Abstract

With the proposal of China’s “carbon peak, carbon neutral” strategy, the increasing awareness of low carbon production among consumers, and the government’s introduction of carbon trading mechanism and low carbon consumption subsidy policies, enterprises are facing good opportunities for development. However, how the government can reasonably formulate low carbon policies and how enterprises can implement optimal low-carbon production decisions are still key issues in China’s low-carbon transition development. In this context, this paper is based on the carbon trading mechanism and carbon consumption subsidies. In this context, based on the carbon trading mechanism, this paper focuses on green production and green consumption, considers the impact of low-carbon consumer preferences and government subsidies on enterprises’ low-carbon production decisions, and uses the optimal theory to study the optimal pricing strategy and the optimal carbon reduction strategy. The study shows that the increase in carbon price has a positive effect on the increase in enterprise profit; the increase of carbon emission has a negative effect on the increase of enterprise profit and the high carbon price will intensify this effect. In addition, changing the intensity of government subsidies to consumers will lead to the change of enterprise carbon emission strategy. The study of this paper provides a certain reference for the government to reasonably formulate carbon trading prices and consumer low-carbon subsidies. In addition, considering consumer low-carbon preferences is also conducive to promoting green production practices of enterprises, thus promoting the realization of the carbon neutral strategy.

1. Introduction

With the intensification of global warming and other phenomena, environmental problems are becoming more and more serious and their challenges to human survival and development are becoming greater and greater. Carbon emissions, as one of the important factors contributing to global warming, have drawn widespread attention from countries around the world and prompted them to continuously search for a balance between economic development and energy conservation and emission reduction [1]. In order to cope with the increasingly prominent environmental and climate problems, China has actively participated in energy saving and emission reduction and has continuously pressed itself to put forward the development strategy of “carbon peaking and carbon neutral”, putting forward higher requirements for carbon emission reduction and taking more practical and effective actions to actively respond to climate change. In addition, with the rapid development of the low-carbon economy, consumers’ low-carbon awareness is increasing and the government has introduced a carbon trading mechanism and a series of green consumption incentives and subsidies such as trade-in and consumption vouchers, which have stimulated the supply and demand of green and low-carbon products in the market. From a series of carbon trading and consumption subsidy policies, we can see that the development of a low-carbon economy is the general trend and that taking more social responsibility is also a problem that enterprises must face in their future development [2].

As the main body of various economic activities in society, enterprises, in the context of the development of a low-carbon economy advocated by all walks of life, are also tasked with controlling carbon emissions while pursuing economic benefits [3]. On the one hand, the government has introduced various low-carbon subsidy policies to ensure the realization of the goal of controlling carbon emissions; on the other hand, as consumers’ awareness of low-carbon production has been increasing, the carbon footprint of products has gradually begun to affect their willingness to purchase. Under the combined effect of these factors, enterprises’ production decisions and carbon emission reduction activities will be influenced to different degrees. Therefore, under the carbon trading mechanism it becomes an urgent issue to solve how the government can reasonably formulate low-carbon policies and how enterprises can make carbon emission reduction and pricing decisions to achieve a balance between economic benefits and energy saving and emission reduction.

The rest of the paper is organized as follows: After reviewing the relevant literature in Section 2, in Section 3 we describe the research problems and propose research hypotheses. We construct and solve the optimal decision model for the enterprise in Section 4. The example analysis is presented in Section 5, followed by the relevant conclusions and management recommendations in Section 6.

2. Literature Review

At present, many scholars have studied the carbon trading mechanism and supply chain subsidy mechanism. By establishing a mixed integer linear programming model, we can study the distribution vehicle routing optimization problem [4]. Government subsidies cannot guarantee that enterprises will reduce their total carbon emissions. Subsidies based on emission reduction have greater emission reductions, but the total carbon emissions are also greater [5]. Based on the closed-loop supply chain model, this paper analyzes the trade-off between carbon tax and total amount control and transaction and finds that the direct subsidy and policy deviation adopted by the government are equally helpful to enterprises [6]. Replacement subsidies can encourage customers to use new products and remanufactured products. Remanufacturing subsidies and tax rebates are conducive to manufacturers’ remanufacturing [7]. Based on the consideration of the impact of consumers’ low-carbon preference on market demand and the uncertainty of carbon emission reduction behavior, the stochastic differential game model of upstream and downstream enterprises is established. It is found that the government’s cost subsidy policy can promote carbon emission reduction investment and improve supply chain profits [8]. Comprehensive fitness can enhance physique and improve health level [9]. By negotiating the transfer price and sharing the incentive mechanism of government subsidies, enterprises can be encouraged to strengthen cooperation to reduce carbon and pollutant emissions [10]. Consumers’ demand for new energy vehicles is gradually increasing, and centralized decision making makes the efficiency of the supply chain better. The high cost of carbon emission reduction technology will be detrimental to enterprises’ technology R & D and innovation [11]. The government can encourage enterprises to reduce carbon dioxide emissions by controlling carbon prices [12]. China’s ETS has a significant impact on the high carbon price and the market of high carbon enterprises [13]. Strengthening the market trading construction of carbon emission rights will help to reduce carbon dioxide emissions [14]. As an important part of the subsidy mechanism, allowance allocation and allowance distribution contribute to the construction of carbon trading [15]. The implementation of carbon tax and carbon trading policies helps to reduce carbon emissions.

In terms of the research on government subsidies under the carbon trading mechanism, Kundu T and others used game theory to analyze the impact of government subsidies on the behavior of shippers in the context of the Belt and Road [16]. The government can implement a combination of dynamic punishment and dynamic subsidies to reduce environmental pollution [17]. Ma et al. discussed the impact of government subsidies on low-carbon consumption and supply chain pricing under the condition of asymmetric information on carbon emission reduction [18]. Although industrial development is conducive to economic development, it will also produce large carbon emissions and pollute the environment [19]. Li et al. studied the impact of government subsidies on green technology investment and green marketing coordination in the supply chain under the carbon quota trading mechanism [20]. Strengthening supervision and punishment can promote enterprises to carry out green energy conservation and emission reduction [21]. Yi analyzed the impact of government carbon tax policy and government energy-saving subsidy policy on enterprise decision making in the two-level supply chain [22]. Based on the consideration of asymmetric information, Li C analyzes the impact of government incentive mechanism on enterprises’ optimal pollution control R & D investment and puts forward that the government can appropriately carry out incentive compensation to make enterprises reach Nash equilibrium [23]. Limiting the amount of carbon trading is conducive to reducing carbon dioxide emissions [24]. The implementation of carbon tax should consider the characteristics of carbon emissions [25]. Different transportation modes of biodegradable products have an important influence on green supply chain management [26]. Credit sales, flexible production, and quality improvement can effectively promote the sustainable development of the energy supply chain system [27].

Through Table 1 and the above related literature, we can find that the existing literature mainly studies the optimal decision making and carbon emissions of the supply chain when the government subsidizes enterprises. In other words, most of the research focuses on the green production of enterprises but ignores the consumers’ key role of green consumption. Based on this, aiming at the carbon emissions under the background of carbon trading, this paper constructs the profit function of enterprises, analyzes the positive and negative effects of carbon trading behavior, considers the government guidance, takes the market as the core, implements consumption subsidies to consumers, comprehensively considers the low-carbon consumption willingness and consumption subsidies, and puts forward the optimal pricing and optimal carbon emission strategies for enterprises under the carbon trading mechanism.

Table 1.

Comparison of this paper with existing related research.

3. Problem Description and Symbol Description

Considering the product pricing and carbon emission of enterprises under the consumer subsidy under the carbon trading mechanism, this paper analyzes the carbon emission reduction strategy of enterprises according to the different preferences of consumers for low-carbon products. Under the carbon emission mechanism, this paper mainly discusses: (1) How to decide the product price and carbon emission based on the government carbon quota from the green production side of enterprises given the exogenous carbon trading price and consumers’ different low-carbon preferences. (2) From the green consumption side of consumers, we consider the impact of low-carbon subsidies on enterprises’ carbon emission reduction strategies when the government provides low-carbon subsidies to consumers.

The parameter symbols and descriptions involved in this paper are shown in Table 2.

Table 2.

Symbols and descriptions.

Hypothesis 1:

Under the carbon trading policy environment, in order to achieve carbon emission reduction the enterprise will conduct low-carbon production of a certain product, with a unit production cost of and a unit price of for low-carbon products and a unit price of for similar non-low-carbon products. Assuming that the enterprise is completely rational, the enterprise will make its own product pricing and optimal carbon emission reduction investment according to the government’s carbon emission quota in order to maximize profits. At this time, the enterprise’s decision-making objectives are:

where represents the product demand function and represents the carbon emissions when there are emission reduction inputs. Considering the impact of consumer’s low-carbon preference, the product demand function is determined by the price of low-carbon products and the carbon emissions of enterprises [28]. In addition, enterprises will reduce carbon emissions under government supervision, and the carbon emissions of enterprises are negatively correlated with the government supervision factor () and is the actual carbon emissions of enterprises with carbon emission reduction input under the supervision of the government [29]. Therefore, indicates the carbon emission reduction input and is the impact coefficient of carbon emission reduction on carbon emission reduction input.

Hypothesis 2:

Assuming that the carbon emission limit for the enterprise that is allocated free of charge by the government is (hereafter referred to as the carbon limit), when the total carbon emission is less than the carbon limit, the enterprise will sell the remaining carbon emission rights through the carbon trading market [30]; otherwise, it will need to purchase carbon emission rights. The transaction price of the unit carbon emission rights is (hereafter referred to as the carbon trading price).

Hypothesis 3:

Due to the level of consumers’ preference for low carbon being positively correlated with the level of enterprises’ carbon emission reduction [31], consumers’ acceptance of low-carbon products is different. Assuming that consumers’ preference for low-carbon products follows a uniform distribution on , where means that consumers have no low-carbon awareness. At this time, consumers choose products without considering the carbon emission level; means that consumers have a strong low-carbon awareness. At this time, consumers have more recognition on the carbon emission level of products and are more inclined to buy low-carbon products.

Hypothesis 4:

Under the background of carbon peak and carbon neutralization, the government explores the possibility of carbon emission reduction from the consumption side and implements low-carbon subsidies to consumers to improve consumers’ low-carbon awareness. It is assumed that the government has complete information on the carbon emission of products and provides low-carbon subsidies to consumers based on the carbon emission reduction of products . Where represents the government subsidy coefficient and represents the carbon emissions without emission reduction input.

Hypothesis 5:

Assuming that consumers are absolutely rational, the condition for purchasing low-carbon products is that the total utility of purchasing low-carbon products is not less than that of purchasing ordinary products. When consumers’ low-carbon preference is , the critical conditions for consumers to buy low-carbon products are:

where represents the utility coefficient of consumers’ low-carbon awareness, and the solution is:

At this time, consumers’ demand for low-carbon products in the market is:

4. Analysis of Supply Chain Pricing Strategy Considering Consumer Subsidies

The government will set carbon emission limits for enterprises in each cycle. Under the condition of known carbon emission limits, enterprises adjust production strategies to obtain the maximum economic benefits in the production cycle. At this time, the decision-making objectives of enterprises are:

, therefore, there is a unique optimal pricing so that can be obtained:

Substitute into the enterprise profit function to obtain:

Theorem 1:

Government subsidies to consumers make enterprises obtain more benefits to a certain extent.

Proof.

, , get the proof.

This is because when the government increases the subsidies to consumers, the subsidies will be subsidized to consumers in a form included in the selling price. At this time, enterprises will obtain more benefits in the form of raising the selling price in a disguised form.

The second derivative of the total profit of the enterprise with respect to carbon emission reduction is obtained: because the symbol of cannot be determined. In order to study the optimal carbon emission of enterprises, it is necessary to take as the threshold for discussion:

(1) When :

Nature 1: When , that is, when , the enterprise profit function has a linear relationship with carbon emission . At this time, the minimum carbon emission is the optimal carbon emission strategy of the enterprise. □

Proof.

When , , it can be seen that the profit function of the enterprise is a strict reduction function about the optimal carbon emission. Therefore, at this time the enterprise should reduce the production of carbon emissions as much as possible. □

Theorem 2:

When the carbon emission reduction coefficient is a certain value, the government’s relaxation of carbon emission constraints on enterprises can reduce the cost pressure of enterprises, but it will also lead to a higher opportunity for the cost of the carbon trading price.

Proof.

Because , it can be seen that with the rise of the carbon trading price, gradually increases, that is, the decline rate of enterprise profit gradually increases, which is proved. □

The rise of carbon trading price will aggravate the trend that the profits of enterprises will decrease with the increase in carbon emissions. At this time, the government’s reduction in carbon emission regulation of enterprises will reduce the pressure of enterprise production to a certain extent. If enterprises choose the strategy of reducing production costs and increasing carbon emissions, they will pay more carbon trading costs due to the increase in that carbon trading price, that is, the opportunity cost of carbon trading.

(2) When :

Nature 2: When , that is, when , the optimal carbon emission reduction of enterprise theory is:

Proof.

When , , at this time there is a unique optimal solution for the optimal carbon emission of enterprises. If , we can get and get the certificate. □

Theorem 3:

When the carbon emission reduction coefficient is greater than a certain threshold, the higher the carbon trading price, the more enterprises should obtain more benefits from the carbon trading market by reducing carbon emissions to reduce the cost pressure.

Proof.

It can be seen from that the optimal carbon emission of the enterprise is inversely proportional to the carbon trading price. □

This is because the higher the carbon trading price, the higher the cost for enterprises to purchase carbon quotas. At this time, the opportunity cost of carbon trading is greater than the cost for enterprises to invest in carbon emission reduction. Therefore, enterprises taking the initiative to increase carbon emission reduction investment to reduce carbon emissions is a better production strategy.

Nature 3: When , the enterprise theoretical optimal carbon emission reduction is , so the enterprise optimal carbon emission reduction is . When , the optimal carbon emission reduction of the enterprise is .

Proof .

When is known, the enterprise profit is a strictly concave function. At this time, it is necessary to compare the theoretical optimal carbon emission of the enterprise with the maximum real carbon emission reduction of the enterprise: (1) when , ; (2) when , ; (3) when , . □

From , we can get .

From , we can get or .

If you want to make , you need to meet , which is obviously inconsistent with the facts. Therefore, take . For , it can be obtained from that is strictly less than and the certificate is completed.

(3) When :

Nature 4: When , that is, when , the high carbon emission of the enterprise makes the enterprise profit the lowest, and the worst carbon emission is:

Proof.

When , that is, when , , get the certificate. □

Nature 5: When , the optimal carbon emission of enterprises is the minimum carbon emission.

Proof.

When , , the objective function is convex to . At this time, the optimal carbon emission reduction of the enterprise can be obtained by comparing the function values of endpoint and . Replace Formula (6) with and , respectively, to solve .

When , , now

When , , now

If Equation (10) holds, it needs to meet . If it does not meet the reality, this situation is omitted. Similarly, in Equation (9), is always established and proved. □

Theorem 4:

It can be proved by property 5 that when the carbon emission reduction coefficient is less than a certain threshold, the enterprise should reduce the carbon emission reduction as much as possible because, at this time, the enterprise can reduce the production pressure of the enterprise through carbon trading.

Proof.

When the enterprise’s carbon emission reduction coefficient is small, the cost for enterprises to increase carbon emission reduction investment is small. At this time, enterprises are willing to take the initiative to obtain more carbon emission limit savings through carbon emission reduction and resell this part of the carbon limit savings to other enterprises in the form of carbon trading to obtain certain benefits. □

Theorem 5:

Increasing government subsidies to consumers may encourage enterprises to choose the minimum carbon emission strategy.

Proof.

There is a close relationship between enterprises’ choice of carbon emission strategy and the size of and . When the government subsidy coefficient to consumers increases, it will change the size relationship between and , thus affecting enterprises’ carbon emission strategies.

For example, when , the optimal carbon emission strategy of the enterprise is , and with an increase in , , the optimal strategy of the enterprise changes to reduce carbon emissions as much as possible, which is proved. □

This is because the increase in government subsidies to consumers will increase the income of enterprises to a certain extent. At this time, enterprises are more willing to bear more social responsibilities and take the initiative to increase carbon emission reduction investment to reduce carbon emissions.

5. Example Analysis

This paper analyzes the optimal carbon emission reduction strategy of enterprises under different situations by establishing models. In this part, the properties and conclusions derived from the mathematical model are analyzed by the real production background of a small manufacturing enterprise in China. The relevant parameter settings are shown in Table 3.

Table 3.

Relevant parameter settings.

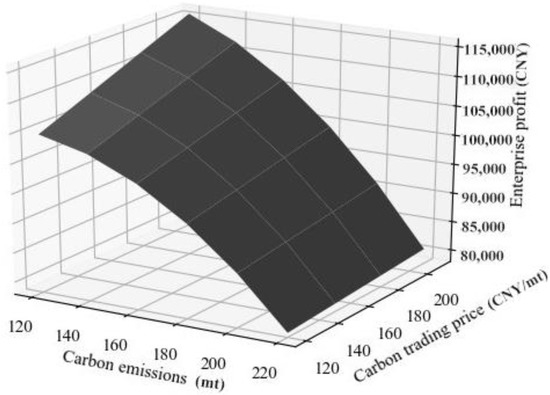

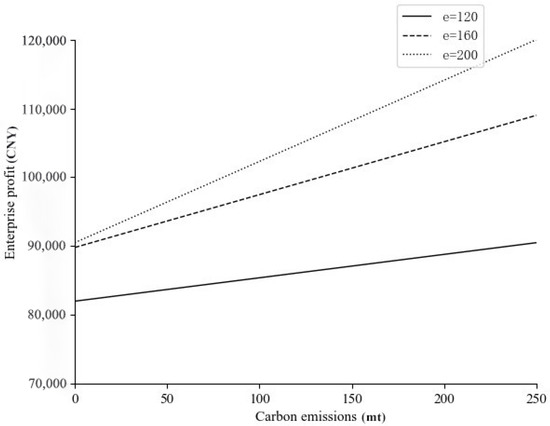

5.1. The Impact of Carbon Emissions and Carbon Trading Prices on Supply Chain Profits

When , the enterprise profit function is linear.

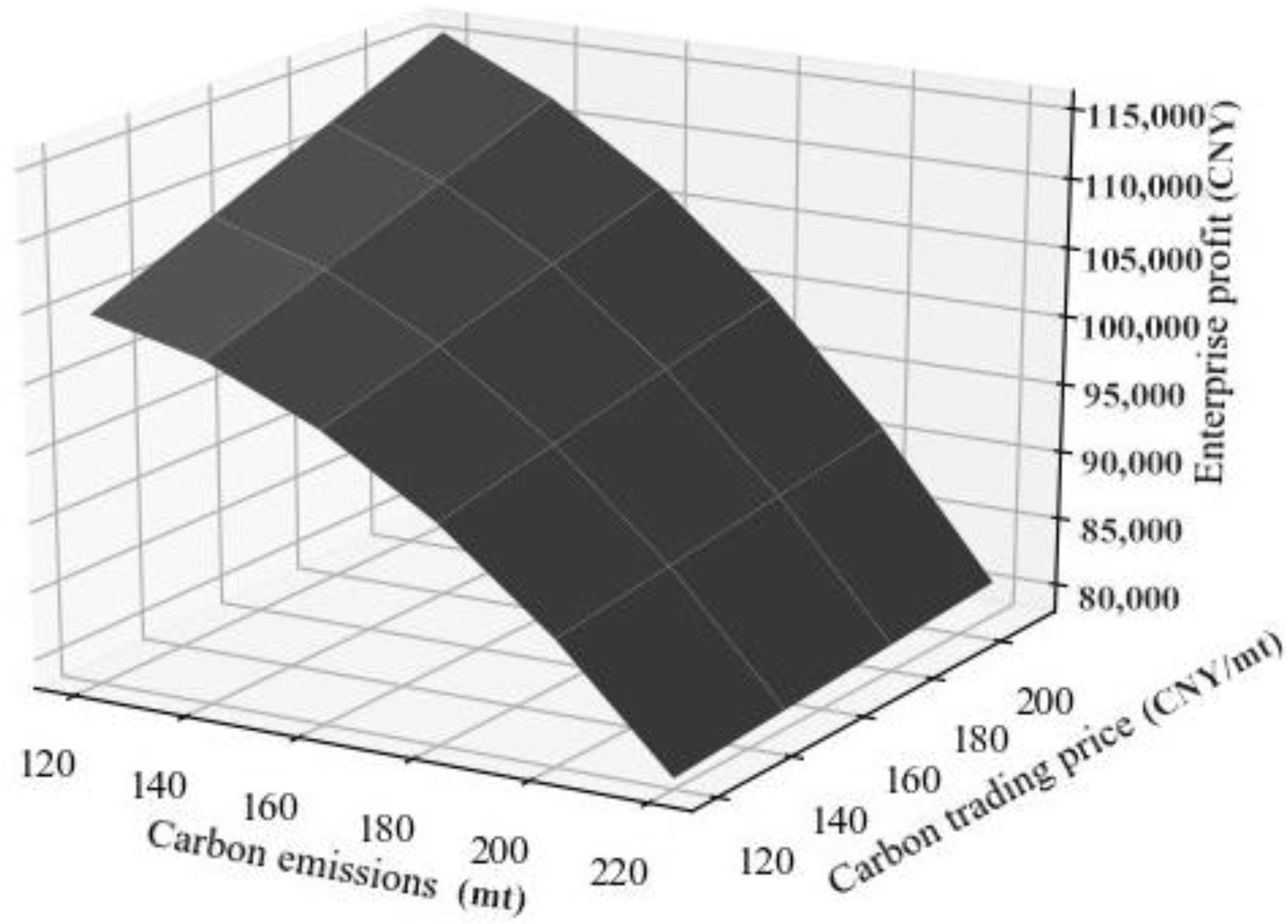

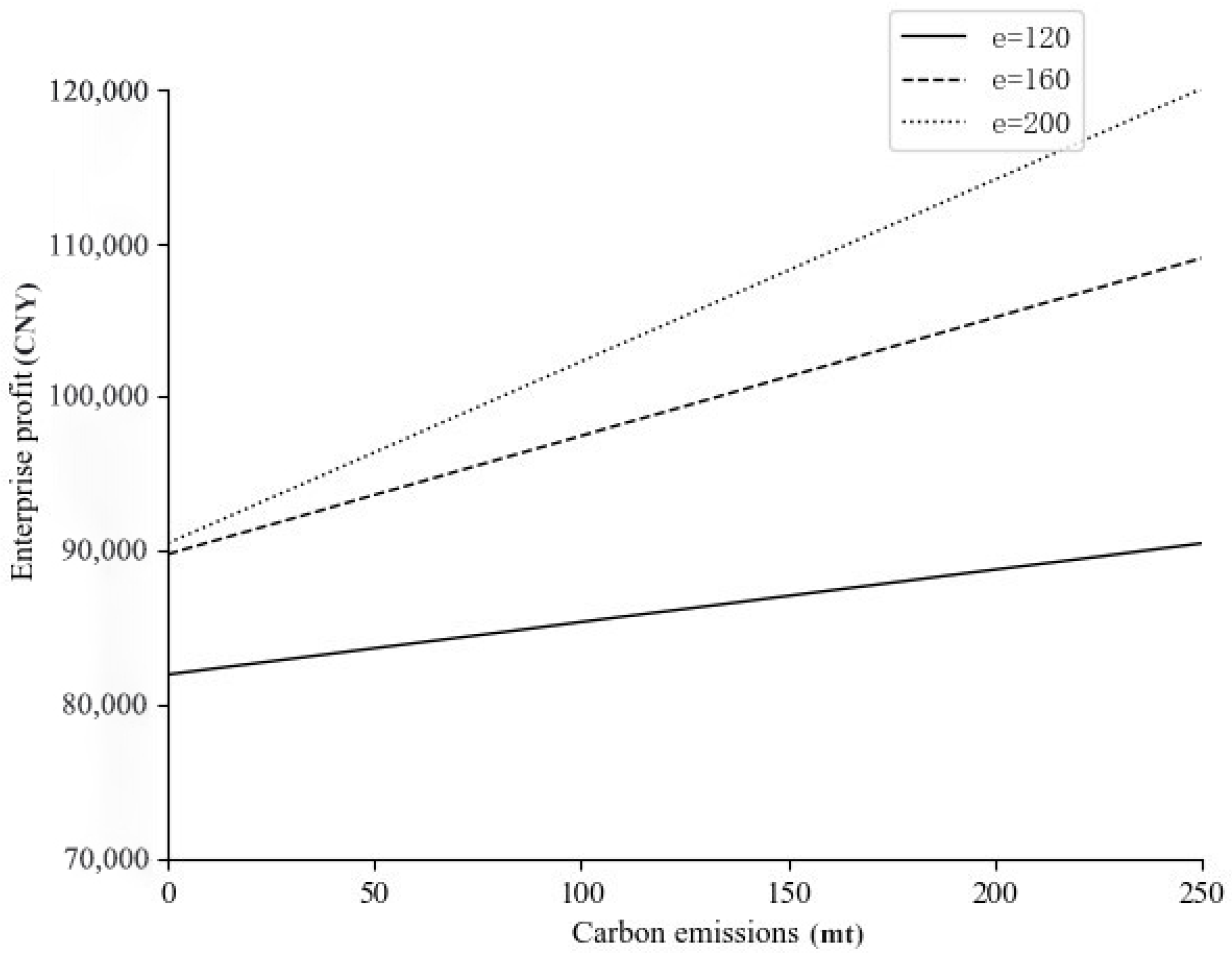

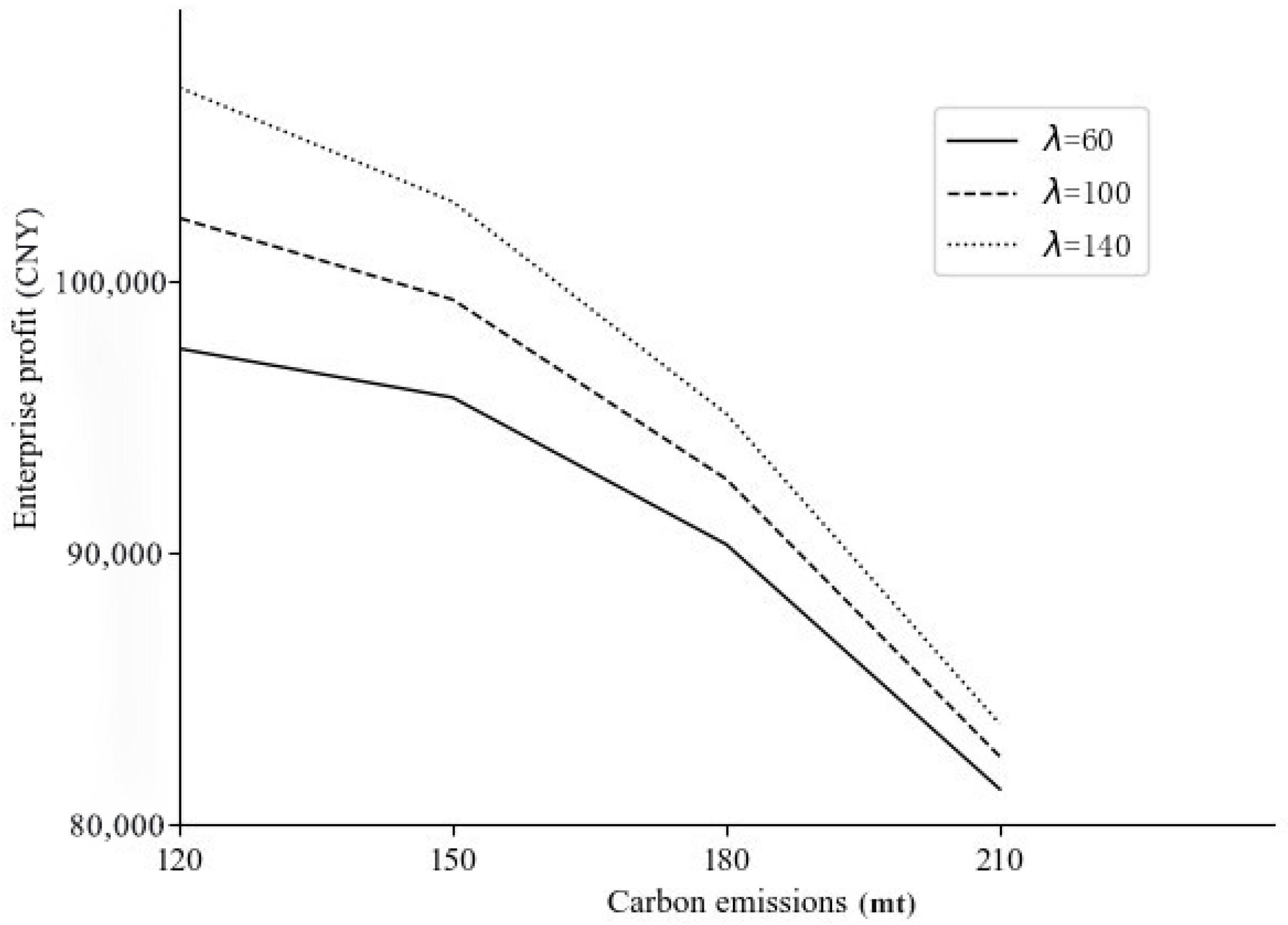

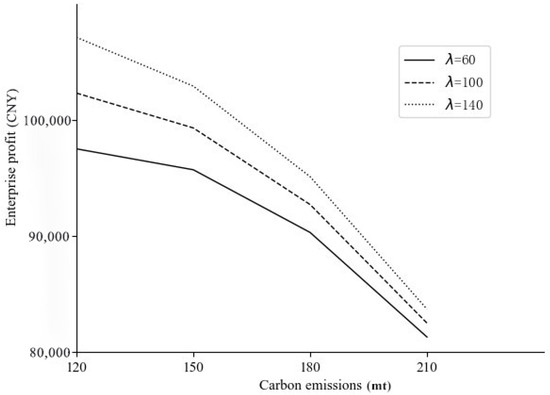

Under the joint influence of carbon emissions and carbon trading price, the change trend of enterprise profits is shown in Figure 1. From the change trend of the graph, compared with the carbon trading price, the impact of carbon emissions on enterprise profits is more obvious, so carbon emissions have a greater impact on enterprise profits. The impact trend of single factors on corporate profits is shown in Figure 2 and Figure 3. It can be seen from Figure 2 that the increase in carbon trading price will improve the overall profit level of enterprises, and under the same carbon trading price, reducing carbon emissions can effectively improve corporate profits. It can be seen from Figure 3 that the higher the carbon trading price is, the faster the decline rate of enterprise profits will be with an increase in carbon emissions. This is because when the carbon trading price is at a high level, if the enterprise deregulation increases carbon emissions, it will bear the opportunity cost of higher carbon trading. In addition, through the above results we can find that reducing carbon emissions and raising carbon trading prices can effectively increase corporate profits, thus achieving the balance of economic and environmental benefits and promoting the sustainable development of social economy.

Figure 1.

The impact of carbon emissions and carbon trading prices on corporate profits.

Figure 2.

The impact of carbon trading price on enterprise profits.

Figure 3.

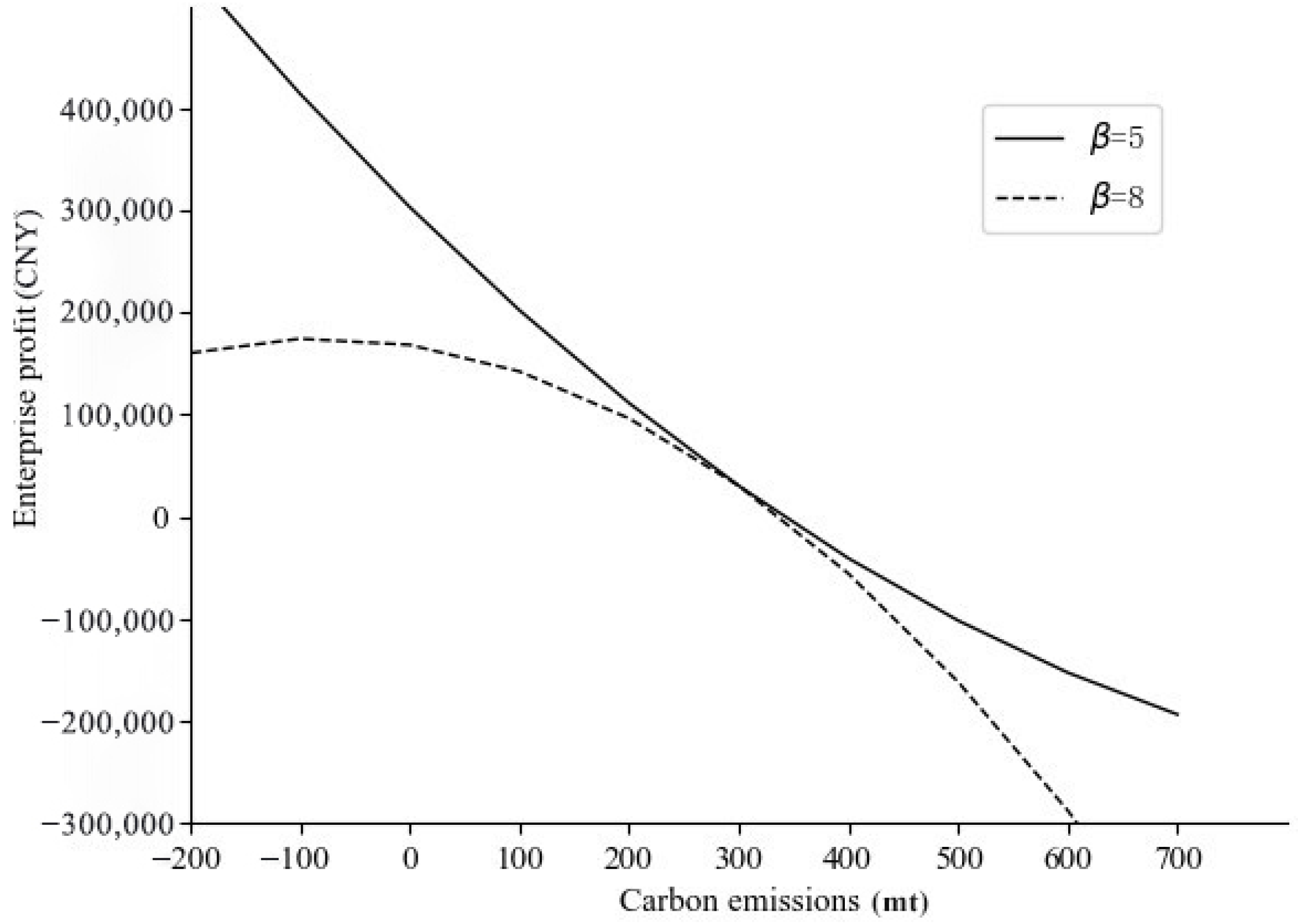

The impact of carbon emissions on corporate profits.

5.2. Influence of the Carbon Emission Coefficient on Supply Chain

When , the enterprise profit function is nonlinear.

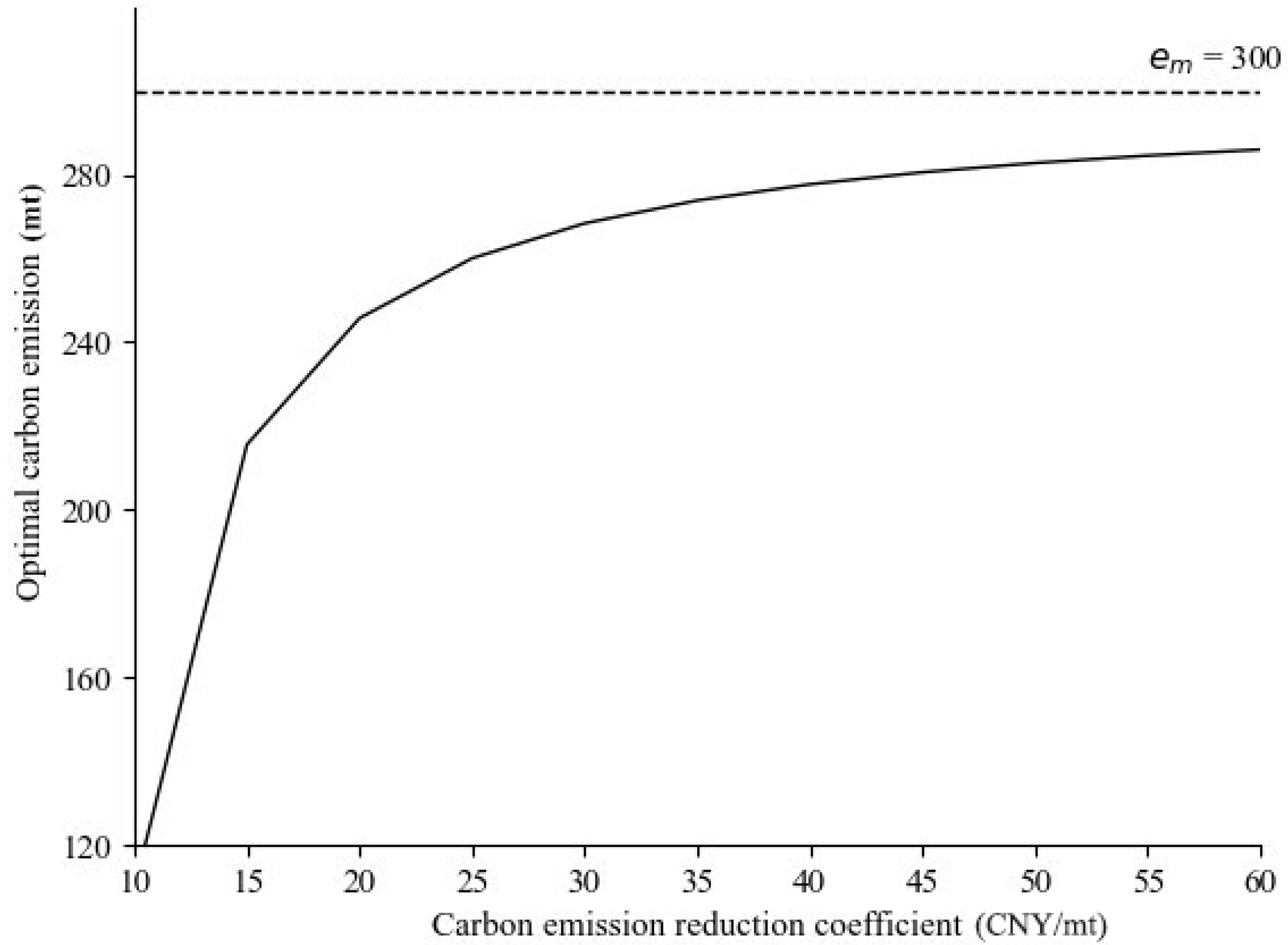

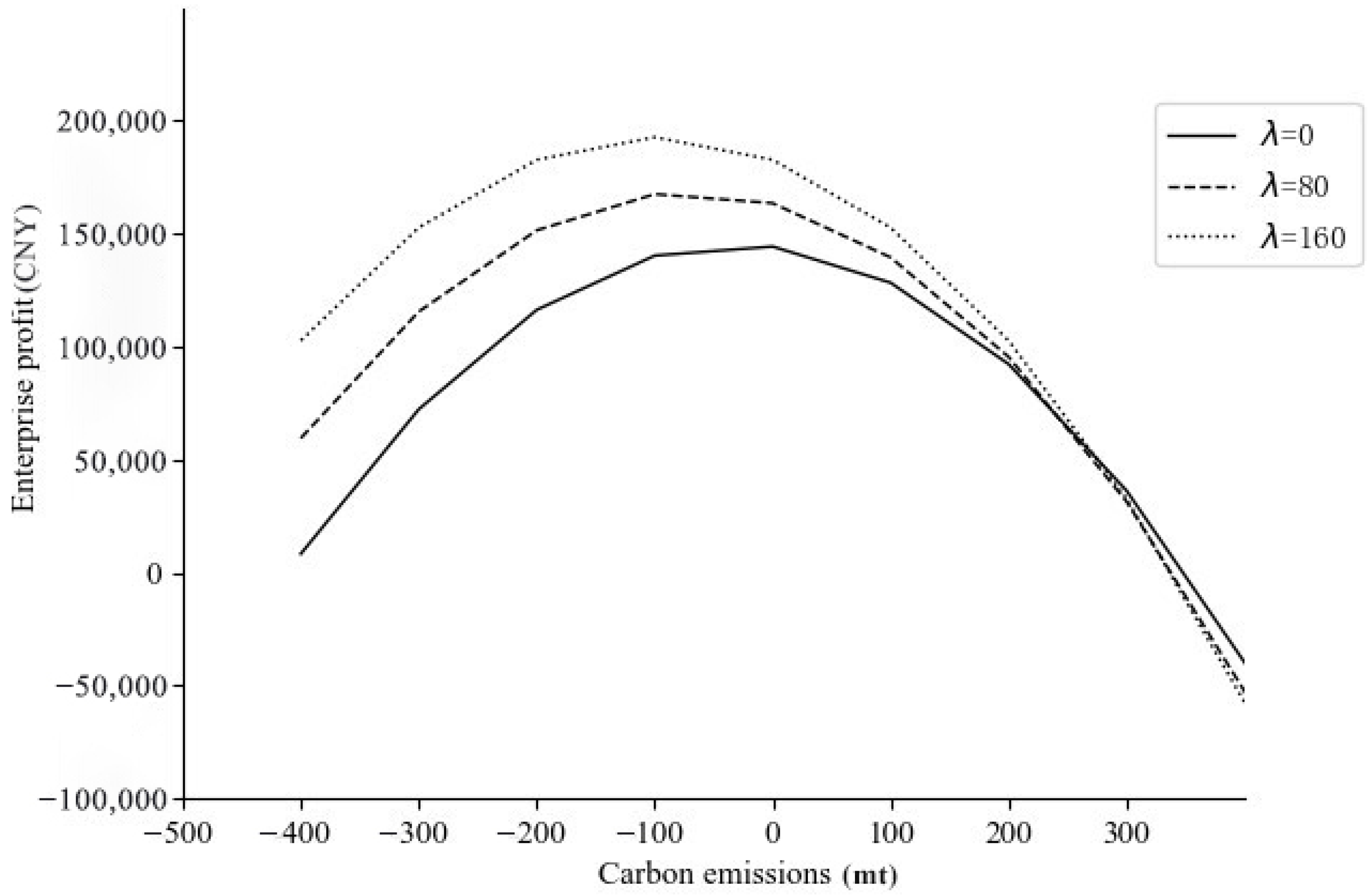

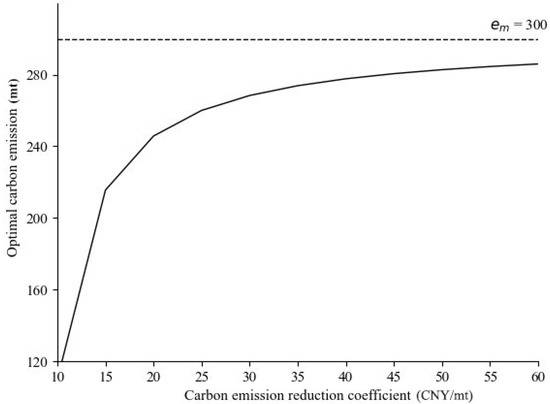

When , the influence of the carbon emission reduction coefficient on the optimal carbon emission reduction is shown in Figure 4. As can be seen from Figure 4, with the increase in carbon emission reduction coefficient, the enterprise will adjust the production strategy to increase the target carbon emissions. At the same time, the increase rate of target carbon emissions will gradually decrease and take the maximum carbon emission as the limit value. This is because the positive effect of the carbon emission reduction coefficient on the optimal carbon emission is limited by the enterprise capacity.

Figure 4.

Influence of the carbon emission reduction coefficient on optimal carbon emission reduction.

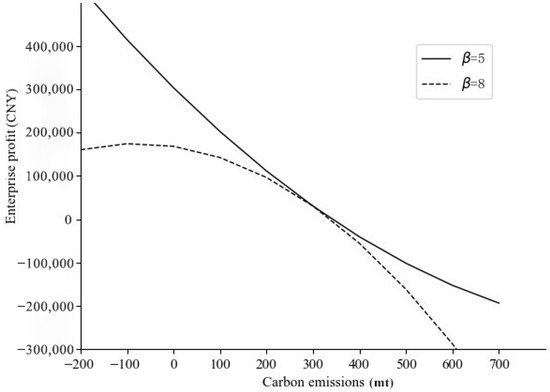

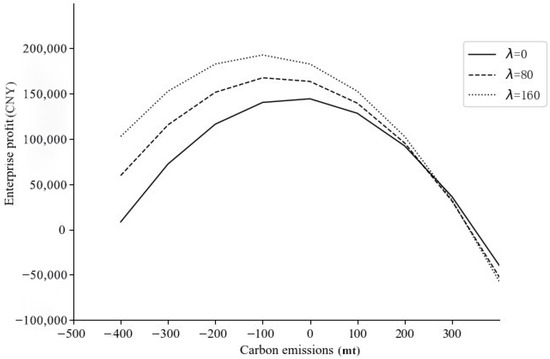

The impact of carbon emissions on corporate profits under different carbon emission reduction coefficients and different carbon trading prices is shown in Figure 5. It can be seen from Figure 5 that the change in carbon emission reduction coefficient changes the concavity and convexity of the objective function, but the enterprise profit corresponding to the stable point remains unchanged in the two cases. As can be seen from Figure 6, the higher the carbon trading price, the less carbon emissions the enterprise will achieve for the global optimization of profits. At the same time, from the change trend of the curve, the higher the carbon trading price, the faster the profit decline caused by the increase in carbon emissions. Therefore, raising the carbon trading price means it is beneficial for enterprises to invest in carbon emission reduction, thus promoting the green development of economy and the environment.

Figure 5.

The impact of carbon emissions on corporate profits under different carbon emission reduction coefficients.

Figure 6.

The impact of carbon emissions on corporate profits under different carbon trading prices.

6. Conclusions

Considering the consumer subsidies under the background of carbon trading and aiming at green production and green consumption, this paper analyzes the impact of carbon trading price on enterprise profits when the target profits are different, the impact of government subsidies to consumers on enterprise carbon emission reduction strategies, and discusses the optimal pricing strategy and optimal carbon emission reduction strategy of enterprise products under the factors of consumers’ low-carbon preference and government subsidies to consumers. The research shows:

- (1)

- Increasing the carbon trading price is beneficial for increasing corporate profits; however, with the increase in carbon emissions, corporate profits keep decreasing and the higher the carbon trading price, the more obvious the negative effect of carbon emissions on corporate profits.

- (2)

- An increase in government subsidies to consumers leads to a change in firms’ carbon emission reduction strategies, and when consumer subsidies increase, firms will reduce carbon emissions as much as possible to gain more profits due to higher levels of consumer low-carbon preferences.

- (3)

- When the price of carbon trading is higher, due to the higher opportunity cost of carbon trading, enterprises will reduce carbon emissions as much as possible to gain more profit.

Based on the above conclusions, we can get the following management insights:

- (1)

- For enterprises: When the enterprise carbon emission reduction factor is small, the enterprise carbon emission reduction cost is lower than the cost of purchasing carbon allowances; at this time, enterprises should reduce the carbon footprint in the production cycle as much as possible. When the carbon price is high, selling carbon allowances in the carbon trading market has a larger profit space; at this time, enterprises should also reduce carbon emissions as much as possible. When consumers’ awareness of low-carbon production gradually increases, enterprises should improve the level of carbon emission reduction and actively take the responsibility of social emission reduction in order to improve the brand image of enterprises and increase their profits.

- (2)

- For the government: The government can adjust the cost structure of enterprises by adjusting the subsidies to consumers to promote the implementation of carbon emission reduction by enterprises. In addition, it can also force enterprises to reduce carbon emissions by regulating carbon prices in the carbon trading market.

However, there are also two deficiencies in this study. First, the government carbon quota is set as an exogenous variable in the research process; in practice, there are great differences in carbon emission quotas between different industries and enterprises. Second, the price that each consumer is willing to pay for low-carbon products is unified, which is often different to the actual situation. In future research, we will consider empirical studies to analyze the effects of different governmental low-carbon policies and consumers’ environmental awareness of firms’ low-carbon decisions.

Author Contributions

Conceptualization, formal analysis, data curation, methodology, Z.L.; Methodology, investigation, writing—review & editing, W.S.; Investigation, B.H.; Data curation, C.H.; Methodology, P.I.; Formal analysis, Y.Z.; Writing—original draft, J.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the National Social Science Fund of China (Grant No. 22GLB03983).

Data Availability Statement

The simulation experiment data used to support the findings of this study are available from the corresponding author upon request.

Conflicts of Interest

The authors declare that there are no conflict of interest regarding the publication of this paper.

References

- Osieczko, K.; Zimon, D.; Placzek, E.; Prokopiuk, I. Factors that influence the expansion of electric delivery vehicles and trucks in EU countries. J. Environ. Manag. 2021, 296, 113177. [Google Scholar] [CrossRef] [PubMed]

- Jum’a, L.; Ikram, M.; Alkalha, Z.; Alaraj, M. Factors affecting managers’ intention to adopt green supply chain management practices: Evidence from manufacturing firms in Jordan. Environ. Sci. Pollut. Res. 2022, 29, 5605–5621. [Google Scholar] [CrossRef] [PubMed]

- Zimon, D.; Tyan, J.; Sroufe, R. Implementing sustainable supply chain management: Reactive, cooperative, and dynamic models. Sustainability 2019, 11, 7227. [Google Scholar] [CrossRef]

- Jharkharia, S.; Das, C. Vehicle routing analyses with integrated order picking and delivery problem under carbon cap and trade policy. Manag. Res. Rev. 2019, 43, 223–243. [Google Scholar] [CrossRef]

- Li, Z.; Yang, W.; Pan, Y. Carbon emission reduction cooperation in supply chain with government subsidies. Earth Environ. Sci. 2020, 647, 2145951. [Google Scholar] [CrossRef]

- Hu, X.; Yang, Z.; Sun, J.; Zhang, Y. Carbon tax or cap-and-trade: Which is more viable for Chinese remanufacturing industry? J. Clean. Prod. 2020, 243, 118606. [Google Scholar] [CrossRef]

- Shu, T.; Peng, Z.; Chen, S.; Wang, S.; Lai, K.K.; Yang, H. Government subsidy for remanufacturing or carbon tax rebate: Which is better for firms and a low-carbon economy. Sustainability 2017, 9, 156. [Google Scholar] [CrossRef]

- Yu, S.; Hou, Q. Supply chain investment in carbon emission-reducing technology based on stochasticity and low-carbon preferences. Complexity 2021, 2021, 8881605. [Google Scholar] [CrossRef]

- Liu, Z.; Zhang, S.; Li, L.; Hu, B.; Liu, R.; Zhao, Z.; Zhao, Y. Research on the construction and prediction of China’s national fitness development index system under social reform. Front. Public Health 2022, 783, 878515. [Google Scholar] [CrossRef]

- Ding, H.; Zhao, Q.; An, Z.; Tang, O. Collaborative mechanism of a sustainable supply chain with environmental constraints and carbon caps. Int. J. Prod. Econ. 2016, 181, 191–207. [Google Scholar] [CrossRef]

- Yin, Y.; Liu, F. Carbon Emission Reduction and Coordination Strategies for New Energy Vehicle Closed-Loop Supply Chain under the Carbon Trading Policy. Complexity 2021, 2021, 3720373. [Google Scholar] [CrossRef]

- Kang, K.; Zhao, Y.; Zhang, J.; Qiang, C. Evolutionary game theoretic analysis on low-carbon strategy for supply chain enterprises. J. Clean. Prod. 2019, 230, 981–994. [Google Scholar] [CrossRef]

- Wang, W.; Zhang, Y.J. Does China’s carbon emissions trading scheme affect the market power of high-carbon enterprises? Energy Econ. 2022, 108, 105906. [Google Scholar] [CrossRef]

- Ren, C. Carbon Emissions Trading Market Mechanism Design: Perspectives of Legal Economics. In Proceedings of the 2021 International Conference on Social Development and Media Communication (SDMC 2021), Sanya, China, 26–28 November 2021; Atlantis Press: Amsterdam, The Netherlands, 2022; pp. 1204–1212. [Google Scholar]

- Xiong, L.; Shen, B.; Qi, S.; Price, L.; Ye, B. The allowance mechanism of China’s carbon trading pilots: A comparative analysis with schemes in EU and California. Appl. Energy 2017, 185, 1849–1859. [Google Scholar] [CrossRef]

- Kundu, T.; Sheu, J.B. Analyzing the effect of government subsidy on shippers’ mode switching behavior in the Belt and Road strategic context. Transp. Res. Part E Logist. Transp. Rev. 2019, 129, 175–202. [Google Scholar] [CrossRef]

- Liu, Z.; Lang, L.; Li, L.; Zhao, Y.; Shi, L. Evolutionary game analysis on the recycling strategy of household medical device enterprises under government dynamic rewards and punishments. Math. Biosci. Eng. 2021, 18, 6434–6451. [Google Scholar]

- Ma, C.; Yang, H.G.; Zhang, W.P.; Huang, S. Low-carbon consumption with government subsidy under asymmetric carbon emission information. J. Clean. Prod. 2021, 318, 128423. [Google Scholar] [CrossRef]

- Liu, Z.; Lang, L.; Hu, B.; Shi, L.; Huang, B.; Zhao, Y. Emission reduction decision of agricultural supply chain considering carbon tax and investment cooperation. J. Clean. Prod. 2021, 294, 126305. [Google Scholar] [CrossRef]

- Li, Z.M.; Pan, Y.C.; Yang, W.; Ma, J.H.; Zhou, M. Effects of government subsidies on green technology investment and green marketing coordination of supply chain under the cap-and-trade mechanism. Energy Econ. 2021, 101, 105426. [Google Scholar] [CrossRef]

- Liu, Z.; Qian, Q.; Hu, B.; Shang, W.L.; Li, L.; Zhao, Y.; Han, C. Government regulation to promote coordinated emission reduction among enterprises in the green supply chain based on evolutionary game analysis. Resour. Conserv. Recycl. 2022, 182, 106290. [Google Scholar] [CrossRef]

- Yi, Y.; Li, J. The effect of governmental policies of carbon taxes and energy-saving subsidies on enterprise decisions in a two-echelon supply chain. J. Clean. Prod. 2018, 181, 675–691. [Google Scholar]

- Li, C.; Zuo, N. Optimal R&D Investment Strategy of Pollution Abatement and Incentive Mechanism Design under Asymmetric Information. Discret. Dyn. Nat. Soc. 2021, 2021, 1042791. [Google Scholar]

- Chen, Z.R.; Nie, P.Y. Implications of a cap-and-trade system for emission reductions under an asymmetric duopoly. Bus. Strategy Environ. 2020, 29, 3135–3145. [Google Scholar] [CrossRef]

- Nie, P.Y.; Wang, C.; Wen, H.X. Optimal tax selection under monopoly: Emission tax vs carbon tax. Environ. Sci. Pollut. Res. 2022, 29, 12157–12163. [Google Scholar] [CrossRef] [PubMed]

- Sarkar, B.; Ganguly, B.; Pareek, S.; Cárdenas-Barrón, L.E. A three-echelon green supply chain management for biodegradable products with three transportation modes. Comput. Ind. Eng. 2022, 174, 108727. [Google Scholar] [CrossRef]

- Mishra, M.; Ghosh, S.K.; Sarkar, B. Maintaining energy efficiencies and reducing carbon emissions under a sustainable supply chain management. AIMS Environ. Sci. 2022, 9, 603–635. [Google Scholar] [CrossRef]

- Sun, L.; Cao, X.; Alharthi, M.; Zhang, J.; Taghizadeh-Hesary, F.; Mohsin, M. Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. J. Clean. Prod. 2020, 264, 121664. [Google Scholar] [CrossRef]

- Hu, B.; Liu, Z.; Guo, H.; Zhao, Y. Carbon Emission Reduction and Pricing Optimization under Government Supervision and Carbon Trading Mechanism. Front. Sci. Technol. Eng. Manag. 2022, 41, 83–89. [Google Scholar]

- Liu, Z.; Huang, Y.; Shang, W.; Zhao, Y.; Yang, L.; Zhao, Z. Precooling Energy and Carbon Emission Reduction Technology Investment Model in a Fresh Food Cold Chain based on a Differential Game. Appl. Energy 2022, 10, 119945. [Google Scholar] [CrossRef]

- Xinjun, L.; Meina, C.; Qingli, D. Optimization Decision of Government-driving Closed-loop Supply Chain for Automobile Manufacturers from the Perspective of Carbon Trading. Manag. Rev. 2020, 32, 269. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).