The Impact of Oil Price Fluctuations on Consumption, Output, and Investment in China’s Industrial Sectors

Abstract

:1. Introduction

2. Literature Review

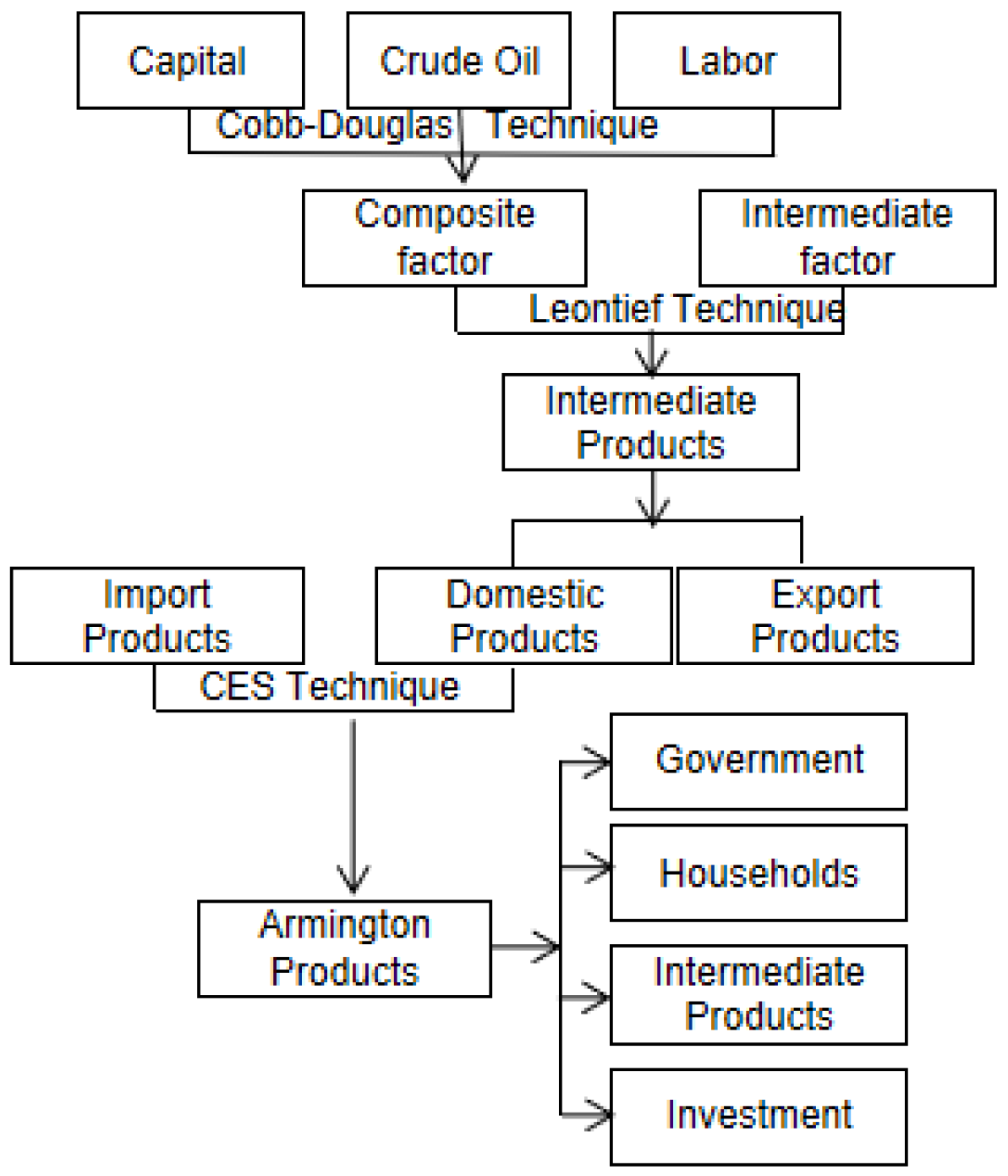

3. Model Description

3.1. Production in Economy

3.2. Government Description

3.3. Household Description

3.4. International Trade

3.5. Market Equilibrium

4. Data and Parameters Calibration

4.1. Data

4.2. Parameters Calibration

4.2.1. Calibration of Cobb-Douglas Production Function

4.2.2. Calibration of the Leontief Function

4.2.3. Calibration of the CES Function

4.2.4. Calibration of CET Function

4.2.5. Calibration of Other Coefficients

5. Results of Simulation

5.1. Impact of Crude Oil Price Fluctuations on Consumption

Changes in Household Consumption

5.2. Impact of Crude Oil Price Fluctuations on Output

5.3. Impact of Crude Oil Price Fluctuations on Investment

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| CGE | Computable General Equilibrium; |

| SAM | Social Accounting Matrix; |

| CES | Constant Elasticity of Substitution; |

| CET | Constant Elasticity of Transformation. |

Appendix A

| Number | Industry Calssification | Sector Code |

|---|---|---|

| 1 | Daily consumption products | 01001, 02002, 03003, 04004, 05005, 13012, 13013, 13014, 13015, 13016, 13017, 13018, 14019, 14020, 14021, 14022, 15023, 15024, 15025, 16026, 51105, 52106, 61119, 62120 |

| 2 | Coal mining and washing products | 06006 |

| 3 | Crude oil and gas extraction products | 07007 |

| 4 | Metal, non-metallic mining products, and mining auxiliary activities | 08008, 09009, 10010, 11011 |

| 5 | Textile, clothing, shoes, and hats, leather, down products | 17027, 17028, 17029, 17030, 17031, 18032, 19033, 19034 |

| 6 | Woodworking products, paper printing, and cultural and educational supplies | 20035, 21036, 22037, 23038, 24039, 24040 |

| 7 | Crude oil, refined coke products, and processed nuclear fuel products | 25041, 25042 |

| 8 | Chemical products | 26043, 26044, 26045, 26046, 26047, 26048, 26049, 27050, 28051, 29052, 29053 |

| 9 | Metal, non-metallic products | 30054, 30055, 30056, 30057, 30058, 30059, 30060, 31061, 31062, 31063, 32064, 32065, 33066 |

| 10 | Hardware and equipment | 34067, 34068, 34069, 34070, 34072a, 34071, 34072b, 35073, 35074, 35075, 35076a, 35076b, 36077, 36078, 37079, 37080, 37081, 38082, 38083, 38084, 38085, 38086, 38087, 39088, 39089, 39090, 39091, 39092, 39093, 40094, 41095, 42096, 43097 |

| 11 | Electricity, gas production, and supply | 44098, 45099 |

| 12 | Water production and supply | 46100 |

| 13 | Real estate | 47101a, 47101b, 48102a, 48102b, 49103, 50104, 70129 |

| 14 | Transportation, storage, and postal | 53107, 53108, 54109, 54110, 55111, 55112, 56113, 56114, 57115, 58116, 59117, 60118 |

| 15 | Information transmission, software, and information technology services | 63121, 63122, 64123, 65124, 65125 |

| 16 | Finance | 66126, 67127, 68128 |

| 17 | Public utilities | 71130, 72131, 73132, 74133, 75134, 76135, 77136, 78137, 80138, 81139, 83140, 84141, 85142, 86143, 87144, 88145, 89146, 90147, 94148, 91149 |

| Sector | |

|---|---|

| Daily consumption products | 0.194 |

| Coal mining and washing products | |

| Crude oil and gas extraction products | |

| Metal, non-metallic mining products, and mining auxiliary activities | |

| Textile, clothing, shoes and hats, leather, down products | 0.026 |

| Woodworking products, paper printing and cultural and educational supplies | 0.013 |

| Crude oil, refined coke products, and processed nuclear fuel products | 0.004 |

| Chemical products | 0.022 |

| Metal, non-metallic products | 0.002 |

| Hardware and equipment | 0.066 |

| Electricity, gas production, and supply | 0.012 |

| Water production and supply | 0.002 |

| Real estate | 0.205 |

| Transportation, storage, and postal | 0.028 |

| Information transmission, software, and information technology services | 0.026 |

| Finance | 0.208 |

| Public utilities | 0.192 |

| Sector | |||

|---|---|---|---|

| Daily consumption products | 0.006 | 0.680 | 0.314 |

| Coal mining and washing products | 0.010 | 0.551 | 0.439 |

| Crude oil and gas extraction products | 0.010 | 0.280 | 0.710 |

| Metal, non-metallic mining products, and mining auxiliary activities | 0.150 | 0.471 | 0.378 |

| Textile, clothing, shoes and hats, leather, down products | 0.010 | 0.588 | 0.402 |

| Woodworking products, paper printing, and cultural and educational supplies | 0.017 | 0.503 | 0.480 |

| Crude oil, refined coke products, and processed nuclear fuel products | 0.335 | 0.192 | 0.472 |

| Chemical products | 0.200 | 0.321 | 0.479 |

| Metal, non-metallic products | 0.117 | 0.361 | 0.523 |

| Hardware and equipment | 0.010 | 0.493 | 0.496 |

| Electricity, gas production, and supply | 0.060 | 0.325 | 0.615 |

| Water production and supply | 0.003 | 0.495 | 0.503 |

| Real estate | 0.028 | 0.472 | 0.499 |

| Transportation, storage, and postal | 0.136 | 0.433 | 0.431 |

| Information transmission, software, and information technology services | 0.003 | 0.395 | 0.602 |

| Finance | 0.007 | 0.513 | 0.480 |

| Public utilities | 0.175 | 0.644 | 0.181 |

| Sector | |

|---|---|

| Daily consumption products | 1.926 |

| Coal mining and washing products | 2.086 |

| Crude oil and gas extraction products | 1.906 |

| Metal, non-metallic mining products, and mining auxiliary activities | 2.738 |

| Textile, clothing, shoes and hats, leather, down products | 2.066 |

| Woodworking products, paper printing, and cultural and educational supplies | 2.155 |

| Crude oil, refined coke products, and processed nuclear fuel products | 2.823 |

| Chemical products | 2.826 |

| Metal, non-metallic products | 2.606 |

| Hardware and equipment | 2.103 |

| Electricity, gas production, and supply | 2.299 |

| Water production and supply | 2.032 |

| Real estate | 2.230 |

| Transportation, storage, and postal | 2.709 |

| Information transmission, software, and information technology services | 1.993 |

| Finance | 2.071 |

| Public utilities | 2.453 |

| Sector | ||

|---|---|---|

| Daily consumption products | 0.957 | 0.043 |

| Coal mining and washing products | 0.934 | 0.066 |

| Crude oil and gas extraction products | 0.417 | 0.583 |

| Metal, non-metallic mining products, and mining auxiliary activities | 0.957 | 0.043 |

| Textile, clothing, shoes and hats, leather, down products | 0.944 | 0.056 |

| Woodworking products, paper printing, and cultural and educational supplies | 0.943 | 0.057 |

| Crude oil, refined coke products, and processed nuclear fuel products | 0.938 | 0.062 |

| Chemical products | 0.910 | 0.090 |

| Metal, non-metallic products | 0.956 | 0.044 |

| Hardware and equipment | 0.847 | 0.153 |

| Electricity, gas production, and supply | 1.000 | |

| Water production and supply | 1.000 | |

| Real estate | 0.998 | 0.002 |

| Transportation, storage, and postal | 0.941 | 0.059 |

| Information transmission, software, and information technology services | 0.968 | 0.032 |

| Finance | 0.943 | 0.057 |

| Public utilities | 0.982 | 0.018 |

| Sector | |

|---|---|

| Daily consumption products | 4.907 |

| Coal mining and washing products | 3.989 |

| Crude oil and gas extraction products | 2.032 |

| Metal, non-metallic mining products, and mining auxiliary activities | 4.451 |

| Textile, clothing, shoes and hats, leather, down products | 4.352 |

| Woodworking products, paper printing, and cultural and educational supplies | 4.271 |

| Crude oil, refined coke products, and processed nuclear fuel products | 3.741 |

| Chemical products | 3.248 |

| Metal, non-metallic products | 4.611 |

| Hardware and equipment | 2.781 |

| Electricity, gas production, and supply | 63.439 |

| Water production and supply | 248,545.736 |

| Real estate | 25.148 |

| Transportation, storage, and postal | 3.751 |

| Information transmission, software, and information technology services | 5.646 |

| Finance | 4.281 |

| Public utilities | 6.461 |

| Sector | ||

|---|---|---|

| Daily consumption products | 0.960 | 0.040 |

| Coal mining and washing products | 0.999 | 0.001 |

| Crude oil and gas extraction products | 0.997 | 0.003 |

| Metal, non-metallic mining products, and mining auxiliary activities | 0.993 | 0.007 |

| Textile, clothing, shoes and hats, leather, down products | 0.814 | 0.186 |

| Woodworking products, paper printing, and cultural and educational supplies | 0.892 | 0.108 |

| Crude oil, refined coke products and processed nuclear fuel products | 0.978 | 0.022 |

| Chemical products | 0.939 | 0.061 |

| Metal, non-metallic products | 0.957 | 0.043 |

| Hardware and equipment | 0.830 | 0.170 |

| Electricity, gas production, and supply | 0.999 | |

| Water production and supply | 1.000 | |

| Real estate | 0.998 | 0.002 |

| Transportation, storage, and postal | 0.948 | 0.052 |

| Information transmission, software, and information technology services | 0.976 | 0.024 |

| Finance | 0.998 | 0.002 |

| Public utilities | 0.990 | 0.010 |

| Sector | |

|---|---|

| Daily consumption products | 4.936 |

| Coal mining and washing products | 24.371 |

| Crude oil and gas extraction products | 12.601 |

| Metal, non-metallic mining products, and mining auxiliary activities | 10.934 |

| Textile, clothing, shoes and hats, leather, down products | 2.568 |

| Woodworking products, paper printing, and cultural and educational supplies | 3.146 |

| Crude oil, refined coke products, and processed nuclear fuel products | 5.840 |

| Chemical products | 4.008 |

| Metal, non-metallic products | 4.760 |

| Hardware and equipment | 2.587 |

| Electricity, gas production, and supply | 30.416 |

| Water production and supply | 165,222.099 |

| Real estate | 19.963 |

| Transportation, storage, and postal | 4.468 |

| Information transmission, software, and information technology services | 6.504 |

| Finance | 20.880 |

| Public utilities | 9.854 |

| Sector | ||

|---|---|---|

| Daily consumption products | 0.012 | 0.028 |

| Coal mining and washing products | ||

| Crude oil and gas extraction products | ||

| Metal, non-metallic mining products, and mining auxiliary activities | ||

| Textile, clothing, shoes and hats, leather, down products | 0.001 | |

| Woodworking products, paper printing, and cultural and educational supplies | 0.008 | |

| Crude oil, refined coke products, and processed nuclear fuel products | ||

| Chemical products | 0.003 | |

| Metal, non-metallic products | 0.007 | |

| Hardware and equipment | 0.202 | |

| Electricity, gas production, and supply | ||

| Water production and supply | ||

| Real estate | 0.661 | |

| Transportation, storage, and postal | 0.018 | 0.009 |

| Information transmission, software, and information technology services | 0.041 | |

| Finance | 0.023 | |

| Public utilities | 0.948 | 0.039 |

| Sector | ||

|---|---|---|

| Daily consumption products | 0.040 | 0.044 |

| Coal mining and washing products | 0.146 | 0.014 |

| Crude oil and gas extraction products | 0.454 | 0.008 |

| Metal, non-metallic mining products, and mining auxiliary activities | 0.134 | 0.012 |

| Textile, clothing, shoes and hats, leather, down products | 0.001 | 0.023 |

| Woodworking products, paper printing, and cultural and educational supplies | 0.025 | 0.010 |

| Crude oil, refined coke products, and processed nuclear fuel products | 0.169 | 0.014 |

| Chemical products | 0.044 | 0.017 |

| Metal, non-metallic products | 0.034 | 0.018 |

| Hardware and equipment | 0.028 | 0.022 |

| Electricity, gas production, and supply | 0.041 | 0.061 |

| Water production and supply | 0.066 | 1.000 |

| Real estate | 0.057 | 0.016 |

| Transportation, storage, and postal | 0.010 | 0.016 |

| Information transmission, software, and information technology services | 0.014 | 0.014 |

| Finance | 0.056 | 0.014 |

| Public utilities | 0.011 | 0.014 |

| Sector | 1% | 5% | 10% | 15% | 20% |

|---|---|---|---|---|---|

| Daily consumption products | −0.707 | −0.908 | −1.150 | −1.384 | −1.610 |

| Coal mining and washing products | 1.313 | 1.091 | 0.822 | 0.563 | 0.312 |

| Crude oil and gas extraction products | 17.085 | 16.623 | 16.061 | 15.514 | 14.980 |

| Metal, non-metallic mining products, and mining auxiliary activities | 4.708 | 4.131 | 3.440 | 2.780 | 2.147 |

| Textile, clothing, shoes and hats, leather, down products | −7.533 | −7.684 | −7.864 | −8.036 | −8.199 |

| Woodworking products, paper printing, and cultural and educational supplies | −3.350 | −3.537 | −3.763 | −3.980 | −4.187 |

| Crude oil, refined coke products, and processed nuclear fuel products | 13.368 | 12.648 | 11.780 | 10.944 | 10.137 |

| Chemical products | 5.279 | 4.687 | 3.977 | 3.297 | 2.644 |

| Metal, non-metallic products | 2.081 | 1.625 | 1.078 | 0.555 | 0.053 |

| Hardware and equipment | −3.122 | −3.368 | −3.665 | −3.949 | −4.223 |

| Electricity, gas production, and supply | 1.376 | 1.079 | 0.721 | 0.377 | 0.046 |

| Water production and supply | −0.323 | −0.548 | −0.818 | −1.080 | −1.332 |

| Real estate | −0.324 | −0.670 | −1.087 | −1.487 | −1.872 |

| Transportation, storage, and postal | 2.322 | 1.804 | 1.184 | 0.591 | 0.023 |

| Information transmission, software, and information technology services | −1.494 | −1.663 | −1.867 | −2.064 | −2.254 |

| Finance | −0.431 | −0.659 | −0.936 | −1.203 | −1.461 |

| Public utilities | −9.015 | −9.654 | −10.418 | −11.149 | −11.849 |

| Sector | −1% | −5% | −10% | −15% | −20% |

|---|---|---|---|---|---|

| Daily consumption products | −0.604 | −0.394 | −0.120 | 0.166 | 0.467 |

| Coal mining and washing products | 1.427 | 1.660 | 1.963 | 2.279 | 2.611 |

| Crude oil and gas extraction products | 17.319 | 17.797 | 18.413 | 19.050 | 19.712 |

| Metal, non-metallic mining products, and mining auxiliary activities | 5.005 | 5.617 | 6.420 | 7.270 | 8.171 |

| Textile, clothing, shoes and hats, leather, down products | −7.455 | −7.294 | −7.083 | −6.858 | −6.620 |

| Woodworking products, paper printing, and cultural and educational supplies | −3.253 | −3.054 | −2.794 | −2.521 | −2.231 |

| Crude oil, refined coke products, and processed nuclear fuel products | 13.737 | 14.494 | 15.480 | 16.512 | 17.598 |

| Chemical products | 5.583 | 6.209 | 7.028 | 7.893 | 8.807 |

| Metal, non-metallic products | 2.315 | 2.799 | 3.432 | 4.101 | 4.809 |

| Hardware and equipment | −2.995 | −2.734 | −2.393 | −2.035 | −1.656 |

| Electricity, gas production, and supply | 1.529 | 1.843 | 2.252 | 2.682 | 3.136 |

| Water production and supply | −0.208 | 0.027 | 0.332 | 0.652 | 0.988 |

| Real estate | −0.146 | 0.220 | 0.698 | 1.200 | 1.730 |

| Transportation, storage, and postal | 2.589 | 3.138 | 3.859 | 4.622 | 5.430 |

| Information transmission, software, and information technology services | −1.408 | −1.231 | −1.002 | −0.762 | −0.511 |

| Finance | −0.314 | −0.074 | 0.236 | 0.561 | 0.901 |

| Public utilities | −8.687 | −8.010 | −7.122 | −6.183 | −5.187 |

| Sector | 1% | 5% | 10% | 15% | 20% |

|---|---|---|---|---|---|

| Daily consumption products | −0.199 | −0.455 | −0.763 | −1.057 | −1.340 |

| Coal mining and washing products | 7.113 | 6.750 | 6.315 | 5.898 | 5.498 |

| Crude oil and gas extraction products | 26.668 | 25.944 | 25.068 | 24.223 | 23.406 |

| Metal, non-metallic mining products, and mining auxiliary activities | 11.004 | 10.652 | 10.230 | 9.825 | 9.437 |

| Textile, clothing, shoes and hats, leather, down products | −11.294 | −11.435 | −11.600 | −11.754 | −11.898 |

| Woodworking products, paper printing, and cultural and educational supplies | −2.435 | −2.697 | −3.009 | −3.308 | −3.593 |

| Crude oil, refined coke products, and processed nuclear fuel products | 10.693 | 10.223 | 9.660 | 9.121 | 8.605 |

| Chemical products | 7.222 | 6.837 | 6.375 | 5.933 | 5.510 |

| Metal, non-metallic products | 2.054 | 1.772 | 1.435 | 1.113 | 0.804 |

| Hardware and equipment | −4.270 | −4.482 | −4.735 | −4.976 | −5.205 |

| Electricity, gas production, and supply | 4.889 | 4.566 | 4.178 | 3.807 | 3.451 |

| Water production and supply | 0.508 | 0.233 | −0.098 | −0.415 | −0.720 |

| Real estate | −1.419 | −1.711 | −2.061, | −2.396 | −2.717 |

| Transportation, storage, and postal | 8.402 | 8.018 | 7.559 | 7.121 | 6.700 |

| Information transmission, software, and information technology services | −0.417 | −0.664 | −0.961 | −1.245 | −1.519 |

| Finance | 1.916 | 1.641 | 1.309 | 0.989 | 0.680 |

| Public utilities | 2.695 | 2.180 | 1.562 | 0.972 | 0.407 |

| Sector | −1% | −5% | −10% | −15% | −20% |

|---|---|---|---|---|---|

| Daily consumption products | −0.068 | 0.203 | 0.557 | 0.930 | 1.325 |

| Coal mining and washing products | 7.299 | 7.683 | 8.185 | 8.715 | 9.276 |

| Crude oil and gas extraction products | 27.039 | 27.800 | 28.789 | 29.824 | 30.911 |

| Metal, non-metallic mining products, and mining auxiliary activities | 11.185 | 11.558 | 12.045 | 12.559 | 13.103 |

| Textile, clothing, shoes and hats, leather, down products | −11.221 | −11.069 | −10.865 | −10.646 | −10.409 |

| Woodworking products, paper printing, and cultural and educational supplies | −2.300 | −2.022 | −1.657 | −1.270 | −0.859 |

| Crude oil, refined coke products, and processed nuclear fuel products | 10.934 | 11.432 | 12.084 | 12.773 | 13.503 |

| Chemical products | 7.421 | 7.830 | 8.365 | 8.932 | 9.532 |

| Metal, non-metallic products | 2.199 | 2.498 | 2.890 | 3.304 | 3.744 |

| Hardware and equipment | −4.161 | −3.935 | −3.637 | −3.321 | −2.984 |

| Electricity, gas production and supply | 5.055 | 5.398 | 5.847 | 6.321 | 6.823 |

| Water production and supply | 0.649 | 0.939 | 1.318 | 1.716 | 2.137 |

| Real estate | −1.269 | −0.960 | −0.556 | −0.129 | 0.322 |

| Transportation, storage, and postal | 8.599 | 9.006 | 9.539 | 10.102 | 10.700 |

| Information transmission, software, and information technology services | −0.290 | −0.029 | 0.313 | 0.672 | 1.053 |

| Finance | 2.057 | 2.346 | 2.722 | 3.117 | 3.531 |

| Public utilities | 2.960 | 3.507 | 4.223 | 4.981 | 5.785 |

| Sector | 1% | 5% | 10% | 15% | 20% |

|---|---|---|---|---|---|

| Daily consumption products | −6.109 | −6.183 | −6.270 | −6.352 | −6.430 |

| Coal mining and washing products | −4.199 | −4.290 | −4.399 | −4.503 | −4.603 |

| Crude oil and gas extraction products | 10.714 | 10.415 | 10.051 | 9.695 | 9.348 |

| Metal, non-metallic mining products, and mining auxiliary activities | −0.989 | −1.412 | −1.917 | −2.398 | −2.857 |

| Textile, clothing, shoes and hats, leather, down products | −12.564 | −12.598 | −12.636 | −12.668 | −12.696 |

| Woodworking products, paper printing, and cultural and educational supplies | −8.608 | −8.672 | −8.747 | −8.817 | −8.881 |

| Crude oil, refined coke products, and processed nuclear fuel products | 7.200 | 6.652 | 5.991 | 5.355 | 4.742 |

| Chemical products | −0.449 | −0.885 | −1.408 | −1.907 | −2.384 |

| Metal, non-metallic products | −3.473 | −3.785 | −4.157 | −4.511 | −4.849 |

| Hardware and equipment | −8.392 | −8.512 | −8.654 | −8.788 | −8.915 |

| Electricity, gas production, and supply | −4.139 | −4.302 | −4.495 | −4.679 | −4.855 |

| Water production and supply | −5.746 | −5.842 | −5.955 | −6.063 | −6.166 |

| Real estate | −5.747 | −5.958 | −6.210 | −6.450 | −6.679 |

| Transportation, storage, and postal | −3.245 | −3.615 | −4.056 | −4.476 | −4.877 |

| Information transmission, software, and information technology services | −6.854 | −6.898 | −6.949 | −6.997 | −7.042 |

| Finance | −5.848 | −5.947 | −6.066 | −6.180 | −6.289 |

| Public utilities | −13.966 | −14.463 | −15.058 | −15.625 | −16.168 |

| Sector | −1% | −5% | −10% | −15% | −20% |

|---|---|---|---|---|---|

| Daily consumption products | −6.071 | −5.992 | −5.888 | −5.777 | −5.658 |

| Coal mining and washing products | −4.151 | −4.054 | −3.925 | −3.789 | −3.644 |

| Crude oil and gas extraction products | 10.867 | 11.176 | 11.575 | 11.987 | 12.414 |

| Metal, non-metallic mining products, and mining auxiliary activities | −0.770 | −0.319 | 0.275 | 0.905 | 1.577 |

| Textile, clothing, shoes and hats, leather, down products | −12.545 | −12.505 | −12.449 | −12.385 | −12.312 |

| Woodworking products, paper printing, and cultural and educational supplies | −8.574 | −8.503 | −8.408 | −8.304 | −8.191 |

| Crude oil, refined coke products, and processed nuclear fuel products | 7.482 | 8.059 | 8.811 | 9.599 | 10.429 |

| Chemical products | −0.224 | 0.239 | 0.848 | 1.491 | 2.174 |

| Metal, non-metallic products | −3.312 | −2.979 | −2.541 | −2.076 | −1.580 |

| Hardware and equipment | −8.330 | −8.201 | −8.030 | −7.847 | −7.651 |

| Electricity, gas production, and supply | −4.055 | −3.882 | −3.653 | −3.410 | −3.151 |

| Water production and supply | −5.697 | −5.595 | −5.462 | −5.320 | −5.168 |

| Real estate | −5.638 | −5.413 | −5.117 | −4.804 | −4.472 |

| Transportation, storage, and postal | −3.054 | −2.659 | −2.138 | −1.586 | −0.997 |

| Information transmission, software, and information technology services | −6.831 | −6.783 | −6.719 | −6.650 | −6.576 |

| Finance | −5.797 | −5.691 | −5.552 | −5.405 | −5.250 |

| Public utilities | −13.709 | −13.180 | −12.485 | −11.749 | −10.967 |

References

- Guan, L.; Zhang, W.W.; Ahmad, F.; Naqvi, B. The volatility of natural resource prices and its impact on the economic growth for natural resource-dependent economies: A comparison of oil and gold dependent economies. Resour. Policy 2021, 72, 102125. [Google Scholar] [CrossRef]

- van Eyden, R.; Difeto, M.; Gupta, R.; Wohar, M.E. Oil price volatility and economic growth: Evidence from advanced economies using more than a century’s data. Appl. Energy 2019, 233, 612–621. [Google Scholar] [CrossRef] [Green Version]

- Yildirim, Z.; Arifli, A. Oil price shocks, exchange rate and macroeconomic fluctuations in a small oil-exporting economy. Energy 2021, 219, 119527. [Google Scholar] [CrossRef]

- Xu, Q.; Fu, B.; Wang, B. The effects of oil price uncertainty on China’s economy. Energy Econ. 2022, 107, 105840. [Google Scholar] [CrossRef]

- Liu, D.; Meng, L.; Wang, Y. Oil price shocks and Chinese economy revisited: New evidence from SVAR model with sign restrictions. Int. Rev. Econ. Financ. 2020, 69, 20–32. [Google Scholar] [CrossRef]

- Kim, S.; Kim, S.Y.; Choi, K. Effect of Oil Prices on Exchange Rate Movements in Korea and Japan Using Markov Regime-Switching Models. Energies 2020, 13, 4402. [Google Scholar] [CrossRef]

- Mohaddes, K.; Pesaran, M.H. Oil prices and the global economy: Is it different this time around? Energy Econ. 2017, 65, 315–325. [Google Scholar] [CrossRef] [Green Version]

- Mallick, H.; Mahalik, M.K.; Sahoo, M. Is crude oil price detrimental to domestic private investment for an emerging economy? The role of public sector investment and financial sector development in an era of globalization. Energy Econ. 2018, 69, 307–324. [Google Scholar] [CrossRef]

- Lorusso, M.; Pieroni, L. Causes and consequences of oil price shocks on the UK economy. Econ. Model. 2018, 72, 223–236. [Google Scholar] [CrossRef] [Green Version]

- Jin, S.; Hamori, S. The Response of US Macroeconomic Aggregates to Price Shocks in Crude Oil vs. Natural Gas. Energies 2020, 13, 2603. [Google Scholar]

- Nasir, M.A.; Naidoo, L.; Shahbaz, M.; Amoo, N. Implications of oil prices shocks for the major emerging economies: A comparative analysis of BRICS. Energy Econ. 2018, 76, 76–88. [Google Scholar] [CrossRef]

- Charfeddine, L.; Barkat, K. Short- and long-run asymmetric effect of oil prices and oil and gas revenues on the real GDP and economic diversification in oil-dependent economy. Energy Econ. 2020, 86, 104680. [Google Scholar] [CrossRef]

- Nusair, S.A.; Olson, D. Asymmetric oil price and Asian economies: A nonlinear ARDL approach. Energy 2021, 219, 119594. [Google Scholar] [CrossRef]

- Cheng, D.; Shi, X.; Yu, J.; Zhang, D. How does the Chinese economy react to uncertainty in international crude oil prices? Int. Rev. Econ. Financ. 2019, 64, 147–164. [Google Scholar] [CrossRef]

- Khan, K.; Su, C.W.; Umar, M.; Yue, X.G. Do crude oil price bubbles occur? Resour. Policy 2021, 71, 101936. [Google Scholar] [CrossRef]

- Jia, Z.; Wen, S.; Lin, B. The effects and reacts of COVID-19 pandemic and international oil price on energy, economy, and environment in China. Appl. Energy 2021, 302, 117612. [Google Scholar] [CrossRef] [PubMed]

- Thorbecke, W. How oil prices affect East and Southeast Asian economies: Evidence from financial markets and implications for energy security. Energy Policy 2019, 128, 628–638. [Google Scholar] [CrossRef]

- Otero, J.D.Q. Not all sectors are alike: Differential impacts of shocks in oil prices on the sectors of the Colombian economy. Energy Econ. 2020, 86, 104691. [Google Scholar] [CrossRef]

- Nobuhiro, H.; Gasawa, K.; Hashimoto, H. Textbook of Computable General Equilibrium Modelling: Programming and Simulations; Springer: Berlin/Heidelberg, Germany, 2010. [Google Scholar]

- Robinson, S.; Cattaneo, A.; El-Said, M. Updating and estimating a social accounting matrix using cross entropy methods. Econ. Syst. Res. 2001, 13, 47–64. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, Z.; Cai, X.; Huang, W.-C. The Impact of Oil Price Fluctuations on Consumption, Output, and Investment in China’s Industrial Sectors. Energies 2022, 15, 3411. https://doi.org/10.3390/en15093411

Sun Z, Cai X, Huang W-C. The Impact of Oil Price Fluctuations on Consumption, Output, and Investment in China’s Industrial Sectors. Energies. 2022; 15(9):3411. https://doi.org/10.3390/en15093411

Chicago/Turabian StyleSun, Zhaoyong, Xinyu Cai, and Wei-Chiao Huang. 2022. "The Impact of Oil Price Fluctuations on Consumption, Output, and Investment in China’s Industrial Sectors" Energies 15, no. 9: 3411. https://doi.org/10.3390/en15093411

APA StyleSun, Z., Cai, X., & Huang, W.-C. (2022). The Impact of Oil Price Fluctuations on Consumption, Output, and Investment in China’s Industrial Sectors. Energies, 15(9), 3411. https://doi.org/10.3390/en15093411