Point and Interval Forecasting of Coal Price Adopting a Novel Decomposition Integration Model

Abstract

1. Introduction

- (1)

- In the decomposition stage of a hybrid model, EMD and its variants are unable to effectively decompose the high volatile coal price series, being limited by various decomposition errors. In addition, when using VMD to decompose coal price series, the empirical judgment is not scientific enough. Therefore, there is still room for improvement in the decomposition stage.

- (2)

- The current academic research mainly focuses on point forecasting of coal prices, and the existing research on probabilistic forecasting mainly adopts kernel density estimation, whose result is vulnerable to the width of the subintervals. Therefore, probabilistic forecasting needs to be further supplemented.

- (1)

- In the signal decomposition stage, using a meta-heuristic algorithm can be used to optimize the parameter of the VMD, improving the reasonableness of the decomposition, as well as the accuracy of the decomposition.

- (2)

- This paper proposes a new hybrid model that enables point and interval forecasts of Chinese coal prices. Specifically, this paper combines the optimized VMD with N-BEATS to achieve point forecasts of Chinese coal prices, and based on these forecasts, it uses quantile regression to achieve the probabilistic prediction of coal prices, compensating for the shortcomings of kernel density estimation.

- (3)

- This paper extends the interpretability of coal prices prediction. Combining the mean impact value algorithm (MIV) with N-BEATS, we solve the problem that N-BEATS cannot analyze the importance of drivers on coal price forecasting, increasing the extent of the hybrid model’s application.

2. Methodology

2.1. Coal Price Sequence Decomposition Method

2.1.1. Variational Modal Decomposition

2.1.2. Chameleon Swarm Algorithm

- (1) Tracking the prey.

- (2) Locating the prey.

- (3) Capturing the prey.

2.1.3. Hybrid Model for Coal Price Sequence Decomposition

2.2. Point Forecasting of Coal Price Adopting N-BEATS

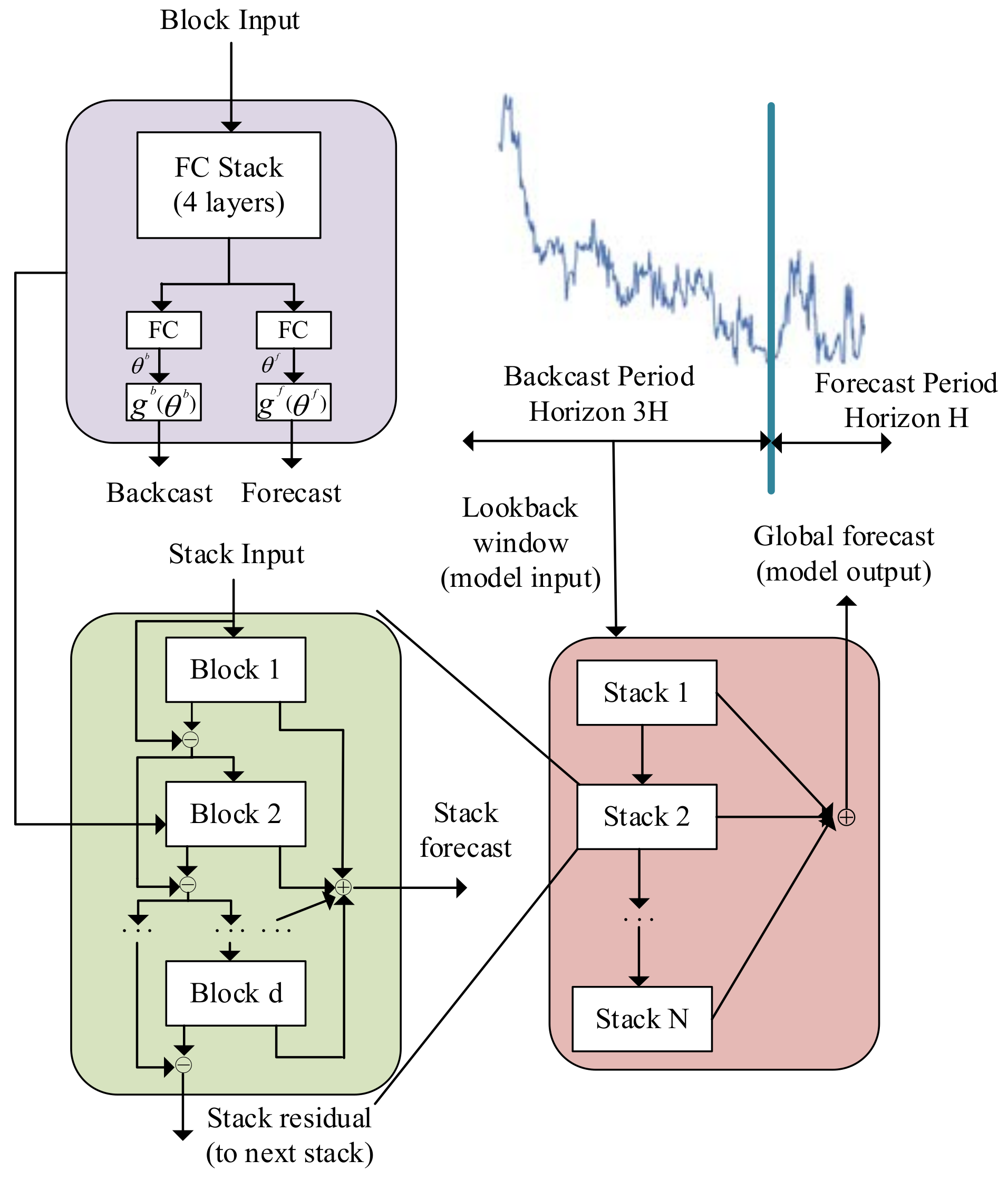

Forecasting Process of N-BEATS

- (1) Basic block.

- (2) Doubly residual stacking.

- (3) Interpretable architecture.

2.3. Interval Forecasting of Coal Price Adopting Quantile Regression

2.4. Significance Analysis of Covariates

3. Empirical Study

3.1. Data Description

3.2. Benchmark Model and Parameter Setting

- (1)

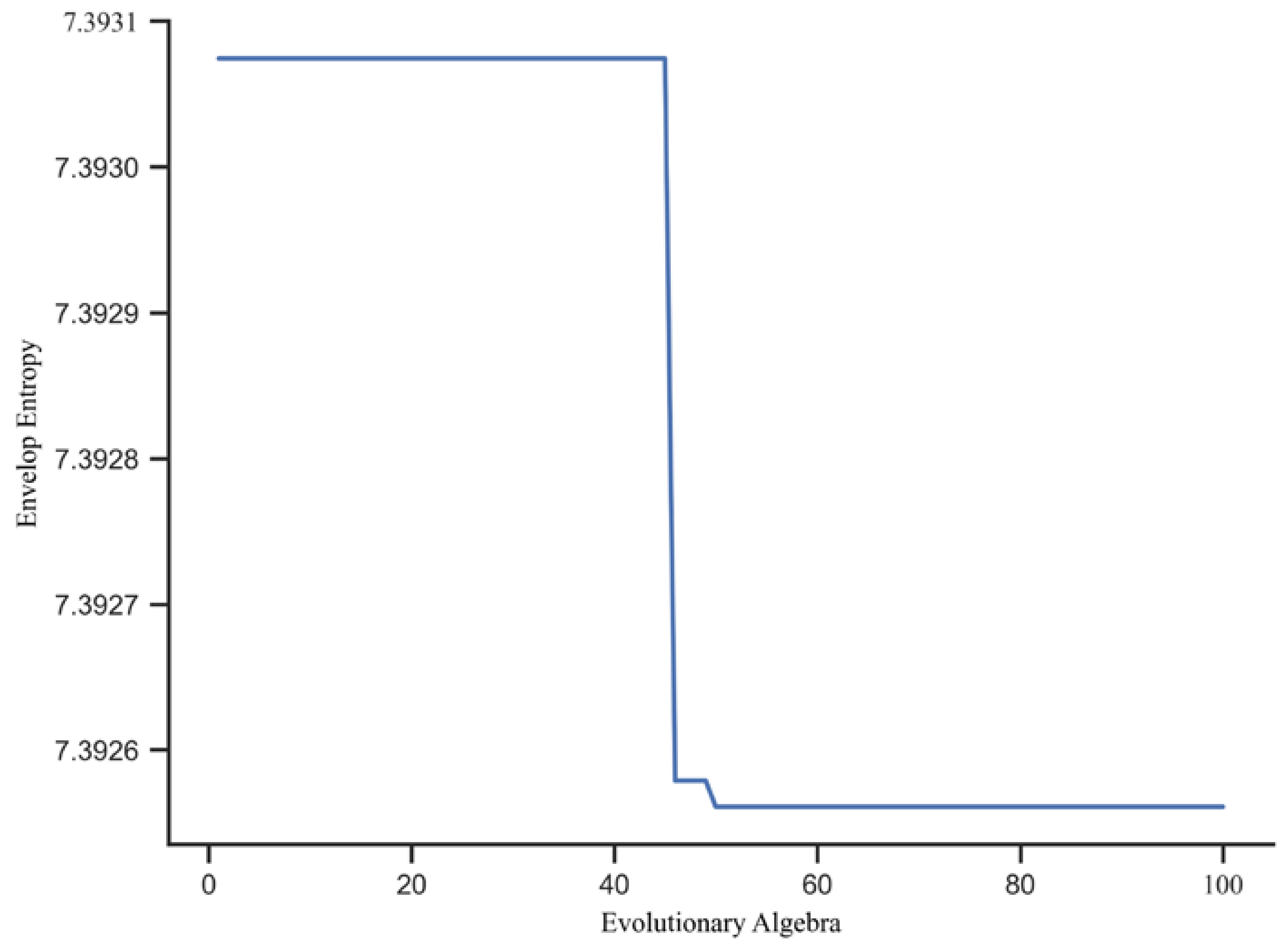

- In the CSA-VMD model, the population size of CSA is 30 and T is 100; is in the range of [2, 10], and is in the range of [1000, 10,000].

- (2)

- In N-BEATS, the maximum value of time steps for backcasting and forecasting are 10 and 7, respectively, and the learning rate is 0.002; the pieces of information processed per batch are 16, 32, 64; the numbers of stacks are 16, 32, 64, with the numbers of blocks per stack being 1, 2, 3, and 5, respectively; the numbers of neurons that make up each fully connected layer in each block of each stack are 32, 64, 128.

4. Results and Discussion

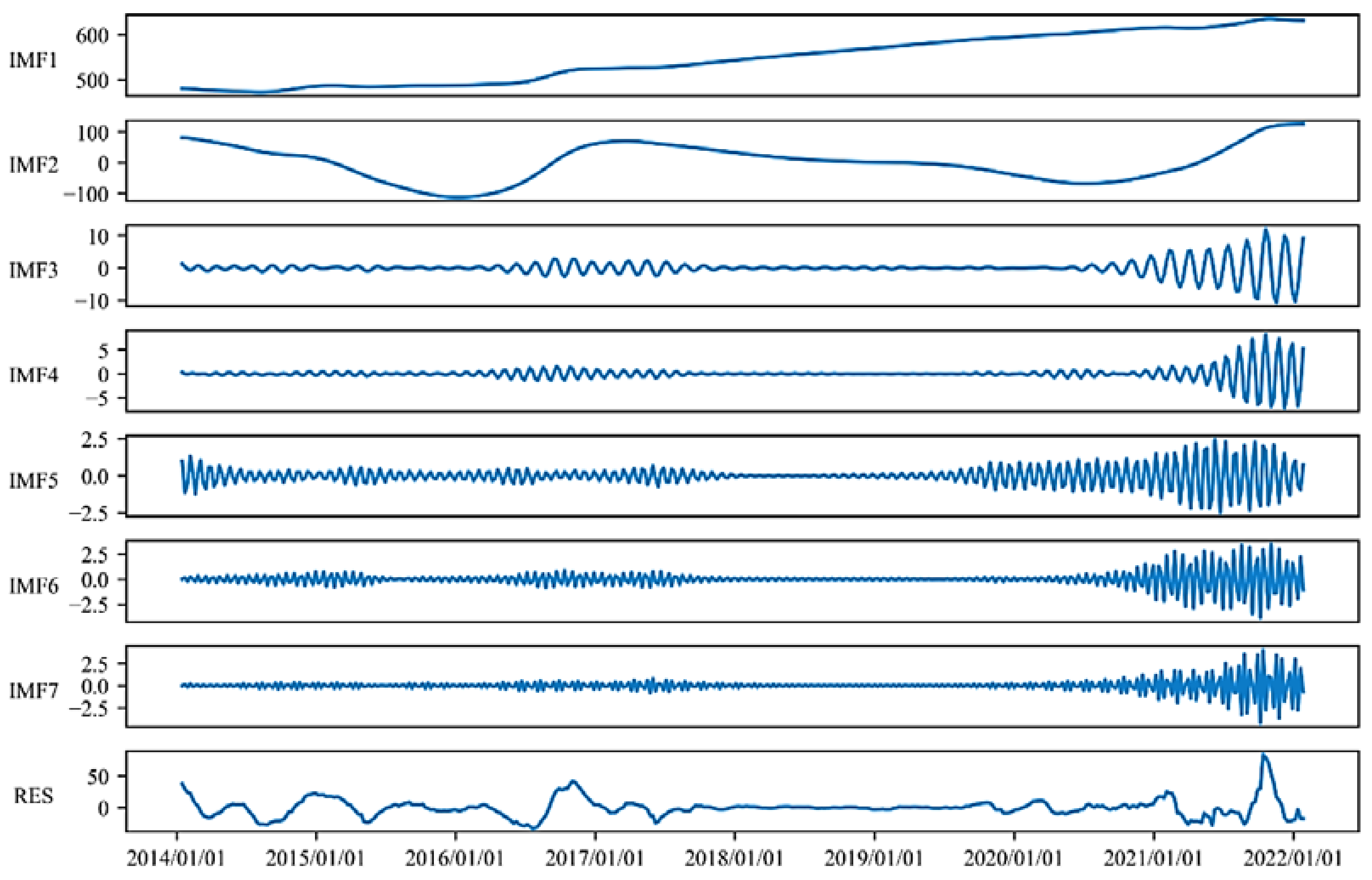

4.1. Results of Coal Price Decomposition Using the CSA-VMD

4.2. Results of Point and Interval Forecasting Using the VCNQM Model

4.3. Importance Analysis of Drivers

4.4. Comparison Analysis of Different Models’ Forecasting Performance

5. Conclusions

- (1)

- CSA-VMD as the decomposition method can effectively improve the stationarity and linearity of the coal price series. Specifically, the CSA-VMD model enhances not only the rationality of parameter determination but also the decomposition accuracy, but also decomposes the coal price signal into multiple sub-signals with weaker volatility.

- (2)

- Quantile regression can perform the interval forecasting for coal prices and extends the breadth of application of the VCNQM hybrid model.

- (3)

- The A-share power industry index and the coal industry index are the most important drivers of China’s steam coal price. They all directly or indirectly have an impact on coal supply and thus coal prices.

- (4)

- In comparison with previous deep neural networks, the VCNQM hybrid model exhibits superior prediction performance, with remarkably lower errors. Excluding the decomposition part of the hybrid model, the predictive performance of the single model N-BEATS is worse than that of the hybrid model.

5.1. Literature Contributions

5.2. Management Insights

- (1)

- To control coal prices, the government can realize this goal by controlling coal mining, adjusting coal imports, and developing relevant power industry policies.

- (2)

- To timely respond to the drastic volatility of the coal market, relevant enterprises should always pay attention to the information related to the power industry, coal mining and domestic coal imports, and make corresponding assessments and adjustments of future coal prices according to their changes.

5.3. Future Prospects

- (1)

- Adding multiple decompositions to the hybrid model may be more effective in weakening the fluctuation of the coal price series and increasing its predictive effectiveness.

- (2)

- Incorporating more factors into the coal price driver system, such as relevant policies, environmental quality, etc.

- (3)

- Investigating other interval prediction methods to accomplish better prediction results.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wang, C.; Xu, G.; Sun, C.; Xu, J.; Xu, K.; Jiang, L.; Wang, Y.; Su, S.; Hu, S.; Xiang, J. Modeling and forecasting of coal price based on influencing factors and time series. J. Clean. Prod. 2024, 467, 143030. [Google Scholar] [CrossRef]

- Pan, W.; Guo, Z.; Zhang, J.S.Y.; Luo, L. Forecasting of coal and electricity prices in China: Evidence from the quantum bee colony-support vector regression neural network. Energy Econ. 2024, 134, 107565. [Google Scholar] [CrossRef]

- Kostecka-Jurczyk, D.; Struś, M.; Marak, K. The Role of Energy Cooperatives in Ensuring the Energy and Economic Security of Polish Municipalities. Energies 2024, 17, 3082. [Google Scholar] [CrossRef]

- Gajdzik, B.; Wolniak, R.; Nagaj, R.; Zuromskaite-Nagaj, B.; Grebski, W.W. The influence of the global energy crisis on energy efficiency: A comprehensive analysis. Energies 2024, 17, 947. [Google Scholar] [CrossRef]

- Ferrari, D.; Ravazzolo, F.; Vespignani, J. Forecasting energy commodity prices: A large global dataset sparse approach. Energy Econ. 2021, 98, 105268. [Google Scholar] [CrossRef]

- Guo, X.; Shi, J.; Ren, D. Coal price forecasting and structural analysis in China. Discret. Dyn. Nat. Soc. 2016, 7, 1236168. [Google Scholar] [CrossRef]

- Jiang, S.; Yang, C.; Guo, J.; Ding, Z. ARIMA forecasting of China’s coal consumption, price and investment by 2030. Energy Sources Part B Econ. Plan. Policy 2018, 13, 190–195. [Google Scholar] [CrossRef]

- Zhao, Z.Y.; Zhu, J.; Xia, B. Multi-fractal fluctuation features of thermal power coal price in China. Energy 2016, 117, 10–18. [Google Scholar] [CrossRef]

- Herrera, G.P.; Constantino, M.; Tabak, B.M.; Pistori, H.; Su, J.J.; Naranpanawa, A. Long-term forecast of energy commodities price using machine learning. Energy 2019, 179, 214–221. [Google Scholar] [CrossRef]

- Bonita, O.; Muflikhah, L. Comparison of Gaussian and ANOVA Kernel in Support Vector Regression for Predicting Coal Price. In Proceedings of the 2018 International Conference on Sustainable Information Engineering and Technology (SIET), Malang, Indonesia, 10–12 November 2018; pp. 147–150. [Google Scholar] [CrossRef]

- Fan, X.; Wang, L.; Li, S. Predicting chaotic coal prices using a multi-layer perceptron network model. Resour. Policy 2016, 50, 86–92. [Google Scholar] [CrossRef]

- Matyjaszek, M.; Fernández, P.R.; Krzemień, A.; Wodarski, K.; Valverde, G.F. Forecasting coking coal prices by means of ARIMA models and neural networks, considering the transgenic time series theory. Resour. Policy 2019, 61, 283–292. [Google Scholar] [CrossRef]

- Chen, X.; Yu, R.; Ullah, S.; Wu, D.; Li, Z.; Li, Q.; Qi, H.; Liu, J.; Liu, M.; Zhang, Y. A novel loss function of deep learning in wind speed forecasting. Energy 2022, 238, 121808. [Google Scholar] [CrossRef]

- Yeh, H.H.; Sun, M.T. Coal price prediction using financial indices. In Proceedings of the 2019 International Conference on Technologies and Applications of Artificial Intelligence (TAAI), Kaohsiung, Taiwan, 21–23 November 2019; pp. 1–6. [Google Scholar] [CrossRef]

- Wang, H.; Ye, J.; Huang, L.; Wang, Q.; Zhang, H. A multivariable hybrid prediction model of offshore wind power based on multi-stage optimization and reconstruction prediction. Energy 2023, 262, 125428. [Google Scholar] [CrossRef]

- Alameer, Z.; Fathalla, A.; Li, K.; Ye, H.; Jianhua, Z. Multistep-ahead forecasting of coal prices using a hybrid deep learning model. Resour. Policy 2020, 65, 101588. [Google Scholar] [CrossRef]

- Wang, B.; Wang, J. Energy futures prices forecasting by novel DPFWR neural network and DS-CID evaluation. Neurocomputing 2019, 338, 1–15. [Google Scholar] [CrossRef]

- Wei, L.Y. A hybrid ANFIS model based on empirical mode decomposition for stock time series forecasting. Appl. Soft Comput. 2016, 42, 368–376. [Google Scholar] [CrossRef]

- Wu, Z.; Huang, N.E. Ensemble empirical mode decomposition: A noise-assisted data analysis method. Adv. Adapt. Data Anal. 2009, 1, 1–41. [Google Scholar] [CrossRef]

- Torres, M.E.; Colominas, M.A.; Schlotthauer, G.; Flandrin, P. A complete ensemble empirical mode decomposition with adaptive noise. In Proceedings of the 2011 IEEE International Conference on Acoustics, Speech and Signal Processing (ICASSP), Prague, Czech Republic, 22–27 May 2011; pp. 4144–4147. [Google Scholar] [CrossRef]

- Niu, H.; Xu, K.; Liu, C. A decomposition-ensemble model with regrouping method and attention-based gated recurrent unit network for energy price prediction. Energy 2021, 231, 120941. [Google Scholar] [CrossRef]

- Wang, P.; Tao, Z.; Liu, J.; Chen, H. Improving the forecasting accuracy of interval-valued carbon price from a novel multi-scale framework with outliers detection: An improved interval-valued time series analysis mode. Energy Econ. 2023, 118, 106502. [Google Scholar] [CrossRef]

- Rayi, V.K.; Mishra, S.P.; Naik, J.; Dash, P.K. Adaptive VMD based optimized deep learning mixed kernel ELM autoencoder for single and multistep wind power forecasting. Energy 2022, 244, 122585. [Google Scholar] [CrossRef]

- Li, H.; Chang, J.; Xu, F.; Liu, Z.; Yang, Z.; Zhang, L.; Zhang, S.; Mao, R.; Du, X.; Liu, B. Efficient lidar signal denoising algorithm using variational mode decomposition combined with a whale optimization algorithm. Remote Sens. 2019, 11, 126. [Google Scholar] [CrossRef]

- Zhang, K.; Cao, H.; Thé, J.; Yu, H. A hybrid model for multi-step coal price forecasting using decomposition technique and deep learning algorithms. Appl. Energy 2022, 306, 118011. [Google Scholar] [CrossRef]

- Zhang, S.; Luo, J.; Wang, S.; Liu, F. Oil price forecasting: A hybrid GRU neural network based on decomposition–reconstruction methods. Expert Syst. Appl. 2023, 218, 119617. [Google Scholar] [CrossRef]

- Fang, Y.; Wang, W.; Wu, P.; Zhao, Y. A sentiment-enhanced hybrid model for crude oil price forecasting. Expert Syst. Appl. 2023, 215, 119329. [Google Scholar] [CrossRef]

- Li, R.; Song, X. A multi-scale model with feature recognition for the use of energy futures price forecasting. Expert Syst. Appl. 2023, 211, 118622. [Google Scholar] [CrossRef]

- Wu, S.; Xia, G.; Liu, L. A novel decomposition integration model for power coal price forecasting. Resour. Policy 2023, 80, 103259. [Google Scholar] [CrossRef]

- Ding, L.; Zhao, Z.; Han, M. Probability density forecasts for steam coal prices in China: The role of high-frequency factors. Energy 2021, 220, 119758. [Google Scholar] [CrossRef]

- Mirjalili, S.; Gandomi, A.H.; Mirjalili, S.Z.; Saremi, S.; Faris, H.; Mirjalili, S.M. Salp swarm algorithm: A bio-inspired optimizer for engineering design problems. Adv. Eng. Softw. 2017, 114, 163–191. [Google Scholar] [CrossRef]

- Braik, M.S. Chameleon swarm algorithm: A bioinspired optimizer for solving engineering design problems. Expert Syst. Appl. 2021, 174, 114685. [Google Scholar] [CrossRef]

- Kin, G.O.; Challu, C.; Marcjasz, G.; Weron, R.; Dubrawski, A. Neural basis expansion analysis with exogenous variables: Forecasting electricity prices with NBEATSx. Int. J. Forecast. 2023, 39, 884–900. [Google Scholar] [CrossRef]

- Dragomiretskiy, K.; Zosso, D. Variational mode decomposition. IEEE Trans. Signal Process 2014, 62, 531–544. [Google Scholar] [CrossRef]

- Oreshkin, B.N.; Carpov, D.; Chapados, N.; Carpov, D. N-BEATS: Neural basis expansion analysis for interpretable time series forecasting. arXiv 2019, 1905, 10437. [Google Scholar] [CrossRef]

- Zheng, G.; Li, K.; Yue, X.; Zhang, Y. A multifactor hybrid model for carbon price interval prediction based on decomposition-integration framework. J. Environ. Manag. 2024, 363, 121273. [Google Scholar] [CrossRef]

- Filimonova, I.V.; Nemov, V.Y.; Komarova, A.V.; Mishenin, M.V.; Kozhevin, V.D. Relationship of renewable energy consumption to economic, environmental and institutional factors in Europe. Energy Rep. 2021, 7, 358–365. [Google Scholar] [CrossRef]

- Li, R.; Leung, G.C. The relationship between energy prices, economic growth and renewable energy consumption: Evidence from Europe. Energy Rep. 2021, 7, 1712–1719. [Google Scholar] [CrossRef]

- Batten, J.A.; Brzeszczynski, J.; Ciner, C.; Lau, M.C.; Lucey, B.; Yarovaya, L. Price and volatility spillovers across the international steam coal market. Energy Econ. 2019, 77, 119–138. [Google Scholar] [CrossRef]

- Chandrarin, G.; Sohag, K.; Cahyaningsih, D.S.; Yuniawan, D.; Herdhayinta, H. The response of exchange rate to coal price, palm oil price, and inflation in Indonesia: Tail dependence analysis. Resour. Policy 2022, 77, 102750. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Y. Dynamic linkages and spillover effects between CET market, coal market and stock market of new energy companies: A case of Beijing CET market in China. Energy 2019, 172, 1198–1210. [Google Scholar] [CrossRef]

- Gu, F.; Wang, J.; Guo, J.; Fan, Y. How the supply and demand of steam coal affect the investment in clean energy industry? Evidence from China. Resour. Policy 2020, 69, 101788. [Google Scholar] [CrossRef]

- Nevendra, M.; Singh, P. Empirical investigation of hyperparameter optimization for software defect count prediction. Expert Syst. Appl. 2022, 191, 116217. [Google Scholar] [CrossRef]

- Gao, R.; Liu, J.; Zhou, Q.; Duru, O.; Yuen, K.F. Newbuilding ship price forecasting by parsimonious intelligent model search engine. Expert Syst. Appl. 2022, 201, 117119. [Google Scholar] [CrossRef]

- Sundaram, A.; Alkhaldi, N.S. Multi-Objective Stochastic Paint Optimizer for Solving Dynamic Economic Emission Dispatch with Transmission Loss Prediction Using Random Forest Machine Learning Model. Energies 2024, 17, 860. [Google Scholar] [CrossRef]

- Acharya, S.K.; Yu, H.; Wi, Y.M.; Lee, J. Multihousehold Load Forecasting Based on a Convolutional Neural Network Using Moment Information and Data Augmentation. Energies 2024, 17, 902. [Google Scholar] [CrossRef]

- Wang, F.; Lin, H.; Ma, Z. Transmission Line Icing Prediction Based on Dynamic Time Warping and Conductor Operating Parameters. Energies 2024, 17, 945. [Google Scholar] [CrossRef]

| Drivers | Tem | CMII | II | ASESI | A/C |

|---|---|---|---|---|---|

| Correlation coefficients | −0.10 * | 0.18 ** | −0.03 | −0.23 ** | 0.05 |

| Drivers | U/C | SMTY | SHIBOR | CII | ASI |

| Correlation coefficients | 0.18 ** | 0.05 | 0.14 ** | 0.18 ** | 0.04 |

| Drivers | NPCSP | NYNGSP | DCOP | HII | WPII |

| Correlation coefficients | 0.81 ** | 0.17 ** | 0.34 ** | 0.43 ** | 0.12 * |

| Steam coal weekly price | Observations | Max | Min | Average | Standard Deviation | Variance | Skewness | Kurtosis |

| 420 | 848 | 371 | 547.048 | 86.883 | 7548.580 | 0.076 | 1.110 |

| Model | MAPE | MASE | MAE | SMAPE |

|---|---|---|---|---|

| N-Beats | 11.49% | 27.16 | 67.53 | 10.45% |

| VCNQM | 11.33% | 26.83 | 66.72 | 10.42% |

| Model | MAPE | MASE | MAE | SMAPE |

|---|---|---|---|---|

| RF | 16.28% | 43.04 | 89.73 | 15.97% |

| SVM | 14.9% | 42.11 | 86.51 | 14.75% |

| RNN | 13.6% | 31.45 | 78.19 | 12.47% |

| GRU | 12.55% | 29.10 | 72.67 | 11.89% |

| LSTM | 12.37% | 28.89 | 71.84 | 11.24% |

| N-Beats | 11.49% | 27.16 | 67.53 | 10.45% |

| VCNQM | 11.33% | 26.83 | 66.72 | 10.42% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, J.; Liu, L. Point and Interval Forecasting of Coal Price Adopting a Novel Decomposition Integration Model. Energies 2024, 17, 4166. https://doi.org/10.3390/en17164166

Liu J, Liu L. Point and Interval Forecasting of Coal Price Adopting a Novel Decomposition Integration Model. Energies. 2024; 17(16):4166. https://doi.org/10.3390/en17164166

Chicago/Turabian StyleLiu, Junjie, and Lang Liu. 2024. "Point and Interval Forecasting of Coal Price Adopting a Novel Decomposition Integration Model" Energies 17, no. 16: 4166. https://doi.org/10.3390/en17164166

APA StyleLiu, J., & Liu, L. (2024). Point and Interval Forecasting of Coal Price Adopting a Novel Decomposition Integration Model. Energies, 17(16), 4166. https://doi.org/10.3390/en17164166