance energy security [8]. Consequently. the adoption of MGs typically includes their use in residential, commercial, and industrial settings where the emphasis is on ensuring reliable power supply [9]. Moreover, ref. [2] has mentioned the transformative potential of microgrids, their alignment with sustainable strategy, and their unique context to promote the imperative of overcoming challenges to their widespread adoption. The focus was on the alignment of microgrids with overarching social, economic, and environmental objectives. Ref. [10] have advocated for the transition from centralized grids to interconnected microgrids, promoting energy self-sufficiency and community resilience. The methodologies they used comprised qualitative approaches for the content analysis, to discuss the viability and benefits of microgrid implementation. The study focused on the quantitative results for comprehensive analysis of conventional centralized grid models in meeting modern energy demands. The study has used the statistical regression models using SPSS and quantifies the inefficiencies inherent in centralized grids. Hence, it emphasizes the urgent need for alternative energy solutions such as microgrids.

For microgrid performance, ref. [1] focused on a qualitative approach that involved systematically analyzing textual data from interviews and industry reports to identify key themes and insights.

2.2. Government Policies and Incentives

Given the high upfront costs associated with the establishment of microgrids, government policies and incentives are crucial for their adoption worldwide. Countries such as England, Germany, and Australia have implemented supportive measures to encourage investment in microgrid projects. The purpose is mainly to promote the integration of MGs into existing energy landscape [11]. Through these incentives and programs, investment in microgrid becomes more appealing to businesses and communities. Additionally, policy frameworks encourage energy sustainability, resilience, and independence. These frameworks are generally aligned with broader national goals [12,13]. Meanwhile, case-specific regulations address issues such as grid interconnection, permits, and standards. Managing these issues leads to a conducive environment for the development and expansion of microgrid projects [6].

Recently, countries in the Middle East have witnessed a growing interest in microgrid adoption. Several successful microgrid projects that emphasize energy security enhancement, the reduction of carbon emissions, and the promotion of sustainable development have already been implemented, including in the UAE [14]. The integration of renewable energy sources and the availability of advanced technologies make microgrids a strategic component of the region’s transition toward a more sustainable and diversified energy portfolio.

The findings on the inefficiencies by [10] is an empirical contribution that is valuable for policymakers and energy planners to address the dynamic challenges of energy sustainability and resilience in contemporary societies.

2.3. Financial Models for Microgrid Investment

Financial viability is crucial for the successful implementation of microgrid projects. Accordingly, various financial models have been developed to manage costs and operational expenses associated with microgrid implementation. Public–private partnerships (PPPs), where private entities collaborate with governmental bodies, are prevalent in sharing the financial risks and benefits [15]. Under such partnerships, governments provide funding, including grants, subsidies, and low-interest loans, aimed at stimulating investments from the private sector. Modern, innovative financing approaches, such as energy-as-a-service and community-based funding, have been developed to offer alternatives to traditional financing, democratizing access to microgrid benefits [16]. Understanding these financial models is crucial for stakeholders as they navigate the economic landscape of microgrid development, ensuring the sustainability and scalability of such projects.

2.4. Benefits of Microgrid

A review of the existing literature on microgrid technology highlights its multifaceted benefits across diverse contexts. A recurring theme in the literature is the pivotal role of microgrids in fostering energy resilience [14]. By decentralizing energy generation and distribution, microgrids offer a robust solution to mitigate the impact of grid failures or natural disasters [11]. This decentralized nature ensures a reliable power supply to critical facilities during emergencies, such as hospitals, emergency services, and essential infrastructure.

Research also highlights the potential of microgrids to serve as platforms for incorporating solar, wind, and biomass energy into the energy mix. This integration aligns with global sustainability goals, reducing dependence on conventional fossil fuels, and subsequently curbs greenhouse gas emissions [11].

The literature emphasizes the positive environmental impact of microgrids as they facilitate the transition towards cleaner and more sustainable energy systems. Energy efficiency emerges as a prominent theme in the literature review, with microgrids recognized for their ability to optimize energy utilization. The decentralized nature of microgrids minimizes transmission and distribution losses associated with centralized power systems [11]. This results in enhanced energy efficiency and cost saving, reinforcing the attractiveness of the microgrid as a solution for communities and industries seeking to manage and optimize their energy consumption.

Furthermore, the literature underscores the role of microgrids in load management and peak shaving. By enabling users to control and balance their energy consumption, microgrids contribute to more efficient grid operations. The implementation of demand-response strategies and the incorporation of energy storage systems allow microgrids to participate actively in peak shaving, alleviating stress on the main grid during periods of high demand [17].

2.5. Environmental Impact and Community Awareness

Numerous studies have discussed the environmental impact of microgrid implementation, providing valuable insights into sustainability metrics. There has been a particular focus on carbon footprint reduction, energy efficiency gains, and broader environmental implications. For instance, assessments may quantify the reduction in greenhouse gas emissions achieved through the integration of renewable energy sources within microgrids. Studies also explore the life cycle analysis of microgrid components, evaluating their overall environmental footprint [8,18]. These environmental impact assessments contribute to shaping eco-friendly microgrid designs, ensuring that the technology aligns with global sustainability goals. The findings aid policymakers, businesses, and communities in making informed decisions that prioritize both energy security and environmental stewardship.

The success of microgrid projects is intricately linked to community awareness and education programs. Research investigates the effectiveness of initiatives aimed at informing and engaging local communities regarding microgrid technology. It explains the benefits of microgrids, and addresses concerns related to cost and implementation [19,20]. Studies explore how informed communities are likely to support and invest in sustainable initiatives. Many of these studies emphasize the importance of transparent communication. Further, the research analyzes the impact of educational programs, with a need of sense of ownership and participation among community members. The dynamics of community awareness and education are crucial for the successful implementation of microgrid projects. For example, ref. [21] assessed public awareness of renewable energy sources in Saudi Arabia. According to initial findings, government policies and subsidies have a major influence on people’s inclination for employing green energy.

The research undertaken by [22] in the UK found that end users have a positive attitude towards renewable energy technologies but are often unable to afford the initial investment required. Although they acknowledge the advantages of adopting renewable energy, most end users find it difficult to justify the initial costs associated with microgrid-enabled DER technology. Conversely, a study conducted by [23] examined the attitudes of consumers in three US states towards investing in microgrid technology to improve electricity services. The study found that 40% of respondents expressed a desire to invest. The difference in willingness to pay is a result of customers in different places having differing perceptions of the cost–benefit ratios. Consumer willingness to invest in power infrastructure improvements and renewable energy projects worldwide has been examined in many studies, including [6,24,25,26,27]. Although there is a widespread optimistic outlook on investing in these power grid and REs, obstacles such as financial limitations and inadequate institutional funding impede large-scale investments. Research conducted in Greece [28,29] and the Middle East, namely Qatar [30], showed that the inclination of individuals to financially support local initiatives is notably impacted by socio-demographic characteristics and community attitudes. Notwithstanding these obstacles, implementing strategies such as utilizing insurance schemes to distribute expenses over a period, incentivizing social involvement, and increasing public knowledge have the potential to improve customer participation in sustainable-energy-related expenditures.

2.6. Challenges of Implementing Microgrids

The literature on microgrid technology also sheds light on various challenges associated with its implementation. One recurrent challenge is the high initial capital expenditure (CapEx) required for establishing microgrid infrastructure [20]. Researchers consistently point out that the upfront costs associated with designing, installing, and integrating microgrids can be substantial, posing a barrier to widespread adoption. Moreover, traditional financing models may not align seamlessly with the unique characteristics of microgrids, which involve distributed energy resources and complex ownership structures. This financial challenge is linked with the community or municipal microgrids, for which suitable financing mechanisms are crucial [7].

Interoperability and standardization issues represent another set of challenges. This could lead to a lack of standardized protocols for microgrid components and communication, which could be a barrier to successful integration and interoperability [9]. This challenge increases because microgrids often involve diverse technologies, energy sources, and equipment from various vendors. Operational and maintenance challenges arise due to the need for skilled personnel for the ongoing management of microgrid systems. A well-trained workforce is also needed to deal with issues related to system reliability, equipment maintenance, and troubleshooting. It ensures the continuous and efficient operation of microgrid infrastructure [10]. Furthermore, inconsistent or unclear regulations, processes, and grid interconnection standards can create hurdles for developers and investors. Policymakers need to create a conducive regulatory environment that supports the integration of microgrids into the existing energy landscape. To add, social and cultural factors are significant determinants of microgrid adoption. The willingness of a community to participate in a certain government-imposed technology can vary based on factors such as socio-economic status, cultural norms, and trust in government initiatives [15]. Overcoming these social and cultural barriers requires targeted community engagement and awareness-building efforts.

2.7. Solutions for the Successful Implementation of Microgrid

Researchers and industry experts have extensively examined the financial barriers associated with microgrid implementation. It is believed that innovative financial mechanisms are crucial for overcoming this hurdle. There are funding models such as public-private partnerships, community-based financing, and the utilization of green bonds or energy performance contracts [15,31] that provide accessible and affordable funding to facilitate the widespread adoption of microgrid technology.

Another important point is the need for standardization and interoperability within the microgrid sector. Developing industry standards and protocols to enhance the integration of diverse microgrid components [32] is of significant importance. Collaboration among stakeholders, regulatory bodies, and standard-setting organizations establishes and promotes standardized frameworks for communication, control systems, and hardware interfaces, hence ensuring the interoperability and system efficiency [16].

Moreover, workforce development and capacity building are critical considerations for the successful operation and maintenance of microgrid systems. Educational initiatives, training programs, and certification courses are recommended to enhance workforce capacity and efficiency [11]. In addition, collaboration between educational institutions, industry associations, and government agencies build the technical expertise required for the design, installation, and management of microgrids.

Policy and regulatory frameworks constitute a substantial focus in the literature, which emphasizes the need for clear and supportive policies to create an enabling environment for microgrid development [14]. For example, Germany’s commitment to transitioning to renewable energy includes the development of smart grids and microgrids for improved energy efficiency and sustainability. However, the implementation faced challenges associated with the high initial investments required for advanced metering infrastructure and smart grid technologies. The solution to address these financial challenges came in the form of government incentives, including grants and low-interest loans, which encouraged utilities and consumers to invest in smart grid technologies [10]. This case underscores the pivotal role of policy support in overcoming the initial CapEx obstacles.

In addition, community engagement and awareness are underscored as pivotal factors for successful microgrid deployment. Engaging local communities through awareness campaigns, participatory decision-making processes, and collaborative planning can foster trust and garner support for microgrid projects [16]. Furthermore, tailoring communication strategies to address cultural and social norms is deemed essential for effective community engagement. A good example is the Brooklyn Microgrid project in Brooklyn, New York, which stands as a community-driven effort to establish a peer-to-peer energy marketplace using Blockchain technology. The initiative faced challenges associated with high initial capital expenditure (CapEx), involving investments in smart meters, Blockchain infrastructure, and grid integration [18]. The solution emerged through collaborative financing models, encouraging community members to collectively invest in the required infrastructure. The success of the Brooklyn Microgrid was attributed to the strong sense of community and shared environmental values that motivated residents to contribute to the project’s financial needs [19].

Technological innovations constitute significantly, as they advance the efficiency, reliability, and scalability of microgrid components [15,33]. Research and development efforts are directed towards integrating smart grid technologies, advanced control systems, and energy storage solutions to enhance the overall resilience and performance of microgrid systems [12].

Based on the recurrent themes in the literature, it is apparent that the challenges and potential solutions identified are not universal but contingent on the socio-economic context of the target region. The intricate relationships between high initial CapEx, the feasibility of sharing costs as a solution, and the socio-economic factors influencing individuals’ and communities’ willingness to embrace collaborative financing models necessitate a nuanced and context-specific approach.

2.8. Gaps in Existing Research

Despite the growing body of literature on microgrid technologies and their global applications, there exists a notable gap in research, particularly within the specific socio-economic and environmental context of the United Arab Emirates (UAE). While the literature extensively explores the benefits, challenges, and potential solutions associated with microgrid adoption worldwide, there is a lack of studies focusing on the unique circumstances and barriers faced by the UAE in harnessing the transformative potential of microgrids.

The existing research primarily originates from regions with different economic structures, regulatory frameworks, and societal norms, which may not align with the distinctive landscape of the UAE. The socio-economic dynamics, coupled with the environmental considerations specific to the UAE, create a nuanced backdrop that requires dedicated investigation. The lack of literature addressing these specificities hinders the development of targeted strategies for the successful integration of microgrids into the UAE’s energy landscape.

Furthermore, the underutilization of microgrid technology within the UAE poses a critical challenge that has not been comprehensively explored in the existing research. The gap lies in the absence of a thorough examination of the factors contributing to this underutilization, whether they be economic, social, or regulatory in nature. Understanding these intricacies is pivotal for devising effective measures that can drive widespread microgrid adoption in alignment with the nation’s Sustainable Development Goals for 2030.

The gap in the surveyed literature can be summarized in the following points:

- The existing literature doesn’t capture trends related to MG adoption in the UAE.

- There are no policy frameworks suggested for the UAE to better utilize and facilitate the adoption of microgrid (such as a public-private partnership).

- Although the existing research has identified that capital expenditure for MG adoption is considerably high in many cases in the UAE, the research does not offer tangible solutions to this challenge, such as engaging investments from the end users.

- There is an evident lack of research addressing the possibility of utilizing MG on a widescale, despite the established sustainability and resiliency benefits.

- While some analysis of the economic and technical context of the UAE has been conducted, no similar efforts have been made to explore the country’s socio-economic landscape to find community engaging solutions such as creating policy that involves end user investments in capital expenditure.

- There is an apparent lack of research on how microgrid adoption contributes to CO2 emission reduction within the unique environmental context of the UAE.

- The previous research lacks an in-depth analysis of the economic, social, and regulatory factors influencing the level of investment commitment in microgrid initiatives. In addition, the willingness of UAE end-users to invest in microgrid projects has been overlooked.

3. Theoretical Framework and Hypotheses

The theoretical framework for this study draws on several key perspectives that guide the investigation into the adoption and implementation of microgrids in the UAE. These perspectives provide a conceptual foundation to understand the complex interplay of factors influencing microgrid utilization within the unique socio-economic and environmental context of the UAE.

The study is informed by innovation diffusion theory, which explores how new technologies, such as microgrids, are adopted and spread within a society [34,35]. This theoretical outlook allows for an examination of the factors that facilitate or impede the diffusion of MG technology in the UAE. By considering the innovation-decision process, the study aims to identify key influencers affecting the adoption of MGs, providing insights into the dynamics of technological innovation within the UAE’s energy landscape.

Socio-technical transitions theory is employed to understand the broader societal and technological shifts associated with the transition from conventional centralized grids to decentralized microgrids. This perspective enables an analysis of the socio-technical factors influencing the acceptance and integration of microgrid technologies. By exploring the interactions between social, economic, and technological dimensions, the study aims to unravel the complexities of transitioning to a more sustainable and resilient energy system in the UAE.

The study incorporates elements of policy innovation theory to examine the role of governmental policies and incentives in promoting or hindering microgrid adoption. This theoretical perspective helps in understanding the impact of regulatory frameworks, financial incentives, and policy interventions on shaping the microgrid landscape in the UAE. By evaluating the effectiveness of existing policies, the study seeks to propose policy recommendations that align with the nation’s sustainable development goals.

The environmental governance framework is integrated into this study to assess the environmental implications and governance structures related to microgrid implementation. This perspective allows for an evaluation of how microgrids contribute to environmental sustainability and how governance mechanisms can be optimized to ensure effective and responsible deployment [36]. The study aims to explore the balance between energy security and environmental stewardship within the UAE’s specific context.

Public–private-partnership theory emphasizes the owners’ willingness to invest, with the government, in public infrastructure development and maintenance. Based on traditional PPP concepts, this theory holds that private owners, motivated by investment, share public project costs and risks [37]. In other words, contributing capital alongside the government shows owners’ willingness to invest, encouraging shared responsibility [38]. The theory emphasizes government and private sector funding of infrastructure projects. It introduces innovative risk-sharing systems that match owners’ willingness to invest. This may involve sharing financial, operational, and performance risks to balance duties. To suit private owners’ investment preferences, the approach encourages project design flexibility [38]. This is because partnership arrangements are more appealing when tailored to owners’ interests and capabilities.

The theoretical framework proposed for this study guides the analysis of socio-economic, environmental, and policy factors, offering an examination of the consumers’ willingness to invest in community microgrids as a solution to the high CapEx of the microgrid technology. This paper addresses cost, since it is a major gap in the existing research, and therefore contributes to the advancement of knowledge in the field of sustainable energy transitions.

3.1. Research Hypotheses

This research is guided by the following hypotheses:

- If the microgrid is aligned with UAE strategic direction, then consumers should be willing to invest in microgrid.

- If microgrid projects bring profitable returns, then consumers should be willing to invest in microgrids.

- If the microgrid supports digitization, then consumers should be willing to invest in it.

- If the microgrid improves the utilization of RE, then consumers should be willing to invest in it.

- If the microgrid reduces CO2 emissions, then consumers should be willing to invest in it.

- If the microgrid improves disaster recovery, then consumers should be willing to invest in it.

4. Research Methodology

The research methodology employed in this study is a mixed-methods approach, integrating both quantitative and qualitative methods to comprehensively investigate the factors influencing microgrid adoption among villa owners in the UAE. A structured survey questionnaire in Appendix A was meticulously designed to gather quantitative data on the willingness of villa owners to invest in MG technology. The closed-ended format of the questionnaire facilitates systematic data analysis, enabling the identification of patterns, correlations, and trends related to MG adoption.

The research adopts a positivist philosophy, viewing the social world as objective and measurable. Positivism emphasizes the application of scientific principles to uncover empirical truths and establish causal relationships [39]. In this study, the aim is to objectively examine the quantitative data gathered through structured surveys, adhering to the principles of objectivity, neutrality, and reproducibility. Positivism aligns with the goal of identifying patterns and correlations within numerical data, providing a systematic and empirical foundation for understanding villa owners’ willingness to invest in microgrid technology.

This research relies on a primary data approach, emphasizing the collection of firsthand data directly from the target population. Quantitative data is gathered systematically through a structured survey questionnaire. This approach ensures the data is tailored to the study’s objectives, offering real-time insights into the factors influencing microgrid adoption. Primary data, derived directly from the participants, enhances the study’s accuracy and relevance, allowing for a focused analysis of their attitudes and perceptions.

The research is inherently quantitative, focusing on numerical data and statistical analyses to draw conclusions. Descriptive statistics, correlation analysis, and regression analysis are employed to quantitatively measure and interpret the willingness of villa owners to invest in microgrid technology. This approach allows for the identification of trends, patterns, and statistical relationships within the data. The quantitative nature of the research aligns with its goal of providing empirical insights and establishing objective conclusions based on numerical evidence.

4.1. Survey Questionnaire Design

A survey questionnaire has been designed with the aim of assessing the willingness of property owners in the UAE to invest in microgrid technology and gaining insights into various factors influencing their investment decisions. The research instrument employed was a close-ended survey questionnaire. This is because close-ended questions are well-suited for quantitative research, providing structured and measurable data. Additionally, this approach is particularly useful when the goal is to analyze and interpret numerical data to identify patterns, correlations, and trends.

4.2. Study Population and Sample Size

The population of the study comprised new owners of villas or townhouses in the SZHP program, irrespective of age or specialization. The specific target of this survey was owners in the Al Mowradda 8 neighborhood, Al Suyoh area, in the Emirate of Sharjah. All participants in the SZHP (and therefore, all participants in the survey) are Emirati nationals. Most participants had at least a high-school degree and represented a mix of white- and blue-collar workers, aligning with long-term investment considerations.

The sample consists of 400 participants selected from 818 villa owners, who actively participate in a WhatsApp group dedicated to post-handover discussions related to the SZHP program. The focus on the selected neighborhood mentioned above is due to the ongoing handover process, making this a critical time for homeowners to consider long-term investments. The choice of the WhatsApp group ensures representation from those actively engaged in discussions related to their housing community. The survey invitation was sent as a link through WhatsApp (Version 2.24.5.75) and the questionnaire was hosted on the SurveyMonkey platform.

4.3. Analysis Methods

Responses to the survey were analyzed using SPSS and the main analysis tests were the descriptive statistics of the responses. These statistics summarize and present the key features of the quantitative data, including measures of central tendency (mean, median) and measures of variability (standard deviation). The analysis also targets the descriptive statistics for each variable, particularly those related to the respondents’ understanding of microgrid technologies, their awareness of costs, and their willingness to invest.

Correlation analysis was also used to examine the relationships between different variables (UAE strategy, profitable returns, digitalization, renewable energy, CO2 emission reduction, disaster recovery, and willingness to invest). This analysis was conducted to assess the strength and direction of these relationships using correlation coefficients. Finally, regression analysis was conducted to test the hypotheses formulated in Section 3.1. The dependent variable was “willingness to invest”, and independent variables included UAE strategy, profitable returns, digitalization, renewable energy, CO2 emission reduction, and disaster recovery.

4.4. Research Ethics Procedures

The survey was conducted with a commitment to upholding ethical standards in research, prioritizing participant confidentiality, voluntary participation, and informed consent. All collected data were handled with the utmost confidentiality. Participants’ identities were safeguarded through anonymization to ensure that individual responses are not directly linked to personal information.

Participation in the survey was entirely voluntary. Individuals had the right to choose whether to take part in the study without facing any consequences or coercion. The consent process was transparent, ensuring that participants are fully informed before deciding to participate. Anonymization ensures that individual responses cannot be traced back to specific participants, maintaining their privacy.

4.5. Generalizability and Reliability

The study’s focus on a specific neighborhood and the use of a WhatsApp group may limit generalizability. However, the targeted approach increases the reliability of responses, as participants share a common context and similarly actively engage in discussions related to their housing community. The reliability of the questionnaire was checked through Cronbach’s Alpha and results presented are 0.889. The value of reliability is closer to 1, making the questionnaire highly reliable.

5. Results and Discussion

This section will present the results of the quantitative analysis of the responses to the survey, with the aim of shedding light on the determinants that influence property owners in the UAE to invest in microgrid technology. The data obtained from the survey of 59 property owners have been meticulously analyzed, employing robust statistical methods including descriptive statistics, correlation, and regression analyses. The findings presented here are not just statistical interpretations but are also contextualized within the broader background of the UAE’s strategic energy objectives, market dynamics, and sustainability goals.

5.1. Descriptive Statistics

The descriptive information is obtained from the general information questions answered by the respondents; for example, whether they had a villa or townhouse in UAE, understood the differences between microgrid and conventional grid, and had any knowledge of costs associated with implementation of microgrids. In this study, a total of 59 out of 78 persons owned a villa. The descriptive statistics for these responses are presented in Table 1.

Table 1.

Descriptive Statistics for the Responses of Villa Owners in SZHP.

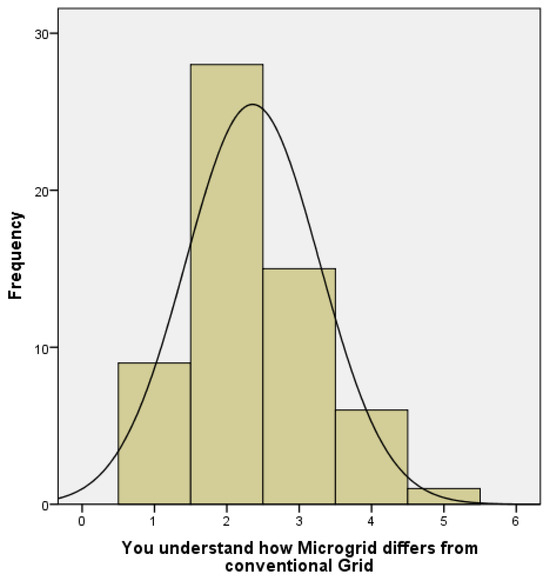

Figure 1 shows the distribution of the responses with respect to understanding the differences between microgrid and conventional grid technologies. It shows that the average response was 2.36 (out of 5), indicating a moderate level of agreement. This suggests that, on average, the participants somewhat agree that they understand how microgrid differs from the conventional grid. The responses exhibited a standard deviation of 0.924, which indicates some variability in understanding among participants. The understanding of individuals regarding the difference between MG and conventional grid is crucial in guiding their decision of investing in MG.

Figure 1.

Difference between Conventional and Microgrid Technologies.

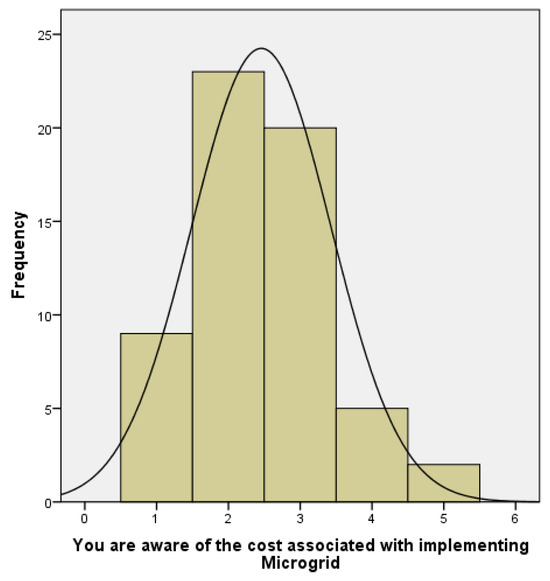

Additionally, the distribution in Figure 2 shows an average of 2.46 for the responses of the participants regarding awareness about the costs associated with implementing microgrid technology. This shows that there is a moderate level of awareness among the participants about this issue. The results exhibited a standard deviation of 0.971, implying a range of awareness levels among participants. Individuals who are aware of the associated cost can easily assess their budgets and make an informed decision regarding their investment in the microgrid.

Figure 2.

Awareness of Costs Associated with MG.

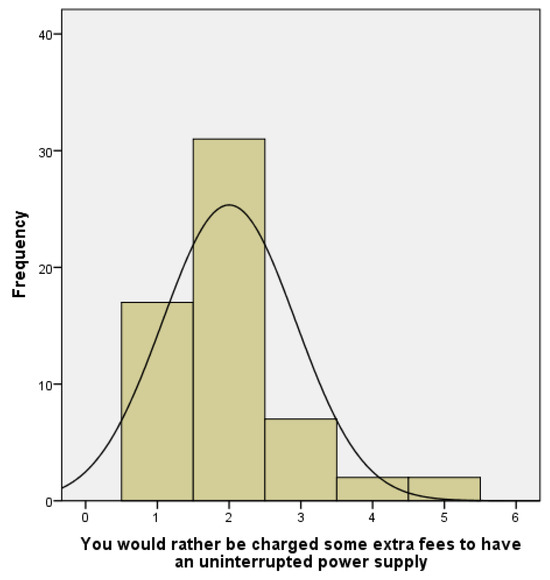

Lastly, Figure 3 shows that responses to the question of whether the respondents would prefer to pay extra fees for an uninterrupted power supply scored an average of 2.00. These results indicate that the participants had a somewhat neutral stance on the issue. The results exhibited a standard deviation of 0.928, suggesting variability in preferences among participants. The respondents were ready to pay some additional charges so they can have an uninterrupted power supply and make profit. Such individuals are more inclined toward better services and are less concerned about the cost.

Figure 3.

Distribution of Responses to Question about Cost Awareness of MG.

This analysis indicates a critical recurring concern regarding the high upfront costs associated with microgrid installations. Both individuals and businesses worry about spending a lot of money at the beginning. However, the cost is not the sole concern; would-be investors are also concerned about the viability of this investment in the long run. Businesses consider whether such an investment fits their long-term plans, while regular individuals have to balance their everyday expenses with the potential benefits.

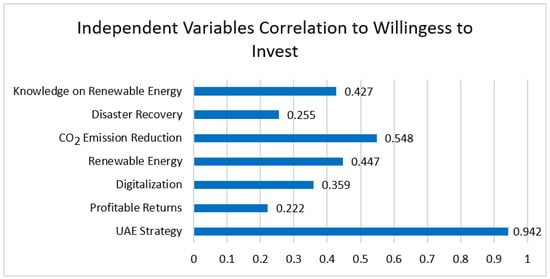

5.2. Correlation Analysis

Correlation analysis examines how different factors related to the willingness of respondents to invest in a microgrid are related to each other. It investigates the relationships among the different variables: microgrid alignment with the UAE strategy, long-term profitability, digitization support, renewable energy utilization, carbon emission reduction, and disaster recovery improvement. To show more of an indication on the respondent’s knowledge on renewable energy and willingness to invest in microgrid, an additional variable “knowledge of renewable energy” was extracted from the renewable energy variable for the correlation analysis. It quantifies how these factors interrelate, providing insights into the potential associations outlined in the hypotheses. The results presented in Table 2 and Figure 4 show that the United Arab Emirates (UAE) has strategically aligned its priorities with the various critical variables chosen for the research.

Table 2.

Analysis of the Correlation between the Different Variables.

Figure 4.

Independent Variables Correlation to Willingness to Invest.

The results indicate a strong positive correlation between the UAE strategy and renewable energy (0.505 **). This shows that the country’s strategic initiatives are significantly linked to a commitment to renewable energy sources. This correlation is highly significant at the 0.01 level, underscoring the importance of sustainability in the UAE’s overall strategy.

Moreover, the results indicate a correlation of 0.371 between the UAE strategy and digitalization variables, suggesting a strong association of the country’s strategic goals and technological advancements. Similarly, a strong positive relationship between technological innovation and environmental responsibility is indicated by the strong correlation (0.552) between digitalization and CO2 emission reduction. Additionally, the correlation between disaster recovery and CO2 emission reduction (0.571) shows a substantial connection between efforts to mitigate the impact of disasters and the broader goal of reducing carbon emissions. The correlation between willingness to invest and the UAE strategy shows a very significant value of 0.942, signifying an exceptionally strong positive relationship. This correlation suggests that a robust commitment to the UAE strategy is closely associated with a high level of willingness to invest in various sectors. The correlation between Knowledge on Renewable Energy and Willingness to Invest (0.427 **) also shows a moderate but significant relationship among variables.

5.3. Hypotheses Testing through Linear Regression

Linear regression is instrumental in evaluating the strength and direction of relationships between variables and provides a quantitative understanding of how changes in one variable may predict changes in another. The regression analysis in Table 3 through the ANOVA table assesses the overall statistical significance of the regression model. The regression sum of squares (18.963) and residual sum of squares (1.918) contribute to the total sum of squares (20.881). With 6 degrees of freedom for regression and 52 degrees of freedom for residual, the F statistic (85.690) is highly significant (Sig. < 0.001). This implies that at least one of the independent variables significantly predicts the dependent variable. The low residual sum of squares indicates that the model captures a substantial portion of the variability in the dependent variable.

Table 3.

ANOVA.

Table 4.

Model Summary.

Table 5.

Regression Model Coefficients and Collinearity Statistics.

The ANOVA in Table 3 assesses the overall statistical significance of the regression model. The regression sum of squares (18.963) and residual sum of squares (1.918) contribute to the total sum of squares (20.881). With 6 degrees of freedom for regression and 52 degrees of freedom for residual, the F statistic (85.690) is highly significant (Sig. < 0.001). ANOVA table is generated through SPSS. The regression Df (6) represents the number of predictors, while the residual Df (52) is calculated as the total number of observations minus the parameters estimated in the model, usually reported as the total minus the number of predictors minus 1. This implies that at least one of the independent variables significantly predicts the dependent variable. The low residual sum of squares indicates that the model captures a substantial portion of the variability in the dependent variable.

The model summary in Table 4 provides an overview of the regression model’s performance. The R Square value of 0.908 indicates that approximately 90.8% of the variability in the dependent variable is accounted for by the independent variables. The adjusted R square (0.898) considers the number of predictors, offering a slightly more conservative estimate. The Std. error of the estimate (0.192) reflects the accuracy of the model, measuring the average distance between the observed and predicted values. Overall, the high R square suggests a robust model fit, indicating that the included predictors effectively explain the variance in the dependent variable.

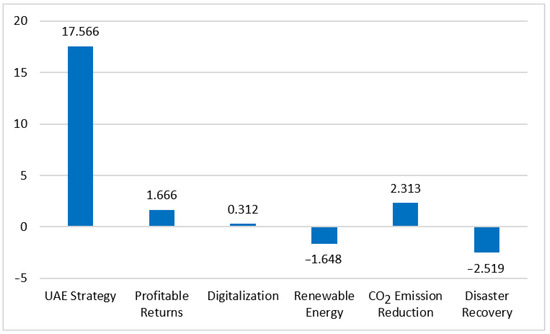

The regression analysis in Table 5 presents the coefficients and statistical significance of each predictor variable. The constant (intercept) is not statistically significant (p = 0.658). The predictor variables, namely UAE strategy, CO2 emission reduction, and disaster recovery, demonstrate statistically significant relationships with the dependent variable (p < 0.05). The t-values indicate the strength and direction of these relationships. UAE strategy (t = 17.566) exhibits a particularly strong influence, followed by CO2 emission reduction (t = 2.313), as shown in Figure 5. Other variables such as profitable returns, digitalization, and renewable energy do not show statistically significant relationships with the dependent variable at the conventional significance level (p > 0.05). The standardized coefficients (Beta) provide insights into the relative importance of each predictor, with UAE strategy having the highest impact on the dependent variable.

Figure 5.

t-test Statistic for Independent Variables.

Based on the results of collinearity statistics, it can be stated that VIF values below 10 suggest low multicollinearity. In our analysis, the variables “UAE Strategy”, “Profitable Returns”, “Digitalization”, “Renewable Energy”, “CO2 Emission Reduction”, and “Disaster Recovery” have VIF values ranging from 1.087 to 2.155. This means that there is an acceptable level of multicollinearity. Tolerance values close to 1 indicate low multicollinearity. Here, all variables have tolerance values above 0.4, with “UAE Strategy” having the lowest at 0.623. Hence, the collinearity for “UAE Strategy,” is not severe. Overall, the collinearity statistics suggest that multicollinearity is generally low among the independent variables.

Based on the regression results in Table 5, only three variables are positively associated with willingness to invest, which are UAE strategy, CO2 Emission Reduction, and Disaster Recovery. Then, these variables were tested again using stepwise regression analysis. Stepwise regression is used to select the most relevant independent variables for inclusion in a regression model. It iteratively adds or removes variables based on their statistical significance. Stepwise regression contributes the most to explaining the variation in the dependent variable. Further, it automates the variable selection process to deal with a large number of potential predictor variables. The results are presented in the Table 6 and Table 7.

Table 6.

Stepwise Regression Analysis Coefficients.

Table 7.

Stepwise Regression Analysis Excluded Variables.

In the stepwise regression analysis in the Table 6 and Table 7, UAE Strategy emerges is the only significant predictor of willingness to invest (p < 0.001), indicating its strong positive impact. CO2 Emission Reduction and Disaster Recovery were excluded from the model due to their non-significant contributions, as these has shown negligible effects on willingness to invest (β = 0.058 and −0.065, respectively).

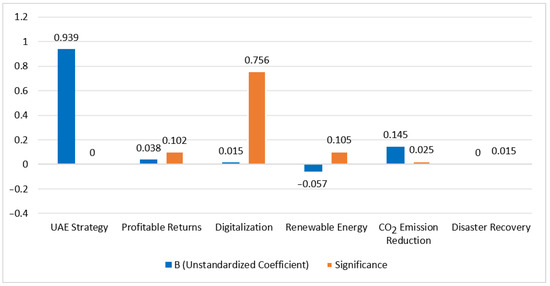

Based on the results of the regression analysis, and as shown in Figure 6, we can develop the following responses to the hypotheses of Section 3.1:

Figure 6.

Unstandardized Coefficients and Significance for Independent Variables.

H1.

If the microgrid is aligned with UAE strategic direction, then consumers should be willing to invest in microgrid.

The highly significant positive coefficient for UAE strategy (B = 0.939, p < 0.001) strongly supports the hypothesis. As microgrids align with UAE strategy, there is a substantial increase in consumers’ willingness to invest. This underscores the strategic importance of aligning energy initiatives with national goals. When the UAE strategic direction is in a positive trend which supports customers and offers services that are beneficial to them, then customers become willing to invest in microgrid projects. The hypothesis supports that the perception that UAE government views MG as a promising avenue for aligning personal values with energy choices.

H2.

If microgrid projects bring profitable returns, then consumers should be willing to invest in microgrids.

While the variable profitable returns show marginal significance (B = 0.038, p = 0.102), data analysis indicates that the p-value is above 0.1, which makes the association less significant. A p-value of 0.05 or below would have provided strong support to the hypotheses. A value of 0.102, as in this case, makes the relationship weak. In this regard, H2 is not acceptable. The reason of the non-significance of this variable could be because all respondents catered are those who own a villa. These individuals might be less concerned about the cost and can invest conveniently in microgrids. Consequently, the overall results do not support the hypotheses.

H3.

If the microgrid supports digitization, then consumers should be willing to invest in it.

Digitalization (B = 0.015, p = 0.756) lacks significance, indicating it may not be a significant predictor of the participants’ willingness to invest. The relationship between these variables is not found, hence, we reject the H3. Respondents may have considered digitization as a form of gaining energy independence. This balancing act illustrates that the benefits need to be higher than the challenges for people to enthusiastically invest in microgrids. Individuals and businesses want to be sure that digitalization it is beneficial and profitable.

H4.

If the microgrid improves the utilization of RE, then consumers should be willing to invest in it.

The non-significant coefficient for renewable energy (B = −0.057, p = 0.105) suggests that improved utilization may not be a driving factor in consumer investment decisions. This calls for a reevaluation of the assumed relationship between renewable energy and the willingness to invest. Hence, we reject the 4th hypothesis. The idea of utilizing renewable energy corresponds to the group opinion about microgrids. Breaking down the complexity and showing that microgrids can be affordable is important. It is like unraveling a mystery; the more awareness there is about the issue, the less intimidating it becomes. Targeted communication that speaks directly to these concerns can be a game-changer.

H5.

If the microgrid reduces CO2 emissions, then consumers should be willing to invest in it.

The significant positive coefficient for CO2 emission reduction (B = 0.145, p = 0.025) indicates that consumers are more willing to invest when microgrids contribute to lower carbon emissions. This aligns with the concept that environmental concerns influence investment decisions. Therefore, the fifth hypothesis can be accepted. Beyond the association between sustainability and willingness to invest, it can be said that there is a strong emphasis on the environmental impact of microgrid adoption. Respondents had a commitment to reducing their ecological footprint, showcasing a values-driven approach that extends beyond mere cost considerations.

H6.

If the microgrid improves disaster recovery, then consumers should be willing to invest in it.

The highly significant coefficient for disaster recovery (B = −0.120, p < 0.015) indicates that enhanced disaster recovery is associated with reduced willingness to invest. This warrants in-depth exploration of the factors influencing investor perceptions in the context of disaster recovery management. Hypothesis Six is, therefore, acceptable, as the p-value is high significant (below 0.001).

It is evident from the data collected here that the participants prefer to understand the risks and benefits of microgrid technologies before they are prepared to invest in it. Disaster management is about more than just money; it is about whether microgrids can easily fit into how things already work. Businesses are concerned about how microgrids can make their operations smoother.

5.4. Comparison of Findings with the Existing Literature

The comparison of findings with the existing literature is a critical aspect of research, providing valuable insights into the alignment or divergence of current study outcomes with established knowledge. In the context of the research on villa owners’ willingness to invest in microgrid technology in the UAE, it is essential to compare the study’s findings with the existing body of literature on renewable energy adoption, consumer behavior, and technology investment in similar contexts.

Strategic alignment and community awareness are identified as key factors that significantly impact consumers’ willingness to invest in microgrid technology [8,18]. This is consistent with previous research that highlights the importance of using standards of sustainability and clear communication to involve local communities [19,20]. For UAE villa owners, aligning their investment plans with government policies on the environment might serve as a catalyst for consumer commitment [8], echoing the global trend of reducing CO2 emissions [9]. Nevertheless, some inconsistencies necessitate additional investigation.

Profitability (which shows all that has been achieved, taking into account projects, savings, sales, revenues, and other elements of the enterprise), has been shown to have an impact on investment decisions, although previous research suggests that they may not be as significant as financial returns (return on investment) [12,35,40]. This necessitates additional examination of the financial factors that influence the decisions of villa owners in the UAE. The lack of a significant correlation between digitalization and the participants’ willingness to invest contradicts previous studies that have indicated beneficial effects of digitalization [16]. This discrepancy raises inquiries regarding the specific factors that may influence consumer attitudes in the UAE. The alignment of renewable energy programs with the national strategy increases the rate at which they are adopted [6], as it corresponds with the UAE’s strategy’s favorable association with the willingness to invest. In addition, the importance of reducing CO2 emissions is in line with the worldwide emphasis on sustainability [30]. Nevertheless, the lack of a substantial correlation with digitization contradicts the findings in the literature [4], which justifies the need to investigate the specific subtleties in the UAE context. The impact of disaster recovery on the willingness to invest is a subject of interest, as it may correspond with the findings of previous research [18]. Therefore, comprehending the unique socioeconomic and geographical features particular to the UAE might provide valuable insights for designing resilient microgrids.

To sum up, several studies discuss the effects of public awareness on the willingness of its members to invest in and pay for microgrid projects [6,18,19,20,21,22,23,24,25,26,27,28,29]. For instance, for [19], the marginal significance of profitable returns in influencing the public’s willingness to invest contrasts with some studies that emphasize the pivotal role of financial returns in driving technology adoption. This discrepancy could stimulate further exploration into the unique economic considerations of villa owners in the UAE.

6. Policy Implications and Recommendations

6.1. Insights for Policymakers and Industry Stakeholders

Policymakers and industry stakeholders can gain valuable insights from this research, particularly by understanding that aligning microgrid projects with the broader UAE strategy significantly boosts the consumers’ willingness to invest. This underscores the importance of incorporating microgrid initiatives into national strategic energy plans. Policymakers should consider adjusting regulations and providing incentives to encourage industry stakeholders to align their projects with national strategies, fostering a collaborative approach to sustainable energy development.

6.2. Recommendations for Promoting Microgrid Technology

To promote microgrid technology, policymakers can implement a multi-faceted approach. Firstly, they should consider offering financial incentives, tax breaks, or subsidies to make microgrid investments more appealing to businesses and individuals. These incentives could be structured to align with sustainability goals, encouraging stakeholders to adopt environmentally friendly practices. Additionally, fostering collaboration between policymakers and industry stakeholders is crucial. Initiating pilot programs or demonstration projects can showcase the benefits of microgrids, instilling confidence and encouraging broader adoption.

6.3. Strategies for Enhancing Consumer Awareness

Enhancing consumer awareness involves a targeted and comprehensive approach. Policymakers, in collaboration with industry stakeholders, should launch robust public awareness campaigns highlighting the advantages of microgrid technology. These campaigns should address common misconceptions, emphasizing benefits related to disaster recovery, carbon emissions reduction, and long-term profitability. Educational initiatives can include workshops, webinars, and informational materials to empower consumers with knowledge. In addition, success stories and case studies should be showcased to demonstrate real-world applications, creating a positive narrative around microgrid investments. By fostering a culture of innovation and resilience, consumers are more likely to embrace microgrid technology as a viable and beneficial solution.

7. Limitations and Future Research

7.1. Limitations of the Study

This study has some limitations, and acknowledging these constraints is crucial for interpreting its findings accurately. Firstly, the research focuses on a specific neighborhood in Sharjah, limiting the generalizability of the results to a broader population. To add, the reliance on a WhatsApp group for participant selection may introduce a sampling bias, as individuals engaged in such groups might possess distinct characteristics from others who are not active on such groups. Additionally, the study’s quantitative nature may have led the researcher to overlook nuanced qualitative insights that could provide a deeper understanding of the factors influencing microgrid investment decisions. Furthermore, the cross-sectional design captures a specific point in time, and changes in attitudes over time are not accounted for. Another limitation is that the independent variable of UAE strategy is the dominant variable that motivates willingness to invest in microgrid. This means other variables are less influential on willingness to invest and, therefore, it could indicate that there are other variables that are important but not identified and assessed by the researcher.

7.2. Future Research Suggestions and Scope

To build on the findings of this study, future research topics are recommended. Firstly, covering a more extensive and diverse sample of participants across various regions in the UAE could enhance the study’s external validity. Exploring the qualitative aspects through in-depth interviews or focus groups would provide a richer understanding of the consumers’ perspectives, complementing the quantitative analysis. Moreover, in depth interviews with experts in the field is needed to better evaluate the qualitative aspect, while longitudinal studies could capture evolving attitudes over time, offering insights into the dynamic nature of microgrid adoption in the UAE. Comparative studies across different demographic groups or economic sectors would contribute to a more comprehensive understanding of the factors influencing microgrid investment decisions. Additionally, investigating the role of government policies and regulatory frameworks in shaping consumer perceptions and decisions would be a valuable avenue for future research. By addressing these suggestions, future research endeavors can contribute to a more nuanced and holistic comprehension of the dynamics surrounding microgrid technology adoption in the UAE.

The future scope for this study is to survey the private community villa and townhouse compounds by commercial property developers rather than the governmental development that is SZHP, in which it will cover the huge population of UAE residents alongside its Emirati citizens. Moreover, policymakers can further increase the economic activity in the country by considering financial programs to help end users who are interested in investing in renewable energy integrated microgrids and distributed generation in general while achieving sustainability and emission reduction goals along with economic benefits for society and government.

8. Conclusions

Overall, the study discusses and analyzes the complexity of factors influencing the willingness of consumers to invest in microgrid technology. Strategic alignment with national goals, considerations of profitability, environmental concerns, and the nuanced perception of disaster recovery all play crucial roles in shaping public attitudes toward microgrid adoption. These findings contribute to a deeper understanding of the intricacies involved in promoting sustainable and resilient energy solutions in the UAE.

Additionally, the findings of this study highlight the complex interplay of the factors influencing the willingness of consumers to invest in microgrid technology, encompassing strategic alignment, profitability, digitization, renewable energy utilization, CO2 emission reduction, and disaster recovery considerations. Policymakers and industry stakeholders can use these insights to design more effective initiatives that are based on a comprehensive and inclusive approach to encourage widespread adoption of microgrid technology. Understanding the participants’ perspectives revealed by this analysis promotes the successful navigation of the relationship between the variables surrounding microgrid adoption.

Further investigation of the role of digitization in influencing consumer decisions and the potential mitigation strategies for perceived barriers, such as high upfront costs, is highly recommended. Moreover, an in-depth examination of the public’s perceptions of disaster recovery and their impact on investment choices could offer valuable guidance for policymakers and industry stakeholders. Continuous research in these areas will contribute to a more holistic understanding of the factors shaping the adoption of microgrid technology and inform targeted interventions for sustainable energy transitions.

Author Contributions

Conceptualization, H.A.S.; Methodology, B.S.; Formal analysis, H.A.S.; Investigation, H.A.S.; Writing—original draft, H.A.S.; Writing—review & editing, B.S.; Supervision, B.S. and A.G.O.; Project administration, A.G.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data presented in this study are available on request from the corresponding author due to ethical reasons.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Questionnaire Sample

References

- Bajwa, A.A.; Mokhlis, H.; Mekhilef, S.; Mubin, M. Enhancing power system resilience leveraging microgrids: A review. J. Renew. Sustain. Energy 2019, 11, 035503. [Google Scholar] [CrossRef]

- Martínez-Peláez, R.; Ochoa-Brust, A.; Rivera, S.; Félix, V.G.; Ostos, R.; Brito, H.; Félix, R.A.; Mena, L.J. Role of Digital Transformation for Achieving Sustainability: Mediated Role of Stakeholders, Key Capabilities, and Technology. Sustainability 2023, 15, 11221. [Google Scholar] [CrossRef]

- Singh, M. UAE Government Launches National Housing Platform ‘Darak’. Gulf Business, May 2023. [Online]. Available online: https://gulfbusiness.com/uae-govt-launches-national-housing-platform-darak/ (accessed on 6 February 2024).

- Qamar, S.B.; Janajreh, I. Renewable Energy Sources for Isolated Self-sufficient Microgrids: Comparison of Solar and Wind Energy for UAE. Energy Procedia 2016, 103, 413–418. [Google Scholar] [CrossRef]

- Sajwani, H.A.; Soudan, B.; Olabi, A.G. Comprehensive Review of Socio-Economic Costs and Benefits, Policy Frameworks, Market Dynamics, and Environmental Implications of Microgrid Development in the UAE. Energies 2024, 17, 70. [Google Scholar] [CrossRef]

- Hotaling, C.; Bird, S.; Heintzelman, M.D. Willingness to pay for microgrids to enhance community resilience. Energy Policy 2021, 154, 112248. [Google Scholar] [CrossRef]

- Wallsgrove, R.; Woo, J.; Lee, J.H.; Akiba, L. The emerging potential of microgrids in the transition to 100% renewable energy systems. Energies 2021, 14, 1687. [Google Scholar] [CrossRef]

- Parag, Y.; Ainspan, M. Sustainable microgrids: Economic, environmental and social costs and benefits of microgrid deployment. Energy Sustain. Dev. 2019, 52, 72–81. [Google Scholar] [CrossRef]

- Wang, Y.; Rousis, A.O.; Strbac, G. On microgrids and resilience: A comprehensive review on modeling and operational strategies. Renew. Sustain. Energy Rev. 2020, 134, 110313. [Google Scholar] [CrossRef]

- Rosales-Asensio, E.; de Simón-Martín, M.; Borge-Diez, D.; Blanes-Peiró, J.J.; Colmenar-Santos, A. Microgrids with energy storage systems as a means to increase power resilience: An application to office buildings. Energy 2019, 172, 1005–1015. [Google Scholar] [CrossRef]

- Berka, A.; Dreyfus, M. Decentralisation and inclusivity in the energy sector: Preconditions, impacts and avenues for further research. Renew. Sustain. Energy Rev. 2021, 138, 110663. [Google Scholar] [CrossRef]

- Azimian, M.; Amir, V.; Javadi, S.; Siano, P.; Alhelou, H.H. Enabling demand response for optimal deployment of multi-carrier microgrids incorporating incentives. IET Renew. Power Gener. 2022, 16, 547–564. [Google Scholar] [CrossRef]

- García-García, J.; Sarmiento-Ariza, Y.; Campos-Rodríguez, L.; Rey-López, J.; Osma-Pinto, G. Evaluation of tax incentives on the financial viability of microgrids. Appl. Energy 2023, 329, 120293. [Google Scholar] [CrossRef]

- Almarzooqi, A.H.; Osman, A.H.; Shabaan, M.; Nassar, M. An Exploratory Study of the Perception of Peer-to-Peer Energy Trading within the Power Distribution Network in the UAE. Sustainability 2023, 15, 4891. [Google Scholar] [CrossRef]

- Mendes, G.; Nigmatulina, N. Grid-Connected Microgrids: From Research to Sustainable Implementation. In Affordable and Clean Energy; Springer: Berlin/Heidelberg, Germany, 2020; pp. 1–15. [Google Scholar] [CrossRef]

- Botelho, D.F.; Dias, B.H.; de Oliveira, L.W.; Soares, T.A.; Rezende, I.; Sousa, T. Innovative business models as drivers for prosumers integration—Enablers and barriers. Renew. Sustain. Energy Rev. 2021, 144, 111057. [Google Scholar] [CrossRef]

- Howell, S.; Rezgui, Y.; Hippolyte, J.L.; Jayan, B.; Li, H. Towards the next generation of smart grids: Semantic and holonic multi-agent management of distributed energy resources. Renew. Sustain. Energy Rev. 2017, 77, 193–214. [Google Scholar] [CrossRef]

- Shan, S.; Yang, S.; Becerra, V.; Deng, J.; Li, H. A Case Study of Existing Peer-to-Peer Energy Trading Platforms: Calling for Integrated Platform Features. Sustainability 2023, 15, 16284. [Google Scholar] [CrossRef]

- Sodiq, A.; Baloch, A.A.B.; Khan, S.A.; Sezer, N.; Mahmoud, S.; Jama, M.; Abdelaal, A. Towards modern sustainable cities: Review of sustainability principles and trends. J. Clean. Prod. 2019, 227, 972–1001. [Google Scholar] [CrossRef]

- Vartiainen, E.; Masson, G.; Breyer, C.; Moser, D.; Román Medina, E. Impact of weighted average cost of capital, capital expenditure, and other parameters on future utility-scale PV levelised cost of electricity. Prog. Photovolt. Res. Appl. 2020, 28, 439–453. [Google Scholar] [CrossRef]

- Düştegör, D.; Sultana, N.; Felemban, N.; Al-Qahtani, D. Public acceptance of renewable energy and Smart-Grid in Saudi Arabia. In Proceedings of the 2015 IEEE 8th GCC Conference & Exhibition, Muscat, Oman, 1–4 February 2015; pp. 1–4. [Google Scholar] [CrossRef]

- Scarpa, R.; Willis, K. Willingness-to-pay for renewable energy: Primary and discretionary choice of British households’ for micro-generation technologies. Energy Econ. 2010, 32, 129–136. [Google Scholar] [CrossRef]

- Kaczmarski, J.I. Public support for community microgrid services. Energy Econ. 2022, 115, 106344. [Google Scholar] [CrossRef]

- Baik, S.; Morgan, M.G.; Davis, A.L. Providing limited local electric service during a major grid outage: A first assessment based on customer willingness to pay. Risk Anal. 2018, 38, 272–282. [Google Scholar] [CrossRef] [PubMed]

- Kalkbrenner, B.J.; Roosen, J. Citizens’ willingness to participate in local renewable energy projects: The role of community and trust in Germany. Energy Res. Soc. Sci. 2016, 13, 60–70. [Google Scholar] [CrossRef]

- Rommel, K.; Sagebiel, J. Preferences for micro-cogeneration in Germany: Policy implications for grid expansion from a discrete choice experiment. Appl. Energy 2017, 206, 612–622. [Google Scholar] [CrossRef]

- Sirr, G.; Power, B.; Ryan, G.; Eakins, J.; O’Connor, E.; le Maitre, J. An analysis of the factors affecting Irish citizens’ willingness to invest in wind energy projects. Energy Policy 2023, 173, 113364. [Google Scholar] [CrossRef]

- Skordoulis, M.; Ntanos, S.; Arabatzis, G. Socioeconomic evaluation of green energy investments: Analyzing citizens’ willingness to invest in photovoltaics in Greece. Int. J. Energy Sect. Manag. 2020, 14, 871–890. [Google Scholar] [CrossRef]

- Karasmanaki, E.; Galatsidas, S.; Ioannou, K.; Tsantopoulos, G. Investigating Willingness to Invest in Renewable Energy to Achieve Energy Targets and Lower Carbon Emissions. Atmosphere 2023, 14, 1471. [Google Scholar] [CrossRef]

- Abdmouleh, Z.; Gastli, A.; Ben-Brahim, L. Survey about public perception regarding smart grid, energy efficiency & renewable energies applications in Qatar. Renew. Sustain. Energy Rev. 2018, 82, 168–175. [Google Scholar]

- Marzal, S.; Salas, R.; González-Medina, R.; Garcerá, G.; Figueres, E. Current challenges and future trends in the field of communication architectures for microgrids. Renew. Sustain. Energy Rev. 2018, 82, 3610–3622. [Google Scholar] [CrossRef]

- Hussain, A.; Bui, V.H.; Kim, H.M. Microgrids as a resilience resource and strategies used by microgrids for enhancing resilience. Appl. Energy 2019, 240, 56–72. [Google Scholar] [CrossRef]

- Hirsch, A.; Parag, Y.; Guerrero, J. Microgrids: A review of technologies, key drivers, and outstanding issues. Renew. Sustain. Energy Rev. 2018, 90, 402–411. [Google Scholar] [CrossRef]

- Wani, T.A.; Ali, S.W. Innovation diffusion theory. J. Gen. Manag. Res. 2015, 3, 101–118. [Google Scholar]

- Sonnenwald, D.H.; Maglaughlin, K.L.; Whitton, M.C. Using innovation diffusion theory to guide collaboration technology evaluation: Work in progress. In Proceedings of the Tenth IEEE International Workshop on Enabling Technologies: Infrastructure for Collaborative Enterprises. WET ICE 2001, Cambridge, MA, USA, 20–22 June 2001; pp. 114–119. [Google Scholar] [CrossRef]

- Bennett, N.J.; Satterfield, T. A practical framework to guide design, evaluation, and analysis. Conservation Letters. Conserv. Lett. 2018, 11, e12600. [Google Scholar] [CrossRef]

- Liu, J.; ED Love, P.; Smith, J.; Regan, M.; Sutrisna, M. Public-private partnerships: A review of theory and practice of performance measurement. Int. J. Product. Perform. Manag. 2014, 63, 499–512. [Google Scholar] [CrossRef]

- Roumboutsos, A.; Macário, R. Public private partnerships in transport: Theory and practice. Built Environ. Proj. Asset Manag. 2013, 3, 160–164. [Google Scholar] [CrossRef]

- Saunders, M. Research Methods For Business Students, 7th ed.; Pearson: London, UK, 2016; ISBN 9781292016627. [Google Scholar]

- Fama, E.F.; French, K.R. Profitability, investment and average returns. J. Financ. Econ. 2006, 82, 491–518. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).