Developing an Appropriate Energy Trading Algorithm and Techno-Economic Analysis between Peer-to-Peer within a Partly Independent Microgrid

Abstract

:1. Introduction

- The P2P trading process is divided into three layers: registration, matchmaking, and pricing. Each layer plays a unique role in facilitating the entire P2P trading process.

- The excess energy of prosumers will be consumed by consumers. The pricing pattern is determined by the total selling and buying power of the peers.

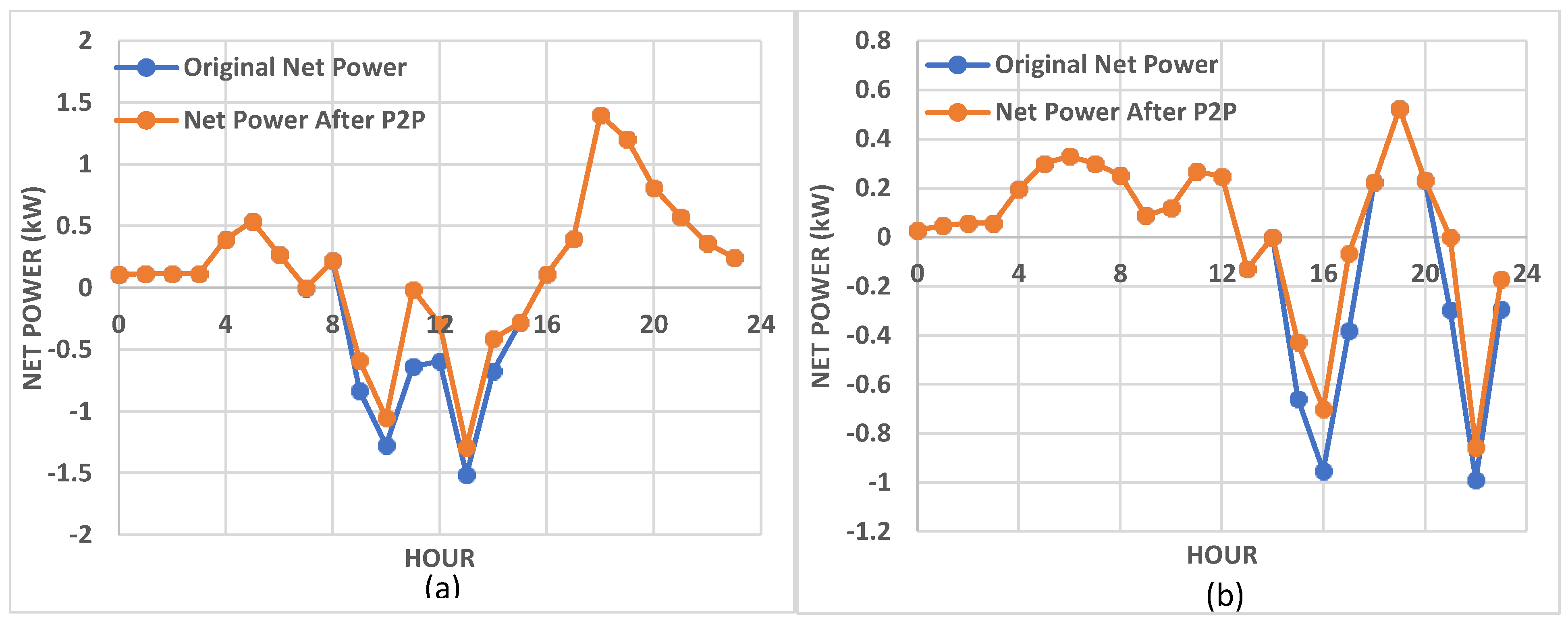

- As excess energy will be utilized in trading, the peer self-optimization of electricity is given priority. Higher self-optimization enables prosumers to store more energy, allowing them to trade more electricity and increase profits for both parties.

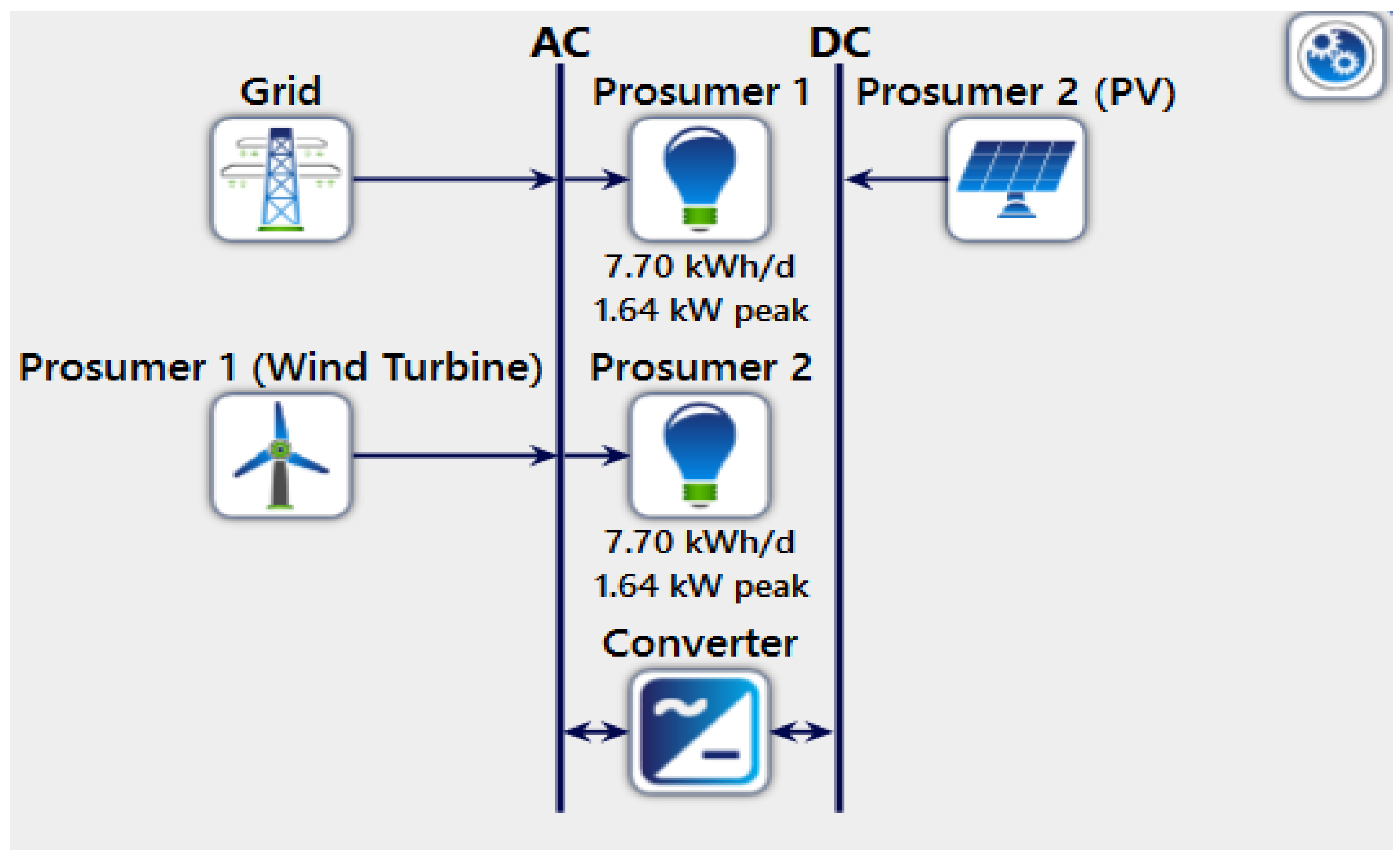

- Homer Pro software is used to simulate real-time data. To evaluate the potential of P2P, we analyzed the consumption pattern in July, as it is a month when energy consumption is higher due to the frequent use of air conditioners and ceiling fans. Therefore, this month is considered an ideal month to validate the effectiveness of P2P as the load consumption is relatively higher, resulting in less excess energy.

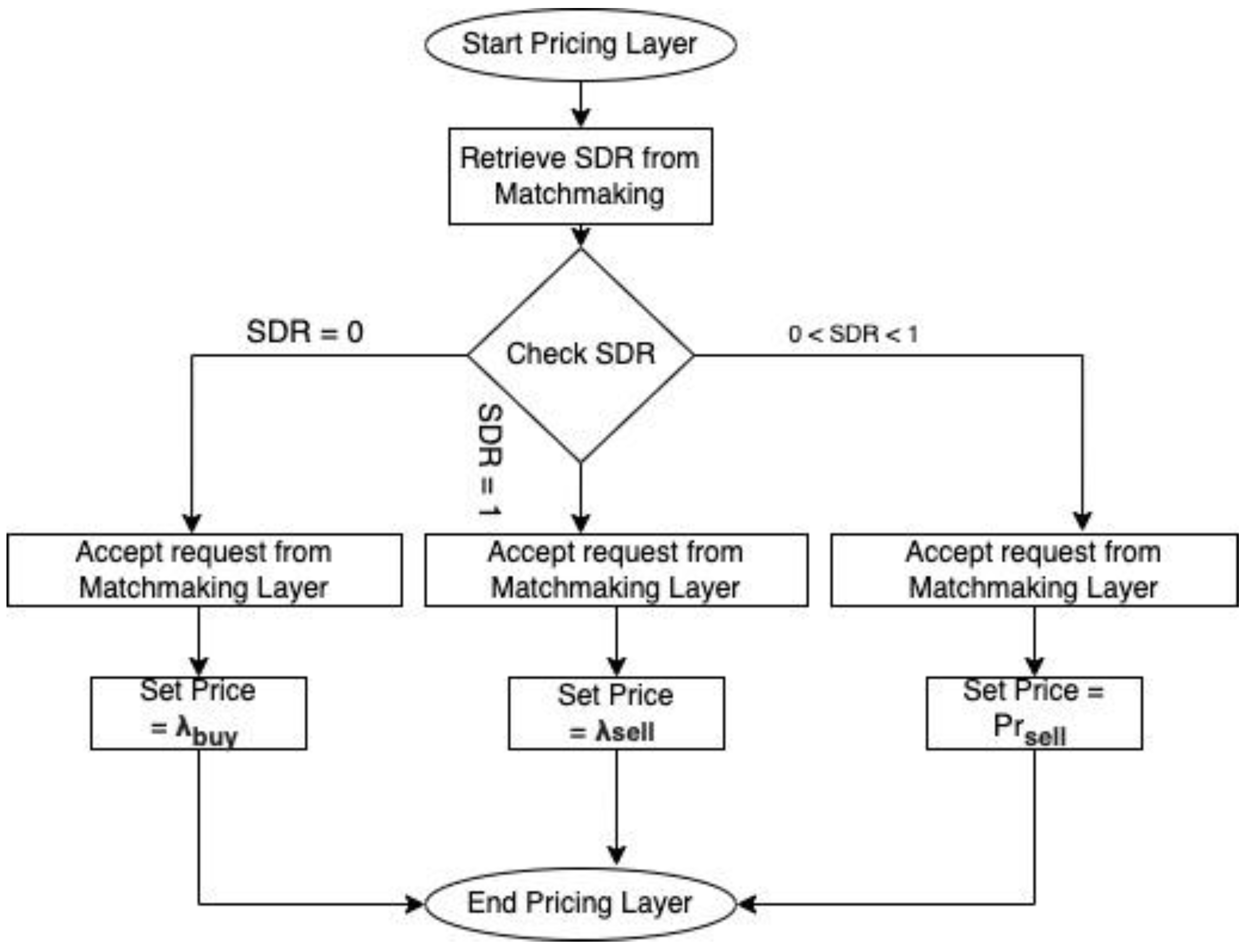

- This paper proposes an effective pricing method based on SDR that concentrates more on maximizing the energy sharing and profit of the prosumers by optimizing the load as per the energy generation and demand response pattern. Outstanding prosumers are introduced in this paper and a simplified matchmaking algorithm has been developed to make the most suitable match between prosumers and consumers, significantly reducing the trading time in the network, eventually enhancing the energy trade efficiency.

2. Project Description and Methods

2.1. Proposed Project Methodology

- A microgrid community has been designed in Homer Pro for P2P energy trading between two prosumers and one consumer. Hourly generation, consumption, and excess energy are extracted and examined by simulating the proposed system. The available excess energy from the prosumers is used for trading and is used by the consumers. As a result, the prosumers do not have to dump the surpass energy through a dump load.

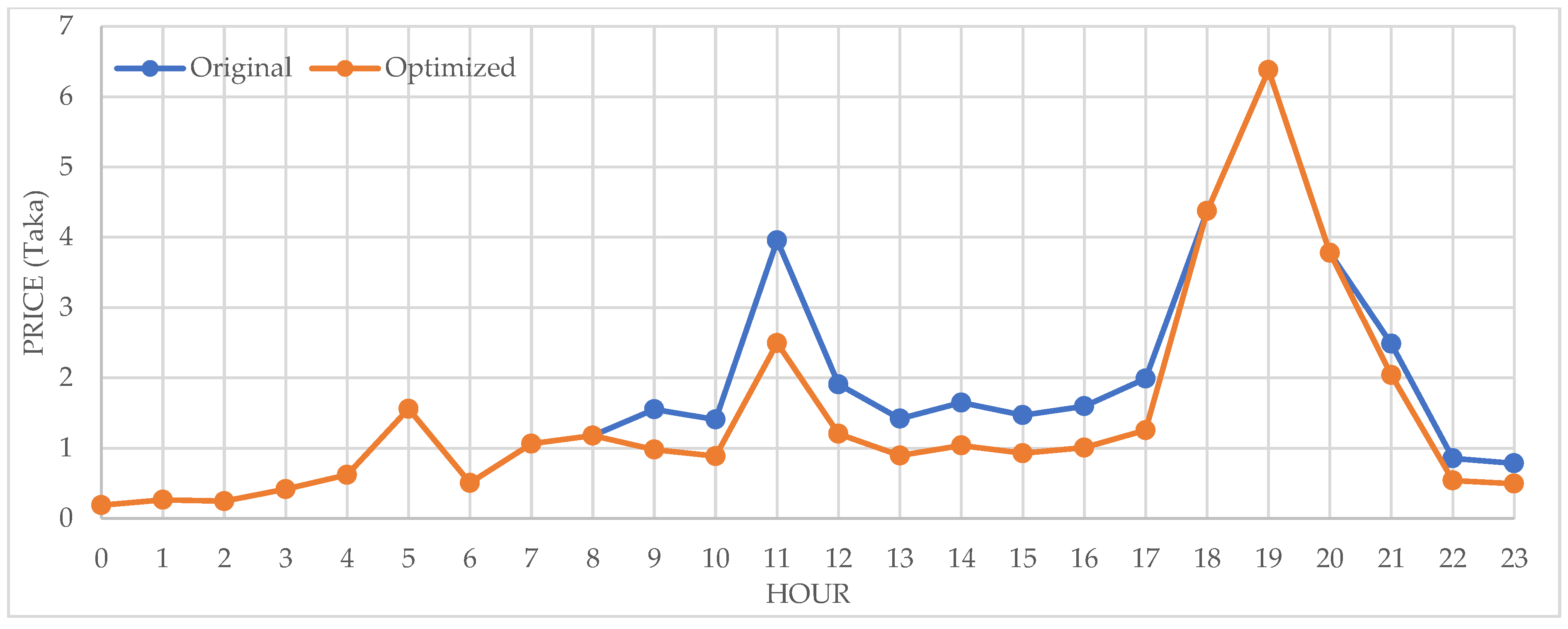

- The prosumer’s total selling power and the consumer’s total buying power is used to calculate SDR. Based on the SDR, prosumer and consumer buying and selling prices are declared.

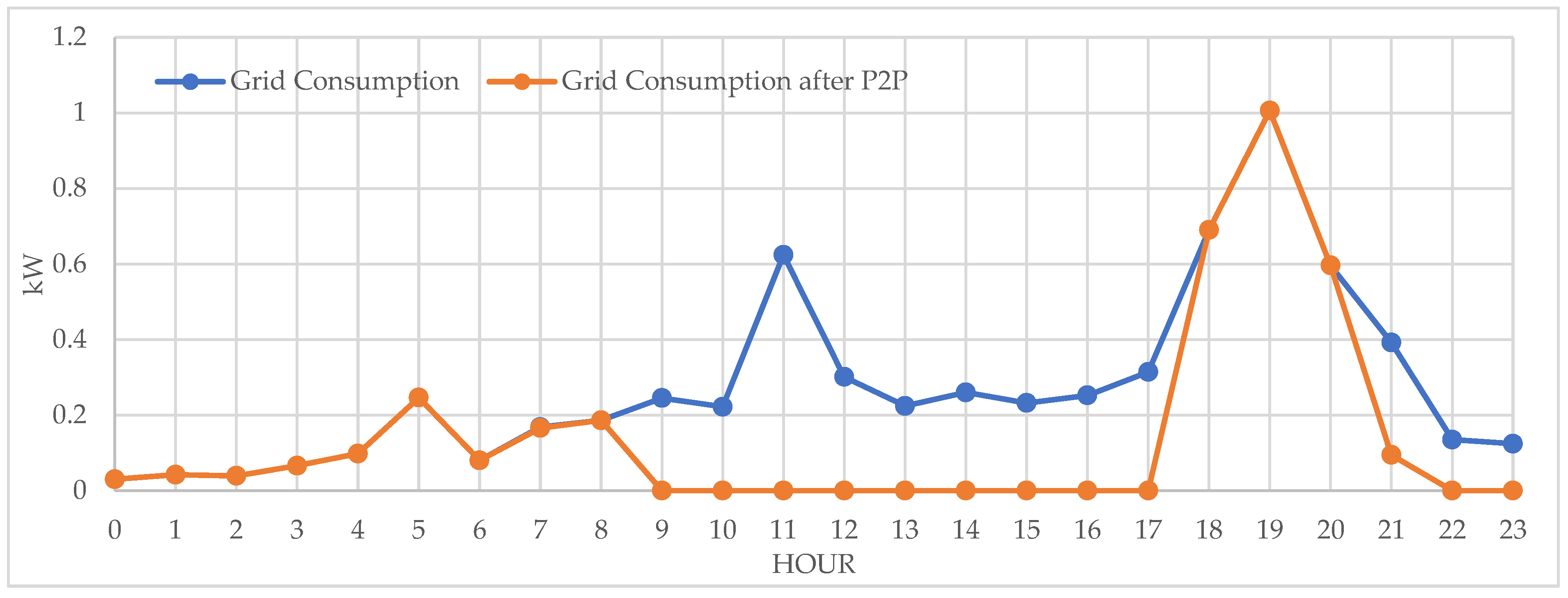

- Load flow analysis is performed to verify the effectiveness of P2P trading among buyers and sellers in the peak month of July, when the consumption is generally higher than in other months. The average electricity bills and integration with the centralized network of the consumers are compared before and after the implementation of the P2P trading.

- The peers are encouraged to self-optimize the electricity consumption to maintain the supply and demand at an equilibrium level, ensuring maximum benefit from the pricing model to both prosumers and consumers.

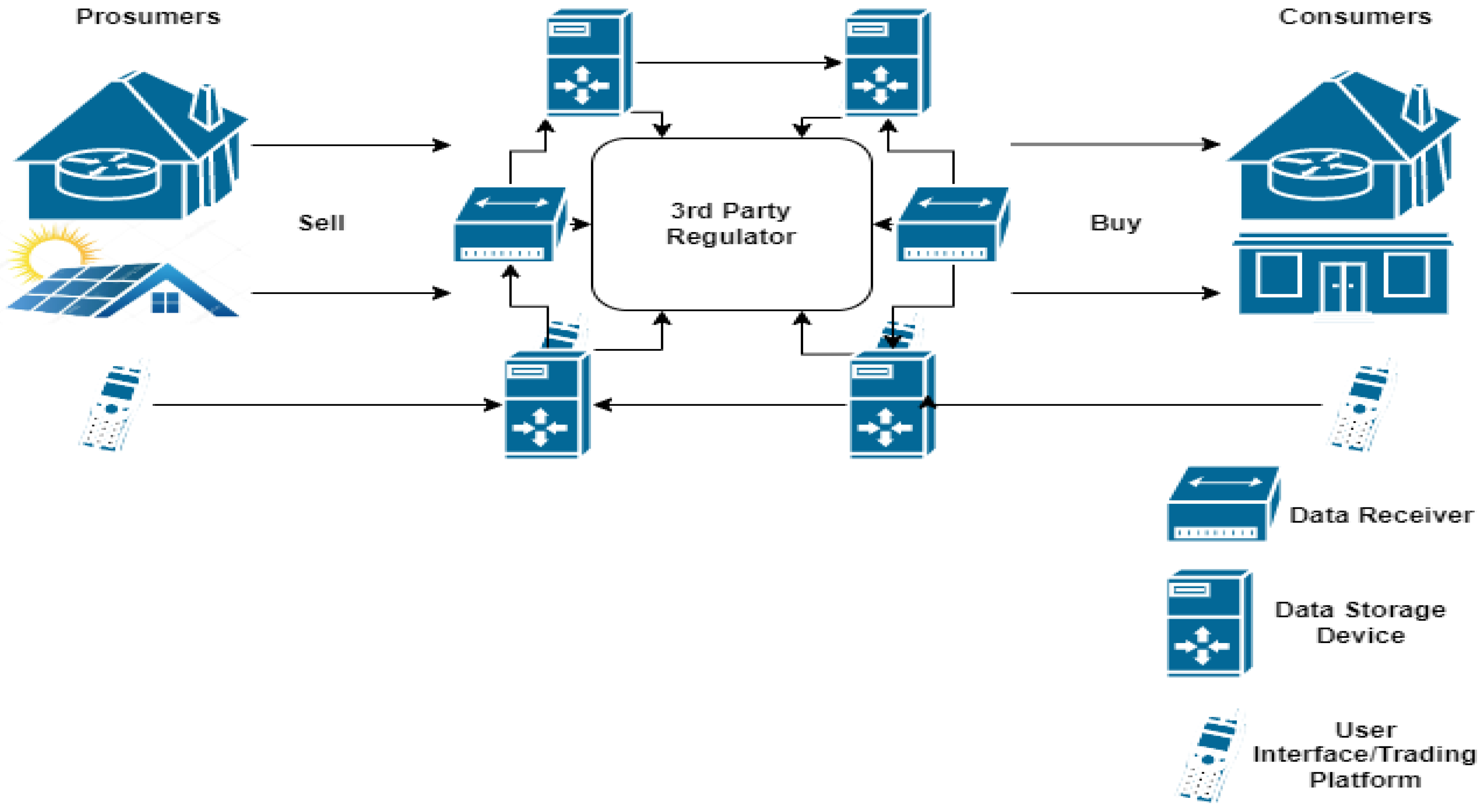

- The recording and facilitating of transactions between generators and consumers via a third-party regulator.

2.2. Architectural Model of the P2P Trading

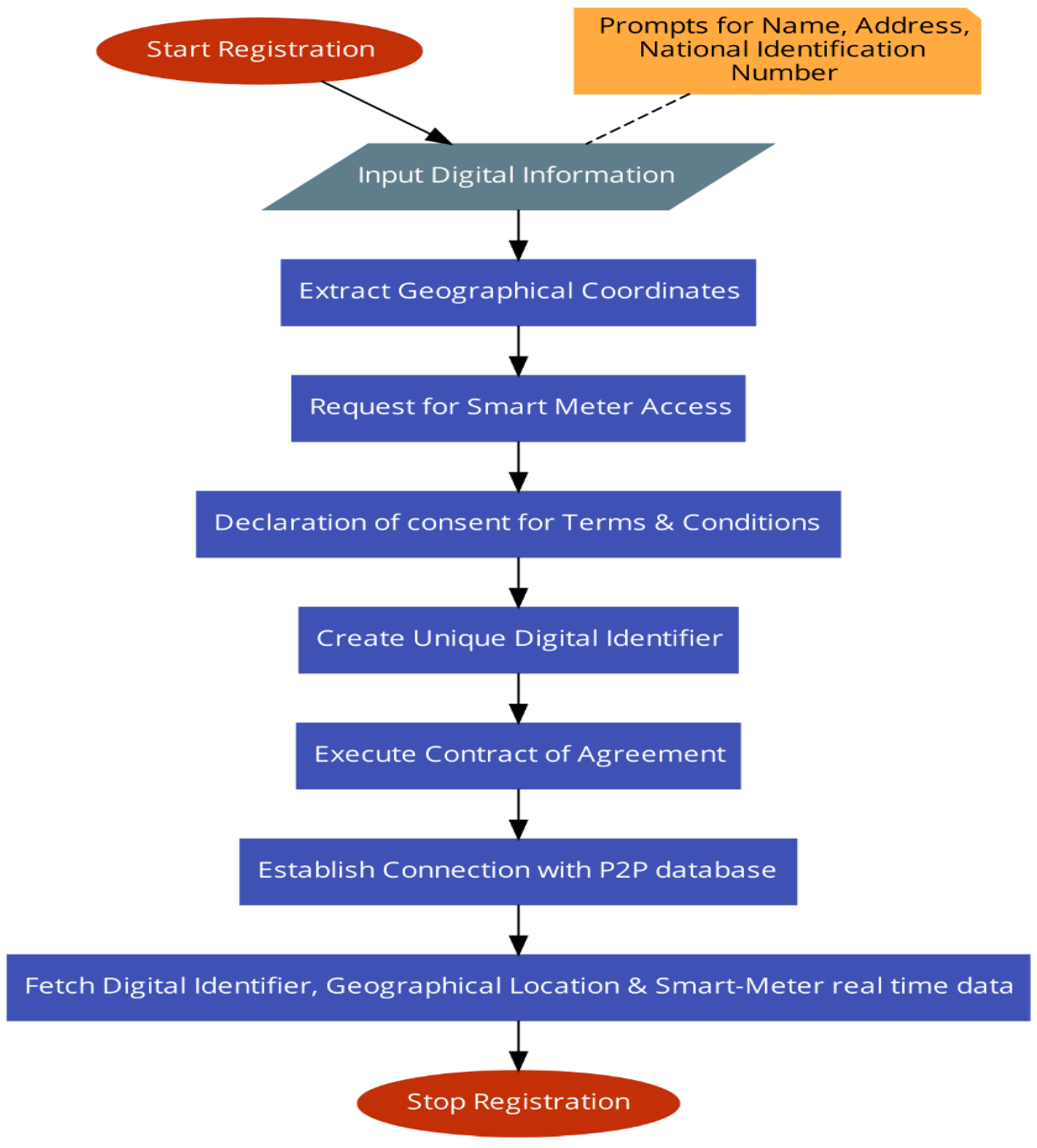

2.2.1. Registration Layer

2.2.2. Cyber Security Scheme

2.2.3. Matchmaking Layer

| Algorithm 1: Algorithm for Matchmaking Layers | ||||

| 1: | Start: Initialize Matchmaking Layer | |||

| 2: | Process: Establish Connection with Registration Layer Database | |||

| 3: | Process: Compute Net Power (Np) of each participant | |||

| 4: | Process: If (Np < 0)? | |||

| 5: | True | Insert Digital Identifier in Supplier Array | ||

| 6: | True | Sort Supplier Array with sort algorithm & Identify Outstanding Prosumer (OP) | ||

| 7: | True | Compute Total Selling Power (TSP) | ||

| 8: | False | Insert Digital Identifier in demand array | ||

| 9: | False | Sort demand array with sort algorithm | ||

| 10: | False | Compute Total Buying Power (TBP) | ||

| 11: | Process: Compute Supply Demand Ratio (SDR) | |||

| 12: | Process: If (SDR >= 1)? | |||

| 13: | True | Process: if (OP > C(j)) | ||

| 14: | True | True | Process: **Matchmaking Succeed** Trade energy from outstanding prosumer to C(j) | |

| 15: | True | True | Process: Increment j = j + 1 | |

| 16: | True | True | Process: Establish Connection with pricing layer | |

| 17: | True | True | Process: Establish loop network with 13 | |

| 18: | True | False | Process: Compute energyDeficit < C(j) − P(i) > | |

| 19: | True | False | Process: If energyDeficit < P(i+1) | |

| 20: | True | False | True | Process: Trade Energy to Outstanding Prosumer |

| 21: | True | False | True | Process: Establish connection with pricing layer |

| 22: | True | False | True | Process Establish loop network with algorithm number 19 |

| 23: | True | False | False | Process: Trade energy from P(i+1) to outstanding prosumer (OP) |

| 24: | True | False | False | Process: Compute energyDeficit = energyDeficit − P(i+1) |

| 25: | True | False | False | Process: Increase i = i + 1 |

| 26: | True | False | False | Process: Establish loop network with algorithm number 19 |

| 27: | False | Process: if (0 < SDR <1) | ||

| 28: | False | True | Process: energyDeficit = TBP − TSP | |

| 29: | False | True | Process: Trade deficit energy from utility grid to Outstanding Prosumer (OP). | |

| 30: | False | True | Process: Establish Connection with pricing layer. | |

| 31: | False | True | Process: Establish loop network with 13 | |

| 32: | False | False | Process: energyDeficiet = TBP | |

| 33: | False | False | Process: Trade deficit energy from utility grid to outstanding prosumer (OP) | |

| 34: | False | False | Process: Establish Connection with pricing layer | |

| 35: | False | False | Process: Establish loop network with after check | |

2.2.4. Pricing Mechanism

3. Inconvenience Factor

4. Results

Variation of the Inconvenience Factor α

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Alhasnawi, B.N.; Jasim, B.H.; Rahman, Z.A.S.A.; Guerrero, J.M.; Esteban, M.D. A novel internet of energy based optimal multi-agent control scheme for microgrid including renewable energy resources. Int. J. Environ. Res. Public Health 2021, 18, 8146. [Google Scholar] [CrossRef] [PubMed]

- Alskaif, T.; Crespo-Vazquez, J.L.; Sekuloski, M.; Van Leeuwen, G.; Catalao, J.P.S. Blockchain-Based Fully Peer-to-Peer Energy Trading Strategies for Residential Energy Systems. IEEE Trans. Ind. Inform. 2022, 18, 231–241. [Google Scholar] [CrossRef]

- Camilo, H.F.; Udaeta, M.E.M.; Veiga Gimenes, A.L.; Grimoni, J.A.B. Assessment of photovoltaic distributed generation–Issues of grid connected systems through the consumer side applied to a case study of Brazil. Renew. Sustain. Energy Rev. 2017, 71, 712–719. [Google Scholar] [CrossRef]

- Baig, M.J.A.; Iqbal, M.T.; Jamil, M.; Khan, J. Blockchain-Based Peer-to-Peer Energy Trading System Using Open-Source Angular Framework and Hypertext Transfer Protocol. Electronics 2023, 12, 287. [Google Scholar] [CrossRef]

- Baig, M.J.A.; Iqbal, M.T.; Jamil, M.; Khan, J. A Low-Cost, Open-Source Peer-to-Peer Energy Trading System for a Remote Community Using the Internet-of-Things, Blockchain, and Hypertext Transfer Protocol. Energies 2022, 15, 4862. [Google Scholar] [CrossRef]

- Baig, M.J.A.; Iqbal, M.T.; Jamil, M.; Khan, J. Design and Implementation of an Open-Source IoT and Blockchain-Based Peer-to-Peer Energy Trading Platform Using ESP32-S2, Node-Red and, MQTT Protocol. Energy Rep. 2021, 7, 5733–5746. [Google Scholar] [CrossRef]

- Elsaraf, H.; Jamil, M.; Pandey, B. Techno-Economic Design of a Combined Heat and Power Microgrid for a Remote Community in Newfoundland Canada. IEEE Access 2021, 9, 91548–91563. [Google Scholar] [CrossRef]

- Rasheed, M.B.; Javaid, N.; Ahmad, A.; Jamil, M.; Khan, Z.A.; Qasim, U.; Alrajeh, N. Energy Optimization in Smart Homes Using Customer Preference and Dynamic Pricing. Energies 2016, 9, 593. [Google Scholar] [CrossRef]

- Luo, Y.; Itaya, S.; Nakamura, S.; Davis, P. Autonomous cooperative energy trading between prosumers for microgrid systems. In Proceedings of the 39th Annual IEEE Conference on Local Computer Networks Workshops, Edmonton, AB, Canada, 8–11 September 2014; pp. 693–696. [Google Scholar] [CrossRef]

- Carrión, M.; Arroyo, J.M.; Conejo, A.J. A bilevel stochastic programming approach for retailer futures market trading. IEEE Trans. Power Syst. 2009, 24, 1446–1456. [Google Scholar] [CrossRef]

- Jia, L.; Tong, L. Dynamic Pricing and Distributed Energy Management for Demand Response. IEEE Trans. Smart Grid 2016, 7, 1128–1136. [Google Scholar] [CrossRef]

- Abdella, J.; Shuaib, K. Peer to peer distributed energy trading in smart grids: A survey. Energies 2018, 11, 1560. [Google Scholar] [CrossRef]

- Du, P.; Lu, N. Appliance commitment for household load scheduling. IEEE Trans. Smart Grid 2011, 2, 411–419. [Google Scholar] [CrossRef]

- Özkan, H.A. Appliance based control for Home Power Management Systems. Energy 2016, 114, 693–707. [Google Scholar] [CrossRef]

- Alhasnawi, B.N.; Jasim, B.H.; Mansoor, R.; Alhasnawi, A.N.; Rahman, Z.A.S.A.; Haes Alhelou, H.; Guerrero, J.M.; Dakhil, A.M.; Siano, P. A new Internet of Things based optimization scheme of residential demand side management system. IET Renew. Power Gener. 2022, 16, 1992–2006. [Google Scholar] [CrossRef]

- Lauinger, D.; Caliandro, P.; Van Herle, J.; Kuhn, D. A linear programming approach to the optimization of residential energy systems. J. Energy Storage 2016, 7, 24–37. [Google Scholar] [CrossRef]

- Ye, Y.; Qiu, D.; Wang, H.; Tang, Y.; Strbac, G. Real-time autonomous residential demand response management based on twin delayed deep deterministic policy gradient learning. Energies 2021, 14, 531. [Google Scholar] [CrossRef]

- Wang, Z.; Sun, M.; Gao, C.; Wang, X.; Ampimah, B.C. A new interactive real-time pricing mechanism of demand response based on an evaluation model. Appl. Energy 2021, 295, 117052. [Google Scholar] [CrossRef]

- Liu, N.; Yu, X.; Wang, C.; Li, C.; Ma, L.; Lei, J. Energy-Sharing Model with Price-Based Demand Response for Microgrids of Peer-to-Peer Prosumers. IEEE Trans. Power Syst. 2017, 32, 3569–3583. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C.; Ming, W. State-of-the-Art Analysis and Perspectives for Peer-to-Peer Energy Trading. Engineering 2020, 6, 739–753. [Google Scholar] [CrossRef]

- U.S. Energy Information Administration (EIA). Prices and Factors Affecting Prices. Available online: https://www.eia.gov/energyexplained/electricity/prices-and-factors-affecting-prices.php (accessed on 27 July 2022).

- Paudel, A.; Chaudhari, K.; Long, C.; Gooi, H.B. Peer-to-peer energy trading in a prosumer-based community microgrid: A game-theoretic model. IEEE Trans. Ind. Electron. 2019, 66, 6087–6097. [Google Scholar] [CrossRef]

- Vahedipour-Dahraie, M.; Rashidizadeh-Kermani, H.; Shafie-Khah, M.; Siano, P. Peer-to-Peer Energy Trading between Wind Power Producer and Demand Response Aggregators for Scheduling Joint Energy and Reserve. IEEE Syst. J. 2021, 15, 705–714. [Google Scholar] [CrossRef]

- Alam, M.R.; St-Hilaire, M.; Kunz, T. Peer-to-peer energy trading among smart homes. Appl. Energy 2019, 238, 1434–1443. [Google Scholar] [CrossRef]

- Spiliopoulos, N.; Sarantakos, I.; Nikkhah, S.; Gkizas, G.; Giaouris, D.; Taylor, P.; Rajarathnam, U.; Wade, N. Peer-to-peer energy trading for improving economic and resilient operation of microgrids. Renew. Energy 2022, 199, 517–535. [Google Scholar] [CrossRef]

- Mohamed, M.A.; Hajjiah, A.; Alnowibet, K.A.; Alrasheedi, A.F.; Awwad, E.M.; Muyeen, S.M. A Secured Advanced Management Architecture in Peer-to-Peer Energy Trading for Multi-Microgrid in the Stochastic Environment. IEEE Access 2021, 9, 92083–92100. [Google Scholar] [CrossRef]

- Springer. Springer Briefs in Applied Sciences Series Editor; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar]

- Meinke, R.J.; Sun, H.; Jiang, J. Optimising Demand and Bid Matching in a Peer-to-Peer Energy Trading Model. IEEE Int. Conf. Commun. 2020, 2020. [Google Scholar] [CrossRef]

- Residential Rates. Available online: https://berc.portal.gov.bd/ (accessed on 6 December 2022).

| Range of kWh | Rate (Taka)/kWh | Rate (USD)/kWh |

|---|---|---|

| 0–50 | 3.75 | 0.036 |

| 0–75 | 4.19 | 0.04 |

| 76–200 | 5.72 | 0.055 |

| 201–300 | 6.00 | 0.058 |

| 301–400 | 6.34 | 0.061 |

| 401–600 | 9.94 | 0.096 |

| 600+ | 11.56 | 0.11 |

| Hour | Net Output from PV (kWh) | Net Output from Wind (kWh) | Consumer Consumption (kWh) | SDR |

|---|---|---|---|---|

| 0 | 0.107 | 0.027 | 0.030 | N/A |

| 1 | 0.114 | 0.047 | 0.042 | N/A |

| 2 | 0.114 | 0.057 | 0.039 | N/A |

| 3 | 0.114 | 0.057 | 0.066 | N/A |

| 4 | 0.392 | 0.196 | 0.098 | N/A |

| 5 | 0.539 | 0.300 | 0.246 | N/A |

| 6 | 0.268 | 0.330 | 0.080 | N/A |

| 7 | −0.002 | 0.300 | 0.168 | 0.013 |

| 8 | 0.219 | 0.252 | 0.186 | N/A |

| 9 | −0.834 | 0.088 | 0.245 | <1 |

| 10 | −1.275 | 0.119 | 0.222 | <1 |

| 11 | −0.637 | 0.268 | 0.624 | <1 |

| 12 | −0.594 | 0.247 | 0.301 | <1 |

| 13 | −1.514 | −0.129 | 0.224 | <1 |

| 14 | −0.673 | 0.000 | 0.260 | <1 |

| 15 | −0.280 | −0.659 | 0.232 | <1 |

| 16 | 0.110 | −0.952 | 0.252 | <1 |

| 17 | 0.399 | −0.380 | 0.314 | <1 |

| 18 | 1.398 | 0.223 | 0.690 | N/A |

| 19 | 1.204 | 0.524 | 1.006 | N/A |

| 20 | 0.811 | 0.232 | 0.596 | N/A |

| 21 | 0.576 | −0.297 | 0.392 | 0.750 |

| 22 | 0.360 | −0.990 | 0.135 | <1 |

| 23 | 0.245 | −0.294 | 0.124 | <1 |

| Original bill (Taka/Day) | Optimized bill (Taka/Day) | Reduction (%) |

| 41.66 | 34.35 | 17.54 |

| Original exchange (kW/Day) | Exchange after P2P (kW/Day) | Reduction (%) |

| 6.56 | 3.33 | 49.23 |

| Prosumers | Income (Taka/Day) (α =0.01) | Income (Taka/Day) (α = 0.02) | Income (Taka/Day) (α = 0.03) |

|---|---|---|---|

| PV | 14.54 | 14.14 | 13.03 |

| Wind | 10.17 | 9.8 | 8.4 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Muntasir, F.; Chapagain, A.; Maharjan, K.; Baig, M.J.A.; Jamil, M.; Khan, A.A. Developing an Appropriate Energy Trading Algorithm and Techno-Economic Analysis between Peer-to-Peer within a Partly Independent Microgrid. Energies 2023, 16, 1549. https://doi.org/10.3390/en16031549

Muntasir F, Chapagain A, Maharjan K, Baig MJA, Jamil M, Khan AA. Developing an Appropriate Energy Trading Algorithm and Techno-Economic Analysis between Peer-to-Peer within a Partly Independent Microgrid. Energies. 2023; 16(3):1549. https://doi.org/10.3390/en16031549

Chicago/Turabian StyleMuntasir, Fahim, Anusheel Chapagain, Kishan Maharjan, Mirza Jabbar Aziz Baig, Mohsin Jamil, and Ashraf Ali Khan. 2023. "Developing an Appropriate Energy Trading Algorithm and Techno-Economic Analysis between Peer-to-Peer within a Partly Independent Microgrid" Energies 16, no. 3: 1549. https://doi.org/10.3390/en16031549

APA StyleMuntasir, F., Chapagain, A., Maharjan, K., Baig, M. J. A., Jamil, M., & Khan, A. A. (2023). Developing an Appropriate Energy Trading Algorithm and Techno-Economic Analysis between Peer-to-Peer within a Partly Independent Microgrid. Energies, 16(3), 1549. https://doi.org/10.3390/en16031549