Abstract

The circular economy (CE) poses major challenges to the citizens of European countries. Proper waste management is a priority here. Poland is one of the countries that has been trying for many years to meet the requirements to achieve an appropriate level of recovery as well as the recycling of municipal and packaging waste. In order to achieve appropriate levels of packaging waste recycling, it was planned to implement an otherwise refundable deposit system starting in January 2023. Currently, work is still underway to implement this system starting in January 2025. The aim of the study is to describe the current work of the ministry, entrepreneurs and recovery organizations in this area and, on this basis, to indicate the barriers and uncertainties encountered in the implementation of this system. The authors want to answer the question of what barriers and benefits can be expected after the implementation of the deposit system. The implementation of the system has been postponed many times (for several years). The current involvement of various organizations (large cities, chain stores and recovery organizations) indicates that the system will be implemented on 1 January 2025. Based on the example of other EU countries, what estimated benefits can be expected after implementing the system in Poland? An extensive literature review and survey research indicate that Polish society views the deposit system favorably and Poland is ready to implement it. Specific regulations from the Minister of Climate and Environment need to be implemented as well as special machine need to be put in stores to start the deposit system. Examples of ongoing efforts to create appropriate infrastructure also show that Poland is on track to join the deposit system from January 2025. The deposit system will be continuously improved and expanded with more packages. Currently, it is planned to be introduced only for selected packages.

1. Introduction

The main principle of the circular economy (CE) [1,2,3,4] is the change in production system from linear to circular. In the CE, priority is placed on extending the life cycle of products by reducing waste, i.e., changing consumers’ attitudes toward borrowing, reusing, repairing, renewing, and recycling existing materials and products for as long as possible. When a product life’s cycle comes to an end, raw materials and waste remain in the economy thanks to recycling [5,6,7,8,9]. They can be successfully reused, thus creating additional value—this is the case with packaging waste. There are many types of packaging from which packaging waste is generated (bottles, containers, cans, boxes, bags and crates). Used packaging made of paper and cardboard, plastic, glass, tinplate cans, aluminum, multi-material plastics (e.g., Tetra Pak) and wood can be recovered and reused [8,10,11]. The deposit system for packaging is one of the most important stages in the achievement of a CE and is consistent with the Sustainable Development Goals 2030 (SDG 2030) [12].

In addition to Communication from the Commission to the European Parliament [1,2], the European Union has published a package of directives related to the CE, including waste, the landfilling of waste and packaging waste [13,14,15,16], and in 2019, a strategy for plastics was formed (the so-called Single-Use Plastics Directive) [16]. The main goal was to use plastics more efficiently by improving the product design process (so-called eco-design), using biodegradable materials, creating the possibility of reusing them, significantly reducing or even eliminating plastics from the market of disposable items, more efficiently operating the current system, and extending producer responsibility (EPR) [8,9,17,18].

The pace of implementation of the deposit system depends on many factors and varies in European countries, as does the level of recovery and recycling of municipal and packaging waste. According to Eurostat data, in some countries, the recycling of packaging waste is almost 99% (Belgium and Finland), and in others, it is only 40% (Malta) [19,20]. The sooner the deposit system is implemented on a large scale, the sooner its capabilities can be used (in terms of the recovery of good-quality packaging and packaging waste), and the life cycle of unusable waste can be extended, which, after its recovery, gains new material value and can bring tangible economic benefits. In this way, the SDG 2030 goal, i.e., the ‘Recycling Society’, can also be achieved.

In this article, in addition to discussing the current work of the Ministry of Climate and Environment, entrepreneurs and recovery organizations in the implementation of the CE and, above all, the deposit system in Poland, it will also detail the barriers to and inaccuracies that arise during its implementation. A set of benefits for Poland that is expected from the introduction of the deposit system has also been developed. This is the main goal of the article. The authors present current research that shows the benefits of joining the deposit system, as exemplified in other EU countries. The efforts to build the infrastructure for the system in Poland are also shown. The system is supposed to start from 1 January 2025. This topic is particularly important and current because its results may be useful for stakeholders (private and state-owned enterprises, municipal managers and non-governmental organizations) in creating and implementing appropriate initiative and strategies for public policies and waste management.

2. Materials and Methods

In order to achieve the aim of this work and obtain answers to the questions posed by the authors, the article was divided in sections. Section 3 contains the results of the study, which were broken up into three parts (Section 3.1. The deposit system in Poland and other European countries; Section 3.2. Barriers to the implementation of the deposit system in Poland; and Section 3.3. Benefits of implementing the system depository in Poland). The article ends with a discussion in Section 4 and our conclusions and references in Section 5.

By analyzing the literature on the subject of the CE and the implementation of the deposit system in European Union countries, the authors show the pace of the changes taking place in this area. A list of the obstacles and benefits of this system is then described. The tables were prepared on the basis of the secondary literature, the latest data from Eurostat [19], the EEA—European Environment Agency [20], the Central Statistical Office (Polish: GUS) [21] and other publications, which are mentioned in the references section.

The article also uses survey research conducted in Poland in 2019 and published in the co-author’s book [7]. This is compared to research not yet published from the end of 2023, in which respondents indicate suggestions to increase the effectiveness of selective waste collection and packaging recycling. For the study, an original survey was developed among 1067 residents of Poland from 16 provinces. A sampling method that is often used in social sciences was used. The survey was sent using the “snowball” method via traditional interviews (PAPI—Paper & Pen Personal Interview) and via the Internet (CAWI—Computer-Assisted Web Interview). Respondents filling in the survey had to be of age. The author of the study wanted to include citizens of different education, age, place of residence and different incomes (as diverse as possible socially) in the study. To sum up, in order to effectively achieve the assumed research goals, several research methods were used in the publication:

- Analysis of the subject literature;

- Tabular and descriptive charts;

- Survey method;

- Deductive method;

- Analysis of source documents.

The authors want to answer the question regarding whether the date of 1 January 2025 for the implementation of the deposit system is a realistic deadline. Based on the example of other EU countries, what estimated benefits can be expected after implementing the system in Poland? In response to the questions, the following hypotheses were formulated:

Hypothesis 1 (H1).

The date of 1 January 2025 is realistic for the implementation of the partial deposit system in Poland.

Hypothesis 2 (H2).

Both entrepreneurs and consumers in Poland speak positively about the implementation of the deposit system and want its introduction, seeing the great benefits.

Hypothesis 3 (H3).

Despite being implemented in 2025, the deposit system will require continuous expansion and improvement of the infrastructure.

3. Results

3.1. The Deposit System in Poland and Other European Countries

According to COM/2023/306 fina [2] “in the EU, 8.1 billion tonnes of raw materials are converted into energy or products every year, but only 0.8 billion tonnes of them are recycled. Although the material reuse rate in the EU is increasing and was 11.7% in 2021, an increase of 3.4 percentage points compared to 2004, there is significant potential for improvement, in particular by increasing the use of recycled materials and reducing the amount of materials used in the economy”. To effectively monitor changes in improving the pursuit of CE, the EU has adopted 11 indicators grouped into five dimensions: (1) production and consumption; (2) waste management; (3) secondary raw materials; (4) competitiveness and innovation; and (5) global sustainability and resilience. The monitoring framework includes several new indicators: material footprint (tonnes per inhabitant), resource productivity (EUR/kg), consumption footprint, and greenhouse gas emissions from production activities [9,22].

The second dimension, i.e., waste management, is very important because over 2.2 billion tons of waste are produced annually in the EU, of which 10% of all waste is municipal waste. The amount of municipal waste generated increased from 503 kg per European inhabitant in 2010 to 530 kg per inhabitant in 2021. In 2020, the EU generated 59 million tonnes of food waste (131 kg per inhabitant). In 2021, each EU resident generated on average 189 kg of packaging waste. This is over 20% more than 10 years ago [21]. Different countries produce different amounts of packaging waste—from only 74 kg per inhabitant in Croatia to 246 kg per inhabitant in Ireland (in Poland, 172 kg per inhabitant in 2019) [19,21].

In 2022, in Poland, the increase in consumption was not accompanied by an increase in the amount of municipal waste generated, which is consistent with the goals of the Circular Economy and Sustainable Development. In cities, 156 kg of municipal waste was collected selectively per capita, and in rural areas, 121 kg per capita was collected. Of all municipal waste collected separately (5361 thousand tonnes), 11% is mixed packaging waste. In 2022, the amount of collected or separately collected waste in Poland amounted to 142 kg per inhabitant, including the following [21] (p. 158):

- Biodegradable waste—51 kg per inhabitant (49 kg in 2021);

- Glass—21 kg per inhabitant (21 kg in 2021);

- Bulky waste—17 kg per inhabitant (20 kg in 2021);

- Mixed packaging waste—15 kg per inhabitant (16 kg in 2021);

- Paper and cardboard—15 kg per inhabitant (14 kg in 2021);

- Plastics—14 kg per inhabitant (14 kg in 2021).

In 2021, the EU generated a total of 84.3 million tonnes of packaging waste—4.8 million tonnes more than the year before. The largest share was paper and cardboard (40.3%), which was followed by plastics (19%), glass (18.5%), wood (17.1%) and metal (4.9%). As you can see, the production of packaging waste is very large and has an increasing tendency, increasing year by year. This is a big problem because in 2021, around 80% was recovered, but only around 64% of packaging waste was recycled. Does this mean that the rest of the packaging waste was burned, disposed of in landfills or stored, or no one knows what happened to it? [2,20,23,24].

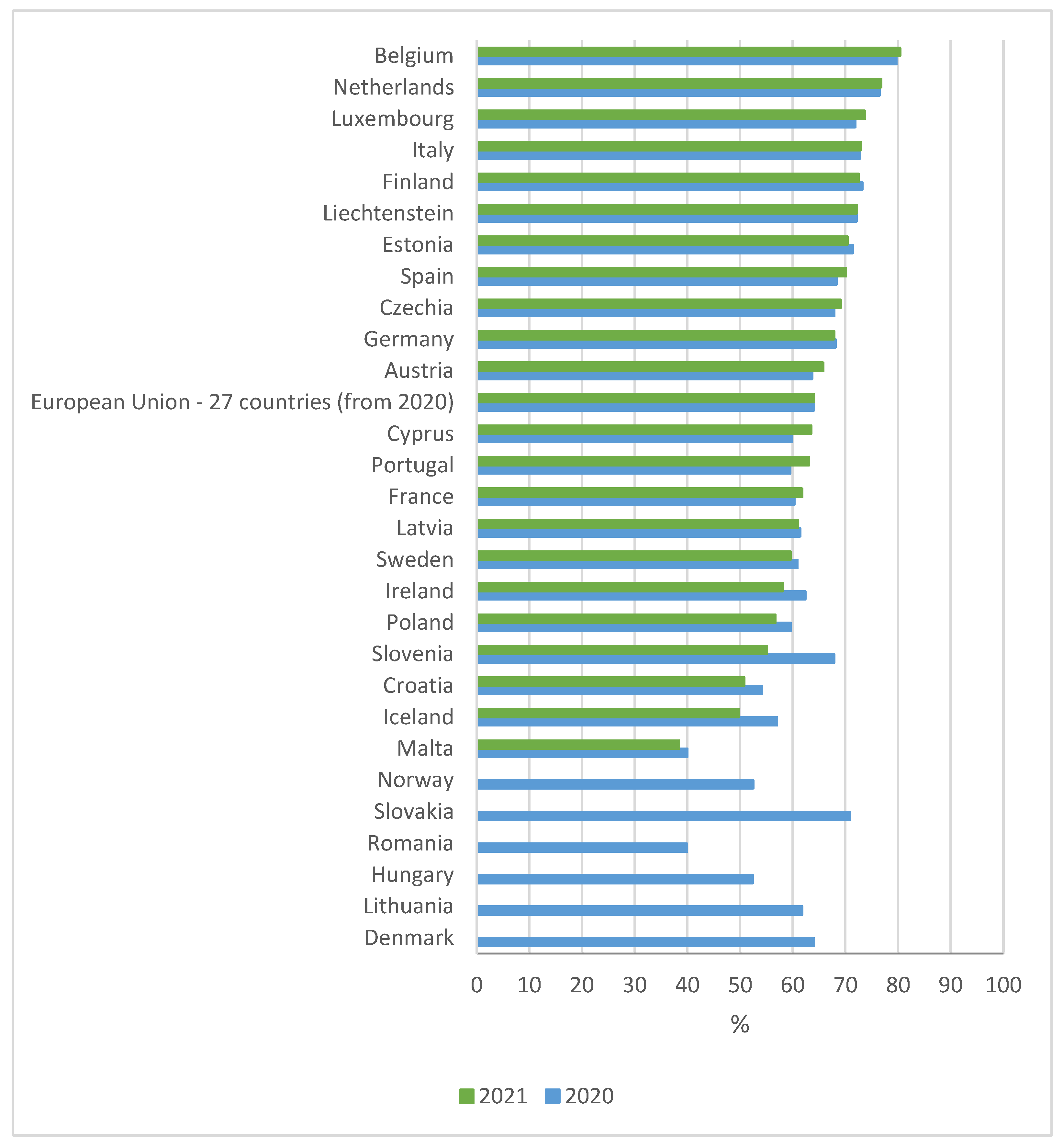

Figure 1 presents the percentage of recycling of packaging waste in selected European countries.

Figure 1.

Recycling of packaging waste in selected European countries (%). Source: own research based on [19,21].

Analyzing Eurostat [19] and Central Statistical Office [21] data for individual European countries, it can be noted that the recycling level in 2020 was below 64% (i.e., the average in the EU-27) in countries such as Cyprus (60%), Portugal (60%), Ireland (62%), Sweden (61%), Greece (60%), France (60%), Poland (60%), Croatia (54%), Latvia (61%), Lithuania (62%), Hungary (52%), Iceland (57%), Norway (53%), Romania (40%), and Malta (40%). It is true that not all of the countries mentioned belong to the EU, but the table in Figure 1 shows a large difference in the percentage levels of packaging waste recycling in individual countries. The highest recycling rates in 2021 are in countries such as Belgium—80%, Netherlands—77%, Luxembourg—74%, and Italy—73%. The largest decline in the recycling rate from 2020 to 2021 was recorded in Slovenia (from 68% to 55%). In 2020 and 2021, several countries recorded an increase in recycling rates, but it was small and ranged from 1% to 3%.

In the European Union, 177.9 kg of packaging waste was generated per inhabitant in 2020. The value of the indicator for individual countries ranged from 66.0 kg per capita in Croatia to 225.8 kg per capita in Germany. In the EU countries, the most paper and cardboard was produced (41%), which was followed by plastic (19%), glass (19%), wood (15%) and metal (5%). In 2020, Croatia, Hungary, Malta and Romania did not achieve the recovery level required by the Packaging Directive, while five countries—Croatia, Norway, Hungary, Malta and Romania—did not achieve the required recycling level [19].

In the years 2010–2020, the amount of packaging waste generated in the EU increased by 11.6 million tons (17.1%), of which the amount of paper and cardboard waste generated increased by 5.2 million tons (18.9%), plastic waste increased by 3.1 million tons (25.1%), wood waste increased by 1.3 million tons (11.5%), glass packaging waste increased by 1.9 million tons (14.5%) and metal waste increased by 0.2 million tons (5.8%). In the same period, the amount of recycled packaging waste increased by 7.5 million tons (17%), which included plastic waste increasing by 1.5 million tons (34%), paper and cardboard waste increasing by 3.6 million tons (16%), metal waste increasing by 0.2 million tons (7%), glass waste increasing by 2.1 million tons (22%), and wood waste increasing by 0.02 million tons (1%) [21].

In accordance with objective 12.5 of the Sustainable Development Goals [12], the EU by 2030 is to “reduce the level of waste generation through prevention, reduction, recycling and reuse”, while by 2050, the goal is to create a circular economy (CE). The European Parliament is working on legislation to improve waste management and help in the transition from a linear economy to a CE. These actions aim to make European businesses cleaner and more competitive and to make society a “recycling society”. Achieving these goals is only possible by limiting the use of resources, limiting the amount of waste and stimulating the sustainable production and consumption [20,25].

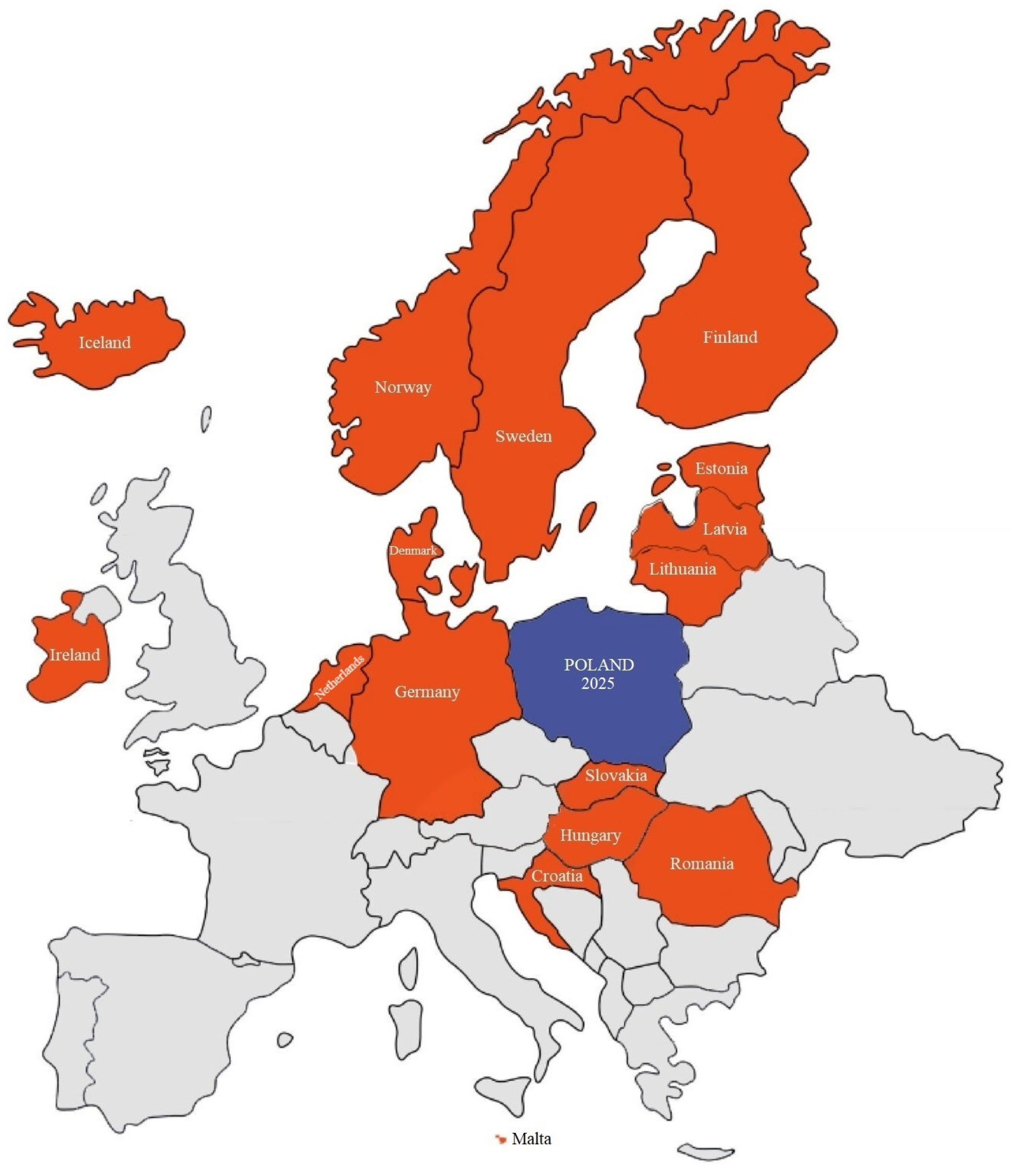

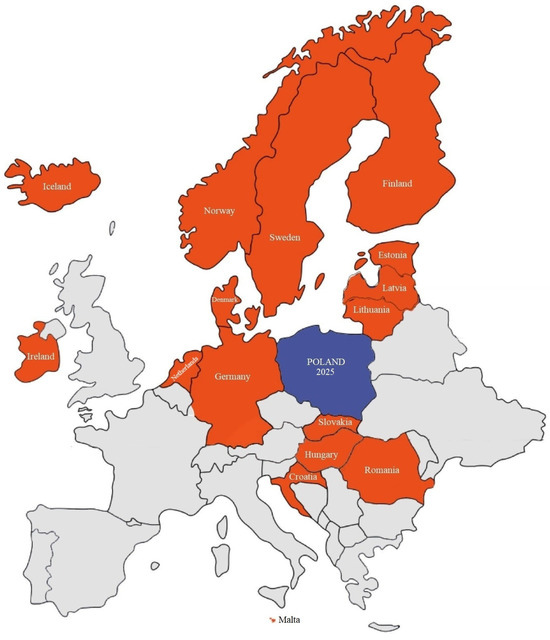

New EU plans and targets for CE [1,2] for a cleaner and more competitive Europe constitute a big challenge for many European countries, including Poland. An example is the recovery and recycling of packaging waste and the implemented packaging deposit system and the willingness of other European countries to join it. Currently, the deposit system in Europe is used by 138 million people (about 1/4 of the population), and it operates in 16 countries, including Croatia, Denmark, Estonia, Finland, the Netherlands, Iceland, Ireland, Lithuania, Latvia, Malta, Germany, Norway, Romania, Slovakia, Sweden, and Hungary (Figure 2). More and more countries are considering its introduction, including Austria, Belgium, Spain, Portugal and Great Britain. The used solutions differ in terms of the mandatory nature of the system, the scope of application, the amount of the deposit, the type of material from which the packaging is made and collected, and the size of the packaging covered by the system. In European countries, 90% of systems are centralized with one operator [9,26,27].

Figure 2.

European countries with an introduced deposit system and Poland (planned introduction of the system in 2025).

Implementing the deposit system is very complicated and requires new actions, such as new law, the preparation of appropriate infrastructure (reception, storage, processing and transport), and the purchase of bottle/can machines. What is more, the whole implementing process involves reconciling consumers’ interests, large and small trading companies (shops) and beverage producers [24,26]. In Poland, the start of the system was planned from 1 January 2023. Talks, debates and legislative work took place much earlier, and the system and the deposit are currently planned for 1 January 2025 (with the system being extended in the following years).

The deposit system consists of a deposit being imposed on each glass, plastic bottle or can product that is sold. It is up to each country how large the deposit is. For example, in Germany, the deposit is 25 eurocents (0.27 USD) for single-use packaging, while in the Baltic countries, it is 10 eurocents (0.11 USD), and in Poland, it will be [28] 50 groszy (0.13 USD) for plastic bottles or aluminum cans and 1 zloty (0.25 USD) for reusable glass bottles from 2025 onwards (the current refund for glass or plastic bottles depends on the store having a packaging machine and ranges from 5 to 50 groszy—in USD from 0.01 to 0.13).

In each country, specific laws specify the size of stores that are obliged to accept beverage packaging and return the deposit added when selling them. Lithuania is an example of a country in which the obligation involves stores that are bigger than 300 m2. Estonia obliged stores over 200 m2. The operator is the one in charge of operating the deposit system. They are responsible for collecting packages from the shops and transferring them to recycling. For example, the operator could be an association of beverages producers. The same operator settles traders and entrepreneurs for deposits paid. Stores can install machines for collecting packaging and issuing deposits; most often, these are facilities with an area of over 250 m2. By throwing a bottle or can into the vending machine, the customer receives a receipt, which entitles them to collect the equivalent of the amount specified on the receipt or spend it on purchases in this store. The way in which packaging is collected depends on the size of the store and the amount of packaging accepted. For the collection service, stores receive the so-called handling fee. Machines are sources in different ways; e.g., shops buy them by themselves (Scandinavia, Estonia) or receive them from the operators (Lithuania). Special codes are placed on the packaging (both from manual and automated collection systems), thanks to which the operator identifies a specific seller. Based on the number and type of introduced packaging declared by the person placing them on the market, the operator calculates the cost of their collection and management and, on this basis, charges a specific fee each month. The system is financed with approximately 10% of funds from packaging. This is why the customers do not receive a deposit from administrative fees incurred by producers and from the sale of collected waste, which can be recycled and sold in the form of a new product [26,29].

In Germany, 85% out of 135,000 collection points are automatized. The remaining 15% are the manual ones. A glass bottle is recycled here on average 45 times, while a PET (polyethylene terephthalate) bottle is recycled about 20 times [30] (p. 7), [31] (p. 47). A reusable Finnish glass bottle is filled on average 33 times before being recycled, and a PET bottle (polyethylene terephthalate) is filled on average 18 times. There must a way to organize the collection of empty packaging to make the deposit system effective. Most Europeans use reusable bottles a minimum of 20 times. Poland is far behind Europe. Polish people reuse bottles only eight to nine times. There might be different reasons, such as the bottle being used only for 2–3 years for aesthetic reasons (brewery’s system) and difficulties in returning the beverage packaging (e.g., no receipt). What is more, the consumers feel defrauded because they receive a smaller refund than the deposit [9,31].

Literature data [7,9,20,21,23,29] show that segregated glass packaging and aluminum cans can be recycled many times without loss of quality. Paper is reused 6-7 times, and 75% of milk and juice cartons is high-quality cellulose, which can be used to make new paper products. Plastics can be recycled 10 times. What is more, ferrous and non-ferrous metals are also fully reusable.

The deposit system most often includes packages from the following [31] (pp. 41–44):

- Plastics: mainly PET bottles—polyethylene terephthalate (in Norway also HDPE: high-density polyethylene),

- Metals: mainly aluminum cans; additionally, tin-plated packaging in Croatia, Sweden and Norway; steel packaging in Estonia,

- Glass: depending on the country, including bottles of beer, juices, soft drinks, weak alcohol (less than 10%), and strong alcohol (only collected in Finland).

Unfortunately, existing deposit systems do not cover all packaging. Most systems excluded milk and dairy drinks as well as wine and spirits. Some systems also do not allow juices poured into glass or plastic packaging such as PET. Germany and Finland are the only countries that reuse PET bottles. Half of the deposit systems for single-use packaging include or cooperate with operators of reusable packaging systems.

According to data from Deloitte Polska 2019 [32], the average collection level for all packaging in Croatia is approximately 90%. Collection is mostly manual, which means that sellers have to sort the packaging themselves according to the material from which they are made (glass, plastic, aluminum). There are 14,916 points in Finland where you can return empty packaging. The return rate for single-use packaging in 2016 was 88% for glass, 92% for PET, and 96% for metal. In Lithuania, the average return in 2016 was approximately 90% for all collected packaging. The seller selects the type of collection system (manual or automated). At once, glass beer bottles are collected for recycling. In Germany, collection is 80% automatic. Since there is no handling fee for sellers, they do not make money but appear to be the owners of the waste. In 2014, 96% of cans, 98% of PET, and 84% of glass bottles were returned. In Germany, there is also an optional collection system for reusable packaging. Sellers are not obliged to accept such packaging (e.g., reusable bottles or boxes); they are collected only by those participating in the voluntary system. In Sweden, the system is self-sufficient and 95% automatic. The collection rate in 2016 was 82% for plastics and 86% for cans.

According to Deloitte data from 2019 [32], a total of approximately 900,000 tons of packaging reaches the Polish market (which is only approximately 7% of the total mass of municipal waste). These estimates are based on Polish and international statistical data and numerous consultations with the packaging industry. The following approximate weights of packaging were introduced to the market: PET bottles—200,000 tons, aluminum cans—80 thousand tons, glass bottles—500 thousand tons, multi-material packaging—75 thousand tons. Currently, the recycling of these fractions largely depends on the material from which the packaging is made and ranges from 25% to 80% [33] (p. 61).

The Act of 13 July 2023 amending the Act on the management of packaging and packaging waste [28] defined the deposit system as “a system in which, when selling products in single-use or reusable beverage packaging referred to in Annex No. 1a to the Act (Table 1), which are beverages, a deposit is collected, which is returned to the end user in upon the return of packaging covered by the deposit-refund system or packaging waste generated from packaging covered by the deposit-refund system”, respectively. It was also proposed that the system would be universal, non-discriminatory and that there would be no obligation to have a receipt in order to recover the deposit. The proposed law obliges shops with a sales area of more than 100 m2 to collect empty packaging and packaging waste.

Table 1.

Minimum levels of separate collection of packaging and packaging waste. Annex 1 to the Act [28].

The Ministry of Climate and Environment announced the introduction of the following changes to the deposit system [34]:

- VAT deposit exemption (for disposable and reusable packaging);

- Collecting a deposit at every stage of sale;

- Increasing the deposit to PLN 1 for reusable glass bottles;

- Maintaining a low product fee for failure to meet the required collection levels in the first year of operation of the deposit system (in 2025, it is 77%);

- Ability to return reusable glass packaging wherever they are sold;

- Postponing the collection of milk and dairy product packaging under the deposit system to 2026;

- Keeping disposable glass packaging outside the system (including “monkeys”, juices, alcohol);

- Inclusion of standard glass packaging (various types of bottles and jars) in the refund system gradually from 2026;

- Minimum one collection point in each commune.

The first machines for packaging and packaging waste appeared on the Polish market in Krakow on 17 April 2019. The machine worth PLN 20,000 was then loaned to the Krakow City Hall for two weeks by Grand Technology. Currently, due to the short period of entry into force of the Act, the Kaufland, Żabka, Lidl, Biedronka, Spar, Carrefour and PSH Lewiatan store chains are taking the initiative to install bottle vending machines themselves [32,34,35]. Figure 3 shows a packaging return machine in a Lidl store.

Figure 3.

A bottle vending machine in the Lidl store in Gostyń (near Poznań). Source: own photo.

In Poland, the National Deposit System ZWROTKA S.A. (Cracow, Małopolska Voivodeship, Poland) was established, which is a company jointly established by Biosystem S.A. (Cracow, Małopolska Voivodeship, Poland) and the Polish Chamber of Commerce for Environmental Protection (Warsaw, Mazowieckie Voivodeship, Poland) to launch in 2025 and continue to operate a nationwide deposit system for plastic and metal beverage packaging (excluding glass packaging). Packaging collection under the ZWROTKA system will be carried out mainly automatically, using generally available RVM machines, mostly located in retail and wholesale outlets. The devices will enable the selective collection and preliminary crushing of plastic and metal packaging. Automatic collection will be complemented by a manual beverage packaging collection system implemented in small commercial units where it is not possible to place an RVM machine. The collection will be carried out using hand-held scanners enabling the scanning of the barcode on the packaging. Manual collection points will also collect plastic and metal packaging, including packaging for dairy products. Beverage packaging collected manually will be subject to additional control counting carried out in dedicated counting centers [35].

3.2. Barriers to the Implementation of the Deposit System in Poland

The specificity of the EU member states means that the process of implementing CE and its tool, the deposit system, proceeds at different paces and encounters various barriers. In some countries, it is being implemented successfully; in Poland, it is planned to be introduced in 2025, and in some countries, it is not planned at all.

The basic barrier is considered to be too high initial investment costs related to adapting stores to the system and purchasing machines (e.g., SORTBOX RC 120—an automatic collection point for PET bottles and ALU cans cost in 2019—net price of EUR 6320.00 plus 23% VAT; SORTBOX BCR 140-C/1300—net price EUR 12,300.00 plus 23% of Polish VAT; RECYCLEVER—automatic machine from the Polish company Ekofabryka from Krosno Odrzańskie (Lubuskie Voivoeship), Poland for the collection of plastic and metal packaging—gross price PLN 80,000) or appropriate equipment, time-consuming efforts related to the investment and the need for appropriate equipment trained employees who have appropriate competences [35,36,37,38]. The very act of adapting the law and reconciling the system’s stakeholders also raises a lot of emotions. The barriers Poland faces are summarized in Table 2.

Table 2.

Barriers of the implementation of the deposit system in Poland.

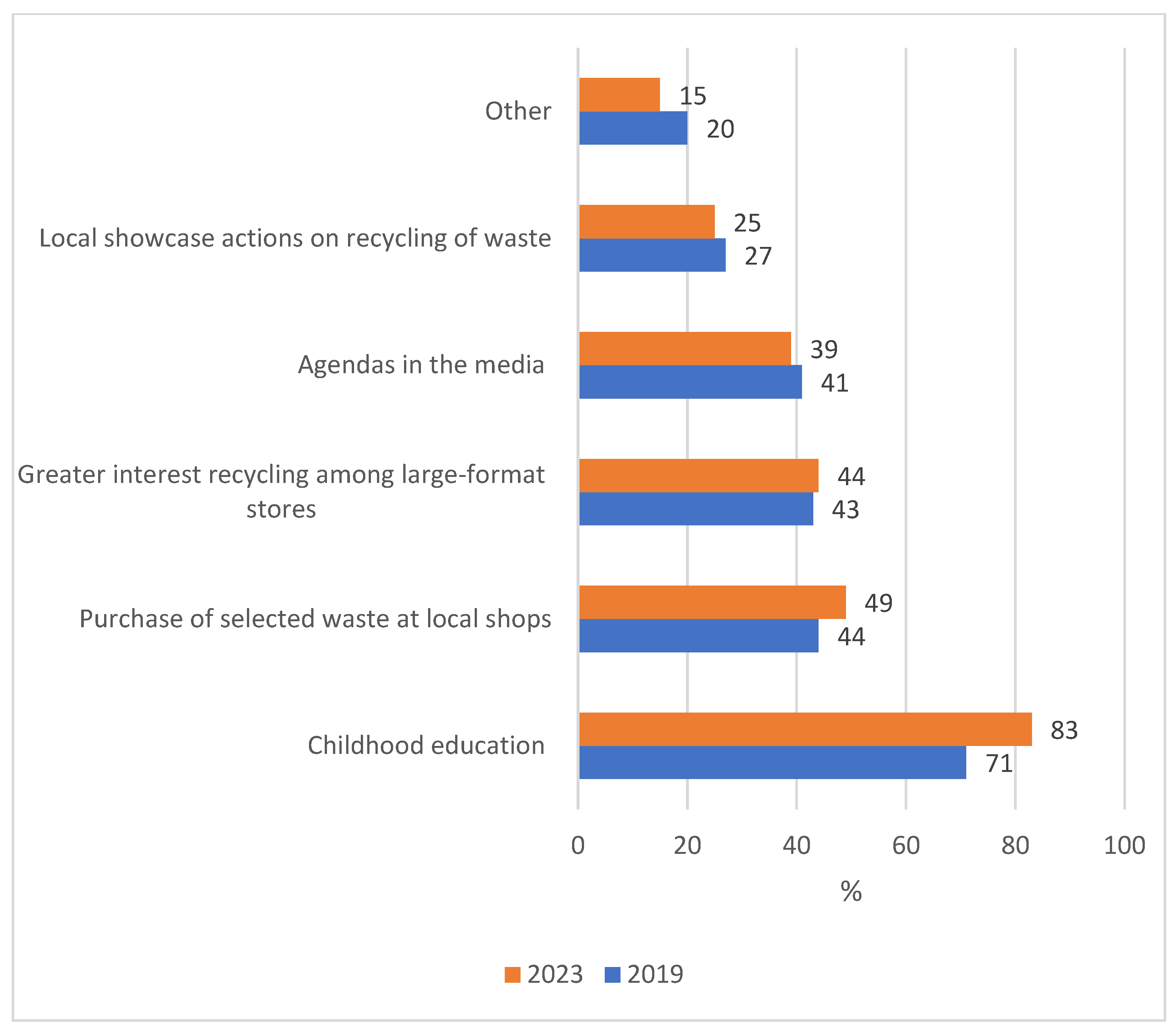

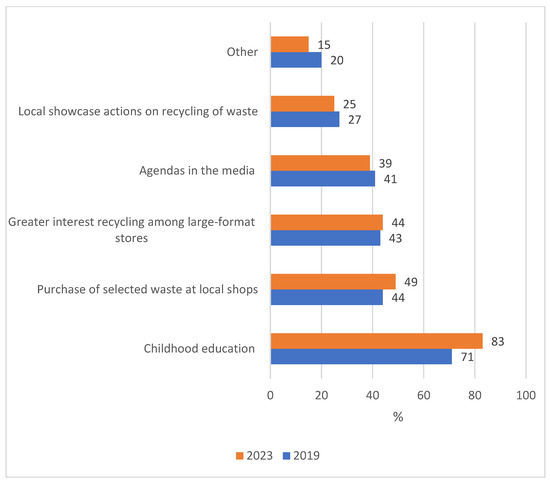

In Zarębska’s book titled Management of Packaging Waste in the Context of a Circular Economy—Essence, Tools, Environmental Communication [7] (p. 265), published in Poland in 2019, the author publishes research conducted on a group of 1067 people from all over the country, which indicates that consumers see a great need to improve the current municipal waste management system, especially packaging waste. For comparison, the present authors supply the results of the research that has not been published yet. The data is from the end of 2023. The results presented in Figure 4 indicate that 71% of respondents consider the need to educate the youngest to be a priority factor in improving the waste management system and management (2023—83%). The purchase of selected waste at local shops (supermarkets) and smaller local stores—44% (2023—49%), greater interest recycling among large-format stores—43% (2023—44%), information programs in the media—40% (2023—39%), demonstration campaigns for the public on the correct segregation of waste—27% (2023—25%).

Figure 4.

Poles’ proposals regarding improving the municipal waste management system and recycling of packaging waste.

Summarizing the above analyses, it can be safely said that Hypothesis 1 was confirmed and H1 ‘The date of 1 January 2025 is realistic for the implementation of the partial deposit system in Poland’. Poland is on the right track to implementing a deposit system for packaging, and the intensity of work of various system stakeholders indicates their success already at the end of this year. Of course, the system will also be improved in the coming years, which is also indicated by the assumptions of the 2023 Act [28]. In the coming years, it will be necessary to expand the system to include additional packaging not planned in the first phase of system implementation (metal, multi-material and other packaging).

3.3. Benefits of the Implementation of the Deposit System in Poland

Each newly implemented system raises controversy and uncertainty regarding whether its results will be as expected. The same applies to the implementation of the deposit system into Polish waste management. In the previous Section 3.2, the authors have presented in tables selected barriers/difficulties that can be expected after analyzing the literature and documents as well as various types of reports and listening to public debates. In Section 3.3, the authors of the publication summarize the benefits that Polish society, enterprises and the environment, above all, can expect from the implementation of the deposit system.

In the case of introducing a deposit–refund system in Poland, the benefits include an increase in packaging recycling and thus savings in primary (non-renewable) raw materials, reducing the littering of streets and landfills with packaging waste. Another benefit is the clear, transparent and consistent deposit–refund system for the whole country as well as reducing the consumption of primary raw materials. The advantages of implementing a deposit system translate into CE advantages. In Table 3, they are divided into three categories consistent with the pillars of sustainable development: the environment, society, and the economy.

Table 3.

Benefits of implementing a deposit system in Poland.

A simulation of the possible increase in recycling levels in Poland was carried out for plastic packaging (PET bottles), household glass and multi-material packaging after the introduction of the deposit system. The simulation results indicate that introducing the system could improve recycling levels for plastic packaging by 11.1%, for household glass by 13.8%, and for multi-material packaging by 65%. Thanks to the opening of borders, Poles are traveling more and more and thus seeing the bottle dispensers and the involvement of the society of other countries; they are also supporters of this system and are waiting for its introduction. The research [23,32] shows that over 81% of Poles want to introduce a deposit system and place bottle dispensers in stores.

The current preparation of the deposit system indicates the confirmation of Hypothesis H2. Both entrepreneurs and consumers in Poland speak positively about the implementation of the deposit system and want it to be introduced, seeing the great benefits.

4. Discussion

The deposit system for beverage packaging is a huge, circular business model with many stakeholders. From producers of RVM, Recyclever and other machines through to recipients of packaging waste and all logistics and transport—many companies will be able to operate in this system. This is a huge business, but it is a business that goes hand in hand with environmental protection. The society also plays an important role in this circular system because it is the people who will use the bottle and can vending machines, and they will “drive” the deposit system.

Unfortunately, as in all social research, the most valuable aspect is the people, whose actions as well as thoughts cannot always be predicted. To the general barriers and opportunities for implementing the deposit system in Poland listed in Table 2 and Table 3, one can additionally add barriers and opportunities resulting from the specificity of a given community, mentality, culture, upbringing, and ecological education [39,40].

As shown by Zarębska’s research [7] (pp. 265–305), sometimes, the character of society in the field of pro-ecological activities is passive and indifferent. People know that collecting waste paper and returning empty bottles to collection centers are pro-ecological activities that protect the environment and reduce the demand for primary raw materials, yet they do not take such actions and are indifferent to them. This situation has improved significantly since 2019, and triple waste containers (paper, plastic, glass) can be found more and more often in public places and educational institutions (an example is the University of Zielona Góra). However, this situation does not occur at homes where small kitchens do not accommodate several containers for sorted waste. Further research showed that the reason for the low level of recovery and recycling of packaging waste is [7] lack of faith in the proper functioning of the “at source” segregation system—33% of respondents; lack of variety and sufficient number of containers in the place of residence—19.9%; lack of space at home for several containers—19.1%; lack of habits in separating waste—8.6%; and lack of time—7%. Only 75% of respondents declared that they segregated municipal waste, but only 70% of them segregated waste in all waste groups, and the remaining 30% segregated only paper, plastic or glass, and some segregated only plastic.

Respondents see the possibility of increasing the effectiveness of the selective collection system for packaging waste: education of the youngest, purchase of selected waste by large-area stores (supermarkets) and smaller housing estate stores, information programs in the media, and demonstration actions for the society concerning proper waste segregation.

Poles’ good attitude toward the deposit system is the beginning of good changes. We can hope that it will bring the intended benefits not only for the environment but also for all system stakeholders (packaging producers, system logisticians, stores, society and others). The benefits of the deposit system, which will allow obtaining a sufficient amount of high-quality raw materials necessary for the production of recycled packaging, will also allow the costs of managing beverage packaging waste to be transferred from municipalities and residents to producers and consumers.

The deposit collection and recycling system promotes eco-design that ensures a higher quality of recycling, which also has a higher market value [7,9,17,18]. Depending on the solution adopted, beverage sellers may also receive additional revenues from a handling fee related to the operation of equipment or the sale of packaging waste if they become owners of the received waste. For producers, unreturned deposits can provide additional profit, and they can also benefit from tax breaks and reduced fees if they achieve an appropriate level of return or recycling of packaging.

There are a few months left until the introduction of the deposit system. The deposit system is to be a mechanism promoting recycling and reuse of packaging. This system is to be created by entrepreneurs introducing beverages in packaging covered by the deposit system to the market through a representative entity and shops where such products are offered. Constant legal changes may become a problem. Additionally, new companies are constantly being established as new operators in the deposit system. Companies of the Schwarz Group have submitted an application for a permit to run an operator of the deposit system (this will be the third operator). The Schwarz Group is the owner of Lidl, Kaufland and PreZero Recycling Południe [41]. Another question is whether these companies will not want to burn packaging waste from the deposit system if there is a problem with its management. And what will the municipalities do in the event of a lack of cost reimbursement? The Ministry of Climate announced that it will not introduce compensation for the costs incurred by the municipalities for the management of waste covered by the deposit system and not returned under this system [34].

The authors of the publication are aware of the imperfections of their research. In the future, they plan to check what the implementation of the system will look like in the following years, 2025 and beyond. Comparing current research results and preparation for the implementation of the system in Poland, the authors believe, in accordance with H3, that ‘the deposit system, despite being implemented in 2025, will require continuous expansion and improvement of the infrastructure.’ As scientists, they want to track this process, its progress and examine the benefits it will bring in the three pillars of sustainable development (for the economy, society and the environment). Moreover, it would be advisable to prepare a life cycle assessment (LCA) for the implemented system. LCA is a popular environmental management tool that is also used by Polish scientists [42,43,44,45,46]. Zarębska [45] developed such an ecological assessment but for milk packaging. It should be remembered that the packaging recycling process also involves costs (e.g., energy used to heat water for washing glass bottles, energy used to melt aluminum cans). Since 2013, the packaging market in Poland and the principles of its functioning have changed radically, hence the idea for further research taking into account the specificity of the studied country.

5. Conclusions

The transition to a circular economy will contribute to a more sustainable economy and improve the protection of biodiversity and ecosystems. It will also increase competitiveness, stimulate innovation and reduce the consumption of natural resources, which is in line with the EU strategy beyond 2030 [2].

The overall awareness of market participants, both public and private entities and individuals, is dominated by trends related to waste management (recycling and recovery) based on selective waste collection. This is a small part of the entire CE idea, but selective waste collection is at its core. Correctly collected raw material from the market (packaging), of good quality, gives a chance for its re-use. All barriers described in Table 2 can be overcome. With small steps and pro-ecological activity, Poland will implement a deposit system and achieve the recycling levels assumed in the Act [28]. If we assume that a total of about 900 thousand tons of packaging is introduced to the Polish market [32] and the system will allow for the recovery of about 80% of it, then a total of about 720 thousand tons of packaging waste will be recovered. Less pollution of public space, developing pro-environmental attitudes in society, improving recycling levels and thus reducing the level of use of primary raw materials are opportunities that we are able to achieve as a European ‘recycling society’.

Author Contributions

Conceptualization, J.Z. and A.Z.; methodology, J.Z; software, A.Z.; validation, A.Z. and J.Z.; formal analysis, J.Z.; resources, A.Z. and J.Z.; data curation, A.Z. and J.Z.; writing—original draft preparation, J.Z.; writing—review and editing, A.Z. and K.M.; visualization, A.Z.; supervision, J.Z. and K.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- COM 98/2020 Final. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, A New Circular Economy Action Plan for a Cleaner and More Competitive Europe. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2020%3A98%3AFIN (accessed on 1 October 2024).

- COM/2023/306 Final. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions on a Revised Monitoring Framework for the Circular Economy. Available online: https://eur-lex.europa.eu/legal-content/PL/TXT/?uri=CELEX:52023DC0306 (accessed on 1 August 2024).

- Geissdoerfer, M.; Savaget, P.; Bocken, N.; Jan Hultink, E. The Circular Economy—A New Sustainability Paradigm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef]

- Smol, M.; Kulczycka, J.; Avdiushchenko, A. Circular economy indicators in relation to eco-innovation in European regions. Clean Technol. Environ. Policy 2017, 19, 669–678. [Google Scholar] [CrossRef]

- Stahel, W. The Circular Economy: A User’s Guide, 1st ed.; Routledge: London, UK; New York, NY, USA, 2019; ISBN 978-0-367-20014-5. [Google Scholar]

- Kopnina, H.; Poldner, K. Circular Economy Challenges and Opportunities for Ethical and Sustainable Business; Routledge: London, UK; New York, NY, USA, 2022. [Google Scholar]

- Zarębska, J. Zagospodarowanie Odpadów Opakowaniowych w Kontekście Gospodarki o Obiegu Zamkniętym—Istota, Narzędzia, Komunikacja Środowiskowa, 1st ed.; Oficyna Wydawnicza Uniwersytetu Zielonogórskiego: Zielona Góra, Poland, 2019; pp. 30–72. (In Polish) [Google Scholar]

- Gregorio, V.F.; Pie, L.; Terceno, A. A Systematic Literature Review of Bio, Green and Circular Economy Trends in Publications in the Field of Economics and Business Management. Sustainability 2018, 10, 4232. [Google Scholar] [CrossRef]

- Lewicka, D.; Zarębska, J.; Batko, R.; Woźniak, M.; Cichoń, D.; Tarczydło, B.; Pec, M. Circular Economy in the European Union Organisational Practice and Future Directions in Germany, Poland and Spain, 1st ed.; Routledge: London, UK; New York, NY, USA, 2023; pp. 42–56. [Google Scholar] [CrossRef]

- Weetman, C. A Circular Economy Handbook: How to Build a More Resilient, Competitive and Sustainable Business, 2nd ed.; Kogan Page Ltd.: London, UK, 2020; pp. 250–348. [Google Scholar]

- Zarębska, J.; Zarębski, A.; Lewandowska, A. Polish society towards the implementation of the circular economy and the change of municipal waste management—Ecological, economic and social aspect. Management 2021, 25, 91–112. [Google Scholar] [CrossRef]

- The 2030 Agenda and the Sustainable Development Goals An opportunity for Latin America and the Caribbean. 2018. Available online: https://repositorio.cepal.org/server/api/core/bitstreams/6321b2b2-71c3-4c88-b411-32dc215dac3b/content (accessed on 28 April 2024).

- Directive (EU) 2018/850 of the European Parliament and of the Council of 30 May 2018 Amending Directive 1999/31/EC on the Landfill of Waste (Text with EEA Relevance). Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L0850 (accessed on 1 October 2024).

- Directive (EU) 2018/851 of the European Parliament and of the Council of 30 May 2018 amending Directive 2008/98/EC on waste (Text with EEA relevance). Available online: https://eur-lex.europa.eu/eli/dir/2018/851/oj (accessed on 1 October 2024).

- Directive (EU) 2018/852 of the European Parliament and of the Council of 30 May 2018 Amending Directive 94/62/EC on Packaging and Packaging Waste (Text with EEA Relevance). Available online: https://eur-lex.europa.eu/eli/dir/2018/852/oj (accessed on 1 October 2024).

- Directive (EU) 2019/904 of the European Parliament and of the Council of 5 June 2019 on the Reduction of the Impact of Certain Plastic Products on the Environment (Text with EEA Relevance). Available online: https://eur-lex.europa.eu/eli/dir/2019/904/oj (accessed on 1 October 2024).

- Dalhammar, C. Industry attitudes towards ecodesign standards for improved resource efficiency. J. Clean. Prod. 2016, 123, 155–166. [Google Scholar] [CrossRef]

- Lee, C.K.; Lee, J.Y.; Choi, Y.H.; Lee, K.M. Application of the integrated ecodesign method using the GHG emission as a single indicator and its GHG recyclability. J. Clean. Prod. 2016, 112, 1692–1699. [Google Scholar] [CrossRef]

- Eurostat. Available online: https://ec.europa.eu/eurostat (accessed on 5 April 2024).

- EEA Report 13/2023. Accelerating the Circular Economy in Europe. State and Outlook 2024. Available online: https://s3-eu-west-1.amazonaws.com/avfall-norge-no/dokumenter/EEA-report-Accelerating-the-circular-economy-in-Europe-State-and-outlook-2024.pdf (accessed on 28 March 2024).

- GUS. Ochrona Środowiska 2023. Available online: https://stat.gov.pl/obszary-tematyczne/srodowisko-energia/srodowisko/ochrona-srodowiska-2023,1,24.html (accessed on 3 May 2024). (In Polish)

- De Pascale, A.; Di Vita, G.; Giannetto, C.; Ioppolo, G.; Lanfranchi, M.; Limosani, M.; Szopik-Depczyńska, K. The circular economy implementation at the European Union level. Past, present and future. J. Clean. Prod. 2023, 423, 138658. [Google Scholar] [CrossRef]

- Plastics Europe, Plastics—The Fast Facts 2023, Plastics Europe. Available online: https://plasticseurope.org/knowledge-hub/plastics-the-fast-facts-2023/ (accessed on 3 May 2024).

- Topics. European Parliament. Available online: https://www.europarl.europa.eu/topics/en/article/20231109STO09917/how-to-reduce-packaging-waste-in-the-eu-infographics (accessed on 3 May 2024).

- Ellen MacArthur Foundation. Intelligent Assets: Unlocking the Circular Economy Potential. 2016. Available online: https://www.ellenmacarthurfoundation.org/assets/downloads/publications/EllenMacArthurFoundation_Intelligent_Assets_080216.pdf (accessed on 2 February 2024).

- Tugce Tugran. Deposit Refund Systems in the EU. 2023 Update. The Association of Cities and Regions (ACR+). Available online: https://www.acrplus.org/media/origin/images/technical-reports/2023_ACR_Deposit_Refund_Systems_EU_Report.pdf (accessed on 20 March 2024).

- Teraz Środowisko. 2023. Available online: https://www.teraz-srodowisko.pl/aktualnosci/system-kaucyjny-w-polsce-projekt-ustawy-mkis-12490.html (accessed on 2 February 2024). (In Polish).

- Ustawa z Dnia 13 Lipca 2023 r. o Zmianie Ustawy o Gospodarce Opakowaniami i Odpadami Opakowaniowymi Oraz Niektórych Innych Ustaw (Dz. U. 2023, Poz. 1852). Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20230001852/O/D20231852.pdf (accessed on 20 March 2024). (In Polish)

- System kaucyjny od 2025 roku—Kaucja bez VAT. Available online: https://www.inforlex.pl/dok/tresc,FOB0000000000006524666,System-kaucyjny-od-2025-roku-kaucja-bez-VAT.html (accessed on 11 March 2024). (In Polish).

- Bielenstein, T. Refillable Bottle Systems in Germany—A Model for Well-Designed Pool Systems in Europe? Zero Waste Europe Webinar. 10 May 2022. Available online: https://zerowastecities.eu/wp-content/uploads/2022/05/220510_Presentation_Zero_Waste_Europe.pdf (accessed on 30 May 2023).

- Malowaniec, B. Gospodarka Odpadami Opakowaniowymi po Napojach w Polsce: Teraz i w Niedalekiej Przyszłości. Systemy Kaucyjne w Wybranych Krajach Europejskich. Wydawnictwo Polskiego Stowarzyszenia Zero Waste. Warszawa 2022. Available online: https://kaucyjny.pl/wp-content/uploads/2022/02/Raport_Gospodarka-odpadami-10.10.21_poziom_ver.1.docx.pdf (accessed on 1 October 2024). (In Polish).

- Deloitte Polska. Zamknięty Obieg—Otwarte Możliwości w Zakresie Plastiku. Energy, Sustainability and Economics. Deloitte, Warszawa. 2019. Available online: https://www.slideshare.net/DeloittePolska/zamknity-obieg-otwarte-moliwoci-w-obszarze-plastiku (accessed on 16 March 2024). (In Polish).

- Patorska, J.; Paca, D.; Bujny, J. Analiza Możliwości Wprowadzenia Systemu Kaucyjnego dla Opakowań; Opracowanie Eksperckie; Deloitte: Warszawa, Poland, 2017. Available online: https://sdr.gdos.gov.pl/Documents/GO/Ekspertyzy/Analiza%20mo%C5%BCliwo%C5%9Bci%20wprowadzenia%20systemu%20kaucyjnego_06.12.pdf (accessed on 20 January 2024). (In Polish)

- Ministerstwo Klimatu i Środowiska. Serwis Rzeczypospolitej Polskiej. Od 2025 Roku Będzie Obowiązywał w Polsce System Kaucyjny. Rząd Przyjął Nowelizację Ustawy o Gospodarce Opakowaniami i Odpadami Opakowaniowymi. Available online: https://www.gov.pl/web/klimat/od-2025-roku-bedzie-obowiazywal-w-polsce-system-kaucyjny-rzad-przyjal-nowelizacje-ustawy-o-gospodarce-opakowaniami-i-odpadami-opakowaniowymi (accessed on 11 March 2024).

- ZWROTKA S.A.: Jesteśmy Gotowi na System Kaucyjny od 2025 r., Money.pl 2024. Available online: https://www.money.pl/gospodarka/zwrotka-s-a-jestesmy-gotowi-na-system-kaucyjny-od-2025-r-7007341027338976a.html (accessed on 18 March 2024).

- Ekofabryka. 2024. Available online: https://ekofabryka.com.pl/produkt/recyclever/ (accessed on 1 May 2024). (In Polish).

- Butelkomat—Recyclever 2023. Available online: https://www.recyclever.com/pl (accessed on 20 March 2024).

- Kirchherr, J.; Piscicelli, L.; Bour, R.; Kostense-Smit, E.; Muller, J.; Huibrechtse-Truijens, A.; Hekkert, M. Barriers to the Circular Economy: Evidence from the European Union (EU). Ecol. Econ. 2018, 150, 264–272. [Google Scholar] [CrossRef]

- Reller, A.; Holdinghausen, H. Wir konsumieren uns zu Tode: Warum wir unseren Lebensstil ändern müssen, wenn wir überleben wollen; Westend: Frankfurt am Main, Germany, 2013; ISBN 9783864890499. [Google Scholar]

- Böckel, A.; Quaing, J.; Weissbrod, I.; Böhm, J. Mythen der Circular Economy; Indeed Innovation GmbH: Hamburg, Germany, 2022; Available online: https://download.mythencirculareconomy.com/Mythen_der_Circular_Economy_2022.pdf (accessed on 1 May 2024).

- Czy będzie trzeci operator systemu kaucyjnego? Właściciel Lidla i Kauflandu złożył wniosek. E-wydanie rp.pl 2024. Available online: https://www.rp.pl/biznes/art40626281-czy-bedzie-trzeci-operator-systemu-kaucyjnego-wlasciciel-lidla-i-kauflandu-zlozyl-wniosek (accessed on 15 October 2024). (In Polish).

- Relich, M.; Adamczyk, J.; Dylewski, R.; Kister, A. Case-Based Reasoning in Achieving Sustainability Targets of New Products. Sustainability 2024, 16, 1502. [Google Scholar] [CrossRef]

- Dzikuć, M.; Zarębska, J. Analiza porównawcza produkcji energii w Elektrociepłowni Legnica i Elektrociepłowni Lubin z wykorzystaniem metody LCA. Polityka Energetyczna Energy Policy J. 2014, 17, 41–52. Available online: https://min-pan.krakow.pl/wp-content/uploads/sites/4/2017/12/04-Dzikuc-Zarebska.pdf (accessed on 1 August 2024).

- Adamczyk, J.; Dzikuć, M.; Dylewski, R.; Varese, E. Assessment of selected environmental and economic factors for the development of electro-mobility in Poland. Transportation 2023, 51, 2199–2223. [Google Scholar] [CrossRef]

- Zarębska, J. Ekologiczne i Ekonomiczne Aspekty Gospodarki Odpadami Opakowaniowymi w Województwie Lubuskim; Oficyna Wyd. Uniwersytetu Zielonogórskiego: Zielona Góra, Poland, 2013; ISBN 978-83-7842-055-2. (In Polish) [Google Scholar]

- Rybaczewska-Błażejowska, M.; Mena-Nieto, A. Circular economy: Comparative life cycle assessment of fossil polyethylene terephthalate (pet) and its recycled and bio-based counterparts. Manag. Prod. Eng. Rev. 2020, 11, 121–128. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).