Research on the Spillover Effect of China’s Carbon Market from the Perspective of Regional Cooperation

Abstract

1. Introduction

2. Literature Review

3. Methods and Data

3.1. Model

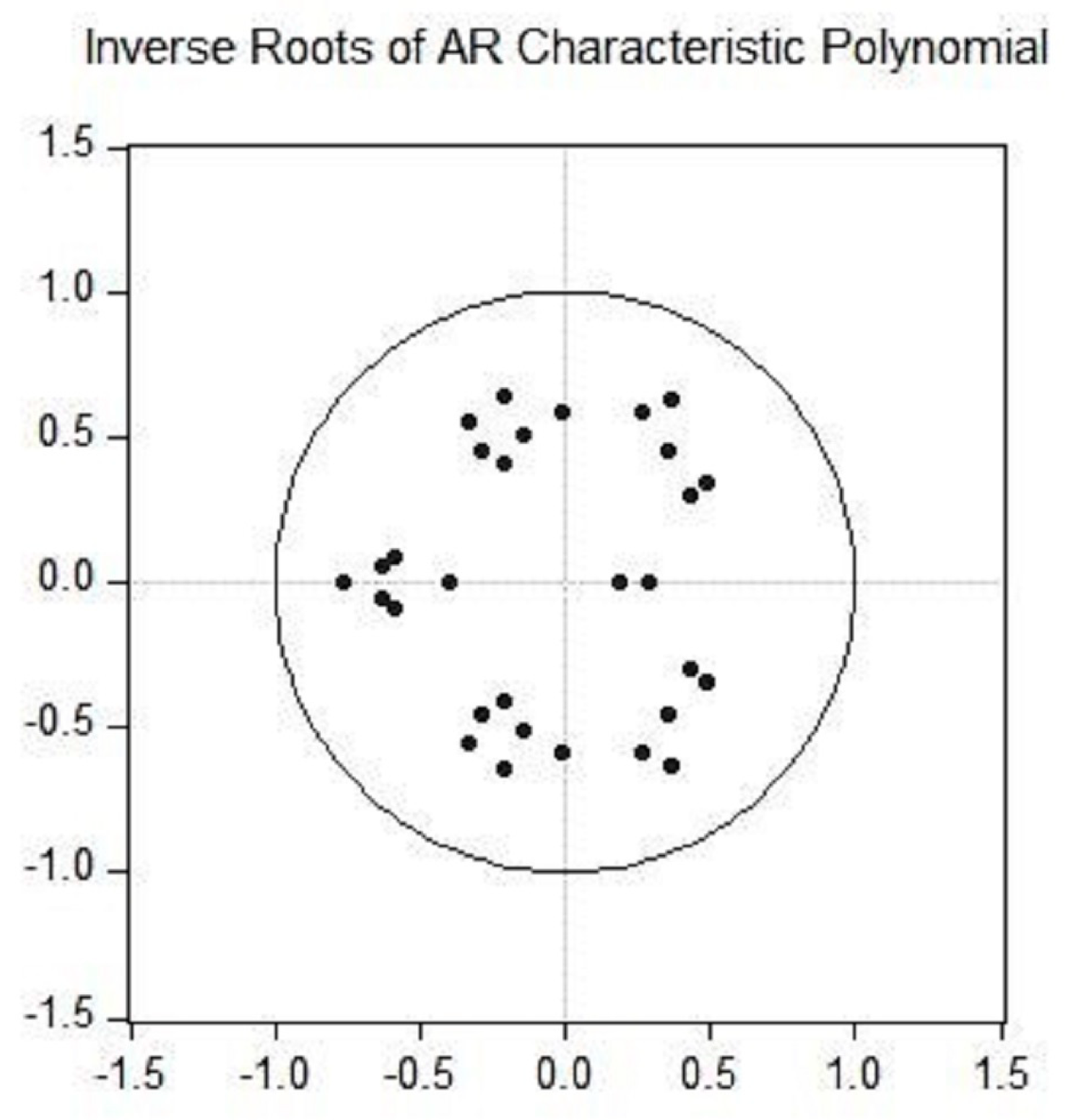

3.1.1. VAR-GARCH-BEKK

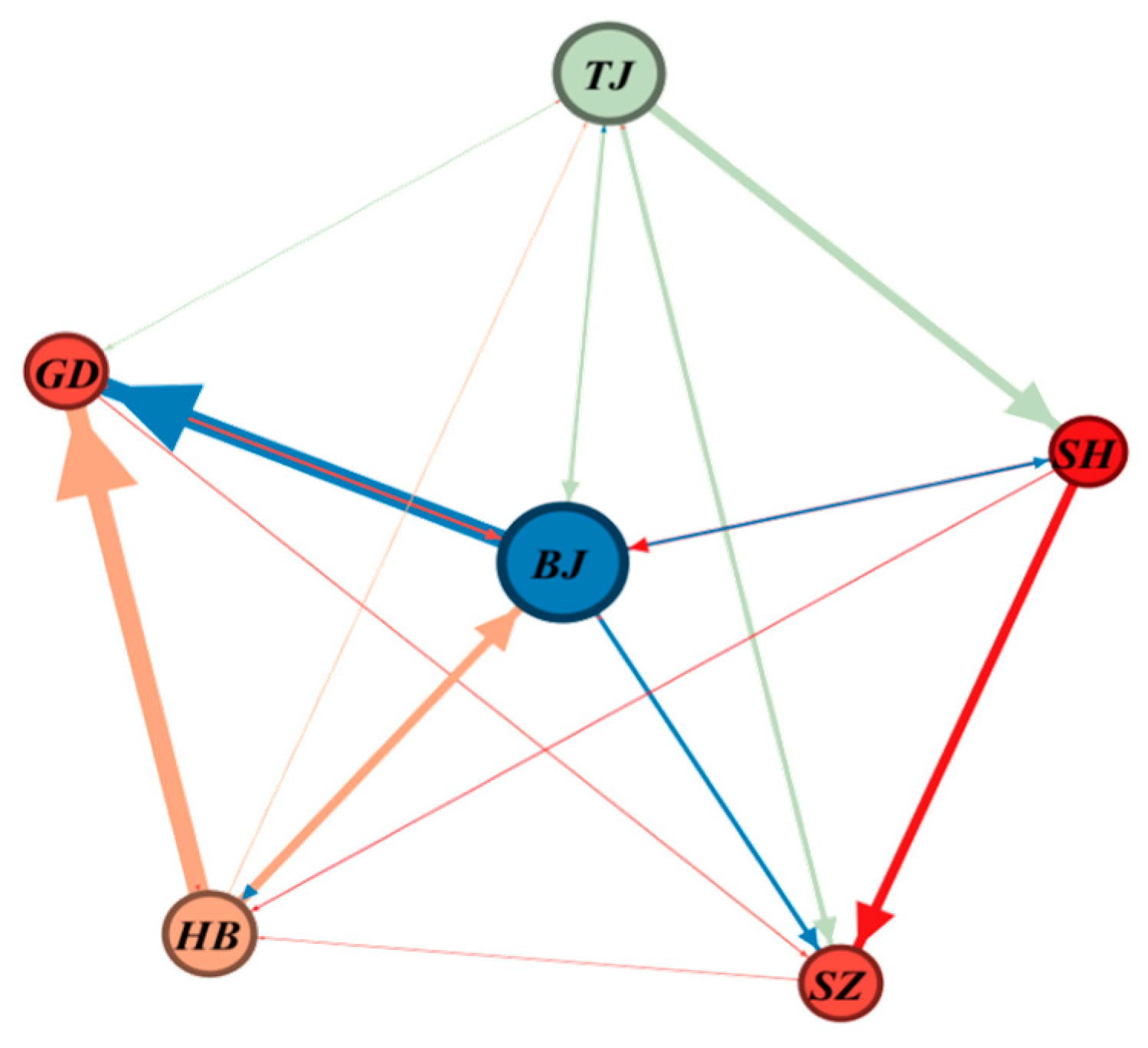

3.1.2. Social Network Analysis

3.2. Data Processing

3.2.1. Data Source

3.2.2. Data Processing

4. Results

4.1. Descriptive Statistics

4.2. Research on the Mean Spillover Effect

4.3. Research on Volatility Spillover Effects

4.4. Network Research on Spillover Effects between Markets

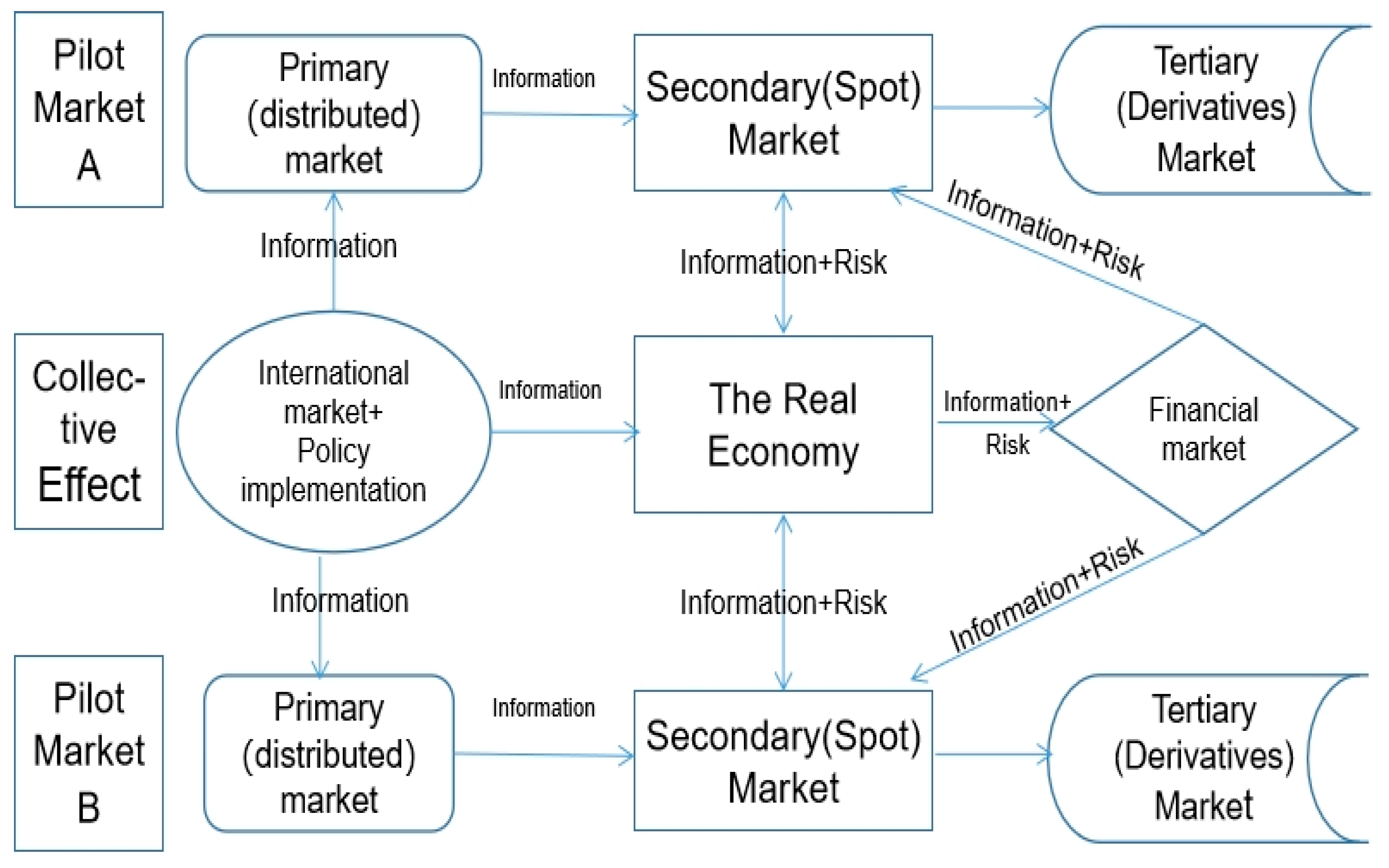

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations and Symbols

| Abbreviations | Symbols | ||

| SZ | Shenzhen | n-dimensional endogenous column vector | |

| BJ | Beijing | n-dimensional constant column vector | |

| SH | Shanghai | parameter matrix | |

| GD | Guangdong | n-dimensional random perturbation column vector | |

| TJ | Tianjin | abbreviation code of the city name of each carbon trading market | |

| HB | Hubei | the rate of return of market on day | |

| rsz | The average returns of Shenzhen carbon market | corresponding price | |

| rsh | The average returns of Shanghai carbon market | n-dimensional constant column vector | |

| rbj | The average returns of Beijing carbon market | ,,,, | parameter matrices |

| rgd | The average returns of Guangdong carbon market | Ht | A positive qualitative set of spillovers |

| rtj | The average returns of Tianjin carbon market | -dimensional lower triangular matrix | |

| rhb | The average returns of Hubei carbon market | parameter matrices | |

| parameter matrices | |||

| volatility spillover between each carbon market and itself | |||

| mutual volatility spillover between carbon markets | |||

| , | fluctuation effects for the market lag period | ||

| a series of carbon market returns | |||

| volatility spillover coefficient of variable to variable | |||

| , | volatility spillover coefficients | ||

References

- Zhang, X.; Loschel, A.; Lewis, J. Emissions Trading Systems for Global Low Carbon Energy and Economic Transformation. Appl. Energy 2020, 279, 115858. [Google Scholar] [CrossRef]

- Wang, X.X.; Huang, J.L.; Liu, H.D. Can China’s carbon trading policy help achieve Carbon Neutrality?—A study of policy effects from the Five-sphere Integrated Plan perspective. J. Environ. Manag. 2022, 305, 114357. [Google Scholar] [CrossRef]

- Strand, J.; Miller, S.; Siddiqui, S. Long-run carbon emission implications of energy-intensive infrastructure investments with a retrofit option. Energy Econ. 2014, 46, 308–317. [Google Scholar] [CrossRef]

- Wu, L.P.; Zhu, Q.Y. Impacts of the carbon emission trading system on China’s carbon emission peak: A new data-driven approach. Nat. Hazards 2021, 107, 2487–2515. [Google Scholar] [CrossRef] [PubMed]

- Gao, Z.; Geng, Y.; Wu, R.; Chen, W.; Wu, F.; Tian, X. Analysis of energy related CO2 emissions in China’s pharmaceutical industry and its driving forces. J. Clean. Prod. 2019, 223, 94–108. [Google Scholar] [CrossRef]

- Chang, K.; Ge, F.; Zhang, C.; Wang, W. The dynamic linkage effect between energy and emissions allowances price for regional emissions trading scheme pilots in China. Renew. Sustain. Energy Rev. 2018, 98, 415–425. [Google Scholar] [CrossRef]

- Goulder, L.H.; Morgenstern, R.D.; Munnings, C.; Schreifels, J. China’s national carbon dioxide emission trading system: An introduction. Econ. Energy Environ. Policy 2017, 6, 1–18. [Google Scholar] [CrossRef]

- Šerešová, M.; Kočí, V. Proposal of Package-to-Product Indicator for Carbon Footprint Assessment with Focus on the Czech Republic. Sustainability 2020, 12, 3034. [Google Scholar] [CrossRef]

- Pizer, W.A.; Zhang, X. China’s New National Carbon Market. AEA Pap. Proc. 2018, 108, 463–467. [Google Scholar] [CrossRef]

- Valerie, J.K. China’s Emissions Trading System: History, Current Status and Prospects; Harvard Climate Pact Project: Cambridge, MA, USA, 2021. [Google Scholar]

- Zou, S.H.; Zhang, T. Correlation and Dynamic Volatility Spillover between Green Investing Market, Coal Market, and CO2 Emissions: Evidence from Shenzhen Carbon Market in China. Adv. Civ. Eng. 2022, 2022, 7523563. [Google Scholar] [CrossRef]

- Tan, X.P.; Sirichand, K.; Vivian, A.; Wang, X. How connected is the carbon market to energy and financial markets? A systematic analysis of spillovers and dynamics. Energy Econ. 2020, 90, 104870. [Google Scholar] [CrossRef]

- Zhou, A.H.; Xin, L.; Li, J. Assessing the impact of the carbon market on the improvement of China’s energy and carbon emission performance. Energy 2022, 258, 124789. [Google Scholar] [CrossRef]

- Liu, Y.; Yang, X.Q.; Wang, M. Global Transmission of Returns among Financial, Traditional Energy, Renewable Energy and Carbon Markets: New Evidence. Energies 2021, 14, 7286. [Google Scholar] [CrossRef]

- Meng, B.; Chen, S.Y.; Yang, M.; Kuang, H. Spillover effects between the carbon and linear shipping markets under COVID-19: A time-varying frequency-domain analysis with applications in portfolio management. Ocean. Coast. Manag. 2022, 229, 106351. [Google Scholar] [CrossRef]

- Yu, L.; Li, J.J.; Tang, L. Dynamic volatility spillover effect analysis between carbon market and crude oil market: A DCC-ICSS approach. Int. J. Glob. Energy Issues 2015, 38, 242–256. [Google Scholar] [CrossRef]

- Song, X.; Geng, Y.; Li, K.; Zhang, X.; Wu, F.; Pan, H.Y.; Zhang, Y.Q. Does environmental infrastructure investment contribute to emissions reduction? A case of China. Front. Energy 2020, 14, 57–70. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Abakah, E.J.A.; Gabauer, D.; Dwumfour, R.A. Dynamic spillover effects among green bond, renewable energy stocks and carbon markets during COVID-19 pandemic: Implications for hedging and investments strategies. Glob. Financ. J. 2022, 51, 100692. [Google Scholar] [CrossRef]

- Ali, S.; Akter, S.; Ymeri, P.; Fogarassy, C. How the Use of Biomass for Green Energy and Waste Incineration Practice Will Affect GDP Growth in the Less Developed Countries of the EU (A Case Study with Visegrad and Balkan Countries). Energies 2022, 15, 2308. [Google Scholar] [CrossRef]

- Ali, S.; Akter, S.; Fogarassy, C. The Role of the Key Components of Renewable Energy (Combustible Renewables and Waste) in the Context of CO2 Emissions and Economic Growth of Selected Countries in Europe. Energies 2021, 14, 2034. [Google Scholar] [CrossRef]

- Xu, Y.Y. Risk spillover from energy market uncertainties to the Chinese carbon market. Pac. Basin Financ. J. 2021, 67, 101561. [Google Scholar] [CrossRef]

- Qiao, S.; Zhao, C.X.; Zhang, K.Q.; Ren, Z.Y. Research on Time-Varying Two-Way Spillover Effects Between Carbon and Energy Markets: Empirical Evidence From China. Front. Energy Res. 2021, 832. [Google Scholar] [CrossRef]

- Sun, X.; Li, H.H.; Xu, L.T. The Time-Varying Spillover Effects between China’s Carbon Markets and Energy Market: Evidence Using the TVP-DY Index Mode. Am. J. Ind. Bus. Manag. 2022, 12, 1105–1124. [Google Scholar] [CrossRef]

- Ma, Y.; Wang, L.; Zhang, T. Research on the dynamic linkage among the carbon emission trading, energy and capital markets. J. Clean. Prod. 2020, 272, 122717. [Google Scholar] [CrossRef]

- Yang, L. Idiosyncratic information spillover and connectedness network between the electricity and carbon markets in Europe. J. Commod. Mark. 2021, 25, 100185. [Google Scholar] [CrossRef]

- Yuan, N.N.; Yang, L. Asymmetric risk spillover between financial market uncertainty and the carbon market: A GAS–DCS–copula approach. J. Clean. Prod. 2020, 259, 120750. [Google Scholar] [CrossRef]

- Jin, J.; Han, L.Y.; Wu, L.; Zeng, H.C. The hedging effect of green bonds on carbon market risk. Int. Rev. Financ. Anal. 2020, 71, 101509. [Google Scholar] [CrossRef]

- Ren, X.F. The interrelationship between the carbon market and the green bonds market: Evidence from wavelet quantile-on-quantile method. Technol. Forecast. Soc. Change 2022, 179, 121611. [Google Scholar] [CrossRef]

- Fang, G.C.; He, Y.; Zhang, Y. Research on the driving mechanism and regional synergy path of carbon trading. Coal Econ. Res. 2020, 40, 37–46. [Google Scholar]

- Xu, Y.Y.; Salem, S. Explosive behaviors in Chinese carbon markets: Are there price bubbles in eight pilots? Renew. Sustain. Energy Rev. 2021, 145, 111089. [Google Scholar] [CrossRef]

- Wang, Z.H.; Hu, Y. Analysis of Influencing Factors of Carbon Emissions Trading Price in China. Ind. Technol. Econ. 2018, 37, 128–136. [Google Scholar]

- Li, Y.; Zheng, P.J. Research on the volatility characteristics of China’s carbon emission trading market returns. Sci. Technol. Manag. Land Resour. 2020, 37, 74–81. [Google Scholar]

- Fan, Y.; Mo, J.L. Major issues and suggestions on top-level design of China’s carbon market. Proc. Chin. Acad. Sci. 2015, 30, 492–502. [Google Scholar]

- Zhang, W. Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy 2020, 196, 117117. [Google Scholar] [CrossRef]

- Zhu, B.; Huang, L.; Yuan, L.; Ye, S.; Wang, P. Exploring the risk spillover effects between carbon market and electricity market: A bidimensional empirical mode decomposition based conditional value at risk approach. Int. Rev. Econ. Financ. 2020, 67, 163–175. [Google Scholar] [CrossRef]

- Zhu, B.Z.; Zhou, X.X.; Liu, X.F.; Wang, H.F.; He, K.J.; Wang, P. Exploring the risk spillover effects among China’s pilot carbon markets: A regular vine copula-CoES approach. J. Clean. Prod. 2020, 242, 118455. [Google Scholar] [CrossRef]

- Pan, C.Y. A Linkage Framework for the China National Emission Trading System (CETS): Insight from Key Global Carbon Markets. Sustainability 2021, 13, 7459. [Google Scholar] [CrossRef]

- Deng, M.Z.; Zhang, W.X. Recognition and analysis of potential risks in China’s carbon emission trading markets. Adv. Clim. Change Res. 2019, 10, 30–46. [Google Scholar] [CrossRef]

- Chen, X.; Lin, B.Q. Towards carbon neutrality by implementing carbon emissions trading scheme: Policy evaluation in China. Energy Policy 2021, 157, 112510. [Google Scholar] [CrossRef]

- Yi, L. Evaluation on the effectiveness of China’s pilot carbon market policy. J. Clean. Prod. 2020, 246, 119039. [Google Scholar] [CrossRef]

- Guo, L.Y.; Feng, C. Are there spillovers among China’s pilots for carbon emission allowances trading? Energy Econ. 2021, 103, 105574. [Google Scholar] [CrossRef]

- Peng, W.Y.; Chen, S.Y. Analysis and forecast of carbon trading price in China’s carbon emission pilot market. Tech. Econ. 2020, 39, 102–110. [Google Scholar]

- Ji, C.-J.; Hu, Y.-J.; Tang, B.-J.; Qu, S. Price Drivers in the Carbon Emissions Trading Scheme: Evidence from Chinese Emissions Trading Scheme Pilots. J. Clean. Prod. 2021, 278, 123469. [Google Scholar] [CrossRef]

- Jiang, Y. Factors affecting the pilot trading market of carbon emissions in China. Pet. Sci. 2018, 15, 412–420. [Google Scholar] [CrossRef]

- Li, F.F.; Jiang, H.; Xu, Z.S. Characteristics of price fluctuations in carbon emission trading in pilot areas in China—Analysis based on GARCH family model and value-at-risk VAR. J. Jinling Inst. Sci. Technol. 2019, 33, 35–40. [Google Scholar]

- Chen, Y.Q. Efficiency of China’s carbon market: A case study of Hubei pilot market. Energy 2021, 222, 119946. [Google Scholar] [CrossRef]

- Fan, L.L.; Liu, L. Analysis of China’s carbon price yield fluctuation based on ARMA-GARCH model. Economics 2020, 25–32. [Google Scholar]

- Wang, Q.; Gao, C.Y. Research on the Spillover Effect of China’s Pilot Carbon Markets—Based on the Six-Element VAR-GARCH-BEKK Model and Social Network Analysis. J. Wuhan Univ. 2016, 69, 57–67. [Google Scholar]

- Zhao, L.L.; Wen, F.H.; Wang, X. Interaction among China carbon emission trading markets: Nonlinear Granger causality and time-varying effect. Energy Econ. 2020, 91, 104901. [Google Scholar] [CrossRef]

- Jiang, Y.H.; Liu, L.; Cheng, J. A study on the volatility spillover effect between China’s carbon markets from the perspective of time and frequency. Soft Sci. 2022, 1–18. [Google Scholar]

- Peng, H.F.; Ma, S.Q. Research on the dynamic spillover effect between China’s carbon trading markets. Account. Econ. Res. 2022, 36, 74–92. [Google Scholar]

- Doan, T.; Litterman, R.B.; Sims, C.A. Forecasting and conditional projection using realistic prior distributions. Econom. Rev. 1984, 3, 1–100. [Google Scholar] [CrossRef]

- Lin, H.; Lin, L.; Jia, B.; Zhu, Z.Q. Review and Prospect of Domestic Social Network Analysis Application Researc—Based on CiteSpaceIII Quantitative Analysis. J. Subtrop. Resour. Environ. 2018, 13, 85–94. [Google Scholar]

- Song, X.; Geng, Y.; Dong, H.; Chen, W. Social network analysis on industrial symbiosis: A case of Gujiao eco-industrial park. J. Clean. Prod. 2018, 193, 414–423. [Google Scholar] [CrossRef]

- Watson, D.; Krug, M.; Carbon, C. The relationship between citations and the linguistic traits of specific academic discourse communities identified by using social network analysis. Scientometrics 2022, 127, 1755–1781. [Google Scholar] [CrossRef]

- Wang, W.J.; Zhao, Y. Global carbon market research and enlightenment to China’s carbon market construction. Northeast. Asia Forum 2019, 28, 97–112. [Google Scholar]

- Zhou, X.; Wu, X.; Ding, P.; Li, X.; He, N.; Zhang, G.; Zhang, X. Research on Transformer Partial Discharge UHF Pattern Recognition Based on Cnn-lstm. Energies 2020, 13, 61. [Google Scholar] [CrossRef]

- Lv, J.Y.; Cao, M.; Zhang, J.S.; Fan, X.F. Research on the price volatility of China’s carbon emission rights market based on wavelet multi-resolution. Syst. Eng. Theory Pract. 2021, 41, 1699–1708. [Google Scholar]

- Kaifeng, L.; Chuanzhe, L. Construction of Carbon Finance System and Promotion of Environmental Finance Innovation in China. Energy Procedia 2011, 5, 1065–1072. [Google Scholar] [CrossRef]

| Carbon Market | Abbreviation Code | Opening Day | Sample Interval | Number of Samples |

|---|---|---|---|---|

| Shenzhen | SZ | 19 June 2013 | 2 April 2014 to 29 October 2021 | 1827 |

| Beijing | BJ | 28 November 2013 | 2 April 2014 to 29 October 2021 | 1827 |

| Shanghai | SH | 19 December 2013 | 2 April 2014 to 29 October 2021 | 1827 |

| Guangdong | GD | 19 December 2013 | 2 April 2014 to 29 October 2021 | 1827 |

| Tianjin | TJ | 26 December 2013 | 2 April 2014 to 29 October 2021 | 1827 |

| Hubei | HB | 2 April 2014 | 2 April 2014 to 29 October 2021 | 1827 |

| Variable | Average Value | Standard Deviation | Skewness | Kurtosis | JB Value | ADF Test |

|---|---|---|---|---|---|---|

| rsz | −0.123541 | 31.36912 | 0.397249 | 25.73365 | 39369.34 | −31.31352 *** |

| rsh | 0.001237 | 6.108674 | 1.746293 | 76.65056 | 413634.9 | −45.38217 *** |

| rbj | 0.005201 | 6.474637 | −0.508336 | 9.195862 | 2999.383 | −44.90281 *** |

| rgd | −0.027468 | 17.66717 | −0.463345 | 45.03286 | 134486.4 | −20.18001 *** |

| rtj | −0.017915 | 4.595567 | 0.034742 | 111.3978 | 893985.5 | −47.51752 *** |

| rhb | 0.027724 | 3.909783 | 0.079718 | 9.703824 | 3421.214 | −36.47516 *** |

| Market Variables | rsz | rsh | rbj | rgd | rtj | rhb |

|---|---|---|---|---|---|---|

| rsz | 1.0102 | 0.3470 | 1.9323 * | 2.8091 ** | 3.5259 *** | |

| rsh | 0.4634 | 1.0300 | 2.1775 * | 0.7203 | 0.3837 | |

| rbj | 0.8852 | 0.8097 | 1.0963 | 0.5633 | 1.0385 | |

| rgd | 0.9105 | 1.7058 | 1.2616 | 0.1942 | 0.3779 | |

| rtj | 0.1795 | 9.5647 *** | 2.1685 * | 1.1246 | 2.7937 ** | |

| rhb | 0.7302 | 1.2341 | 0.4252 | 4.0023 *** | 2.2786 ** |

| A | rsz | rsh | rbj | rgd | rtj | rhb | |

| rsz | 0.2737 *** | 0.0015 | −0.0117 *** | 0.0079 | 0.0055 *** | −0.0094 *** | |

| rsh | 0.1589 *** | 0.4025 *** | 0.0994 *** | −0.0020 | −0.0081 | −0.0309 *** | |

| rbj | 0.1756 *** | 0.0436*** | 0.2634 *** | 0.3939 *** | −0.0015 | 0.0451 *** | |

| rgd | 0.0318 | 0.0011 | 0.0439 *** | 0.6236 *** | −0.0002 | 0.0064 | |

| rtj | 0.1997 *** | 0.3597 *** | −0.0101 | 0.0299 | 0.4677 *** | −0.0061 | |

| rhb | 0.0339 | 0.0291 | −0.1116 *** | 0.0781 | 0.0055 | 0.5987 *** | |

| B | rsz | rsh | rbj | rgd | rtj | rhb | |

| rsz | 0.9638 *** | −0.0013 | −0.0037 | −0.0007 | −0.0015 *** | 0.0037 *** | |

| rsh | −0.2337 *** | 0.4696 *** | −0.0444 *** | −0.0376 | 0.0061 | −0.0132 | |

| rbj | −0.0734 | −0.0595 *** | −0.9227 *** | 0.3956 *** | 0.0288 *** | 0.0784 *** | |

| rgd | −0.0402 *** | −0.0014 | 0.0578 *** | 0.7802 *** | −0.0021 *** | −0.0193 *** | |

| rtj | −0.0360 *** | −0.0876 *** | 0.1740 *** | −0.0550 *** | 0.9355 *** | 0.0048 | |

| rhb | 0.0354 | 0.0358 | 0.2755 *** | 0.8291 *** | −0.0197 *** | 0.4114 *** |

| One-way spillover | Shanghai→Shenzhen 70.5392 *** | Tianjin→Shanghai 161.0404 *** |

| Shenzhen→Hubei 17.9050 *** | Hubei→Beijing 174.8486 *** | |

| Two-way spillover | ||

| Shenzhen→Tianjin 46.4942 *** | Tianjin→Shenzhen 13.4369 *** | Shenzhen ⇌Tianjin 58.64784 *** |

| Shanghai→Beijing 94.7533 *** | Beijing→Shanghai 10.0796 *** | Shanghai ⇌Beijing 105.8683 *** |

| Beijing→Guangdong 477.125 *** | Guangdong→Beijing 73.8282 *** | Beijing ⇌Guangdong 516.3152 *** |

| rsz | rsh | rbj | rgd | rtj | rhb | |

|---|---|---|---|---|---|---|

| rsz | - | - | 0.0117 | - | 0.007 | 0.0131 |

| rsh | 0.3926 | - | 0.1438 | - | - | 0.0309 |

| rbj | 0.1756 | 0.1031 | - | 0.7895 | 0.0288 | 0.1235 |

| rgd | 0.0402 | - | 0.1017 | - | 0.0021 | 0.0193 |

| rtj | 0.2357 | 0.4473 | 0.174 | 0.055 | - | - |

| rhb | - | - | 0.3871 | 0.8291 | 0.0197 | - |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, J.; Ding, X.; Song, X.; Dong, T.; Zhao, A.; Tan, M. Research on the Spillover Effect of China’s Carbon Market from the Perspective of Regional Cooperation. Energies 2023, 16, 740. https://doi.org/10.3390/en16020740

Liu J, Ding X, Song X, Dong T, Zhao A, Tan M. Research on the Spillover Effect of China’s Carbon Market from the Perspective of Regional Cooperation. Energies. 2023; 16(2):740. https://doi.org/10.3390/en16020740

Chicago/Turabian StyleLiu, Jing, Xin Ding, Xiaoqian Song, Tao Dong, Aiwen Zhao, and Mi Tan. 2023. "Research on the Spillover Effect of China’s Carbon Market from the Perspective of Regional Cooperation" Energies 16, no. 2: 740. https://doi.org/10.3390/en16020740

APA StyleLiu, J., Ding, X., Song, X., Dong, T., Zhao, A., & Tan, M. (2023). Research on the Spillover Effect of China’s Carbon Market from the Perspective of Regional Cooperation. Energies, 16(2), 740. https://doi.org/10.3390/en16020740