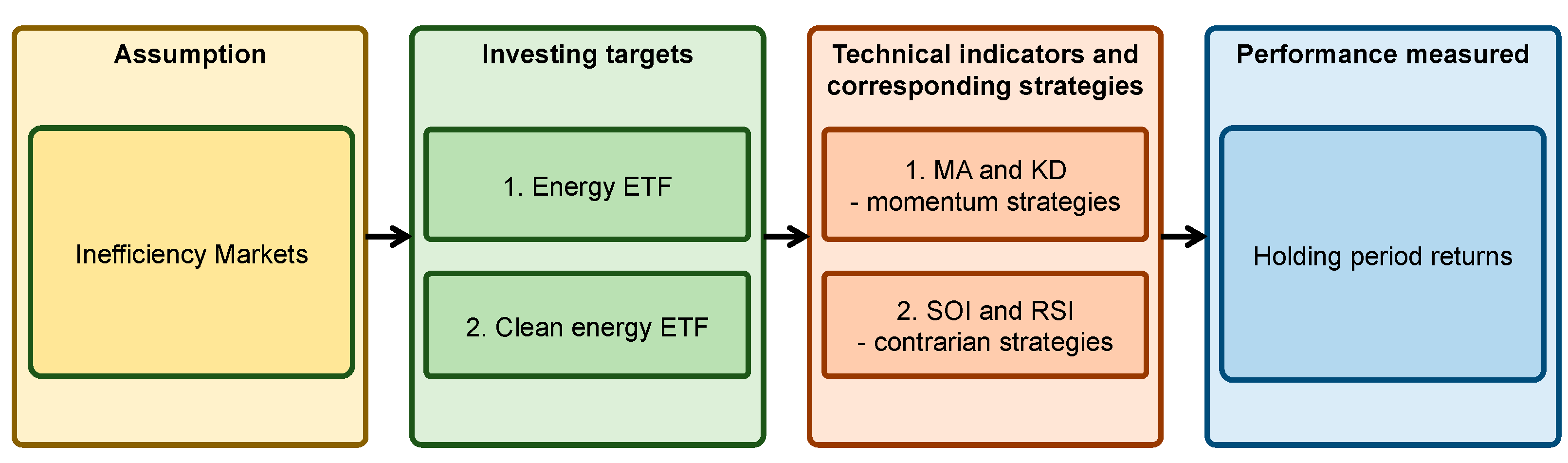

Do Investment Strategies Matter for Trading Global Clean Energy and Global Energy ETFs?

Abstract

1. Introduction

2. Literature Review

2.1. Diverse Technical Trading Rules

2.1.1. Trading Signals Triggered by Moving Average (MA)

2.1.2. Trading Signals Triggered by Stochastic Oscillator Indicators (SOI)

2.1.3. Trading Signals Triggered by Relative Strength Index (RSI)

2.1.4. Trading Signals Triggered by KD

2.2. Investing Strategies

2.2.1. Momentum Strategies

2.2.2. Contrarian Strategies

2.3. Investing Strategies and Trading Rules for Energy and Green Energy Portfolios

3. Data and Methodology

4. Empirical Results and Analysis

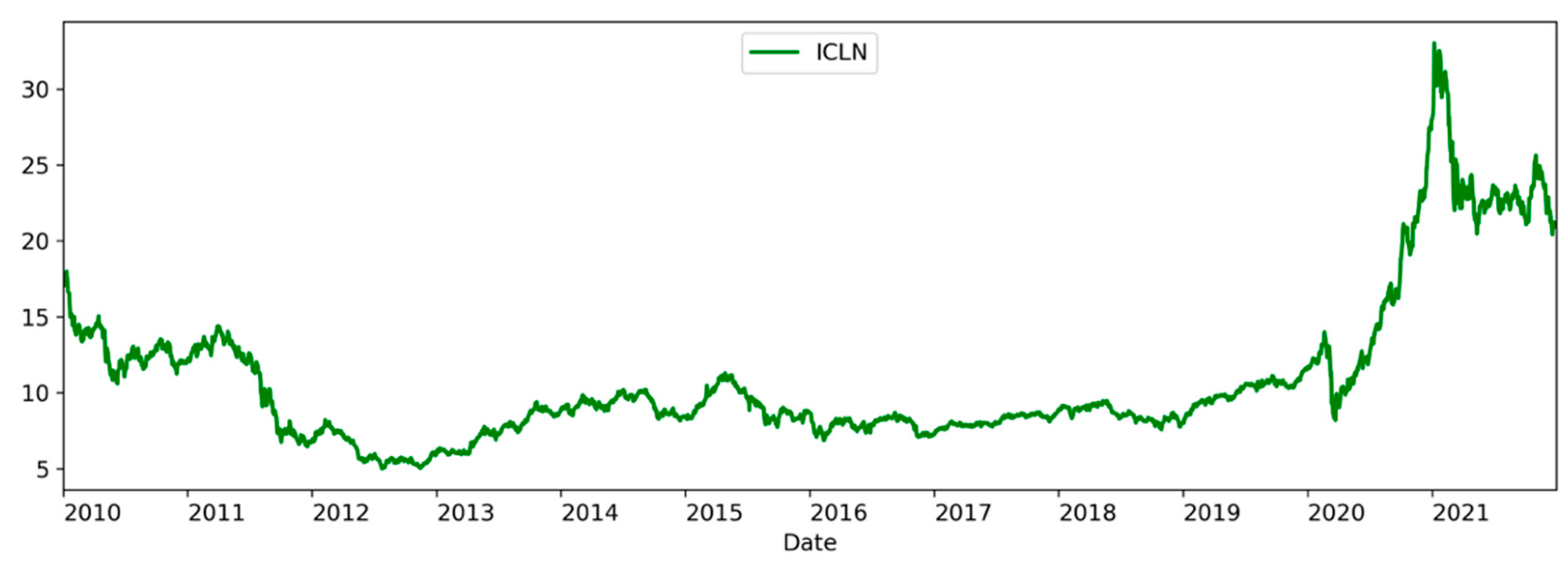

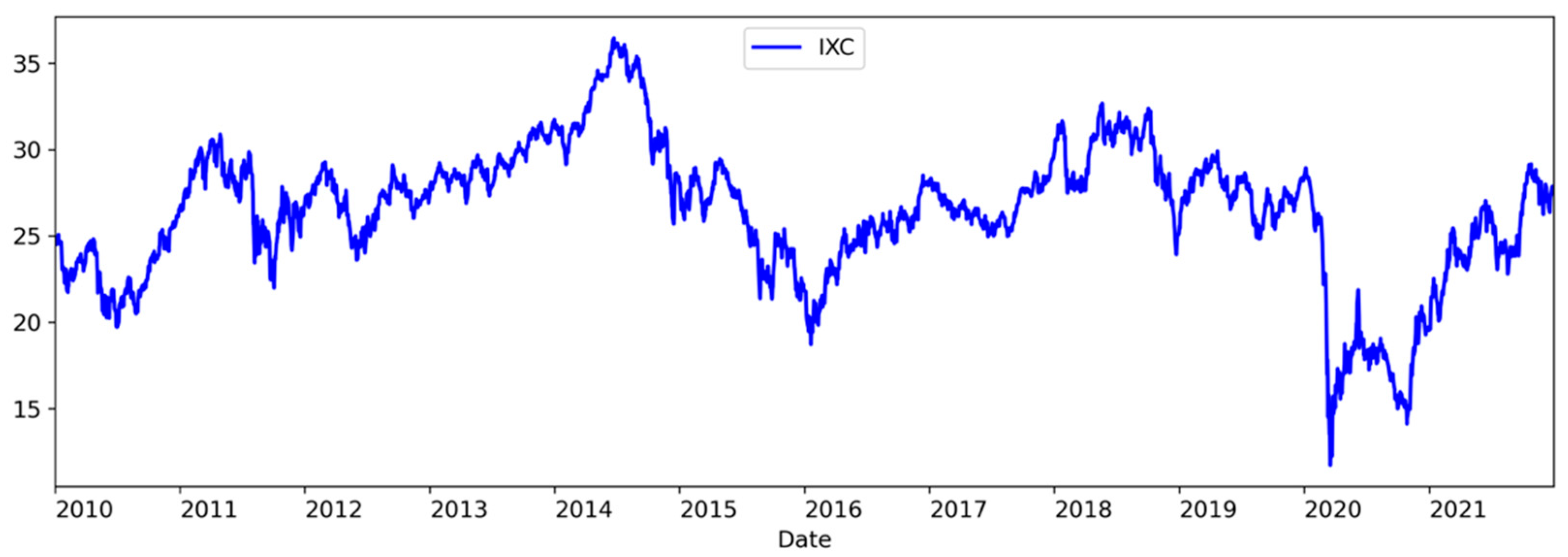

4.1. Descriptive Statistics

4.2. Empirical Results

4.2.1. Momentum Strategies

4.2.2. Contrarian Strategies

5. Discussion and Conclusions

5.1. Main Conclusions

5.2. Study Strength and Contributions

5.3. Research Implications

5.4. Future Research and Limitation

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Fama, E.F. The behavior of stock-market prices. J. Bus. 1965, 38, 34–105. [Google Scholar] [CrossRef]

- Fama, E.F. Efficient capital markets: A review of theory and empirical work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Latif, M.; Arshad, S.; Fatima, M.; Farooq, S. Market efficiency, market anomalies, causes, evidences, and some behavioral aspects of market anomalies. Res. J. Financ. Account. 2011, 2, 1–13. [Google Scholar]

- Phan, K.C.; Zhou, J. Market efficiency in emerging stock markets: A case study of the Vietnamese stock market. IOSR J. Bus. Manag. 2014, 16, 61–73. [Google Scholar] [CrossRef]

- Masteika, S.; Rutkauskas, A.V. Research on futures trend trading strategy based on short term chart pattern. J. Bus. Econ. Manag. 2012, 13, 915–930. [Google Scholar] [CrossRef][Green Version]

- Narayan, P.K.; Narayan, S.; Sharma, S.S. An analysis of commodity markets: What gain for investors? J. Bank. Financ. 2013, 37, 3878–3889. [Google Scholar] [CrossRef]

- Bessembinder, H.; Chan, K. The profitability of technical trading rules in the Asian stock markets. Pac.-Basin Financ. J. 1995, 3, 257–284. [Google Scholar] [CrossRef]

- Gencay, R. Linear, non-linear and essential foreign exchange rate prediction with simple technical trading rules. J. Int. Econ. 1999, 47, 91–107. [Google Scholar] [CrossRef]

- Lo, A.W.; Mamaysky, H.; Wang, J. Foundations of technical analysis: Computational algorithms, statistical inference, and empirical implementation. J. Financ. 2000, 55, 1705–1765. [Google Scholar] [CrossRef]

- Lento, C.; Gradojevic, N. The profitability of technical trading rules: A combined signal approach. J. Appl. Bus. Res. 2007, 23, 13–27. [Google Scholar] [CrossRef][Green Version]

- Metghalchi, M.; Marcucci, J.; Chang, Y.-H. Are moving average trading rules profitable? Evidence from the European stock markets. Appl. Econ. 2012, 44, 1539–1559. [Google Scholar] [CrossRef]

- Ni, Y.-S.; Lee, J.-T.; Liao, Y.-C. Do variable length moving average trading rules matter during a financial crisis period? Appl. Econ. Lett. 2013, 20, 135–141. [Google Scholar] [CrossRef]

- Yu, H.; Nartea, G.V.; Gan, C.; Yao, L.J. Predictive ability and profitability of simple technical trading rules: Recent evidence from Southeast Asian stock markets. Int. Rev. Econ. Financ. 2013, 25, 356–371. [Google Scholar] [CrossRef]

- Sadorsky, P. A random forests approach to predicting clean energy stock prices. J. Risk Financ. Manag. 2021, 14, 48. [Google Scholar] [CrossRef]

- Chien, T.; Hu, J.-L. Renewable energy and macroeconomic efficiency of OECD and non-OECD economies. Energy Policy 2007, 35, 3606–3615. [Google Scholar] [CrossRef]

- Hsiao, W.-L.; Hu, J.-L.; Hsiao, C.; Chang, M.-C. Energy efficiency of the Baltic Sea countries: An application of stochastic frontier analysis. Energies 2018, 12, 104. [Google Scholar] [CrossRef]

- Chang, T.-P.; Hu, J.-L. Total-factor energy productivity growth, technical progress, and efficiency change: An empirical study of China. Appl. Energy 2010, 87, 3262–3270. [Google Scholar] [CrossRef]

- Hu, J.-L.; Kao, C.-H. Efficient energy-saving targets for APEC economies. Energy Policy 2007, 35, 373–382. [Google Scholar] [CrossRef]

- Li, L.-B.; Hu, J.-L. Ecological total-factor energy efficiency of regions in China. Energy Policy 2012, 46, 216–224. [Google Scholar] [CrossRef]

- Wang, L.; An, H.; Liu, X.; Huang, X. Selecting dynamic moving average trading rules in the crude oil futures market using a genetic approach. Appl. Energy 2016, 162, 1608–1618. [Google Scholar] [CrossRef]

- Shintani, M.; Yabu, T.; Nagakura, D. Spurious regressions in technical trading. J. Econom. 2012, 169, 301–309. [Google Scholar] [CrossRef]

- Fifield, S.G.; Power, D.M.; Donald Sinclair, C. An analysis of trading strategies in eleven European stock markets. Eur. J. Financ. 2005, 11, 531–548. [Google Scholar] [CrossRef]

- Ni, Y.; Cheng, Y.; Liao, Y.; Huang, P. Does board structure affect stock price overshooting informativeness measured by stochastic oscillator indicators? Int. J. Financ. Econ. 2020, 27, 2290–2302. [Google Scholar] [CrossRef]

- Chiang, Y.-C.; Ke, M.-C.; Liao, T.L.; Wang, C.-D. Are technical trading strategies still profitable? Evidence from the Taiwan Stock Index Futures Market. Appl. Financ. Econ. 2012, 22, 955–965. [Google Scholar] [CrossRef]

- Wang, Z.-M.; Chiao, C.; Chang, Y.-T. Technical analyses and order submission behaviors: Evidence from an emerging market. Int. Rev. Econ. Financ. 2012, 24, 109–128. [Google Scholar] [CrossRef]

- Shik, T.C.; Chong, T.T.-L. A comparison of MA and RSI returns with exchange rate intervention. Appl. Econ. Lett. 2007, 14, 371–383. [Google Scholar] [CrossRef]

- Chong, T.T.-L.; Ng, W.-K. Technical analysis and the London stock exchange: Testing the MACD and RSI rules using the FT30. Appl. Econ. Lett. 2008, 15, 1111–1114. [Google Scholar] [CrossRef]

- Farmer, J.D.; Joshi, S. The price dynamics of common trading strategies. J. Econ. Behav. Organ. 2002, 49, 149–171. [Google Scholar] [CrossRef]

- Aravind, M. Contrarian and momentum strategies: An investigation with reference to sectoral portfolios in NSE. NMIMS Manag. Rev. 2016, 29, 102–117. [Google Scholar]

- Liao, C.-C. Momentum trading, contrarian trading and smart money manipulation. Int. Bus. Res. 2017, 10, 53–62. [Google Scholar] [CrossRef]

- Duxbury, D.; Yao, S. Are investors consistent in their trading strategies? An examination of individual investor-level data. Int. Rev. Financ. Anal. 2017, 52, 77–87. [Google Scholar] [CrossRef][Green Version]

- De Bondt, W.F.; Thaler, R. Does the stock market overreact? J. Financ. 1985, 40, 793–805. [Google Scholar] [CrossRef]

- De Bondt, W.F.; Thaler, R.H. Further evidence on investor overreaction and stock market seasonality. J. Financ. 1987, 42, 557–581. [Google Scholar] [CrossRef]

- Jegadeesh, N.; Titman, S. Returns to buying winners and selling losers: Implications for stock market efficiency. J. Financ. 1993, 48, 65–91. [Google Scholar] [CrossRef]

- Galariotis, E.C.; Holmes, P.; Ma, X.S. Contrarian and momentum profitability revisited: Evidence from the London Stock Exchange 1964–2005. J. Multinatl. Financ. Manag. 2007, 17, 432–447. [Google Scholar] [CrossRef]

- Rouwenhorst, K.G. International momentum strategies. J. Financ. 1998, 53, 267–284. [Google Scholar] [CrossRef]

- Conrad, J.; Kaul, G. An anatomy of trading strategies. Rev. Financ. Stud. 1998, 11, 489–519. [Google Scholar] [CrossRef]

- Hong, H.; Stein, J.C. A unified theory of underreaction, momentum trading, and overreaction in asset markets. J. Financ. 1999, 54, 2143–2184. [Google Scholar] [CrossRef]

- Chui, A.C.; Titman, S.; Wei, K.J. Individualism and momentum around the world. J. Financ. 2010, 65, 361–392. [Google Scholar] [CrossRef]

- Asness, C.S.; Moskowitz, T.J.; Pedersen, L.H. Value and momentum everywhere. J. Financ. 2013, 68, 929–985. [Google Scholar] [CrossRef]

- Novy-Marx, R. Is momentum really momentum? J. Financ. Econ. 2012, 103, 429–453. [Google Scholar] [CrossRef]

- Menkhoff, L.; Sarno, L.; Schmeling, M.; Schrimpf, A. Carry trades and global foreign exchange volatility. J. Financ. 2012, 67, 681–718. [Google Scholar] [CrossRef]

- Vayanos, D.; Woolley, P. An institutional theory of momentum and reversal. Rev. Financ. Stud. 2013, 26, 1087–1145. [Google Scholar] [CrossRef]

- Ni, Y.; Liao, Y.-C.; Huang, P. MA trading rules, herding behaviors, and stock market overreaction. Int. Rev. Econ. Financ. 2015, 39, 253–265. [Google Scholar] [CrossRef]

- Harris, R.D.; Yilmaz, F. A momentum trading strategy based on the low frequency component of the exchange rate. J. Bank. Financ. 2009, 33, 1575–1585. [Google Scholar] [CrossRef][Green Version]

- Miffre, J.; Rallis, G. Momentum strategies in commodity futures markets. J. Bank. Financ. 2007, 31, 1863–1886. [Google Scholar] [CrossRef]

- Szakmary, A.C.; Shen, Q.; Sharma, S.C. Trend-following trading strategies in commodity futures: A re-examination. J. Bank. Financ. 2010, 34, 409–426. [Google Scholar] [CrossRef]

- Friesen, G.C.; Weller, P.A.; Dunham, L.M. Price trends and patterns in technical analysis: A theoretical and empirical examination. J. Bank. Financ. 2009, 33, 1089–1100. [Google Scholar] [CrossRef]

- Lee, S.J.; Oh, K.J.; Kim, T.Y. How many reference patterns can improve profitability for real-time trading in futures market? Expert Syst. Appl. 2012, 39, 7458–7470. [Google Scholar] [CrossRef]

- Leigh, W.; Paz, N.; Purvis, R. Market timing: A test of a charting heuristic. Econ. Lett. 2002, 77, 55–63. [Google Scholar] [CrossRef]

- Gregory-Williams, J.; Williams, B.M. Trading Chaos: Maximize Profits with Proven Technical Techniques; John Wiley & Sons: Hoboken, NJ, USA, 2004; Volume 161. [Google Scholar]

- Zou, L.; Chen, R. Earnings surprises, investor sentiments and contrarian strategies. Int. J. Econ. Financ. Issues 2017, 7, 133–143. [Google Scholar]

- Gopal, K. A Review of Contrarian Strategies in Capital Markets. Int. J. Manag. Bus. Soc. Sci. 2016, 4, 115–120. [Google Scholar]

- Kumar, V.V.P. A study of momentum and contrarian strategies based portfolios in US market. Int. J. Inf. Bus. Manag. 2016, 8, 61–73. [Google Scholar]

- Asif, J.; Yahya, M.; Muhammad, J. The Performance of Contrarian Strategy in Mature and Immature Stocks: Evidence from Malaysia. J. Econ. Manag. Perspect. 2018, 12, 395–405. [Google Scholar]

- Vieru, M.; Perttunen, J.; Schadewitz, H. How investors trade around interim earnings announcements. J. Bus. Financ. Account. 2006, 33, 145–178. [Google Scholar] [CrossRef]

- De Haan, L.; Kakes, J. Momentum or contrarian investment strategies: Evidence from Dutch institutional investors. J. Bank. Financ. 2011, 35, 2245–2251. [Google Scholar] [CrossRef]

- Cho, J.H.; Daigler, R.; Ki, Y.; Zaima, J. Destabilizing momentum trading and counterbalancing contrarian strategy by large trader groups. Rev. Account. Financ. 2019, 19, 83–106. [Google Scholar] [CrossRef]

- Shi, H.-L.; Zhou, W.-X. Time series momentum and contrarian effects in the Chinese stock market. Physica A 2017, 483, 309–318. [Google Scholar] [CrossRef][Green Version]

- Yu, L.; Fung, H.-G.; Leung, W.K. Momentum or contrarian trading strategy: Which one works better in the Chinese stock market. Int. Rev. Econ. Financ. 2019, 62, 87–105. [Google Scholar] [CrossRef]

- Lakonishok, J.; Shleifer, A.; Vishny, R.W. Contrarian investment, extrapolation, and risk. J. Financ. 1994, 49, 1541–1578. [Google Scholar] [CrossRef]

- Lubnau, T.; Todorova, N. Trading on mean-reversion in energy futures markets. Energy Econ. 2015, 51, 312–319. [Google Scholar] [CrossRef]

- Narayan, P.K. Evidence of oil market price clustering during the COVID-19 pandemic. Int. Rev. Financ. Anal. 2022, 80, 102009. [Google Scholar] [CrossRef]

- Wang, L.; An, H.; Xia, X.; Liu, X.; Sun, X.; Huang, X. Generating moving average trading rules on the oil futures market with genetic algorithms. Math. Probl. Eng. 2014, 2014, 101808. [Google Scholar] [CrossRef]

- Bouri, E.; Iqbal, N.; Klein, T. Climate policy uncertainty and the price dynamics of green and brown energy stocks. Financ. Res. Lett. 2022, 102740. [Google Scholar] [CrossRef]

- Liu, X.; An, H.; Wang, L.; Jia, X. An integrated approach to optimize moving average rules in the EUA futures market based on particle swarm optimization and genetic algorithms. Appl. Energy 2017, 185, 1778–1787. [Google Scholar] [CrossRef]

- Chang, C.-L.; Ilomäki, J.; Laurila, H.; McAleer, M. Market timing with moving averages for fossil fuel and renewable energy stocks. Energy Rep. 2020, 6, 1798–1810. [Google Scholar] [CrossRef]

- He, X.-Z.; Li, K. Profitability of time series momentum. J. Bank. Financ. 2015, 53, 140–157. [Google Scholar] [CrossRef]

- Kosc, K.; Sakowski, P.; Ślepaczuk, R. Momentum and contrarian effects on the cryptocurrency market. Physica A 2019, 523, 691–701. [Google Scholar] [CrossRef]

- Chang, C.-L.; Ilomäki, J.; Laurila, H.; McAleer, M. Moving average market timing in European energy markets: Production versus emissions. Energies 2018, 11, 3281. [Google Scholar] [CrossRef]

| Technical Trading Rules | Investing Strategies Adopted and Buying Signals Emitted |

|---|---|

| MA trading rules | Momentum strategies are adopted when the golden cross appears (i.e., the SMA increases beyond the LMA). |

| KD trading rules | Momentum strategies are adopted when the golden cross appears (i.e., the K line crosses up the D line). |

| SOI trading rules | Contrarian strategies are adopted when SOI falls into the oversold zone (i.e., K ≤ 20). |

| RSI trading rules | Contrarian strategies are adopted when RSI falls into the oversold zone (i.e., RSI ≤ 30). |

| Energy ETFs | Sample | Mean | SD | CV | Median | Min | Max |

|---|---|---|---|---|---|---|---|

| ICLN | 3021 | 10.82 | 4.99 | 46.09% | 9.04 | 5.00 | 33.04 |

| IXC | 3021 | 26.45 | 3.88 | 14.67% | 26.97 | 11.71 | 36.47 |

| iShares Global Clean Energy ETF (ICLN) | iShares Global Energy ETF (IXC) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Strategy | Holding Period | Count | Mean | p-Value | Sig. | Count | Mean | p-Value | Sig. |

| MA-GC | 5 | 85 | 0.03% | 0.9461 | 84 | 0.18% | 0.5762 | ||

| MA-GC | 10 | 85 | 0.36% | 0.5379 | 84 | 0.25% | 0.5975 | ||

| MA-GC | 25 | 85 | 1.21% | 0.2252 | 83 | 1.05% | 0.1775 | ||

| MA-GC | 50 | 85 | 2.88% | 0.0551 | * | 83 | 0.78% | 0.5124 | |

| MA-GC | 100 | 83 | 4.61% | 0.0498 | ** | 82 | 1.20% | 0.5033 | |

| MA-GC | 150 | 82 | 7.40% | 0.0143 | ** | 80 | 2.95% | 0.1247 | |

| MA-GC | 200 | 78 | 9.03% | 0.0262 | ** | 79 | 4.10% | 0.0709 | * |

| MA-GC | 250 | 78 | 10.31% | 0.0079 | *** | 77 | 3.73% | 0.1601 | |

| KD-GC | 5 | 221 | 0.13% | 0.6703 | 213 | 0.29% | 0.2126 | ||

| KD-GC | 10 | 220 | 0.14% | 0.7091 | 212 | 0.58% | 0.0857 | * | |

| KD-GC | 25 | 219 | 0.57% | 0.3568 | 211 | 0.87% | 0.1094 | ||

| KD-GC | 50 | 218 | 1.19% | 0.2097 | 209 | 1.78% | 0.0162 | ** | |

| KD-GC | 100 | 215 | 3.18% | 0.0446 | ** | 203 | 1.74% | 0.0830 | * |

| KD-GC | 150 | 213 | 5.20% | 0.0121 | ** | 198 | 2.80% | 0.0209 | ** |

| KD-GC | 200 | 209 | 7.97% | 0.0035 | *** | 194 | 3.00% | 0.0341 | ** |

| KD-GC | 250 | 205 | 10.25% | 0.0002 | *** | 192 | 3.70% | 0.0225 | ** |

| iShares Global Clean Energy ETF (ICLN) | iShares Global Energy ETF (IXC) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Strategy | Holding Period | Count | Mean | p-Value | Sig. | Count | Mean | p-Value | Sig. |

| K ≤ 20 | 5 | 274 | 0.20% | 0.4377 | 218 | 0.59% | 0.1714 | ||

| K ≤ 20 | 10 | 273 | 0.49% | 0.1152 | 218 | 1.23% | 0.0245 | ** | |

| K ≤ 20 | 25 | 270 | 1.75% | 0.0002 | *** | 218 | 1.03% | 0.1859 | |

| K ≤ 20 | 50 | 270 | 1.73% | 0.0346 | ** | 216 | 3.47% | 0.0034 | *** |

| K ≤ 20 | 100 | 268 | 2.85% | 0.0253 | ** | 216 | 5.91% | 0.0000 | *** |

| K ≤ 20 | 150 | 268 | 5.17% | 0.0047 | *** | 213 | 2.81% | 0.0986 | * |

| K ≤ 20 | 200 | 265 | 8.55% | 0.0020 | *** | 213 | 4.57% | 0.0164 | ** |

| K ≤ 20 | 250 | 265 | 8.31% | 0.0014 | *** | 211 | 7.10% | 0.0014 | *** |

| RSI ≤ 30 | 5 | 200 | 0.45% | 0.1846 | 186 | −0.46% | 0.3842 | ||

| RSI ≤ 30 | 10 | 196 | 0.35% | 0.3458 | 186 | −0.54% | 0.4028 | ||

| RSI ≤ 30 | 25 | 195 | 0.26% | 0.6648 | 186 | −1.95% | 0.0921 | * | |

| RSI ≤ 30 | 50 | 195 | −0.39% | 0.6740 | 186 | 3.78% | 0.0086 | *** | |

| RSI ≤ 30 | 100 | 195 | 4.77% | 0.0019 | *** | 186 | 6.05% | 0.0002 | *** |

| RSI ≤ 30 | 150 | 195 | 6.56% | 0.0001 | *** | 186 | 0.28% | 0.8885 | |

| RSI ≤ 30 | 200 | 195 | 7.43% | 0.0029 | *** | 186 | 3.10% | 0.1426 | |

| RSI ≤ 30 | 250 | 184 | 8.96% | 0.0001 | *** | 186 | 8.60% | 0.0009 | *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Day, M.-Y.; Ni, Y.; Hsu, C.; Huang, P. Do Investment Strategies Matter for Trading Global Clean Energy and Global Energy ETFs? Energies 2022, 15, 3328. https://doi.org/10.3390/en15093328

Day M-Y, Ni Y, Hsu C, Huang P. Do Investment Strategies Matter for Trading Global Clean Energy and Global Energy ETFs? Energies. 2022; 15(9):3328. https://doi.org/10.3390/en15093328

Chicago/Turabian StyleDay, Min-Yuh, Yensen Ni, Chinning Hsu, and Paoyu Huang. 2022. "Do Investment Strategies Matter for Trading Global Clean Energy and Global Energy ETFs?" Energies 15, no. 9: 3328. https://doi.org/10.3390/en15093328

APA StyleDay, M.-Y., Ni, Y., Hsu, C., & Huang, P. (2022). Do Investment Strategies Matter for Trading Global Clean Energy and Global Energy ETFs? Energies, 15(9), 3328. https://doi.org/10.3390/en15093328