The Negative Impact of Electrical Energy Subsidies on the Energy Consumption—Case Study from Jordan

Abstract

1. Introduction

1.1. Energy Situation in Jordan

1.2. Energy Subsidy

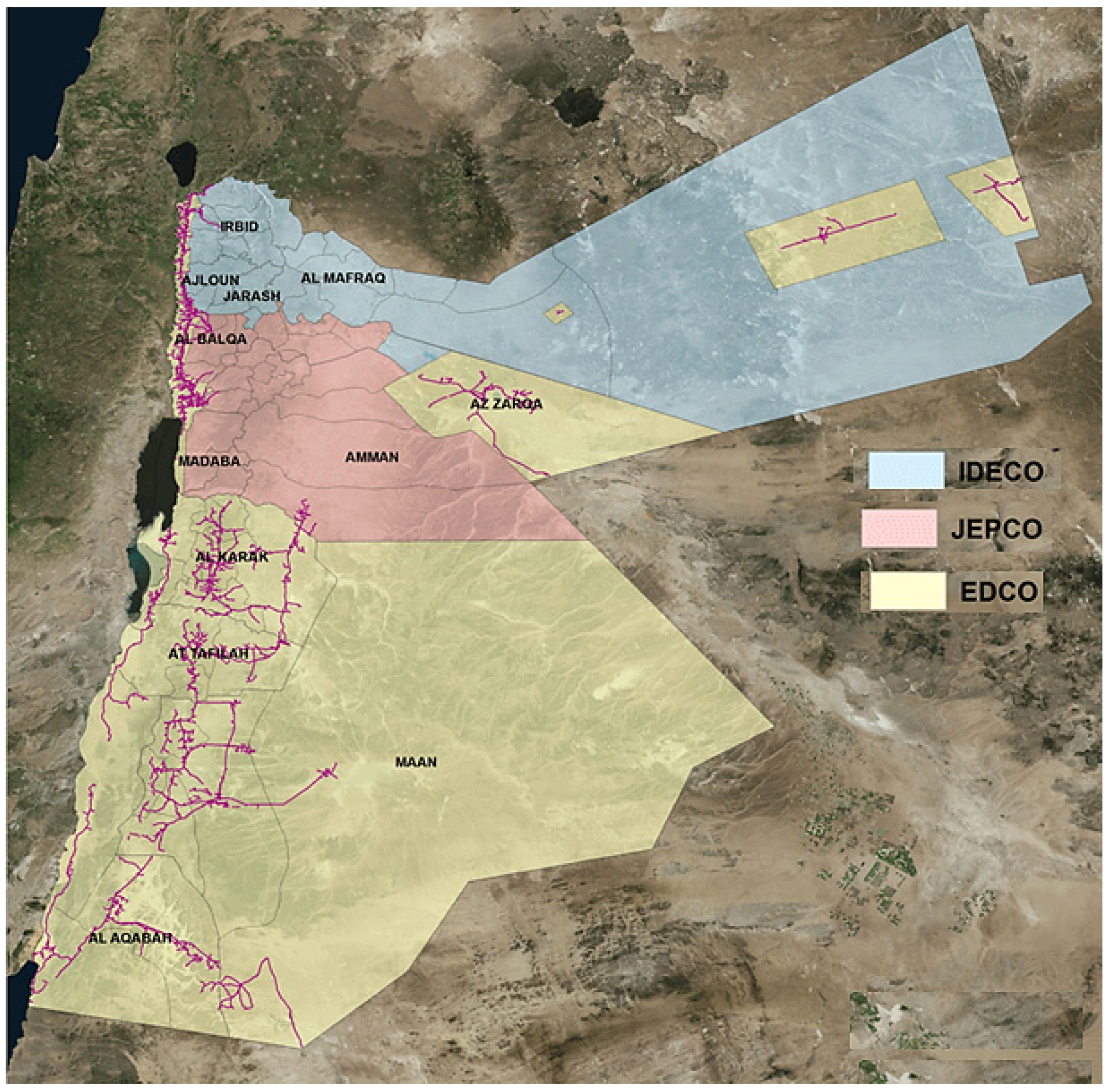

2. Data Collection Methodology

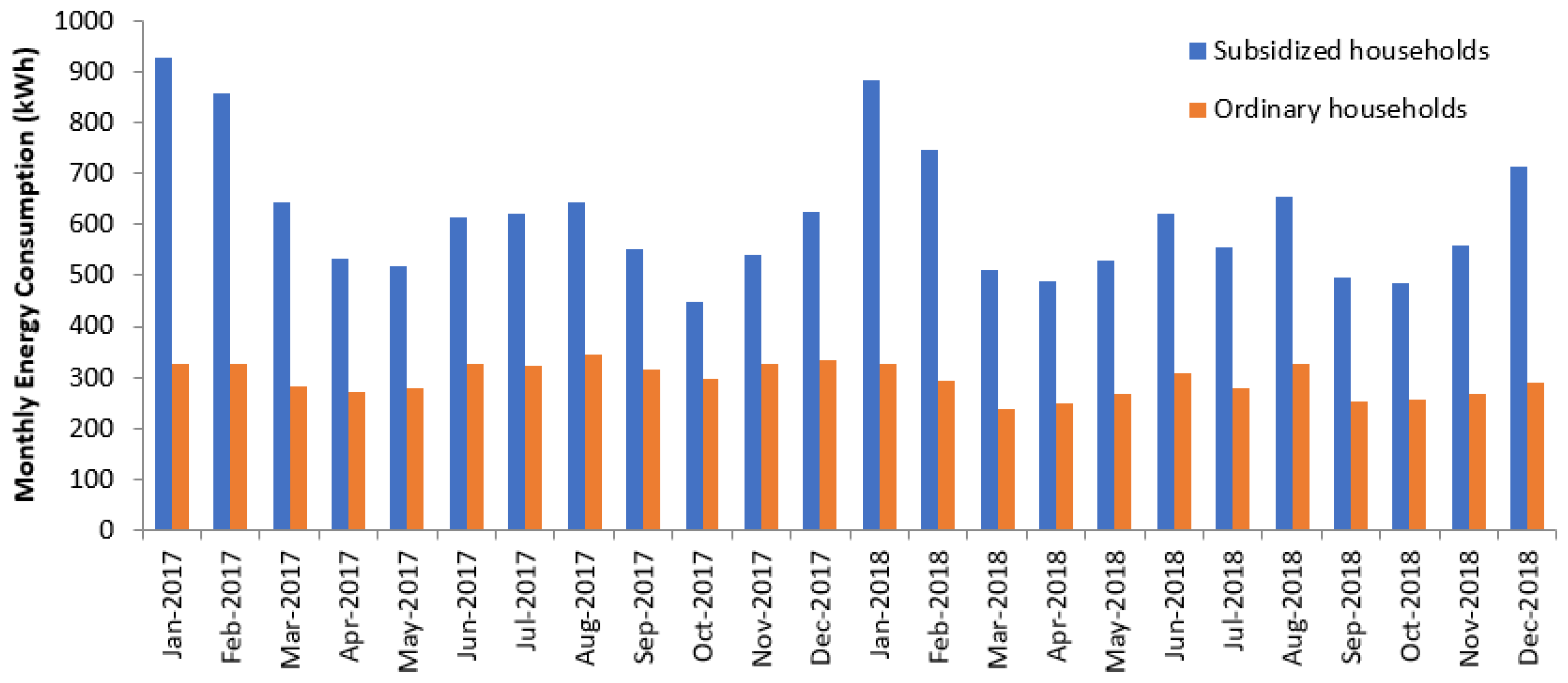

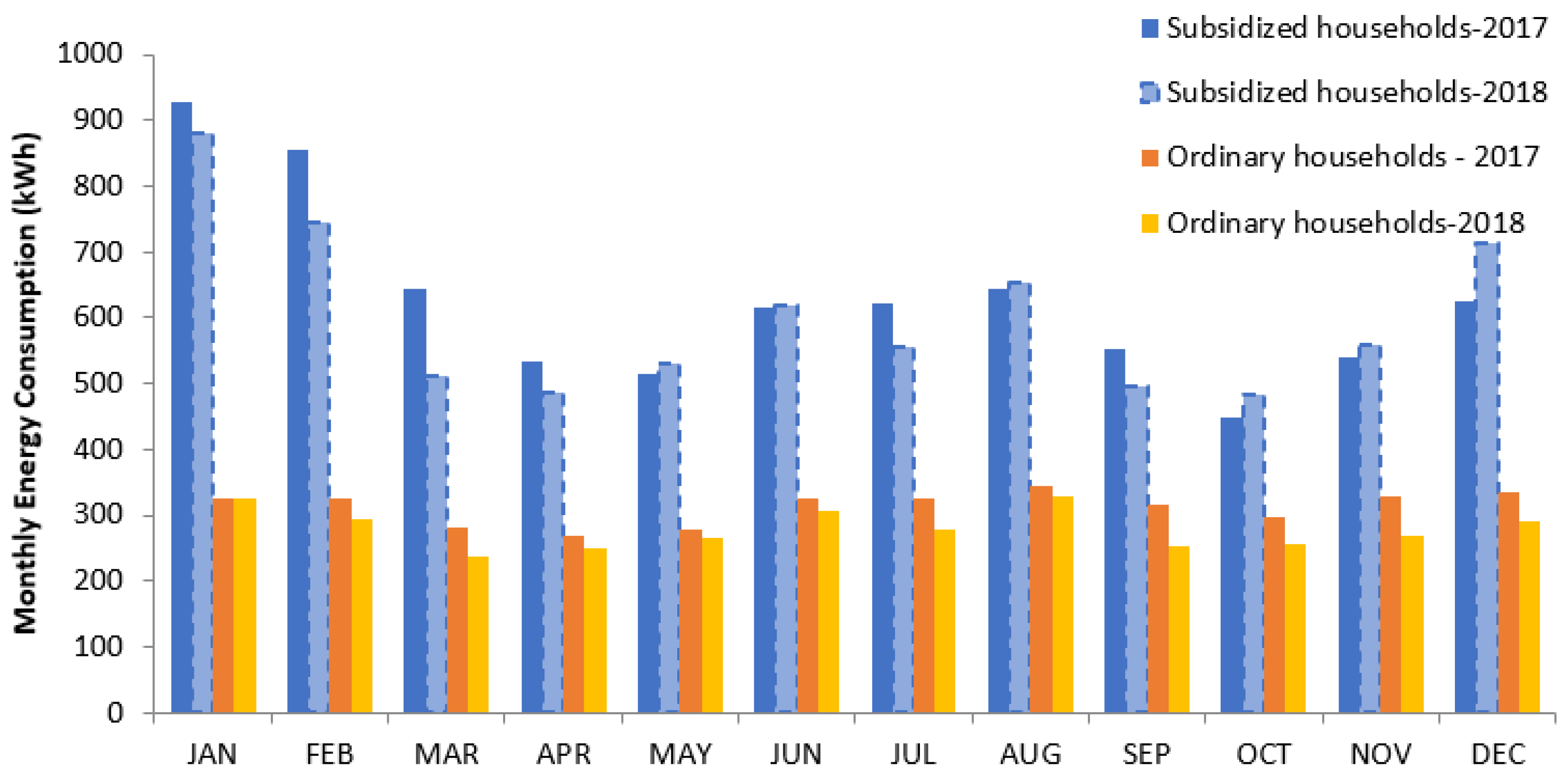

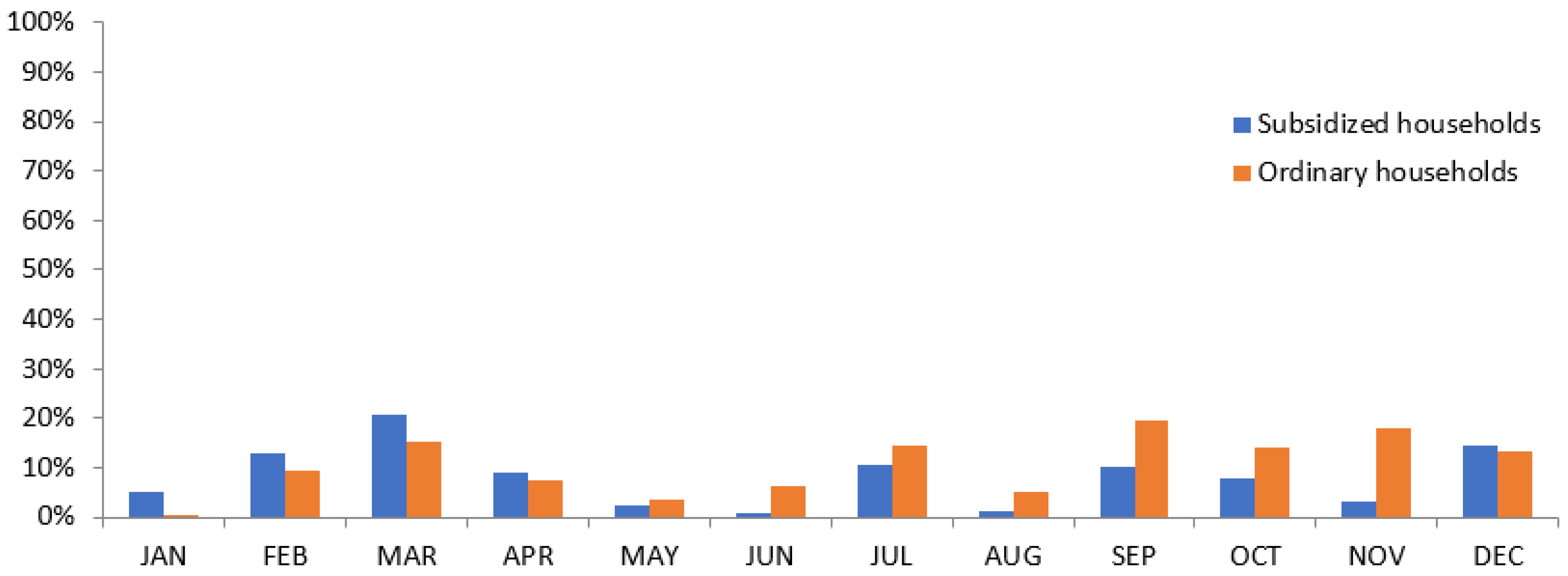

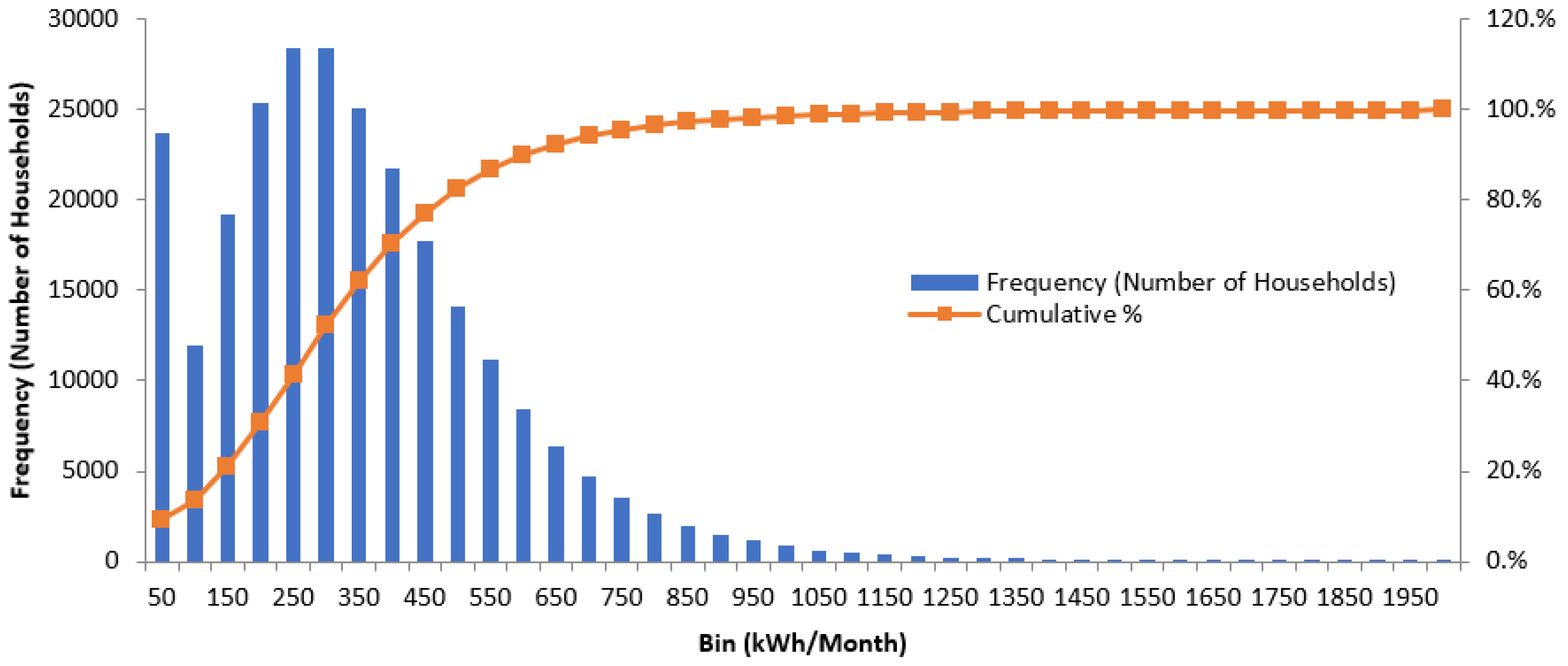

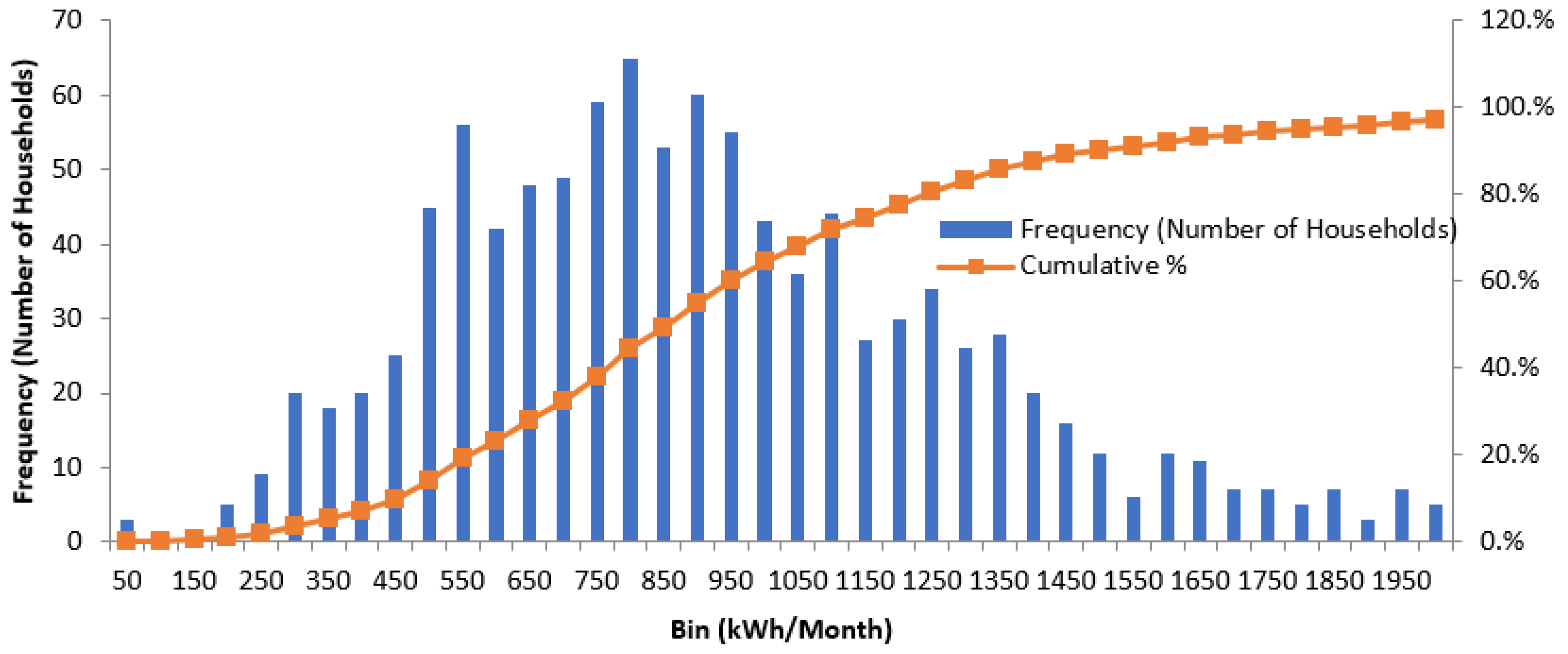

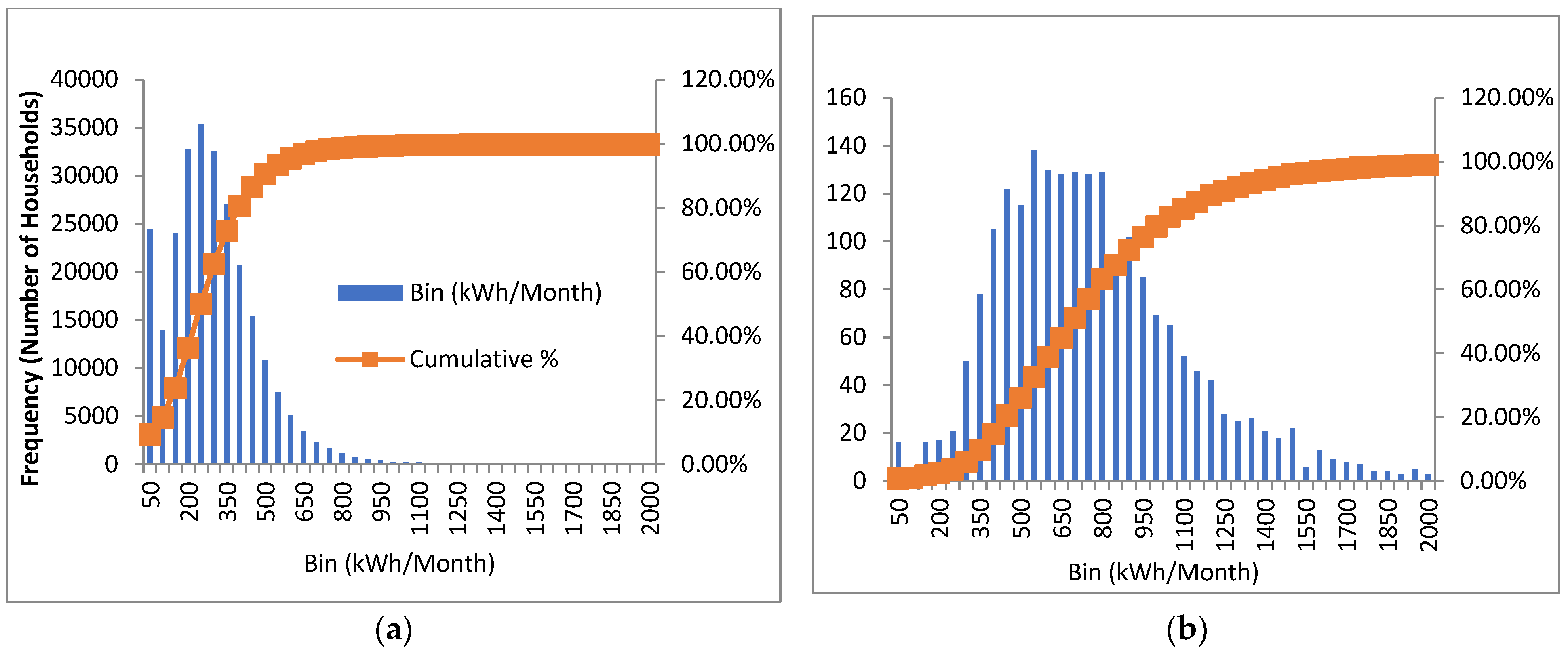

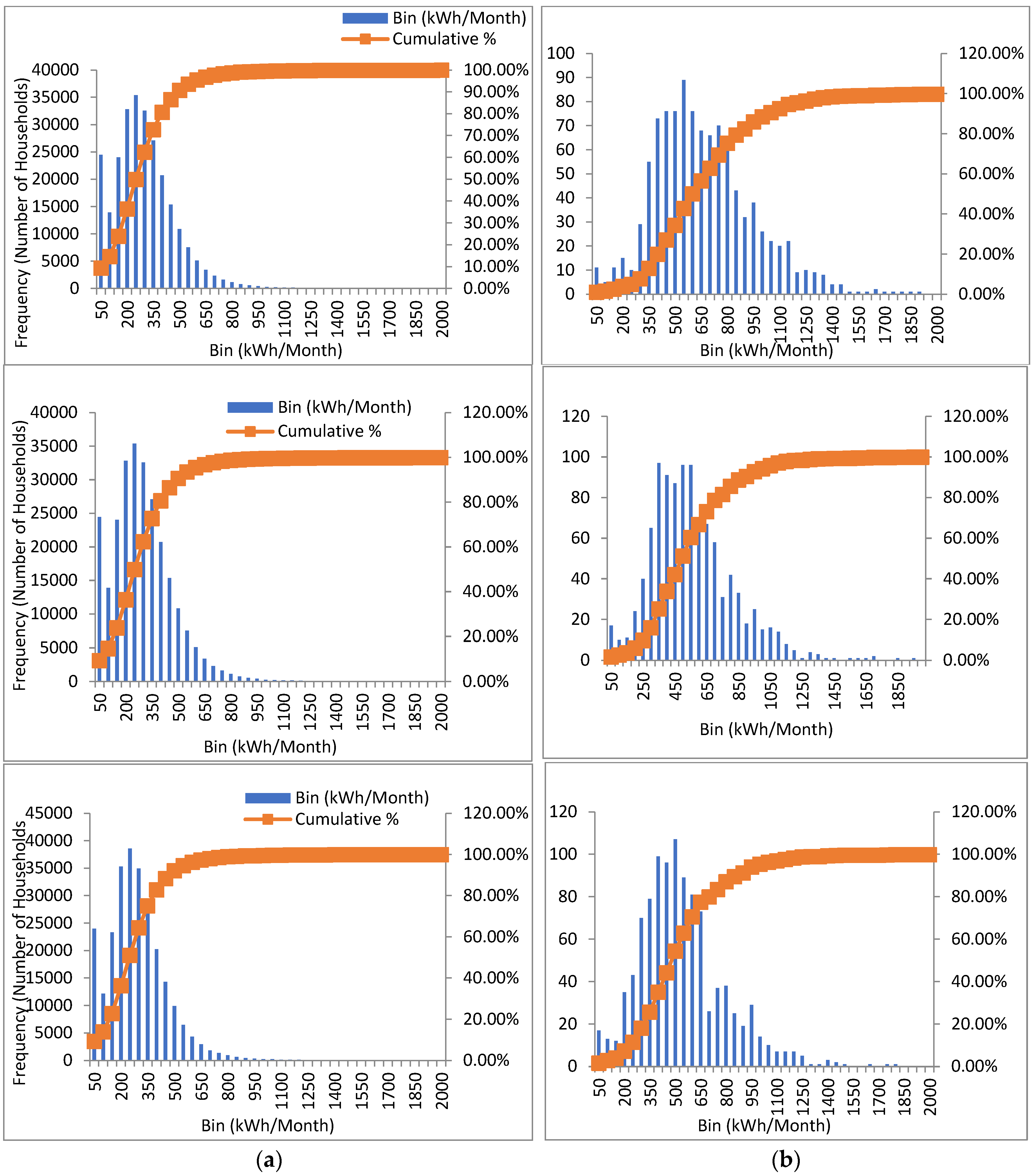

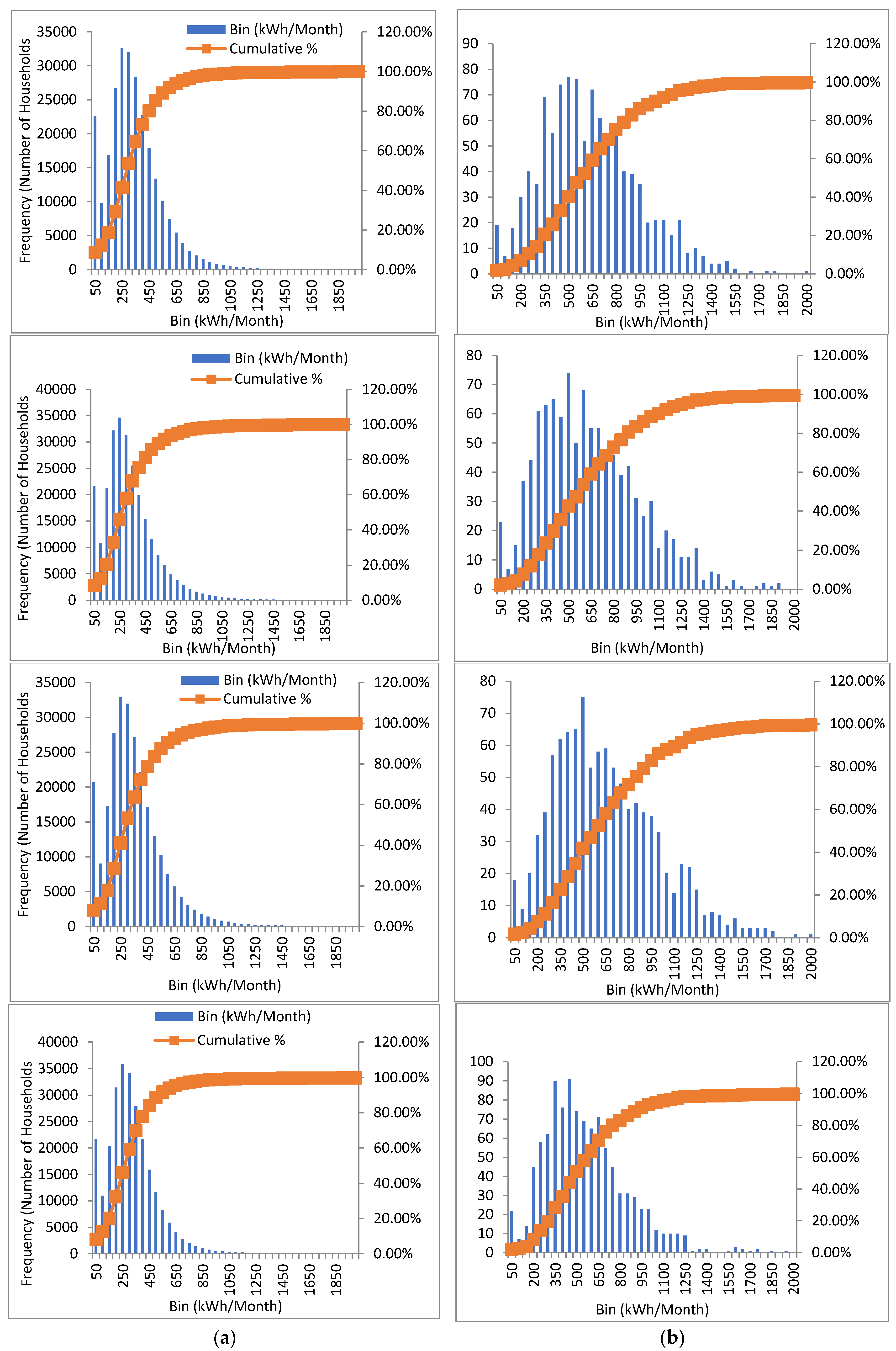

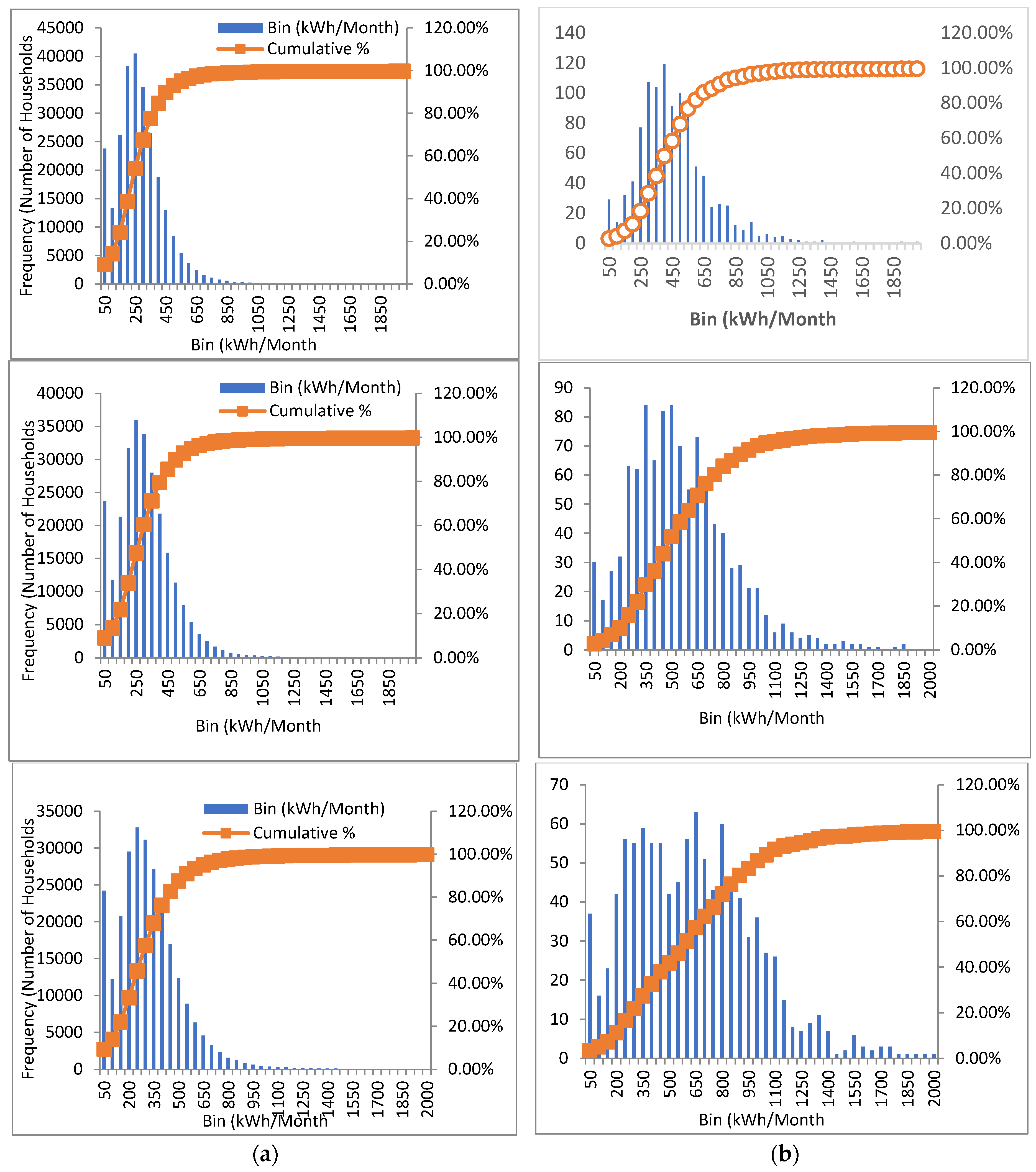

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Global Energy & CO2 Status Report—The Latest Trends in Energy and Emissions in 2018. International Energy Agency. Available online: https://www.iea.org/reports/global-energy-co2-status-report-2019 (accessed on 20 May 2022).

- Abu-Rumman, G.; Khdair, A.I.; Khdair, S.I. Current status and future investment potential in renewable energy in Jordan: An overview. Heliyon 2020, 6, e03346. [Google Scholar] [CrossRef] [PubMed]

- Google Maps. Available online: https://www.google.com/maps/@31.2798856,37.122627,4z (accessed on 22 May 2022).

- Nepco.com.jo. Nationl Electric Power Company—NEPCO HomePage. 2019. Available online: http://www.nepco.com.jo/en/electricity_sector_structure_en.aspx (accessed on 15 April 2019).

- Lipton, D. Energy Subsidy Reform: The Way Forward; Lipton, D., Ed.; International Monetary Fund: Washington, DC, USA, 2013. [Google Scholar]

- Acharya, R.H.; Sadath, A.C. Implications of energy subsidy reform in India. Energy Policy 2017, 102, 453–462. [Google Scholar] [CrossRef]

- Wesseh, P.K., Jr.; Lin, B. Refined oil import subsidies removal in Ghana: A ‘triple’ win? J. Clean. Prod. 2016, 139, 113–121. [Google Scholar] [CrossRef]

- Zhang, F. Energy Price Reform and Household Welfare: The Case of Turkey. Energy J. 2015, 36, 71–95. [Google Scholar] [CrossRef]

- Soile, I.; Mu, X. Who benefit most from fuel subsidies? Evidence from Nigeria. Energy Policy 2015, 87, 314–324. [Google Scholar] [CrossRef]

- Dennis, A. Household welfare implications of fossil fuel subsidy reforms in developing countries. Energy Policy 2016, 96, 597–606. [Google Scholar] [CrossRef]

- Siddig, K.; Aguiar, A.; Grethe, H.; Minor, P.; Walmsley, T. Impacts of removing fuel import subsidies in Nigeria on poverty. Energy Policy 2014, 69, 165–178. [Google Scholar] [CrossRef]

- del Granado, F.J.A.; Coady, D.; Gillingham, R. The Unequal Benefits of Fuel Subsidies: A Review of Evidence for Developing Countries. World Dev. 2012, 40, 2234–2248. [Google Scholar] [CrossRef]

- Abdelrahim, K.E. Economic impact of energy subsidy and subsidy reform measures: New evidence from Jordan. Int. J. Bus. Soc. Res. 2014, 4, 98–110. [Google Scholar]

- Sdralevich, M.C.A.; Sab, M.R.; Zouhar, M.Y.; Albertin, G. Subsidy Reform in the Middle East and North Africa: Recent Progress and Challenges Ahead; International Monetary Fund: Washington, DC, USA, 2014. [Google Scholar]

- Cooke, E.F.; Hague, S.; Tiberti, L.; Cockburn, J.; El Lahga, A.-R. Estimating the impact on poverty of Ghana’s fuel subsidy reform and a mitigating response. J. Dev. Eff. 2016, 8, 105–128. [Google Scholar] [CrossRef]

- Plante, M. The long-run macroeconomic impacts of fuel subsidies. J. Dev. Econ. 2014, 107, 129–143. [Google Scholar] [CrossRef]

- Demery, L. Benefit Incidence: A Practitioner’s Guide; The World Bank: Washington, DC, USA, 2000. [Google Scholar]

- Coady, D. The Distributional Impacts of Indirect Tax and Public Pricing Reforms: A Review of Methods and Empirical Evidence; Poverty and Social Impact Analysis by the IMF: Review of Methodology and Selected Evidence; International Monetary Fund: Washington, DC, USA, 2008. [Google Scholar]

- Maboshe, M.; Kabechani, A.; Chelwa, G. The welfare effects of unprecedented electricity price hikes in Zambia. Energy Policy 2019, 126, 108–117. [Google Scholar] [CrossRef]

- Feng, K.; Hubacek, K.; Liu, Y.; Marchán, E.; Vogt-Schilb, A. Managing the distributional effects of energy taxes and subsidy removal in Latin America and the Caribbean. Appl. Energy 2018, 225, 424–436. [Google Scholar] [CrossRef]

- Gharibnavaz, M.R.; Waschik, R. Food and energy subsidy reforms in Iran: A general equilibrium analysis. J. Policy Model. 2015, 37, 726–741. [Google Scholar] [CrossRef]

- Araar, A.; Verme, P. Reforming Subsidies A Tool-kit for Policy Simulations. World Bank Policy Res. Work. Pap. 2012, 6148. [Google Scholar] [CrossRef]

- Rentschler, J. Incidence and impact: The regional variation of poverty effects due to fossil fuel subsidy reform. Energy Policy 2016, 96, 491–503. [Google Scholar] [CrossRef]

- Dartanto, T. Reducing fuel subsidies and the implication on fiscal balance and poverty in Indonesia: A simulation analysis. Energy Policy 2013, 58, 117–134. [Google Scholar] [CrossRef]

- Al Iriani, M.A.; Trabelsi, M. The economic impact of phasing out energy consumption subsidies in GCC countries. J. Econ. Bus. 2016, 87, 35–49. [Google Scholar] [CrossRef]

- Mundaca, G. Energy subsidies, public investment and endogenous growth. Energy Policy 2017, 110, 693–709. [Google Scholar] [CrossRef]

- Jiang, Z.; Ouyang, X.; Huang, G. The distributional impacts of removing energy subsidies in China. China Econ. Rev. 2015, 33, 111–122. [Google Scholar] [CrossRef]

- Henseler, M.; Maisonnave, H. Low world oil prices: A chance to reform fuel subsidies and promote public transport? A case study for South Africa. Transp. Res. Part A Policy Pract. 2018, 108, 45–62. [Google Scholar] [CrossRef]

- Elshennawy, A. The implications of phasing out energy subsidies in Egypt. J. Policy Model. 2014, 36, 855–866. [Google Scholar] [CrossRef]

- Li, K.; Jiang, Z. The impacts of removing energy subsidies on economy-wide rebound effects in China: An input-output analysis. Energy Policy 2016, 98, 62–72. [Google Scholar] [CrossRef]

- Coady, D.; Parry, I.; Sears, L.; Shang, B. How Large Are Global Fossil Fuel Subsidies? World Dev. 2017, 91, 11–27. [Google Scholar] [CrossRef]

- Gelan, A.U. Kuwait’s energy subsidy reduction: Examining economic and CO2 emission effects with or without compensation. Energy Econ. 2018, 71, 186–200. [Google Scholar] [CrossRef]

- Li, Y.; Shi, X.; Su, B. Economic, social and environmental impacts of fuel subsidies: A revisit of Malaysia. Energy Policy 2017, 110, 51–61. [Google Scholar] [CrossRef]

- Mundaca, G. How much can CO2 emissions be reduced if fossil fuel subsidies are removed? Energy Econ. 2017, 64, 91–104. [Google Scholar] [CrossRef]

- Wesseh, P.K., Jr.; Lin, B.; Atsagli, P. Environmental and welfare assessment of fossil-fuels subsidies removal: A computable general equilibrium analysis for Ghana. Energy 2016, 116, 1172–1179. [Google Scholar] [CrossRef]

- Li, J.; Sun, C. Towards a low carbon economy by removing fossil fuel subsidies? China Econ. Rev. 2018, 50, 17–33. [Google Scholar] [CrossRef]

- Solaymani, S.; Kari, F. Impacts of energy subsidy reform on the Malaysian economy and transportation sector. Energy Policy 2014, 70, 115–125. [Google Scholar] [CrossRef]

- Yusoff, N.Y.B.M.; Bekhet, H.A. The Effect of Energy Subsidy Removal on Energy Demand and Potential Energy Savings in Malaysia. Procedia Econ. Finance 2016, 35, 189–197. [Google Scholar] [CrossRef]

- Baker, P.; Blundell, R.; Micklewright, J. Modelling Household Energy Expenditures Using Micro-Data. Econ. J. 1989, 99, 720. [Google Scholar] [CrossRef]

- Moshiri, S. The effects of the energy price reform on households consumption in Iran. Energy Policy 2015, 79, 177–188. [Google Scholar] [CrossRef]

- Lin, B.; Jiang, Z. Estimates of energy subsidies in China and impact of energy subsidy reform. Energy Econ. 2011, 33, 273–283. [Google Scholar] [CrossRef]

- Liu, W.; Li, H. Improving energy consumption structure: A comprehensive assessment of fossil energy subsidies reform in China. Energy Policy 2011, 39, 4134–4143. [Google Scholar] [CrossRef]

- Mills, E. Global Kerosene Subsidies: An Obstacle to Energy Efficiency and Development. World Dev. 2017, 99, 463–480. [Google Scholar] [CrossRef]

- Hussein, N. Greenhouse Gas Emissions Reduction Potential of Jordan’s Utility Scale Wind and Solar Projects. Jordan J. Mech. Ind. Eng. 2016, 10, 199–203. [Google Scholar]

- Nepco.com.jo. Nationl Electric Power Company—NEPCO Homepage. 2020. Available online: https://www.nepco.com.jo/en/default_en.aspx (accessed on 19 October 2020).

- AlFaris, F.; Juaidi, A.; Manzano-Agugliaro, F. Energy retrofit strategies for housing sector in the arid climate. Energy Build. 2016, 131, 158–171. [Google Scholar] [CrossRef]

- Albatayneh, A.; Alterman, D.; Page, A.; Moghtaderi, B. Renewable Energy Systems to Enhance Buildings Thermal Performance and Decrease Construction Costs. Energy Procedia 2018, 152, 312–317. [Google Scholar] [CrossRef]

- Albatayneh, A.; Alterman, D.; Page, A.; Moghtaderi, B. Alternative Method to the Replication of Wind Effects into the Buildings Thermal Simulation. Buildings 2020, 10, 237. [Google Scholar] [CrossRef]

- Albatayneh, A.; Jaradat, M.; AlKhatib, M.; Abdallah, R.; Juaidi, A.; Manzano-Agugliaro, F. The Significance of the Adaptive Thermal Comfort Practice over the Structure Retrofits to Sustain Indoor Thermal Comfort. Energies 2021, 14, 2946. [Google Scholar] [CrossRef]

- Muhaidat, J.; Albatayneh, A.; Assaf, M.N.; Juaidi, A.; Abdallah, R.; Manzano-Agugliaro, F. The Significance of Occupants’ Interaction with Their Environment on Reducing Cooling Loads and Dermatological Distresses in East Mediterranean Climates. Int. J. Environ. Res. Public Health 2021, 18, 8870. [Google Scholar] [CrossRef]

- Sandri, S.; Hussein, H.; Alshyab, N. Sustainability of the Energy Sector in Jordan: Challenges and Opportunities. Sustainability 2020, 12, 10465. [Google Scholar] [CrossRef]

- Albatayneh, A.; Juaidi, A.; Abdallah, R.; Peña-Fernández, A.; Manzano-Agugliaro, F. Effect of the subsidised electrical energy tariff on the residential energy consumption in Jordan. Energy Rep. 2022, 8, 893–903. [Google Scholar] [CrossRef]

- Energy & Minerals Regulatory Commission (EMRC). Available online: https://emrc.gov.jo/Pages/viewpage?pageID=368 (accessed on 31 December 2022).

- Albatayneh, A.; Hindiyeh, M.; AlAmawi, R. Potential of Renewable energy in Water-Energy-Food Nexus in Jordan. Energy Nexus 2022, 7, 100140. [Google Scholar] [CrossRef]

- Hussein, H.; Lambert, L. A Rentier State under Blockade: Qatar’s Water-Energy-Food Predicament from Energy Abundance and Food Insecurity to a Silent Water Crisis. Water 2020, 12, 1051. [Google Scholar] [CrossRef]

| Household Tariff | USD/kWh |

|---|---|

| 1–160 kWh/Month | 0.05 |

| 161−300 kWh/Month | 0.10 |

| 301−500 kWh/Month | 0.12 |

| 501−600 kWh/Month | 0.16 |

| 601−750 kWh/Month | 0.22 |

| 751−1000 kWh/Month | 0.26 |

| >1000 kWh/Month | 0.37 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Albatayneh, A.; Juaidi, A.; Manzano-Agugliaro, F. The Negative Impact of Electrical Energy Subsidies on the Energy Consumption—Case Study from Jordan. Energies 2023, 16, 981. https://doi.org/10.3390/en16020981

Albatayneh A, Juaidi A, Manzano-Agugliaro F. The Negative Impact of Electrical Energy Subsidies on the Energy Consumption—Case Study from Jordan. Energies. 2023; 16(2):981. https://doi.org/10.3390/en16020981

Chicago/Turabian StyleAlbatayneh, Aiman, Adel Juaidi, and Francisco Manzano-Agugliaro. 2023. "The Negative Impact of Electrical Energy Subsidies on the Energy Consumption—Case Study from Jordan" Energies 16, no. 2: 981. https://doi.org/10.3390/en16020981

APA StyleAlbatayneh, A., Juaidi, A., & Manzano-Agugliaro, F. (2023). The Negative Impact of Electrical Energy Subsidies on the Energy Consumption—Case Study from Jordan. Energies, 16(2), 981. https://doi.org/10.3390/en16020981