Abstract

Because of electricity markets, environmental concerns, transmission constraints, and variable renewable energy sources (VRES), coordinated operation of demand response (DR) and battery energy storage systems (BESS) has become critical. In turn, the optimal coordinated operation of DR and BESS by an entity can affect overall electricity market outcomes and transmission network conditions. The coordinated operation is desirable for the profit-seeking entity, but it may adversely affect the cost and revenues of other market participants or cause system congestion. Though few coordinated operation models already exist, our aim in this research is to provide a novel multi-objective optimization-based methodology for the coordinated operation of DR and BESS to boost market profit. Moreover, another goal is to simultaneously study the combined effects of such coordinated models on transmission networks and electricity markets for the first time. This paper has proposed a new method for coordinated DR and BESS utilization by a load-serving entity (LSE) to increase its profit. Moreover, it has employed agent-based modeling of the electricity systems (AMES) for testing our coordinated DR and BESS method under day-ahead market and transmission system conditions. Simulation results of case studies indicate that the operating costs of all LSEs decreased, and there was as much as 98,260 $/day in cost savings for BESS deploying LSE1. Although revenues of cheaper generation companies (GenCos) decreased, those of expensive GenCos increased or showed mixed trends. For example, GenCo 3 exhibits an 8765 $/day decrease in revenue for 25% BESS capacity, whereas a 6328 $/day increase in revenue for 37.5% BESS capacity. The variance of LMPs, widely used as a risk index, greatly decreased for the LSE utilizing the coordinated methodology, somewhat decreased for other LSEs but increased for cheaper GenCos with no LSE at the local node. Since BESS deployment decisions of an LSE can have system-wide or market-wide consequences, simulation analysis before deployment can help reduce market distortions or system congestions.

1. Introduction

1.1. Motivation and Aim

LOW carbon power has for some time been a fundamental issue in the power sector to adapt to depleting fossil energy resources, rising environmental contamination, and increasing demand. Carbon-free Renewable energy sources (RES) [1] are divided into fixed RES and Variable Renewable Energy Sources (VRES) [2,3]. Together, these factors have increased the need for integrating variable renewable energy resources and raised global awareness of interrelated energy, economic, and environmental challenges. Therefore, the introduction of new technologies like battery energy storage systems (BESS) and demand response (DR) in the power sector is essential for meeting these challenges and increasing the penetration of VRES.

Over the past decade, the share of VRES in the energy mix has continuously increased, especially in Europe, China, and the USA. [4]. However, these assets have inherent intermittency depending upon the weather and seasonal changes. This is a weakness of VRES that can lead to an unstable power system prone to failures [5]. This weakness can become overwhelming after the addition of BESS, DR, or both [6]. When VRES is insufficient to meet demand, remaining electrical energy requirements are tapped from the grid. Electrical energy from VRES can be retained in some assembly or storage units and transformed back to electric power when VRES is insufficient to fulfill the demand. This helps balance generation and demand, thus improving power system stability. However, energy lost in a charging-discharging cycle of VRES is extremely high, as only 75–80% of the saved energy is retrieved [7].

Under the circumstances of smart grid-related innovation, maintenance, and spot market change, it is important to make full use of VRES and BESS to investigate the capability of demand-side participants to take part in the spot market [2]. The transformation of industry and development in modern times has caused a rise in electricity requirements. If a country needs a large amount of electricity, then some power transmission lines can become congested. Consequently, the generation plants’ commitment and BESS charging/discharging should conform to transmission constraints. Furthermore, the equipment cost of the BESS is extremely high-level, and BESS mostly incurs a maintenance cost [8].

This research aims to manage the uncertainty of VRES by DR and BESS. Although DR and BESS have already been applied from the perspective of the distribution system, impact analysis for a DISCO or LSE connected to a transmission system is missing in the literature. Moreover, another goal is to simultaneously study the combined effects of such coordinated models on transmission networks and electricity markets.

1.2. Applications of DR and BESS for Managing VRES

1.2.1. Uncertainty of VRES

In [9], the author proposed a generic unit commitment model considering VRES under unpredictable market conditions. This model is devised as mixed integer linear programming and evaluated in terms of its limitations and advantages, including better usage of VRES under uncertainty. A significant problem of optimal operation in terms of voltage regulation and line congestion management is discussed in [10]. A broadcast-based unified control algorithm is applied for maintaining node voltage throughout 24 h when controllable resources are considered. Authors in [11] proposed a stochastic programming methodology considering renewable generation uncertainty for finding the solution to multi-period power flow problems on four-bus and 39-bus systems showing advantages in terms of re-dispatch cost. In this paper, the methodology is also tested on IEEE test networks of at most 300 buses for finding the solution of operating points of large units while covering an extensive variety of renewable generation scenarios. A BESS is generally useful for satisfying transmission constraints but installing a BESS of large capacity is not feasible due to high installation cost. In [12], the deep reinforcement learning (DRL) method is used in this work to propose an intelligent EMS. In the MG EMS, DRL is used as an efficient way of managing the computational complexity of the best scheduling of the charge/discharge of battery energy storage. To determine the most optimal energy exchange with the market for a certain scheduling period while taking into consideration transmission constraints, a dynamic programming approach is used. According to the scheduling plan, energy storage is used during operations to smooth changes in wind power production [13]. The micro-energy grid can accommodate varying load demands and realize the complimentary benefits of various energy sources, offering a fresh approach to the issues of efficient energy use and environmental degradation. This study suggests a chance-constrained programming (CCP)-based optimal scheduling model that takes into account the charging characteristics of electric vehicles (EVs), integrated electricity-heat demand response, and ladder-type carbon trading against a background of various renewable uncertainty [14].

1.2.2. Managing VRES by DR

In [15], the author develops a multi-period optimal power flow (OPF) that makes use of reactive consumers on demand to improve steady-state voltage stability, which is gauged by the power flow’s smallest single value. Because wind and solar provide erratic amounts of energy, increasing the penetration of VRES harms the power grid. The smallest singular value of the power-flow Jacobian matrix, which is a measure of steady-state voltage stability, is used to suggest a multi-period optimal power flow that incorporates demand-responsive loads. The purpose of the objective function presented in this work is to balance the smallest singular value improvements against generation costs. In another work, an OPF model is proposed for the optimization of demand response management. Operating constraints of generation and transmission power capacities are considered, along with customer satisfaction levels. In this paper, modeling is done on two networks, i.e., a 38-bus system and the de-facto IEEE 123-bus system [16].

This study suggests a chance-constrained programming (CCP)-based optimal scheduling model that takes into account the charging characteristics of electric vehicles (EVs), integrated electricity-heat demand response, and ladder-type carbon trading against a background of various renewable uncertainty. A hybrid control system with two control loops that take into account different real-world conditions is proposed in [17]. To lessen the effect of load disruptions on the performance of the control, variable universe fuzzy logic control is utilized in the inner loop. An incremental genetic algorithm is used in the outer loop to online optimize the control parameters. On a real-world 49-bus power system and an LFC model built using MATLAB and Simulink, the performance of the suggested control approach is thoroughly examined. After developing an optimal power flow model with a minimal line loss objective in [18], the alternating direction method of multipliers is used to break the problem into smaller pieces for an OPF solution under prevailing power system constraints. Furthermore, the complexity of test systems is increased by integrating power grids of varying sizes with the standard 14-bus and 30-bus test systems.

Authors in [19] proposed a residential energy model encompassing multiple objectives of consumer needs (electricity, heating, and cooling demands at the production interface). The objective considered in this paper is fulfilling desired loads using DR. This model is proposed on a residential network over a 24-h horizon. A methodology of distributed BESS to execute post-contingency restorative control actions is described in [20]. The proposed methodology is formulated as an OPF problem with increased security constraints; the first stage (minimizing generator cost) improves pre-contingency generation dispatch, while the second stage reduces remedial activities for each contingency. Case studies on six bus systems and RTS 96 validate efficient corrective measures and ensure operational reliability and economy. The effectiveness of demand response is considered by evaluating its consequence on the energy market clearing price, introducing two concepts of the real price, which imitates the price of the next accessible unit of electricity or the price of all loads participating in the demand response. In another scenario, OPF methodology is used in which the optimum magnitude of DR services is determined to minimize the actual price. Optimal outcomes for residential consumers are determined by OPF methodology while considering data from generators [21].

1.2.3. Applications of BESS for VRES Management

In [22], transmission system expansion is proposed while maintaining the power systems’ reliability. A mathematical model is presented which considers BESS and the influence of different lines and batteries in the transmission network. This approach is applied to Graver’s system and IEEE 24 bus system indicating that deferral of construction of new lines is possible when further BESS are attached to specific nodes. Many BESS technologies are available for utility-scale grid integration. These technologies start from mature industry-tested BESS units to prototypes for experimental demonstration under practical conditions. Several types of batteries are useful for large-scale transmission-grade applications. The installation size varies from kilowatt hours to gigawatt hours, whereas the discharge time ranges from seconds to hours.

1.2.4. Optimization and Efficiency of Different Types of Batteries

A detailed overview of different batteries, their capacity, efficiency, lifetime, and discharge time is presented in Table 1. However, this section focuses on a short review of Lead-acid batteries and Sodium Sulphur batteries because only these two technologies are commercially available for transmission or distribution-grade applications. Note that pumped-hydro and compressed air energy storage (CAES) are site-specific and may not always be available. The rest of the BESS technologies in Table 1 are still in the demonstration phase for transmission and distribution applications [23].

Table 1.

Energy Storage Technology Comparisons [23].

Lead (Pb)-acid batteries have a non-linear power output, and the amount of energy used during charging/discharging and the number of deep discharge cycles determine their useful life. The cost of lead has an impact on the cost of lead-acid batteries. Lead (Pb)-acid batteries have long been utilized as a backup power source and to preserve the quality of the power supplied to switchgear and control systems. The lifecycle and performance of a lead-acid battery can be improved using innovative materials. There are certain cutting-edge lead-acid batteries, currently under development, notably for transmission and distribution network-level support. A major advantage of lead (Pb)-acid batteries is their low cost. Due to lead (Pb)-acid batteries’ limited lifespan, they are frequently utilized for power quality control and emergency power supply.

The sodium-sulfur (NaS) battery operates between 300–360 °C. High performance, high-energy density, high charge density efficiency, good temperature stability, extended cycle life, and inexpensive material are desirable characteristics of the NaS battery. NaS batteries offer an impressive 85% DC conversion efficiency. Due to their high conversion efficiency, these high DC NaS batteries are excellent candidates for use in a potential DC distribution system. NaS batteries have a wide range of applications, including peak shaving, integration of renewable energy sources, power quality management, and emergency power supply. NaS batteries are ideal for controlling power operation quality as well as peak shaving.

Redox flow batteries include zinc/bromine (Zn/Br) batteries. An internal pump mechanism is used to move reactants around in zinc/bromine batteries. ZBB Energy, a BESS supplier, creates Zn/Br batteries in 50 kWh modules comprised of three stacks of 60 cells connected in parallel. The battery modules are designed to discharge at a rate of 150 A for 4 h at an average voltage of 96 V. Individual stacks rather than the complete module can be changed thanks to the battery stack architecture. Because it is reversible and non-destructive, the electrochemical reaction utilized to charge and discharge energy can reach 100% depth of discharge [23].

By pumping water from a low tank to a high tank, which is higher in elevation than the low tank, PHES was able to retain energy. A PHES features an electric motor in addition to the two tanks. This motor can be employed as a power generator or a pump when charging and discharging. The amount of water that is kept in the tanks and the difference in altitude between them both affect the amount of energy that is stored. The storage effectiveness of PHES ranges from 65% to 85% [24].

The CAES operates by compressing air using cheap energy during times of low energy demand, then releasing that compressed air onto a turbine to power an electric generator. A compressor, a storage tank, and a turbine make up a CAES. Brayton’s thermodynamic cycle is the foundation for the turbines utilized in the CAES to generate electricity. The way a CAES works is comparable to how a typical turbine works. The generator functions as a motor during charging, powering the air compressor. The combustion chamber is filled with compressed air during discharge, which is subsequently released onto the turbine. The electric power generator is moved by the turbine.

Because of their active species remaining in solution at all times during charge/discharge cycling, their great reversibility, and their higher power output, vanadium redox flow battery (VRFB) systems are the most developed among flow batteries. These systems’ capital costs, however, continue to be much too costly to allow for widespread market adoption. Li-ion has the most potential for advancement and improvement among these. Li-ion batteries are the best choice for portable electronics due to their small size, low weight, high energy density, and storage efficiency of almost 100%. The high cost of Li-ion technology (caused by manufacturing complexity resulting from the necessary circuitry to protect the battery) and the negative impact that deep discharging has on its lifetime are some of its main downsides, though [25]. The HNT-MCF/CNT/PC Li-ion storage system uses a dual-storage system that includes intercalation and surface adsorption (pseudo capacitance), as shown by cyclic voltammetry and symmetric cell analysis. This research sheds light on how to build a thick electrode with great mechanical stability for use in future large-areal capacity Li-ion batteries [26]. However, both VRFB and Li-ion technologies are still in the demonstration phase for transmission and distribution applications.

1.2.5. Combined Applications of DR and BESS

In [27], a stochastic programming model is proposed for the consolidation of DR and BESS in the generation and transmission of energy. The model determines the best place and size for new storage, generation, and distribution assets. An isolated case study of La Graciosa, Canary Islands, Spain, is reported in another research in [28] to investigate the effects of BESS and DR on maximizing social welfare. The paper’s main goal is to increase the framework’s overall net social benefit. In [29], a stochastic bidding technique is proposed for increasing the income of wind power plants by considering a virtual power plant involving BESS and DR. The authors of [27] presented a method based on MILP (mixed integer linear programming), which considers CAES (compressed air energy storage) and DR and CAES to minimize operational costs. This work achieves a solution to the optimization problem by GAMS. Both instances with and without DR and CAES are studied in [28] to discover an optimal battery energy storage capacity for smart grid operation. In [30], stochastic self-scheduling of renewable energy sources (RESs) considering compressed air energy storage (CAES) in the presence of a demand response program (DRP) is proposed. In [31], an energy management system is proposed in which DR necessities are also counted as different scenarios. Its main consideration is real-time pricing and critical peak pricing, which can be counted as time-based programs and incentive-based programs, respectively. The objective function of the proposed methodology is to consider the possibility of unreliable DR scenarios and BESS power applied to a commercial building model with a 500 kW chiller system and 1000 kW BESS (Li-ion battery).

1.3. Effects of DR and BESS on Market Pricing

The effects of the implementation of DR and BESS on the electricity market are discussed here. In the literature on DR, the focus remains on the response of customers to dynamic pricing. While in the case of BESS, financial viability and capacity to compete in the markets are major factors.

1.3.1. Effects of DR

In [32], the price-market retailer (PMR) maximizes its profit by advocating optimal pricing strategies for a pool-based electricity model in a bi-level Stackelberg model between retailers and consumers. The bi-level Stackelberg model’s findings indicated improved retailer profits, the impact of DR programs on power usage during peak hours, and improved consumer welfare. In [33], the author examined the effectiveness of dynamic pricing and its economic effects using a three-stage stochastic game. Results indicated that by utilizing both markets, a retailer could partially assume demand uncertainty (DA and real-time). A stochastic decision-making model is presented in a competitive context for an interface between the market and customers for a DR aggregator, and it discusses the impact of load reduction caused by DR contracts. To analyze the consequences of various DR measures and the risk aversion factor on the profit of the aggregator, a thorough case study on the Nordic energy market is explored [34]. A transactive day-ahead market model is proposed in [35], which establishes costs for congestion creation, energy and losses, voltage violations during peak loads, and extensive renewable energy penetration.

1.3.2. Effects of BESS

In [36], the author discusses the operation of a standalone BESS in the frequency containment reserve (FCR) market. The work aims at improving economic efficiency by identifying two research lines. The author’s initial study line is focused on increasing revenue using the FCR operation of the BESS in conjunction with additional applications like arbitrage trading or peak shaving. As hybrid solutions, including BESS and power-to-heat units for FCR, are more affordable than standalone BESS, the author is more focused on them in the second study line. Using market data from 2018 to 2019, a techno-economic model is examined. However, the system incurs a cost of $2 million for 12 years of operation, and further arbitrage trading produced no benefits.

In [37], agent-based market simulation studies the impact of installed BESS and declining traditional thermal power stations on the FCR market pricing. In [38], the author proposed a pre-share rental strategy to increase the profit of battery sales and battery owners participating in the frequency control ancillary services market. Additionally, the fluctuation of market clearing prices is also studied. Results indicate that BESS’s pre-share rental model offers consumers and the battery sales company a win-win situation. Authors in [39] proposed a trading-oriented two-stage BESS model for the distribution market. The first step aims to maximize the distribution of internal resources, such as solar panels and wind turbines, while the second stage employs a double auction model for trading in energy. The planning of BESS and the optimization of distribution electricity markets are the key topics of this article.

While exploring the above variety of literature on combined aspects of DR and BESS, we did not find any paper offering an impact analysis of applying DR and BESS to the transmission systems and wholesale market. Table 2 presents a taxonomy of recent works for comparison with this paper. All the factors mentioned in Table 2 are thoroughly discussed and explained as follows. DR and BESS are the key factors on which our research is based. From the point of view of environmental factors, carbon emissions are also considered as this is the fundamental issue in power organizations to adapt to environmental change, fossil energy deficiency, and environmental contamination. Technical aspects include battery size and its charging and discharging rates which are also considered in this paper. Economic factors include the most extreme benefit and least expense allowed with DR and BESS. In market aspects, our presented model covers DA, RT, and intraday markets, but the focus of results in this paper is on the DA market. By modifying this proposed work, we can also extend to intraday and real-time market pricing results. Based on the literature review, the contributions of this paper are to propose a coordinated methodology to discover the optimum arbitrage trading levels by hourly charging/discharging decisions, including DR and BESS, in a planned activity in the DA market. The optimization method is linearized to expand its efficiency, and it is framed as multi-objective optimization. Different methodologies considering DR, BESS, and both are examined in detail and summarized in this paper. It is interpreted that this coordinated operation will result in a superior advantage in the market too. The extent of the proposed work is evident from Table 2 to comprehend the highlights of this work. Although uncoordinated methodologies of the DR and BESS are separately addressed in the literature, they are not tested by case studies. Transmission network congestion, which is the result of transmission lines’ limited capacity and high power demand in remote locations, is another obstacle that the ISO (independent system operator) must overcome. Applying BESS in power systems provides security and flexibility by reducing transmission congestion. Some of the social factors include customer cost-comfort trade-off (distinct levels of reliability to different customers depending on their preferences). To model the uncertainties of DR and BESS and market prices (in DA, intraday, and balancing markets), a multi-objective optimization framework is used. Different methodologies with/without DR and BESS are thoroughly studied and compared; it is inferred that the coordinated operation results in a higher profit from DR and BESS in the electricity market compared to existing literature works. To summarize the unique features of the proposed methodology relative to the previous works in the area, the taxonomy of recent works can be seen in Table 2. According to this model, BESS will store energy during the time of low price and then discharge its energy during the period of high price; thus, DR can also be scheduled with the BESS.

Table 2.

Taxonomy of Recent Work.

1.4. Research Contributions and Paper Outline

Key contributions of this research paper include:

- i.

- Proposed a novel coordinated methodology of DR and BESS operation for minimizing cost and maximizing DA, intra-day, and real-time market profit;

- ii.

- The coordinated methodology of DR and BESS is applied from the perspective of a profit-seeking LSE connected to a transmission network;

- iii.

- Effects of the coordinated methodology of DR and BESS are explored on outcomes of the wholesale power market operating across transmission networks;

- iv.

- The Coordinated methodology is tested on an agent-based simulation platform for enabling independent private decision-making by multiple intelligent LSE agents.

2. Methodology

In this section, DR and BESS models are separately formulated before introducing the proposed coordinated methodology. Both DR activation and BESS charging/discharging decisions of an LSE depend on variable energy prices and the availability of VRES, among other factors. Therefore, the coordinated operation of DR and BESS inherently offers a better reaction to the variabilities of concern. Moreover, the uncoordinated methodologies of DR and BESS are individually discussed but not tested by case studies. This section ends with a description of how the coordinated model is tested on an agent-based electricity market simulation (AMES).

2.1. Uncoordinated Model in General

Because of smart grid-related innovation, maintenance, and spot market change, it is important to make full use of VRES and BESS to investigate the capability of demand-side assets to take part in the spot market to encourage the utilization of cost-effective techniques [29].

The proposed basic uncoordinated methodology of DR [29,46] is devised as:

Subject to

In the uncoordinated methodology of DR, the profit is maximized by (1). The first and second summation terms maximize DA profit and intraday market profit, whilst the third and fourth terms reflect profit and cost. In (1), we have and , It implies that the surplus generation is purchased at a lower cost, and the generation deficiency carries a bigger penalty. The limitation in (2) limits the available power plant’s rated power in the DA market. The offer of the DA market is constrained in (3) to its rated power. The DA and intraday market offer make up the scheduled power in (4). The positive and negative power deviations in the objective function result in profit and cost, respectively, in (1). The positive and negative variances are extracted using (4). Note that only one of the and can be nonzero in one individual period: if ≠ 0. It’s worth noting that when equals zero, the maximum value of occurs.

Another uncoordinated model presented in [42] is

Subject to

If the start-up and shut-down costs are both greater than zero, then these costs are included in (5). Constraint in (6) shows start-up and shutdown costs are included in the operation cost of BESS. Equations (7) and (8) show the limits of the start-up and shutdown costs of BESS. In (9), the projected market cost and cost of used energy are calculated.

Formulation of LP (linear programming) algorithm of two analyzed situations considering DR and BESS in [43]:

Subject to

This equation includes the cost of generation [40]:

So, the final objective function includes

In addition, running costs are considered in (10), equipment costs in (11), the variable cost of a wind power plant and generation of wind power in (12) and scheduled power is considered in (13). Thus, the scheduled power, start-up and shutdown costs, power variance, and energy prices in the DA and intraday markets comprise the optimization technique of the model in (14).

2.2. Uncoordinated Model for DR

The proposed model of the uncoordinated methodology of DR is devised as in [29,40,43,47].

The overall Objective function of the Uncoordinated model of DR is formulated in (15). This objective function includes curtailable load offer in the DA market in (16), new load with the consideration of DRP, the potential of DRP implementation, and shifted load in (17). At the time ‘t’ and scenario ‘s,’ DR considers max DR quantity limit ratio and min DR quantity limit ratio in (18), min transmission constraints in (19) and specific cost for DR and energy-charged in batteries in (20).

2.3. Uncoordinated Model of BESS

The proposed model of an uncoordinated model of BESS is devised as [29,30,43]:

Subjected to

The overall objective function of the uncoordinated model of BESS is discussed in (21). Constraints consider BESS charging and discharging of power in (22), the charging offer of BESS in the DA market, and discharging offer of BESS in (23) and the specific cost for storage and energy-charge in batteries in (24).

is tackled to incorporate the initial cost of investment for equipment that cannot be inserted due to the linearity property of linear programming.

In (25) Cycle cost of the equipment is discussed, while in (26) specific cost of the equipment is examined.

2.4. Proposed Coordinated Model of BESS and DR

The model proposed by our research work considers coordinated DR and BESS:

Subject to constraints:

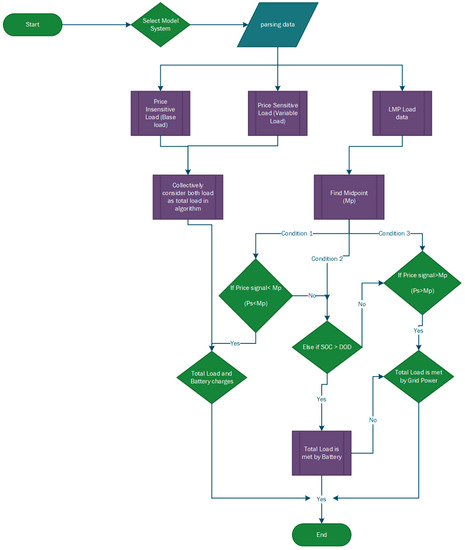

In this proposed methodology, we assume the use of DR and BESS in DA, IA, and balancing real-time markets as a defining criterion. These variables can be predicted in advance. Different scenarios can be generated by adding different capacities of batteries. In (27), the 1st part consisting of the first 2 summation terms represents the base load and variable load for a period with their changing variable price signal, the 2nd part of (27) depicts the equipment cost and battery life cycle, and the 3rd and 4th parts tell us about the cost and operating cost of the battery. Constraint in (28) shows a new load profile when the price signal is lower than the mid-point and BESS charges, whereas (29) shows profile when . Equations (30) and (31) display the pricing signal and load signal’s upper and lower bounds. Constraint in (32) shows the cost of load B and (33) shows the limits of . Finally, (34) shows the power delivered by the grid.

In Figure 1, a flow chart of the coordinated methodology of DR and BESS is shown.

Figure 1.

Flow chart of proposed algorithm based on the coordinated model of DR and BESS.

2.5. Agent-Based Modeling Framework

The coordinated model of DR and BESS assumes that forecasted energy prices are available to a Load Serving Entity (LSE) that is utilizing the model. However, LSE faces uncertain market prices (DA, ID, and balancing market) that are influenced and determined by the individual actions of all market participants and result in collective market outcomes. Battery charging and discharging decisions from the coordinated model of DR and BESS are used to update the base case hourly load profile of an LSE before it sends its energy bids to the day-ahead market. This kind of simulation involves individual decision-making by profit-seeking LSEs and GenCos, followed by collective decision-making by the day-ahead market operator. Since agent-based modeling works best for catering decision-making by multiple interacting market participants, our research employs Agent-based modeling of the electricity system (AMES), a software developed at Iowa State University [48]. The AMES wholesale power market is made up of the Independent System Operator (ISO) and a collection of energy traders made up of Load-Serving Entities (LSEs), and Generation Companies (GenCos) scattered along the transmission grid’s buses. We have used Java-based AMES to study the effects of DR and BESS on (i) hourly locational marginal prices (LMPs), (ii) profits of all LSEs whether utilizing or not utilizing the coordinated model of BESS and DR, (iii) profits of GenCos, (iv) flows on critical transmission lines, and (v) GenCo commitments. The locational marginal pricing (LMP)-settled AMES wholesale power market works over an AC transmission grid from day 1 through a user-specified maximum day. There are 24 consecutive hours H = 00, 01…23 in each day D. However, to capture the hourly load fluctuation effects on outcomes of the proposed coordinated methodology of DR and BESS, we ran a 1-day simulation using AMES. With consideration for generation and transmission constraints, the ISO seeks to maximize overall net benefits. Power security is a goal for each LSE’s downstream (retail) clients. Each LSE sends a demand bid to the ISO for the day-ahead market on day D + 1 in the early hours of day D. (i.e., a 24-h load profile). Each simulation run begins with user-specified LSE demand bids. The daily maximum net income levels are what each GenCo aspires to. Upon receipt of GenCos’ supply offers and LSEs’ demand bids before gate closure on Day D, the ISO runs an OPF algorithm to determine hourly power supply commitments of LSEs, dispatch levels of GenCos, and LMPs for the day-ahead market for day D + 1 [23,49].

3. Numerical Results and Discussion

3.1. Implementation and Test Case Data

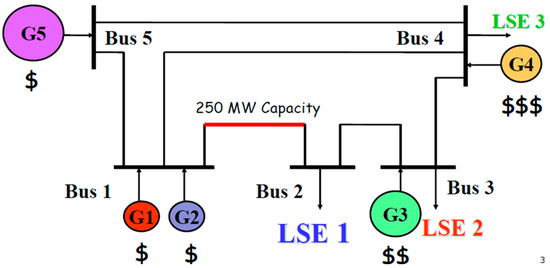

A 1.3 GHz Intel Core i5 personal computer equipped with MATLAB and Java integrated development environment is used for the integrated modeling and simulation needs of this research work. The mathematical optimization details of the proposed coordinated methodology for an LSE are implemented in a Matlab environment. The resulting optimal battery charging/discharging hourly profiles are passed to the Java environment to update the overall load profile of the LSE. Consequently, the LSE participates in a DA market implemented in AMES simulation software setup in an integrated development environment for Java. A five-bus test system shown in Figure 2 is used for developing case studies presented in this paper. Nevertheless, the coordinated DR and BESS methodology developed in this paper is generic and can be applied to any LSE on any node of a larger transmission network like the IEEE 118 bus test system. Table 3 and Table 4 depict the line characteristics and generator data, respectively.

Figure 2.

5-Bus system [50].

Table 3.

Line characteristics [50].

Table 4.

Capacities and Cost Coefficients of Generators [50].

In this five-bus test system, there are five GenCos, three LSEs, and six transmission lines. Genco 1 and 2 are relatively small and cheap GenCos as compared to others. Genco 3 is relatively expensive as compared to Genco 1 and 2 but less expensive as compared to Genco 4. Genco 4 is the most expensive generator and is only used in the hours of peak demand. LSE 1 is located on Bus 2, LSE 2 is located on Bus 3, and LSE 3 is located on Bus 4. Complete data of the five-bus model, including the 24-hourly loads of LSEs, can be seen in a dedicated appendix [50].

On Bus 2, DA pricing is very high, so it was initially decided to add a BESS for LSE1. Later a BESS added at each LSE location was also explored, but similar results were obtained that are omitted for brevity. Firstly, we will consider the load data of 24 h in the base case and evaluate the results of the proposed coordinated methodology for 1 day. The proposed coordinated methodology is tested for four different capacities of BESS (equal to the peak value of the total load, 75% of the peak value of the total load, 50% of the peak value of the total load, and 25% of the peak value of load).

In the base case, we consider system and market operation without utilizing any coordinated model of DR and BESS. However, in the remaining four case studies with 25%, 50%, 75% and 100% BESS capacities, the proposed coordinated model of DR and BESS is used. Hence, we use LMPs (locational marginal pricing) data to predict DA pricing for the next 24 h. In this base case, max demand is at the 17th and 18th hours and approximately equal to 500 MW. Our proposed methodology is comprehensive and incorporates minimizing the DA, Intraday, and real-time cost and thus maximizing the profit using DR and BESS. However, in this paper, our case study is limited to maximizing profits from the DA market alone. Nevertheless, the effects of using the coordinated methodology by a single entity on the system and market-wide results are also discussed in this paper.

3.2. Optimal DR and BESS Utilization by a Single Load Serving Entity

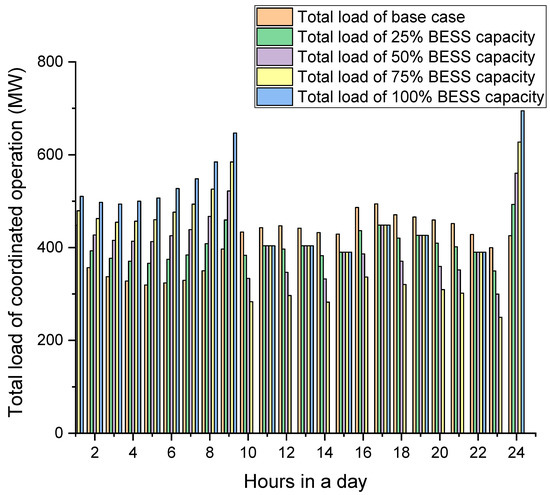

(a): Load due to coordinated methodology with different BESS capacities

In Figure 3, the total load is shown when 0% (base case), 25%, 50%, 75%, and 100% capacity of BESS are added. This shows that the load is increased in the 1st to 9th hour because, at that time, BESS is also charging. The magnitude of load increase is directly related to the capacity of the battery. However, after the 10th hour, there is a decrease in load because this is when charging and discharging of batteries takes place in alternative hours. 100% BESS capacity means it can serve all loads during times of high prices of power supplied by the grid. In the same way, 75% BESS capacity means it will serve 75% load in the hour of discharging, whereas the remaining load will be served by the grid.

Figure 3.

Total load due to Coordinated Methodology.

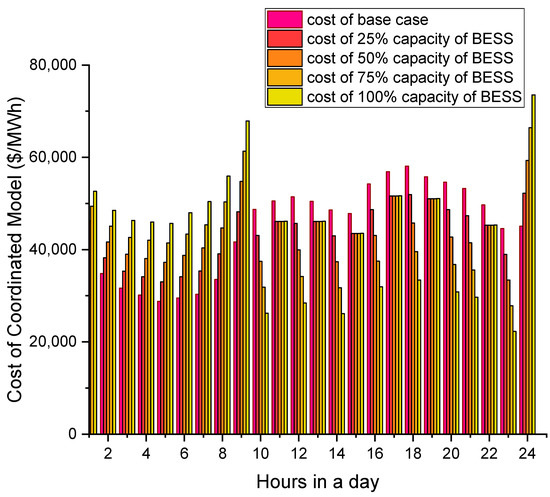

(b): Cost of coordinated methodology for different BESS capacities

In Figure 4, a comparison of costs for all BESS capacity cases with the base case is presented. It is seen that the overall operating cost is high in low pricing hours due to BESS charging. Furthermore, the operating cost is low in high pricing hours because BESS earns revenue by discharging. LSE’s cost of operating in the DA market also varies depending upon the BESS capacity.

Figure 4.

Cost of Operation due to Coordinated Model with different capacities.

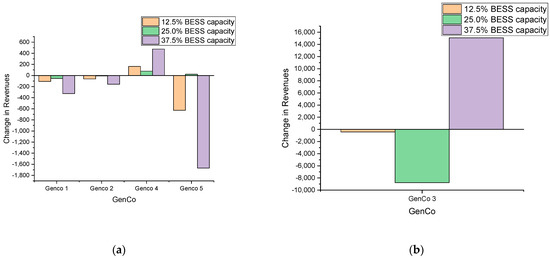

3.3. System and Market-Wide Impacts

BESS is added to LSE 1 to compare the effects on LMPs, Genco commitment, and branch flows. In AMES, we perform this simulation testing on the base case as well as 12.5%, 25% and 37.5% BESS capacity cases. Even higher BESS capacity cases (50%, 75%, and 100%) were found to be infeasible during some of the 24 h, so we are not presenting their partial results in this paper. Change in revenues of all GenCos, as compared to the base case, for 12.5%, 25%, and 37.5% BESS capacity cases are shown in Figure 5.

Figure 5.

Change in Revenues of all GenCos as compared to Base Case. (a) Change in revenue of GenCos 1, 2, 4 & 5; (b) Change in revenue of GenCo 3.

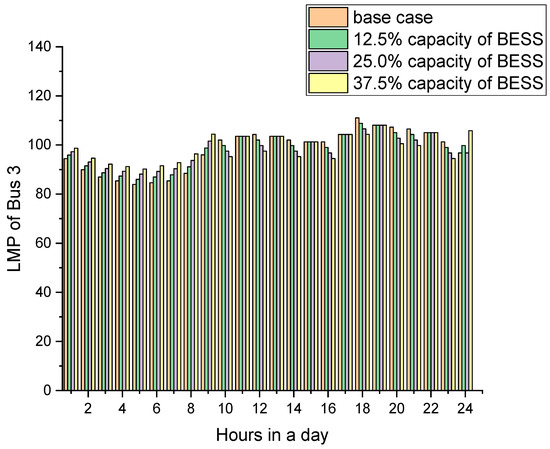

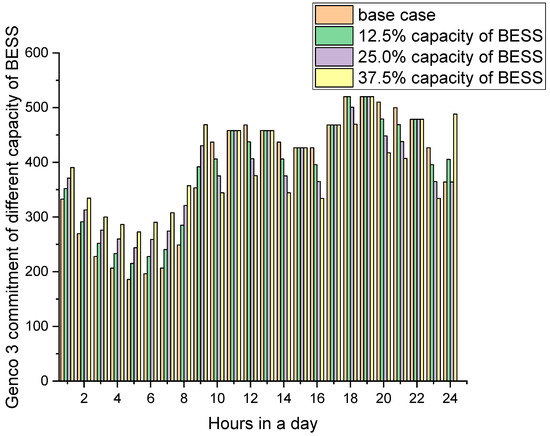

It is pertinent to note that the introduction of BESS increases (decreases) the revenue of GenCo 4 (GenCos 1 and 2) in all case studies, as displayed in Figure 5a. The increase (decrease) in revenue of GenCo 4 (GenCos 1 and 2) is due to two factors: (i) higher (lower) LMPs at the local bus during non-peak hours and (ii) higher (lower) commitment for power generation during the non-peak hours. Both factors experience increases (decreases) because of additional charging for BESS at node 2 in the non-peak hours. The results of GenCo 5 are similar to those of GenCos 1 and 2 because all of these GenCos have low costs of generation and lie in a region away from the load centers. As compared to other BESS cases, the second case of 25% BESS capacity is the most favorable in terms of reduced negative change in revenues for GenCos 1 and 2 but a positive change in revenue for GenCo 5. The uncertainty in revenue of GenCo 3 is most prominent, and Figure 5b exhibits an 8765 $/day decrease in revenue for 25% BESS capacity but a 6328 $/day increase in revenue for 37.5% BESS capacity. The uncertain change in revenue of GenCo 3 is most probably due to the unusually lower LMPs and commitment in hour 24, as shown in Figure 6 and Figure 7, respectively, for 25% BESS capacity as compared to 12.5% BESS capacity.

Figure 6.

LMP of Bus 3.

Figure 7.

GenCo 3 Commitment.

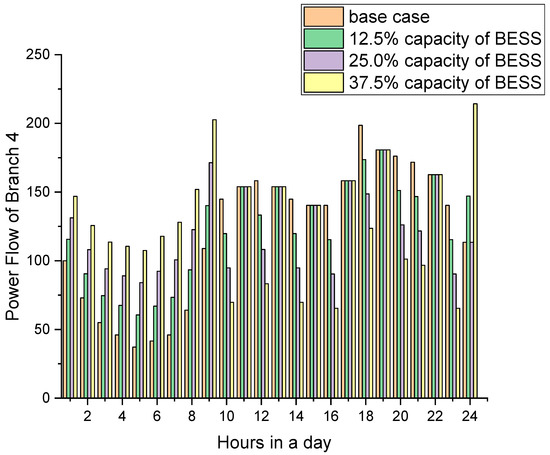

Note that node 2 is directly connected to the rest of the network through branches 1 and 4; since branch 1 is operating at its maximum capacity of 250 MW, the additional charging power for BESS must flow in through branch 4. Therefore, with increasing BESS deployment, power flows of branch 4 drastically increase compared to the base case during the non-peak hours, as shown in Figure 8. Note that node 2 is directly connected to the rest of the network through branches 1 and 4; since branch 1 is operating at its maximum capacity of 250 MW, the additional charging power for BESS must flow in through branch 4. Therefore, with increasing BESS deployment, power flows of branch 4 drastically increase compared to the base case during the non-peak hours, as shown in Figure 8.

Figure 8.

Power Flow of Branch 4.

After the deployment of different BESS capacities by LSE 1, changes in revenues of GenCos are summarized in Table 5 because the exact values cannot be read from Figure 6.

Table 5.

Change in Revenue of GenCos as compared to Base Case.

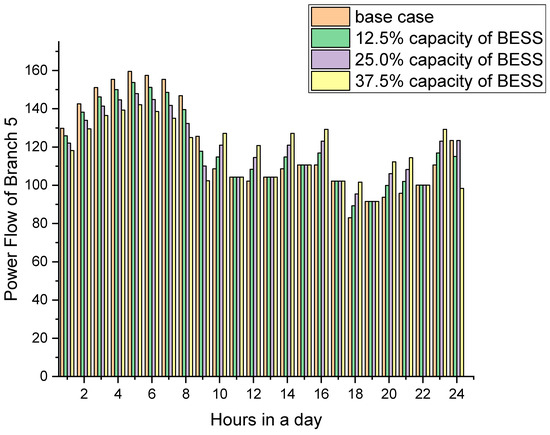

However, irrespective of 0%, 25%, or 50% BESS, branch power flows decrease from hours 1 to 5 and then increase from hours 6 to 9, except that branch 5 shows a reverse pattern illustrated in Figure 9. As the load decreases from hour 1 to 5, the commitments of GenCo3 also decrease because it is a more expensive generator as compared to all generators running during the hours. However, the commitments of Genco 3, illustrated in Figure 7, fall more drastically as compared to the load of LSE1, as shown in Figure 3. Therefore, the cheaper power of GenCos 1, 2, and 5 flows in through branch 5, as shown in Figure 9. Subsequently, the patterns in branch 5 power flows and GenCo 3 commitments are reversed from hours 6 to 9.

Figure 9.

Power Flow of Branch 5.

All LSEs experience cost savings after the introduction of BESS by LSE 1, as summarized in Table 6. It shows that in our test case, market conditions become favorable for all LSE when BESS is deployed by only one LSE.

Table 6.

Cost Savings of LSEs compared to Base Case.

The variance of LMPs for all 5 nodes is calculated and shown in Table 7. Variance is useful as a risk index while planning trading decisions by market participants. Low variance indicates that market prices are expected to be rather stable, and a centralized auction is a good trading option, whereas the high value of variance requires locking in forward bilateral trading to hedge against anticipated market volatility. GenCos with the least operating costs are connected at nodes 1 and 5, and the variance of LMPs at these nodes considerably rises with increasing BESS. Therefore, the centralized auction becomes riskier for both generators, i.e., G1 and G5. Although node 2 experiences the highest LMP variance in the system, BESS deployment by L1 causes the greatest improvement in the risk index, as the variance reduces by one-third (from 104.93 to 44.41). Both nodes 3 and 4 hosting L2 and L3, besides the most expensive GenCos of the whole system, i.e., G3 and G4, also experience a reduction in LMP variance.

Table 7.

Variance of LMPs at all nodes.

4. Conclusions

To boost profits for the owner of BESS, a methodology was developed for the coordinated operation of DR and BESS. The methodology was tested for different capacities of BESS deployment by an LSE participating in the wholesale market across a transmission network prone to congestion. Although the proposed methodology increased the company profits of an LSE, mixed market-wide effects were experienced on the revenues of GenCos as well as the variance of LMPs. BESS deployment on LSE 1 shows its cost saving of as much as 98,260 $/day. The introduction of BESS leads to uncertain revenues for GenCos; for example, GenCo 3 exhibits an 8765 $/day decrease in revenue for 25% BESS capacity but a 6328 $/day increase in revenue for 37.5% BESS capacity. The variance of LMPs, widely used as a risk index, greatly decreased (from 104.93 to 41.41) for the LSE utilizing the coordinated methodology, somewhat decreased (9.96–5.61) for other LSEs but increased (0.07–2.76) for cheaper GenCos with no LSE at the local node. In terms of system-wide effects, higher BESS capacity cases are not practically feasible because the underlying optimal power flow (OPF) by the market operator has no solution in certain critical hours due to transmission congestion.

Future Work

In future work, the owner of the energy storage unit can specify an appropriate weighting factor to tradeoff between the anticipated increase in profit due to coordinated DR and BESS operation and the anticipated risk of a drop in profit because reduced LMP variance can decrease the value of arbitrage energy trading. Although the proposed methodology can cater to simultaneous participation in three markets (DA, Intraday, and real-time), it is only tested for the DA market in this research, and the rest is identified as future work. In future work, this methodology can also be tested on another bus system (118 bus system) which includes renewable energy sources. This paper is also of interest to the market operator, system operator and regulator because it offers insight into how BESS deployment by one utility can affect the revenues and costs of all other stakeholders.

Author Contributions

P.B.: Investigation, Software, Methodology, Writing—Original draft preparation. K.I.: Supervision, Conceptualization, Methodology, Writing—Review & Editing. A.K.J.: Software, Formal Analysis, Investigation. A.A.: Conceptualization, Writing—Review & Editing. K.F.: Visualization. H.A.: Funding Acquisition, Writing—Review & Editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research work was funded by Institutional Fund Projects under grant no. (IFPNC-001-135-2020). Therefore, the authors acknowledge financial and technical support from the Ministry of Education and Deanship of Scientific research (DSR), King Abdulaziz University (KAU), Jeddah, Saudi Arabia.

Data Availability Statement

Not applicable.

Acknowledgments

The authors also gratefully acknowledge the full support of the National University of Sciences and Technology (NUST), Islamabad and the National Skills University (NSU), Islamabad, Pakistan.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Liang, Z.; Chen, H.; Wang, X.; Idris, I.I.; Tan, B.; Zhang, C. An extreme scenario method for robust transmission expansion planning with wind power uncertainty. Energies 2018, 11, 2116. [Google Scholar] [CrossRef]

- Tahir, M.F.; Haoyong, C.; Khan, A.; Javed, M.S.; Laraik, N.A.; Mehmood, K. Optimizing size of variable renewable energy sources by incorporating energy storage and demand response. IEEE Access 2019, 7, 103115–103126. [Google Scholar] [CrossRef]

- Sedighizadeh, M.; Esmaili, M.; Jamshidi, A.; Ghaderi, M.H. Stochastic multi-objective economic-environmental energy and reserve scheduling of microgrids considering battery energy storage system. Int. J. Electr. Power Energy Syst. 2018, 106, 1–16. [Google Scholar] [CrossRef]

- Bao, Y.Q.; Li, Y.; Wang, B.; Hu, M.; Chen, P. Demand response for frequency control of multi-area power system. J. Mod. Power Syst. Clean Energy 2017, 5, 20–29. [Google Scholar] [CrossRef]

- Faizantahir, M.; Teheeb-Ul-hassan, H.; Mehmood, K.; Qamar, H.G.M.; Rashid, U. Optimal load shedding using an ensemble of artifcial neural networks. Int. J. Electr. Comput. Eng. Syst. 2016, 7, 39–46. [Google Scholar]

- Faisal, M.; Hannan, M.A.; Ker, P.J.; Hussain, A.; Bin Mansor, M.; Blaabjerg, F. Review of energy storage system technologies in microgrid applications: Issues and challenges. IEEE Access 2018, 6, 35143–35164. [Google Scholar] [CrossRef]

- Miguel, M.; Nogueira, T.; Martins, F. Energy storage for renewable energy integration: The case of Madeira Island, Portugal. Energy Procedia 2017, 136, 251–257. [Google Scholar] [CrossRef]

- Díaz-González, F.; Sumper, A.; Gomis-Bellmunt, O.; Villafáfila-Robles, R. A review of energy storage technologies for wind power applications. Renew. Sustain. Energy Rev. 2012, 16, 2154–2171. [Google Scholar] [CrossRef]

- Perry, P. Energy distribution systems. In CDM 2007; Routledge: Abingdon, UK, 2020; pp. 275–278. [Google Scholar] [CrossRef]

- Christakou, K. A unified control strategy for active distribution networks via demand response and distributed energy storage systems. Sustain. Energy Grids Netw. 2016, 6, 1–6. [Google Scholar] [CrossRef]

- Bukhsh, W.A.; Zhang, C.; Pinson, P. An Integrated Multiperiod OPF Model with Demand Response and Renewable Generation Uncertainty. IEEE Trans. Smart Grid 2016, 7, 1495–1503. [Google Scholar] [CrossRef]

- Sun, Z.; Eskandari, M.; Zheng, C.; Li, M. Handling Computation Hardness and Time Complexity Issue of Battery Energy Storage Scheduling in Microgrids by Deep Reinforcement Learning. Energies 2022, 16, 90. [Google Scholar] [CrossRef]

- Korpås, M.; Holen, A.; Hildrum, R. Operation and sizing storage for wind power plants in a market system. Int. J. Electr. Power Energy Syst. 2003, 25, 599–606. [Google Scholar] [CrossRef]

- Wang, H.; Xing, H.; Luo, Y.; Zhang, W. Optimal scheduling of micro-energy grid with integrated demand response based on chance-constrained programming. Int. J. Electr. Power Energy Syst. 2023, 144, 108602. [Google Scholar] [CrossRef]

- Ma, R.; Li, X.; Luo, Y.; Wu, X.; Jiang, F. Multi-objective dynamic optimal power flow of wind integrated power systems considering demand response. CSEE J. Power Energy Syst. 2019, 5, 466–473. [Google Scholar] [CrossRef]

- Khonji, M.; Chau, C.-K.; Elbassioni, K. Optimal Power Flow with Inelastic Demands for Demand Response in Radial Distribution Networks. IEEE Trans. Control Netw. Syst. 2016, 5, 513–524. [Google Scholar] [CrossRef]

- Aziz, S.; Wang, H.; Liu, Y.; Peng, J.; Jiang, H. Variable Universe Fuzzy Logic-Based Hybrid LFC Control With Real-Time Implementation. IEEE Access 2019, 7, 25535–25546. [Google Scholar] [CrossRef]

- Aziz, S.; Peng, J.; Wang, H.; Jiang, H. ADMM-based distributed optimization of hybrid MTDC-AC grid for determining smooth operation point. IEEE Access 2019, 7, 74238–74247. [Google Scholar] [CrossRef]

- Brahman, F.; Honarmand, M.; Jadid, S. Optimal electrical and thermal energy management of a residential energy hub, integrating demand response and energy storage system. Energy Build. 2015, 90, 65–75. [Google Scholar] [CrossRef]

- Ma, J.; Venkatesh, B. Integrating net benefits test for demand response into optimal power flow formulation. IEEE Trans. Power Syst. 2021, 36, 1362–1372. [Google Scholar] [CrossRef]

- Ma, J.; Venkatesh, B. A new measure to evaluate demand response effectiveness and its optimization. Electr. Power Syst. Res. 2020, 182, 106257. [Google Scholar] [CrossRef]

- Aguado, J.A.; de la Torre, S.; Triviño, A. Battery energy storage systems in transmission network expansion planning. Electr. Power Syst. Res. 2017, 145, 63–72. [Google Scholar] [CrossRef]

- Sparacino, A.R.; Reed, G.F.; Kerestes, R.J.; Grainger, B.M.; Smith, Z.T. Survey of battery energy storage systems and modeling techniques. In Proceedings of the 2012 IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 22–26 July 2012; pp. 1–8. [Google Scholar] [CrossRef]

- Divya, K.C.; Østergaard, J. Battery energy storage technology for power systems-An overview. Electr. Power Syst. Res. 2009, 79, 511–520. [Google Scholar] [CrossRef]

- Kampouris, K.P.; Drosou, V.; Karytsas, C.; Karagiorgas, M. Energy storage systems review and case study in the residential sector. IOP Conf. Ser. Earth Environ. Sci. 2020, 410, 012033. [Google Scholar] [CrossRef]

- Wu, Y.; Ouyang, T.; Xiong, T.; Jiang, Z.; Hu, Y.; Deng, J.; Wang, Z.; Huang, Y.; Balogun, M. Boosted Storage Kinetics in Thick Hierarchical Micro–Nano Carbon Architectures for High Areal Capacity Li-Ion Batteries. Energy Environ. Mater. 2022, 5, 1251–1259. [Google Scholar] [CrossRef]

- Asensio, M.; de Quevedo, P.M.; Munoz-Delgado, G.; Contreras, J. Joint distribution network and renewable energy expansion planning considering demand response and energy storage-part I: Stochastic programming model. IEEE Trans. Smart Grid 2018, 9, 655–666. [Google Scholar] [CrossRef]

- Asensio, M.; de Quevedo, P.M.; Munoz-Delgado, G.; Contreras, J. Joint distribution network and renewable energy expansion planning considering demand response and energy storage-part II: Numerical results. IEEE Trans. Smart Grid 2018, 9, 667–675. [Google Scholar] [CrossRef]

- Jamali, A.; Aghaei, J.; Esmaili, M.; Nikoobakht, A.; Niknam, T.; Shafie-Khah, M.; Catalao, J.P.S. Self-scheduling approach to coordinating wind power producers with energy storage and demand response. IEEE Trans. Sustain. Energy 2020, 11, 1210–1219. [Google Scholar] [CrossRef]

- Ghalelou, A.N.; Fakhri, A.P.; Nojavan, S.; Majidi, M.; Hatami, H. A stochastic self-scheduling program for compressed air energy storage (CAES) of renewable energy sources (RESs) based on a demand response mechanism. Energy Convers. Manag. 2016, 120, 388–396. [Google Scholar] [CrossRef]

- Son, J.; Hara, R.; Kita, H.; Tanaka, E. Operation scheduling considering demand response in a commercial building with chiller system and energy storage system. In Proceedings of the 2015 IEEE PES Asia-Pacific Power and Energy Engineering Conference (APPEEC), Brisbane, Australia, 15–18 November 2015; pp. 96–101. [Google Scholar] [CrossRef]

- Sharifi, R.; Anvari-Moghaddam, A.; Fathi, S.H.; Vahidinasab, V. Electrical Power and Energy Systems A bi-level model for strategic bidding of a price-maker retailer with fl exible demands in day-ahead electricity market. Int. J. Electr. Power Energy Syst. 2020, 121, 106065. [Google Scholar] [CrossRef]

- Clastres, C.; Khalfallah, H. Dynamic pricing efficiency with strategic retailers and consumers: An analytical analysis of short-term market interactions. Energy Econ. 2021, 98, 105169. [Google Scholar] [CrossRef]

- Rashidizadeh-Kermani, H.; Vahedipour-Dahraie, M.; Shafie-Khah, M.; Catalão, J.P. Electrical Power and Energy Systems Stochastic programming model for scheduling demand response aggregators considering uncertain market prices and demands. Electr. Power Energy Syst. 2019, 113, 528–538. [Google Scholar] [CrossRef]

- Faqiry, M.N.; Edmonds, L.; Wu, H.; Pahwa, A. Distribution locational marginal price-based transactive day-ahead market with variable renewable generation. Appl. Energy 2019, 259, 114103. [Google Scholar] [CrossRef]

- Draheim, P.; Schlachter, U.; Wigger, H.; Worschech, A.; Brand, U.; Diekmann, T.; Schuldt, F.; Hanke, B.; von Maydell, K.; Vogt, T. Business case analysis of hybrid systems consisting of battery storage and power-to-heat on the German energy market. Util. Policy 2020, 67, 101110. [Google Scholar] [CrossRef]

- Badeda, J.; Meyer, J.; Sauer, D.U. Modeling the influence of installed battery energy storage systems on the German frequency containment reserve market. In Proceedings of the NEIS 2017 Conference on Sustainable Energy Supply and Energy Storage Systems, Hamburg, Germany, 21–22 September 2020; pp. 315–321. [Google Scholar]

- Sun, L.; Qiu, J.; Han, X.; Yin, X.; Dong, Z. Per-use-share rental strategy of distributed BESS in joint energy and frequency control ancillary services markets. Appl. Energy 2020, 277, 115589. [Google Scholar] [CrossRef]

- Zhang, C.; Qiu, J.; Yang, Y.; Zhao, J. International Journal of Electrical Power and Energy Systems Trading-oriented battery energy storage planning for distribution market. Int. J. Electr. Power Energy Syst. 2021, 129, 106848. [Google Scholar] [CrossRef]

- Bitaraf, H.; Rahman, S. Reducing curtailed wind energy through energy storage and demand response. IEEE Trans. Sustain. Energy 2018, 9, 228–236. [Google Scholar] [CrossRef]

- Liu, T.; Zhang, D.; Wang, S.; Wu, T. Standardized modelling and economic optimization of multi-carrier energy systems considering energy storage and demand response. Energy Convers. Manag. 2019, 182, 126–142. [Google Scholar] [CrossRef]

- Howlader, H.O.R.; Matayoshi, H.; Senjyu, T. Distributed generation integrated with thermal unit commitment considering demand response for energy storage optimization of smart grid. Renew. Energy 2016, 99, 107–117. [Google Scholar] [CrossRef]

- GLorenzi, G.; Silva, C.A.S. Comparing demand response and battery storage to optimize self-consumption in PV systems. Appl. Energy 2016, 180, 524–535. [Google Scholar] [CrossRef]

- Kerdphol, T.; Qudaih, Y.; Mitani, Y. Optimum battery energy storage system using PSO considering dynamic demand response for microgrids. Int. J. Electr. Power Energy Syst. 2016, 83, 58–66. [Google Scholar] [CrossRef]

- Ebadi, R.; Yazdankhah, A.S.; Mohammadi-Ivatloo, B.; Kazemzadeh, R. Coordinated power and train transportation system with transportable battery-based energy storage and demand response: A multi-objective stochastic approach. J. Clean. Prod. 2020, 275, 123923. [Google Scholar] [CrossRef]

- Zheng, M.; Meinrenken, C.J.; Lackner, K.S. Agent-based model for electricity consumption and storage to evaluate economic viability of tariff arbitrage for residential sector demand response. Appl. Energy 2014, 126, 297–306. [Google Scholar] [CrossRef]

- Xu, L.; Wei, W.; Cai, X.; Liu, C.; Jiang, X.; Yan, J. Day-Ahead Economic Dispatch Strategy for Distribution Network Considering Total Cost Price-Based Demand Response. Energy Res. 2022, 10, 870893. [Google Scholar] [CrossRef]

- Kim, H.T.; Jin, Y.G.; Yoon, Y.T. An economic analysis of load leveling with battery energy storage systems (BESS) in an electricity market environment: The Korean case. Energies 2019, 12, 1608. [Google Scholar] [CrossRef]

- Poullikkas, A. A comparative overview of large-scale battery systems for electricity storage. Renew. Sustain. Energy Rev. 2013, 27, 778–788. [Google Scholar] [CrossRef]

- Imran, K. Agent Based Modelling and Simulation of Operating Strategies of Generators and Loads in Wholesale Electricity Markets. Ph.D. Thesis, University of Strathclyde, Glasgow, UK, 2015. Available online: https://stax.strath.ac.uk/concern/theses/7m01bk69s (accessed on 11 January 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).