Towards Carbon Neutrality and Circular Economy in the Glass Industry by Using the Production Decision Model

Abstract

:1. Introduction

2. Literature Review

2.1. Carbon Emissions and Circular Economy Development in the Glass Industry

2.2. Carbon Tax, Carbon Fee Collection, and Carbon Rights Trading System

2.3. Green Activity-Based Costing and Theory of Constraints

3. Research Design

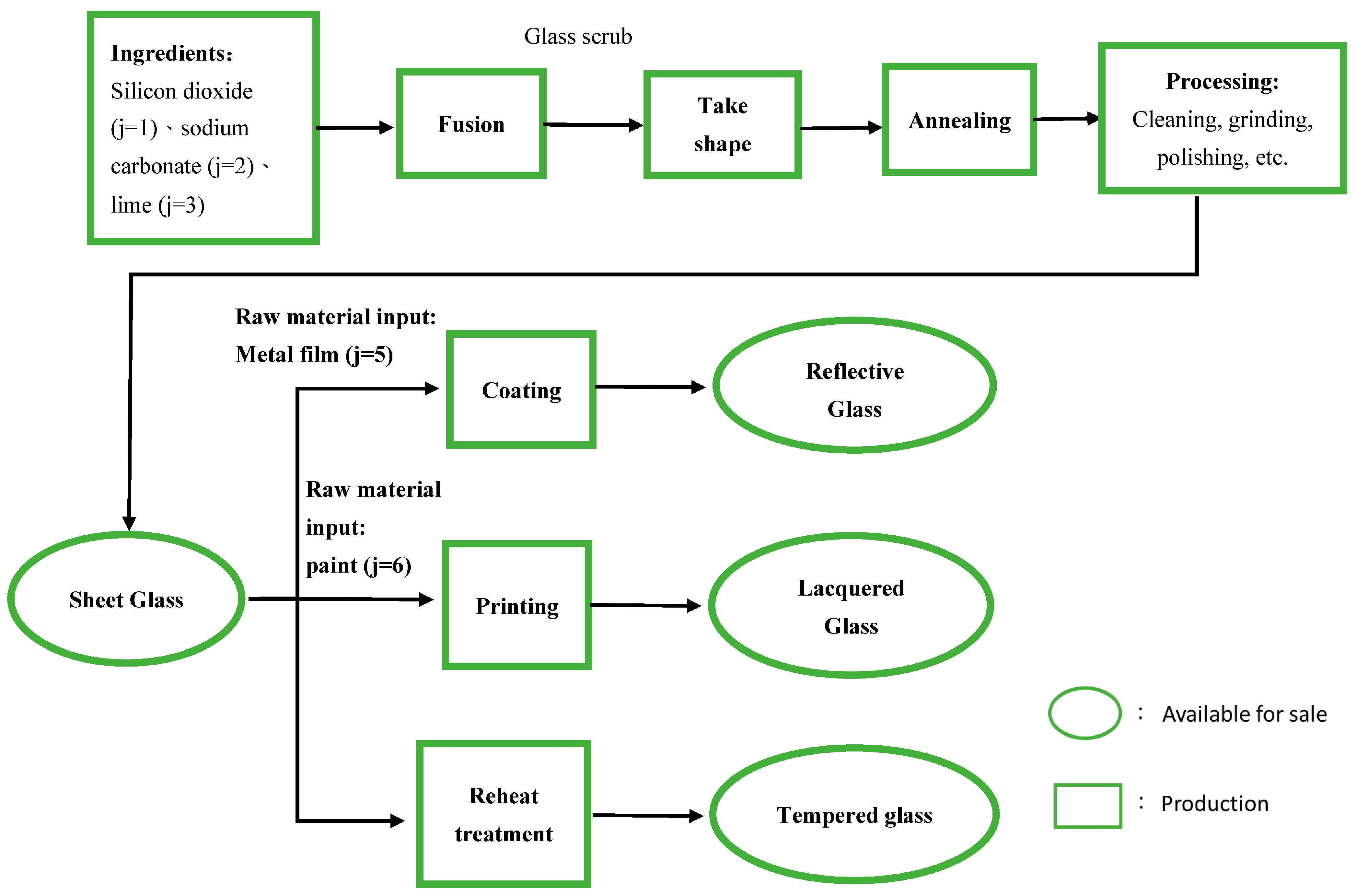

3.1. Glass Industry Production Process

3.2. Research Hypothesis

3.3. Basic Production Model

3.3.1. General Formula of Objective Function

3.3.2. Direct Material Cost Function

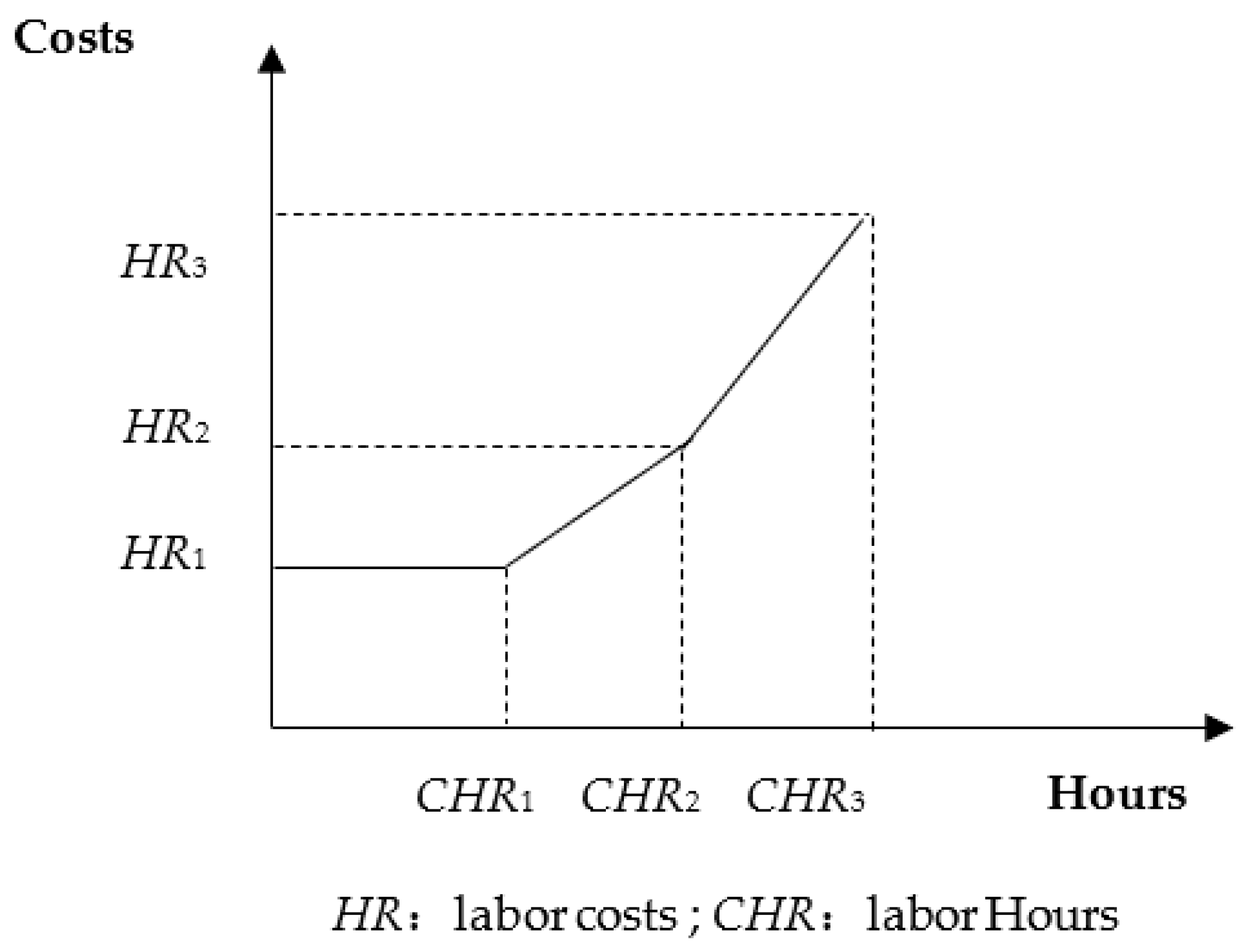

3.3.3. Direct Labor Cost Function

3.3.4. Material Handling Costs

3.3.5. Batch Level Job—Set Job Cost Function

3.3.6. Machine Hour Limit

3.4. Carbon Tax Cost Function

3.4.1. Continuous Carbon Tax Cost Function

3.4.2. Continuous Carbon Tax Cost Function with Carbon Rights

3.4.3. Continuous Carbon Tax Cost Function with Allowances

3.4.4. Continuous Carbon Tax Cost Function of Carbon Rights and Allowances

4. Model Analysis

4.1. Sample Data

4.2. Optimal Solution and Analysis of the Model

4.3. Sensitivity Analysis

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Nomenclature

| π | Firms maximize profits. |

| t | t = 1~3: the label of the multi-period model, which means 1~3 periods. |

| i | Product category i = 1~4: product 1 (i = 1): flat glass; product 2 (i = 2): reflective glass; product 3 (i = 3): lacquered glass; product 4 (i = 4): tempered glass. |

| Si | The unit sales price of the i-th product (i = 1~4). |

| Pi | The production volume of the i-th product (i = 1~4). |

| j | Raw material type j = 1∼7: j = 1: silicon dioxide; j = 2: sodium carbonate; j = 3: lime; j = 4: petroleum coke; j = 5: metal film; j = 6: paint; j = 7: waste glass. |

| Re | The ratio of waste glass to all raw materials. |

| MCj | j material unit cost (j = 1~7). |

| qij | The quantity of raw materials j used to produce a unit of product i (i = 1~4, j = 1~7). |

| HR1, HR2, HR3 | Under normal circumstances, the direct labor cost (HR1), the first overtime labor cost (HR2), and the second overtime labor cost (HR3). |

| ε0, ε1, ε2 | Must be a set of non-negative variables, at most two variables may be non-zero. |

| Co | The job cost of performing a unit of job o (o = 5~6). |

| Qo | Demand quantity under material handling operations (o = 5). |

| Bo | Batch operation quantity (o = 5) under material handling operations. |

| dio | The demand quantity of product i under setting operation (o = 6). |

| Bio | Batch quantity of product i under setup job (o = 6). |

| F | Other fixed costs. |

| MRe | The proportion of waste glass produced in the previous process to the weight of all products in the previous period. |

| uio | The labor hours needed to produce a unit of product i in operation o. |

| CHR1, CHR2, CHR3 | Under normal circumstances, the maximum direct labor hours (CHR1), the first period of overtime hours (CHR2), and the second period of overtime hours (CHR3). |

| , | Dummy variables (0,1); when one of the variables is 1, the other must be exactly zero. |

| Carbon emissions per unit of product i. | |

| 1, 2, 3 | Dummy variable (0,1); only one of the three can be 1. |

| ctr1, ctr2, ctr3 | The first paragraph (ctr1), the second paragraph (ctr2), and the third paragraph (ctr3) carbon tax rate. |

| CTQ1,CTQ2, CTQ3 | The maximum carbon emissions are in the first segment (CTQ1), the second segment (CTQ2), and the third segment (CTQ3). |

| TCTQ | The company’s total carbon emissions. |

| ,, | Dummy variable (0,1); only one of the three can be 1. |

| ctfr1, ctfr2, ctfr3 | First segment (ctfr1), second segment (ctfr2), and third segment (ctfr3) carbon tax rates. |

| CTFQ0,CTFQ1, CTFQ2,CTFQ3 | Tax-free carbon emissions (CTFQ0); the maximum carbon emissions in the first paragraph (CTFQ1), the second paragraph (CTFQ2), and the third paragraph (CTFQ3) (the maximum carbon emission in the third paragraph is the implementation of the mathematical programming model and is formulated with no upper limit). |

References

- Zhao, C. Carbon Neutrality: Aiming for a net-zero carbon future. Carbon Neutrality 2022, 1, 2. [Google Scholar] [CrossRef]

- Höhne, N.; Gidden, M.J.; den Elzen, M.; Hans, F.; Fyson, C.; Geiges, A.; Jeffery, M.L.; Gonzales-Zuñiga, S.; Mooldijk, S.; Hare, W. Wave of net zero emission targets opens window to meeting the Paris Agreement. Nat. Clim. Chang. 2021, 11, 820–822. [Google Scholar] [CrossRef]

- Van Soest, H.L.; den Elzen, M.G.; van Vuuren, D.P. Net-zero emission targets for major emitting countries consistent with the Paris Agreement. Nat. Commun. 2021, 12, 2140. [Google Scholar] [CrossRef] [PubMed]

- Rogelj, J.; Geden, O.; Cowie, A.; Reisinger, A. Net-zero emissions targets are vague: Three ways to fix. Nature 2021, 591, 365–368. [Google Scholar] [CrossRef]

- Dixon, J.; Bell, K.; Brush, S. Which way to net zero? a comparative analysis of seven UK 2050 decarbonisation pathways. Renew. Sustain. Energy Transit. 2022, 2, 100016. [Google Scholar] [CrossRef]

- Chen, P.-H.; Lee, C.-H.; Wu, J.-Y.; Chen, W.-S. Perspectives on Taiwan’s Pathway to Net-Zero Emissions. Sustainability 2023, 15, 5587. [Google Scholar] [CrossRef]

- Wu, H.-H. Moving Toward Net-Zero Emission Society: With Special Reference to the Recent Law and Policy Development in Some Selected Countries. In Moving Toward Net-Zero Carbon Society: Challenges and Opportunities; Springer International Publishing: Cham, Switzerland, 2023; pp. 151–169. [Google Scholar]

- Del Rio, D.D.F.; Sovacool, B.K.; Foley, A.M.; Griffiths, S.; Bazilian, M.; Kim, J.; Rooney, D. Decarbonizing the glass industry: A critical and systematic review of developments, sociotechnical systems and policy options. Renew. Sustain. Energy Rev. 2022, 155, 111885. [Google Scholar] [CrossRef]

- Springer, C.; Hasanbeigi, A. Emerging Energy Efficiency and Carbon Dioxide Emissions-Reduction Technologies for the Glass Industry; Energy Analysis and Environmental Impacts Division, Lawrence Berkeley National Laboratory [LBNL], University of California: Berkeley, CA, USA, 2017. [Google Scholar]

- Eid, J. Glass is the hidden gem in a carbon-neutral future. Nature 2021, 599, 7. [Google Scholar]

- Deng, W.; Backhouse, D.J.; Kabir Kazi, F.; Janani, R.; Holcroft, C.; Magallanes, M.; Marshall, M.; Jackson, C.M.; Bingham, P.A. Alternative raw material research for decarbonization of UK glass manufacture. Int. J. Appl. Glass Sci. 2023, 14, 341–365. [Google Scholar] [CrossRef]

- Gärtner, S.; Marx-Schubach, T.; Gaderer, M.; Schmitz, G.; Sterner, M. Techno-economic analysis of carbon dioxide separation for an innovative energy concept towards low-emission glass melting. Energies 2023, 16, 2140. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Lu, Y.-H.; Hsieh, C.-L. Comparison of production decision-making models under carbon tax and carbon rights trading. J. Clean. Prod. 2022, 379, 134462. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Lai, S.-Y.; Hsieh, C.-L. Exploring the impact of different carbon emission cost models on corporate profitability. Ann. Oper. Res. 2023, 322, 41–74. [Google Scholar] [CrossRef]

- Al-Eidan, D.; Al-Ahmad, M.; Al-Ajmi, M.; Al-Sayed, N.; Al-Ajmi, R.; Smew, W. Activity-based costing (ABC) for manufacturing costs reduction and continuous improvement: A case study. In Proceedings of the International Conference on Industrial Engineering and Operations Management Issue, Pilsen, Czech Republic, 23–26 July 2019; pp. 23–26. [Google Scholar]

- Skousen, C.J.; Walther, L.M. Process and Activity-Based Costing. In Managerial and Cost Accounting; Ventus Publishing: Telluride, CO, USA, 2010; p. 39. [Google Scholar]

- Ingrao, C.; Saja, C.; Primerano, P. Application of Life Cycle Assessment to chemical recycling of post-use glass containers on the laboratory scale towards circular economy implementation. J. Clean. Prod. 2021, 307, 127319. [Google Scholar] [CrossRef]

- Schmitz, A.; Kamiński, J.; Scalet, B.M.; Soria, A. Energy consumption and CO2 emissions of the European glass industry. Energy Policy 2011, 39, 142–155. [Google Scholar] [CrossRef]

- Nodehi, M.; Mohamad Taghvaee, V. Sustainable concrete for circular economy: A review on use of waste glass. Glass Struct. Eng. 2022, 7, 3–22. [Google Scholar] [CrossRef]

- Lin, K.-Y. User experience-based product design for smart production to empower industry 4.0 in the glass recycling circular economy. Comput. Ind. Eng. 2018, 125, 729–738. [Google Scholar] [CrossRef]

- Allwood, J.M. Squaring the circular economy: The role of recycling within a hierarchy of material management strategies. In Handbook of Recycling; Elsevier: Amsterdam, The Netherlands, 2014; pp. 445–477. [Google Scholar]

- Chan, Y.T.; Zhao, H. Optimal carbon tax rates in a dynamic stochastic general equilibrium model with a supply chain. Econ. Model. 2023, 119, 106109. [Google Scholar] [CrossRef]

- Bebbington, J.; Larrinaga-González, C. Carbon trading: Accounting and reporting issues. Eur. Account. Rev. 2008, 17, 697–717. [Google Scholar] [CrossRef]

- Streck, C.; von Unger, M. Creating, regulating and allocating rights to offset and pollute: Carbon rights in practice. Carbon Clim. Law Rev. 2016, 10, 178–189. [Google Scholar] [CrossRef]

- Matschoss, P.; Welsch, H. International emissions trading and induced carbon-saving technological change: Effects of restricting the trade in carbon rights. Environ. Resour. Econ. 2006, 33, 169–198. [Google Scholar] [CrossRef]

- Coase, R.H. The Problem of Social Cost. J. Law Econ. 1960, 3, 1–44. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, S.; Shao, X.; He, Y. Policy spillover effect and action mechanism for environmental rights trading on green innovation: Evidence from China’s carbon emissions trading policy. Renew. Sustain. Energy Rev. 2022, 153, 111779. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Anderson, S.R. Time-Driven Activity-Based Costing: A Simpler and More Powerful Path to Higher Profits; Harvard Business Press: Brighton, MA, USA, 2007. [Google Scholar]

- Kaplan, R.S.; Cooper, R. Cost & Effect: Using Integrated Cost Systems to Drive Profitability and Performance; Harvard Business Press: Brighton, MA, USA, 1998. [Google Scholar]

- Kaplan, R.S.; Witkowski, M.; Abbott, M.; Guzman, A.B.; Higgins, L.D.; Meara, J.G.; Padden, E.; Shah, A.S.; Waters, P.; Weidemeier, M. Using time-driven activity-based costing to identify value improvement opportunities in healthcare. J. Healthc. Manag. 2014, 59, 399–412. [Google Scholar] [CrossRef] [PubMed]

- Tsai, W.-H.; Tsaur, T.-S.; Chou, Y.-W.; Liu, J.-Y.; Hsu, J.-L.; Hsieh, C.-L. Integrating the activity-based costing system and life-cycle assessment into green decision-making. Int. J. Prod. Res. 2015, 53, 451–465. [Google Scholar] [CrossRef]

- Goldratt, E.M. Theory of Constraints; North River: Croton-on-Hudson, NY, USA, 1990. [Google Scholar]

- Gupta, M.C.; Boyd, L.H. Theory of constraints: A theory for operations management. Int. J. Oper. Prod. Manag. 2008, 28, 991–1012. [Google Scholar] [CrossRef]

- Weber, R.H. Emission Trading Schemes: A Coasean Answer to Climate Change? In Environmental Law and Economics; Mathis, K., Huber, B.R., Eds.; Springer International Publishing: Cham, Switzerland, 2017; pp. 355–377. [Google Scholar]

| Year/Product | Sheet Glass | Glass Container |

|---|---|---|

| 2019 | 19.40% | 51.35% |

| 2020 | 21.06% | 47.92% |

| 2021 | 19.37% | 47.92% |

| Products | ||||||

|---|---|---|---|---|---|---|

| Symbol | Sheet Glass | Reflective Glass | Lacquered Glass | Tempered Glass | ||

| Minimum demand (production volume)/ton | Pi | >8,400,000 | >850,000 | >900,000 | >1,575,000 | |

| Sales price/ton | Si | TWD 7297 | TWD 11,512 | TWD 14,583 | TWD 9942 | |

| Carbon tax | CTei | 0.5 | 0.8 | 0.8 | 0.7 | |

| Unit Level Material Price | ||||||

| silicon dioxide (j = 1) | MC1 = TWD 1546/ton | qi1 | 0.7 | 0.7 | 0.7 | 0.7 |

| Sodium carbonate (j = 2) | MC2 = TWD 13,168/ton | qi2 | 0.2 | 0.2 | 0.2 | 0.2 |

| lime (j = 3) | MC3 = TWD 1676/ton | qi3 | 0.1 | 0.1 | 0.1 | 0.1 |

| fuel: Petroleum Coke (j = 4) | MC4 = TWD 12,590/ton | qi4 | 0.2 | 0.25 | 0.25 | 0.3 |

| metallic film (j = 5) | MC5 = TWD 18,000/ton | qi5 | 0 | 0.1 | 0 | 0 |

| paint (j = 6) | MC6 = TWD 20,000/ton | qi6 | 0 | 0 | 0.2 | 0 |

| glass (j = 7) | MC7 = TWD 3000/ton | qi7 | 1 | 1 | 1 | 1 |

| Products | ||||||||

|---|---|---|---|---|---|---|---|---|

| o | Symbol | Sheet Glass | Reflective Glass | Lacquered Glass | Tempered Glass | Capacity Cap | ||

| Batch-Level Activity | ||||||||

| Material handling | C5 = TWD 10,000/batch | 5 | Q5 | 1 | PC5 = 20,000 | |||

| η5 | 10,000 | |||||||

| Set | C6 = TWD 27,000/batch | 6 | di6 | 2 | 3 | 4 | 3 | PC6 = 500,000 |

| Γi6 | 100 | 50 | 50 | 70 | ||||

| machine hours | Processing | 1 | mhi1 | 5 | 5 | 5 | 5 | LMP1 = 71,837,823 |

| Coating | 2 | mhi2 | 0 | 3 | 0 | 0 | LMP2 = 4,910,394 | |

| Printing | 3 | mhi3 | 0 | 0 | 3 | 0 | LMP2 = 4,910,394 | |

| Reheating | 4 | mhi4 | 0 | 0 | 0 | 2 | LMP4 = 4,067,684 | |

| Direct Labor Cost | |||

| Cost | HR1 = TWD 4,489,777,600 | HR2 = TWD 8,319,117,500 | HR3 = TWD 14,186,373,000 |

| Labor hour | CHR1 = 25,510,100 | CHR2 = 35,400,500 | CHR3 = 48,089,400 |

| Wage rate | TWD 176/h | TWD 235/h | TWD 295/h |

| Cost of each segment | CT1 = TWD 1,050,000,000 | CT2 = TWD 4,073,840,100 | CT3 = TWD 148,436,978,600 |

| Upper limit of carbon emissions in each stage | CTQ1 = 7,000,000 | CTQ2 = 13,579,467 | CTQ3 = 395,831,943 |

| Various tax rates | ctr1 = TWD 150/ton | ctr2 = TWD 300/ton | ctr3 = TWD 375/ton |

| Carbon credit cost | = TWD 250/ton | ||

| Recycling operations (use ratio of glass) | |||

| Single period | = 0.3 | ||

| Recycling glass from the previous period | = 0.1 | ||

| Product | Optimal Solution | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 9,029,200 | (E11) | 0.3639651 | 1084 | 90,292 | (W01) | 0 | |||

| 1,605,350 | (E21) | 0 | 32,107 | (W11) | 0.9552286 | ||||

| 1,699,100 | 7,913,538,000 | 33,982 | (W21) | 0.0447714 | |||||

| 2,033,842 | Tax | 1,185,382,000 | 29,055 | (W31) | 0 | ||||

| Product | Optimal Solution | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 9,029,100 | (E11) | 0.3639651 | 1084 | 90,291 | 1) | 0 | |||

| 1,605,400 | (E21) | 0 | 8,589,894,000 | 32,108 | 11) | 0.9552299 | |||

| 1,699,100 | Tax | 1,185,378,000 | 33,982 | (W21) | 0.0447701 | ||||

| 2,033,842 | Carbon right | +676,359,100 | 29,055 | (W31) | 0 | ||||

| Products | Optimal Solution | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 9,029,284 | (E11) | 0.3639694 | 1084 | 90,293 | 1) | 0.0293422 | |||

| 1,605,400 | (E21) | 0 | 32,108 | 11) | 0.9706578 | ||||

| 1,699,100 | 8,079,743,000 | 33,982 | (W21) | 0 | |||||

| 2,033,780 | Tax | 1,019,191,000 | 29,054 | (W31) | 0 | ||||

| Products | Optimal Solution | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 9,029,200 | (E11) | 0.3639651 | 1084 | 90,292 | 1) | 0.0293469 | |||

| 1,605,350 | (E21) | 0 | 8,756,091,000 | 32,107 | 11) | 0.9706531 | |||

| 1,699,100 | Tax | 1,019,186,000 | 33,982 | (W21) | 0 | ||||

| 2,033,842 | Carbon right | +676,357,000 | 29,055 | (W31) | 0 | ||||

| Model 1 | Model 3 | ||

| 7,913,538,000 | 8,079,743,000 | ||

| Tax | 1,185,382,000 | Tax | 1,019,191,000 |

| Model 2 | Model 4 | ||

| 8,589,894,000 | 8,756,091,000 | ||

| Tax | 1,185,378,000 | Tax | 1,019,186,000 |

| Carbon right | +676,359,100 | Carbon right | +676,357,000 |

| Carbon Credit Unit Cost (Decrease/Increase: 250 Is the Base Period) | Carbon Tax Cost | Carbon Credit Income | Profit | Profit Change (%) |

|---|---|---|---|---|

| 200 (−20%) | 1,185,385,000 | 541,083,900 | 8,454,625,000 | −1.57% |

| 225 (−10%) | 1,185,382,000 | 608,721,300 | 8,522,260,000 | −0.79% |

| 250 | 1,185,378,000 | 676,359,100 | 8,589,894,000 | 0.00% |

| 275 (+10%) | 1,185,382,000 | 743,992,700 | 8,657,531,000 | 0.79% |

| 300 (+20%) | 1,185,382,000 | 811,628,400 | 8,725,167,000 | 1.57% |

| Carbon Credit Unit Cost (Decrease/Increase: 250 Is the Base Period) | Carbon Tax Cost | Carbon Credit Income | Profit | Profit Change (%) |

|---|---|---|---|---|

| 200 (−20%) | 1,019,187,000 | 541,083,900 | 8,620,824,000 | −1.54% |

| 225 (−10%) | 1,019,191,000 | 608,713,900 | 8,688,457,000 | −0.77% |

| 250 | 1,019,186,000 | 676,357,000 | 8,756,091,000 | 0.00% |

| 275 (+10%) | 1,019,186,000 | 743,992,700 | 8,823,727,000 | 0.77% |

| 300 (+20%) | 1,019,186,000 | 811,628,400 | 8,891,363,000 | 1.54% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hsieh, C.-L.; Tsai, W.-H. Towards Carbon Neutrality and Circular Economy in the Glass Industry by Using the Production Decision Model. Energies 2023, 16, 7570. https://doi.org/10.3390/en16227570

Hsieh C-L, Tsai W-H. Towards Carbon Neutrality and Circular Economy in the Glass Industry by Using the Production Decision Model. Energies. 2023; 16(22):7570. https://doi.org/10.3390/en16227570

Chicago/Turabian StyleHsieh, Chu-Lun, and Wen-Hsien Tsai. 2023. "Towards Carbon Neutrality and Circular Economy in the Glass Industry by Using the Production Decision Model" Energies 16, no. 22: 7570. https://doi.org/10.3390/en16227570

APA StyleHsieh, C.-L., & Tsai, W.-H. (2023). Towards Carbon Neutrality and Circular Economy in the Glass Industry by Using the Production Decision Model. Energies, 16(22), 7570. https://doi.org/10.3390/en16227570