1. Introduction

Green growth will require large-scale changes in the behavior of households, businesses and governments. Taxes and other market-based instruments are key policy tools for providing clear and sustained incentives meant to reduce environmental damage and limit CO

2 emissions [

1,

2,

3].

Climate policy, both in mitigation and adaptation, by its very nature, addresses a collective action problem, sometimes without being represented by a clearly identifiable organization or by a person whose purpose is to solve the defined difficulties. Reducing greenhouse gas emissions requires the voluntary or involuntary participation of all sectors of society, from energy production to household energy consumption and from agricultural production to individual consumption habits. How this climate risk develops or reduces depends on how individuals, sectors of society or habitats exposed to hazards react and how vulnerable they are to them [

4].

In recent years, due to increasing pollution, governments under pressure have tried to find ways to minimize environmental damage while reducing the negative impact of natural resource exploitation and the use of energy. In response to this immense pressure, countries have applied a variety of tools to achieve sustainable development and environmental conservation goals. Even though various instruments are available to governments, green taxes have become the most significant and used financial instrument in the fight against climate change and environmental conservation [

5].

Green taxes can be used to reflect the costs of pollution in prices, which encourages both polluters and consumers to take these costs into account. They not only reduce pollution but do so in efficient and cost-effective ways [

6].

Environmental taxes are assimilated into green taxes, an important category of green financial instruments, and can take the form of energy taxes, pollution taxes, transport taxes and resource taxes. The definition of environmental taxes does not explicitly link these taxes to the amount of environmental damage or external costs; instead, it refers only to a taxable base [

6].

Green taxes are effective tools for achieving environmental goals because they are mandatory, and thus encourage environmentally friendly behavior. However, these measures are economically inefficient because they are uniform for all firms, and therefore, the total cost is not minimized (they may result in different marginal abatement costs), and they do not promote continuous innovation in the technologies of pollution [

7,

8].

Green taxes can effectively help developing countries achieve a low-carbon transformation while supporting an inclusive and equitable growth path. Especially in lower-income countries, environmental tax reforms can improve social equality. First, this happens because wealthier urban households tend to have more energy-intensive lifestyles and, secondly, because the structural change induced by environmental taxes can generate increases in the relative return to labor [

9,

10,

11].

Following studies carried out by other researchers, we found that the objective of the green economy is to ensure sustainable production and consumption. Although the transition to a green economy has been approached from many perspectives, the tendency is to present or emphasize the environmental component more and the financial one less. The main objective of this paper is to analyze the impact of energy consumption and CO2 emissions on green taxes at the level of the European countries. Thus, a dynamic panel analysis was carried out regarding the existing links between green taxes at the European level and the indicators of sustainable development.

For these reasons, we considered it relevant to show in this research paper what the influencing factors are on green taxes using dynamic regressions. So, we realized an empirical analysis for 31 countries—EU member states plus Switzerland, Iceland and Norway—for the period 2012–2021, with the most important explanatory variables taken into account being: GDP/capita; Primary energy consumption; net greenhouse gas emissions; Supply, transformation and consumption of renewable sources. The innovative elements of our study are provided by the realization of two dynamic regressions, with unique variables, and by highlighting the significant and positive correlation between green taxes with respect to their most important component: energy taxes and primary energy consumption.

This paper is divided into five sections, ending with conclusions on the analysis conducted, its limitations and future research.

Section 2 presents a brief specialized literature review on green taxes and their components, economic impact and energy consumption impact.

Section 3 presents the data and the research methodology; the empirical results and discussions are presented in the next section. We can note the following conclusions of empirical analysis: First, there is a lack of research evaluating the effectiveness of green taxes, particularly in emerging economies. The study carried out in this paper examines the relationship between environmental tax revenues and sustainable development principal indicators, among them being GDP real per capita; the Human Development Index; net greenhouse gas emissions; supply, the transformation and consumption of renewable sources and waste; primary energy consumption; etc. This approach is unique, and the combination of these variables has not been used in other research studies. Second, energy taxes are a possible solution for addressing the costs of emissions in EU countries and may even stimulate climate action, but the EU does not take them into account in its carbon footprint emissions for imported goods.

The variation in real GDP/capita significantly and positively influences transport taxes and pollution taxes. Increased primary energy consumption and the consumption of raw materials cause an increase in environmental taxes, energy taxes and transport taxes. In contrast, net greenhouse gas emissions do not significantly influence green taxes or their components.

2. Literature Review

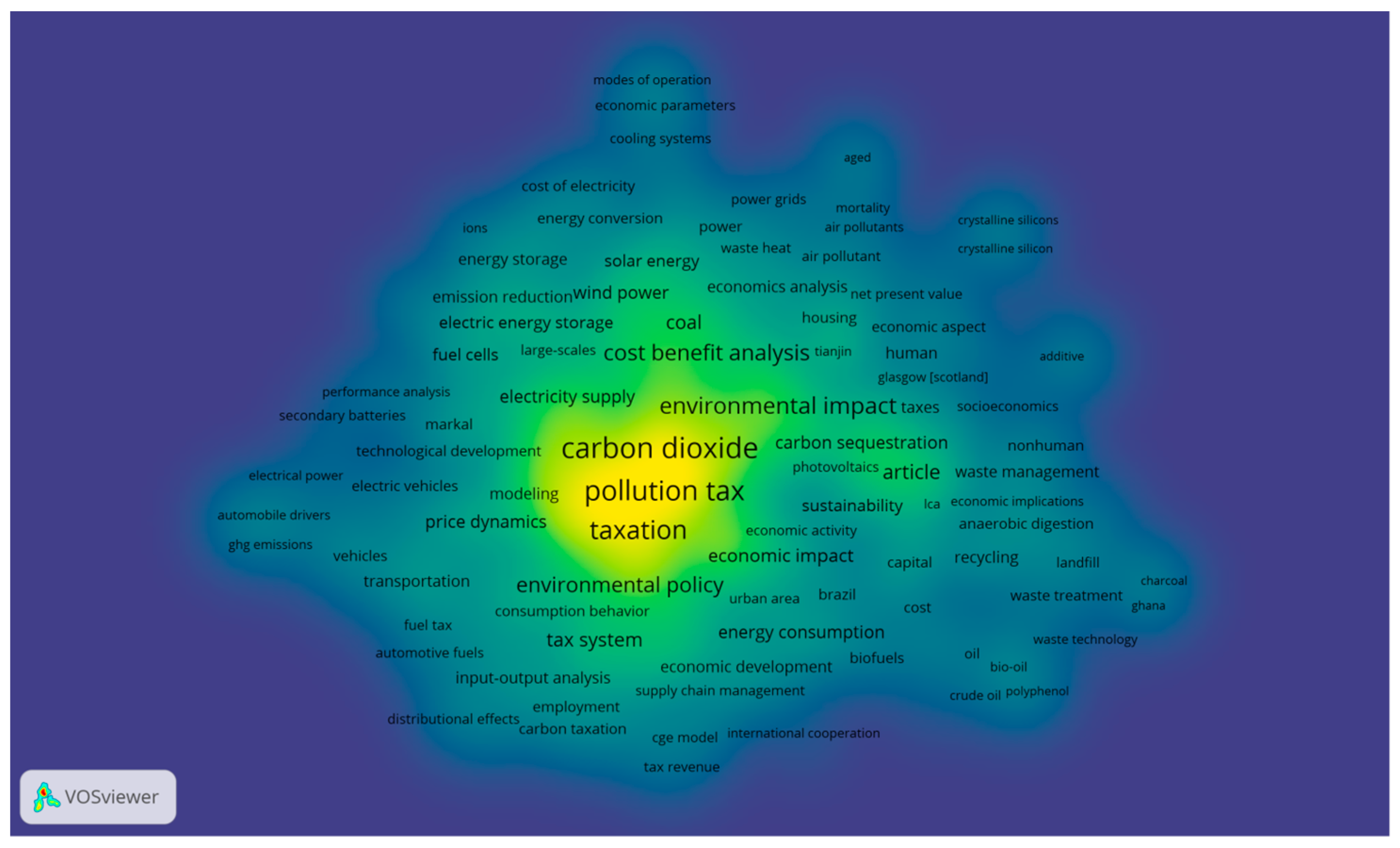

A bibliometric analysis of the correlation between energy consumption, CO

2 emissions and green taxes was carried out using the Scopus/Elsevier database. Keywords such as energy, energy policy, renewable resources, pollution, taxation, pollution taxation, energy consumption and economic impact were inserted in the database, resulting in 367 articles. These keywords are intended to highlight the increase in taxation and the impact of this measure on the context of the use of energy produced with the help of hydrocarbons or the high consumption of carbon dioxide. The articles were published in journals corresponding to the fields of energy, economics and energy management or public policies in the field of energy. The links between these keywords can be observed using the VOS viewer 1.6.20 software in

Figure 1:

Terms like carbon dioxide, taxation, pollution tax, energy, energy policy, renewable resources, pollution, taxation, pollution taxation and energy consumption or economic impact are all closely related.

Most articles were published between 2012 and 2022. Moreover, it can be concluded that the field of green energy and taxation is becoming an important topic at an international level, gaining special attention for future debates. The implications of this sector are important considering the long transition from energy produced with the help of primary resources resulting in carbon dioxide to renewable energies with a low carbon dioxide intensity.

The literature studied for this article highlighted several important aspects that can be used to divide the authors into several groups. Group 1: This includes all the authors who believe that carbon and energy taxes significantly contribute to reducing carbon dioxide emissions. Group 2: This includes all the authors who believe that carbon and energy taxes significantly lead to reduced carbon dioxide emissions but that these measures must be combined with subsidies from states to help the business environment and the population. Group 3: This includes all the authors who believe that carbon and energy taxes lead to friction in the economy and affect firms and the population, representing a disruptive factor in the process of economic growth.

In the first group of authors, we have Nakata and Lamont [

12], who examine the impact of using carbon and energy taxes to reduce carbon emissions and the impact of these changes on the Japanese energy system up to 2040. The model indicates that taxes on carbon and energy will reduce carbon dioxide emissions by causing a shift in the use of resources from coal to gas.

A reasonable carbon tax can be applied to achieve a certain target level of reduction in emissions and resource use, as per Choi et al. [

13]. In the short run, in theory, a larger CO

2 reduction can be achieved with a higher price elasticity in demand or a larger percentage increase in the price. The first option corresponds to a more sensitive demand response to a change in the fixed price, while the second is based on a higher carbon tax when the elasticity of demand is fixed. Therefore, two issues are essential: a demand management policy and the design of a reasonable tax scheme.

Liu et al. [

14] point out that coal use is the focus of China’s energy policies, with model results suggesting that tax reform will reduce both the price of coal and the profitability of the coal industry if the tax charged per ton of coal is kept at the same level as before the reform, regardless of whether the market is in a shortage or oversupply. Sun and Wang [

15], who focus on China, a country facing an increasingly prominent conflict between its growing energy consumption and its environmental impact, think exactly the same. Their study suggests policies meant to adjust the structure of energy consumption, such as reducing energy with high carbon emissions or implementing energy price reform carbon tax.

Hájek et al. [

16] have the same opinion; the implementation of a carbon tax is desired, considering that it is one of the environmental protection policy instruments that should contribute to a reduction in greenhouse gas emissions. The results of their analysis suggest that carbon tax in the energy industry is environmentally efficient, with a high tax rate allowing for a reduction in greenhouse gas production. The more the carbon tax increases by one monetary unit for each ton, the more it can reduce annual per capita emissions.

The same approach is found in Shi et al. [

17], who believe that improving the energy efficiency of the construction sector can be an important way to reduce CO

2 emissions. As a reasonable energy policy tool, a carbon tax can improve energy efficiency and reduce CO

2 emissions.

Zhu et al. [

18] believe that ambitious targets for renewable energy and CO

2 taxation are both policy tools for decarbonizing the energy system. A sufficiently high CO

2 tax results in a more efficient use of variable renewable energy via heat pumps and hot water storage. Their study considers that a CO

2 tax is needed to decarbonize the electricity and heating sectors.

Rafique et al. [

19] want to explore the role of environmental taxes and economic growth in the growing ecological footprints of 29 OECD economies. Their results show that environmental taxes, economic growth, foreign direct investment, energy use, urbanization, renewable energy and industrialization significantly influence the ecological footprint.

Shahbaz et al. [

20] explore the impact of green taxes on carbon emissions for the G7 nations. The results suggest that green taxes significantly reduce emissions for the G7 countries and confirm the assumption that the marginal effects of environmental taxes on traditional energy consumption, natural resource use, and renewable energy consumption increase with the level of taxation in a significant way.

The second group of authors begins with the work of the collective coordinated by Lucena et al. [

21], who assessed the effects of market mechanisms and carbon emission restrictions on the Brazilian energy system. The results of their study show that low taxes do not significantly reduce CO

2 emissions, while higher taxes produce average emission reductions of around 60% compared with the baseline. Emission reductions are mainly due to the following factors: taxation; the increased penetration of renewable energy (especially biomass and wind); carbon capture; and storage technologies for fossil fuels and/or biomass.

Doran et al. [

22] identified the influence of fiscal policy, financial development and economic growth on the increase in the consumption of renewable sources in Romania using the Autoregressive Distributed Lag method in the period 2000–2020. The external debt stocks; real GDP per capita; and implicit tax rate on energy variables have a significant positive influence on the consumption of renewable energy, while the market capitalization of listed domestic companies and environmental tax revenues from energy taxes independent variables have a significant negative impact on the dependent variable.

Nakata [

23] believes that appropriate environmental regulation can promote corporate innovation. The energy–economic model is a decision-making tool for a variety of purposes, such as energy security planning, climate policy analysis and the assessment of technological innovation, encouraged or discouraged by policy measures such as taxation, subsidies and investment in research and development. Hence, the author came up with the idea of using a dichotomy of measures by stimulating the research and development of new technologies regarding the use of energy resources and taxing the use of polluting energy resources. Development through research and dual support through taxation but also reward through grants is also encouraged in a study by Khan et al. [

24] and in an analysis by Kumbaroglu [

25].

Cansino et al. [

26] observed a change in the Spanish energy mix that contributed to lower emissions, this change coming from a lower use of coal. The coke and refined petroleum industries and other non-metallic mineral sectors could remain at the center of policy measures aimed at mitigation due to their weight in the carbonization effect trend. This mitigation would follow the change in demand with the help of subsidies granted in the purchase of panels or hybrid and electric cars.

Garcia [

27] quantifies a carbon tax value that will allow the emission reduction target to be achieved and assesses its impact on the economy. Their mathematical model showed that it is more cost-effective to tax only producers than to tax both producers and households. The most-affected productive sectors are the oil-refining, transport and electricity sectors. Also, the electricity production from fossil fuels will decrease, but the electricity from renewable sources will increase.

Bashir et al. [

28] shed new light on the ambiguous role of environmental taxes in the process of reducing energy consumption. The implementation of an environmental tax helps control overall energy consumption and promotes energy efficiency by encouraging decision-makers, industries and residents to promote innovation in new environmentally related technologies.

Li and Lin [

29] start from the premise that reducing carbon dioxide, which is the central issue in addressing global warming, depends on the extent to which clean energy can replace CO

2-emitting coal and non-energy factors. Their empirical results suggest a substitution between different types of energy sources, as well as substitutability between energy, labor and capital. The size of the cross-price elasticities indicates that the substitutions are inelastic, which limits the scope of the government in implementing a substitution strategy aimed at energy conservation and environmental management.

Wanting and Zhi-Hua [

30] believe that governments in both developed and developing countries are monitoring the growing problems of environmental pollution, resource consumption and energy scarcity. These governments use carbon taxes to discourage polluting production and use subsidies to encourage low-carbon production methods. Their results showed that static carbon taxes and subsidy mechanisms implemented by governments cannot provide necessary positive impacts on producers’ decisions. Among the three dynamic tax and subsidy mechanisms, dynamic taxes and subsidy mechanisms are the most effective because they provide more incentives for producers to move toward low-carbon production.

A different approach is taken by Máté et al. [

31], who state that carbon dioxide is a significant source of greenhouse gas emissions and plays a crucial role in climate change and global warming; therefore, their study aims to explain the effects of primary and renewable energy supply and taxation. Their empirical findings suggest that the impact of taxation is more important than the incentives offered to companies or the population, as legal and natural persons react more quickly to taxation than to receiving a subsidy.

Group three comes up with an approach that analyzes not only the correlation between taxation, energy consumption and pollution but also the impact on the population. Here, Ahmed et al. [

32] show a bidirectional correlation between green taxes and energy intensity and energy intensity. This conclusion supports the authors’ claim that green taxes can reduce energy consumption.

Wissema and Delink [

33] trace the impact of implementing energy taxation on reducing carbon dioxide emissions. Their study states that the objective of reducing CO

2 emissions can be achieved with a green tax and that effects on the well-being of the population would be felt because it would decrease, but only by small percentages. Production and consumption patterns would also change significantly, with a shift in demand from fuels with a high CO

2 emission factor to energy sources with lower carbon intensity.

Guo et al. [

34] applied a computable general equilibrium model to investigate the impact of a carbon tax on China’s economy and carbon emissions. The authors conclude that a moderate carbon tax would significantly reduce carbon emissions and fossil fuel energy consumption and slightly reduce the pace of economic growth. However, a high carbon tax would have a significant negative impact on China’s economy and social welfare.

Along the same line, Tang et al. [

35] focus on the Chinese government’s implementation of coal resource tax reform, from quantity-based collection to ad valorem collection, to develop a low-carbon economy. The results of the study indicate that China’s gross domestic product would be negatively affected by this reform; it would lead to a decrease in production in most sectors, and the effect would be more negative the higher the tax rate.

The same idea is reinforced by Coady et al. [

36], who consider that global energy subsidies—as measured by the difference between what consumers should pay for fossil fuel energy and what they actually pay—have to be very large thanks to their helping the poor through subsidized energy. The authors concluded that a sharp increase in energy prices can have a significant impact on the budgets of poor households, both directly through higher energy prices and indirectly through lower real income due to the higher prices of other consumer goods.

Hu et al. [

37] conducted a comparative study of the effects of a resource tax and a carbon tax. A carbon tax leads to a reduction in all types of energy consumption but is more appropriate to use than a resource tax. In the case of the dual taxation of resources and carbon, the authors conclude that the economy will contract due to a reduction in consumption but also an increase in the price of energy, which is not indicated.

On the contrary, Lin and Jia [

38] believe that human activities have led to an increase in carbon dioxide emissions, and carbon taxes are the main government policy tool for reducing global emissions. The impact of the taxation of carbon dioxide emissions on GDP development is acceptable.

3. Data and Methodology

The data set analyzed in this paper contains 310 observations (31 countries—EU member states plus Switzerland, Iceland and Norway—for 10 years), with the analysis period being set between the years 2012 and 2021 and the source of data being the Eurostat [

39] and Human Development Reports [

40].

The dependent variables are green taxes and their components, and the independent variables are GDP/capita; primary energy consumption; CO2 emissions and supply; and the transformation and consumption of renewable sources.

In estimating the regression models, we also took into account other explanatory variables that constitute the indicators of sustainable development, including real GDP/capita; the Human Development Index; municipal waste through waste management operations—waste generated; municipal waste through waste management operations—waste treatment; net greenhouse gas emissions; government expenditure—environmental protection; private investment and the gross added value related to the circular economy sector; climate-related economic losses; and raw material consumption. However, in the end, we focused this article only on the influence of real GDP/capita, and of primary and renewable energy consumption with respect to CO2 emissions on green taxes.

Table 1 lists the variables that were taken into consideration for our model as well as the symbol used, the unit of measure and the database source accessed.

3.1. Description and Analysis of the Data Used in the Dynamic Panel

In the following, we will present the relevant variables for the purpose and objectives of our article. Before conducting the empirical analysis, we calculated the descriptive statistics of the dependent and independent variables used in the panel analysis. Half of the countries analyzed for the period 2012–2021 had values between 205.49 million EUR (minimum) and 5084.68 million EUR (median), and the other 50% of countries had values between 5084.68 million EUR (median) and 64,714 million EUR (maximum). It can be seen in

Table 2 that the standard deviation is high for all dependent variables, which means that the values recorded by the European countries under analysis are very different in terms of green taxes, both overall and for each category. Kurtosis is a measure of the skewness of data distribution. A positive skew and kurtosis, as in the case of the variables TEVTAX and ENGTAX, indicate that the distribution is more skewed to the right, while a negative skew indicates a skew to the left. A positive skewness indicates a longer and heavier tail on the right side of the distribution, while a negative skewness indicates a longer and heavier tail on the left side.

The dependent variables—green taxes and their components—include environmental tax revenues from energy taxes, transport taxes and taxes on polluting resources [

39].

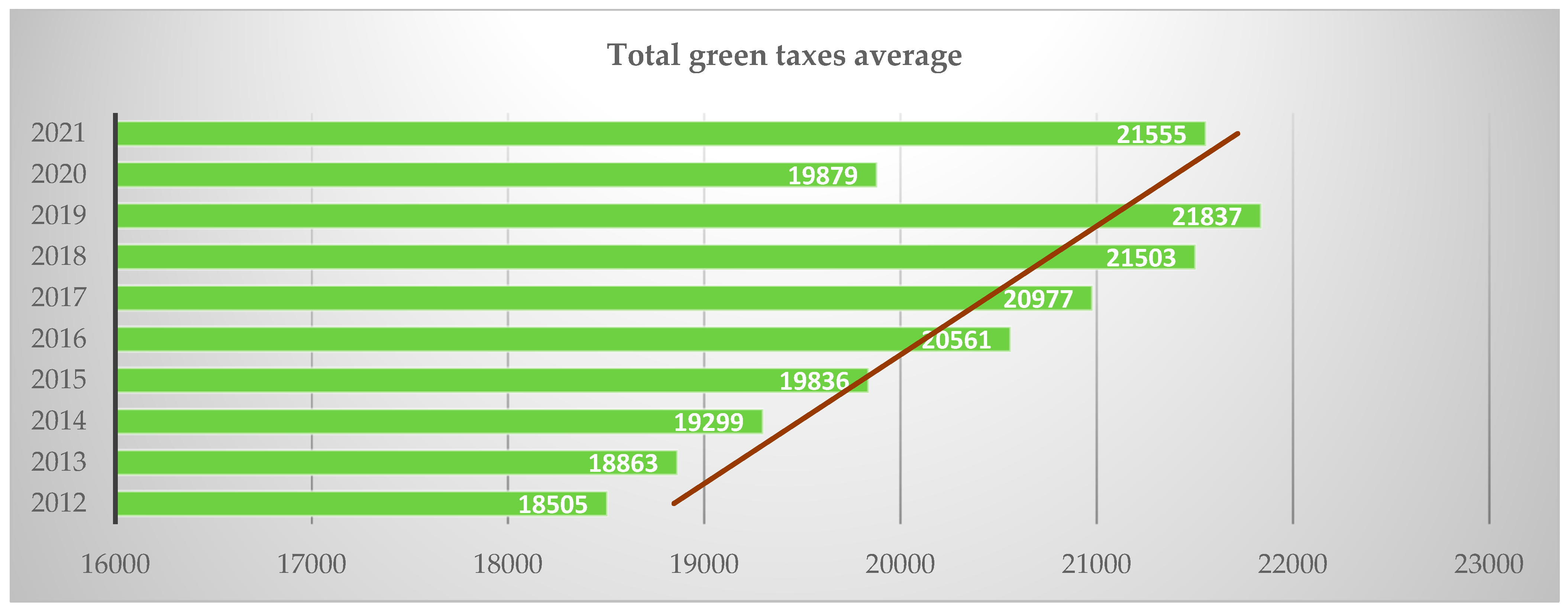

Figure 2 captures the evolution of total environmental taxes for European countries from 2012 to 2021. The trend is linear, with a constant increase from one year to the next, except for 2020, when a sudden decrease can be noted from an average of 21,837.07 million EUR to 19,878.94 million EUR.

The COVID-19 pandemic affected the amount of revenue from some environmental taxes during 2020 and 2021, such as air travel taxes, which fell due to reduced air travel. Another explanation for the decrease in total environmental taxes is mainly due to lower revenues from agriculture, forestry and fishing; the service sector; and the transport industry. In agriculture, forestry and fishing, revenues fell mainly due to carbon taxes, which coincided with larger tax cuts for the use of certain fuels in this industry. Regarding the dependent variable total green taxes, the minimum value was recorded in Malta in 2012 at 205.49 million EUR, and the maximum value was reached in 2021 in Germany at 64,714 million EUR. Every year, Germany registers the highest value of green tax receipts and the highest value of supply, transformation and consumption of renewable resources and waste, although it is in 12th place among the countries analyzed in terms of real GDP/capita.

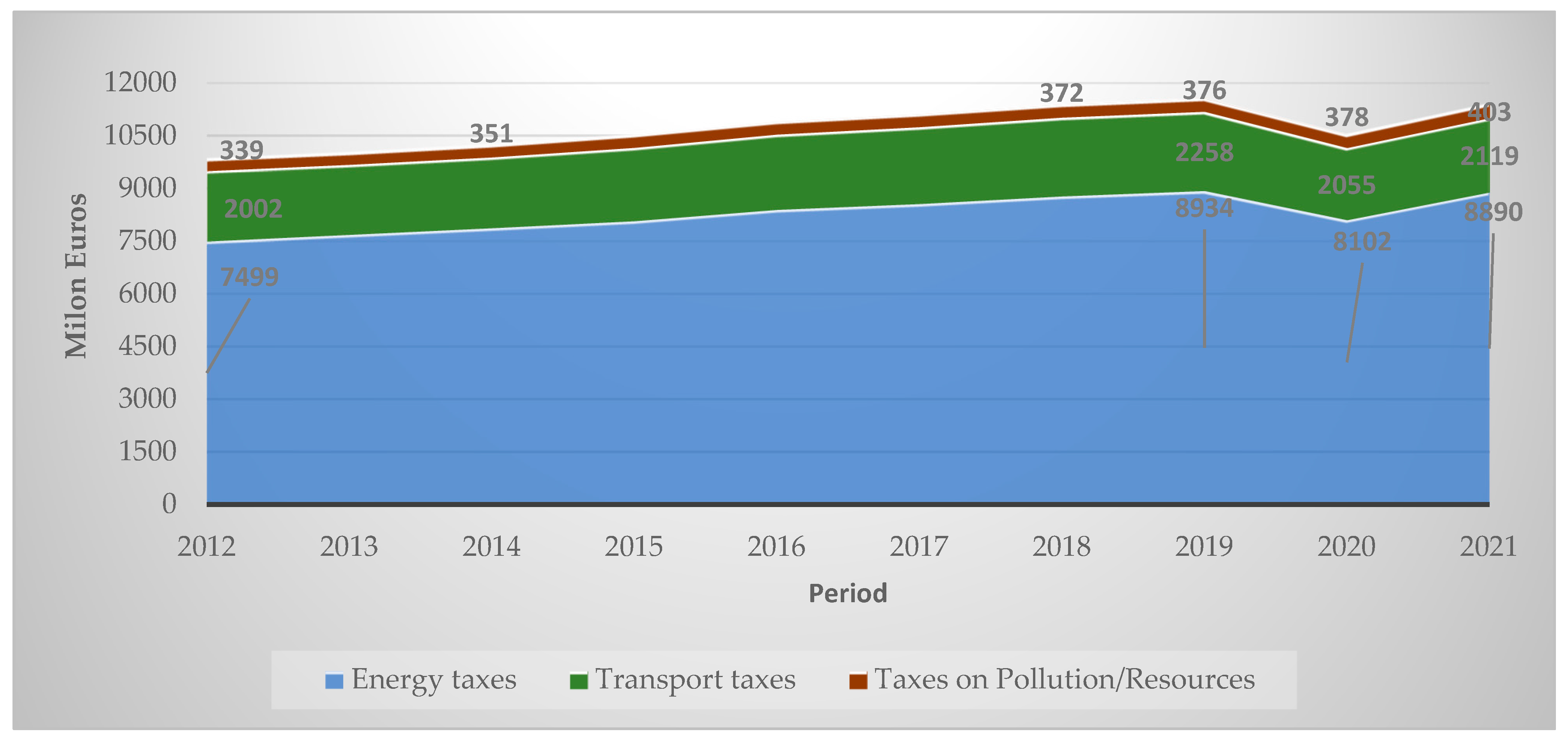

Figure 3 shows the values of green taxes broken down by component, namely, energy taxes, transport taxes and pollution/resource taxes in European countries in the period 2012–2021. Their presentation is in parallel not only to show their evolution but also to emphasize their weight and contribution to total revenues.

Energy taxes have the largest share of total environmental taxes, followed by transport taxes and pollution/resource taxes. This fact is largely explained by the value of the domestic consumption tax on energy products.

The differences between the three categories are notable, and they are exponential if we make a comparison between energy and pollution taxes. Energy and transportation taxes were primarily set and manipulated to generate more revenue, with priorities other than the environment in mind, such as budget targets, natural disaster management, income distribution, inflation control and industrial competitiveness. However, in recent times, there has been an increasing influence of environmental concerns on the implementation and design of new measures, with existing instruments being revised to align with environmental objectives. For example, vehicle registration taxes and property taxes have been adjusted to penalize the owners of more powerful cars in Italy. Moreover, as Zatti [

41] states, the environmental class of a vehicle is also considered when determining the recurring property tax. At the same time, taxes on natural resources have the lowest share due to the reduced activity of extraction.

The variable energy taxes include taxes on energy production and energy products used both for transport (gasoline and diesel) and for stationary use (fuel oil, natural gas, coal and electricity). The minimum value of the collected energy taxes was recorded in Malta in 2013 at 107.56 million EUR, and the maximum value was reached in 2021 in Germany at 54,619 million EUR.

The variable

transport taxes include taxes related to the ownership and use of motor vehicles. Also, taxes on other means of transport (e.g., aircraft, ships or rail stock) and related transport services are included here [

39]. The non-stationary variable transport taxes capture the countries in the data set that had higher transport taxes than in the previous year by an average of 15,683.95 million EUR for the period 2012–2021. The minimum value of this variable was recorded in Estonia in 2012 with 10.79 million EUR, and the maximum value was reached in 2018 in Italy with 10,877 million EUR. Although the trend illustrated in

Figure 3 is steady, a slight decrease can be noted from 2019 onward. This decrease is explained by the sudden increase in vehicles using diesel, which has been subject to lower taxes and no inflation indexation on most environmental tax rates. At the same time, fuel consumption due to blockages during the pandemic in 2020 is also felt in the case of transport taxes.

The

taxes on pollution/

resources variable represents a very small share of the total environmental tax revenues and includes taxes on measured or estimated emissions into air and water, taxes on solid waste and taxes related to the extraction or use of natural resources such as water, forests, wildlife etc. This category includes taxes related to the extraction or use of natural resources such as water, forests, wildlife, etc., as these activities deplete natural resources [

39]. The minimum value of this variable was recorded in Cyprus in 2014 at 0.9 million EUR, and the maximum value was reached in 2021 in the Netherlands at 3712 million EUR. Although the situation is alarming at the level of the European Union, air pollution continues to give rise to serious health effects, causing premature deaths. Luxembourg has among the lowest pollution/resource tax revenues and the lowest net greenhouse gas emissions of the countries analyzed.

In

Table 3, the main explanatory variables analyzed are statistically represented, more precisely, GDP/capita; primary energy consumption; and the transformation and supply of renewable energy with respect to net CO

2 emissions. Half of the countries analyzed for the period 2012–2021 had values of primary energy consumption between 0 tons (minimum) and 22.75 million tons of oil (median), and the other 50% of countries had values between 22.75 mil. tons (median) and 1396.2 mil. tons (maximum). It can be seen in

Table 3 that the standard deviation is high for all dependent variables, which means that the values of explanatory variables recorded by the European countries under analysis are very different in terms of green taxes, both overall and for each category. The difference in real GDP/capita and the variable primary energy consumption have positive skew and kurtosis, thus indicating a longer and heavier tail on the right side of the distribution.

GDP/per capita is part of the EU Sustainable Development Goal (SDG) set of indicators. It is used to monitor progress toward SDG 8: decent work and economic growth. Half of the countries analyzed for the period 2012–2021 had differences in GDP/capita values lower than in the previous year by 3400.00 million EUR and higher by 375.00 million euro (median), and the other 50% of the analyzed countries had higher values than in the previous year with values between 375.00 million EUR (median) and 9250.00 million EUR (maximum).

The research carried out indicates that environmental taxes are significantly and positively correlated with GDP per capita, which implies that the higher the level of economic development, the higher the receipts from green taxes (taxes on pollution and transport taxes). From this, we generated the hypothesis that green tax revenue and green economic growth could vary with a country’s GDP per capita.

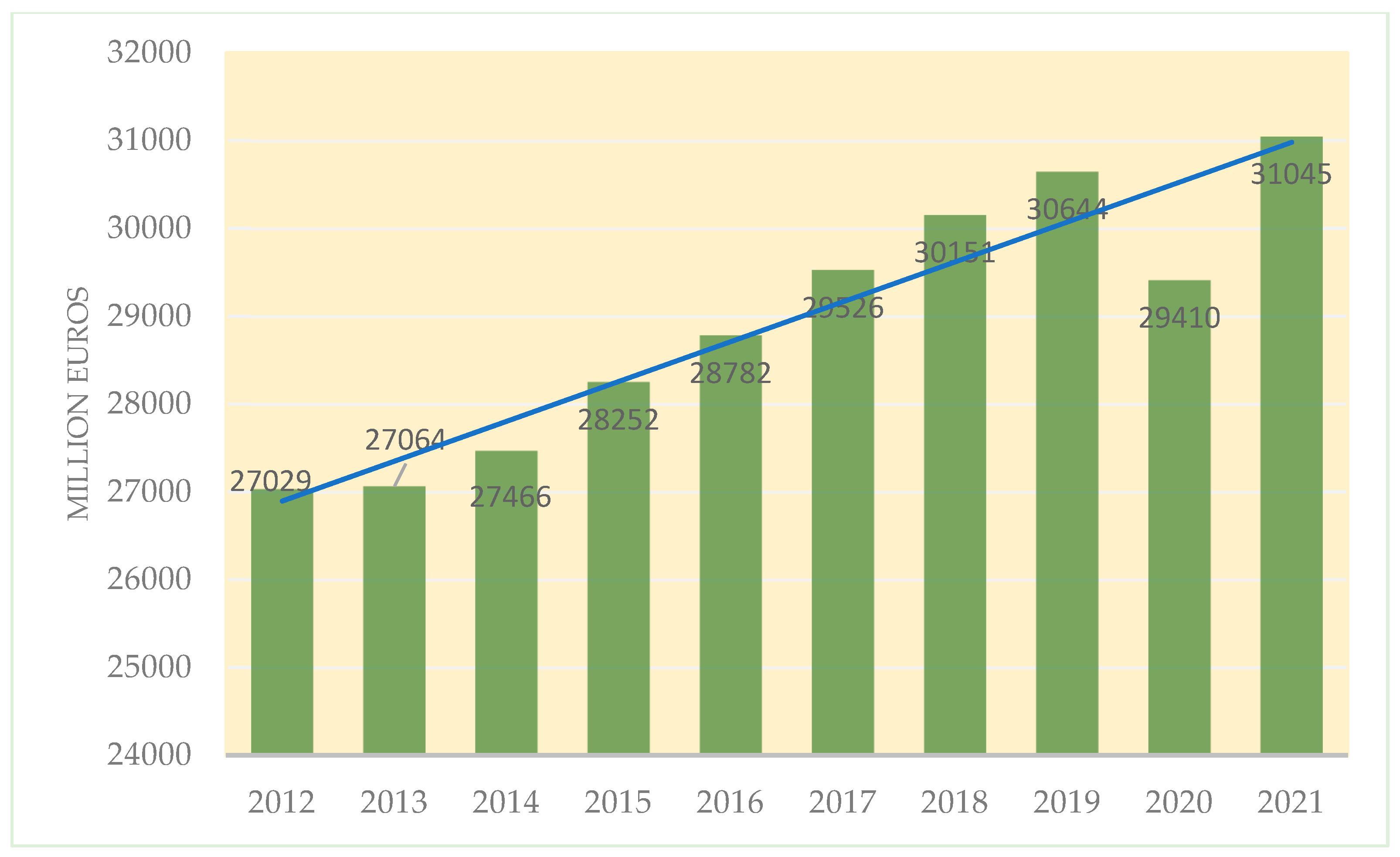

As can be seen in

Figure 4, GDP per capita in European countries had a constant increase of up to 30644 million EUR until 2019, and in 2020 suffered a sudden decrease, with the COVID-19 pandemic having a significant effect. Regarding the real GDP per capita variable, the minimum value was recorded in Bulgaria in 2012 at 5390 million EUR, and the maximum value was reached in 2016 in Luxembourg at 84,750 million EUR.

Primary energy consumption is also part of the EU Sustainable Development Goal (SDG) set of indicators. It is used to monitor progress toward SDG 7, clean and affordable energy, and measures a country’s total energy needs, excluding all non-energy uses of energy carriers [

39]. The most notable fluctuation in primary energy consumption is between the years 2019 and 2020 from 47.78 million tons to 43.68 million tons due to the COVID-19 pandemic, which influenced primary energy consumption.

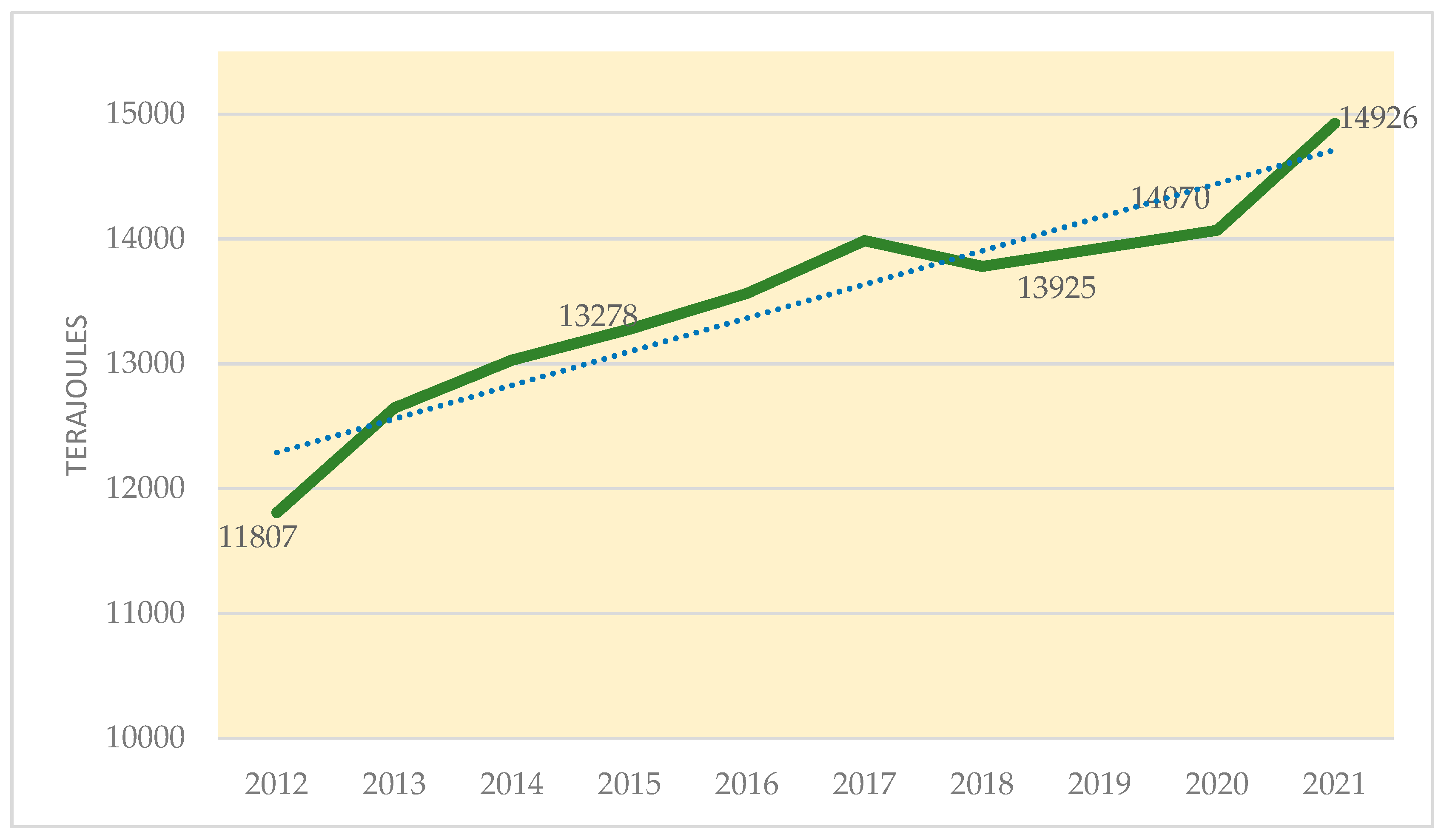

As we can see in

Figure 5, the minimum value of the primary energy consumption variable was recorded in Malta in 2016 with 0.7 million tons of oil equivalent, and the maximum value was reached in 2013 in Germany with 308.3 million tons of oil equivalent. During the analyzed period, Germany recorded a continuous decreasing trend in the amount of primary energy consumed and a continuous increasing trend in supply, transformation and consumption of renewables and wastes, with the highest values of renewable energy supplied and consumed year after year.

The supply, transformation and consumption of renewable resources and waste variable includes quantities of crude oil, petroleum products, natural and process gases, electricity and derived heat, solid fossil fuels, renewables and waste, covering the entire spectrum of the energy sector, from supply to transformation and final consumption, based on sector and fuel type [

39]. The variable representing the average difference in the supply, transformation and consumption of renewable energy is 482.74, while the median difference in energy supply and transformation and consumption is 0.01.

Figure 6 relates to the supply, transformation and consumption of renewable sources and municipal waste in European countries from 2012 to 2021 and shows a constant, increasing trend without fluctuations. The minimum value of the variable regarding the supply, transformation and consumption of renewable resources and waste was recorded in Romania in 2012 with 1 terajoule, and the maximum value was reached in 2017 in Germany with 134,686 terajoules.

Net greenhouse gas emissions are part of the EU Sustainable Development Goal (SDG) set of indicators [

39].

Figure 7 captures the net emissions of greenhouse gases at the EU 27 level from 2012 to 2021, showing us a constant trend without major fluctuations, with a decrease starting in 2020. The values are between a minimum of 7 tons per inhabitant in the year 2020 and 8.5 tons per inhabitant in 2012. Regarding variable net greenhouse gas emissions, the minimum value was recorded in Sweden in 2020 at 0.6 tons/capita, and the maximum value was reached in 2012 in Iceland at 45.8 tons/capita.

According to the EEA [

42], currently in the EU, greenhouse gas emissions have decreased by about a third since 1990. This is mainly due to the implementation of EU and national policies and measures, the massive use of renewable sources, the transition from coal to gas for power generation, improved energy efficiency. Emissions have decreased in almost all sectors, especially in the energy supply industry, even though in agriculture emissions have increased in recent years.

Previous studies, such as those by Zhu et al. [

18], Shahbaz et al. [

20], Zhao et al. [

11] and Ahmed et al. [

43], have shown a negative correlation between renewable energy production and consumption and net gas emissions. In the case of most analyzed countries, such as Germany, France and Spain, this observation is also confirmed here. However, according to data published by Eurostat [

39], Iceland has the highest level of net gas emissions and is powered almost entirely by renewable energy. Instead, Romania has the lowest production and consumption of renewable energy and is among the European countries with the lowest net gas emissions.

3.2. Model Construction

All variables were logarithmized, thus reducing the chances of heteroscedasticity [

43]. As a first step, we analyzed the stationarity of the data series used in the analysis using the Harris–Tsavalis test, which is an improved unit root test for panel data based on the traditional Dickey–Fuller test (ADF). This test considers both individual heterogeneity and cross-sectional dependence, thus allowing for more precise inference within panel data settings. In an article published in the

Journal of Econometrics by Richard D.F. Harris and Irene Tzavalis [

44], a methodology is presented for the inference of unit roots in dynamic panels, where the temporal dimension is fixed. The test provides a detailed explanation of the test methodology, including the estimation of individual–specific fixed effects and trends, the calculation of residuals and the calculation of the cross-sectional mean of the individual test statistics.

To remove trends from a time series and achieve stationarity, we used the differentiation process. The trend of a time series is characterized by a constant increase or decrease in its level, which makes the series non-stationary. Differentiation involves calculating the difference between consecutive values in the series. By applying the difference function to an artificial data set with a linear growth trend, a new time series is obtained where the trend has been removed.

Table 4 shows the results of the stationarity tests applied to the panel data. For the non-stationary variables, we used differentiation, working afterward with the variables thus obtained.

Then, we proceeded to test for autocorrelation in the data series using the xtserial command. The xtserial command in the Stata 16 software uses the approach developed by Baltagi and Li [

45] to test for cross-sectional dependence in panel data. This command provides several serial correlation tests, including the Lagrange Multiplier (LM) test, the Robust LM test and the Breusch–Pagan test. Typically, the xtserial command is used after estimating a panel data model using fixed effects or random effects methods. This allows researchers to test for serial correlation in the residuals of the panel data model and to assess the presence of cross-sectional dependence.

The next step consisted of applying the Hausman test to assess the presence of endogeneity in a regression model. Its purpose is to determine which estimation method, either fixed effects or random effects, is more appropriate for panel data models. This test was proposed by Jerry A. Hausman in 1978 [

46]. The main idea of the Hausman test is to compare the efficiency of the two estimation methods by analyzing the difference between the coefficients obtained from fixed effects models and random effects models. If the difference is statistically significant, this suggests the presence of endogeneity and indicates a preference for the fixed effects model because it provides consistent estimates.

Next, the xtabond2 command from Stata was used to estimate the dynamic panel data models using the generalized method of moments (GMM). This command is user-developed and provides an efficient solution for handling endogeneity and serial correlation in panel data settings. Linear dynamic panel data models include the lags of the dependent variable as the explanatory variables and include unobserved effects at the panel data level, which can be either fixed or random. Arellano and Bond [

47] developed a consistent estimator for these models using the generalized method of moments (GMM), and the xtabond2 command implements this estimator. The Arellano–Bond test is used to diagnose the presence of serial correlation in the differentiated data.

To test the robustness of the regression equations, we applied the Wald test [

48], named after the statistician Abraham Wald, which is a statistical test used to determine whether a certain parameter in a statistical model differs significantly from a hypothetical value. The main idea of the Wald test is to compare the estimated value of a parameter with its hypothetical value under the null hypothesis. The general formula for the Wald test statistic is W = (estimated value − hypothesized value)/standard error. If the obtained

p-value is less than a predefined significance level (e.g., 0.05), the null hypothesis is rejected, and it is concluded that there is enough evidence to support that the parameter is significantly different from the hypothesized value.

We show the form of the regression models for the various combinations of dependent variables and factor variables that we used.

where

TEVTAX, ENGTAX, TRTAX and POL/RESTAX represent the dependent variables;

const. represents the constant of the equation;

α, β1, β2, β3, β4, β5, β6, β7, β8, β9, β10 and β11 are the coefficients associated with the independent variables;

L.Y is a continuous independent variable representing the lag of the dependent variable,

L indicates the first offset of the variable (t − 1), D indicates the differentiated variable (t − 1);

εit represents the error term or error component of the model;

i represents the individual (country), and t the time (year);

All analyses were run in Excel in Office 2021 and STATA 16.

4. Results and Discussion

In the case of the first two dynamic regression equations, the results are presented synthetically in

Table 5.

Based on the provided coefficients and p-values, we can interpret the following for the dependent variables: total environmental taxes and energy taxes.

The variables are explained by their previous values, from t − 1. The coefficients are 0.75 and 0.76, respectively, and are statistically significant at the 0.05 level of significance. These results suggest that the past values of total green taxes and energy taxes are positively and significantly correlated with the current values, indicating a historical effect on these two variables.

The GDP per capita variable is not statistically significant at the 0.05 significance level in the case of both dependent variables. This result indicates that there is insufficient evidence to support a significant link between real GDPs per capita and total green taxes and energy taxes in these models.

Primary energy consumption has significant coefficients in the case of the first two regression models and p-values lower than 0.5, which indicate a direct and positive correlation with total environmental and energy taxes.

Other significant independent variables, waste treatment and climate-related economic losses, have significant coefficients and p-values less than 0.05, indicating a significant correlation with the energy taxes. These results suggest that differences in waste treatment and climate-related economic losses negatively influence the level of energy taxes.

Other insignificant independent variables in relation to total environmental taxes and energy taxes—such as human development index; net greenhouse gas emissions; supply, transformation and consumption of renewable sources; general public expenses for environmental protection; private investment and gross value added related to circular economy sectors; and the consumption of raw materials—are not statistically significant at the 0.05 significance level. This means that these variables do not have a significant relationship with total environmental taxes or energy taxes in this model.

In the case of the last two dynamic regression equations, the results are presented synthetically in

Table 6.

Based on the coefficients and p-values provided, we can interpret the following for the dependent variables of transportation taxes, pollution and resource taxes:

The transport tax and pollution tax variables are explained by their previous values, from t − 1. The coefficients are −0.42 and −0.31 and are statistically significant at a level of 0.05. This result suggests that past values of transportation taxes are negatively and significantly correlated with current values, indicating the historical effect on this variable.

The real GDP per capita variable is not statistically significant at p > 0.05, both in the case of transport taxes and in the case of pollution taxes. This result indicates that there is insufficient evidence to support a significant link between real GDP per capita and transport taxes or pollution taxes in these models.

The differences in the supply, transformation and consumption of the renewable and wastes variable has significant coefficients in the case of both the regression models and p-values lower than 0.5, which indicate a direct and positive correlation with transport taxes with respect to pollution taxes.

Other non-significant independent variables, generated waste; treated waste; the Human Development Index; net greenhouse gas emissions; raw material consumption; environmental protection expenses; and primary energy consumption, are not statistically significant at a significance level of 0.05. This means that these variables are not significantly related to transport taxes in this model.

To assess the robustness of the obtained results, we replaced the original methodology with the panel-corrected standard error estimation (PCSE) methodology. Thus, obtaining similar results in significance confirms the robustness, stability and validity of the main results of the dynamic regression equations presented earlier.

Based on the provided coefficients and their associated statistical tests (

t-tests) shown in

Table 7, we can interpret the results of an estimated panel-corrected standard error regression model for the

total green taxes and energy taxes variables (dependent variables) in relation to the independent variables:

The primary energy consumption variable has significant coefficients at the 1% level (p-value = 0.00) in both regression models, which indicates that there is a positive relationship between primary energy consumption and total environmental taxes with respect to energy taxes.

Other variables, such as real GDP per capita; the Human Development Index; waste generated; waste treated; net greenhouse gas emissions; the supply, transformation and consumption of renewable sources; government expenditures for environmental protection; economic losses related to the climate; and raw material consumption, have p > 0.05; this suggests that there is no significant relationship between the mentioned explanatory variables and total environmental taxes with respect to energy taxes.

The constant term suggests that, when all independent variables are zero, the estimated level of total environmental taxes is 337.23 units and that of energy taxes is 103.85. The coefficients are not statistically significant at conventional levels (p-values > 0.05).

Based on the provided coefficients and their associated statistical tests (

t-tests) shown in

Table 8, we can interpret the results of an estimated PCSE regression model for the variables “transport taxes” and “pollution taxes” (dependent variables) in relation to the independent variables:

The variable difference in real GDP per capita has a statistically significant coefficient (p-value < 0.05) in both the regression models, suggesting that there is a positive relationship between the difference in real GDP per capita and transport taxes with respect to pollution taxes. For a 1-unit increase in the difference in real GDP per capita, there is a 0.08-unit increase in transport taxes and a 0.01-unit increase in pollution taxes.

Other variables—such as waste generated; waste treated; net greenhouse gas emissions; the supply, transformation and consumption of renewable sources and waste; general public expenditures for environmental protection; primary energy consumption; private investment and gross value added related to circular economy sectors; raw material consumption; and climate-related economic losses—have values of p > 0.05; this suggests that there is no significant relationship between the mentioned explanatory variables and taxes on transport with respect to pollution taxes.

The constant term in the case of the variable difference in transport taxes suggests that, when all independent variables are zero, the estimated level of freight charges is −50.25 units. The coefficient is statistically significant at the 5% level (p-value = 0.03).

Regarding the hypotheses of the dynamic panel analysis regarding the existing links between green taxes on the one hand and variations in GDP/capita; CO2 emissions; and energy consumption on the other hand, they present the following characteristics, as follows:

H1: An increase in primary energy consumption generates an increase in total environmental taxes and energy taxes.

This research hypothesis is confirmed. Primary energy consumption has significant coefficients and p = 0.02 values in the first two regression models, indicating a significant relationship between total environmental taxes and energy taxes. These results suggest that primary energy consumption significantly and positively influences the level of total environmental taxes and energy taxes. Every year, Germany registers the highest value of green tax receipts and records a continuous decreasing trend in the amount of primary energy consumed and a continuous increasing trend in the supply, transformation and consumption of renewables and wastes, with the highest values of renewable energy supplied and consumed, year after year.

H2: Net greenhouse gas emissions significantly influence total environmental taxes.

This research hypothesis is not confirmed. Both in the four dynamic regression equations and when testing the robustness of the models, the p-values are greater than 0.05, so the relationship of CO2 emissions with green taxes and their components is not statistically significant at acceptable levels.

H3: The variation in real GDP/capita significantly influences transportation and pollution taxes.

This research hypothesis is confirmed. For a 1-unit increase in the difference in real GDP per capita, there is a 0.08-unit increase in transport taxes. Changes in the level of GDP per capita significantly and positively influence transport taxes and taxes on polluting resources. Italy, France, Denmark and Norway, which register the highest levels of revenue from collected transport taxes and pollution/resources taxes, have the lowest net greenhouse gas emissions of the countries analyzed and have a real GDP/capita over the EU average.

H4: The generation of waste treatment; the Human Development Index; the level of private investment; the supply, transformation and consumption of renewable sources; the level of climate-related economic losses; and public spending on environmental protection all significantly influence total environmental taxes.

This research hypothesis is not confirmed. Both in the four dynamic regression equations and when testing the robustness of the panel models, the p-values are greater than 0.05, so the relationship of the explanatory variables listed in hypothesis H4 with green taxes and their components is not statistically significant at acceptable levels.

5. Conclusions

In this article, we analyzed correlations between green taxes on the one hand and GDP/capita variations and energy consumption on the other hand. Green taxes are the main instruments used to limit activities that have a negative impact on the environment. These consist of taxes paid by producers and/or consumers for any activity that generates pollution.

The results of the dynamic regressions, validated by robustness tests, indicate a significant and positive correlation between primary energy consumption and total environmental taxes with respect to energy taxes. These results suggest that primary energy consumption significantly and positively influences the level of total environmental taxes and energy taxes. Every year, Germany registers the highest value of green tax receipts and records a continuous decreasing trend in the amount of primary energy consumed and a continuous increasing trend in the supply, transformation and consumption of renewables and wastes, with the highest values of renewable energy supplied and consumed, year after year.

The variation in real GDP/capita significantly and positively influences transport taxes and pollution taxes. In contrast, net greenhouse gas emissions do not significantly influence green taxes or their components. Italy, France, Denmark and Norway, which register the highest levels of revenue from collected transport taxes and pollution/resources taxes, have the lowest net greenhouse gas emissions of the countries analyzed and have a real GDP/capita over the EU average.

Considering the empirical analyses carried out, these findings contradict the research results of the third group of authors [

35,

37,

38], according to whom green taxes negatively affect the economy and the population.

Our results show that there is a positive correlation between green taxes on the one hand and real GDP per capita and primary energy consumption on the other hand. In contrast, we did not identify a significant correlation between CO2 emissions and green taxes. This finding is useful to both academic research and governments, especially finance ministries and environment ministries, for the realistic substantiation of the level of green tax revenues and for establishing appropriate measures to reduce CO2 emissions.

The limits of our research can be found in the analyzed time period and the fact that we analyzed only European countries. The results invite us to conduct more in-depth research, with more countries analyzed and perhaps more variables that can influence CO2 emissions, which might lead to more robust models.