1. Introduction

Until the end of 2021, the Russian Federation was the second largest ammonia (NH

3) producer worldwide, with an annual production volume of 16 million metric tons (Mt), of which about a quarter went to export [

1]. About half of the Russian NH

3 export volume was handled via the Baltic ports (i.e., the volume of about two million/Mt of ammonia was majorly handled via the ports of Sillamäe in Estonia and Ventspils in Latvia). In the case of the Sillamäe Port, Russian ammonia was delivered through a pipeline from Russia, supplying up to about 1.4 million Mt of ammonia annually [

2]. Furthermore, the Port of Sillamäe is equipped with ammonia storage tanks that serve as ammonia terminals in the harbor [

3]. However, after the start of the conflict in Ukraine, the European Union enforced strong trade sanctions against Russia, which put an end to the ammonia exports via Baltic ports and consequently led to gaps in the ammonia supply. Consequently, the ammonia supply gaps worsened after the reduction of its production in European plants due to high oil and gas prices. Thus, ammonia prices increased from a previous range of USD 200–400 per Mt seen between 2017 and 2020 to USD 1300 by the summer of 2022 [

4].

This situation provoked consideration from Eastern Europe, particularly Estonia, to construct an ammonia production plant in Eastern Estonia, aiming at a prospering regional development strategy [

5]. The plan is to find a reasonable economic use for oil shale and to utilize the existing ammonia infrastructure in the region, especially in the Port of Sillamäe located in the northeastern parts of the country (Ida-Virumaa County).

The NH

3 issue touches the maritime sector since the most frequently discussed future marine fuels are electricity, hydrogen (H

2), and ammonia (NH

3) [

6]. Among the three, NH

3 seems to enjoy a vanguard position as a future bunker fuel. According to Gerlitz et al. [

3], ammonia is the most cost-effective carbon-free fuel when the properties and potentials of the earlier-mentioned fuels are compared. For instance, the physical properties and economic, technological, and social factors appear to be superior to those of other fuels (DNV-GL 2020) [

7]. Furthermore, ammonia is easier to handle and distribute if the infrastructure is in place, because it has a higher volumetric energy density and would result in cheaper costs per unit of stored energy [

8].

For the shipping industry, this is a welcoming development, as one of the long-term objectives of the International Maritime Organization (IMO) on GHG emissions’ reduction seeks to increase the supply of non-fossil fuel by 2050 (as also supported by the EU 2019 climate and transport policy) [

9]. This reduction of GHG emissions in shipping also means long-term total independence of the Baltic States from Russian oil. Before investing in the construction of an ammonia plant, a detailed investment appraisal would need to be undertaken that should include the infrastructural, technical, logistics, operations, environmental, and economic aspects [

10].

Given the above discussions, the objectives of this paper are to develop a fuzzy real options approach to first explore the value of multiple options available for the ammonia plant investment and its production facilities in the Baltic Sea Region (BSR) and then to evaluate the Baltic Sea ammonia markets with an enlarged focus on the economic aspects. Given the objectives, the research seeks to answer the following questions: What are the economic implications of building an ammonia plant and its infrastructure in the BSR (RQ1)? How do we value the probable options available for strategic investment (RQ2)? Finally, to what extent would the future ammonia demand in the maritime sector impact investment plans (RQ3)?

The financial analysis of this non-fossil-fuel plant uses the fuzzy real options model to estimate uncertain intervals for the costs of the ammonia plant. The authors use the fuzzy real options to correct the shortcomings of traditional appraisal methods. Usually, investment assessment involves classical capital budgeting based on NPV (net present value) and DCF (discounted cash flow), where project valuation assumes an immediate project start and a continuous operation when there are predictable cash flows until the end of the investment lifetime [

11]. However, these methods are not adequate in the case of investments of a magnitude typical of oil and gas production investment such as the ammonia plant, because changes in discount rates or changes in market conditions may jeopardize the estimations of the underlying investment value [

12]. Flexible evaluation approaches such as the options given provide fitting choices, especially when the economic life of such a plant ranges up to 15 years [

13]. Moreover, managerial flexibilities must be included in the assessment of an investment with high value in an uncertain or volatile market [

14,

15] such as the oil and maritime markets.

Concentrating on both technological and market uncertainties, the authors took into consideration an incremental continuous strategy, the radical changing strategy, and the explorative pilot strategy, as elucidated by Carlsson et al. [

16], effectively plan and coordinate the demand for ammonia and its supply as a bunker fuel. Since the exact values of the ammonia plant under consideration are not specified with clarity yet, the fuzzy real options model, which has been successfully applied to several investments in natural resources and long-term high-volume investment, i.e., [

17,

18,

19,

20,

21], is employed.

The fuzzy real options are ideal because this approach to project evaluation improves the inadequacies of traditional appraisal methods such as capital budgeting (i.e., rate of return, payback period, net present value, and profitability index) [

22].

The authors estimated the investment sum, as well as the future cash flows by trapezoidal fuzzy numbers based on technical data from various legal European reports and complemented them with data from expert interviews and case studies. By doing so, fuzzy real options analysis offers new insights into the value of investments that are discussed in the context of the current literature.

The foundation of real options for this study is the idea that there is an underlying source of uncertainty for the future project, such as the cost of goods, the results of a study, etc., and that the real option estimation assesses investments and flexible decision-making through option evaluation simulations. This method is valuable for managerial strategy and proves that an investment could still have a better value in an unstable or uncertain market if the investment decision is flexible. Uncertainty in the study is used in place of risk in portfolio selection because it is complicated to estimate cash flow alongside quality, as both of them have different criteria for merit and can be conflicting. While the former is linked to profitability, the latter is connected to productivity. This complicated relationship between cash flow and quality is what managerial flexibility solves.

The remaining parts of the work are organized in the following manner: The next section is a reviewed summary of the maritime industry’s responses to emissions, the current state of ammonia production in the BSR, and the importance of fuzzy option selection in future projects. This is followed by a detailed account of the methods used in

Section 3.

Section 4 highlights the study results and the implications. The authors conclude the study in the last section.

3. Materials and Methods

The research methodology follows a triangulation approach based on different empirical data. A review of the literature and document review of archives, reports, and case studies were carried out to set the premise for research questions and to provide a background for the research approach. All empiric activities took place between August and November 2022.

The proposed Estonia ammonia production plant is a single study unit used to empirically test and validate the investment evaluations and risks analysis of ammonia production and distribution, according to Gillham [

55], on case-study research methods.

Expert interviews were conducted face-to-face and via phone calls and based on semi-structured questionnaires that involved managers and executives actively involved in the day-to-day strategic decisions (i.e., ammonia-producing plant, shipbuilders, and port authorities). The authors conducted eight interviews around the BSR. Experts from ammonia plants provided in-depth knowledge of the parameters of ammonia fuel; energy demand; prevailing cost of electricity; and expected life span of a fuel production plant and its production processes, such as bunkering and its environmental safety routine. From the shipbuilders and port technical officials, the interviews reveal concise and benchmarked information on required energy/power consumption and port bunkering facilities, existing ammonia pipeline systems, etc. The shipowners and ship operators gave insight into energy demand and supply. The interviews also comprise questions on financial and operational issues of an ammonia plant, investment volumes (CAPEX), the operational expenses per ton of produced NH3 (OPEX), logistics, and forecasts of ammonia prices and demands, as well as financial topics comprising inflation and interest-rate developments. These data were taken into the account to feed the fuzzy Return on Assets (ROAs) model for the planned NH3 plant.

After the fuzzy ROA modeling, the authors enriched the analysis by calculating a fuzzy value at risk (

FVaR) indicator based on the underlying set, A, and the related membership function,

μA. The

FVaR enjoys an analogous definition to the traditional value at risk, but this time in a fuzzy context [

56]. The classical value at risk (

VaR) represents a commonly used metric ton to determine the extent and probabilities of potential losses of a portfolio or an investment by quantifying the risk of potential losses of an investment over a specific period.

The approach for finding the fuzzy intervals for the ROA model involves taking averages over the experts’ answers. As an orientation, the authors confronted the experts with figures from the literature and document review by highlighting the results from Brown [

57], who fixed the CAPEX per ton capacity of NH

3 in the interval between USD 900 and USD 1200 for a plant based on natural gas by 340 days of operations per year. The OPEX per ton of produced NH

3 ranges between USD 270 and USD 450 depending on the process of hydrogen (H

2) production. The figures for electrolysis-based H

2 production are placed on the higher edge; that is, for a green ammonia factory, CAPEX per ton capacity ranges around USD 1000–1200, and the OPEX is around USD 450 per ton, depending on the energy price.

Other energy- and business-related factors used for the assessment included the exogenous baseline of the fuel costs (benchmarking costs through the historical price of ammonia per energy content) and the environmental sustainability index (ESI), and financial and environmental cooperate governance performance indicators of sustainability-driven companies. The authors first used a descriptive analysis of the interview data, putting each statement in a grid to classify all responses. An accumulated reflective overview of the summaries of the data was made to discover how multiple sources of evidence are related. This was followed by the interpretation and narration of the data according to Yin [

58].

4. Results and Discussions

For the realization of the ammonia production plant, different scenarios are used. Since oil shale is a special type of resource that is comparable to brown coal, the first impression was to include the oil shale in the production process. This inclusion is considered in two ways:

Use oil shale for H2 production with a reactor like in the traditional Haber–Bosch process.

Use the technology of electrolysis to produce H2, which requires a lot of energy.

Using oil shale for H2 production with a reactor, as seen in the classical Haber–Bosch process, is the basic processing of a coal-based ammonia plant that consists of a separate module to separate O2 and N2 from the air, the gasifier, the sour-gas-shift module, the acid-gas-removal module, and the ammonia-synthesis module (an air separation process). Oxygen from the air-separation module is fed to the gasifier to convert coal into synthesis gas (H2, CO, CO2, and CH4). There are many gasifier designs, but most gasifiers are based on fluidized beds that operate above atmospheric pressure and can utilize different coal feeds.

Note again that the ammonia (NH3) production process is based on coal that is widely used in large producing countries, such as China, Russia, and India. Since oil shale is chemically comparable to brown coal, the ammonia process for the proposed NH3 plant should be compared to the technical and economic process parameters of the Chinese and Russian values. However, the disadvantage of the coal-based hydrogen (H2) approach is the emission of CO2 and the production of brown ammonia, which implies that the later use of NH3 as a carbon-free fuel is ruined by carbon emissions during the production process.

The authors therefore recommend and put forward the technology of electrolysis to produce H2 for the production of green ammonia even though it requires very significant amounts of energy. Fortunately, the oil shale infrastructure of the proposed plant has enough capacity to produce the needed electrical energy, i.e., the process of burning oil shale in the existing electrical plant. This process is not CO2 emissions-free either but remains better, as later shown, when compared to producing H2 with a Haber–Bosch-process-like reactor. Based on this, the authors decided to focus on the production of H2 through electrolysis.

4.1. Technical and Economical Preliminaries of NH3 Production

To address RQ1—what are the economic implications of building an ammonia plant and its infrastructure in the BSR?—the authors evaluated the technical and economical preliminaries of ammonia production.

In Kirova-Yordanova’s work [

59], the author precisely delineates the limits of energy demands for ammonia synthesis, where the baseline for the energy demand for ammonia production is about 27 GJ per ton of NH

3. This is equal to 7.5 MWh per Mt of NH

3 produced. However, a study from Fermi Energia [

60] estimates the needed energy consumption to be slightly higher, with 100 MWh of electricity for 9 Mt of ammonia. Further important techno-economic data of the Estonian oil shale industry are as follows:

Answers from experts’ interviews, however, revealed that even with the rapidly rising price level of CO2, electricity can still be obtained in Estonian oil shale plants at 120–140 EUR/MWh. However, since Estonia is part of the Nord Pool Energy Exchange, the ongoing energy crisis since spring 2022 levelled the average electricity prices during the first 9 months of 2022, i.e., around 184 EUR/MWh. This energy-cost disparity between Estonia’s energy capacity and the Nord Pool Energy Exchange spurred policy-based debates in Estonia with a strong political inclination toward leaving the Nord Exchange and building a country-owned nuclear power plant.

Based on the above considerations, when asked about the most likely technology for the new NH3 plant in Estonia and the corresponding technological and economical parameters, the experts gave the following explanations.

Firstly, the current unused annual NH3 handling volume in Estonia, which equals around 2 million Mt of ammonia, represents the missing Russian export volume via the Baltic ports. Ammonia pipelines from Russia to the Baltic ports safeguarded the NH3 handling volume and could serve as supply infrastructure for the future NH3 terminals in the Baltic ports. Focusing only on the Port of Sillamäe with an annual handling capacity of 1.4 million Mt of NH3, the construction of new Estonian ammonia plants will open up the possibility of an annual production capacity of 1.3–1.4 million Mt that represents about 2/3 of the Russian export volume via the Baltic States. Assuming 340 working days of such an ammonia plant per year yields a daily ammonia production volume of approximately 3800 Mt per day. The distribution of such an NH3 production volume is easily handled seaborne through the Port of Sillamäe, using the existing pipeline system (easily adaptable) to link the location of the new plant. The estimated construction time for the plant is about 3 years, and the expected lifetime of the NH3 plant is 15 years.

Secondly, to make estimations for the costs of the NH3 plant in Estonia, it would be sensible to use a large-scale ammonia plant, as seen in the Gulf Coast Ammonia (GCA) plant in Texas City, which has an annual production volume of 1.3 million Mt of NH3. However, the process uses traditional methane gas to produce ammonia, which leads to brown ammonia. In the case of a country like Estonia, whose focus is green NH3 production to reduce CO2 emissions, the GCA cannot be used as a comparable case. Rather, Freeport in Texas, where Yara International and BASF Corporation (both chemical companies) built a green ammonia plant with an annual capacity of 750,000 Mt of NH3, fits this context. Another practical case would be the plant in the Coega Special Economic Zone along the Port of Ngqura in South Africa with an annual production volume of 780,000 Mt of NH3 where the investment costs (CAPEX) are about half of the CAPEX of the Texas plant. Meanwhile, the CAPEX for the Yara/BASF plant was about USD 600 million.

In the end, when it comes to the cost of the proposed NH

3 plant, the authors followed the Brown’s study [

56], which gave the cost estimations for NH

3 plants in the USA and Nepal from experts who participated in a Delphi program. From this, the CAPEX estimation of the Estonian green ammonia plant is projected to have an annual production capacity of 750,000 Mt of ammonia based on electrolysis would cost between USD 800 million and 1000 million, which equals USD 900–1200 per annual ton capacity. The corresponding OPEX values are estimated to be about USD 450–500 per ton of NH

3 due to increased energy prices.

Note that some of the study’s expert interviews took place between October 2022 and November 2022 when USD 1 equaled about EUR 1, so the actual prices were taken under account, especially the costs for electricity, which was about 130 EUR/MWh in 2021 but increased by about 40% in 2022. Therefore, if a higher OPEX value might appear in the calculation, it was already considered using the Fermi Energia [

60]; the report analyzed the production of ammonia on the bases of nuclear power to costs approximately EUR 815 per ton of produced NH

3.

4.2. Energetical Analysis

Consequently, instead of minimizing energy consumption, the optimization of energy becomes critical. Using the heat generated in the process of ammonia production for other on-site purposes at this point would be the best practice. Optimization also refers to the balancing of capital investment and operational costs, so the authors considered the impact of climatic conditions on energy demands. Hence, the assumed daily production volume of ammonia in the studied case plant with an annual production volume of 750,000 Mt of ammonia amounts to about 2200 Mt on the bases of 340 annual production days. Furthermore, the needed energy consumption for the annual production volume of 750,000 Mt sums up to an additional daily energy consumption of 16,500 MWh, or 16.5 GWh; that is, for the full annual production volume of 750,000 Mt of ammonia, an annual energy of about 12 TWh is needed. A comparison with the total annual Estonian electricity production ranging between 9 and 12 TWh already shows that the needed energy supply for a new NH3 plant could be challenging.

Therefore, to improve energy generation, three options were tabled for discussion. The options are the use of nuclear power; increased use of fossil fuel, especially oil shale; and, lastly, the use of wind energy. The construction of a nuclear plant in Estonia was discussed extensively, but, currently, there are no concrete plans to realize such a project. The second option that involves the use of fossil fuels for energy production would involve oil shale, which is the largest part of Estonian electricity production complemented by oil. However, strictly speaking, it also means that the needed annual energy amount of 12 TWh for the new ammonia plant corresponds to 18 million Mt of oil shale with related CO2 emissions of about 19 million Mt of CO2, which leaves the third option open.

In some of the interviews, the experts recommend that, to produce green ammonia, the use of oil shale for energy production must be replaced by a renewable energy source. Looking in this direction, wind energy remains the most promising option, since hydroelectric power, as well as photovoltaic power, is not suitable for Estonian conditions (i.e., geography and location).

A more detailed assessment of the Estonian wind-energy situation reveals that, currently, 144 wind turbines are installed with a total capacity of 320 MW and produced 730 GWh of energy in 2021 [

62]. Hence, the average wind turbine has a capacity of about 2.2 MW and generates about 5 GWh annually. Full green energy production from wind farms for the new ammonia plant requires an annual energy volume of 12 TWh, which equals the installation of 2400 new turbines with the same average performance similar to those already installed. Following the Stehly and Duffy [

63] calculations, the installation of such 2400 new wind turbines with a capacity of about 2.8 MW on an onshore site near the new ammonia plant would generate a CAPEX of about USD 8 billion (using an average CAPEX for each of the 2400 turbines of about USD 3.3 million).

The number of windmills can be reduced by using turbines with higher performance onshore wind farms or offshore wind parks. The use of offshore wind parks especially is linked with the possibility to use windmills with a power up to 15 MW that reduces the number of needed turbines to only 400. The cost of the electric energy from the 2400 wind turbines is comparable to the prices of brown coal or oil shale energy plants.

4.3. Fuzzy Real Option Analysis

The application of a real options model helps value probable options available for strategic investment (RQ2). First, the assessment of investments requires the fixation of several parameters. The parameters for the new Estonian ammonia plant elucidated above are all elaborated in cooperation with the expert group. Here, the authors present the relevant parameter in data blocks used to calculate the indicators of the model in

Table 1.

Moreover,

Table 2 describes the economic parameters. This task is realized by an economic data block that includes the financial circumstances of the investment shown.

Based on the set data, the authors first calculated the investment indicators by using classical capital budgeting. As already mentioned, the study assumes an exchange rate parity between the EUR and USD in a ratio of 1:1, which was the reality in November 2022; therefore, the presented financial figures can be interpreted in Euros or USD in

Table 3.

The result of this classical analysis delivers the first economic assessment of the investment plan, which currently neglects a dynamic consideration of the volatile business environment touching energy prices, the market price of ammonia, and global changes in demand and supply. Nevertheless, the result indicators of the capital budgeting approach highlight that, under current conditions, the ammonia plant investment seems to be a favorable decision, especially considering that the demand for ammonia has the prospective to grow considerably in the future, considering the importance of ammonia for decarbonization efforts.

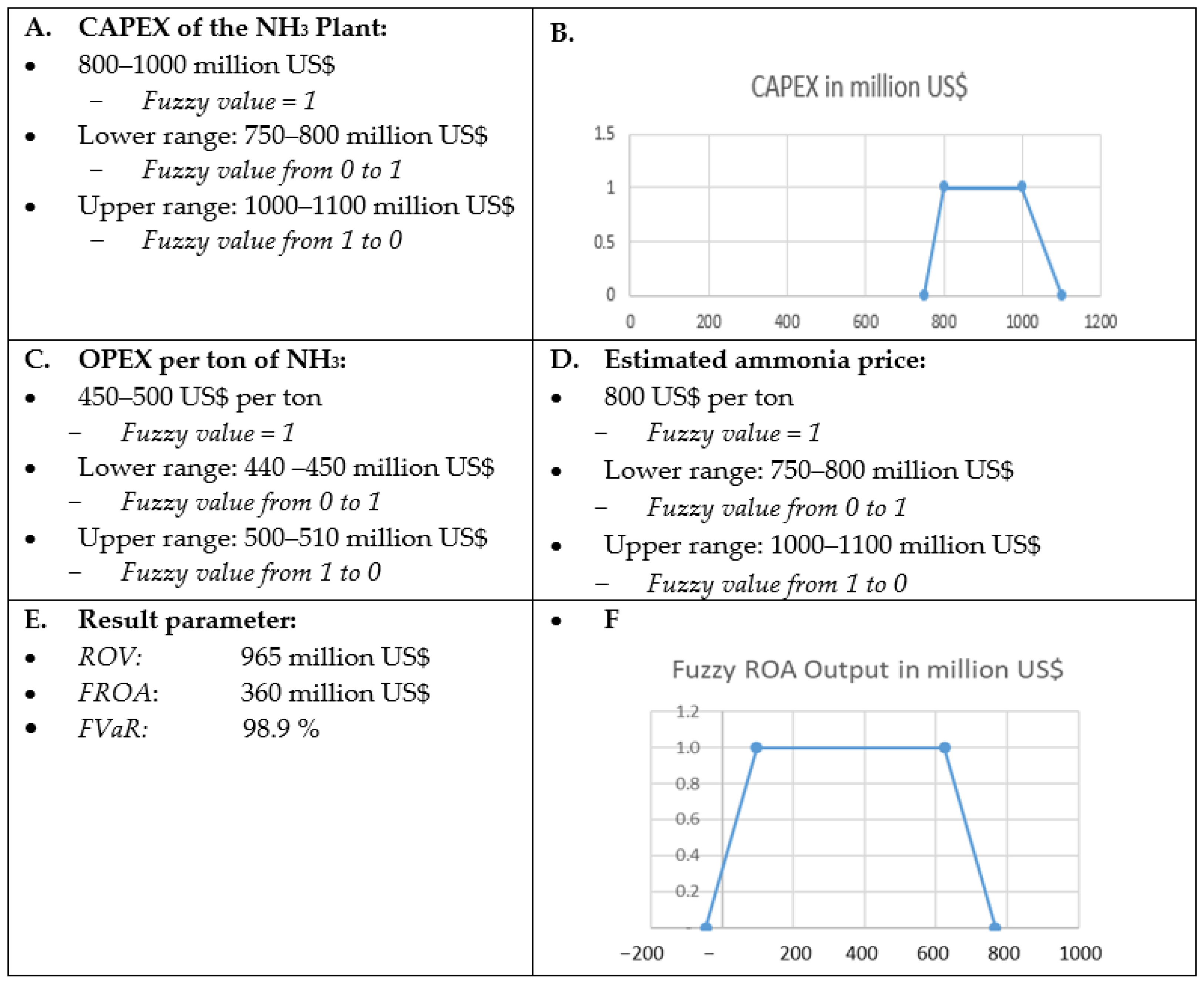

The inability of the classical capital budgeting approach to take into account the energy price volatility can be bridged by the real options analysis or, better still, by applying the modeling and estimation of fuzzy data through the fuzzy real options analysis (FROA). The authors extracted the confidence intervals for the listed parameters already benchmarked with the literature. It is important to note that, in the assessment of the ammonia plant, the cost ranges for the CAPEX, OPEX, and market prices for ammonia should model the investment decision, as well as the upcoming years of operations of the plant. The calculations revealed the following fuzzy data shown in

Figure 1.

The result parameter of the fuzzy model formula reveals the real option value (ROV) of the investment that yields USD 965 million; that is, the financial indicator for the investment is more favorable than the classical indicator. The underlying standard deviation for the NPV of the expected cash flows is 15%.

However, the uncertainty of the cost and price ranges of the input parameter of the investment leads to a trapezoidal fuzzy number that is presented on the right side of the result parameter in

Figure 1B,F. Following Carlsson and Fullér [

19], the fuzzy number can be described as a corresponding expectation value, which is called the result parameter for the fuzzy real options analysis (

FROA) and ranges around USD 360 million (

Figure 1E). This

FROA value integrates the output, which is a geometrical figure.

Furthermore, the trapezoidal fuzzy number touches the 0-line, implying that, under the parameters of the fuzzy model, there is a possibility that the result of the investment might be negative. To describe the risk of a negative outcome of the investment, the authors calculate the trapezoid area that is based on an x-value greater or equal to zero and compare this part with the total surface area of the trapezoid. The corresponding parameter can be interpreted as a fuzzy value at risk (

FVaR), and this value is 98.9% (

Figure 1E), suggesting the possibility that the investment ends up with a negative sign is rather low.

In addition to the directly calculated FROA indicators, the authors also executed a sensitivity analysis with the future market price of ammonia since the ammonia price lays out the influence of the NH3 plant, so the high volatility of the ammonia price represents a possible risk factor. However, as long as the ammonia price stays above a threshold of USD 530 per ton, the NH3 plant will operate within a profitable zone.

4.4. Strategic Perspective of the Ammonia Plant

Finally, the study looked into various strategic perspectives of building an ammonia plant at this point and, in a particular, in the Eastern Estonia region to provide the answer to the extent to which the future ammonia demand for the maritime sector might influence the investment plans (RQ3).

The current gap witnessed in ammonia exports through Baltic ports from the Russian exports summed up to about 1.5 million Mt of NH

3 annually for Estonia. If Estonia wants to fill this gap, two ammonia production plants with an annual production capacity of 750,000 Mt are eminent. Afterward, the annual production of 1.5 million must double to 3 million Mt of NH

3 yearly by 2050 due to the rising demand from the maritime sector; that is, by 2050, four ammonia production plants having an annual production volume of 750,000 Mt must operate in parallel to fulfil the expected demand. The construction of additional NH

3 plants makes the growth process flexible and scalable and reduces the investment risk over the next 33 years, as shown in

Figure 2. Considering that the lifetime of a production plant is limited to 15 years, the time until 2050 has to be bridged by at least six ammonia plants.

Together, six plants representing a total CAPEX of 3.6 (=6 × 600) billion Euros until 2050 is the necessary investment volume to put in place. In addition to the investment sum for the NH

3 plant, wind farms can safeguard the green production process for ammonia. Stehly and Duffy [

63] estimated the lifetime of a wind turbine to be 20–30 years, i.e., until 2050, so the additional investment of wind farms is necessary. The current study revealed that the investment into the production of green electricity currently reaches a financial volume that lies beyond the costs of the ammonia plants.

A final remark is the idea to construct a urea factory (usually for urea used as fertilizer, feed supplement, etc.) to bind 1 million Mt of CO2 emissions, but it requires an additional production volume of ammonia up to about 760,000 Mt annually. This implies that, for the next 25 years, an additional two NH3 plants have to be constructed to safeguard a continuous process flow. The energy for the operation of the ammonia plants, together with the urea plant, will then come from oil shale. The corresponding electricity prices will be comparable to those of wind energy. Nevertheless, further research has to be performed to describe the detailed economic differences between the considered technologies.

5. Conclusions

The study evaluated how the Baltic Sea Region is impacted heavily by ongoing global turbulences up to an annual two million Mt supply of ammonia. Estonia, in particular, was an export harbor for Russian ammonia production, and this explains the current plans to construct an ammonia production infrastructure in Eastern Estonia. The authors thus developed fuzzy real options to explore the value of multiple options available for the investment and evaluated the Baltic Sea ammonia market and the corresponding investment on ammonia production facilities in the Baltic Sea Region (BSR), with an enlarged focus on the economic aspects.

The results show that the creation of the ammonia-production capacity in Eastern Estonia is technically and economically reasonable if the focus is green ammonia production. The investigated investment model proposes a scalable ammonia production from 2025 until 2050 which reaches a production capacity of 750,000 Mt of ammonia in 2025 (one plant) up to 3 million Mt in 2050 (four plants). The time from 2025 until 2050 requires the construction of six ammonia plants, each with an annual production volume of 750,000 Mt. The costs of the investment to build the ammonia plants sum up to about USD 3.3 billion. This investment sum has to be complemented by the costs for the installation of green electricity production that can be realized by wind farms. The investment volume for the proposed green electricity production currently goes beyond the investments of the plants by the demand, but the current pricing of ammonia markets ensures a financially secured investment covered by expected future cash flow.

This prediction is supported by an expected growing demand from the maritime sector in BSR. The study also reveals significant extra investment for the construction of ammonia plants, together with wind farms. Furthermore, from 2025, the current ammonia capacity needs will start at 1.5 million Mt annually until it reaches about 3 million Mt in 2050. The doubling of the demand will likely come from the maritime sector in BSR. Already the BSR has an estimated demand of about 1.5 million Mt of ammonia as marine fuel, representing 25% of the current marine consumption within the BSR. The portfolio option selection of the investment determines the investment decision factors and their relative significance of investments in ammonia production plants.

The current global turbulences increase the strong need for continuous detailed recommendations and future research to develop the applied database and findings of the current study in several ways. An interesting path could explore and empirically test different conceptual variations of the fuzzy real options analysis. The study would also benefit the formulation of more detailed managerial and policy recommendations in the wider field of ammonia production, transport, and infrastructure.