Effect of Governmental Subsidies on Green Energy Supply Chains: A Perspective of Meteorological Disasters

Abstract

1. Introduction

2. Problem Description and Model Hypothesis

2.1. Symbol Description

2.2. Model Assumptions

- 1.

- Both suppliers and retailers are rational people, their information is completely symmetrical, and the information in the market is transparent. This paper studies the Stackelberg game between the retailer and supplier, in which only the retailer is the leader and the supplier is the follower.

- 2.

- Consideration of profit-oriented approach, usually , in order to facilitate calculations. With reference to the research of [13], we assume that , where .

- 3.

- 4.

- The market demand for green energy products is influenced by both the price and the greenness of the products. Therefore, consumers have a certain preference for green energy products, and they are more willing to buy green energy products with a high degree of green and low sale price [29,31]. When there is no meteorological disaster, the market demand function is , where is satisfied. Considering the background of meteorological disaster, the market demand function is , where is satisfied.

- 5.

- Within the scope of meteorological disasters, the government plays a pivotal role in incentivizing retailers to sell green energy products and foster energy conservation and emission reductions. To this end, the government provides subsidies to retailers based on the input costs associated with promoting these products. These promotion cost subsidies are specifically aimed at covering the expenses incurred by retailers in marketing and publicizing green energy products. This form of subsidy is not only instrumental in enhancing the willingness of retailers to sell green energy products but is also recognized as one of the most direct and effective strategies to encourage such behavior. The effectiveness and dynamics of this subsidy approach have been previously explored and documented in the research conducted by [13], providing valuable insights into its impact and utility.

- 6.

- In response to meteorological disasters, the government adopts a strategy of subsidizing retailers for selling green energy products, with the aim of promoting energy conservation and emission reductions. These subsidies are twofold: Firstly, promotion cost subsidies cover the expenses incurred by retailers in marketing and publicizing green energy products, thereby enhancing their motivation to sell such products. This subsidy strategy has been effectively analyzed by [13]. Secondly, the government provides direct subsidies to energy products based on their greenness, as detailed in the research by [20]. The amount of these subsidies usually correlates with the greenness of the products. To represent the subsidy coefficient per unit product based on greenness, refs. [21,22] introduced an approach which denotes the government’s subsidy expenditure per unit. This comprehensive subsidy approach, encompassing both promotional costs and direct subsidies based on product greenness, is designed to foster the sale of green energy products, especially in the challenging context of meteorological disasters.

3. Model Construction and Solution

3.1. Energy Supply Chain Game Model without Considering Meteorological Disasters

3.2. Energy Supply Chain Game Model Considering Meteorological Disasters

3.3. Energy Supply Chain Game Model in Which the Government Subsidizes the Promotion Cost of Retailers

3.4. Energy Supply Chain Game Model of Government Subsidies to Retailers Based on Product Greenness

4. Comparative Analysis of the Effect of Two Kinds of Subsidies

4.1. Comparability of Subsidy Effect

4.2. Comparative Analysis

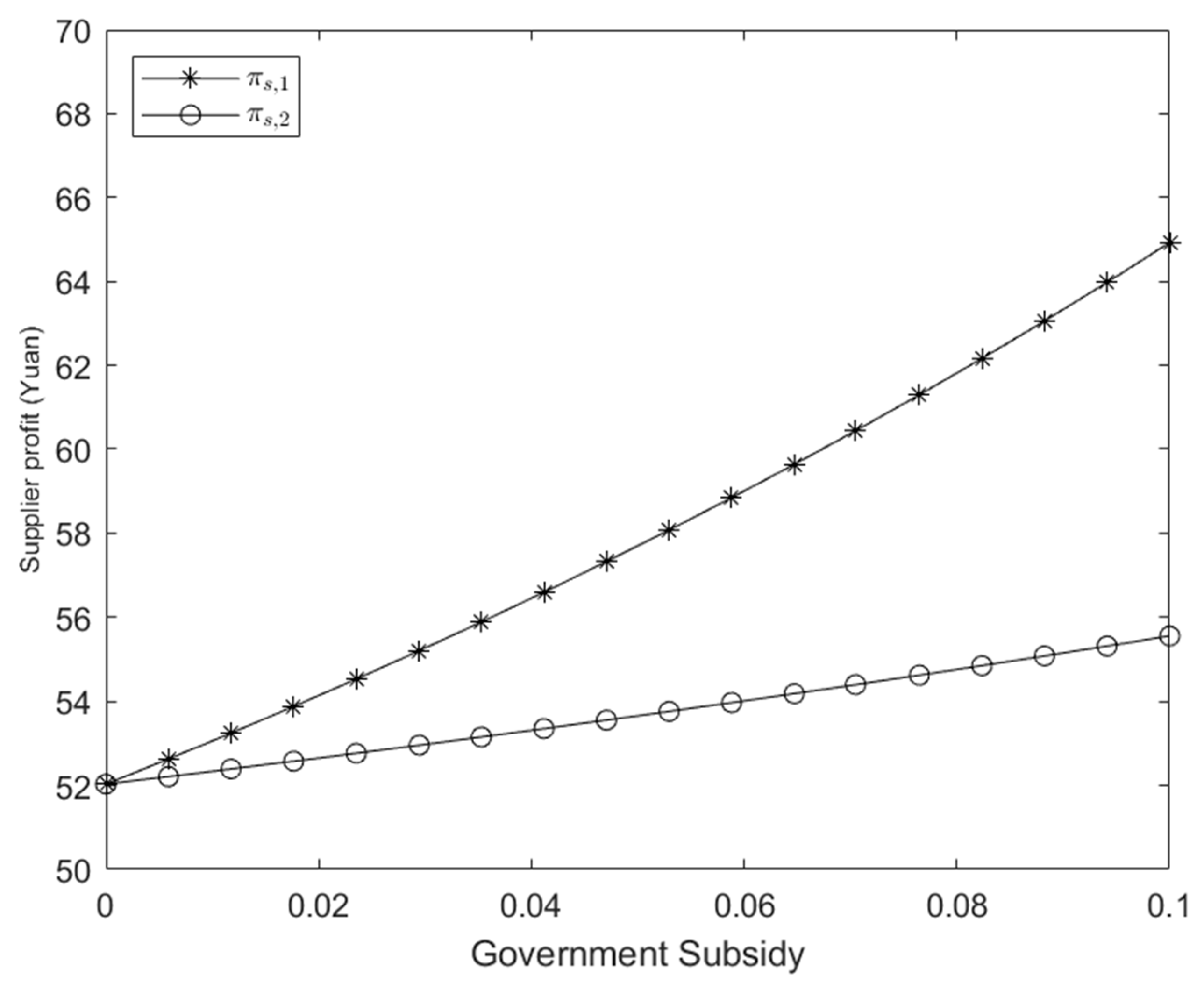

5. Numerical Simulation

6. Concluding Remarks

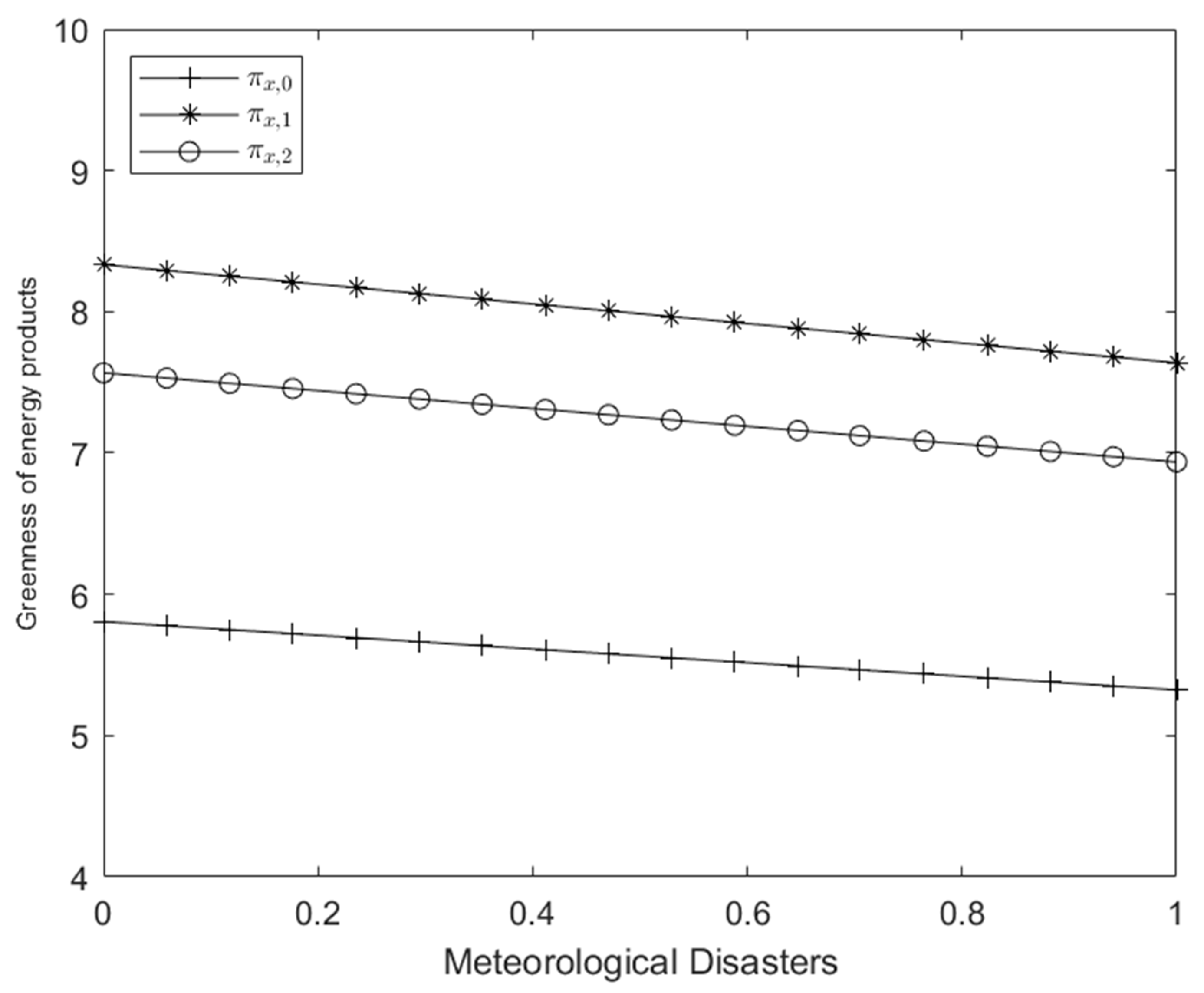

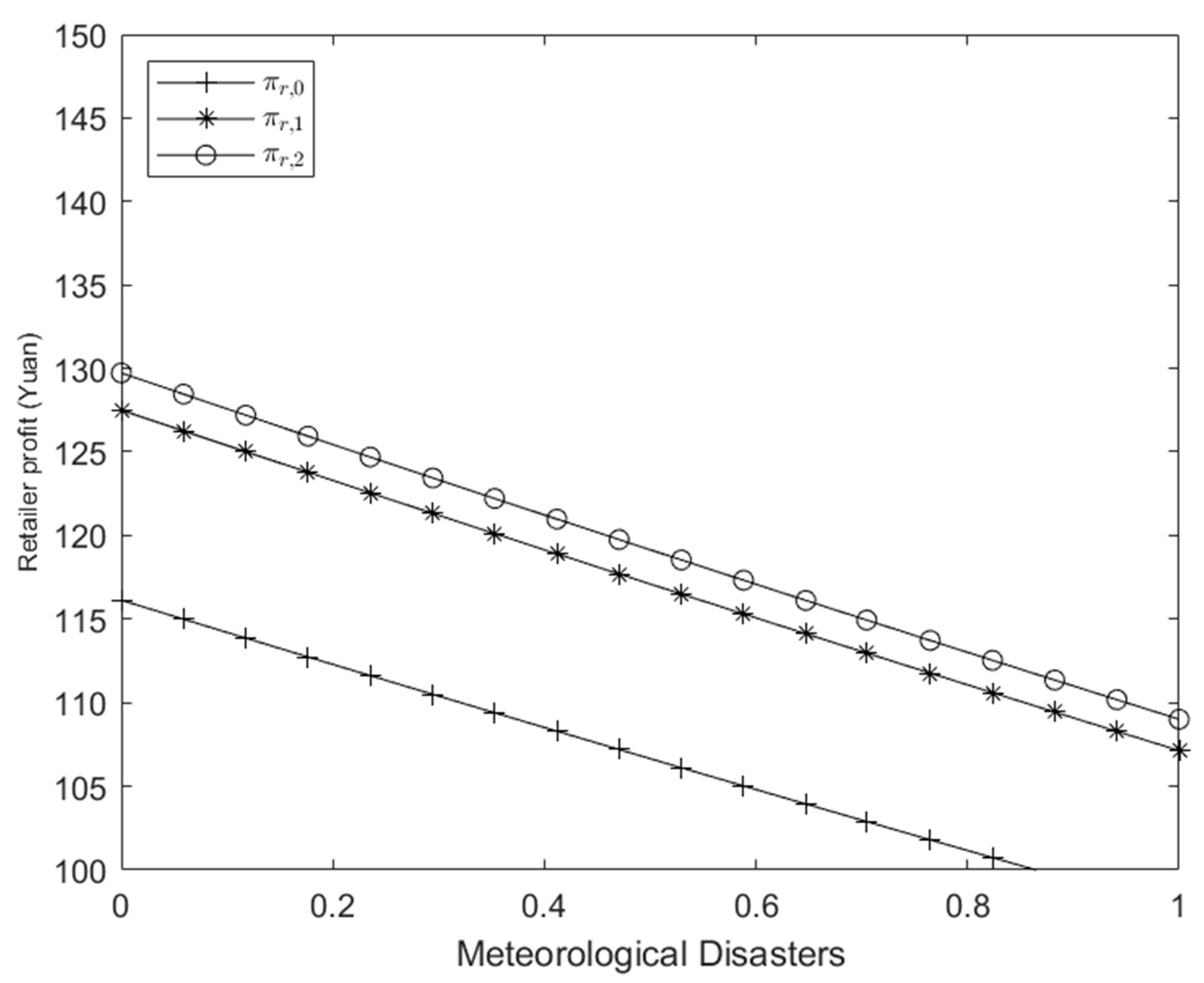

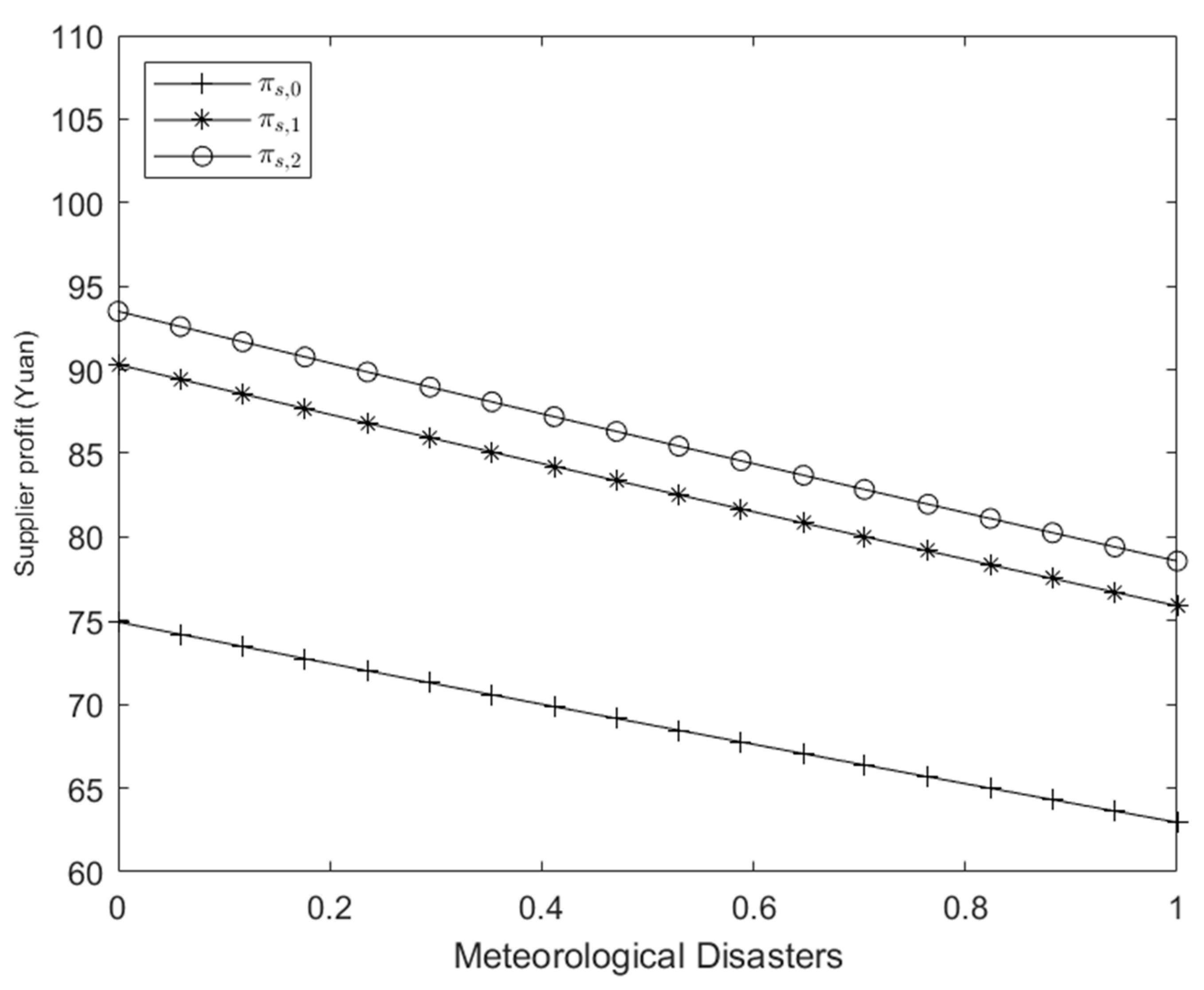

- Irrespective of the presence or type of government subsidies, meteorological disasters exert a negative impact on the greenness of energy products, as well as on the profits of retailers and suppliers. This conclusion is very much in line with reality and is similar to that of previous researchers [32]. The energy sector, as the core driving force for the functioning of the socioeconomic system, is affected by changes in climatic conditions in many aspects such as production, transport, and consumption, and this effect is mainly reflected in two aspects: (1) On the supply side, the pull effect of changes in meteorological conditions on energy demand, for example, extreme weather, disrupts the supply of hydroelectricity and wind power, which results in power tensions [28,29,30,31]. (2) On the demand side, the disruptive effects of meteorological hazards on energy output, e.g., extreme weather, exacerbates electricity and gas demand. The relative strength of the impact of the two effects determines the direction and magnitude of the impact of extreme weather on the energy sector [33,34,35,36].

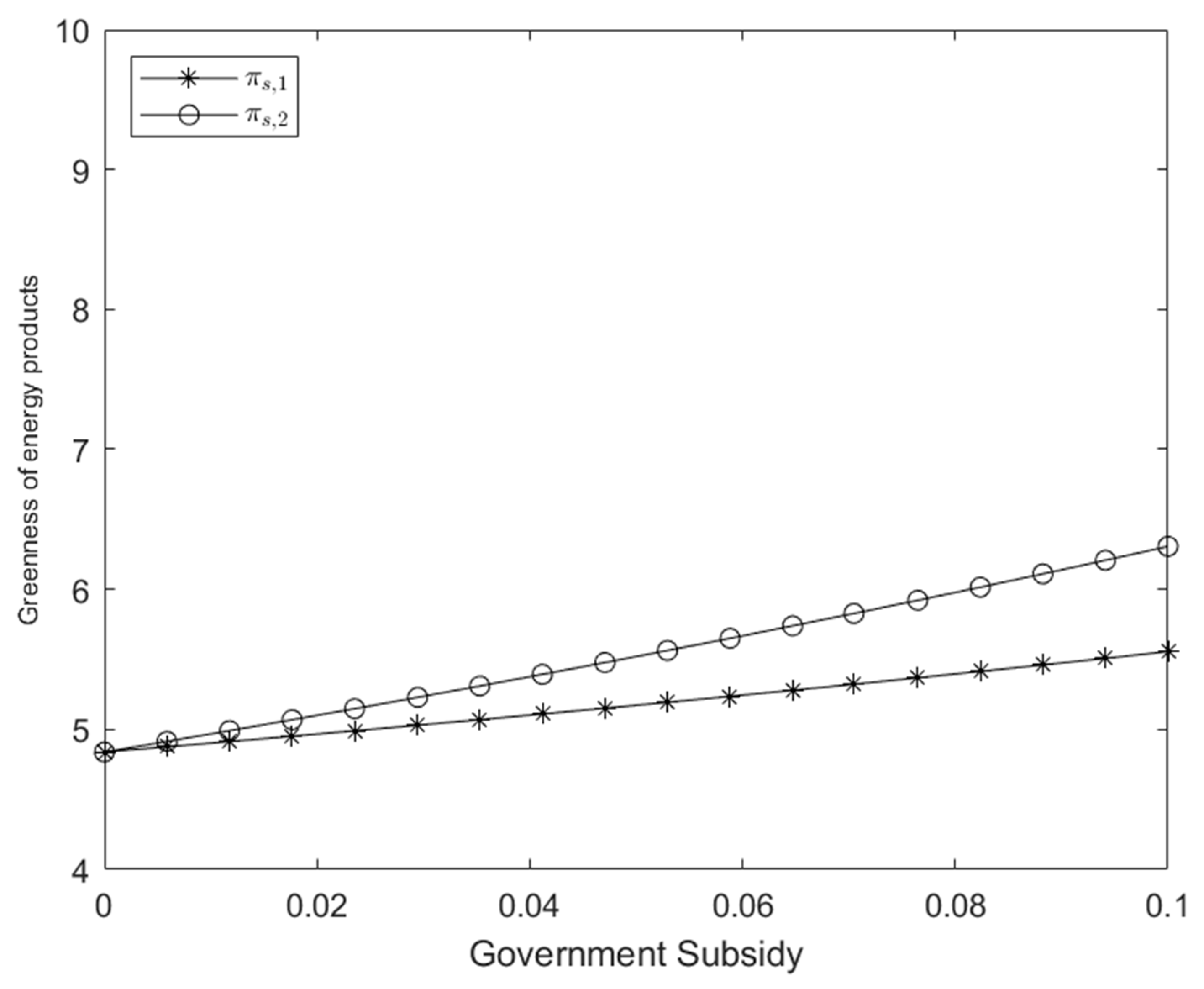

- The optimal strategy selection varies based on the chosen evaluation criteria. If the focus is on product greenness, the marketing cost subsidy strategy emerges as the most effective. Conversely, when considering the benefits to retailers and suppliers, subsidizing the greenness of energy products proves to be the most advantageous. In fact, research on different subsidies has also received more and more attention in recent years [28,37,38,39,40,41], but there is still a lack of energy supply chain-related research [40,41,42]. This paper compares and analyses the impact of different types of subsidies on the energy supply chain, and the role of government subsidies will be different in different situations, which can provide some reference significance for the choice of subsidy forms in practice.

- Increase R&D investment in green technology:

- 2.

- Optimize supply chain management:

- 3.

- Strengthen co-operation with the government:

- Differentiated subsidy strategies:

- 2.

- Strengthen the meteorological disaster warning and response mechanism:

- 3.

- Policy publicity and guidance:

7. Limitation and Directions for Future Research

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Gilbert, N. Climate change will boost animal meet-ups-and viral outbreaks. Nature 2022, 605, 20. [Google Scholar] [CrossRef]

- Vilà, R.; Medrano, M.; Castell, A. Climate change influences in the determination of the maximum power potential of radiative cooling. Evolution and seasonal study in Europe. Renew. Energy 2023, 212, 500–513. [Google Scholar] [CrossRef]

- Guan, D.; Comite, U.; Sial, M.S. The impact of renewable energy sources on financial development, and economic growth: The empirical evidence from an emerging economy. Energies 2021, 14, 8033. [Google Scholar] [CrossRef]

- Chang, B.H.; Alzoubi, H.M.; Salman, A. The Nexus Between Energy Demand and Currency Valuation: Evidence from Selected OECD Countries. Ann. Financ. Econ. 2024, 2450002. [Google Scholar] [CrossRef]

- Crook, J.A.; Jones, L.A.; Forster, P.M.; Crook, R. Climate change impacts on future photovoltaic and concentrated solar power energy output. Energy Environ. Sci. 2011, 4, 3101–3109. [Google Scholar] [CrossRef]

- Bartos, M.D.; Chester, M.V. Impacts of climate change on electric power supply in the Western United States. Nat. Clim. Chang. 2015, 5, 748–752. [Google Scholar] [CrossRef]

- Owusu, P.A.; Asumadu-Sarkodie, S.A. Review of renewable energy sources, sustainability issues and climate change mitigation. Cogent Eng. 2016, 3, 1167990. [Google Scholar] [CrossRef]

- Karnauskas, K.B.; Lundquist, J.K.; Zhang, L. Southward shift of the global wind energy resource under high carbon dioxide emissions. Nat. Geosci. 2018, 11, 38–43. [Google Scholar] [CrossRef]

- Isaac, M.; Van Vuuren, D.P. Modeling global residential sector energy demand for heating and air conditioning in the context of climate change. Energy Policy 2009, 37, 507–521. [Google Scholar] [CrossRef]

- Ciscar, J.C.; Dowling, P. Integrated assessment of climate impacts and adaptation in the energy sector. Energy Econ. 2014, 46, 531–538. [Google Scholar] [CrossRef]

- Ravestein, P.; Schrier, G.; Haarsma, R.; Scheele, R.; Broek, M. Vulnerability of European intermittent renewable energy supply to climate change and climate variability. Renew. Sustain. Energy Rev. 2018, 97, 497–508. [Google Scholar] [CrossRef]

- Perera, A.; Nik, V.M.; Chen, D.; Scartezzini, J.L.; Hong, T. Quantifying the impacts of climate change and extreme climate events on energy systems. Nat. Energy 2020, 5, 150–159. [Google Scholar] [CrossRef]

- Liu, Y.; Salman, A.; Khan, K. The effect of green energy production, green technological innovation, green international trade, on ecological footprints. Environ. Dev. Sustain. 2023, 1–14. [Google Scholar] [CrossRef]

- Chen, J.; Su, F.; Jain, V. Does renewable energy matter to achieve sustainable development goals? The impact of renewable energy strategies on sustainable economic growth. Front. Energy Res. 2022, 10, 829252. [Google Scholar] [CrossRef]

- Li, B.; Zhu, M.; Jiang, Y. Pricing policies of a competitive dual-channel green supply Chain. J. Clean. Prod. 2015, 112, 2029–2042. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J.A. Comparative analysis of greening policies across supply chain Structures. Int. J. Prod. Econ. 2012, 135, 568–583. [Google Scholar] [CrossRef]

- Taylor, T.A. Supply Chain Coordination Under Channel Rebates with Sales Effort Effects. Manag. Sci. 2002, 48, 992–1007. [Google Scholar] [CrossRef]

- Karray, S. Periodicity of pricing and marketing efforts in a distribution channel. Eur. J. Oper. Res. 2013, 228, 635–647. [Google Scholar] [CrossRef]

- Ma, P.; Wang, H.; Shang, J. Supply chain channel strategies with quality and marketing effort-dependent demand. Int. J. Prod. Econ. 2017, 144, 572–581. [Google Scholar] [CrossRef]

- Zhu, Q.; Dou, Y. Based on analysis of government subsidy of green supply chain management game mode. J. Manag. Sci. 2011, 14, 10. (In Chinese) [Google Scholar]

- Dai, R.; Zhang, J.; Tang, W. Cartelization or Cost-sharing? Comparison of cooperation modes in a green supply chain. J. Clean. Prod. 2017, 156, 159–173. [Google Scholar] [CrossRef]

- Yang, D.; Xiao, T. Pricing and green level decisions of a green supply chain with governmental interventions under fuzzy uncertainties. J. Clean. Prod. 2017, 149, 1174–1187. [Google Scholar] [CrossRef]

- Chen, X.; Li, J.; Tang, D. Stackelberg game analysis of government subsidy policy in green product market. Environ. Dev. Sustain. 2024, 26, 13273–13302. [Google Scholar] [CrossRef]

- Yi, S.; Wen, G. Game model of transnational green supply chain management considering government subsidies. Ann. Oper. Res. 2023, 1–12. [Google Scholar] [CrossRef]

- Barman, A.; De, P.K.; Chakraborty, A.K. Optimal pricing policy in a three-layer dual-channel supply chain under government subsidy in green manufacturing. Math. Comput. Simul. 2023, 204, 401–429. [Google Scholar] [CrossRef]

- Shang, W.F.; Teng, L.L. Retailer-led green supply chain game strategy considering government subsidy and sales effort. Syst. Eng. 2020, 38, 40–50. (In Chinese) [Google Scholar]

- Sun, B.; Li, M.; Wang, F. An incentive mechanism to promote residential renewable energy consumption in China’s electricity retail market: A two-level Stackelberg game approach. Energy 2023, 269, 126861. [Google Scholar] [CrossRef]

- Zhang, R.; Li, Z. Stackelberg game model of green tourism supply chain with governmental subsidy. INFOR Inf. Syst. Oper. Res. 2023, 61, 141–168. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int. J. Prod. Econ. 2017, 164, 319–329. [Google Scholar] [CrossRef]

- Zhao, J.; Wei, J. The coordinating contracts for a fuzzy supply chain with effort and price dependent demand. Appl. Math. Model. 2014, 38, 2476–2489. [Google Scholar] [CrossRef]

- Liu, P.; Yi, S.P. Pricing policies of green supply chain considering targeted advertising and product green degree in the Big Data environment. J. Clean. Prod. 2017, 164, 1614–1622. [Google Scholar] [CrossRef]

- Qing, L.; Yao, Y.; Sinisi, C.I. Do trade openness, environmental degradation and oil prices affect green energy consumption? Energy Strategy Rev. 2024, 52, 101342. [Google Scholar] [CrossRef]

- Ebinger, J.O.; Vergara, W. Climate Impacts on Energy Systems: Key Issues for Energy Sector Adaptation; World Bank: Washington, DC, USA, 2011. [Google Scholar]

- Allen, M.R.; Fernandez, S.J.; Fu, J.S. Impacts of climate change on sub-regional electricity demand and distribution in the southern United States. Nat. Energy 2016, 1, 16103. [Google Scholar] [CrossRef]

- Auffhammer, M.; Baylis, P.; Hausman, C.H. Climate change is projected to have severe impacts on the frequency and intensity of peak electricity demand across the United States. Proc. Natl. Acad. Sci. USA 2017, 114, 1886–1891. [Google Scholar] [CrossRef] [PubMed]

- van Ruijven, B.J.; De Cian, E.; Sue Wing, I. Amplification of future energy demand growth due to climate change. Nat. Commun. 2019, 10, 2762. [Google Scholar] [CrossRef] [PubMed]

- Yuan, X.; Zhang, X.; Zhang, D. Research on the dynamics game model in a green supply chain: Government subsidy strategies under the retailer’s selling effort level. Complexity 2020, 2020, 3083761. [Google Scholar] [CrossRef]

- Shao, J.; Hua, L. Research on government subsidy policy for firms R&D investment considering spillover effects: A Stackelberg game approach. Financ. Res. Lett. 2023, 58, 104415. [Google Scholar]

- Zhao, S.; Yu, L.; Zhang, Z. Photovoltaic supply chain and government subsidy decision-making based on China’s industrial distributed photovoltaic policy: A power perspective. J. Clean. Prod. 2023, 413, 137438. [Google Scholar] [CrossRef]

- Meng, Q.; Li, M.; Liu, W. Pricing policies of dual-channel green supply chain: Considering government subsidies and consumers’ dual preferences. Sustain. Prod. Consum. 2021, 26, 1021–1030. [Google Scholar] [CrossRef]

- Wang, W.; Lin, W.; Cai, J. Impact of demand forecast information sharing on the decision of a green supply chain with government subsidy. Ann. Oper. Res. 2023, 329, 953–978. [Google Scholar] [CrossRef]

- Li, M.; Cao, G.; Cui, L. Examining how government subsidies influence firms’ circular supply chain management: The role of eco-innovation and top management team. Int. J. Prod. Econ. 2023, 261, 108893. [Google Scholar] [CrossRef]

| Symbol | Meaning |

|---|---|

| a | Market base size |

| p | Unit retail price of energy products set by the retailer (CNY) |

| w | Wholesale price per unit of energy products set by the supplier (CNY) |

| c | Supplier of energy products’ unit cost (CNY) |

| x | Greenness of energy products |

| f | The sensitivity of market demand to price of energy products |

| b | Sensitivity of market demand to energy product greenness |

| β | Sensitivity of energy supply to meteorological hazards |

| ų | Meteorological disaster risk |

| η | Retailers’ promotion subsidy coefficient |

| g | The difference between retail and wholesale prices (CNY) |

| n | Retailer promotion cost coefficient |

| Unit energy product subsidy coefficient based on greenness |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liang, S.; Zhang, H.; Zhang, T. Effect of Governmental Subsidies on Green Energy Supply Chains: A Perspective of Meteorological Disasters. Energies 2024, 17, 4271. https://doi.org/10.3390/en17174271

Liang S, Zhang H, Zhang T. Effect of Governmental Subsidies on Green Energy Supply Chains: A Perspective of Meteorological Disasters. Energies. 2024; 17(17):4271. https://doi.org/10.3390/en17174271

Chicago/Turabian StyleLiang, Shan, Huiming Zhang, and Tianyi Zhang. 2024. "Effect of Governmental Subsidies on Green Energy Supply Chains: A Perspective of Meteorological Disasters" Energies 17, no. 17: 4271. https://doi.org/10.3390/en17174271

APA StyleLiang, S., Zhang, H., & Zhang, T. (2024). Effect of Governmental Subsidies on Green Energy Supply Chains: A Perspective of Meteorological Disasters. Energies, 17(17), 4271. https://doi.org/10.3390/en17174271