Role of Renewables in Energy Storage Economic Viability in the Western Balkans

Abstract

1. Introduction

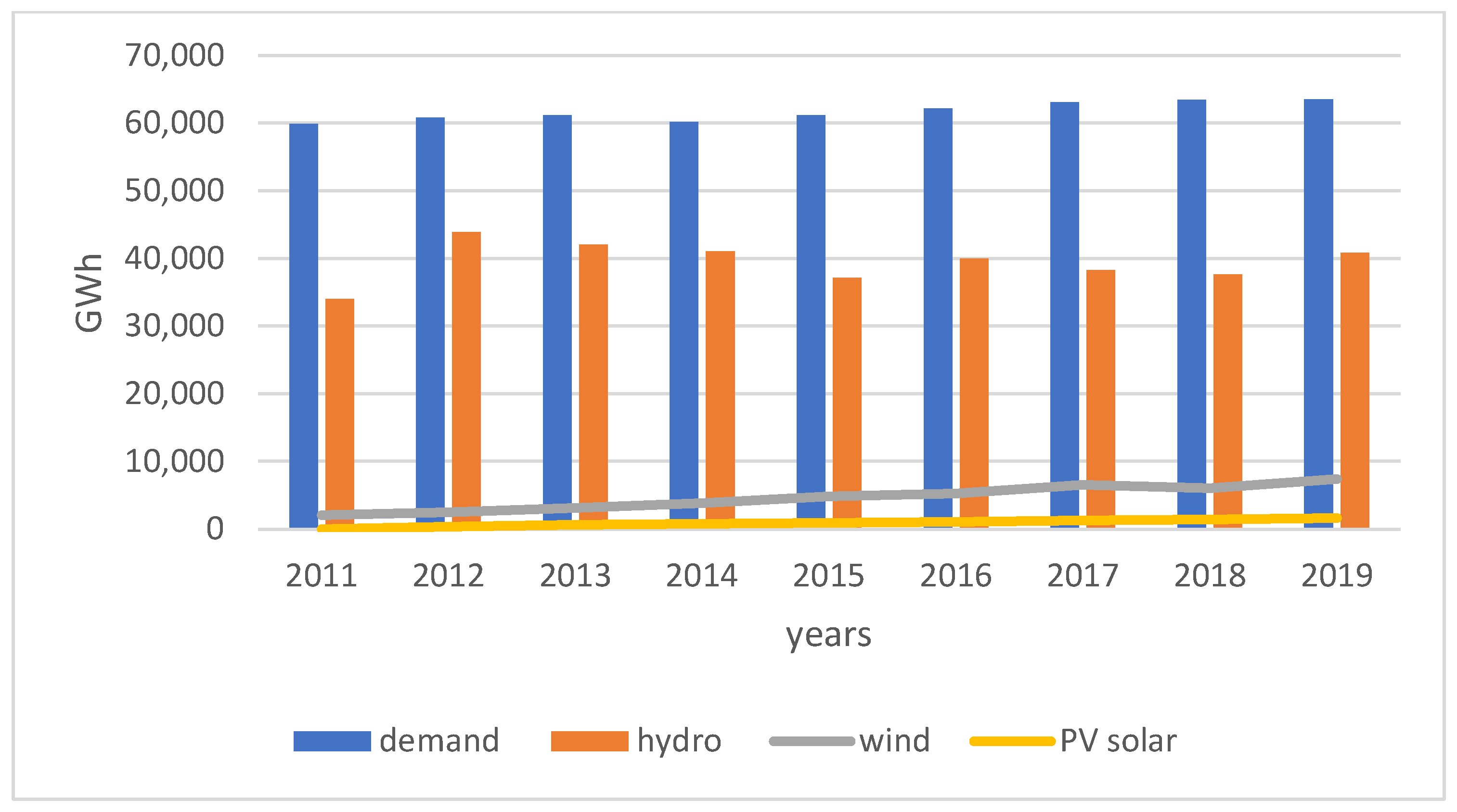

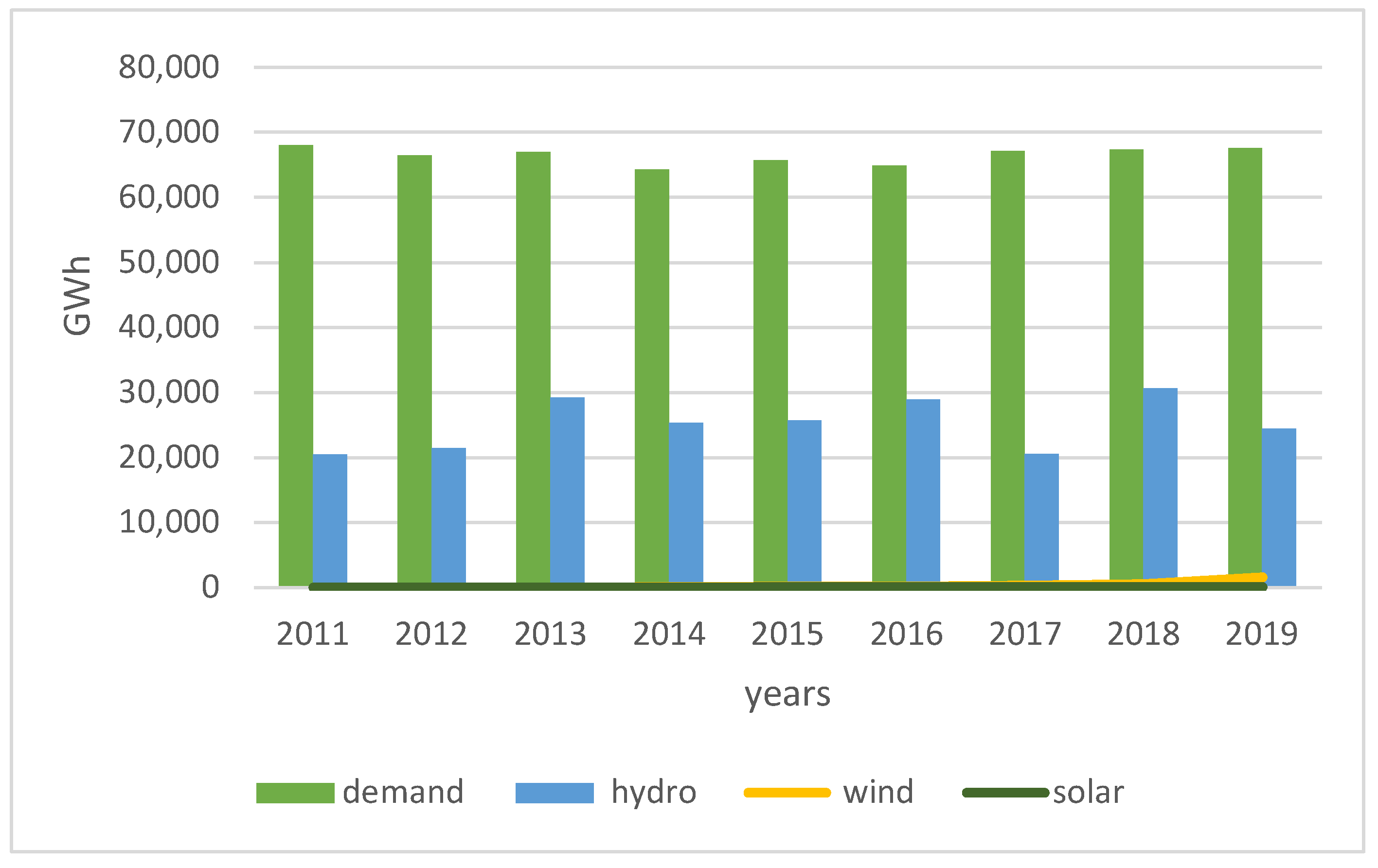

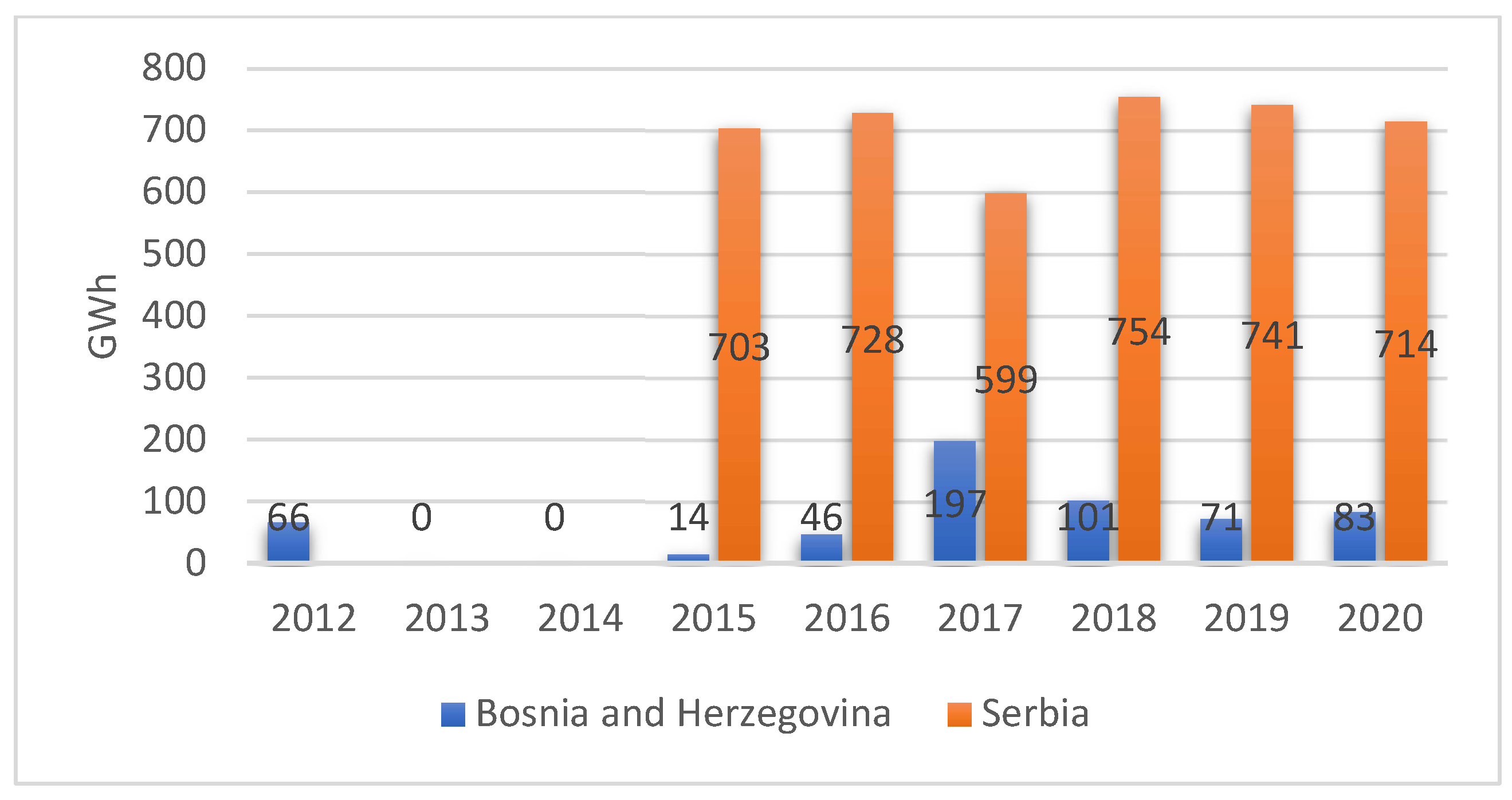

2. Renewables in the Western Balkans

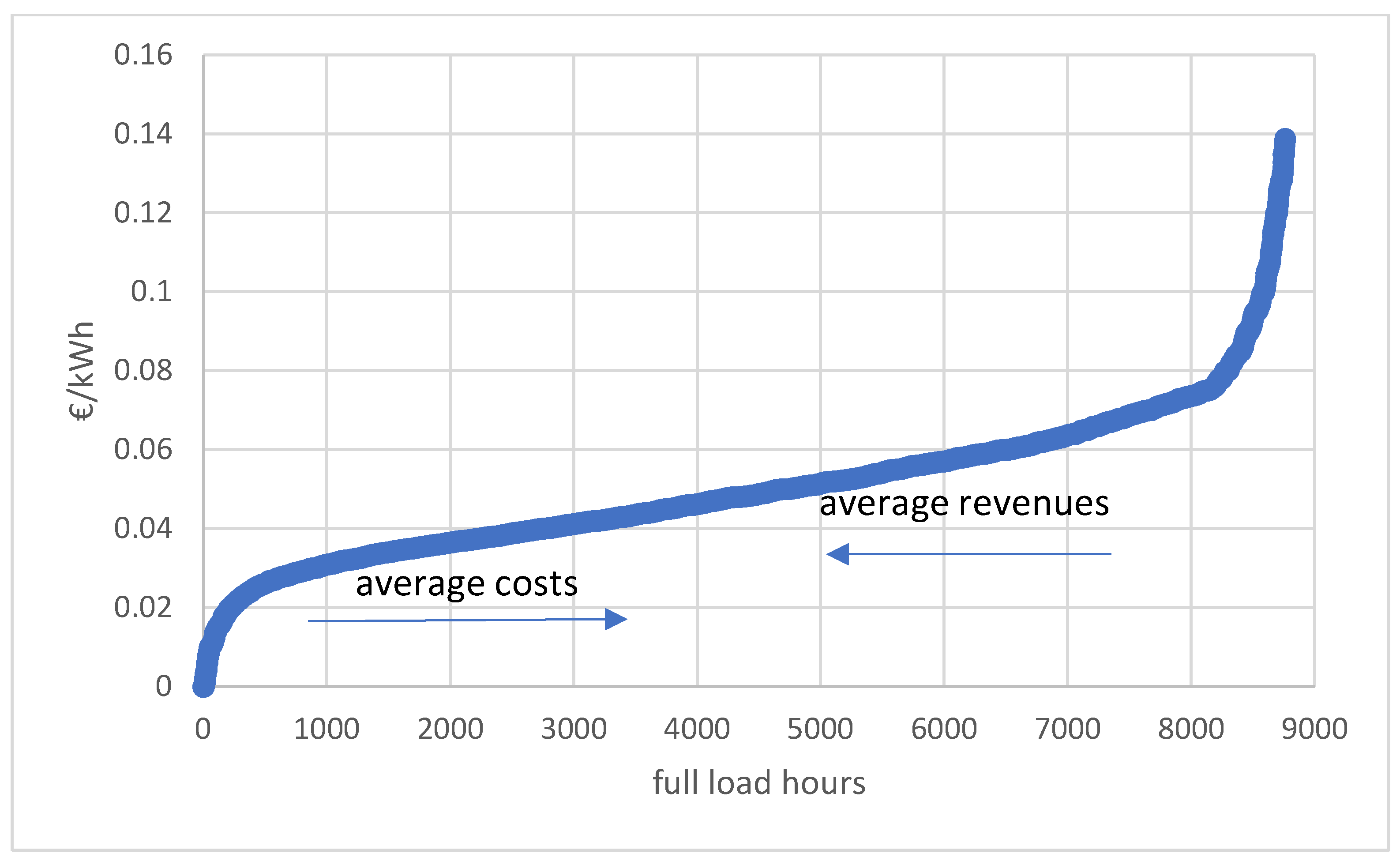

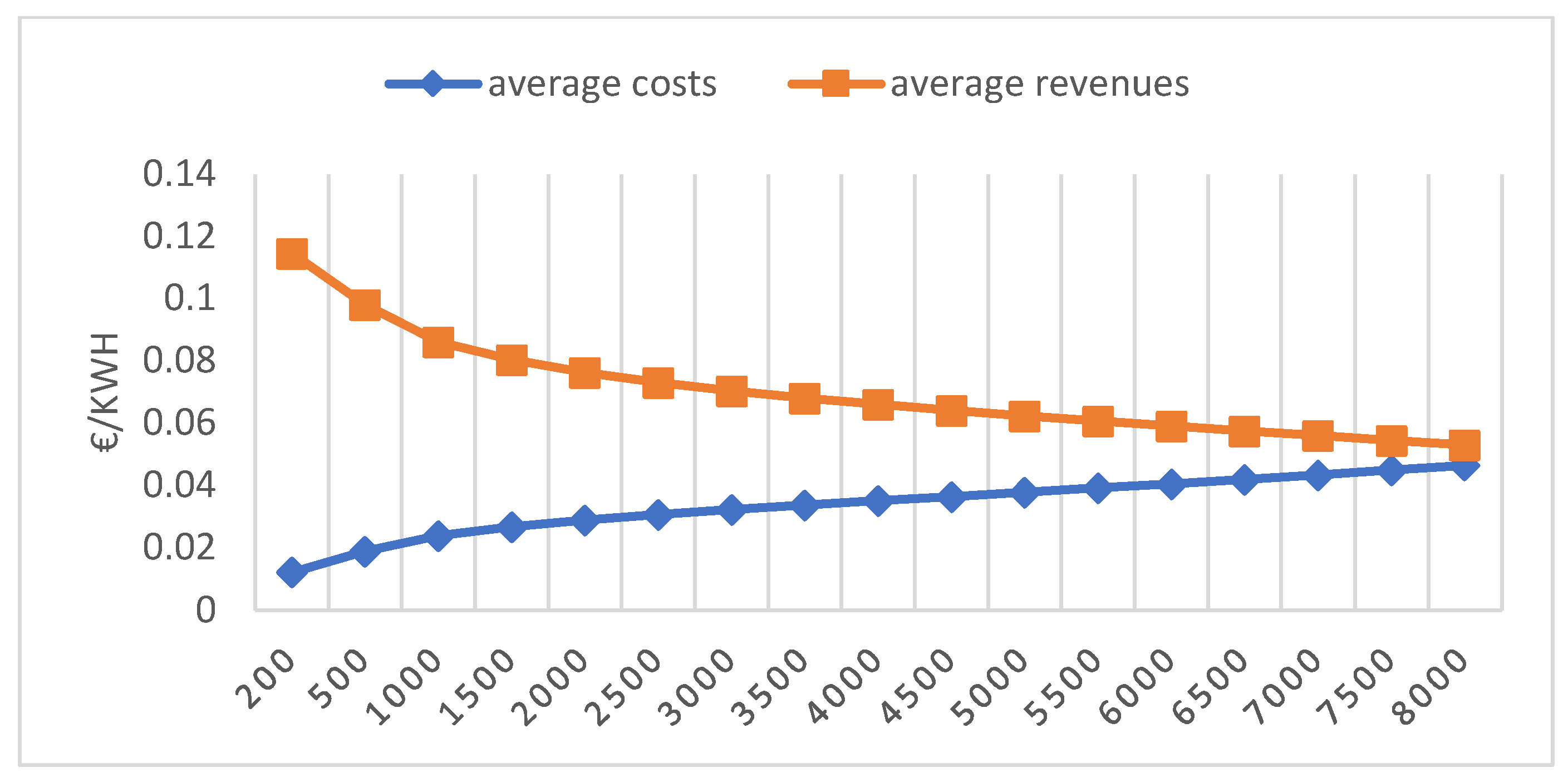

3. Method

| Costs | Pumped Hydro Storage |

|---|---|

| in €/kW | 1072 |

| (%) | 5 |

| (years) | 50 |

| 0.8 | |

| in €/kW | 4.6 |

| in €/kWh | 0.00022 |

4. Results and Discussion

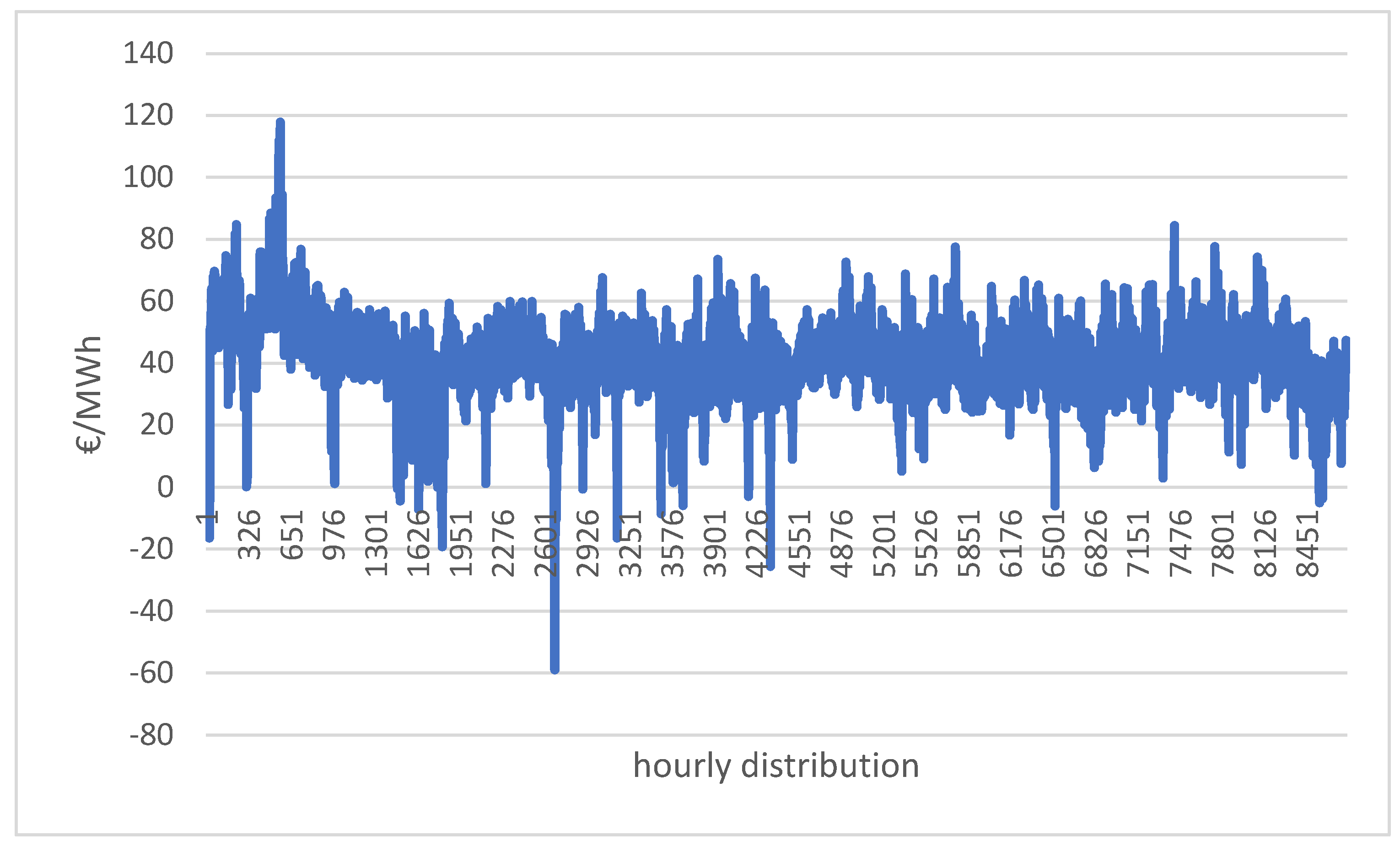

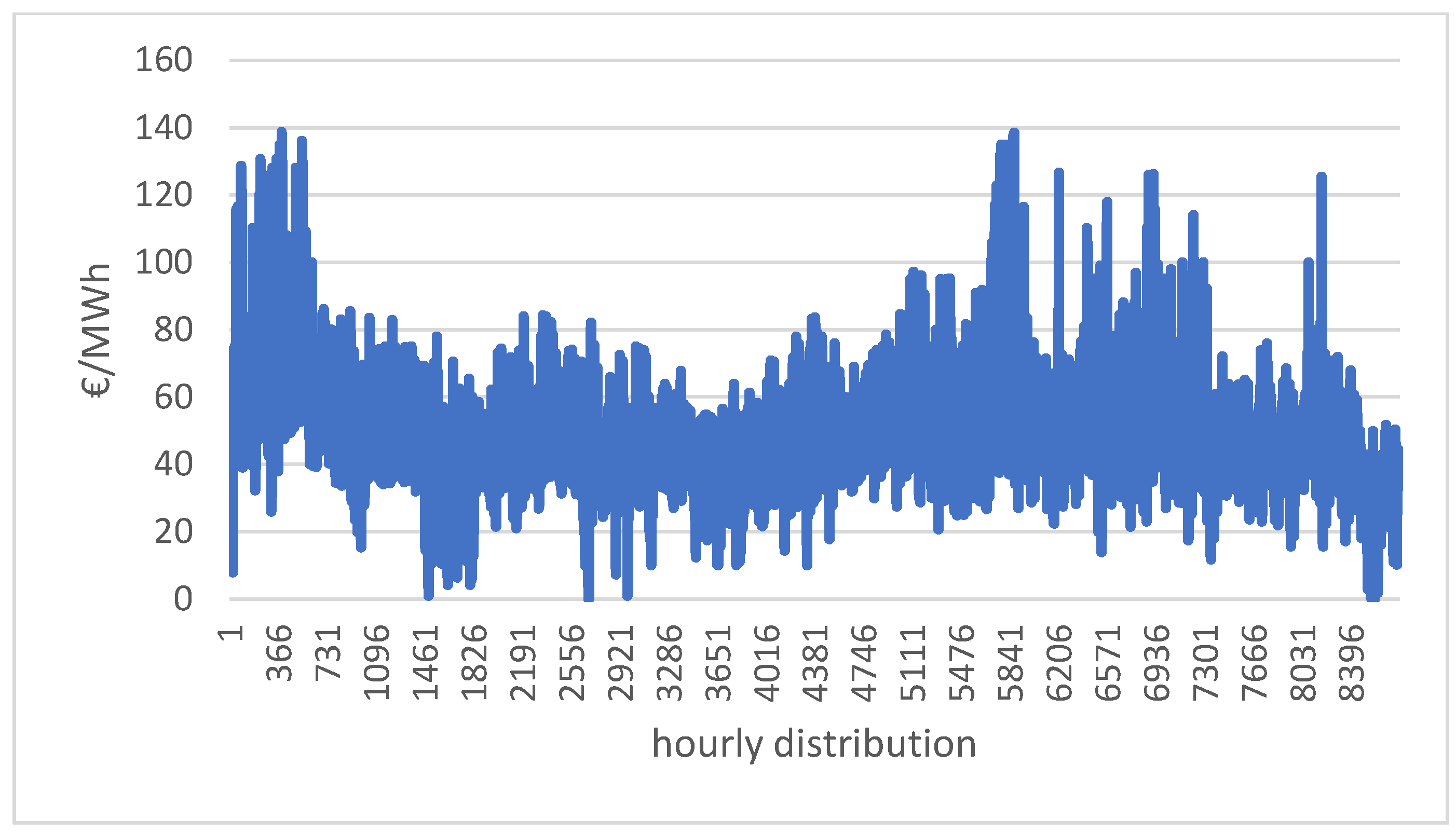

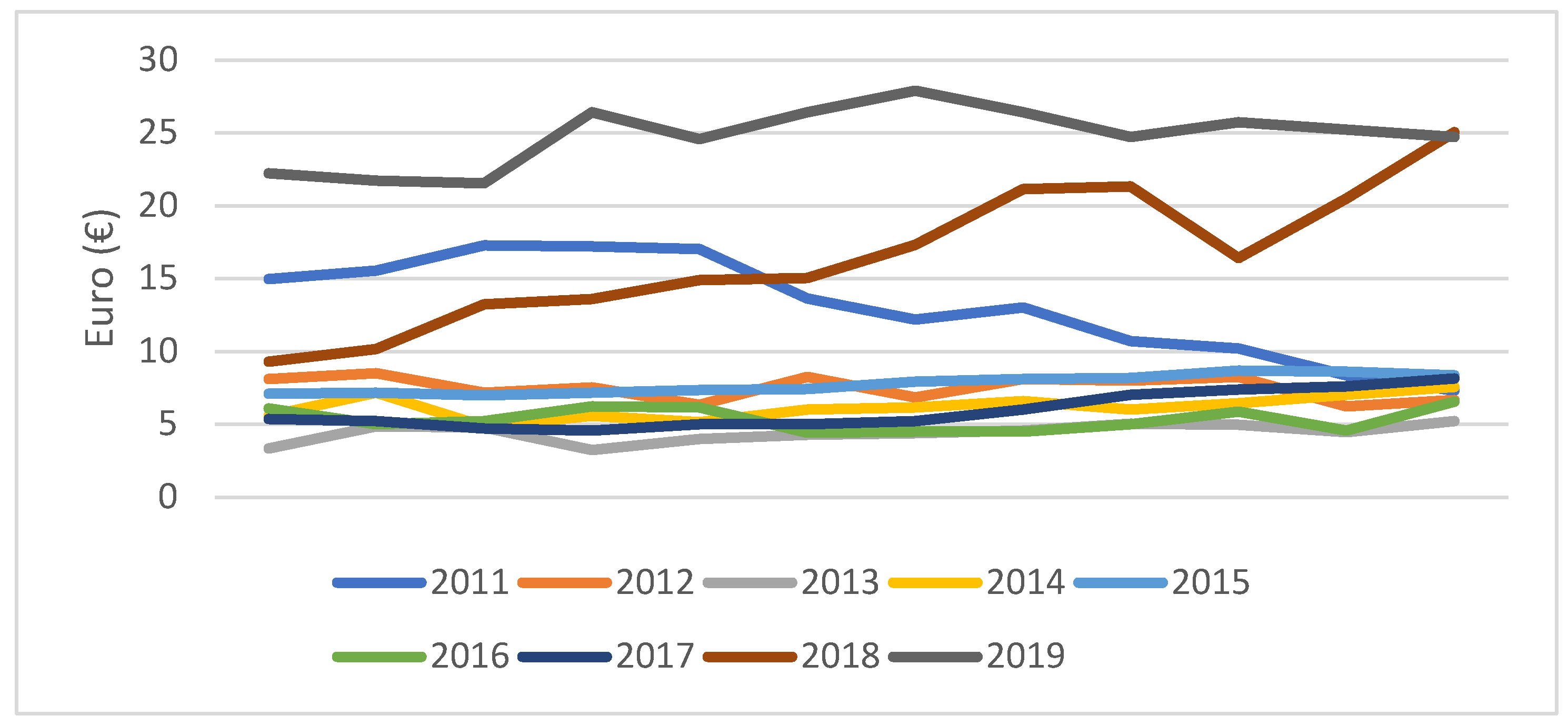

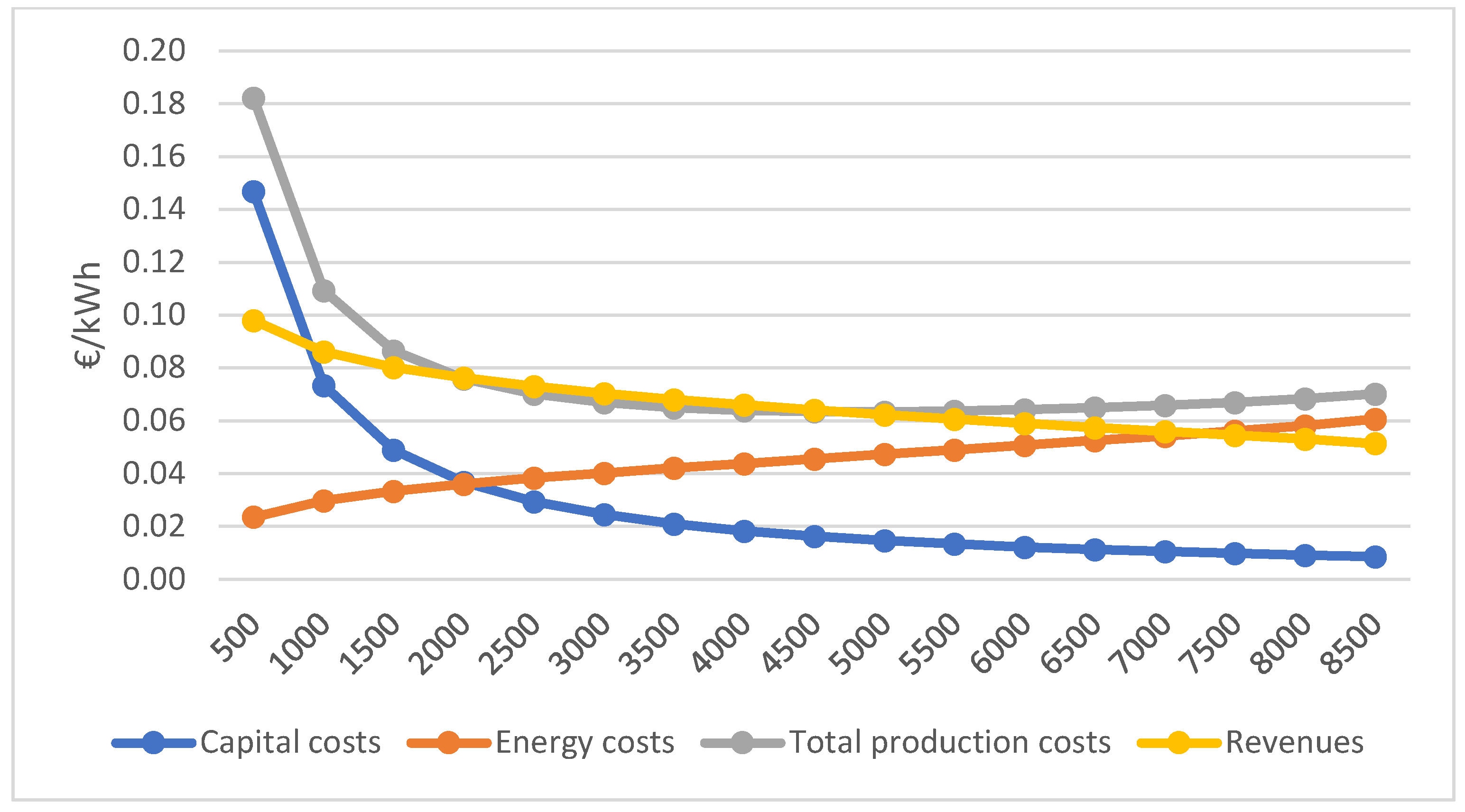

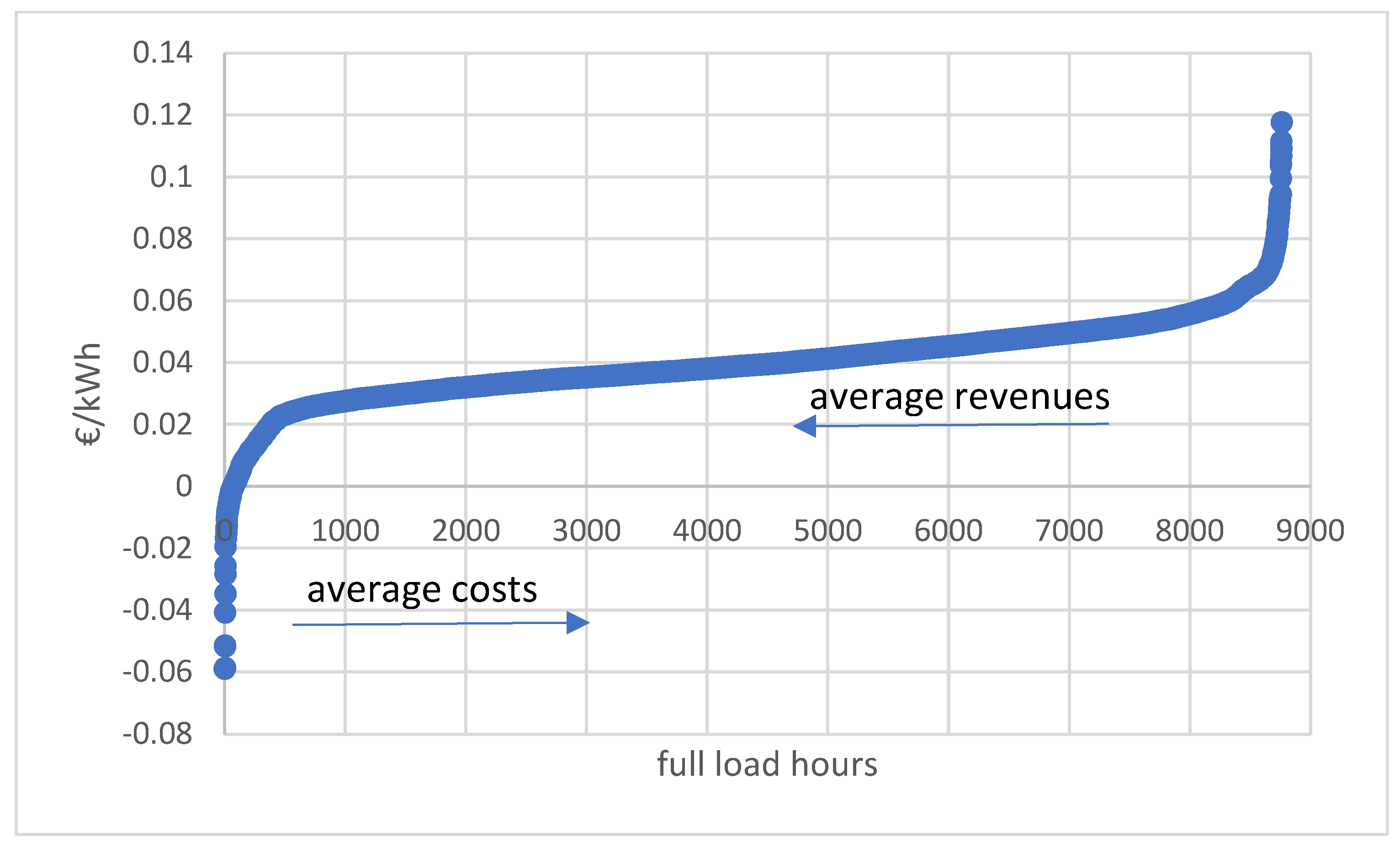

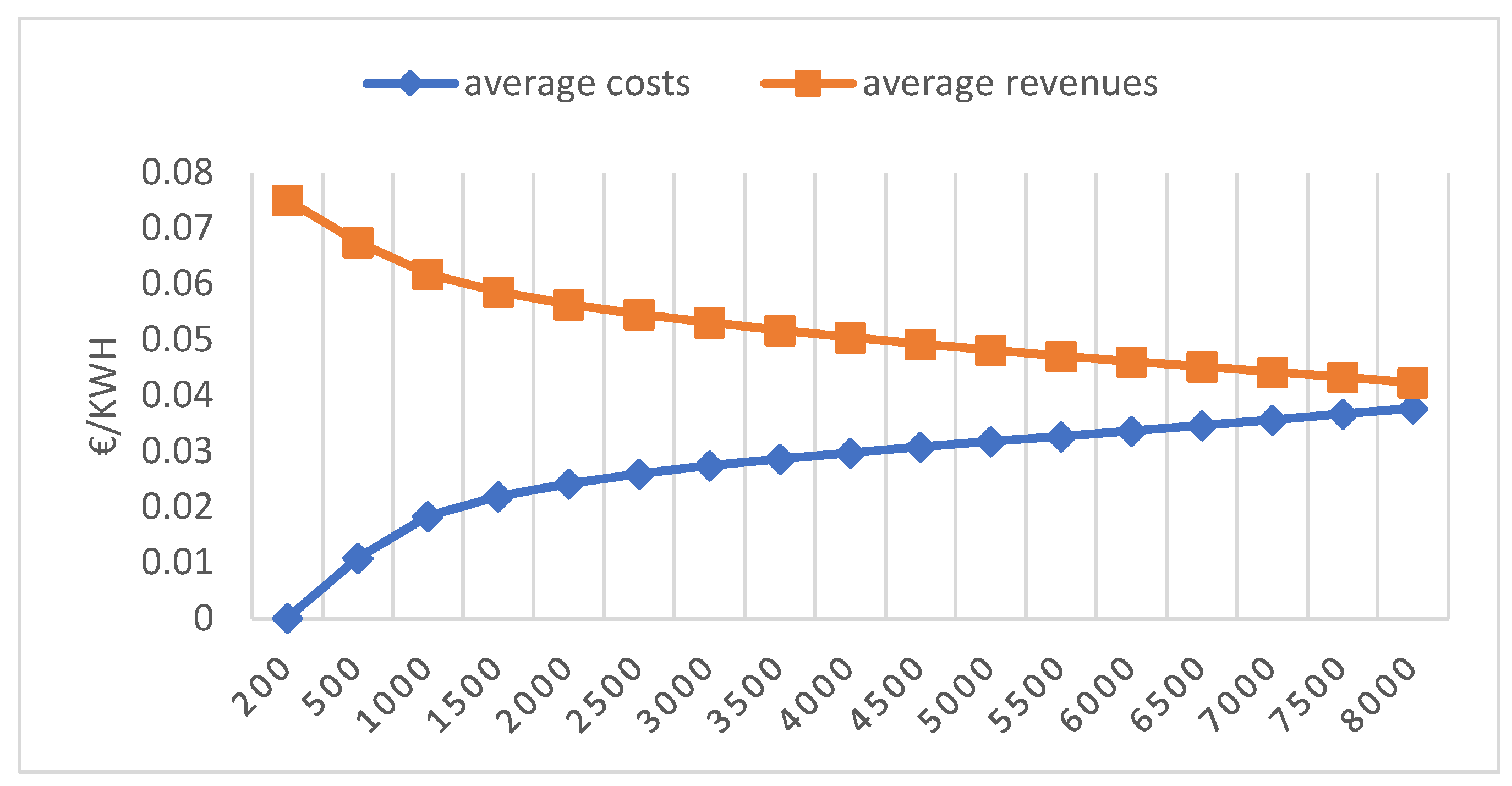

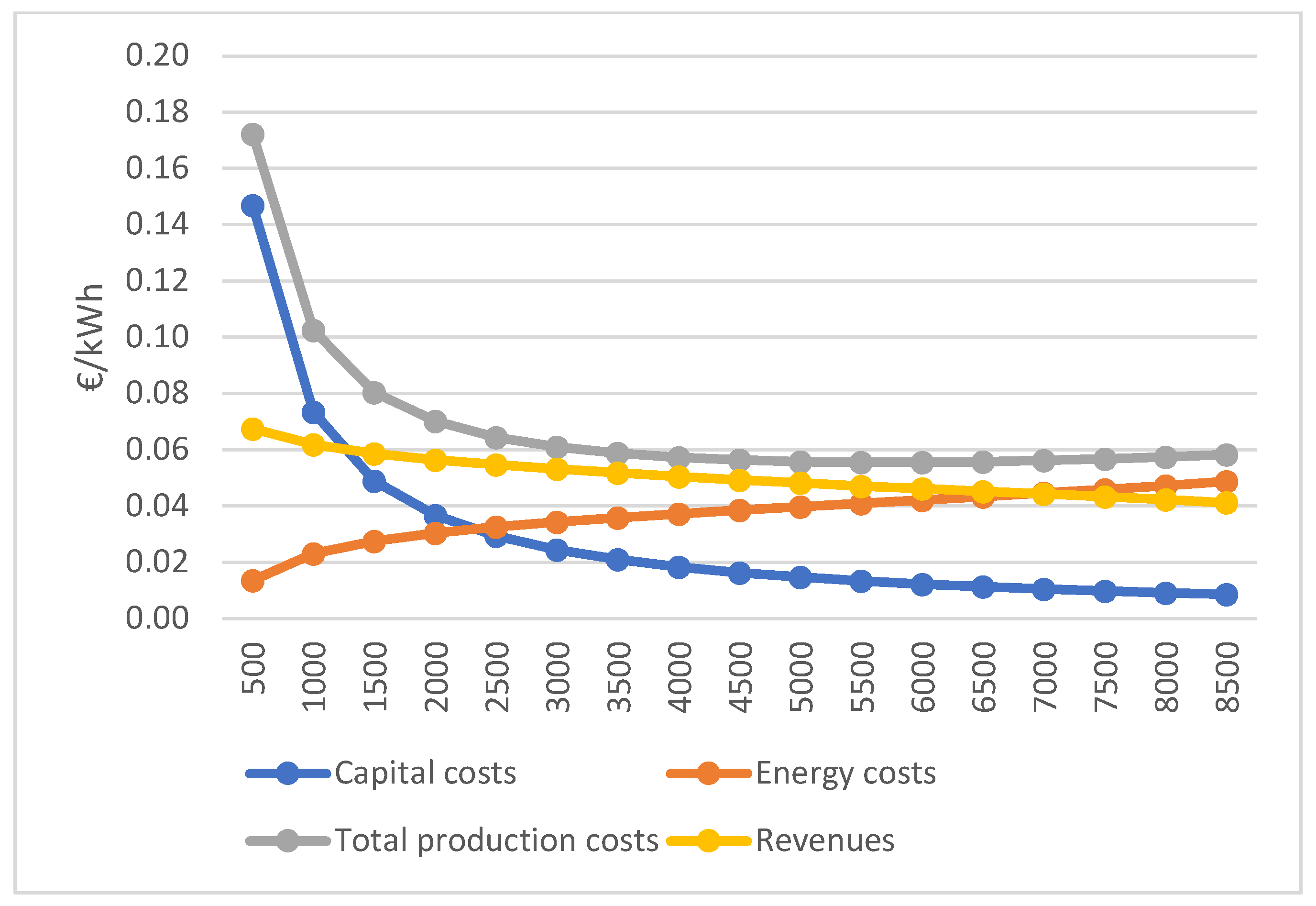

4.1. Price Spread Effects on Storage Profitability

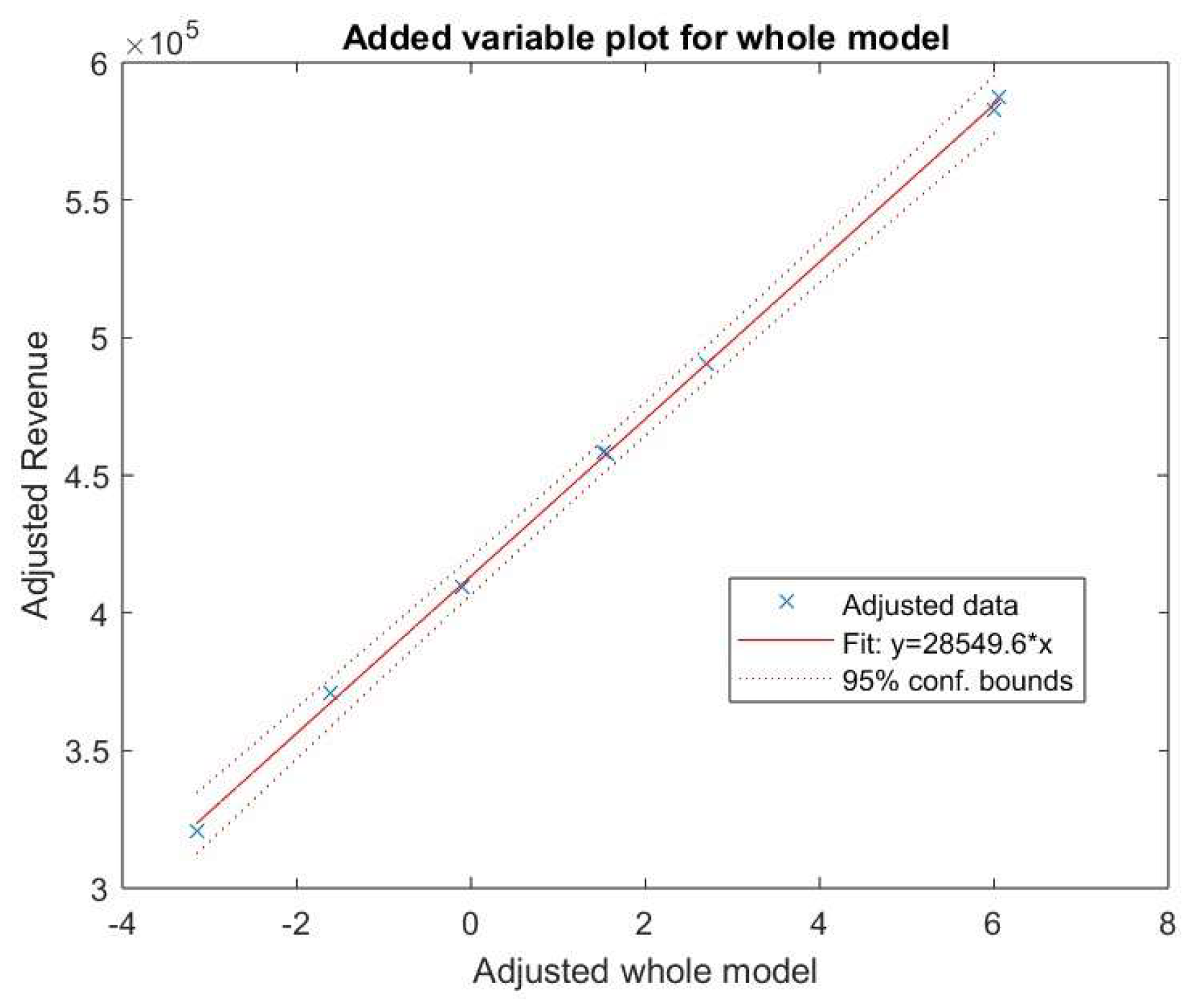

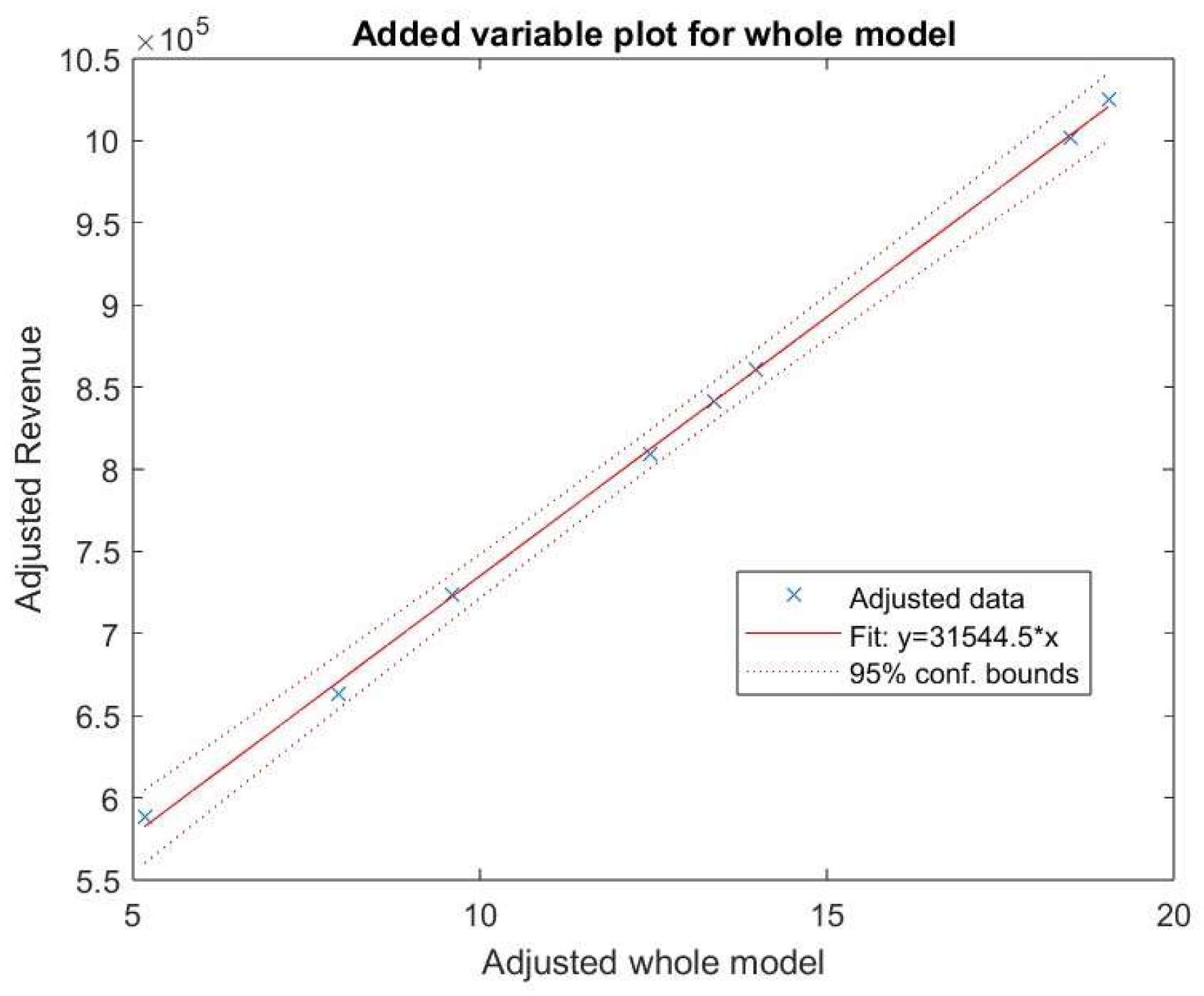

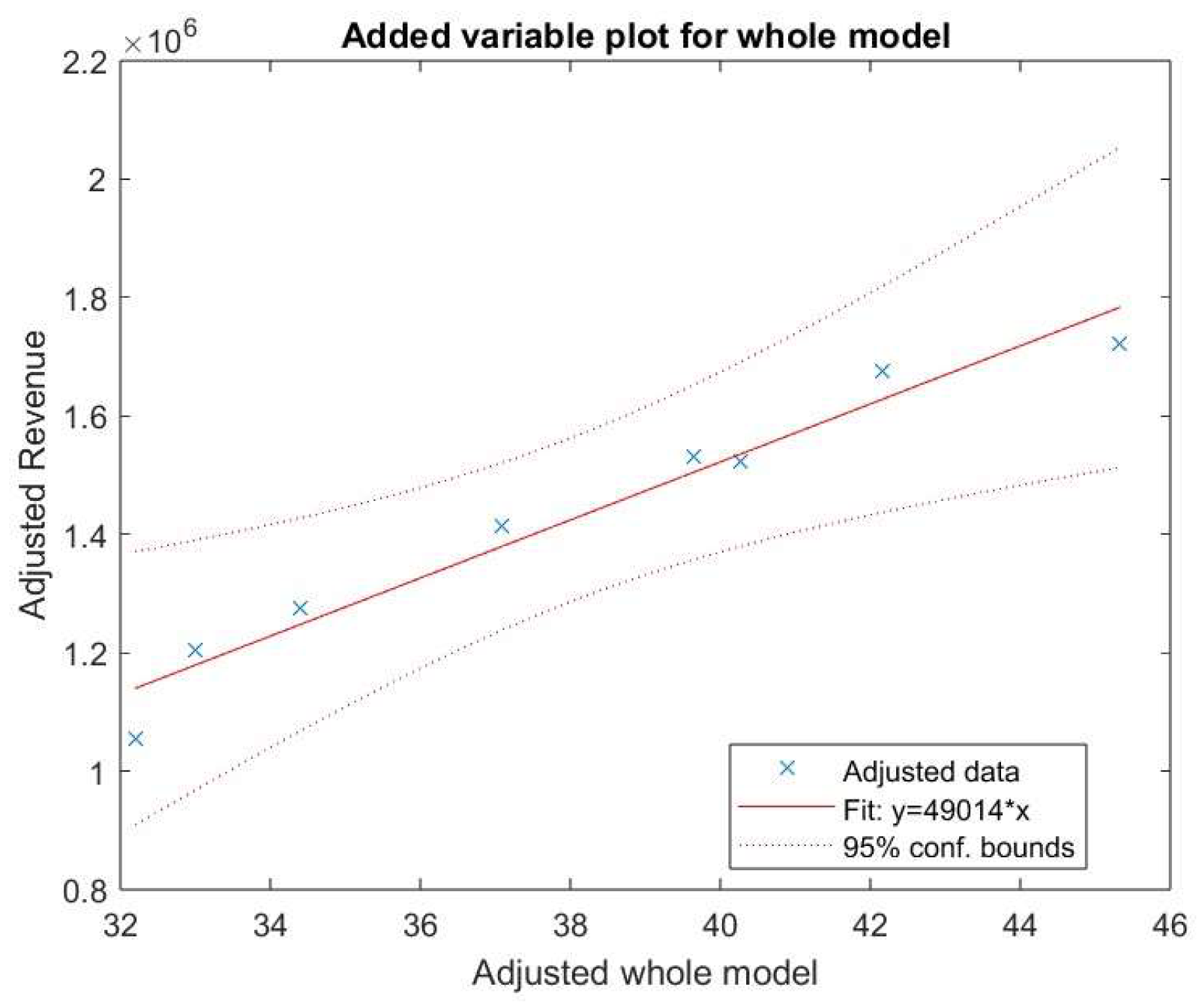

4.2. Impacting Factors on Energy Storage Revenues

4.3. Prospects for Energy Storage

4.4. Limitations

5. Conclusions

- Energy storage development will continue if it is economically viable.

- There is a high potential for energy storage arbitrage in the Western Balkans.

- Wind generation and EU ETS prices impact storage revenues positively.

- Solar generation negatively affects storage revenues.

- Energy storage systems are not economically viable for the long run.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Energy Statistics Data Browser, IEA, Paris. Available online: https://www.iea.org/data-and-statistics/data-tools/energy-statistics-data-browser (accessed on 16 February 2024).

- World Energy Outlook 2023, IEA, Paris. Available online: https://www.iea.org/reports/world-energy-outlook-2023 (accessed on 16 February 2024).

- Energy Community. Available online: https://commission.europa.eu/news/un-climate-change-conference-world-agrees-transition-away-fossil-fuels-and-reduce-global-emissions-2023-12-13_en (accessed on 22 January 2024).

- Rahman, M.M.; Oni, A.O.; Gemechu, E.; Kumar, A. Assessment of energy storage technologies: A review. Energy Convers. Manag. 2020, 223, 113295. [Google Scholar] [CrossRef]

- Topalović, Z.; Haas, R.; Ajanović, A.; Sayer, M. Prospects of electricity storage. Renew. Energy Environ. Sustain. 2023, 8, 2. [Google Scholar] [CrossRef]

- Gilfillan, D.; Pittock, J. Pumped Storage Hydropower for Sustainable and Low-Carbon Electricity Grids in Pacific Rim Economies. Energies 2022, 15, 3139. [Google Scholar] [CrossRef]

- Koeva, D.; Kutkarska, R.; Zinoviev, V. High Penetration of Renewable Energy Sources and Power Market Formation for Countries in Energy Transition: Assessment via Price Analysis and Energy Forecasting. Energies 2023, 16, 7788. [Google Scholar] [CrossRef]

- Hossain, E.; Faruque, H.M.R.; Sunny, M.S.H.; Mohammad, N.; Nawar, N. A comprehensive review on energy storage systems: Types, comparison, current scenario, applications, barriers, and potential solutions, policies, and future prospects. Energies 2020, 13, 3651. [Google Scholar] [CrossRef]

- Tan, K.M.; Babu, T.S.; Ramachandaramurthy, V.K.; Kasinathan, P.; Solanki, S.G.; Raveendran, S.K. Empowering smart grid: A comprehensive review of energy storage technology and application with renewable energy integration. J. Energy Storage 2021, 39, 102591. [Google Scholar] [CrossRef]

- Cárdenas, B.; Swinfen-Styles, L.; Rouse, J.; Hoskin, A.; Xu, W.; Garvey, S.D. Energy storage capacity vs. renewable penetration: A study for the UK. Renew. Energy 2021, 171, 849–867. [Google Scholar] [CrossRef]

- Auguadra, M.; Ribó-Pérez, D.; Gómez-Navarro, T. Planning the deployment of energy storage systems to integrate high shares of renewables: The Spain case study. Energy 2023, 264, 126275. [Google Scholar] [CrossRef]

- Wang, W.; Yuan, B.; Sun, Q.; Wennersten, R. Application of energy storage in integrated energy systems—A solution to fluctuation and uncertainty of renewable energy. J. Energy Storage 2022, 52, 104812. [Google Scholar] [CrossRef]

- Jafari, M.; Korpås, M.; Botterud, A. Power system decarbonization: Impacts of energy storage duration and interannual renewables variability. Renew. Energy 2020, 156, 1171–1185. [Google Scholar] [CrossRef]

- Prol, J.L.; Schill, W.-P. The Economics of Variable Renewables and Electricity Storage. Annu. Rev. Resour. Econ. 2020, 13, 443–467. [Google Scholar] [CrossRef]

- Mallapragada, D.S.; Sepulveda, N.A.; Jenkins, J.D. Long-run system value of battery energy storage in future grids with increasing wind and solar generation. Appl. Energy 2020, 275, 115390. [Google Scholar] [CrossRef]

- Lamp, S.; Samano, M. Large-scale battery storage, short-term market outcomes, and arbitrage. Energy Econ. 2022, 107, 105786. [Google Scholar] [CrossRef]

- Haas, R.; Auer, H.; Resch, G. Heading towards democratic and sustainable electricity systems—The example of Austria. Renew. Energy Environ. Sustain. 2022, 7, 20. [Google Scholar] [CrossRef]

- Kebede, A.A.; Kalogiannis, T.; Van Mierlo, J.; Berecibar, M. A comprehensive review of stationary energy storage devices for large scale renewable energy sources grid integration. Renew. Sustain. Energy Rev. 2022, 159, 112213. [Google Scholar] [CrossRef]

- Haas, R.; Kemfert, C.; Auer, H.; Ajanovic, A.; Sayer, M.; Hiesl, A. On the economics of storage for electricity: Current state and future market design prospects. Wiley Interdiscip. Rev. Energy Environ. 2022, 11, e431. [Google Scholar] [CrossRef]

- Child, M.; Kemfert, C.; Bogdanov, D.; Breyer, C. Flexible electricity generation, grid exchange and storage for the transition to a 100% renewable energy system in Europe. Renew. Energy 2019, 139, 80–101. [Google Scholar] [CrossRef]

- Energy Community. Report on the Implementation of the Declaration on Energy Security and Green Transition in the Western Balkans; Energy Community: Vienna, Austria, 2023. [Google Scholar]

- Bankwatch, 2023. Available online: https://bankwatch.org/beyond-fossil-fuels (accessed on 16 February 2024).

- Ioana, C.; Pippa, G.; CEE Bankwatch Network. The Western Balkan power sector: Between crisis and transition. Eur. Parliam. Res. Serv. Blog 2022, 1–35. [Google Scholar]

- Energy Community. Decision of the Ministerial Council of the Energy Community; Energy Community: Vienna, Austria, 2022; pp. 1–6. [Google Scholar]

- Đurašković, J.; Konatar, M.; Radović, M. Renewable energy in the Western Balkans: Policies, developments and perspectives. Energy Rep. 2021, 7, 481–490. [Google Scholar] [CrossRef]

- Energy Community. Energy Community Secretariat’s CBAM-Readiness Tracker Report; Energy Community: Vienna, Austria, 2023. [Google Scholar]

- International Renewable Energy Agency. Renewable Energy Statistics 2022 Statistiques D’éNergie Renouvelable 2022 Estadísticas de Energía Renovable 2022 about Irena. 2022, p. 2. Available online: www.irena.org (accessed on 16 January 2024).

- Enervis. Powering the Future of the Western Balkans with Renewables: Study on behalf of Agora Energiewende; Enervis: Berlin, Germany, 2022. [Google Scholar]

- Trading Economics, 2023. Available online: https://tradingeconomics.com/commodity/carbon (accessed on 16 February 2024).

- Topalović, Z.; Haas, R.; Ajanovi, A.; Hiesl, A. Economics of electric energy storage. The case of Western Balkans. Energy J. 2022, 238, 121669. [Google Scholar] [CrossRef]

- Hiesl, A.; Ajanovic, A.; Haas, R. On current and future economics of electricity storage. Greenh. Gases Sci. Technol. 2020, 10, 1176–1192. [Google Scholar] [CrossRef]

- Montgomery, D.C.; Peck, E.A.; Vining, G.G. Introduction to Linear Regression Analysis, 4th ed.; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2012. [Google Scholar]

- Weron, R. Electricity price forecasting: A review of the state-of-the-art with a look into the future. Int. J. Forecast. 2014, 30, 1030–1081. [Google Scholar] [CrossRef]

- Prokhorov, O.; Dreisbach, D. The impact of renewables on the incidents of negative prices in the energy spot markets. Energy Policy 2022, 167, 113073. [Google Scholar] [CrossRef]

- Falk, R.F.; Miller, N.B. A Primer for Soft Modeling; University of Akron Press: Akron, OH, USA, 1992; p. 80. Available online: http://books.google.com/books/about/A_Primer_for_Soft_Modeling.html?id=3CFrQgAACAAJ (accessed on 16 February 2024).

- Davidson, R.; MacKinnon, J.G. Econometric Theory and Methods; Oxford University Press: Oxford, UK, 2004. [Google Scholar]

- Szabó, L.; Kelemen, Á.; Mezősi, A.; Pató, Z.; Kácsor, E.; Resch, G.; Liebmann, L. South East Europe electricity roadmap–modelling energy transition in the electricity sectors. Clim. Policy 2019, 19, 495–510. [Google Scholar] [CrossRef]

- Falcan, I.; Heidecke, L.; Zondag, M.-J.; Liebmann, L.; Resch, G.; Wien, T.U.; Szabó, L.; Kácsor, E.; Diallo, A.; Mezősi, A.; et al. Study on the Central and South Eastern Europe Energy Connectivity (CESEC) Cooperation on Electricity Grid Development and Renewables Final Report; European Commission: Brussels, Belgium, 2022. [Google Scholar]

- Schmidt, O.; Staffell, I. Monetizing Energy Storage; Oxford University Press: Oxford, UK, 2023. [Google Scholar]

| Contracting Party | 2020 Targets of Energy from RES in Gross Final Energy Consumption | 2030 Targets of Energy from RES in Gross Final Energy Consumption |

|---|---|---|

| Albania | 38% | 52.0% |

| Bosnia and Herzegovina | 40% | 43.6% |

| Kosovo | 25% | 32.0% |

| Montenegro | 33% | 50.0% |

| North Macedonia | 21% | 38.0% |

| Serbia | 27% | 40.7% |

| Year | Scenario | Full Load Hours | HUPX | EPEX | ||||

|---|---|---|---|---|---|---|---|---|

| Total Costs | Revenues | Profit | Total Costs | Revenues | Profit | |||

| €/kWh | €/kWh | € | €/kWh | €/kWh | € | |||

| 2011 | S | 500 | 0.1831 | 0.1080 | −375,505.8 | 0.1867 | 0.0746 | −560,734.3 |

| S1 | 1000 | 0.1124 | 0.0939 | −184,849.6 | 0.1154 | 0.0713 | −440,899.9 | |

| S2 | 2000 | 0.0811 | 0.0816 | 9606.2 | 0.0832 | 0.0676 | −312,223.1 | |

| S3 | 3000 | 0.0731 | 0.0756 | 75,449.0 | 0.0745 | 0.0649 | −287,519.3 | |

| S4 | 4000 | 0.0706 | 0.0714 | 31,443.2 | 0.0712 | 0.0625 | −349,440.6 | |

| 2012 | S | 500 | 0.1705 | 0.1165 | −269,964.2 | 0.1739 | 0.0732 | −503,892.4 |

| S1 | 1000 | 0.1000 | 0.1025 | 25,563.9 | 0.1018 | 0.0672 | −346,133.8 | |

| S2 | 2000 | 0.0691 | 0.0861 | 339,957.5 | 0.0697 | 0.0616 | −161,891.7 | |

| S3 | 3000 | 0.0613 | 0.0773 | 481,765.6 | 0.0611 | 0.0580 | −92,708.6 | |

| S4 | 4000 | 0.0592 | 0.0715 | 489,670.4 | 0.0581 | 0.0552 | −116,255.7 | |

| 2013 | S | 500 | 0.1670 | 0.0917 | −376,269.3 | 0.1671 | 0.0709 | −480,867.6 |

| S1 | 1000 | 0.0941 | 0.0809 | −131,596.5 | 0.0942 | 0.0655 | −287,539.2 | |

| S2 | 2000 | 0.0624 | 0.0707 | 165,929.9 | 0.0621 | 0.0593 | −55,458.6 | |

| S3 | 3000 | 0.0545 | 0.0645 | 300,091.3 | 0.0536 | 0.0545 | 26,800.0 | |

| S4 | 4000 | 0.0520 | 0.0595 | 302,799.3 | 0.0506 | 0.0507 | 6932.1 | |

| 2014 | S | 500 | 0.1718 | 0.0819 | −449,687.1 | 0.1663 | 0.0601 | −531,204.9 |

| S1 | 1000 | 0.0982 | 0.0724 | −258,788.7 | 0.0932 | 0.0552 | −380,203.8 | |

| S2 | 2000 | 0.0648 | 0.0638 | −21,069.5 | 0.0610 | 0.0496 | −227,554.2 | |

| S3 | 3000 | 0.0556 | 0.0589 | 96,959.8 | 0.0520 | 0.0460 | −180,905.9 | |

| S4 | 4000 | 0.0526 | 0.0551 | 101,048.9 | 0.0483 | 0.0431 | −208,706.2 | |

| 2015 | S | 500 | 0.1743 | 0.0741 | −500,755.6 | 0.1642 | 0.0568 | −537,011.9 |

| S1 | 1000 | 0.1007 | 0.0664 | −343,438.9 | 0.0920 | 0.0527 | −393,059.9 | |

| S2 | 2000 | 0.0669 | 0.0602 | −135,593.7 | 0.0596 | 0.0480 | −231,315.3 | |

| S3 | 3000 | 0.0577 | 0.0565 | −37,339.5 | 0.0505 | 0.0447 | −175,438.2 | |

| S4 | 4000 | 0.0546 | 0.0535 | −45,034.5 | 0.0469 | 0.0419 | −197,273.9 | |

| 2016 | S | 500 | 0.1729 | 0.0641 | −544,056.5 | 0.1625 | 0.0558 | −533,650.9 |

| S1 | 1000 | 0.0986 | 0.0589 | −397,151.2 | 0.0910 | 0.0500 | −409,660.3 | |

| S2 | 2000 | 0.0638 | 0.0528 | −220,944.8 | 0.0582 | 0.0439 | −286,173.1 | |

| S3 | 3000 | 0.0540 | 0.0490 | −150,656.9 | 0.0486 | 0.0406 | −239,217.8 | |

| S4 | 4000 | 0.0506 | 0.0463 | −173,061.5 | 0.0445 | 0.0382 | −254,309.8 | |

| 2017 | S | 500 | 0.1770 | 0.1175 | −297,564.3 | 0.1551 | 0.0771 | −390,376.8 |

| S1 | 1000 | 0.1046 | 0.1002 | −44,508.3 | 0.0862 | 0.0645 | −216,942.8 | |

| S2 | 2000 | 0.0716 | 0.0837 | 242,347.1 | 0.0578 | 0.0544 | −69,688.5 | |

| S3 | 3000 | 0.0630 | 0.0751 | 365,387.8 | 0.0506 | 0.0494 | −35,771.6 | |

| S4 | 4000 | 0.0603 | 0.0692 | 356,103.0 | 0.0478 | 0.0462 | −66,027.3 | |

| 2018 | S | 500 | 0.1760 | 0.0916 | −422,135.4 | 0.1660 | 0.0813 | −423,547.8 |

| S1 | 1000 | 0.1044 | 0.0841 | −202,922.2 | 0.0976 | 0.0758 | −218,349.1 | |

| S2 | 2000 | 0.0732 | 0.0765 | 67,019.7 | 0.0685 | 0.0693 | 16,935.4 | |

| S3 | 3000 | 0.0656 | 0.0716 | 180,629.8 | 0.0614 | 0.0647 | 97,138.2 | |

| S4 | 4000 | 0.0635 | 0.0675 | 160,074.6 | 0.0594 | 0.0611 | 64,457.9 | |

| 2019 | S | 500 | 0.1822 | 0.0981 | −420,807.4 | 0.1722 | 0.0675 | −523,308.5 |

| S1 | 1000 | 0.1092 | 0.0861 | −231,661.1 | 0.1024 | 0.0618 | −406,093.0 | |

| S2 | 2000 | 0.0760 | 0.0762 | 4212.8 | 0.0701 | 0.0564 | −274,594.5 | |

| S3 | 3000 | 0.0669 | 0.0704 | 103,185.7 | 0.0609 | 0.0531 | −235,197.0 | |

| S4 | 4000 | 0.0639 | 0.0660 | 83,747.8 | 0.0573 | 0.0505 | −271,935.1 | |

| Coefficients | Revenue | Hydro | Wind | Solar | ETS |

|---|---|---|---|---|---|

| Revenue | 1 | 0 | 0 | 0 | 0 |

| Hydro | −0.72451 | 1 | 0 | 0 | 0 |

| Wind | 0.060548 | 0.049868 | 1 | 0 | 0 |

| Solar | −0.24519 | 0.244404 | 0.827332 | 1 | 0 |

| ETS | 0.180287 | −0.01469 | 0.875327 | 0.557031 | 1 |

| Scenario | Full Load Hours | p-Value | R-Squared | |||

|---|---|---|---|---|---|---|

| Hydro | Wind | Solar | EU ETS | |||

| S | 500 | −0.000356 *** | −0.032874 ** | 0.001063 ** | −0.001831 ** | 0.9995 |

| S1 | 1000 | −0.000511 *** | −0.00354 ** | 0.001368 ** | −0.005242 * | 0.9993 |

| S2 | 2000 | −0.03415 ** | −0.085058 * | 0.070501 * | −0.271771 | 0.9565 |

| S3 | 3000 | −0.17314 | −0.309321 | 0.330888 | −0.831425 | 0.8098 |

| S4 | 4000 | −0.268517 | −0.450408 | 0.543159 | 0.831335 | 0.7323 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Topalović, Z.; Haas, R. Role of Renewables in Energy Storage Economic Viability in the Western Balkans. Energies 2024, 17, 955. https://doi.org/10.3390/en17040955

Topalović Z, Haas R. Role of Renewables in Energy Storage Economic Viability in the Western Balkans. Energies. 2024; 17(4):955. https://doi.org/10.3390/en17040955

Chicago/Turabian StyleTopalović, Zejneba, and Reinhard Haas. 2024. "Role of Renewables in Energy Storage Economic Viability in the Western Balkans" Energies 17, no. 4: 955. https://doi.org/10.3390/en17040955

APA StyleTopalović, Z., & Haas, R. (2024). Role of Renewables in Energy Storage Economic Viability in the Western Balkans. Energies, 17(4), 955. https://doi.org/10.3390/en17040955