Robust Multiobjective Decision Making in the Acquisition of Energy Assets

Abstract

1. Introduction

2. Theoretical Reference

2.1. Private Investments in Energy

2.2. Generalization of the Classical Approach to Dealing with Information Uncertainty

- The minimum level of objective function:which is the most optimistic estimate if the objective function is to be minimized or the most pessimistic estimate if the objective function is to be maximized;

- The maximum level of objective function:which is the most optimistic estimate for the maximized objective function or the most pessimistic estimate if the objective function is to be minimized;

- The average level of objective function:

- The maximum level of regret:where is an excess of expenses that occur under the combination of the state of nature and the choice of the solution alternative instead of the solution alternative that is locally optimal for the given .

- The first step involves constructing q payoff matrices, corresponding to the number of objective functions. These matrices account for all combinations of solution alternatives and the representative states of nature . To construct payoff matrices, it is necessary to solve q multicriteria problems formalized within the framework of models. By solving them, it is possible to obtain the solution alternatives (). After that, are substituted for . These substitutions generate q payoff matrices;

- The second step is related to the analysis of the obtained payoff matrices. The execution of this phase is based on the approach proposed in [11] discussed above. However, the insufficient resolving capacity of this phase may lead to non-unique or not well-distinguished solutions, and this circumstance demands the application of the third phase;

- The third step is associated with the construction and analysis of models [11,22] for the subsequent contraction of decision uncertainty regions. The use of models allows taking into account indices of quantitative character and qualitative character, based on the knowledge, experience, and intuition of the involved experts

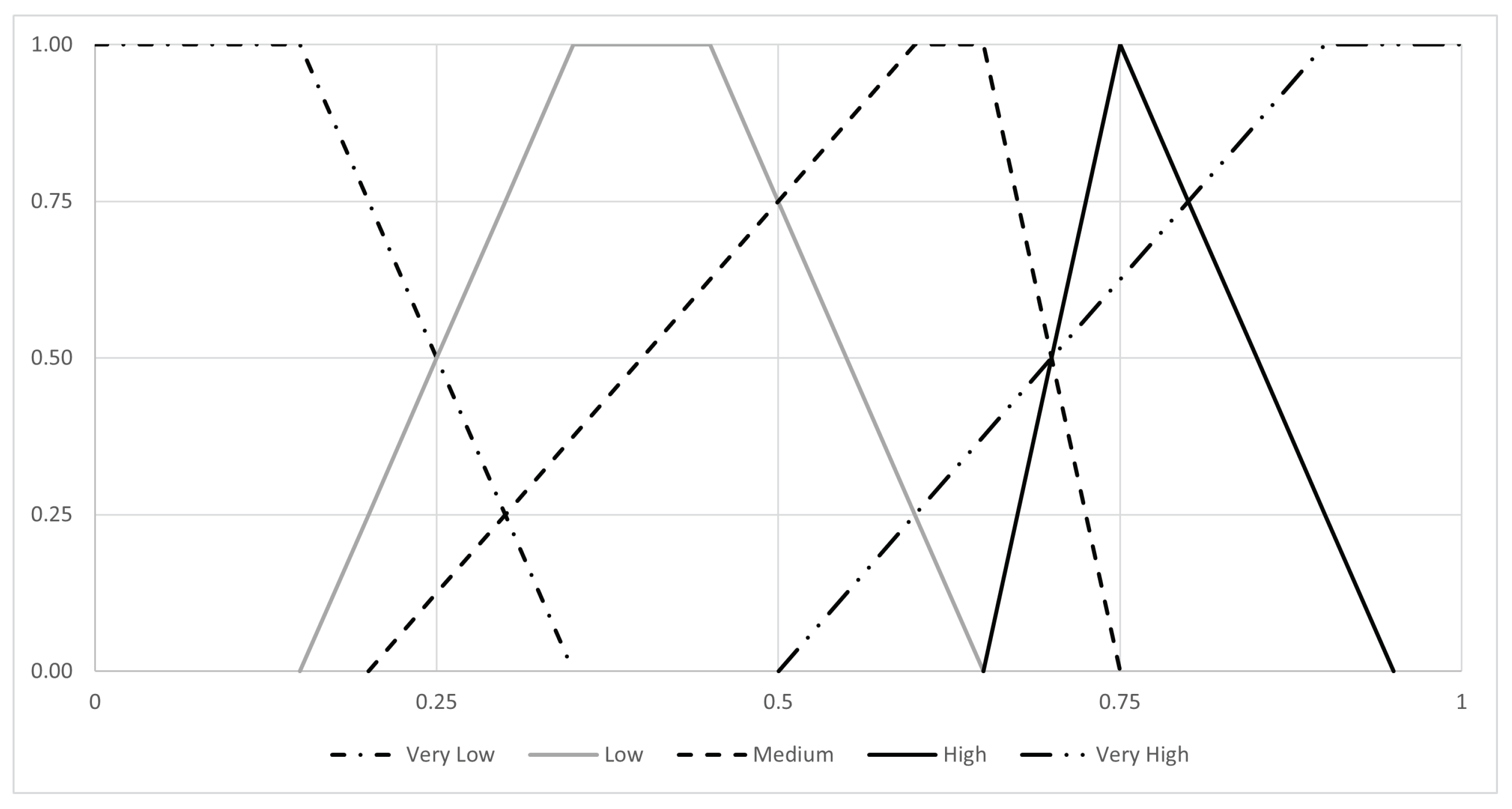

2.3. Decision-Making Models

3. Objectives in Energy Investments

- Prioritize alternatives that have the greatest synergy with the portfolio’s resources;

- Prioritize alternatives with the lowest operational risk.

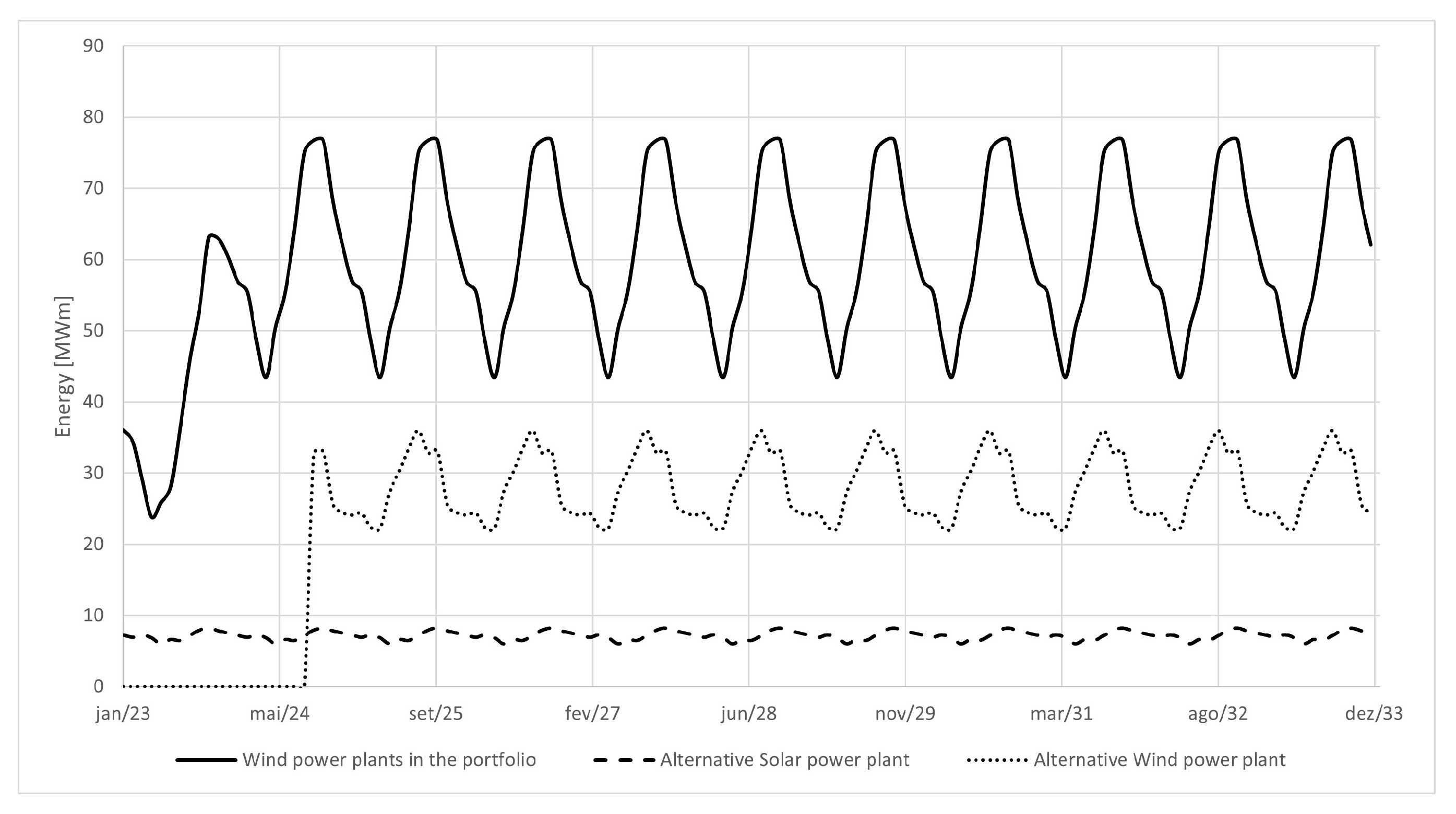

4. Application Example

- : Maintain the current portfolio;

- : Current portfolio with the addition of the solar plant with a contract sale of 100% of its physical guarantee;

- : Current portfolio with the addition of the wind plant with a contract sale of 100% of its physical guarantee;

- : Current portfolio with the addition of the wind plant with a contract sale of 80% of its physical guarantee;

- : Current portfolio with the addition of the wind plant with a contract sale of 50% of its physical guarantee;

- : Current portfolio with the addition of the wind and solar plants with a contract sale of 100% of their physical guarantees;

- : Current portfolio with the addition of the solar plant with a contract sale of 75% of its physical guarantee;

- : Current portfolio with the addition of the solar plant with a contract sale of 75% of its physical guarantee and the wind plant with a contract sale of 80% of its physical guarantee.

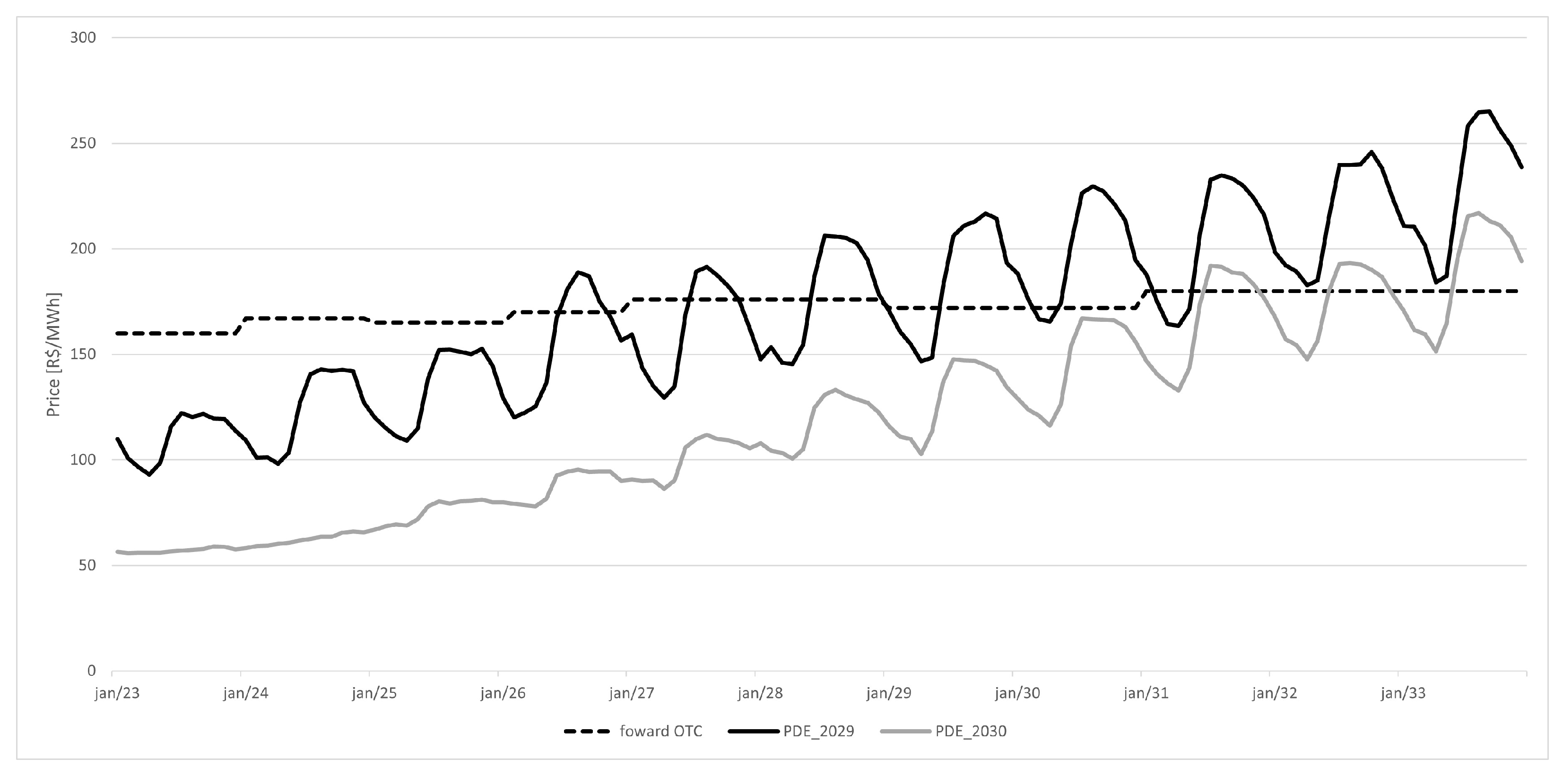

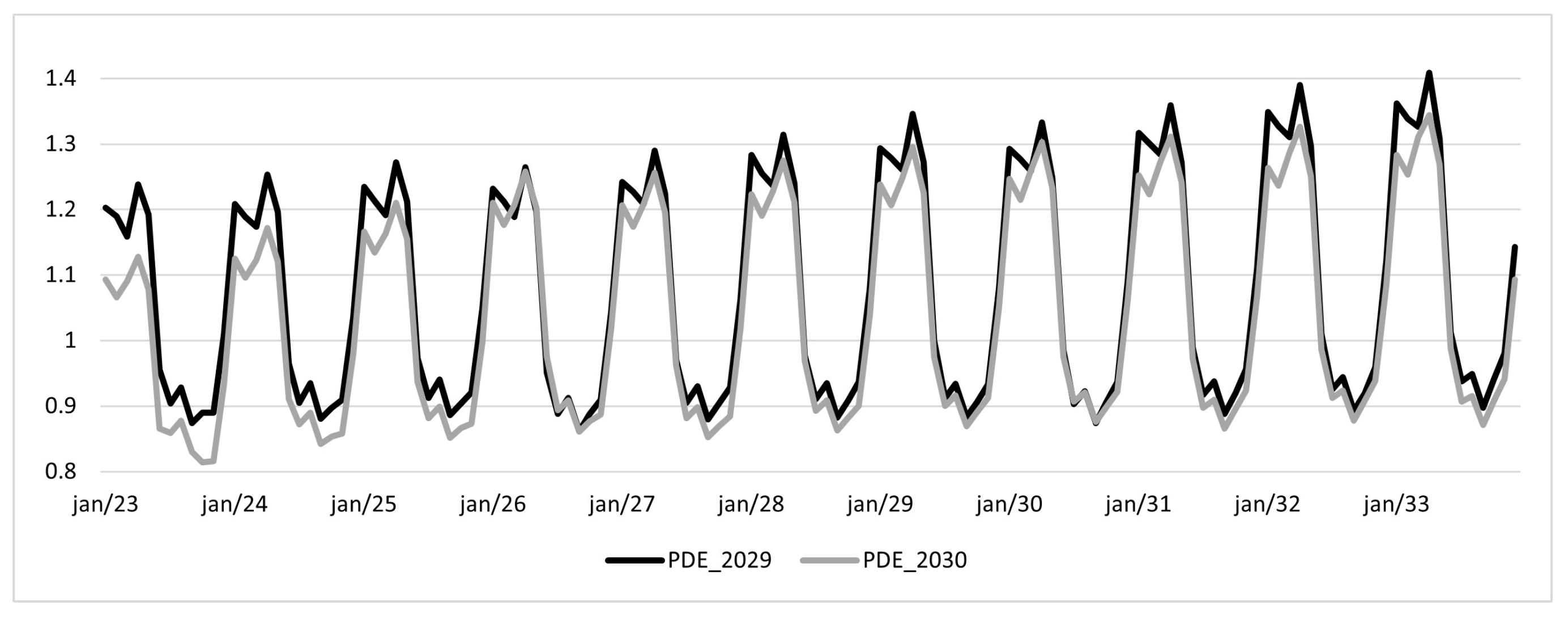

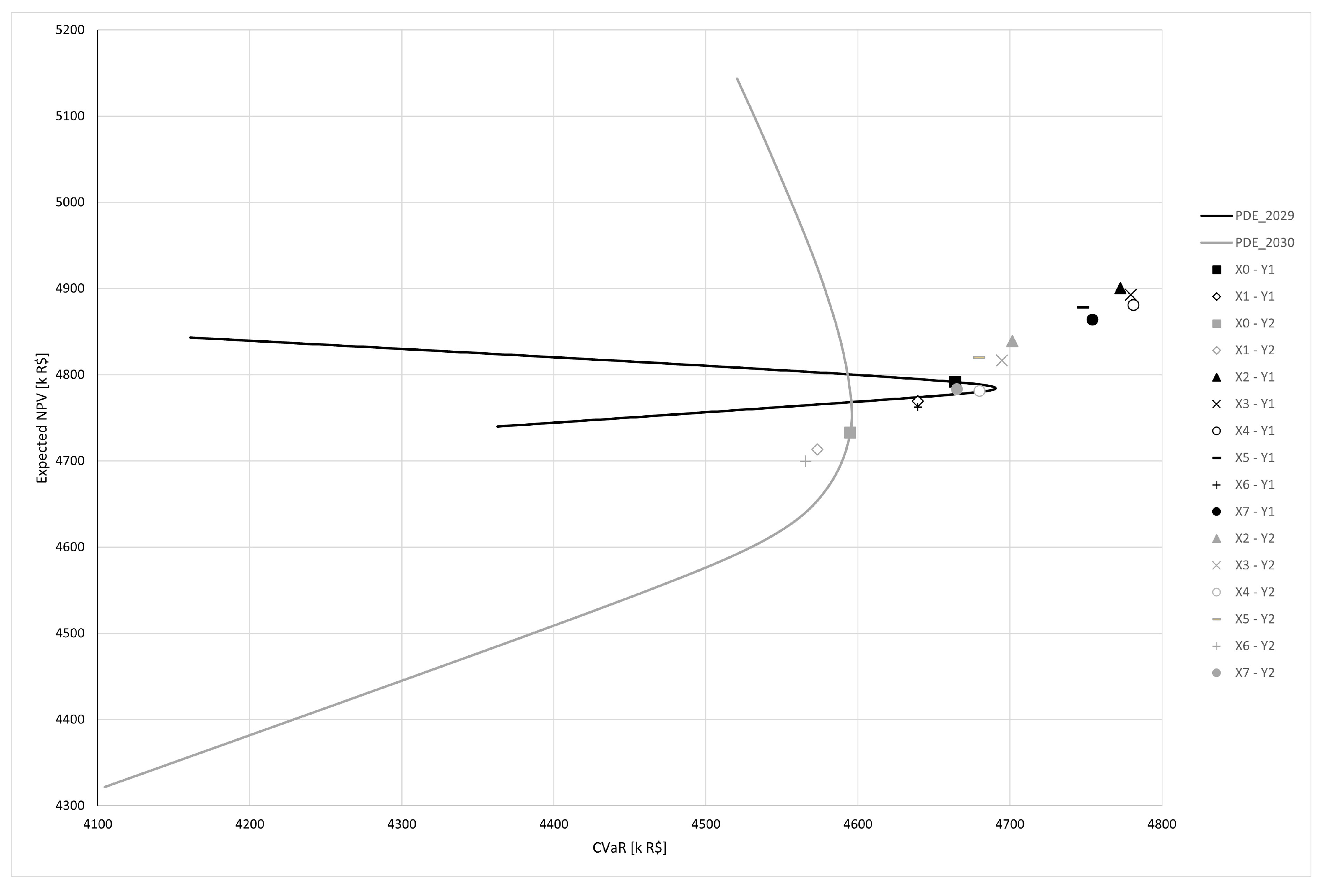

5. Results

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| CVaR | conditional value at risk |

| GSF | generation scaling factor |

| InS | insurance index |

| MRE | energy reallocation mechanism |

| NPV | net present value |

| PLD | settlement price for differences |

| OTC | over the counter |

| RaR | revenue at risk |

| VaR | value at risk |

References

- Božić, Z.; Dobromirov, D.; Arsić, J.; Radišić, M.; Ślusarczyk, B. Power Exchange Prices: Comparison of Volatility in European Markets. Energies 2020, 13, 5620. [Google Scholar] [CrossRef]

- Sadeghi, M.; Shavvalpour, S. Energy risk management and value at risk modeling. Energy Policy 2006, 34, 3367–3373. [Google Scholar] [CrossRef]

- Weron, R. Energy price risk management. Phys. A Stat. Mech. Its Appl. 2000, 285, 127–134. [Google Scholar] [CrossRef]

- Chawda, S.; Bhakar, R.; Mathuria, P. Uncertainty and risk management in electricity market: Challenges and opportunities. In Proceedings of the 2016 National Power Systems Conference (NPSC), Bhubaneswar, India, 19–21 December 2016; pp. 1–6. [Google Scholar] [CrossRef]

- Dahlgren, R.; Liu, C.C.; Lawarree, J. Risk assessment in energy trading. IEEE Trans. Power Syst. 2003, 18, 503–511. [Google Scholar] [CrossRef]

- Denton, M.; Palmer, A.; Masiello, R.; Skantze, P. Managing market risk in energy. IEEE Trans. Power Syst. 2003, 18, 494–502. [Google Scholar] [CrossRef]

- Pérez Odeh, R.; Watts, D.; Negrete-Pincetic, M. Portfolio applications in electricity markets review: Private investor and manager perspective trends. Renew. Sustain. Energy Rev. 2018, 81, 192–204. [Google Scholar] [CrossRef]

- Fu, Y.; Sun, Q.; Wennersten, R. Effectiveness of the CVaR method in risk management in an integrated energy system. Energy Rep. 2020, 6, 1010–1015. [Google Scholar] [CrossRef]

- Peixoto, G.M.; Pereira, R.B.; da Silva Amorim, L.; Machado-Coelho, T.M.; Soares, G.L.; Parma, G.G. Analysis of the Participation of Small Hydroelectric Power Plants in the Energy Reallocation Mechanism (in portuguese). In Proceedings of the 14º Simpósio Brasileiro de Automação Inteligente, Ouro Preto, Brazil, 27–30 October 2019; pp. 1–7. [Google Scholar] [CrossRef]

- Gökgöz, F.; Atmaca, M.E. Portfolio optimization under lower partial moments in emerging electricity markets: Evidence from Turkey. Renew. Sustain. Energy Rev. 2017, 67, 437–449. [Google Scholar] [CrossRef]

- Ekel, P.; Pedrycz, W.; Pereira, J. Multicriteria Decision-Making under Conditions of Uncertainty: A Fuzzy Set Perspective; John Wiley & Sons: Hoboken, NJ, USA, 2020. [Google Scholar]

- Maceiral, M.; Penna, D.; Diniz, A.; Pinto, R.; Melo, A.; Vasconcellos, C.; Cruz, C. Twenty Years of Application of Stochastic Dual Dynamic Programming in Official and Agent Studies in Brazil-Main Features and Improvements on the NEWAVE Model. In Proceedings of the 2018 Power Systems Computation Conference (PSCC), Dublin, Ireland, 11–15 June 2018; pp. 1–7. [Google Scholar] [CrossRef]

- Ramalho, F.D.; Ekel, P.Y.; Pedrycz, W.; Pereira Júnior, J.G.; Soares, G.L. Multicriteria decision making under conditions of uncertainty in application to multiobjective allocation of resources. Inf. Fusion 2019, 49, 249–261. [Google Scholar] [CrossRef]

- Abba, Z.; Balta-Ozkan, N.; Hart, P. A holistic risk management framework for renewable energy investments. Renew. Sustain. Energy Rev. 2022, 160, 112305. [Google Scholar] [CrossRef]

- Camargo, L.A.S.; Leonel, L.D.; Rosa, P.S.; Ramos, D.S. Optimal Portfolio Selection of Wind Power Plants Using a Stochastic Risk-Averse Optimization Model, Considering the Wind Complementarity of the Sites and a Budget Constraint. Energy Power Eng. 2020, 12, 459–476. [Google Scholar] [CrossRef]

- Bradshaw, A. Regulatory change and innovation in Latin America: The case of renewable energy in Brazil. Util. Policy 2017, 49, 156–164. [Google Scholar] [CrossRef]

- Ilbahar, E.; Kahraman, C.; Cebi, S. Risk assessment of renewable energy investments: A modified failure mode and effect analysis based on prospect theory and intuitionistic fuzzy AHP. Energy 2022, 239, 1–11. [Google Scholar] [CrossRef]

- Martínez, L.; Dinçer, H.; Yüksel, S. A hybrid decision making approach for new service development process of renewable energy investment. Appl. Soft Comput. 2023, 133, 1–17. [Google Scholar] [CrossRef]

- de Freitas, R.A.; Vogel, E.P.; Korzenowski, A.L.; Oliveira Rocha, L.A. Stochastic model to aid decision making on investments in renewable energy generation: Portfolio diffusion and investor risk aversion. Renew. Energy 2020, 162, 1161–1176. [Google Scholar] [CrossRef]

- Yang, L.; Sun, Q.; Zhang, N.; Li, Y. Indirect Multi-Energy Transactions of Energy Internet with Deep Reinforcement Learning Approach. IEEE Trans. Power Syst. 2022, 37, 4067–4077. [Google Scholar] [CrossRef]

- Wang, L.; Zhou, Q.; Xiong, Z.; Zhu, Z.; Jiang, C.; Xu, R.; Li, Z. Security constrained decentralized peer-to-peer transactive energy trading in distribution systems. CSEE J. Power Energy Syst. 2022, 8, 188–197. [Google Scholar] [CrossRef]

- Pedrycz, W.; Ekel, P.; Parreiras, R. Fuzzy Multicriteria Decision-Making: Models, Methods and Applications; John Wiley & Sons: Hoboken, NJ, USA, 2011. [Google Scholar]

- Santos, F.F.G.D.; Vieira, D.A.G.; Saldanha, R.R.; Lisboa, A.C.; de Castro Lobato, M.V. Seasonal energy trading portfolio based on multiobjective optimisation. Int. J. Logist. Syst. Manag. 2014, 17, 180. [Google Scholar] [CrossRef]

- Luce, R.; Raiffa, H. Games and Decisions; John Wiley & Sons: Hoboken, NJ, USA, 1957. [Google Scholar]

- Raiffa, H. Decision Analysis: Introductory Lectures on Choices under Uncertainty; Addison-Wesley: Boston, MA, USA, 1968. [Google Scholar]

- Belyaev, L.S. A Practical Approach to Choosing Alternative Solutions to Complex Optimization Problems under Uncertainty. Int. Inst. Appl. Syst. Anal. 1977, 1, 1–60. [Google Scholar]

- Hodges, J.L.; Lehmann, E.L. The use of Previous Experience in Reaching Statistical Decisions. Ann. Math. Stat. 1952, 23, 396–407. [Google Scholar] [CrossRef]

- Trukhaev, R. Models of Decision Making in Conditions of Uncertainty; Nauka: Moscow, Russia, 1981. [Google Scholar]

- Figueiredo, L.R.; Frej, E.A.; Soares, G.L.; Ekel, P.Y. Group Decision-Based Construction of Scenarios for Multicriteria Analysis in Conditions of Uncertainty on the Basis of Quantitative and Qualitative Information. Group Decis. Negot. 2021, 30, 665–696. [Google Scholar] [CrossRef]

- Ekel, P. Fuzzy sets and models of decision making. Comput. Math. Appl. 2002, 44, 863–875. [Google Scholar] [CrossRef]

- Bellman, R.E.; Zadeh, L.A. Decision-Making in a Fuzzy Environment. Manag. Sci. 1970, 17, 141–164. [Google Scholar] [CrossRef]

- Ekel, P.; Kokshenev, I.; Parreiras, R.; Pedrycz, W.; Pereira, J., Jr. Multiobjective and multiattribute decision making in a fuzzy environment and their power engineering applications. Inf. Sci. 2016, 361-362, 100–119. [Google Scholar] [CrossRef]

- Pereira, J.; Ekel, P.; Palhares, R.; Parreiras, R. On multicriteria decision making under conditions of uncertainty. Inf. Sci. 2015, 324, 44–59. [Google Scholar] [CrossRef]

- Ralston, B.; Wilson, I. The Scenario Planning Handbook; South-Western: Nashville, TN, USA, 2006. [Google Scholar]

- Amer, M.; Daim, T.U.; Jetter, A. A review of scenario planning. Futures 2013, 46, 23–40. [Google Scholar] [CrossRef]

- Ekel, P.; Martins, C.; Pereira, J.; Palhares, R.; Canha, L. Fuzzy set based multiobjective allocation of resources and its applications. Comput. Math. Appl. 2006, 52, 197–210. [Google Scholar] [CrossRef][Green Version]

- Yager, R. On ordered weighted averaging aggregation operators in multicriteria decisionmaking. IEEE Trans. Syst. Man Cybern. 1988, 18, 183–190. [Google Scholar] [CrossRef]

- Pinheiro Neto, D.; Domingues, E.G.; Coimbra, A.P.; de Almeida, A.T.; Alves, A.J.; Calixto, W.P. Portfolio optimization of renewable energy assets: Hydro, wind, and photovoltaic energy in the regulated market in Brazil. Energy Econ. 2017, 64, 238–250. [Google Scholar] [CrossRef]

- Rockafellar, R.T.; Uryasev, S. Optimization of conditional value-at-risk. J. Risk 2000, 2, 21–41. [Google Scholar] [CrossRef]

- Carrano, E.G.; Tarôco, C.G.; Neto, O.M.; Takahashi, R.H. A multiobjective hybrid evolutionary algorithm for robust design of distribution networks. Int. J. Electr. Power Energy Syst. 2014, 63, 645–656. [Google Scholar] [CrossRef]

- Empresa de Pesquisa Energética. Plano Decenal de Expansão de Energia 2029; Ministério de Minas e Energia: Lisboa, Portugal, 2020. [Google Scholar]

- Empresa de Pesquisa Energética. Plano Decenal de Expansão de Energia 2030; Ministério de Minas e Energia: Lisboa, Portugal, 2021. [Google Scholar]

| Type | Total Physical Guarantee [MWm] | Average Cost of Operation and Maintenance [R$/MWh] | Concession Expiration |

|---|---|---|---|

| Hydraulic power plants—Group 1 | 38.3 | 0.54 | 31 May 2028 |

| Hydraulic power plants—Group 2 | 36.0 | 0.54 | 31 July 2032 |

| Hydraulic power plants—Group 3 | 128.6 | 0.54 | 31 December 2035 |

| Hydraulic power plants—Group 4 | 122.8 | 0.54 | 25 August 2036 |

| Wind power plants | 67.5 | 0.21 | 31 December 2033 |

| Sales contracts 1 | −325.0 | 225.00 | 31 December 2033 |

| Sales contracts 2 | −23.0 | 230.00 | 31 December 2033 |

| Alternative Type | Physical Guarantee (MWm) | Operation Cost (R$/MWh) | Portfolio Entry | Concession Expiration |

|---|---|---|---|---|

| Wind power plant | 28.0 | 0.00 | 1 September 2024 | 31 May 2057 |

| Solar power plant | 8.0 | 0.00 | 1 January 2022 | 31 December 2033 |

| Wind power plant sales contract | −28.0 | 210.00 | 1 January 2022 | 31 December 2033 |

| Solar power plant sales contract | −8.0 | 197.50 | 1 September 2024 | 31 December 2033 |

| Name | Installed Capacity (MW) | Capacity Factor | Investment Cost (M R$) |

|---|---|---|---|

| Wind power plant | 53.7 | 0.52 | 250.00 |

| Solar power plant | 47.0 | 0.17 | 172.00 |

| Alternative | PDE_2029 | PDE_2030 |

|---|---|---|

| 4791.51 | 4732.74 | |

| 4769.46 | 4713.26 | |

| 4900.36 | 4839.31 | |

| 4892.69 | 4816.45 | |

| 4880.84 | 4781.12 | |

| 4878.31 | 4819.83 | |

| 4762.62 | 4699.49 | |

| 4863.80 | 4783.20 |

| Alternative | PDE_2029 | PDE_2030 |

|---|---|---|

| 4664.09 | 4594.92 | |

| 4639.48 | 4573.23 | |

| 4772.78 | 4701.65 | |

| 4779.64 | 4694.74 | |

| 4781.34 | 4680.04 | |

| 4748.16 | 4679.91 | |

| 4639.42 | 4565.59 | |

| 4754.29 | 4665.14 |

| Alternative | PDE_2029 | PDE_2030 |

|---|---|---|

| 127.42 | 137.82 | |

| 129.98 | 140.03 | |

| 127.58 | 137.66 | |

| 113.05 | 121.71 | |

| 99.50 | 101.08 | |

| 130.14 | 139.92 | |

| 123.20 | 133.90 | |

| 109.50 | 118.06 |

| Alternative | PDE_2029 | PDE_2030 |

|---|---|---|

| 0.00 | 0.00 | |

| 143.45 | 143.45 | |

| 119.91 | 119.91 | |

| 111.46 | 111.46 | |

| 94.05 | 94.05 | |

| 125.14 | 125.14 | |

| 133.94 | 133.94 | |

| 116.34 | 116.34 |

| Alternative | Wald | Laplace | Savage | Hurwicz |

|---|---|---|---|---|

| 0.00 | 0.00 | 0.00 | 0.00 | |

| 0.00 | 0.00 | 0.00 | 0.00 | |

| 0.06 | 0.07 | 0.06 | 0.06 | |

| 0.47 | 0.51 | 0.47 | 0.49 | |

| 0.58 | 0.66 | 0.58 | 0.65 | |

| 0.00 | 0.00 | 0.00 | 0.00 | |

| 0.00 | 0.00 | 0.00 | 0.00 | |

| 0.56 | 0.61 | 0.56 | 0.59 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bambirra, R.; Schiavo, L.; Lima, M.; Miranda, G.; Reis, I.; Cassemiro, M.; Andrade, A.; Laender, F.; Silva, R.; Vieira, D.; et al. Robust Multiobjective Decision Making in the Acquisition of Energy Assets. Energies 2023, 16, 6089. https://doi.org/10.3390/en16166089

Bambirra R, Schiavo L, Lima M, Miranda G, Reis I, Cassemiro M, Andrade A, Laender F, Silva R, Vieira D, et al. Robust Multiobjective Decision Making in the Acquisition of Energy Assets. Energies. 2023; 16(16):6089. https://doi.org/10.3390/en16166089

Chicago/Turabian StyleBambirra, Rafael, Lais Schiavo, Marina Lima, Giovanna Miranda, Iolanda Reis, Michael Cassemiro, Antônio Andrade, Fernanda Laender, Rafael Silva, Douglas Vieira, and et al. 2023. "Robust Multiobjective Decision Making in the Acquisition of Energy Assets" Energies 16, no. 16: 6089. https://doi.org/10.3390/en16166089

APA StyleBambirra, R., Schiavo, L., Lima, M., Miranda, G., Reis, I., Cassemiro, M., Andrade, A., Laender, F., Silva, R., Vieira, D., & Ekel, P. (2023). Robust Multiobjective Decision Making in the Acquisition of Energy Assets. Energies, 16(16), 6089. https://doi.org/10.3390/en16166089