Abstract

The growing importance of climate change and the depletion of natural resources, as well as geopolitical risks associated with the distribution of energy resources, cause an increase in the urgency of ensuring energy security. In modern conditions, the criteria of energy security are the level of production of traditional and renewable energy, the efficiency of energy production, the rationality of its consumption, and the level of pollution arising in the process of the functioning of the energy sector. Different types of regulatory instruments are used internationally to achieve different goals related to energy security. This study involves testing the hypothesis that the effectiveness of energy taxes in ensuring energy security is determined based on the choice of the object of taxation and should be measured via the complex effect of changes in various parameters of energy security. To test this hypothesis, a sample of data from 24 European countries for the period 1994–2020 was formed and energy taxes were grouped into 12 groups (energy taxes on the consumption of different energy sources, energy taxes on fossil fuels, taxes on electricity consumption, taxes to stimulate renewable energy production, contributions to energy funds, etc.). The assessment was carried out with the help of panel regression modeling tools with the installation of a three-year time lag in the model. This method made it possible to determine the short- and medium-term effects of the regulatory influence of certain types of energy taxes. Moreover, the research provides an assessment of the regulatory effectiveness of various types of energy taxes across countries with different initial structures of energy production. The obtained results proved that the comprehensive efficiency of different types of energy taxes is different and depends on the features of the construction of the country’s energy system. In general, complex energy taxes are the most effective method of taxation, while contributions to energy funds are the least effective method of taxation. In the countries with energy systems based on fossil fuels, taxes on mineral oils are the most effective in ensuring of energy security, as well as in the countries with a high initial level of renewable energy use, while complex energy taxes are the most effective in the countries with well-diversified energy systems. This study creates the basis for improving strategies for the use of regulatory instruments of energy transformation in building a clean, secure, and sustainable energy system for the country.

1. Introduction

Given limited availability of fossil energy resources, as well as the growing level of depletion of the natural environment, the issue of energy security of countries becomes an important problem that determines the stability of their economies, as well as their strategic compliance with the Goals of Sustainable Development. Eliminating environmental threats is traditionally considered an urgent problem involved in ensuring sustainable economic development (maintaining a sufficient level of natural resources, preventing natural disasters due to climate change, ensuring soil fertility, etc.). However, energy production from fossil fuels is not only environmentally harmful, but also less economically effective in general [1,2]. However, research conducted during the COVID-19 pandemic proved that climate change can be a prerequisite for the spread of the disease, which creates direct and intense threats to people’s lives and health [3].

Modern trends in ensuring energy security in countries are largely related to the development of renewable energy, which can meet economic needs and minimize environmental burdens at the same time. Despite the proven prospects of renewable energy, it should be noted that its development is associated with several geopolitical risks, which proves the need for a balanced policy regarding its stimulation [4].

The existing trial relationship between energy production, economic growth, and environmental pollution determines the impossibility of a quick transition to carbon-neutral energy without creating corresponding losses for the national economy; however, it requires consideration of additional incentives for such a transition, such as public health, the need to regulate of energy prices, etc. [5].

Analyzing the prospects for the development of carbon-neutral energy, researchers consider not only the improvement in the quality of the environment, but also the positive transmission effects on the health of the population [6,7]. Even though the renewable energy sector requires significant initial investment, its development can ensure the creation of new jobs in the country [8]. The need for financial support for building a carbon-neutral economy is also proven through quantitative indicators. Thus, directing 6.5% of world GDP to subsidize ecologically neutral energy made it possible to prevent an increase in total carbon emissions of 21% and an increase in mortality from air pollution of 55% [9].

It should be noted that the energy sector transformation policy must be comprehensive and consider a wide range of challenges. Thus, the development of carbon-neutral energy must simultaneously take place in the direction of replacing energy production, considering the behavior of end-users of energy and the interdependencies between various sectors of the economy [10]. In this context, not only is direct government support is important, but so is the use of regulatory tools capable of changing the behavior patterns of energy producers and consumers. Environmental taxes play this role in global practice. At the same time, the system of environmental taxation in different countries is diverse in terms of the number of tax instruments, objects of taxation, and taxpayers. In this connection, there is a need to investigate the effectiveness of environmental taxes in achieving the goals of transforming the energy system. The purpose of this study is a comparative analysis of different types of energy taxes based on the results of evaluating their impact on changes in energy security indicators, which include the structure of energy production, parameters of renewable energy, efficiency, and level of pollution in the energy production process. The study involves the grouping of energy taxes by tax objects and the assessment of the regulatory impact of the increase in revenues from energy taxes on the provision of energy security parameters separately for each group of energy taxes. To assess the influence of the initial structure of energy production in the country on the intensity of the regulatory impact of energy taxes, it is proposed to cluster countries according to the structure of energy production at the beginning of the study period. Calculations carried out separately for each cluster make it possible to determine strategic guidelines for the use of energy taxes to ensure energy security, depending on the specifics of the construction of the energy sector in the country.

2. Literature Review

Energy security is considered by scientists to be a stable state of the energy system, in which the social needs of the country are provided and the ability to resist risks and threats is formed [11]. Indicators of energy security in the modern economy include not only the ability of the energy sector to provide the national economy with stable and continuous sources of energy with the minimum possible level of damage to the environment, but also its contribution to the achievement of the Sustainable Development Goals. This approach determines the need for national monitoring of a significant number of indicators related to energy production and consumption to characterize the purity and safety of its production [12].

To determine the indicators that are targeted to ensure energy security, the main factors related to energy production and consumption should be considered. The practice of managing the global energy economy proves that the use of combustible fossil energy resources is associated with significant risks related to energy security, which are equally dangerous for producers, exporters, and importers of energy and energy resources [13]. In this context, the diversification of the energy sector and the energy autonomy of countries are important factors. It was previously proved that the transformation of the structure of the energy sector from the strategy of consumption and export of available fuel energy resources to the creation of a diversified energy system with a significant role for renewable energy requires a fundamental change in economic policy [14]. One of the important directions regarding the transformation of the country’s energy system is the implementation of a policy to overcome energy efficiency gaps, which at the initial stages arise due to the negative financial effects of the development of energy-efficient technologies against a background of a decrease in revenues from the use of fuel energy resources [15]. At the same time, researchers refuted the hypothesis that significant reserves of natural energy resources prevent countries from developing renewable energy [16]. The new environmental and economic policy of the countries of the European Union envisages a gradual transition to carbon-free development, which involves the growth of renewable energy, the establishment of environmental standards, and the introduction of environmental innovations [17,18,19].

It was previously proved that the growth of renewable energy is more closely related to energy security than other factors regarding the development of the energy sector [20]. It should be noted that the development of renewable energy ensures the improvement of energy security not only due to the replacement of fossil fuel energy and the reduction in electricity prices, but also due to the reduction in fluctuations in the energy sector [21]. The development of the renewable energy market requires the simultaneous involvement of political, technological, and financial and economic incentives. One of the most promising types of renewable energy in the global context is solar energy, which has a powerful potential [22]. State support and preferential taxation of solar energy allowed it to receive significant advantages for development; however, the cost of solar energy remains high, which indicates the need for permanent stimulation of alternative technologies [23]. Moreover, the production of energy from waste has significant prospects for the development of renewable energy, which allows countries to solve several environmental and economic problems at the same time [24,25].

Active integration of the Sustainable Development Goals takes place not only in national and global economic policies, but also in business strategy. Modern innovative business solutions aim not only to improve the technological efficiency and profitability of business activities, but also to reduce the impact on the environment both because of the greening of the production process and due to the production of products that are environmentally neutral when used [26,27,28,29]. Corporate social responsibility becomes a guarantee not only of sustainable business development, but also of its financial success, which is measured based on the impact of the company’s reputation and the formation of its green brand [30,31,32].

In today’s world, environmental aspects become paramount and determine the priorities of regulatory policy in almost every field. Regarding ensuring energy security, greening refers to the reduction in the carbon footprint through the transformation of the structure of energy production and the optimization of its transportation processes. At the same time, it is important that environmental effects are always long-term; therefore, the impact of regulatory instruments should be evaluated with a delay in time [33]. On the other hand, it is important that the transformation of the energy system can provide not only long-term environmental effects, but also the leveling of the harmful effects of the polluted environment on the health of the population [34]. Even though the policy of sustainable development does not have a direct impact on the competitiveness of individual sectors of the country on the same level as factors such as labor productivity or local innovations, its observance ensures the strategic development of the country, the results of which cannot always be measured, even in a ten-year perspective [35].

Energy security research cannot be conducted without considering the role of global energy flows, which form the basis of international trade between individual economies [36]. At the same time, it was previously proved that the environmental policy does not cause significant damage to the export competitiveness of the manufacturing sector and even promotes the development of ecological exports [37]. It was also previously proved that the indicators of energy consumption in the economy are not only related to the structure of the national economy, but also determined based on the level of the shadow economy in the country [38]. It is important that one of the parameters that increases the level of energy consumption is energy losses in the process of its distribution and delivery [39].

It should be emphasized that the country’s energy security is determined not only via the structure and methods of its production and supply, but also via the approach to its consumption. Thus, society’s behavior regarding frugal energy consumption, i.e., the use of renewable energy in its own households, can provide a significant contribution to maintaining the country’s energy balance and the corresponding reduction in the carbon footprint in the environment. At the same time, as the researchers proved, the behavior of the population is not always rational and conscious [40]. This problem demonstrates the important role of regulatory mechanisms. Their use should stimulate the actions required of society to maintain energy security. Some researchers emphasize the factors of education and social values for the formation of sustainable consumer behavior and management behavior [41,42]. Despite the significant public resonance regarding the need to ensure sustainable development, advertising campaigns, and educational programs, the most effective methods are direct incentives that allow savings due to rational energy consumption or provide an additional cost for a lack of environmentally responsible behavior [43]. For example, fuel taxes turned out to be an effective tool for reducing the demand for fuel in the transport sector [44]. On the other hand, previous studies proved that environmental taxes also have an impact on the environmentally responsible behavior of economic entities; however, this impact is not as broad as the impact on producers of products that have environmental effects [45].

The transition of states to a renewable energy strategy requires the infusion of significant financial resources. Global transformation requires a significant scale of state support for the energy sector, the creation of clusters of companies in the field of renewable energy, and the involvement of international donors and public–private partnership programs [46]. In the cases of implementation of complex projects related to renewable energy production, only direct state support can be a guarantee of ecological development, given the insufficient financial resources of individual regions or companies [47]. It was previously empirically confirmed that the strategy of financial support for the development of renewable energy must consider the energy needs of the territory, its natural and resource base, and the installed capacity of renewable energy facilities and their economic potential [48].

The limited amount of direct state support available to ensure the transformation of the energy system and the development of renewable energy necessitates the use of other regulatory tools to stimulate economic entities to switch to the production and consumption of renewable energy. Tax credits, i.e., preferential tariffs for renewable energy and green certificates, have become the most common instruments used to achieve this goal [49]. The growing attention of the world community to ensuring progress in achieving the Sustainable Development Goals has led to the growth of the market for green financial instruments, such as green loans and green bonds [50], and sustainable energy development [51]. The successful experience of using green bonds was demonstrated by supranational financial institutions, which used this tool to support renewable energy not only in European countries, but also in countries that have a significant lag in overcoming environmental problems and developing renewable energy [52].

To popularize renewable energy in the world, environmental taxation tools are also widely used. Most European countries supplement the system of environmental regulation with a range of tax benefits, such as the exemption of energy produced from renewable sources from environmental taxes, reduced rates of value added tax for renewable energy, tax deductions from corporate income tax for producers of renewable energy, etc. [53]. It was previously empirically confirmed that the implementation of environmental tax reforms in most scenarios leads to a reduction in carbon emissions in the economy [54,55]. On the other hand, it was also proved that the effect of the carbon tax reduces carbon emissions from energy-intensive enterprises to a rather small extent, and achieving a more significant effect because of increasing tax rates is associated with risks of economic losses [56,57]. At the same time, researchers proved that carbon taxes are a more effective strategy for the development of a carbon-neutral economy compared to state subsidies [58].

It should be noted that the actual implementation of environmental taxes and subsidies does not always lead to the expected environmental and other regulatory consequences, which is evidenced by the experience of Italy [59]. The introduction of environmental taxes aims to increase the level of greening of production; however, its achievement in certain sectors leads to significant initial costs, which is reflected in competitiveness. That problem is why the effectiveness of environmental tax reforms often depends on the initial structure of the economic system [60]. At the same time, it was previously proved that for better effectiveness and perception in society, mechanisms of public discussion and study of public reaction should be used [61,62]. Using the example of the introduction of carbon taxes, researchers prove that tax mechanisms should consider the need to balance the asymmetry of household incomes or the competitiveness of various sectors of the economy, for which tax distribution mechanisms should be used or tax incentives should be added [63,64]. In addition, mechanisms for using additional financial revenues from environmental taxes are important [65]. At the same time, it should be noted that existing studies on the effectiveness of environmental taxes tend to focus on the study of one type of tax instrument, such as fuel taxes or carbon taxes.

The purpose of this study is to identify the most effective types of energy taxes in ensuring the energy security of countries. For this purpose, the experience of introducing energy taxes in European countries was studied, with experiences grouped according to the types of taxation objects. The proposed study currently has no analogues in the scientific literature. At the same time, previous studies proved that transport and energy taxes have a wide potential for regulatory influence on the production and consumption of biofuels [66], and the choice of the tax base when applying transport taxes determines their effectiveness in achieving the goals of environmental, economic, and energy security [67]. Parameters characterizing the structure of thermal energy production and consumption, renewable energy development indicators, parameters of environmental pollution in the energy production process, the level of energy import, and energy loss in the production and distribution process were chosen to assess energy security. Moreover, the research provides an analysis of the effectiveness of various types of energy taxes based on the specifics of the construction of the energy system. For this purpose, the sample of research countries is divided into clusters based on the structure of energy production at the beginning of the research period, and an assessment of the impact of different types of energy taxes in ensuring the energy security of countries with different types of energy system constructions is carried out.

3. Materials and Methods

The variety of energy taxes used in the economies of different countries determined the scientific interest in finding the maximum efficiency of regulatory instruments. The main hypothesis of the study was that the choice of the object of taxation with energy taxes determined the degree of their effectiveness in ensuring energy security. The review of literary sources made it possible to determine the main directions of the energy security characteristics of the countries studied. Indicators of energy security were chosen to characterize the level of energy production from renewable sources, the capacity of domestic production to meet the country’s needs, the efficiency of energy transportation and distribution, and the level of environmental pollution during energy production:

- OGCE—electricity production from oil, gas and coal sources, % of total;

- FFEC—fossil fuel energy consumption, % of total;

- RSE—share of energy from renewable sources, %;

- HSE—gross production of electricity and derived heat from hydro sources, gigawatt-hour;

- WSE—gross production of electricity and derived heat from wind sources, gigawatt-hour;

- SSE—gross production of electricity and derived heat from solar sources, gigawatt-hour;

- RMWE—gross energy production from renewable municipal waste, thousand tons of oil equivalent;

- EI—net energy imports, % of energy use;

- TDL—electric power transmission and distribution losses, % of output;

- CO2int—CO2 intensity, kg per kg of oil equivalent energy use;

- CO2em—CO2 emissions from electricity and heat production, % of total fuel combustion;

- ME—energy related methane emissions, % of total;

- NOE—nitrous oxide emissions in energy sector, % of total.

A sample of 24 European countries was formed for the study: Austria, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Italy, Latvia, Lithuania, Netherlands, Poland, Portugal, Romania, Slovak Republic, Slovenia, Spain, United Kingdom, Ukraine, and Sweden. The research period covers the years 1994–2020.

The analysis of energy taxes operating in the studied countries allowed them to be grouped into 12 groups in accordance with the objects of taxation to which these taxes are applied:

- CDT—energy taxes on the consumption of different energy sources;

- FFT—energy taxes on fossil fuels;

- MOT—energy taxes on mineral oil;

- CT—energy taxes on coal;

- NGT—energy taxes on natural gas;

- ECT—taxes on electricity consumption;

- EPT—taxes on electricity production;

- REPT—taxes on electricity production from renewable sources;

- REST—taxes to stimulate renewable energy production;

- NET—taxes on nuclear energy production;

- WOT—taxes on waste oils;

- EFC—contributions to energy funds.

A description of the tax instruments representing these groups is given in Table 1.

Table 1.

Variety of energy taxes in European countries in terms of different taxation objects.

For the assessment, a panel regression modeling tool was chosen, which allowed us to identify general effects for a sample of countries. Checking the input data using the Hausman and Breusch–Pagan tests proved that the generalized least square model with random effects was the most relevant. The study involved the construction of a series of univariate regression dependences of the impact of energy taxes (measured using aggregate tax revenues from a certain group of energy taxes, quantified in million USD) on each of the parameters of energy security. In general, the model has the following construction:

where is n parameter of energy security in the country i in the period t; is an indicator of tax revenues of m group of environmental taxes in the country i in the period t; and ε is the error of measurement and specification.

To test the hypothesis regarding the delayed impact of environmental taxes on ensuring energy security, two options were evaluated for each of the dependencies: without a time lag and with a time lag of three years.

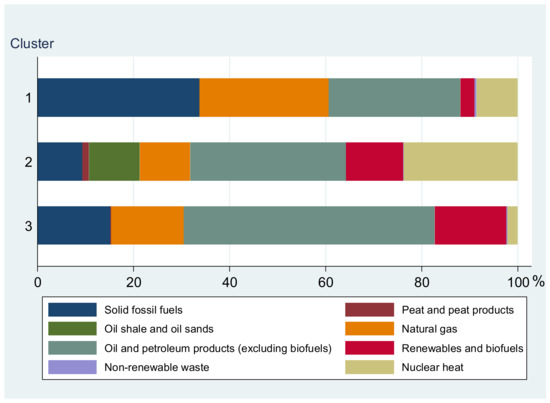

The next hypothesis of the study was that the initial structure of energy production in the country determined the intensity of the transition to renewable energy and the possibility of increasing energy security in the country. To test this hypothesis, the countries were grouped into clusters according to the parameters of the energy production structure (solid fossil fuels, peat and peat products, oil shale and oil sands, natural gas, oil and petroleum products (excluding biofuel portion), renewables and biofuels, non-renewable waste, nuclear heat). For clustering, the Calinski–Harabasz stopping rule was used, which made it possible to determine the optimal number of clusters for distribution, as well as the k-means method, which made it possible to divide countries into clusters and determine the key characteristics of each of the clusters. At this stage of the study, a set of regression dependencies describing the impact of energy taxes on energy security parameters was built in the section of each of the clusters.

4. Results

The first stage of the study involves assessing the impact of energy taxes on energy security parameters in general for the entire sample of the studied countries. Table 2 presents the results of the assessment of the impact of energy taxes on the indicators of heat and renewable energy production.

Table 2.

Results of assessment of various energy taxes’ impacts on structure of energy production and consumption parameters in European countries for period 1994–2021.

The calculations demonstrate a broad impact of different variations in energy taxes on energy security indicators, which are related to the structure of the country’s energy system. In particular, the growth of revenues from complex energy taxes, which simultaneously ensure taxation of various energy sources, causes a reduction in the share of energy production from oil, gas, and coal. It is important that this effect is short-term and does not persist when a time lag is introduced into the model. Considering the impact of energy taxes, which are set separately for different methods of consuming energy resources, we note that taxes on mineral oils and natural gas, which determine the reduction in the share of energy production from combustible resources in both the short and medium term, turned out to be the most effective. At the same time, coal taxes have shown effectiveness only in the short term. The statistically insignificant impact of energy taxes, which are set simultaneously for different combustible energy sources, turned out to be unexpected. It is also important that the taxation of electricity production and consumption in general also ensures a reduction in the share of energy production from fossil sources, which corresponds to modern strategies for ensuring the sustainable development of energy. In this context, we noted that the establishment of energy taxes to stimulate the production of energy from renewable sources ensured a reduction in the share of energy production from fossil sources in the short term; however, within three years, this effect changed to the opposite. Along with this issue, the increase in the share of energy production was also influenced by the increase in contributions to energy funds. The influence of the studied groups of energy taxes on the indicator of energy consumption from combustible sources turned out to be almost identical.

To ensure the energy security of the country, it is strategically important to increase the share of renewable energy. Four groups of energy taxes (comprehensive taxes on different energy sources, taxes on mineral oils, taxes on energy production and consumption, and taxes on energy production from renewable sources) have demonstrated such an impact. At the same time, the fact that the establishment of incentive taxes for the development of renewable energy has the opposite effect to the expected one is strategically important, as it leads to a reduction in the share of energy production from renewable sources. In addition, taxes on waste oil and complex taxes on fossil energy resources also determine the reduction in the share of renewable energy.

For a more in-depth analysis of the tax policies that stimulate the development of renewable energy, we will also investigate the dependence of the amount of energy produced from renewable sources on various energy taxes. In this context, it is important that complex taxes on the consumption of various energy resources ensure the growth of production volumes of all investigated types of renewable energy (solar, wind, hydropower, and energy from waste) in different periods of analysis. Comprehensive taxes on the consumption of fossil energy resources have the same effect. In addition, taxes on the production and consumption of electricity turned out to be effective tools for stimulating the development of renewable energy in all directions except for hydropower, for which the impact turned out to be statistically insignificant. The stimulating effect of taxes on natural gas was confirmed for the development of hydropower in the medium-term period, as well as for other directions simultaneously in the short- (less than 1 year) and medium-term (3 years) periods. Taxes on mineral oils proved to be an inhibitor of the development of hydropower, while at the same time stimulating the growth of other types of renewable energy. Taxation of oil waste also has a limited stimulating effect. In contrast, coal taxes are a disincentive to almost all types of renewable energy production. We noted that the impact of taxes on the stimulation of renewable energy has a somewhat limited effectiveness: statistically significant dependencies were confirmed for the production of solar and wind energy, as well as for the production of energy from waste (only in the short term), while the taxation of these areas of energy is only a significant deterrent factor for wind power generation. At the same time, the presence of contributions to national energy funds in countries has a controversial effect, which stimulating for the production of energy from waste, restraining for solar energy, and statistically insignificant for other types.

The next important area of energy security research is the effectiveness of the national energy system, both in the context of fully meeting the country’s needs and in terms of energy production losses and related environmental damage. The results presented in Table 3 proved that energy taxes also have regulatory effectiveness in this direction.

Table 3.

Results of assessment of energy taxes’ impact on efficiency of national energy systems in European countries for period 1994–2021.

The obtained results confirmed that individual energy taxes ensured a reduction in the import of energy resources. Such an impact is recorded for taxes on the production and consumption of electricity, taxes on nuclear energy, taxes on oil waste, contributions to state energy funds, and comprehensive energy and energy resource taxation instruments. Instead, the increase in taxes used to stimulate renewable energy turned out to be the reason for the increase in the share of energy imports. Comprehensive energy taxes, taxation of oil and oil products, contributions to state energy funds, and taxes for stimulating renewable energy turned out to be tools for reducing losses during energy distribution and transportation. In the context of minimizing environmental damage from the functioning of the energy system, the impact of most energy taxes turned out to be controversial, simultaneously ensuring the reduction in emissions of some types of harmful substances while the emissions of other pollutants increased. Use of taxes on coal can reduce emissions of different pollutants. On the other hand, the growth of the contributions to national energy funds led to an increase in environmental pollution.

Generalizing the results of the first stage of the study, the regulatory impact of certain types of regulatory taxes on ensuring the country’s energy security parameters should be summarized (Table 4). Summarizing the level of regulatory effectiveness of certain types of energy taxes, we noted that complex taxes on both energy resources and energy sources turned out to be the most effective methods, as they ensure the improvement of the values of almost all parameters of energy security and lead to minimal deterioration of individual indicators. The establishment of comprehensive energy taxes on fossil energy resources, oil and oil products, natural gas, coal, energy production, and consumption also proved to be effective. At the same time, the taxation of renewable energy is debatable, since the achieved effects are controversial—the improvement in certain parameters of energy security is offset through the deterioration of others. Taxes related to nuclear energy separately had the same final effect. Establishing contributions to national energy funds turned out to be ineffective for ensuring energy security—in most cases, their presence worsens the value of the studied parameters.

Table 4.

Regulatory impact of various energy taxes on ensuring energy security in European countries.

The next stage of the research is to check the role of the formed pattern of building the country’s energy system on the effectiveness of its transformation to ensure energy security. Using the cluster analysis toolkit (k-means method), three models of energy system construction in the studied countries were identified (Figure 1).

Figure 1.

Description of different clusters of European countries according to structure of energy production in 1994, %. Note: authors’ calculations based on data from https://ec.europa.eu/eurostat/en/web/main/data/database, accessed on 10 February 2023.

The conducted study proved that the structure of energy production in European countries in 1994 was characterized by three main models, which became the basis for grouping countries into clusters (Table 5). In the countries included in the first cluster, the basis of energy production was fossil energy resources, while the ratio of oil, gas, and solid fossil fuels was evenly diversified. The countries included in the second cluster had the highest degree of energy diversification, providing energy production from all available types of resources, while the concentration of one type of energy resource in the system did not exceed 33%. In the countries that formed the third cluster, the highest level of the share of renewable energy is observed among all objects of the study; at the same time, the concentration of the energy system on one type of energy resources (oil and oil products) exceeds 50%.

Table 5.

Results of European countries’ clustering according to structure of energy production in 1994.

Evaluating the impact of energy taxes on energy security indicators in terms of individual clusters determines the effectiveness of tax instruments under different initial conditions. The results presented in Table 6 show that complex energy taxes only proved to be an effective tool for stimulating the reduction in the share of energy production from fossil sources in countries that initially had well-diversified structures of energy production.

Table 6.

Results of assessment of energy taxes’ impact on percentage of electricity production from oil, gas, and coal sources in European countries with different initial structures of energy production.

At the same time, comprehensive taxes on fossil fuels led to an increase in the share of energy production from fossil sources in countries with a high and medium concentration of combustible energy resources. Taxes on mineral oil and taxes on natural gas were most effective in reducing fossil energy production in countries focused on such energy production, while coal taxes are more effective in diversified energy systems. It is quite important that taxes on the production and consumption of electricity became an incentive to reduce its production from fossil sources only in those countries in which the share of renewable energy was initially the highest. At the same time, taxes on the production of electricity from renewable sources in countries with an initial low level of renewable energy became a disincentive for the further development of carbon-neutral energy. The impact of energy taxes on fossil fuel energy consumption also turned out to be diversified (Table 7). Thus, comprehensive taxes proved to be a significant incentive only in the second cluster of countries, which had the lowest share of combustible energy resources in energy production. Taxes on all energy resources, therefore, were only an incentive to reduce the production of the most environmentally harmful energy, while specialized taxes on combustible energy resources were a more valuable fiscal instrument. Among the energy taxes related to individual objects of taxation, the greatest incentives to reduce the consumption of fossil fuel energy turned out to be taxes on mineral oils for the countries in the first and third clusters, taxes on natural gas for the countries in the first cluster, and taxes on nuclear energy for the countries in the second cluster. Taxes on the production and consumption of electricity were also characterized by efficiency for certain types of economies.

Table 7.

Results of assessment of energy taxes’ impact on percentage of fossil fuel energy consumption in European countries with different initial structures of energy production.

Comprehensive energy taxes proved to be an effective incentive for the development of renewable energy for countries with an initial low level of renewable energy in the energy system, while disincentivizing its further development in systems with a higher level of renewable energy (Table 8). At the same time, extensive taxation of fossil energy resources discouraged the development of renewable energy in countries whose energy system was focused on the use of this type of energy resource. On the other hand, taxation of certain types of fossil energy resources in such countries created incentives for the development of renewable energy. Unfortunately, the existing array of data did not allow a relevant assessment of the impact of taxes on renewable energy across countries with different types of energy system structures.

Table 8.

Results of assessment of energy taxes’ impact on percentage of energy from renewable sources in European countries with different initial structures of energy production.

Tax instruments for increasing renewable energy production vary for different types of economies. Thus, in countries with a predominance of thermal energy production, incentives for the development of hydropower turned out to be complex taxes on combustible energy resources, taxes on electricity production, and taxes in the field of renewable energy. In countries with diversified energy systems, such incentives were comprehensive taxes on energy resources and taxes on combustible resources, as well as taxes on coal and on the production of renewable energy; however, these taxes only provide incentives in the short term. In countries with a high initial level of renewable energy, taxes on mineral oils and their waste, taxes on coal, taxes on natural gas, and taxes on electricity consumption in general provided the greatest incentives (Table 9).

Table 9.

Results of assessment of energy taxes’ impact on gross production of electricity and derived heat from hydropower sources in European countries with different initial structures of energy production.

It should be noted that all energy taxes turned out to be incentives for wind energy production for countries with an initially high level of renewable energy, the impacts of which were assessed (Table 10). At the same time, for other countries, coal taxes turned out to be a disincentive to this process, while for countries with an initially minimal level of renewable energy, nuclear energy taxes and electricity consumption taxes also had a disincentive effect.

Table 10.

Results of assessment of energy taxes’ impact on gross production of electricity and derived heat from wind sources in European countries with different initial structures of energy production.

The influence of energy taxes on the production of solar energy is characterized by a similar specificity compared to the previously identified dependencies related to the influence of the development of renewable energy (Table 11).

Table 11.

Results of assessment of energy taxes’ impact on gross production of electricity and derived heat from solar sources in European countries with different initial structures of energy production.

At the same time, of strategic importance is the fact that for the countries in the first cluster, taxation of energy production from renewable sources turned out to be a disincentive, while taxes aimed at stimulating renewable energy were confirmed as efficient.

The production of energy from waste has a double environmental impact; thus, it is important to determine the most effective incentives for such production (Table 12). Therefore, tax instruments had the broadest effect for the countries in the first cluster. The impact of most types of energy taxes turned out to be direct, with only taxes on coal, nuclear energy, and electricity consumption in general turning out to be limiting instruments. The set of stimulants for other countries also turned out to be different. Thus, for countries that had a well-diversified energy structure at the beginning of the study, taxes on electricity consumption, taxes on energy production from renewable sources, and taxes on nuclear energy became effective tools. For countries with an initially high level of renewable energy, taxes on oil, oil products, and oil waste, complex energy taxes, and coal taxes proved to be effective with a time lag of three years.

Table 12.

Results of assessment of energy taxes’ impact on gross energy production from renewable municipal waste in European countries with different initial structures of energy production.

The effectiveness of the impact of energy taxes on energy imports turned out to be quite wide, depending on the structure of the energy system of the countries (Table 13). For example, in countries whose energy system was based on fossil energy resources, natural gas taxes and renewable energy production taxes became the determinants of energy import reduction in the short term, while electricity production taxes and complex energy taxes were determinants in the medium term. At the same time, taxation of fossil energy resources turned out to be a stimulus for the growth of energy imports at all time intervals in the study, stimulating taxes on renewable energy in the medium term, as well as taxes on electricity consumption in the short term. For countries with a well-diversified energy sector, taxation of nuclear energy became a limiting factor for energy imports, while the imposition of taxes on combustible energy resources and on renewable energy sources lead to an increase in the country’s energy dependence on external resources. The last group of countries demonstrated the effectiveness of the restrictive effect on energy imports for instruments such as comprehensive energy taxes (in the short term), mineral oil taxes (with an average time lag), and electricity consumption taxes (at different time horizons). At the same time, taxation of energy production from coal, natural gas, and nuclear fuel leads to an increase in energy imports.

Table 13.

Results of assessment of energy taxes’ impact on percentage of net energy imports in European countries with different initial structures of energy production.

The results of the calculations proved that the presence of energy taxes also stimulated the efficiency of energy distribution and transportation from the point of view of minimizing energy losses (Table 14). Thus, complex energy taxes and taxes on fossil fuels turned out to be incentives for the countries in the first and second clusters, while taxes on mineral oils were incentives for the countries in the first and third clusters. Moreover, taxes on natural gas were incentives for the countries in the third cluster, while taxes on energy production from renewable sources were incentives for the countries in the second cluster. At the same time, the presence of taxes for stimulation of renewable energy production in the countries in the first cluster increased the level of energy losses in the process of its production and distribution.

Table 14.

Results of assessment of energy taxes’ impact on percentage of electric power transmission and distribution losses in European countries with different initial structures of energy production.

Taxation of fuel energy resources, complex taxation of energy production, and taxation of electricity production and consumption in most cases lead to a reduction in the level of CO2 intensity of energy use (Table 15). On the other hand, taxation of natural gas in countries with an initially higher level of renewable energy was the reason for the growth of the carbon footprint, while in countries with a low level of renewable energy, taxes on renewable energy had such an effect.

Table 15.

Results of assessment of energy taxes’ impact on CO2 intensity of energy use in European countries with different initial structures of energy production.

In countries with an initially extremely high level of energy production from fossil fuels, comprehensive taxes on fossil energy sources, taxes on coal and natural gas, and taxes on electricity production in general can reduce CO2 emissions in the energy production process. On the other hand, the introduction of taxation of renewable energy and nuclear energy leads to an increase in the level of pollution related to energy production (Table 16).

Table 16.

Results of assessment of energy taxes’ impact on CO2 emissions from electricity and heat production in European countries with different initial structures of energy production.

In the cluster of countries with diversified energy production structures, complex taxes on fossil fuels, taxes on coal, and taxes on renewable energy production proved to be effective incentives for the transition to a carbon-neutral economy, while nuclear energy taxes and complex energy taxes demonstrated the opposite effect. In the third cluster of countries, whose energy systems were more concentrated on the production of energy from oil, taxes on coal, natural gas, and oil waste lead to an increase in the carbon footprints of their national energy industries.

Energy taxes demonstrated the broadest impact in reducing methane emissions in countries focused on energy production from fossil sources (Table 17). Only complex energy taxes in this group turned out to be a trigger for the further growth of this type of pollution in the process of energy production. At the same time, this group of taxes proved to be an effective inhibitor of methane emissions in a well-diversified energy system. In contrast, in the countries in the second cluster, there was an increase in methane emissions from the energy system because of the impact of taxes on fuel energy resources, taxes on coal, and taxes on nuclear energy and renewable energy, while comprehensive energy taxes and taxes on electricity consumption were determinants of a decline in energy-related methane production. In the countries in the third cluster, taxes on electricity production turned out to be the only effective tool for limiting methane emissions.

Table 17.

Results of assessment of energy taxes’ impact on percentage of energy-related methane emissions in European countries with different initial structures of energy production.

The effectiveness of tax instruments in influencing the level of nitrate oxide emissions was significantly differentiated depending on the initial functioning conditions of the country’s energy system (Table 18). Thus, complex energy taxes proved to be an effective inhibitor only in countries with diversified energy systems, and in other cases led to an increase in pollution. Systematic taxation of fuel and energy resources almost always led to an increase in environmental pollution, as did taxation of mineral oils and natural gas and taxation of electricity consumption. Coal taxes proved to be an effective inhibitor of nitrous oxide emissions in the countries in the first and second clusters, and taxes on nuclear energy were a relevant tool for the countries in the first cluster. In contrast, while taxes on renewable energy showed the expected deterrent effect for the countries in the second cluster, they had the opposite effect in the countries in the first cluster.

Table 18.

Results of assessment of energy taxes’ impact on percentage of nitrous oxide emissions in energy sector in European countries with different initial structures of energy production.

Summarizing the results of the conducted research, a list of the most effective types of energy taxes should be devised, which should be applied to countries with various prerequisites for the formation of energy systems. Thus, Table 19 summarizes the results of evaluating the effectiveness of energy taxes in countries with an energy system focused on the uniform use of various types of fossil energy resources.

Table 19.

Regulatory impact of various energy taxes’ impact on ensuring energy security in European countries with structures of energy system initially based on fossil fuels (cluster 1).

For this group of countries, taxes on mineral oils and taxes on natural gas proved to be the most effective methods, as they improved most indicators of energy security and had almost no reversal effects that reduced their effectiveness. Complex energy taxes, taxes on fossil energy resources, and stimulating taxes on the development of renewable energy were also proved to be quite effective. On the other hand, in countries of this type, taxation of energy production from renewable resources and nuclear energy turned out to be extremely ineffective from the point of view of the complex impact on energy security.

In countries with a well-diversified structure of energy production, integrated energy taxes, nuclear energy taxes, and electricity consumption taxes proved to be the most effective (Table 20).

Table 20.

Regulatory impact of various energy taxes’ impact on ensuring energy security in European countries with initially well-diversified structures of their energy systems (cluster 2).

It should be noted that the cumulative effect of taxes on the production of energy from fossil and renewable sources on energy security is minimized, since the positive effects of improving some indicators are offset via the deterioration of other parameters. The non-confirmed statistical significance of the effects of other taxes on energy security indicate that, in the countries in this group, they have a fiscal rather than a regulatory purpose.

Calculations for the final group of countries showed that the most effective method is taxes on mineral oils, which is quite natural, given the high reliance of the energy systems of these countries on the production of energy from oil (Table 21). Taxation of oil waste was also relatively effective in these countries.

Table 21.

Regulatory impact of various energy taxes’ impact on ensuring energy security in European countries with initially high levels of renewables in the structures of their energy systems (cluster 3).

The difference between this group of countries and the previous groups is the high efficiency of taxation of electricity production and consumption in ensuring energy security, along with the relatively low efficiency of complex energy taxes. Another important factor is the fact that in countries with a high level of energy production from renewable sources, taxes on renewable energy do not have any regulatory effectiveness.

5. Discussion

The research conducted made it possible to select the optimal energy taxes in the context of ensuring energy security. The grouping of energy taxes in terms of tax objects made it possible to test the hypothesis regarding the importance of choosing an approach to the establishment of regulatory instruments. The calculations confirmed that the impact of the same energy taxes on different parameters of energy security can be different, which proves the need to consider the complex effectiveness of tax instruments when deciding on their application. It is important that, in most cases, the obtained effects of energy taxes on energy security parameters are similar in the short- and long-term periods. This finding increases the value of environmental taxes as tools for achieving the regulatory goals of the state in ensuring energy security. The results of the calculations proved that complex energy taxes are the most effective in most cases. Considering the calculations separately for each type of energy taxes, this finding determines the perspective of further research on the effectiveness of the simultaneous application of different types of energy taxes in individual countries. We noted that the modeling process did not consider tax benefits when applying energy taxes, as well as the differentiation between tax rates when applying the same types of energy taxes in different countries or when simultaneously taxing different objects with the same tax. These factors are also decisive for maximizing the regulatory potential of tax instruments and should be considered when making management decisions.

The cluster analysis of European countries based on the structures of their energy systems allowed us to reveal significant differentiation at the time of the beginning of the study. Modeling the effects of influence in the section of individual clusters proved that the regulatory efficiency of energy taxes also depends on the former model of the national energy system. The obtained results revealed that the same types of energy taxes can have different effects on certain aspects of ensuring energy security. This finding indicates the necessity of forming an energy taxation strategy that considers systemically important branches of the energy sector and depends on the priority goals of the state environmental and energy policy. It is important that the complex impact of energy taxes on energy security often involves the leveling of several achieved positive effects at the expense of negative effects on other aspects, which in some cases leads to a decrease in the overall level of energy security because of the functioning of energy taxes. In addition, it was found that in some groups of countries, certain types of energy taxes do not have a regulatory effect on energy security at all, which allows them to be interpreted as fiscal rather than regulatory instruments. It should be noted that during the research, individual models could not be built due to insufficient data, which relates to the tax reforms that took place in the countries during the research and led to the cancellation or introduction of certain types of energy taxes. This outcome creates prospects for further research on the effectiveness of such tax instruments using data from a wider sample of countries.

6. Conclusions

The research conducted proved that the choice of objects of taxation with energy taxes is important for ensuring energy security. At the same time, the obtained results should be interpreted in the context of the achieved effects of influence on various parameters of energy security. It was proved that the total efficiency was greatest for complex energy taxes, while it was lowest for contributions to energy funds, the presence of which ultimately leads to a deterioration of energy security parameters. In the research process, it was also confirmed that the strategy for setting energy taxes should be formed depending on the prerequisites for building the country’s energy system. Thus, the effectiveness of complex energy taxes is the highest in countries with a well-diversified energy system structure, and the lowest in countries with a high level of reliance on one type of energy resource. At the same time, complex taxes on fossil fuel sources were proved to be effective only in countries whose energy system is focused on the use of fossil fuel energy resources. Importantly, taxes to stimulate renewable energy were proved to be effective only in countries with an initially minimal level of renewable energy use. In most cases, the differentiation between the achieved regulatory effects of energy taxes in the short- and medium-term perspectives was not confirmed, which is of great importance for evaluating and forecasting the effectiveness of the tax policy of states in the field of energy. The obtained results create significant value for the development of strategies for the transformation of energy systems of countries in the context of ensuring the sustainable development of energy. Balancing the effects of energy taxes on various aspects of energy security, as well as considering their fiscal effectiveness, will allow states to maximize their progress toward achieving the goals of state regulation of the economy, and accelerate progress toward achieving the Sustainable Development Goals through forming an environmentally safe and economically efficient energy system. The obtained results provide a powerful background for policymakers to develop a system of energy taxation. The system of energy taxation should be built based on the initial structure of energy production and according to the priority goals of policy. However, it is also important to choose a workable combination of several energy taxes to provide the maximum positive effect.

Author Contributions

Conceptualization, A.K., Y.S. and S.L.; methodology, AK., Y.S., S.L. and D.K.; validation, A.K., D.K. and D.G.; formal analysis, S.L., D.K. and D.G.; investigation, Y.S. and S.L.; resources, A.K., Y.S., D.K. and D.G.; data curation, A.K., S.L.; writing—original draft preparation, A.K., Y.S., S.L. and D.K.; writing—review and editing, A.K. and D.G.; visualization, A.K., Y.S. and D.K.; supervision, A.K. and Y.S.; project administration, A.K. and S.L.; funding acquisition, A.K. and Y.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Ministry of Education and Science of Ukraine and contains the results of the projects no. 0122U000777, 0122U000778, and 0123U100112. The research received funding via the research subsidy of the Department of Applied Social Sciences of the Faculty of Organization and Management of the Silesian University of Technology in Poland for 2023, grant number 13/020/BK_23/0081.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data were obtained from the Database on Policy Instruments for the Environment (https://pinedatabase.oecd.org/Default.aspx, accessed on 15 January 2023), The International Energy Agency https://ec.europa.eu/eurostat/data/database, accessed on February 10, 2023), and the World Bank World Development Indicators (https://databank.worldbank.org/source/world-development-indicators, accessed on 25 March 2023).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Mushtaq, Z.; Wei, W.; Jamil, I.; Sharif, M.; Chandio, A.A.; Ahmad, F. Evaluating the factors of coal consumption inefficiency in energy intensive industries of China: An epsilon-based measure model. Resour. Policy 2022, 78, 102800. [Google Scholar] [CrossRef]

- Wei, W.; Mushtaq, Z.; Sharif, M.; Zeng, X.; Wan-Li, Z.; Qaisrani, M.A. Evaluating the coal rebound effect in energy intensive industries of China. Energy 2020, 207, 118247. [Google Scholar] [CrossRef]

- Fadel, S.; Rouaski, K.; Zakane, A.Z.A.; Djerboua, A. Estimating Climate Influence of The Potential COVID-19 Pandemic Spreading in Algeria. Socioecon. Chall. 2022, 6, 24–40. [Google Scholar] [CrossRef]

- Vakulchuk, R.; Overland, I.; Scholten, D. Renewable energy and geopolitics: A review. Renew. Sustain. Energy Rev. 2020, 122, 109547. [Google Scholar] [CrossRef]

- Supriyanto; Adawiyah, W.R.; Arintoko; Rahajuni, D.; Kadarwati, N. Economic growth and environmental degradation paradox in ASEAN: A simultaneous equation model with dynamic panel data approach. Environ. Econ. 2022, 13, 171–184. [Google Scholar] [CrossRef]

- Matvieieva, Y. Modelling and Forecasting Energy Efficiency Impact on the Human Health. Health Econ. Manag. Rev. 2022, 3, 78–85. [Google Scholar] [CrossRef]

- Kolosok, S.; Bilan, Y.; Vasylieva, T.; Wojciechowski, A.; Morawski, M. A Scoping Review of Renewable Energy, Sustainability and the Environment. Energies 2021, 14, 4490. [Google Scholar] [CrossRef]

- Charles Rajesh Kumar, J.; Majid, M.A. Renewable energy for sustainable development in India: Current status, future prospects, challenges, employment, and investment opportunities. Energy Sustain. Soc. 2020, 10, 1–36. [Google Scholar] [CrossRef]

- Coady, D.; Parry, I.; Sears, L.; Shang, B. How Large Are Global Fossil Fuel Subsidies? World Dev. 2017, 91, 11–27. [Google Scholar] [CrossRef]

- Papadis, E.; Tsatsaronis, G. Challenges in the decarbonization of the energy sector. Energy 2020, 205, 118025. [Google Scholar] [CrossRef]

- Cherp, A.; Jewell, J. The concept of energy security: Beyond the four As. Energy Policy 2014, 75, 415–421. [Google Scholar] [CrossRef]

- Naumenkova, S.; Mishchenko, V.; Mishchenko, S. Key energy indicators for sustainable development goals in Ukraine. Probl. Perspect. Manag. 2022, 20, 379–395. [Google Scholar] [CrossRef]

- Oussama, M.H.Z.; Ibtissem, G. The role of economic diplomacy in the promotion of non-hydrocarbon exports in Algeria. Socioecon. Chall. 2022, 6, 97–105. [Google Scholar] [CrossRef]

- Aliyeva, A. Post-Oil Period in Azerbaijan: Economic Transformations, Anti-Inflation Policy and Innovations Management. Mark. Manag. Innov. 2022, 2, 268–283. [Google Scholar] [CrossRef]

- Vasylieva, T.; Pavlyk, V.; Bilan, Y.; Mentel, G.; Rabe, M. Assessment of Energy Efficiency Gaps: The Case for Ukraine. Energies 2021, 14, 1323. [Google Scholar] [CrossRef]

- Tu, Y.-X.; Kubatko, O.; Piven, V.; Sotnyk, I.; Kurbatova, T. Determinants of Renewable Energy Development: Evidence from the EU Countries. Energies 2022, 15, 7093. [Google Scholar] [CrossRef]

- Dzwigol, H.; Kwilinski, A.; Lyulyov, O.; Pimonenko, T. Renewable Energy, Knowledge Spillover and Innovation: Capacity of Environmental Regulation. Energies 2023, 16, 1117. [Google Scholar] [CrossRef]

- Kretek, H.A. Current Assumptions of the European Union’s Energy and Climate Policy in the Aspect of Opportunities and Threats. Sci. Pap. Sil. Univ. Technol. Organ. Manag. Ser. 2022, 165, 149–171. [Google Scholar] [CrossRef]

- Gavkalova, N.; Lola, Y.; Prokopovych, S.; Akimov, O.; Smalskys, V.; Akimova, L. Innovative Development of Renewable Energy During The Crisis Period and Its Impact on the Environment. Virtual Econ. 2022, 5, 65–77. [Google Scholar] [CrossRef]

- Wang, B.; Wang, Q.; Wei, Y.-M.; Li, Z.-P. Role of renewable energy in China’s energy security and climate change mitigation: An index decomposition analysis. Renew. Sustain. Energy Rev. 2018, 90, 187–1944. [Google Scholar] [CrossRef]

- Sotnyk, I.; Kurbatova, T.; Romaniuk, Y.; Prokopenko, O.; Gonchar, V.; Sayenko, Y.; Prause, G.; Sapiński, A. Determining the Optimal Directions of Investment in Regional Renewable Energy Development. Energies 2022, 15, 3646. [Google Scholar] [CrossRef]

- Hosseini, S.E.; Wahid, M.A. Hydrogen from solar energy, a clean energy carrier from a sustainable source of energy. Int. J. Energy Res. 2020, 44, 4110–4131. [Google Scholar] [CrossRef]

- Timilsina, G.R.; Kurdgelashvili, L.; Narbel, P.A. Solar energy: Markets, economics and policies. Renew. Sustain. Energy Rev. 2012, 16, 449–465. [Google Scholar] [CrossRef]

- Matvieieva, Y.; Sulym, V.; Rosokhata, A.; Jasnikowski, A. Influence of Waste Incineration and Obtaining Energy from it to the Public Health for Certain Territories: A Bibliometric and Substantive Study. Health Econ. Manag. Rev. 2023, 4, 71–80. [Google Scholar] [CrossRef]

- Danish; Wang, Z. Does biomass energy consumption help to control environmental pollution? Evidence from BRICS countries. Sci. Total Environ. 2019, 670, 1075–1083. [Google Scholar] [CrossRef]

- Oe, H.; Yamaoka, Y.; Duda, K. How to Sustain Businesses in the Post-COVID-19 Era: A Focus on Innovation, Sustainability and Leadership. BEL 2022, 6, 1–9. [Google Scholar] [CrossRef]

- Kuzior, A.; Sira, M.; Brozek, P. Using Blockchain and Artificial Intelligence in Energy Management as a Tool to Achieve Energy Efficiency. Virtual Econ. 2022, 5, 69–90. [Google Scholar] [CrossRef]

- Borysiak, O.; Mucha-Kuś, K.; Brych, V.; Kinelski, G. Toward the Climate-Neutral Management of Innovation and Energy Security in Smart World; Logos Verlag Berlin GmbH: Berlin, Germany, 2022; pp. 1–174. [Google Scholar]

- Kuzior, A.; Vyshnevskyi, O.; Trushkina, N. Assessment of the Impact of Digitalization on Greenhouse Gas Emissions on the Example of EU Member States. Prod. Eng. Arch. 2022, 28, 407–419. [Google Scholar] [CrossRef]

- Lahouirich, M.W.; Oulfarsi, S.; Eddine, A.S.; Sakalli, H.E.B.; Boutti, R. From financial performance to sustainable development: A great evolution and an endless debate. Financ. Mark. Inst. Risks 2022, 6, 68–79. [Google Scholar] [CrossRef]

- Us, Y.; Pimonenko, T.; Lyulyov, O. Corporate Social Responsibility and Renewable Energy Development for the Green Brand within SDGs: A Meta-Analytic Review. Energies 2023, 16, 2335. [Google Scholar] [CrossRef]

- Kuzior, A.; Postrzednik-Lotko, K.A.; Postrzednik, S. Limiting of Carbon Dioxide Emissions through Rational Management of Pro-Ecological Activities in the Context of CSR Assumptions. Energies 2022, 15, 1825. [Google Scholar] [CrossRef]

- Bardy, R.; Rubens, A. Weighing Externalities of Economic Recovery Projects: An Alternative to Green Taxonomies that is Fairer and more Realistic. Bus. Ethic- Leadersh. 2022, 6, 23–34. [Google Scholar] [CrossRef]

- Vakulenko, I.; Lieonov, H. Renewable Energy and Health: Bibliometric Review of Non-Medical Research. Health Econ. Manag. Rev. 2022, 3, 44–53. [Google Scholar] [CrossRef]

- Hakhverdyan, D.; Shahinyan, M. Competitiveness, innovation and productivity of the country. Mark. Manag. Innov. 2022, 1, 108–123. [Google Scholar] [CrossRef]

- Chen, B.; Li, J.; Wu, X.; Han, M.; Zeng, L.; Li, Z.; Chen, G. Global energy flows embodied in international trade: A combination of environmentally extended input–output analysis and complex network analysis. Appl. Energy 2017, 210, 98–107. [Google Scholar] [CrossRef]

- Costantini, V.; Mazzanti, M. On the green and innovative side of trade competitiveness? The impact of environmental policies and innovation on EU exports. Res. Policy 2012, 41, 132–153. [Google Scholar] [CrossRef]

- Sedmíková, E.; Vasylieva, T.; Tiutiunyk, I.; Navickas, M. Energy consumption in assessment of shadow economy. Eur. J. Interdisc. Stud. 2021, 13, 47–64. [Google Scholar] [CrossRef]

- Wołowiec, T.; Kolosok, S.; Vasylieva, T.; Artyukhov, A.; Skowron, Ł.; Dluhopolskyi, O.; Sergiienko, L. Sustainable Governance, Energy Security, and Energy Losses of Europe in Turbulent Times. Energies 2022, 15, 8857. [Google Scholar] [CrossRef]

- Hakobyan, N.; Dabaghyan, A.; Khachatryan, A. Strategies of Post-War Anomie’s Overcoming in the Fields of Social Interactions and Business. BEL 2022, 6, 105–112. [Google Scholar] [CrossRef]

- Jiang, S.; Pu, R. Reconceptualizing and modeling sustainable consumption behavior: A synthesis of qualitative evidence from online education industry. Innov. Mark. 2021, 17, 144–156. [Google Scholar] [CrossRef]

- Kuzior, A.; Kwilinski, A.; Hroznyi, I. The Factorial-Reflexive Approach to Diagnosing the Executors’ and Contractors’ Attitude to Achieving the Objectives by Energy Supplying Companies. Energies 2021, 14, 2572. [Google Scholar] [CrossRef]

- Fasoranti, M.M.; Alimi, R.S.; Ofonyelu, C.C. Effect of prepaid meters on the household expenditure on electricity consumption in Ondo state. Socioecon. Chall. 2022, 6, 86–96. [Google Scholar] [CrossRef]

- Sterner, T. Fuel taxes: An important instrument for climate policy. Energy Policy 2007, 35, 3194–3202. [Google Scholar] [CrossRef]

- Samusevych, Y.; Babenko, V.; Bestuzheva, S.; Bondarenko, S.; Nesterenko, I. Environmental Taxation: Role in Promotion of the Pro-Environmental Behaviour. WSEAS Trans. Bus. Econ. 2023, 20, 410–427. [Google Scholar] [CrossRef]

- Nsouli, Z.F. Can Private Public Partnership Pullout Lebanon Out of Its Worst Economic Crisis? FMIR 2022, 6, 13–17. [Google Scholar] [CrossRef]

- Slavinskaite, N.; Lapinskiene, G.; Hlawiczka, R.; Vasa, L. Financial Innovation Management: Impact of Fiscal Decentralization on Economic Growth of the Baltic Countries. Mark. Manag. Innov. 2022, 1, 257–271. [Google Scholar] [CrossRef]

- Sotnyk, I.; Kurbatova, T.; Kubatko, O.; Prokopenko, O.; Prause, G.; Kovalenko, Y.; Trypolska, G.; Pysmenna, U. Energy Security Assessment of Emerging Economies under Global and Local Challenges. Energies 2021, 14, 5860. [Google Scholar] [CrossRef]

- Abolhosseini, S.; Heshmati, A. The main support mechanisms to finance renewable energy development. Renew. Sustain. Energy Rev. 2014, 40, 876–885. [Google Scholar] [CrossRef]

- Makarenko, I.; Bilan, Y.; Streimikiene, D.; Rybina, L. Investments support for Sustainable Development Goal 7: Research gaps in the context of post-COVID-19 recovery. Investig. Manag. Financ. Innov. 2023, 20, 151–173. [Google Scholar] [CrossRef]

- Tutak, M.; Brodny, J.; Siwiec, D.; Ulewicz, R.; Bindzár, P. Studying the Level of Sustainable Energy Development of the European Union Countries and Their Similarity Based on the Economic and Demographic Potential. Energies 2020, 13, 6643. [Google Scholar] [CrossRef]

- Versal, N.; Sholoiko, A. Green bonds of supranational financial institutions: On the road to sustainable development. Investig. Manag. Financ. Innov. 2022, 19, 91–105. [Google Scholar] [CrossRef]

- Cansino, J.M.; Pablo-Romero, M.P.; Román-Collado, R.; Yñiguez, R. Tax incentives to promote green electricity: An overview of EU-27 countries. Energy Policy 2010, 38, 6000–6008. [Google Scholar] [CrossRef]

- Barker, T.; Junankar, S.; Pollitt, H.; Summerton, P. Carbon leakage from unilateral Environmental Tax Reforms in Europe, 1995–2005. Energy Policy 2007, 35, 6281–6292. [Google Scholar] [CrossRef]

- Ma, Q.; Murshed, M.; Khan, Z. The nexuses between energy investments, technological innovations, emission taxes, and carbon emissions in China. Energy Policy 2021, 155, 112345. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. The energy, environmental and economic impacts of carbon tax rate and taxation industry: A CGE based study in China. Energy 2018, 159, 558–568. [Google Scholar] [CrossRef]

- Liang, Q.-M.; Fan, Y.; Wei, Y.-M. Carbon taxation policy in China: How to protect energy- and trade-intensive sectors? J. Policy Model. 2007, 29, 311–333. [Google Scholar] [CrossRef]

- Chen, W.; Hu, Z.-H. Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. J. Clean. Prod. 2018, 201, 123–141. [Google Scholar] [CrossRef]

- Zatti, A. Environmental taxes and subsidies: Some insights from the Italian experience. Environ. Econ. 2020, 11, 39–53. [Google Scholar] [CrossRef]

- Ekins, P.; Speck, S. Competitiveness and Exemptions from Environmental Taxes in Europe. Environ. Resour. Econ. 1999, 13, 369–396. [Google Scholar] [CrossRef]

- Dresner, S.; Dunne, L.; Clinch, P.; Beuermann, C. Social and political responses to ecological tax reform in Europe: An introduction to the special issue. Energy Policy 2006, 34, 895–904. [Google Scholar] [CrossRef]

- Murray, B.; Rivers, N. British Columbia’s revenue-neutral carbon tax: A review of the latest “grand experiment” in environmental policy. Energy Policy 2015, 86, 674–683. [Google Scholar] [CrossRef]

- Wang, Q.; Hubacek, K.; Feng, K.; Wei, Y.-M.; Liang, Q.-M. Distributional effects of carbon taxation. Appl. Energy 2016, 184, 1123–1131. [Google Scholar] [CrossRef]

- Yuyin, Y.; Jinxi, L. The effect of governmental policies of carbon taxes and energy-saving subsidies on enterprise decisions in a two-echelon supply chain. J. Clean. Prod. 2018, 181, 675–691. [Google Scholar] [CrossRef]

- Zhang, Z.; Baranzini, A. What do we know about carbon taxes? An inquiry into their impacts on competitiveness and distribution of income. Energy Policy 2004, 32, 507–518. [Google Scholar] [CrossRef]

- Bilan, Y.; Samusevych, Y.; Lyeonov, S.; Strzelec, M.; Tenytska, I. The Keys to Clean Energy Technology: Impact of Environmental Taxes on Biofuel Production and Consumption. Energies 2022, 15, 9470. [Google Scholar] [CrossRef]

- Samusevych, Y.; Lyeonov, S.; Artyukhov, A.; Martyniuk, V.; Tenytska, I.; Wyrwisz, J.; Wojciechowska, K. Optimal design of transport tax on the way to national security: Balancing environmental footprint, energy efficiency and economic growth. Sustainability 2022, 15, 831. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).