Electricity Market Reforms for Energy Transition: Lessons from China

Abstract

1. Introduction

2. The 2002 Electricity Market Reforms and the Renewable Energy Law

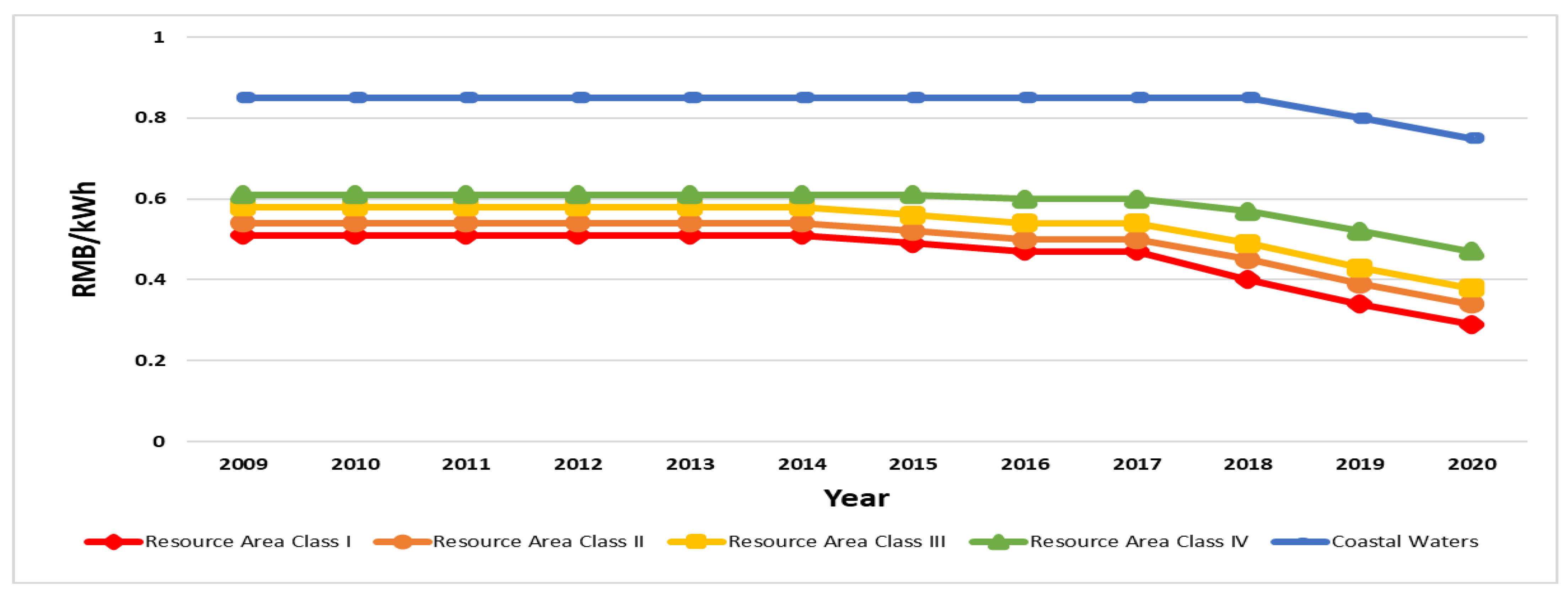

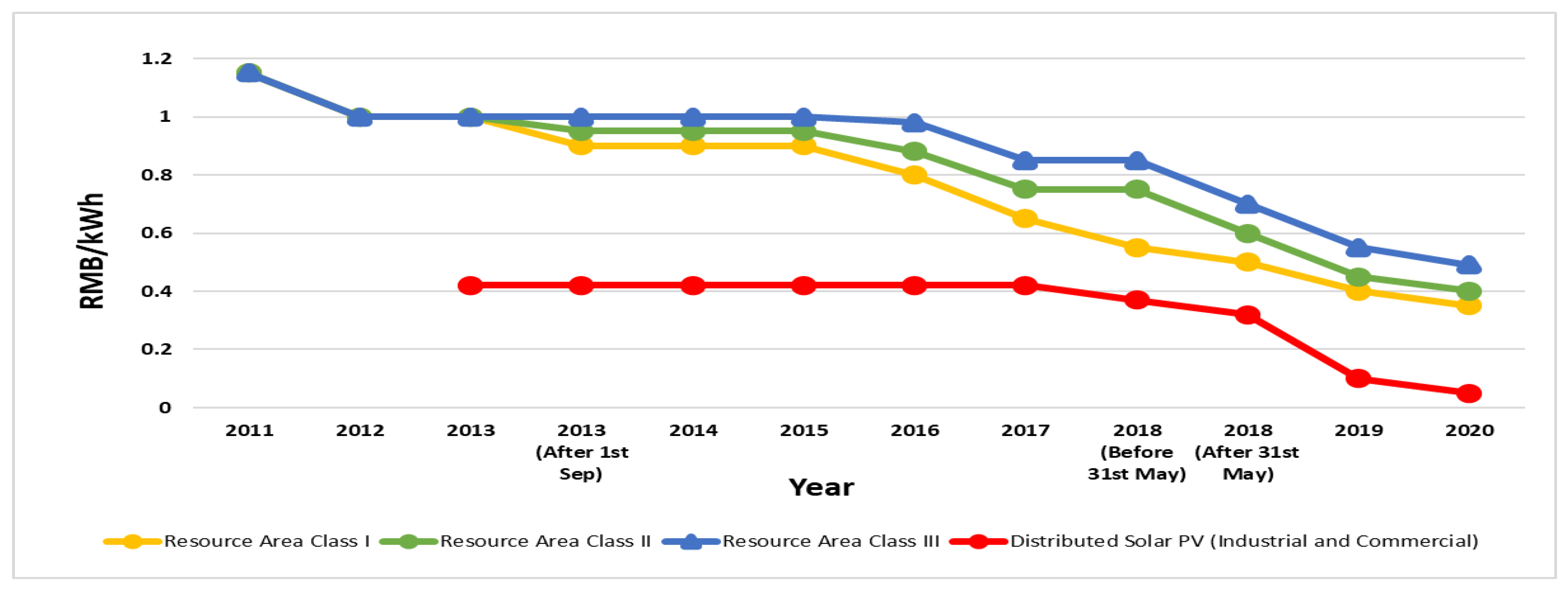

3. The Introduction of FiTs during 2009–2013

4. The 2015 Reforms to Set Up a Multiple-Layered Market

5. Acceleration of Reforms since 2020

5.1. Renewable Portfolio Standards (RPS)

5.2. Market for Green Electricity

6. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Büsgen, U.; Dürrschmidt, W. The expansion of electricity generation from renewable energies in Germany: A review based on the Renewable Energy Sources Act Progress Report 2007 and the new German feed-in legislation. Energy Policy 2009, 37, 2536–2545. [Google Scholar] [CrossRef]

- European Commission. Commission Staff Working Document. The Support of Electricity from Renewable Energy Sources. Accompanying Document to the Proposal for a Directive of the European Parliament and of the Council on the Promotion of the Use of Energy from Renewable Sources. Brussels, 23 January 2008, COM(2008) 19 Final. Available online: https://www.europarl.europa.eu/registre/docs_autres_institutions/commission_europeenne/sec/2008/0057/COM_SEC(2008)0057_EN.pdf (accessed on 31 October 2022).

- Huntington, S.C.; Rodilla, P.; Herrero, I.; Batlle, C. Revisiting support policies for RES-E adulthood: Towards market compatible schemes. Energy Policy 2017, 104, 474–483. [Google Scholar] [CrossRef]

- Palmer, K.; Burtraw, D. Cost-effectiveness of renewable electricity policies. Energy Econ. 2005, 27, 873–894. [Google Scholar] [CrossRef]

- Özdemir, Ö.; Hobbs, B.F.; van Hout, M.; Koutstaal, P.R. Capacity vs. energy subsidies for promoting renewable investment: Benefits and costs for the EU power market. Energy Policy 2020, 137, 111166. [Google Scholar] [CrossRef]

- Cheung, K. Integration of Renewables: Status and Challenges in China; IEA Energy Papers 2011/9; OECD Publishing: Paris, France, 2011. [Google Scholar]

- Kahrl, F.; Williams, J.; Ding, J.; Hu, J. Challenges to China’s transition to a low carbon electricity system. Energy Policy 2011, 39, 4032–4041. [Google Scholar] [CrossRef]

- IEA Wind TCP Secretariat. Wind Energy in China: 2020 Wind Energy Numbers. 2021. Available online: https://iea-wind.org/about-iea-wind-tcp/members/cwea/ (accessed on 31 October 2022).

- IEA Photovoltaic Power System Programme. Task 1 Strategic PV Analysis and Outreach–Snapshot or Global PV Market 2021; IEA: Rheine, Germany, 2021; ISBN 978-3-907281-17-8. Available online: https://iea-pvps.org/snapshot-reports/snapshot-2021/ (accessed on 31 October 2022).

- Chen, B.; Cheng, Y.S. The impacts of environmental regulation on industrial activities: Evidence from a quasi-natural experiment in Chinese prefectures. Sustainability 2017, 9, 571. [Google Scholar] [CrossRef]

- Chen, Y.J.; Li, P.; Lu, Y. Career concerns and multitasking local bureaucrats: Evidence of a target-based performance evaluation system in China. J. Dev. Econ. 2018, 133, 84–101. [Google Scholar] [CrossRef]

- Wu, M.; Cao, X. Greening the career incentive structure for local officials in China: Does less pollution increase the chances of promotion for Chinese local leaders? J. Environ. Econ. Manag. 2021, 107, 102440. [Google Scholar] [CrossRef]

- Christoff, P. Cold climate in Copenhagen: China and the United States at COP15. Environ. Politics 2010, 19, 637–656. [Google Scholar] [CrossRef]

- Lau, L.C.; Lee, K.T.; Mohamed, A.R. Global warming mitigation and renewable energy policy development from the Kyoto Protocol to the Copenhagen Accord—A comment. Renew. Sustain. Energy Rev. 2012, 16, 5280–5284. [Google Scholar] [CrossRef]

- Démurger, S.; Sachs, J.D.; Woo, W.T.; Bao, S.; Chang, G.; Mellinger, A. Geography, economic policy, and regional development in China. Asian Econ. Pap. 2002, 1, 146–197. [Google Scholar] [CrossRef]

- Kanbur, R.; Zhang, X. Fifty years of regional inequality in China: A journey through central planning, reform, and openness. Rev. Dev. Econ. 2005, 9, 87–106. [Google Scholar] [CrossRef]

- Cheng, Y.; Li, R.; Woo, C. Regional Energy-growth Nexus and Energy Conservation Policy in China. Energy 2021, 217, 119414. [Google Scholar] [CrossRef]

- Yue, X. Proper Planning to Realize “Dual Carbon Goals”. China Daily, 27 April 2022. Available online: http://global.chinadaily.com.cn/a/202204/27/WS6268840ba310fd2b29e597e7.html (accessed on 13 October 2022).

- Zeng, M.; Yang, Y.; Wang, L.; Sun, J. The power industry reform in China 2015: Policies, evaluations and solutions. Renew. Sustain. Energy Rev. 2016, 57, 94–110. [Google Scholar] [CrossRef]

- Lei, N.; Chen, L.; Sun, C.; Tao, Y. Electricity market creation in China: Policy options from political economics perspective. Sustainability 2018, 10, 1481. [Google Scholar] [CrossRef]

- Guo, S.; Zhang, W.; Gao, X. Business risk evaluation of electricity retail company in China using a hybrid MCDM method. Sustainability 2020, 12, 2040. [Google Scholar] [CrossRef]

- Cheng, Y.S.; Wong, W.K.; Woo, C.K. How much have electricity shortages hampered China’s GDP growth? Energy Policy 2013, 55, 369–373. [Google Scholar] [CrossRef]

- Xu, S.; Chen, W. The reform of electricity power sector in the PR of China. Energy Policy 2006, 34, 2455–2465. [Google Scholar] [CrossRef]

- Ministry of Electric Power Industry. Regulations for Managing On-grid Operation of Wind Power Station (Pilot). The Website of National Energy Administration. 1994. Available online: http://www.nea.gov.cn/2011-08/16/c_131051397.htm (accessed on 18 October 2022).

- Yang, X. The Inter-Provincial and Inter-Regional Transaction of Renewable Energies Have Huge Development Potential, The Website of BJX. 2022. Available online: https://news.bjx.com.cn/html/20220223/1205834.shtml (accessed on 18 October 2022).

- Ma, C.; He, L. From state monopoly to renewable portfolio: Restructuring China’s electric utility. Energy Policy 2008, 3, 1697–1711. [Google Scholar] [CrossRef]

- Schuman, S.; Lin, A. China’s Renewable Energy Law and its impact on renewable power in China: Progress, challenges and recommendations for improving implementation. Energy Policy 2012, 51, 89–109. [Google Scholar] [CrossRef]

- Xinhua News. Renewable Energy Law of the People’s Republic of China, The Website of The Central People’s Government of the Government of The People’s Republic of China. 2006. Available online: http://www.gov.cn/ziliao/flfg/2005-06/21/content_8275.htm (accessed on 8 October 2022).

- Wang, Z.; Wang, C.; Shi, J.; Li, J. Review and Evaluation of the Implementation of China’s Renewable Energy Law, Energy Research Institution of the National Development and Reform Commission, and Beijing Orient Environmental Research Institute. 2006. Available online: https://www.efchina.org/Attachments/Report/reports-efchina-20070515-1-en/RE%20Law%20Imp%20Review_0407_Chinese%20only.pdf (accessed on 8 October 2022).

- National Energy Administration. Guiding Opinions from the National Energy Administration on the Implementation of the 13th Five-Year Plan for Renewable Energy Development. The Website of the People’s Government of Guangdong Province. 2017. Available online: http://www.gd.gov.cn/zwgk/wjk/zcfgk/content/post_2726682.html (accessed on 13 October 2022).

- Li, J.; Wang, X.; Shi, J.; Li, Q.; Xie, H.; Gao, H.; Tang, W.; Peng, P.; Li, D. China Solar PV Power Policy Report: Differential Feed-in Tariffs, Chinese Renewable Energy Industries Association. 2013. Available online: https://www.efchina.org/Attachments/Report/report-cre-20130509/reports-20130402-zh (accessed on 8 October 2022).

- National Development and Reform Commission. Administrative Measures for the Full Guaranteed Purchase of Renewable Energy Electricity Generation, The Website of the Central Government of The People’s Republic of China. 2016. Available online: http://www.gov.cn/xinwen/2016-03/29/5059383/files/403db895dbc346708e43f5eee4ce72aa.pdf (accessed on 15 October 2022).

- National People’s Congress. Renewable Energy Law of The People’s Republic of China (Amendment). The Website of the National People’s Congress. 2009. Available online: http://www.npc.gov.cn/zgrdw/huiyi/cwh/1112/2009-12/26/content_1533216.htm (accessed on 18 October 2022).

- National Development and Reform Commission. National Development and Reform Commission Notice on Improving the Feed-in Tariff Policy for Wind Power Electricity Generation, The Website of National Development and Reform Commission. 2009. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/200907/t20090727_965206.html?code=&state=123 (accessed on 6 October 2022).

- National Development and Reform Commission. National Development and Reform Commission Notice on Improving the On-Grid Price Policy for Solar Photovoltaic Electricity Generation, The Website of National Development and Reform Commission. 2011. Available online: http://www.gov.cn/zwgk/2011-08/01/content_1917358.htm (accessed on 6 October 2022).

- National Development and Reform Commission. Notice of National Development and Reform Commission on the Role of Price Leverage and Promoting the Healthy Development of Photovoltaic Industry, The website of National Development and Reform Commission. 2013. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/201308/t20130830_963934.html?code=&state=123 (accessed on 6 October 2022).

- Zhao, X.; Zeng, Y.; Zhao, D. Distributed solar photovoltaics in China: Policies and economic performance. Energy 2015, 88, 572–583. [Google Scholar] [CrossRef]

- Xu, T. The Changes of Wind Electricity Price and the Evolution of Policies in China. 2019. Available online: https://www.china5e.com/news/news-1066392-1.html (accessed on 19 October 2022).

- Shui, Q. Six Reductions in Eight Years: Subsidy for Solar PV Will Exhaust Its Historical Role. The Website of BJX. 2020. Available online: https://guangfu.bjx.com.cn/news/20200218/1044342.shtml (accessed on 19 October 2022).

- National Development and Reform Commission; Ministry of Finance; National Energy Administration. Notice of the Ministry of Finance, the National Development and Reform Commission and the National Energy Administration on Issuing the Interim Measures for the Administration of the Collection and Use of the Renewable Energy Development Fund, The Website of the Government of The People’s Republic of China. 2011. Available online: http://www.gov.cn/gongbao/content/2012/content_2131981.htm (accessed on 7 October 2022).

- GCL. Photovoltaic Industry: Subsidies Will Be Gradually Phased out. “Weaning” Will Help Market Competition, The Website of GCL. 2016. Available online: http://www.gcl-power.com/tc/about/newdetail/3959.html (accessed on 10 October 2022).

- National Energy Administration and Poverty Alleviation Office. Strategy for Poverty Alleviation with the Use of Solar PV. The Website of National Energy Administration. 2014. Available online: http://zfxxgk.nea.gov.cn/auto87/201411/t20141105_1862.htm (accessed on 14 October 2022).

- Energy Poverty Alleviation Has Entered the Household Level, Illuminating the Road to a Moderately Prosperous Society for the Masses (a Hundred Years of Struggle, Set Sail for a New Journey Answers to Poverty Alleviation). People’s Daily, 18 February 2021. Available online: http://politics.people.com.cn/BIG5/n1/2021/0218/c1001-32030292.html (accessed on 14 October 2022).

- Paulson Institute. Photovoltaics in China: Embracing the Post-Subsidy Era. The website of Paulson Institute. 2020. Available online: https://paulsoninstitute.org.cn/green-finance/green-scene/the-state-of-solar-bracing-for-a-post-subsidy-era-in-china/ (accessed on 18 October 2022).

- National Energy Administration. National Energy Administration Release Statistics Related to Photovoltaic Electricity Generation of 2015. The Website of the Government of the People’s Republic of China. 2016. Available online: http://www.gov.cn/xinwen/2016-02/05/content_5039508.htm (accessed on 13 October 2022).

- National Energy Administration. The Development Situation of the Wind Energy Industry in 2015. The Website of National Energy Administration. 2016. Available online: http://www.nea.gov.cn/2016-02/02/c_135066586.htm (accessed on 13 October 2022).

- National Energy Administration. Circular of the National Energy Administration on the 2020 National Renewable Energy Electricity Development Monitoring and Evaluation Results. The Website of National Energy Administration. 2021. Available online: http://zfxxgk.nea.gov.cn/2021-06/20/c_1310039970.htm (accessed on 15 October 2022).

- National Development and Reform Commission; Ministry of Finance; National Energy Administration. Notice of National Development and Reform Commission, Ministry of Finance and National Energy Administration on the Matters Related to Photovoltaic Electricity Generation in 2018, The Website of National Development and Reform Commission. 2018. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/201806/t20180601_962736.html (accessed on 15 October 2022).

- Wang, S. The Era of Private-Sector-Led Photovoltaic Power Station Investment Has Come to an End, The website of BJX. 2019. Available online: https://guangfu.bjx.com.cn/news/20191202/1024905.shtml (accessed on 15 October 2022).

- Auffhammer, M.; Wang, M.; Xie, L.; Xu, J. Renewable electricity development in China: Policies, performance, and challenges. Rev. Environ. Econ. Policy 2021, 15, 323–339. [Google Scholar] [CrossRef]

- STCN. To Solve the Problem of Renewable Energy Subsidies, Three Ministries Authorized the Power Grid Companies to Set Up Companies. STCN. 2022. Available online: https://news.stcn.com/sd/202208/t20220818_4806370.html (accessed on 18 October 2022).

- Song, Y.; Liu, T.; Ye, B.; Li, Y. Linking carbon market and electricity market for promoting the grid parity of photovoltaic electricity in China. Energy 2020, 211, 118924. [Google Scholar] [CrossRef]

- The General Office of National Development and Reform Commission. Opinions about the Pilot Tests of the Local Consumption of Renewable Energy. The Website of National Development and Reform Commission. 2015. Available online: https://www.ndrc.gov.cn/fzggw/jgsj/yxj/sjdt/201510/t20151019_986836.html?code=&state=123 (accessed on 18 October 2022).

- The Central Committee of the Communist Party and the State Council. Opinions of the Central Committee of the Communist Party of China and the State Council on Further Deepening the Reform of the Electric Power System. The Website of Fujian Energy Regulatory Office of the National Energy Administration. 2015. Available online: http://fjb.nea.gov.cn/pufa_view.aspx?id=31434 (accessed on 14 October 2022).

- Lin, K.C.; Purra, M.M. Transforming China’s electricity sector: Politics of institutional change and regulation. Energy Policy 2019, 124, 401–410. [Google Scholar] [CrossRef]

- National Development and Reform Commission and National Energy Administration. Notice of the National Development and Reform Commission and the National Energy Administration on the Orderly Release of Plans for Development and Consumption of Electricity. The website of National Development and Reform Commission. 2017. Available online: https://www.ndrc.gov.cn/fzggw/jgsj/yxj/sjdt/201704/t20170410_986939.html?code=&state=123 (accessed on 14 October 2022).

- Sun, Q.; Guo, Y.; Current Situation and Trend: A Bird’s-Eye View of China’s Electricity Market. Dentons. 2022. Available online: https://www.dentons.com/zh/insights/articles/2022/april/4/current-situation-and-trend-of-power-market (accessed on 18 October 2022).

- Liu, X. 50 TWh of Electricity from Wind Power and Photovoltaic Curtailed. State Grid “There are Four Major Barriers to Inter-provincial Electricity Consumption”. The Website of EEO. 2018. Available online: http://m.eeo.com.cn/2018/0331/325786.shtml (accessed on 18 October 2022).

- The Law Enforcement Inspection Team of the National People’s Congress Standing Committee. Report on Inspection of the Implementation of the Renewable Energy Law of the People’s Republic of China, The Website of The National People’s Congress of the People’s Republic of China. 2019. Available online: http://www.npc.gov.cn/npc/c30834/201912/2b7568de01944c33b9326c325dcd498f.shtml (accessed on 16 October 2022).

- Zhang, H. The Analysis of the Current Status and Trend of the Development of Renewable Energy in China, Lack of Competitiveness due to High Electricity Generation Costs, The website of Huaon Information. 2021. Available online: https://m.huaon.com/detail/722186.html (accessed on 18 October 2022).

- National Development and Reform Commission. The Action Plan for Consumption of Clean Energy (2018–2020) The Website of National Development and Reform Commission. 2018. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/ghxwj/201812/W020190905495739358481.pdf (accessed on 13 October 2022).

- National Development and Reform Commission and National Energy Administration. Notice about Establishing A Comprehensive Mechanism For Guaranteed Consumption of Renewable Electricity. The Website of Central Government of People’s Republic of China. 2019. Available online: http://www.gov.cn/xinwen/2019-05/16/content_5392082.htm (accessed on 16 October 2022).

- National Energy Administration. Letter from the National Energy Administration on Soliciting Proposals for the for Renewable Energy Power Consumption Quota in 2021 and the Prospective Targets for 2022–2030. The Website of China Solar Thermal Alliance. 2021. Available online: http://cnste.org/html/zixun/2021/0210/7551.html (accessed on 15 October 2022).

- National Development and Reform Commission and National Energy Administration. Notice of the National Development and Reform Commission and the National Energy Administration on Renewable Energy Power Consumption and Related Matters in 2021. The Website of National Development and Reform Commission. 2021. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/202105/t20210525_1280789.html?code=&state=123 (accessed on 18 October 2022).

- National Development and Reform Commission, Ministry of Finance, National Energy Administration. Notice of the Three Departments on the Trial Implementation of the Renewable Energy Green Power Certificate Issuance and Voluntary Trading System, The Website of the Government of The People’s Republic of China. 2017. Available online: http://www.gov.cn/xinwen/2017-02/03/content_5164836.htm (accessed on 14 October 2022).

- National Development and Reform Commission. National Development and Reform Commission and National Energy Administration: Guiding Opinions on Accelerating the Construction of a National Unified Electricity Market System. The Website of National Development and Reform Commission. 2022. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/202201/t20220128_1313653.html?code=&state=123 (accessed on 15 October 2022).

- Zhejiang Province Commission of Development and Reform; Zhejiang Province Energy Bureau and Zhejiang Supervisory Office of National Energy Administration. Notice on the Launch of Zhejiang Province Green Electricity Marketisation Pilot Scheme in 2021, The Website of the People’s Government of Zhejiang Province. 2021. Available online: https://zjjcmspublic.oss-cn-hangzhou-zwynet-d01-a.internet.cloud.zj.gov.cn/jcms_files/jcms1/web2944/site/attach/0/9d07d46e5a344e42a2fa7befc626578e.pdf (accessed on 18 October 2022).

- North China Supervisory Office of NEA. Notice from North China Supervisory Office of the National Energy Administration on the Printing and Distributing of the Beijing-Tianjin-Hebei Green Electricity Marketized Transaction Rule and Implementation Rules for Supporting Priority Scheduling. The website of State Power Rixin Tech. 2020. Available online: https://www.sprixin.com/uploads/soft/210225/1-210225143642.pdf (accessed on 18 October 2022).

- Xinhua News. The Official Commission of China’s Pilot Renewable Energies Trading, The Website of the Government of The People’s Republic of China. 2021. Available online: http://www.gov.cn/xinwen/2021-09/07/content_5636072.htm (accessed on 18 October 2022).

- Zhang, Y.; Wu, K. Exploring Green Electricity Trading: Urgently Needed to Renewable Link-up Electricity Certification and Carbon Market, The Website of ESCN. 2022. Available online: https://www.escn.com.cn/news/show-1427064.html (accessed on 18 October 2022).

- National Development and Reform Commission; Ministry of Industry and Information Technology; Ministry of Housing and Urban-Rural Development; Ministry of Commerce; State Administration for Market Regulation; National Government Offices Administration; Government Offices Administration of the CPC Central Committee. Notice of the National Development and Reform Commission and Other Departments on Printing and Distributing the “Implementation Plan for Promoting Green Consumption”, The Website of National Development and Reform Commission. 2022. Available online: https://www.ndrc.gov.cn/xwdt/tzgg/202201/t20220121_1312525_ext.html (accessed on 18 October 2022).

- IEA. Special Report on Solar PV Global Supply Chains, July 2022. Available online: https://www.iea.org/reports/solar-pv-global-supply-chains (accessed on 4 January 2023).

- National Development and Reform Commission; National Energy Administration; Ministry of Finance; Ministry of Natural Resources; Ministry of Ecology and Environment; Ministry of Housing and Urban-Rural Development; Ministry of Agriculture and Rural Affairs; China Meteorological Administration; National Forestry and Grassland Administration. The Renewable Energy Development Plan in the 14th Five-Year Plan Period, The Website of National Development and Reform Commission. 2021. Available online: https://www.ndrc.gov.cn/xwdt/tzgg/202206/t20220601_1326720.html?code=&state=123 (accessed on 17 October 2022).

- Hi-tech Department of NDRC. Episode 4 of the Introduction of “Eastern Data and Western Computation” Program: Accelerating “Eastern Data and Western Computation” Program and Nurturing the Computation Economy, The Website of National Development and Reform Commission. 2022. Available online: https://www.ndrc.gov.cn/xxgk/jd/jd/202203/t20220315_1319459.html?code=&state=123 (accessed on 18 October 2022).

- Han, B. China’s Renewables 14th Five-Year Plan: Official Targets to be remarkably outpaced? S&P Global Commodity Insights. Available online: https://www.spglobal.com/commodityinsights/en/ci/research-analysis/chinas-renewables-14th-fiveyear-plan-official-targets.html (accessed on 4 January 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, Y.-s.; Chung, M.-k.; Tsang, K.-p. Electricity Market Reforms for Energy Transition: Lessons from China. Energies 2023, 16, 905. https://doi.org/10.3390/en16020905

Cheng Y-s, Chung M-k, Tsang K-p. Electricity Market Reforms for Energy Transition: Lessons from China. Energies. 2023; 16(2):905. https://doi.org/10.3390/en16020905

Chicago/Turabian StyleCheng, Yuk-shing, Man-kit Chung, and Kam-pui Tsang. 2023. "Electricity Market Reforms for Energy Transition: Lessons from China" Energies 16, no. 2: 905. https://doi.org/10.3390/en16020905

APA StyleCheng, Y.-s., Chung, M.-k., & Tsang, K.-p. (2023). Electricity Market Reforms for Energy Transition: Lessons from China. Energies, 16(2), 905. https://doi.org/10.3390/en16020905