1. Introduction

Energy commodity trading and valuation play a key role in both the financial and economic spheres. On the economic front, several energy specialists, e.g., [

1,

2], have claimed that changes in the price of crude oil can dramatically disrupt the nation’s financial system and the economy. According to [

2], shocks to the price of oil have the greatest potential to destabilize the economy, increase risks for the energy industry, and raise inflation in the short term. For instance, the report released by the World Bank in 2022 highlighted that the increase in crude oil prices, along with other factors like commodity price shocks and wage pressures, has led to an acceleration in inflation in most economies worldwide since mid-2021, primarily because it coincided with the start of the geopolitical conflict between Russia and Ukraine. Additionally, the rise in this risk pushes up energy expenses for national budgets. Therefore, by taking measures to promote demand reduction, fuel substitution, and the development of renewable energy sources, economic decision-makers can benefit from these significant changes in oil prices. Financially speaking, it is to the benefit of investors to cut back on their investments in risky assets like energy assets. Because the crude oil contract is not a true investment from the start and does not provide guarantees at the time of settlement and receipt, Ref. [

3] has demonstrated that it is a dangerous investment. As a result, inexperienced traders should not view these contracts as investment instruments and instead should follow the same procedures as for other investment instruments like bonds and assets. By doing this, investors and energy regulators can control the impact of regulatory procedures on the oil market and develop effective hedging strategies.

Furthermore, Ref. [

4] emphasizes that mitigating the risk of significant variations in oil prices requires a thorough understanding of oil prices and their determinants. To better understand the various elements that affect crude oil prices and their variations, several previous studies (such as [

3,

5,

6,

7]) have been published. The first set of studies concentrated on supply issues, such as world crude oil production, global crude oil exports, surplus OPEC capacity for producing crude oil, and utilization of US refineries. The second set of research looks at demand elements, such as global economic expansion, the ISM manufacturing index, and global crude oil imports. Financial factors like equity markets, exchange rates, and US interest rates are included in the third category of studies. The fourth set of research considers aspects related to commodities, including the S&P GSCI non-energy index, gas prices, and the CRB industrial commodities index. The COVID-19 pandemic and political issues (political instability) are the topics of the fifth group of studies. Recently, a growing body of literature has concentrated on the effect of uncertainty on crude oil prices (e.g., [

3,

7,

8,

9,

10]). They consider factors that quantify risk brought on by geopolitical circumstances (such as geopolitical risk and terrorist incidents), financial and economic circumstances (such as the implied volatility risk index (VIX) and economic policy uncertainty (EPU)), and media-related conditions (such as equity market volatility (EMV) trackers). Market players and politicians have also emphasized that this uncertainty becomes more dangerous when combined with a financial crisis such as what occurred in December 2008, a pandemic such as COVID-19, and geopolitical tensions such as the war in Ukraine in 2021. These factors also play a role in the crude oil price’s more intricate coupling with the underlying uncertainty indicators. This is reinforced by statistics from the Bank’s 2022 study, which shows that between April 2020 and April 2022, oil prices rose by 350% in nominal terms. This price surge, which corresponds with the COVID-19 epidemic and the geopolitical conflict between Russia and Ukraine in 2021–2022, is the largest in a corresponding two-year period since the 1970s.

In this study, we aim to find out how crude oil returns and uncertainty variables interact. For this, we employ a set of variables consisting mainly of the Brent oil return (BRENT), the Geopolitical Risk Index (RGPR), the Economic Policy Uncertainty (REPU), the CBOE Crude Oil Volatility Index (ROVX), the CBOE Volatility Index (RVIX), and the Bloomberg Energy Subindex Index (RBEI), using a time–frequency approach for a period spanning from May 2014 to October 2022. Overall, the study’s motivation is expressed by two key elements: First, understanding that existing and ongoing uncertainty in the financial, commodity, and energy markets, as well as uncertainty related to economic policy and geopolitical conflicts, has an impact on crude oil return and it can spread to the oil market or that it does not exceed the internal limits of the source. Second, our study differs from previous studies in that it provides a comprehensive view of the most numerous sources of uncertainty and their impact on crude oil returns. We use an innovative approach that deepens our understanding of the impact of uncertainty on crude oil returns at different frequencies, enabling a more nuanced and comprehensive analysis. This makes a substantial contribution to the understanding of the spillover effects between crude oil returns and uncertainty. It significantly advances knowledge of the complexities and interdependencies within the oil market, providing valuable guidance to beneficiaries such as oil market investors to consider the impact of various sources of uncertainty when diversifying their investment portfolios.

In addition, the reason for the necessity of studying these variables that represent uncertainty is mainly because the stability of the oil market in terms of demand, supply, and prices is considered the main concern of all those involved in the oil market, whether decision-makers, investors, producers, exporters, and suppliers. Prices are the first thing to focus on, given that the fluctuations in oil prices in global markets reflect the existing interaction between the geopolitical and economic forces that are plaguing the world today and the rising concerns about the situation of demand and supply, starting from wars and ending with high-interest rates and pandemic viruses, such as Corona. These fluctuations are not immune to the effects of many other factors that can cause this, such as financial markets, countries’ economic policies, and other commodity markets, based on the contagion effect theory. The continued price turmoil in one of the most important commodity markets in the world necessarily means unstable oil returns for investors who are always looking for stability in their portfolios, which has raised cases of uncertainty. From this economic and financial standpoint, the increasing uncertainty requires an in-depth study of its most important sources and the extent of its impact on crude oil returns.

On the econometrical side, we will be applying the DCC-GARCH (1.1) approach to examine the dynamic conditional correlation in both the variance and mean between the return on crude oil and the different uncertainty indices at the time domain. As proven by [

11,

12,

13], the DCC-GARCH (1.1) model has many advantages: The first feature of this model is its robustness to detect potential changes in conditional correlations caused by news and uncertainty over time. Furthermore, the dynamic conditional correlations metric is also appropriate for examining potential contagion effects brought on by the spread of uncertainty between markets. The second feature of the DCC model is that it explicitly accounts for heteroscedasticity by estimating correlation coefficients of standardized errors. The Granger causality test in the frequency domain established by [

14] is used in frequency analysis. This approach has an additional two benefits above the first. First, by taking into account spillover dynamics across several frequencies, Granger causality allows the investigation of causation across variables in a dynamic manner. Second, Refs. [

15,

16,

17] propose that causality may be deduced at any point along the frequency distribution. As a result, the causality between crude oil returns and various uncertainty indices at different frequencies, including the short, medium, and long-term, is broken down in our analysis. As well, Ref. [

18] indicated that the frequency domain assessment provides several advantages, including the ability to (i) eliminate changes associated with seasonal fluctuations already existing in financial series and (ii) take into account non-linearities and causality cycles, or causal relationships in high or low frequencies.

The contributions of this research in contrast to previous studies can be summarized as follows. To begin with, as far as we are aware, no research has examined the influence of the Geopolitical Risk Index, the Economic Policy Uncertainty, the OVX index, and the VIX index on crude oil returns in the time–frequency domain using these variables as proxy variables for uncertainty. We present the first research to investigate the dynamic spillover between return on crude oil and uncertainty at all frequency distribution points. As demonstrated by [

19], given that market players choose to trade over various time horizons, evaluating connections over the frequency spectrum is essential for the investigation of volatility spillovers. Second, unlike previous literature that only considers the unidirectional effect of economic policy uncertainty on the oil market ([

20,

21,

22]), the current study is the first to explore the mutual effect between various uncertainty sources caused by the economic policy, the financial market, the commodity market, and geopolitical events on crude oil market over time and frequency levels. Third, we add to the body of knowledge on this subject by suggesting the Bloomberg Energy Subindex Index as a brand-new variable that can have an impact on crude oil returns over a time spectrum. This factor, which has never been considered before, allows us to study the transmission of uncertainty between the commodity market and the oil market. Fourth, the use of a time–frequency method in our analysis, which enables us to consider the complexity of the oil market and uncertainty conditions, is another way in which it varies from previous energy research. Many authors, including [

23], stressed that the nonlinearities, asymmetries, and regime shifts in oil prices are the cause of this complexity. The arrival of information, uncertainty, and the behavior of energy market participants, according to [

2,

3], are key factors in the complexity of oil prices.

To attain these objectives, we shall rely on numerous fundamental steps, the most significant of which are as follows: First, we undertake a revision and detailed assessment of the literature background, after which we identify limits and gaps in our study. Second, data will be gathered, processed, and analyzed with statistical and stationarity tests. Third, we will look at modeling with the DCC-GARCH (1.1) model and the Granger causality test in the frequency domain models. Fourth, we will evaluate, debate, and compare these models to existing research. Finally, before offering financial and economic suggestions, we analyze the robustness results.

Our investigation indicates three significant outcomes based on daily data from May 2014 to October 2022. First, strong dynamic conditional connections between oil returns and commodities uncertainty, oil returns and stock market uncertainty, and oil returns and energy uncertainty are discovered across time. Second, the empirical evidence shows a strong spillover impact from the commodities, energy, and financial markets to the oil market when using spectral analysis. Third, we find that uncertainty in the financial, commodity, and energy markets, as well as uncertainty related to economic policy and geopolitical conflicts, has an impact on crude oil return and it can spread to the oil market by exceeding the internal limits of the source. Our findings have major implications for increasing investor confidence in risky energy assets. Our results also appear robust when using WTI prices to measure oil returns.

The remaining portion of this work is organized as follows.

Section 2 is a review of the literature. The data analysis and methodological framework are described in

Section 3.

Section 4 depicts major findings. The robustness analysis is reported in

Section 5.

Section 6 is an overview of the key results and policy implications.

2. Literature Review

In recent years, there have been numerous financial crises that have been characterized by frequent and significant changes in the price of crude oil. Since then, academics, researchers, and decision-makers have paid particular attention to the evaluation of oil prices and the study of factors that can impact the oil market ([

2,

3,

24,

25,

26]). First, a lot of scholars have concentrated on the uncertainty of economic policy as a key factor in determining crude oil returns. Ref. [

25] investigated the influence of uncertainty in US economic policy on West Texas Intermediate returns over time and frequency. The authors demonstrated the existence of a negative dynamic conditional association between US EPU indices and WTI returns using a DCC-GARCH model. Additionally, they led to suggestions that all EPU indexes can have a considerable short- and long-term impact on West Texas Intermediate returns (1–6 months and 6–12 months). Conversely, long-term returns on the West Texas Intermediate can be considerably impacted by uncertainty in monetary policy, regulatory policy, and national security policy. Like this, Ref. [

21] concentrated on economic policies, crude oil prices, and their short- and long-term implications on China’s commodity sectors. To investigate any potential dynamic correlations between the various variables, they choose to use the vector autoregression network approach of sliding-window wavelets. Their findings imply that the association between EPU, WTI, and commodities markets gets stronger as the time scale gets longer. They discovered that the WTI crude oil index and EPU have an impact on commodities markets. Otherwise, Ref. [

9] established a comparative study between various economic policy uncertainty indices in terms of the propensity for forecasting crude oil return series. Using the EPU of America, China, Canada, Mexico, Russia, and Europe, the authors showed that in the short term, crude oil return volatility is predictable by the volatility of the Chinese EPU. Compared to the other EPU indexes, the American EPU appears to have a higher long-term prediction ability. Furthermore, Ref. [

27] evaluated the impact of varying global oil prices on economic policy uncertainty and vice versa with a focus on the BRICS countries. They also looked at the relationship between changing global oil prices and changing economic policy uncertainty. They demonstrated how the long-term impact of China and India’s EPU on the global price of oil was detrimental. Only the EPUs of China and Brazil demonstrated negative effects in the near term. Additionally, Russia’s EPU only showed a significant detrimental impact under low fluctuation conditions.

Second, two additional uncertainty indices have been the focus of several recent research, including [

28,

29,

30,

31]. We are discussing the OVX and VIX indices. The COVID-19 health problem piqued the interest of [

28]. Their research focuses on the predictive abilities of seven uncertainty indicators (EMU, EMV, EPU, FSI, OVX, SKEW, and VIX) for the volatility of crude oil futures. The authors primarily employed two techniques to address this issue: rubber band nets, the absolute least indent, and the selection (lasso) operator. The findings demonstrate that due to data overlap, the simultaneous adoption of numerous uncertainty metrics has little impact on enhancing volatility estimates. However, OVX, EMV, and VIX have the most impact on oil volatility, whereas EPU and SKEW have the least impact. Recently, Ref. [

31] investigated whether investor sentiment has a better ability to predict realized volatility of WTI and BRENT oil prices spot than the VIX, the GEPU, and USEPU uncertainty indices. Additionally, the sample’s findings indicate that each of the five energy assets is strongly impacted favorably by the VIX. The out-of-sample data, however, show that investor sentiment, followed by the VIX, produces the best predictions for the actual volatility of crude oil. More recently, Ref. [

3] used eXtreme Gradient Boosting modeling to examine the VIX’s ability to predict changes in the price of crude oil from May 2007 to August 2021. The VIX index had a considerable impact on crude oil prices, according to the authors. Ref. [

32] investigated OVX’s potential for predicting the volatility of oil futures prices. To test how effectively the heterogeneous autoregressive model of realized volatility might predict those decompositions, they split the OVX into major and small components. According to the findings, weekly and daily RV has a significant effect on future oil volatility. In other words, the OVX makes the price of crude oil futures more volatile. Additionally, Ref. [

30] investigated how OVX and the spot variance of WTI and Brent exchanged information. The empirical findings from an entropy-based methodology show that an increase in information flow between OVX has an impact on the variance of Brent return. The findings also show a decline in information flow with WTI recovery. Recently, Ref. [

3] has shown that the information content of the LOVX index outperforms that of the other uncertainty indices in predicting crude oil prices using eXtreme Gradient Boosting modeling for the period May 2007–August 2021.

Third, academics have investigated another aspect of the work. Specifically, the correlation between crude oil indicators and geopolitical risk GPR is of importance in this domain. On this topic, Ref. [

33] investigated the geopolitical risk’s potential to predict the volatility of the oil market. The authors also demonstrated the GPR’s potent capacity to forecast long-term oil price volatility, particularly during recessionary periods, using a Markov-switching model with basic and out-of-simple estimation. Like this, both the out-of-simple and in-of-simple estimates show that the GPR has information that can be used to forecast the volatility of the oil market and that a high GPR can result in significant volatility in the oil market. Geopolitical risk, according to [

34], is a significant factor influencing the price of oil and the volatility of the stock market. The dynamic conditional correlation model was used by [

34] because of the changing nature of the size of the geopolitical risk effect and oil stock return connection. The results of this model show that both short-term and long-term volatility in the prices of stocks and oil persist. Geopolitical risk is found to have a positive association with oil returns and a negative correlation with stock returns, according to the results of the DCC model.

In conclusion, within the vast prior literature, there is a notable gap regarding the comprehensive understanding of the impact of sources of uncertainty on crude oil returns. While various studies have explored specific aspects or isolated relationships, there is a need for comprehensive research that integrates the mutual interplay between different uncertainty sources and crude oil returns. This comprehensive perspective can unveil subtle interconnections and contribute to a more comprehensive understanding of how multifaceted uncertainties impact the oil market across different periods and frequencies, allowing for a more precise understanding and potentially more effective predictive models in this area. In addition, the literature review presents studies that use traditional statistical and econometric methods to understand oil market dynamics concerning uncertainty. To expand on the existing findings, we examine a significant methodological advance in analyzing the relationship between crude oil returns and uncertainty using a time–frequency domain approach.

5. Robustness Analysis

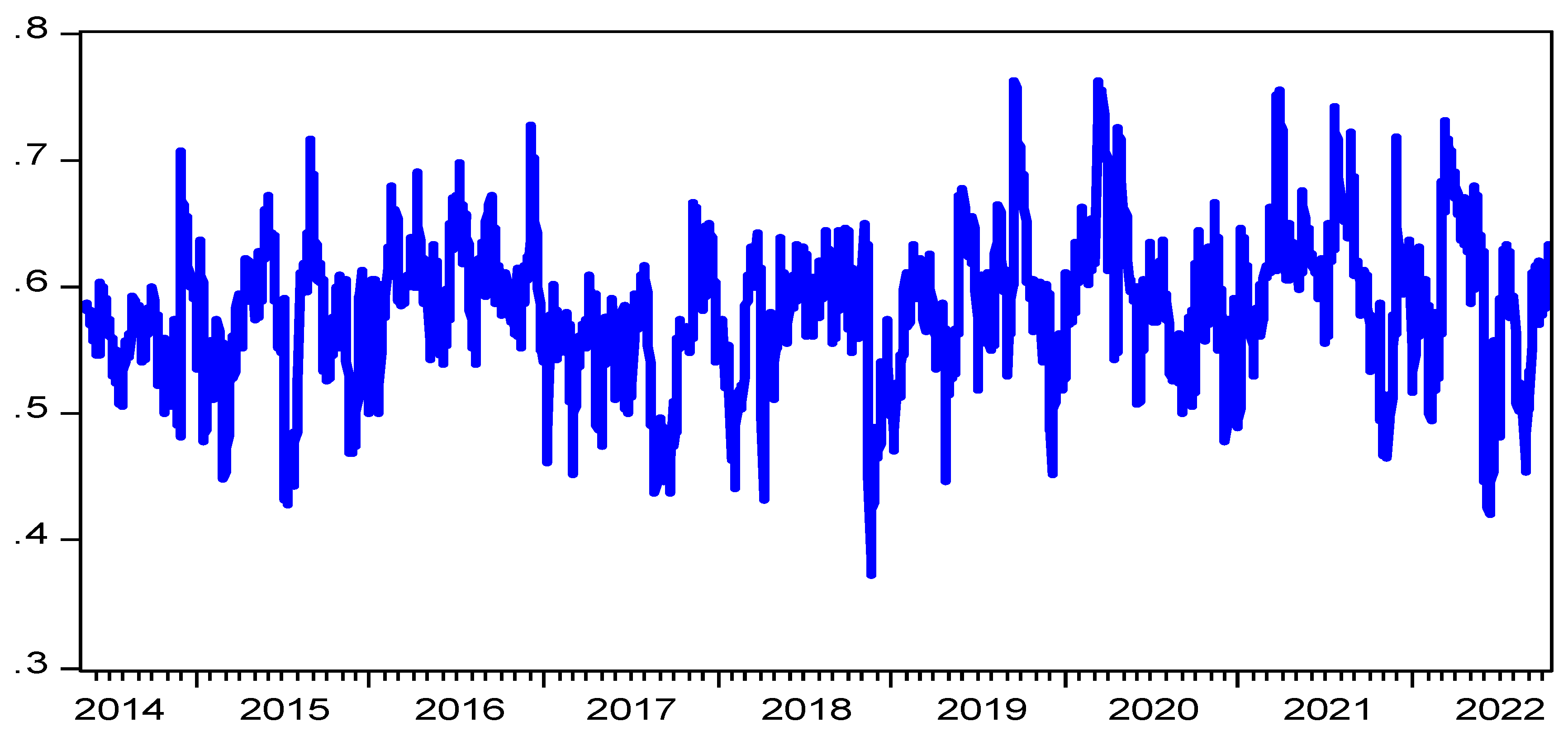

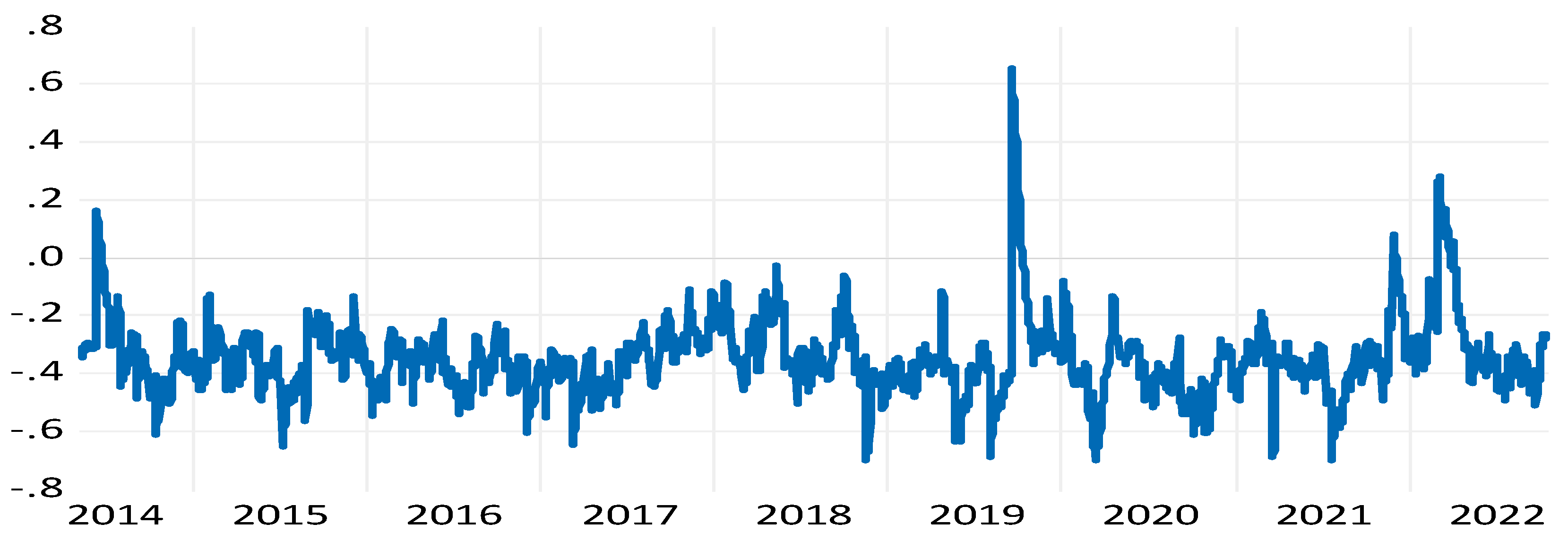

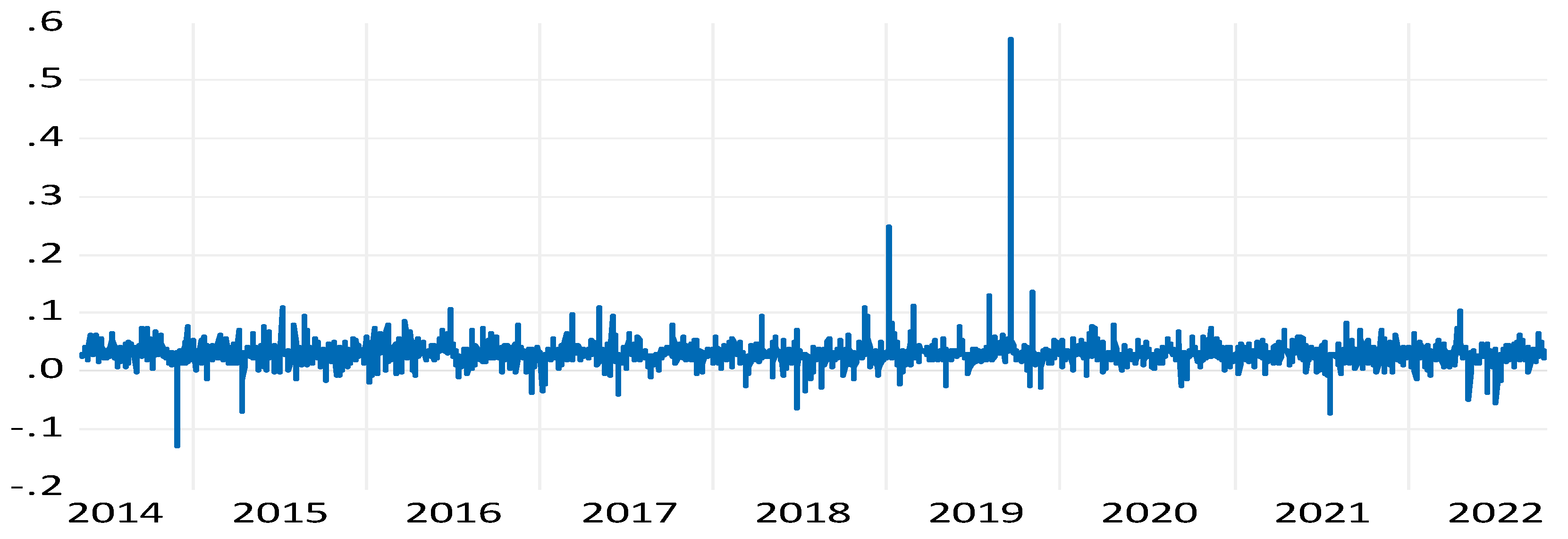

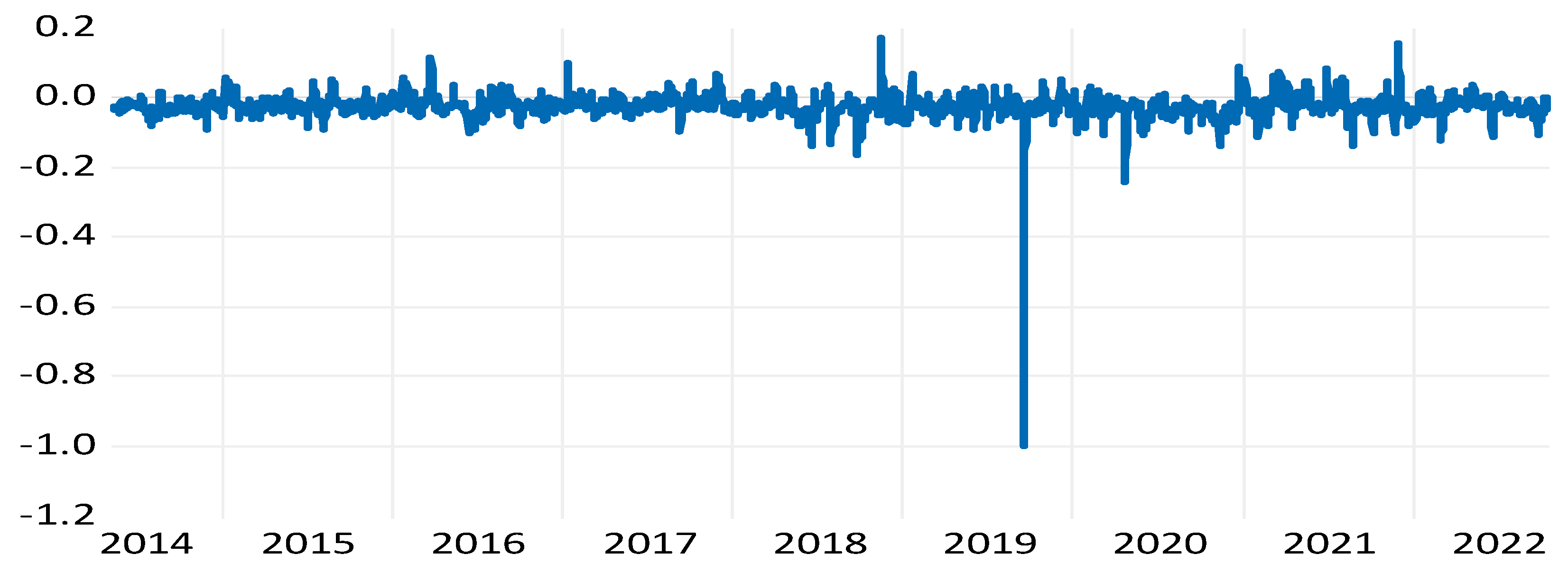

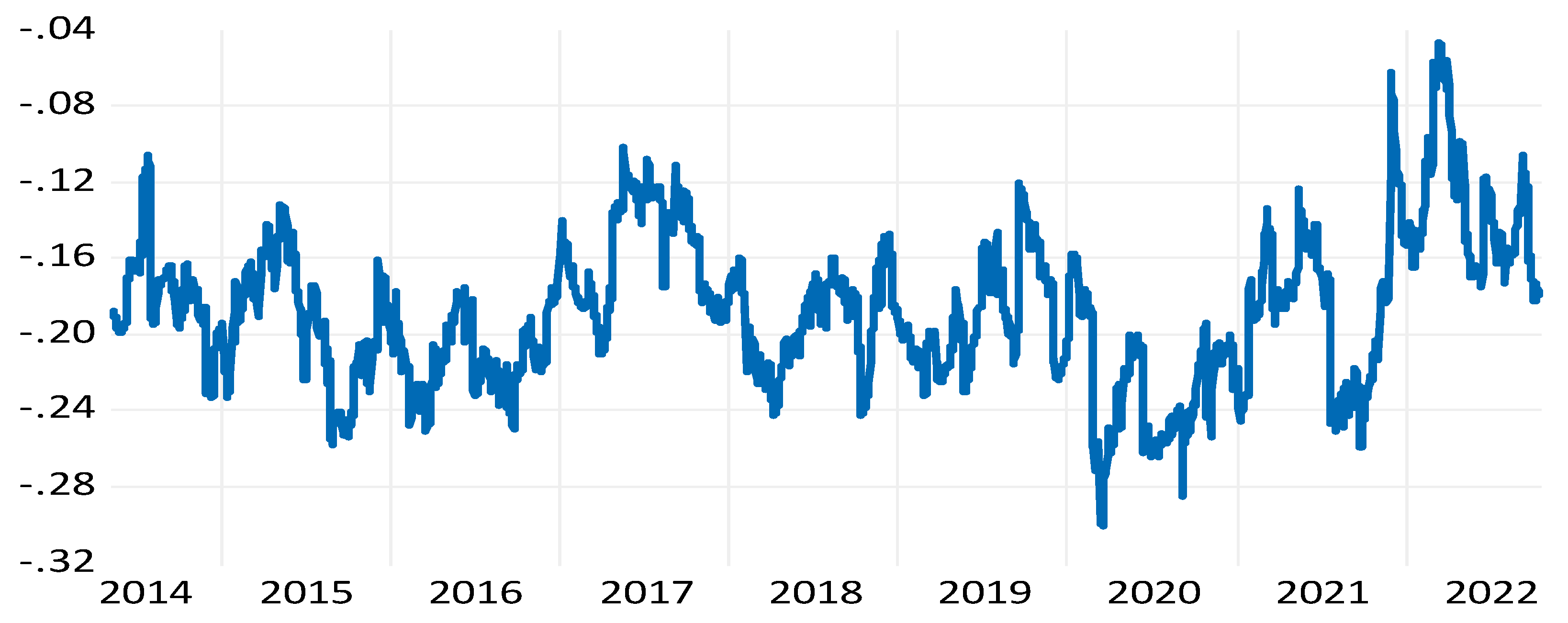

This section is allocated to assess the robustness of our main results. We apply the DCC-GARCH (1.1) model and the Granger causality test in the frequency domain to explain the WTI crude return by using the uncertainty factors. First, the results of DCC-GARCH (1.1) model estimations are plotted in

Figure 11,

Figure 12,

Figure 13,

Figure 14 and

Figure 15. The results are similar to those presented in the BRENT example. More specifically, the dynamic connectedness for the WTI oil return-RWTI peer (

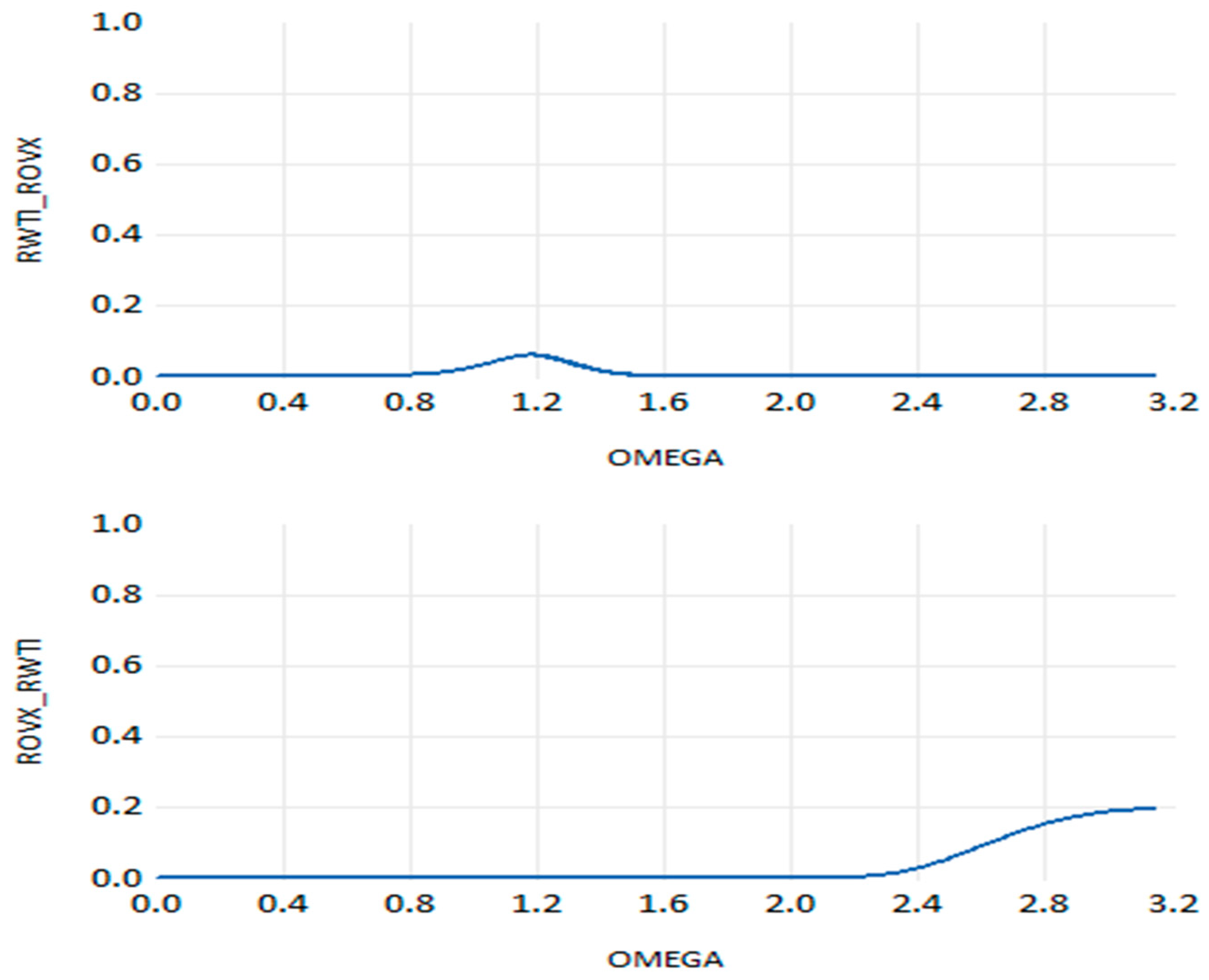

Figure 1) is positive, demonstrating a positive link between the oil market and the commodities uncertainty index. The WTI oil return-ROVX peer graph (

Figure 2), On the other hand, demonstrates that the ROVX shock has a significant, negative influence on the WTI oil return. This shows that crude oil risk innovations negatively impact the oil market and vice versa.

Figure 3 and

Figure 4 show distinct results. We find that the dynamic conditional correlation between REPU and RGPR shocks and the WTI return is inconsequential since the DCC values are close to zero.

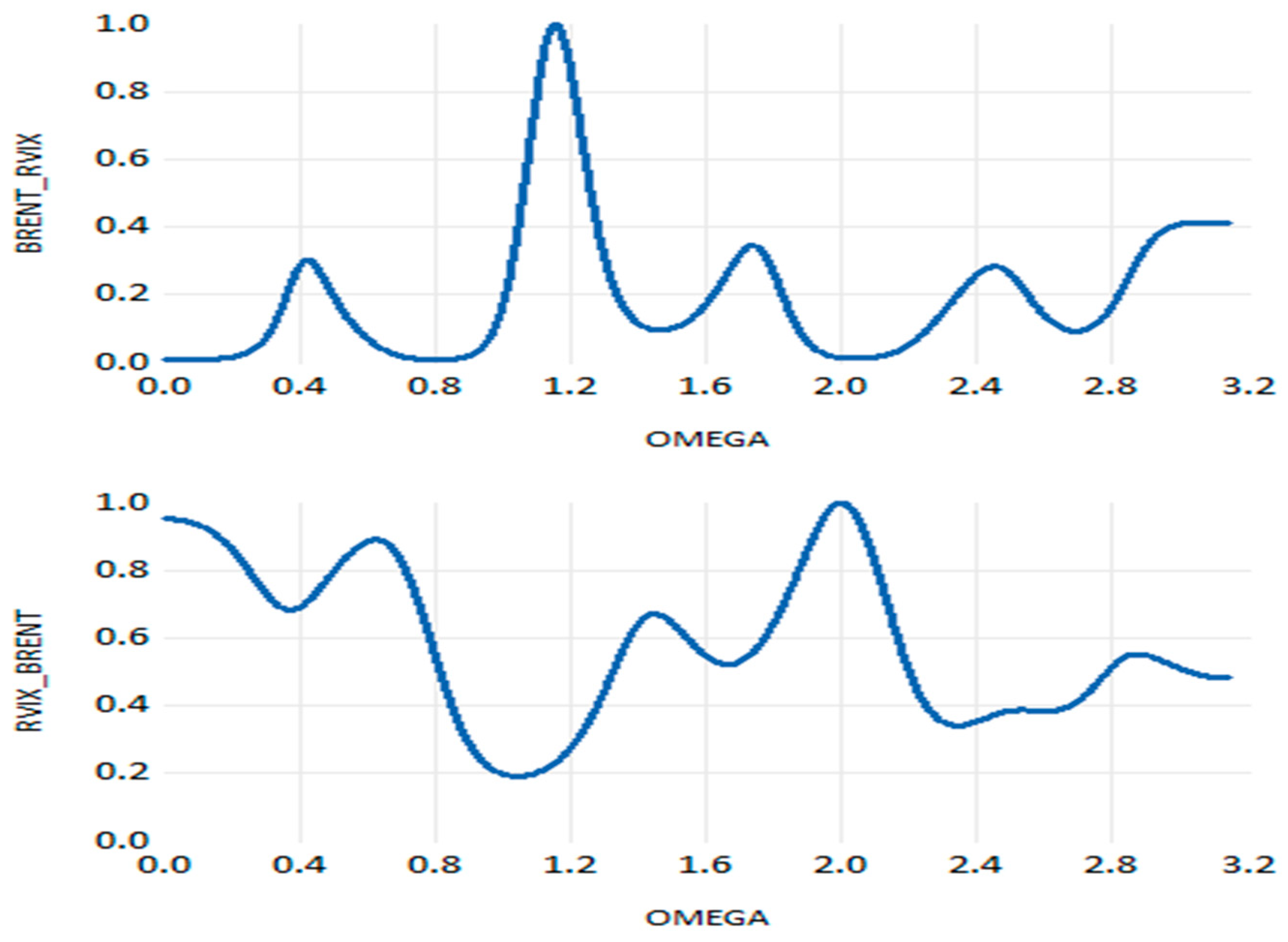

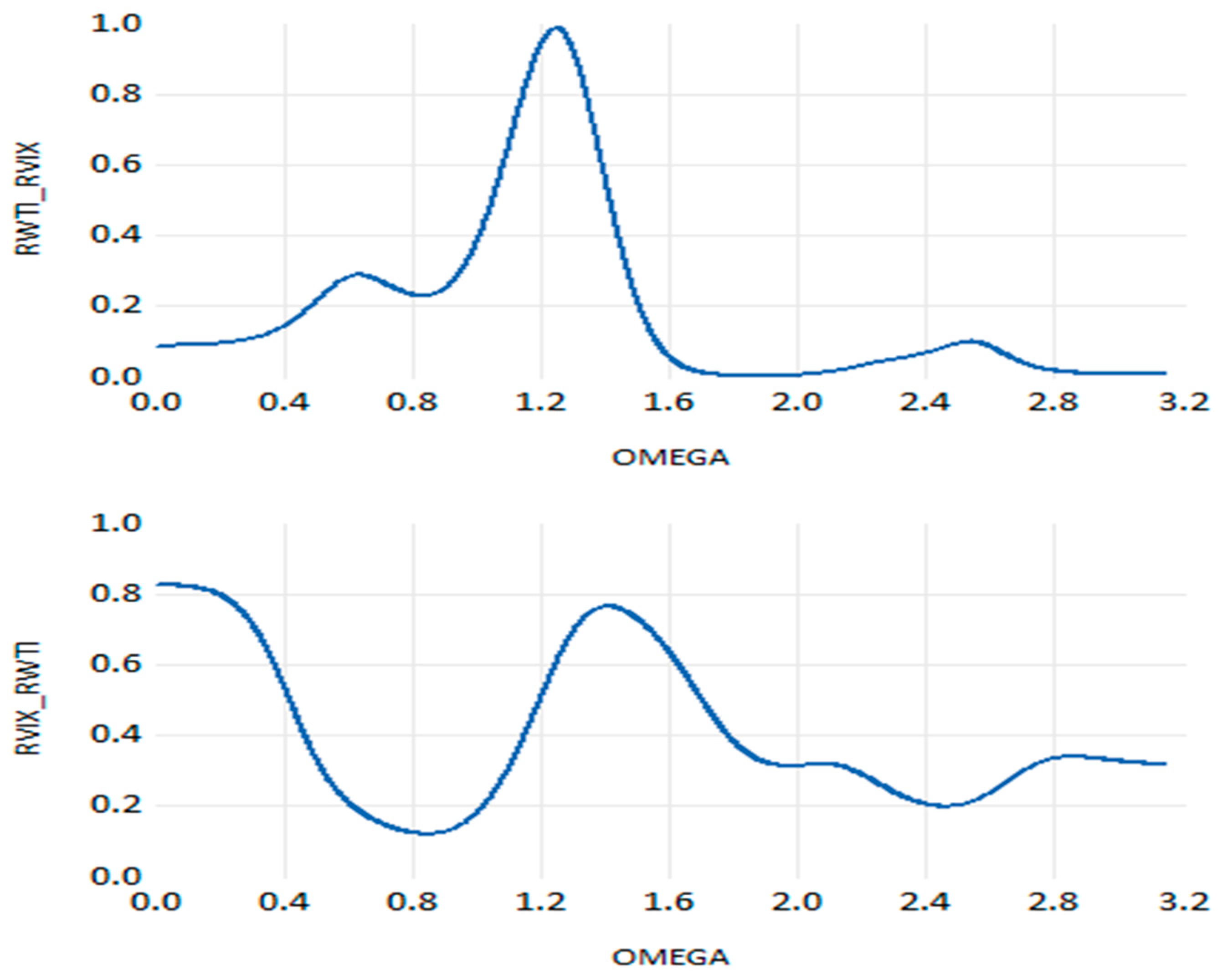

We find that the shock to the RVIX index has a strong negative relationship with the WTI return (

Figure 15). This demonstrates that crude oil risk innovations negatively impact the oil market and vice versa.

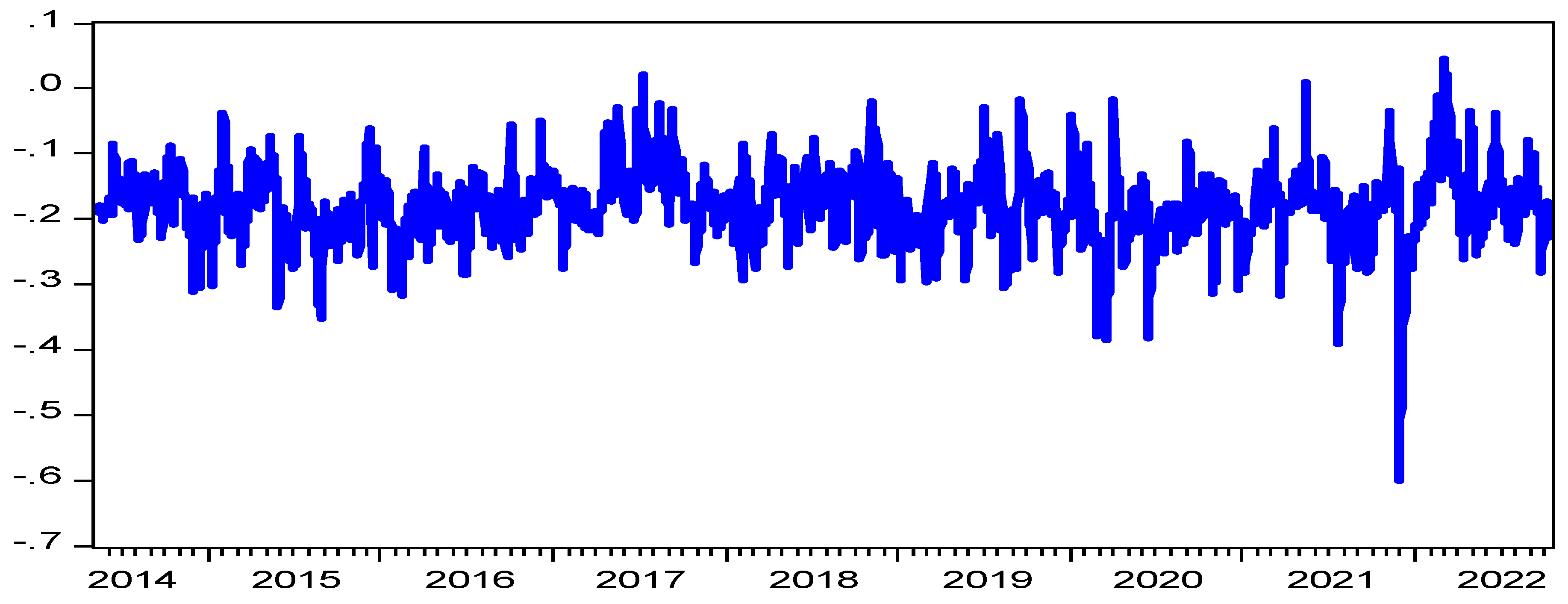

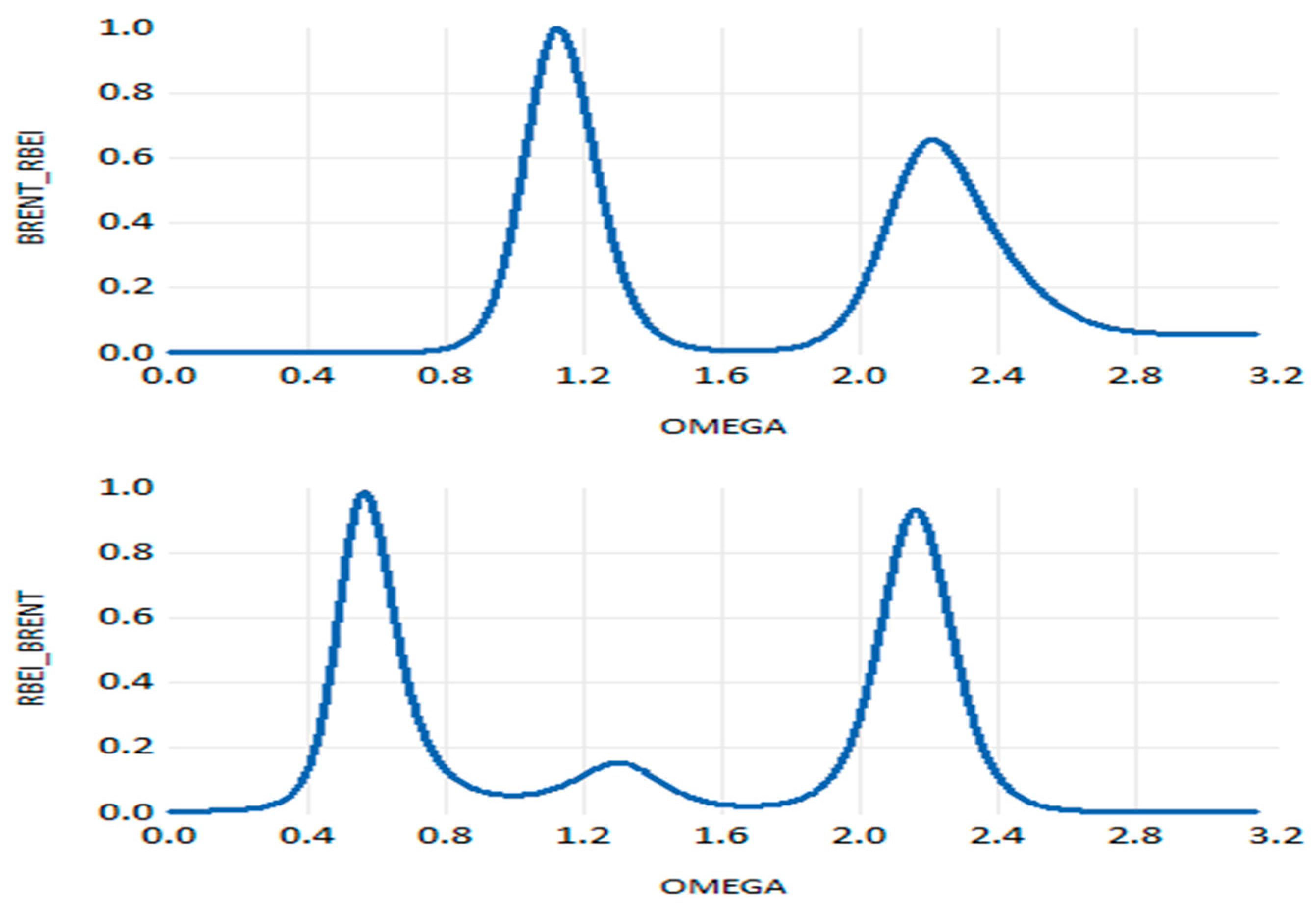

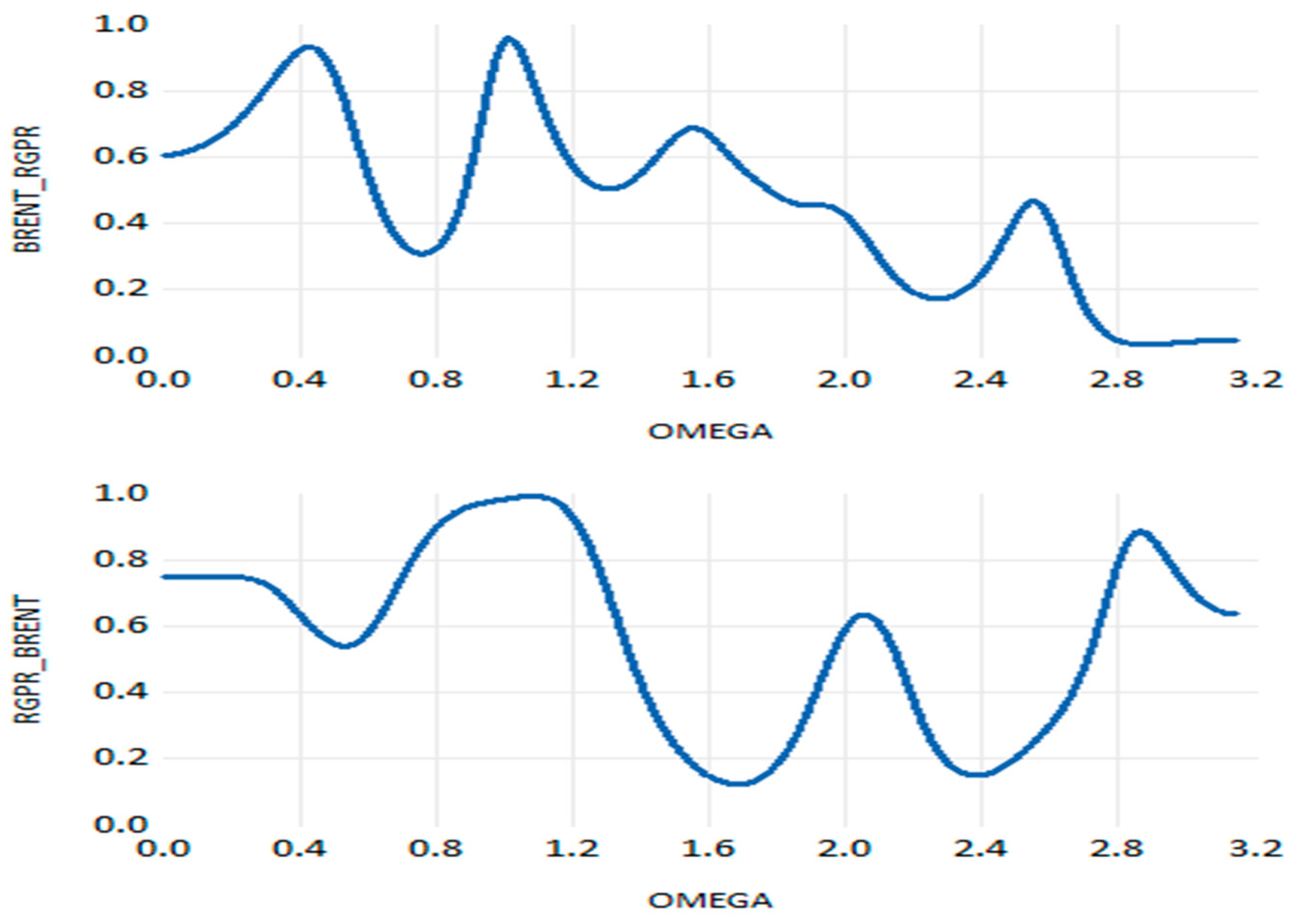

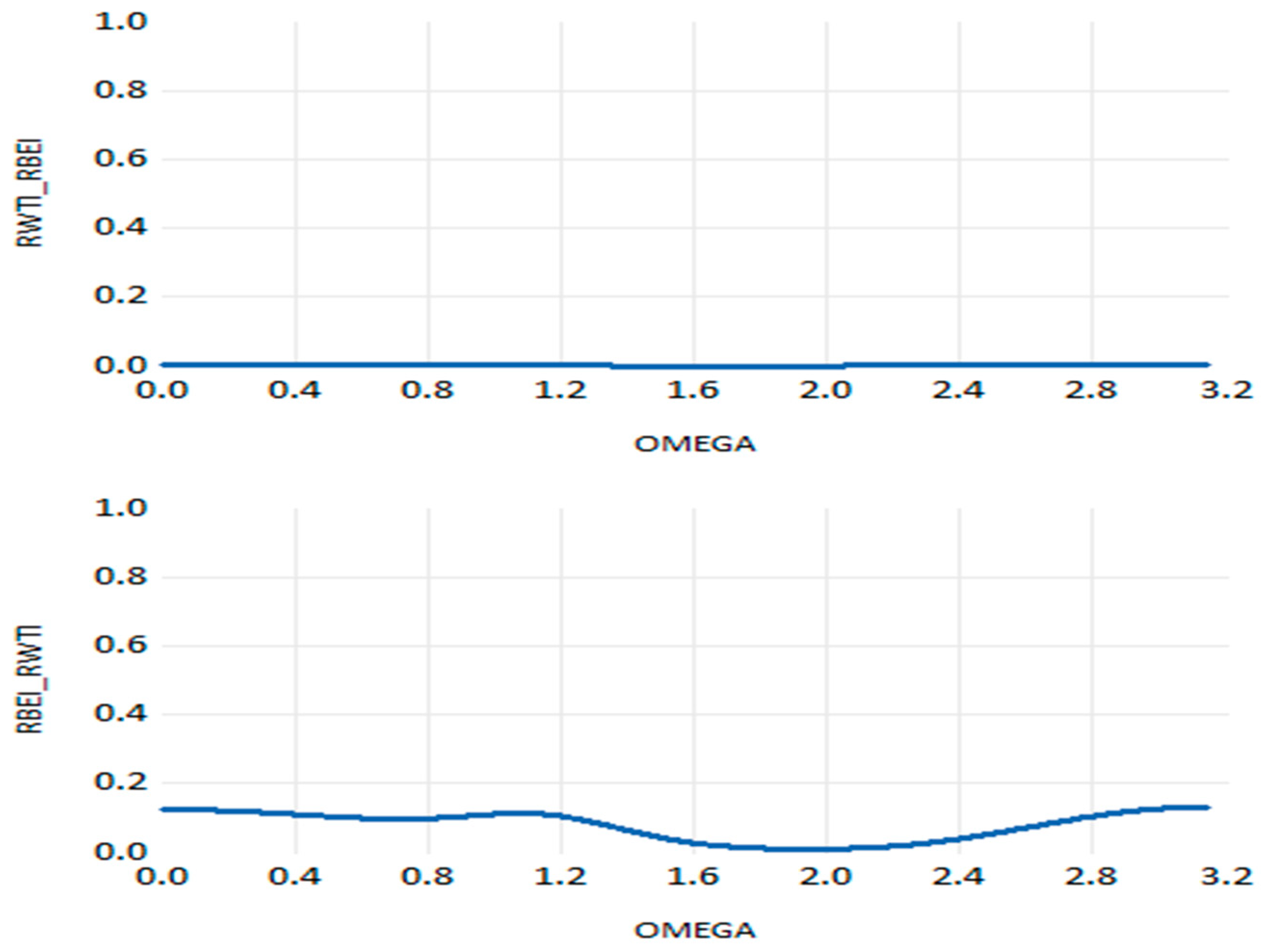

Now we consider the Granger causality test in the frequency domain to investigate the direction of the causal relationship between the WTI return on crude oil and the various metrics of uncertainty. This is completed after analyzing the dynamic conditional correlation between the variables using the DCC-GARCH technique. For the link between WTI oil return and RBEI (

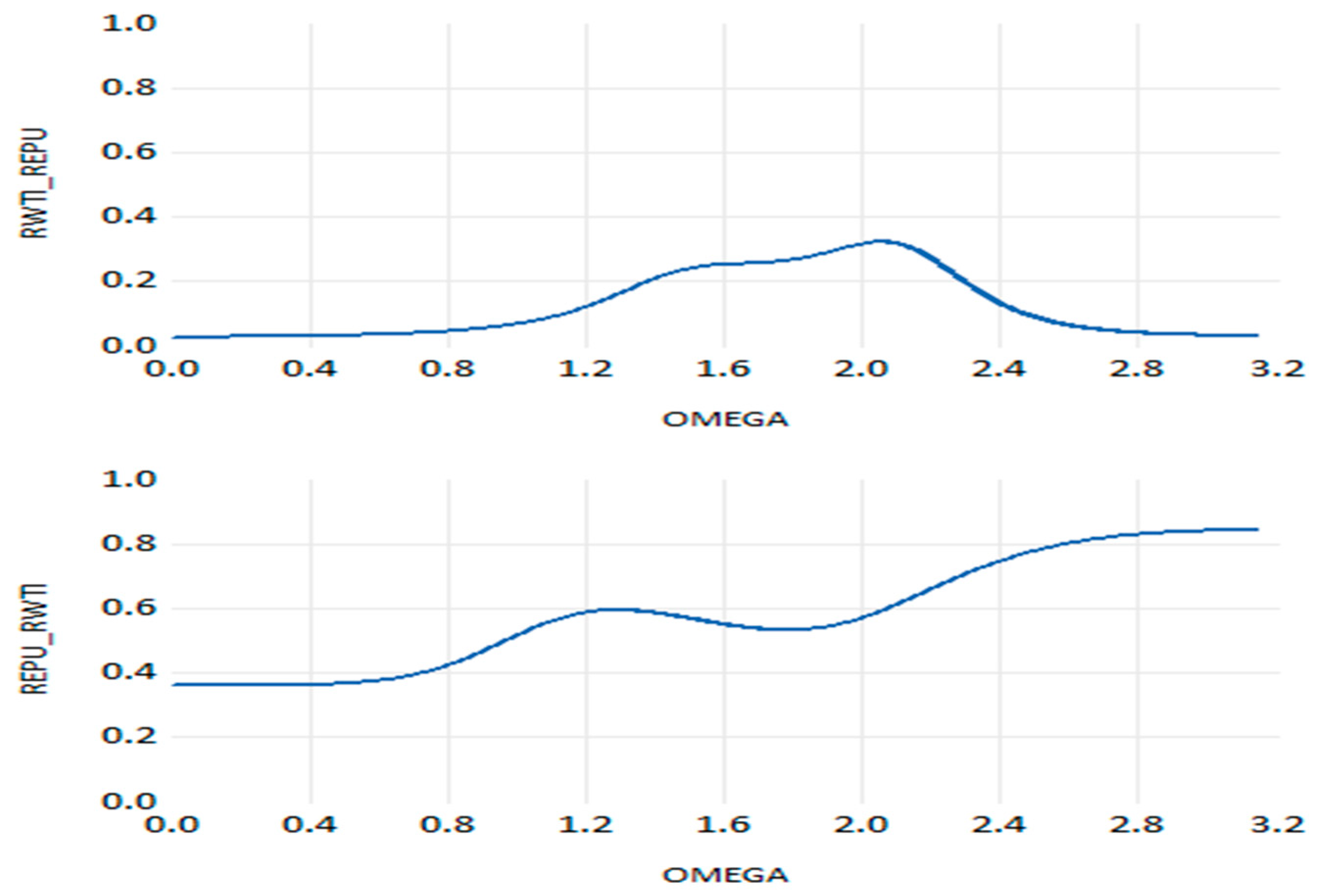

Figure 16), we find a significant spillover effect from uncertainty in the commodity market to the crude oil market over all different frequencies (from ω = 0.00203 to ω = 3.14). This indicates a permanent dynamic spillover causality from short to long-term horizon running from uncertainty of the commodity market to the oil market. Thus, the significant effect of uncertainty in the commodity market on the oil market is more pronounced in the WTI case than in the BRENT case. Regarding the nexus between WTI oil return and EPU (

Figure 17), findings provide evidence of a significant effect from the EPU to WTI oil return over different frequencies (from ω = 0.00203 to ω = 1.13 and from ω = 2.46 to ω = 3.14). This means that the transmission of uncertainty caused by the economic policy has a short- and long-run effect on the WTI oil return. However, a non-significant effect was proven for the reverse direction. In addition to this,

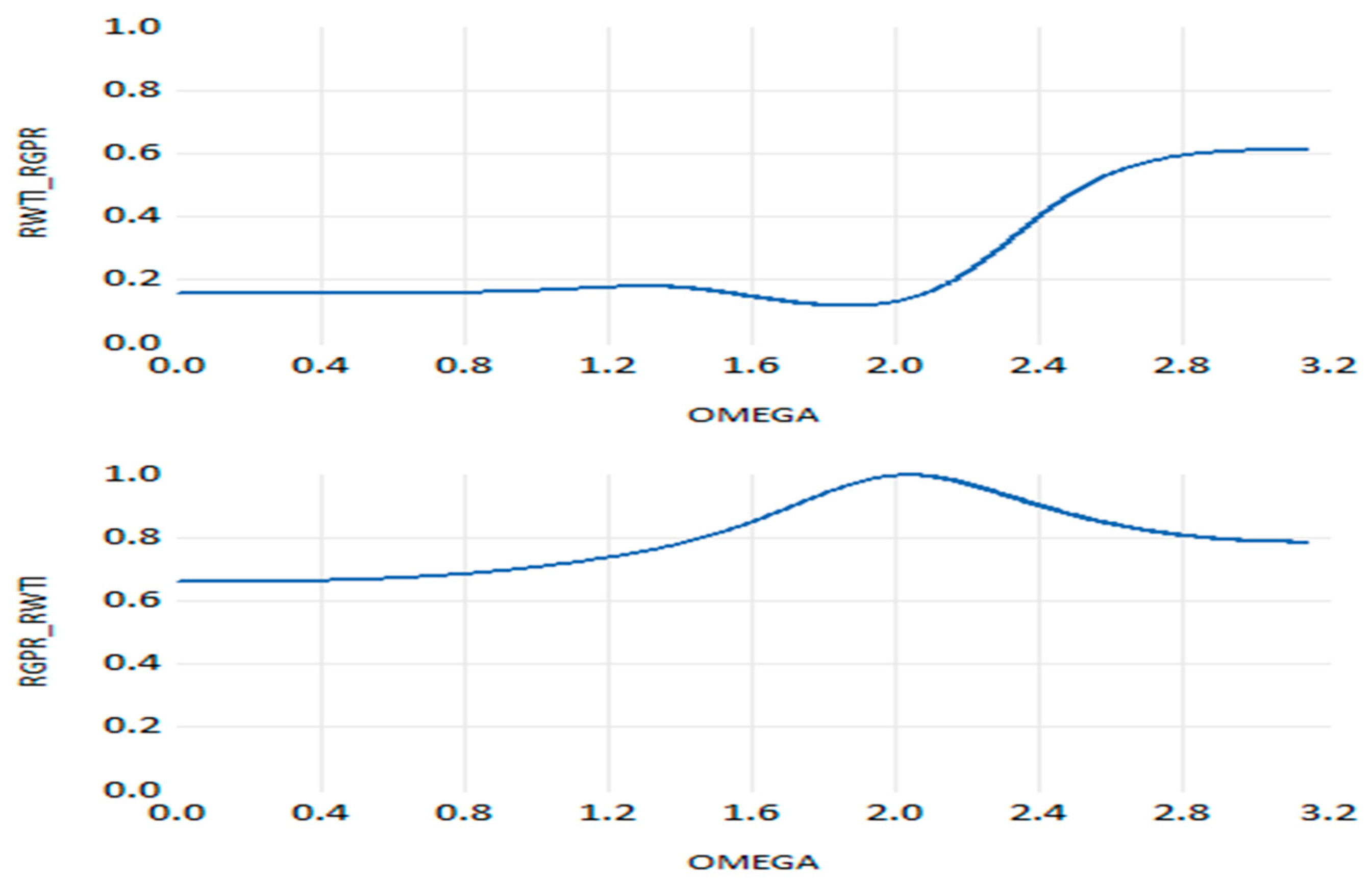

Figure 18 plots the interaction between WTI oil return and GPR. Non-significant causality between two variables in both directions has been detected. Concerning the nexus between WTI oil return and OVX,

Figure 19 provides evidence of a significant spillover effect from uncertainty in the energy market to WTI oil return over all different frequencies (from ω = 0.00203 to ω = 3.14). In the reverse direction, the causality is significant in both the long run and short run over the frequencies that range from ω = 0.00203 to ω = 2.62. Finally, for the relationship between WTI oil return and implied volatility (RVIX),

Figure 20 illustrates that there was considerable spectral causality from the RVIX to WTI oil return throughout a range of frequencies (ω) from 0.00203 to 0.24 and from 1.59 to 3.14. This suggests that dynamic spillover causation persists in the long run as well as in the short term from the financial market to the oil market.

6. Conclusions and Policy Recommendations

Given that they are so important in discussions of energy and economic issues, we concentrated in this work on the dynamic spillover effects between the crude oil market and uncertainty. Considering this, we suggested the DCC-GARCH model and the Granger causality test in the frequency domain for daily data from 2014 to 2022. The findings of the DCC-GARCH estimations demonstrated that the dynamic conditional correlations for BRENT oil-RBEI, BRENT oil-ROVX, and BRENT oil-RVIX are significant, which suggests that conditional correlations have significantly changed over time. These results support Celik’s outcomes (2012). These findings imply that a contagion effect may be responsible for the highest correlation between the oil market and other sources of uncertainty. The results also indicate that in contrast to sources with low volatility persistence, sources with high volatility persistence have more substantial interactions with the oil market. Furthermore, the findings indicate that there is no obvious long-term dynamic association between crude returns and risk innovations brought about by the US political economy and US geopolitical events. For the EPU, these results contradict the findings of [

25] that all EPU indexes can have a considerable short- and long-term impact on West Texas Intermediate returns when using a DCC-GARCH model. Regarding the geopolitical risk index, our findings are different from [

34], which show that geopolitical risk is found to have a positive association with oil returns and a negative correlation with stock returns, according to the results of the DCC model. Overall, the significance of most of the many relationships was observed using the DCC-GARCH test. Identifying the direction of the causal relationship between variables involves applying the Granger causality test in the frequency domain.

The findings of the spectral causality test supported the existence of persistent causality that connects the uncertainty of commodity markets to the oil markets and vice versa. We also stressed that Brent oil returns will always be driven by crude oil uncertainty. In agreement with [

46], which showed that higher uncertainty indices have a positive impact on crude oil returns only at specific periods, we also demonstrate how uncertainty from the US financial market spills over to the oil market and helps to explain crude oil returns. Empirically, we discover that the implied volatility risk’s uncertainty has a significant impact on the returns of oil in the short run as well as in the long run. In addition, we identify a long-run effect of the US political economy on the crude oil return. However, a short-run effect of geopolitical risk events on the crude oil return is detected. Consequently, the following intriguing findings were made: First, the oil market is significantly impacted in the short, medium, and long terms by shocks in the commodity, energy, and financial markets. This suggests that these shocks have a lasting effect on oil return. In contrast to US geopolitical events and US circumstances for economic policy, we see more frequent spillovers of uncertainty from US commodities, energy, and financial markets to international oil markets. This suggests that market uncertainty-related shocks are more likely to affect the oil market than shocks caused by other sources.

Our findings have several policy implications. First, it is critical that investors and regulators correctly pinpoint the variables influencing oil returns. According to our research, uncertainty in the US commodity, energy, and financial markets is a significant factor in explaining crude oil returns. Because of this, it is crucial that energy policymakers continually enhance their control and attention to these diverse sources of uncertainty through mitigation and hedging strategies. As a result, experienced traders like energy ETFs are becoming more confident. Due to the resulting rise in risk perception, optimal asset allocation and increased investment in energy-risky assets like oil futures are generated. But if decision-makers do not keep an eye on and rein in the uncertainty that is spreading from the financial and commodity markets, it will make novice investors more anxious about the future of their wealth and portfolios. Therefore, rather than investing in oil futures, these investors should put their money into real assets like the stock of energy companies. For example, on 20 April 2020, oil prices, specifically American crude oil, fell below zero for the first time in history, reaching a negative price estimated at

$37.63 per barrel, which surprised many investors and the general public alike and increased investor uncertainty. In the oil industry, one of the causes of the crisis was that inexperienced traders held the May 2020 contracts until the end of the last session before the settlement date, failing to get rid of them and sell them to oil refineries that refrained from buying due to the market’s double shock. In the end, they are compelled to accept the raw resources. However, because the vast majority of May contract holders were traders with no need for oil as a commodity, most of them rushed to get rid of the contract at any cost to avoid having to receive the oil themselves, and they were willing to pay money to whoever wanted to buy that contract from them. Many of these traders not only lost their money but may have borrowed to avoid the contract at any cost. This example demonstrates that investors must first understand that as speculators, they will be playing in a limited time frame and that by the time the settlement date arrives, they must have sold the contract unless they have a desire to receive oil, but they must pay attention. One contract calls for the delivery of 1000 barrels of crude oil, which must be stored somewhere. Furthermore, defensive equities are a good way for investors to balance and lower risk when uncertainties are higher. Second, the spread of persistent uncertainty from the energy, commodities, and financial markets to the oil market is a risky sign of volatility in the oil market, pushing investors to reconsider injecting liquidity into environmentally friendly energy companies. This study had some valuable findings, but it also had several flaws. First, this study focuses solely on the transmission of uncertainty between the oil market and other sources of uncertainty, neglecting the possibility of spillovers in the risk domain that go beyond volatility. Future studies should focus on tail risk spillovers. Exploring extreme risk spillovers within oil markets presents an intriguing and essential avenue for future research [

47,

48]. Understanding how extreme events propagate through these markets, causing sudden and profound impacts on interconnected sectors, economies, and global financial systems, is critical. Investigating the mechanisms and dynamics of extreme risk transmission from oil markets to other financial markets during periods of heightened volatility or geopolitical tensions can shed light on systemic vulnerabilities and contagion pathways. Furthermore, delving into the implications of such extreme spillovers on asset pricing, risk management strategies, and policy frameworks could offer invaluable insights for market participants, regulators, and policymakers seeking to enhance market resilience and mitigate the impact of extreme events in the future. Second, the research topic was not addressed from the aspect of forecasting. Utilizing artificial intelligence techniques like particle swarm optimization (PSO) to predict the return of crude oil can help enhance the trial findings of this study in the future.