1. Introduction

Energy consumption constitutes a fundamental component of contemporary economies, being involved in the matrix of residential needs [

1,

2], industrial functionality [

3,

4,

5], and macroeconomic dynamics [

6,

7]. The significance of energy consumption exceeds its utilitarian value, emerging as a key factor influencing a nation’s economic robustness [

8], environmental protection [

9], and general resident well-being, including functional [

10], visual [

11,

12], and thermal comfort [

13]. In the face of escalating global energy requisites, driven by politics [

14], demographic expansion [

15], and economic progression [

16], the necessity for efficient energy utilization and a paradigmatic shift towards renewable energy sources has gained extraordinary importance. This compulsion not only visualizes the improvement of harmful climatic change phenomena, but also aims at strengthening energy sovereignty [

14], weakening dependence on exhaustible resources, and stimulating sustainable growth trajectories [

17]. Within this broad context, the substantial discussion on energy utilization consequences covers a complex range of challenges related to energy frameworks that are sustainable, efficient, and innovative from a variety of real estate market efficiency economic perspectives. A significant scientific problem within this scope, especially in terms of residential real estate markets, relates to information asymmetry between sellers and buyers concerning energy performance and costs [

18]. As underlined by Bilyay-Erdogan, companies might have more information than investors about the energy efficiency of a property, which can lead to market inefficiencies if not properly disclosed or understood by potential investors [

19]. Another challenge underlined in the current state-of-the-art literature is the accuracy of energy-efficient feature estimation within the real estate market [

20]. The difficulty in quantifying the financial benefits of energy efficiency and reflecting this in the value of sustainable properties (as introduced by Walacik et al.) can lead to the underestimation of energy-efficient properties’ values [

21]. In this regard, developing accurate predictive models that can forecast long-term energy costs and savings for different types of properties also remains a complex problem [

22,

23]. These models need to account for fluctuating energy prices, changes in technology, and variations in property use [

24]. Most studies concentrate on modelling and forecasting energy consumption from methodological [

25] and informative [

26,

27,

28] perspectives. According to Tanveer, the reason for this is that “(…) energy consumption models play an integral part in energy management and conservation (…)” these can “(…) assist in evaluating building energy efficiency, in carrying out building commissioning, and in identifying and diagnosing building system faults” [

29]. Abbasabadi adds that “urban energy use modeling is important for understanding and managing energy performance in cities (…)”, but unfortunately “there is a lack of an integrated approach for modeling and analyzing different components of urban energy use” [

30]. One of the components in the identified research gap that needs deeper investigation is the impact of characteristics and energy costs on the functioning of the real estate market itself, including its efficiency. This conclusion motivated the authors of this paper to articulate the following main research aim: providing a methodology to enable the identification of the influence of building energy performance on real estate market efficiency via the lens of property maintenance costs. Considering the fact that real estate market efficiency encompasses phenomena of dynamic character, the research empirical strategy required the formulation of additional specific research questions (SQ) that were the subject of further investigation:

SQ1—How does the rise in energy costs determine the efficiency of the real estate market?

SQ2—What is the responsiveness of the real estate market to dynamically rising energy prices?

SQ3—How do property maintenance costs determine the market value of properties?

Addressing the aforementioned scientific problems required the formation of an interdisciplinary methodological architecture. The realization of the assumed research objectives resulted in three scientific contributions. Firstly, the proposed methodology constitutes an original comprehensive solution that enhances both energy performance and market efficiency in the real estate sector. The developed methodology offers a novel, holistic approach to analyze energy and market efficiency in the real estate industry and provides results for decision making towards inefficiency reduction, addressing the “lack of an integrated approach for modeling and analyzing different components of urban energy use” underlined by Abbasabadi. Secondly, the performed research and the conclusions drawn substantially enhance the literature, emphasizing the need for further investigation in this area and the formulation of appropriate housing policies [

31]. Assessing price inefficiencies is important to help investors, real estate analysts, and policymakers better understand market phenomena and make more informed investments and regulatory decisions. Thirdly, the research contributes to a strand of the ESG literature focusing on the significance of sustainable solutions and the consequences of their utilization for residents.

The rest of the paper is structured in the following way:

Section 2 and

Section 3 provide a scientific discussion based on the current state-of-the-art literature, with special respect to the notion of real estate market efficiency and the factors determining it, such as building energy performance.

Section 4 provides a substantial justification for the methodology and enables the identification of the influence of building energy performance on real estate market efficiency, with special respect to necessary data acquisition and preprocessing, as well as the utilization of both modified HO-MAR and random forest algorithms for property market efficiency index estimation. The results of the proposed methodology utilization are presented in

Section 5. This section additionally justifies the sensitivity analysis performance of the formulation of the answers to our specific research questions. The

Section 6 is devoted to discussion and the formulation of final conclusions.

2. Real Estate Market Efficiency—Scientific Problem Indication/What Is the Problem?

The real estate sector constitutes a distinctive segment within both national and global economies. The availability of and inherent lack of precision in property data affect the real estate market and properties, as do the sudden and unpredictable shifts frequently observed in property analyses in different geographic locations.

The main elements within the real estate market (i.e., market subject, market object, and space) combine and condition each other [

32,

33]. The nature of the real estate market and the unpredictability of changes in it, as well as the peculiarities of the market players largely shaping it, mean that all decisions made in the context of real estate are subject to risk and uncertainty, which ultimately affects the efficiency of the real estate market [

34,

35,

36,

37]. The efficiency of the real estate market, from an interpretative perspective, is identified as the ability to achieve specific development goals with the maximum use of available information, maximizing the productivity of individual participants in the market. It refers to the degree to which the market operates efficiently, effectively linking real estate supply and demand and enabling market participants to make rational investment decisions. Efficiency can be evaluated from various perspectives, including the following:

The efficiency of resource allocation and the implementation of investments in line with the location of demand—allocative efficiency;

The state of knowledge of real estate market players about the processes taking place in the market—informational efficiency;

The efficiency and effectiveness of the processes taking place in the market, such as buying, selling, management, etc.—operational efficiency;

The degree to which the market value of real estate is reflected by transaction prices and the adequacy of price changes in relation to the market and economic situation (e.g., price efficiency and market competitiveness)—competitive efficiency [

38].

According to classical theories, in an efficient real estate market, one can assume that the transaction price accurately reflects all the information flowing through the market in both static and dynamic terms. Transaction price constitutes a measure of value; therefore, transaction price quotations are a good signal for capital allocation decisions, compensating for the risk of the investment [

39].

Investor engagement in the real estate market exhibits significant dynamism, and is influenced by the interplay between the real estate sector and other economic spheres such as banking, construction, and finance, along with the unique attributes of real estate that impact investment returns [

40,

41].

The heterogeneity of real estate, the lack of complete information, and the ignorance of this impact on price formation make the real estate market an inefficient one [

33]. This phenomenon has a number of consequences. In particular, the market’s inefficiency affects the valuation process, the formation of transaction prices, and the decision-making process for acquiring real estate. In the context of market mechanisms, the inefficiency in the real estate market can be expressed via the lack of flexible market response to current information on demand, and the failure to reflect current changes in the environment, especially when transaction prices are influenced by unknown circumstances, or factors difficult to predict of a random nature [

36,

39,

42]. Transaction prices, not being a reliable measure of value, do not provide a reliable basis for investment decisions; there are opportunities to earn anomalous returns on real estate investments, but investors’ actions are subject to significant risk.

Efficiency in the real estate market can be increased through various strategies. Among the factors that influence the efficiency of the real estate market are sustainable solutions. Building energy performance is at the center of these solutions.

3. Building Energy Performance

Energy Performance Certification (EPC) is one of the key policy tools adopted throughout the European Union. The EPC serves as an assessment of assets and aims to educate prospective buyers about the inherent energy efficiency of a building and the services it provides. The EPC implementation was imposed by the European Directive, who determined the details of the certification. According to the Directive, an EPC determining a building’s energy performance is required for newly constructed and existing houses, as well as those sold, leased, or undergoing a major renovation (i.e., one where the total cost of renovation work exceeds 25% of the building’s value or the renovation covers more than 25% of the building’s area). Energy Performance Certificates are designed not only to enhance awareness regarding the energy efficiency of buildings and to promote transparency regarding energy usage, but also to provide recommendations. These recommendations, when comprehended and communicated effectively, can significantly impact future investments by identifying the most financially appealing measures for reducing energy consumption [

43,

44]. Several studies have explored how energy performance certificates (EPCs) correlate with house prices.

Building energy performance is a crucial aspect of Environmental, Social, and Governance (ESG) considerations in the real estate sector. The conceptual relation of this is presented in

Figure 1.

According to the Global Sustainable Investment Review [

45], the global adoption of sustainable investing is on the rise. While ESG has long been a focal point for policymakers, institutional investors, and corporations, it is increasingly influencing the investment decisions of individual investors [

46].

Recently, the correlation between Environmental, Social, and Governance (ESG) factors and real estate misvaluation has strengthened, reflecting the growing emphasis on ESG. This heightened relevance is evident in the increased market sentiment towards sustainability, suggesting that the more aware society and investors are of ESG criteria, the more significant the impact of ESG is on misvaluation indicators [

47].

Energy Performance Certificates contain three basic characteristics [

20]:

EU—The annual usable energy demand index which measures the energy required per square meter of a house (kWh/m2·year).

EK—This is the most important energy parameter for a building owner who is concerned about maintenance costs. The EK value determines the amount of energy consumed and, consequently, the amount of bills. It provides data on the energy needed to maintain the right temperature in a building, taking into account any losses in energy generation and heat transmission throughout the building (kWh/m2·year).

EP—The energy obtained directly from natural resources. The annual demand for non-renewable primary energy is a critical indicator for formal purposes as it reflects the building’s compliance with evolving construction laws (kWh/m2·year).

Over the past decade, a substantial collection of real-world data from European housing markets has consistently indicated that energy efficiency influences property prices [

44]. In this context, an important issue is to assess the impact of energy performance parameters not only on the development of property prices and values, but also property market efficiency. For the purposes of this research, this is measured with the following property valuation model accuracy measures: mean absolute percentage error, mean absolute error, and root mean square error.

4. Materials and Methods

The highlighted and formulated scientific problem required the creation of a substantially justified methodological research architecture to enable provisional answers to all of the articulated specific research questions (

Figure 2). The proposed methodology is based on the eight stages below.

4.1. Data Acquisition and Database Creation

The methodical framework required adopting an experimental approach, resulting in the empirical investigation of a chosen case study area. Determining the spatial scope of analysis enabled ETL solution implementation (extraction, transformation, and loading) from multiple data sources. Public registers for real estate transactions (RETs) that provided information on selected property attributes (usable area, storeys, rooms, basement, building storeys, technology, lift, transaction date, address, transaction price) were indispensable data sources. RETs do not contain information on building energy performance; therefore, the initially created database had to be complemented with particular data (the annual usable energy demand index (EK) from the central register for the energy performance of buildings (BEP)). Additionally, the need for a spatially homogenous area selection required further database complementation with particular data derived from open street map (OSM) that included the locations of buildings, commercial public services, healthcare objects, education, culture, and recreation centers, roads, green spaces, car parks, railways, and bus stops.

The extraction of all the either intrinsic or georeferenced extrinsic attributes required the transformation of property prices into temporally comparable units [

48]. For this reason, all the records included in the database were divided into quarters and adjusted with the use of time trend (Formula (1)).

where

C stands for unit transaction price of property,

VTS for time trend index, and

T for number of time units. The elaboration of the time trend index (

VTS) was based on one of the most frequently used property valuation parametric methods—linear regression. The creation of a database on the aforementioned assumptions enabled the implementation of a modified HO-MAR algorithm.

4.2. HO-MAR Algorithm Application

A thorough analysis of the real estate market necessitates recognizing submarkets or specific regions where pricing mechanisms take place, and considering factors that affect real estate values that are expected to be uniform. Given the intricate and varied structure of the real estate market, it is difficult to represent it with a single, representative property value model. Therefore, dividing the market space into submarkets based on internal similarities can help minimize this challenge. Each submarket should exhibit maximum similarity in terms of spatial and physical property characteristics. This segmentation into homogeneous zones facilitates the reflection of price dynamics over time and space, as well as market dynamics and investment trends, and also aids in urban planning effectiveness. To extract property attributes closely linked to structural and functional features (intrinsic variables) and reduce the distortion caused by spatial interactions and urban environmental factors, an adapted HO-MAR methodology was utilized. This revised algorithm specifically targets the identification of uniform geo-market areas. The evaluation of real estate properties is conducted within homogeneous zones that share similar locational traits. As outlined in [

49], the method integrates concepts from entropy theory, Rough Set Theory, fuzzy logic, and geoprocessing methods including Gauss filtering, geocoding, reverse geocoding, and a tessellation model that allows for overlapping spatial areas.

4.3. RE Algorithm Application

A number of approaches and methods are used to value real estate, the choice of which depends on the extent and type of data underlying the determined value. One of the most popular methods is multiple regression (MLR), which belongs to the group of linear additive models [

39]. Significant reasons for using such models are their simplicity and ease of interpretation. MLRs, by assumption, allow for the study of interrelationships between factors and provide a tool for predicting the future values of a phenomenon. In the practice of real estate valuation, the use of MLRs is hampered by the method’s assumptions about the linear nature of the data. Machine learning algorithms, such as random forest, can answer such problems, as these are also used in solving regression problems. As random forest incorporates the characteristics of decision trees, it can address both linear and nonlinear relationships without requiring explicit user-defined specifications. This implies that random forest might offer a more suitable solution for overcoming the challenges faced by MLR in selecting the appropriate functional form. Moreover, random forest can effectively handle the variability in variable importance across different subsets of data because it is constructed from multiple decision trees. Another advantage of the random forest method is its ability to handle categorical variables with multiple levels. In contrast, MLR tends to encounter issues such as overfitting when dealing with numerous qualitative variables, leading to a higher number of estimated parameters. Despite the advantages random forest offers over MLR and decision trees, [

50] suggests that interpreting the results from this approach can be more complex, although not insurmountably so. As random forest grows multiple decision trees, the complexity of the model increases, which may reduce its interpretability [

51]. Summing up, the following advantages of random forest justify its implementation in the executed research:

- -

Imputation of missing data: the algorithm incorporates mechanisms for managing absent data points effectively.

- -

Independence from feature normalization: the methodology does not require the normalization or scaling of features prior to analysis.

- -

Resistance to variability in data quality: the algorithm demonstrates robustness against noise and outliers within the dataset.

- -

Significance of predictors: the methodology is capable of identifying and ranking the importance of various features within the dataset.

- -

Mitigation of model overfitting: the model employs strategies to prevent overfitting, enhancing model generalizability.

- -

Precision in predictive performance: the algorithm achieves high levels of accuracy in predictive outcomes.

The random forest approach is a machine learning method that employs an ensemble of decision trees for regression tasks. This algorithm is rooted in the bagging technique, also known as Bootstrap Aggregating, where several models are constructed on various subsets of data, each returning different results. In regression analysis, each tree within the forest is developed using a randomly selected subset of the training data, and the final prediction is derived by averaging the predictions from all these trees. Describing the process of training the model for a regression task, one can define the procedure as follows:

where

X1 is the feature vector and

Y1 is the corresponding value of the target parameter.

The model randomizes B subsets of data with returns from D. Let Db be the bth random subset of data, where b = 1, 2, …, B.

Construct the decision trees: For each bth subset of data Db, a decision tree ℎb(X) is built using the CART (classification and regression trees) method.

Average the forecasts: After building B decision trees, forecasts for new observations are calculated by averaging the forecasts from each tree. The final forecast for observation X is given by

where

is the forecast value of the target parameter for observation

X, and

hb(

X) denotes the forecast of the

bth tree for the same observation.

The variables’ significance evaluation was carried out on the basis that information on what changes in a given variable affects the quality of the model’s prediction. The procedure for determining the importance of individual attributes is as follows [

52]:

For each ith tree, identify the number of correct ki classifications in its out-of-bag (OOB) set, which comprises observations not included in D, and is known as the OOB set. For each attribute, randomly reorder the values of the considered attribute j, calculate the number of accurately classified samples kij on the set with the altered order of values in the jth attribute, and subsequently restore the original sequence of values in the kth attribute.

For each attribute j, calculate the average difference in the number of correct classifications between the original set and the set where the order of values in the attribute has been shuffled. Then, average these differences across all T trees:

The average establishes the importance of the jth attribute—the greater the value, the more significant the attribute is deemed. Employing the algorithm described facilitated the determination of the significance of energy maintenance costs and the execution of real estate market efficiency analysis.

4.4. REME Analysis

Real estate market efficiency may refer to various aspects of market functions. For this reason, there are several performance measures that can be used to evaluate performance, including the duration of the transaction, the ratio of property prices to investor income, supply and demand ratio, real estate price index relative to rental prices, and real estate turnover ratio. Property valuation model accuracy measures like mean absolute percentage error (MAPE), mean absolute error (MAE), and root mean square error (RMSE) can also be treated as REME measures.

MAPE in property valuation models is a statistical measure used to assess the accuracy of predictions. It calculates the average of the absolute differences between the predicted and actual property values, expressed as a percentage of the actual values. This metric is particularly useful in property valuation as it provides a clear indication of how much the model’s predictions deviate from the real market values on average. The formula for MAPE determination is as follows:

where n stands for the number of observations,

Ai is the actual value of the ith observation, and

Pi is the predicted value of the

ith observation (in proceeding formulas of MAE and RMSE, the components are the same).

MAE (mean absolute error) in property valuation quantifies the average size of errors between the forecasted property values and their actual market values, disregarding the direction of these errors. Specifically, MAE is calculated as the average of the absolute discrepancies between each predicted value and its actual counterpart using the following formula:

RMSE in property valuation quantifies the standard deviation of prediction errors, providing insights into the typical error magnitude in a model’s predictions. The metric is determined with the following formula:

The determination of the aforementioned real estate market efficiency measures and the selection of the most appropriate one from the perspective of the research objectives enabled the determination of REM responsiveness and REME change consequences, forming the basis for the formulation of answers to the posed research questions.

5. Results

The assumed methodological framework imposed the necessity of selecting a case study area; for this reason, the research was executed in the Olsztyn municipality area, a city situated in northeastern Poland within the Warmia and Mazury Voivodeship (

Figure 3). According to the authors, the area chosen for the case study was suitable for the research objectives due to its mature and well-developed residential property market, with over one thousand free market transactions between 2021 and 2023, and a high demand-to-supply ratio.

The identification of the case study area delineated the spatial extent of the data derived from multiple sources (RET, BEP, OSM), which, due to its encoding—either numeric or descriptive—necessitated detailed descriptions: usable area (1 m

2), storeys (numeric), rooms (numeric), year (numeric), basement (1 if present, 0 if absent), building storeys (numeric), technology (1 if traditional, 0 if industrialized), lift (1 if present, 0 if absent), unit price (PLN per square meter), and EK (annual final energy demand index) (kWh/(1 m

2·year). This specific data characterization facilitated the use of the modified HO-MAR algorithm for selecting homogenous geo-market areas. The process allowed for the selection of 198 homogeneous geo-market areas.

Figure 4 showcases the geolocation of the largest area, containing 744 property transactions from 2021 to 2023, along with descriptive statistics of the property transaction attributes.

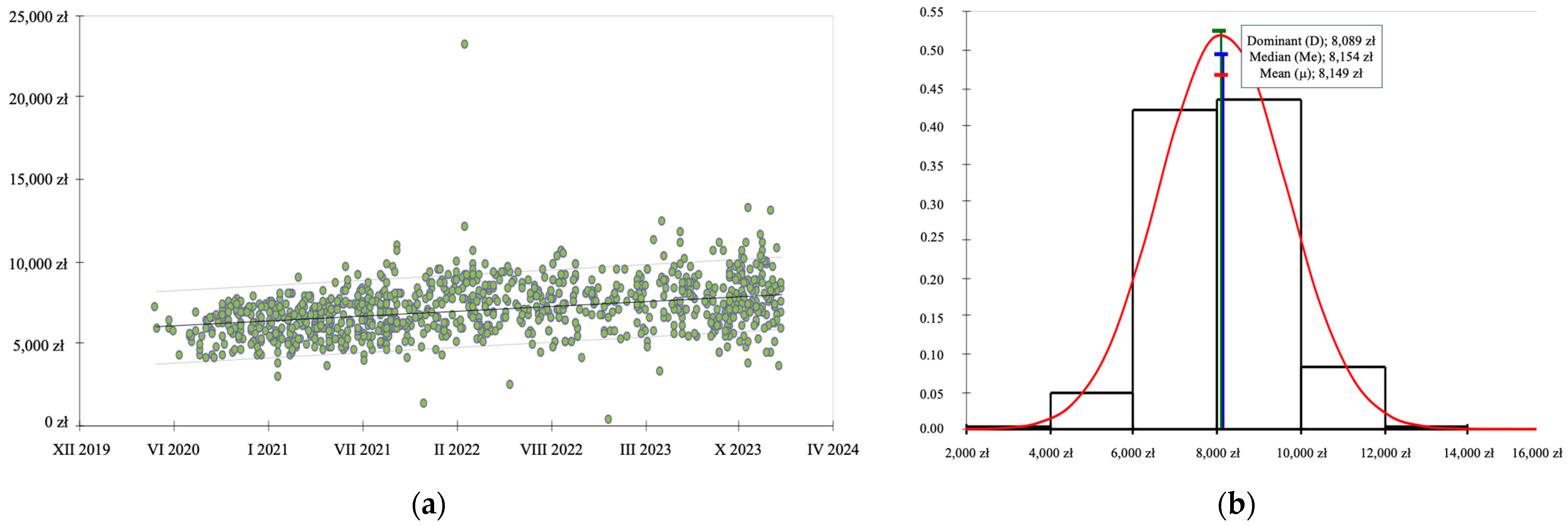

The unit price of the selected group of properties, from the perspective of the methodological assumptions, required time adjustment implementation. For this purpose, linear regression was utilized. What was concluded from the analysis was that, for the analyzed period of time (2021–2023), the annual time trend equaled 8.5%. The analyzed time trend and the normality of distribution of property unit prices are presented in

Figure 5.

Having fulfilled the assumed requirement of the unit’s temporal comparability, the next stage of the research involved the utilization of the random forest algorithm.

Property valuations were carried out independently for the analysis of each quarter. The valuation process was based on appropriately updated prices. The construction of the random forest model for the property value took into account the property features discussed above. In accordance with the purpose of this article, which was to answer the specific research questions posed, the valuation of the properties was carried out, taking into account the cost of energy calculated for each property on the basis of the EK parameter, usable floor area, and the average price of 1 kWh of energy (according to mean market prices applicable in the individual quarters analyzed) for households relevant to each analyzed quarter.

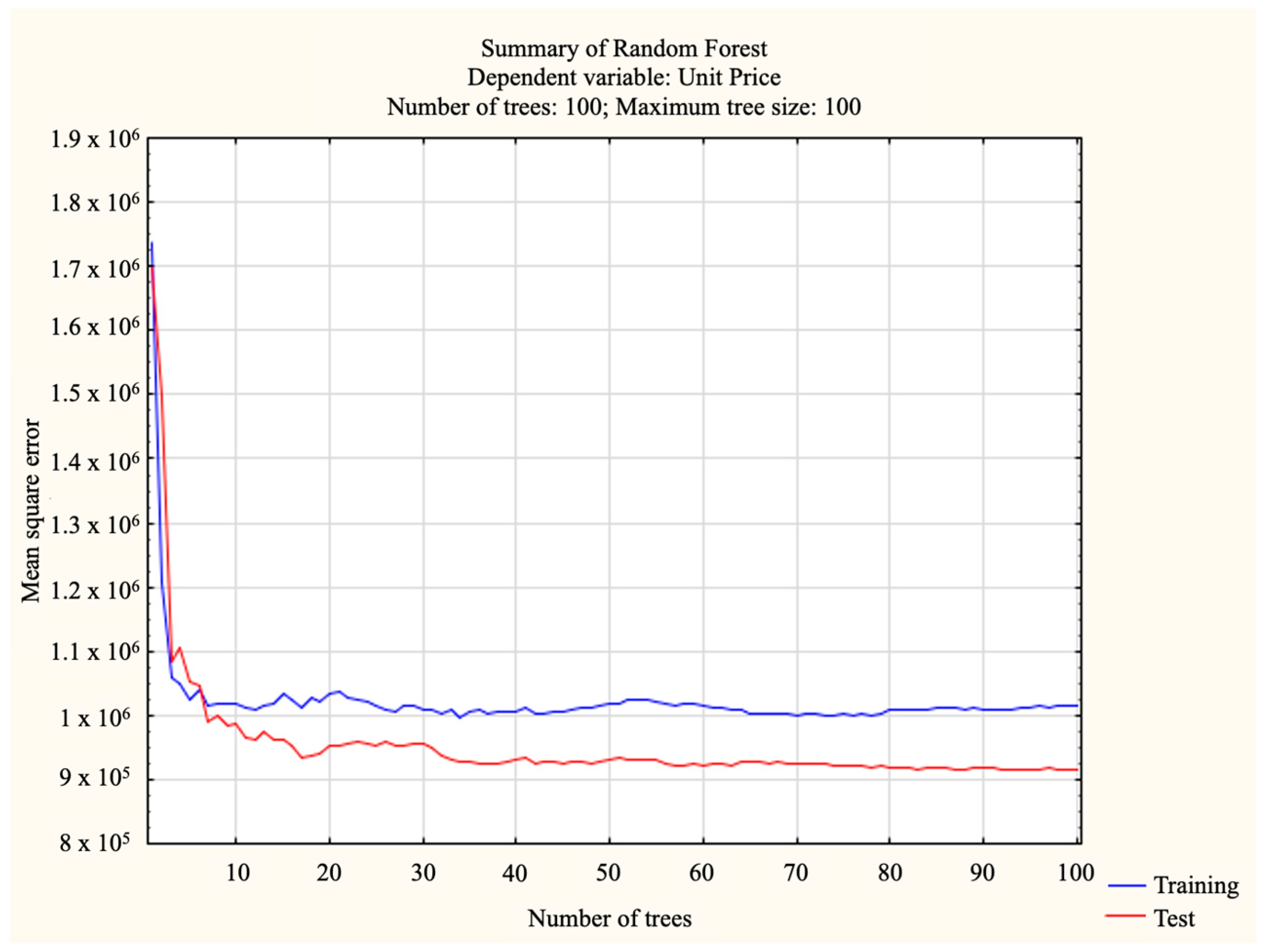

The model parameters were determined via iterative processing. Datasets were randomly divided into training sets and subjected to learning, considering variables like the model’s size (number of trees), the initial setting of the random number generator, and the stopping criteria for the procedure.

Figure 6 displays a training graph for the random forest model, developed using the specified parameters for the third quarter of 2022.

The model’s residuals display a Gaussian distribution, affirming the reliability of the model’s estimations and predictions (

Figure 7).

As a result of the valuation, the significance of the property features was determined for each quarter (

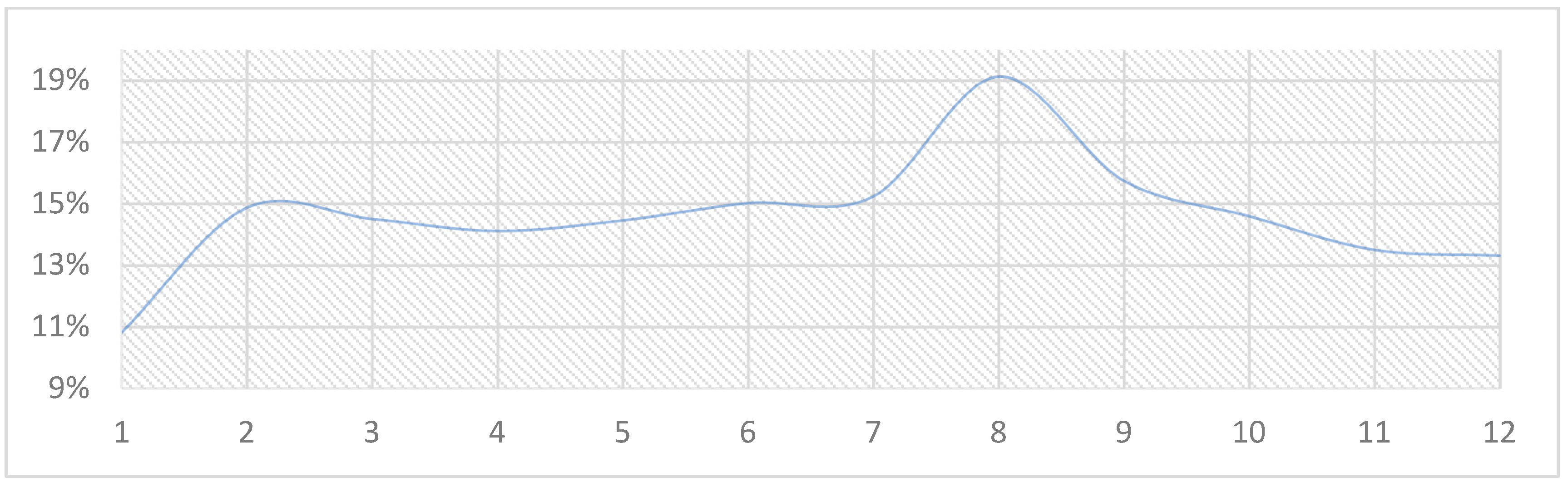

Table 1). The significance values obtained indicate to what extent individual property features shaped property values in each of the analyzed quarters and how these values changed over the analyzed period.

The features with the lowest impact on property value on average included the following: lift (4.00%), storeys (5.50%), basement (8.48%), and building storeys (8.54%). The features with the highest mean significance were year (21.47%) and energy cost (14.60%). The other features with a medium impact were usable area (12.98%), technology (12.82%), and rooms (11.60%). In accordance with the objective of this article, most attention was focused on the significance of energy costs on the shape of property values for each of the analyzed 12 quarters. Changes in the significance of this feature are shown in

Figure 8.

Figure 8 presents the changes in the percentage significance of energy cost traits on the development of property values. The dynamics of the changes indicate that the weighting of the analyzed feature remained at 13–15% in the long term. A noticeable increase in the significance of energy costs on the value model was recorded in Q IV 2022 (approx. 19%). As can be seen from the graph, in the following quarter (QI 2023), the significance level of the feature fell to a comparable value for the periods prior to the sudden increase.

The analysis of real estate market efficiency was carried out using the MAPE, MAE, and RMSE measures. The interrelation between property prices and their values determined by the random forest method was examined. The results for each measure are presented in

Table 2.

The results indicate that all of the analyzed measures recorded a significant increase in QIV 2022 compared to the previous quarters. For further analysis and the presentation of the results, the MAPE parameter was adopted, which expresses the forecast error as a percentage of the actual value, allowing easier interpretation of the real estate market efficiency phenomenon. The chart below shows the relationship between the MAPE value and the average current prices over the analyzed period (

Figure 9).

The significant increase in the MAPE index in QIV 2022 indicates the occurrence of greater deviations between property transaction prices and values, which indicates a decline in the price efficiency of the property market. The fact of the occurrence of price inefficiency demonstrates a periodic problem of a low reflection of property values in transaction prices. The analysis indicates that the periodic decrease in efficiency is caused by a sudden increase in energy prices, which in effect causes a market disequilibrium. Further evidence of market inefficiency is the delayed market reaction to the change in the level of energy prices, which was found in three of the quarters. The lack of a flexible market response to current information is therefore a problem in that transaction prices may not provide a reliable measure of value, and do not provide a robust basis for decision making.

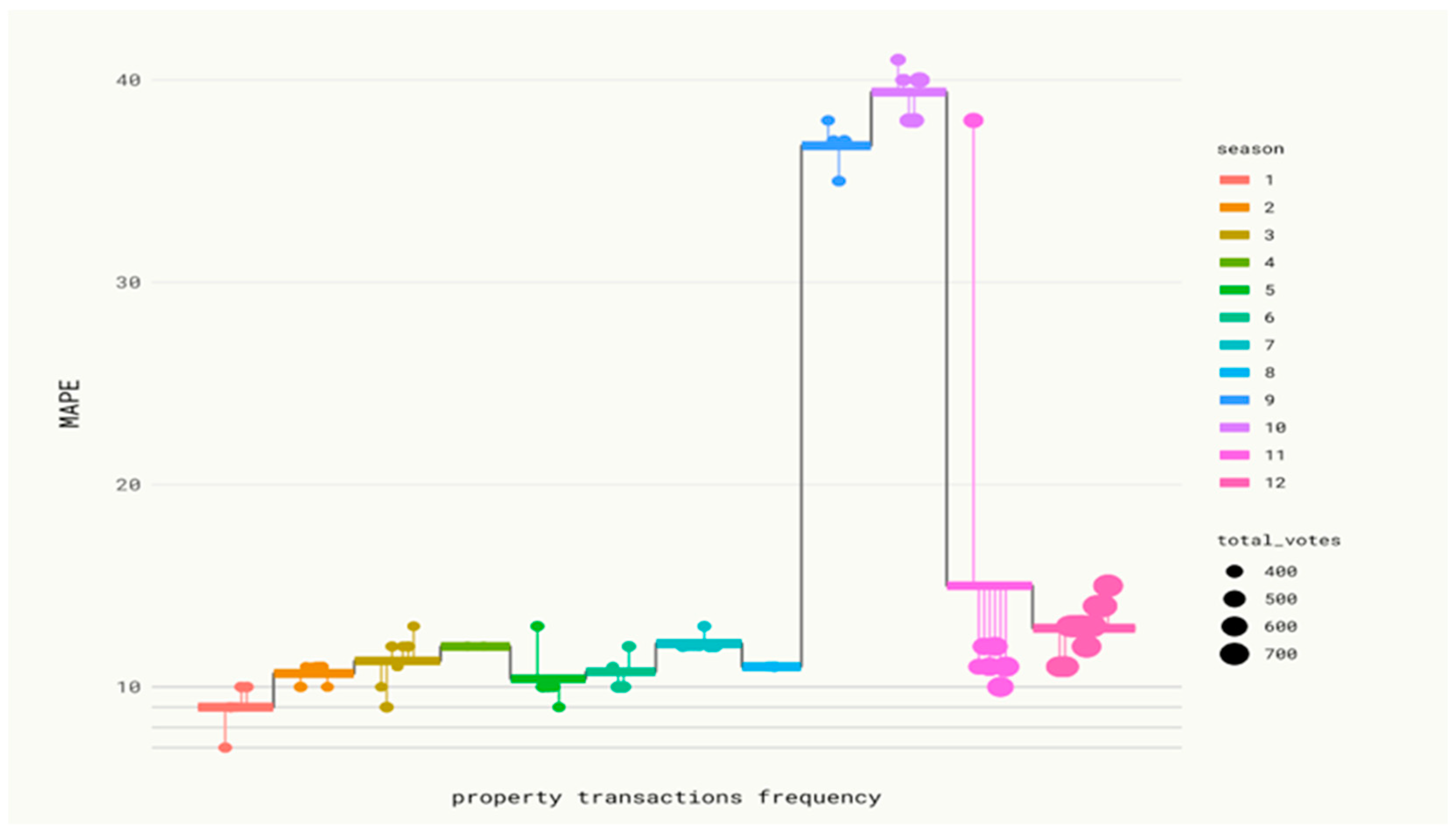

In order to verify the scope of the potential sensitivity of property market efficiency, additional criteria for compliance within the investigated unit (except time comparability achieved by time adjustment and locational conformity reached by utilization of the modified HO-MAR algorithm) were implemented based on the frequency of the occurring transactions (

Figure 10).

After analyzing the frequency of each of the 10 additional property transaction appearances within the 12 analyzed quarters, with additional reference to MAPE and property energy maintenance costs, it was noticed that the property market activity significantly decreased three quarters after the dramatic energy cost increase that started in QIV 2021. When energy costs were at their highest, the market activity recovered, surpassing the results before the decrease in the 9th and 10th quarters. The 11th and 12th quarters were characterized by a continuous increase in the cost of property energy maintenance with a simultaneous decrease in the efficiency expressed by MAPE that reached approximately 14%. The size of the dots on the graph indicate the average size of the maintenance costs calculated for each of the moments shown. As can be seen in

Figure 10, the maintenance costs of the property gradually increased until the end of the analyzed period, where they reached the clearly highest values.

6. Conclusions and Summary

The main aim of this research was providing a methodology to enable the identification of the influence of building energy performance on real estate market efficiency via the lens of property maintenance costs. The authors carried out a detailed analysis of the transaction prices of properties in the selected homogenous area in the period 2021–2023 by quarter. Taking into account that real estate is defined by environment, as well as unique technical and functional attributes, the property transactions under study, situated in the targeted area, were documented using information from public records of real estate transactions. Due to the aims of the study, it was necessary to supplement the listed property characteristics with data from the central register of building energy performance, specifically focusing on the annual usable energy demand index, EK. A quarter-by-quarter analysis of average energy prices was carried out, which made it possible to determine the approximate maintenance cost of each property analyzed. In accordance with the property price valuation procedure, the trend in price change over time was determined and an update of these prices was carried out at a date relevant to the quarter analyzed. The application of the random forest method made it possible to carry out a property valuation for each analyzed quarter. The applied method showed high utility for solving regression problems in the real estate market, characterized by complexity, the randomness of the processes occurring in it, and the non-linearity of relationships between variables. In order to assess the efficiency of the analyzed real estate market, the accuracy of the MAE, MAPE, and RMSE forecasts were determined, which allowed the analysis of the dynamics and dependencies of real estate market phenomena. As a result, answers to the following specific questions were obtained.

SQ1—How does the rise in energy costs determine the efficiency of the real estate market? The rise in energy costs influenced the trends in the property transaction prices, leading to a deterioration in the accuracy of the prediction model. This decline was demonstrated by higher values in the mean absolute percentage error (MAPE), mean absolute error (MAE), and root mean square error (RMSE). During the period of significant increases in energy prices, the degree to which property values were reflected in transaction prices decreased compared to previous periods, increasing market uncertainty regarding the factors and circumstances affecting price levels. An empirical confirmation of the precise degree of inefficiency in the property market is impossible due to the nature of the phenomenon under study and the multiplicity of factors affecting it. The inefficiency in this case was reflected by the fact that real estate transaction prices did not fulfil the functions of the random forest model to varying degrees, and during the period of energy price increases they did not correspond to the value model to a significant extent.

SQ2—What is the responsiveness of the real estate market to dynamically rising energy prices? The analysis indicated that the increase in property prices was a change to which the property market reacted with a lag. The onset of a period of rising property costs did not result in significant changes in the level of price inefficiency. The timing of the sudden increase in price prediction error occurred about three quarters after the onset of the energy price spur and remained at a similar level for the next three quarters, after which it notably declined. This market inefficiency caused by a lack of flexible response to current information could have been driven by a number of factors, including the delayed reaction of investors to new information, a long and complicated transaction process, low price elasticity, and a reduced propensity to make long-term investments in a situation of dynamic economic change. The property market recorded a marked slowdown in investor activity in QIII 2023, as evidenced by the decline in the number of transactions completed during the period.

SQ3—How do property maintenance costs determine the market value of properties? Following the analysis, significance values were assigned to each property feature, highlighting their impact on predicting property values. The evaluation of these features revealed the presence of multiple critical determinants that significantly influence property valuations. The calculated average significance values indicated that the cost of property maintenance was a significant driver of property values in the analyzed property market, particularly in QIV 2022, when significance reached its highest value. The increasing trend in the significance of this feature recorded in QIII 2022 correlated with an increase in forecast error, indicating an increase in market inefficiency.

Solving the aforementioned scientific problems required an interdisciplinary methodological framework. Achieving the research objectives led to three significant contributions. Firstly, the developed methodology offers a novel, holistic approach to analyze energy and market efficiency in the real estate industry and provides results for decision-making towards inefficiency reduction. Secondly, the conducted study and its conclusions significantly strengthen the existing literature, highlighting the need for additional research to develop appropriate housing policies that respond to current economic issues and the needs of real estate market participants. Finally, the study complements the ESG literature by highlighting the importance of sustainable solutions and their impact on residents. In addition, the research demonstrates the high potential for the application of machine learning techniques in property valuation, which, in addition to their ability to solve non-linear regression problems, also offer the possibility of including an extended (relative to the classically applied) set of attributes in the analysis, thus allowing the value of the property to better reflect factors currently affecting the functioning of the property market.

The research presented in this paper introduces a comprehensive methodology for evaluating the impact of building energy performance on real estate market efficiency through the lens of property maintenance costs. While the methodology has demonstrated significant potential in analyzing the dynamics of the real estate market and predicting future trends, it is not without its limitations. The accuracy and robustness of predictions heavily rely on the quality and completeness of the data used. In cases where data are incomplete, the precision of the random forest model’s output may be compromised. This limitation is particularly pertinent in regions where real estate data are not systematically collected or publicly available. In order to prevent errors in the analysis and to ensure the maximum reliability of the model built, the authors carried out a detailed analysis of the database in terms of its completeness and supplemented the information on the properties analyzed with data from various available information systems and official registers.

Another limitation of using the proposed methodology may be the model’s complexity. The use of advanced machine learning algorithms like random forest involves a trade-off between model accuracy and interpretability. While these models can capture complex nonlinear relationships within data, they can also become black boxes, making it difficult to discern directly how input features influence the output. One of the appeals of using random forest models, despite their ‘black box’ nature, is their ability to achieve high accuracy and performance in a variety of applications. Random forest is particularly effective in solving classification and regression problems where other more transparent models, such as linear regression, may not be able to cope with the complexity of the data or its non-linearity.

The results provided by the model used are tailored to the specific economic and regulatory environments of the study area, and therefore cannot provide a direct basis for decision-making in other markets. However, the proposed methodology has universal validity. The real estate market is influenced by numerous factors, including economic policies, investor emotionality, and international events, which can fluctuate unpredictably. Therefore, in future research, the authors intend to explore the potential of the proposed methodology in markets characterized by limited or varying access to data.

In summary, while the proposed methodology faces certain limitations, it opens up several avenues for practical applications across different sectors. It is imperative that future research addresses these limitations, possibly through the integration of more adaptive models and broader datasets, to enhance the robustness and applicability of the methodology. This ongoing refinement will contribute to a deeper understanding of the critical relationship between energy efficiency and real estate market efficiency.

Assessing real estate market inefficiencies is important to help investors, real estate analysts, and policymakers better understand market phenomena and make more informed investment and regulatory decisions. The authors’ proposed solutions for researching and analyzing the efficiency of the property market in the context of rising energy prices and property maintenance costs can be applied in several areas, including the following:

Policy making—Governments and regulatory bodies can use insights derived from the methodology to craft policies that promote energy efficiency in building constructions and renovations. By understanding the impact of energy performance on market efficiency, policies can be better targeted to encourage sustainable practices.

Real estate development—The methodology can be applied by developers and investors to assess the potential market value of properties based on their energy efficiency ratings. This could guide investment decisions, particularly in markets where energy efficiency is becoming a significant factor in consumer choice.

Urban planning—The findings obtained from the proposed methodology application can be utilized by urban planners to design cities that optimize energy consumption and enhance real estate market efficiency. The methodology can aid in planning the placement and development of residential areas to maximize energy efficiency and market stability.

Academic research—The methodology provides a foundation for further academic study into the interplay between energy efficiency and real estate market dynamics. Researchers can build upon this framework to explore additional variables and refine predictive models.

It is becoming a scientific challenge to study the impact of changes in energy costs on other sectors of the economy such as the real estate market. Analyzing the impact of changes in building codes, energy standards, and sustainability policies on real estate market dynamics is complex. The challenge lies in predicting market reactions to new regulations and their effectiveness in promoting energy-efficient practices. Trends that are shaping the real estate market and that will shape it in the coming years—such as ESG, the further rise of high technology, including artificial intelligence, and the progressive transfer of transactions and business activity to the virtual world—may present opportunities, but may also prove to be negative traps for market participants. As early as 1865, William Stanley Jevons proved in his work “The Coal Question” that the more efficiently a raw material is used, the more its consumption increases (Jevons’ paradox). This may result in the effects of these changes in other sectors of the economy being neglected at the expense of attempts to achieve energy efficiency.

Previously, the real estate market was primarily driven by quantitative demands, but today, it is significantly influenced by qualitative needs. The quality of building construction is now closely linked to issues of energy performance [

53]. The energy transition is a phenomenon inseparable from the development of future cities and real estate markets. The proper formulation of a climate and energy policy ensuring, among other things, a reduction in greenhouse gas emissions, the promotion of an increase in the use of energy from renewable sources, and an increase in energy efficiency, is one of the major challenges arising for European Union members.