4.1. Temporal Evolution of the Global Energy Trade Network

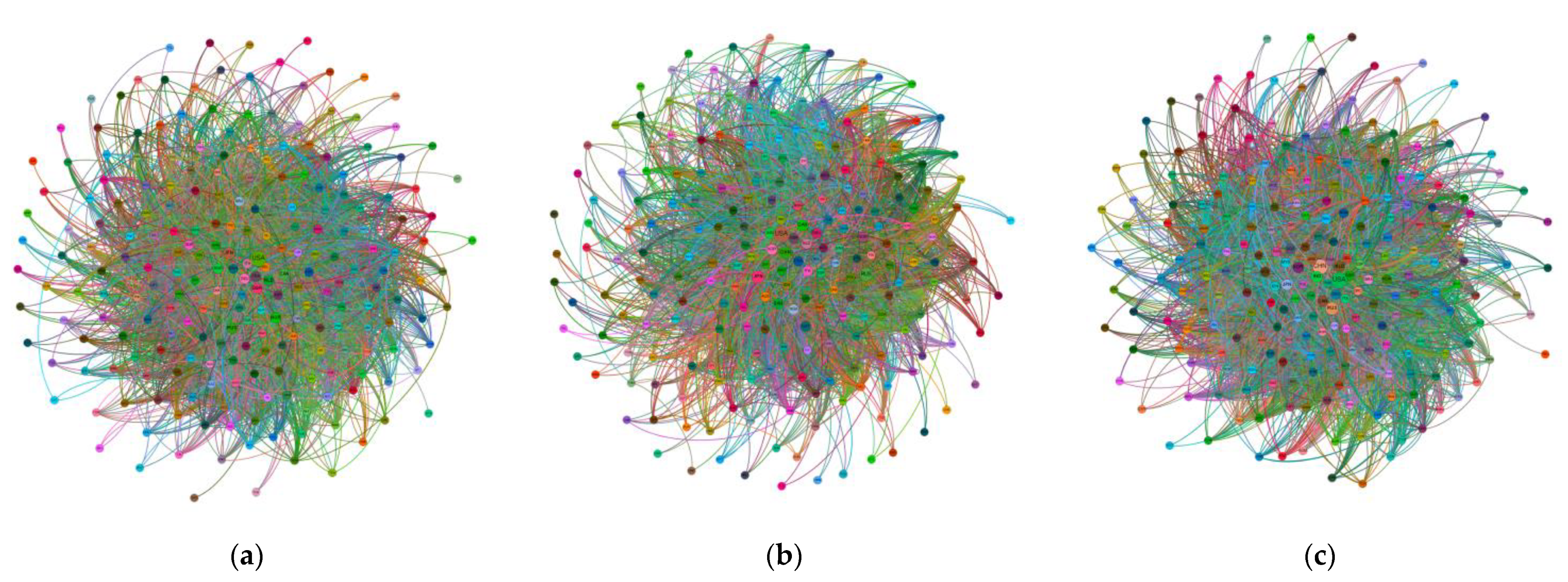

To visualize the topology and evolution of the global energy cross-border trade network more visually, this study uses Gephi-0.9.2 software to create a visual representation of the cross-border trade country network: 2001 (

Figure 1a), 2011 (

Figure 1b), and 2020 (

Figure 1c). In each case, the global energy trade network is constructed using trade values as weights. Comparing the spatial structure of trade networks provides insight into the evolutionary properties of the networks. The size of a country node in the network topology map represents the weight of that country, measured by the total number of M&As at that node, regardless of direction. The arrow direction of the lines in the map represents the direction of capital flows, and the line thickness represents the frequency of energy trade activities between the two connected countries. The result is a global cross-border energy trade network topology map.

For ease of reference, a table of country abbreviations is compiled, as shown in

Table 2. Due to space limitations, only commonly mentioned countries in the text are presented.

As trade between energy-demanding and energy-supplying countries increases, the world energy trade network exhibits different stage characteristics over time.

Table 3 records the main topological indicator values of the world energy trade network over the 20-year period from 2001 to 2020. Over this period, the number of countries involved in energy trade is projected to range from 228 to 234, indicating a clear trend in trade-exposed countries. The number of border zones has increased significantly, from 8089 in 2001 to 11,465 in 2020, implying an increase of 41.74%. The average order of the network was only 35.478 in 2001, but it has remained around 50 since 2012. The average clustering coefficient shows a slight upward trend from 0.613 to 0.717, indicating increases in the density and intensity of the global energy trade network. The average path length decreased sharply to 0.3001 in 2002; it has increased slightly since then but remains below the 2001 level. These results suggest that the world energy trade network is highly accessible and trade-efficient between countries during this period.

In terms of temporal movements, global energy trade experienced two major declines in 2011 and 2018, which can be attributed to the increased international interest in environmental issues. In particular, the United Nations Climate Change Conference held in Copenhagen in December 2009 led many countries to sign the Copenhagen Accord and commit to reducing greenhouse gas emissions [

33]. These national policies and actions have had a direct impact on energy trade as demand in the global energy market has weakened and prices have fallen. Key network indicators showed special values in 2011. However, after markets adapted and adjusted to the policy changes, energy trade gradually recovered to its original levels, peaking again in 2018.

However, with the rise of unilateralism and protectionism in the world in 2019, intensifying trade friction, Brexit-related uncertainty, a surge in non-tariff measures, geopolitical tensions, and the impending climate crisis, energy trade did not recover significantly that year [

34]. Furthermore, the outbreak of the COVID-19 pandemic in 2020 restricted the transportation industry, leading to a continued decline in energy trade trends [

35]. At present, the energy trade market remains in a long recovery period.

4.2. Analysis of Import/Export Patterns in the Global Energy Trade Network

As mentioned, the out-degree represents the number of countries to which energy is exported, while the in-degree represents the number of countries from which energy is imported. By assigning trade amounts as weights to the out-degree and in-degree of a particular country, the weighted out-degree and weighted in-degree can be obtained. In

Table 4, the top ten countries in terms of out-degree, in-degree, weighted out-degree, and weighted in-degree in global energy trade in 2001 are summarized and presented. As shown in

Table 4, without considering trade volumes, the major energy-importing countries in 2001 were the U.S., France, the U.K., Germany, Belgium, Italy, Spain, and Japan. The major energy exporters are the U.S., the U.K., France, Germany, Belgium, the Netherlands, Norway, Canada, Saudi Arabia, and Venezuela. The largest importers and exporters, mainly developed Western countries, remain largely unchanged in their rankings.

When trade volumes are considered, the largest energy importers are the U.S., Japan, Germany, France, South Korea, the U.K., Italy, Spain, the Netherlands, and Belgium—the U.S. imports about twice as much as Japan, the second largest importer. The major energy exporters are Russia, Canada, Norway, Saudi Arabia, the U.K., the Netherlands, Kuwait, Venezuela, Iran, and Mexico.

Most of the largest energy importers are developed Western countries, which are heavily dependent on industry and have high energy demands. On the other hand, most energy exporters are emerging developing countries rich in natural resources and relying on energy exports as a driving force for economic growth. In sum, developed and developing countries played important but different roles in the global energy trade network at the beginning of the 21st century [

36]. A comparison in

Table 4 shows a significant change in ranking before and after weighting. Japan moves from 9th to 2nd place when weight is considered in the entry (i.e., penetration) ranking, while Korea jumps to 5th. These results suggest that Japan and Korea have maintained high trade volumes despite having few trading partners. In addition, in the weighted output rankings, the U.S. drops from 1st to 10th place, the U.K. drops from 2nd to 5th place, and the Netherlands drops from 6th to 9th place. Most Western industrialized countries have many export links, but their trade volumes and values are relatively small. Emerging developing countries, however, while having small numbers of trading partners, have large volumes of trade, indicating the presence of important energy trading partners [

37,

38].

Table 5 presents a summary of the top ten countries in terms of out-degree, in-degree, weighted out-degree, and weighted in-degree in global energy trade in 2011. In 2011, without weighting, the top five energy importing countries were China, the U.S., the U.K., Germany, and France, as shown in

Table 5. For energy exports, the top five countries include China, Canada, the U.S., France, and the Netherlands. Notably, China, the U.S., and France are in the top five in both the import and export rankings and have multiple trading partners. After accounting for weights, the countries in the top five for both imports and exports are the U.S., Saudi Arabia, Russia, China, and the Netherlands. The top five countries with weighted exits are the U.S., China, Japan, Russia, and South Korea. The U.S., China, and Russia maintain the top five weighted entries and exits, indicating that their energy imports and exports are significant in terms of trade value.

A comparison of

Table 5 with

Table 4 reveals significant changes over the 10 years. With regard to imports and exports, the most notable change is that China has replaced the U.S. as the top importer and exporter, with 158 imports and 155 exports in 2011, respectively. It implies that China’s diversified trade association countries are associated with “in” and “out” strategies [

39,

40]. For weighted inputs and outputs, the U.S. has jumped significantly, reaching 1st place, unlike in 2001. Active U.S. trade has been boosted by the post-financial crisis economic recovery. Furthermore, since 2001, several emerging developing countries have moved into the top 10 in the weighted entry ranking, while several developed Western countries are in the weighted exit rankings. This is because emerging developing countries have embarked on large-scale infrastructure and industrial development that requires large energy supplies. On the other hand, Western developed countries have sufficient supplies to meet their own needs [

33,

41].

Table 6 presents a summary of the top ten countries in terms of out-degree, in-degree, weighted out-degree, and weighted in-degree in global energy trade in 2020. As shown in

Table 6, the Netherlands, the U.S., China, the United Arab Emirates, and Belgium ranked among the top five energy importers in the 2020 Global Energy Trade Network. The Netherlands ranks first with a score of 150, lower than China’s 158 in 2011. China, the U.S., the Netherlands, Turkey, and France rank in the top five for energy exports. China’s export score of 199 is well above its highest scores in 2001 and 2011, indicating extensive energy export cooperation with other countries.

In terms of weighted in-degree, the U.S., China, Russia, Saudi Arabia, and the Netherlands rank in the top five after taking into account the weight of energy transactions. In terms of production, China, the U.S., Russia, India, and South Korea are among the top five. In weighted participation and weighted out-degree, the U.S., China, and Russia all rank in the top three, with the U.S. and China, respectively, in the first place positions.

The ranking shows that emerging developing countries such as the United Arab Emirates, India, China, and Turkey are playing a greater role in the global energy market compared to 2011. The Netherlands rose from 8th in 2001 to 6th in 2011 and 1st in 2020. China rose from 7th in 2001 to 1st in both 2011 and 2020, reflecting the current multipolar pattern. In addition, in terms of participation and output weights, developing countries such as China, Saudi Arabia, India, and Russia are major players in energy import and export transactions, approaching and influencing the central position of the U.S. in energy trade.

When considering

Table 4 and

Table 6 together, it can be observed that in 2001, among the top ten countries with the highest weighted in-degree, only China, a developing country, was included, ranking tenth. However, by 2020, four developing countries were among the top ten. This further confirms the earlier statement that the position of developing countries has been elevated in import patterns. Furthermore, in 2001, five of the top ten countries in terms of energy exports were developed countries. However, by 2020, developed countries occupied seven out of the top ten positions, thereby confirming the assertion that the presence of developed countries has increased in the export market. These findings provide further evidence of the rising importance of developing countries in the import landscape while indicating an increased involvement of developed countries in energy exports.

4.3. Analysis of Bilateral Relations between Countries in the Global Energy Trade Network

Table 7 displays the top 10 pairs of countries in terms of OBR values, showing that the top 10 unilateral export relationships in 2001, 2011, and 2020 represent 21.36%, 15.16%, and 15.58% of the network, respectively. Only a few countries are becoming less dominant in the global energy trade network, and the diversified nature of global energy trade is becoming increasingly evident [

42].

Further examination of

Table 7 shows that in 2001 and 2011, the country with the most unilateral bilateral relationships was the U.S., and Canada was a major U.S. energy importer. In 2001, Canada’s OBR to the U.S. was 7.12%, far ahead of Venezuela’s energy exports to the U.S., which ranked second. In 2011, Canada’s sole export to the U.S. declined but still ranked first. In 2020, China had five top 10 unilateral bilateral relationships. China’s influence in the energy trade market has increased, with its trading partners being mainly Russia, Iraq, and other lesser-mentioned countries, further indicating the collapse of the energy trade dominated by a few countries. It can be observed that China’s role in the energy trade network has been increasingly prominent. The underlying reasons for this can be attributed to China’s rapid economic development in the 2010s. Additionally, efforts have been made by China to seek cooperative development on the international stage. In 2013, the Belt and Road Initiative was proposed by China, effectively strengthening the energy trade activity and resilience between China and neighboring countries.

Table 8 shows the top 10 bilateral trade relations in terms of TBR. It is observed that the top 10 bilateral trade relations in 2001, 2011, and 2020 accounted for 23.33%, 20.09%, and 19.38% of the total network, respectively. Although the share of bilateral trade is slightly lower, it remains an integral part of the global energy trade network. The U.S. dominates international energy trade, as it occupies a very important position in bilateral trade relations with Canada and Mexico, consistently occupying the top three positions. Moreover, in 2001, the top four relations all included the U.S., followed by other developed countries such as the U.K., Norway, Germany, Hungary, and Belgium. However, by 2011, emerging developing countries such as Saudi Arabia, China, and Nigeria begin to appear in the top 10, and by 2020, China and Russia occupy a significant share of bilateral trade, surpassing the energy trade between the U.S. and Mexico, which has always been in second place. In addition, China’s bilateral trade with the U.S. and Mexico has increased, and Brazil and Saudi Arabia have also become important partners for China. Cooperation among the emerging developing countries, once in a “marginal” position, has become increasingly closer, influencing the “core” position of the developed countries for more than a decade [

43].

4.4. Analysis of the Global Energy Trade Network

The global energy trade network shows that countries with the highest k-value have the largest trade volumes of energy exports or imports in the energy trade market. For

Figure 2, the k-core algorithm is employed to calculate the group of countries with the highest k-values in the energy cross-border trade network in 2001 (

Figure 2a), 2011 (

Figure 2b), and 2020 (

Figure 2c). The results show that in 2001, the highest k-value was 69, with 61 countries having this k-value, including the U.S., Canada, France, China, and Australia; in 2011, the highest k-value was 79, with 62 countries having this k-value, including the U.S., the U.K., China, and Saudi Arabia; in 2020, the highest k-value was 97, with 70 countries having this k-value, including the U.S., China, Japan, and Russia.

The increase in the number of countries with the highest k-value indicates that an increasing number of countries have greater energy import and export capacities in the international energy trade network. The increase in k-value also indicates that the energy import and export capacities of these countries are also increasing, giving these countries a stronger voice in the international energy trade network. Thus, these countries have become major players in the energy trade market. The subgroups of countries with the highest k-value and the ranking of bilateral intensity for each year show a high overlap. Countries with high bilateral intensity, such as the U.S., Canada, China, Saudi Arabia, France, and the U.K., also have high k-values. These findings suggest that there is a strong positive correlation between the countries with the highest k-value and those with the highest bilateral intensity.

Firstly, when considering the overall perspective, an increase in the number of countries with the highest k-values can be observed, from 61 countries in 2001 to 62 countries in 2011 and further to 70 countries in 2020. This indicates that a greater number of countries are gaining larger energy import and export capabilities within the global energy trade network. Moreover, it can be noted that there was a mere increase of one country between 2001 and 2011, whereas there was an increase of eight countries between 2011 and 2020. This suggests that over time, the rate of growth in the number of countries with strong energy trade capacities has intensified, leading to a faster convergence among nations participating in global energy trade. The k-values have also increased over time, with a k-value of only 69 in 2001, reaching 79 in 2011, and a notable high of 97 in 2020. This signifies the increasing energy import and export capabilities of these countries, granting them a stronger position and influence within the international energy trade network. Additionally, it can be observed that the decade from 2001 to 2011 witnessed a 10-unit increase in k-value, reflecting a growth rate of 14.493%, while the period from 2011 to 2020 saw an 18-unit increase, corresponding to a growth rate of 22.785%. These findings highlight the accelerating growth rate of energy import and export capacities over time.

Secondly, when examining the details, it can be observed that countries such as the United States, China, Saudi Arabia, France, Canada, and the United Kingdom have consistently held the highest k-values in global energy trade. Consequently, these countries have become major participants in the energy trade market. Furthermore, a strong correlation is evident between the groups of countries with the highest k-values and the rankings of bilateral intensities. Countries with high bilateral intensities, including the United States, Canada, and China, also exhibit high k-values. These findings indicate a significant positive relationship between countries with the highest k-values and those with the highest bilateral intensities.