A Health-Aware Energy Storage Sharing Mechanism for a Renewable Energy Base

Abstract

1. Introduction

- This paper refines the coupling relationship between the degradation laws and key parameters in the operation process of shared energy storage, and establishes a refined degradation model for the operation of electrochemical energy storage sharing. This model can better reflect the changes in performance parameters such as shared energy storage charging and discharging efficiencies and state of health (SoH), thus quantifying the degree of degradation in the lifespan of shared energy storage. It also provides important theoretical support for the practical application of shared energy storage.

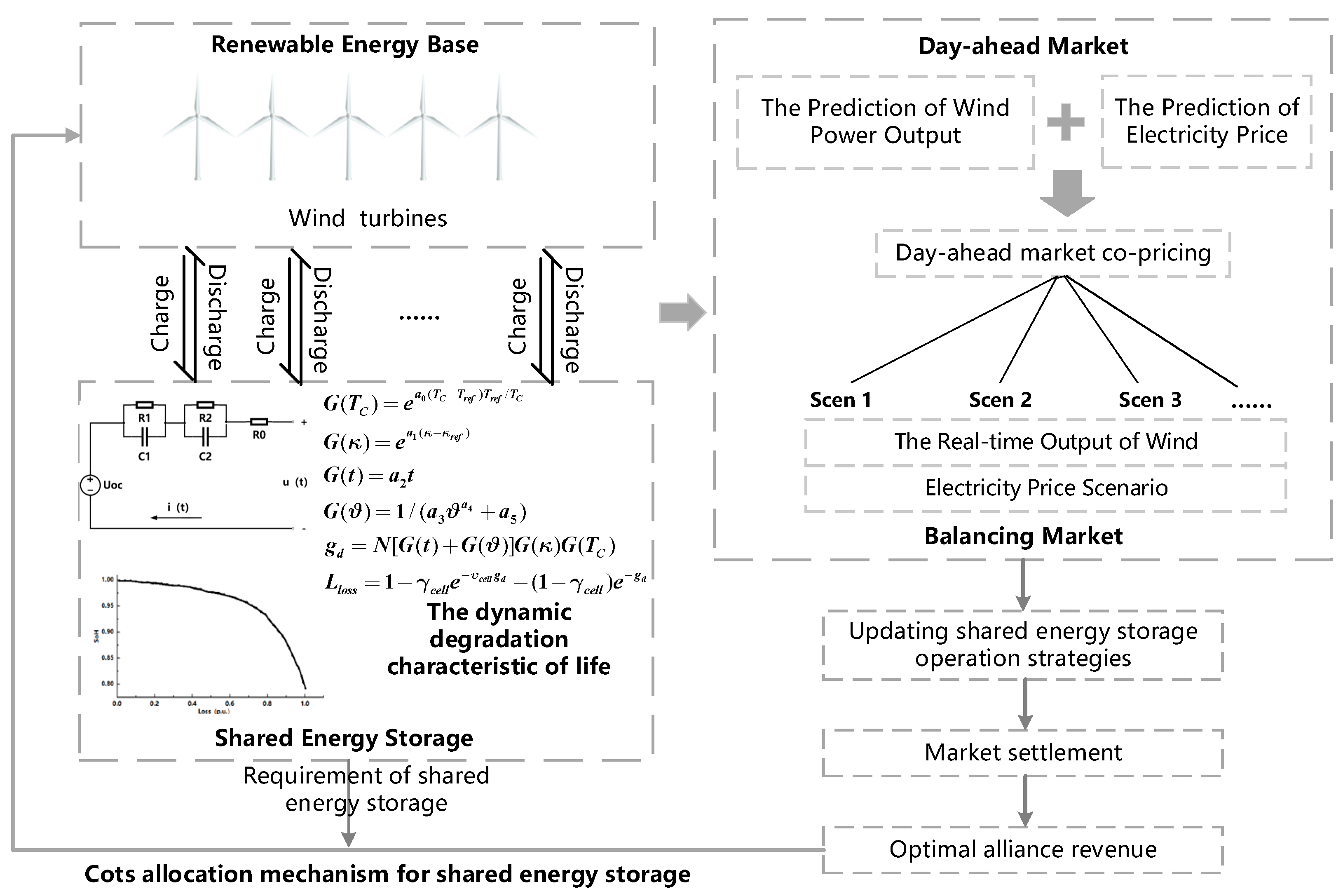

- A renewable energy base–shared energy storage operation framework that considers dynamic lifespan degradation is designed. This framework fully utilizes the advantages of shared energy storage and enhances the profitability of various units within high renewable energy bases in the day-ahead market through “peak shaving and valley filling”. At the same time, it mitigates the uncertainty of wind power output and reduces the assessment cost of real-time balancing markets. The design of this framework can better promote the sustainable development of renewable energy generation.

- A shared energy storage cost allocation mechanism is proposed for renewable energy bases based on the marginal contribution in both the day-ahead and the real-time market. This mechanism can meet the energy storage demands of different renewable energy generators and incentivize compatibility. The numerical results demonstrate a positive correlation between the shared energy storage costs allocated to different renewable energy generators and their corresponding energy storage demands. The implementation of this mechanism can better promote the coordinated optimization of renewable energy and shared energy storage operations, achieving a win-win situation.

2. Framework of Energy Storage Sharing

3. Dynamic Degradation Model in Battery Energy Storage Sharing

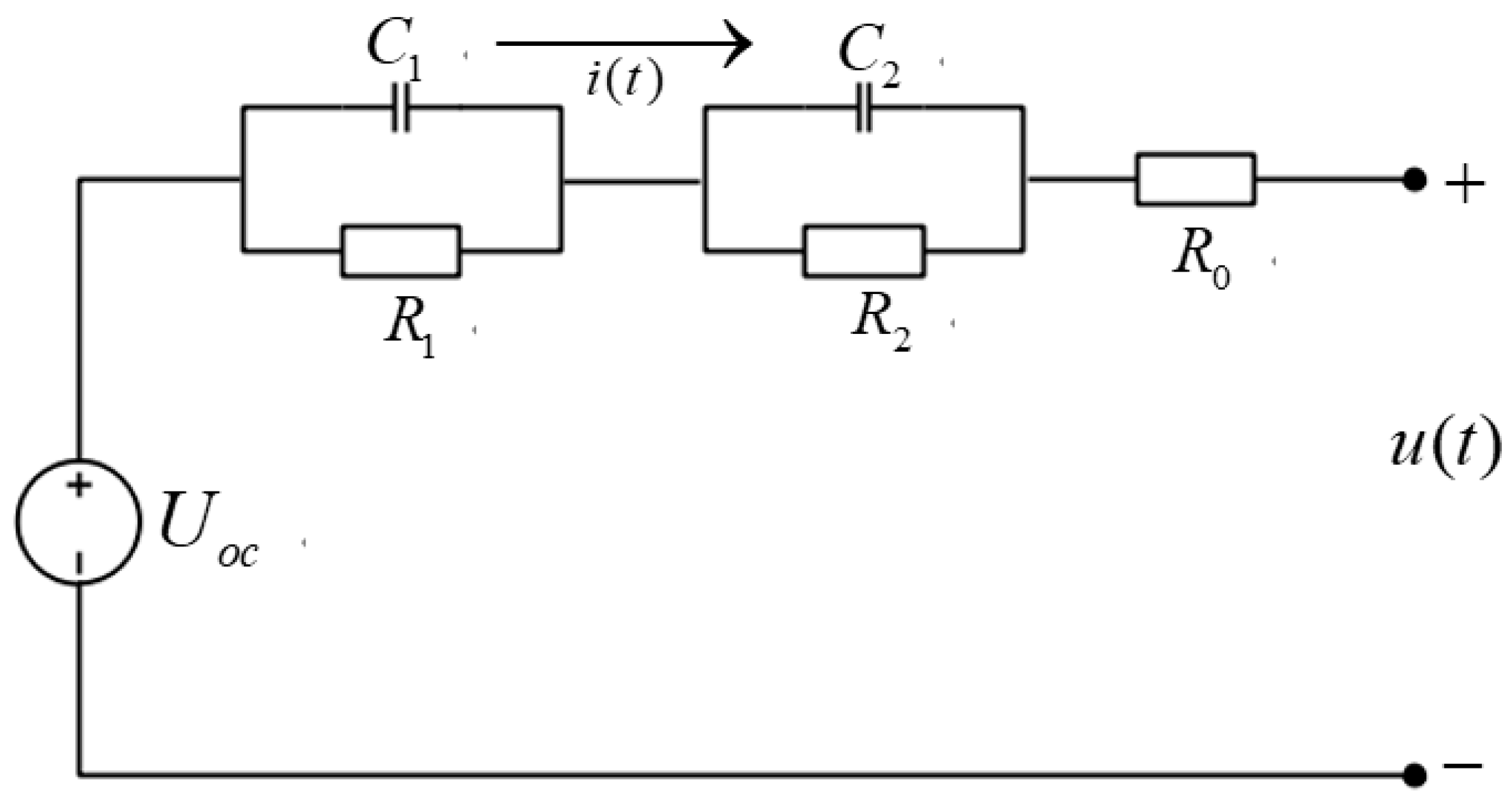

3.1. Health-Aware Perception Model

3.2. Energy Storage Battery Life Degradation Model

3.3. Dynamic Efficiency Model for Energy Storage Batteries

3.3.1. Segmented Linearization of Power for EES Batteries

3.3.2. Storage Capacity of EES Batteries

4. Shared Energy Storage Operation Model

4.1. Objective Function

4.2. Constraints

5. Cost Allocation Mechanism of Shared Energy Storage

5.1. Electricity Value in the Day-Ahead Market

5.2. Flexibility Value in the Real-Time Balancing Market

6. Case Study

6.1. Data Description

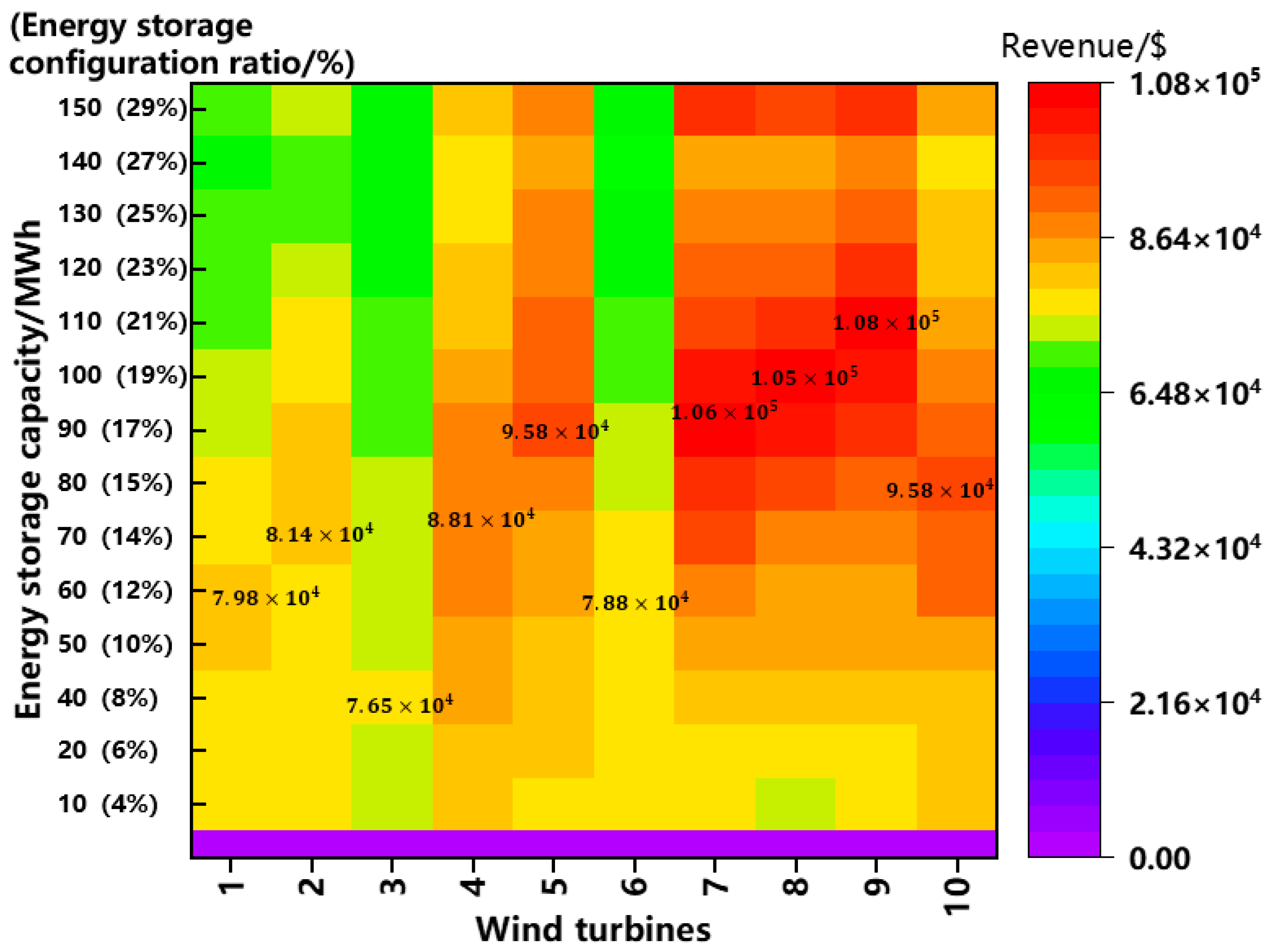

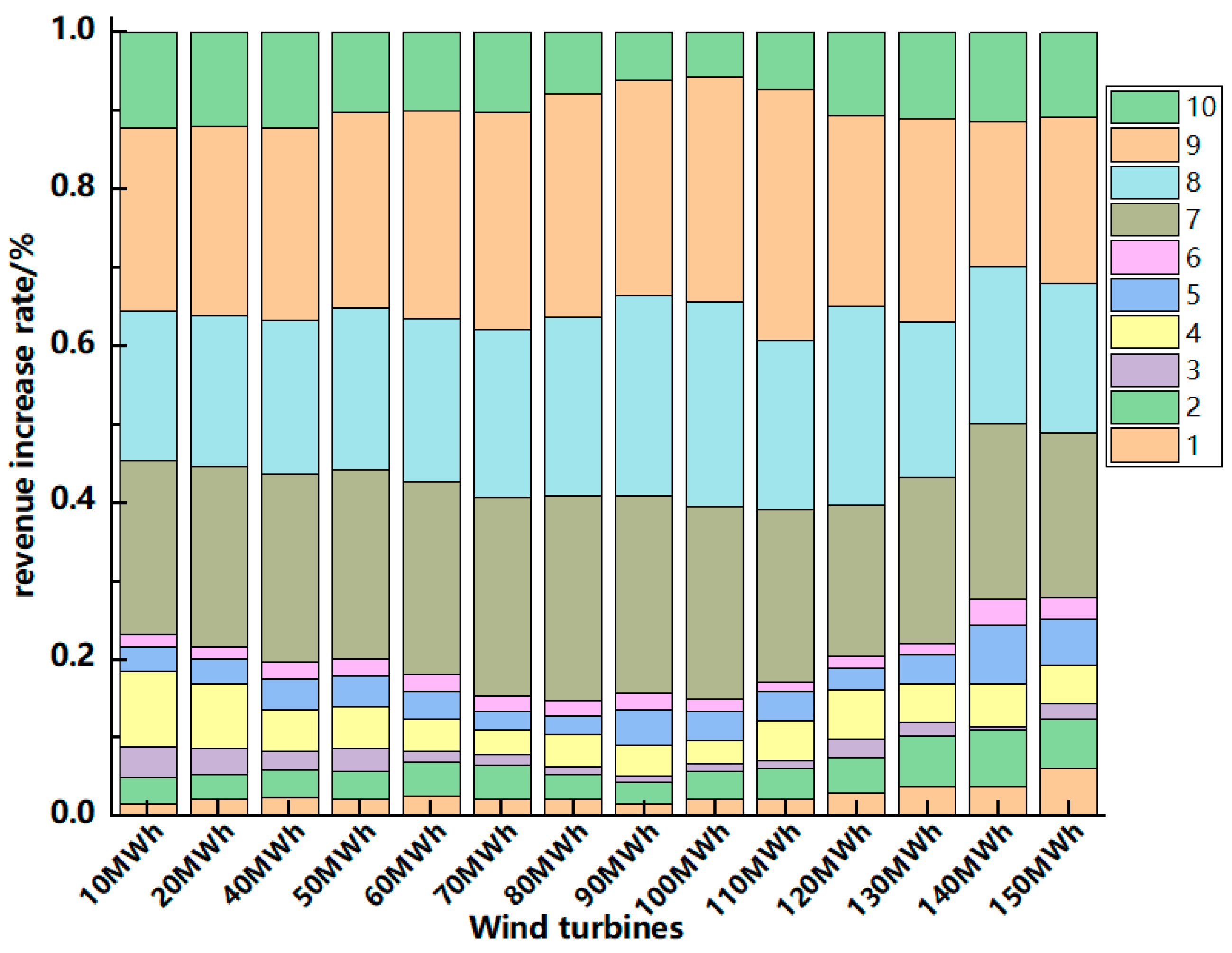

6.2. Results and Discussion

7. Conclusions

- (1)

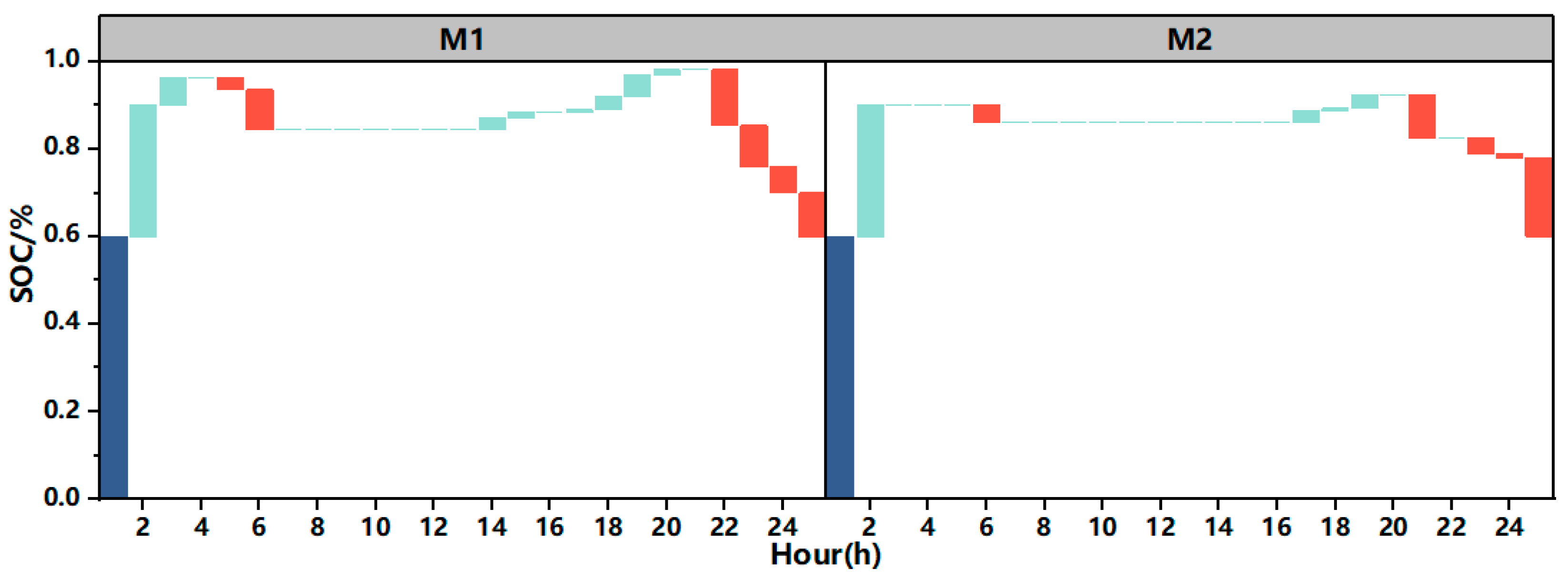

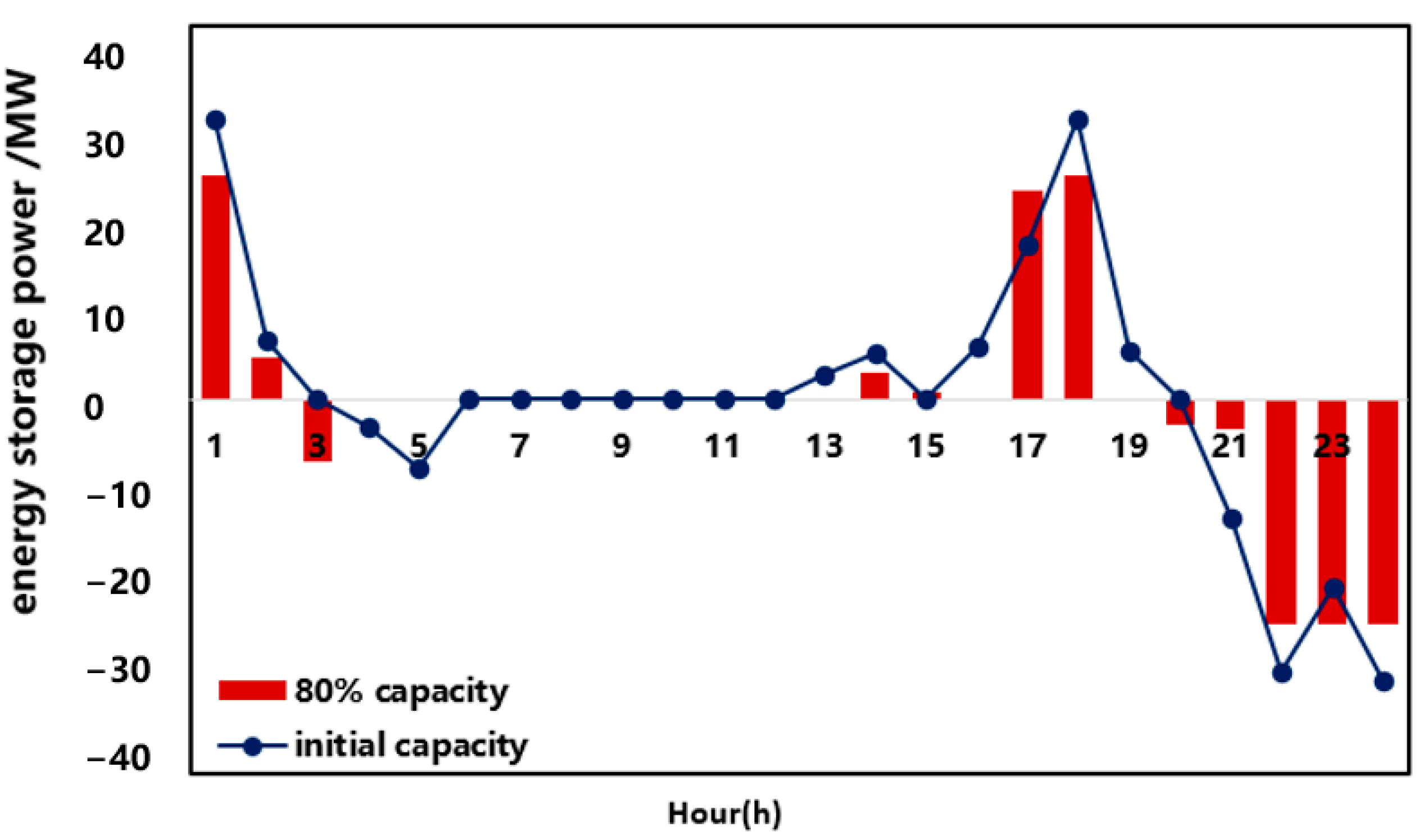

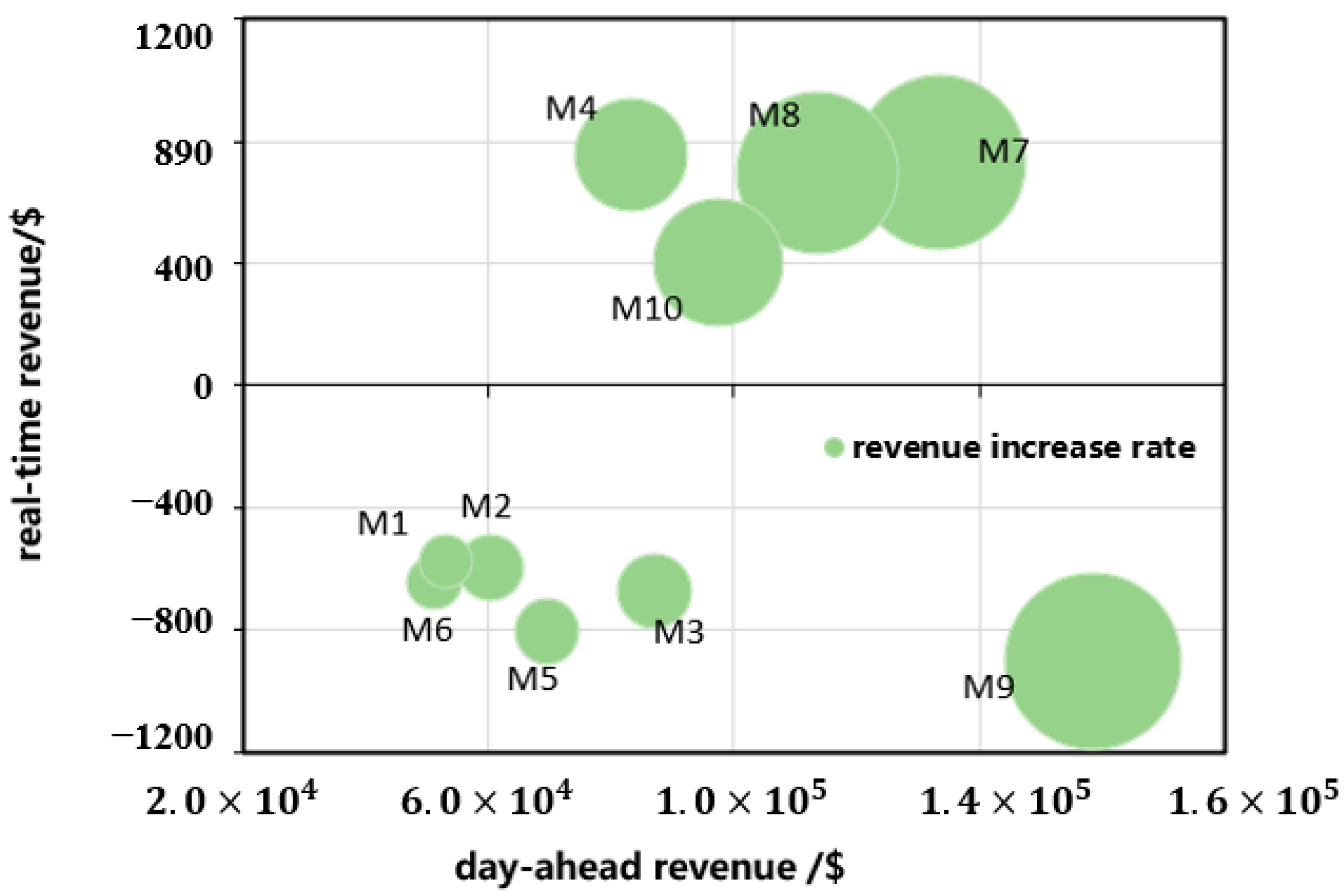

- The most suitable capacity ratio for SES in a REB is in the range of 17% to 20%, which can balance the economic benefits of alliances and ES investment costs well. When wind turbines form an alliance with SES, their profits increase compared to when they participate in the market alone. Considering the dynamic decay of ES, the utilization rate of ES is considerably reduced to increase the overall profits of the alliance, and the charging-and-discharging frequency and quantity in the REM are also reduced.

- (2)

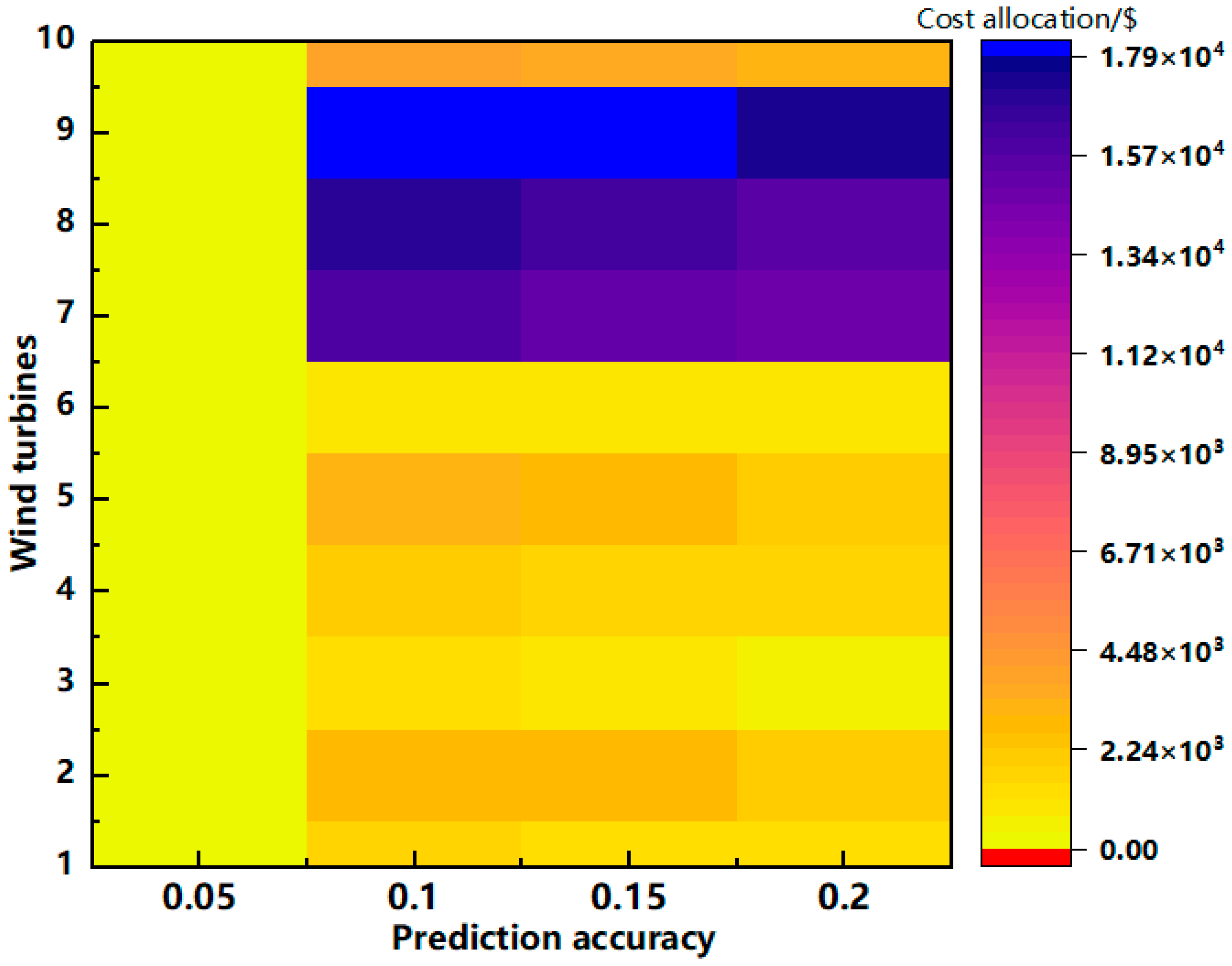

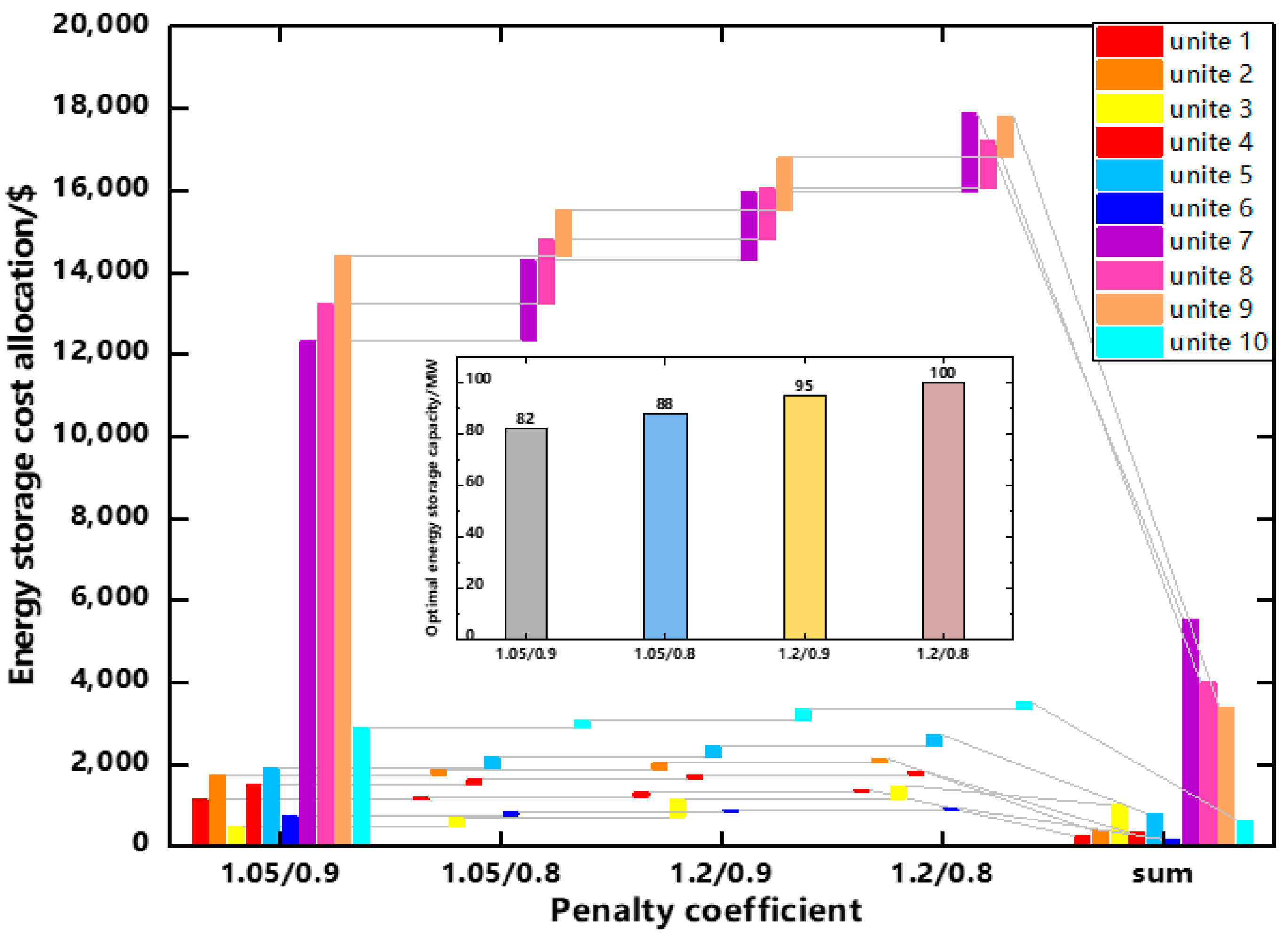

- The capacity and prediction errors of wind turbines will affect their share of SES costs. When the prediction accuracy is similar, wind turbines with larger installed capacities need to bear a higher proportion of ES costs, and as the prediction accuracy improves, the SES costs borne by each wind turbine decrease to varying degrees.

- (3)

- The penalty factor of the REM price in the alliance also affects the optimal SES capacity configuration and the SES costs of each wind turbine in the REB. When the penalty factor changes, the capacity demand for SES in each wind turbine in the REB increases, and the SES costs increase. Moreover, wind turbines with lower output prediction accuracy and similar installed capacity have larger increases in SES costs.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wu, Z.; Zhou, M.; Zhang, Z.; Zhao, H.; Wang, J.; Xu, J.; Li, G. An incentive profit-sharing mechanism for welfare transfer in balancing market integration. Renew. Sustain. Energy Rev. 2022, 168, 112762. [Google Scholar] [CrossRef]

- IRENA. Global Energy Transformation: A Roadmap to 2050, 2019th ed.; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- Wu, Z.; Chen, L.; Wang, J.; Zhou, M.; Li, G.; Xia, Q. Incentivizing the Spatiotemporal Flexibility of Data Centers Toward Power System Coordination. IEEE Trans. Netw. Sci. Eng. 2023, 10, 1766–1778. [Google Scholar] [CrossRef]

- Wu, Z.; Wang, J.; Zhong, H.; Gao, F.; Pu, T.; Tan, C.-W.; Chen, X.; Li, G.; Zhao, H.; Zhou, M.; et al. Sharing Economy in Local Energy Markets. J. Mod. Power Syst. Clean Energy 2022, 11, 714–726. [Google Scholar] [CrossRef]

- Chen, Y.; Yang, Y.; Xu, X. Towards transactive energy: An analysis of information-related practical issues. Energy Convers. Econ. 2022, 3, 112–121. [Google Scholar] [CrossRef]

- Malka, L.; Daci, A.; Kuriqi, A.; Bartocci, P.; Rrapaj, E. Energy Storage Benefits Assessment Using Multiple-Choice Criteria: The Case of Drini River Cascade, Albania. Energies 2022, 15, 4032. [Google Scholar] [CrossRef]

- Wu, Z.; Wang, J.; Zhou, M.; Xia, Q.; Tan, C.-W.; Li, G. Incentivizing Frequency Provision of Power-to-Hydrogen toward Grid Resiliency Enhancement. IEEE Trans. Ind. Inform. 2022, 1–10. [Google Scholar] [CrossRef]

- Liu, D.; Cao, J.; Liu, M. Joint Optimization of Energy Storage Sharing and Demand Response in Microgrid Considering Multiple Uncertainties. Energies 2022, 15, 3067. [Google Scholar] [CrossRef]

- Yao, M.; Molzahn, D.K.; Mathieu, J.L. An Optimal Power-Flow Approach to Improve Power System Voltage Stability Using Demand Response. IEEE Trans. Control Netw. Syst. 2019, 6, 1015–1025. [Google Scholar] [CrossRef]

- Chen, L.; Wang, J.; Wu, Z.; Li, G.; Zhou, M.; Li, P.; Zhang, Y. Communication Reliability-Restricted Energy Sharing Strategy in Active Distribution Networks. Appl. Energy 2021, 282, 116238. [Google Scholar] [CrossRef]

- Atawi, I.E.; Al-Shetwi, A.Q.; Magableh, A.M.; Albalawi, O.H. Recent Advances in Hybrid Energy Storage System Integrated Renewable Power Generation: Configuration, Control, Applications, and Future Directions. Batteries 2023, 9, 29. [Google Scholar] [CrossRef]

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032. [Google Scholar] [CrossRef]

- Sousa, T.; Soares, T.; Pinson, P.; Moret, F.; Baroche, T.; Sorin, E. Peer-to-peer and community-based markets: A comprehensive review. Renew. Sustain. Energy Rev. 2019, 104, 367–378. [Google Scholar] [CrossRef]

- Zhu, K.; Victoria, M.; Andresen, G.B.; Greiner, M. Impact of climatic, technical and economic uncertainties on the optimal design of a coupled fossil-free electricity, heating and cooling system in Europe. Appl. Energy 2020, 262, 114500. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Long, C.; Cheng, M. Review of existing peer-to-peer energy trading projects. Energy Procedia 2017, 105, 2563–2568. [Google Scholar] [CrossRef]

- Chomać-Pierzecka, E.; Sobczak, A.; Soboń, D. Wind Energy Market in Poland in the Background of the Baltic Sea Bordering Countries in the Era of the COVID-19 Pandemic. Energies 2022, 15, 2470. [Google Scholar] [CrossRef]

- Jiang, Y.; Zheng, C. Two-stage Operation Optimization for Grid-connected Wind Farm Cluster with Shared Energy Storage. Power Syst. Technol. 2022, 46, 3426–3439. [Google Scholar]

- Scarabaggio, P.; Carli, R.; Dotoli, M. Noncooperative Equilibrium-Seeking in Distributed Energy Systems Under AC Power Flow Nonlinear Constraints. IEEE Trans. Control Netw. Syst. 2022, 9, 1731–1742. [Google Scholar] [CrossRef]

- Lai, S.; Qiu, J.; Tao, Y. Credit-Based Pricing and Planning Strategies for Hydrogen and Electricity Energy Storage Sharing. IEEE Trans. Sustain. Energy 2022, 13, 67–80. [Google Scholar] [CrossRef]

- Awnalisa, W.; Soongeol, K. Analysis on impact of shared energy storage in residential community: Individual versus shared energy storage. Appl. Energy 2021, 282, 116172. [Google Scholar]

- Karunakaran, V.; Uma, G. Optimal power flow control of hybrid renewable energy system with energy storage: A WOANN strategy. J. Renew. Sustain. Energy 2019, 11, 015501. [Google Scholar]

- Nicola, M.; Paolo, S.; Raffaele, C.; Dotoli, M. Control frameworks for transactive energy storage services in energy communities. Control Eng. Pract. 2023, 130, 105364. [Google Scholar]

- Niu, J.; Tian, Z.; Lu, Y.; Zhao, H. Flexible dispatch of a building energy system using building thermal storage and battery energy storage. Appl. Energy 2019, 243, 274–287. [Google Scholar] [CrossRef]

- Zafar, R.; Ravishankar, J.; Fletcher, J.E.; Pota, H.R. Multi-Timescale Model Predictive Control of Battery Energy Storage System Using Conic Relaxation in Smart Distribution Grids. IEEE Trans. Power Syst. 2018, 33, 7152–7161. [Google Scholar] [CrossRef]

- Wu, J.; Lu, Z.; Qiao, Y.; Yang, H. Wind-Storage Power Station Operation Optimization Considering Dynamic Efficiency Characteristics of Energy Storage Charging and Discharging. Autom. Electr. Power Syst. 2018, 42, 41–47+101. [Google Scholar]

- Sakti, A.; Gallagher, K.G.; Sepulveda, N.; Uckun, C.; Vergara, C.; de Sisternes, F.J.; Dees, D.W.; Botterud, A. Enhanced representations of lithium-ion batteries in power systems models and their effect on the valuation of energy arbitrage applications. J. Power Sources 2017, 342, 279–291. [Google Scholar] [CrossRef]

- Musallam, M.; Johnson, C.M. An Efficient Implementation of the Rainflow Counting Algorithm for Life Consumption Estimation. IEEE Trans. Reliab. 2012, 61, 978–986. [Google Scholar] [CrossRef]

- You, H.W.; Bae, J.I.; Cho, S.J.; Lee, J.M.; Kim, S.-H. Analysis of equivalent circuit models in lithium-ion batteries. AIP Adv. 2018, 8, 125101. [Google Scholar] [CrossRef]

- Roscher, M.A.; Assfalg, J.; Bohlen, O.S. Detection of Utilizable Capacity Deterioration in Battery Systems. IEEE Trans. Veh. Technol. 2011, 60, 98–103. [Google Scholar] [CrossRef]

- Xu, B.; Oudalov, A.; Ulbig, A.; Andersson, G.; Kirschen, D.S. Modeling of Lithium-Ion Battery Degradation for Cell Life Assessment. IEEE Trans. Smart Grid 2018, 9, 1131–1140. [Google Scholar] [CrossRef]

- Förstl, M.; Azuatalam, D.; Chapman, A.; Verbič, G.; Jossen, A.; Hesse, H. Assessment of residential battery storage systems and operation strategies considering battery aging. Int. J. Energy Res. 2020, 44, 718–731. [Google Scholar] [CrossRef]

- Bašić, M.; Vukadinović, D.; Višnjić, V.; Rakić, I. Dynamic Equivalent Circuit Models of Lead-Acid Batteries—A Performance Comparison. IFAC-PapersOnLine 2022, 55, 189–194. [Google Scholar] [CrossRef]

- Lin, C.; Tang, A.; Wang, W. A Review of SOH Estimation Methods in Lithium-ion Batteries for Electric Vehicle Applications. Energy Procedia 2015, 75, 1920–1925. [Google Scholar] [CrossRef]

- USABC. Electric Vehicle Battery Test Procedures Manual; Revision 2; Idaho National Engineering Laboratory: Idaho Falls, ID, USA, 1996. [Google Scholar]

- Groenewald, J.; Grandjean, T.; Marco, J. Accelerated energy capacity measurement of lithium-ion cells to support future circular economy strategies for electric vehicles. Renew. Sustain. Energy Rev. 2017, 69, 98–111. [Google Scholar] [CrossRef]

- Sessa, P.G.; Walton, N.; Kamgarpour, M. Exploring the Vickrey-Clarke-Groves Mechanism for Electricity Markets. IFAC-PapersOnLine 2017, 50, 189–194. [Google Scholar] [CrossRef]

| Parameter | Value | Parameter | Value |

|---|---|---|---|

| 20 °C | 0.5 | ||

| 0.0693 | 1.04 | ||

| −0.501 | |||

| 0.0575 | 121 | ||

| 100 MW·h | 30 MW | ||

| 100% | 300 USD/kW | ||

| 1200 USD/kWh | 8% |

| Wind Turbine Number | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Revenue increase rate | 2.24% | 3.47% | 1.00% | 2.99% | 3.81% |

| Wind turbine number | 6 | 7 | 8 | 9 | 10 |

| Revenue increase rate | 1.51% | 24.44% | 26.22% | 28.61% | 5.72% |

| Wind Turbine | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Prediction accuracy | 15% | 10.5% | 6% | 20% | 13% |

| Wind turbine | 6 | 7 | 8 | 9 | 10 |

| Prediction accuracy | 15% | 5% | 8% | 8.3% | 17% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shao, C.; Zhang, B.; Wei, B.; Liu, W.; Yang, Y.; Wu, Z. A Health-Aware Energy Storage Sharing Mechanism for a Renewable Energy Base. Energies 2023, 16, 5356. https://doi.org/10.3390/en16145356

Shao C, Zhang B, Wei B, Liu W, Yang Y, Wu Z. A Health-Aware Energy Storage Sharing Mechanism for a Renewable Energy Base. Energies. 2023; 16(14):5356. https://doi.org/10.3390/en16145356

Chicago/Turabian StyleShao, Chong, Bolin Zhang, Bo Wei, Wenfei Liu, Yong Yang, and Zhaoyuan Wu. 2023. "A Health-Aware Energy Storage Sharing Mechanism for a Renewable Energy Base" Energies 16, no. 14: 5356. https://doi.org/10.3390/en16145356

APA StyleShao, C., Zhang, B., Wei, B., Liu, W., Yang, Y., & Wu, Z. (2023). A Health-Aware Energy Storage Sharing Mechanism for a Renewable Energy Base. Energies, 16(14), 5356. https://doi.org/10.3390/en16145356