The Impact of ICT Capital Services on Economic Growth and Energy Efficiency in China

Abstract

1. Introduction

2. Literature Review

2.1. ICT and Economic Growth

2.2. ICT and Energy Efficiency

3. Methods

3.1. Measurement of Capital Services

3.1.1. Capital Investment Series—Gross Fixed Capital Formation

3.1.2. Retirement Profile

3.1.3. Age-Efficiency Profile

3.1.4. Productive Stock

3.1.5. The Price of Capital Services

(net production taxes) ∗ [((depreciation of fixed assets) + (operating surplus))/

((labor compensation) + (depreciation of fixed assets) + (operating surplus))].

3.2. Measurement of ICT’s Contribution to Economic Growth

3.3. Measurement of Energy Efficiency and the Regression Model of ICT and Energy Efficiency

4. Measurement and Empirical Results

4.1. Capital Services

4.1.1. Capital Services of China

4.1.2. ICT Capital Services of Industries

4.2. The Contribution of Capital Services to Economic Growth

4.2.1. The Contribution of Capital Services to Economic Growth in China

4.2.2. The Contribution of ICT Capital Services to Economic Growth in Different Industries

4.3. Energy Efficiency and the Impact of ICT on Energy Efficiency

4.3.1. Energy Efficiency

4.3.2. The Impact of ICT on Energy Efficiency

- Unit root test and multicollinearity test

- 2.

- Panel regression results

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Yong, S.W.; Law, S.H.; Ibrahim, S.; Mohamad, W.N.W. ICTs, growth, and environmental quality nexus: Dynamic panel threshold regression. Environ. Sci. Pollut. Res. 2022, 30, 20849–20861. [Google Scholar] [CrossRef] [PubMed]

- Cai, Y.Z.; Niu, X.X. Scale measurement and structural analysis of the value- added of China’s digital economy. Soc. Sci. China 2021, 11, 4–30+204. [Google Scholar]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development. 2015. Available online: https://documents-dds-ny.un.org/doc/UNDOC/GEN/N15/291/89/PDF/N1529189.pdf?OpenElement (accessed on 1 December 2022).

- Wang, H.; Wang, J.; Jin, Z. How ICT development affects manufacturing carbon emissions: Theoretical and empirical evidence. Environ. Sci. Pollut. Res. 2022, 30, 33674–33685. [Google Scholar] [CrossRef]

- Zhong, M.R.; Cao, M.Y.; Zou, H. The carbon reduction effect of ICT: A perspective of factor substitution. Technol. Forecast. Soc. Chang. 2022, 181, 121754. [Google Scholar] [CrossRef]

- Saleem, H.; Khan, M.B.; Mahdavian, S.M. The role of economic growth, information technologies, and globalization in achieving environmental quality: A novel framework for selected Asian countries. Environ. Sci. Pollut. Res. 2023, 30, 39907–39931. [Google Scholar] [CrossRef] [PubMed]

- Zhang, X.; Wei, C. The economic and environmental impacts of information and communication technology: A state-of-the-art review and prospects. Resour. Conserv. Recycl. 2022, 185, 106477. [Google Scholar] [CrossRef]

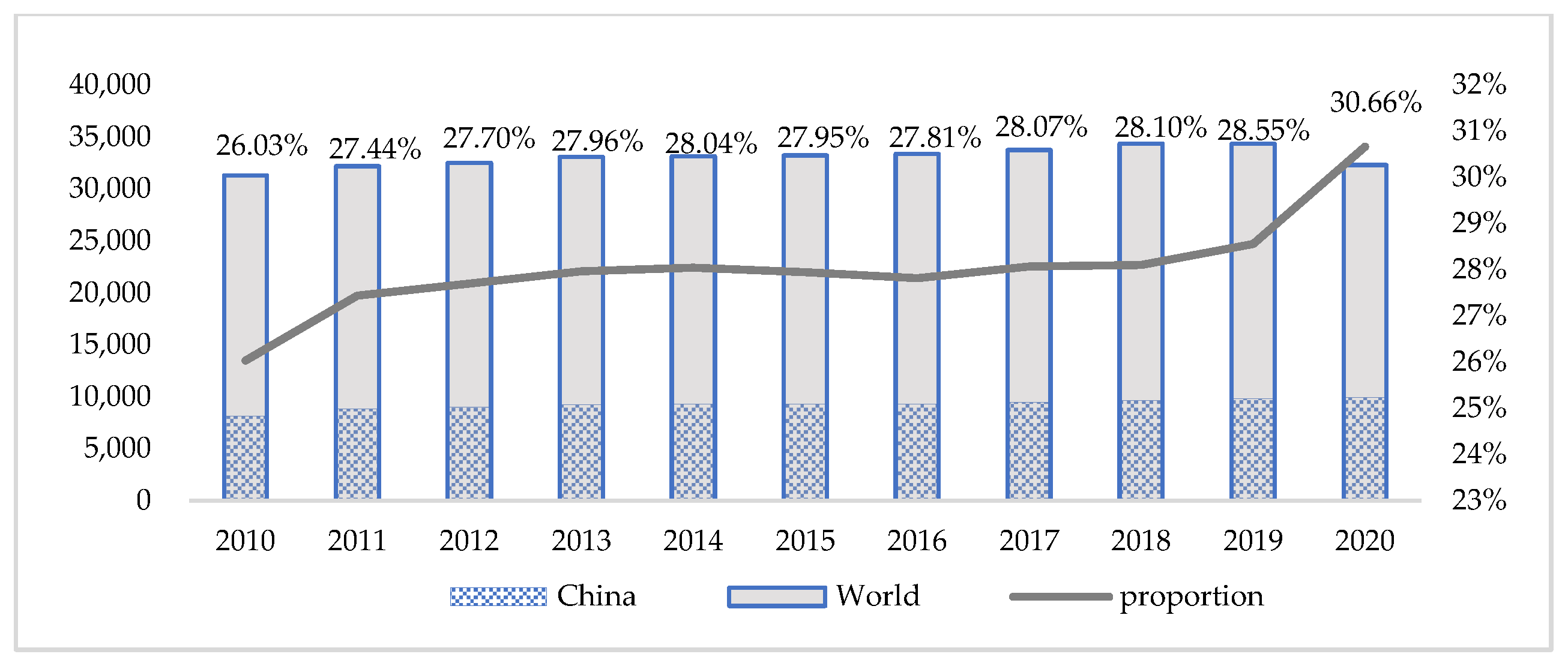

- BP, Statistical Review of World Energy 2021. 2021. Available online: https://www.bp.com.cn/content/dam/bp/country-sites/zh_cn/china/home/reports/statistical-review-of-world-energy/2021/BP_Stats_2021.pdf (accessed on 1 December 2022).

- The State Council the People’s Republic of China. Opinions on Complete and Accurate Implementation of the New Development Concept to Do a Good Job of Carbon Peaking and Carbon Neutral Work [EB/OL]. 2021. Available online: http://www.gov.cn/zhengce/2021-10/24/content_5644613.htm (accessed on 1 November 2022).

- Oliner, S.D.; Sichel, D.E. The resurgence of growth in the late 1990s: Is information technology the story? J. Econ. Perspect. 2000, 14, 3–22. [Google Scholar] [CrossRef]

- Jorgenson, D.W. Information technology and the US economy. Am. Econ. Rev. 2001, 91, 1–32. [Google Scholar] [CrossRef]

- Jorgenson, D.W.; Vu, K. Information technology and the world economy. Scand. J. Econ. 2005, 107, 631–650. [Google Scholar] [CrossRef]

- Vu, K.M. Information and communication technology (ICT) and Singapore’s economic growth. Inf. Econ. Policy 2013, 25, 284–300. [Google Scholar] [CrossRef]

- Shahiduzzaman, M.; Alam, K. Information technology and its changing roles to economic growth and productivity in Australia. Telecommun. Policy 2014, 38, 125–135. [Google Scholar] [CrossRef]

- Appiah-Otoo, I.; Song, N. The impact of ICT on economic growth-Comparing rich and poor countries. Telecommun. Policy 2021, 45, 102082. [Google Scholar] [CrossRef]

- Tsachtsiris, G.; Magoutas, A.; Papadogonas, T. ICT and Economic Growth in EU: A macro Level Comparison of Estimated ICT Output Elasticities. J. Glob. Inf. Technol. Manag. 2022, 25, 202–216. [Google Scholar] [CrossRef]

- Cardona, M.; Kretschmer, T.; Strobel, T. ICT and productivity: Conclusions from the empirical literature. Inf. Econ. Policy 2013, 25, 109–125. [Google Scholar] [CrossRef]

- Díaz-Roldán, C.; Ramos-Herrera, M.C. Innovations and ICT: Do they favour economic growth and environmental quality? Energies 2021, 14, 1431. [Google Scholar] [CrossRef]

- Xu, S.H.; Mao, X.B. The analysis of the contribution of information industry to economic growth. J. Manag. World 2004, 8, 75–80. [Google Scholar]

- Wang, B.; Yu, D.J. Layer-by-layer analysis on economic structures effect of informatization in China—On the basis of empirical research on econometric model. China Ind. Econ. 2004, 7, 21–28. [Google Scholar]

- Sun, L.L.; Zheng, H.T.; Ren, R.E. The contribution of informatization to China’s economic growth: Empirical evidence from industry panel data. J. World Econ. 2012, 35, 3–25. [Google Scholar]

- Yang, X.W.; He, F. The contribution of information and communication technology on Chinese economy—Based on measuring productive stock of capitals. Res. Econ. Manag. 2015, 36, 66–73. [Google Scholar]

- Liu, H.; Zhang, J.P. Empirical analysis on the relationship between ICT and economic growth under Internet + background: From the Chinese provincial panel data research. J. Stat. Inf. 2015, 30, 73–78. [Google Scholar]

- Cai, Y.Z.; Zhang, J.N. The substitution and pervasiveness effects of ICT on China’s economic growth. Econ. Res. J. 2015, 50, 100–114. [Google Scholar]

- Zhou, J. Research on the contribution of ICT capital services to China’s economic growth. World Surv. Res. 2022, 11, 44–53. [Google Scholar]

- Chen, M.G.; Zhang, X. The scale measurement and productivity analysis of China’s digital economy. J. Quant. Technol. Econ. 2022, 39, 3–27. [Google Scholar]

- Ishida, H. The Effect of ICT Development on Economic Growth and Energy Consumption in Japan. Telemat. Inform. 2015, 32, 79–88. [Google Scholar] [CrossRef]

- Schulte, P.; Welsch, H.; Rexhäuser, S. ICT and the Demand for Energy: Evidence from OECD Countries. Environ. Resour. Econ. 2016, 63, 119–146. [Google Scholar] [CrossRef]

- May, G.; Stahl, B.; Taisch, M.; Kiritsis, D. Energy management in manufacturing: From literature review to a conceptual framework. J. Clean. Prod. 2017, 167, 1464–1489. [Google Scholar] [CrossRef]

- Khuntia, J.; Saldanha, T.J.; Mithas, S.; Sambamurthy, V. Information technology and sustainability: Evidence from an emerging economy. Prod. Oper. Manag. 2018, 27, 756–773. [Google Scholar] [CrossRef]

- Zhang, S.F.; Wei, X.H. Does information and communication technology reduce enterprise’s energy consumption-Evidence from Chinese manufacturing enterprises survey. China Ind. Econ. 2019, 2, 155–173. [Google Scholar]

- Zhou, X.; Zhou, D.; Wang, Q. How does information and communication technology affect China’s energy intensity? A three-tier structural decomposition analysis. Energy 2018, 151, 748–759. [Google Scholar] [CrossRef]

- Sun, Y.; Ajaz, T.; Razzaq, A. How infrastructure development and technical efficiency change caused resources consumption in BRICS countries: Analysis based on energy, transport, ICT, and financial infrastructure indices. Resour. Policy 2022, 79, 102942. [Google Scholar] [CrossRef]

- Tzeremes, P.; Dogan, E.; Alavijeh, N.K. Analyzing the nexus between energy transition, environment and ICT: A step towards COP26 targets. J. Environ. Manag. 2023, 326, 116598. [Google Scholar] [CrossRef]

- Wang, P.; Zhong, P.; Yu, M.; Pu, Y.; Zhang, S.; Yu, P. Trends in energy consumption under the multi-stage development of ICT: Evidence in China from 2001 to 2030. Energy Rep. 2022, 8, 8981–8995. [Google Scholar] [CrossRef]

- Lange, S.; Pohl, J.; Santarius, T. Digitalization and energy consumption. Does ICT reduce energy demand? Ecol. Econ. 2020, 176, 106760. [Google Scholar] [CrossRef]

- Popkova, E.G.; Inshakova, A.O.; Bogoviz, A.V.; Lobova, S.V. Energy Efficiency and Pollution Control through ICTs for Sustainable Development. Front. Energy Res. 2021, 9, 755. [Google Scholar] [CrossRef]

- Bildirici, M.E.; Castanho, R.A.; Kayıkçı, F.; Genç, S.Y. ICT, energy intensity, and CO2 emission nexus. Energies 2022, 15, 4567. [Google Scholar] [CrossRef]

- Hao, Y.; Guo, Y.; Wu, H. The role of information and communication technology on green total factor energy efficiency: Does environmental regulation work? Bus. Strategy Environ. 2022, 31, 403–424. [Google Scholar] [CrossRef]

- Gao, D.; Li, G.; Yu, J. Does digitization improve green total factor energy efficiency? Evidence from Chinese 213 cities. Energy 2022, 247, 123395. [Google Scholar] [CrossRef]

- OECD. Measuring Capital—OECD Manual 2009; OECD Publishing: Paris, France, 2009. [Google Scholar]

- Wang, Y.F.; Wang, C.Y. Capital services accounting of ICT at industry level in China. Stat. Res. 2017, 34, 24–36. [Google Scholar]

- Stone, R. Multiple Classification in Social Accounting. Bull. Inst. Int. Stat. 1962, 39, 215–231. [Google Scholar]

- National Bureau of Statistics of China. Data and Statistics. Available online: http://www.stats.gov.cn/sj/ndsj/ (accessed on 1 December 2022).

- Jorgenson, D.W.; Griliches, Z. The Explanation of Productivity Change. Rev. Econ. Stud. 1967, 34, 249–283. [Google Scholar] [CrossRef]

- Hulten, C.R. Divisia index numbers. Econom. J. Econom. Soc. 1973, 41, 1017–1025. [Google Scholar] [CrossRef]

- Hu, J.L.; Wang, S.C. Total-factor energy efficiency of regions in China. Energy Policy 2006, 34, 3206–3217. [Google Scholar] [CrossRef]

- Li, S.; Diao, H.; Wang, L.; Li, C. Energy Efficiency Measurement: A VO TFEE Approach and Its Application. Sustainability 2021, 13, 1605. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Popelo, O.; Dubyna, M.; Kholiavko, N. World experience in the introduction of modern innovation and information technologies in the functioning of financial institutions. Balt. J. Econ. Stud. 2021, 7, 188–199. [Google Scholar] [CrossRef]

- Yao, M.; Di, H.; Zheng, X.; Xu, X. Impact of payment technology innovations on the traditional financial industry: A focus on China. Technol. Forecast. Soc. Chang. 2018, 135, 199–207. [Google Scholar] [CrossRef]

- Lu, H.; Zhang, Q.; Cui, Q.; Luo, Y.; Pishdad-Bozorgi, P.; Hu, X. How can information technology use improve construction labor productivity? an empirical analysis from china. Sustainability 2021, 13, 5401. [Google Scholar] [CrossRef]

- Feng, Y.; Lu, C.C.; Lin, I.; Yang, A.C.; Lin, P.C. Total factor energy efficiency of China’s thermal power industry. Sustainability 2022, 14, 504. [Google Scholar] [CrossRef]

- Zuo, D.; Liang, Q.; Zhan, S.; Huang, W.; Yang, S.; Wang, M. Using energy consumption constraints to control the freight transportation structure in China (2021–2030). Energy 2023, 262, 125512. [Google Scholar] [CrossRef]

- Xu, M.; Lin, B.; Wang, S. Towards energy conservation by improving energy efficiency? Evidence from China’s metallurgical industry. Energy 2021, 216, 119255. [Google Scholar] [CrossRef]

- Li, J.; Du, Q.; Lu, C.; Huang, Y.; Wang, X. Simulations for double dividend of carbon tax and improved energy efficiency in the transportation industry. Environ. Sci. Pollut. Res. 2023, 30, 19083–19096. [Google Scholar] [CrossRef] [PubMed]

| Year | ICT Hardware | ICT Software | Construction and Installation Works | Equipment and Apparatus Purchase | Other Costs |

|---|---|---|---|---|---|

| 2000 | 3327.60 | 261.82 | 128,682.05 | 24,396.39 | 16,667.42 |

| 2001 | 4794.21 | 406.31 | 161,613.06 | 32,228.90 | 23,067.11 |

| 2002 | 6679.86 | 633.52 | 194,149.23 | 38,125.79 | 30,104.31 |

| 2003 | 8662.19 | 853.89 | 217,043.52 | 43,654.20 | 36,778.68 |

| 2004 | 11,504.57 | 1124.18 | 251,817.92 | 52,329.30 | 44,365.69 |

| 2005 | 16,282.11 | 2004.93 | 347,364.43 | 60,728.70 | 62,877.71 |

| 2006 | 18,860.63 | 2984.23 | 387,069.09 | 74,441.31 | 64,906.15 |

| 2007 | 19,474.08 | 4110.20 | 432,306.52 | 89,922.25 | 74,118.67 |

| 2008 | 20,383.76 | 5666.07 | 481,997.17 | 104,439.60 | 81,383.23 |

| 2009 | 20,167.84 | 7109.75 | 496,996.03 | 109,431.78 | 80,186.69 |

| 2010 | 25,227.29 | 11,393.32 | 548,504.43 | 135,217.25 | 99,008.01 |

| 2011 | 23,780.54 | 15,055.13 | 477,057.59 | 141,153.11 | 95,916.42 |

| 2012 | 23,340.97 | 22,317.14 | 532,809.84 | 158,908.68 | 102,152.74 |

| 2013 | 23,991.86 | 31,698.74 | 597,654.42 | 188,275.82 | 113,366.54 |

| 2014 | 23,460.03 | 41,317.54 | 675,187.19 | 213,405.15 | 120,367.52 |

| 2015 | 22,865.66 | 52,447.16 | 768,932.43 | 241,479.77 | 125,277.41 |

| 2016 | 25,403.04 | 65,399.36 | 854,405.67 | 262,374.41 | 131,617.61 |

| 2017 | 30,480.66 | 78,061.51 | 956,344.22 | 273,993.63 | 136,369.61 |

| 2018 | 36,100.56 | 83,616.41 | 1,068,870.17 | 281,548.20 | 138,661.55 |

| 2019 | 42,180.37 | 92,838.19 | 1,162,303.63 | 302,936.77 | 149,665.00 |

| 2020 | 48,099.31 | 101,680.79 | 1,220,375.01 | 323,538.40 | 163,995.13 |

| Average growth rate | 14.29% | 34.73% | 11.90% | 13.80% | 12.11% |

| Industry Classification | 2010 | 2012 | 2014 | 2016 | 2018 | 2020 | ICT Proportion in 2020 (%) |

|---|---|---|---|---|---|---|---|

| Agriculture, forestry, animal husbandry and fishery | 322.09 | 320.11 | 355.54 | 419.28 | 479.51 | 572.18 | 0.94 |

| Mining | 147.18 | 242.71 | 393.45 | 511.75 | 339.68 | 306.28 | 0.82 |

| Manufacturing | 25,957.38 | 24,475.15 | 25,987.42 | 30,431.77 | 41,206.36 | 53,613.20 | 8.87 |

| Computer, communications and other electronic equipment manufacturing | 18,784.51 | 17,147.83 | 17,194.04 | 19,330.25 | 28,484.68 | 38,116.75 | 52.29 |

| Electricity, heat, gas and water production and supply industry | 396.40 | 478.54 | 801.96 | 1204.20 | 1128.25 | 1210.29 | 1.48 |

| Construction | 2197.61 | 3563.86 | 6747.97 | 10,425.91 | 10,140.62 | 11,112.72 | 52.41 |

| Wholesale and retail | 669.58 | 753.48 | 1111.39 | 1708.11 | 2273.56 | 2832.48 | 6.68 |

| Transportation, storage and postal industry | 619.72 | 1180.56 | 2120.87 | 3485.03 | 5294.02 | 6764.58 | 4.12 |

| Hotels and catering industry | 106.25 | 198.84 | 323.96 | 471.81 | 726.39 | 928.31 | 5.01 |

| Information transmission, software and information technology services | 1630.86 | 5741.87 | 11,976.72 | 19,998.59 | 28,316.53 | 35,558.17 | 64.74 |

| Financial industry | 1237.18 | 2969.40 | 5298.53 | 7619.26 | 9510.54 | 11,449.81 | 77.38 |

| Real estate | 192.68 | 370.63 | 666.73 | 1042.83 | 1370.84 | 1680.17 | 0.42 |

| Leasing and business services | 1042.32 | 1069.72 | 1568.39 | 2349.74 | 3068.97 | 3802.16 | 10.25 |

| Scientific research and technical services | 376.90 | 737.34 | 1116.90 | 1676.42 | 2930.59 | 3927.92 | 19.96 |

| Water, environment and public facilities management industry | 86.08 | 139.80 | 250.14 | 384.09 | 408.42 | 473.63 | 0.25 |

| Residential services, repairs and other services | 264.21 | 382.82 | 528.39 | 680.88 | 857.30 | 1084.97 | 14.31 |

| Education | 265.58 | 580.33 | 1013.20 | 1402.77 | 1712.78 | 2047.88 | 6.43 |

| Health and social work | 238.01 | 520.03 | 950.76 | 1464.57 | 1861.66 | 2279.64 | 10.92 |

| Culture, sports and entertainment | 87.28 | 167.48 | 305.77 | 462.45 | 594.72 | 723.10 | 2.95 |

| Public administration, social security and social organizations | 783.32 | 1765.43 | 3259.50 | 5062.93 | 7496.22 | 9412.61 | 29.27 |

| Stages | GDP | ICT Capital | ICT Hardware | ICT Software | Non-ICT Capital | Construction and Installation Works | Equipment and Apparatus Purchase | Other costs | Labor | TFP |

|---|---|---|---|---|---|---|---|---|---|---|

| 2000–2005 | 8.47 | 0.49 | 0.43 | 0.06 | 4.64 | 2.72 | 1.23 | 0.68 | 0.64 | 2.70 |

| 2006–2010 | 9.63 | 0.41 | 0.21 | 0.20 | 4.54 | 3.01 | 1.11 | 0.42 | 1.38 | 3.30 |

| 2011–2015 | 7.65 | 0.49 | −0.02 | 0.51 | 3.40 | 2.09 | 1.06 | 0.25 | 1.29 | 2.47 |

| 2016–2020 | 4.73 | 0.48 | 0.16 | 0.33 | 2.36 | 1.66 | 0.48 | 0.22 | 0.45 | 1.44 |

| 2000–2020 | 7.96 | 0.55 | 0.18 | 0.37 | 3.76 | 2.42 | 0.98 | 0.37 | 0.86 | 2.78 |

| Stages | GDP | ICT Capital | ICT Hardware | ICT Software | Non-ICT Capital | Construction and Installation Works | Equipment and Apparatus Purchase | Other Costs | Labor | TFP |

|---|---|---|---|---|---|---|---|---|---|---|

| 2000–2005 | 100 | 5.82 | 5.13 | 0.69 | 54.71 | 32.12 | 14.55 | 8.04 | 7.58 | 31.89 |

| 2006–2010 | 100 | 4.26 | 2.14 | 2.11 | 47.14 | 31.26 | 11.53 | 4.36 | 14.33 | 34.27 |

| 2011–2015 | 100 | 6.39 | −0.27 | 6.67 | 44.46 | 27.34 | 13.83 | 3.30 | 16.80 | 32.34 |

| 2016–2020 | 100 | 10.22 | 3.32 | 6.91 | 49.88 | 35.19 | 10.06 | 4.62 | 9.46 | 30.44 |

| 2000–2020 | 100 | 6.95 | 2.27 | 4.68 | 47.26 | 30.35 | 12.30 | 4.61 | 10.86 | 34.93 |

| Industry | 2001 | 2006 | 2008 | 2010 | 2012 | 2014 | 2016 | 2018 | 2020 |

|---|---|---|---|---|---|---|---|---|---|

| Agriculture, forestry, animal husbandry and fishery | 1.85 | 3.51 | 0.50 | 0.83 | 0.13 | 0.46 | 0.96 | 0.09 | 0.09 |

| Mining | 1.10 | 0.62 | 0.07 | 0.43 | 1.09 | −1.00 | 0.21 | 2.05 | 0.72 |

| Manufacturing | 33.42 | 13.79 | 16.12 | 13.71 | 12.46 | 12.31 | 34.14 | 20.03 | 28.66 |

| Electricity, heat, gas and water production and supply industry | 0.31 | 0.58 | 0.42 | 0.70 | 0.70 | 4.94 | 5.05 | 0.38 | 0.56 |

| Construction | 17.71 | 9.86 | 10.18 | 24.83 | 42.53 | 39.42 | 39.03 | 36.31 | −18.91 |

| Wholesale and retail | 4.27 | 2.84 | 0.35 | 3.90 | 2.33 | 5.50 | 9.70 | 3.76 | −2.63 |

| Transportation, storage and postal industry | 0.30 | 0.98 | 1.56 | 1.81 | 6.59 | 4.64 | 7.33 | 5.87 | −3.25 |

| Hotels and catering industry | 3.33 | 3.35 | 1.45 | 3.03 | 3.89 | 2.45 | 2.76 | 5.83 | −1.42 |

| Information transmission, software and information technology services | 14.74 | 23.27 | 22.80 | 42.23 | 32.15 | 36.28 | 39.20 | 27.40 | 39.01 |

| Financial industry | 48.44 | 36.49 | 42.32 | 39.05 | 28.37 | 30.48 | 36.81 | 41.89 | 43.98 |

| Real estate | 0.03 | 0.06 | 1.95 | 0.31 | 1.14 | 1.81 | 0.50 | 0.31 | 2.96 |

| Leasing and business services | 18.34 | −4.01 | 8.84 | 6.10 | 6.94 | 11.51 | 7.07 | 1.41 | −4.26 |

| Scientific research and technical services | 5.79 | −2.08 | 5.59 | 6.93 | 18.67 | 13.91 | 24.51 | 14.96 | 11.13 |

| Water, environment and public facilities management industry | 0.03 | 0.21 | 0.16 | 0.18 | 0.21 | 0.32 | 1.06 | −0.10 | 0.09 |

| Residential services, repairs and other services | 4.33 | 34.43 | 13.38 | 6.07 | 28.31 | 4.77 | 3.55 | 3.31 | 2.62 |

| Education | 0.06 | 0.47 | 0.25 | 0.20 | 3.47 | 2.34 | 2.28 | 1.24 | 1.84 |

| Health and social work | 0.55 | 5.85 | 2.99 | 2.36 | 4.13 | 3.47 | 3.48 | 1.01 | 4.18 |

| Culture, sports and entertainment | 0.58 | 1.68 | 0.29 | 0.76 | 5.41 | 4.58 | 3.63 | 1.75 | 1.26 |

| Public administration, social security and social organizations | 0.10 | 0.23 | 0.20 | 4.07 | 9.45 | 9.87 | 2.96 | 8.35 | 9.61 |

| Industries | 2000–2005 | 2006–2010 | 2011–2015 | 2016–2020 | AVERAGE |

|---|---|---|---|---|---|

| Agriculture, forestry, animal husbandry and fishery (AFAF) | 0.998 | 1.000 | 0.982 | 0.981 | 0.990 |

| Mining (MIN) | 0.434 | 0.521 | 0.513 | 0.523 | 0.498 |

| Manufacturing (MAN) | 0.475 | 0.451 | 0.536 | 0.569 | 0.508 |

| Electricity, heat, gas and water production and supply (EHGW) | 0.365 | 0.363 | 0.370 | 0.373 | 0.368 |

| Construction (CON) | 0.812 | 0.901 | 0.933 | 0.921 | 0.892 |

| Transportation, storage, and postal industry (TSP) | 0.465 | 0.486 | 0.469 | 0.511 | 0.483 |

| Wholesale, retail, hotels, and catering (WRHC) | 0.931 | 0.942 | 0.943 | 0.999 | 0.954 |

| AVERAGE | 0.640 | 0.666 | 0.678 | 0.697 | —— |

| CO2 Cumulative Redundant Emissions (MT) | 7961.734 | 10,857.814 | 13,994.132 | 13,611.858 | —— |

| Variables | Testing Method | Identify | |||

|---|---|---|---|---|---|

| LLC | IPS | ADF-Fisher | PP-Fisher | ||

| TFEE | −2.5841 *** (0.0049) | −2.4828 *** (0.0065) | −4.0813 *** (0.000) | −1.9324 ** (0.0267) | Stationary |

| lnICT | −6.4011 *** (0.000) | −2.3993 *** (0.0082) | −3.8205 *** (0.0001) | −4.2745 *** (0.000) | Stationary |

| lnNICT | −8.9370 *** (0.000) | 0.8082 (0.7905) | −4.8534 *** (0.000) | −10.7403 *** (0.000) | Stationary |

| lnGDP | −3.7475 *** (0.0001) | −0.8231 (0.2052) | −4.5479 *** (0.000) | −1.9387 ** (0.0263) | Stationary |

| lnR&D | −1.4799 * (0.0694) | −1.5649 * (0.0588) | −3.8393 *** (0.0001) | −0.5818 (0.2803) | Stationary |

| Variables | VIF | 1/VIF |

|---|---|---|

| lnICT | 2.88 | 0.3476 |

| lnNICT | 1.98 | 0.5058 |

| lnGDP | 1.84 | 0.5449 |

| lnR&D | 1.14 | 0.8777 |

| Mean VIF | 1.96 | |

| DV | (1) TFEE | (2) TFEE | (3) EI | (4) EI | |

|---|---|---|---|---|---|

| IV | |||||

| lnICT | 0.0117 * (0.051) | 0.0039 ** (0.0436) | 0.1279 ** (0.032) | 0.0202 * (0.0658) | |

| lnGDP | —— | 0.2041 *** (0.001) | —— | 0.5969 *** (0.0001) | |

| lnNICT | —— | 0.0174 (0.603) | —— | 0.3002 *** (0.000) | |

| lnR&D | —— | −0.0165 ** (0.014) | —— | 0.0014 * (0.0911) | |

| 0.6391 *** (0.000) | 1.1815 * (0.083) | 0.7391 *** (0.01) | 1.9555 * (0.089) |

| Industries | AFAF | MIN | MAN | EHGW | CON | TSP | WRHC |

|---|---|---|---|---|---|---|---|

| (1) TFEE | 0.03075 ** (0.04) | 0.0324 ** (0.013) | 0.0008 * (0.0947) | −0.00194 (0.799) | 0.0105 (0.44) | −0.0024 ** (0.033) | 0.0277 * (0.076) |

| (2) EI | 0.0249 * (0.0629) | 0.044 *** (0.007) | 0.2318 *** (0.000) | 0.1284 *** (0.000) | 0.0118 ** (0.032) | 0.01417 (0.548) | 0.0963 ** (0.031) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

E, H.; Li, S.; Wang, L.; Xue, H. The Impact of ICT Capital Services on Economic Growth and Energy Efficiency in China. Energies 2023, 16, 3926. https://doi.org/10.3390/en16093926

E H, Li S, Wang L, Xue H. The Impact of ICT Capital Services on Economic Growth and Energy Efficiency in China. Energies. 2023; 16(9):3926. https://doi.org/10.3390/en16093926

Chicago/Turabian StyleE, Huifang, Shuangjie Li, Liming Wang, and Huidan Xue. 2023. "The Impact of ICT Capital Services on Economic Growth and Energy Efficiency in China" Energies 16, no. 9: 3926. https://doi.org/10.3390/en16093926

APA StyleE, H., Li, S., Wang, L., & Xue, H. (2023). The Impact of ICT Capital Services on Economic Growth and Energy Efficiency in China. Energies, 16(9), 3926. https://doi.org/10.3390/en16093926