Abstract

The evolving legislation regarding electricity billing for both consumers and prosumers, coupled with the growing interest in photovoltaic installations with energy storage, provided the motivation to examine the operational and financial viability of a prosumer photovoltaic installation located in Poland. Two options were considered: a standard photovoltaic system without energy storage and an installation with batteries. Furthermore, four scenarios were analyzed, each reflecting a different way of accounting for the electricity bought and sold by the prosumer. Another scenario is that energy prices are influenced by a high share of renewable sources. As the changes to the billing scheme are a recent development, there is no relevant analysis currently available. In order to ensure the reliability of the analysis, PVsyst 7.4 software was employed to establish the main performance and financial parameters for the selected PV systems. Analysis showed that using an energy storage system will increase the energy self-consumption from 28.6% to 60.4%, which in some cases would have a great influence on profitability of the investment. In the worst scenario, the payback period is too long (13.7 years). But in the most favorable scenario, with additional financing, it drops to 3.9 years.

1. Introduction

According to recent reports, energetic transformation both in European Union (EU) and worldwide is a factor that has a great influence on industry, macro- and micro-economy, as well as the life of ordinary people. A number of research groups are currently examining the energy transformation in terms of economic, social, or environmental impact [1,2,3]. Furthermore, in light of the increasing interest in electric vehicles, their potential impact on the renewable energy market is being evaluated [4]. In particular the subject of the economics of photovoltaic systems as well as renewable energy sources [5] has become a matter of increasing importance on a global scale. This issue is analyzed from a variety of perspectives. As reported in [6], the operation costs became an important issue in places where natural disasters appear. Another factor contributing to the profitability of PV investments is the availability of subsidies [7,8,9,10]. Also, the economy of different PV systems are taken into account: systems with the batteries [11,12] and building integrated system [13] or photovoltaic hybrid systems [14,15,16]. This latest research demonstrates that the global interest in photovoltaic (PV) economics is a significant influencing factor for investors and is a leading research subject.

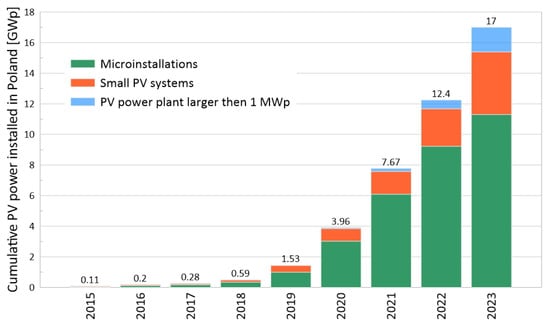

Renewable energy sources constitute a very important aspect of transformation, and for Poland, the role of photovoltaics is becoming increasingly significant on an annual basis [17,18]. In 2020, the proportion of energy generated from photovoltaics was 1.3%, while in 2023 this figure had risen to 8%. It can be seen that over the last 8 years, cumulative photovoltaic power reached 17 GWp, while cumulative power in 2016 was 0.199 GWp [18] (Figure 1). What is worth mentioning is that almost 67% of the whole installed PV power are so called micro-installations—the installations with power that does not exceed 50 kWp. It means that 11.3 GWp PV installed in Poland are in the hands of so called prosumers—private or company owners who produce and consume electrical energy at the same time [19,20,21]. When the Polish government started to encourage investors to install photovoltaics, the method of accounting for energy injected into the power grid was based on the so-called net-metering [22,23]. Almost all surplus energy injected during sunny days into the electrical grid could be used during the period when the sun radiation was low. Thus, in other words, the electrical grid was treated as an energy bank characterized by an efficiency of 80% (or 70% when power of the PV system exceeded 10 kWp). Also, the supporting program “Moj Prad” for prosumers was introduced in 2019 by the Polish National Fund for Environmental Protection and Water Management. It helped to reduce the costs of the investment and shorten the payback period. The way of accounting produced energy and supporting programs encouraged a lot of investors to install PV systems, which can be seen in Figure 1.

Figure 1.

Cumulative photovoltaic power installed in Poland [18].

Since 1 April 2022, the way new prosumers are obliged to settle surplus energy with the electrical company changed from net-metering to net-billing [24]. The energy injected into the grid was sold to the provider at an average wholesale price from the previous month. As presented in the previous work [25] and reported in [26,27], net-billing is definitely less profitable than net-metering, also because usually the average energy wholesale price is half the price of the energy that a prosumer buys from the provider [26]. The main motivation for the investors to install a PV system is profitability; according to this factor, the parameter called self-consumption (SC) has to be considered in order to decrease the payback period and increase profitability [28,29,30]. While net-metering regulations were in force, energy self-consumption was not so important in terms of investment profitability. However, when net-billing regulations came into effect, the auto-consumption of produced energy became an important factor to consider when planning a photovoltaic installation. Energy self-consumption, as presented in [31,32,33], can be increased by installing energy storage or by proper matching power of a PV system with user energy needs. Also, the orientation of the photovoltaic modules can influence self-consumption [25,34]. Also, as reported in [35], the self-consumption parameter can be increased by using a heat pomp. Moreover, due to rapid increase in the number of PV systems in Poland, the electrical grid during sunny days becomes overloaded and voltage increases over the maximal permissible value [36,37], which causes photovoltaic inverters to turn off after reaching 253 V. This problem becomes more common because the PV energy production profile does not correspond to the energy demand profile and usually around 70–80% of produced energy is introduced to the electrical grid, causing a rising of the voltage and overloading of the distribution network [38]. In this case, self-consumption of produced energy would also be a good option to reduce electrical grid overload and introduce sustainable energy usage.

Taking these factors into account, the Polish government, in successive editions of the “Moj Prad 5.0” support program, is increasing subsidies for the PV installations that rely on self-consumption [39]. It can be achieved by installing energy storage systems or by using additional devices that control the power demand of a building according to the energy production of a photovoltaic installation [38]. Hence, in terms of profitability as well as the amount of supporting subsidies, self-consumption becomes very important factor in planning the PV system.

Furthermore, changes in the way that the energy market is selling and buying electrical energy are not to be underestimated. When net-billing was introduced, prosumers bought energy at a fixed rate and sold electrical energy at the average wholesale price from the previous month [40]. However, the settlement with an electrical company became more complicated due to freezing energy prices for households depending on their yearly energy demand and whether a family has more than two children. For a family with two children and a lower energy demand limit, the energy price is reduced to 0.21 EUR/kWh, and the energy limit is 3 MWh/year. When the energy demand exceeds this limit, the price rises to 0.47 EUR/kWh. For larger families, the energy limit is 4 MWh/year [41]. The Polish government has introduced these regulations on an interim basis in response to the elevated cost of energy.

In the near future (1 July 2024), the energy prices are going to be released for prosumers and the energy prices will be determined by a market with an hourly step [41]. This change would have a great effect on the cost effectivity of photovoltaic systems. The question is crucial for both existing prosumers and future investors. Therefore, in this article, all the possibilities related to both auto-consumption and the changing regulations for current and future electricity billing were considered. Also, the financial supporting program as well as the possibility of energy storage installation were taken into account. Energy storage system increases energy auto consumption but at the same time significantly increases the price of investment. On the other hand, because the policy of the Polish government is to support energy self-consumption, one can obtain higher reimbursement from the government supporting program. Given all the changing factors in a photovoltaic market, changing energy law, and changing model of surplus energy sale, it is very hard for investors to establish whether the investment in photovoltaics is still profitable. All possible options for present and future models of financial settlement with energy provider were considered in order to systematize given possibilities and analyze their influence on the profitability of the investment.

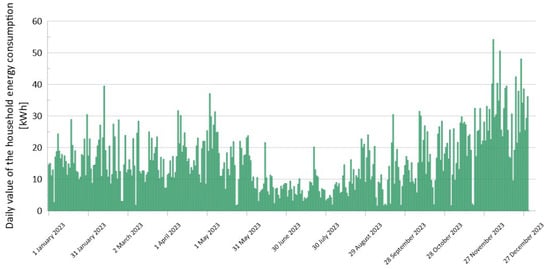

Simulations of different scenarios were performed in PVsyst software that enabled the acquirement of very detailed and reliable results based on a specific meteorological data, 3D scene, energy demand profiles, and different financial models. In order to make the simulations more reliable, standard households located in the southeast of Poland were taken into account. The yearly energy demand profile (Figure A1) was measured with a 15 min step and introduced to the PVsyst software. This detailed data enabled a precise calculation of the self-consumption parameter, which is crucial in terms of profitability and sustainable energy usage.

In the face of changing renewable energy legislation as well as electrical energy market, the results of the presented analysis would be helpful for a present and future prosumers and could be a good starting point for the investors that want to invest in photovoltaics and are faced with the choice of a specific technological solution. Also, the results may lead to conclusions as to whether PV support schemes will really be able to encourage investors to turn to the technologies that favor self-consumption.

2. Materials and Methods

In order to compare different scenarios, a standard photovoltaic installation was designed with a power sufficient to balance yearly household energy needs. This parameter was established on the basis of the real houses located on the southeast part of Poland in Lublin. Measurements of energy needs were extracted from the Solar Edge Energy Meter with Modbus connection installed in 2020. The measurements are made with a 15 min step and, for the analysis, year 2023 was taken into account. The annual energy required to power the considered house in 2023 was approximately 5.74 MWh. On the basis of this assumption, it is proposed that a photovoltaic installation with a nominal power of 5.2 kWp was designed and introduced to the simulations. The PV system was based on the middle-range silicon monocrystalline Longi Green Energy Technology (China)module (LR6-72 PH 370M), which is popular in Poland. The Fronius inverter model Symo 4.5-3-S (Austria) was selected as the optimal choice. The inverter is characterized with 4.5 kW nominal power and one maximal power point tracker (MPPT) which enables photovoltaics to produce maximal possible power under the given insolation and temperature conditions.

In order to concentrate on the elements of fluctuating electricity billing conditions in Poland and the various subsidy options, the designed photovoltaic installation is relatively straightforward. In total, 14 modules were connected to the inverter MPPT in one string, which gave total nominal PV power of 5.18 kWp. This is 15% more than the nominal power of the inverter, but it does not generate any overload losses.

In order to acquire reliable simulation results, all required data were introduced to the PVsyst software:

- Meteorological data for Lublin in Poland—Meteonorm 8.0 [42];

- Azimuth angle—0°, modules facing south direction;

- Tilt angle—30°;

- In order to obtain shadow impact information, 3D scene was built;

- All the electrical and mechanicals parameters concerning modules, inverters, and electrical circuits;

- Aging effects based on the Longi Solar datasheet for LR6-72 PH 370M module;

- For the scenarios with the energy storage (hybrid system), a battery LG RESU 13 12.4 kWh (South Korea) was chosen;

- Profile of the user electrical energy needs in 15 min measurement step for year 2023 (Figure A1);

- The anticipated lifespan of the installation was 25 years;

- The anticipated lifespan of the batteries was 10 years.

- As the simulations included a standard rooftop PV installation, no maintenance costs were considered. All financial parameters depended on the examined scenario.

Following scenarios for a given household were taken into account:

- Scenario 1

Scenario 1 is based on the current regulations governing the billing of prosumers in Poland.

Buying electrical energy: The electric energy prices for prosumers are frozen to the 3 MWh/year limit when one has a family with two or fewer children and the cost of electrical energy is 0.21 EUR/kWh. When the 3 MWh limit is exceeded, the price of the electricity increases to 0.42 EUR/kWh. The 3 MWh/year limit changes to 4 MWh/year when a family has three or more children. The energy prices are the same in both cases.

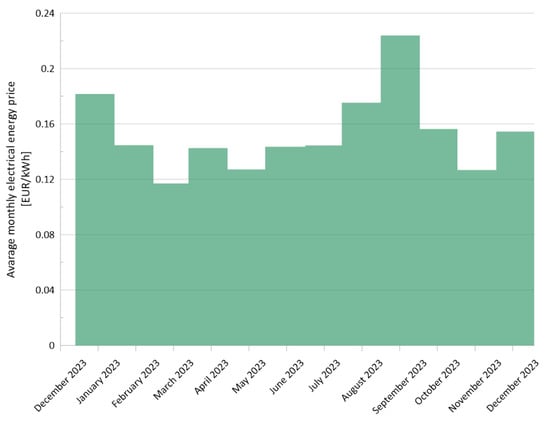

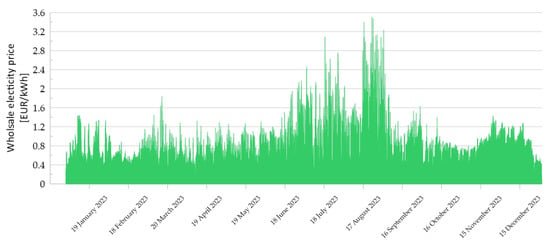

Selling electrical energy: wholesale price of the electrical energy from a previous month (Figure A2).

- Scenario 2

Scenario 2 is similar to scenario 1 but without the help of Polish government lowering the costs of the electrical energy.

Buying electrical energy: The electric energy price is fixed at 0.42 kWh.

Selling electrical energy: wholesale price of the electrical energy from a previous month (Figure A2).

- Scenario 3

The third scenario is based on the directive of the UE [43] stating that electricity prices should be liberalized and electricity will be billed in an hourly step for consumers as well as for prosumers.

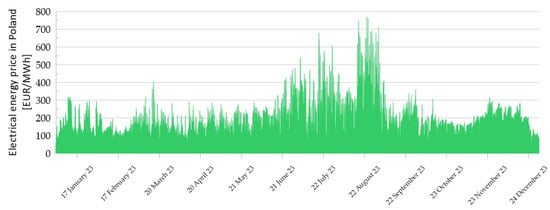

Buying electrical energy: The electric energy price is established in an hourly step. Figure A3 shows change in the electrical energy price in Poland in 2023.

Selling electrical energy: Electrical energy is sold at a wholesale price established at an hourly step (Figure A4).

- Scenario 4

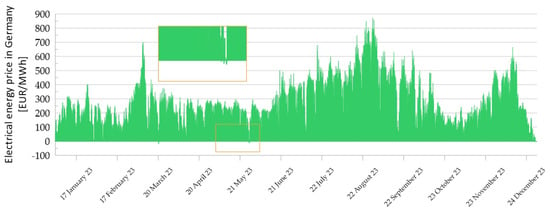

The fourth scenario is based on the settlement method from scenario three, but the hourly profiles of changing electricity prices are from Germany in 2023 [44]. This is because Germany has a significant proportion of renewable energy in its energy balance, at around 63.3% [45]. As previous years have shown, this has a significant impact on energy prices. With the increasing share of renewable energy sources in Poland, it can be assumed that in a few years’ time, electricity prices will be changing similarly to those in Germany. It is worth mentioning that in Germany, the market prices of electricity in the situations characterized by high irradiation and favorable wind conditions can reach zero EUR per kWh, or even have negative values (Figure A5).

Furthermore, all the scenarios include an option with or without an energy storage system (hybrid system), as well as the option of additional financing through the “Moj Prad 5.0” program. The “Moj Prad” subsidy program favors PV systems with energy storage, an investor with an energy storage system may be eligible for a subsidy of EUR 5260, while a standard PV installation is eligible for a subsidy of EUR 1320. In both cases, the amount of the grant may not exceed 50% of the eligible costs [39].

In order to establish the price of the analyzed PV instalation, an avarage price for a standard PV system and a system with an energy storage was taken from [18]. The prices of the PV systems as well as electric energy were changed from PLN to EUR at an avarage exchange rate from 2023 (1 EUR = 4.5437 PLN) [46].

Analyzed Parameters

All the technical data and financial options were introduced to the PVsyst software, and simulations were performed for each scenario. PVsyst provides information about various parameters characterizing PV systems in an hourly step during the entire year. The following parameters were taken into account during the analysis:

EP—represents the yearly electrical energy production by PV.

Eneed—represents the yearly electrical energy needs of prosumers.

EGRID—represents the electrical energy that was provided to a user from the electrical grid.

ESC—represents the electrical energy that comes from the photovoltaic system and is used in the household (self-consumption).

EPV-GRID—represents the electrical energy injected into the electrical grid.

SC—represents the self-consumption parameter, defined by (1).

The financial parameters that were analyzed are as follows:

IRR—internal rate of return [47], it is financial parameter which helps to establish whether an investment is profitable in a given period of time. The higher value of this parameter, the better for the investor.

ROI—return of investment is defined as a ratio between net income (NI) over the given period and investment costs (IC) (2).

Payback period—the period of time following the implementation of a given investment, during which the total net benefits of the investment will cover the expenditure incurred for its implementation. The amount recovered for year X is calculated by the Formula (3):

Recovered amount for year X = Net balance of year X + Self-consumption saving for year X + Redemption part of the loan for year X

For the sake of simplicity, it was assumed that the investment costs are covered by the investor, which implies that the redemption part of the loan each year is EUR 0.

3. Results and Discussion

On the basis of all the analyzed data extracted from simulations the results for different scenarios were compered.

3.1. Photovoltaic System Performance

At the beginning, the parameters connected with PV system performance were analyzed (Table 1). There are two different cases that apply to all scenarios: one option is the system without an energy storage, whilst the second option implies the utilization of energy storage system.

Table 1.

Main performance parameters of the designed PV system for the considered household.

The designed PV system with a nominal power of 5.2 kWp had an energy production of 5.6 MWh during one year (specific production 1089 kWh/kWp/y). This parameter matches the yearly energy needs of the household. When analyzing Table 1, one can clearly see that investing in energy storage system will increase the energy self-consumption by a factor of 2, from 28.6% to 60.4%. Moreover, by carefully analyzing the data distribution above for each day and month, it can be seen that these parameters change according to the season (Figure 2).

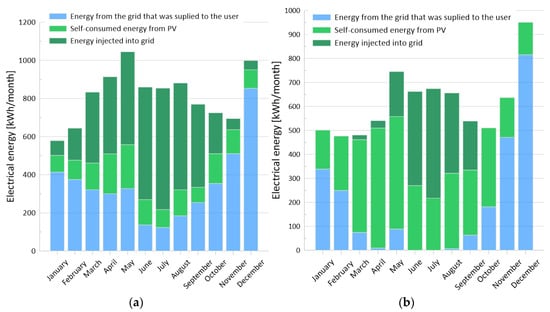

Figure 2.

Monthly energy distribution for the considered household without energy storage (a) and with energy storage system (b).

Also, the energy storage system has a significant influence on the SC value. A PV system without energy storage is characterized by SC value changing from 38% to 68% during winter months and from 13% to 34% during spring and summer months (Figure 2a). However, the household that contains the energy storage has the SC value from 32% in July to even 100% during winter months. During June and July, the household does not require any electrical energy from the grid, so all the energy comes from the photovoltaic system (Figure 2b). Moreover, 59% of the produced energy in June and 68% in July is injected into the electrical grid. Detailed energy distribution during two characteristic months (January and June) are shown in Figure 3 and Figure 4. These two months are representative of the winter and summer seasons.

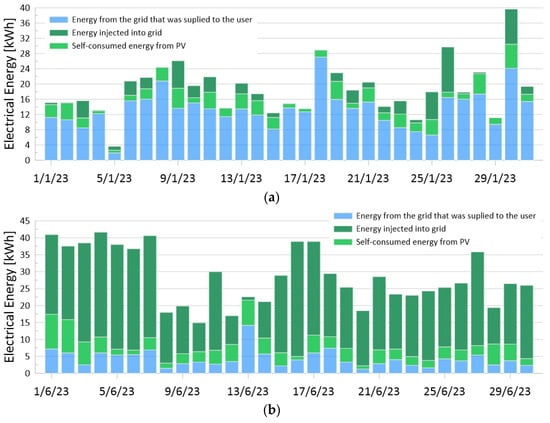

Figure 3.

Daily energy distribution for the considered household without the energy storage during January (a) and June (b).

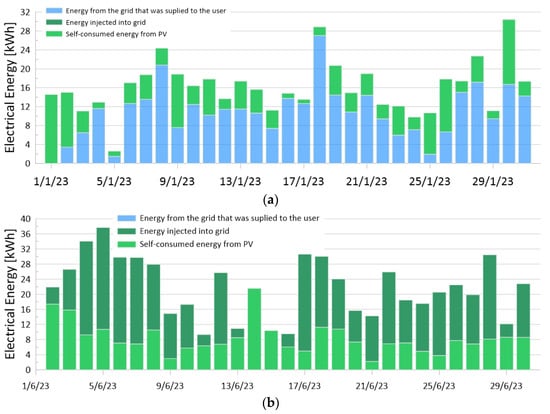

Figure 4.

Daily energy distribution for the considered household with the energy storage during January (a) and June (b).

When analyzing Figure 3 and Figure 4, it is clear that the energy distribution profiles are different during the winter and summer months. In winter, the energy production is low and a significant amount of the produced energy is used within the household (Figure 3a and Figure 4a). During the summer months, when photovoltaic energy production is at its highest, a considerable quantity of the generated energy is injected into the grid (Figure 3b). Storage system significantly changes the energy distribution profiles (Figure 4a,b). In January (Figure 4a), all the produced energy is stored and used to power all of the households. Conversely, the photovoltaic system is insufficient to ensure energy stability, with a considerable portion of electricity imported from the grid. An opposite situation is observed during the summer months. The energy production capacity is sufficient to provide 100% of the power supply for the household, with the surplus being fed into the electricity grid. Therefore, the household is capable of satisfying its own electricity requirements independently (Figure 4b).

These profiles (Figure 3 and Figure 4) show that under the Polish conditions, relying only on the photovoltaic system, even with an energy storage, is challenging. During the winter months there is not enough solar irradiation, but in contrast, the amount of solar energy during the summer months is much higher than the household needs. During the designing process, one has to balance these two opposite cases in order to have a sustainable PV system with an energy storage.

The presented results for the system with the batteries are consistent with other recent publications that present the influence of the energy storage in PV system under Polish conditions [48].

3.2. Financial Parameters

Nowadays, when electrical energy prices are rising, a lot of consumers are considering installing photovoltaics in order to balance their energy needs. The principal motivation to engage in photovoltaic investment is the potential to curtail electricity expenditure. However, in order for photovoltaics to be a financially prudent venture in the long term, several factors need to be taken into account, including the length of time until payback, the internal rate of return (IRR) and the return on investment (ROI). The cost of investments was determined on the basis of average prices for the 5.2 kWp PV system with or without energy storage [6]. The average price for the standard PV system characterized by 5.2 kWp nominal power is EUR 6 420. A comparable installation, including an energy storage system, would cost approximately EUR 13 022 in 2023. Therefore, it is clear that the incorporation of energy storage into a system results in a doubling of the initial investment costs.

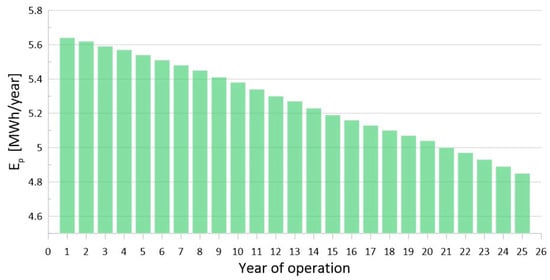

All the parameters describing the financial situation for each of the considered scenarios were introduced to PVsyst software. Furthermore, the impact of PV modules aging on the financial parameters was considered. This is significant because PV modules will inevitably experience a slight decline in performance over time. This would result in an annual increasing current mismatch in the string, which would have an influence on the energy produced by the system each year. The results are presented in Figure 5, which illustrates the changing energy production of the PV installation over a 25-year period. After introducing all required parameters, simulations were performed. Financial results were extracted and presented in Table 2, Table 3, Table 4 and Table 5.

Figure 5.

Changing energy production of the PV system over 25-year period due to the PV modules aging and resulting string mismatch process.

Table 2.

The financial parameters for a photovoltaic system that has been accounted for under scenario 1.

Table 3.

The financial parameters for a photovoltaic system that has been accounted for under scenario 2.

Table 4.

The financial parameters for a photovoltaic system that has been accounted for under scenario 3.

Table 5.

The financial parameters for a photovoltaic system that has been accounted for under scenario 4.

As presented in Table 2, scenario 1 which reflects the current energy market situation for prosumers, the profitability of the system without energy storage is at an acceptable level for both energy limits. The payback period without any additional financing is around 6.5 years and with additional financing is around 5.5 years. The IRR and ROI parameters also show that the investment in standard PV system would be profitable even without any subsidy. However, the situation with energy storage is quite the opposite. The payback period with no additional financing is more than 13 years and even with the “Mój Prad” subsidy, it reaches 8 years. Considering the 10-year lifespan of the energy storage system, such an investment may be unacceptable. After 10 years, the prosumer would have to change the battery set, which represents a significant proportion of the costs.

Table 3 presents the results for scenario 2, in which the prosumer purchases electrical energy at a constant rate of 0.42 EUR/kWh. Consequently, the self-consumption savings are also equal to 0.42 EUR/kWh. Furthermore, the prosumer sells the electrical energy at a wholesale price from a previous month. It is also noteworthy that there are no energy usage limits as a form of subsidy for households. In this scenario, due to the high self-consumption savings and high self-consumption parameter, a system with the energy storage becomes more profitable compared to scenario 1.

Even in the absence of additional financing, the payback period is shorter than in scenario 1 with subsidy. When the “Moj Prad” subsidy is considered, the payback period is found to be even shorter, with the difference between the system with and without energy storage being only one year. Also, the IRR and ROI parameters show that investing in photovoltaics with energy accounting according to scenario 2 is beneficial for both traditional installations and the installations with energy storage.

Another scenario for which the financial results are shown in Table 4 and is based on the assumption that the energy prices in Poland will be freed as in the Netherlands or in Germany, for example. The electrical energy produced by prosumers will be bought by a provider with a one hour step with a wholesale price which is on average half the retail price. The hourly energy price profiles were derived from the data collected in 2023. A detailed examination of the results for this scenario, as presented in Table 4, reveals the following: it is evident that without a subsidy, investing in energy storage is futile, as the payback period is 13 years, whereas for the system without energy storage, it is 7.7 years. Furthermore, the IRR and ROI parameters confirm the soundness of the investment in the system without energy storage. The situation changes when subsidy is taken into account. The subsidy for the energy storage is much higher compared to the subsidy for a standard PV system; moreover, self-consumption for the system with the energy storage is twice as high, thus the self-consumption savings would be much higher. These factors make a subsidized energy storage system viable. The payback period is 7.7 years, whereas for the system without energy storage, it is only 1.3 year shorter.

The last scenario is based on the assumption that Poland is pursuing a share of renewable energy in its energy mix in accordance with the European Union’s guidelines. Consequently, it can be postulated that the energy mix on the market will undergo a comparable transformation in the future, akin to the changes currently underway in Germany. For the simulations, wholesale electrical energy prices in German market in hourly step from 2023 were introduced to PVsyst in order to analyze profitability of the PV investment. The financial results are shown in Table 5.

Given the significant impact of renewable energies on the price profile of electricity and the negative values associated with it, one might be led to believe that the profitability of photovoltaics would be less favorable than in previous cases. This appears not to be the case here. The values of IRR and ROI clearly show that investment in PV can be a prudent decision. The payback period even without additional financing and with energy storage would be shorter than 7 years. With the subsidy program, the difference between the system with or without energy storage is shorter than 10 months, and it is 3.1 years and 3.9 years with energy storage. These values are more than acceptable in terms of investment, even the system with the energy storage with a 10-year lifespan of the battery becomes an interesting option.

4. Conclusions

The main motivation for carrying out the analysis above was the changing legislation on electricity billing for both consumers and prosumers who produce energy. Changing billing conditions with the energy supplier will also change the profitability of existing as well as emerging PV installations. This kind of analysis has not yet been conducted, and the results could be of interest to both present and future prosumers. Since the Polish government introduced the “Moj Prad” subsidy program, which provides a different degree of subsidy depending on the scheme supporting self-consumption, the viability of PV installations with energy storage is also worthy of consideration.

A standard household located in Southeastern Poland was taken into account. The yearly energy demand was balanced with designed PV installation and two options were introduced to simulation software—one system consists of an inverter and PV modules, while the other additionally contains energy storage. Furthermore, four scenarios were analyzed, each representing a distinct situation related to the settlement of purchased and sold electrical energy. The prospective amendments to Polish energy legislation will introduce a new pricing structure for the purchase of electrical energy. Instead of a fixed rate, the price will fluctuate on an hourly basis. The impact of this change on the financial parameters of PV systems was also investigated.

According to the performance simulations (Table 1, Figure 2, Figure 3 and Figure 4), the presence of the energy storage significantly changes distribution of produced energy. On a yearly scale, it doubles the self-consumption of electrical energy. During the winter months, all of the produced energy is consumed but the irradiation is not enough to balance all energy demand. Thus, a significant amount of electrical energy has to be imported from the electrical grid. During the summer months, the irradiation is high enough to provide power to supply household demands and all the surplus energy is sold to the energy provider. As one can conclude, the considerable annual fluctuations in solar radiation in Poland make the selection of an appropriate PV system with energy storage a challenging task.

The financial parameters presented in Table 2, Table 3, Table 4 and Table 5 show that in all the considered cases, a standard PV system is profitable, the payback period varies from 7.7 years to 3.8 years without any subsidies. Also, taking into account the IRR and ROI parameters as well as the 25 years of the PV system lifespan, investing in photovoltaics would be still a good idea. Under recent legislation conditions (scenario 1) the system with an energy storage is not profitable even with the “Moj Prad” subsidy. This is due to the fact that cost of the system with batteries is twice as high as for the system without the energy storage. Furthermore, in this scenario, the savings from self-consumption do not offset the investment costs associated with purchasing batteries. In the second scenario, the situation changes when additional investment funding is taken into account. The system with energy storage becomes profitable due to the higher energy prices and the resulting savings from electrical energy self-consumption.

In scenario 3, where the energy prices in Poland are accounted for on an hourly basis, the system with an energy storage solution, as in scenario 1, would be unprofitable even with a subsidy. With a battery’s life span of 10 years, a payback time of 7.7 years becomes questionable. An hourly changing price of the electrical energy was also introduced in scenario 4, but the profile of changing prices was taken from a German market. This was carried out due to the fact that Germany has a high proportion of renewable sources in its energy mix, and Poland will have to meet similar standards in future due to EU regulations. When introducing German energy profiles, all the considered cases become profitable even without subsidies. With additional financing, the payback period for the system with the energy storage is shorter than 4 years.

The results presented for the system with the energy storage are not promising under the current accounting scheme, which may discourage investors from investing in such installations. Nevertheless, recent regulatory changes have created an opportunity for further development of PV systems in Poland, even in the batteries. Such installations would have a significant environmental and economic impact, leading to the sustainable use of electricity. This would assist in reducing the expenditure on electrical energy, while also reducing the overloading of the electrical grid, which is a common problem in Poland. The high self-consumption parameter will result in a decrease in the demand for electricity from the grid, which will subsequently lead to a reduction in carbon dioxide emissions from the combustion of fossil fuels in conventional power plants. The analysis presented was conducted in accordance with the specific conditions of Poland. However, the resulting conclusions can be successfully extended to other countries where renewable energy sources play or will play a dominant role in energy mix.

Funding

This research was supported by the statutory funds granted to the Faculty of Environmental Engineering, Lublin University of Technology, Poland by the Polish Ministry of Science and Higher Education internal grant number FD-006.

Data Availability Statement

Data is contained within the article.

Acknowledgments

The author would like to express gratitude to Michal Wiackowski of Solsystem Sp. Z o.o. for providing data regarding energy user needs for the considered building.

Conflicts of Interest

The author declares no conflicts of interest.

Abbreviations

| PV | Photovoltaics |

| SC | Self-consumption parameter |

| IRR | Internal rate of return |

| ROI | Return on investment |

| NI | Net income |

| IC | Investment costs |

| Payback Period | The period of time following the implementation of a given investment, during which the total net benefits of the investment will cover the expenditure incurred for its implementation |

| Symbols | |

| EP | Yearly electrical energy production by PV |

| Eneed | Yearly electrical energy needs of prosumers |

| EGRID | Electrical energy that was provided to a user from the electrical grid |

| ESC | Electrical energy that comes from the photovoltaic system and is used in the household (self-consumption) |

| EPV-GRID | Electrical energy injected into the electrical grid. |

Appendix A

Figure A1.

Daily energy consumption in 2023 of the considered household.

Figure A2.

Average monthly price for electrical energy in 2023 in Poland.

Figure A3.

Hourly profile of the retail electricity prices in Poland during 2023.

Figure A4.

Hourly profile of the wholesale electricity prices in Poland during 2023.

Figure A5.

Hourly profile of the wholesale electricity prices in Germany during 2023. The loupe shows electric prices below 0 EUR.

References

- Svazas, M.; Bilan, Y.; Navickas, V. Research Directions of the Energy Transformation Impact on the Economy in the Aspect of Asset Analysis. Sustainability 2024, 16, 2556–2577. [Google Scholar] [CrossRef]

- Lei, H.; Xu, W. How does the transformation of the energy structure impact the coordinated development of economy and environment? Environ. Sci. Pollut. Res. 2023, 30, 112368–112384. [Google Scholar] [CrossRef]

- Swain, R.B.; Karimu, A.; Gråd, E. Sustainable development, renewable energy transformation and employment impact in the EU. Int. J. Sustain. Dev. World Ecol. 2022, 29, 695–708. [Google Scholar] [CrossRef]

- Zamfir, A.I.; Croitoru, E.O.; Burlacioiu, C.; Dobrin, C. Renewable Energies: Economic and Energy Impact in the Context of Increasing the Share of Electric Cars in EU. Energies 2022, 15, 8882. [Google Scholar] [CrossRef]

- Chomać-Pierzecka, E.; Rogozińska-Mitrut, J.; Różycka, M.; Soboń, D.; Stasiak, J. Energy Innovation for Individual Consumers in Poland—Analysis of Potential and Evaluation of Practical Applications in Selected Areas. Energies 2023, 16, 5766. [Google Scholar] [CrossRef]

- Biswas, S. Optimal investment policy in sharing and standalone economy for solar PV panel under operational cost. Sol. Energy 2023, 264, 112003. [Google Scholar] [CrossRef]

- De Groote, O.; Gautier, A.; Verboven, F. The political economy of financing climate policy—Evidence from the solar PV subsidy programs. Resour. Energy Econ. 2024, 77, 101436. [Google Scholar] [CrossRef]

- Rydehell, H.; Lantz, B.; Mignon, I.; Lindahl, J. The impact of solar PV subsidies on investment over time—The case of Sweden. Energy Econ. 2024, 133, 107552. [Google Scholar] [CrossRef]

- Hagerman, S.; Jaramillo, P.; Granger Morgan, M. Is rooftop solar PV at socket parity without subsidies? Energy Policy 2016, 89, 84–94. [Google Scholar] [CrossRef]

- Dong, C.; Zhou, R.; Li, J. Rushing for subsidies: The impact of feed-in tariffs on solar photovoltaic capacity development in China. Appl. Energy 2021, 281, 116007. [Google Scholar] [CrossRef]

- Benalcazar, P.; Kalka, M.; Kamiński, J. From consumer to prosumer: A model-based analysis of costs and benefits of grid-connected residential PV-battery systems. Energy Policy 2024, 191, 114167. [Google Scholar] [CrossRef]

- Chen, Q.; Kuang, Z.; Liu, X.; Zhang, T. Application-oriented assessment of grid-connected PV-battery system with deep reinforcement learning in buildings considering electricity price dynamics. Appl. Energy 2024, 364, 123163. [Google Scholar] [CrossRef]

- Shboul, B.; Zayed, M.E.; Ashraf, W.M.; Usman, M.; Roy, D.; Irshad, K.; Rehman, S. Energy and economic analysis of building integrated photovoltaic thermal system: Seasonal dynamic modeling assisted with machine learning-aided method and multi-objective genetic optimization. Alex. Eng. J. 2024, 94, 131–148. [Google Scholar] [CrossRef]

- Shboul, B.; Zayed, M.E.; Tariq, R.; Ashraf, W.M.; Odat, A.; Rehman, S.; Abdelrazik, A.S.; Krzywanski, J. New hybrid photovoltaic-fuel cell system for green hydrogen and power production: Performance optimization assisted with Gaussian process regression method. Int. J. Hydrog. Energy 2024, 59, 1214–1229. [Google Scholar] [CrossRef]

- Brown, P.R.; Williams, T.; Brown, M.L.; Murphy, C. System-cost-minimizing deployment of PV-wind hybrids in low-carbon U.S. power systems. Appl. Energy 2024, 365, 123151. [Google Scholar] [CrossRef]

- Salau, A.O.; Maitra, S.K.; Kumar, A.; Mane, A.; Dumicho, R.W. Design, modeling, and simulation of a PV/diesel/battery hybrid energy system for an off-grid hospital in Ethiopia. e-Prime Adv. Electr. Eng. Electron. Energy 2024, 8, 100607. [Google Scholar] [CrossRef]

- Kurz, D.; Nowak, A. Analysis of the Impact of the Level of Self-Consumption of Electricity from a Prosumer Photovoltaic Installation on Its Profitability under Different Energy Billing Scenarios in Poland. Energies 2023, 16, 946. [Google Scholar] [CrossRef]

- Institute for Renewable Energy. Photovoltaic Market in Poland. 2024. Available online: https://ieo.pl/raport-rynek-fotowoltaiki-w-polsce-2024 (accessed on 17 June 2024).

- Parra-Domínguez, J.; Sánchez, E.; Ordóñez, Á. The Prosumer: A Systematic Review of the New Paradigm in Energy and Sustainable Development. Sustainability 2023, 15, 10552. [Google Scholar] [CrossRef]

- Santa, A.-M.I. Prosumers—A New Mindset for Citizens in Smart Cities. Smart Cities 2022, 5, 1409–1420. [Google Scholar] [CrossRef]

- Gržanić, M.; Capuder, T.; Zhang, N.; Huang, W. Prosumers as active market participants: A systematic review of evolution of opportunities, models and challenges. Renew. Sustain. Energy Rev. 2022, 154, 111859. [Google Scholar] [CrossRef]

- Sharma, T.; Kanwar, N.; Sharma, M.K. Net metering from smart grid perspective. In Proceedings of the A Two-Day Conference on Flexible Electronics for Electric Vehicles, Jaipur, India, 5–6 March 2020. [Google Scholar]

- Act of 20 February 2015 on Renewable Energy Sources (In Polish: Ustawa z Dnia 20 Lutego 2015 r. o Odnawialnych ´Zródłach Energii (Dz.U. 2015, poz. 478)). Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20150000478/T/D20150478L.pdf (accessed on 17 June 2024).

- Malciak, M.; Nowakowska, P. Zmiany w Funkcjonowaniu i Zasadach Rozliczania Fotowoltaika. Nowa Energ. 2021, 5–6, 81. [Google Scholar]

- Cieślak, K.J. Multivariant Analysis of Photovoltaic Performance with Consideration of Self-Consumption. Energies 2022, 15, 6732. [Google Scholar] [CrossRef]

- Dufo-López, R.; Bernal-Agustín, J.L. A comparative assessment of net metering and net billing policies. Study cases for Spain. Energy 2015, 84, 684–694. [Google Scholar] [CrossRef]

- Ordóñez, Á.; Sánchez, E.; Rozas, L.; García, R.; Parra-Domínguez, J. Net-metering and net-billing in photovoltaic self-consumption: The cases of Ecuador and Spain. Sustain. Energy Technol. Assess. 2022, 53, 102434. [Google Scholar] [CrossRef]

- Bertsch, V.; Geldermann, J.; Lühn, T. What drives the profitability of household PV investments, self-consumption and self-sufficiency? Appl. Energy 2017, 204, 1–15. [Google Scholar] [CrossRef]

- Luthander, R.; Widén, J.; Nilsson, D.; Palm, J. Photovoltaic self-consumption in buildings: A review. Appl. Energy 2015, 142, 80–94. [Google Scholar] [CrossRef]

- Villar, C.H.; Neves, D.; Silva, C.A. Solar PV self-consumption: An analysis of influencing indicators in the Portuguese context. Energy Strategy Rev. 2017, 18, 224–234. [Google Scholar] [CrossRef]

- Barzegkar-Ntovom, G.A.; Chatzigeorgiou, N.G.; Nousdilis, A.I.; Vomva, S.A.; Kryonidis, G.C.; Kontis, E.O.; Georghiou, G.E.; Christoforidis, G.C.; Papagiannis, G.K. Assessing the viability of battery energy storage systems coupled with photovoltaics under a pure self-consumption scheme. Renew. Energy 2020, 152, 1302–1309. [Google Scholar] [CrossRef]

- Muñoz-Rodríguez, F.J.; Jiménez-Castillo, G.; de la Casa Hernández, J.; Aguilar Pena, J.D. A new tool to Analysing photovoltaic self-consumption systems with batteries. Renew. Energy 2021, 168, 1327–1343. [Google Scholar] [CrossRef]

- Gulkowski, S. Specific Yield Analysis of the Rooftop PV Systems Located in South-Eastern Poland. Energies 2022, 15, 3666. [Google Scholar] [CrossRef]

- Khatib, T.; Deria, R. East-west oriented photovoltaic power systems: Model, benefits and technical evaluation. Energy Convers. Manag. 2022, 266, 115810–115825. [Google Scholar] [CrossRef]

- Pater, S. Increase of energy self-consumption in hybrid RES installations with PV panels and air-source heat pumps. Chem. Process Eng. New Front. 2023, 44, e43. [Google Scholar] [CrossRef]

- Pijarski, P.; Kacejko, P. Elimination of Line Overloads in a Power System Saturated with Renewable Energy Sources. Energies 2023, 16, 3751. [Google Scholar] [CrossRef]

- Reibsch, R.; Blechinger, P.; Kowal, J. The importance of battery storage systems in reducing grid issues in sector-coupled and renewable low-voltage grids. J. Energy Storage 2023, 72 Pt. E, 108726. [Google Scholar] [CrossRef]

- Kurz, D. Analiza możliwości zarządzania i rozdziału energii elektrycznej, wyprodukowanej w prosumenckiej instalacji fotowoltaicznej, w budynku z automatyką budynkową. Przegląd Elektrotechniczny 2022, 1, 259. [Google Scholar] [CrossRef]

- Mój Prąd. Program Dofinansowania Mikroinstalacji Fotowoltaicznych. Available online: https://mojprad.gov.pl/nabor-v (accessed on 17 June 2024).

- Ministry of Climate and Environment Republic of Poland. Nowe Zasady Rozliczen Prosumentów od 2022 r. Available online: https://www.gov.pl/web/klimat/nowy-system-rozliczania-tzw-net-billing (accessed on 17 June 2024).

- Act of 16 August 2023 On Amending the Act on Special Solutions for the Protection of Electricity Consumers in 2023. (In Polish: Ustawa z Dnia 16 Sierpnia 2023 r. o Zmianie Ustawy o Szczególnych Rozwiązaniach Służących Ochronie Odbiorców Energii Elektrycznej w 2023 Roku w Związku z Sytuacją na Rynku Energii Elektrycznej Oraz Niektórych Innych Ustaw (Dz.U. 2023, poz. 1785)). Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20230001785/O/D20231785.pdf (accessed on 17 June 2024).

- Available online: https://meteonorm.com/en/ (accessed on 18 June 2024).

- Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on Common Rules for the Internal Market for Electricity and Amending Directive 2012/27/EU. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32019L0944 (accessed on 17 June 2024).

- SMARD Market Data. Available online: https://www.smard.de/en/downloadcenter/download-market-data/ (accessed on 18 June 2024).

- Fraunhofer ISE Photovoltaics Report. Available online: https://www.ise.fraunhofer.de/en/publications/studies/photovoltaics-report.html (accessed on 18 June 2014).

- Ministry of Finance Republic of Poland. Available online: https://www.gov.pl/web/finanse/srednie-arytmetyczne (accessed on 18 June 2024).

- Kellison, S.G. The Theory of Interest, 3rd ed.; McGraw-Hill Irwin: Boston, MA, USA, 2009. [Google Scholar]

- Lis, M.; Antonov, V.; Olczak, P. Hybrid photovoltaic and energy storage system in order to enhance self-consumption energy—Poland case study. J. Energy Storage 2024, 91, 112096. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).